UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-649

Fidelity Puritan Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | July 31 |

| |

Date of reporting period: | January 31, 2012 |

Item 1. Reports to Stockholders

Fidelity®

Low-Priced Stock Fund

Semiannual Report

January 31, 2012

(Fidelity Cover Art)

Contents

Chairman's Message | (Click Here) | The Chairman's message to shareholders. |

Shareholder Expense Example | (Click Here) | An example of shareholder expenses. |

Investment Changes | (Click Here) | A summary of major shifts in the fund's investments over the past six months. |

Investments | (Click Here) | A complete list of the fund's investments with their market values. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | (Click Here) | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | (Click Here) | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

(The Acting Chairman's photo appears here.)

Dear Shareholder:

Following a year marked by unusually high volatility, 2012 began with most major asset classes advancing steadily in January. For U.S. equities, it was the strongest start to a new year since 1997. International stocks fared even better, despite continued uncertainty related to the sovereign debt crisis in Europe. Investors have been acutely sensitive to the latest news, for better or worse, coming out of the eurozone and its impact on financial markets. As we look ahead, the unresolved debt crisis in Europe remains at the center of a series of risk factors, summarized below, that we believe have the greatest potential to influence the global investment landscape.

Deleveraging and the economy

In the euro-currency area, fiscal austerity among nations and debt deleveraging among financial companies loaded with sovereign debt are deflationary measures and serve to hinder economic growth in the short term. Such an economic and financial-market scenario has not been historically supportive of strong performance among riskier assets, and emerges at a time when many nations need a resurgent economy to assist them in closing their budget deficits and in building confidence among bond buyers to help them refinance their existing debt obligations.

Slowdown in China and Europe

China's economy is the second-largest in the world, and it has been the biggest contributor to global growth since the end of the last recession. Thus, the slower pace of domestic growth in China has led to lower demand for imports of commodities and other construction materials from the rest of the world. In addition, economic weakness in Europe and the broad-based global economic slowdown are putting pressure on China's export growth, which has been largely responsible for its breakneck pace of annual gross domestic product (GDP) growth during the past three decades.

Credit deterioration and contagion

The heightened macroeconomic risk and elevated credit risk swirling around certain European nations and financial institutions have caused many market participants to avoid purchases of or reduce exposure to short-term debt offerings by these issuers. With increased credit risk, there are growing concerns about the potential credit contraction and contagion from European issuers spreading to other financial markets.

We invite you to learn more by visiting us on the Internet or calling us by phone. It is our privilege to provide the resources you need to choose investments that are right for you.

Sincerely,

(The Acting Chairman's signature appears here.)

James C. Curvey

Acting Chairman

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2011 to January 31, 2012).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Semiannual Report

Shareholder Expense Example - continued

| Annualized Expense Ratio | Beginning

Account Value

August 1, 2011 | Ending

Account Value

January 31, 2012 | Expenses Paid

During Period*

August 1, 2011 to January 31, 2012 |

Low-Priced Stock | .96% | | | |

Actual | | $ 1,000.00 | $ 1,001.20 | $ 4.83 |

HypotheticalA | | $ 1,000.00 | $ 1,020.31 | $ 4.88 |

Class K | .84% | | | |

Actual | | $ 1,000.00 | $ 1,001.90 | $ 4.23 |

HypotheticalA | | $ 1,000.00 | $ 1,020.91 | $ 4.27 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

Semiannual Report

Investment Changes (Unaudited)

Top Ten Stocks as of January 31, 2012 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

UnitedHealth Group, Inc. | 3.5 | 3.3 |

Microsoft Corp. | 3.0 | 0.4 |

Next PLC | 2.0 | 1.9 |

Seagate Technology | 2.0 | 1.2 |

Ross Stores, Inc. | 1.9 | 1.4 |

Metro, Inc. Class A (sub. vtg.) | 1.8 | 1.6 |

ENI SpA | 1.4 | 1.3 |

Coventry Health Care, Inc. | 1.3 | 1.4 |

Best Buy Co., Inc. | 1.3 | 1.1 |

Bed Bath & Beyond, Inc. | 1.2 | 1.1 |

| 19.4 | |

Top Five Market Sectors as of January 31, 2012 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Consumer Discretionary | 27.3 | 26.1 |

Information Technology | 19.9 | 15.7 |

Health Care | 12.7 | 12.5 |

Industrials | 9.3 | 7.2 |

Financials | 8.5 | 7.6 |

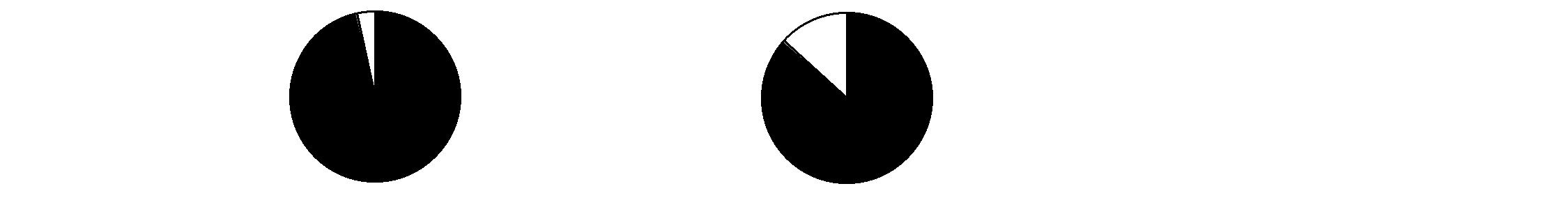

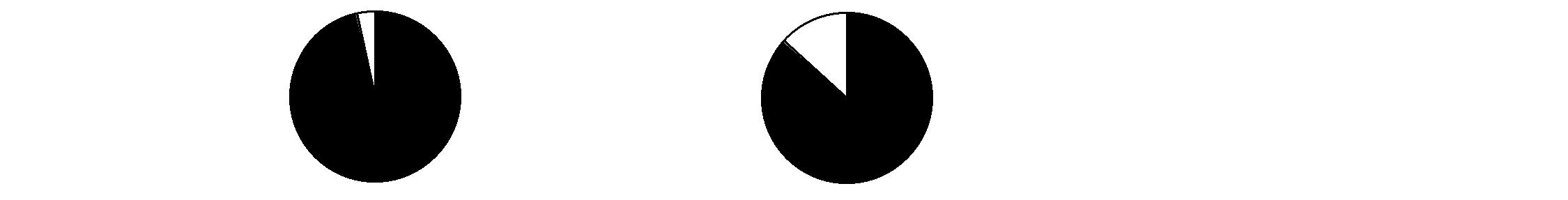

Asset Allocation (% of fund's net assets) |

As of January 31, 2012 * | As of July 31, 2011 ** |

| Stocks 96.1% | |  | Stocks 86.2% | |

| Convertible

Securities 0.5% | |  | Convertible

Securities 0.5% | |

| Short-Term

Investments and

Net Other Assets 3.4% | |  | Short-Term

Investments and

Net Other Assets 13.3% | |

* Foreign investments | 39.1% | | ** Foreign investments | 39.5% | |

Semiannual Report

Investments January 31, 2012

Showing Percentage of Net Assets

Common Stocks - 96.1% |

| Shares | | Value (000s) |

CONSUMER DISCRETIONARY - 26.9% |

Auto Components - 1.4% |

ASTI Corp. (e) | 1,683,000 | | $ 4,857 |

Drew Industries, Inc. (a) | 635,183 | | 16,496 |

FCC Co. Ltd. | 500,000 | | 10,600 |

Federal Screw Works (a)(e) | 150,000 | | 563 |

Hi-Lex Corp. | 1,200,000 | | 19,126 |

INZI Controls Co. Ltd. (e) | 1,516,000 | | 7,329 |

Johnson Controls, Inc. | 7,400,000 | | 235,098 |

Motonic Corp. (e) | 3,299,900 | | 24,413 |

Murakami Corp. (e) | 700,000 | | 7,484 |

Musashi Seimitsu Industry Co. Ltd. | 1,000,000 | | 23,009 |

Nippon Seiki Co. Ltd. | 2,530,000 | | 29,970 |

Nissin Kogyo Co. Ltd. | 1,160,000 | | 17,850 |

Nittan Valve Co. Ltd. | 360,000 | | 1,336 |

Piolax, Inc. (e) | 1,010,000 | | 23,822 |

Samsung Climate Control Co. Ltd. (e) | 460,050 | | 3,018 |

Sewon Precision Industries Co. Ltd. | 498,600 | | 5,149 |

Shoei Co. Ltd. | 625,000 | | 4,263 |

SJM Co. Ltd. (e) | 1,270,000 | | 7,021 |

SJM Holdings Co. Ltd. (e) | 1,332,974 | | 3,786 |

Strattec Security Corp. (e) | 330,000 | | 6,947 |

Wescast Industries, Inc. Class A (sub. vtg.) (a) | 200,000 | | 1,655 |

Yachiyo Industry Co. Ltd. | 900,000 | | 5,266 |

Yutaka Giken Co. Ltd. (e) | 1,482,000 | | 31,417 |

| | 490,475 |

Automobiles - 0.1% |

Thor Industries, Inc. | 1,375,000 | | 42,158 |

Distributors - 0.3% |

Doshisha Co. Ltd. | 700,000 | | 22,094 |

Educational Development Corp. (e) | 386,892 | | 1,896 |

Goodfellow, Inc. (e) | 857,000 | | 7,102 |

Nakayamafuku Co. Ltd. | 10,000 | | 80 |

SPK Corp. | 165,000 | | 2,900 |

Uni-Select, Inc. (e) | 2,011,100 | | 52,947 |

| | 87,019 |

Diversified Consumer Services - 0.8% |

Apollo Group, Inc. Class A (non-vtg.) (a) | 20,000 | | 1,048 |

Ascent Capital Group, Inc. (a) | 225,000 | | 10,663 |

Capella Education Co. (a)(e) | 870,000 | | 36,827 |

Career Education Corp. (a)(e) | 4,700,000 | | 47,517 |

Clip Corp. (e) | 328,600 | | 3,996 |

Common Stocks - continued |

| Shares | | Value (000s) |

CONSUMER DISCRETIONARY - continued |

Diversified Consumer Services - continued |

Corinthian Colleges, Inc. (a)(d) | 2,500,000 | | $ 7,525 |

H&R Block, Inc. | 600,000 | | 9,816 |

Kyoshin Co. Ltd. (a) | 100,000 | | 184 |

Matthews International Corp. Class A | 40,314 | | 1,329 |

Meiko Network Japan Co. Ltd. | 730,000 | | 6,732 |

Regis Corp. | 1,500,000 | | 25,710 |

Shingakukai Co. Ltd. | 200,000 | | 787 |

Shuei Yobiko Co. Ltd. | 125,000 | | 494 |

Steiner Leisure Ltd. (a)(e) | 1,650,000 | | 81,477 |

Step Co. Ltd. (e) | 1,204,000 | | 7,755 |

Up, Inc. (e) | 750,000 | | 6,366 |

YBM Sisa.com, Inc. (e) | 950,000 | | 5,743 |

| | 253,969 |

Hotels, Restaurants & Leisure - 2.5% |

Aeon Fantasy Co. Ltd. | 550,000 | | 9,574 |

Ambassadors Group, Inc. (e) | 1,770,356 | | 7,984 |

ARK Restaurants Corp. (e) | 298,992 | | 4,335 |

B-R 31 Ice Cream Co. Ltd. | 5,000 | | 184 |

Brinker International, Inc. (e) | 7,000,000 | | 180,950 |

BRONCO BILLY Co. Ltd. | 12,000 | | 334 |

Carnival Corp. unit | 205,600 | | 6,209 |

CEC Entertainment, Inc. (e) | 2,000,000 | | 70,340 |

Darden Restaurants, Inc. | 2,000,000 | | 91,740 |

Echo Entertainment Group Ltd. (a) | 1,933,333 | | 7,409 |

Flanigan's Enterprises, Inc. | 50,357 | | 354 |

Hiday Hidaka Corp. (e) | 903,300 | | 16,447 |

Ibersol SGPS SA | 500,000 | | 2,649 |

Intralot SA | 1,000,000 | | 1,086 |

Jack in the Box, Inc. (a)(e) | 6,569,000 | | 139,263 |

Kangwon Land, Inc. | 125,000 | | 2,932 |

Kura Corp. Ltd. (d) | 650,000 | | 9,115 |

Monarch Casino & Resort, Inc. (a)(e) | 1,350,000 | | 14,378 |

Ohsho Food Service Corp. | 75,000 | | 1,837 |

Papa John's International, Inc. (a)(e) | 2,700,000 | | 104,598 |

Plenus Co. Ltd. | 1,675,000 | | 29,224 |

Ruby Tuesday, Inc. (a)(e) | 6,372,030 | | 47,854 |

Ruth's Hospitality Group, Inc. (a)(e) | 2,375,000 | | 14,701 |

Shinsegae Food Co. Ltd. | 17,000 | | 1,224 |

Sonic Corp. (a)(e) | 6,223,500 | | 42,631 |

Sportscene Group, Inc. Class A (e) | 400,000 | | 3,371 |

Common Stocks - continued |

| Shares | | Value (000s) |

CONSUMER DISCRETIONARY - continued |

Hotels, Restaurants & Leisure - continued |

St. Marc Holdings Co. Ltd. | 480,000 | | $ 18,777 |

Tabcorp Holdings Ltd. | 1,933,333 | | 5,973 |

| | 835,473 |

Household Durables - 2.8% |

Abbey PLC (e) | 3,400,000 | | 23,792 |

Barratt Developments PLC (a)(e) | 84,000,199 | | 144,564 |

Bellway PLC (e) | 7,525,000 | | 87,404 |

Chromcraft Revington, Inc. (a) | 217,146 | | 276 |

D.R. Horton, Inc. (e) | 20,000,000 | | 278,400 |

Dorel Industries, Inc. Class B (sub. vtg.) | 3,272,600 | | 80,873 |

Emak SpA | 3,300,000 | | 2,482 |

First Juken Co. Ltd. (e) | 1,690,000 | | 15,053 |

Helen of Troy Ltd. (a)(e) | 2,850,000 | | 91,685 |

Henry Boot PLC (e) | 10,774,000 | | 22,753 |

HTL International Holdings Ltd. (e) | 29,655,500 | | 8,252 |

Jarden Corp. | 3,028,400 | | 102,027 |

M/I Homes, Inc. (a)(e) | 1,803,400 | | 20,469 |

Maruzen Co., Ltd. (e) | 1,800,000 | | 12,397 |

Merry Electronics Co. Ltd. | 500,000 | | 603 |

P&F Industries, Inc. Class A (a)(e) | 361,038 | | 1,401 |

Pace Micro Technology PLC | 1,000,000 | | 1,344 |

Sanei Architecture Planning Co. Ltd. | 710,400 | | 7,483 |

Stanley Furniture Co., Inc. (a)(e) | 1,289,638 | | 4,527 |

Steinhoff International Holdings Ltd. | 3,500,500 | | 11,194 |

Token Corp. (e) | 1,000,000 | | 36,364 |

| | 953,343 |

Internet & Catalog Retail - 0.2% |

Belluna Co. Ltd. (e) | 5,100,000 | | 40,677 |

NutriSystem, Inc. (d) | 575,000 | | 6,843 |

PetMed Express, Inc. (d)(e) | 2,425,100 | | 30,241 |

| | 77,761 |

Leisure Equipment & Products - 0.3% |

Accell Group NV (e) | 1,322,905 | | 28,135 |

Daikoku Denki Co. Ltd. | 50,000 | | 516 |

Fenix Outdoor AB | 5,000 | | 125 |

Giant Manufacturing Co. Ltd. | 5,000,555 | | 21,121 |

JAKKS Pacific, Inc. (e) | 2,793,139 | | 42,679 |

Kabe Husvagnar AB (B Shares) | 107,279 | | 1,530 |

Marine Products Corp. | 1,155,248 | | 6,897 |

Mars Engineering Corp. | 350,000 | | 6,446 |

Common Stocks - continued |

| Shares | | Value (000s) |

CONSUMER DISCRETIONARY - continued |

Leisure Equipment & Products - continued |

Miroku Corp. | 678,000 | | $ 1,387 |

Trigano SA | 85,000 | | 1,468 |

| | 110,304 |

Media - 1.2% |

1010 Printing Group Ltd. (a) | 383,736 | | 23 |

Aegis Group PLC | 5,600,000 | | 13,927 |

Astral Media, Inc. Class A (non-vtg.) | 2,750,000 | | 96,672 |

Chime Communications PLC (e) | 4,500,000 | | 15,514 |

Cinderella Media Group Ltd. | 10,158,000 | | 2,502 |

Digital Generation, Inc. (a) | 178,500 | | 2,481 |

DISH Network Corp. Class A | 1,660,000 | | 46,347 |

DreamWorks Animation SKG, Inc. Class A (a)(d) | 3,500,000 | | 62,125 |

Gannett Co., Inc. | 850,000 | | 12,045 |

GFK AG | 175,000 | | 7,782 |

Harte-Hanks, Inc. (e) | 3,360,000 | | 32,424 |

Intage, Inc. (e) | 1,040,000 | | 20,655 |

New Frontier Media, Inc. (a)(e) | 1,949,400 | | 2,125 |

Omnicom Group, Inc. | 1,000,000 | | 45,610 |

Pico Far East Holdings Ltd. | 8,000,000 | | 1,661 |

Proto Corp. | 130,000 | | 4,255 |

RKB Mainichi Broadcasting Corp. | 50,000 | | 539 |

Saga Communications, Inc. Class A (a) | 375,077 | | 15,472 |

STW Group Ltd. | 3,000,000 | | 2,834 |

Tow Co. Ltd. (e) | 1,223,000 | | 7,460 |

TVA Group, Inc. Class B (non-vtg.) | 2,000,400 | | 17,555 |

| | 410,008 |

Multiline Retail - 2.6% |

Don Quijote Co. Ltd. | 3,100,000 | | 115,167 |

Hanwha Timeworld Co. Ltd. | 88,960 | | 1,612 |

Harvey Norman Holdings Ltd. (d) | 22,050,000 | | 48,221 |

Next PLC (e) | 16,650,000 | | 687,236 |

Tuesday Morning Corp. (a)(e) | 4,310,697 | | 14,656 |

Watts Co. Ltd. (e) | 387,300 | | 4,080 |

Zakkaya Bulldog Co. Ltd. | 335,000 | | 967 |

| | 871,939 |

Specialty Retail - 12.0% |

ABC-Mart, Inc. | 135,000 | | 4,831 |

Abercrombie & Fitch Co. Class A (e) | 6,500,000 | | 298,610 |

Aeropostale, Inc. (a)(e) | 8,177,100 | | 133,859 |

Ascena Retail Group, Inc. (a) | 650,000 | | 22,991 |

Common Stocks - continued |

| Shares | | Value (000s) |

CONSUMER DISCRETIONARY - continued |

Specialty Retail - continued |

AT-Group Co. Ltd. | 566,000 | | $ 7,120 |

AutoZone, Inc. (a) | 900,000 | | 313,092 |

Bed Bath & Beyond, Inc. (a) | 6,600,000 | | 400,620 |

Best Buy Co., Inc. | 18,280,489 | | 437,818 |

Big 5 Sporting Goods Corp. (e) | 2,199,000 | | 17,460 |

BMTC Group, Inc. Class A (sub. vtg.) (e) | 5,607,600 | | 100,716 |

Brown Shoe Co., Inc. (d)(e) | 3,250,000 | | 30,713 |

Cash Converters International Ltd. | 16,000,000 | | 9,512 |

Chico's FAS, Inc. | 1,700,000 | | 19,448 |

Citi Trends, Inc. (a)(e) | 1,166,801 | | 10,525 |

Collective Brands, Inc. (a) | 1,450,000 | | 24,157 |

Destination Maternity Corp. | 100,000 | | 1,669 |

Fantastic Holdings Ltd. | 25,000 | | 55 |

Folli Follie Group (a)(e) | 3,372,000 | | 29,109 |

Fourlis Holdings SA (a) | 250,000 | | 497 |

GameStop Corp. Class A (a)(d)(e) | 8,000,000 | | 186,880 |

Glentel, Inc. (e) | 1,950,000 | | 43,269 |

Guess?, Inc. | 3,500,000 | | 105,000 |

Gulliver International Co. Ltd. (e) | 1,011,500 | | 39,475 |

Halfords Group PLC | 400,000 | | 2,011 |

Honeys Co. Ltd. (d)(e) | 1,650,000 | | 28,009 |

I A Group Corp. (e) | 672,000 | | 4,575 |

John David Group PLC | 50,000 | | 563 |

Jos. A. Bank Clothiers, Inc. (a)(d)(e) | 2,737,500 | | 130,716 |

Jumbo SA (e) | 11,000,000 | | 52,226 |

K'S Denki Corp. | 2,750,000 | | 96,140 |

Kyoto Kimono Yuzen Co. Ltd. (e) | 1,555,200 | | 19,402 |

Le Chateau, Inc. Class A (sub. vtg.) | 2,022,600 | | 3,288 |

Leon's Furniture Ltd. | 750,000 | | 9,424 |

Lithia Motors, Inc. Class A (sub. vtg.) | 1,587,894 | | 35,267 |

Lowe's Companies, Inc. | 230,000 | | 6,171 |

Macintosh Retail Group NV | 150,000 | | 1,913 |

MarineMax, Inc. (a)(e) | 1,425,335 | | 11,716 |

Mr. Bricolage SA (e) | 760,492 | | 9,847 |

Nafco Co. Ltd. (e) | 1,892,900 | | 33,249 |

Nishimatsuya Chain Co. Ltd. (e) | 6,950,000 | | 56,435 |

Pal Co. Ltd. (e) | 810,000 | | 33,790 |

Point, Inc. | 25,000 | | 1,025 |

Reitmans (Canada) Ltd. Class A (non-vtg.) | 100,000 | | 1,466 |

Right On Co. Ltd. | 610,000 | | 4,777 |

RONA, Inc. | 675,000 | | 6,361 |

Common Stocks - continued |

| Shares | | Value (000s) |

CONSUMER DISCRETIONARY - continued |

Specialty Retail - continued |

Ross Stores, Inc. (e) | 12,500,000 | | $ 635,250 |

Second Chance Properties Ltd. | 12,489,130 | | 3,376 |

Second Chance Properties Ltd. warrants 9/27/13 (a) | 3,828,125 | | 97 |

Sonic Automotive, Inc. Class A (sub. vtg.) (d) | 2,182,317 | | 34,022 |

Staples, Inc. | 22,000,000 | | 321,860 |

Super Cheap Auto Group Ltd. | 60,000 | | 376 |

The Buckle, Inc. (d) | 850,000 | | 37,086 |

USS Co. Ltd. (e) | 2,000,000 | | 191,001 |

Workman Co. Ltd. (e) | 1,428,000 | | 41,399 |

| | 4,050,264 |

Textiles, Apparel & Luxury Goods - 2.7% |

Adolfo Dominguez SA (a) | 350,000 | | 2,225 |

Arts Optical International Holdings Ltd. (e) | 33,970,640 | | 9,637 |

Bijou Brigitte Modische Accessoires AG (d) | 45,000 | | 4,179 |

Cherokee, Inc. (d) | 200,411 | | 2,158 |

Delta Apparel, Inc. (a)(e) | 852,200 | | 13,039 |

F&F Co. Ltd. | 552,290 | | 3,171 |

Fossil, Inc. (a) | 2,600,000 | | 247,130 |

Geox SpA (d) | 1,000,000 | | 3,317 |

Gildan Activewear, Inc. (e) | 12,057,412 | | 262,371 |

Hampshire Group Ltd. (a)(e) | 920,000 | | 2,300 |

Handsome Co. Ltd. (e) | 2,436,150 | | 73,089 |

Iconix Brand Group, Inc. (a) | 850,000 | | 15,649 |

JLM Couture, Inc. (a)(e) | 197,100 | | 256 |

K-Swiss, Inc. Class A (a)(d) | 2,510,000 | | 8,484 |

Li Ning Co. Ltd. | 100,000 | | 103 |

Marimekko Oyj | 100,000 | | 1,562 |

Movado Group, Inc. | 359,910 | | 6,626 |

Pandora A/S (d) | 1,500,000 | | 19,663 |

Rocky Brands, Inc. (a)(e) | 696,200 | | 7,728 |

Skechers U.S.A., Inc. Class A (sub. vtg.) (a) | 3,859,399 | | 46,930 |

Sun Hing Vision Group Holdings Ltd. (e) | 23,939,000 | | 8,334 |

Ted Baker PLC | 250,000 | | 2,936 |

Texwinca Holdings Ltd. | 54,000,000 | | 59,255 |

True Religion Apparel, Inc. (a) | 10,000 | | 362 |

TSI Holdings Co. Ltd. (a) | 2,062,500 | | 10,390 |

Tungtex Holdings Co. Ltd. (e) | 22,000,000 | | 2,525 |

Van de Velde | 75,000 | | 3,649 |

Victory City International Holdings Ltd. | 61,000,000 | | 6,293 |

Youngone Corp. | 700,000 | | 16,546 |

Common Stocks - continued |

| Shares | | Value (000s) |

CONSUMER DISCRETIONARY - continued |

Textiles, Apparel & Luxury Goods - continued |

Youngone Holdings Co. Ltd. (e) | 929,000 | | $ 43,007 |

Yue Yuen Industrial (Holdings) Ltd. | 8,450,000 | | 25,878 |

| | 908,792 |

TOTAL CONSUMER DISCRETIONARY | | 9,091,505 |

CONSUMER STAPLES - 8.2% |

Beverages - 1.1% |

Baron de Ley SA (a) | 200,000 | | 11,118 |

C&C Group PLC | 1,100,285 | | 4,525 |

Constellation Brands, Inc. Class A (sub. vtg.) (a) | 8,850,000 | | 184,965 |

Monster Beverage Corp. (a) | 1,500,000 | | 156,765 |

Muhak Co. Ltd. (e) | 1,349,968 | | 14,302 |

Treasury Wine Estates Ltd. | 1,000 | | 4 |

| | 371,679 |

Food & Staples Retailing - 5.3% |

Alimentation Couche-Tard, Inc. Class A (multi-vtg.) | 125,000 | | 3,757 |

Aoki Super Co. Ltd. | 100,000 | | 1,081 |

Belc Co. Ltd. (e) | 2,086,000 | | 33,905 |

Cosmos Pharmaceutical Corp. (d)(e) | 1,900,000 | | 89,355 |

Create SD Holdings Co. Ltd. (e) | 2,106,100 | | 47,852 |

CVS Caremark Corp. | 2,000,000 | | 83,500 |

Daikokutenbussan Co. Ltd. | 550,000 | | 16,017 |

Dong Suh Companies, Inc. | 772,388 | | 22,279 |

Fyffes PLC (Ireland) (e) | 33,000,000 | | 16,618 |

Growell Holdings Co. Ltd. | 340,987 | | 8,396 |

Halows Co. Ltd. (e) | 1,401,500 | | 13,513 |

Ingles Markets, Inc. Class A | 531,521 | | 9,264 |

Kroger Co. | 750,000 | | 17,820 |

Kusuri No Aoki Co. Ltd. | 145,300 | | 2,989 |

Majestic Wine PLC | 400,016 | | 2,509 |

Marukyu Co. Ltd. | 50,000 | | 538 |

Maxvalu Nishinihon Co. Ltd. | 25,000 | | 409 |

Metro, Inc. Class A (sub. vtg.) (e) | 10,925,833 | | 596,440 |

North West Co., Inc. | 650,000 | | 12,575 |

Safeway, Inc. (d) | 12,650,000 | | 278,047 |

San-A Co. Ltd. | 375,000 | | 15,201 |

Shoppers Drug Mart Corp. | 5,000,000 | | 206,931 |

Sligro Food Group NV | 1,800,000 | | 50,794 |

Sundrug Co. Ltd. | 2,225,000 | | 65,936 |

Common Stocks - continued |

| Shares | | Value (000s) |

CONSUMER STAPLES - continued |

Food & Staples Retailing - continued |

SUPERVALU, Inc. (d)(e) | 12,600,000 | | $ 87,066 |

Tesco PLC | 500,000 | | 2,518 |

Total Produce PLC | 9,600,000 | | 4,709 |

Village Super Market, Inc. Class A | 120,000 | | 3,810 |

Walgreen Co. | 1,960,000 | | 65,386 |

Yaoko Co. Ltd. | 725,000 | | 24,309 |

| | 1,783,524 |

Food Products - 1.6% |

Aryzta AG | 1,850,000 | | 85,439 |

Cranswick PLC | 200,000 | | 2,459 |

Dean Foods Co. (a)(e) | 12,500,000 | | 134,500 |

Dutch Lady Milk Industries Bhd | 250,000 | | 2,112 |

Food Empire Holdings Ltd. (e) | 52,900,000 | | 13,668 |

Fresh Del Monte Produce, Inc. (e) | 6,359,900 | | 155,690 |

Global Bio-Chem Technology Group Co. Ltd. | 13,000,000 | | 2,933 |

Greggs PLC | 1,325,000 | | 10,650 |

Hilton Food Group PLC | 100,000 | | 407 |

Industrias Bachoco SA de CV sponsored ADR | 999,339 | | 20,067 |

Iwatsuka Confectionary Co. Ltd. | 13,200 | | 482 |

Nam Yang Dairy Products | 11,000 | | 8,412 |

Pacific Andes (Holdings) Ltd. | 86,211,183 | | 15,421 |

Pacific Andes International Holdings Ltd. | 54,992,872 | | 5,247 |

People's Food Holdings Ltd. (a) | 40,100,000 | | 21,997 |

President Rice Products PCL | 1,000,000 | | 1,355 |

Robert Wiseman Dairies PLC | 750,000 | | 4,592 |

Rocky Mountain Chocolate Factory, Inc. (e) | 503,917 | | 4,364 |

Samyang Genex Co. Ltd. | 145,795 | | 7,853 |

Select Harvests Ltd. (e) | 5,196,000 | | 9,819 |

Sunjin Co. Ltd. (a)(e) | 813,630 | | 5,070 |

Sunjin Holdings Co. Ltd. (a)(e) | 138,537 | | 2,516 |

Synear Food Holdings Ltd. | 39,000,000 | | 4,186 |

United Food Holdings Ltd. | 22,400,000 | | 962 |

Yutaka Foods Corp. | 147,500 | | 2,808 |

| | 523,009 |

Personal Products - 0.2% |

American Oriental Bioengineering, Inc. (a)(d) | 350,000 | | 266 |

Atrium Innovations, Inc. (a) | 1,400,000 | | 16,475 |

Avon Products, Inc. | 1,140,000 | | 20,258 |

CCA Industries, Inc. | 179,095 | | 894 |

Inter Parfums, Inc. | 600,073 | | 10,021 |

Common Stocks - continued |

| Shares | | Value (000s) |

CONSUMER STAPLES - continued |

Personal Products - continued |

Nutraceutical International Corp. (a)(e) | 1,143,504 | | $ 14,694 |

Physicians Formula Holdings, Inc. (a) | 626,100 | | 1,891 |

Sarantis SA (a) | 1,299,952 | | 3,639 |

USANA Health Sciences, Inc. (a)(d) | 420,000 | | 14,608 |

| | 82,746 |

Tobacco - 0.0% |

Imperial Tobacco Group PLC | 25,000 | | 894 |

Karelia Tobacco Co., Inc. | 2,452 | | 257 |

| | 1,151 |

TOTAL CONSUMER STAPLES | | 2,762,109 |

ENERGY - 6.2% |

Energy Equipment & Services - 2.7% |

AKITA Drilling Ltd. Class A (non-vtg.) | 1,777,000 | | 17,225 |

Bristow Group, Inc. | 1,600,017 | | 78,497 |

BW Offshore Ltd. | 5,000,000 | | 7,550 |

Cal Dive International, Inc. (a)(e) | 6,624,500 | | 19,940 |

CE Franklin Ltd. (a)(e) | 1,475,000 | | 12,430 |

Divestco, Inc. (a)(e) | 3,586,000 | | 572 |

Essential Energy Services Ltd. (a) | 250,000 | | 511 |

Farstad Shipping ASA (e) | 3,200,000 | | 86,716 |

Flint Energy Services Ltd. (a)(f) | 300,000 | | 4,422 |

Fugro NV (Certificaten Van Aandelen) unit | 1,600,027 | | 105,161 |

Hercules Offshore, Inc. (a) | 2,750,000 | | 12,348 |

Nabors Industries Ltd. (a) | 1,060,000 | | 19,737 |

Noble Corp. | 1,147 | | 40 |

Oil States International, Inc. (a) | 2,000,000 | | 159,380 |

Patterson-UTI Energy, Inc. | 605,000 | | 11,416 |

Precision Drilling Corp. (a) | 5,150,000 | | 52,848 |

ProSafe ASA | 7,900,000 | | 61,262 |

Rowan Companies, Inc. (a) | 689,700 | | 23,457 |

Solstad Offshore ASA | 1,250,000 | | 20,985 |

Total Energy Services, Inc. (e) | 2,500,000 | | 41,935 |

Unit Corp. (a)(e) | 3,800,000 | | 171,950 |

| | 908,382 |

Oil, Gas & Consumable Fuels - 3.5% |

Adams Resources & Energy, Inc. (e) | 319,268 | | 12,174 |

AOC Holdings, Inc. (e) | 6,050,000 | | 41,508 |

Beach Energy Ltd. (d) | 18,500,000 | | 29,067 |

Common Stocks - continued |

| Shares | | Value (000s) |

ENERGY - continued |

Oil, Gas & Consumable Fuels - continued |

ENI SpA | 20,900,000 | | $ 463,043 |

Great Eastern Shipping Co. Ltd. | 4,360,000 | | 20,486 |

Hankook Shell Oil Co. Ltd. (e) | 68,000 | | 12,895 |

HollyFrontier Corp. | 908,256 | | 26,648 |

Marathon Oil Corp. | 4,663,000 | | 146,372 |

Michang Oil Industrial Co. Ltd. (e) | 173,900 | | 7,307 |

Stone Energy Corp. (a) | 750,000 | | 21,038 |

Sunoco, Inc. | 1,800,000 | | 69,048 |

Tesoro Corp. (a) | 4,900,000 | | 122,647 |

Tsakos Energy Navigation Ltd. | 725,000 | | 4,843 |

W&T Offshore, Inc. (d)(e) | 4,000,100 | | 86,442 |

Williams Companies, Inc. | 310,300 | | 8,943 |

World Fuel Services Corp. | 2,000,022 | | 90,761 |

WPX Energy, Inc. | 1,000,000 | | 16,480 |

| | 1,179,702 |

TOTAL ENERGY | | 2,088,084 |

FINANCIALS - 8.5% |

Capital Markets - 0.3% |

ABG Sundal Collier ASA | 50,000 | | 38 |

AllianceBernstein Holding LP | 510,000 | | 7,762 |

Federated Investors, Inc. Class B (non-vtg.) (d) | 600,000 | | 10,248 |

GFI Group, Inc. | 523,800 | | 2,425 |

Investment Technology Group, Inc. (a) | 675,000 | | 7,655 |

Kyokuto Securities Co. Ltd. | 10,000 | | 67 |

Morgan Stanley | 5,000 | | 93 |

State Street Corp. | 1,150,000 | | 45,057 |

Tullett Prebon PLC | 1,600,000 | | 7,509 |

Waddell & Reed Financial, Inc. Class A | 550,000 | | 15,098 |

| | 95,952 |

Commercial Banks - 1.1% |

Bank of Ireland (a) | 646,000,040 | | 96,472 |

Bank of the Ozarks, Inc. (d) | 25,000 | | 700 |

BBCN Bancorp, Inc. (a) | 1,700,000 | | 17,204 |

Cathay General Bancorp (e) | 4,125,000 | | 64,928 |

Codorus Valley Bancorp, Inc. | 138,734 | | 1,408 |

Dimeco, Inc. | 29,140 | | 983 |

East West Bancorp, Inc. | 4,000,000 | | 87,840 |

First Bancorp, Puerto Rico (a)(d) | 199,999 | | 740 |

Common Stocks - continued |

| Shares | | Value (000s) |

FINANCIALS - continued |

Commercial Banks - continued |

First Bancorp, Puerto Rico (g) | 7,428,572 | | $ 24,737 |

First Financial Service Corp. (a)(d) | 102,373 | | 259 |

Irish Bank Resolution Corp. Ltd. (a) | 9,500,373 | | 0 |

National Penn Bancshares, Inc. | 535,226 | | 4,651 |

North Valley Bancorp (a)(e) | 650,000 | | 6,513 |

Norwood Financial Corp. | 31,801 | | 861 |

OmniAmerican Bancorp, Inc. (a) | 6,888 | | 113 |

Oriental Financial Group, Inc. (e) | 2,504,542 | | 28,652 |

Orrstown Financial Services, Inc. | 20,000 | | 151 |

Pacific Premier Bancorp, Inc. (a)(e) | 948,105 | | 7,168 |

Popular, Inc. (a) | 18,000,000 | | 28,260 |

Sandy Spring Bancorp, Inc. | 25,000 | | 457 |

Sparebanken More (primary capital certificate) | 92,008 | | 2,791 |

Sparebanken Rogaland (primary capital certificate) | 1,061,327 | | 7,181 |

The First Bancorp, Inc. | 9,711 | | 155 |

West End Indiana Bancshares, Inc. | 12,000 | | 133 |

Wilshire Bancorp, Inc. (a) | 200,000 | | 700 |

| | 383,057 |

Consumer Finance - 0.1% |

Advance America Cash Advance Centers, Inc. | 105,000 | | 826 |

Aeon Credit Service (Asia) Co. Ltd. | 12,400,000 | | 9,034 |

Nicholas Financial, Inc. | 200,827 | | 2,595 |

| | 12,455 |

Diversified Financial Services - 0.1% |

Newship Ltd. (a) | 2,500 | | 158 |

NICE Holdings Co. Ltd. | 56,147 | | 2,524 |

NICE Information Service Co. Ltd. | 255,334 | | 5,467 |

Ricoh Leasing Co. Ltd. | 50,000 | | 1,185 |

The NASDAQ Stock Market, Inc. (a) | 400,000 | | 9,912 |

| | 19,246 |

Insurance - 6.3% |

Admiral Group PLC | 1,100,000 | | 16,313 |

AEGON NV (a) | 40,000,000 | | 194,311 |

AFLAC, Inc. | 395,000 | | 19,051 |

Amlin PLC | 3,500,000 | | 18,754 |

April | 1,000,000 | | 16,192 |

Assurant, Inc. (e) | 5,581,000 | | 221,008 |

Axis Capital Holdings Ltd. (e) | 8,150,000 | | 250,857 |

Employers Holdings, Inc. | 675,000 | | 12,123 |

Endurance Specialty Holdings Ltd. (e) | 2,600,000 | | 97,240 |

Common Stocks - continued |

| Shares | | Value (000s) |

FINANCIALS - continued |

Insurance - continued |

FBD Holdings PLC | 20,000 | | $ 183 |

FBL Financial Group, Inc. Class A | 325,110 | | 11,294 |

Genworth Financial, Inc. Class A (a) | 14,500,000 | | 111,795 |

Hartford Financial Services Group, Inc. | 7,750,000 | | 135,780 |

HCC Insurance Holdings, Inc. | 960,000 | | 26,650 |

Lincoln National Corp. | 8,350,000 | | 179,859 |

National Interstate Corp. (e) | 1,118,933 | | 29,215 |

National Western Life Insurance Co. Class A | 148,870 | | 21,506 |

Primerica, Inc. | 650,000 | | 15,925 |

Progressive Corp. | 600,000 | | 12,168 |

Protective Life Corp. | 2,400,000 | | 60,024 |

RenaissanceRe Holdings Ltd. (e) | 3,100,000 | | 226,641 |

Symetra Financial Corp. | 175,000 | | 1,614 |

Torchmark Corp. | 600,000 | | 27,402 |

Tower Group, Inc. | 325,000 | | 7,017 |

Unum Group (e) | 15,900,000 | | 362,997 |

Validus Holdings Ltd. | 2,000,812 | | 64,166 |

| | 2,140,085 |

Real Estate Investment Trusts - 0.0% |

Nieuwe Steen Investments NV | 112,125 | | 1,379 |

Nieuwe Steen Investments NV warrants 4/1/13 (a) | 125,000 | | 0 |

Rouse Properties, Inc. (a) | 175,000 | | 2,163 |

| | 3,542 |

Real Estate Management & Development - 0.1% |

Airport Facilities Co. Ltd. | 260,000 | | 1,177 |

Devine Ltd. | 2,125,000 | | 1,647 |

Relo Holdings Corp. (e) | 1,214,800 | | 32,987 |

Tejon Ranch Co. (a) | 300,000 | | 8,550 |

| | 44,361 |

Thrifts & Mortgage Finance - 0.5% |

Bank Mutual Corp. | 125,000 | | 501 |

Beneficial Mutual Bancorp, Inc. (a) | 200,000 | | 1,770 |

Capitol Federal Financial, Inc. | 100,000 | | 1,155 |

Fox Chase Bancorp, Inc. (d) | 571,900 | | 7,229 |

Genworth MI Canada, Inc. (e) | 5,650,000 | | 128,129 |

Hudson City Bancorp, Inc. | 3,900,000 | | 26,247 |

Common Stocks - continued |

| Shares | | Value (000s) |

FINANCIALS - continued |

Thrifts & Mortgage Finance - continued |

North Central Bancshares, Inc. (e) | 134,461 | | $ 2,427 |

WSB Holdings, Inc. (a) | 16,329 | | 48 |

| | 167,506 |

TOTAL FINANCIALS | | 2,866,204 |

HEALTH CARE - 12.7% |

Biotechnology - 0.6% |

Amgen, Inc. | 3,000,000 | | 203,730 |

Gentium SpA sponsored ADR (a) | 25,000 | | 194 |

| | 203,924 |

Health Care Equipment & Supplies - 1.3% |

Atrion Corp. | 10,000 | | 2,444 |

Exactech, Inc. (a) | 342,898 | | 5,672 |

Hoshiiryou Sanki Co. Ltd. (e) | 280,000 | | 7,456 |

Huvitz Co. Ltd. (e) | 900,000 | | 7,796 |

Integra LifeSciences Holdings Corp. (a) | 320,000 | | 9,446 |

Mani, Inc. | 335,000 | | 11,668 |

Medical Action Industries, Inc. (a)(e) | 1,634,280 | | 8,662 |

Medtronic, Inc. | 3,990,000 | | 153,894 |

Microlife Corp. | 2,760,000 | | 4,476 |

Nakanishi, Inc. | 271,300 | | 26,657 |

Prim SA (e) | 1,615,000 | | 8,175 |

Span-America Medical System, Inc. (e) | 269,900 | | 4,097 |

St. Shine Optical Co. Ltd. | 400,200 | | 4,233 |

Syneron Medical Ltd. (a)(e) | 2,140,544 | | 23,246 |

Techno Medica Co. Ltd. | 86 | | 329 |

Theragenics Corp. (a)(e) | 3,304,620 | | 5,552 |

Top Glove Corp. Bhd | 1,000,000 | | 1,664 |

Utah Medical Products, Inc. (e) | 438,418 | | 12,675 |

Value Added Technologies Co. Ltd. | 650,000 | | 4,317 |

Young Innovations, Inc. (e) | 750,000 | | 22,905 |

Zimmer Holdings, Inc. | 2,000,000 | | 121,500 |

| | 446,864 |

Health Care Providers & Services - 9.0% |

A/S One Corp. | 190,000 | | 4,070 |

Advocat, Inc. (e) | 351,269 | | 2,002 |

Almost Family, Inc. (a)(e) | 936,814 | | 17,650 |

Amedisys, Inc. (a)(d)(e) | 2,882,000 | | 30,261 |

AMERIGROUP Corp. (a)(e) | 4,850,000 | | 329,849 |

Common Stocks - continued |

| Shares | | Value (000s) |

HEALTH CARE - continued |

Health Care Providers & Services - continued |

AmSurg Corp. (a)(e) | 2,350,000 | | $ 60,513 |

Bio-Reference Laboratories, Inc. (a) | 220,000 | | 4,257 |

Corvel Corp. (a) | 100,054 | | 4,871 |

Coventry Health Care, Inc. (a)(e) | 14,793,492 | | 444,840 |

DVx, Inc. | 97,100 | | 1,392 |

Grupo Casa Saba SA de CV sponsored ADR (a)(d) | 1,263,900 | | 10,617 |

Healthways, Inc. (a)(e) | 1,747,900 | | 13,214 |

Henry Schein, Inc. (a) | 100,000 | | 7,089 |

LHC Group, Inc. (a)(e) | 1,880,839 | | 27,874 |

LifePoint Hospitals, Inc. (a) | 1,881,806 | | 75,630 |

Lincare Holdings, Inc. (e) | 13,453,537 | | 345,621 |

Medica Sur SA de CV | 325,500 | | 601 |

Mediq NV | 25,000 | | 398 |

MEDNAX, Inc. (a) | 100,000 | | 7,122 |

Metropolitan Health Networks, Inc. (a) | 25,000 | | 201 |

National Healthcare Corp. | 6,700 | | 297 |

Patterson Companies, Inc. | 3,700,000 | | 119,177 |

Pelion SA | 50,000 | | 505 |

Psychemedics Corp. | 115,000 | | 1,118 |

Rhoen-Klinikum AG | 800,000 | | 16,580 |

Triple-S Management Corp. (a)(e) | 1,957,734 | | 41,758 |

Tsukui Corp. (d) | 325,000 | | 3,577 |

U.S. Physical Therapy, Inc. | 50,000 | | 1,020 |

United Drug PLC: | | | |

(Ireland) | 9,400,000 | | 23,975 |

(United Kingdom) | 533,719 | | 1,346 |

UnitedHealth Group, Inc. | 23,000,000 | | 1,191,135 |

Universal American Spin Corp. (a) | 1,550,000 | | 17,035 |

VCA Antech, Inc. (a) | 1,770,000 | | 39,613 |

Wellcare Health Plans, Inc. (a) | 1,000,000 | | 59,760 |

WellPoint, Inc. | 2,250,000 | | 144,720 |

Win International Co., Ltd. (e) | 800,071 | | 6,476 |

| | 3,056,164 |

Health Care Technology - 0.0% |

Arrhythmia Research Technology, Inc. (e) | 271,041 | | 981 |

ND Software Co. Ltd. | 31,000 | | 660 |

| | 1,641 |

Life Sciences Tools & Services - 0.1% |

ICON PLC sponsored ADR (a) | 1,800,000 | | 35,118 |

Common Stocks - continued |

| Shares | | Value (000s) |

HEALTH CARE - continued |

Pharmaceuticals - 1.7% |

Bukwang Pharmaceutical Co. Ltd. | 50,000 | | $ 688 |

Daewon Pharmaceutical Co. Ltd. (e) | 1,419,990 | | 8,660 |

DongKook Pharmaceutical Co. Ltd. (e) | 447,272 | | 6,968 |

Endo Pharmaceuticals Holdings, Inc. (a) | 5,175,000 | | 192,355 |

Forest Laboratories, Inc. (a) | 2,100,000 | | 66,738 |

Fornix Biosciences NV | 260,000 | | 216 |

Fuji Pharma Co. Ltd. | 19,500 | | 305 |

Hanmi Holdings Co. Ltd. | 104,947 | | 1,864 |

Hospira, Inc. (a) | 3,700,000 | | 127,502 |

Ildong Pharmaceutical Co. Ltd. (e) | 2,505,065 | | 16,503 |

Jeil Pharmaceutical Co. (e) | 1,469,930 | | 18,059 |

Kaken Pharmaceutical Co. Ltd. | 10,000 | | 132 |

KunWha Pharmaceutical Co., Ltd. (e) | 325,900 | | 3,772 |

Kwang Dong Pharmaceutical Co. Ltd. | 25,000 | | 98 |

Merck & Co., Inc. | 1,300,000 | | 49,738 |

Pacific Pharmaceutical Co. Ltd. | 81,000 | | 1,511 |

Recordati SpA | 6,105,534 | | 48,354 |

Torii Pharmaceutical Co. Ltd. | 620,000 | | 11,785 |

Whanin Pharmaceutical Co. Ltd. (e) | 1,860,000 | | 10,316 |

Yuyu Pharma, Inc. | 255,000 | | 1,358 |

| | 566,922 |

TOTAL HEALTH CARE | | 4,310,633 |

INDUSTRIALS - 9.3% |

Aerospace & Defense - 0.4% |

CAE, Inc. | 6,500,000 | | 71,693 |

Ceradyne, Inc. (a) | 450,831 | | 14,918 |

Ducommun, Inc. | 71,280 | | 1,030 |

Magellan Aerospace Corp. (a) | 555,000 | | 1,716 |

Meggitt PLC | 2,708,000 | | 15,492 |

Moog, Inc. Class A (a) | 1,000,000 | | 42,620 |

| | 147,469 |

Air Freight & Logistics - 0.3% |

Air T, Inc. (e) | 244,600 | | 2,211 |

Kintetsu World Express, Inc. | 500,000 | | 14,981 |

Pacer International, Inc. (a)(e) | 2,021,201 | | 12,208 |

Sinwa Ltd. (a)(e) | 21,000,000 | | 1,870 |

Yusen Logistics Co. Ltd. (e) | 4,221,500 | | 57,870 |

| | 89,140 |

Common Stocks - continued |

| Shares | | Value (000s) |

INDUSTRIALS - continued |

Airlines - 0.1% |

MAIR Holdings, Inc. (a)(e) | 2,000,026 | | $ 0 |

Pinnacle Airlines Corp. (a) | 859,096 | | 1,211 |

Republic Airways Holdings, Inc. (a)(e) | 3,740,000 | | 20,607 |

SkyWest, Inc. | 1,540,000 | | 19,712 |

| | 41,530 |

Building Products - 0.2% |

AAON, Inc. | 1,000,000 | | 20,250 |

Apogee Enterprises, Inc. | 7,700 | | 106 |

Insteel Industries, Inc. (e) | 1,184,330 | | 15,159 |

Kingspan Group PLC (Ireland) | 2,300,000 | | 21,485 |

Kondotec, Inc. (e) | 2,000,000 | | 13,039 |

| | 70,039 |

Commercial Services & Supplies - 2.0% |

Aeon Delight Co. Ltd. | 475,000 | | 9,752 |

AJIS Co. Ltd. (e) | 538,500 | | 8,555 |

Asia File Corp. Bhd | 348,000 | | 413 |

Avery Dennison Corp. (e) | 10,619,600 | | 288,322 |

Corrections Corp. of America (a) | 674,000 | | 15,859 |

Fursys, Inc. (e) | 774,994 | | 23,734 |

HNI Corp. | 250,000 | | 6,783 |

Industrial Services of America, Inc. (a)(d) | 84,200 | | 488 |

Knoll, Inc. (e) | 4,475,000 | | 71,421 |

Mitie Group PLC (e) | 24,025,000 | | 96,362 |

Moshi Moshi Hotline, Inc. | 620,000 | | 5,701 |

Multi-Color Corp. | 595,110 | | 13,634 |

NICE e-Banking Services (e) | 2,599,700 | | 4,791 |

Republic Services, Inc. | 720,000 | | 21,082 |

RPS Group PLC | 1,500,000 | | 4,929 |

Teems, Inc. (e) | 124,950 | | 1,207 |

United Stationers, Inc. (e) | 2,431,544 | | 78,612 |

VICOM Ltd. | 3,268,000 | | 9,483 |

| | 661,128 |

Construction & Engineering - 1.6% |

AECOM Technology Corp. (a) | 1,050,000 | | 24,035 |

Arcadis NV | 1,275,000 | | 24,623 |

Astaldi SpA | 100,000 | | 661 |

Aveng Ltd. | 625,000 | | 2,780 |

Bird Construction, Inc. (d) | 25,000 | | 322 |

Daiichi Kensetsu Corp. (e) | 1,709,600 | | 15,475 |

Dongyang Engineering & Construction Corp. (e) | 289,500 | | 1,590 |

Common Stocks - continued |

| Shares | | Value (000s) |

INDUSTRIALS - continued |

Construction & Engineering - continued |

EMCOR Group, Inc. | 1,000,000 | | $ 28,830 |

EPCO Co. Ltd. | 50,000 | | 758 |

Foster Wheeler AG (a) | 875,700 | | 19,668 |

Granite Construction, Inc. | 250,000 | | 6,658 |

Hanil Construction Co. Ltd. (a) | 18,379 | | 36 |

Heijmans NV unit | 10,000 | | 118 |

Imtech NV (d) | 1,525,768 | | 47,137 |

Jacobs Engineering Group, Inc. (a) | 6,147,000 | | 275,140 |

Kaneshita Construction Co. Ltd. | 602,000 | | 2,527 |

Kier Group PLC | 100,000 | | 2,112 |

Koninklijke BAM Groep NV | 1,800,000 | | 7,769 |

Kyeryong Construction Industrial Co. Ltd. (e) | 893,000 | | 11,090 |

Kyowa Exeo Corp. | 3,000 | | 30 |

Meisei Industrial Co. Ltd. | 1,250,000 | | 3,509 |

Mirait Holdings Corp. | 2,449,940 | | 19,605 |

Sanyo Engineering & Construction, Inc. | 900,000 | | 3,247 |

Severfield-Rowen PLC | 1,000,000 | | 3,093 |

Shinnihon Corp. | 1,800,000 | | 5,573 |

Shinsegae Engineering & Construction Co. Ltd. (e) | 314,469 | | 4,059 |

ShoLodge, Inc. (a)(e) | 500,627 | | 5 |

Sterling Construction Co., Inc. (a)(e) | 1,055,807 | | 12,680 |

Tutor Perini Corp. (a) | 1,420,000 | | 21,570 |

United Integration Services Co. Ltd. | 2,700,000 | | 2,577 |

Vianini Lavori SpA | 675,000 | | 2,949 |

| | 550,226 |

Electrical Equipment - 0.5% |

Aichi Electric Co. Ltd. | 1,000,000 | | 4,198 |

Aros Quality Group AB | 665,819 | | 4,062 |

AZZ, Inc. (e) | 1,110,000 | | 54,490 |

Canare Electric Co. Ltd. (d) | 160,000 | | 2,519 |

Chiyoda Integre Co. Ltd. | 522,500 | | 6,443 |

Deswell Industries, Inc. | 477,800 | | 1,022 |

Dynapack International Technology Corp. | 200,000 | | 993 |

Fushi Copperweld, Inc. (a)(e) | 2,932,800 | | 24,372 |

FW Thorpe PLC | 504,300 | | 6,656 |

General Cable Corp. (a) | 511,000 | | 15,769 |

Graphite India Ltd. | 2,200,000 | | 3,339 |

I-Sheng Electric Wire & Cable Co. Ltd. (a)(e) | 11,000,000 | | 14,031 |

Jinpan International Ltd. (d) | 382,640 | | 3,348 |

Korea Electric Terminal Co. Ltd. (e) | 700,000 | | 13,959 |

Common Stocks - continued |

| Shares | | Value (000s) |

INDUSTRIALS - continued |

Electrical Equipment - continued |

Nexans SA (d) | 200,000 | | $ 12,416 |

PK Cables OY | 250,000 | | 4,715 |

Prysmian SpA | 425,000 | | 6,381 |

Servotronics, Inc. | 50,000 | | 450 |

Universal Security Instruments, Inc. (a)(e) | 241,255 | | 1,402 |

| | 180,565 |

Industrial Conglomerates - 0.9% |

DCC PLC (Ireland) (e) | 8,310,000 | | 200,534 |

Reunert Ltd. | 1,200,000 | | 10,000 |

Seaboard Corp. | 47,600 | | 92,416 |

| | 302,950 |

Machinery - 1.7% |

Aalberts Industries NV (e) | 10,143,528 | | 190,186 |

Actuant Corp. Class A | 1,140,000 | | 28,899 |

ASL Marine Holdings Ltd. | 17,500,000 | | 6,956 |

CKD Corp. (e) | 5,525,000 | | 42,690 |

Foremost Income Fund (e) | 2,141,103 | | 15,480 |

Gencor Industries, Inc. (a) | 391,000 | | 2,803 |

Hardinge, Inc. | 236,600 | | 2,515 |

Harsco Corp. | 477,700 | | 10,619 |

Hurco Companies, Inc. (a)(e) | 631,800 | | 14,892 |

Hwacheon Machine Tool Co. Ltd. (e) | 219,900 | | 8,839 |

Ihara Science Corp. (e) | 875,000 | | 6,164 |

Industrea Ltd. | 50,000 | | 61 |

Inoue Kinzoku Kogyo Co. Ltd. (e) | 1,082,000 | | 5,564 |

Jaya Holdings Ltd. (a)(e) | 74,670,000 | | 34,431 |

John Bean Technologies Corp. | 30,000 | | 492 |

Kyowakogyosyo Co.,Ltd. | 140,000 | | 1,589 |

NACCO Industries, Inc. Class A | 310,000 | | 31,682 |

Nadex Co. Ltd. (e) | 651,000 | | 2,246 |

Nichidai Corp. | 150,000 | | 634 |

Nitta Corp. | 75,000 | | 1,400 |

Oshkosh Truck Corp. (a) | 4,320,000 | | 104,890 |

S&T Holdings Co. Ltd. | 700,020 | | 8,133 |

Semperit AG Holding | 550,000 | | 23,488 |

Takamatsu Machinery Co., Ltd. | 105,000 | | 547 |

Takeuchi Manufacturing Co. Ltd. (a) | 270,000 | | 2,115 |

Tocalo Co. Ltd. | 560,000 | | 12,628 |

Common Stocks - continued |

| Shares | | Value (000s) |

INDUSTRIALS - continued |

Machinery - continued |

Trifast PLC (a) | 3,715,000 | | $ 2,518 |

Trinity Industrial Corp. | 665,000 | | 2,451 |

| | 564,912 |

Marine - 0.0% |

Excel Maritime Carriers Ltd. (a)(d) | 150,000 | | 221 |

Tokyo Kisen Co. Ltd. (e) | 1,000,000 | | 6,428 |

| | 6,649 |

Professional Services - 0.7% |

Akka Technologies SA | 60,000 | | 1,612 |

Boardroom Ltd. | 3,000,000 | | 1,216 |

Clarius Group Ltd. | 4,142,382 | | 1,891 |

Corporate Executive Board Co. | 100,000 | | 3,933 |

CRA International, Inc. (a)(e) | 600,000 | | 12,966 |

en-japan, Inc. | 6,100 | | 6,642 |

Equifax, Inc. | 2,900,000 | | 113,013 |

Hyder Consulting PLC | 625,000 | | 3,866 |

RCM Technologies, Inc. (a)(e) | 1,299,917 | | 7,072 |

SmartPros Ltd. | 125,000 | | 231 |

Sporton International, Inc. (e) | 6,849,000 | | 14,580 |

Stantec, Inc. (a)(e) | 2,640,000 | | 73,454 |

Synergie SA | 210,684 | | 2,342 |

Temp Holdings Co., Ltd. (d) | 325,000 | | 3,176 |

VSE Corp. | 167,400 | | 4,388 |

| | 250,382 |

Road & Rail - 0.4% |

Alps Logistics Co. Ltd. (e) | 1,723,700 | | 16,394 |

Con-way, Inc. | 501,000 | | 15,902 |

Contrans Group, Inc.: | | | |

(sub. vtg.) (a)(f) | 130,000 | | 1,154 |

Class A | 1,251,900 | | 11,111 |

Hamakyorex Co. Ltd. (e) | 521,100 | | 16,037 |

Hutech Norin Co. Ltd. (e) | 1,043,700 | | 10,474 |

Sakai Moving Service Co. Ltd. (e) | 778,000 | | 17,473 |

Trancom Co. Ltd. (e) | 1,032,400 | | 20,098 |

Universal Truckload Services, Inc. | 500,000 | | 8,890 |

Vitran Corp., Inc. (a) | 737,051 | | 5,197 |

| | 122,730 |

Common Stocks - continued |

| Shares | | Value (000s) |

INDUSTRIALS - continued |

Trading Companies & Distributors - 0.4% |

AddTech AB (B Shares) | 460,000 | | $ 11,497 |

Grafton Group PLC unit | 6,700,017 | | 23,564 |

Hanwa Co. Ltd. | 3,500,000 | | 16,713 |

Houston Wire & Cable Co. (d)(e) | 1,070,000 | | 15,269 |

KS Energy Services Ltd. (a) | 14,100,000 | | 11,098 |

MFC Industrial Ltd. | 36,538 | | 282 |

Otec Corp. | 125,000 | | 818 |

Parker Corp. (e) | 2,400,000 | | 5,132 |

Richelieu Hardware Ltd. | 350,000 | | 10,401 |

Senshu Electric Co. Ltd. (e) | 1,080,000 | | 13,771 |

Strongco Corp. (a)(e) | 1,025,288 | | 6,145 |

Tanaka Co. Ltd. | 100,000 | | 565 |

TECHNO ASSOCIE CO., LTD. | 180,000 | | 1,514 |

Totech Corp. (d) | 200,000 | | 745 |

Uehara Sei Shoji Co. Ltd. | 1,100,000 | | 4,964 |

Wakita & Co. Ltd. | 650,000 | | 5,125 |

Yamazen Co. Ltd. | 1,050,000 | | 8,182 |

| | 135,785 |

Transportation Infrastructure - 0.1% |

Isewan Terminal Service Co. Ltd. (e) | 1,575,000 | | 9,298 |

Meiko Transportation Co. Ltd. | 905,000 | | 8,370 |

| | 17,668 |

TOTAL INDUSTRIALS | | 3,141,173 |

INFORMATION TECHNOLOGY - 19.9% |

Communications Equipment - 1.1% |

Aastra Technologies Ltd. (e) | 1,175,000 | | 19,791 |

Bel Fuse, Inc. Class A | 314,963 | | 6,469 |

Black Box Corp. (e) | 1,800,840 | | 55,682 |

Blonder Tongue Laboratories, Inc. (a) | 152,040 | | 210 |

Brocade Communications Systems, Inc. (a) | 2,000,000 | | 11,220 |

China TechFaith Wireless Communication Technology Ltd. sponsored ADR (a) | 1,110,000 | | 2,287 |

Cisco Systems, Inc. | 5,000,000 | | 98,150 |

ClearOne Communications, Inc. (a)(e) | 455,495 | | 2,268 |

Comtech Telecommunications Corp. (e) | 1,300,000 | | 40,118 |

Ditech Networks, Inc. (a)(e) | 1,810,000 | | 1,466 |

Harris Corp. | 75,000 | | 3,075 |

NEC Mobiling Ltd. | 300,000 | | 10,453 |

Common Stocks - continued |

| Shares | | Value (000s) |

INFORMATION TECHNOLOGY - continued |

Communications Equipment - continued |

Nera Telecommunications Ltd. | 9,000,000 | | $ 3,041 |

NETGEAR, Inc. (a) | 1,112,620 | | 44,305 |

Optical Cable Corp. | 300,000 | | 1,062 |

Tessco Technologies, Inc. | 70,000 | | 1,247 |

TKH Group NV unit | 3,000,000 | | 68,667 |

| | 369,511 |

Computers & Peripherals - 3.2% |

Compal Electronics, Inc. | 153,500,000 | | 172,198 |

Logitech International SA (Reg.) (a)(d) | 7,600,000 | | 58,182 |

Pinnacle Technology Holdings Ltd. | 6,989,000 | | 11,604 |

QLogic Corp. (a) | 775,000 | | 13,423 |

Quantum Corp. (a) | 4,250,000 | | 10,710 |

Rimage Corp. (e) | 966,192 | | 12,019 |

Roland DG Corp. | 210,000 | | 2,416 |

Seagate Technology (e) | 31,500,000 | | 665,910 |

Super Micro Computer, Inc. (a)(e) | 2,703,500 | | 45,635 |

Synaptics, Inc. (a) | 337,000 | | 12,910 |

TPV Technology Ltd. | 58,500,000 | | 14,936 |

Western Digital Corp. (a) | 700,000 | | 25,445 |

Xyratex Ltd. (e) | 2,080,000 | | 33,030 |

| | 1,078,418 |

Electronic Equipment & Components - 3.5% |

A&D Co. Ltd. (e) | 1,650,000 | | 5,476 |

Arrow Electronics, Inc. (a) | 166,200 | | 6,862 |

Beijer Electronics AB | 150,000 | | 1,400 |

CNB Technology, Inc. | 110,000 | | 883 |

Delta Electronics PCL (For. Reg.) | 25,000,000 | | 17,264 |

DigiTech Systems Co., Ltd. (a) | 280,000 | | 3,116 |

Dolby Laboratories, Inc. Class A (a) | 255,000 | | 9,274 |

Elec & Eltek International Co. Ltd. | 1,800,000 | | 4,752 |

Elematec Corp. (d)(e) | 1,810,000 | | 32,767 |

Excel Co. Ltd. (e) | 909,800 | | 9,309 |

Fabrinet (a) | 60,000 | | 988 |

Hanla IMS Co. Ltd. | 22,420 | | 94 |

Hi-P International Ltd. | 20,802,000 | | 10,998 |

Hon Hai Precision Industry Co. Ltd. (Foxconn) | 118,800,000 | | 382,552 |

Huan Hsin Holdings Ltd. (a) | 7,200,000 | | 469 |

Image Sensing Systems, Inc. (a)(e) | 365,685 | | 2,340 |

Insight Enterprises, Inc. (a) | 1,600,127 | | 29,538 |

Intelligent Digital Integrated Security Co. Ltd. (e) | 691,242 | | 7,231 |

Common Stocks - continued |

| Shares | | Value (000s) |

INFORMATION TECHNOLOGY - continued |

Electronic Equipment & Components - continued |

Intelligent Digital Integrated Security Co. Ltd. (e) | 310,558 | | $ 11,004 |

INTOPS Co. Ltd. (e) | 859,900 | | 15,158 |

Jurong Technologies Industrial Corp. Ltd. (a) | 29,873,347 | | 0 |

Kingboard Chemical Holdings Ltd. | 42,000,000 | | 144,870 |

Kingboard Chemical Holdings Ltd. warrants 10/31/12 (a) | 4,100,000 | | 196 |

Kingboard Laminates Holdings Ltd. | 9,000,000 | | 4,816 |

KITAGAWA INDUSTRIES CO., LTD. | 100,000 | | 1,102 |

Mesa Laboratories, Inc. (e) | 317,500 | | 14,113 |

Multi-Fineline Electronix, Inc. (a) | 350,000 | | 8,701 |

Muramoto Electronic Thailand PCL (For. Reg.) (e) | 1,699,000 | | 11,458 |

Nippo Ltd. (e) | 797,600 | | 4,290 |

Orbotech Ltd. (a)(e) | 3,100,000 | | 32,395 |

Posiflex Technologies, Inc. | 1,801,629 | | 2,940 |

Rofin-Sinar Technologies, Inc. (a) | 398,865 | | 11,316 |

ScanSource, Inc. (a)(e) | 2,000,000 | | 75,140 |

SED International Holdings, Inc. (a)(e) | 475,000 | | 1,287 |

Shibaura Electronics Co. Ltd. (e) | 777,800 | | 13,489 |

Shinko Shoji Co. Ltd. | 50,000 | | 428 |

Sigmatron International, Inc. (a)(e) | 381,880 | | 1,409 |

Store Electronic Systems SA (a) | 21,950 | | 298 |

SYNNEX Corp. (a)(e) | 3,501,000 | | 126,666 |

Taitron Components, Inc. Class A (sub. vtg.) (a) | 359,023 | | 331 |

Tomen Devices Corp. (e) | 559,400 | | 13,789 |

Tomen Electronics Corp. (e) | 1,492,400 | | 19,636 |

Venture Corp. Ltd. (e) | 23,000,000 | | 132,019 |

VST Holdings Ltd. (a)(e) | 91,724,000 | | 13,956 |

Winland Electronics, Inc. (a)(e) | 275,000 | | 184 |

Wireless Telecom Group, Inc. (a)(e) | 1,767,712 | | 2,210 |

XAC Automation Corp. (e) | 9,430,000 | | 9,766 |

| | 1,198,280 |

Internet Software & Services - 1.3% |

Daou Technology, Inc. | 1,581,290 | | 19,146 |

DeNA Co. Ltd. | 305,000 | | 7,718 |

eBay, Inc. (a) | 7,500,000 | | 237,000 |

Gabia, Inc. | 400,000 | | 2,336 |

Gurunavi, Inc. | 282,600 | | 3,262 |

j2 Global, Inc. (e) | 3,780,000 | | 101,909 |

Jorudan Co. Ltd. (e) | 525,000 | | 3,333 |

Macromill, Inc. | 5,000 | | 49 |

Meetic (e) | 1,665,000 | | 26,851 |

Common Stocks - continued |

| Shares | | Value (000s) |

INFORMATION TECHNOLOGY - continued |

Internet Software & Services - continued |

Melbourne IT Ltd. (e) | 8,050,000 | | $ 13,673 |

Monster Worldwide, Inc. (a) | 300,000 | | 2,160 |

NetGem SA | 1,000,000 | | 3,257 |

Rentabiliweb Group SA | 75,000 | | 638 |

Softbank Technology Corp. (e) | 700,000 | | 5,730 |

The Stanley Gibbons Group PLC | 800,000 | | 2,263 |

UANGEL Corp. (e) | 1,200,000 | | 5,336 |

United Internet AG | 50,000 | | 934 |

Web.com, Inc. (a) | 871,000 | | 11,149 |

| | 446,744 |

IT Services - 3.6% |

Accenture PLC Class A | 100,000 | | 5,734 |

ALTEN | 555,000 | | 15,342 |

Amdocs Ltd. (a) | 8,240,000 | | 242,586 |

Argo Graphics, Inc. (e) | 526,500 | | 7,266 |

Calian Technologies Ltd. (e) | 778,500 | | 14,518 |

Cielo SA | 40,000 | | 1,192 |

Computer Sciences Corp. | 6,200,000 | | 160,146 |

Computer Services, Inc. | 190,600 | | 5,909 |

Convergys Corp. (a) | 800,000 | | 10,648 |

CSE Global Ltd. (e) | 46,905,000 | | 33,934 |

Data#3 Ltd. | 300,000 | | 398 |

EOH Holdings Ltd. (e) | 8,322,000 | | 31,371 |

Groupe Steria SCA | 1,005 | | 20 |

HCL Technologies Ltd. | 1,630,000 | | 14,407 |

Heartland Payment Systems, Inc. (e) | 3,500,000 | | 84,000 |

HIQ International AB | 900,000 | | 4,644 |

Indra Sistemas (d)(e) | 16,413,000 | | 216,069 |

Jack Henry & Associates, Inc. | 1,800,432 | | 61,575 |

Know IT AB (d)(e) | 1,650,000 | | 13,948 |

ManTech International Corp. Class A | 365,563 | | 12,850 |

Mastek Ltd. (a)(e) | 2,025,000 | | 3,501 |

Matsushita Electric Works Information Systems Co. Ltd. | 500,000 | | 13,774 |

NCI, Inc. Class A (a)(e) | 800,000 | | 5,856 |

NeuStar, Inc. Class A (a) | 375,000 | | 13,691 |

Patni Computer Systems Ltd. sponsored ADR (a) | 258,566 | | 4,776 |

Rolta India Ltd. | 2,699,942 | | 4,310 |

SAIC, Inc. (a) | 3,050,000 | | 39,223 |

SinoCom Software Group Ltd. (e) | 78,334,000 | | 6,667 |

Softcreate Co., Ltd. | 110,500 | | 1,615 |

Common Stocks - continued |

| Shares | | Value (000s) |

INFORMATION TECHNOLOGY - continued |

IT Services - continued |

The Western Union Co. | 2,573,000 | | $ 49,144 |

Total System Services, Inc. | 5,700,000 | | 122,208 |

| | 1,201,322 |

Office Electronics - 0.2% |

Xerox Corp. | 10,000,000 | | 77,500 |

Semiconductors & Semiconductor Equipment - 1.2% |

Alpha & Omega Semiconductor Ltd. (a) | 1,199,694 | | 11,133 |

Axell Corp. (d)(e) | 925,000 | | 20,167 |

Diodes, Inc. (a)(e) | 4,560,000 | | 117,557 |

Entegris, Inc. (a) | 843,771 | | 8,083 |

Gennum Corp. (e) | 3,050,000 | | 41,001 |

GSI Technology, Inc. (a) | 20,000 | | 99 |

KEC Holdings Co. Ltd. (a)(e) | 1,399,999 | | 2,131 |

Lasertec Corp. | 362,000 | | 5,523 |

Leeno Industrial, Inc. | 175,000 | | 3,241 |

Marvell Technology Group Ltd. (a) | 800,000 | | 12,424 |

MediaTek, Inc. | 500,000 | | 4,773 |

Melexis NV (e) | 3,350,000 | | 49,951 |

Miraial Co. Ltd. | 216,900 | | 3,087 |

Nextchip Co. Ltd. (e) | 1,070,110 | | 10,337 |

Novatek Microelectronics Corp. | 1,675,000 | | 4,760 |

Omnivision Technologies, Inc. (a) | 804,000 | | 10,701 |

ON Semiconductor Corp. (a) | 1,025,000 | | 8,918 |

Powertech Technology, Inc. | 9,460,000 | | 23,654 |

Sunplus Technology Co. Ltd. | 7,000,000 | | 2,578 |

Telechips, Inc. (e) | 1,058,800 | | 6,108 |

Tessera Technologies, Inc. (a) | 775,000 | | 15,345 |

Trio-Tech International (a)(e) | 322,543 | | 761 |

UKC Holdings Corp. (e) | 1,570,000 | | 16,497 |

Varitronix International Ltd. (e) | 16,500,000 | | 7,000 |

Y. A. C. Co., Ltd. | 300,000 | | 2,546 |

| | 388,375 |

Software - 5.8% |

AdaptIT Holdings Ltd. | 3,200,000 | | 430 |

Adobe Systems, Inc. (a) | 1,530,000 | | 47,354 |

ANSYS, Inc. (a)(e) | 5,100,000 | | 308,499 |

Axway Software SA (a) | 5,000 | | 98 |

Cybernet Systems Co. Ltd. (e) | 20,500 | | 5,704 |

DTS Corp. | 176,500 | | 2,299 |

Ebix, Inc. (d)(e) | 2,110,000 | | 52,286 |

Common Stocks - continued |

| Shares | | Value (000s) |

INFORMATION TECHNOLOGY - continued |

Software - continued |

Exact Holdings NV | 725,000 | | $ 16,609 |

Geodesic Ltd. (e) | 4,873,000 | | 4,601 |

ICSA (India) Ltd. | 1,599,999 | | 1,013 |

ICT Automatisering NV (d)(e) | 874,000 | | 3,109 |

IGE + XAO SA | 30,000 | | 1,013 |

Infomedia Ltd. (e) | 16,200,000 | | 3,440 |

init innovation in traffic systems AG | 10,000 | | 186 |

JDA Software Group, Inc. (a) | 229,240 | | 6,756 |

Kingdee International Software Group Co. Ltd. | 1,000,000 | | 298 |

KSK Co., Ltd. (e) | 623,100 | | 3,678 |

Mentor Graphics Corp. (a) | 901,000 | | 12,497 |

Metrologic Group | 7,058 | | 211 |

Micro Focus International PLC | 22,000 | | 147 |

MICROS Systems, Inc. (a) | 100,036 | | 4,973 |

Microsoft Corp. | 34,600,000 | | 1,021,738 |

Net 1 UEPS Technologies, Inc. (a) | 550,000 | | 5,830 |

NSD Co. Ltd. | 250,000 | | 2,178 |

Nucleus Software Exports Ltd. | 1,050,000 | | 1,515 |

Oracle Corp. | 13,000,000 | | 366,600 |

Parametric Technology Corp. (a) | 627,000 | | 15,782 |

Playtech Ltd. | 10,000 | | 47 |

Pro-Ship, Inc. | 147,600 | | 3,001 |

Progress Software Corp. (a) | 528,300 | | 12,325 |

Sage Group PLC | 650,000 | | 3,003 |

Shanda Games Ltd. sponsored ADR | 200,000 | | 712 |

Societe Pour L'Informatique Industrielle SA (e) | 1,228,629 | | 7,553 |

Software AG (Bearer) | 1,320,000 | | 43,007 |

SWORD Group (e) | 571,130 | | 9,614 |

Vasco Data Security International, Inc. (a) | 55,000 | | 464 |

Vitec Software Group AB | 9,000 | | 83 |

Zensar Technologies Ltd. | 300,000 | | 1,052 |

| | 1,969,705 |

TOTAL INFORMATION TECHNOLOGY | | 6,729,855 |

MATERIALS - 3.8% |

Chemicals - 2.4% |

Aditya Birla Chemicals India Ltd. (e) | 2,338,600 | | 4,338 |

American Vanguard Corp. (d) | 384,628 | | 5,781 |

C. Uyemura & Co. Ltd. (e) | 653,800 | | 25,730 |

Chase Corp. (e) | 894,586 | | 11,898 |

Common Stocks - continued |

| Shares | | Value (000s) |

MATERIALS - continued |

Chemicals - continued |

Core Molding Technologies, Inc. (a) | 314,306 | | $ 2,672 |

Deepak Fertilisers and Petrochemicals Corp. Ltd. (e) | 6,900,026 | | 19,238 |

Deepak Nitrite Ltd. (e) | 652,891 | | 1,980 |

EcoGreen Fine Chemical Group Ltd. (e) | 45,112,000 | | 9,889 |

FMC Corp. | 2,000,000 | | 185,360 |

Fujikura Kasei Co., Ltd. (e) | 3,271,600 | | 16,609 |

Gujarat Narmada Valley Fertilizers Co. | 3,850,000 | | 6,531 |

Gujarat State Fertilizers & Chemicals Ltd. | 2,550,000 | | 19,325 |

Honshu Chemical Industry Co., Ltd. (e) | 800,000 | | 5,405 |

Innospec, Inc. (a) | 1,150,000 | | 37,226 |

KPC Holdings Corp. | 43,478 | | 1,589 |

KPX Chemical Co. Ltd. | 163,083 | | 8,522 |

Kraton Performance Polymers, Inc. (a) | 1,450,000 | | 41,238 |

LyondellBasell Industries NV Class A | 325,000 | | 14,008 |

Miwon Chemicals Co. Ltd. (a) | 36,485 | | 716 |

Miwon Commercial Co. Ltd. | 13,552 | | 1,132 |

Muto Seiko Co. Ltd. | 139,000 | | 766 |

Nuplex Industries Ltd. | 1,044,996 | | 2,148 |

OM Group, Inc. (a)(e) | 3,245,000 | | 88,037 |

SK Kaken Co. Ltd. | 390,000 | | 16,320 |

Soda Aromatic Co. Ltd. | 60,000 | | 535 |

Soken Chemical & Engineer Co. Ltd. (e) | 805,000 | | 7,561 |

Solutia, Inc. | 620,000 | | 17,050 |

T&K Toka Co. Ltd. (e) | 700,000 | | 8,512 |

Thai Carbon Black PCL (For. Reg.) | 11,600,000 | | 9,545 |

Thai Rayon PCL (For. Reg.) | 3,200,000 | | 7,435 |

Yara International ASA | 4,750,000 | | 191,137 |

Yip's Chemical Holdings Ltd. (e) | 31,002,000 | | 23,386 |

| | 791,619 |

Construction Materials - 0.1% |

Brampton Brick Ltd. Class A (sub. vtg.) (a) | 850,700 | | 2,961 |

Mitani Sekisan Co. Ltd. (e) | 1,339,000 | | 10,627 |

Titan Cement Co. SA (Reg.) | 575,000 | | 9,634 |

| | 23,222 |

Containers & Packaging - 0.5% |

Ball Corp. | 314,130 | | 12,333 |

Chuoh Pack Industry Co. Ltd. (e) | 409,000 | | 4,775 |

Kohsoku Corp. (e) | 2,097,300 | | 18,131 |

Silgan Holdings, Inc. | 2,600,000 | | 108,056 |

Starlite Holdings Ltd. | 3,000,000 | | 128 |

Common Stocks - continued |

| Shares | | Value (000s) |

MATERIALS - continued |

Containers & Packaging - continued |

The Pack Corp. (e) | 1,990,000 | | $ 29,838 |

Vidrala SA | 110,000 | | 2,619 |

| | 175,880 |

Metals & Mining - 0.8% |

Alconix Corp. (e) | 635,000 | | 14,411 |

Blue Earth Refineries, Inc. (a) | 274,309 | | 121 |

Chubu Steel Plate Co. Ltd. | 500,000 | | 2,774 |

Compania de Minas Buenaventura SA sponsored ADR | 2,500,000 | | 107,250 |

Fortescue Metals Group Ltd. | 1,490,203 | | 7,989 |

Hill & Smith Holdings PLC | 1,700,600 | | 7,940 |

Horsehead Holding Corp. (a)(e) | 2,370,000 | | 25,786 |

Korea Steel Shapes Co. Ltd. | 41,760 | | 1,764 |

Orosur Mining, Inc. (a) | 3,100,000 | | 2,659 |

Orvana Minerals Corp. (a)(d) | 1,350,000 | | 1,521 |

Pacific Metals Co. Ltd. | 4,000,000 | | 22,458 |

Sherritt International Corp. | 2,660,000 | | 16,792 |

SunCoke Energy, Inc. (a) | 2,108,836 | | 28,322 |

Tohoku Steel Co. Ltd. (e) | 755,000 | | 9,161 |

Tokyo Kohtetsu Co. Ltd. | 125,000 | | 795 |

Tokyo Tekko Co. Ltd. (e) | 4,600,000 | | 20,215 |

Webco Industries, Inc. (a) | 9,122 | | 1,049 |

Yamato Kogyo Co. Ltd. | 285,000 | | 8,962 |

| | 279,969 |

Paper & Forest Products - 0.0% |

Gunns Ltd. (a) | 750,000 | | 96 |

Stella-Jones, Inc. | 35,000 | | 1,454 |

Stella-Jones, Inc. (a) | 165,000 | | 6,853 |

| | 8,403 |

TOTAL MATERIALS | | 1,279,093 |

TELECOMMUNICATION SERVICES - 0.4% |

Diversified Telecommunication Services - 0.1% |

Atlantic Tele-Network, Inc. (e) | 1,338,800 | | 48,317 |

Wireless Telecommunication Services - 0.3% |

MetroPCS Communications, Inc. (a) | 2,550,000 | | 22,542 |

NII Holdings, Inc. (a) | 1,800,000 | | 36,198 |

Common Stocks - continued |

| Shares | | Value (000s) |

TELECOMMUNICATION SERVICES - continued |

Wireless Telecommunication Services - continued |

Okinawa Cellular Telephone Co. | 209 | | $ 452 |

SK Telecom Co. Ltd. sponsored ADR | 1,875,000 | | 26,269 |

| | 85,461 |

TOTAL TELECOMMUNICATION SERVICES | | 133,778 |

UTILITIES - 0.2% |

Electric Utilities - 0.0% |

Duke Energy Corp. | 721,400 | | 15,373 |

PPL Corp. | 95,000 | | 2,640 |

| | 18,013 |

Gas Utilities - 0.1% |

Hokuriku Gas Co. | 1,600,000 | | 4,408 |

Keiyo Gas Co. Ltd. | 606,000 | | 2,727 |

KyungDong City Gas Co. Ltd. | 153,670 | | 7,538 |

Otaki Gas Co. Ltd. | 725,000 | | 3,728 |

UGI Corp. | 100,000 | | 2,691 |

| | 21,092 |

Independent Power Producers & Energy Traders - 0.1% |

Drax Group PLC | 750,000 | | 6,282 |

Mega First Corp. Bhd (e) | 22,662,000 | | 12,965 |

| | 19,247 |

Multi-Utilities - 0.0% |

CMS Energy Corp. | 729,700 | | 15,929 |

TOTAL UTILITIES | | 74,281 |

TOTAL COMMON STOCKS (Cost $23,282,990) |

32,476,715

|

Preferred Stocks - 0.4% |

| | | |

Convertible Preferred Stocks - 0.4% |

CONSUMER DISCRETIONARY - 0.4% |

Auto Components - 0.3% |

Johnson Controls, Inc. 11.50% | 500,000 | | 76,380 |

Preferred Stocks - continued |

| Shares | | Value (000s) |

Convertible Preferred Stocks - continued |

CONSUMER DISCRETIONARY - continued |

Automobiles - 0.1% |

General Motors Co. 4.75% | 990,000 | | $ 39,659 |

TOTAL CONSUMER DISCRETIONARY | | 116,039 |

FINANCIALS - 0.0% |

Commercial Banks - 0.0% |

East West Bancorp, Inc. Series A, 8.00% | 3,195 | | 4,912 |

TOTAL CONVERTIBLE PREFERRED STOCKS | | 120,951 |

Nonconvertible Preferred Stocks - 0.0% |

CONSUMER STAPLES - 0.0% |

Beverages - 0.0% |

Hite Holdings Co. Ltd. | 48,534 | | 355 |

Food Products - 0.0% |

Nam Yang Dairy Products | 4,917 | | 1,440 |

TOTAL CONSUMER STAPLES | | 1,795 |

HEALTH CARE - 0.0% |

Pharmaceuticals - 0.0% |

Pacific Pharmaceutical Co. Ltd. | 15,000 | | 240 |

MATERIALS - 0.0% |

Construction Materials - 0.0% |

Buzzi Unicem SpA (Risparmio Shares) | 1,250,000 | | 6,442 |

TOTAL NONCONVERTIBLE PREFERRED STOCKS | | 8,477 |

TOTAL PREFERRED STOCKS (Cost $88,159) |

129,428

|

Convertible Bonds - 0.1% |

| Principal Amount (000s) | | Value (000s) |

ENERGY - 0.1% |

Oil, Gas & Consumable Fuels - 0.1% |

USEC, Inc. 3% 10/1/14 (Cost $35,204) | | $ 37,150 | | $ 22,702 |

Money Market Funds - 4.9% |

| Shares | | |

Fidelity Cash Central Fund, 0.12% (b) | 1,127,208,099 | | 1,127,208 |

Fidelity Securities Lending Cash Central Fund, 0.12% (b)(c) | 532,894,582 | | 532,895 |

TOTAL MONEY MARKET FUNDS (Cost $1,660,103) |

1,660,103

|

TOTAL INVESTMENT PORTFOLIO - 101.5% (Cost $25,066,456) | 34,288,948 |

NET OTHER ASSETS (LIABILITIES) - (1.5)% | (499,963) |

NET ASSETS - 100% | $ 33,788,985 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

(e) Affiliated company |

(f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $5,576,000 or 0.0% of net assets. |

(g) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $24,737,000 or 0.1% of net assets. |

Additional information on each restricted holding is as follows: |

Security | Acquisition Date | Acquisition Cost (000s) |

First Bancorp, Puerto Rico | 10/6/11 | $ 26,000 |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned

(Amounts in thousands) |

Fidelity Cash Central Fund | $ 1,254 |

Fidelity Securities Lending Cash Central Fund | 2,765 |

Total | $ 4,019 |

Other Affiliated Issuers |

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows: |

Affiliates

(Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Value,

end of

period |

A&D Co. Ltd. | $ 8,254 | $ - | $ - | $ - | $ 5,476 |

Aalberts Industries NV | 156,502 | 34,156 | - | - | 190,186 |

Aastra Technologies Ltd. | 22,728 | - | - | 200 | 19,791 |

Abbey PLC | 24,817 | - | - | 227 | 23,792 |

Abercrombie & Fitch Co. Class A | 475,280 | - | - | 2,275 | 298,610 |

Accell Group NV | 14,825 | 13,737 | - | - | 28,135 |

Adams Resources & Energy, Inc. | 8,983 | - | 1,064 | 198 | 12,174 |

Aditya Birla Chemicals India Ltd. | 6,774 | - | - | - | 4,338 |

Advocat, Inc. | 3,365 | - | 946 | 39 | 2,002 |

Aeropostale, Inc. | 137,784 | - | - | - | 133,859 |

Air T, Inc. | 2,184 | - | - | - | 2,211 |

AJIS Co. Ltd. | 7,862 | 1,562 | - | - | 8,555 |

Alconix Corp. | 17,429 | 489 | - | 185 | 14,411 |

Almost Family, Inc. | 22,743 | 837 | - | - | 17,650 |

Alps Logistics Co. Ltd. | 17,312 | - | - | 365 | 16,394 |

Ambassadors Group, Inc. | 10,479 | 2,806 | - | 182 | 7,984 |

Amedisys, Inc. | 74,529 | - | - | - | 30,261 |

AMERIGROUP Corp. | 266,750 | - | - | - | 329,849 |

AmSurg Corp. | 59,761 | - | - | - | 60,513 |

ANSYS, Inc. | 258,060 | - | - | - | 308,499 |

AOC Holdings, Inc. | 46,614 | - | - | - | 41,508 |

Arctic Cat, Inc. | 13,184 | - | 15,304 | - | - |

Argo Graphics, Inc. | 7,060 | - | - | - | 7,266 |

ARK Restaurants Corp. | 4,545 | - | 14 | 150 | 4,335 |

Affiliates

(Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Value,

end of

period |

Arrhythmia Research Technology, Inc. | $ 1,163 | $ - | $ - | $ - | $ 981 |

Arts Optical International Holdings Ltd. | 13,730 | - | - | 283 | 9,637 |

Assurant, Inc. | 190,567 | 7,858 | 20 | 1,968 | 221,008 |

ASTI Corp. | 5,051 | - | - | 102 | 4,857 |

Atlantic Tele-Network, Inc. | 50,566 | - | - | 616 | 48,317 |

Avery Dennison Corp. | 31,550 | 260,563 | 3,055 | 3,911 | 288,322 |

Axell Corp. | 19,494 | - | - | 336 | 20,167 |

Axis Capital Holdings Ltd. | 259,741 | - | - | 3,831 | 250,857 |

AZZ, Inc. | 55,533 | - | - | 278 | 54,490 |

Barratt Developments PLC | 135,826 | - | - | - | 144,564 |

Belc Co. Ltd. | 30,030 | - | - | 455 | 33,905 |

Belluna Co. Ltd. | 35,517 | - | - | 463 | 40,677 |

Bellway PLC | 81,530 | - | - | 1,024 | 87,404 |

Big 5 Sporting Goods Corp. | 18,137 | 4 | - | 330 | 17,460 |

Black Box Corp. | 45,779 | 5,017 | - | 252 | 55,682 |

Blyth, Inc. | 50,355 | - | 46,368 | - | - |

BMTC Group, Inc. Class A (sub. vtg.) | 132,588 | - | 7,934 | 1,173 | 100,716 |

Brinker International, Inc. | 184,954 | - | 18,656 | 2,464 | 180,950 |

Brown Shoe Co., Inc. | 11,565 | 16,058 | - | 333 | 30,713 |

C. Uyemura & Co. Ltd. | 29,052 | - | - | - | 25,730 |

Cal Dive International, Inc. | 36,287 | 970 | 172 | - | 19,940 |

Calian Technologies Ltd. | 16,460 | - | - | 335 | 14,518 |

Capella Education Co. | - | 26,181 | - | - | 36,827 |

Career Education Corp. | 106,643 | - | - | - | 47,517 |

Cathay General Bancorp | 57,173 | - | - | 83 | 64,928 |

CE Franklin Ltd. | 13,509 | - | - | - | 12,430 |

CEC Entertainment, Inc. | 77,400 | - | - | 840 | 70,340 |

Center Financial Corp. | 13,462 | - | - | - | - |

Chase Corp. | 12,542 | - | - | 313 | 11,898 |

Chime Communications PLC | 18,690 | - | - | 147 | 15,514 |

Chuoh Pack Industry Co. Ltd. | 4,932 | 34 | - | 89 | 4,775 |

Citi Trends, Inc. | 15,755 | 2,123 | 1,570 | - | 10,525 |

CKD Corp. | 47,666 | - | - | 402 | 42,690 |

ClearOne Communications, Inc. | 2,423 | - | - | - | 2,268 |

Clip Corp. | 3,958 | - | - | - | 3,996 |

Comtech Telecommunications Corp. | 33,014 | 1,969 | - | 715 | 40,118 |

Affiliates

(Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Value,

end of

period |