Filed by Seacoast Financial Services Corporation

(Commission File No. 000-25077)

Pursuant to Rule 425 under the

Securities Act of 1933, as amended

Subject Company: Abington Bancorp, Inc.

Commission File No.: 0-16018

This filing contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the financial condition, results of operations and business of Seacoast Financial Services Corporation following the consummation of the merger that are subject to various factors which could cause actual results to differ materially from such projections or estimates. Such factors include, but are not limited to, the following: (1) the businesses of Seacoast Financial Services Corporation and Abington Bancorp, Inc. may not be combined successfully, or such combination may take longer to accomplish than expected; (2) expected cost savings from the merger cannot be fully realized or realized within the expected timeframes; (3) operating costs, customer loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with government approvals of the merger; (5) the stockholders of Abington may fail to approve the merger; (6) adverse governmental or regulatory policies may be enacted; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) the risks associated with continued diversification of assets and adverse changes to credit quality; (9) competitive pressures from other financial service companies in Seacoast Financial’s and Abington’s markets may increase significantly; and (10) the risk of an economic slowdown that would adversely affect credit quality and loan originations. Other factors that may cause actual results to differ from forward-looking statements are described in Seacoast Financial’s filings with the Securities and Exchange Commission. Seacoast Financial does not undertake or intend to update any forward-looking statements.

Seacoast Financial and Abington will be filing relevant documents concerning the transaction with the Securities and Exchange Commission, including a registration statement on Form S-4. Investors are urged to read the registration statement on Form S-4 containing a prospectus/proxy statement regarding the proposed transaction and any other documents filed with the SEC, as well as any amendments or supplements to those documents, because they contain (or will contain) important information. Investors are able to obtain those documents free of charge at the SEC’s website, (http://www.sec.gov). In addition, documents filed with the SEC by Seacoast Financial can be obtained, without charge, by directing a request to Seacoast Financial Services Corporation, One Compass Place, New Bedford, Massachusetts 02740, Attn: James R. Rice, Senior Vice President, Marketing, telephone (508) 984-6000. In addition, documents filed with the SEC by Abington can be obtained, without charge, by directing a request to Abington Bancorp, Inc., 97 Libbey Parkway, Weymouth, Massachusetts 02189, Attn: Corporate Secretary, telephone (781) 682-3400. WE URGE SHAREHOLDERS TO READ THESE DOCUMENTS, AS WELL AS ANY AMENDMENTS AND SUPPLEMENTS TO

THOSE DOCUMENTS BECAUSE THEY CONTAIN (OR WILL CONTAIN) IMPORTANT INFORMATION. Abington and its directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the merger.

Information about the directors and executive officers of Abington and their ownership of Abington common stock is set forth in the proxy statement for Abington’s 2003 annual meeting of stockholders as filed on Schedule 14A with the SEC on June 27, 2003. Additional information about the interests of those participants may be obtained from reading the definitive prospectus/proxy statement regarding the proposed transaction when it becomes available.

THE FOLLOWING IS A SERIES OF SLIDES THAT WILL BE USED AT A PRESENTATION TO INSTITUTIONAL INVESTORS ON WEDNESDAY, NOVEMBER 5, 2003, AT APPROXIMATELY 3:30 P.M. EASTERN STANDARD TIME TO DISCUSS VARIOUS ASPECTS OF SEACOAST FINANCIAL SERVICES CORPORATION, INCLUDING THE TRANSACTION.

2

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Presentation to the

FBR Bus Tour

November 5, 2003

[LOGO]

The following contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical facts and include expressions about management’s confidence and strategies and management’s expectations about new and existing programs and products, relationships, opportunities, technology and market conditions. Such forward-looking statements involve certain risks and uncertainties. These include, but are not limited to, the direction of movements in interest rates, the possibility of disruption in credit markets, successful implementation and integration of acquisitions (including Bay State and Abington), the effects of economic conditions and the impact of legal and regulatory barriers and structures. Actual results may differ materially from such forward looking statements. Seacoast Financial assumes no obligation for updating any such forward-looking statements at any time.

Seacoast and Abington will be filing relevant documents concerning the merger of Abington into Seacoast with the Securities and Exchange Commission, including a registration statement on Form S-4. Investors are urged to read the registration statement on Form S-4 containing a prospectus/proxy statement regarding the proposed transaction and any other documents filed with the SEC, as well as any amendments or supplements to those documents, because they contain (or will contain) important information. Investors are able to obtain those documents free of charge at the SEC’s website, (http://www.sec.gov). In addition, documents filed with the SEC by Seacoast Financial can be obtained, without charge, by directing a request to Seacoast Financial Services Corporation, One Compass Place, New Bedford, Massachusetts 02740, Attn: James R. Rice, Senior Vice President, telephone (508) 984-6000. In addition, documents filed with the SEC by Abington can be obtained, without charge, by directing a request to Abington Bancorp, Inc. 97 Libbey Parkway, Weymouth, MA 02189, Attn: Corporate Secretary, telephone (781)682-6400. WE URGE SHAREHOLDERS TO READ THESE DOCUMENTS, AS WELL AS ANY AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS BECAUSE THEY CONTAIN (OR WILL CONTAIN) IMPORTANT INFORMATION. Abington and its directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the merger.

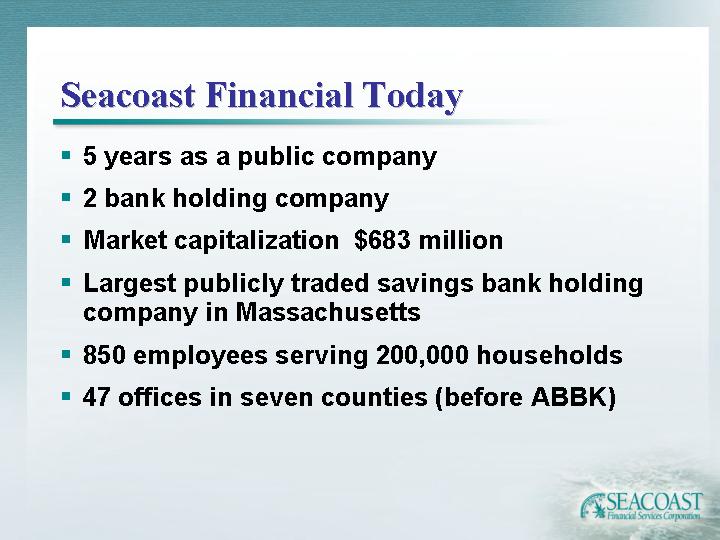

Seacoast Financial Today

• 5 years as a public company

• 2 bank holding company

• Market capitalization $683 million

• Largest publicly traded savings bank holding company in Massachusetts

• 850 employees serving 200,000 households

• 47 offices in seven counties (before ABBK)

Seacoast & Abington

[GRAPHIC]

Most Significant Southeastern

Massachusetts Franchise

Combination of Compass Bank & Abington Bank

• Largest independent savings bank in Massachusetts with pro forma market capitalization of $709.5 million (1)

• Non-replicable franchise presence

• 64 branches extending from Boston to the Rhode Island border, through the Cape and Islands

• Seven counties within Massachusetts

• Full-Service community banking focus

• Seasoned, experienced acquirer

(1) Based on October 17, 2003 Seacoast stock price.

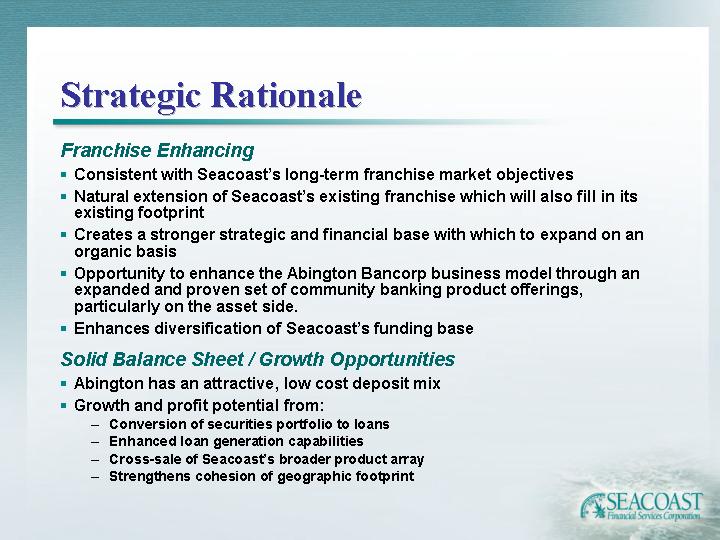

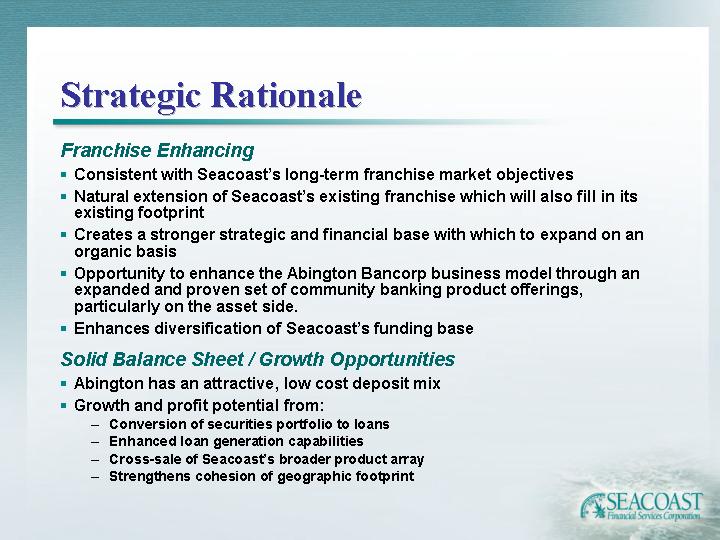

Strategic Rationale

Franchise Enhancing

• Consistent with Seacoast’s long-term franchise market objectives

• Natural extension of Seacoast’s existing franchise which will also fill in its existing footprint

• Creates a stronger strategic and financial base with which to expand on an organic basis

• Opportunity to enhance the Abington Bancorp business model through an expanded and proven set of community banking product offerings, particularly on the asset side.

• Enhances diversification of Seacoast’s funding base

Solid Balance Sheet / Growth Opportunities

• Abington has an attractive, low cost deposit mix

• Growth and profit potential from:

• Conversion of securities portfolio to loans

• Enhanced loan generation capabilities

• Cross-sale of Seacoast’s broader product array

• Strengthens cohesion of geographic footprint

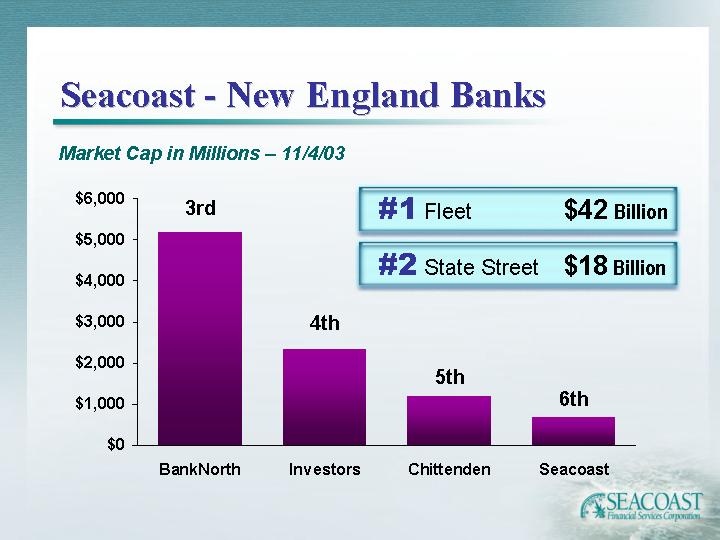

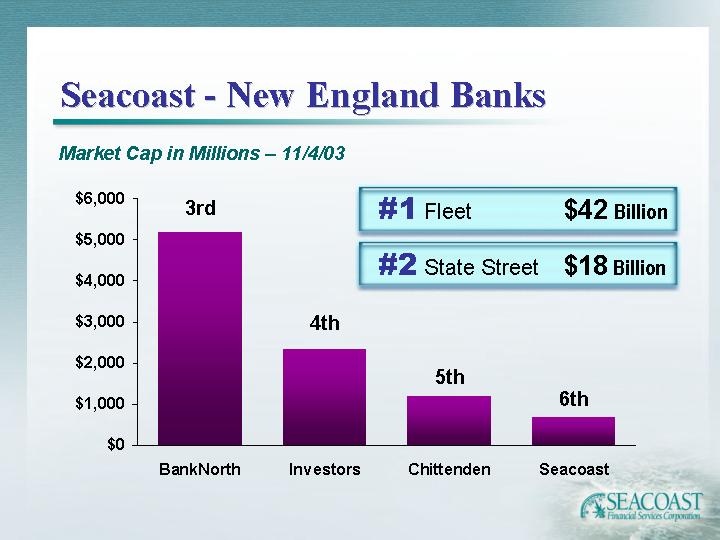

Seacoast - New England Banks

Market Cap in Millions – 11/4/03

#1 Fleet | $42 Billion |

#2 State Street | $18 Billion |

[CHART]

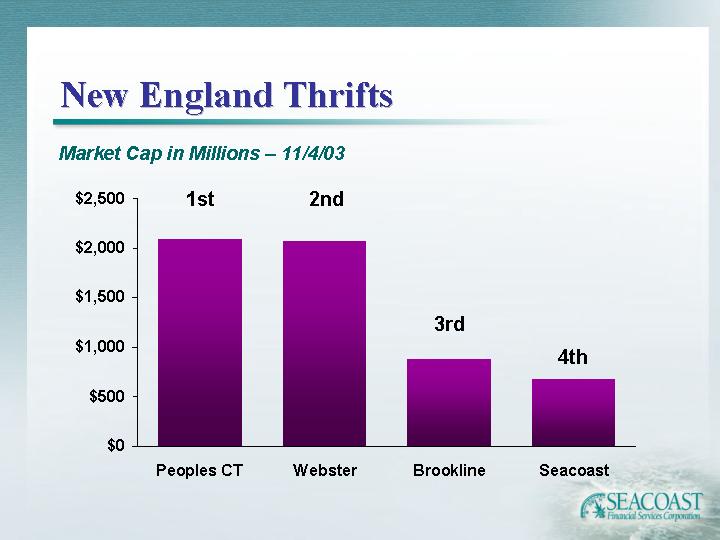

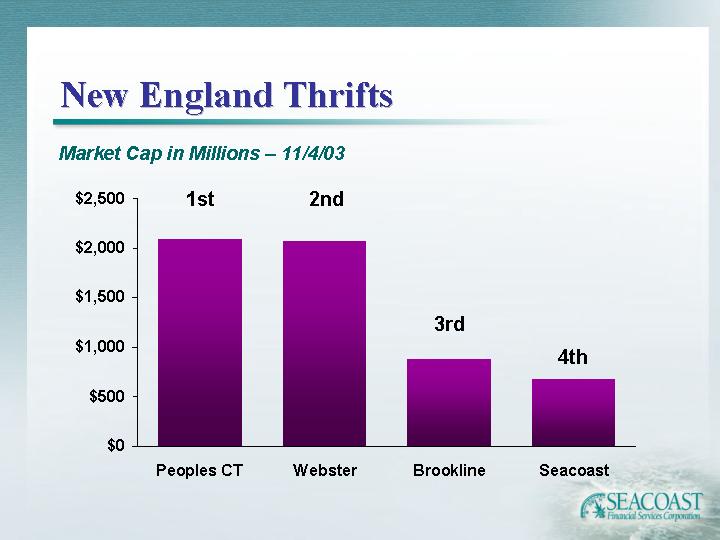

New England Thrifts

Market Cap in Millions – 11/4/03

[CHART]

Financial Highlights

Total Assets

In Millions

[CHART]

Equity to Assets

[CHART]

Loans

Dollars in Millions

[CHART]

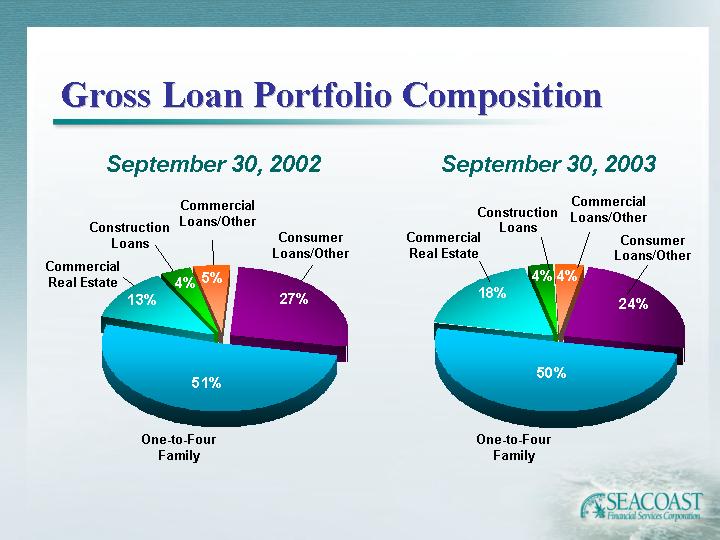

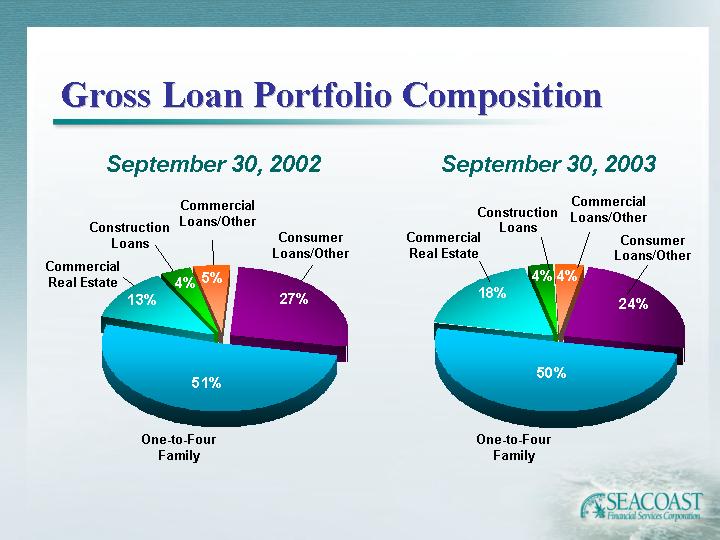

Gross Loan Portfolio Composition

September 30, 2002 | | September 30, 2003 | |

| | | |

[CHART] | | [CHART] | |

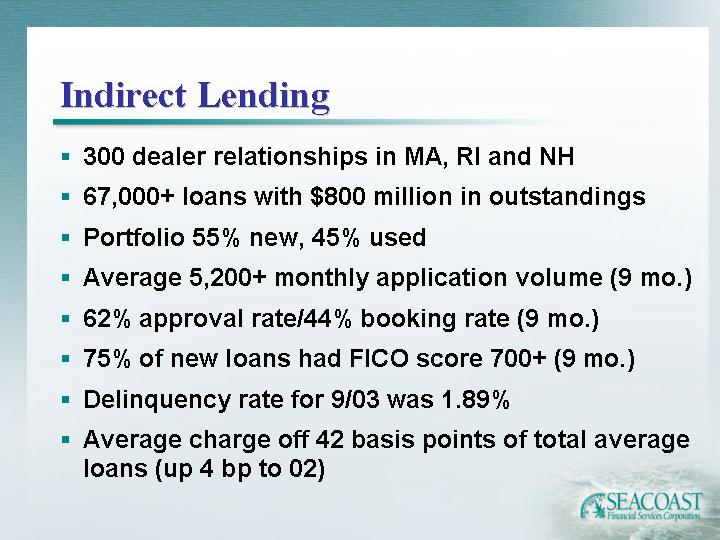

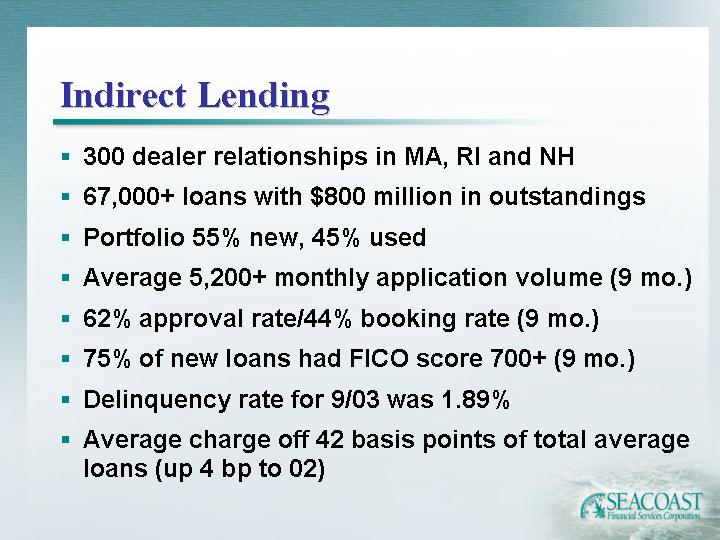

Indirect Lending

• 300 dealer relationships in MA, RI and NH

• 67,000+ loans with $800 million in outstandings

• Portfolio 55% new, 45% used

• Average 5,200+ monthly application volume (9 mo.)

• 62% approval rate/44% booking rate (9 mo.)

• 75% of new loans had FICO score 700+ (9 mo.)

• Delinquency rate for 9/03 was 1.89%

• Average charge off 42 basis points of total average loans (up 4 bp to 02)

[GRAPHIC]

[LOGO]

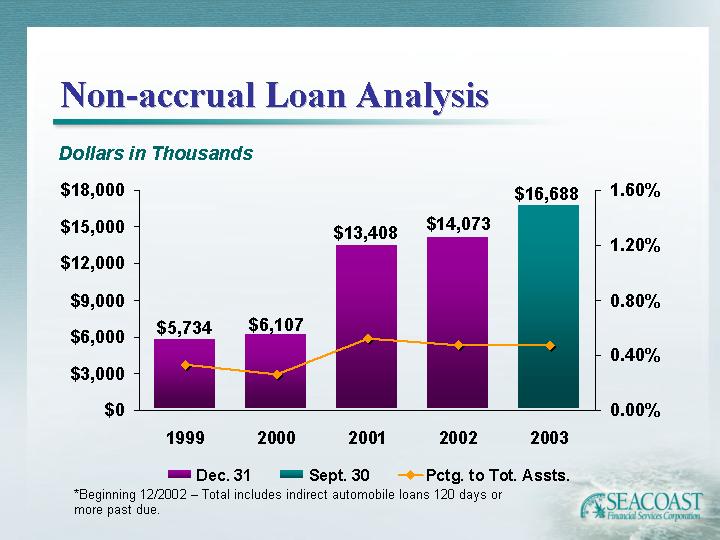

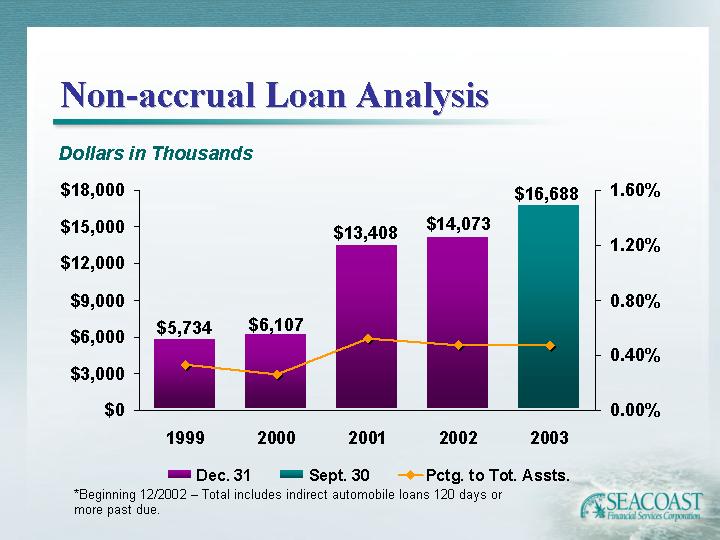

Non-accrual Loan Analysis

[CHART]

*Beginning 12/2002 – Total includes indirect automobile loans 120 days or more past due.

[LOGO]

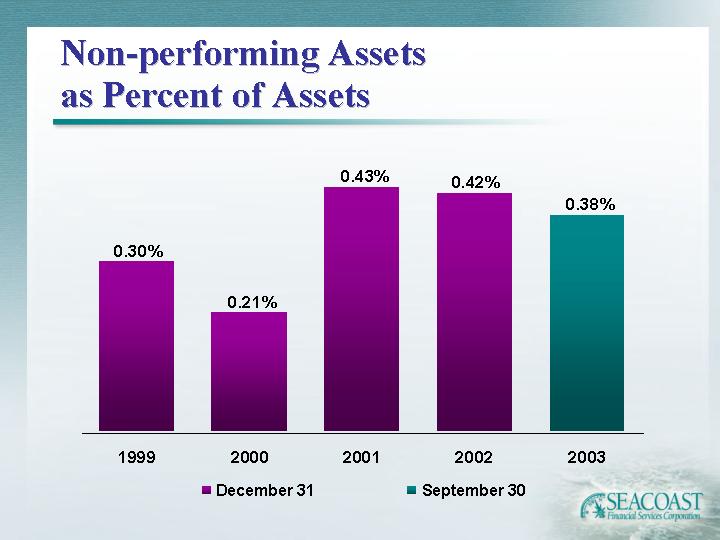

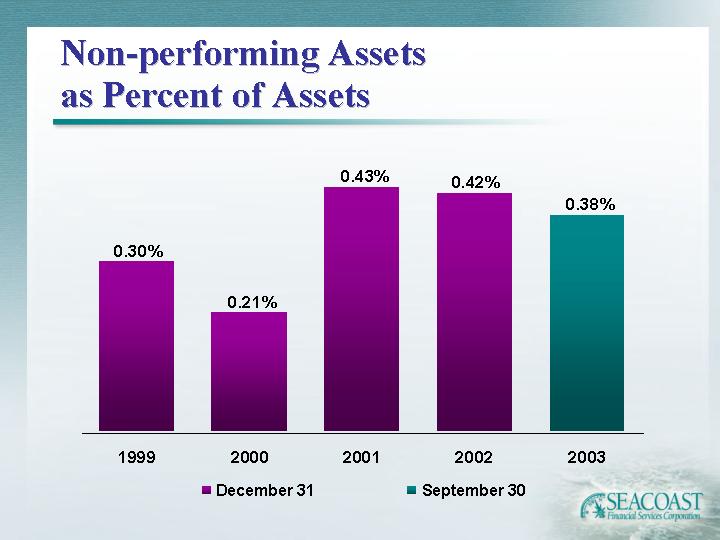

Non-performing Assets

as Percent of Assets

[CHART]

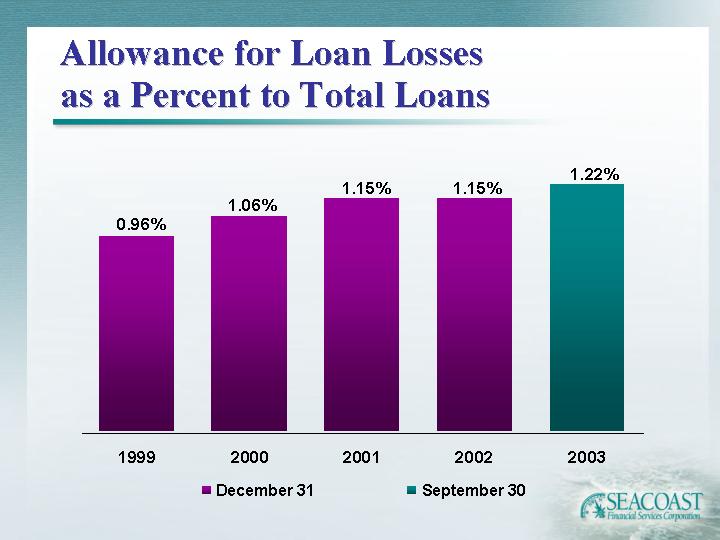

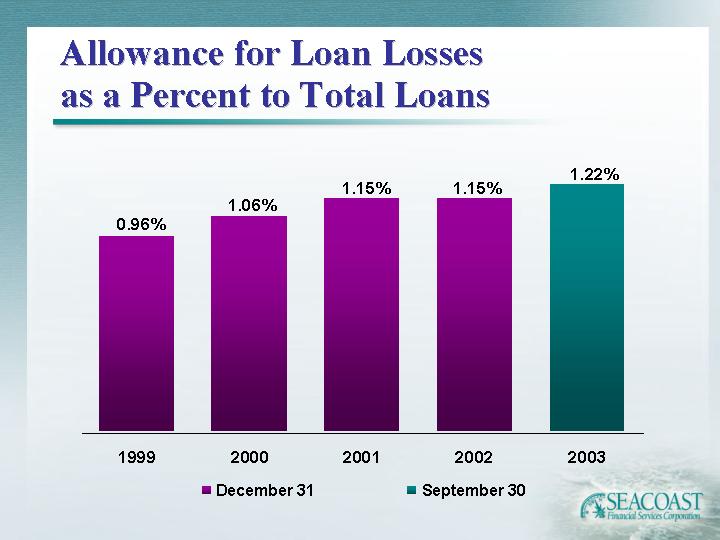

Allowance for Loan Losses

as a Percent to Total Loans

[CHART]

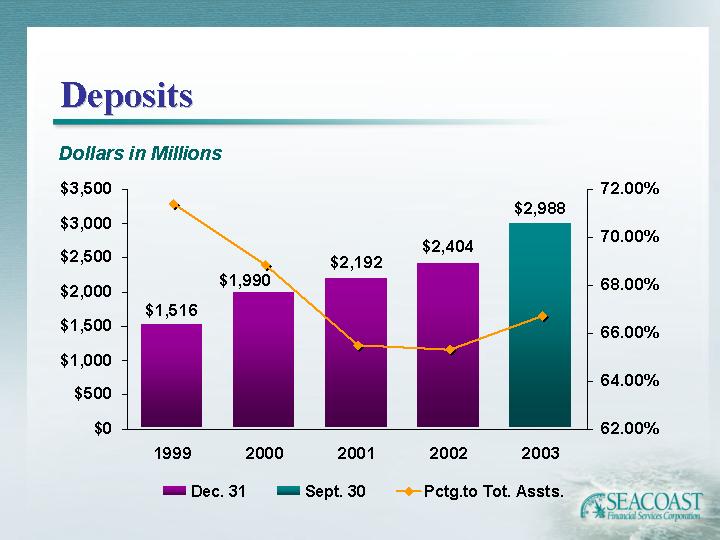

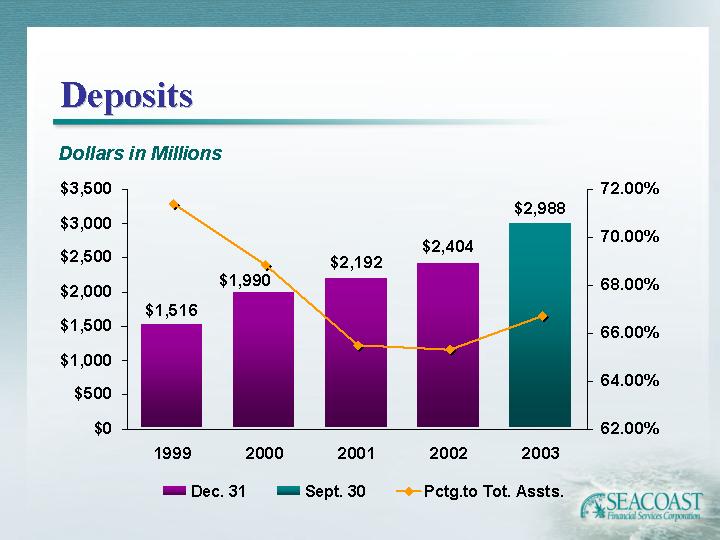

Deposits

Dollars in Millions

[CHART]

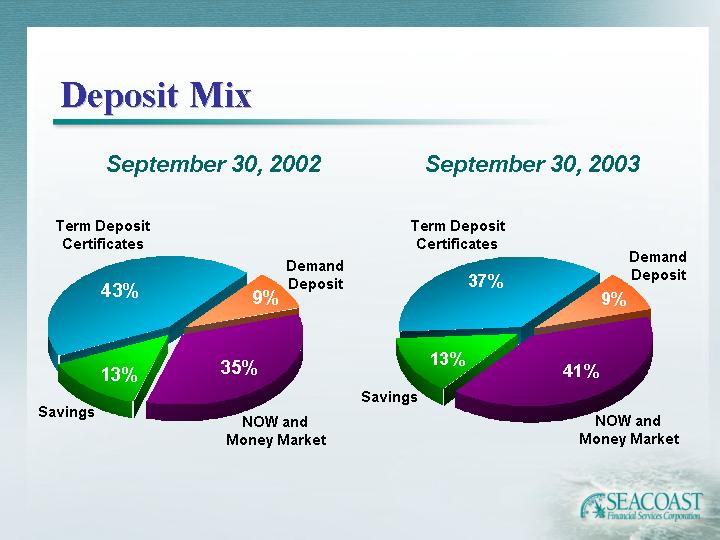

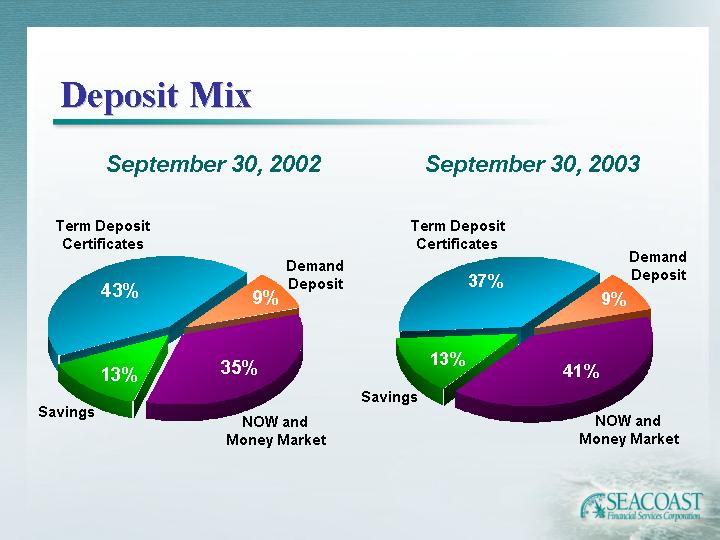

Deposit Mix

September 30, 2002 | | September 30, 2003 | |

| | | |

[CHART] | | [CHART] | |

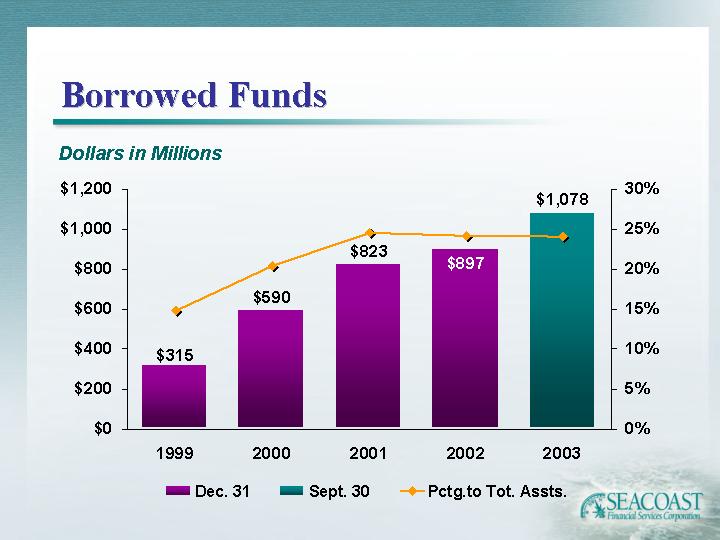

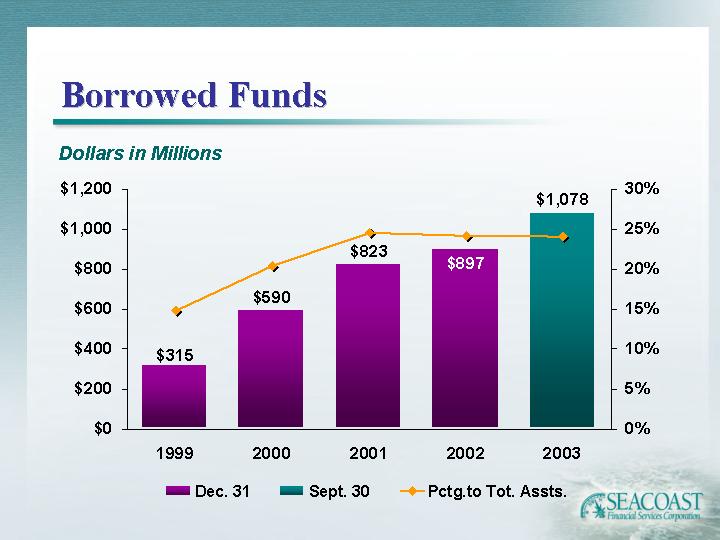

Borrowed Funds

Dollars in Millions

[CHART]

Net Interest Income

[CHART]

Net Interest Margin

[CHART]

*Includes minority interest expense associated with outstanding subordinated debentures (Seacoast Capital Trust I at 8.50% and Seacoast Capital Trust II at 6.65%).

Net Interest Rate Spread

[CHART]

* Includes minority interest expense associated with outstanding subordinated debentures (Seacoast Capital Trust I at 8.50% and Seacoast Capital Trust II at 6.65%).

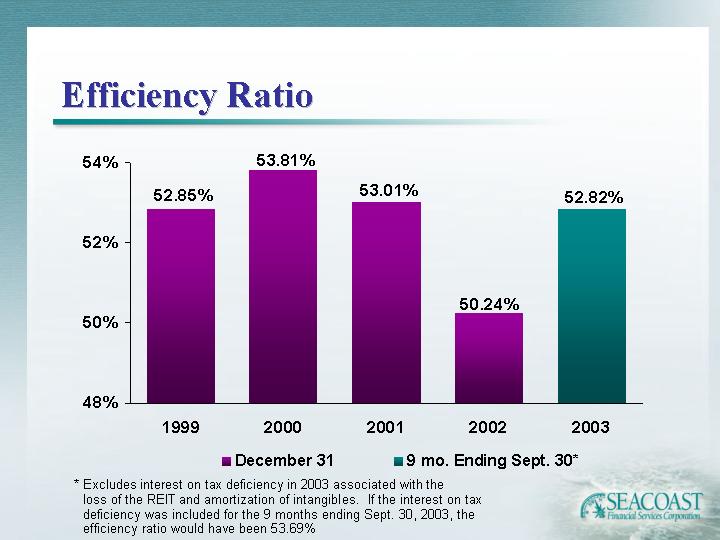

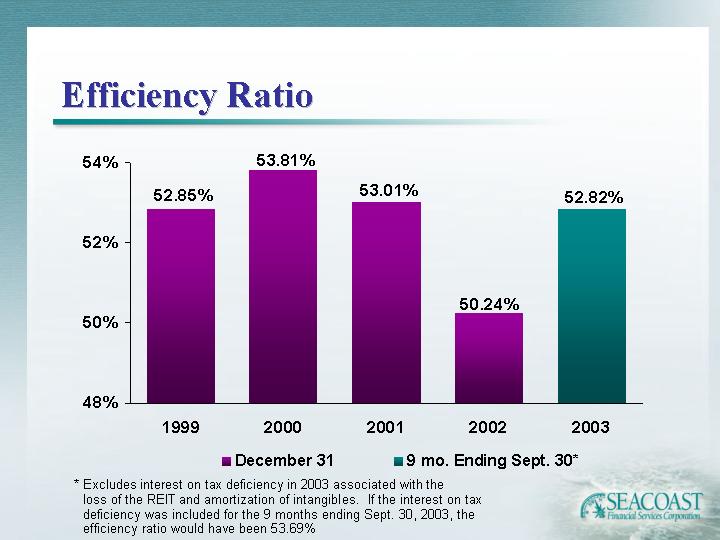

Efficiency Ratio

[CHART]

* Excludes interest on tax deficiency in 2003 associated with the loss of the REIT and amortization of intangibles. If the interest on tax deficiency was included for the 9 months ending Sept. 30, 2003, the efficiency ratio would have been 53.69%

Net Income

In Thousands

[CHART]

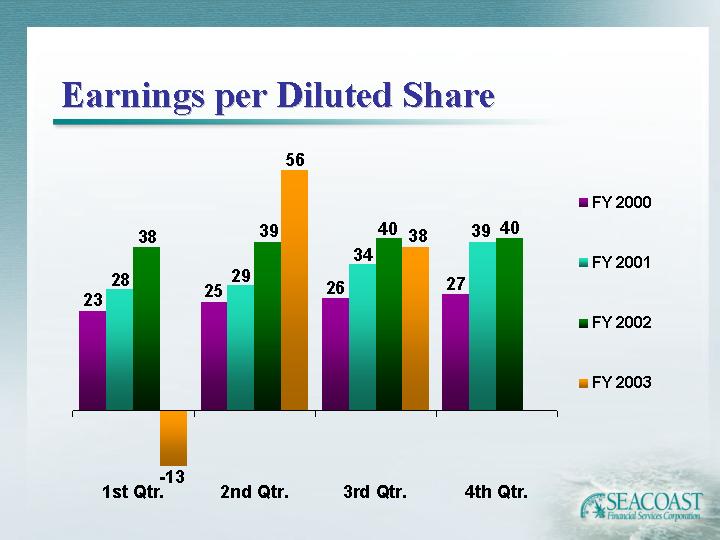

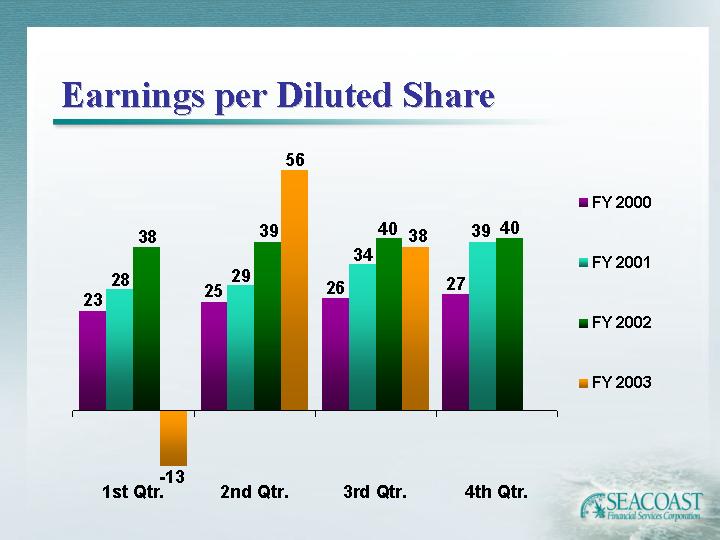

Earnings per Diluted Share

[CHART]

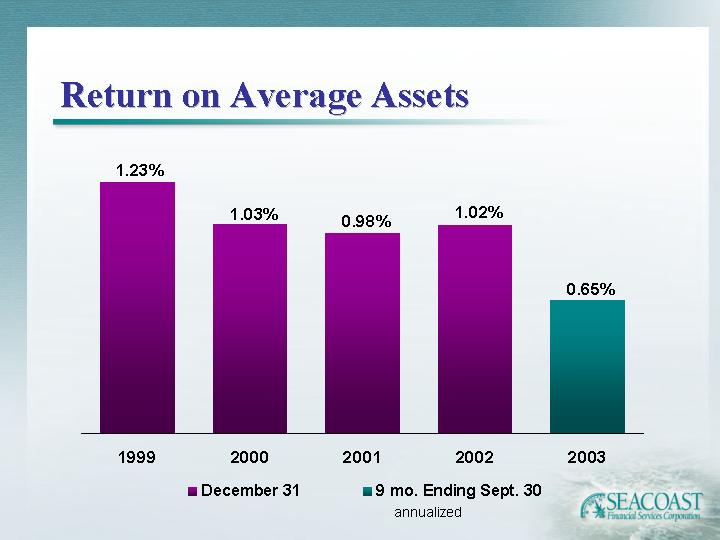

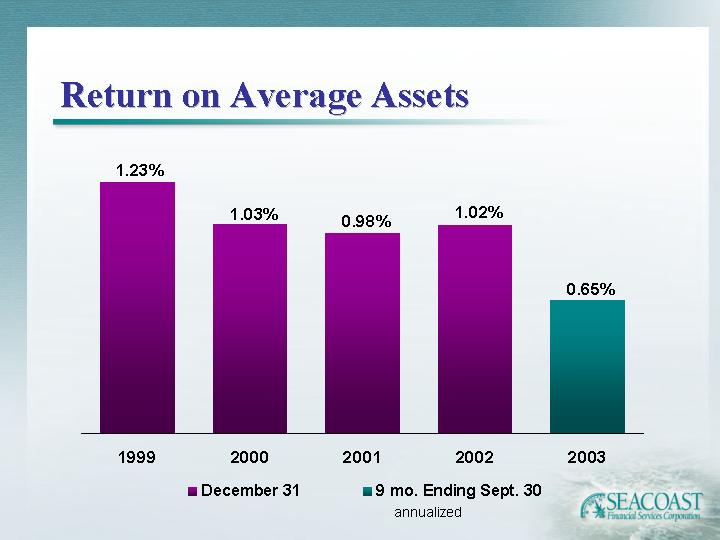

Return on Average Assets

[CHART]

annualized

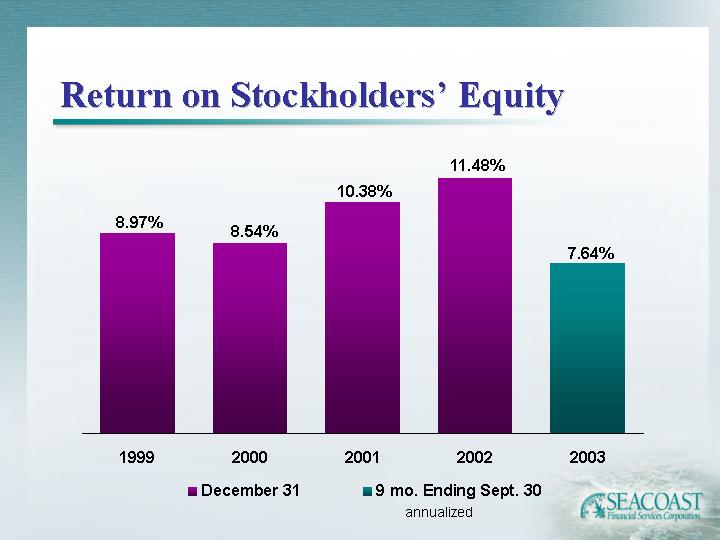

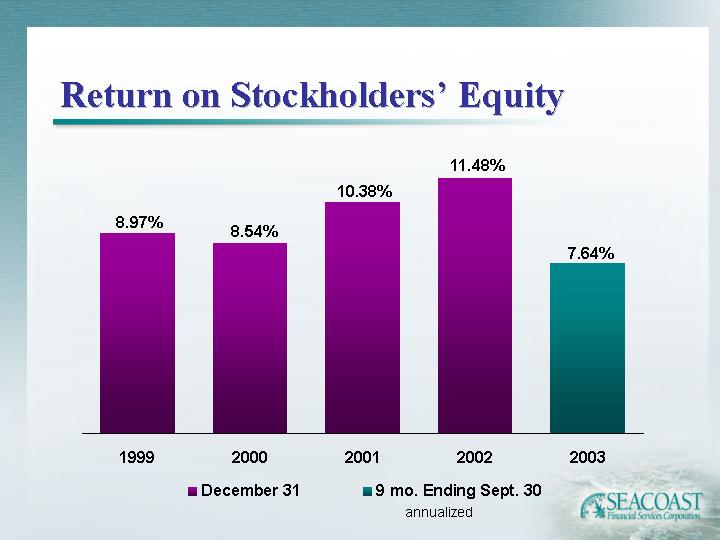

Return on Stockholders’ Equity

[CHART]

annualized

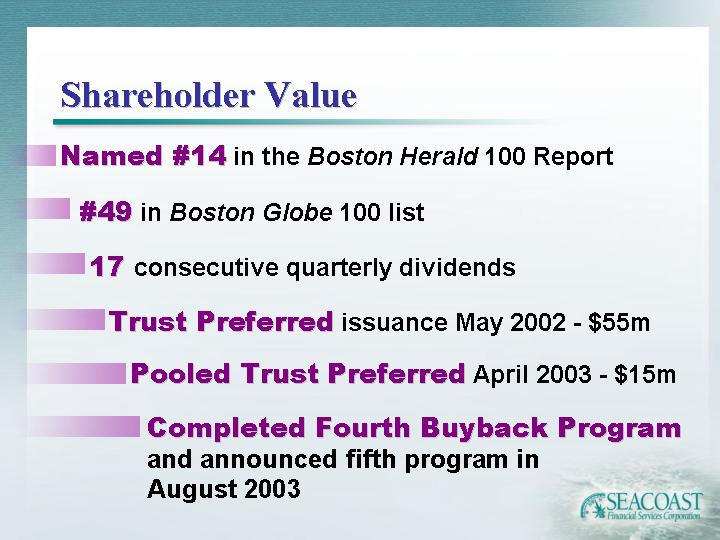

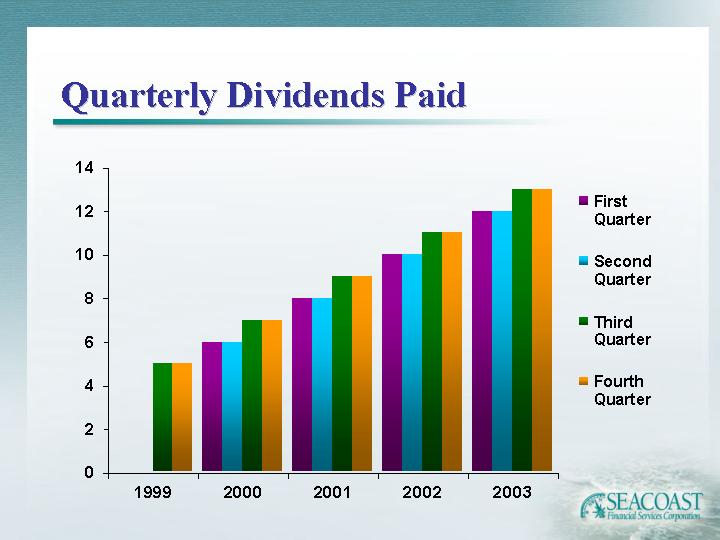

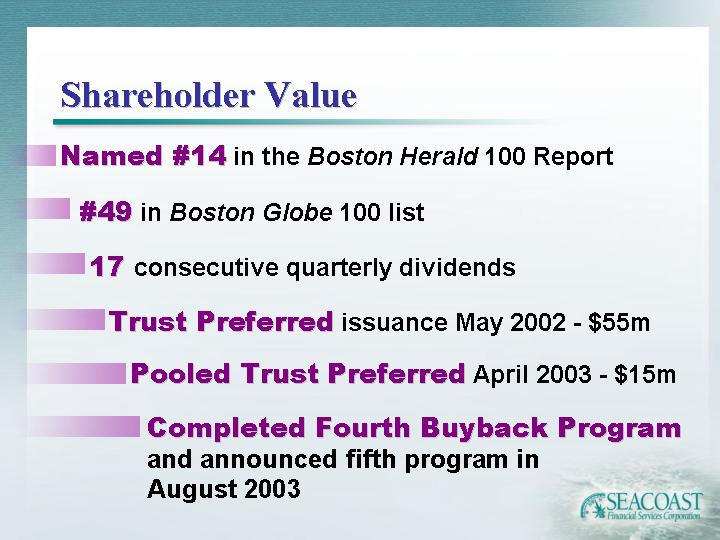

Shareholder Value

Named #14 in the Boston Herald 100 Report

#49 in Boston Globe 100 list

17 consecutive quarterly dividends

Trust Preferred issuance May 2002 - $55m

Pooled Trust Preferred April 2003 - $15m

Completed Fourth Buyback Program and announced fifth program in August 2003

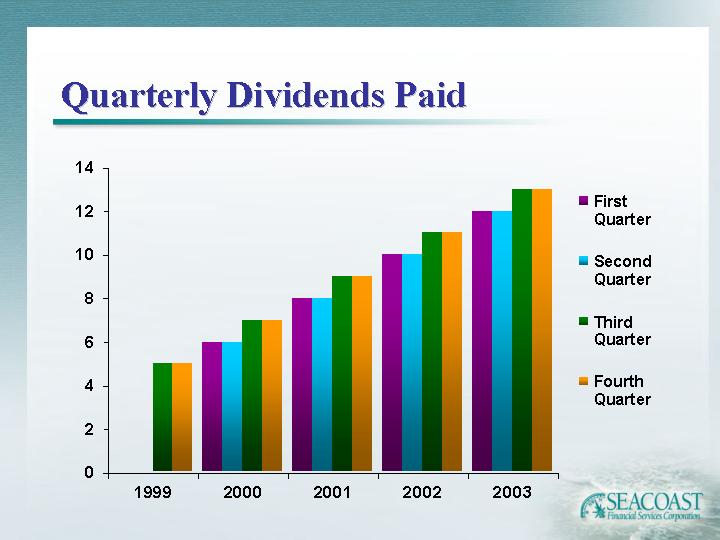

Quarterly Dividends Paid

[CHART]

Strategic Direction

• Complete the integration of Bay State

• Plan for integration of Abington Savings

• Grow customer base and revenue from new geographic footprint

• Continued focus on sales and service

• Continued focus on employee training and education

• Remain good corporate citizens

• Enhance shareholder value

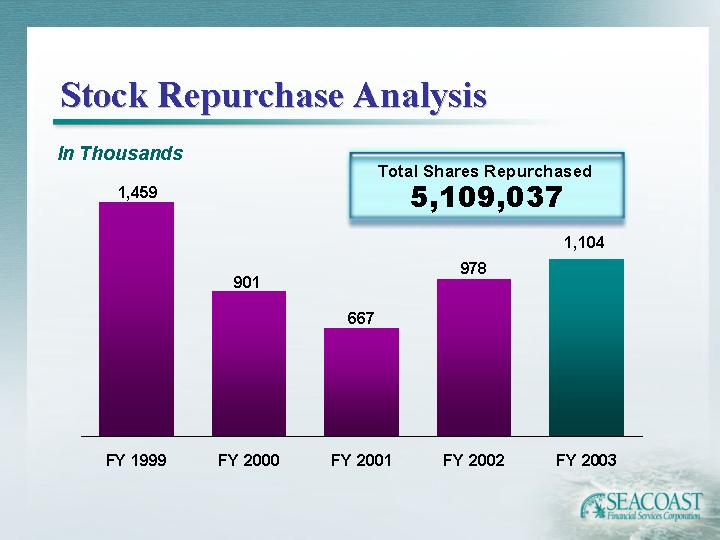

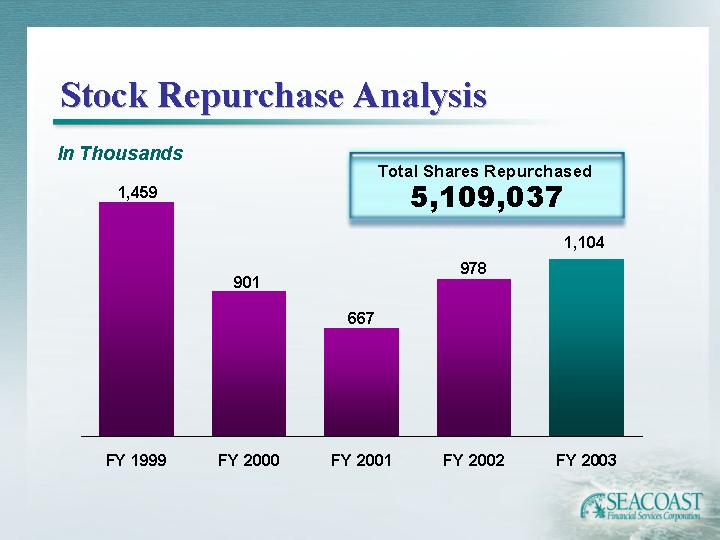

Stock Repurchase Analysis

In Thousands

Total Shares Repurchased

5,109,037

[CHART]

Thank You