United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

Investment Company Act file number: 811-05075

Thrivent Mutual Funds

(Exact name of registrant as specified in charter)

901 Marquette Avenue, Suite 2500

Minneapolis, Minnesota 55402-3211

(Address of principal executive offices) (Zip code)

John D. Jackson, Secretary and Chief Legal Officer

Thrivent Mutual Funds

901 Marquette Avenue, Suite 2500

Minneapolis, Minnesota 55402-3211

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 844-7190

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Report to Stockholders

(a) A copy of the registrant’s report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”), as amended, is filed herewith.

(b) Not applicable.

Thrivent Diversified Income Plus Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about the Thrivent Diversified Income Plus Fund (the Fund) for the 12 months ended December 31, 2024.You can find additional information about the Fund at www.thriventmutualfunds.com/prospectus. You can also request this information by contacting us at 800-847-4836.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class | Cost of a $10K Investment | Cost Paid as a % of a $10K Investment |

|---|

| Class A | $96 | 0.93% |

|---|

How did the Fund perform over the past 12 months?

For the 12 months ended December 31, 2024, Diversified Income Plus Fund (excluding sales charge), earned a return of 6.81%, outperforming the average return of its peer group, the Morningstar Conservative Allocation category which returned 5.41%. The Fund’s broad-based benchmark MSCI All Country World Index - USD Net Returns earned a return of 17.49% over the same period.

The key factors that contributed to the Fund's performance over the past 12 months include:

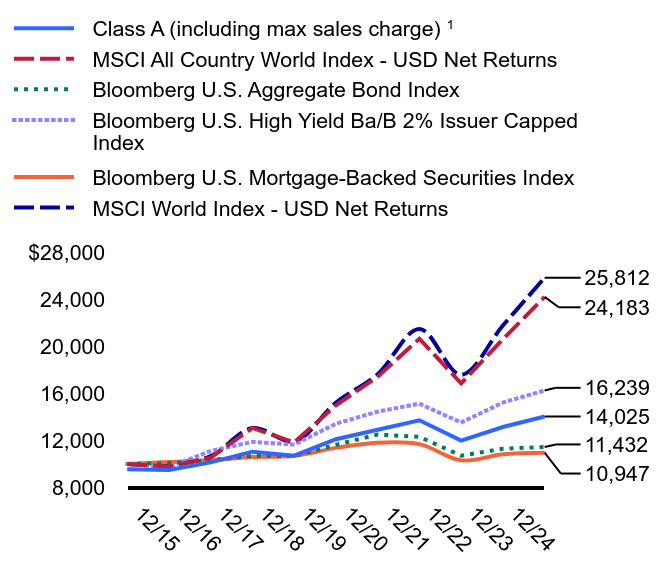

How did the Fund perform over the past 10 years?

| Class A (including max sales charge) Footnote Reference1 | MSCI All Country World Index - USD Net Returns | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. High Yield Ba/B 2% Issuer Capped Index | Bloomberg U.S. Mortgage-Backed Securities Index | MSCI World Index - USD Net Returns |

|---|

| 12/14 | 9,550 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 |

|---|

| 12/15 | 9,491 | 9,764 | 10,055 | 9,728 | 10,151 | 9,913 |

|---|

| 12/16 | 10,127 | 10,531 | 10,321 | 11,099 | 10,321 | 10,657 |

|---|

| 12/17 | 11,037 | 13,056 | 10,687 | 11,867 | 10,577 | 13,045 |

|---|

| 12/18 | 10,694 | 11,827 | 10,688 | 11,644 | 10,682 | 11,908 |

|---|

| 12/19 | 12,097 | 14,973 | 11,620 | 13,412 | 11,360 | 15,203 |

|---|

| 12/20 | 12,904 | 17,406 | 12,492 | 14,440 | 11,800 | 17,621 |

|---|

| 12/21 | 13,707 | 20,633 | 12,299 | 15,111 | 11,677 | 21,465 |

|---|

| 12/22 | 11,975 | 16,844 | 10,699 | 13,513 | 10,298 | 17,571 |

|---|

| 12/23 | 13,130 | 20,584 | 11,291 | 15,210 | 10,817 | 21,751 |

|---|

| 12/24 | 14,025 | 24,183 | 11,432 | 16,239 | 10,947 | 25,812 |

|---|

U.S. Government & Agencies

| Average Annual Total Returns * | 1 year | 5 year | 10 year |

|---|

Class A (excluding sales charge)Footnote Reference1 | 6.81% | 3.00% | 3.92% |

|---|

Class A (including max sales charge)Footnote Reference1 | 2.06% | 2.06% | 3.45% |

|---|

| MSCI All Country World Index - USD Net Returns | 17.49% | 10.06% | 9.23% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 1.25% | -0.33% | 1.35% |

|---|

| Bloomberg U.S. High Yield Ba/B 2% Issuer Capped Index | 6.77% | 3.90% | 4.97% |

|---|

| Bloomberg U.S. Mortgage-Backed Securities Index | 1.20% | -0.74% | 0.91% |

|---|

| MSCI World Index - USD Net Returns | 18.67% | 11.17% | 9.95% |

|---|

* Total returns assume reinvestment of all dividends and capital gains. At various times, the Fund's adviser may have waived certain fees and/or reimbursed expenses, without which total returns would have been lower.

1 The Fund's past performance is not a good predictor of the Fund's future performance. The line graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Call 800-847-4836 or visit www.thriventfunds.com/mutual-funds/performance-summary.html for performance results current to the most recent month-end.

| Total Net Assets | # of Portfolio Holdings | Portfolio Turnover Rate | Advisory Fees Paid |

|---|

| $975,807,380 | 1,957 | 50% | $5,213,972 |

|---|

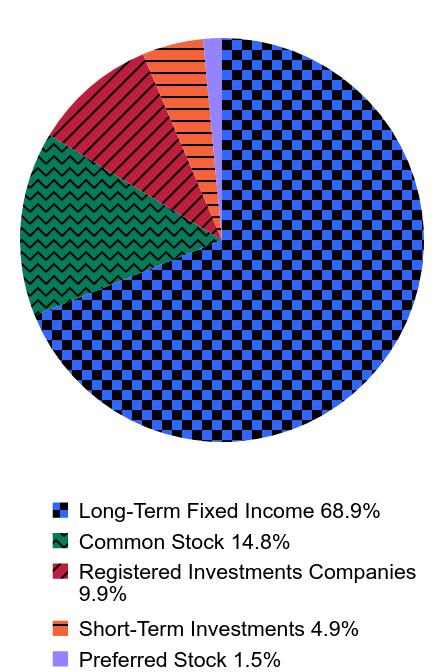

What did the Fund invest in?

Top Ten Holdings (% of Net Assets)

| Thrivent Core Emerging Markets Debt Fund | 7.9% |

| U.S. Treasury Notes | 3.0% |

| U.S. Treasury Notes | 1.6% |

| Federal National Mortgage Association Conventional 30-Yr. Pass Through | 1.6% |

| U.S. Treasury Notes | 1.2% |

| Thrivent Core International Equity Fund | 1.1% |

| Federal National Mortgage Association Conventional 30-Yr. Pass Through | 0.9% |

| Federal National Mortgage Association Conventional 30-Yr. Pass Through | 0.9% |

| Federal National Mortgage Association Conventional 30-Yr. Pass Through | 0.9% |

| Federal Home Loan Mortgage Corporation Conventional 30-Yr. Pass Through | 0.9% |

Portfolio Composition (% of Portfolio)

| Value | Value |

|---|

| Long-Term Fixed Income | 68.9% |

| Common Stock | 14.8% |

| Registered Investments Companies | 9.9% |

| Short-Term Investments | 4.9% |

| Preferred Stock | 1.5% |

Major Market Sectors (% of Net Assets)

| Mortgage-Backed Securities | 21.0% |

| Financials | 11.5% |

| U.S. Affiliated Registered Investment Companies | 9.0% |

| U.S. Government & Agencies | 7.9% |

| Asset-Backed Securities | 6.4% |

| Information Technology | 5.9% |

| Collateralized Mortgage Obligations | 5.8% |

| Consumer Discretionary | 4.8% |

| Consumer Staples | 3.8% |

| Energy | 3.2% |

This is a summary of certain changes of the Fund since December 31, 2023. For more complete information, you may review the Fund's next prospectus which will be available at thriventmutualfunds.com/prospectus or upon request at 800-847-4836.

Changes in or Disagreements with Accountants

There were no changes to the Fund's auditor or disagreements with them for the year ended December 31, 2024.

Certain additional fund information is available on the Fund's website, including the Fund's prospectus, financial information, holdings, and proxy voting information.

Important data provider notices and terms available at www.thriventfunds.com/privacy-and-security/index-provider-notices.html

Thrivent Distributors, LLC, a registered broker-dealer and member of FINRA, is the distributor for Thrivent Mutual Funds. Thrivent Asset Management, LLC, an SEC-registered investment adviser, provides asset management services. Both entities are subsidiaries of Thrivent, the marketing name for Thrivent Financial for Lutherans.

Thrivent Diversified Income Plus Fund - Class A: AAHYX

Annual Shareholder Report - December 31, 2024

Thrivent Diversified Income Plus Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about the Thrivent Diversified Income Plus Fund (the Fund) for the 12 months ended December 31, 2024.You can find additional information about the Fund at www.thriventmutualfunds.com/prospectus. You can also request this information by contacting us at 800-847-4836.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class | Cost of a $10K Investment | Cost Paid as a % of a $10K Investment |

|---|

| Class S | $71 | 0.68% |

|---|

How did the Fund perform over the past 12 months?

For the 12 months ended December 31, 2024, Diversified Income Plus Fund, earned a return of 7.01%, outperforming the average return of its peer group, the Morningstar Conservative Allocation category which returned 5.41%. The Fund’s broad-based benchmark MSCI All Country World Index - USD Net Returns earned a return of 17.49% over the same period.

The key factors that contributed to the Fund's performance over the past 12 months include:

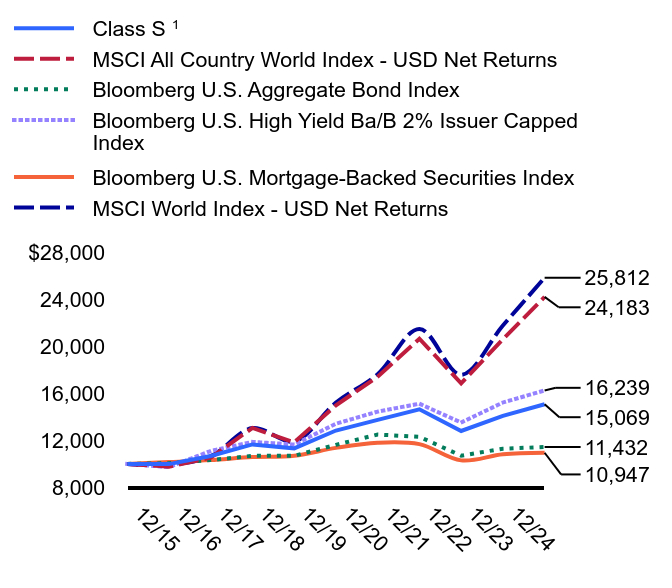

How did the Fund perform over the past 10 years?

| Class SFootnote Reference1 | MSCI All Country World Index - USD Net Returns | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. High Yield Ba/B 2% Issuer Capped Index | Bloomberg U.S. Mortgage-Backed Securities Index | MSCI World Index - USD Net Returns |

|---|

| 12/14 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 |

|---|

| 12/15 | 9,981 | 9,764 | 10,055 | 9,728 | 10,151 | 9,913 |

|---|

| 12/16 | 10,671 | 10,531 | 10,321 | 11,099 | 10,321 | 10,657 |

|---|

| 12/17 | 11,653 | 13,056 | 10,687 | 11,867 | 10,577 | 13,045 |

|---|

| 12/18 | 11,318 | 11,827 | 10,688 | 11,644 | 10,682 | 11,908 |

|---|

| 12/19 | 12,833 | 14,973 | 11,620 | 13,412 | 11,360 | 15,203 |

|---|

| 12/20 | 13,733 | 17,406 | 12,492 | 14,440 | 11,800 | 17,621 |

|---|

| 12/21 | 14,633 | 20,633 | 12,299 | 15,111 | 11,677 | 21,465 |

|---|

| 12/22 | 12,796 | 16,844 | 10,699 | 13,513 | 10,298 | 17,571 |

|---|

| 12/23 | 14,081 | 20,584 | 11,291 | 15,210 | 10,817 | 21,751 |

|---|

| 12/24 | 15,069 | 24,183 | 11,432 | 16,239 | 10,947 | 25,812 |

|---|

U.S. Government & Agencies

| Average Annual Total Returns * | 1 year | 5 year | 10 year |

|---|

Class SFootnote Reference1 | 7.01% | 3.26% | 4.19% |

|---|

| MSCI All Country World Index - USD Net Returns | 17.49% | 10.06% | 9.23% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 1.25% | -0.33% | 1.35% |

|---|

| Bloomberg U.S. High Yield Ba/B 2% Issuer Capped Index | 6.77% | 3.90% | 4.97% |

|---|

| Bloomberg U.S. Mortgage-Backed Securities Index | 1.20% | -0.74% | 0.91% |

|---|

| MSCI World Index - USD Net Returns | 18.67% | 11.17% | 9.95% |

|---|

* Total returns assume reinvestment of all dividends and capital gains. At various times, the Fund's adviser may have waived certain fees and/or reimbursed expenses, without which total returns would have been lower.

1 The Fund's past performance is not a good predictor of the Fund's future performance. The line graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Call 800-847-4836 or visit www.thriventfunds.com/mutual-funds/performance-summary.html for performance results current to the most recent month-end.

| Total Net Assets | # of Portfolio Holdings | Portfolio Turnover Rate | Advisory Fees Paid |

|---|

| $975,807,380 | 1,957 | 50% | $5,213,972 |

|---|

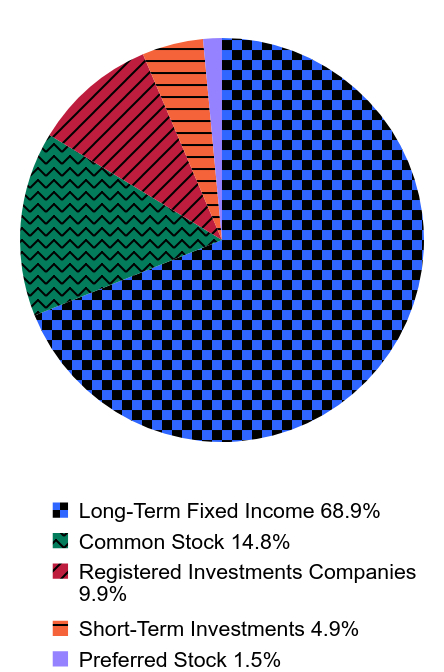

What did the Fund invest in?

Top Ten Holdings (% of Net Assets)

| Thrivent Core Emerging Markets Debt Fund | 7.9% |

| U.S. Treasury Notes | 3.0% |

| U.S. Treasury Notes | 1.6% |

| Federal National Mortgage Association Conventional 30-Yr. Pass Through | 1.6% |

| U.S. Treasury Notes | 1.2% |

| Thrivent Core International Equity Fund | 1.1% |

| Federal National Mortgage Association Conventional 30-Yr. Pass Through | 0.9% |

| Federal National Mortgage Association Conventional 30-Yr. Pass Through | 0.9% |

| Federal National Mortgage Association Conventional 30-Yr. Pass Through | 0.9% |

| Federal Home Loan Mortgage Corporation Conventional 30-Yr. Pass Through | 0.9% |

Portfolio Composition (% of Portfolio)

| Value | Value |

|---|

| Long-Term Fixed Income | 68.9% |

| Common Stock | 14.8% |

| Registered Investments Companies | 9.9% |

| Short-Term Investments | 4.9% |

| Preferred Stock | 1.5% |

Major Market Sectors (% of Net Assets)

| Mortgage-Backed Securities | 21.0% |

| Financials | 11.5% |

| U.S. Affiliated Registered Investment Companies | 9.0% |

| U.S. Government & Agencies | 7.9% |

| Asset-Backed Securities | 6.4% |

| Information Technology | 5.9% |

| Collateralized Mortgage Obligations | 5.8% |

| Consumer Discretionary | 4.8% |

| Consumer Staples | 3.8% |

| Energy | 3.2% |

This is a summary of certain changes of the Fund since December 31, 2023. For more complete information, you may review the Fund's next prospectus which will be available at thriventmutualfunds.com/prospectus or upon request at 800-847-4836.

Changes in or Disagreements with Accountants

There were no changes to the Fund's auditor or disagreements with them for the year ended December 31, 2024.

Certain additional fund information is available on the Fund's website, including the Fund's prospectus, financial information, holdings, and proxy voting information.

Important data provider notices and terms available at www.thriventfunds.com/privacy-and-security/index-provider-notices.html

Thrivent Distributors, LLC, a registered broker-dealer and member of FINRA, is the distributor for Thrivent Mutual Funds. Thrivent Asset Management, LLC, an SEC-registered investment adviser, provides asset management services. Both entities are subsidiaries of Thrivent, the marketing name for Thrivent Financial for Lutherans.

Thrivent Diversified Income Plus Fund - Class S: THYFX

Annual Shareholder Report - December 31, 2024

Item 2. Code of Ethics

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. There were no amendments made to or waivers granted under the code of ethics during the period covered by this report. The registrant’s code of ethics is filed herewith pursuant to Item 19(a)(1) of this Form N-CSR.

Item 3. Audit Committee Financial Expert

Registrant’s board of trustees has determined that Robert J. Chersi, an independent trustee, is the Audit Committee Financial Expert.

Item 4. Principal Accountant Fees and Services

(a) through (d)

Thrivent Diversified Income Plus Fund a series of Thrivent Mutual Funds, a Massachusetts business trust (the “Trust”). The Trust, as of the date of filing this Form N-CSR, contains a total of 23 series (the “Series”), including the Funds. This Form N-CSR relates to the annual report of each Fund.

The following table presents the aggregate fees billed to the Funds for the respective fiscal years ended December 31, 2023 and December 31, 2024 by the Funds’ independent public accountants, PricewaterhouseCoopers LLP (“PwC”), for professional services rendered for the audit of the Funds’ annual financial statements and fees billed for other services rendered by PwC during those periods.

Fiscal Years Ended | 12/31/2023 | 12/31/2024 |

| | | |

| Audit Fees | $49,592 | $28,609 |

| | | |

Audit-Related Fees(1) | $0 | $0 |

| | | |

Tax Fees(2) | $14,870 | $8,322 |

| | | |

All Other Fees(3) | $0 | $0 |

| | | |

| Total | $64,462 | $36,931 |

| | | |

| | | |

(1) Audit-related fees consist of the aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit of financial statements and are not reported under the category of audit fees.

(2) Tax fees consist of the aggregate fees billed for professional services rendered by the principal accountant relating to tax compliance, tax advice, and tax planning and specifically include fees for tax return preparation. These fees include payments for tax return compliance services, excise distribution review services, and other tax related matters.

(3) All other fees consist of the aggregate fees billed for products and services provided by the principal accountant other than audit, audit-related, and tax services. These figures are also reported in the response to Item 4(g) below.

The following table presents the aggregate fees billed to all Series of the Trust (other than the Funds) with fiscal years ending on October 31 for the fiscal years ended October 31, 2023 and October 31, 2024 by PwC for professional services rendered for the audit of the annual financial statements of the applicable Series and fees billed for other services rendered by PwC during those periods.

Fiscal Years Ended | 10/31/2023 | 10/31/2024 |

| | | |

| Audit Fees | $625,508 | $629,391 |

| | | |

Audit-Related Fees(1) | $0 | $0 |

| | | |

Tax Fees(2) | $171,000 | $196,680 |

| | | |

All Other Fees(3) | $0 | $0 |

| | | |

| Total | $796,508 | $826,071 |

| | | |

| | | |

(1) Audit-related fees consist of the aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit of financial statements and are not reported under the category of audit fees.

(2) Tax fees consist of the aggregate fees billed for professional services rendered by the principal accountant relating to tax compliance, tax advice, and tax planning and specifically include fees for tax return preparation. These fees include payments for tax return compliance services, excise distribution review services, and other tax related matters.

(3) All other fees consist of the aggregate fees billed for products and services provided by the principal accountant other than audit, audit-related, and tax services. These figures are also reported in response to Item 4(g) below.

(e) Registrant’s audit committee charter, adopted in February 2010, provides that the audit committee (comprised of the independent Trustees of registrant) is responsible for pre‑approval of all auditing services performed for the registrant. The audit committee also is responsible for pre-approval (subject to the de minimis exceptions for non-audit services described in Section 10A(i)(1)(B) of the Securities Exchange Act of 1934) of all non-auditing services performed for the registrant or an affiliate of registrant. In addition, registrant’s audit committee charter permits a designated member of the audit committee to pre-approve, between meetings, one or more audit or non-audit service projects, subject to an expense limit and notification to the audit committee at the next committee meeting. Registrant’s audit committee pre-approved all fees described above that PwC billed to registrant.

(f) Less than 50% of the hours billed by PwC for auditing services to registrant for the fiscal year ended December 31, 2024 was for work performed by persons other than full-time permanent employees of PwC.

(g) The aggregate non-audit fees billed by PwC to registrant and to registrant’s investment adviser and any entity controlling, controlled by, or under common control with registrant’s investment adviser for the fiscal years set forth below are disclosed in the table below. These figures are also reported in response to Item 4(d) above.

Fiscal Year Ended | 10/31/2023 | 12/31/2023 | 10/31/2024 | 12/31/2024 |

Registrant(1) | $0 | $0 | $0 | $0 |

| Adviser | $0 | $0 | $0 | $0 |

(h) Registrant’s audit committee has considered the non-audit services provided to the registrant and registrant’s investment adviser and any entity controlling, controlled by, or under common control with registrant’s investment adviser as described above and determined that these services do not compromise PwC’s independence.

Item 5. Audit Committee of Listed Registrants

(a) Not applicable.

(b) Not applicable.

Item 6. Investments

(a) Registrant’s Schedules of Investments are included in the financial statements filed under Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies

The registrant’s audited financial statements and financial highlights as of the end of the period covered by this report are included in this Form N-CSR.

Financial

Statements

and

Additional

Information

Report

of

Independent

Registered

Public

Accounting

Firm

2

Schedule

of

Investments

Thrivent

Diversified

Income

Plus

Fund

3

Statement

of

Assets

and

Liabilities

38

Statement

of

Operations

39

Statement

of

Changes

in

Net

Assets

40

Notes

to

Financial

Statements

41

Financial

Highlights

54

Federal

Tax

Information

56

Change

in

and

Disagreement

with

Accountants

(Item

8)

57

Proxy

Disclosures

(Item

9)

58

Remuneration

Paid

to

Directors,

Officers,

and

Oth-

ers

(Item

10)

59

Statement

Regarding

Basis

for

Approval

of

Invest-

ment

Advisory

Contract

(Item

11)

60

To

the

Board

of

Trustees

of

Thrivent

Mutual

Funds

and

Shareholders

of

Thrivent

Diversified

Income

Plus

Fund

Opinion

on

the

Financial

Statements

We

have

audited

the

accompanying

statement

of

assets

and

liabilities,

including

the

schedule

of

investments,

of

Thrivent

Diversified

Income

Plus

Fund

(one

of

the

funds

constituting

Thrivent

Mutual

Funds,

hereafter

collectively

referred

to

as

the

"Fund")

as

of

December

31,

2024,

the

related

statement

of

operations

for

the

year

ended

December

31,

2024,

the

statement

of

changes

in

net

assets

for

each

of

the

two

years

in

the

period

ended

December

31,

2024,

including

the

related

notes,

and

the

financial

highlights

for

each

of

the

five

years

in

the

period

ended

December

31,

2024

(collectively

referred

to

as

the

“financial

statements”).

In

our

opinion,

the

financial

statements

present

fairly,

in

all

material

respects,

the

financial

position

of

the

Fund

as

of

December

31,

2024,

the

results

of

its

operations

for

the

year

then

ended,

the

changes

in

its

net

assets

for

each

of

the

two

years

in

the

period

ended

December

31,

2024

and

the

financial

highlights

for

each

of

the

five

years

in

the

period

ended

December

31,

2024

in

conformity

with

accounting

principles

generally

accepted

in

the

United

States

of

America.

Basis

for

Opinion

These

financial

statements

are

the

responsibility

of

the

Fund’s

management.

Our

responsibility

is

to

express

an

opinion

on

the

Fund’s

financial

statements

based

on

our

audits.

We

are

a

public

accounting

firm

registered

with

the

Public

Company

Accounting

Oversight

Board

(United

States)

(PCAOB)

and

are

required

to

be

independent

with

respect

to

the

Fund

in

accordance

with

the

U.S.

federal

securities

laws

and

the

applicable

rules

and

regulations

of

the

Securities

and

Exchange

Commission

and

the

PCAOB.

We

conducted

our

audits

of

these

financial

statements

in

accordance

with

the

standards

of

the

PCAOB.

Those

standards

require

that

we

plan

and

perform

the

audit

to

obtain

reasonable

assurance

about

whether

the

financial

statements

are

free

of

material

misstatement,

whether

due

to

error

or

fraud.

Our

audits

included

performing

procedures

to

assess

the

risks

of

material

misstatement

of

the

financial

statements,

whether

due

to

error

or

fraud,

and

performing

procedures

that

respond

to

those

risks.

Such

procedures

included

examining,

on

a

test

basis,

evidence

regarding

the

amounts

and

disclosures

in

the

financial

statements.

Our

audits

also

included

evaluating

the

accounting

principles

used

and

significant

estimates

made

by

management,

as

well

as

evaluating

the

overall

presentation

of

the

financial

statements.

Our

procedures

included

confirmation

of

securities

owned

as

of

December

31,

2024

by

correspondence

with

the

custodian,

transfer

agent

and

brokers;

when

replies

were

not

received

from

brokers,

we

performed

other

auditing

procedures.

We

believe

that

our

audits

provide

a

reasonable

basis

for

our

opinions.

Minneapolis,

Minnesota

February

18,

2025

We

have

served

as

the

auditor

of

one

or

more

investment

companies

in

the

Thrivent

Financial

investment

company

complex

since

1987.

PricewaterhouseCoopers

LLP,

45

South

Seventh

Street,

Suite

3400,

Minneapolis,

MN

55402

T:

(612)

596

6000,

www.pwc.com/us

Report

of

Independent

Registered

Public

Accounting

Firm

Diversified

Income

Plus

Fund

Schedule

of

Investments

as

of

December

31,

2024

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

schedule.

Principal

Amount

Long-Term

Fixed

Income

68.9%

Value

Asset-Backed

Securities 6.4%

Affirm

Asset

Securitization

Trust

$

1,250,000

6.820%,

9/15/2028,

Ser.

2023-B,

Class

A

a

$

1,267,514

64,680

7.110%,

11/15/2028,

Ser.

2023-X1,

Class

A

a

64,839

1,500,000

5.610%,

2/15/2029,

Ser.

2024-A,

Class

A

a

1,510,941

AGL

CLO

13,

Ltd.

1,100,000

6.529%,

(TSFR3M

+

1.912%),

10/20/2034,

Ser.

2021-13A,

Class

B

a,b

1,100,516

Anchorage

Capital

CLO

20,

Ltd.

850,000

7.570%,

(TSFR3M

+

3.200%),

1/20/2035,

Ser.

2021-20A,

Class

DR

a,b

850,000

Anchorage

Capital

CLO

21,

Ltd.

1,225,000

7.279%,

(TSFR3M

+

2.662%),

10/20/2034,

Ser.

2021-21A,

Class

C

a,b

1,229,740

Balboa

Bay

Loan

Funding,

Ltd.

625,000

6.331%,

(TSFR3M

+

1.750%),

10/20/2035,

Ser.

2020-1A,

Class

BRR

a,b

625,041

Ballyrock

CLO,

Ltd.

1,450,000

6.429%,

(TSFR3M

+

1.812%),

10/20/2031,

Ser.

2020-2A,

Class

A2R

a,b

1,452,781

Business

Jet

Securities,

LLC

814,148

4.455%,

6/15/2037,

Ser.

2022-1A,

Class

A

a

789,580

1,635,738

6.197%,

5/15/2039,

Ser.

2024-1A,

Class

A

a

1,663,487

CarVal

CLO

IV,

Ltd.

1,250,000

6.629%,

(TSFR3M

+

2.012%),

7/20/2034,

Ser.

2021-1A,

Class

B

a,b

1,250,621

CarVal

CLO,

Ltd.

1,700,000

8.317%,

(TSFR3M

+

3.700%),

4/21/2034,

Ser.

2022-1A,

Class

D

a,b

1,705,909

Cascade

Funding

Mortgage

Trust,

LLC

724,917

4.250%,

4/25/2033,

Ser.

2023-HB12,

Class

A

a,b

717,808

Dryden

36

Senior

Loan

Fund

1,025,000

6.968%,

(TSFR3M

+

2.312%),

4/15/2029,

Ser.

2014-36A,

Class

CR3

a,b

1,026,170

FirstKey

Homes

Trust

1,400,000

1.968%,

10/19/2037,

Ser.

2020-SFR2,

Class

D

a

1,359,569

Hotwire

Funding,

LLC

1,500,000

5.893%,

6/20/2054,

Ser.

2024-1A,

Class

A2

a

1,515,085

HTAP

964,024

7.000%,

4/25/2037,

Ser.

2024-1,

Class

A

a

956,894

HTAP

Issuer

Trust

702,097

6.500%,

4/25/2042,

Ser.

2024-2,

Class

A

a

692,049

Principal

Amount

Long-Term

Fixed

Income 68.9%

Value

Asset-Backed

Securities 6.4%

-

continued

Huntington

Bank

Auto

Credit-

Linked

Notes

$

233,491

5.442%,

10/20/2032,

Ser.

2024-2,

Class

B1

a

$

233,675

Madison

Park

Funding

XVIII,

Ltd.

1,725,000

6.779%,

(TSFR3M

+

2.162%),

10/21/2030,

Ser.

2015-18A,

Class

CRR

a,b

1,727,175

MetroNet

Infrastructure

Issuer,

LLC

1,500,000

6.230%,

4/20/2054,

Ser.

2024-1A,

Class

A2

a

1,530,123

MFA

Trust

732,064

6.330%,

9/25/2054,

Ser.

2024-NPL1,

Class

A1

c

733,402

Neuberger

Berman

CLO,

Ltd.

1,650,000

7.918%,

(TSFR3M

+

3.262%),

10/15/2029,

Ser.

2013-15A,

Class

DR2

a,b

1,652,759

Pagaya

AI

Debt

Grantor

Trust

1,150,000

5.092%,

7/15/2032,

Ser.

2024-11,

Class

A

a

1,150,671

Pagaya

AI

Debt

Grantor

Trust

and

Pagaya

AI

Debt

Trust

694,956

6.093%,

11/15/2031,

Ser.

2024-6,

Class

A

a

701,933

Palmer

Square

Loan

Funding,

Ltd.

250,000

6.150%,

(TSFR3M

+

1.700%),

1/15/2033,

Ser.

2024-2A,

Class

B

a,b

250,005

Pretium

Mortgage

Credit

Partners,

LLC

1,900,000

5.438%,

1/25/2052,

Ser.

2022-NPL1,

Class

A2

a,c

1,826,806

1,222,076

7.021%,

2/25/2054,

Ser.

2024-NPL2,

Class

A1

a,c

1,227,173

1,252,641

7.143%,

3/25/2054,

Ser.

2024-RN1,

Class

A1

a,c

1,256,863

1,455,836

7.520%,

4/27/2054,

Ser.

2024-NPL3,

Class

A1

a,c

1,471,056

1,324,375

3.721%,

7/25/2051,

Ser.

2021-NPL3,

Class

A2

a,c

1,300,752

1,462,817

6.996%,

7/25/2054,

Ser.

2024-NPL4,

Class

A1

a,c

1,469,150

Progress

Residential

Trust

2,350,000

3.600%,

4/17/2039,

Ser.

2022-SFR3,

Class

B

a

2,262,364

PRPM,

LLC

437,853

6.474%,

7/25/2026,

Ser.

2021-6,

Class

A2

a,c

430,928

RCKT

Mortgage

Trust

1,020,402

6.147%,

6/25/2044,

Ser.

2024-CES4,

Class

A1A

a,c

1,028,218

RCO

VII

Mortgage,

LLC

1,067,321

7.021%,

1/25/2029,

Ser.

2024-1,

Class

A1

a,c

1,070,216

Renaissance

Home

Equity

Loan

Trust

1,429,634

5.797%,

8/25/2036,

Ser.

2006-2,

Class

AF3

c

518,476

RR

8,

Ltd.

1,250,000

6.356%,

(TSFR3M

+

1.700%),

7/15/2037,

Ser.

2020-8A,

Class

A2R

a,b

1,256,010

Diversified

Income

Plus

Fund

Schedule

of

Investments

as

of

December

31,

2024

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

schedule.

Principal

Amount

Long-Term

Fixed

Income 68.9%

Value

Asset-Backed

Securities 6.4%

-

continued

Saxon

Asset

Securities

Trust

$

567,623

2.546%,

8/25/2035,

Ser.

2004-2,

Class

MF2

b

$

488,286

Sculptor

CLO,

Ltd.

950,000

7.279%,

(TSFR3M

+

2.662%),

1/20/2035,

Ser.

28A,

Class

C

a,b

951,522

Signal

Peak

CLO

1,

Ltd.

1,100,000

6.295%,

(TSFR3M

+

1.950%),

4/17/2034,

Ser.

2014-1A,

Class

CR4

a,b

1,100,000

Silver

Point

CLO

2,

Ltd.

1,800,000

7.317%,

(TSFR3M

+

2.700%),

4/20/2035,

Ser.

2023-2A,

Class

A2

a,b

1,806,764

Stanwich

Mortgage

Loan

Company,

LLC

59,243

6.235%,

10/16/2026,

Ser.

2021-NPB1,

Class

A1

a

59,373

Symphony

CLO

XX,

Ltd.

1,050,000

7.647%,

(TSFR3M

+

3.000%),

1/16/2032,

Ser.

2018-20A,

Class

DR2

a,b

1,052,381

TCW

CLO,

Ltd.

1,400,000

6.330%,

(TSFR3M

+

1.800%),

10/25/2035,

Ser.

2018-1A,

Class

BR3

a,b

1,399,175

Unlock

HEA

Trust

1,382,529

7.000%,

10/25/2038,

Ser.

2023-1,

Class

A

a

1,374,855

1,386,991

7.000%,

4/25/2039,

Ser.

2024-1,

Class

A

a

1,377,746

647,129

6.500%,

10/25/2039,

Ser.

2024-2,

Class

A

a

632,669

Upstart

Securitization

Trust

117,225

6.770%,

6/20/2033,

Ser.

2023-2,

Class

A

a

117,661

Vericrest

Opportunity

Loan

Transferee

1,311,680

4.826%,

2/27/2051,

Ser.

2021-NPL2,

Class

A2

a,c

1,306,662

1,628,469

4.949%,

2/27/2051,

Ser.

2021-NPL3,

Class

A2

a,c

1,622,535

1,145,049

4.826%,

4/25/2051,

Ser.

2021-NPL6,

Class

A2

a,c

1,128,518

338,654

4.949%,

4/25/2051,

Ser.

2021-NPL8,

Class

A2

a,c

333,893

1,736,615

4.826%,

5/25/2051,

Ser.

2021-NPL9,

Class

A2

a,c

1,701,380

401,813

5.438%,

12/26/2051,

Ser.

2021-NP12,

Class

A2

a,c

382,383

Whitebox

CLO

I,

Ltd.

500,000

6.635%,

(TSFR3M

+

2.000%),

7/24/2036,

Ser.

2019-1A,

Class

CRR

a,b

500,893

Whitebox

CLO

IV,

Ltd.

1,250,000

7.217%,

(TSFR3M

+

2.600%),

4/20/2036,

Ser.

2023-4A,

Class

B

a,b

1,257,305

Principal

Amount

Long-Term

Fixed

Income 68.9%

Value

Asset-Backed

Securities 6.4%

-

continued

Wind

River

CLO,

Ltd.

$

950,000

6.879%,

(TSFR3M

+

2.262%),

7/20/2030,

Ser.

2013-1A,

Class

BRR

a,b

$

950,927

Total

62,421,227

Basic

Materials 0.9%

Alliance

Resource

Operating

Partners,

LP/Alliance

Resource

Finance

Corporation

167,000

8.625%,

6/15/2029

a

175,473

ATI,

Inc.

268,000

7.250%,

8/15/2030

275,585

Axalta

Coating

Systems

Dutch

Holding

B

BV

163,000

7.250%,

2/15/2031

a

168,678

Cascades,

Inc./Cascades

USA,

Inc.

297,000

5.125%,

1/15/2026

a,d

294,004

Chemours

Company

270,000

5.750%,

11/15/2028

a

250,813

Cleveland-Cliffs,

Inc.

130,000

5.875%,

6/1/2027

129,263

210,000

4.625%,

3/1/2029

a

194,991

118,000

4.875%,

3/1/2031

a

105,333

78,000

7.375%,

5/1/2033

a

76,612

118,000

6.250%,

10/1/2040

101,799

Consolidated

Energy

Finance

SA

409,000

5.625%,

10/15/2028

a

333,576

Ecolab,

Inc.

174,000

2.125%,

2/1/2032

144,638

First

Quantum

Minerals,

Ltd.

149,000

6.875%,

10/15/2027

a

148,293

FMC

Corporation

135,000

5.150%,

5/18/2026

135,146

FMG

Resources

August

2006,

Pty.

Ltd.

118,000

5.875%,

4/15/2030

a

115,969

Glencore

Funding,

LLC

136,000

5.893%,

4/4/2054

a

131,940

196,000

4.000%,

3/27/2027

a

192,178

Hecla

Mining

Company

160,000

7.250%,

2/15/2028

161,003

Hudbay

Minerals,

Inc.

198,000

4.500%,

4/1/2026

a

195,171

Illuminate

Buyer,

LLC/Illuminate

Holdings

IV,

Inc.

142,000

9.000%,

7/1/2028

a

143,781

INEOS

Finance

plc

353,000

7.500%,

4/15/2029

a

361,339

International

Flavors

&

Fragrances,

Inc.

201,000

1.230%,

10/1/2025

a

195,391

Magnera

Corporation

179,000

7.250%,

11/15/2031

a

174,749

Mercer

International,

Inc.

143,000

5.125%,

2/1/2029

123,608

Methanex

Corporation

179,000

5.125%,

10/15/2027

175,187

119,000

5.250%,

12/15/2029

114,675

Diversified

Income

Plus

Fund

Schedule

of

Investments

as

of

December

31,

2024

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

schedule.

Principal

Amount

Long-Term

Fixed

Income 68.9%

Value

Basic

Materials 0.9%

-

continued

Methanex

US

Operations,

Inc.

$

102,000

6.250%,

3/15/2032

a

$

100,914

Mineral

Resources,

Ltd.

192,000

9.250%,

10/1/2028

a

201,441

Mosaic

Company

198,000

5.375%,

11/15/2028

d

200,172

Newmont

Corporation/Newcrest

Finance,

Pty.

Ltd.

200,000

5.350%,

3/15/2034

198,988

Novelis

Corporation

53,000

3.250%,

11/15/2026

a

50,483

124,000

4.750%,

1/30/2030

a

114,455

150,000

3.875%,

8/15/2031

a

129,149

Nutrien,

Ltd.

273,000

4.000%,

12/15/2026

269,217

Peabody

Energy

Corporation,

Convertible

354,000

3.250%,

3/1/2028

d

446,394

SCIL

IV,

LLC/SCIL

USA

Holdings,

LLC

250,000

5.375%,

11/1/2026

a

244,852

Sherwin-Williams

Company

144,000

4.800%,

9/1/2031

142,104

Smurfit

Kappa

Treasury,

ULC

210,000

5.777%,

4/3/2054

a

207,995

SNF

Group

SACA

392,000

3.375%,

3/15/2030

a

343,536

SunCoke

Energy,

Inc.

435,000

4.875%,

6/30/2029

a

396,565

Taseko

Mines,

Ltd.

248,000

8.250%,

5/1/2030

a

253,145

Tronox,

Inc.

124,000

4.625%,

3/15/2029

a

111,296

United

States

Steel

Corporation,

Convertible

242,000

5.000%,

11/1/2026

620,972

Westlake

Corporation

130,000

3.600%,

8/15/2026

d

127,345

Total

8,778,218

Capital

Goods 1.7%

Advanced

Drainage

Systems,

Inc.

242,000

6.375%,

6/15/2030

a

242,021

AECOM

128,000

5.125%,

3/15/2027

126,771

Array

Technologies,

Inc.,

Convertible

459,000

1.000%,

12/1/2028

333,922

BAE

Systems

plc

200,000

5.500%,

3/26/2054

a

194,701

Boeing

Company

136,000

6.858%,

5/1/2054

144,547

412,000

5.930%,

5/1/2060

381,227

222,000

2.196%,

2/4/2026

215,294

197,000

3.250%,

3/1/2028

185,105

293,000

5.150%,

5/1/2030

288,893

68,000

6.528%,

5/1/2034

71,237

Bombardier,

Inc.

56,000

7.875%,

4/15/2027

a

56,085

146,000

6.000%,

2/15/2028

a

145,408

258,000

7.250%,

7/1/2031

a

266,069

Principal

Amount

Long-Term

Fixed

Income 68.9%

Value

Capital

Goods 1.7%

-

continued

$

338,000

7.000%,

6/1/2032

a,d

$

343,834

Builders

FirstSource,

Inc.

250,000

5.000%,

3/1/2030

a

237,654

Camelot

Return

Merger

Sub,

Inc.

177,000

8.750%,

8/1/2028

a

169,611

Canpack

SA/Canpack

US,

LLC

366,000

3.875%,

11/15/2029

a

329,588

Carrier

Global

Corporation

265,000

2.722%,

2/15/2030

237,055

Chart

Industries,

Inc.

296,000

7.500%,

1/1/2030

a

307,745

Clydesdale

Acquisition

Holdings,

Inc.

58,000

6.625%,

4/15/2029

a

58,384

Crown

Cork

&

Seal

Company,

Inc.

142,000

7.375%,

12/15/2026

145,685

EMRLD

Borrower,

LP/Emerald

Co-

Issuer,

Inc.

252,000

6.625%,

12/15/2030

a

252,336

ESAB

Corporation

98,000

6.250%,

4/15/2029

a

99,219

Fluor

Corporation,

Convertible

416,000

1.125%,

8/15/2029

d

522,704

GFL

Environmental,

Inc.

311,000

4.000%,

8/1/2028

a

294,484

300,000

3.500%,

9/1/2028

a

282,740

Greenbrier

Companies,

Inc.,

Convertible

249,000

2.875%,

4/15/2028

d

301,414

H&E

Equipment

Services,

Inc.

386,000

3.875%,

12/15/2028

a

352,780

Herc

Holdings,

Inc.

76,000

5.500%,

7/15/2027

a

75,029

194,000

6.625%,

6/15/2029

a

196,458

Honeywell

International,

Inc.

272,000

5.250%,

3/1/2054

254,723

Howmet

Aerospace,

Inc.

205,000

6.750%,

1/15/2028

214,323

Huntington

Ingalls

Industries,

Inc.

196,000

4.200%,

5/1/2030

185,992

Ingersoll

Rand,

Inc.

226,000

5.176%,

6/15/2029

228,233

68,000

5.700%,

8/14/2033

69,582

John

Bean

Technologies

Corporation,

Convertible

299,000

0.250%,

5/15/2026

296,907

John

Deere

Capital

Corporation

141,000

4.700%,

6/10/2030

140,643

280,000

4.400%,

9/8/2031

271,675

144,000

3.900%,

6/7/2032

133,826

67,000

5.150%,

9/8/2033

67,217

L3Harris

Technologies,

Inc.

144,000

5.400%,

1/15/2027

145,770

Lockheed

Martin

Corporation

187,000

5.200%,

2/15/2064

173,442

Martin

Marietta

Materials,

Inc.

111,000

5.150%,

12/1/2034

108,993

Miter

Brands

Acquisition

Holdco,

Inc./MIWD

Borrower,

LLC

74,000

6.750%,

4/1/2032

a

74,347

Diversified

Income

Plus

Fund

Schedule

of

Investments

as

of

December

31,

2024

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

schedule.

Principal

Amount

Long-Term

Fixed

Income 68.9%

Value

Capital

Goods 1.7%

-

continued

MIWD

Holdco

II,

LLC

$

72,000

5.500%,

2/1/2030

a

$

68,009

Mueller

Water

Products,

Inc.

249,000

4.000%,

6/15/2029

a

230,045

Nesco

Holdings

II,

Inc.

284,000

5.500%,

4/15/2029

a

263,524

New

Enterprise

Stone

and

Lime

Company,

Inc.

359,000

5.250%,

7/15/2028

a

346,806

Northrop

Grumman

Corporation

275,000

5.200%,

6/1/2054

255,813

63,000

4.700%,

3/15/2033

61,067

OI

European

Group

BV

251,000

4.750%,

2/15/2030

a

223,450

Otis

Worldwide

Corporation

230,000

2.056%,

4/5/2025

228,226

Owens-Brockway

Glass

Container,

Inc.

216,000

6.625%,

5/13/2027

a

215,072

Pactiv

Evergreen

Group

116,000

4.375%,

10/15/2028

a

115,907

Parker-Hannifin

Corporation

141,000

4.250%,

9/15/2027

139,514

Patrick

Industries,

Inc.,

Convertible

180,000

1.750%,

12/1/2028

244,780

Republic

Services,

Inc.

131,000

3.950%,

5/15/2028

127,546

131,000

5.000%,

12/15/2033

128,866

Resideo

Funding,

Inc.

246,000

6.500%,

7/15/2032

a

246,307

Reworld

Holding

Corporation

111,000

4.875%,

12/1/2029

a

102,655

Roller

Bearing

Company

of

America,

Inc.

336,000

4.375%,

10/15/2029

a

313,950

RTX

Corporation

204,000

5.750%,

1/15/2029

210,594

575,000

4.500%,

6/1/2042

496,280

Sealed

Air

Corporation/Sealed

Air

Corporation

(US)

188,000

6.125%,

2/1/2028

a

188,626

Smyrna

Ready

Mix

Concrete,

LLC

343,000

8.875%,

11/15/2031

a

359,620

Spirit

AeroSystems,

Inc.

103,000

3.850%,

6/15/2026

100,520

60,000

9.750%,

11/15/2030

a

66,396

SRM

Escrow

Issuer,

LLC

85,000

6.000%,

11/1/2028

a

82,906

Standard

Industries,

Inc./NY

118,000

4.750%,

1/15/2028

a

112,926

118,000

3.375%,

1/15/2031

a

101,174

Textron,

Inc.

196,000

3.650%,

3/15/2027

190,992

Trane

Technologies

Financing,

Ltd.

151,000

5.100%,

6/13/2034

149,296

TransDigm,

Inc.

75,000

6.750%,

8/15/2028

a

75,654

416,000

7.125%,

12/1/2031

a

425,969

347,000

6.625%,

3/1/2032

a

350,132

Trivium

Packaging

Finance

184,000

5.500%,

8/15/2026

a

181,365

Principal

Amount

Long-Term

Fixed

Income 68.9%

Value

Capital

Goods 1.7%

-

continued

United

Rentals

North

America,

Inc.

$

310,000

4.000%,

7/15/2030

$

282,200

Veralto

Corporation

139,000

5.350%,

9/18/2028

140,777

Waste

Connections,

Inc.

70,000

3.200%,

6/1/2032

61,266

WESCO

Distribution,

Inc.

124,000

6.375%,

3/15/2029

a

125,657

87,000

6.625%,

3/15/2032

a

88,425

Total

16,325,985

Collateralized

Mortgage

Obligations 5.8%

A&D

Mortgage

Trust

353,493

6.498%,

4/25/2069,

Ser.

2024-NQM2,

Class

A1

a,c

356,704

ACRA

Trust

695,840

5.912%,

10/25/2064,

Ser.

2024-NQM1,

Class

A2

a,c

693,483

Alternative

Loan

Trust

532,785

6.000%,

8/1/2036,

Ser.

2006-24CB,

Class

A9

276,284

Banc

of

America

Alternative

Loan

Trust

495,339

6.000%,

11/25/2035,

Ser.

2005-10,

Class

3CB1

431,072

Banc

of

America

Mortgage

Securities

Trust

284,509

6.404%,

9/25/2035,

Ser.

2005-H,

Class

3A1

b

266,681

Bear

Stearns

Adjustable

Rate

Mortgage

Trust

77,480

7.080%,

(CMT

1Y

+

2.300%),

10/25/2035,

Ser.

2005-9,

Class

A1

b

72,683

CAFL

Issuer,

LLC

666,539

2.239%,

3/28/2029,

Ser.

2021-RTL1,

Class

A1

a,c

661,002

CHL

Mortgage

Pass-Through

Trust

106,822

6.744%,

12/20/2035,

Ser.

2005-HYB8,

Class

3A1

b

103,081

701,303

6.000%,

11/25/2037,

Ser.

2007-18,

Class

1A2

303,125

CHNGE

Mortgage

Trust

1,185,285

3.757%,

3/25/2067,

Ser.

2022-2,

Class

A1

a,b

1,118,046

1,042,316

5.000%,

5/25/2067,

Ser.

2022-3,

Class

A1

a,b

1,026,840

1,080,868

6.525%,

6/25/2058,

Ser.

2023-2,

Class

A1

a,c

1,088,661

743,462

5.820%,

6/25/2067,

Ser.

2022-NQM1,

Class

A3

a,c

741,081

709,971

7.100%,

7/25/2058,

Ser.

2023-3,

Class

A1

a,c

718,700

776,549

6.000%,

10/25/2057,

Ser.

2022-4,

Class

A1

a,c

773,353

CIM

Trust

1,282,000

7.100%,

4/25/2058,

Ser.

2023-I1,

Class

A3

a,c

1,291,833

Citigroup

Mortgage

Loan

Trust,

Inc.

83,258

5.500%,

8/25/2034,

Ser.

2004-NCM2,

Class

1CB1

80,210

Diversified

Income

Plus

Fund

Schedule

of

Investments

as

of

December

31,

2024

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

schedule.

Principal

Amount

Long-Term

Fixed

Income 68.9%

Value

Collateralized

Mortgage

Obligations 5.8%

-

continued

$

840,813

5.251%,

4/25/2037,

Ser.

2007-AR5,

Class

1A1A

b

$

743,327

COLT

Mortgage

Loan

Trust

1,129,629

6.328%,

12/25/2068,

Ser.

2024-INV1,

Class

A2

a,c

1,137,708

Countrywide

Alternative

Loan

Trust

414,659

5.000%,

3/25/2035,

Ser.

2005-3CB,

Class

1A1

335,284

219,232

4.160%,

10/25/2035,

Ser.

2005-43,

Class

4A1

b

176,678

143,860

5.500%,

2/25/2036,

Ser.

2005-85CB,

Class

2A2

113,073

Countrywide

Home

Loan

Mortgage

Pass

Through

Trust

437,780

5.190%,

11/25/2035,

Ser.

2005-22,

Class

2A1

b

358,102

CSMC

Trust

674,074

6.567%,

8/25/2067,

Ser.

2022-ATH3,

Class

A3

a,b

674,136

535,074

2.572%,

11/25/2066,

Ser.

2022-NQM1,

Class

A2

a,b

449,520

Deutsche

Alt-A

Securities,

Inc.,

Mortgage

Loan

Trust

631,262

5.250%,

6/25/2035,

Ser.

2005-3,

Class

4A6

559,177

290,863

4.250%,

8/25/2035,

Ser.

2005-AR1,

Class

2A3

b

253,746

Federal

Home

Loan

Mortgage

Corporation

1,354,672

3.500%,

8/15/2035,

Ser.

345,

Class

C8

e

131,622

Federal

Home

Loan

Mortgage

Corporation

-

REMIC

2,646,995

4.000%,

1/25/2051,

Ser.

5249,

Class

LA

2,560,258

1,540,299

Zero

Coupon,

9/25/2053,

Ser.

5334,

Class

BO

1,214,315

5,907,190

1.500%,

12/25/2050,

Ser.

5107,

Class

IO

e

463,386

33,758

2.500%,

5/15/2027,

Ser.

4106,

Class

HI

e

137

360,743

3.000%,

5/15/2027,

Ser.

4046,

Class

GI

e

6,975

439,715

3.000%,

7/15/2027,

Ser.

4084,

Class

NI

e

11,018

582,606

3.000%,

7/15/2027,

Ser.

4074,

Class

IO

e

14,737

240,554

2.500%,

2/15/2028,

Ser.

4162,

Class

AI

e

5,586

501,765

2.500%,

2/15/2028,

Ser.

4161,

Class

UI

e

12,254

804,779

2.500%,

3/15/2028,

Ser.

4177,

Class

EI

e

21,497

1,088,284

3.500%,

10/15/2032,

Ser.

4119,

Class

KI

e

90,392

730,689

3.000%,

2/15/2033,

Ser.

4170,

Class

IG

e

51,746

931,143

3.000%,

4/15/2033,

Ser.

4203,

Class

DI

e

38,949

Federal

National

Mortgage

Association

-

REMIC

1,365,893

4.500%,

6/25/2052,

Ser.

2022-43,

Class

MA

1,339,060

Principal

Amount

Long-Term

Fixed

Income 68.9%

Value

Collateralized

Mortgage

Obligations 5.8%

-

continued

$

709,099

3.000%,

7/25/2027,

Ser.

2012-73,

Class

DI

e

$

15,548

434,586

3.000%,

7/25/2027,

Ser.

2012-74,

Class

AI

e

9,195

584,280

3.000%,

8/25/2027,

Ser.

2012-95,

Class

HI

e

7,566

479,625

3.500%,

9/25/2027,

Ser.

2012-98,

Class

YI

e

11,747

1,392,099

3.000%,

11/25/2027,

Ser.

2012-121,

Class

BI

e

35,533

979,391

3.000%,

12/25/2027,

Ser.

2012-139,

Class

DI

e

23,456

331,538

2.500%,

1/25/2028,

Ser.

2012-152,

Class

AI

e

7,759

872,440

3.000%,

1/25/2028,

Ser.

2012-147,

Class

EI

e

19,122

236,311

2.500%,

2/25/2028,

Ser.

2013-46,

Class

CI

e

3,452

331,551

3.000%,

2/25/2028,

Ser.

2013-2,

Class

GI

e

9,073

209,775

3.000%,

4/25/2028,

Ser.

2013-30,

Class

DI

e

6,105

310,325

3.000%,

11/25/2031,

Ser.

2013-69,

Class

IO

e

2,720

1,017,454

3.000%,

2/25/2033,

Ser.

2013-1,

Class

YI

e

77,267

First

Horizon

Alternative

Mortgage

Securities

Trust

158,744

7.003%,

3/25/2035,

Ser.

2005-AA2,

Class

1A1

b

154,606

138,070

5.576%,

7/25/2035,

Ser.

2005-AA5,

Class

2A1

b

127,400

Flagstar

Mortgage

Trust

468,237

2.500%,

9/25/2041,

Ser.

2021-9INV,

Class

A1

a,b

412,411

GCAT

Trust

1,048,675

4.250%,

5/25/2067,

Ser.

2023-NQM4,

Class

A2

a,b

959,890

324,266

6.000%,

9/25/2054,

Ser.

2024-INV3,

Class

A1

a,b

323,392

GMAC

Mortgage

Corporation

Loan

Trust

311,447

3.863%,

5/25/2035,

Ser.

2005-AR2,

Class

4A

b

264,521

Government

National

Mortgage

Association

77,413

4.000%,

1/16/2027,

Ser.

2012-3,

Class

IO

e

1,003

GS

Mortgage-Backed

Securities

Trust

997,633

5.500%,

10/27/2053,

Ser.

2023-PJ3,

Class

A16

a,b

992,611

Home

RE,

Ltd.

1,550,000

9.160%,

(SOFR30A

+

4.600%),

10/25/2033,

Ser.

2023-1,

Class

M1B

a,b

1,605,912

1,336,987

8.069%,

(SOFR30A

+

3.500%),

10/25/2034,

Ser.

2022-1,

Class

M1B

a,b

1,345,915

IndyMac

IMJA

Mortgage

Loan

Trust

949,211

6.250%,

11/25/2037,

Ser.

2007-A3,

Class

A1

389,552

Diversified

Income

Plus

Fund

Schedule

of

Investments

as

of

December

31,

2024

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

schedule.

Principal

Amount

Long-Term

Fixed

Income 68.9%

Value

Collateralized

Mortgage

Obligations 5.8%

-

continued

J.P.

Morgan

Mortgage

Trust

$

697,394

2.774%,

5/25/2052,

Ser.

2021-LTV2,

Class

A2

a,b

$

571,979

1,017,534

5.000%,

10/25/2053,

Ser.

2023-3,

Class

A4A

a,b

1,000,518

71,312

6.500%,

1/25/2035,

Ser.

2005-S1,

Class

1A2

72,078

351,492

5.289%,

2/25/2036,

Ser.

2006-A1,

Class

2A2

b

249,219

LHOME

Mortgage

Trust

900,000

7.017%,

1/25/2029,

Ser.

2024-RTL1,

Class

A1

a,c

909,292

750,000

6.900%,

5/25/2029,

Ser.

2024-RTL3,

Class

A1

a,c

757,513

Merrill

Lynch

Alternative

Note

Asset

Trust

891,555

6.000%,

3/25/2037,

Ser.

2007-F1,

Class

2A1

307,583

MFA

Trust

1,500,000

7.093%,

2/25/2029,

Ser.

2024-RTL1,

Class

A1

a,c

1,509,978

MortgageIT

Securities

Corporation

Mortgage

Loan

Trust

1,622,106

4.913%,

(TSFR1M

+

0.574%),

6/25/2047,

Ser.

2007-1,

Class

1A1

b

1,419,654

NYMT

Loan

Trust

1,000,000

7.154%,

2/25/2029,

Ser.

2024-BPL1,

Class

A1

a,c

1,011,098

1,150,000

6.509%,

5/25/2039,

Ser.

2024-BPL2,

Class

A1

a,c

1,159,174

Pretium

Mortgage

Credit

Partners,

LLC

350,000

8.956%,

10/25/2054,

Ser.

2024-NPL7,

Class

A2

a,c

349,909

PRKCM

Trust

1,263,579

7.087%,

6/25/2058,

Ser.

2023-AFC2,

Class

A3

a

1,269,340

1,148,426

7.627%,

11/25/2058,

Ser.

2023-AFC4,

Class

A2

a,c

1,172,583

PRPM,

LLC

1,122,924

4.000%,

1/25/2054,

Ser.

2024-RCF1,

Class

A1

a,c

1,095,989

1,000,000

3.500%,

5/25/2054,

Ser.

2024-RPL2,

Class

A2

a,c

920,916

798,266

5.689%,

9/25/2029,

Ser.

2024-5,

Class

A1

a,c

795,232

487,339

5.699%,

11/25/2029,

Ser.

2024-6,

Class

A1

a,c

487,388

750,000

8.835%,

12/25/2029,

Ser.

2024-7,

Class

A2

a,c

749,269

Residential

Accredit

Loans,

Inc.

Trust

391,883

6.000%,

8/25/2035,

Ser.

2005-QS10,

Class

2A

337,446

281,137

6.000%,

1/25/2037,

Ser.

2007-QS1,

Class

1A1

216,867

528,491

6.250%,

4/25/2037,

Ser.

2007-QS6,

Class

A6

432,052

Residential

Asset

Securitization

Trust

424,850

4.971%,

1/25/2034,

Ser.

2004-IP1,

Class

A1

b

399,300

Principal

Amount

Long-Term

Fixed

Income 68.9%

Value

Collateralized

Mortgage

Obligations 5.8%

-

continued

Residential

Funding

Mortgage

Security

I

Trust

$

361,241

6.000%,

7/25/2037,

Ser.

2007-S7,

Class

A20

$

283,069

Roc

Mortgage

Trust

408,731

3.487%,

8/25/2026,

Ser.

2021-RTL1,

Class

A1

a,b

408,731

1,250,000

5.589%,

10/25/2039,

Ser.

2024-RTL1,

Class

A1

a,c

1,241,335

Saluda

Grade

Alternative

Mortgage

Trust

2,000,000

7.439%,

7/25/2030,

Ser.

2024-RTL6,

Class

A1

a,c

2,012,137

Sequoia

Mortgage

Trust

424,383

3.972%,

9/20/2046,

Ser.

2007-1,

Class

4A1

b

284,546

Structured

Adjustable

Rate

Mortgage

Loan

Trust

177,369

5.166%,

7/25/2035,

Ser.

2005-15,

Class

4A1

b

150,116

Toorak

Mortgage

Trust

1,500,000

7.333%,

2/25/2031,

Ser.

2024-1,

Class

A1

a,c

1,513,890

Triangle

Re,

Ltd.

1,556,223

7.969%,

(SOFR30A

+

3.400%),

11/25/2033,

Ser.

2023-1,

Class

M1A

a,b

1,579,967

TVC

Mortgage

Trust

1,500,000

8.250%,

11/25/2027,

Ser.

2023-RTL1,

Class

A1

a,c

1,516,395

Verus

Securitization

Trust

1,069,424

2.491%,

11/25/2066,

Ser.

2021-8,

Class

A3

a,b

938,427

1,091,017

6.560%,

12/25/2067,

Ser.

2023-1,

Class

A2

a,c

1,096,657

WaMu

Mortgage

Pass-Through

Certificates

128,325

6.600%,

5/25/2033,

Ser.

2003-AR4,

Class

A7

b

125,339

Washington

Mutual

Mortgage

Pass-Through

Certificates

304,029

6.000%,

3/25/2035,

Ser.

2005-1,

Class

2A

254,667

Total

56,170,931

Commercial

Mortgage-Backed

Securities 0.5%

BANK

2018-BNK12

1,000,000

4.342%,

5/15/2061,

Ser.

2018-BN12,

Class

AS

b

966,440

BBCMS

Mortgage

Trust

5,970,388

1.150%,

9/15/2055,

Ser.

2022-C17,

Class

XA

b,e

422,139

ROCK

Trust

1,150,000

5.388%,

11/13/2041,

Ser.

2024-CNTR,

Class

A

a

1,146,794

Silver

Hill

Trust

145,886

3.102%,

11/25/2049,

Ser.

2019-1,

Class

A1

a,b

142,497

Velocity

Commercial

Capital

Loan

Trust

707,504

6.550%,

1/25/2054,

Ser.

2024-1,

Class

A

a,b

710,060

Diversified

Income

Plus

Fund

Schedule

of

Investments

as

of

December

31,

2024

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

schedule.

Principal

Amount

Long-Term

Fixed

Income 68.9%

Value

Commercial

Mortgage-Backed

Securities 0.5%

-

continued

$

548,628

6.650%,

6/25/2054,

Ser.

2024-3,

Class

A

a,b

$

552,747

1,042,586

7.670%,

11/25/2053,

Ser.

2023-4,

Class

A

a,b

1,066,400

Total

5,007,077

Communications

Services 2.3%

AMC

Networks,

Inc.

62,000

10.250%,

1/15/2029

a

65,830

American

Tower

Corporation

260,000

4.400%,

2/15/2026

258,672

135,000

1.450%,

9/15/2026

127,626

191,000

5.500%,

3/15/2028

193,823

136,000

5.800%,

11/15/2028

139,616

196,000

3.800%,

8/15/2029

185,547

191,000

5.000%,

1/31/2030

189,900

AppLovin

Corporation

225,000

5.500%,

12/1/2034

223,323

AT&T,

Inc.

224,000

5.700%,

3/1/2057

214,983

688,000

3.550%,

9/15/2055

462,739

407,000

4.300%,

2/15/2030

394,169

136,000

5.400%,

2/15/2034

136,545

Bell

Telephone

Company

of

Canada

134,000

5.100%,

5/11/2033

130,217

Cable

One,

Inc.,

Convertible

178,000

1.125%,

3/15/2028

d

146,405

CCO

Holdings,

LLC/CCO

Holdings

Capital

Corporation

433,000

5.125%,

5/1/2027

a

425,475

42,000

5.000%,

2/1/2028

a

40,484

16,000

4.750%,

3/1/2030

a

14,611

695,000

4.500%,

8/15/2030

a

623,829

291,000

4.250%,

2/1/2031

a

253,614

204,000

4.750%,

2/1/2032

a

179,046

360,000

4.250%,

1/15/2034

a

292,064

CenterPoint

Energy,

Inc.,

Convertible

9,881

3.369%,

9/15/2029

391,683

Charter

Communications

Operating,

LLC/Charter

Communications

Operating

Capital

Corporation

537,000

4.200%,

3/15/2028

519,101

196,000

5.050%,

3/30/2029

191,784

199,000

6.550%,

6/1/2034

203,559

Clear

Channel

Outdoor

Holdings,

Inc.

266,000

7.875%,

4/1/2030

a

273,765

Clear

Channel

Worldwide

Holdings,

Inc.

198,000

5.125%,

8/15/2027

a

190,588

Comcast

Corporation

408,000

5.650%,

6/1/2054

394,403

326,000

3.400%,

4/1/2030

302,494

Crown

Castle,

Inc.

218,000

2.900%,

3/15/2027

209,300

83,000

4.900%,

9/1/2029

82,078

Deluxe

Corporation

73,000

8.125%,

9/15/2029

a

74,023

Principal

Amount

Long-Term

Fixed

Income 68.9%

Value

Communications

Services 2.3%

-

continued

Deutsche

Telekom

International

Finance

BV

$

368,000

8.750%,

6/15/2030

$

427,561

DIRECTV

Financing,

LLC/DIRECTV

Financing

Co-Obligor,

Inc.

642,000

5.875%,

8/15/2027

a

625,500

Frontier

Communications

Holdings,

LLC

250,000

5.875%,

10/15/2027

a

249,207

GCI,

LLC

250,000

4.750%,

10/15/2028

a

233,482

Gray

Television,

Inc.

78,000

10.500%,

7/15/2029

a

77,995

Iliad

Holding

SASU

313,000

8.500%,

4/15/2031

a

332,770

160,000

7.000%,

4/15/2032

a

160,809

Intelsat

Jackson

Holdings

SA

317,000

6.500%,

3/15/2030

a

292,392

Lamar

Media

Corporation

238,000

3.625%,

1/15/2031

209,465

LCPR

Senior

Secured

Financing

DAC

501,000

6.750%,

10/15/2027

a

453,305

Level

3

Financing,

Inc.

51,000

3.625%,

1/15/2029

a,d

40,545

119,524

10.500%,

4/15/2029

a

133,198

119,524

11.000%,

11/15/2029

a

134,455

213,000

10.500%,

5/15/2030

a

231,957

McGraw-Hill

Education,

Inc.

355,000

5.750%,

8/1/2028

a

346,609

Meta

Platforms,

Inc.

267,000

5.550%,

8/15/2064

260,281

132,000

3.850%,

8/15/2032

122,673

250,000

4.750%,

8/15/2034

243,357

News

Corporation

197,000

3.875%,

5/15/2029

a

182,744

Nexstar

Media,

Inc.

145,000

5.625%,

7/15/2027

a

141,427

155,000

4.750%,

11/1/2028

a

144,519

Optics

Bidco

SPA

262,000

6.000%,

9/30/2034

a

251,530

Outfront

Media

Capital,

LLC/

Outfront

Media

Capital

Corporation

27,000

4.625%,

3/15/2030

a

24,950

Paramount

Global

417,000

6.375%,

3/30/2062

b

403,065

Playtika

Holding

Corporation

189,000

4.250%,

3/15/2029

a

171,329

Rogers

Communications,

Inc.

250,000

5.250%,

3/15/2082

a,b

242,900

204,000

5.000%,