UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): June 26, 2007

REHABCARE GROUP, INC.

(Exact name of Company as specified in its charter)

| Delaware | 0-19294 | 51-0265872 | |

| (State or other jurisdiction | (Commission | (I.R.S. Employer | |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | | | | |

| 7733 Forsyth Boulevard | |

| Suite 2300 | |

| St. Louis, Missouri | 63105 | |

(Address of principal executive offices) | (Zip Code) |

| | | | | | | | |

(314) 863-7422

(Company's telephone number, including area code)

Not applicable

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 | Regulation FD Disclosure |

Beginning on June 26, 2007, RehabCare executives will make presentations at investor conferences to analysts and in other forums using the slides as included in this Form 8-K as Exhibit 99. Presentations will be made using these slides, or modifications thereof, in connection with other presentations in the foreseeable future.

Information contained in this presentation is an overview and intended to be considered in the context of RehabCare's SEC filings and all other publicly disclosed information. We undertake no duty or obligation to update or revise this information. However, we may update the presentation periodically in a Form 8-K filing.

Forward-looking statements have been provided pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from forecasted results. These risks and uncertainties may include but are not limited to, our ability to consummate acquisitions and other partnering relationships at reasonable valuations; our ability to integrate acquisitions and partnering relationships within the expected timeframes and to achieve the revenue, cost savings and earnings levels from such acquisitions and relationships at or above the levels projected; our ability to comply with the terms of our borrowing agreements; changes in governmental reimbursement rates and other regulations or policies affecting reimbursement for the services provided by us to clients and/or patients; the operational, administrative and financial effect of our compliance with other governmental regulations and applicable licensing and certification requirements; our ability to attract new client relationships or to retain and grow existing client relationships through expansion of our service offerings and the development of alternative product offerings; the future financial results of any unconsolidated affiliates; the adequacy and effectiveness of our operating and administrative systems; our ability to attract and the additional costs of attracting and retaining administrative, operational and professional employees; shortages of qualified therapists and other healthcare personnel; significant increases in health, workers compensation and professional and general liability costs; litigation risks of our past and future business, including our ability to predict the ultimate costs and liabilities or the disruption of our operations; competitive and regulatory effects on pricing and margins; our ability to effectively respond to fluctuations in our census levels and number of patient visits; the proper functioning of our information systems; natural disasters and other unexpected events which could severely damage or interrupt our systems and operations; changes in federal and state income tax laws and regulations, the effectiveness of our tax planning strategies and the sustainability of our tax positions; and general and economic conditions, including efforts by governmental reimbursement programs, insurers, healthcare providers and others

to contain healthcare costs.

Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits - See exhibit index |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: June 26, 2007

By: /s/ Jay W. Shreiner

Name: Jay W. Shreiner

Title: Senior Vice President and

Chief Financial Officer

EXHIBIT INDEX

99 | Investor Relations Presentation in use beginning June 26, 2007. |

Exhibit 99

Investor Presentation

First Quarter, 2007

0

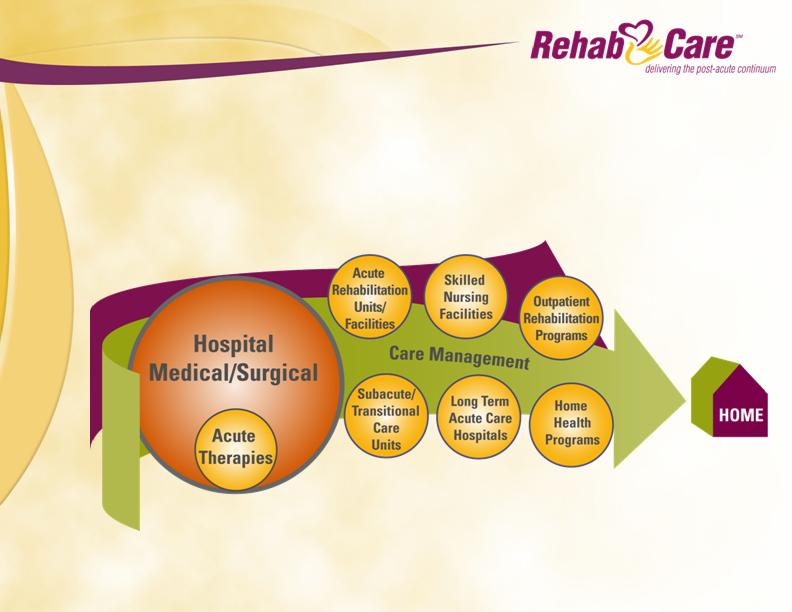

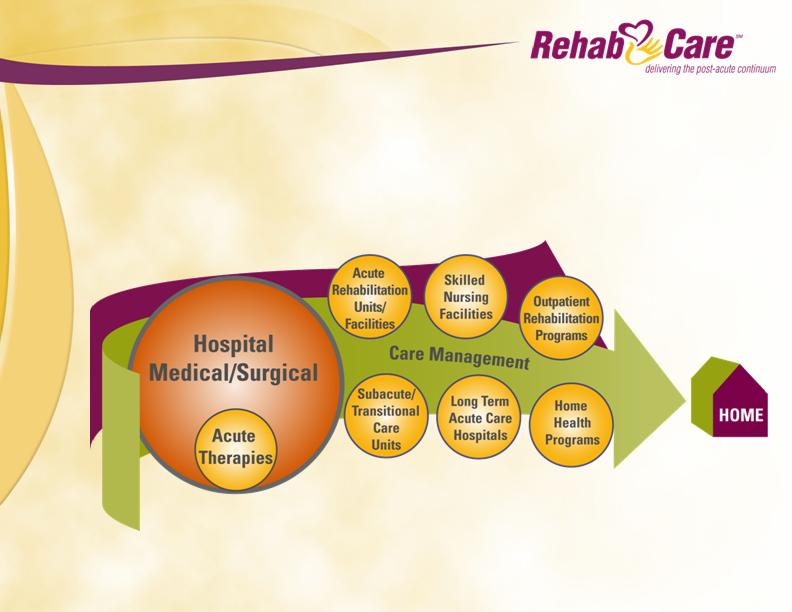

RehabCare's vision is to provide a clinically integrated continuum of

post-acute care resulting in people regaining their lives. That means

linking together our resources and clinical expertise in our various

settings to create a coordinated system that supports patients in their

transition from an acute episode to home.

Our Strategic Vision

1

What We Do

Skilled Nursing Facility-Based Rehabilitation Programs

1,146 programs – 7.6 million patient visits annually

Hospital-Based Rehabilitation Programs – 164 Total Units

Acute Rehabilitation Units

112 programs –44,000 discharges annually

Subacute/Transitional Care Units

17 units –131,200 patient days annually

Outpatient Rehabilitation Programs

35 units –1.1 million visits annually

Freestanding Hospitals

6 Inpatient Rehabilitation Hospitals*

256 Beds – 4500 discharges annually

3 Long-Term Acute Care Hospitals

186 Beds – 1600 discharges annually

Other Healthcare Services

Phase 2 – consulting services for acute care hospitals

Polaris Group - consulting services for long-term care facilities

VTA Management Services – therapist staffing for healthcare facilities and

schools in New York

*One minority owned

2

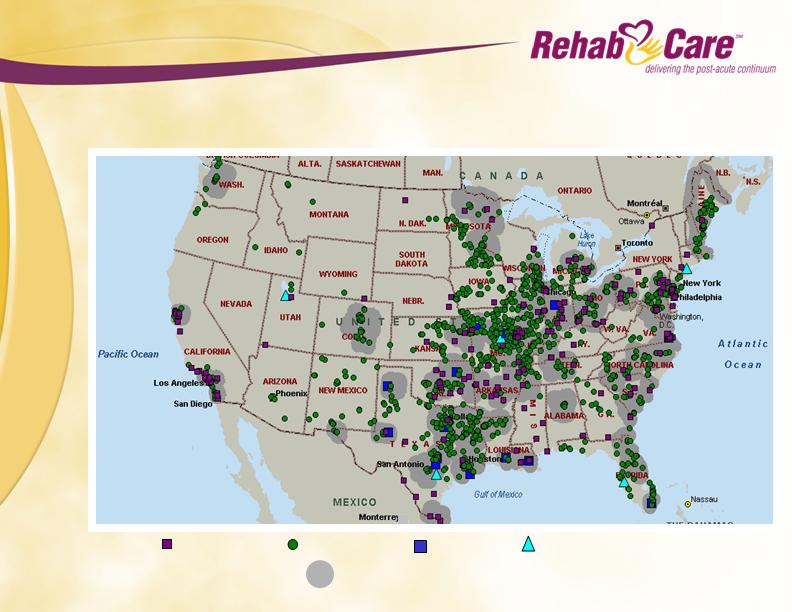

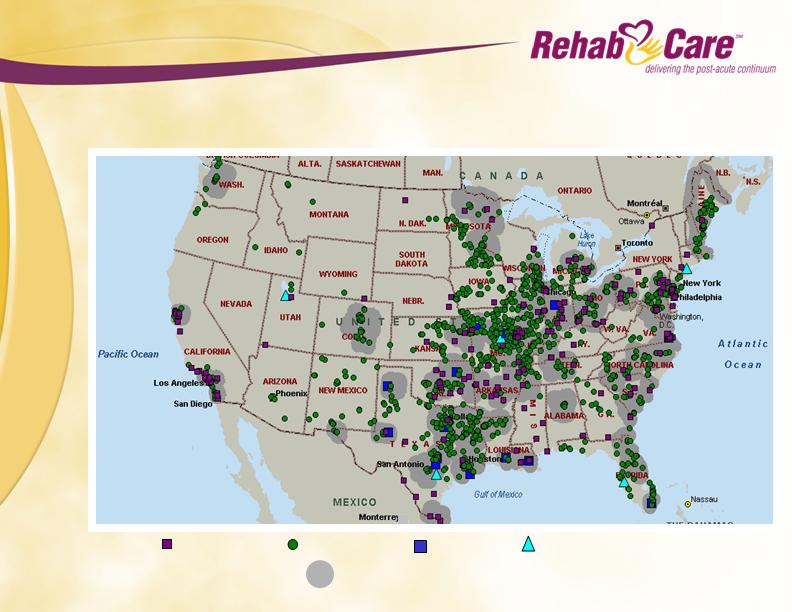

Where We Are

Over 1,300 locations servicing over 22,000 patient visits each day

Skilled-based

Freestanding

Other Healthcare Services

Hospital-based

87 Strategic Continuum Markets

3

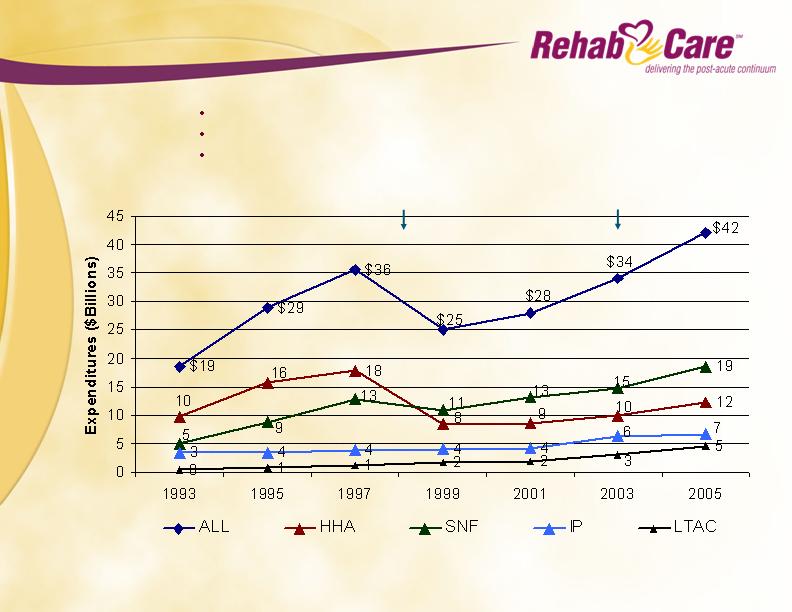

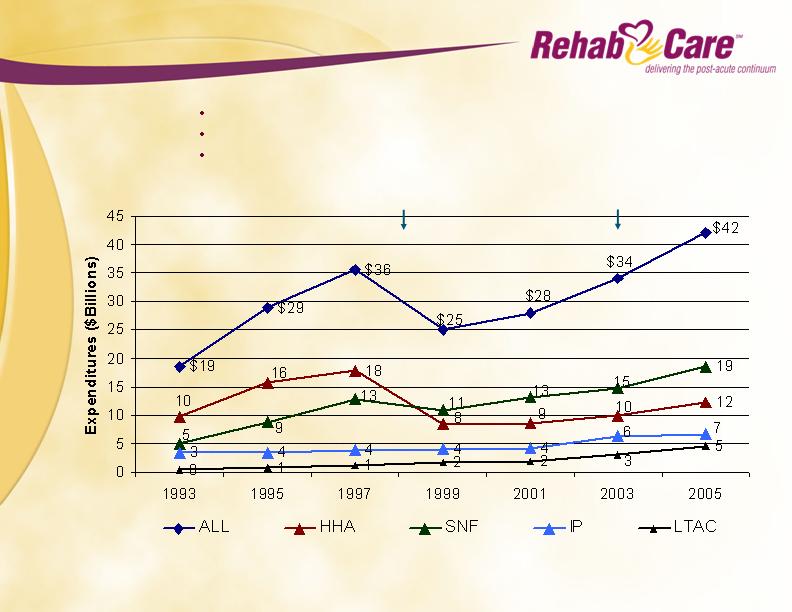

Medicare Reimbursement for

Post-Acute Services

Medicare reimbursement for post-acute services:

Totaled $42 billion in 2005, an increase of 68% since 1999

Projected $97 billion by 2014

Represents 13% of Medicare’s total spending

CMS contains costs by its PPS adjustments and regulations

HH & SNF PPS

IRF PPS

4

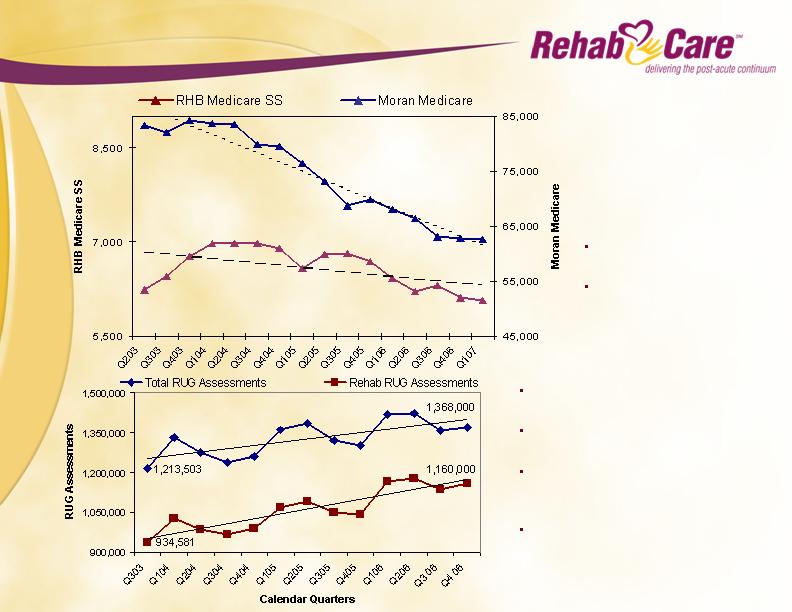

Our Revenues Follow Patient Care

Trends

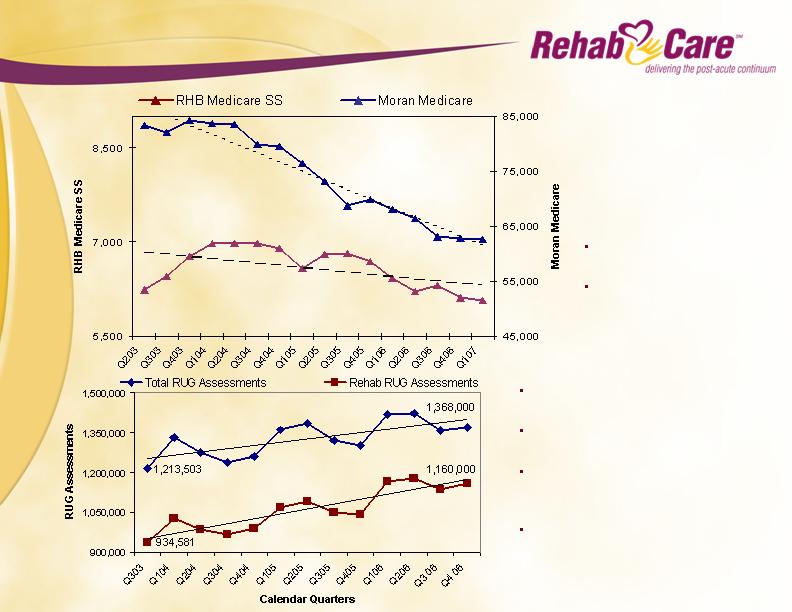

From the May 2007 Moran

Report comparing the four

quarters ending Q1:2007 to

the four quarters ending

Q1:2004:

Moran facilities declined

23.5%

RehabCare facilities

decreased 6.6%

Since Q3/03, RUG assessments

nationally increased 12.7%

Rehab RUG assessments in that period

increased 24.1%

During the same period, the number of

skilled facilities nationally remained

relatively stable

The number of rehabilitation

assessments outpaced the overall

increase in total assessments

5

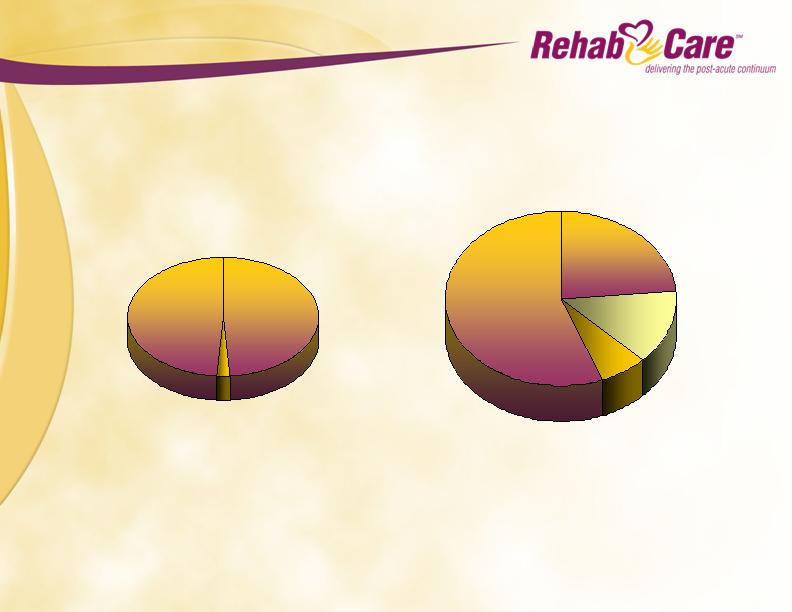

Hospital-Based

Rehabilitation Programs

(HRS Division)

$43.3M

SNF-Based

Rehabilitation Programs

(Contract Therapy Division)

$102.8M

1Q/07

Total Revenue $184.0 million

Other Healthcare

Services

$11.9M*

6%

24%

56%

Freestanding

Hospitals

(IRFs and LTACHs)

$26.0M

14%

Our Revenue Trends

Hospital-Based

Rehabilitation Programs

(HRS Division)

$47.8M

SNF-Based

Rehabilitation Programs

(Contract Therapy Division)

$52.5M

1Q/05

Total Revenue $102.4 million

Other Healthcare

Services

$2.1M*

2%

51%

47%

*Net of intercompany eliminations

6

Skilled Nursing Facility-Based

Rehabilitation

Largest Medicare post acute reimbursement setting

Growing care setting, in part due to 75% Rule

Lower operating margins require scale for better

economies and improve profitability

Acquisition of Symphony

Adds critical mass for selective markets; entry

into other markets

Adds significant therapist resources and client

relationships

Provides $10-14 million projected annualized

cost savings and operating efficiencies over 18

months – Q1 2007 run rate of $12.3 million

annualized cost savings

7

Hospital-Based Rehabilitation

Provides 3-5 year contractual relationships with host

hospitals and health systems with existing market

share and flow of patients

Remains highest margin business with cash flows to

fund other businesses

Expect 3-5% historical growth to return after full

implementation of 75% Rule

8

Freestanding Hospitals

Provides anchor operations in continuum markets

Continues strategy of working with host hospitals and

health systems with existing market share and flow of

patients

Establishes ownership position and reduces risk of

contract loss

Provides a vehicle for expansion of bed capacity

Enhances control over quality and competency in

clinical and medical matters

9

Freestanding Hospitals

Joint Venture Strategy

Definitive Agreements – Previously Announced

Austin -

Phase 1 - 20-bed IRF – open third quarter 2007

Phase 2 - replace 20-bed IRF with 36-bed IRF and 40-bed

LTACH – projected open 2009

North Kansas City – 35-bed LTACH – open early 2008

St. Louis - 35-bed IRF – open early 2009

Other Development Projects

Howard Regional – 26-bed LTACH – open late 2007

Peoria – 50-bed LTACH – open late 2008

In addition to these 6, there are several letters of intent and

additional opportunities under review

10

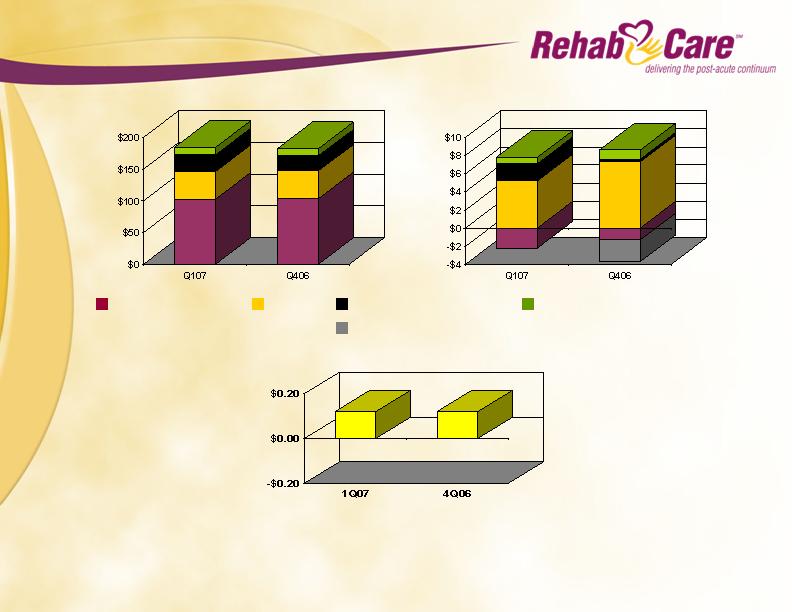

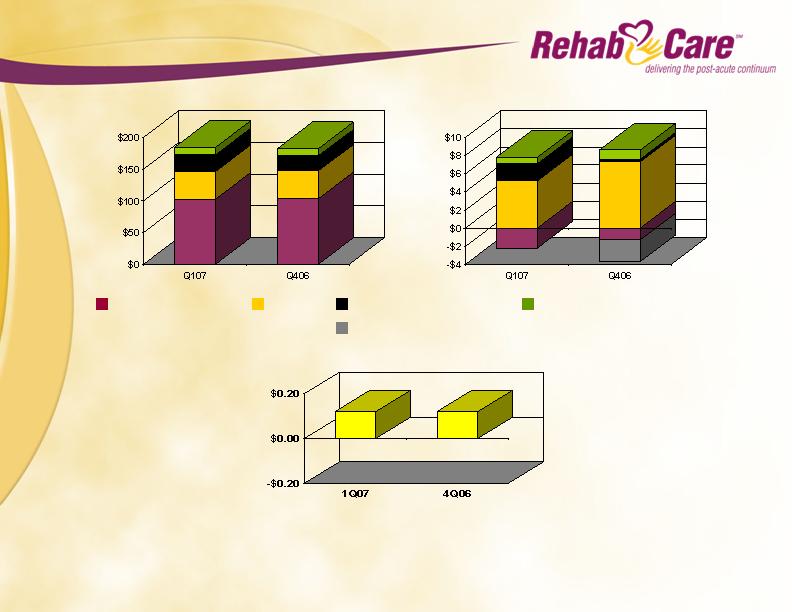

1Q/07 Versus 4Q/06

$184.0

$182.2

Revenues (in millions)

Operating Earnings (in millions)

$5.5

$4.7

Consolidated Earnings Per Share

$0.12

$0.12 (1)

Contract Therapy

HRS

Freestanding Hospitals

Other Healthcare Services

(1) Includes a pretax software development impairment charge in Q4 2006 of $2.4 million, or $0.09 per diluted share after tax

Unallocated Costs (1)

11

Sources

Cash flows from operations - $8.8 million

Uses

Capital expenditures $1.3 million, principally

information systems

Paid down $7.1 million in long-term debt

Debt Outstanding

$107.0 million outstanding debt under $175 million

revolving credit facility at 3/31/07

$6.5 million in subordinated debt related to

acquisitions at 3/31/07

Q1 2007 Sources and Uses Of Capital

12

Inpatient Rehabilitation Facilities - 75% Rule

Limits the type and number of rehabilitation patients cared for in an acute hospital setting

Transitions to 65% and 75% in July 2007 and 2008, respectively

Proposed legislation in Senate and House freezes threshold at 60%. Support

continues to grow

CMS willing to reconsider the 75% Rule comorbidity exception set to expire after

7/1/08

In the current 60% compliance period, HRS division operating at average 63%

compliance; Freestanding division operating at average 59% compliance

LTACH - 25% Rule

Restricts HIH LTACHs to less than 25% of their admissions from host acute care hospital

Final rule issued on 5/1/07 by CMS covers all LTACHs with phase-in over three years

for cost report years starting 7/1/07; mitigation strategies expected to substantially

eliminate the estimated operational impact

Expect Q2 2007 impairment of $4.5-$5.0 million for grandfathered New Orleans

LTACH intangible asset

Skilled Nursing Facility Part B Therapy Caps Autoexception

Expires on 12/31/07. Congressional action required for change/extension

2008 Market Basket Payment Changes

IRFs - 3.3% increase less estimated outlier payment and other adjustments of 0.9%

LTACHs - 3.2% increase less estimated coding practices adjustment of 2.5%

SNFs - 3.3% increase

Medicare Reimbursement Initiatives

Impacting Rehabilitation Services

13

Expectations for the Future

Contract Therapy Division

Return to 5-6% operating margins in 2008

HRS Division

Modest growth in discharges and stable operating

margins during 2007

Freestanding Hospitals Division

EBITDA margins at mature facilities of 17–19%

One rehab hospital and one LTACH opened in

2007

Other Healthcare Services

Continued growth in revenue and earnings in 2007

14

Safe Harbor

Forward-looking statements have been provided pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown

risks and uncertainties that may cause our actual results in future periods to differ materially from

forecasted results. These risks and uncertainties may include but are not limited to, our ability to

consummate acquisitions and other partnering relationships at reasonable valuations; our ability to

integrate acquisitions and partnering relationships within the expected timeframes and to achieve the

revenue, cost savings and earnings levels from such acquisitions and relationships at or above the

levels projected; our ability to comply with the terms of our borrowing agreements; changes in

governmental reimbursement rates and other regulations or policies affecting reimbursement for the

services provided by us to clients and/or patients; the operational, administrative and financial effect

of our compliance with other governmental regulations and applicable licensing and certification

requirements; our ability to attract new client relationships or to retain and grow existing client

relationships through expansion of our service offerings and the development of alternative product

offerings; the future financial results of any unconsolidated affiliates; the adequacy and effectiveness

of our operating and administrative systems; our ability to attract and the additional costs of attracting

and retaining administrative, operational and professional employees; shortages of qualified

therapists and other healthcare personnel; significant increases in health, workers compensation and

professional and general liability costs; litigation risks of our past and future business, including our

ability to predict the ultimate costs and liabilities or the disruption of our operations; competitive and

regulatory effects on pricing and margins; our ability to effectively respond to fluctuations in our

census levels and number of patient visits; the proper functioning of our information systems; natural

disasters and other unexpected events which could severely damage or interrupt our systems and

operations; changes in federal and state income tax laws and regulations, the effectiveness of our tax

planning strategies and the sustainability of our tax positions; and general and economic conditions,

including efforts by governmental reimbursement programs, insurers, healthcare providers and others

to contain healthcare costs.

15

Investor Presentation

First Quarter, 2007

16