Worldwide Emerging Markets Fund

Top Ten Equity Holdings as of June 30, 2006* (unaudited)

Petróleo Brasileiro S.A. (Petrobras)

(Brazil, 6.1%)

Petrobras explores for, produces, refines, transports, and markets petroleum and petroleum products, including gasoline, diesel oil, jet fuel, aromatic extracts, petrochemicals and turpentine. The company operates refineries, oil tankers and a distribution pipeline grid in Brazil and markets its products in Brazil and abroad.

LUKOIL

(Russia, 4.6%)

LUKOIL explores for, produces, refines, transports and markets oil and gas, mainly from Western Siberia. The company also manufactures petrochemicals, fuels, and other petroleum products. LUKOIL operates refineries, and gasoline filling stations in Russia and the United States. The company transports oil through pipelines, and petroleum products with its fleet of ships.

Samsung Electronics Co. Ltd.

(South Korea, 3.3%)

Samsung Electronics manufactures and exports a wide range of consumer and industrial electronic equipment, such as memory chips, semiconductors, personal computers, telecommunications equipment and televisions.

Kookmin Bank

(South Korea, 3.3%)

Kookmin Bank provides various commercial banking services, such as deposits, credit cards, trust funds, foreign exchange transactions, and corporate finance. The Bank also offers Internet banking services.

Cia Vale do Rio Doce (CVRD)

(Brazil, 3.0%)

Cia Vale do Rio Doce produces and sells iron ore, pellets, manganese, iron alloys, gold, kaolin, bauxite, alumina, aluminum and potash. The company owns stakes in several steel companies. CVRD also owns and operates railroads and maritime terminals in Brazil.

HON HAI Precision Industry Co. Ltd.

(Taiwan, 2.6%)

HON HAI Precision manufactures and assembles a broad range of products for the computer and communications industries, including personal computer (PC) connectors and cable assemblies used in desktop PCs and PC servers.

SFA Engineering Corp.

(South Korea, 2.6%)

SFA Engineering’s principal activities are manufacturing and servicing technologies in factory automation and logistic management systems. The company focuses on key production and distribution attributes including quality control, communications, highly reliable production, system engineering and precision processing.

Hyundai Mobis

(South Korea, 2.4%)

Hyundai Mobis manufactures and markets automotive parts and equipment both for auto assembly and the after-sales market.

FirstRand Ltd.

(South Africa, 2.2%)

FirstRand provides diverse financial services in the areas of retail, corporate, investment and merchant banking, life insurance, employee benefits, health insurance and asset and property management. The banking and insurance activities of the group are consolidated in the wholly owned subsidiaries FirstRand Bank Holdings Limited and Momentum Group Limited.

Mahindra & Mahindra Ltd.

(India, 2.0%)

Mahindra & Mahindra manufactures automobiles, farm equipment and automotive components. The company’s automobile products include light-, medium- and heavy-commercial vehicles, multi-utility vehicles and passenger cars. Its farm equipment sector designs, develops, manufactures and markets tractors, servicing the Indian market.

*Portfolio is subject to change.

Company descriptions courtesy of Bloomberg.com.7

Worldwide Emerging Markets Fund

Explanation of Expenses (unaudited)

Hypothetical $1,000 investment at beginning of period

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including program fees on purchase payments; and (2) ongoing costs, including management fees and other Fund expenses. This disclosure is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, January 1, 2006 to June 30, 2006.

Actual Expenses

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over a period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as program fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | Expenses Paid |

| | | Beginning | Ending | During Period* |

| | | Account Value | Account Value | January 1, 2006- |

| | | January 1, 2006 | June 30, 2006 | June 30, 2006 |

|

|

|

|

|

| Initial Class | Actual | $1,000.00 | $1,107.90 | $7.16 |

| | Hypothetical (5% return before expenses) | $1,000.00 | $1,018.00 | $6.85 |

|

|

|

|

|

| Class R1 | Actual | $1,000.00 | $1,108.00 | $7.21 |

| | Hypothetical (5% return before expenses) | $1,000.00 | $1,017.95 | $6.90 |

|

|

|

|

|

| * | Expenses are equal to the Fund’s annualized expense ratio (for the six months ended June 30, 2006) of 1.37% on the Initial Class shares and 1.38% on the Class R1 shares, multiplied by the average account value over the period, multiplied by 181 divided by 365 (to reflect the one-half year period) |

| |

8

Worldwide Emerging Markets Fund

Schedule of Portfolio Investments

June 30, 2006 (unaudited)

| | No. of | | | | Value |

Country | Shares | | Securities | | (Note 1) |

|

|

|

|

|

|

Common Stocks: | | | | |

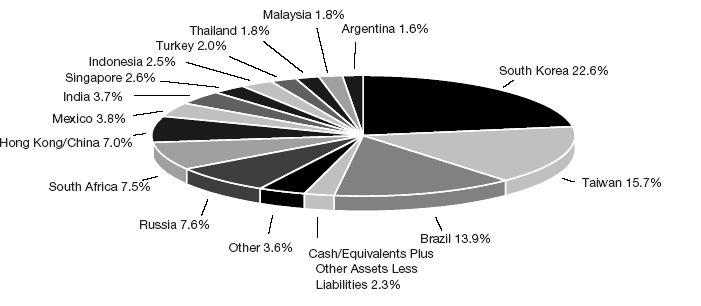

ARGENTINA 1.6% | | | | |

| | 220,000 | | Inversiones y Representaciones | |

| | | | S.A. (GDR)† | $ | 2,470,600 |

| | 35,000 | | Tenaris S.A. (ADR) | | 1,417,150 |

| | | |

|

|

| | | | | | 3,887,750 |

| | | |

|

|

BRAZIL 12.3% | | | | |

| | 100,000,000 | | AES Tiete S.A. | | 2,400,850 |

| | 269,532 | | Cia Vale do Rio Doce | | 5,485,466 |

| | 32,000 | | Guararapes Confeccoes S.A. | 1,167,182 |

| | 1,048,837 | | Investimentos Itau S.A. | | 4,222,660 |

| | 150,000 | | Petroleo Brasileiro S.A. (ADR) | 13,396,500 |

| | 208,000 | | Saraiva S.A. Livreiros Editores | 1,949,490 |

| | 115,000 | | Vivax S.A.† | | 1,627,384 |

| | | |

|

|

| | | | | | 30,249,532 |

| | | |

|

|

| CHINA 0.6% | | | | |

| | 1,230,000 | | Weiqiao Textile Co.# | | 1,577,908 |

| | | |

|

|

| EGYPT 0.4% | | | | |

| | 25,000 | | Orascom Telecom Holding SAE | |

| | | | (GDR)# R | | 1,019,351 |

| | | |

|

|

HONG KONG 6.4% | | | | |

| | 3,120,000 | | Chen Hsong Holdings# | | 1,670,277 |

| | 5,997,000 | | CNOOC Ltd.# | | 4,817,234 |

| | 1,140,000 | | Kingboard Chemical Holdings | |

| | | | Ltd.# | | 3,212,468 |

| | 1,026,000 | | Lifestyle International Holdings | |

| | | | Ltd.# | | 1,875,262 |

| | 440,000 | | Midland Holdings Ltd.# | | 195,584 |

| | 2,965,000 | | Techtronic Industries Co.# | | 4,010,890 |

| | | |

|

|

| | | | | | 15,781,715 |

| | |

|

|

HUNGARY 0.9% | | | | |

| | 80,000 | | OTP Bank PCL# | | 2,266,219 |

| | | |

|

|

| INDIA 3.7% | | | | |

| | 55,000 | | Bharat Electronics Ltd.# | | 1,286,855 |

| | 45,000 | | Infosys Technologies Ltd.# | | 3,010,959 |

| | 360,000 | | Mahindra & Mahindra Ltd.# | 4,875,938 |

| | | |

|

|

| | | | | | 9,173,752 |

| | | |

|

|

INDONESIA 2.5% | | | | |

| | 19,714,000 | | Berlian Laju Tanker Tbk PT# | 3,684,450 |

| | 2,000,000 | | Perusahaan Gas Negara | | |

| | | | Tbk PT# | | 2,433,067 |

| | | |

|

|

| | | | | | 6,117,517 |

| | | |

|

|

| | | | | | |

MALAYSIA 1.8% | | | | |

| | 500,000 | | KNM Group BHD# | | 816,333 |

| | 895,000 | | MAA Holdings BHD# | | 757,082 |

| | 1,500,000 | | Media Prima BHD† | | 661,314 |

| | 132,920 | | Multi-Purpose Holdings | | |

| | | | BHD Rights (MYR 1.00, | | |

| | | | expiring 2/26/09)† | | 7,596 |

| | 595,000 | | Transmile Group BHD | | 2,072,663 |

| | | |

|

|

| | | | | | 4,314,988 |

| | | |

|

|

| MEXICO 3.8% | | | | |

| | 50,000 | | America Movil S.A. de C.V. | | |

| | | | (ADR) | | 1,663,000 |

| | 798,500 | | Corporacion GEO, S.A. | | |

| | | | de C.V. (Series B)† | | 2,645,884 |

| | 30,000 | | Fomento Economico Mexico | | |

| | | | S.A. (ADR) | | 2,511,600 |

| | 905,000 | | Grupo Financiero Banorte | | |

| | | | S.A. de C.V. | | 2,098,666 |

| | 187,500 | | Urbi Desarrollos Urbanos S.A. | | |

| | | | de C.V.† | | 434,807 |

| | | |

|

|

| | | | | | 9,353,957 |

| | | |

|

|

NIGERIA 0.2% | | | | |

| | 3,999,990 | | Guaranty Trust Bank | | 443,301 |

| | | |

|

|

PANAMA 1.3% | | | | |

| | 140,000 | | Copa Holdings S.A. (ADR) | | 3,171,000 |

| | | |

|

|

PHILIPPINES 0.8% | | | | |

| | 506,400 | | SM Investments Corp.# | | 2,042,257 |

| | | |

|

|

| RUSSIA 7.6% | | | | |

| | 135,000 | | LUKOIL (ADR) | | 11,286,000 |

| | 85,000 | | OAO Gazprom (ADR) | | 3,562,327 |

| | 285,000 | | Ritek (USD)# | | 2,364,989 |

| | 200,000 | | TNK-BP Holding (USD) | | 540,000 |

| | 5,000 | | Vismpo-Avisma Corp. (USD)†# | | 951,669 |

| | | |

|

|

| | | | | | 18,704,985 |

| | | |

|

|

SINGAPORE 2.6% | | | | |

| | 2,400,000 | | Citiraya Industries Ltd.†# | | — |

| | 2,190,000 | | Ezra Holdings Ltd.# | | 3,064,994 |

| | 2,151,000 | | First Engineering Ltd.# | | 1,170,880 |

| | 550,000 | | Goodpack Ltd.†# | | 567,723 |

| | 31,250 | | Goodpack Ltd. Warrants | | |

| | | | (SGD 1.00, expiring | | |

| | | | 4/13/07 | | 11,253 |

| | 2,400,000 | | Tat Hong Holdings Ltd.# | | 1,599,607 |

| | | |

|

|

| | | | | | 6,414,457 |

| | | |

|

|

See Notes to Financial Statements

9

Worldwide Emerging Markets Fund

Schedule of Portfolio Investments

June 30, 2006 (unaudited) (continued)

| | No. of | | | | Value |

Country | Shares | | Securities | | (Note 1) |

|

|

|

|

|

|

| SOUTH AFRICA 7.5% | | |

| | 501,000 | | African Bank Investments Ltd.# $ | $ | 1,955,402 |

| | 240,000 | | Bidvest Group Ltd.# | | 3,294,935 |

| | 2,269,200 | | FirstRand Ltd.# | | 5,315,000 |

| | 175,000 | | Naspers Ltd.# | | 2,974,448 |

| | 390,000 | | Spar Group Ltd.# | | 1,875,392 |

| | 150,000 | | Standard Bank Group Ltd.# | | 1,603,182 |

| | 115,775 | | Sun International Ltd.# | | 1,349,677 |

| | | |

|

|

| | | | 18,368,036 |

| | | |

|

|

| SOUTH KOREA 22.6% | | |

| | 38,000 | | Core Logic, Inc.# | | 1,098,454 |

| | 209,806 | | From30 Co. Ltd.†# | | 1,568,846 |

| | 77,000 | | Hynix Semiconductor, Inc.†# | | 2,488,712 |

| | 69,500 | | Hyundai Mobis# | | 5,871,669 |

| | 32,000 | | Hyundai Motor Co.# | | 2,716,338 |

| | 100,800 | | Hyunjin Materials Co. Ltd.†# | | 1,456,278 |

| | 137,250 | | Kenertec Co. Ltd.# | | 902,737 |

| | 99,000 | | Kookmin Bank# | | 8,156,817 |

| | 60,000 | | LS Industrial Systems Co. Ltd.# | | 2,105,973 |

| | 120,000 | | Meritz Fire & Marine Insurance | | |

| | | | Co. Ltd.# | | 713,519 |

| | 125,000 | | Phicom Corp.# | | 1,479,396 |

| | 12,950 | | Samsung Electronics Co. Ltd.# | | 8,219,469 |

| | 181,000 | | SFA Engineering Corp.# | | 6,327,478 |

| | 5,550 | | Shinsegae Co. Ltd.# | | 2,778,477 |

| | 177,510 | | STX Shipbuilding Co Ltd.# | | 1,905,216 |

| | 210,157 | | Taewoong Co. Ltd.# | | 4,344,484 |

| | 125,000 | | Woori Finance holdings Co. | | |

| | | | Ltd.# | | 2,346,699 |

| | 150,000 | | YNK KOREA, Inc.†# | | 953,643 |

| | | |

|

|

| | | | 55,434,205 |

| | | |

|

|

TAIWAN 15.7% | | | | |

| | 1,034,751 | | Advantech Co. Ltd.# | | 2,965,660 |

| | 2,834,671 | | Asia Vital Components Co. Ltd.# | | 1,416,473 |

| | 440,000 | | Catcher Technology Co. Ltd.# | | 4,654,530 |

| | 3,750,000 | | Formosa Taffeta Co. Ltd.# | | 1,963,196 |

| | 330,000 | | Foxconn Technology Co. Ltd.# | | 2,647,591 |

| | 1,440,090 | | Gemtek Technology Corp.# | | 2,491,948 |

| | 150,000 | | High Tech Computer Corp.# | | 4,123,183 |

| | 1,045,103 | | HON HAI Precision Industry | | |

| | | | Co. Ltd.# | | 6,452,572 |

| | 4,060,000 | | King Yuan Electronics Co. Ltd.# | | 3,401,070 |

| | 158,000 | | MediaTek, Inc.# | | 1,462,477 |

| | 510,744 | | Novatek Microelectronics Corp. | | |

| | | | Ltd.# | | 2,476,006 |

| | 1,750,000 | | Uni-President Enterprises | | |

| | | | Corp.# | | 1,524,018 |

| | 1,850,000 | | Zyxel Communications Corp.# | | 3,031,224 |

| | | |

|

|

| | | | 38,609,948 |

| | | |

|

|

| | | | | | |

THAILAND 1.8% | | | | |

| | 605,000 | | Bangkok Bank PCL# | | 1,621,234 |

| | 6,689,760 | | Minor International PCL | | 1,658,401 |

| | 668,976 | | Minor International PCL | | |

| | | | Warrants (THB 6.00, | | |

| | | | expiring 3/29/08)† | | 85,991 |

| | 205,000 | | Siam Cement PCL# | | 1,151,941 |

| | | |

|

|

| | | | | | 4,517,567 |

| | | |

|

|

| TURKEY 2.0% | | | | |

| | 419,999 | | Enka Insaat ve Sanayi A.S.# | | 3,051,325 |

| | 1,249,999 | | GSD Holding†# | | 1,091,194 |

| | 141,249 | | Haci Omer Sabanci Holding | | |

| | | | A.S.# | | 376,380 |

| | 98,000 | | Selcuk Ecza Deposu Ticaret | | |

| | | | ve Sanayi A.S.† | | 287,343 |

| | | |

|

|

| | | | | | 4,806,242 |

| | | |

|

|

| Total Common Stocks 96.1% | | |

| (Cost: $158,236,061) | | 236,254,687 |

|

|

|

Preferred Stocks: | | | | |

| BRAZIL 1.6% | | | | |

| | 96,000 | | Cia Vale do Rio Doce (ADR) | | 1,975,680 |

| | 77,600 | | Petroleo Brasileiro S.A. | | 1,547,056 |

| | 125,000 | | Randon Participacoes S.A. | | 410,915 |

| |

| | | |

| Total Preferred Stocks 1.6% |

|

|

(Cost: $7,886,943) | | 3,933,651 |

| | | |

|

|

See Notes to Financial Statements

10

Worldwide Emerging Markets Fund

Schedule of Portfolio Investments

June 30, 2006 (unaudited) (continued)

Principal | Date of | Interest | | Value |

Amount | Maturity | Rate | | (Note 1) |

|

|

|

|

|

Short-Term Obligations 2.0% | | | |

| Repurchase Agreement (Note 11): | | | |

| Purchased on 6/30/06; | | | | |

| Maturity value $5,037,805 | | | | |

| (with State Street Bank | | | | |

| & Trust Co., collateralized | | | | |

| by $5,280,000 Federal Home | | | |

| Loan Bank 4.375% due | | | | |

| 9/17/10 with a value of | | | | |

| $5,138,058) | | | | |

| (Cost: $5,036,000) | 7/3/06 | 4.30% | $ | 5,036,000 |

| | |

|

|

Total Investments 99.7% | | | | |

| (Cost: $171,159,004) | | | | 245,224,338 |

|

Other assets less liabilities 0.3% | | | 685,109 |

| |

|

|

|

Net Assets 100.0% | | | $ | 245,909,447 |

| | |

|

|

| Summary of | | % of |

| Investments by Sector | | Net Assets |

|

|

|

|

| Basic Materials | | 4.9 | % |

| Communications | | 6.3 | % |

| Consumer, Cyclical | | 14.9 | % |

| Consumer, Non-Cyclical | | 1.5 | % |

| Diversified | | 3.2 | % |

| Energy | | 15.3 | % |

| Financial | | 13.5 | % |

| Industrial | | 21.4 | % |

| Technology | | 14.7 | % |

| Utilities | | 2.0 | % |

| Short-Term Obligations | | 2.0 | % |

| Other Assets Less Liabilities | | 0.3 | % |

| |

|

|

| | | 100.0 | % |

| |

|

|

Glossary:

ADR-American Depositary Receipt

GDR-Global Depositary Receipt

MYR-Malaysian Ringgit

SGD-Singapore Dollar

THB-Thai Baht

USD-United States Dollar

| † - Non-income producing |

| # - Indicates a fair valued security which has not been valued utilizing an independent quote, but has been valued pursuant to |

| guidelines established by the Board of Trustees. The aggregate value of fair valued securities is $168,976,259 which represented |

| 68.7% of net assets. |

| R - Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended, or otherwise restricted. These |

| securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At June 30, 2006, these |

| securities are considered liquid and the market value amounted to $1,091,351 or 0.4% of total net assets. |

| |

| Restricted securities held by the Fund are as follows: |

| | | | | | | | | | | Value | |

| | | Acquisition | | | | Acquisition | | | | as % of | |

| Security | | Date | | Shares | | Cost | | Value | | Net Assets | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Orascom Telecom Holding SAE | | 8/24/05 | | 25,000 | | 1,124,500 | | $1,091,351 | | 0.4% | |

| | | | | | | |

| |

| |

11

Worldwide Emerging Markets Fund

| Statement of Assets and Liabilities | | | |

| June 30, 2006 (unaudited) | | | |

| | | | |

| Assets: | | | |

| Investments, at value (cost $171,159,004) (Note 1) | | $ | 245,224,338 |

| Cash | | | 29 |

| Foreign currency (cost: $3,056,716) | | | 3,034,626 |

| Receivables: | | | |

| Securities sold | | | 91,706 |

| Capital shares sold | | | 766,152 |

| Dividends and interest | | | 338,826 |

| Prepaid expenses and other assets | | | 42,210 |

| |

|

|

| Total assets | | | 249,497,887 |

| |

|

|

| |

| Liabilities: | | | |

| Payables: | | | |

| Securities purchased | | | 2,231,570 |

| Capital shares redeemed | | | 666,471 |

| Due to Adviser | | | 230,487 |

| Due to Trustees | | | 36,574 |

| Accrued expenses | | | 423,338 |

| |

|

|

| Total liabilities | | | 3,558,440 |

| |

|

|

| |

| Net Assets | | $ | 245,909,447 |

| |

|

|

| Initial Class Shares: | | | |

| Net Assets | | $ | 183,180,138 |

| |

|

|

| Shares outstanding | | | 9,230,909 |

| |

|

|

| Net asset value, redemption and offering price per share | | $ | 19.84 |

| |

|

|

| Class R1 Shares: | | | |

| Net Assets | | $ | 62,729,309 |

| |

|

|

| Shares outstanding | | | 3,164,245 |

| |

|

|

| Net asset value, redemption and offering price per share | | $ | 19.82 |

| |

|

|

| |

| Net Assets consist of: | | | |

| Aggregate paid in capital | | $ | 137,902,933 |

Unrealized appreciation of investments and foreign currency transactions | | | 73,765,630 |

| Undistributed net investment income | | | 676,607 |

| Undistributed net realized gain | | | 33,564,277 |

| |

|

|

| | | $ | 245,909,447 |

| |

|

|

See Notes to Financial Statements

12

Worldwide Emerging Markets Fund

| Statement of Operations | | | | | | | |

| Six Months Ended June 30, 2006 (unaudited) | | | | | | | |

| |

| Income (Note 1): | | | | | | | |

| Dividends (net of foreign taxes withheld of $218,317) | | | | | $ | 2,384,410 | |

| Interest | | | | | | 364,851 | |

| | | | |

|

| |

| Total income | | | | | | 2,749,261 | |

| |

| Expenses: | | | | | | | |

| Management (Note 2) | | $ | 1,395,358 | | | | |

| Custodian | | | 234,555 | | | | |

| Insurance | | | 87,084 | | | | |

| Professional | | | 71,166 | | | | |

| Report to shareholders | | | 53,888 | | | | |

| Trustees’ fees and expenses | | | 34,966 | | | | |

| Transfer agency - Initial Class Shares | | | 6,809 | | | | |

| Transfer agency - R1 Class Shares | | | 6,111 | | | | |

| Interest (Note 10) | | | 1,486 | | | | |

| Other | | | 24,670 | | | | |

| |

|

| | | | |

| Total expenses | | | 1,916,093 | | | | |

| Expenses assumed by the Adviser (Note 2) | | | (1,813 | ) | | | |

| |

|

| | | | |

| Net expenses | | | | | | 1,914,280 | |

| | | | |

|

| |

| Net investment income | | | | | | 834,981 | |

| | | | |

|

| |

| |

| Realized and Unrealized Gain (Loss) on Investments (Note 3): | | | | | | | |

| Realized gain from security transactions | | | | | | 36,343,101 | |

| Realized loss from foreign currency transactions | | | | | | (74,833 | ) |

| Change in unrealized appreciation of investments | | | | | | (7,346,495 | ) |

| Change in unrealized appreciation of foreign denominated assets and liabilities | | | | | | (12,369 | ) |

| | | | |

|

| |

| Net realized and unrealized gain on investments | | | | | | 28,909,404 | |

| | | | |

|

| |

| |

| Net Increase in Net Assets Resulting from Operations | | | | | $ | 29,744,385 | |

| | | | |

|

| |

See Notes to Financial Statements

13

Worldwide Emerging Markets Fund

| Statements of Changes in Net Assets | | | | | | | |

| | | Six Months Ended | | Year Ended | |

| | | June 30, | | December 31, | |

| | | 2006 | | 2005 | |

| |

|

| |

|

| |

| | | (unaudited) | | | | |

| Change in Net Assets From: | | | | | | | |

| Operations: | | | | | | | |

| Net investment income | | $ | 834,981 | | $ | 2,318,878 | |

| Realized gain from security transactions | | | 36,343,101 | | | 34,711,410 | |

Realized loss from forward currency contracts and foreign currency transactions | | | (74,833 | ) | | (705,682 | ) |

| Change in unrealized appreciation of investments | | | (7,346,495 | ) | | 24,255,867 | |

Change in unrealized appreciation of foreign denominated assets and liabilities | | | (12,369 | ) | | (15,667 | ) |

| |

|

| |

|

| |

| Net increase in net assets resulting from operations | | | 29,744,385 | | | 60,564,806 | |

| |

|

| |

|

| |

| Distributions to shareholders from: | | | | | | | |

| Net investment income | | | | | | | |

| Initial Class Shares | | | (1,321,301 | ) | | (1,381,136 | ) |

| Class R1 Shares | | | (396,892 | ) | | (252,304 | ) |

| |

|

| |

|

| |

| | | | (1,718,193 | ) | | (1,633,440 | ) |

| |

|

| |

|

| |

| Net realized gains | | | | | | | |

| Initial Class Shares | | | (20,803,043 | ) | | — | |

| Class R1 Shares | | | (6,248,813 | ) | | — | |

| |

|

| |

|

| |

| | | | (27,051,856 | ) | | — | |

| |

|

| |

|

| |

| Total distributions | | | (28,770,049 | ) | | (1,633,440 | ) |

| |

|

| |

|

| |

| Capital share transactions*: | | | | | | | |

| Proceeds from sales of shares | | | | | | | |

| Initial Class Shares | | | 27,469,715 | | | 33,826,927 | |

| Class R1 Shares | | | 16,890,301 | | | 33,366,527 | |

| Reimbursement from Adviser (Note 13) | | | — | | | 140,145 | |

| |

|

| |

|

| |

| | | | 44,360,016 | | | 67,333,599 | |

| |

|

| |

|

| |

| Reinvestment of distributions | | | | | | | |

| Initial Class Shares | | | 22,124,344 | | | 1,381,136 | |

| Class R1 Shares | | | 6,645,705 | | | 252,304 | |

| |

|

| |

|

| |

| | | | 28,770,049 | | | 1,633,440 | |

| |

|

| | |

| |

| Cost of shares reacquired | | | | | | | |

| Initial Class Shares | | | (66,567,869 | ) | | (54,488,928 | ) |

| Class R1 Shares | | | (15,957,792 | ) | | (14,879,770 | ) |

| Redemption fees | | | 34,168 | | | 16,421 | |

| |

|

| | |

| |

| | | | (82,491,493 | ) | | (69,352,277 | ) |

| |

|

| | |

| |

| Net decrease in net assets resulting from capital share transactions | | | (9,361,428 | ) | | (385,238 | ) |

| |

|

| | |

| |

| Total increase (decrease) in net assets | | | (8,387,092 | ) | | 58,546,128 | |

| Net Assets: | | | | | | | |

| Beginning of year | | | 254,296,539 | | | 195,750,411 | |

| |

|

| | |

| |

| End of period (including undistributed net investment | | | | | | | |

| income of $676,607 and $1,634,652 respectively) | | $ | 245,909,447 | | $ | 254,296,539 | |

| |

|

| |

|

| |

* Shares of Beneficial Interest Issued and Reacquired (unlimited number of | | | | | | | |

| $.001 par value shares authorized):- | | | | | | | |

| Initial Class Shares: | | | | | | | |

| Shares sold | | | 1,338,678 | | | 2,013,780 | |

| Reinvestment of distributions | | | 1,110,660 | | | 88,876 | |

| Shares reacquired | | | (3,167,822 | ) | | (3,322,230 | ) |

| |

|

| | |

| |

| Net decrease | | | (718,484 | ) | | (1,219,574 | ) |

| |

|

| | |

| |

| Class R1 Shares: | | | | | | | |

| Shares sold | | | 819,251 | | | 2,020,334 | |

| Reinvestment of distributions | | | 333,955 | | | 16,236 | |

| Shares reacquired | | | (815,154 | ) | | (913,491 | ) |

| |

|

| | |

| |

| Net increase | | | 338,052 | | | 1,123,079 | |

| |

|

| | |

| |

See Notes to Financial Statements

14

Worldwide Emerging Markets Fund

Financial Highlights | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For a share outstanding throughout each period: | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Initial Class | | | | | | | | | Class R1 Shares | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | | | | | For the | |

| | | | | | | | | | | | | | | | | | | | | | | | | | Period | |

| Six Months | | | | | | | | | | | | Six Months | | | | | | May 1, 2004* | |

| Ended | | Year Ended December 31, | | | Ended | | | Year Ended | | | through | |

| June 30, | | |

|

|

|

|

|

|

|

|

|

|

|

|

| | | June 30, | | | December 31, | | | December 31, | |

| 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | | | 2006 | | | 2005 | | | 2004 | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| (unaudited) | | | | | | | | | | | | | | | | | | (unaudited) | | | | | | | |

| Net Asset Value, | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Beginning of Period | $ | 19.91 | | $ | 15.21 | | $ | 12.15 | | $ | 7.89 | | $ | 8.15 | | $ | 8.29 | | $ | 19.89 | | $ | 15.21 | | $ | 11.94 | |

|

|

| |

|

| |

|

|

|

|

| |

|

| |

|

| |

|

| |

|

|

|

|

| |

| Income (Loss) From | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Investment ncome | | 0.07 | | | 0.20 | | | 0.15 | | | 0.13 | | | 0.04 | | | 0.08 | | | 0.06 | | | 0.17 | | | 0.06 | |

| Net Realized and Unrealized | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gain (Loss) on Investments | | 2.08 | | | 4.63 | | | 2.98 | | | 4.14 | | | (0.28 | ) | | (0.22 | ) | | 2.09 | | | 4.64 | | | 3.21 | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Total from Investment Operations | | 2.15 | | | 4.83 | | | 3.13 | | | 4.27 | | | (0.24 | ) | | (0.14 | ) | | 2.15 | | | 4.81 | | | 3.27 | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Less Distributions from: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Investment Income | | (0.13 | ) | | (0.13 | ) | | (0.07 | ) | | (0.01 | ) | | (0.02 | ) | | — | | | (0.13 | ) | | (0.13 | ) | | — | |

| Distributions from capital gains | | (2.09 | ) | | — | | | — | | | — | | | — | | | — | | | (2.09 | ) | | — | | | — | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Total Distributions | | (2.22 | ) | | (0.13 | ) | | (0.07 | ) | | (0.01 | ) | | (0.02 | ) | | — | | | (2.22 | ) | | (0.13 | ) | | — | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Redemption fees | | — | (c) | | — | (c) | | — | (c) | | — | | | — | | | — | | | — | (c) | | — | (c) | | — | (c) |

|

|

| |

|

| |

|

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Net Asset Value, End of Period | $ | 19.84 | | $ | 19.91 | | $ | 15.21 | | $ | 12.15 | | $ | 7.89 | | $ | 8.15 | | $ | 19.82 | | $ | 19.89 | | $ | 15.21 | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Total Return (a) | | 10.79 | % | | 32.00 | % | | 25.89 | % | | 54.19 | % | | (3.02 | )% | | (1.69 | )% | | 10.80 | % | | 31.86 | % | | 27.39 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios/Supplementary Data | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Assets, End of Period (000) | $ | 183,180 | | $ | 198,077 | | $ | 169,845 | | $ | 176,308 | | $ | 149,262 | | $ | 134,424 | | $ | 62,729 | | $ | 56,219 | | $ | 25,906 | |

| Ratio of Gross Expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| to Average Net Assets | | 1.37 | %(d) | | 1.35 | % | | 1.39 | % | | 1.43 | % | | 1.36 | % | | 1.30 | % | | 1.39% | (d) | | 1.38 | % | | 1.52%(d) | |

| Ratio of Net Expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| to Average Net Assets (b) | | 1.37 | %(d) | | 1.34 | % | | 1.36 | % | | 1.34 | % | | 1.33 | % | | 1.30 | % | | 1.38% | (d) | | 1.36 | % | | 1.39%(d) | |

| Ratio of Net Investment Income | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| to Average Net Assets ( c) | | 0.60 | %(d) | | 1.09 | % | | 1.07 | % | | 1.27 | % | | 0.39 | % | | 1.04 | % | | 0.60% | (d) | | 1.04 | % | | 1.27%(d) | |

| Portfolio Turnover Rate | | 28 | % | | 65 | % | | 81 | % | | 63 | % | | 125 | % | | 135 | % | | 28 | % | | 65 | % | | 81 | % |

| (a) | | Total return is calculated assuming an initial investment of $10,000 made at the net asset value at the beginning of the period, reinvestment of any dis- |

| | | tributions at net asset value on the distribution payment date and a redemption on the last day of the period. The return does not reflect the deduction |

| | | of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | | Excluding interest expense, the ratio of net expenses to average net assets would be 1.30%, 1.30% and 1.28% for the Initial Class Shares for the years |

| | | ended December 31, 2003, 2002 and 2001, respectively. The ratio for all other periods shown would be unchanged if any interest expense incurred dur- |

| | | ing those periods were excluded. |

| (c) | | Amount represents less tan $0.01 per share. |

| (d) | | Annualized |

* Inception date of Class R1 Shares.

|

See Notes to Financial Statements

|

15

Worldwide Emerging Markets Fund

Notes to Financial Statements (unaudited)

Note 1—Significant Accounting Policies—Van Eck Worldwide Insurance Trust (the “Trust”), organized as a Massachusetts business trust on January 7, 1987, is registered under the Investment Company Act of 1940, as amended. The Worldwide Emerging Markets Fund (the “Fund”) is a diversified fund of the Trust and seeks long-term capital appreciation by investing primarily in equity securities in emerging markets around the world. The Fund offers two classes of shares: shares that have been continuously offered since the inception of the Fund, the Initial Class, and Class R1 shares that became available for purchase on May 1, 2004. The two classes are identical except Class R1 shares are, under certain circumstances, subject to a redemption fee on redemptions within 60 days. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with U.S. generally accepted accounting principles. The preparation of financial statements in conformity with U.S generally accepted accounting principles requires management to make estimates and assumptions that effect the reported amounts in the financial statements. Actual results could differ from those estimates.

A. Security Valuation—Securities traded on national exchanges or traded on the NASDAQ National Market System are valued at the last sales price as reported at the close of each business day. Securities traded on the NASDAQ Stock Market are valued at the NASDAQ official closing price. Over-the-counter securities not included in the NASDAQ National Market System and listed securities for which no sale was reported are valued at the mean of the bid and ask prices. Securities for which market values are not readily available, or whose values have been affected by events occurring before the Fund’s pricing time (4:00 p.m. Eastern Time) but after the close of the securities’ primary market, are valued using methods approved by the Board of Trustees. The Fund may also fair value securities in other situations, for example, when a particular foreign market is closed but the Fund is open. The price which the Fund may realize upon sale may differ materially from the value presented on the Schedule of Portfolio Investments. Short-term obligations purchased with more than sixty days remaining to maturity are valued at market value. Short-term obligations purchased with sixty days or less to maturity are valued at amortized cost, which with accrued interest approximates market value. Forward foreign currency contracts are valued at the spot currency rate plus an amount (“points”) which reflects the differences in interest rates between the U.S. and foreign markets. Securities for which quotations are not available are stated at fair value as determined by a Pricing Committee of the Adviser appointed by the Board of Trustees. Certain factors such as economic conditions, political events, market trends and security specific information are used to determine the fair value for these securities.

B. Federal Income Taxes—It is the Fund’s policy to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Therefore, no federal income tax provision is required.

C. Currency Translation—Assets and liabilities denominated in foreign currencies and commitments under forward foreign currency contracts are translated into U.S. dollars at the mean of the quoted bid and ask prices of such currencies as of the close of each business day. Purchases and sales of investments are translated at the exchange rates prevailing when such investments were acquired or sold. Income and expenses are translated at the exchange rates prevailing when accrued. The portion of realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed. Recognized gains or losses attributable to foreign currency fluctuations on foreign currency denominated assets, other than investments, and liabilities are recorded as realized gains or losses from foreign currency transactions.

D. Distributions to Shareholders—Distributions to shareholders from net investment income and realized gains, if any, are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from such amounts determined in accordance with U.S. generally accepted accounting principles.

E. Other—Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date. Dividends on foreign securities are recorded when the Funds are informed of such dividends. Realized gains and losses are calculated on the identified cost basis. Interest income, including amortization on premiums and discounts, is accrued as earned. Estimated foreign taxes that are expected to be withheld from proceeds at the sale of certain foreign investments are accrued by the Funds and decrease the unrealized gain on investments.

Income, expenses (excluding class-specific expenses) and realized/unrealized gains/losses are allocated proportionately to each class of shares based upon the relative net asset value of outstanding shares of each class at the beginning of the day (after adjusting for current capital share activity of the respective classes). Class-specific expenses are charged directly to the applicable class of shares.

F. Use of Derivative Instruments

Option Contracts—The Fund may invest, for hedging and other purposes, in call and put options on securities, currencies and commodities. Call and put options give the Fund the right but not the obligation to buy (calls) or sell (puts) the instrument underlying the option at a specified price. The premium paid on the option, should it be exercised, will, on a call, increase the cost of the instrument acquired and, on a put, reduce the proceeds received from the sale of the instrument underlying the option. If the options are not exercised, the premium paid will be recorded as a realized loss upon expiration. The Fund may incur additional risk to the extent the value of the underlying instrument does not correlate with the movement of the option value.

The Fund may also write call or put options. As the writer of an option, the Fund receives a premium. The Fund keeps the premium whether or not the option is exercised. The premium will be recorded, upon expiration of the option, as a short-term realized gain. If the option is exercised, the Fund must sell, in the case of a written call, or buy, in the case of a written put, the underlying instrument at the exercise price. The Fund may write only covered puts and calls. A covered call option is an option in which the Fund owns the instrument underlying the call. A covered call sold by the Fund exposes it during the term of the option to possible loss of opportunity to realize appreciation in the market

16

Worldwide Emerging Markets Fund

Notes To Financial Statements (unaudited) (continued)

price of the underlying instrument or to possible continued holding of an underlying instrument which might otherwise have been sold to protect against a decline in the market price. A covered put exposes the Fund during the term of the option to a decline in price of the underlying instrument. A put option sold by the Fund is covered when, among other things, cash or short-term liquid securities are placed in a segregated account to fulfill the obligations undertaken. The Fund may incur additional risk from investments in written currency options if there are unanticipated movements in the underlying currencies. There were no written options outstanding at June 30, 2006.

Futures Contracts—The Fund may buy and sell financial futures contracts for hedging purposes. When a fund enters into a futures contract, it must make an initial deposit (“initial margin”) as a partial guarantee of its performance under the contract. As the value of the futures contract fluctuates, the fund is required to make additional margin payments (“variation margin”) to cover any additional obligation it may have under the contract. In the remote chance that a broker cannot fulfill its obligation, the fund could lose the variation margin due to it. Risks may be caused by an imperfect correlation between the movements in price of the futures contract and the price of the underlying instrument and interest rates. Gains and losses on futures contracts, if any, are separately disclosed. There were no futures contracts outstanding at June 30, 2006.

Note 2—Management Agreement—Van Eck Associates Corporation (the “Adviser”) earns fees for investment management and advisory services provided to the Fund. The fee is based on an annual rate of 1.00% of the average daily net assets. The Adviser agreed to assume expenses exceeding 1.30% of average daily net assets except interest, taxes, brokerage commissions and extraordinary expenses for the period January 1, 2004 through April 30, 2005 and 1.40% from May 1, 2005 through April 30, 2007. For the six months ended June 30, 2006, the Adviser assumed expenses in the amount of $1,813. Certain of the officers and trustees of the Trust are officers, directors or stockholders of the Adviser and Van Eck Securities Corporation, the Distributor.

Note 3—Investments— For the six months ended June 30, 2006, purchases and sales of securities, other than U.S. government securities and short-term obligations, aggregated $71,814,493 and $101,629,053 respectively.

The identified cost of investments owned at June 30, 2006 was $171,159,004 and net unrealized appreciation aggregated $74,065,334 of which $85,868,420 related to appreciated securities and $11,803,086 related to depreciated securities.

Note 4—Income Taxes—The tax character of distributions paid to shareholders were as follows:

| | | | During the Six | | During the Year |

| | | | Months Ended | | Ended |

| | | | June 30, 2006 | | December 31, 2005 |

| |

|

| |

|

|

| Ordinary income | | $ | 4,857,449 | | $ | 1,633,440 |

| Long term capital gains | | | 23,912,600 | | | — |

| |

|

| |

|

|

| Total | | $ | 28,770,049 | | $ | 1,633,440 |

| |

|

| |

|

|

Note 5—Concentration of Risk—The Fund may purchase securities on foreign exchanges. Securities of foreign issuers involve special risks and considerations not typically associated with investing in U.S. issuers. These risks include devaluation of currencies, less reliable information about issuers, different securities transaction clearance and settlement practices, and future adverse political and economic developments. These risks are heightened for investments in emerging market countries. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than those of comparable U.S. issuers.

The aggregate shareholder accounts of a single insurance company own approximately 78% of the Initial Class shares and approximately 99% of the Class R1 shares.

Note 6—Warrants—The Fund may invest in warrants whose values are linked to indices or underlying instruments. The Fund may use these warrants to gain exposure to markets that might be difficult to invest in through conventional securities. Warrants may be more volatile than their linked indices or underlying instruments. Potential losses are limited to the amount of the original investment.

Note 7—Forward Foreign Currency Contracts—The Fund may buy and sell forward foreign currency contracts to settle purchases and sales of foreign denominated securities. In addition, the Fund may enter into forward foreign currency contracts to hedge foreign denominated assets. Realized gains and losses from forward foreign currency contracts are included in realized gain (loss) from foreign currency transactions on the Statement of Operations. The Fund may incur additional risk from investments in forward foreign currency contracts if the counterparty is unable to fulfill its obligation or there are unanticipated movements of the foreign currency relative to the U.S. dollar. At June 30, 2006, the Fund had no forward foreign currency contracts outstanding.

Note 8—Trustee Deferred Compensation Plan—The Trust established a Deferred Compensation Plan (the “Plan”) for Trustees. Commencing January 1, 1996, the Trustees can elect to defer receipt of their trustee fees until retirement, disability or termination from the Board of Trustees. The Fund’s contributions to the Plan are limited to the amount of fees earned by the participating Trustees. The fees otherwise payable to the participating Trustees are invested in shares of the Van Eck Funds as directed by the Trustees and are reflected in the accompanying Statement of Assets and Liabilities.

Note 9—Equity Swap—The Fund may enter into an equity swap to gain investment exposure to the relevant market of the underlying security. A swap is an agreement that obligates the parties to exchange cash flows at specified intervals. The Fund is obligated to pay the counterparty on trade date an amount based upon the value of the underlying instrument (notional amount) and, at termination date, final payment is settled based on the value of the underlying security on trade date versus the value on termination date plus accrued dividends. Risks may arise as a result of the failure of the counterparty to the contract to comply with the terms of the swap contract. The Fund bears the risk of loss of the amount expected to be received under a swap agreement in the event of the default of the counterparty. Therefore, the Fund considers the credit worthiness of each counterparty to a swap contract in evaluating potential credit risk.

17

Worldwide Emerging Markets Fund

Notes To Financial Statements (unaudited) (continued)

Additionally, risks may arise from unanticipated movements in the value of the swap relative to the underlying securities. The net receivable or payable for financial statement purposes is shown as due to or from broker on the Statement of Assets and Liabilities. There were no outstanding equity swaps at June 30, 2006.

Note 10—Bank Line of Credit—The Trust may participate with other funds managed by the Adviser (the “Van Eck Funds”) in a $10 million committed credit facility (“Facility”) to be utilized for temporary financing until the settlement of sales or purchases of portfolio securities, the repurchase or redemption of shares of the Trust and the Van Eck Funds, at the request of the shareholders and other temporary or emergency purposes. The Van Eck Funds have agreed to pay commitment fees, pro rata, based on the unused but available balance. Interest is charged to the Trust and the Van Eck Funds at rates based on prevailing market rates in effect at the time of borrowings. During the six months ended June 30, 2006, there were no borrowings by the Fund under the Facility.

Note 11—Repurchase Agreements—Collateral for repurchase agreements, in the form of U.S. government obligations, the value of which must be at least 102% of the underlying debt obligations, is held by the Fund’s custodian. In the remote chance the counterparty should fail to complete the repurchase agreements, realization and retention of the collateral may be subject to legal proceedings and the Fund would become exposed to market fluctuations on the collateral.

Note 12—Regulatory Matters—In connection with their investigations of practices identified as “market timing” and “late trading” of mutual fund shares, the Office of the New York State Attorney General (“NYAG”) and the United States Securities and Exchange Commission (“SEC”) have requested and received information from the Adviser. The investigations are ongoing, and the Adviser is continuing to cooperate with such investigations. If it is determined that the Adviser or its affiliates engaged in improper or wrongful activity that caused a loss to a Fund, the Board of Trustees of the Funds will determine the amount of restitution that should be made to a Fund or its shareholders. At the present time, the amount of such restitution, if any, has not been determined.

In July 2004, the Adviser received a “Wells Notice” from the SEC in connection with the SEC’s investigation of market-timing activities. This Wells Notice informed the Adviser that the SEC staff is considering recommending that the SEC bring a civil or administrative action alleging violations of the U.S. securities laws against the Adviser and two of its senior officers.

There cannot be any assurance that if the SEC or NYAG were to assess sanctions against the Adviser, such sanctions would not materially and adversely affect the Adviser.

Note 13—Reimbursement from Adviser—During 2005, the Adviser reimbursed the Fund $140,145 in connection with dividends paid in January 2003 to shareholders redeeming on the day between record date and ex-dividend date.

18

Van Eck Worldwide Insurance Trust

Worldwide Bond Fund

Worldwide Emerging Markets Fund

Worldwide Hard Assets Fund

Worldwide Real Estate Fund

Approval of Advisory Agreements

The Investment Company Act of 1940, as amended (the “1940 Act”), provides, in substance, that each investment advisory agreement between a Fund and its investment adviser will continue in effect from year to year only if its continuance is approved at least annually by the Board of Trustees (the “Board”), including by a vote of a majority of the Trustees who are not “interested persons” of the Funds (“Independent Trustees”), cast in person at a meeting called for the purpose of considering such approval.

In considering the renewal of the investment advisory agreements, the Board, comprised exclusively of Independent Trustees, reviewed and considered information that had been provided by Van Eck Associates Corporation, the Funds’ Adviser (the “Adviser”), throughout the year at regular Board meetings, as well as information furnished for the meetings of the Board held on June 13 and 14, 2006 to specifically consider the renewal of each Fund’s investment advisory agreement. This information included, among other things, the following:

- Information about the overall organization of the Adviser and the Adviser’s short-term and long-term business plan with respect to its mutual fund operations;

- The Adviser’s consolidated financial statements for the past 3 fiscal years;

- A description of the advisory agreements with the Funds, their terms and the services provided under each agreement;

- Descriptions of the qualifications, education and experience of the individual investment professionals whose responsibilities include portfolio management and investment research for the Funds, and information relating to their compensation and responsibilities with respect to managing other mutual funds and investment accounts;

- Presentations by the Adviser’s key investment personnel with respect to the Adviser’s investment strategies and general investment outlook in relevant markets, and the resources available to support the implementation of such investment strategies;

- An independently prepared report comparing the management fees and non- investment management expenses of each Fund during its fiscal year ended December 31, 2005 with those of (i) the universe of funds with a similar investment strategy, offered in connection with variable insurance products (the “Expense Universe”), and (ii) a sub-group of the Expense Universe consisting of funds of comparable size and fees and expense structure (the “Peer Group”);

- An independently prepared report comparing each Fund’s annualized investment performance for the one- through five-year periods ended December 31, 2005 with those of (i) the universe of funds with a similar investment strategy, offered in connection with variable insurance products (the “Performance Universe”), (ii) its Peer Group, and (iii) appropriate benchmark indices as identified by an independent data provider;

- An analysis of the profitability of the Adviser with respect to the services it provides to each Fund and the Van Eck complex of mutual funds as a whole;

- Information regarding other accounts and investment vehicles managed by the Adviser, their investment strategy, the net assets under management in each such account and vehicle, and the individuals that are

19

Van Eck Worldwide Insurance Trust

Approval of Advisory Agreements (continued)

performing investment functions with respect to each such account and vehicle;

- Information concerning the Adviser’s compliance program, the resources devoted to compliance efforts undertaken by the Adviser and its affiliates on behalf of the Funds, and reports regarding a variety of compliance-related issues;

- Reports with respect to the Adviser’s brokerage practices, including the benefits received by the Adviser from research acquired with soft dollars; and

- Other information provided by the Adviser in its response to a comprehensive questionnaire prepared by independent legal counsel on behalf of the Independent Trustees.

In considering whether to approve the investment advisory agreements, the Board evaluated the following factors: (1) the quality, nature, cost and character of the investment management as well as the administrative and other non-investment management services provided by the Adviser and its affiliates; (2) the nature, quality and extent of the services performed by the Adviser in interfacing with, and monitoring the services performed by, third parties, such as the Funds’ custodian, transfer agent, sub-accounting agent and independent auditors, and the Adviser’s commitment and efforts to review the quality and pricing of third party service providers to the Funds with a view to reducing non-management expenses of the Funds; (3) the terms of the advisory agreements and the reasonableness and appropriateness of the particular fee paid by each Fund for the services described therein; (4) the Adviser’s willingness to subsidize the operations of the Funds from time to time by means of waiving a portion of its management fees or paying expenses of the Funds; (5) the services, procedures and processes used to determine the value of Fund assets, and the actions taken to monitor and test the effectiveness of such services, procedures and processes; (6) the ongoing efforts of, and resources devoted by, the Adviser with respect to the development of a comprehensive compliance program and written compliance policies and procedures, and the implementation of recommendations of independent consultants with respect to a variety of compliance issues; (7) the responsiveness of the Adviser and its affiliated companies to inquiries from, and examinations by, regulatory agencies such as the SEC, the NASD and the office of the New York Attorney General (“NYAG”); (8) the Adviser’s record of compliance with its policies and procedures; and (9) the ability of the Adviser to attract and retain quality professional personnel to perform investment advisory and administrative services for the Funds.

The Board considered the fact that the Adviser has received a Wells Notice from the SEC in connection with on-going investigations concerning market timing and related matters. The Board determined that the Adviser continues to cooperate with the SEC, the NYAG and the Board in connection with these matters and that the Adviser has taken appropriate steps to implement policies and procedures reasonably designed to prevent harmful market timing activities by investors in the Funds. In addition, the Board concluded that the Adviser has acted in good faith in providing undertakings to the Board to make restitution of damages, if any, that may have resulted from any prior wrongful actions of the Adviser and that it would be appropriate to permit the SEC and the NYAG to bring to conclusion their pending regulatory investigations prior to the Board making any final determination of its own with respect to these same matters.

The Board considered the fact that the Adviser is managing other investment products and vehicles, including hedge funds and separate accounts, that invest in the same financial markets and are managed by the same investment professionals according to a similar investment strategy as certain of the Funds. The Board concluded that the management of these products contributes to the Adviser’s financial stability and is helpful to the Adviser in attracting and retaining quality portfolio management personnel for the Funds. In addition,

20

Van Eck Worldwide Insurance Trust

Approval of Advisory Agreements (continued)

the Board concluded that the Adviser has established appropriate procedures to monitor conflicts of interest involving the management of the Funds and the other products and for resolving any such conflicts of interest in a fair and equitable manner.

In evaluating the investment performance and fees and expenses of each Fund, the Board considered the specific factors set forth below. The Board concluded, with respect to each Fund, that the performance of the Fund is satisfactory, and that the management fee charged to, and the total expense ratio of, the Fund are reasonable. In reaching its conclusions the Board took specific note of the following information with respect to each Fund:

Worldwide Bond Fund

The Board noted that: (1) the Fund had outperformed its Performance Universe average for the annualized four-year period ended December 31, 2005; (2) the Adviser has agreed to waive from May 2006 through April 2007 a portion of its management fee such that the Fund’s overall expense ratio will be capped at 1.10%; and (3) the Fund’s expense ratio, while higher than the median for its Peer Group, is within the range of expense ratios for its Peer Group and is not unreasonable in view of the relatively small size of the Fund and the nature of the global investment strategy used to pursue the Fund’s objective.

Worldwide Emerging Markets Fund

The Board noted that: (1) the Fund had outperformed its Performance Universe average and its benchmark index for the annualized two-through five-year periods ended December 31, 2005; (2) the Adviser has agreed to waive, and will continue to waive through April 2007, a portion of its management fee; and (3) the Fund’s overall management fee and expense ratio, net of fee waivers, were lower than the median for its Peer Group.

Worldwide Hard Assets Fund

The Board noted that: (1) the Fund had outperformed its Performance Universe average for the annualized one- through five-year periods ended December 31, 2005 and was in the top quintile of its Performance Universe for the annualized one- through four-year periods ended December 31, 2005; (2) the Adviser has agreed to waive from May 2006 through April 2007 a portion of its management fee such that the Fund’s overall expense ratio will be capped at 1.20%; and (3) the Fund’s expense ratio is higher than the median for its Peer Group, but within the range of expense ratios for its Peer Group.

Worldwide Real Estate Fund

The Board noted that: (1) the Fund had outperformed its Performance Universe average, and was in the top quintile for its Performance Universe, for the annualized one- through three-year periods ended December 31, 2005; (2) the Adviser has agreed to waive, and will continue to waive through April 2007, a portion of its management fee; (3) the Fund’s overall management fee during 2005, net of fee waivers, was lower than the median for its Peer Group; and (4) the Fund’s expense ratio, net of fee waivers, was higher than the median for its Peer Group, but within the range of expense ratios for its Peer Group.

The Board considered the profits, if any, realized by the Adviser from managing the Funds, in light of the services rendered and the costs associated with providing such services, and concluded that the profits realized by the Adviser from managing the Funds are not excessive. In this regard, the Board also considered the extent to which the Adviser may realize economies of scale as each Fund grows, and whether each Fund’s fee levels reflect these economies of scale for the benefit of shareholders. The Board concluded that, with respect to Worldwide Bond Fund and Worldwide Hard Assets Fund, the advisory fee breakpoints in place will allow the Funds to share the benefits of economies of scale as they grow in a fair and equitable manner. The Board also concluded that neither of Worldwide Emerging Markets Fund nor the Worldwide Real Estate Fund currently has

21

Van Eck Worldwide Insurance Trust

Approval of Advisory Agreements (continued)

sufficient assets, or in the foreseeable future is likely to have sufficient assets, for the Adviser to realize material benefits from economies of scale, and, therefore, the implementation of breakpoints would not be warranted at this time for either Fund.

The Board did not consider any single factor as controlling in determining whether or not to renew the investment advisory agreement. Nor are the items described herein all of the matters considered by the Board. Based on its consideration of the foregoing factors and conclusions, and such other factors and conclusions as it deemed relevant, and assisted by the advice of its independent counsel, the Board concluded that the renewal of the investment advisory agreements, including the fee structures (described herein) is in the interests of shareholders, and accordingly, the Board approved the continuation of the advisory agreements for an additional one-year period.

See Notes to Financial Statements22

Van Eck Worldwide Insurance Trust

Worldwide Emerging Markets Fund

On March 9, 2006, at a Special Meeting of Shareholders, the following proposals were voted:

| | | | | % of Outstanding | | | % of Shares | |

| | | No. of Shares | | Shares | | | Present | |

| |

| |

|

| |

|

|

|

| 1. To elect the following nominees as Trustees | | | | |

| |

| Richard C. Cowell | | | | | | |

| Affirmative | | 10,876,663.192 | | 85.042 | % | | 95.621 | % |

| Withhold | | 498,056.004 | | 3.894 | % | | 4.379 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

| |

| Jon Lukomnik | | | | | | | | |

| Affirmative | | 11,128,421.099 | | 87.010 | % | | 97.835 | % |

| Withhold | | 246,298.097 | | 1.926 | % | | 2.165 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

| |

| David J. Olderman | | | | | | |

| Affirmative | | 10,973,307.015 | | 85.798 | % | | 96.471 | % |

| Withhold | | 401,412.181 | | 3.138 | % | | 3.529 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

| |

| Ralph F. Peters | | | | | | | | |

| Affirmative | | 10,885,633.926 | | 85.112 | % | | 95.700 | % |

| Withhold | | 489,085.270 | | 3.824 | % | | 4.300 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

| |

| Wayne H. Shaner | | | | | | |

| Affirmative | | 10,995,353.190 | | 85.970 | % | | 96.665 | % |

| Withhold | | 379,366.006 | | 2.966 | % | | 3.335 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

| |

| R. Alastair Short | | | | | | |

| Affirmative | | 10,997,680.323 | | 85.988 | % | | 96.685 | % |

| Withhold | | 377,038.873 | | 2.948 | % | | 3.315 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

| |

| Richard D. Stamberger | | | | | | |

| Affirmative | | 10,945,486.541 | | 85.580 | % | | 96.226 | % |

| Withhold | | 429,232.655 | | 3.356 | % | | 3.774 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

23

Van Eck Worldwide Insurance Trust

Worldwide Emerging Markets Fund

| | | | | | | | % of Outstanding | | | % of Shares | |

| | | | | | No. of Shares | | Shares | | | Present | |

| | | | | |

| |

|

| |

|

|

2. To modify or eliminate fundamental investment restrictions to modernize the investment restrictions of the Funds; |

| | | | | | | | | |

(2A) | | Borrowing | | | | | | |

| Affirmative | | 10,784,606.145 | | 84.322 | % | | 94.812 | % |

| Against | | 333,682.129 | | 2.609 | % | | 2.934 | % |

| Abstain | | 256,430.922 | | 2.005 | % | | 2.254 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

| |

(2B) | | Underwriting | | | | | | |

| Affirmative | | 10,815,523.993 | | 84.564 | % | | 95.084 | % |

| Against | | 295,227.411 | | 2.308 | % | | 2.595 | % |

| Abstain | | 263,967.792 | | 2.064 | % | | 2.321 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

|

(2C) | | Lending | | | | | | | | |

| Affirmative | | 10,768,849.578 | | 84.199 | % | | 94.674 | % |

| Against | | 349,438.696 | | 2.732 | % | | 3.072 | % |

| Abstain | | 256,430.922 | | 2.005 | % | | 2.254 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

| |

(2D) | | Senior securities | | | | | | |

| Affirmative | | 10,794,996.053 | | 84.403 | % | | 94.903 | % |

| Against | | 323,292.221 | | 2.528 | % | | 2.843 | % |

| Abstain | | 256,430.922 | | 2.005 | % | | 2.254 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

| |

(2E) | | Real estate | | | | | | |

| Affirmative | | 10,820,650.994 | | 84.604 | % | | 95.129 | % |

| Against | | 297,637.280 | | 2.327 | % | | 2.617 | % |

| Abstain | | 256,430.922 | | 2.005 | % | | 2.254 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

| |

(2F) | | Real estate limited partnerships, oil, gas, and minerals | |

| Affirmative | | 10,797,357.558 | | 84.422 | % | | 94.924 | % |

| Against | | 320,930.716 | | 2.509 | % | | 2.822 | % |

| Abstain | | 256,430.922 | | 2.005 | % | | 2.254 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

24

Van Eck Worldwide Insurance Trust

Worldwide Emerging Markets Fund

| | | | | | | % of Outstanding | | | % of Shares | |

| | | | | No. of Shares | | Shares | | | Present | |

| | | | |

| |

|

| |

|

|

| |

(2G) | | Investing for the purposes of exercising control | | | | |

| Affirmative | | 10,772,464.146 | | 84.227 | % | | 94.705 | % |

| Against | | 345,824.128 | | 2.704 | % | | 3.041 | % |

| Abstain | | 256,430.922 | | 2.005 | % | | 2.254 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

| |

(2H) | | Commodities | | | | | | |

| Affirmative | | 10,794,416.674 | | 84.399 | % | | 94.898 | % |

| Against | | 323,871.600 | | 2.532 | % | | 2.848 | % |

| Abstain | | 256,430.922 | | 2.005 | % | | 2.254 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

| |

(2I) | | Concentration | | | | | | |

| Affirmative | | 10,812,954.899 | | 84.544 | % | | 95.061 | % |

| Against | | 305,333.375 | | 2.387 | % | | 2.685 | % |

| Abstain | | 256,430.922 | | 2.005 | % | | 2.254 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

| |

(2J) | | Diversification | | | | | | |

| Affirmative | | 10,812,675.372 | | 84.542 | % | | 95.059 | % |

| Against | | 305,612.902 | | 2.389 | % | | 2.687 | % |

| Abstain | | 256,430.922 | | 2.005 | % | | 2.254 | % |

| TOTAL | | 11,374,719.196 | | 88.936 | % | | 100.000 | % |

25

| Investment Adviser: | | Van Eck Associates Corporation | | |

| Distributor: | | Van Eck Securities Corporation | | |

| | | 99 Park Avenue, New York, NY 10016 www.vaneck.com | | |

| Account Assistance: | | 1.800.544.4653 | | |

This report must be preceded or accompanied by a Van Eck Worldwide Insurance Trust Prospectus, which includes more complete information. An investor should consider the investment objective, risks, and charges and expenses of the Fund carefully before investing. The prospectus contains this and other information about the investment company. Please read the prospectus carefully before investing.

Additional information about the Fund’s Board of Trustees/Officers and a description of the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities are provided in the Statement of Additional Information and information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve month period ending June 30 is available, without charge, by calling 1.800.826.2333, or by visiting www.vaneck.com, or on the Securities and Exchange Commission’s website at http://www.sec.gov.

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Qs are available on the Commission’s website at http://www.sec.gov and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1.800. SEC.0330. The Fund’s complete schedule of portfolio holdings is also available by calling 1.800.826.2333 or by visiting www.vaneck.com.

Item 2. CODE OF ETHICS.

Not applicable.

Item 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable.

Item 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable.

Item 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

Item 6. SCHEDULE OF INVESTMENTS.

Information included in Item 1.

Item 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END

MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

Item 8. PORTFOLIO MANAGER OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

Item 9. PURCHASE OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT

COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

Item 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

No changes.

Item 11. CONTROLS AND PROCEDURES.

(a) The Chief Executive Officer and the Chief Financial Officer have concluded

that the Worldwide Emerging Markets Fund disclosure controls and procedures

(as defined in Rule 30a-3(c) under the Investment Company Act) provide

reasonable assurances that material information relating to the Worldwide

Emerging Markets Fund is made known to them by the appropriate persons,

based on their evaluation of these controls and procedures as of a date

within 90 days of the filing date of this report.

(b) There were no significant changes in the registrant's internal controls

over financial reporting or in other factors that could significantly

affect these controls over financial reporting subsequent to the date of

our evaluation.

Item 12. EXHIBITS.

(a)(1) Not applicable.

(a)(2) A separate certification for each principal executive officer and

principal financial officer of the registrant as required by Rule 30a-2

under the Act (17 CFR 270.30a-2) is attached as Exhibit 99.CERT.

(b) Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 is

furnished as Exhibit 99.906CERT.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) WORLDWIDE INSURANCE TRUST - WORLDWIDE EMERGING MARKETS FUND

By (Signature and Title) /s/ Bruce J. Smith, SVP & CFO

-----------------------------

Date August 28, 2006

---------------

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, this report has been signed below by the

following persons on behalf of the registrant and in the capacities and on the

dates indicated.

By (Signature and Title) /s/ Keith J. Carlson, CEO

--------------------------

Date August 28, 2006

---------------

By (Signature and Title) /s/ Bruce J. Smith, CFO

-------------------------

Date August 28, 2006

---------------