UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☑ | Filed by a Party other than the Registrant o |

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

VanEck VIP Trust

(Name of Registrant as Specified

In Its Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): | ||

☑ | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

o | Fee paid previously with preliminary materials. | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

VanEck VIP Trust

VanEck VIP Emerging Markets Fund

VanEck VIP Global Gold Fund

VanEck VIP Global Hard Assets Fund

VanEck VIP Unconstrained Emerging Markets Bond Fund

(each, a “Fund,” and collectively, the “Funds”)

666 Third Avenue, 9th Floor

New York, NY 10017

(212) 293-2000

August 19, 2019

Dear Shareholder/Variable Contract Owner:

I am writing to let you know that a special meeting of the shareholders of the Funds of VanEck VIP Trust (the “Trust”) will be held at 10:00 a.m. Eastern time on October 11, 2019, at the principal executive offices of the Trust, 666 Third Avenue, 9th Floor, New York, New York 10017 (the “Meeting”).

I am writing to ask for your instruction and/or vote at the Meeting on the following proposal (the “Proposal”), as well as to transact such other business which may properly come before the Meeting or any adjournment or postponement thereof:

| Proposal: | To elect Jon Lukomnik, Jane DiRenzo Pigott, R. Alastair Short, Richard D. Stamberger, Robert L. Stelzl, and Jan F. van Eck as trustees of the Trust. |

The Trust’s Board of Trustees recommends that the shareholders of the Funds vote FOR ALL trustee nominees.

Each Fund is available for purchase only through variable annuity contracts and variable life insurance policies (collectively, “Variable Contracts”) offered by the separate accounts of participating insurance companies (“Participating Insurance Companies”). The Participating Insurance Companies hereby solicit and agree to vote at the Meeting, to the extent required, the shares of the Funds that are held in separate accounts in accordance with timely instructions received from owners of the Variable Contracts who held such contracts as of August 12, 2019 (the “Record Date”). With respect to all shareholders as of the Record Date, the Board of Trustees of the Trust is soliciting your vote.

If you are a Variable Contract owner, one or more voting instruction cards are enclosed. If your Variable Contract has amounts allocated to two or more Funds, you will receive a voting instruction card for each such Fund. When you vote your voting instruction card(s), it tells the Participating Insurance Company how you wish to vote the Fund shares attributable to your Variable Contract. If you are a

i

shareholder, one or more proxy cards are enclosed. The enclosed materials contain information about the Proposal being presented for your consideration. We request your prompt attention and vote by mail using the enclosed voting instruction card(s) or proxy card(s).

Detailed information about the Proposal is contained in the enclosed materials. Please review and consider the enclosed materials carefully, and then please take a moment to vote.

Attendance at the Meeting will be limited to the shareholders of the Trust as of the Record Date. Photographic identification will be required for admission to the Meeting. Whether or not you plan to attend the Meeting in person, your vote is needed. Shareholders as of the Record Date are entitled to notice of, and to vote at, the Meeting and any adjournment of the Meeting, even if they no longer hold shares of a Fund. Your vote is important no matter how many shares you own. It is important that your vote be received no later than the time of the Meeting. If you are a Variable Contract owner and you wish to participate in the Meeting, please contact your Participating Insurance Company for further information regarding how to represent your vote at the Meeting.

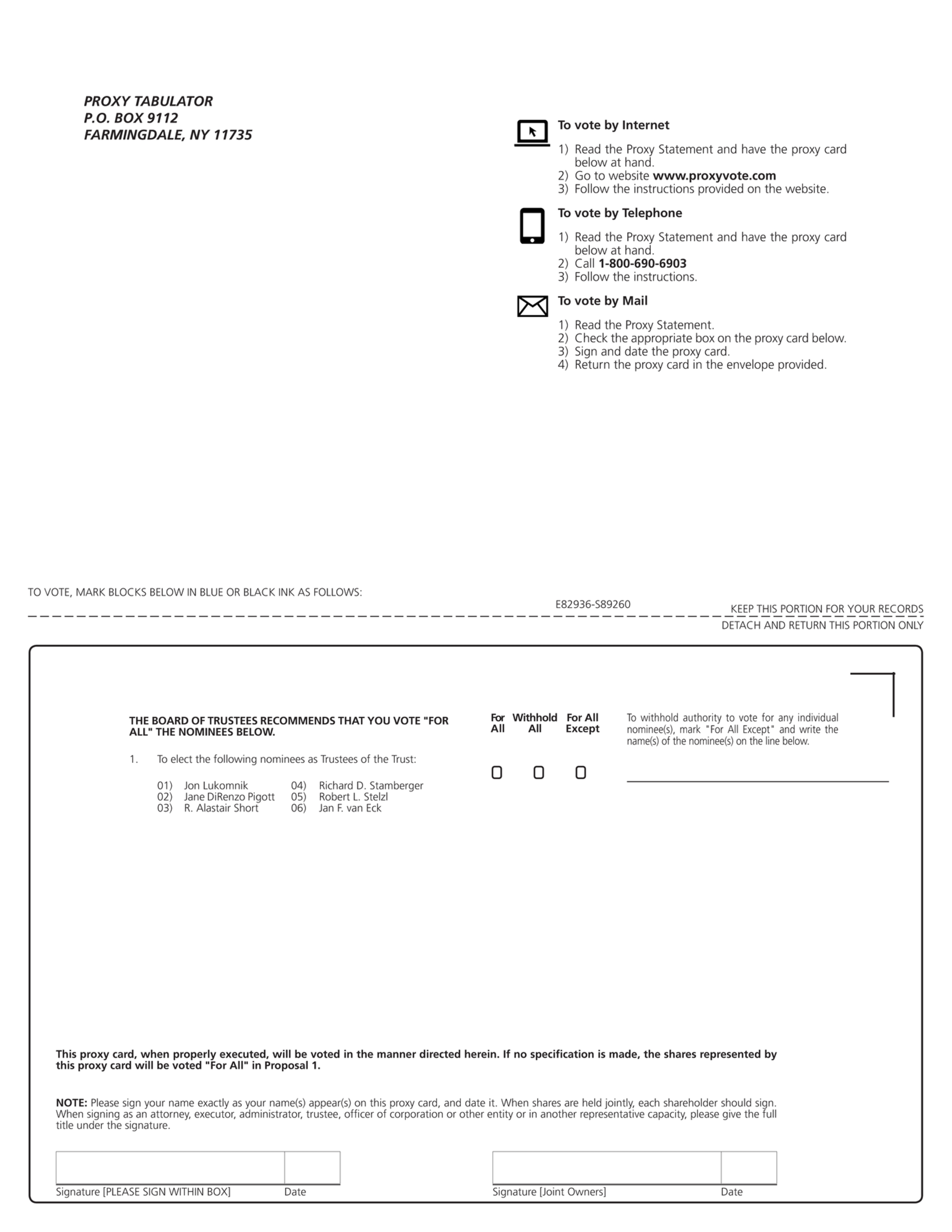

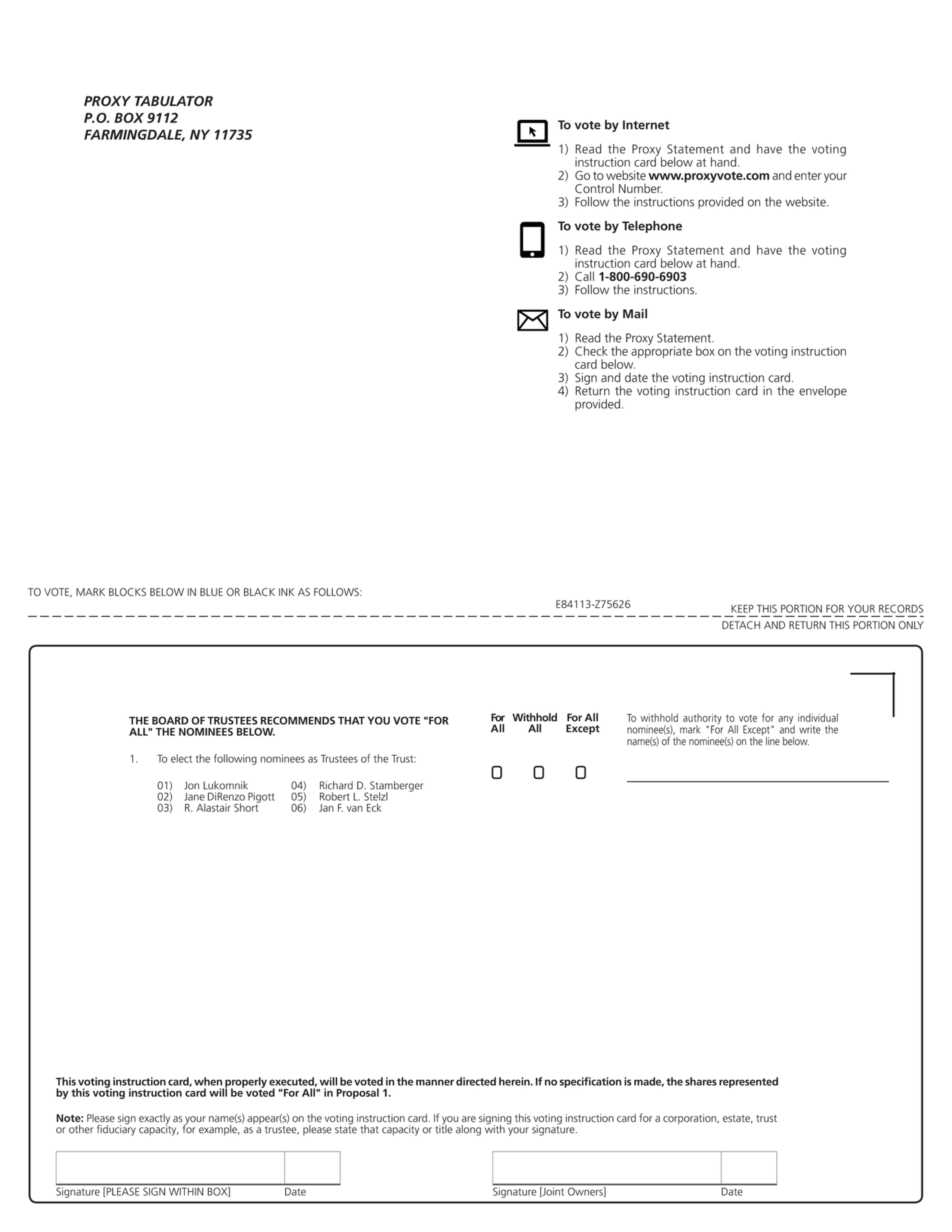

Voting is quick and easy. Everything you need is enclosed. You may vote by: (i) attending the Meeting in person, if you are a shareholder; (ii) signing, dating and mailing your proxy card(s) and/or voting instruction card(s) in the enclosed postage-paid return envelope; (iii) calling the toll-free telephone number listed on your proxy card(s) and/or voting instruction card(s); or (iv) visiting the Internet website listed on your proxy card(s) and/or voting instruction card(s) and following the instructions provided on the website. You may receive more than one set of proxy materials if you hold shares in more than one account and/or if your Variable Contract has amounts allocated to two or more Funds. Please be sure to vote each proxy card and/or voting instruction card you receive.

Your vote is important to us. Thank you for your response and for your investment.

Sincerely yours,

Jonathan R. Simon

Senior Vice President, Secretary and Chief Legal Officer, VanEck VIP Trust

ii

VanEck VIP Trust

VanEck VIP Emerging Markets Fund

VanEck VIP Global Gold Fund

VanEck VIP Global Hard Assets Fund

VanEck VIP Unconstrained Emerging Markets Bond Fund

(each, a “Fund,” and collectively, the “Funds”)

666 Third Avenue, 9th Floor

New York, NY 10017

(212) 293-2000

NOTICE OF SPECIAL MEETING OF

SHAREHOLDERS TO BE HELD ON

OCTOBER 11, 2019

Notice is hereby given that a special meeting of the shareholders (“Meeting”) of the Funds of VanEck VIP Trust (the “Trust”) will be held at 10:00 a.m. Eastern time on October 11, 2019, at the principal executive offices of the Trust, 666 Third Avenue, 9th Floor, New York, New York 10017. At the Meeting, shareholders will be asked to consider and vote on the following proposal (the “Proposal”) and to act upon any other business which may properly come before the Meeting or any adjournment or postponement thereof:

| Proposal: | To elect Jon Lukomnik, Jane DiRenzo Pigott, R. Alastair Short, Richard D. Stamberger, Robert L. Stelzl, and Jan F. van Eck as trustees of the Trust. |

The Trust’s Board of Trustees (the “Board”) recommends that the shareholders of the Funds vote FOR ALL Trustee nominees.

The Proposal is discussed in greater detail in the attached Proxy Statement. Please read the Proxy Statement carefully for information concerning the Proposal. The enclosed proxy is being solicited by the Board, on behalf of the Funds.

Each Fund is available for purchase only through variable annuity contracts and variable life insurance policies (collectively, “Variable Contracts”) offered by the separate accounts of participating insurance companies (“Participating Insurance Companies”). The Participating Insurance Companies hereby solicit and agree to vote at the Meeting, to the extent required, the shares of the Funds that are held in separate accounts in accordance with timely instructions received from owners of the Variable Contracts who held such contracts as of August 12, 2019 (the “Record Date”). With respect to all shareholders as of the Record Date, the Board is soliciting your vote.

If you are a Variable Contract owner, one or more voting instruction cards are enclosed. If your Variable Contract has amounts allocated to two or more Funds, you will receive a voting instruction card for each such Fund. When you vote your

i

voting instruction card(s), it tells the Participating Insurance Company how you wish to vote the Fund shares attributable to your Variable Contract. If you are a shareholder, one or more proxy cards are enclosed. The enclosed materials contain information about the Proposal being presented for your consideration. We request your prompt attention and vote by mail using the enclosed voting instruction card(s) or proxy card(s).

It is not anticipated that any matters other than that listed above will be brought before the Meeting. If, however, any other business is properly brought before the Meeting or any adjournments or postponements thereof, proxies will be voted in accordance with the judgment of the persons designated as proxies or otherwise as described in the attached Proxy Statement. The persons named as proxies will vote in his or her discretion on any other business that may properly come before the Meeting or any adjournments or postponements thereof. In the event that the necessary quorum to transact business is not present at the Meeting, the chairman of the Meeting may adjourn the Meeting to a designated time and place to permit further solicitation of proxies, in accordance with applicable law and the Trust’s Master Trust Agreement, as amended to date. Even if a quorum is present at the Meeting, the chairman of the Meeting may adjourn the Meeting, upon the affirmative vote of the holders of a majority of the shares of the Trust voting on the adjournment, present in person or by proxy at the Meeting or an adjournment thereof. The persons designated as proxies may use their discretionary authority to vote as instructed by the officers of the Trust on questions of adjournment. The persons named as proxies will not vote any shares for which they are directed to abstain from voting on the Proposal.

Shareholders of record of each Fund at the close of business on the Record Date are entitled to receive notice of, and to vote at, the Meeting and any adjournments thereof. We urge you to complete, sign and date the enclosed proxy card(s) and/or voting instruction card(s), and return it (them) in the accompanying postage-paid envelope as promptly as possible, or take advantage of the telephonic or electronic voting procedures described on the proxy card(s) and/or voting instruction card(s). Each shareholder is invited to attend the Meeting in person. If you are a Variable Contract owner and you wish to participate in the Meeting, please contact your Participating Insurance Company for further information regarding how to represent your vote at the Meeting.

Please notify us by calling 1-800-826-2999 if you plan to attend the Meeting. Shareholders who attend the Meeting in person will need to bring proof of share ownership, such as a shareholder statement or letter from a custodian or broker-dealer confirming ownership, as of the Record Date, and a valid picture identification, such as a driver’s license or passport, for admission to the Meeting. Shareholders whose shares are held in “street name” through their broker will need to obtain a legal proxy from their broker and present it at the Meeting in order to vote in person. You may revoke your proxy at any time before or at the Meeting,

ii

and you may attend the Meeting to vote in person even though a proxy card already may have been returned. However, whether or not you expect to attend the Meeting in person, we urge you to complete, date, sign and return the enclosed proxy card(s) in the enclosed postage-paid envelope or vote by telephone or through the Internet. If you properly execute and return the enclosed proxy card(s) in time to be voted at the Meeting, your shares represented by the proxy will be voted at the Meeting in accordance with your instructions. Unless revoked, proxies that have been executed and returned by shareholders without instructions will be voted in favor of the Proposal. If you have any questions about the foregoing information, please call us at 1-800-826-2999.

Your vote is important to us. Thank you for taking the time to consider the Proposal.

By order of the Board of Trustees,

Jonathan R. Simon

Senior Vice President, Secretary and Chief Legal Officer, VanEck VIP Trust

August 19, 2019

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON OCTOBER 11, 2019 The Notice of Special Meeting of Shareholders and Proxy Statement are available on the Internet at www.proxyvote.com. |

iii

VanEck VIP Trust

VanEck VIP Emerging Markets Fund

VanEck VIP Global Gold Fund

VanEck VIP Global Hard Assets Fund

VanEck VIP Unconstrained Emerging Markets Bond Fund

(each, a “Fund,” and collectively, the “Funds”)

666 Third Avenue, 9th Floor

New York, NY 10017

(212) 293-2000

PROXY STATEMENT DATED AUGUST 19, 2019

SPECIAL MEETING OF

SHAREHOLDERS TO BE HELD ON

OCTOBER 11, 2019

This Proxy Statement is being furnished to the shareholders of the Funds, each a series of VanEck VIP Trust (the “Trust”), a Massachusetts business trust, and owners of Variable Contracts (defined below) in connection with the solicitation by the Board of Trustees of the Trust (the “Board” or the “Trustees”) of shareholder votes by proxy to be voted at a special meeting of shareholders to be held at the principal executive offices of the Trust at 666 Third Avenue, 9th Floor, New York, New York 10017, on October 11, 2019, at 10:00 a.m. Eastern time, or at such later time made necessary by any and all adjournments or postponements thereof (the “Meeting”). It is expected that the Notice of Special Meeting of Shareholders, Proxy Statement, and proxy card(s)/voting instruction card(s) will be mailed to shareholders and Variable Contract owners on or about August 12, 2019.

The Fund is available for purchase only through variable annuity contracts and variable life insurance policies (collectively, “Variable Contracts”) offered by the separate accounts of participating insurance companies (“Participating Insurance Companies”). As an owner of a variable contract, you have the right to instruct the participating insurance company how to vote shares of the Fund attributable to your variable contract. For the limited purpose of this proxy statement, the terms “shareholder,” “you” and “your” refer to Variable Contract owners, as beneficial owners of Fund shares, and to the Participating Insurance Companies as direct owners of Fund shares, as well as any other direct shareholders of the Fund, unless the context otherwise requires.

The Participating Insurance Companies hereby solicit and agree to vote at the Meeting, to the extent required, the shares of the Funds that are held in separate

1

accounts in accordance with timely instructions received from owners of the Variable Contracts who held such contracts as of August 12, 2019 (the “Record Date”). With respect to all shareholders as of the Record Date, the Board is soliciting your vote.

If you are a Variable Contract owner, one or more voting instruction cards are enclosed. If your Variable Contract has amounts allocated to two or more Funds, you will receive a voting instruction card for each such Fund. When you vote your voting instruction card(s), it tells the Participating Insurance Company how you wish to vote the Fund shares attributable to your Variable Contract. If you are a shareholder, one or more proxy cards are enclosed. The enclosed materials contain information about the Proposal being presented for your consideration. We request your prompt attention and vote by mail using the enclosed voting instruction card(s) or proxy card(s).

Each Fund provides periodic reports to its shareholders, which highlight relevant information about the Funds, including investment results and a review of portfolio investments. You may receive a copy of each Fund’s audited financial statements and annual report for its last completed fiscal year, and any subsequent semi-annual report to shareholders, free of charge, by calling 1-800-826-1115, by visiting the VanEck website at vaneck.com or by writing to the Trust or to Van Eck Securities Corporation, the Funds’ distributor (“VESC” or the “Distributor”). The Trust’s and the Distributor’s address is 666 Third Avenue, 9th Floor, New York, New York 10017.

THE PROPOSAL; SHAREHOLDERS ENTITLED TO VOTE

At the Meeting, shareholders will be asked to consider and vote on the following proposal (the “Proposal”), which is described more fully below:

| Proposal: | To elect Jon Lukomnik, Jane DiRenzo Pigott, R. Alastair Short, Richard D. Stamberger, Robert L. Stelzl, and Jan F. van Eck as Trustees of the Trust. |

The Board recommends that the shareholders of the Funds vote FOR ALL Trustee nominees.

Shareholders of record of all of the Funds as of the close of business on the Record Date are entitled to attend and vote at the Meeting. If you are a Variable Contract owner and you wish to participate in the Meeting, please contact your Participating Insurance Company for further information regarding how to represent your vote at the Meeting. The number of shares of each Fund outstanding as of the Record Date and entitled to vote at the Meeting are set forth in Appendix A. Pursuant to the Master Trust Agreement of the Trust, as amended to date (the “Master Trust Agreement”), the shareholders of all of the Funds will vote together on the Proposal rather than on a Fund-by-Fund basis.

2

The Meeting will be held at the principal executive offices of the Trust at 666 Third Avenue, 9th Floor, New York, New York 10017. Shareholders who are eligible to vote and attend the Meeting in person will need to bring proof of share ownership, such as a shareholder statement or letter from a custodian or broker-dealer confirming ownership, as of the Record Date, and a valid picture identification, such as a driver’s license or passport, for admission to the Meeting.

If you do not expect to be present at the Meeting and wish to vote your shares, please vote your proxy in accordance with the instructions included on the enclosed proxy card(s)/voting instruction card(s). If your proxy card/voting instruction card is properly returned, shares represented by it will be voted at the Meeting in accordance with your instructions for the Proposal. If your proxy card/voting instruction card is properly executed and returned and no choice is specified on the proxy with respect to the Proposal, the proxy will be voted FOR the Proposal. Any shares of a Fund for which signed voting instruction cards are received but without specified instructions will be voted FOR the approval of the nominees in the Proposal. Any shares of a Fund for which no voting instructions are received generally will be voted by the Participating Insurance Company in proportion to those shares for which timely instructions are received. The effect of this proportional voting is that Variable Contract owners representing a small number of Fund shares may determine the outcome of the vote on the Proposal. Variable Contract owners should contact their Participating Insurance Company for information about any applicable deadline for providing voting instructions to such Participating Insurance Company. Please see your Variable Contract prospectus for information on how to contact your Participating Insurance Company.

For Variable Contract owners: If you are a Variable Contact owner, you may revoke your voting instructions by sending a written notice to the applicable Participating Insurance Company expressly revoking your instructions, by signing and forwarding to the Participating Insurance Company later-dated voting instructions, or otherwise giving notice of revocation at the Meeting. Variable Contract owners should contact their Participating Insurance Company for further information on how to revoke previously given voting instructions, including any applicable deadlines. Please see your Variable Contract prospectus for information on how to contact your Participating Insurance Company.

For Direct Owners (and not Variable Contract owners): Shareholders who execute proxies may revoke or change their proxy at any time prior to the time it is voted by delivering a written notice of revocation, by delivering a subsequently dated proxy by mail, telephone or the Internet or by attending and voting in person at the Meeting. If you revoke a previous proxy, your vote will not be counted unless you submit a subsequent proxy or appear at the Meeting and vote in person or legally appoint another proxy to vote on your behalf.

If you own your shares through a bank, broker-dealer or other third party intermediary who holds your shares in “street name,” and you wish to attend the

3

Meeting and vote your shares or revoke a previous proxy at the Meeting, you must request a legal proxy from such bank, broker-dealer or other third party intermediary. If your proxy has not been revoked, the shares represented by the proxy will be cast at the Meeting and any adjournments thereof. Attendance by a shareholder at the Meeting does not, in itself, revoke a proxy.

TO ASSURE THE PRESENCE OF A QUORUM AT THE MEETING, PLEASE PROMPTLY EXECUTE AND RETURN THE ENCLOSED PROXY CARD(S)/VOTING INSTRUCTION CARD(S). A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. ALTERNATIVELY, YOU MAY VOTE BY TELEPHONE OR THROUGH THE INTERNET AT THE NUMBER OR WEBSITE ADDRESS PRINTED ON THE ENCLOSED PROXY CARD(S)/VOTING INSTRUCTION CARD(S).

SUMMARY OF THE PROPOSAL

At the Meeting, shareholders of the Trust will be asked to elect Jon Lukomnik, Jane DiRenzo Pigott, R. Alastair Short, Richard D. Stamberger and Robert L. Stelzl, each a current Trustee of the Trust (each, a “Current Trustee” and collectively, the “Current Trustees”), as independent Trustees of the Trust; and to elect Jan F. van Eck (the “New Trustee”) as an interested Trustee of the Trust.

The Board has determined to request that shareholders elect the Current Trustees because Ms. Pigott and Mr. Stelzl have been serving as Trustees since 2007, but have not previously been elected by shareholders. In addition, the Independent Trustees (as defined below) have nominated and recommend shareholder election of Mr. van Eck so that the Board, the Trust and its shareholders will benefit from his service as a member of the Board.

THE PROPOSAL: ELECTION OF TRUSTEES

At the Meeting, shareholders of the Trust will be asked to elect the following Current Trustees: Jon Lukomnik, Jane DiRenzo Pigott, R. Alastair Short, Richard D. Stamberger, and Robert L. Stelzl; and the New Trustee: Jan F. van Eck, each to hold office during the continued lifetime of the Trust until he or she dies, resigns, retires or is removed.

Presently, the Current Trustees comprise the entirety of the Board. The Trust’s shareholders most recently elected Mr. Stamberger, Mr. Short and Mr. Lukomnik to the Board at a shareholder meeting in March 2006. In July 2007, the then-current Board appointed Ms. Pigott and Mr. Stelzl as Trustees, but they have not been elected by shareholders. Accordingly, the Board has determined to provide shareholders with the opportunity to elect Ms. Pigott and Mr. Stelzl.

In considering the election of Ms. Pigott and Mr. Stelzl, the Board considered and determined to nominate Mr. van Eck as an interested Trustee. Through Mr. van Eck’s senior positions with Van Eck Associates Corporation (“VEAC” or the

4

“Adviser”), its affiliates and the Trust, he has in-depth knowledge of the asset management industry as well as regarding the businesses of the Adviser, the Trust and each of the Funds. It is expected that his service as a Trustee will provide the Board with additional access to the perspectives and resources of the Adviser and its affiliates. While the present composition of the Board satisfies the requirements of the Investment Company Act of 1940, as amended (the “1940 Act”), Mr. van Eck’s nomination requires a shareholder vote because the 1940 Act limits the number of Trustees who may be appointed by the Board without shareholder election. Specifically, the 1940 Act provides that no trustee may be appointed to the board of an investment company unless, subsequent to such appointment, at least two-thirds of the trustees of the investment company have been elected to such office by holders of the outstanding voting securities of the investment company at an annual or special meeting.

Each Current Trustee is not considered to be an “interested person,” within the meaning of the 1940 Act, of the Trust, any investment adviser to the Trust, or the Distributor. Each Current Trustee is thus referred to as an “Independent Trustee.” Mr. van Eck, who is not currently a Trustee of the Trust, is considered to be an “interested person,” within the meaning of the 1940 Act, of the Trust, due to his position as an officer of the Adviser, the investment adviser of the Trust, and as an officer of the Distributor of the Trust. In addition, Mr. van Eck and members of his family own 100% of the voting stock of VEAC, which in turn owns 100% of the voting stock of the Distributor. Mr. van Eck would thus be an “Interested Trustee” if elected.

At the meeting of the Board on July 30, 2019, the Board, at the recommendation of the Trust’s Governance Committee, nominated each Current Trustee and Mr. van Eck for election to the Board by the shareholders of the Trust. Information about each Trustee nominee is presented immediately below.

The persons named as proxies in the shareholder proxy card intend to vote at the Meeting (unless directed not to vote) FOR the election of Jon Lukomnik, Jane DiRenzo Pigott, R. Alastair Short, Richard D. Stamberger, Robert L. Stelzl, and Jan F. van Eck. The Current Trustees have indicated that they will continue to serve on the Board, and the Board has no reason to believe that any of their number will become unavailable to continue to serve as Trustees. Mr. van Eck has indicated that he consents to serve on the Board, and the Board has no reason to believe that he will become unavailable to serve as Trustee. If the nominees are unavailable to serve for any reason, the persons named as proxies will vote for such other nominees nominated by the Independent Trustees.

5

Certain information regarding the Trustee nominees as well as the executive officers of the Trust is set forth below.

TRUSTEE NOMINEES

TRUSTEE’S NAME, ADDRESS(1) AND YEAR OF BIRTH | POSITION(S) HELD WITH TRUST, TERM OF OFFICE(2) AND LENGTH OF TIME SERVED | PRINCIPAL OCCUPATION(S) DURING PAST FIVE YEARS | NUMBER OF PORTFOLIOS IN FUND COMPLEX OVERSEEN BY TRUSTEE(3) | OTHER DIRECTORSHIPS HELD OUTSIDE THE FUND COMPLEX(3) DURING THE PAST FIVE YEARS |

INDEPENDENT TRUSTEES | ||||

Jon Lukomnik 1956 (A)(G) | Trustee (since 2006) | Managing Partner, Sinclair Capital LLC (consulting firm). Formerly, Executive Director, Investor Responsibility Research Center Institute. | 11 | Member of the Deloitte Audit Quality Advisory Committee; Chairman of the Advisory Committee of Legion Partners; Member of the Standing Advisory Group to the Public Company Accounting Oversight Board; Director of VanEck ICAV (an Irish UCITS) and VanEck Vectors UCITS ETF plc (an Irish UCITS). Formerly, Director of VanEck (a Luxembourg UCITS); Chairman of the Board of the New York Classical Theatre. |

Jane DiRenzo Pigott 1957 (A)(G) | Trustee (since 2007) | Managing Director, R3 Group LLC (consulting firm). | 11 | Trustee of Northwestern University, Lyric Opera of Chicago and the Chicago Symphony Orchestra. Formerly, Director and Chair of Audit Committee of 3E Company (services relating to hazardous material safety); Director of MetLife Investment Funds, Inc. |

R. Alastair Short 1953 (A)(G) | Trustee (since 2004); Vice Chairperson of the Board and Chairperson of the Audit Committee (since 2006) | President, Apex Capital Corporation (personal investment vehicle). | 67 | Chairman and Independent Director, EULAV Asset Management; Director, Kenyon Review. Formerly, Independent Director, Tremont offshore funds. |

6

TRUSTEE’S NAME, ADDRESS(1) AND YEAR OF BIRTH | POSITION(S) HELD WITH TRUST, TERM OF OFFICE(2) AND LENGTH OF TIME SERVED | PRINCIPAL OCCUPATION(S) DURING PAST FIVE YEARS | NUMBER OF PORTFOLIOS IN FUND COMPLEX OVERSEEN BY TRUSTEE(3) | OTHER DIRECTORSHIPS HELD OUTSIDE THE FUND COMPLEX(3) DURING THE PAST FIVE YEARS |

Richard D. Stamberger 1959 (A)(G) | Trustee (since 1995); Chairperson of the Board (since 2006) | President and CEO, SmartBrief, LLC (business media company). | 67 | Director, Food and Friends, Inc. |

Robert L. Stelzl 1945 (A)(G) | Trustee (since 2007); Chairperson of the Governance Committee (since 2017) | Co-Trustee, the estate of Donald Koll; Trustee, Robert D. MacDonald Trust; Trustee, GH Insurance Trusts. Formerly, Trustee, Joslyn Family Trusts; President, Rivas Capital, Inc. (real estate property management services company). | 11 | Director, Brookfield Office Properties, Inc., Brookfield Residential Properties, Inc., Brookfield DTLA Fund Office Trust Investor, Inc., Brookfield Property Finance ULC and Brookfield Property Split Corp. |

INTERESTED TRUSTEE NOMINEE | ||||

Jan F. van Eck(4) 1963 | Trustee (since 2019*); Chief Executive Officer and President (since 2010) | Director, President and Chief Executive Officer of Van Eck Associates Corporation (VEAC), Van Eck Absolute Return Advisers Corporation (VEARA) and Van Eck Securities Corporation (VESC); Officer and/or Director of other companies affiliated with VEAC and/or the Trust. | 67** | Director, National Committee on US-China Relations. |

| * | If elected by shareholders. |

| ** | Number of portfolios includes the four series of the Trust and the seven series of VanEck Funds, each of which would be overseen by Mr. van Eck if he is elected by the shareholders of the Trust and VanEck Funds, respectively. |

| (1) | The address for each Trustee is 666 Third Avenue, 9th Floor, New York, New York 10017. |

| (2) | Each Trustee serves during the continued lifetime of the Trust until his or her resignation, death, retirement or removal. The Board established a mandatory retirement policy applicable to all Independent Trustees, which provides that Independent Trustees shall resign from the Board on December 31 of the year such Trustee reaches the age of 75. |

7

| (3) | The Fund Complex consists of VanEck VIP Trust, VanEck Funds and VanEck Vectors ETF Trust. |

| (4) | If elected, Mr. van Eck would be an Interested Trustee. Mr. van Eck is an officer of VEAC and VESC. In addition, Mr. van Eck and members of his family own 100% of the voting stock of VEAC, which in turn owns 100% of the voting stock of VESC. |

| (A) | Member of the Audit Committee. |

| (G) | Member of the Governance Committee. |

8

CURRENT EXECUTIVE OFFICERS

OFFICER’S NAME, ADDRESS(1) AND YEAR OF BIRTH | POSITION(S) HELD WITH TRUST | TERM OF OFFICE AND LENGTH OF TIME SERVED(2) | PRINCIPAL OCCUPATIONS DURING THE PAST FIVE YEARS |

Matthew A. Babinsky 1983 | Assistant Vice President and Assistant Secretary | Since 2016 | Assistant Vice President, Assistant General Counsel and Assistant Secretary of VEAC, VEARA and VESC; Officer of other investment companies advised by VEAC and VEARA. Formerly, Associate, Clifford Chance US LLP. |

Russell G. Brennan 1964 | Assistant Vice President and Assistant Treasurer | Since 2008 | Assistant Vice President of VEAC; Officer of other investment companies advised by VEAC and VEARA. |

Charles T. Cameron 1960 | Vice President | Since 1996 | Portfolio Manager for VEAC; Officer and/or Portfolio Manager of other investment companies advised by VEAC and VEARA. Formerly, Director of Trading of VEAC. |

John J. Crimmins 1957 | Vice President, Treasurer, Chief Financial Officer and Principal Accounting Officer | Vice President, Chief Financial Officer and Principal Accounting Officer (since 2012); Treasurer (since 2009) | Vice President of VEAC and VEARA; Officer of other investment companies advised by VEAC and VEARA. Formerly, Vice President of VESC. |

F. Michael Gozzillo 1965 | Chief Compliance Officer | Since 2018 | Vice President and Chief Compliance Officer of VEAC and VEARA; Chief Compliance Officer of VESC; Officer of other investment companies advised by VEAC and VEARA. Formerly, Chief Compliance Officer of City National Rochdale, LLC and City National Rochdale Funds. |

9

OFFICER’S NAME, ADDRESS(1) AND YEAR OF BIRTH | POSITION(S) HELD WITH TRUST | TERM OF OFFICE AND LENGTH OF TIME SERVED(2) | PRINCIPAL OCCUPATIONS DURING THE PAST FIVE YEARS |

Laura Hamilton 1977 | Vice President | Since 2019 | Assistant Vice President of VEAC and VESC; Officer of other investment companies advised by VEAC and VEARA. Formerly, Operations Manager of Royce & Associates. |

Laura I. Martínez 1980 | Vice President and Assistant Secretary | Vice President (since 2016); Assistant Secretary (since 2008) | Vice President, Associate General Counsel and Assistant Secretary of VEAC, VEARA and VESC; Officer of other investment companies advised by VEAC and VEARA. Formerly, Assistant Vice President of VEAC, VEARA and VESC. |

James Parker 1969 | Assistant Treasurer | Since 2014 | Assistant Vice President of VEAC; Manager, Portfolio Administration of VEAC and VEARA; Officer of other investment companies advised by VEAC and VEARA. |

Jonathan R. Simon 1974 | Senior Vice President, Secretary and Chief Legal Officer | Senior Vice President (since 2016); Secretary and Chief Legal Officer (since 2014) | Senior Vice President, General Counsel and Secretary of VEAC, VEARA and VESC; Officer and/or Director of other companies affiliated with VEAC and/or the Trust. Formerly, Vice President of VEAC, VEARA and VESC. |

Jan F. van Eck 1963 | Chief Executive Officer and President | Since 2010 | Director, President and Chief Executive Officer of VEAC, VEARA and VESC; Officer and/or Director of other companies affiliated with VEAC and/or the Trust. |

| (1) | The address for each Executive Officer is 666 Third Avenue, 9th Floor, New York, NY 10017. |

| (2) | Officers are elected yearly by the Board. |

10

EXPERIENCE, QUALIFICATIONS AND ATTRIBUTES OF TRUSTEES

Described below for each Trustee nominee are specific experiences, qualifications, attributes or skills that support a conclusion that he or she should serve as a Trustee of the Trust as of the date of this Proxy Statement in light of the Trust’s business and structure. The role of an effective Trustee inherently requires certain personal qualities, such as integrity, as well as the ability to comprehend, discuss and critically analyze materials and issues that are presented so that the Trustee may exercise judgment and reach conclusions in fulfilling his or her duties and fiduciary obligations. It is believed that the specific background of each Trustee nominee evidences those abilities and is appropriate to his or her serving on the Board. Further information about each Trustee nominee is set forth in the table above describing the business activities and other directorships held by each Trustee nominee during the past five years.

Independent Trustees

Jon Lukomnik. Mr. Lukomnik has extensive business and financial experience, particularly in the investment management industry. He currently serves as: Managing Partner of Sinclair Capital LLC, a consulting firm to the investment management industry; a member of Deloitte LLP’s Audit Quality Advisory Council; chairman of the Advisory Committee of Legion Partners Asset Management, a registered investment advisor that provides investment management and consulting services to various institutional clients; and a member of the Standing Advisory Group to the Public Company Accounting Oversight Board.

Jane DiRenzo Pigott. Ms. Pigott has extensive business and financial experience and serves as Managing Director of R3 Group LLC, a firm specializing in talent retention, development and matriculation consulting services. Ms. Pigott has prior experience as an independent trustee of other mutual funds and previously served as chair of the global Environmental Law practice group at Winston & Strawn LLP.

R. Alastair Short. Mr. Short has extensive business and financial experience, particularly in the investment management industry. He has served as a president, board member or executive officer of various businesses, including asset management and private equity investment firms.

Richard D. Stamberger. Mr. Stamberger has extensive business and financial experience and serves as the president and chief executive officer of SmartBrief, LLC, a media company. Mr. Stamberger has experience as a member of the board of directors of numerous not-for-profit organizations and has more than 20 years of experience as a member of the Board of the Trust.

11

Robert L. Stelzl. Mr. Stelzl has extensive business and financial experience, particularly in the investment management and real estate industries. He currently serves as a trust-appointed trustee for a number of family trusts for which he provides investment management services.

Interested Trustee Nominee

Jan F. van Eck. Mr. van Eck has extensive business and financial experience in the investment management industry, and serves as president, executive officer and/or board member of various businesses, including the Adviser and the Distributor. As a result of Mr. van Eck’s senior positions with the Trust, the Adviser and the Distributor, Mr. van Eck has in-depth and longstanding knowledge regarding the Trust and the Funds and is in a position to, among other things, continue to foster the relationship between the Funds and the Adviser and the Distributor and to provide access to resources for the benefit of the Trust and the Funds.

CANDIDATE NOMINATION PROCESS

The Governance Committee evaluates and recommends candidates for Board membership. The Board has adopted a written charter for the Governance Committee, which is attached as Appendix B. The charter calls for the Governance Committee to evaluate Independent Trustee candidates’ independence from the investment adviser and other principal service providers to the Trust. In doing so, the Governance Committee considers whether the candidates are independent in terms of the letter and spirit of the 1940 Act, including whether the effect of any relationships beyond those delineated in the 1940 Act might impair independence. In determining nominees’ qualifications for Board membership, the Governance Committee may consider such factors as it may determine to be relevant to fulfilling the role of being a member of the Board. In considering a candidate’s qualifications, the Governance Committee generally considers the potential candidate’s educational background, business or professional experience, and reputation. In addition, all candidates as members of the Board must demonstrate an ability and willingness to make the considerable time commitment, including personal attendance at Board meetings, believed necessary to his or her function as an effective Board member. The Committee may adopt from time to time specific, minimum qualifications that the Committee believes a candidate must meet before being considered as a candidate for Board membership, subject to approval by the full Board.

The Governance Committee believes that diversity of backgrounds, skills, experience and geography benefits the Board, and it seeks candidates that will provide the Board with a broad cross section of backgrounds, functional disciplines and experience. However, the Governance Committee has not adopted a formal policy in this regard.

12

The Governance Committee shall, when recommending candidates for the position of Independent Trustee, consider candidates recommended by a shareholder of a Fund if such recommendation provides sufficient background information concerning the candidate and evidence that the candidate is willing to serve as an Independent Trustee if selected, and is received in a sufficiently timely manner. Shareholders should address recommendations in writing to the attention of the Governance Committee, c/o the Secretary of the Trust. The Secretary shall retain copies of any shareholder recommendations which meet the foregoing requirements for a period of not more than 12 months following receipt. The Secretary shall have no obligation to acknowledge receipt of any shareholder recommendations.

BOARD LEADERSHIP STRUCTURE

The Board has general oversight responsibility with respect to the operation of the Trust and the Funds. The Board has engaged VEAC to serve as the investment adviser for the Funds and is responsible for overseeing the provision of services to the Trust and the Funds by VEAC and the other service providers in accordance with the provisions of the 1940 Act and other applicable laws. The Board is currently composed of five Trustees, each of whom is an Independent Trustee. In addition to five regularly scheduled meetings per year, the Independent Trustees meet regularly in executive sessions among themselves and with their counsel to consider a variety of matters affecting the Trust. These sessions generally occur prior to, or during, scheduled Board meetings and at such other times as the Independent Trustees may deem necessary. Each Trustee attended 100% of the total number of meetings of the Board in the year ending December 31, 2018, of which there were five. As discussed in further detail below, the Board has established two standing committees to assist the Board in performing its oversight responsibilities.

The Board believes that the Board’s leadership structure is appropriate in light of the characteristics and circumstances of the Trust and each of the Funds, including factors such as the number of Funds that comprise the Trust, the variety of asset classes in which those Funds invest, the net assets of the Funds, the committee structure of the Trust, and the management, distribution and other service arrangements of the Funds. In connection with its determination, the Board considered that the Chairperson of the Board and the Chairperson of each Board committee is an Independent Trustee, and that if Mr. van Eck were to be elected to the Board, five out of the six Trustees would be Independent Trustees. In addition, to further align the Independent Trustees interests’ with those of Fund shareholders, the Board has, among other things, adopted a policy requiring each Independent Trustee to maintain a minimum direct or indirect investment in the Funds.

The Chairperson presides at all meetings of the Board and participates in the preparation of the agenda for such meetings. He also serves as a liaison with management, service providers, officers, attorneys, and the other Independent Trustees generally between meetings. The Chairperson may also perform other such functions as may be delegated by the Board from time to time. The Independent

13

Trustees believe that the Chairperson’s independence facilitates meaningful dialogue between the Adviser and the Independent Trustees. Except for any duties specified herein or pursuant to the Trust’s Master Trust Agreement, the designation of Chairperson does not impose on such Independent Trustee any duties, obligations or liability that is greater than the duties, obligations or liability imposed on such person as a member of the Board, generally.

The Independent Trustees regularly meet outside the presence of management and are advised by independent legal counsel. The Board believes that its Committees help ensure that the Trust has effective and independent governance and oversight. The Board also believes that its leadership structure facilitates the orderly and efficient flow of information to the Independent Trustees from management of the Trust and from the Adviser, and that the addition of Mr. van Eck to the Board will further facilitate such information.

RISK OVERSIGHT

The Funds and the Trust are subject to a number of risks, including investment, compliance, operational, and valuation risks. Day-to-day risk management functions are within the responsibilities of the Adviser, the Distributor and the other service providers (depending on the nature of the risk) that carry out the Funds’ investment management, distribution and business affairs. Each of the Adviser, the Distributor and the other service providers have their own, independent interests and responsibilities in risk management, and their policies and methods of carrying out risk management functions will depend, in part, on their individual priorities, resources and controls.

Risk oversight forms part of the Board’s general oversight of the Funds and the Trust and is addressed through various activities of the Board and its Committees. As part of its regular oversight of the Funds and Trust, the Board, directly or through a Committee, meets with representatives of various service providers and reviews reports from, among others, the Adviser, the Distributor, the Chief Compliance Officer of the Funds, and the independent registered public accounting firm for the Funds, regarding risks faced by the Funds and relevant risk management functions. The Board, with the assistance of management, reviews investment policies and related risks in connection with its review of the Funds’ performance and its evaluation of the nature and quality of the services provided by the Adviser. The Board has appointed a Chief Compliance Officer for the Funds who oversees the implementation and testing of the Funds’ compliance program and reports to the Board regarding compliance matters for the Funds and their principal service providers. The Chief Compliance Officer’s designation, removal and compensation must be approved by the Board, including a majority of the Independent Trustees. Material changes to the compliance program are reviewed by and approved by the Board. In addition, as part of the Board’s periodic review of the Funds’ advisory, distribution and other service provider agreements, the Board may consider risk management aspects of their operations and the functions for

14

which they are responsible, including the manner in which such service providers implement and administer their codes of ethics and related policies and procedures. For certain of its service providers, such as the Adviser and Distributor, the Board also receives reports periodically regarding business continuity and disaster recovery plans, as well as actions being taken to address cybersecurity and other information technology risks. With respect to valuation, the Board approves and periodically reviews valuation policies and procedures applicable to valuing the Funds’ shares. The Adviser is responsible for the implementation and day-to-day administration of these valuation policies and procedures and provides reports periodically to the Board regarding these and related matters. In addition, the Board or the Audit Committee of the Board receives reports at least annually from the independent registered public accounting firm for the Funds regarding tests performed by such firm on the valuation of all securities. Reports received from the Adviser and the independent registered public accounting firm assist the Board in performing its oversight function of valuation activities and related risks.

The Board recognizes that not all risks that may affect the Funds and the Trust can be identified, that it may not be practical or cost-effective to eliminate or mitigate certain risks, that it may be necessary to bear certain risks to achieve the Funds’ or Trust’s goals, and that the processes, procedures and controls employed to address certain risks may be limited in their effectiveness. Moreover, reports received by the Board that may relate to risk management matters are typically summaries of the relevant information. As a result of the foregoing and other factors, the function of the Board with respect to risk management is one of oversight and not active involvement in, or coordination of, day-to-day risk management activities for the Funds or Trust. The Board may, at any time and in its discretion, change the manner in which it conducts its risk oversight role.

COMMITTEES OF THE BOARD

The Board has established a standing Audit Committee and a standing Governance Committee to assist the Board in the oversight and direction of the business and affairs of the Trust. Currently, each Committee is comprised of all of the members of the Board, all of whom are Independent Trustees. Should Mr. van Eck be elected to the Board, he would not be a member of either Committee as he would be an Interested Trustee.

Audit Committee. This Committee met two times during 2018. The duties of this Committee include meeting with representatives of the Trust’s independent registered public accounting firm to review fees, services, procedures, conclusions and recommendations of independent registered public accounting firms and to discuss the Trust’s system of internal controls. Thereafter, the Committee reports to the Board the Committee’s findings and recommendations concerning internal accounting matters as well as its recommendation for retention or dismissal of the auditing firm. Except for any duties specified herein or pursuant to the Trust’s charter document, the designation of Chairperson of the Audit Committee does not

15

impose on such Independent Trustee any duties, obligations or liability that is greater than the duties, obligations or liability imposed on such person as a member of the Board, generally. Currently, Mr. Short serves as the Chairperson of the Audit Committee. A copy of the Trust’s Audit Committee Charter is provided in Appendix C.

Governance Committee. This Committee met four times during 2018. The duties of this Committee include the consideration of recommendations to the Independent Trustees and the full Board candidates for the Board nominations for Trustees, review of the composition of the Board, compensation and similar matters. In addition, the Governance Committee periodically reviews the performance of the Board and its Committees, including the effectiveness and composition of the overall Board, Board’s Committees, and the Chairperson of the Board and other related matters. When considering potential nominees for election to the Board and to fill vacancies occurring on the Board, where shareholder approval is not required, and as part of the annual self-evaluation, the Governance Committee reviews the mix of skills and other relevant experiences of the Trustees. Currently, Mr. Stelzl serves as the Chairperson of the Governance Committee. A copy of the Trust’s Governance Committee Charter is provided in Appendix B.

TRUSTEE NOMINEE OWNERSHIP OF FUND SHARES

For each Trustee nominee, the dollar range of equity securities beneficially owned by the Trustee in the Funds and in all registered investment companies advised by the Advisers or their affiliates (“Family of Investment Companies”) that are overseen by the Trustee nominees as of December 31, 2018 is shown below. Also shown below are the Trustees’ interests in the Funds that are owned through the Trust’s deferred compensation plan, and while they are economic interests in the specified Funds they do not represent beneficial ownership of the specified Fund’s shares.

Name of Trustee Nominee | Dollar Range of Equity Securities in the Trust* | Aggregate Dollar Range of Equity Securities in all Registered Investment Companies Overseen By Trustee In Family of Investment Companies | ||||

Independent Trustees | ||||||

Jon Lukomnik | None | Over $100,000* | ||||

Jane DiRenzo Pigott | None | Over $100,000* | ||||

R. Alastair Short | None | $50,001 - $100,000 | ||||

Richard D. Stamberger | None | Over $100,000* | ||||

Robert L. Stelzl | None | Over $100,000* | ||||

Interested Trustee | ||||||

Jan F. van Eck(1) | None | Over $100,000 | ||||

| (1) | Jan F. van Eck and members of his family own 100% of the voting stock of VEAC. VEAC owns 100% of the voting stock of VESC. |

| * | Includes ownership through the Trust’s deferred compensation plan as of December 31, 2018. |

16

As of March 31, 2019, all of the Trustees and officers, as a group, owned less than 1% of each Fund, and each class of each Fund.

As to each Independent Trustee and his/her immediate family members, as of March 31, 2019, no person owned beneficially or of record securities in an investment manager or principal underwriter of the Funds, or a person (other than a registered investment company) directly or indirectly controlling, controlled by or under common control with the investment manager or principal underwriter of the Funds.

TRUSTEE COMPENSATION

The Independent Trustees are paid for services rendered to the Trust and VanEck Funds (the “VanEck Trusts”), each a registered investment company managed by the Adviser or its affiliates, with such compensation allocated to each series of the VanEck Trusts based on their average daily net assets. The table below shows the compensation paid to the Independent Trustees for the fiscal year ended December 31, 2018.

All of the Independent Trustees are eligible to participate in the Trust’s deferred compensation plan. Under the terms of the deferred compensation plan, each Independent Trustee may elect to defer payment of all or part of the fees payable for such Trustee’s services and thereby shares in the experience alongside the Funds’ shareholders as the compensation deferred increases or decreases depending on the investment performance of the Funds on which such Trustee’s deferral account is based. Deferred amounts remain in the Trust until distributed in accordance with the provisions of the Trust’s deferred compensation plan. The value of a participating Trustee’s deferral account is based on notional investments of deferred amounts, on the normal payment dates, in the Funds, that are designated by the participating Trustee. Pursuant to the Trust’s deferred compensation plan, payments due under the deferred compensation plan are unsecured obligations of the Trust.

17

Annual Trustee fees may be reviewed periodically and changed by the Board. As an Interested Trustee, Mr. van Eck, if elected, would not receive compensation from the Trust.

Independent Trustees | ||||||||||||||||||

Jon Lukomnik(1) | Jane DiRenzo Pigott(2) | Wayne H. Shaner(3) | R. Alastair Short | Richard D. Stamberger(4) | Robert L. Stelzl(5) | |||||||||||||

Aggregate Compensation from the VanEck Trusts | $ | 115,000 | $ | 115,000 | $ | 115,000 | $ | 130,000 | $ | 145,000 | $ | 130,000 | ||||||

Aggregate Deferred Compensation from the VanEck Trusts | $ | 57,500 | $ | 0 | $ | 20,000 | $ | 0 | $ | 14,500 | $ | 0 | ||||||

Pension or Retirement Benefits Accrued as Part of the VanEck Trusts’ Expenses | N/A | N/A | N/A | N/A | N/A | N/A | ||||||||||||

Estimated Annual Benefits Upon Retirement | N/A | N/A | N/A | N/A | N/A | N/A | ||||||||||||

Total Compensation From the VanEck Trusts and the Fund Complex(6) Paid to Trustee | $ | 115,000 | $ | 115,000 | $ | 115,000 | $ | 356,000 | $ | 363,042 | $ | 130,000 | ||||||

| (1) | As of December 31, 2018, the value of Mr. Lukomnik’s account under the deferred compensation plan was $750,327. |

| (2) | As of December 31, 2018, the value of Ms. Pigott’s account under the deferred compensation plan was $519,615. |

| (3) | Mr. Shaner resigned as a Trustee as of December 2018. As of December 31, 2018, the value of Mr. Shaner’s account under the deferred compensation plan was $105,831. |

| (4) | As of December 31, 2018, the value of Mr. Stamberger’s account under the deferred compensation plan was $1,083,020. |

| (5) | As of December 31, 2018, the value of Mr. Stelzl’s account under the deferred compensation plan was $386,011. |

| (6) | The “Fund Complex” consists of the VanEck Trusts and VanEck Vectors ETF Trust. |

SHAREHOLDER COMMUNICATIONS WITH TRUSTEES

Correspondence intended for an individual Trustee or for the Board may be sent to the attention of the individual Trustee or to the Board, in care of the Secretary of the Trust, at 666 Third Avenue, New York, NY 10017. All communications addressed to the Board or any individual Trustee will be logged and sent to the Board or individual Trustee. The Trust does not hold annual meetings of shareholders and, therefore, does not have a policy with respect to Trustees’ attendance at such meetings.

18

REQUIRED VOTE

Approval of the Proposal requires a plurality of the votes cast at a shareholders’ meeting at which quorum is present. The presence at the Meeting, in person or by proxy, of a majority of the shares entitled to vote is required for a quorum, though any lesser amount may be sufficient for adjournment.

The Board recommends that shareholders of the Funds vote FOR ALL Trustee nominees.

OTHER BUSINESS

No business, other than as set forth above, is expected to come before the Meeting. Should any other matters requiring a vote of shareholders properly come before the Meeting, proxies will be voted or not voted as specified. Proxies reflecting no specifications will be voted in favor of the election of the Current Trustees and in favor of the election of the New Trustee and, as to any other matter properly coming before the Meeting, in accordance with the judgment of the persons named in the proxy.

ADDITIONAL INFORMATION

PERIODIC REPORTS TO SHAREHOLDERS

Copies of the Trust’s most recent annual and semi-annual reports, including financial statements, have previously been delivered to shareholders. Shareholders may obtain a free copy of the Trust’s annual report for the fiscal year ended December 31, 2018, including audited financial statements, and/or the Trust’s semi-annual report for the period ended June 30, 2018, by calling toll-free at 1-800-826-1115 or by mailing a written request to VanEck VIP Trust, 666 Third Avenue, 9th Floor, New York, NY 10017.

INFORMATION ON THE FUNDS’ INDEPENDENT PUBLIC ACCOUNTANTS

Ernst & Young LLP (“EY”), 5 Times Square, New York, New York 10036, has been selected by the Trust’s Audit Committee and approved by the Trustees, including a majority of the Independent Trustees, to audit the financial statements of the Funds. EY has confirmed to the Audit Committee that it is an independent registered public accounting firm with respect to the Trust and each Fund.

Representatives of EY are not expected to be present at the Meeting but have been given the opportunity to make a statement if they do so desire and will be available should any matter arise requiring their presence.

19

AUDIT FEES

For the fiscal years ended December 31, 2017 and December 31, 2018, the aggregate fees billed by EY for professional services rendered for the audit of the Trust’s annual financial statements, the review of the financial statements included in the Funds’ annual reports to shareholders and registration statements, and other services that are normally provided by EY in connection with statutory and regulatory filings or engagements, were $124,750 and $123,750, respectively.

AUDIT RELATED FEES

For the fiscal years ended December 31, 2017 and December 31, 2018, EY did not bill any fees for professional services rendered for assurance and related services that were reasonably related to the performance of the audit or review of financial statements, but not reported under “Audit Fees” above, including accounting consultations, agreed-upon procedure reports, attestation reports, comfort letters and internal control reviews not required by regulators.

TAX FEES

For the fiscal years ended December 31, 2017 and December 31, 2018, the aggregate fees billed by EY for professional services rendered for tax compliance, tax advice, and tax planning, including services relating to the filing or amendment of federal, state or local income tax returns, regulated investment company qualification reviews and tax distribution and analysis reviews were $58,480 and $50,906, respectively.

ALL OTHER FEES

For the fiscal years ended December 31, 2017 and December 31, 2018, EY did not bill any fees for products or services other than those reported in Audit Fees, Audit-Related Fees and Tax Fees.

For the fiscal years ended December 31, 2017 and December 31, 2018, EY did not bill any fees for non-audit services provided to the Adviser or any entity controlling, controlled by, or under common control with the Adviser that provides ongoing services to the registrant.

AUDIT COMMITTEE’S PRE-APPROVAL POLICIES AND PROCEDURES

Prior to the commencement of any engagement, the Audit Committee is required to approve the engagement of the independent registered public accounting firm to provide audit or non-audit services to the Funds, or to provide non-audit services to the Adviser or any entity controlling, controlled by, or under common control with the Adviser that provides ongoing services to the Trust if the engagement relates directly to the operations and financial reporting of the Trust. If action is required prior to the next Audit Committee meeting, the Chairperson of the

20

Audit Committee may approve or deny the request on behalf of the Audit Committee or determine to call a meeting of the Audit Committee. If the Chair of the Audit Committee is unavailable, any other member of the Audit Committee to whom the Audit Committee has delegated authority may serve as an alternate for the purpose of approving or denying the request. All of the audit, audit-related and tax services described above for which EY billed the Trust fees for the fiscal years ended December 31, 2017 and December 31, 2018 were pre-approved by the Audit Committee.

There were no services rendered by EY to the Trust or its series for which the approval requirement was waived. During the same period, all services provided by EY to the Trust, the Funds, the Adviser or any entity controlling, controlled by, or under common control with the Adviser that were required to be approved were approved as required. The Audit Committee has considered whether the provision of non-audit services that were rendered by EY to an investment adviser or an adviser-affiliate that were not approved (not requiring approval), if any, is compatible with maintaining EY’s independence.

ADDITIONAL SERVICE PROVIDERS

The service providers currently engaged by the Trust with respect to the Funds to perform non-advisory services will continue to serve the Trust in the capacities indicated below:

Distributor

Van Eck Securities Corporation

666 Third Avenue, 9th Floor

New York, NY 10017

Investment Adviser and Administrator

Van Eck Associates Corporation

666 Third Avenue, 9th Floor

New York, NY 10017

Transfer Agent

DST Systems, Inc., an SS&C Company

210 West 10th Street, 8th Floor

Kansas City, MO 64105

Custodian

State Street Bank and Trust Company

One Lincoln Street

Boston, MA 02111

Accountant

Ernst & Young LLP

Five Times Square

New York, NY 10036

21

Legal Counsel

Stradley Ronon Stevens & Young, LLP

SHAREHOLDER INFORMATION

Holders of record of the shares of the Funds on the Record Date will be entitled to one whole vote for each whole share that they own and fractional shares will be entitled to proportionate fractional votes. No shares have cumulative voting rights in the election of Trustees. The number of shares you may vote is the total of the number shown on the proxy card(s)/voting instruction card(s) accompanying this Proxy Statement. The number of shares issued and outstanding for each Fund and class as of the Record Date is set forth in Appendix A. A list of all persons who owned of record or beneficially 5% or more of the outstanding shares of any class of a Fund as of July 31, 2019 is set forth in Appendix D.

REVOCATION OF PROXY

For Variable Contract owners: If you are a Variable Contact owner, you may revoke your voting instructions by sending a written notice to the applicable Participating Insurance Company expressly revoking your instructions, by signing and forwarding to the Participating Insurance Company later-dated voting instructions, or otherwise giving notice of revocation at the Meeting. Variable Contract owners should contact their Participating Insurance Company for further information on how to revoke previously given voting instructions, including any applicable deadlines. Please see your Variable Contract prospectus for information on how to contact your Participating Insurance Company.

For Direct Owners (and not Variable Contract owners): Any shareholder who has submitted a proxy may revoke or withdraw the proxy with respect to any matter to be considered at the Meeting if such revocation or withdrawal is properly received prior to the vote on that matter, by delivering a duly executed proxy bearing a later date or by attending the Meeting and voting in person on the matter. The superseding proxy need not be voted using the same method (mail, telephone, or Internet) as the original proxy vote.

If you own your shares through a bank, broker-dealer or other third party intermediary who holds your shares of record, and you wish to attend the Meeting and vote your shares or revoke a previous proxy at the Meeting, you must request a legal proxy from such bank, broker-dealer or other third party intermediary.

If you revoke a previous proxy, your vote will not be counted unless you submit a subsequent proxy or appear at the Meeting and vote in person or legally appoint another proxy to vote on your behalf. If your proxy has not been revoked, the shares represented by the proxy will be cast at the Meeting and any adjournments thereof. Attendance by a shareholder at the Meeting does not, in itself, revoke a proxy.

22

QUORUM AND ADJOURNMENT

The presence at the Meeting, in person or by proxy, of a majority of the shares entitled to vote is required for a quorum, though any lesser number shall be sufficient for adjournments. In the event that a quorum is present at the Meeting but sufficient votes to approve the Proposal are not received, the persons named as proxies may propose one or more adjournments of such Meeting to permit further solicitation of proxies. The affirmative vote of a majority of the votes cast at the Meeting, in person or by proxy, is sufficient for adjournments. The persons designated as proxies may use their discretionary authority to vote as instructed by the officers of the Trust on questions of adjournment. A shareholder vote may be taken on the Proposal in this Proxy Statement prior to any such adjournment if sufficient votes have been received and it is otherwise appropriate.

Election of each nominee as a Trustee of the Trust requires the affirmative vote of a plurality of the votes cast at the Meeting in person or by proxy. All shares of all Funds will vote as a single class for the Proposal. Those shareholders or Variable Contract owners who wish to withhold their vote on any specific nominee(s) may do so on the proxy card(s)/voting instruction card(s).

For purposes of determining the presence of a quorum for transacting business at the Meeting, abstentions and broker “non-votes” (i.e., shares held by brokers or nominees, typically in “street name,” as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter) will be treated as shares that are present for purposes of determining a quorum. For purposes of determining the approval of the Proposal, abstentions and broker non-votes do not count as votes cast with respect to the Proposal. Accordingly, abstentions and broker non-votes will have no effect on the Proposal. With respect to a proposed adjournment of the Meeting, shares present and entitled to vote that are represented by broker non-votes, may, at the discretion of the proxies named herein, be voted in favor of such an adjournment.

SOLICITATION OF PROXIES; EXPENSES

The solicitation of proxies, the cost of which will be borne by the Funds, will be made primarily by mail but may also be made by telephone by Broadridge Financial Solutions, Inc. (“Broadridge”), professional proxy solicitors, who will be paid fees and expenses of approximately $29,000 for soliciting services. Any costs borne by the Trust will be borne indirectly by Variable Contract owners and shareholders as beneficial owners of the Funds’ shares. All expenses in connection with preparing this Proxy Statement and its enclosures and additional solicitation expenses will be borne by the Funds, as appropriate. If votes are recorded by

23

telephone, Broadridge will use procedures designed to authenticate shareholders’ identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions and to confirm that shareholders instructions have been properly recorded.

If a shareholder wishes to participate in the Meeting, the shareholder may submit the proxy card(s) originally sent with this Proxy Statement or attend in person. Should shareholders require additional information regarding the proxy or replacement proxy card(s), they may contact the Funds at 1-800-826-2999. If you are a Variable Contract owner and you wish to participate in the Meeting, please contact your Participating Insurance Company for further information regarding how to represent your vote at the Meeting.

SHAREHOLDER PROPOSALS FOR SUBSEQUENT MEETINGS

As a general matter, the Trust does not hold regular annual or other regular meetings of shareholders. Any shareholder who wishes to submit proposals to be considered at a special meeting of the Trust’s shareholders should send such proposals to VanEck VIP Trust, in care of the Secretary of the Trust, at 666 Third Avenue, 9th Floor, New York, New York 10017. Proposals must be received within a reasonable time before the solicitation of proxies for such meeting in order for such proposal to be considered for inclusion in that proxy statement relating to such meeting. Moreover, inclusion of such proposals is subject to limitations under the federal securities laws. Persons named as proxies for any subsequent shareholders meeting will vote in their discretion with respect to proposals submitted on an untimely basis.

OTHER MATTERS TO COME BEFORE THE MEETING

No Trustee is aware of any matters that will be presented for action at the Meeting other than the matters described in this material. Should any other matters requiring a vote of shareholders arise, the proxy in the accompanying form will confer upon the person or persons entitled to vote the shares represented by such proxy the discretionary authority to vote the shares as to any such other matters.

PLEASE COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY

CARD(S)/VOTING INSTRUCTION CARD(S) PROMPTLY.

NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES

By order of the Board of Trustees,

Jonathan R. Simon

Senior Vice President, Secretary and Chief Legal Officer, VanEck VIP Trust

August 19, 2019

24

APPENDIX A

SHARES ISSUED AND OUTSTANDING

As of the Record Date, each Fund had the following number of shares issued and outstanding:

FUND AND CLASS | SHARES OUTSTANDING | ||

VanEck VIP Emerging Markets Fund | |||

VanEck VIP Emerging Markets Fund—Initial Class | 11,034,926.040 | ||

VanEck VIP Emerging Markets Fund—Class S | 18,625.288 | ||

VanEck VIP Global Gold Fund | |||

VanEck VIP Global Gold Fund—Initial Class | — | ||

VanEck VIP Global Gold Fund—Class S | 4,271,922.789 | ||

VanEck VIP Global Hard Assets Fund | |||

VanEck VIP Global Hard Assets Fund—Initial Class | 7,188,503.247 | ||

VanEck VIP Global Hard Assets Fund—Class S | 6,431,435.334 | ||

VanEck VIP Unconstrained Emerging Markets Bond Fund | |||

VanEck VIP Unconstrained Emerging Markets Bond Fund—Initial Class | 2,532,315.741 | ||

VanEck VIP Unconstrained Emerging Markets Bond Fund—Class S | — | ||

A-1

APPENDIX B

VANECK VIP TRUST

GOVERNANCE COMMITTEE CHARTER

Organization

There shall be a committee of each of the Boards of Trustees of each of VanEck Funds and VanEck VIP Trust (the “Funds”) to be known as the Governance Committee. The Governance Committee shall be composed of each trustee named to the Governance Committee who is not an “interested person” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Fund and is free of any relationship that, in the opinion of the Board of Trustees, would interfere with their exercise of independent judgment as a committee member. As referred to herein, “management” of the Fund shall include employees and affiliated persons as defined in the 1940 Act of Van Eck Associates Corporation, or any of the Funds’ investment advisers, distributor or sub advisers.

Statement of Policy

The Governance Committee shall provide assistance to the Funds’ trustees in fulfilling their responsibilities to the shareholders relating to corporate governance matters including, but not by way of limitation, nomination of trustees, election of trustees, retirement policies of non-interested trustees, addressing and resolving conflicts of interests, promoting the education of trustees and enhancing the quality and integrity of the functioning of the Board. In so doing, it is the responsibility of the Governance Committee to maintain free and open communication between the trustees and the management of the Funds. The Governance Committee shall have access to independent counsel, auditors and other advisers, as it deems necessary.

In discharging its responsibilities, the Governance Committee will have broad authority to react promptly and appropriately to changing conditions and to ensure practices of the Funds are in accordance with all legal requirements and are of the highest level of integrity.

Responsibilities and Powers

The Governance Committee shall have the responsibility and power to:

| • | General. Investigate and consider any matter brought to its attention within the scope of its duties, with the power to retain outside counsel and other experts at the Fund’s expense for this purpose as it deems appropriate. |

| • | Assessment of Overall Board Effectiveness. Review periodically the effectiveness and composition of the overall Board, Board Committees, and the Chairperson of the Board and other related matters giving consideration to such factors including: frequency of the meetings, nature |

B-1

and quality of the materials provided to the Board by management and others, adequacy of the time scheduled at meetings to adequately focus on agenda matters, input by the Board in setting the agenda, opportunity to meet separately with counsel and outside advisers, active and meaningful participation by members at Board meetings, appropriate and diverse skills and background of Board members, and agreement with management’s objectives.

| • | Periodic Review of Board Leadership Positions. Periodically, but no less frequently than every two years, review and make recommendations to the Board for the nomination and election of one or more individuals to serve as Chairperson and Vice-Chairperson, if any, of the Board and chair and/or vicechair of each Committee thereof. |

| • | Independent Trustee Compensation. Review periodically the compensation of Board and Committee members for reasonableness and make recommendations to the Board for approval of such compensation. |

| • | Trustee Alignment with Fund Shareholders. Review the investment of trustees in the Funds and review policies, such as a deferred compensation plan, intended to promote investment in the Funds by the trustees. |

| • | Independent Trustee Independence. No less frequently than annually, review the continued independence of the independent trustees, and periodically review the independent trustees’ outside activities for actual or potential conflicts of interest due to any material business relationship with management or other service providers to the Trusts and their affiliates, to help ensure the ongoing independence of the independent trustees. Such periodic review will also entail consideration of whether outside activities could entail other business conflicts or otherwise impair a Trustee’s ability to contribute appropriately as a Trustee. |

| • | Retirement Policy and Term Limits. Review and recommend a retirement policy to the Board which may include the appropriateness of a mandatory retirement age, a grandfather provision for current board members, and consideration of terms and/or term limits for trustees. |

| • | Trustee Nominations. Make recommendations for nominations of trustee candidates for the Board to the independent trustees and to the full Board. In so doing, the Committee shall perform the following tasks. |

Evaluate trustee candidates’ qualifications for Board membership, and independent trustee candidates’ independence from the Funds’ investment adviser and other principal service providers. Persons selected as independent trustee candidates must be independent in terms of both the letter and spirit of the 1940 Act. The Governance Committee shall also consider the effect of any relationships beyond

B-2

those delineated in the 1940 Act that might impair independence, e.g., business, financial or family relationships with the investment adviser or its affiliates. In determining nominees’ qualifications for Board membership, the Governance Committee may consider such other factors as it may determine to be relevant to fulfilling the role of being a member of the Board.