As filed with the Securities and Exchange Commission on February 7, 2020

Registration No. 33-

(Investment Company Act Registration No. 811-00649)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

| | |

| THE SECURITIES ACT OF 1933 | | |

| Pre-Effective Amendment No. | | ☐ |

| Post-Effective Amendment No. | | ☐ |

Fidelity Puritan Trust

(Exact Name of Registrant as Specified in Charter)

Registrant’s Telephone Number (617) 563-7000

245 Summer St., Boston, MA 02210

(Address Of Principal Executive Offices)

Cynthia Lo Bessette, Secretary

245 Summer Street

Boston, MA 02210

(Name and Address of Agent for Service)

Approximate Date of Proposed Public Offering: As soon as practicable after the Registration Statement becomes effective under the Securities Act of 1933.

The Registrant has registered an indefinite amount of securities under the Securities Act of 1933 pursuant to Section 24(f) under the Investment Company Act of 1940; accordingly, no fee is payable herewith because of reliance upon Section 24(f).

It is proposed that this filing will become effective on March 8, 2020, pursuant to Rule 488.

FIDELITY® EVENT DRIVEN OPPORTUNITIES FUND

A SERIES OF

FIDELITY CONCORD STREET TRUST

245 SUMMER STREET, BOSTON, MASSACHUSETTS 02210

1-800-544-8544

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To the Shareholders of Fidelity® Event Driven Opportunities Fund:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the Meeting) of Fidelity® Event Driven Opportunities Fund (the fund) will be held at an office of Fidelity Concord Street Trust (the trust), 245 Summer Street, Boston, Massachusetts 02210 (at the corner of Summer Street and Dorchester Avenue, next to Boston’s South Station) on May 20, 2020 at 7:30 a.m. Eastern Time (ET). The purpose of the Meeting is to consider and act upon the following proposal, and to transact such other business as may properly come before the Meeting or any adjournments thereof.

| | (1) | To approve an Agreement and Plan of Reorganization providing for the transfer of all of the assets of Fidelity® Event Driven Opportunities Fund to Fidelity® Low-Priced Stock Fund in exchange solely for corresponding shares of beneficial interest of Fidelity® Low-Priced Stock Fund and the assumption by Fidelity® Low-Priced Stock Fund of Fidelity® Event Driven Opportunities Fund’s liabilities, in complete liquidation of Fidelity® Event Driven Opportunities Fund. |

The Board of Trustees has fixed the close of business on March 23, 2020 as the record date for the determination of the shareholders of the fund entitled to notice of, and to vote at, such Meeting and any adjournments thereof.

|

By order of the Board of Trustees, CYNTHIA LO BESSETTE |

| Secretary |

March 23, 2020

Your vote is important – please vote your shares promptly.

Shareholders are invited to attend the fund’s Meeting in person. Admission to the Meeting will be on a first-come, first-served basis and will require picture identification. Shareholders arriving after the start of the Meeting may be denied entry. Cameras, cell phones, recording equipment and other electronic devices will not be permitted. Fidelity reserves the right to inspect any persons or items prior to admission to the Meeting.

Any shareholder who does not expect to attend the Meeting is urged to vote using the touch-tone telephone or internet voting instructions below or by indicating voting instructions on the enclosed proxy card, dating and signing it, and returning it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be. If you wish to wait until the Meeting to vote your shares, you will need to request a paper ballot at the Meeting in order to do so.

INSTRUCTIONS FOR EXECUTING PROXY CARD

The following general rules for executing a proxy card may be of assistance to you and help avoid the time and expense involved in validating your vote if you fail to execute your proxy card properly.

| | 1. | Individual Accounts: Your name should be signed exactly as it appears in the registration on the proxy card. |

| | 2. | Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to a name shown in the registration. |

| | 3. | All other accounts should show the capacity of the individual signing. This can be shown either in the form of the account registration itself or by the individual executing the proxy. For example: |

| | | | |

REGISTRATION | | VALID SIGNATURE |

| A. 1) | | ABC Corp. | | John Smith, Treasurer |

| | |

| 2) | | ABC Corp. | | John Smith, Treasurer |

| | |

| | c/o John Smith, Treasurer | | |

| | |

| B. 1) | | ABC Corp. Profit Sharing Plan | | Ann B. Collins, Trustee |

| | |

| 2) | | ABC Trust | | Ann B. Collins, Trustee |

| | |

| 3) | | Ann B. Collins, Trustee | | Ann B. Collins, Trustee |

| | |

| | u/t/d 12/28/78 | | |

| | |

| C. 1) | | Anthony B. Craft, Cust. | | Anthony B. Craft |

| | |

| | f/b/o Anthony B. Craft, Jr. | | |

| | |

| | UGMA | | |

INSTRUCTIONS FOR VOTING BY TOUCH-TONE TELEPHONE OR THROUGH THE INTERNET

| | 1. | Read the proxy statement, and have your proxy card handy. |

| | 2. | Call the toll-free number or visit the web site indicated on your proxy card. |

| | 3. | Enter the number found in the box on the front of your proxy card. |

| | 4. | Follow the recorded or on-line instructions to cast your vote. |

| | | | | | |

| | FIDELITY® EVENT DRIVEN OPPORTUNITIES FUND | | FIDELITY® LOW-PRICED STOCK FUND | | |

| | A SERIES OF | | A SERIES OF | | |

| | FIDELITY CONCORD STREET TRUST | | FIDELITY PURITAN TRUST | | |

245 SUMMER STREET, BOSTON, MASSACHUSETTS 02210

1-800-544-8544

PROXY STATEMENT AND PROSPECTUS

MARCH 23, 2020

This combined Proxy Statement and Prospectus (Proxy Statement) is furnished to shareholders of Fidelity® Event Driven Opportunities Fund (the fund), a series of Fidelity Concord Street Trust (the trust), in connection with a solicitation of proxies made by, and on behalf of, the trust’s Board of Trustees to be used at the Special Meeting of Shareholders of Fidelity® Event Driven Opportunities Fund and at any adjournments thereof (the Meeting), to be held on May 20, 2020 at 7:30 a.m. Eastern Time (ET) at 245 Summer Street, Boston, Massachusetts 02210, an office of the trust and Fidelity Management & Research Company LLC (FMR or the Adviser), the fund’s manager.

As more fully described in the Proxy Statement, shareholders of Fidelity® Event Driven Opportunities Fund are being asked to consider and vote on an Agreement and Plan of Reorganization (the Agreement) relating to the proposed acquisition of Fidelity® Event Driven Opportunities Fund by Fidelity® Low-Priced Stock Fund. The transaction contemplated by the Agreement is referred to as the Reorganization.

If the Agreement is approved by the fund’s shareholders and the Reorganization occurs, each shareholder of Fidelity® Event Driven Opportunities Fund will become a shareholder of Fidelity® Low-Priced Stock Fund. Fidelity® Event Driven Opportunities Fund will transfer all of its assets to Fidelity® Low-Priced Stock Fund in exchange solely for shares of beneficial interest of Fidelity® Low-Priced Stock Fund and the assumption by Fidelity® Low-Priced Stock Fund of Fidelity® Event Driven Opportunities Fund’s liabilities in complete liquidation of the fund. The total value of your fund holdings will not change as a result of the Reorganization. The Reorganization is currently scheduled to take place as of the close of business of the New York Stock Exchange (the NYSE) on June 19, 2020, or such other time and date as the parties may agree (the Closing Date).

Fidelity® Low-Priced Stock Fund (together with Fidelity® Event Driven Opportunities Fund, the funds), an equity fund, is a diversified series of Fidelity Puritan Trust, an open-end management investment company registered with the Securities and Exchange Commission (the SEC). Fidelity® Low-Priced Stock Fund seeks capital appreciation. Fidelity® Low-Priced Stock Fund seeks to achieve its investment objective by normally investing at least 80% of assets in low-priced stocks (those priced at or below $35 per share or with an earnings yield at or above the median for the Russell 2000® Index), which can lead to investments in small and medium-sized companies. Earnings yield represents a stock’s earnings per share for the most recent 12-months divided by current price per share.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC, NOR HAS THE SEC PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROXY STATEMENT AND PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This Proxy Statement and the accompanying proxy card are first being mailed on or about March 23, 2020. The Proxy Statement sets forth concisely the information about the Reorganization and Fidelity® Low-Priced Stock Fund that shareholders should know before voting on the proposed Reorganization. Please read it carefully and keep it for future reference.

The following documents have been filed with the SEC and are incorporated into this Proxy Statement by reference, which means they are part of this Proxy statement for legal purposes:

(i) the Statement of Additional Information dated March 23, 2020, relating to this Proxy Statement;

1

(ii) the Prospectus for Fidelity® Low-Priced Stock Fund dated September 28, 2019, which accompanies this Proxy Statement;

(iii) the Statement of Additional Information for Fidelity® Low-Priced Stock Fund dated September 28, 2019;

(iv) the Prospectus for Fidelity® Event Driven Opportunities Fund dated June 29, 2019, as supplemented; and

(v) the Statement of Additional Information for Fidelity® Event Driven Opportunities Fund dated June 29, 2019.

You can obtain copies of the funds’ current Prospectuses, Statements of Additional Information, or annual or semiannual reports without charge by contacting Fidelity Concord Street Trust or Fidelity Puritan Trust at: Fidelity Distributors Company LLC (FDC), 245 Summer Street, Boston, Massachusetts 02210, by calling 1-800-544-8544, or by logging on to www.fidelity.com.

The trust and Fidelity Puritan Trust are subject to the informational requirements of the Securities and Exchange Act of 1934, as amended. Accordingly, each must file proxy material, reports, and other information with the SEC. You can review and copy such information at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington D.C. 20549, the SEC’s Northeast Regional Office, 200 Vesey Street, Suite 400, New York, NY 10281-1022, and the SEC’s Midwest Regional Office, 175 W. Jackson Blvd., Suite 1450, Chicago, IL 60604. Such information is also available from the EDGAR database on the SEC’s web site at http://www.sec.gov. You can also obtain copies of such information, after paying a duplicating fee, by sending a request by e-mail to publicinfo@sec.gov or by writing the SEC’s Public Reference Room, Office of Consumer Affairs and Information Services, Washington, DC 20549. You may obtain information on the operation of the SEC’s Public Reference Room by calling the SEC at 1-202-551-8090.

An investment in the funds is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You could lose money by investing in the fund.

2

TABLE OF CONTENTS

3

SYNOPSIS

The following is a summary of certain information contained elsewhere in this Proxy Statement, in the Agreement, and/or in the Prospectuses and Statements of Additional Information of Fidelity® Event Driven Opportunities Fund and Fidelity® Low-Priced Stock Fund, which are incorporated herein by reference. Shareholders should read the entire Proxy Statement and the Prospectus of Fidelity® Low-Priced Stock Fund carefully for more complete information.

What proposal am I being asked to vote on?

As more fully described in the “Proposed Transaction” below, shareholders of Fidelity® Event Driven Opportunities Fund are being asked to approve the Agreement relating to the proposed acquisition of Fidelity® Event Driven Opportunities Fund by Fidelity® Low-Priced Stock Fund.

Shareholders of record as of the close of business on March 23, 2020 will be entitled to vote at the Meeting.

If the Agreement is approved by fund shareholders and the Reorganization occurs, each shareholder of Fidelity® Event Driven Opportunities Fund will become a shareholder of Fidelity® Low-Priced Stock Fund instead. Fidelity® Event Driven Opportunities Fund will transfer all of its assets to Fidelity® Low-Priced Stock Fund in exchange solely for shares of beneficial interest of Fidelity® Low-Priced Stock Fund and the assumption by Fidelity® Low-Priced Stock Fund of Fidelity® Event Driven Opportunities Fund’s liabilities in complete liquidation of the fund. Each shareholder of Fidelity® Event Driven Opportunities Fund will receive shares of the corresponding class of Fidelity® Low-Priced Stock Fund. The Reorganization is currently scheduled to take place as of the close of business of the NYSE on the Closing Date.

For more information, please refer to the section entitled “The Proposed Transaction – Agreement and Plan of Reorganization.”

Has the Board of Trustees approved the proposal?

Yes. The fund’s Board of Trustees has carefully reviewed the proposal and approved the Agreement and the Reorganization. The Board of Trustees unanimously recommends that shareholders vote in favor of the Reorganization by approving the Agreement.

What are the reasons for the proposal?

The Board of Trustees considered the following factors, among others, in determining to recommend that shareholders vote in favor of the Reorganization by approving the Agreement:

| | • | | The Reorganization will permit shareholders to pursue the same investment objective in a larger, diversified, and more successful fund. |

| | • | | Fidelity® Event Driven Opportunities Fund’s shareholders are expected to benefit from an expense reduction. |

| | • | | Over the long-term, Fidelity® Low-Priced Stock Fund has outperformed Fidelity® Event Driven Opportunities Fund over all standard time periods. |

| | • | | The Reorganization will qualify as a tax-free reorganization for federal income tax purposes |

For more information, please refer to the section entitled “The Proposed Transaction – Reasons for the Reorganization.”

4

How will you determine the number of shares of Fidelity® Low-Priced Stock Fund that I will receive?

Although the number of shares you own will most likely change, the total value of your holdings will not change as a result of the Reorganization.

As provided in the Agreement, Fidelity® Event Driven Opportunities Fund will distribute the corresponding retail class of shares of Fidelity® Low-Priced Stock Fund to its shareholders so that each shareholder will receive the number of full and fractional shares of Fidelity® Low-Priced Stock Fund equal in value to the net asset value of shares of Fidelity® Event Driven Opportunities Fund held by such shareholder on the Closing Date.

For more information, please refer to the section entitled “The Proposed Transaction – Agreement and Plan of Reorganization.”

What class of shares of Fidelity® Low-Priced Stock Fund will I receive?

Holders of Fidelity® Event Driven Opportunities Fund will receive the corresponding retail class of shares (Fidelity® Low-Priced Stock Fund) of Fidelity® Low-Priced Stock Fund.

Is the Reorganization considered a taxable event for federal income tax purposes?

No. Each fund will receive an opinion of counsel that the Reorganization will not result in any gain or loss for federal income tax purposes either to Fidelity® Event Driven Opportunities Fund or to Fidelity® Low-Priced Stock Fund or to the shareholders of any fund except that Fidelity® Event Driven Opportunities Fund may recognize gain or loss with respect to assets (if any) that are subject to “mark-to-market” tax accounting.

For more information, please refer to the section entitled “The Proposed Transaction – Federal Income Tax Considerations.”

How do the funds’ investment objectives, strategies, policies, and limitations compare?

The funds have the same investment objective. Each fund seeks capital appreciation. Each fund’s investment objective is fundamental, that is, subject to change only by shareholder approval. Through a separate proxy statement, shareholders of each fund are being asked to approve a proposal to make the fund’s fundamental investment objective non-fundamental. If approved by shareholders, the changes will go into effect in connection with each fund’s next annual prospectus revision. There is no present intention to change the way in which the funds are managed if such changes are approved by shareholders.

Although the funds have similar principal investment strategies, there are some differences of which you should be aware. The following compares the principal investment strategies of Fidelity® Event Driven Opportunities Fund and Fidelity® Low-Priced Stock Fund:

| | | | |

Fidelity® Event Driven Opportunities Fund | | Fidelity® Low-Priced Stock Fund | | |

| The Adviser normally invests the fund’s assets primarily in common stocks. The Adviser may invest the fund’s assets in lower-quality debt securities. | | The Adviser normally invests the fund’s assets primarily in common stocks. | | |

5

| | | | |

| | |

The Adviser invests the fund’s assets in securities of companies that the Adviser believes are involved in a special situation event. The types of companies in which the fund may invest include, but are not limited to, companies involved in a corporate reorganization, such as a spin-off or merger; companies that are no longer eligible to be a component of a market index based on the eligibility criteria established by the index sponsor; companies that are undergoing changes in beneficial ownership; companies experiencing positive fundamental change, such as new or changed management, or material changes in management policies or corporate structure; companies undergoing changes in corporate strategy through bankruptcy process; and companies involved in changes to their capital structure. . | | The Adviser normally invests at least 80% of the fund’s assets in low-priced stocks. Low-priced stocks are those that are priced at or below $35 per share or with an earnings yield at or above the median for the Russell 2000® Index. Earnings yield represents a stock’s earnings per share for the most recent 12-months divided by current price per share. For convertible preferred stocks, the Adviser may consider the price of the security itself or the price of the security into which it is convertible. The fund’s strategy is based on the premise that low-priced stocks may offer significant growth potential because they are often overlooked by many investors or because the public is overly pessimistic about the issuer’s prospects. The fund’s strategy can lead to investments in small and medium-sized companies. The Adviser may also invest the fund’s assets in stocks not considered low-priced. | | |

| | |

| The Adviser may invest the fund’s assets in securities of foreign issuers in addition to securities of domestic issuers. | | Same principal strategy. | | |

| | |

| Because the fund is classified as non-diversified, the Adviser may invest a significant percentage of the fund’s assets in a single issuer. | | No corresponding principal strategy. | | |

| | |

| The Adviser is not constrained by any particular investment style. At any given time, the Adviser may tend to buy “growth” stocks or “value” stocks, or a combination of both types. In buying and selling securities for the fund, the Adviser relies on fundamental analysis, which involves a bottom-up assessment of a company’s potential for success in light of factors including its financial condition, earnings outlook, strategy, management, industry position, and economic and market conditions. | | Same principal strategy. | | |

6

For a comparison of the principal risks associated with the funds’ principal investment strategies, please refer to the section entitled “Comparison of Principal Risk Factors.”

Although the funds have similar fundamental and non-fundamental investment policies and limitations, there are some differences of which you should be aware. The following summarizes the investment policy and limitation differences between Fidelity® Event Driven Opportunities Fund and Fidelity® Low-Priced Stock Fund:

| | | | |

Fidelity® Event Driven Opportunities Fund | | Fidelity® Low-Priced Stock Fund | | |

| Fundamental policies and limitations (subject to change only by shareholder vote) | | Fundamental policies and limitations (subject to change only by shareholder vote) | | |

| | |

| No corresponding policy or limitation | | Diversification. The fund may not with respect to 75% of the fund’s total assets, purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities, or securities of other investment companies) if, as a result, (a) more than 5% of the fund’s total assets would be invested in the securities of that issuer, or (b) the fund would hold more than 10% of the outstanding voting securities of that issuer. | | |

| | |

| No corresponding policy or limitation. | | Pooled Funds. The fund may, notwithstanding any other fundamental investment policy or limitation, invest all of its assets in the securities of a single open-end management investment company with substantially the same fundamental investment objective, policies, and limitations as the fund. | | |

7

| | | | |

| Non-Fundamental Policies and Limitations | | Non-Fundamental Policies and Limitations | | |

| | |

Diversification. In order to qualify as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended, the fund currently intends to comply with certain diversification limits imposed by Subchapter M. Subchapter M generally requires the fund to invest no more than 25% of its total assets in securities of any one issuer or in the securities of certain publicly-traded partnerships and to invest at least 50% of its total assets so that (a) no more than 5% of the fund’s total assets are invested in securities of any one issuer, and (b) the fund does not hold more than 10% of the outstanding voting securities of that issuer. However, Subchapter M allows unlimited investments in cash, cash items, government securities (as defined in Subchapter M) and securities of other regulated investment companies. These tax requirements are generally applied at the end of each quarter of the fund’s taxable year. | | Diversification. The fund intends to comply both with the Subchapter M diversification requirements and with the diversification requirements described in the fundamental investment limitations disclosure above. | | |

| | |

| No corresponding policy or limitation. | | Pooled Funds. The fund does not currently intend to invest all of its assets in the securities of a single open-end management investment company with substantially the same fundamental investment objective, policies, and limitations as the fund. | | |

Except as noted above, the funds have the same fundamental and non-fundamental investment policies and limitations.

For more information about the funds’ investment objectives, strategies, policies, and limitations, please refer to the “Investment Details” section of the funds’ Prospectuses, and to the “Investment Policies and Limitations“ section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

Following the Reorganization, the combined fund will be managed in accordance with the investment objective, strategies, policies, and limitations of Fidelity® Low-Priced Stock Fund.

8

How do the funds’ management and distribution arrangements compare?

The following summarizes the management and distribution arrangements of Fidelity® Event Driven Opportunities Fund and Fidelity® Low-Priced Stock Fund:

Management of the Funds

The principal business address of FMR, each fund’s investment adviser, is 245 Summer Street, Boston, Massachusetts 02210.

As the manager, FMR has overall responsibility for directing the fund’s investments and handling their business affairs. As of December 31, 2019, FMR had approximately $[ ] billion in discretionary assets under management, and approximately $[ ] trillion when combined with all of its affiliates’ assets under management.

FMR Investment Management (UK) Limited (FMR UK), located at 1 St. Martin’s Le Grand, London, EC1A 4AS, United Kingdom is a sub-adviser to Fidelity® Low-Priced Stock Fund. Fidelity Management & Research (Hong Kong) Limited (FMR H.K.), located at Floor 19, 41 Connaught Road Central, Hong Kong and Fidelity Management & Research (Japan) Limited (FMR Japan), located at Kamiyacho Prime Place, 1-17, Toranomon-4-Chome, Minato-ku, Tokyo, Japan, are sub-advisers to Fidelity® Event Driven Opportunities Fund and Fidelity® Low-Priced Stock Fund. FMR is expected to continue serving as manager, and FMR UK, FMR H.K, and FMR Japan are expected to continue serving as sub-advisers of the combined fund after the Reorganization.

Arvind Navaratnam is portfolio manager of Fidelity® Event Driven Opportunities Fund, which he has managed since December 2013. He also manages other funds. Since joining Fidelity Investments in 2010, Mr. Navaratnam has worked as a research analyst and portfolio manager.

Joel Tillinghast is lead portfolio manager of Fidelity® Low-Priced Stock Fund, which he has managed since December 1989. He also manages other funds. Since joining Fidelity Investments in 1986, Mr. Tillinghast has worked as a research analyst and portfolio manager.

Sam Chamovitz is co-manager of Fidelity® Low-Priced Stock Fund, which he has managed since April 2017. He also manages other funds. Since joining Fidelity Investments in 2007, Mr. Chamovitz has worked as a research analyst and portfolio manager.

Salim Hart is co-manager of Fidelity® Low-Priced Stock Fund, which he has managed since April 2017. He also manages other funds. Since joining Fidelity Investments in 2007, Mr. Hart has worked as a quantitative research analyst and portfolio manager.

John Mirshekari is co-manager of Fidelity® Low-Priced Stock Fund, which he has managed since September 2011. He also manages other funds. Since joining Fidelity Investments in 2003, Mr. Mirshekari has worked as a research analyst and portfolio manager.

Morgen Peck is co-manager of Fidelity® Low-Priced Stock Fund, which she has managed since May 2016. She also manages other funds. Since joining Fidelity Investments in 2003, Ms. Peck has worked as a research analyst and portfolio manager.

Shadman Riaz is co-manager of Fidelity® Low-Priced Stock Fund, which he has managed since September 2011. He also manages other funds. Since joining Fidelity Investments in 2001, Mr. Riaz has worked as a research analyst and portfolio manager.

Messrs. Tillinghast, Chamovitz, Hart, Mirshekari, and Riaz, as well as Ms. Peck are expected to continue to be responsible for portfolio management of the combined fund after the Reorganization.

For information about the compensation of, any other accounts managed by, and any fund shares held by a fund’s portfolio manager(s), please refer to the “Management Contract(s)” section of each fund’s Statement of Additional Information, which are incorporated herein by reference.

9

Each fund has entered into a management contract with FMR, pursuant to which FMR furnishes investment advisory and other services.

Each fund pays FMR a management fee calculated by adding a group fee rate to an individual fund fee rate, dividing by twelve, and multiplying the result by the fund’s average net assets. The group fee rate is based on the average net assets of a group of mutual funds advised by FMR. This rate cannot rise above 0.52%, and it drops as total assets under management increase. For October 2019, the group fee rate for Fidelity® Event Driven Opportunities Fund and Fidelity® Low-Priced Stock Fund was 0.24%. The individual fund fee rate is 0.60% of average net assets for Fidelity® Event Driven Opportunities Fund and 0.35% of average net assets for Fidelity® Low-Priced Stock Fund.

The performance adjustment rate for Fidelity® Event Driven Opportunities Fund is calculated monthly by comparing over the performance period the fund’s performance to that of the Russell 3000® Index.

For Fidelity® Event Driven Opportunities Fund, each percentage point of difference, calculated to the nearest 0.01% (up to a maximum difference of ±10.00), is multiplied by a performance adjustment rate of 0.01%. The maximum annualized performance adjustment rate is ±0.10% of each fund’s average net assets over the performance period.

The performance adjustment rate for Fidelity® Low-Priced Stock Fund is calculated monthly by comparing over the performance period the fund’s performance to that of the Russell 2000® Index.

For Fidelity® Low-Priced Stock Fund, each percentage point of difference, calculated to the nearest 0.01% (up to a maximum difference of ±10.00), is multiplied by a performance adjustment rate of 0.02%. The maximum annualized performance adjustment rate is ±0.20% of a fund’s average net assets over the performance period.

The performance period for each fund is the most recent 36 month period.

The basis for the Board of Trustees approving the management contract and sub-advisory agreements for Fidelity® Event Driven Opportunities Fund is available in the fund’s annual report for the fiscal period ended April 30, 2019.

The basis for the Board of Trustees approving the management contract and sub-advisory agreements for Fidelity® Low-Priced Stock Fund is available in the fund’s semi-annual report for the fiscal period ended January 31, 2019.

If approved, the combined fund will retain Fidelity® Low-Priced Stock Fund’s management fee structure.

For more information about fund management, please refer to the “Fund Management” section of the funds’ Prospectuses, and to the “Control of Investment Advisers” and “Management Contract(s)” sections of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

Expense Arrangements

For more information about the funds’ fees and operating expenses, please refer to the funds’ Prospectuses, which are incorporated herein by reference, and to “Annual Fund Operating Expenses” below.

If the proposed Reorganization is not approved, the fund will maintain its current expense structure until its liquidation, as discussed in greater detail below.

10

Distribution of Fund Shares

The principal business address of FDC, each fund’s principal underwriter and distribution agent, is 900 Salem Street, Smithfield, Rhode Island, 02917

Each fund has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the Investment Company Act of 1940 (1940 Act) that recognizes that FMR may use its management fee revenues, as well as its past profits or its resources from any other source, to pay FDC for expenses incurred in connection with providing services intended to result in the sale of fund shares and/or shareholder support services. A fund’s Distribution and Service Plan does not authorize payments by the fund other than those that are to be made to FMR under the fund’s management contract.

If the Reorganization is approved, the Distribution and Service Plan for the combined fund will remain unchanged.

For more information about fund distribution, please refer to the “Fund Distribution” section of the funds’ Prospectuses, and to the “Distribution Services” section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

How do the funds’ fees and operating expenses compare, and what are the combined fund’s fees and operating expenses estimated to be following the Reorganization?

The following tables allow you to compare the fees and expenses of each fund and to analyze the pro forma estimated fees and expenses of the combined fund.

Annual Fund and Class Operating Expenses

The following tables show the fees and expenses of Fidelity® Event Driven Opportunities Fund and Fidelity® Low-Priced Stock Fund for the 12 months ended October 31, 2019, and the pro forma estimated fees and expenses of the combined fund based on the same time period after giving effect to the Reorganization. Annual fund or class operating expenses are paid by each fund or class, as applicable.

Attachment 1 shows the fees and expenses of Fidelity® Event Driven Opportunities Fund and Fidelity® Low-Priced Stock Fund for the 12 months ended October 31, 2019, and the pro forma estimated fees and expenses of the combined fund based on the same time period after giving effect to the Reorganization but excluding performance adjustments for each fund.

As shown below, the Reorganization is expected to result in lower total annual operating expenses for Fidelity® Event Driven Opportunities Fund shareholders. Performance fees, which are a component of each fund’s management fee, can fluctuate significantly from month to month. As a result, the rates contained under “Management fee” and “Total annual operating expenses” for the Pro forma combined fund may vary from what is shown in the table below.

Retail Class

Shareholder Fees (paid directly from your investment)

| | | | | | |

| | | Fidelity® Event

Driven

Opportunities

Fund | | Fidelity® Low- Priced Stock Fund | | Fidelity® Low- Priced Stock Fund Pro forma

Combined |

Maximum sales charge (load) on purchases | | None | | None | | None |

| | | |

Maximum contingent deferred sales charge (as a % of the lesser of original purchase price or redemption proceeds) | | None | | None | | None |

11

Annual Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

| | | | | | | | | | | | |

| | | Fidelity® Event

Driven

Opportunities

Fund | | | Fidelity® Low- Priced Stock Fund | | | Fidelity® Low- Priced Stock Fund Pro forma Combined(a) | |

Management fee (fluctuates based on the fund’s performance relative to a securities market index) | | | 0.67 | % | | | 0.40 | % | | | 0.40 | % |

Distribution and/or Service (12b-1) fees | | | None | | | | None | | | | None | |

Other expenses | | | 0.29 | % | | | 0.15 | % | | | 0.15 | % |

Acquired fund fees and expenses | | | 0.01 | % | | | 0.00 | % | | | 0.00 | % |

| | | | | | | | | | | | |

Total annual operating expenses | | | 0.97 | % | | | 0.55 | % | | | 0.55 | % |

| (a) | Based on estimated expenses for the 12 months ended October 31, 2019. |

Examples of Effect of Fund Expenses

The following table illustrates the expenses on a hypothetical $10,000 investment in each fund under the current and pro forma (combined fund) expenses calculated at the rates stated above, assuming a 5% annual return after giving effect to the Reorganization. The table illustrates how much a shareholder would pay in total expenses if the shareholder sells all of his or her shares at the end of each time period indicated and if the shareholder holds his or her shares.

Attachment 2 illustrates the expenses on a hypothetical $10,000 investment in each fund under the current and pro forma (combined fund) expenses calculated at the rates stated above, assuming a 5% annual return after giving effect to the Reorganization, but excluding performance adjustments for each fund.

Retail Class

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fidelity® Event Driven

Opportunities Fund | | | Fidelity® Low-Priced Stock Fund | | | Fidelity® Low-Priced Stock Fund – Pro forma Combined | |

| | | Sell All | | | Hold All | | | Sell All | | | Hold All | | | Sell All | | | Hold All | |

1 Year | | $ | 99 | | | $ | 99 | | | $ | 56 | | | $ | 56 | | | $ | 56 | | | $ | 56 | |

3 Year | | $ | 309 | | | $ | 309 | | | $ | 176 | | | $ | 176 | | | $ | 176 | | | $ | 176 | |

5 Year | | $ | 536 | | | $ | 536 | | | $ | 307 | | | $ | 307 | | | $ | 307 | | | $ | 307 | |

10 Year | | $ | 1,190 | | | $ | 1,190 | | | $ | 689 | | | $ | 689 | | | $ | 689 | | | $ | 689 | |

12

These examples assume that all dividends and other distributions are reinvested and that the percentage amounts listed under Annual Operating Expenses remain the same in the years shown. These examples illustrate the effect of expenses, but are not meant to suggest actual or expected expenses, which may vary. The assumed return of 5% is not a prediction of, and does not represent, actual or expected performance of any fund.

Do the procedures for purchasing and redeeming shares of the funds differ?

Except as discussed below, the procedures for purchasing shares of the funds are the same.

On January 15, 2020, Fidelity® Event Driven Opportunities Fund closed to new accounts pending the Reorganization. Shareholders of Fidelity® Event Driven Opportunities Fund as of that date can continue to purchase shares of the fund. Shareholders of Fidelity® Event Driven Opportunities Fund may redeem shares of the fund through the Closing Date of the fund’s Reorganization.

Aside from the closing of Fidelity® Event Driven Opportunities Fund, the procedures for purchasing and redeeming shares of the funds are the same. If the Reorganization is approved, the procedures for purchasing and redeeming shares of the combined fund will remain unchanged.

If shareholder approval of the Agreement cannot be achieved, the Board of Trustees has approved a plan of liquidation for Fidelity Event Driven Opportunities Fund. Prior to such liquidation the fund’s assets will be managed to provide for sufficient liquidity to meet redemptions prior to liquidation. In this event, effective after the close of business on May 20, 2020, the fund will no longer permit new positions in the fund to be opened. Existing shareholders will be permitted to continue to hold their shares and purchase additional shares through the reinvestment of dividend and capital gain distributions until the fund’s liquidation on or about June 19, 2020.

For more information about the procedures for purchasing and redeeming the funds’ shares, including a description of the policies and procedures designed to discourage excessive or short-term trading of fund shares, please refer to the “Additional Information about the Purchase and Sale of Shares” section of the funds’ Prospectuses, and to the “Buying, Selling and Exchanging Information” section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference

Do the funds’ exchange privileges differ?

No. The exchange privileges currently offered by the funds are the same. If the Reorganization is approved, the exchange privilege offered by the combined fund will remain unchanged.

For more information about the funds’ exchange privileges, please refer to the “Exchanging Shares” section of the funds’ Prospectuses, and to the “Buying, Selling and Exchanging Information” section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

13

Do the funds’ dividend and distribution policies differ?

The fund’s dividend and distribution policies differ. Fidelity® Event Driven Opportunities Fund normally pays dividends and capital gain distributions in June and December, while Fidelity® Low-Priced Stock Fund normally pays dividends and capital gain distributions in September and December. If the Reorganization is approved, the dividend and distribution policies of the combined fund will be the same as the current dividend and distribution policies of Fidelity® Low-Priced Stock Fund.

On or before the Closing Date, Fidelity® Event Driven Opportunities Fund may declare additional dividends or other distributions in order to distribute its net taxable income and net realized capital gain (if any).

Whether or not the Reorganization is approved, Fidelity® Event Driven Opportunities Fund is required to recognize gain or loss on any assets subject to “mark-to-market” tax accounting held by the fund on the last day of its taxable year, which is April 30th. If the Reorganization is approved, gains or losses on such assets held on the Closing Date by Fidelity® Event Driven Opportunities Fund may be required to be recognized on the Closing Date.

For more information about the funds’ dividend and distribution policies, please refer to the “Dividends and Capital Gain Distributions” section of the funds’ Prospectuses, and to the “Distributions and Taxes” section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

Who bears the expenses associated with the Reorganization?

Fidelity® Event Driven Opportunities Fund will bear the cost of the Reorganization.

For more information, please refer to the section entitled “Voting Information – Solicitation of Proxies; Expenses.”

COMPARISON OF PRINCIPAL RISK FACTORS

Many factors affect each fund’s performance. A fund’s share price changes daily based on changes in market conditions and interest rates and in response to other economic, political, or financial developments. A fund’s reaction to these developments will be affected by the types of securities in which the fund invests, the financial condition, industry and economic sector, and geographic location of an issuer, and the fund’s level of investment in the securities of that issuer. When you sell your shares they may be worth more or less than what you paid for them, which means that you could lose money by investing in a fund.

The following is a summary of the principal risks associated with an investment in the funds. Because the funds have identical investment objectives and similar strategies as described above, the funds are subject to similar investment risks. Because the funds have some different principal investment strategies as described above, the funds are also subject to some different investment risks, of which you should be aware.

What risks are associated with an investment in both of the funds?

Each fund is subject to the following principal risks:

Stock Market Volatility. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Different parts of the market, including different market sectors, and different types of securities can react differently to these developments.

Foreign Exposure. Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market, or economic developments and can perform differently from the U.S. market.

14

What additional risks are associated with an investment in Fidelity® Event Driven Opportunities Fund?

Fidelity® Event Driven Opportunities Fund is subject to the following principal risks, which are not principal risks generally associated with an investment in Fidelity® Low-Priced Stock Fund:

Interest Rate Changes. Interest rate increases can cause the price of a debt security to decrease.

Issuer-Specific Changes. The value of an individual security or particular type of security can be more volatile than, and can perform differently from, the market as a whole. The value of securities in companies involved in a special situation event can perform differently from the market as a whole and other types of stocks, and can be more volatile than that of other issuers. Lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds) and certain types of other securities involve greater risk of default or price changes due to changes in the credit quality of the issuer. The value of lower-quality debt securities and certain types of other securities often fluctuates in response to company, political, or economic developments and can decline significantly over short as well as long periods of time or during periods of general or regional economic difficulty.

Fidelity® Event Driven Opportunities Fund is classified as non-diversified under the Investment Company Act of 1940, which means that it has the ability to invest a greater portion of assets in securities of a smaller number of individual issuers than a diversified fund. As a result, changes in the market value of a single investment could cause greater fluctuations in share price than would occur in a more diversified fund.

What additional risks are associated with an investment in Fidelity® Low-Priced Stock Fund?

Fidelity® Low-Priced Stock Fund is subject to the following principal risk, which is not a principal risk generally associated with an investment Fidelity® Event Driven Opportunities Fund:

Issuer-Specific Changes. Changes in the financial condition of an issuer or counterparty, changes in specific economic or political conditions that affect a particular type of security or issuer, and changes in general economic or political conditions can increase the risk of default by an issuer or counterparty, which can affect a security’s or instrument’s value. The value of securities of smaller, less well-known issuers can be more volatile than that of larger issuers. Smaller issuers can have more limited product lines, markets, or financial resources.

For more information about the principal risks associated with an investment in the funds, please refer to the “Investment Details” section of the funds’ Prospectuses, and to the “Investment Policies and Limitations“ section of the funds’ Statements of Additional Information, each of which is incorporated herein by reference.

How do the funds compare in terms of their performance?

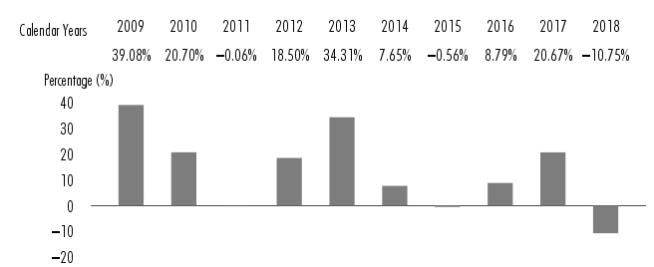

The following information provides some indication of the risks associated with an investment in the funds. The information illustrates the changes in the performance of each fund’s shares from year to year and compares the performance of each fund’s shares to the performance of a securities market index over various periods of time. The index description appears in the Additional Index Information section of the funds’ prospectuses. Past performance before or after taxes is not an indication of future performance.

15

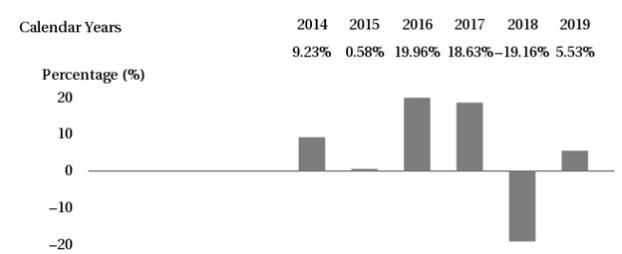

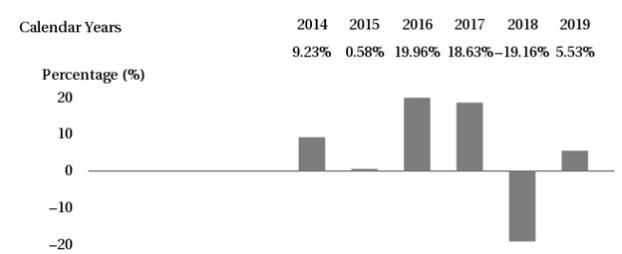

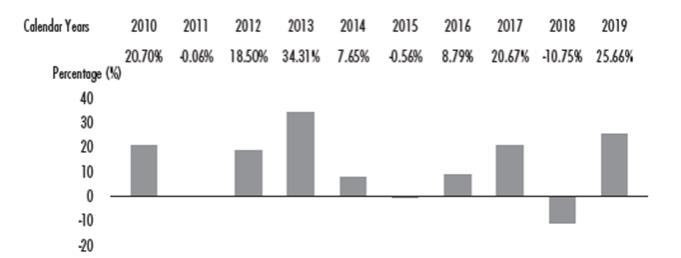

Year-by-Year Returns

Fidelity® Event Driven Opportunities Fund

| | | | | | | | |

During the periods shown in the chart: | | | Returns | | | | Quarter ended | |

Highest Quarter Return | | | 12.28 | % | | | December 31, 2016 | |

Lowest Quarter Return | | | (21.33 | )% | | | December 31, 2018 | |

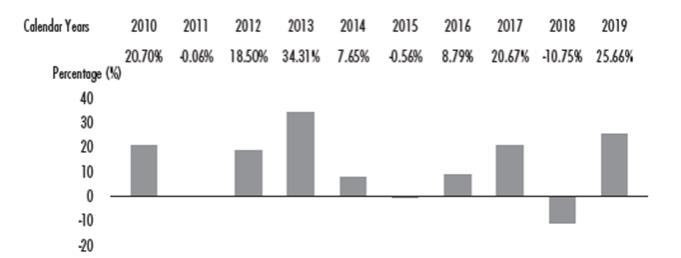

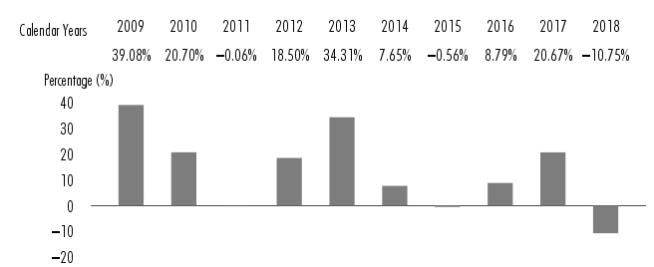

Fidelity® Low-Priced Stock Fund - Retail Class

| | | | | | | | |

During the periods shown in the chart: | | | Returns | | | | Quarter ended | |

Highest Quarter Return | | | 13.97 | % | | | March 31, 2012 | |

Lowest Quarter Return | | | (15.81 | )% | | | September 30, 2011 | |

Average Annual Returns

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, but do not reflect the impact of state or local taxes. Actual after-tax returns may differ depending on your individual circumstances. The after-tax returns shown are not relevant if you hold your shares in a retirement

16

account or in another tax-deferred arrangement, such as an employee benefit plan (profit sharing, 401(k), or 403(b) plan). Return After Taxes on Distributions and Sale of Fund Shares may be higher than other returns for the same period due to a tax benefit of realizing a capital loss upon the sale of fund shares.

Fidelity® Event Driven Opportunities Fund

| | | | | | | | | | | | |

| For the periods ended December 31, 2019 | | Past 1 year | | | Past 5 years | | | Life of fund(a) | |

Fidelity® Event Driven Opportunities Fund | | | | | | | | | | | | |

Return Before Taxes | | | 5.53 | % | | | 4.08 | % | | | 5.41 | % |

Return After Taxes on Distributions | | | 5.53 | % | | | 3.02 | % | | | 4.41 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | | 3.27 | % | | | 3.10 | % | | | 4.15 | % |

Russell 3000® Index (reflects no deduction for fees, expenses, or taxes) | | | 31.02 | % | | | 11.24 | % | | | 12.14 | % |

| (a) | From December 12, 2013 |

Fidelity® Low-Priced Stock Fund

| | | | | | | | | | | | |

| For the periods ended December 31, 2019 | | Past 1 year | | | Past 5 years | | | Past 10 years | |

Fidelity® Low-Priced Stock Fund (Retail Class) | | | | | | | | | | | | |

Return Before Taxes | | | 25.66 | % | | | 7.92 | % | | | 11.71 | % |

Return After Taxes on Distributions | | | 23.19 | % | | | 5.99 | % | | | 10.13 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | | 16.66 | % | | | 5.96 | % | | | 9.46 | % |

Russell 2000® Index (reflects no deduction for fees, expenses, or taxes) | | | 25.52 | % | | | 8.23 | % | | | 11.83 | % |

17

THE PROPOSED TRANSACTION

TO APPROVE AN AGREEMENT AND PLAN OF REORGANIZATION BETWEEN FIDELITY® EVENT DRIVEN OPPORTUNITIES FUND AND FIDELITY® LOW-PRICED STOCK FUND.

Agreement and Plan of Reorganization

The terms and conditions under which the proposed transaction may be consummated are set forth in the Agreement. Significant provisions of the Agreement are summarized below; however, this summary is qualified in its entirety by reference to the Agreement, a copy of which is attached as Exhibit 1 to this Proxy Statement.

The Agreement contemplates (a) Fidelity® Low-Priced Stock Fund acquiring as of the Closing Date all of the assets of Fidelity® Event Driven Opportunities Fund in exchange solely for shares of Fidelity® Low-Priced Stock Fund and the assumption by Fidelity® Low-Priced Stock Fund of Fidelity® Event Driven Opportunities Fund’s liabilities; and (b) the distribution of shares of Fidelity® Low-Priced Stock Fund to the shareholders of Fidelity® Event Driven Opportunities Fund as provided for in the Agreement.

The value of Fidelity® Event Driven Opportunities Fund’s assets to be acquired by Fidelity® Low-Priced Stock Fund and the amount of its liabilities to be assumed by Fidelity® Low-Priced Stock Fund will be determined as of the close of business of the NYSE on the Closing Date, using the valuation procedures set forth in Fidelity® Low-Priced Stock Fund’s then-current Prospectus and Statement of Additional Information. The net asset value of a share of Fidelity® Low-Priced Stock Fund will be determined as of the same time using the valuation procedures set forth in its then-current Prospectus and Statement of Additional Information.

As of the Closing Date, Fidelity® Low-Priced Stock Fund will deliver to Fidelity® Event Driven Opportunities Fund, and Fidelity® Event Driven Opportunities Fund will distribute to its shareholders of record, shares of Fidelity® Low-Priced Stock Fund so that each Fidelity® Event Driven Opportunities Fund shareholder will receive the number of full and fractional shares of Fidelity® Low-Priced Stock Fund equal in value to the aggregate net asset value of shares of Fidelity® Event Driven Opportunities Fund held by such shareholder on the Closing Date; Fidelity® Event Driven Opportunities Fund will be liquidated as soon as practicable thereafter. Each Fidelity® Event Driven Opportunities Fund shareholder’s account shall be credited with the respective pro rata number of full and fractional shares of Fidelity® Low-Priced Stock Fund due that shareholder. The net asset value per share of Fidelity® Low-Priced Stock Fund will be unchanged by the transaction. Thus, the Reorganization will not result in a dilution of any shareholder’s interest.

Any transfer taxes payable upon issuance of shares of Fidelity® Low-Priced Stock Fund in a name other than that of the registered holder of the shares on the books of Fidelity® Event Driven Opportunities Fund as of that time shall be paid by the person to whom such shares are to be issued as a condition of such transfer. Any reporting responsibility of Fidelity® Event Driven Opportunities Fund is and will continue to be its responsibility up to and including the Closing Date and such later date on which Fidelity® Event Driven Opportunities Fund is liquidated.

Fidelity® Event Driven Opportunities Fund will bear the cost of the Reorganization, including professional fees, expenses associated with the filing of registration statements, and the cost of soliciting proxies for the Meeting, which will consist principally of printing and mailing prospectuses and the Proxy Statement, together with the cost of any supplementary solicitation

All of the current investments of Fidelity® Event Driven Opportunities Fund are permissible investments for Fidelity® Low-Priced Stock Fund. Nevertheless, if shareholders approve the Reorganization, FMR may sell certain securities held by the funds and purchase other securities. Any transaction costs associated with portfolio adjustments to Fidelity® Event Driven Opportunities Fund and Fidelity® Low-Priced Stock Fund due to the Reorganization that occur prior to the Closing Date will be borne by Fidelity® Event Driven Opportunities Fund and Fidelity® Low-Priced Stock Fund, respectively. Any transaction costs associated with portfolio adjustments to Fidelity® Event Driven Opportunities Fund and Fidelity® Low-Priced Stock Fund due to the Reorganization that occur after the Closing Date and any additional merger-related costs attributable to Fidelity® Low-Priced Stock Fund that occur after the Closing Date will be borne by Fidelity® Low-Priced Stock Fund. The funds may recognize a taxable gain or loss on the disposition of securities pursuant to these portfolio adjustments.

18

The consummation of the Reorganization is subject to a number of conditions set forth in the Agreement, some of which may be waived by a fund. In addition, the Agreement may be amended in any mutually agreeable manner, except that no amendment that may have a materially adverse effect on Fidelity® Event Driven Opportunities Fund shareholders’ interests may be made subsequent to the Meeting.

Reasons for the Reorganization

In determining whether to approve the Reorganization, each fund’s Board of Trustees (the Board) considered a number of factors, including the following:

| | (1) | the compatibility of the investment objectives, strategies, and policies of the funds; |

| | (2) | the historical performance of the funds; |

| | (3) | the fees and expenses and the relative expense ratios of the funds; |

| | (4) | the potential benefit of the Reorganization to shareholders of the funds; |

| | (5) | the costs to be incurred by each fund as a result of the Reorganization; |

| | (6) | the tax consequences of the Reorganization; |

| | (7) | the relative size of the funds; and |

| | (8) | the potential benefit of the Reorganization to FMR and its affiliates. |

FMR proposed the Reorganization to each fund’s Board at a meeting of the Board held on January 15, 2020. In proposing the Reorganization, FMR advised the Board that the Reorganization would permit Fidelity® Event Driven Opportunities Fund’s shareholders to pursue the same investment objective in a larger, diversified, and more successful fund. The Board considered that Fidelity® Event Driven Opportunities Fund’s shareholders are expected to benefit from an expense reduction of approximately 0.39% (based on actual expenses, excluding performance adjustments and acquired fund fees and expenses, if any) for the twelve months ended October 31, 2019. Because performance fees can vary significantly and cannot be predicted from year to year, comparing total expenses excluding performance fees may provide better insight into a fund’s ongoing operating expenses. The Board also reviewed a chart showing the historical monthly performance fee adjustments (in basis points) for each fund to illustrate the volatility, noting the projected merger benefit including performance fees (based solely on the fee calculated for the month ended December 31, 2019) would be lower. The Board considered that over the long-term, Fidelity® Low-Priced Stock Fund has outperformed Fidelity® Event Driven Opportunities Fund over all standard time periods. The Board also considered that the Reorganization will qualify as a tax-free exchange for federal income tax purposes.

Each fund’s Board carefully reviewed the proposal and determined that the Reorganization is in the best interests of the shareholders of each fund and that the Reorganization will not result in a dilution of the interests of the shareholders of either fund.

Description of the Securities to be Issued

Fidelity® Low-Priced Stock Fund is a series of Fidelity Puritan Trust. The Trustees of Fidelity Puritan Trust are authorized to issue an unlimited number of shares of beneficial interest of separate series. Each share of Fidelity® Low-Priced Stock Fund represents an equal proportionate interest with each other share of the fund, and each such share of Fidelity® Low-Priced Stock Fund is entitled to equal voting, dividend, liquidation, and redemption rights. Each shareholder of Fidelity® Low-Priced Stock Fund is entitled to one vote for each dollar of net asset value of the fund that shareholder owns, with fractional dollar amounts entitled to a proportionate fractional vote. Shares of Fidelity® Low-Priced Stock Fund have no preemptive or conversion rights. Shares are fully paid and nonassessable, except as set forth in the “Description of the Trusts – Shareholder Liability” section of the fund’s Statement of Additional Information, which is incorporated herein by reference.

19

Fidelity Puritan Trust does not hold annual meetings of shareholders. There will normally be no meetings of shareholders for the purpose of electing Trustees unless less than a majority of the Trustees holding office have been elected by shareholders, at which time the Trustees then in office will call a shareholder meeting for the election of Trustees. Under the 1940 Act, shareholders of record of at least two-thirds of the outstanding shares of an investment company may remove a Trustee by votes cast in person or by proxy at a meeting called for that purpose. The Trustees are required to call a meeting of shareholders for the purpose of voting upon the question of removal of any Trustee when requested in writing to do so by the shareholders of record holding at least 10% of the trust’s outstanding shares.

For more information about voting rights and dividend rights, please refer to the “Description of the Trusts – Voting Rights” and the “Distributions and Taxes” sections, respectively, of Fidelity® Low-Priced Stock Fund’s Statement of Additional Information, which is incorporated herein by reference. For more information about redemption rights, please refer to the “Additional Information about the Purchase and Sale of Shares” section and the “Exchanging Shares” sections, respectively, of Fidelity® Low-Priced Stock Fund’s Prospectus, which is incorporated herein by reference.

Federal Income Tax Considerations

The exchange of Fidelity® Event Driven Opportunities Fund’s assets for Fidelity® Low-Priced Stock Fund’s shares and the assumption of the liabilities of Fidelity® Event Driven Opportunities Fund by Fidelity® Low-Priced Stock Fund is intended to qualify for federal income tax purposes as a tax-free reorganization under the Internal Revenue Code (the Code). With respect to the Reorganization, the participating funds will receive an opinion from Dechert LLP, counsel to Fidelity® Event Driven Opportunities Fund and Fidelity® Low-Priced Stock Fund, substantially to the effect that:

(i) The acquisition by Fidelity® Low-Priced Stock Fund of substantially all of the assets of Fidelity® Event Driven Opportunities Fund in exchange solely for Fidelity® Low-Priced Stock Fund shares and the assumption by Fidelity® Low-Priced Stock Fund of all liabilities of Fidelity® Event Driven Opportunities Fund followed by the distribution of Fidelity® Low-Priced Stock Fund shares to the Fidelity® Event Driven Opportunities Fund shareholders in exchange for their Fidelity® Event Driven Opportunities Fund shares in complete liquidation and termination of Fidelity® Event Driven Opportunities Fund will constitute a tax-free reorganization under Section 368(a) of the Code;

(ii) Fidelity® Event Driven Opportunities Fund will recognize no gain or loss upon the transfer of substantially all of its assets to Fidelity® Low-Priced Stock Fund in exchange solely for Fidelity® Low-Priced Stock Fund shares and the assumption by Fidelity® Low-Priced Stock Fund of all liabilities of Fidelity® Event Driven Opportunities Fund, except that Fidelity® Event Driven Opportunities Fund may be required to recognize gain or loss with respect to contracts described in Section 1256(b) of the Code or stock in a passive foreign investment company, as defined in Section 1297(a) of the Code;

(iii) Fidelity® Event Driven Opportunities Fund will recognize no gain or loss upon the distribution to its shareholders of the Fidelity® Low-Priced Stock Fund shares received by Fidelity® Event Driven Opportunities Fund in the Reorganization;

(iv) Fidelity® Low-Priced Stock Fund will recognize no gain or loss upon the receipt of the assets of Fidelity® Event Driven Opportunities Fund in exchange solely for Fidelity® Low-Priced Stock Fund shares and the assumption of all liabilities of Fidelity® Event Driven Opportunities Fund;

(v) The adjusted basis to Fidelity® Low-Priced Stock Fund of the assets of Fidelity® Event Driven Opportunities Fund received by Fidelity® Low-Priced Stock Fund in the Reorganization will be the same as the adjusted basis of those assets in the hands of Fidelity® Event Driven Opportunities Fund immediately before the exchange;

(vi) Fidelity® Low-Priced Stock Fund’s holding periods with respect to the assets of Fidelity® Event Driven Opportunities Fund that Fidelity® Low-Priced Stock Fund acquires in the Reorganization will include the respective periods for which those assets were held by Fidelity® Event Driven Opportunities Fund (except where investment activities of Fidelity® Low-Priced Stock Fund have the effect of reducing or eliminating a holding period with respect to an asset);

20

(vii) The Fidelity® Event Driven Opportunities Fund shareholders will recognize no gain or loss upon receiving Fidelity® Low-Priced Stock Fund shares in exchange solely for Fidelity® Event Driven Opportunities Fund shares;

(viii) The aggregate basis of the Fidelity® Low-Priced Stock Fund shares received by a Fidelity® Event Driven Opportunities Fund shareholder in the Reorganization will be the same as the aggregate basis of the Fidelity® Event Driven Opportunities Fund shares surrendered by the Fidelity® Event Driven Opportunities Fund shareholder in exchange therefor; and

(ix) A Fidelity® Event Driven Opportunities Fund shareholder’s holding period for the Fidelity® Low-Priced Stock Fund shares received by the Fidelity® Event Driven Opportunities Fund shareholder in the Reorganization will include the holding period during which the Fidelity® Event Driven Opportunities Fund shareholder held Fidelity® Event Driven Opportunities Fund shares surrendered in exchange therefor, provided that the Fidelity® Event Driven Opportunities Fund shareholder held such shares as a capital asset on the date of the Reorganization.

The Reorganization could trigger tax rules that would impose annual limits on Fidelity® Low-Priced Stock Fund’s ability to use Fidelity® Event Driven Opportunities Fund’s net realized losses (if any) and net unrealized losses (if any) to offset gains following the Reorganization. These losses do not expire and thus the limits will not prevent Fidelity® Low-Priced Stock Fund from eventually using these losses, but, based on data as of October 31, 2019, it could take over 30 years for Fidelity® Event Driven Opportunities Fund’s losses to become fully available to Fidelity® Low-Priced Stock Fund.

In addition, based on data as of October 31, 2019, Fidelity® Event Driven Opportunities Fund shareholders would be transitioning in the Reorganization from a fund with substantial realized losses and significantly smaller net unrealized gains to a fund with substantial net unrealized gains, and consequently could end up receiving capital gain distributions sooner and/or in larger amounts than they would if Fidelity® Event Driven Opportunities Fund continued as a separate fund. As noted above, however, if the proposed Reorganization does not take place, FMR intends to recommend to the Board of Trustees that Fidelity® Event Driven Opportunities Fund be liquidated (not continued as a standalone fund).

The table below shows each fund’s approximate net assets, capital loss carryforwards, net realized gains/losses and net unrealized gains/losses as of October 31, 2019. The actual impact of the Reorganization on the funds’ losses and on future capital gain distributions will depend on each fund’s net assets, net realized gains/losses and net unrealized gains/losses at the time of the Reorganization, as well as the timing and amount of gains and losses realized by Fidelity® Low-Priced Stock Fund following the Reorganization, and thus cannot be determined precisely at this time.

Tax Position as of October 31, 2019 ($M)

| | | | | | | | | | | | | | | | | | |

Fund Name | | Fiscal Year End | | Net Assets | | | Capital Loss

Carryforwards | | | Current Fiscal

Year Net

Realized Gains/

(Losses) | | | Net

Unrealized

Gains/

(Losses) | |

Fidelity® Event Driven Opportunities Fund | | April | | $ | 125.4 | | | ($ | 38.7 | ) | | ($ | 26.1 | ) | | $ | 4.2 | |

Fidelity® Low-Priced Stock Fund | | July | | $ | 28,912.9 | | | $ | 0 | | | $ | 0 | (a) | | $ | 13,536.3 | |

| (a) | Fidelity® Low-Priced Stock Fund had approximately $8.9 million of net realized gains as of October 31, 2019, but already distributed those gains in December 2019 as part of its normal December distribution. |

Shareholders of Fidelity® Event Driven Opportunities Fund should consult their tax advisers regarding the effect, if any, of the proposed Reorganization in light of their individual circumstances. Because the foregoing discussion relates only to the federal income tax consequences of the Reorganization, those shareholders also should consult their tax advisers as to state and local tax consequences, if any, of the Reorganization.

21

Forms of Organization

Fidelity® Event Driven Opportunities Fund is a non-diversified series of Fidelity Concord Street Trust, an open-end management investment company organized as a Massachusetts business trust on July 10, 1987. Fidelity® Low-Priced Stock Fund is a diversified series of Fidelity Puritan Trust, an open-end management investment company organized as a Massachusetts business trust on October 1, 1984. The trusts are authorized to issue an unlimited number of shares of beneficial interest. Because the funds are series of Massachusetts business trusts, governed by substantially similar Declarations of Trust, the rights of the security holders of Fidelity® Event Driven Opportunities Fund under state law and the governing documents are expected to remain unchanged after the Reorganization.

For more information regarding shareholder rights, please refer to the “Description of the Trust(s)” section of the funds’ Statements of Additional Information, which are incorporated herein by reference.

Operations of Fidelity® Low-Priced Stock Fund Following the Reorganization

FMR does not expect Fidelity® Low-Priced Stock Fund to revise its investment policies as a result of the Reorganization. In addition, FMR does not anticipate significant changes to Fidelity® Low-Priced Stock Fund’s management or to entities that provide the fund with services. Specifically, the Trustees and officers, the investment adviser, distributor, and other entities will continue to serve Fidelity® Low-Priced Stock Fund in their current capacities.

Capitalization

The following table shows the capitalization of Fidelity® Event Driven Opportunities Fund and the corresponding class of shares of Fidelity® Low-Priced Stock Fund as of December 31, 2019, and on a pro forma combined basis (unaudited) as of that date giving effect to the Reorganization. As of December 31, 2019, the net assets of Fidelity® Event Driven Opportunities Fund were $119,111,885, or 0.4% of Fidelity® Low-Priced Stock Fund.

| | | | | | | | | | | | |

| | | Net Assets | | | Net Asset Value

Per Share | | | Shares

Outstanding | |

Fidelity® Event Driven Opportunities Fund(a) | | $ | 119,111,885 | | | $ | 11.07 | | | | 10,762,161 | |

Fidelity® Low-Priced Stock Fund | | $ | 24,945,972,460 | | | $ | 50.05 | | | | 498,470,317 | |

Fidelity® Low-Priced Stock Fund Pro Forma Combined Fund | | $ | 25,065,084,346 | | | $ | 50.05 | | | | 500,850,175 | |

| (a) | Fidelity® Event Driven Opportunities Fund’s estimated one time proxy costs of $18,000 not included in the Pro Forma. |

The table above assumes that the Reorganization occurred on December 31, 2019. The table is for information purposes only. No assurance can be given as to how many Fidelity® Low-Priced Stock Fund shares will be received by shareholders of Fidelity® Event Driven Opportunities Fund on the date that the Reorganization takes place, and the foregoing should not be relied upon to reflect the number of shares of Fidelity® Low-Priced Stock Fund that actually will be received on or after that date.

Conclusion

The Agreement and the Reorganization were approved by the Board of Trustees of Fidelity Concord Street Trust and Fidelity Puritan Trust at a meeting held on January 15, 2020. The Boards of Trustees determined that the proposed Reorganization is in the best interests of shareholders of Fidelity® Event Driven Opportunities Fund and Fidelity® Low-Priced Stock Fund and that the interests of existing

22

shareholders of Fidelity® Event Driven Opportunities Fund and Fidelity® Low-Priced Stock Fund would not be diluted as a result of the Reorganization. If shareholder approval of the Agreement cannot be achieved, the Board of Trustees has approved a plan of liquidation for Fidelity Event Driven Opportunities Fund and the fund would liquidate on or about June 19, 2020.

The Board of Trustees of Fidelity® Event Driven Opportunities Fund unanimously recommends that shareholders vote in favor of the Reorganization by approving the Agreement.

ADDITIONAL INFORMATION ABOUT THE FUNDS

Fidelity® Low-Priced Stock Fund’s financial highlights for the fiscal year ended July 31, 2019, which are included in the fund’s Prospectus and incorporated herein by reference, have been audited by PricewaterhouseCoopers LLP, independent registered public accounting firm, whose report thereon is included in the Annual Report to Shareholders.

Fidelity® Event Driven Opportunities Fund’s financial highlights for the fiscal year ended April 30, 2019, which have been audited by PricewaterhouseCoopers LLP, independent registered public accounting firm, whose report thereon is included in the Annual Report to Shareholders, are included in the fund’s prospectus. The financial highlights are updated to include the corresponding semiannual data (unaudited) included in the Semiannual Report to Shareholders for the six month period ended October 31, 2019. Fidelity® Event Driven Opportunities Fund’s updated financial highlights are incorporated herein by reference

The financial highlights audited by PricewaterhouseCoopers LLP have been incorporated by reference in reliance on their reports given on their authority as experts in auditing and accounting.

VOTING INFORMATION

Solicitation of Proxies; Expenses

This Proxy Statement is furnished in connection with a solicitation of proxies made by, and on behalf of, the trust’s Board of Trustees to be used at the Meeting. The purpose of the/ Meeting is set forth in the accompanying Notice.

The solicitation is being made primarily by the mailing of this Proxy Statement and the accompanying proxy card on or about March 23, 2020. Supplementary solicitations may be made by mail, telephone, facsimile or electronic means, or by personal interview by representatives of the trust. In addition, Computershare Limited may be paid on a per-call basis to solicit shareholders by telephone on behalf of Fidelity® Event Driven Opportunities Fund at an anticipated cost of approximately $3,500. Fidelity® Event Driven Opportunities Fund may also arrange to have votes recorded by telephone. Computershare Limited may be paid on a per-call basis for vote-by-phone solicitations on behalf of Fidelity® Event Driven Opportunities Fund at an anticipated cost of approximately $1,500.

If the fund records votes by telephone or through the internet, it will use procedures designed to authenticate shareholders’ identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded. Proxies voted by telephone or through the internet may be revoked at any time before they are voted in the same manner that proxies voted by mail may be revoked.

The expenses in connection with preparing this Proxy Statement and its enclosures and all solicitations will be paid by Fidelity® Event Driven Opportunities Fund.

The fund will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of shares.

23

For a free copy of Fidelity® Event Driven Opportunities Fund’s annual report for the fiscal year ended April 30, 2019 and semiannual report for the fiscal period ended October 31, 2019 call 1-800-544-8544, log-on to www.fidelity.com, or write to FDC at 900 Salem Street, Smithfield, Rhode Island 02917.

For a free copy of Fidelity® Low-Priced Stock Fund’s annual report for the fiscal year ended July 31, 2019 call 1-800-544-8544, log-on to www.fidelity.com, or write to FDC at 900 Salem Street, Smithfield, Rhode Island 02917.

Record Date; Quorum; and Method of Tabulation

Shareholders of record as of the close of business on March 23, 2020 will be entitled to vote at the Meeting. Each such shareholder will be entitled to one vote for each dollar of net asset value held as of that date, with fractional dollar amounts entitled to a proportional fractional vote.

If the enclosed proxy card is executed and returned, or an internet or telephonic vote is delivered, that vote may nevertheless be revoked at any time prior to its use by written notification received by the trust, by the execution of a later–dated proxy card, by the trust’s receipt of a subsequent valid telephonic or internet vote, or by attending the Meeting and voting in person.

All proxies solicited by the Board of Trustees that are properly executed and received by the Secretary prior to the Meeting, and that are not revoked, will be voted at the Meeting. Shares represented by such proxies will be voted in accordance with the instructions thereon. If no specification is made on a proxy card, it will be voted FOR the matters specified on the proxy card. All shares that are voted and votes to ABSTAIN will be counted toward establishing a quorum, as will broker non-votes. (Broker non-votes are shares for which (i) the beneficial owner has not voted and (ii) the broker holding the shares does not have discretionary authority to vote on the particular matter.)

With respect to fund shares held in Fidelity individual retirement accounts (including Traditional, Rollover, SEP, SAR-SEP, Roth and SIMPLE IRAs), the IRA Custodian will vote those shares for which it has received instructions from shareholders only in accordance with such instructions. If Fidelity IRA shareholders do not vote their shares, the IRA Custodian will vote their shares for them, in the same proportion as other Fidelity IRA shareholders have voted

One-third of the fund’s outstanding voting securities entitled to vote constitutes a quorum for the transaction of business at the Meeting. If a quorum is not present, or if a quorum is present but sufficient votes to approve the proposal are not received, or if other matters arise requiring shareholder attention, the persons named as proxy agents may propose one or more adjournments to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares present or represented by proxy. When voting on a proposed adjournment, the persons named as proxy agents will vote FOR the proposed adjournment all shares that they are entitled to vote FOR the proposal, unless directed to vote AGAINST the proposal, in which case such shares will be voted AGAINST the proposed adjournment. Please visit www.fidelity.com/proxies to determine the status of this scheduled Meeting.

FMR has advised the trust that certain shares are registered to FMR or an FMR affiliate. To the extent that FMR or an FMR affiliate has discretion to vote, these shares will be voted at the Meeting FOR the proposal. Otherwise, these shares will be voted in accordance with the plan or agreement governing the shares. Although the terms of the plans and agreements vary, generally the shares must be voted either (i) in accordance with instructions received from shareholders or (ii) in accordance with instructions received from shareholders and, for shareholders who do not vote, in the same proportion as certain other shareholders have voted.

Share Ownership

As of December 31, 2019, shares of each class of Fidelity® Event Driven Opportunities Fund and Fidelity® Low-Priced Stock Fund issued and outstanding were as follows:

| | |

| | | Number of Shares |