UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 4, 2005

REHABCARE GROUP, INC.

(Exact name of Company as specified in its charter)

Delaware | 0-19294 | 51-0265872 |

(State or other jurisdiction | (Commission File Number) | (I.R.S. Employer |

of incorporation) | | Identification No.) |

| 7733 Forsyth Boulevard | | |

| Suite 2300 | | |

| St. Louis, Missouri | | 63105 |

| (Address of principal executive offices) | | (Zip Code) |

(314) 863-7422

(Company’s telephone number, including area code)

Not applicable

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)

Item | 7.01 | Regulation FD Disclosure |

| | |

| | Beginning on November 4, 2005, RehabCare executives will make presentations at investor conferences to analysts and in other forums using the slides as included in this Form 8-K as Exhibit 99. Presentations will be made using these slides, or modifications thereof, in connection with other presentations in the foreseeable future. Information contained in this presentation is an overview and intended to be considered in the context of RehabCare's SEC filings and all other publicly disclosed information. We undertake no duty or obligation to update or revise this information. However, we may update the presentation periodically in a Form 8-K filing. This presentation in its entirety will be made available in the For Our Investors section of our website, www.rehabcare.com, although this availability may be discontinued at any time. Forward-looking statements have been provided pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from forecasted results. These risks and uncertainties may include but are not limited to, our ability to consummate acquisitions and other partnering relationships; our ability to integrate recent and pending acquisitions and partnering relationships within the expected timeframes and to achieve the revenue and earnings levels from such acquisitions and relationships at or above the levels projected; changes in governmental reimbursement rates and other regulations or policies affecting the services provided by us to clients and/or patients; the operational, administrative and financial effect of our compliance with other governmental regulations and applicable licensing and certification requirements; our ability to attract new client relationships or to retain and grow existing client relationships through expansion of our hospital rehabilitation and contract therapy service offerings and the development of alternative product offerings; the ability of new management of InteliStaf Holdings, Inc., our unconsolidated affiliate, to complete its business assessment of InteliStaf on a timely basis and to institute a business restructuring to improve revenues and earnings; the results of our impairment analysis to be conducted with respect to the carrying value of our investment in InteliStaf; the future financial results of our other unconsolidated affiliates; the adequacy and effectiveness of our operating and administrative systems; our ability to attract and the additional costs of attracting administrative, operational and professional employees; significant increases in health, workers compensation and professional and general liability costs; litigation risks of our past and future business, including our ability to predict the ultimate costs and liabilities or the disruption of our operations; competitive and regulatory effects on pricing and margins; and general and economic conditions, including efforts by governmental reimbursement programs, insurers, healthcare providers and others to contain healthcare costs. |

| | |

| | |

Item | 9.01 | Financial Statements and Exhibits. |

| | |

| (c) | Exhibits. See Exhibit Index. |

| | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 4, 2005

By: | /s/ Mark A. Bogovich |

| Mark A. Bogovich |

| Vice President, |

| Interim Chief Financial Officer |

EXHIBIT INDEX

Exhibit No. | Description |

| |

99 | Text of Investor Relations Presentation in Use |

| Beginning November 4, 2005 |

Exhibit 99

3rd Quarter 2005

Safe Harbor

Forward-looking statements have been provided pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that

may cause our actual results in future periods to differ materially from forecasted results. These risks and

uncertainties may include but are not limited to, our ability to consummate acquisitions and other partnering

relationships; our ability to integrate recent and pending acquisitions and partnering relationships within the

expected timeframes and to achieve the revenue and earnings levels from such acquisitions and relationships at or

above the levels projected; changes in governmental reimbursement rates and other regulations or policies affecting

the services provided by us to clients and/or patients; the operational, administrative and financial effect of our

compliance with other governmental regulations and applicable licensing and certification requirements; our ability

to attract new client relationships or to retain and grow existing client relationships through expansion of our

hospital rehabilitation and contract therapy service offerings and the development of alternative product offerings;

the ability of new management of InteliStaf Holdings, Inc., our unconsolidated affiliate, to complete its business

assessment of InteliStaf on a timely basis and to institute a business restructuring to improve revenues and

earnings; the results of our impairment analysis to be conducted with respect to the carrying value of our investment

in InteliStaf; the future financial results of our other unconsolidated affiliates; the adequacy and effectiveness of our

operating and administrative systems; our ability to attract and the additional costs of attracting administrative,

operational and professional employees; significant increases in health, workers compensation and professional

and general liability costs; litigation risks of our past and future business, including our ability to predict the ultimate

costs and liabilities or the disruption of our operations; competitive and regulatory effects on pricing and margins;

and general and economic conditions, including efforts by governmental reimbursement programs, insurers,

healthcare providers and others to contain healthcare costs.

0

Business Profile

RehabCare, primarily in partnership with hospitals and nursing

homes, provides post-acute program management, medical

direction, physical rehabilitation, quality assurance, specialty

programs and community relations for the following programs

Hospital-Based Rehabilitation Programs

120 Acute Rehabilitation Units (ARUs)

24 Subacute/Transitional Care Units (TCUs)

41 Outpatient Rehabilitation Programs (OP)

Skilled Nursing Facility-Based Rehabilitation Programs

744 Programs

Freestanding Rehabilitation Facilities

2 Acute Rehab Facilities

2 Long Term Acute Care Hospitals

1

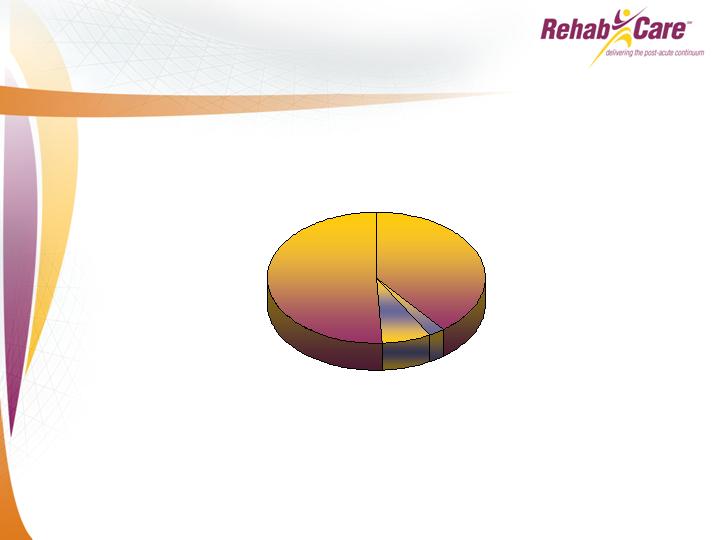

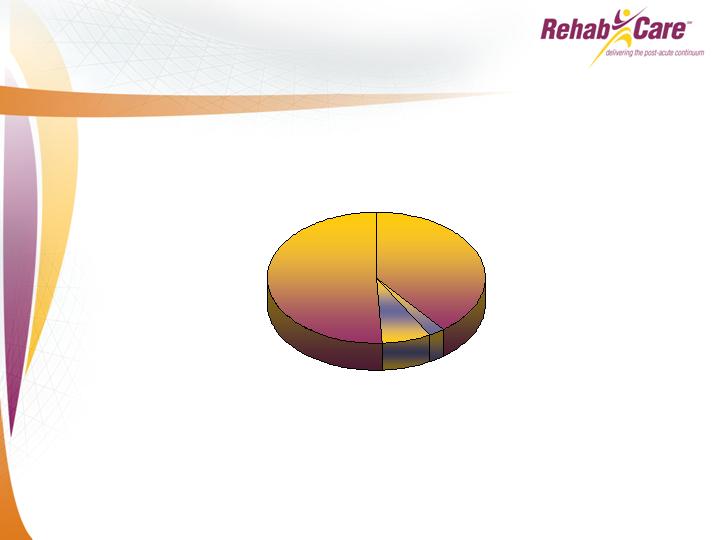

RHB Revenues 3Q/05

Hospital-Based

Rehabilitation Programs

(HRS Division)

$47.2M

SNF-Based

Rehabilitation Programs

(Contract Therapy Division)

$60.9M

Total Revenue $120.0 million

Healthcare Consulting

$3.1M

3%

39%

51%

*Includes the MeadowBrook acquisition as of August 1, 2005

Freestanding Hospitals

$8.8M*

7%

2

Business Profile

The post-acute physical rehabilitation industry provides large

opportunities for new RehabCare clients

5,000 Acute Care Hospitals

120 ARU programs

197 Freestanding Rehabilitation Facilities

2 Acute Rehab Facilities

350 Long-Term Acute Care Hospitals

2 Long-Term Acute Care Hospitals

15,000 Skilled Nursing Facilities

744 programs

Competitors include

Hospital

Self Operation

HealthSouth

Select Medical Corp

Kindred

SNF-Based

Self Operation

Aegis (Beverly Enterprises, Inc.)

RehabWorks

Regional Providers

3

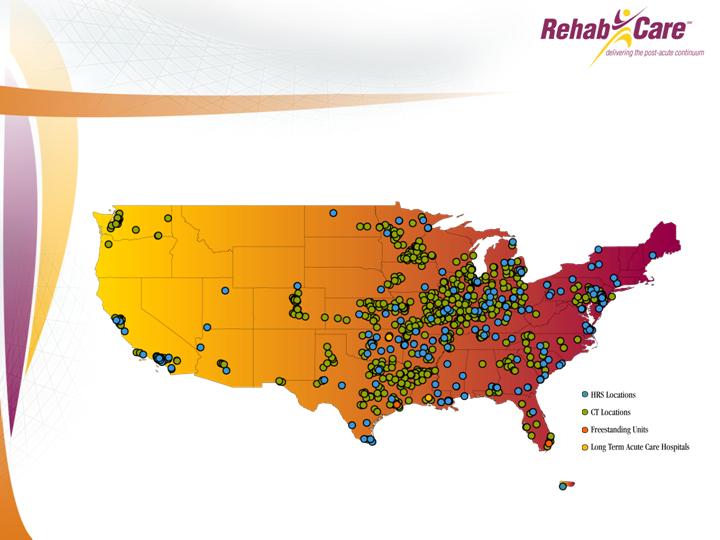

Business Profile

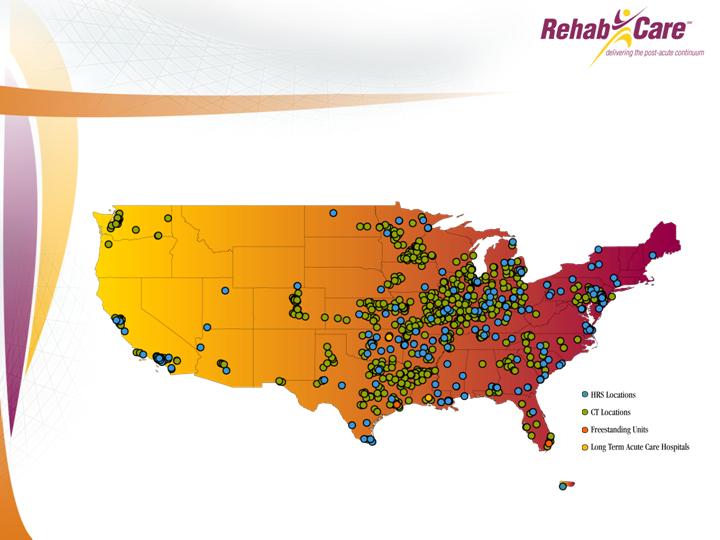

RehabCare Services

RehabCare’s 8,500 clinicians provide physical, occupational and

speech therapy at programs across the country

More than 930 locations nationwide

38 states, the District of Columbia & Puerto Rico

4

Business Profile

RehabCare Patients

RehabCare treats approximately 14,000

patients each day

54,000 inpatient discharges

1.1 million outpatient visits

4.3 million SNF patient visits

Typical diagnoses include:

Stroke

Neurological disorders

Orthopedic conditions

Musculoskeletal conditions

Payer sources for our patients are 72%

Medicare, 4% Medicaid, 24% managed

care and other

5

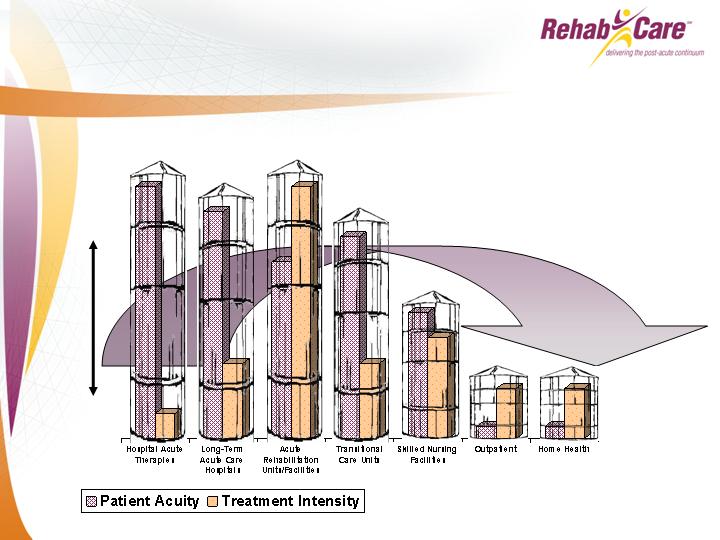

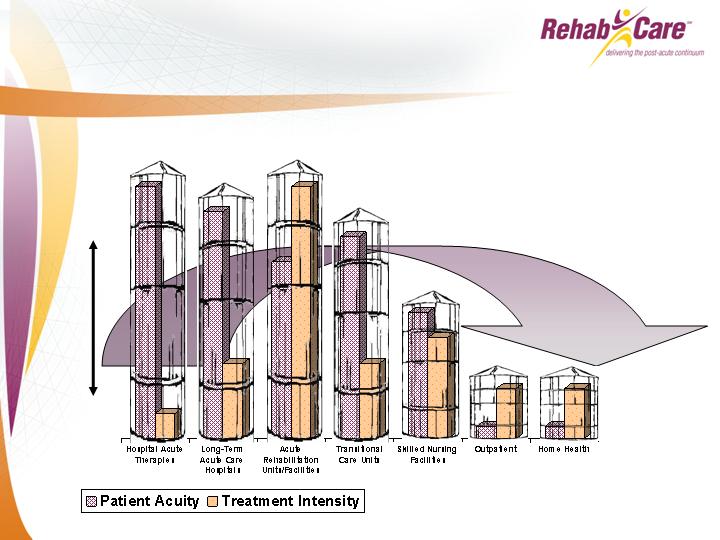

Business Profile

Traditional Silo Delivery Concept

Providers tend to focus on sites of

service rather than continuum of

care. Patients are treated at the sites

in an uncoordinated manner.

Therapy is the common link between

each of these silos.

High

Low

Therapists

6

Business Profile

RehabCare’s Patient-Focused Approach

RehabCare’s patient-focused approach builds integrated

continuums of care, rather than service silos, in markets that

offer sufficient demand and appropriate therapy resources for

these services

7

How Do We Achieve Our Vision?

Target Market Strategy

Acquisitions

Joint Ownership Arrangements

Hospital-Based Rehabilitation Stabilization/Growth Strategy

(HRS)

SNF-Based Rehabilitation Profitability/Growth (CT)

Clinical Research and Development

Information Technology and Management

Access to Capital

8

How Do We Achieve Our Vision?

Target Market Strategy

RehabCare has developed joint venture and other relationships

with market-leading health delivery partners

Provides access to referral networks and market share

Develops long-term relationships: deploys capital, provides joint

ownership and program management

Adds key components to continuums of care

Delivers RehabCare resources more efficiently

St. Louis, MO

Population 2.6 million

Harlingen/Brownsville, TX

Population 1.0 million

Norfolk, VA

Population 1.6 million

Kokomo, IN

Population 301,000

9

The Target Market Experience/Lessons

Target Markets Results

Turnover below company average of 3.75% quarterly

St. Louis and Norfolk run 1-2%

Therapists are willing to rotate among multiple care venues

St. Louis added 10 skilled nursing facilities, 2 outpatient

programs and one home health agency location in last

12 months

10

How Do We Achieve Our Vision?

Acquisitions

RehabCare’s acquisition strategy

supports our target market strategy

EBITDA multiple 4-6 times

Continuing management

2004 acquisitions added $45 million in

annualized operating revenues, 2005 have

added $55 million annualized

Strong balance sheet enables aggressive

acquisition strategy

11

How Do We Achieve Our Vision?

Joint Venture Arrangements

Valley Baptist Health System,

Harlingen/Brownsville, TX

Approximately 50% of local hospital market share

40-bed freestanding rehab hospital under development

Howard Regional Health System, Kokomo, IN

Approximately 57% of local hospital market share

30-bed LTACH currently under development

Projects under development

Arlington, TX

24-bed freestanding acute rehab facility to be owned and

operated by RHB projected to open in December 2005

Amarillo, TX

44-bed freestanding rehab hospital scheduled to open Spring

2006 with Northwest Texas Health System

12 non-binding joint venture letters of intent

Joint ventures help us create longer term relationships and

enhance market presence

12

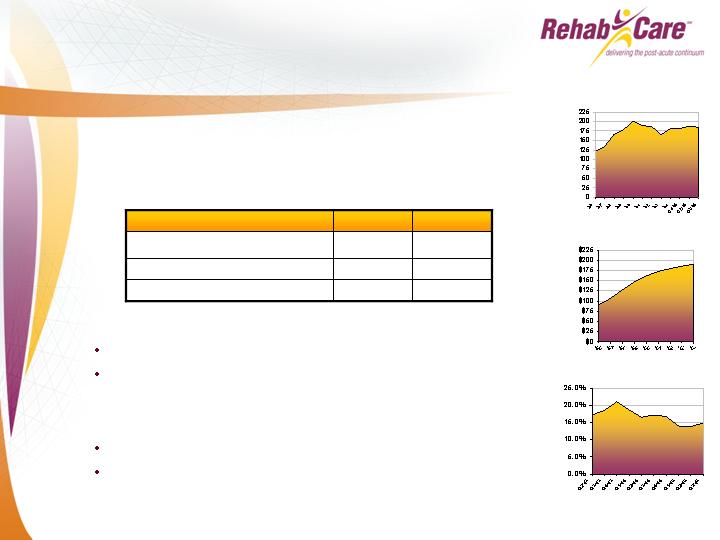

How Do We Achieve Our Vision?

Hospital-Based Rehabilitation Programs

Stabilization & Growth Strategy

Revenue

Longer term relationships using capital

Stabilization of same store discharges despite 75% rule

Operating Earnings

Adjust staffing model

Sequential margin improvement

Number of Programs

Operating Margin

Revenue (Millions)

16

14

HRS Backlog

8

4

HRS Signings

120

113

ARU Programs

Q3/05

Q3/04

13

Successfully managing the 75% rule

RHB’s YOY Q3 same store discharges and revenue

declined 2.1% as a result of the 75% rule

Moran Company reports estimated industry decline of

7.7% in Medicare discharges from July 2004-June

2005

Moran Company reports industry experienced a 15.3%

decline from January–June 2005

Other publicly traded competitors vary from declines of

12.1% in Medicare discharges to a decrease of 10.8%

in revenue

RHB’s same store ARU discharges remained constant

during the first three quarters of 2005

How Do We Achieve Our Vision?

Hospital-Based Rehabilitation Programs

Stabilization & Growth Strategy

14

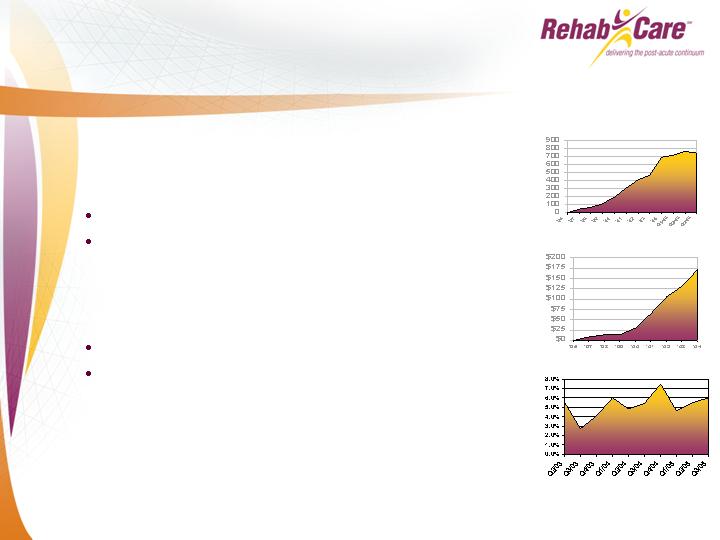

How Do We Achieve Our Vision?

Skilled Nursing Facility-Based Rehabilitation

Programs Profitability/Growth

Operating Margin

Number of

Programs

Revenue (Millions)

Revenue

Total CT programs 744 (Q3/05) vs. 600 (Q3/04)

Same store revenue growth of 10.7%

year-over-year

Operating Earnings

Manage variable cost

Continued SG&A leverage

15

How Do We Achieve Our Vision?

Clinical Research & Development

Partner with academic medical centers (175

affiliates)

Validate physical rehabilitation outcomes through

research. Continuing research to develop clinical

decision-making matrices for 75% rule

Developed CORE program to provide high-quality

care in SNFs for displaced 75% rule orthopedic

patients

Create systems to integrate the continuum of care

CareNexus – our proprietary care management

service

RehabCare must ensure its 8,500 clinicians provide the highest

quality therapy to approximately 14,000 patients daily

16

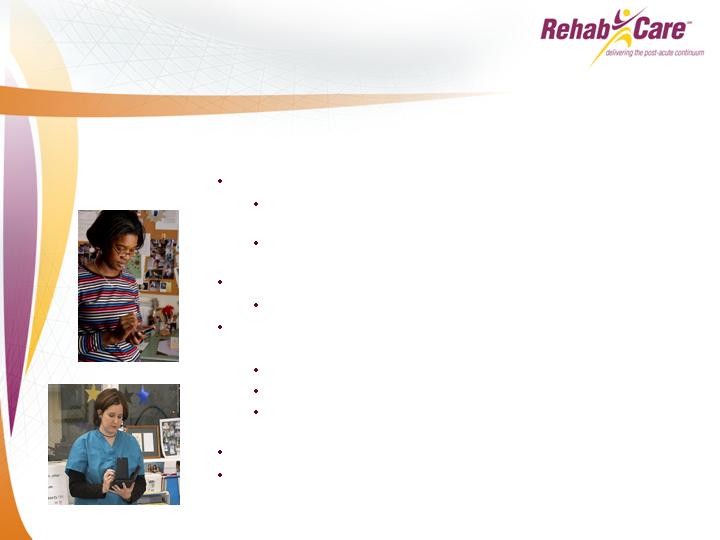

How Do We Achieve Our Vision?

Information Technology & Management

To support continuum of care, RHB has developed a

single-technology platform

RHB PDA based clinical system

Patient-centric view, episodic data capture by clinical

setting

Care management system, with total plan of care

discharge planning and management tool

Clinical and financial outcomes management tools

Manage staff and patients across continuum

Wireless Connectivity will allow 2-way real time

communication at point of service

Clinical pathways decision support

Patient protocols

Real time expertise available: clinical, technical,

operational

Developed tools to manage 75% rule

MeadowBrook Hospital systems will be utilized for new

freestanding hospitals (Arlington, Amarillo, etc.)

17

How Do We Achieve Our Vision?

Access To Capital

As of September 30, 2005

$18.2 million in cash

$11.9 million in subordinated debt related to

acquisitions

$90 million credit facility; expandable to $125 million

18

Challenges

Shortage Of Therapists

Recruiting and retaining therapists are key to our

success

85% annualized retention rate for full-time and part-time

clinicians

11% reduction in average number of openings sequentially

from 709 to 632

11% improvement in average time to fill an opening

sequentially from 49 days to 44 days

Approximately 50% of open positions are due to new

program openings or same store growth

New pricing strategy to re-coup increased labor costs

19

Challenges

Regulatory Impact

75 Percent Rule Definition

Effective July 1, 2004 - 3 year transition (50%, 60%, 65%,

75%)

Senate and House bills call for freeze at 50% and National

Advisory Council to oversee future federal policies that could

deny patient care – RHB supports this effort

Status

As of Sept 30, our units, on average, were at the 60% level

of compliance

45, or 38%, of our units entered the 60% compliance period

during 3Q/05

Part B Therapy Caps (Skilled Nursing Facility-Based

Rehabilitation)

Same Senate bill calls for a one year moratorium

20

Challenges

InteliStaf Holdings

StarMed, our former staffing division, sold to

InteliStaf on 2/2/04 in exchange for 25% of

combined equity

Approximately $2.1 million RHB equity share loss

in Q3/05; $1.0 million related to normal operations

and $1.1 million related to deferred tax asset

Hired new CEO and CFO effective 10/25/05

Potential impairment

21

Quarterly Update

$0.26*

$0.32

$0.29

$0.37

$0.36

EPS (fully diluted)

$10.9

$9.8

$9.0

$11.4

$10.7

Operating Earnings

(millions)

$120.0

$108.4

$102.4

$95.1

$93.3

Revenue

(millions)

Q3/05

Q2/05

Q1/05

Q4/04

Q3/04

GAAP

*Includes InteliStaf equity loss of $2.1 million, or $0.12 per fully diluted share

22

RehabCare Summary

Opportunities

New CT and HRS business growth

Acquisitions

Development of joint venture relationships

Maturity of continuum of care strategy

Challenges

Continued 75% rule implementation

Managing growth in tight labor market

Startup and integration of JVs and acquisitions

Part B Caps

23