Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

Related financial report

OI similar filings

- 26 Aug 08 Cost Associated with Exit or Disposal Activities

- 18 Aug 08 O-I Appoints David H. Y. Ho to Board of Directors

- 4 Aug 08 Cost Associated with Exit or Disposal Activities

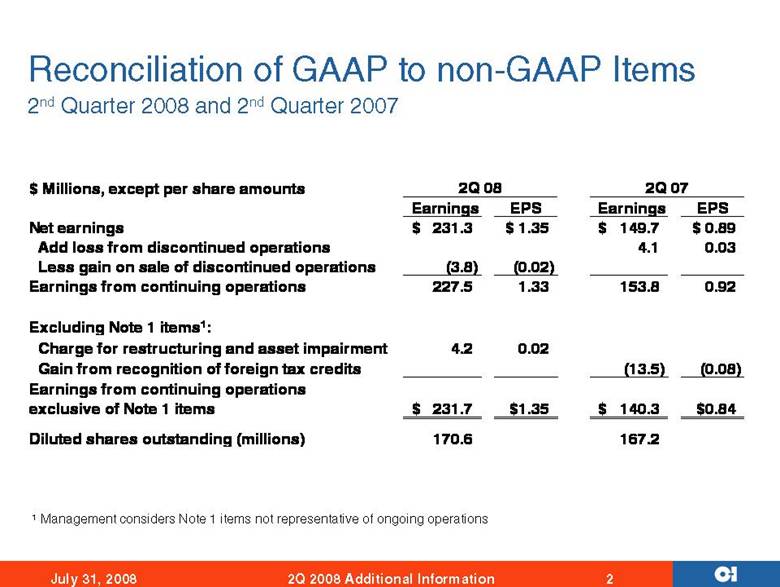

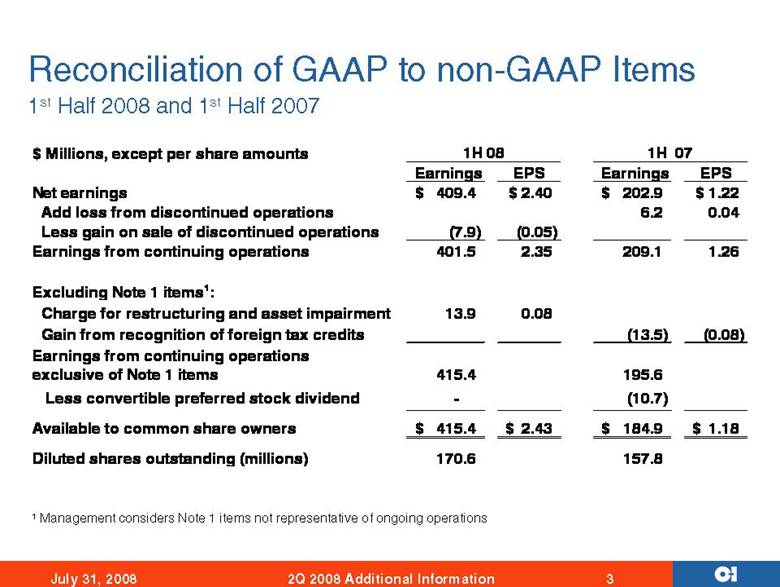

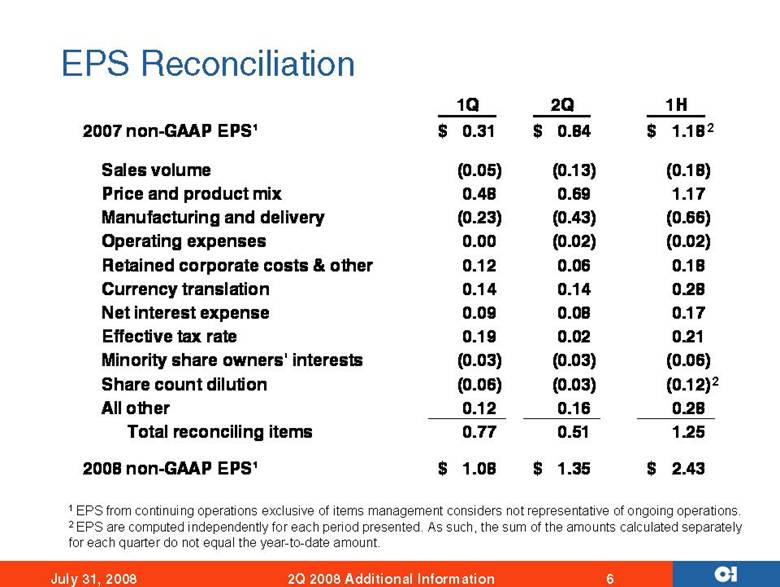

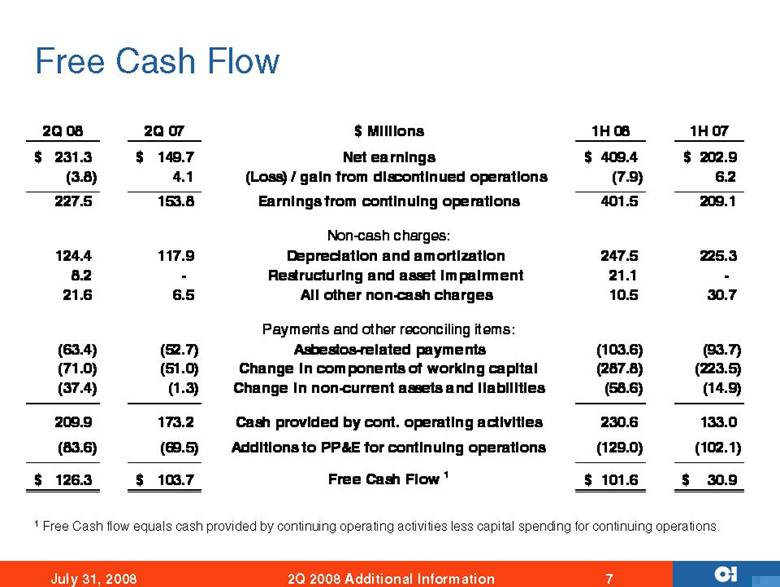

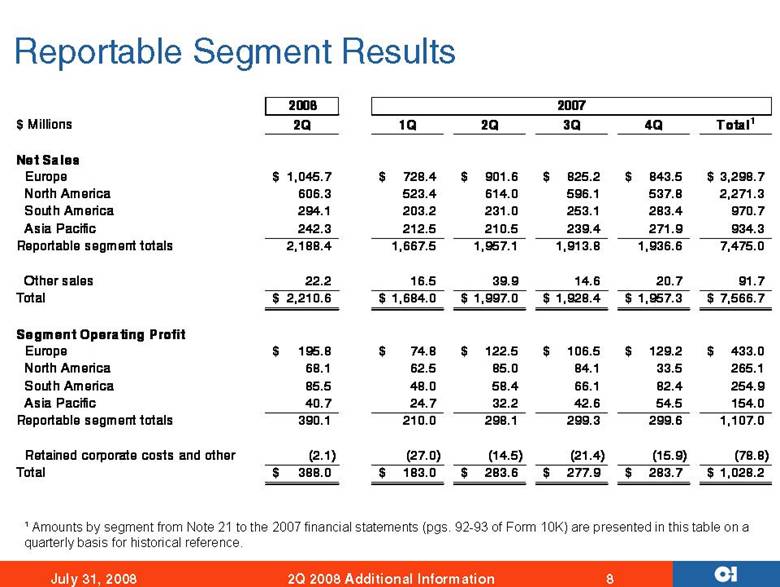

- 31 Jul 08 O-I Reports Record Earnings in the Second Quarter 2008

- 13 May 08 Results of Operations and Financial Condition

- 30 Apr 08 O-I Reports Improved Results in the First Quarter 2008

- 2 Apr 08 Amendments to Articles of Incorporation or Bylaws

Filing view

External links