SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

REHABCARE GROUP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

| (1) | | Title of each class of securities to which transaction applies: |

| (2) | | Aggregate number of securities to which transaction applies: |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | | Proposed maximum aggregate value of transaction: |

| (5) | | Total Fee paid: |

[ ] Fee paid previously with preliminary materials.

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | | Amount Previously Paid: |

| (2) | | Form, Schedule or Registration Statement No.: |

| (3) | | Filing Party: |

| (4) | | Date Filed: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 30, 2003

Dear Stockholder:

The annual meeting of stockholders of RehabCare Group, Inc. will be held at the Pierre Laclede Center, 7733 Forsyth Boulevard, Second Floor, St. Louis, Missouri 63105, on April 30, 2003, at 8:00 a.m., local time, for the following purposes:

| 1. | | To elect six directors to hold office until the next annual meeting or until their successors shall have been duly elected and qualified. |

| 2. | | To transact any and all other business that may properly come before the annual meeting or any adjournment thereof. |

Only our stockholders of record at the close of business on March 3, 2003, are entitled to notice of, and to vote at, the annual meeting or any adjournment thereof.

We cordially invite you to attend the annual meeting. Even if you plan to be present in person at the meeting, you are requested to date, sign and return the enclosed proxy card in the envelope provided so that your shares will be represented. The mailing of an executed proxy card will not affect your right to vote in person should you later decide to attend the annual meeting.

| | Alan C. Henderson

President and Chief Executive Officer |

March 26, 2003

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 30, 2003

GENERAL INFORMATION

This proxy statement is furnished to the stockholders of RehabCare Group, Inc. in connection with our solicitation of proxies for use at the annual meeting of stockholders to be held at the Pierre Laclede Center, 7733 Forsyth Boulevard, Second Floor, St. Louis, Missouri 63105, on April 30, 2003, at 8:00 a.m., local time, and at all adjournments thereof, for the purposes set forth in the preceding notice of annual meeting of stockholders.

This proxy statement, the notice of annual meeting and the accompanying proxy card were first mailed to our stockholders on or about March 26, 2003.

The proxy set forth on the accompanying proxy card is being solicited by our board of directors. All proxies will be voted in accordance with the instructions contained in the proxy. If no direction is specified in the proxy, executed proxies will be voted for the election of the six directors nominated by our board of directors. A proxy may be revoked at any time before it is voted by filing a written notice of revocation or a later-dated proxy card with our corporate secretary at our principal offices or by attending the annual meeting and voting the shares in person. Attendance alone at the annual meeting will not revoke a proxy. Proxy cards that are properly executed, timely received and not revoked will be voted in the manner indicated thereon at the annual meeting and any adjournment thereof.

We will bear the entire expense of soliciting proxies. Proxies initially will be solicited by mail. Our directors, executive officers and employees may also solicit proxies personally or by telephone or other means, but we will not compensate these persons for providing the solicitation services.

Only our stockholders of record at the close of business on March 3, 2003, are entitled to notice of, and to vote at, the annual meeting. On such date, there were 15,852,080 shares of our common stock, $0.01 par value, issued and outstanding.

Each outstanding share of our common stock on March 3, 2003, is entitled to one vote for each director to be elected at the annual meeting. Our stockholders do not have the right to cumulate votes in the election of directors. A majority of the outstanding shares of common stock present in person or by proxy will constitute a quorum at the annual meeting. A plurality of the votes cast is required for the election of directors, which means that the nominees with the six highest vote totals will be elected as our directors. As a result, a designation on the proxy that the stockholder is “withholding authority” for a

nominee or nominees and broker “non-votes” do not have an effect on the results of the vote for the election of directors. A designation on the proxy that the stockholder is “withholding authority” to vote for a nominee or nominees will be counted, but broker “non-votes” will not be counted, for the purpose of determining the number of shares represented at the meeting for purposes of determining whether a quorum of shares is present at the meeting. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The following entities are known to our management to be the beneficial owners of five percent or more of our common stock:

| Name and Address of Beneficial Owner | Number of Shares

Beneficially Owned | Percent of Outstanding

Common Stock(1) |

|---|

| FMR Corp.(2) | | 2,105,581 | | 13 | .3% |

| 82 Devonshire Street | |

| Boston, Massachusetts 02109 | |

| |

| Boston Partners Asset Management, L.P.(3) | | 1,446,700 | | 9 | .1 |

| 28 State Street, 20th Floor | |

| Boston, Massachusetts 02109 | |

| |

| Wasatch Advisors, Inc.(4) | | 1,265,481 | | 8 | .0 |

| 150 Social Hall Avenue | |

| Salt Lake City, Utah 84111 | |

| |

| Dalton, Greiner, Hartman, Maher & Co.(5) | | 859,690 | | 5 | .4 |

| 565 Fifth Avenue, Suite 2101 | |

| New York, New York 10017 | |

| |

| Daruma Asset Management, Inc.(6) | | 847,800 | | 5 | .3 |

| 80 West 40th Street, 9th Floor | |

| New York, New York 10018 | |

| |

| (1) | | The percentage calculations are based upon 15,852,080 shares of our common stock issued and outstanding on March 3, 2003. |

| (2) | | The information provided is based on Amendment No. 8 to Schedule 13G, dated February 14, 2003, filed jointly by FMR Corp., a holding company, Edward C. Johnson 3d, a principal stockholder and the chairman of FMR Corp., and Abigail P. Johnson, a principal stockholder and member of the board of directors of FMR Corp. Each of FMR Corp., Edward C. Johnson 3d and Abigail P. Johnson reported sole dispositive power with respect to all 2,105,581 shares reported as beneficially owned. FMR Corp. reported sole voting power with respect to 368,081 of the shares reported as beneficially owned. |

| (3) | | The information provided is based on Amendment No. 1 to Schedule 13G, dated February 13, 2003, filed jointly by Boston Partners Asset Management, L.P., an investment advisor, BPAM (GP), LLC, the general partner of Boston Partners Asset Management, L.P., BPAM Holding Company, the sole member of BPAM (GP), LLC, and Desmond John Heathwood, a control person of Boston Partners Asset Management, L.P., BPAM (GP), LLC and BPAM Holding Company. Each of Boston Partners Asset Management, L.P. and Desmond John Heathwood reported shared voting and dispositive power with respect to all 1,446,700 shares reported as beneficially owned. |

2

| (4) | | The information provided is based on Amendment No. 1 to Schedule 13G, dated February 13, 2003, filed by Wasatch Advisors, Inc., an investment advisor. Wasatch Advisors, Inc. reported sole voting and dispositive power with respect to all 1,265,481 shares reported as beneficially owned. |

| (5) | | The information provided is based on a Schedule 13G, dated January 27, 2003, filed by Dalton, Greiner, Hartman, Maher & Co., an investment advisor registered under the Investment Advisors Act of 1940. Dalton, Greiner, Hartman, Maher & Co. reported sole voting power with respect to 731,690 of the shares and sole dispositive power with respect to all 859,690 shares reported as beneficially owned. |

| (6) | | The information provided is based on a Schedule 13G, dated February 14, 2003, filed jointly by Daruma Asset Management, Inc., an investment advisor, and Mariko O. Gordon, a principal stockholder and the president of Daruma Asset Management, Inc. Each of Daruma Asset Management, Inc. and Mariko O. Gordon reported sole voting power with respect to 481,700 of the shares and sole dispositive power with respect to all 847,800 shares reported as beneficially owned. |

SECURITY OWNERSHIP BY MANAGEMENT

The following table sets forth, as of March 3, 2003, the beneficial ownership of our common stock by each director and each executive officer named in the Summary Compensation Table, individually, and all directors and executive officers as a group:

| Name of Beneficial Owner | Number of Shares

Beneficially Owned(1)(2) | Percent of Outstanding

Common Stock(3) |

|---|

| Alan C. Henderson | | 575,677 | (4) | 3.5 | % |

| William G. Anderson, CPA | | 224,246 | | 1.4 | |

| Richard E. Ragsdale | | 122,869 | (5) | (6 | ) |

| John H. Short, Ph.D | | 130,061 | | (6 | ) |

| H. Edwin Trusheim | | 188,468 | | 1.2 | |

| Colleen Conway-Welch, Ph.D., R.N. | | 19,911 | | (6 | ) |

| Theodore M. Wight | | 71,861 | | (6 | ) |

| Tom E. Davis | | 123,354 | | (6 | ) |

| Gregory F. Bellomy | | 108,596 | | (6 | ) |

| Patricia M. Henry | | 39,262 | | (6 | ) |

| James M. Douthitt | | 18,000 | | (6 | ) |

| All directors and executive officers as a group (12 persons) | | 1,622,305 | | 9.4 | |

| (1) | Except as otherwise noted, each individual has sole voting and investment power with respect to the shares listed beside his or her name. |

| (2) | Totals include 433,908, 207,061, 117,061, 87,061, 185,468, 19,461, 71,861, 123,354, 68,750, 38,500, 18,000 and 1,370,485 shares subject to stock options owned by Henderson, Anderson, Ragsdale, Short, Trusheim, Conway-Welch, Wight, Davis, Bellomy, Henry and Douthitt and all directors and executive officers as a group, respectively, that are either presently exercisable or exercisable within 60 days of March 3, 2003. With respect to Mr. Henderson’s 433,908 shares, the total includes 362,964 shares subject to stock options owned by a trust of which Mr. Henderson is the trustee that are either presently exercisable or exercisable within 60 days of March 3, 2003. Totals also include 695 shares allocated to Ms. Henry under our 401(k) plan. |

| (3) | Based upon 15,852,080 shares of our common stock issued and outstanding as of March 3, 2003, and, for each director or executive officer or the group, the number of shares subject to options exercisable by such director or executive officer or the group within 60 days of March 3, 2003. |

3

| (4) | Includes (A) 93,675 shares owned by a trust of which Mr. Henderson is the trustee and (B) 2,000 shares owned by Mr. Henderson’s spouse as custodian for Mr. Henderson’s children, as to which shares Mr. Henderson has no voting or investment power. |

| (5) | Includes 5,808 shares of our common stock held by The Ragsdale Family Foundation, of which Mr. Ragsdale is a director, and as to which shares Mr. Ragsdale has shared voting and investment power. |

| (6) | Less than one percent. |

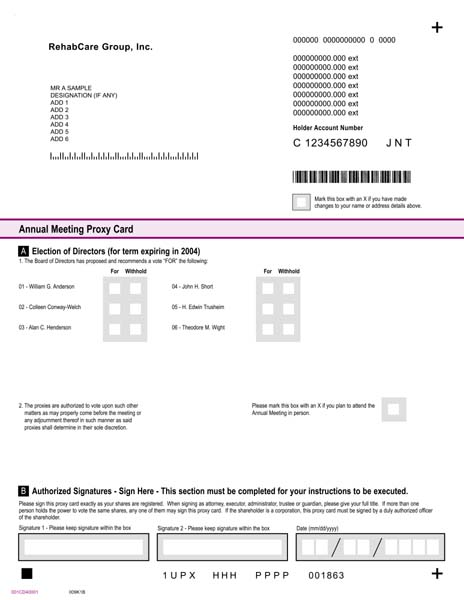

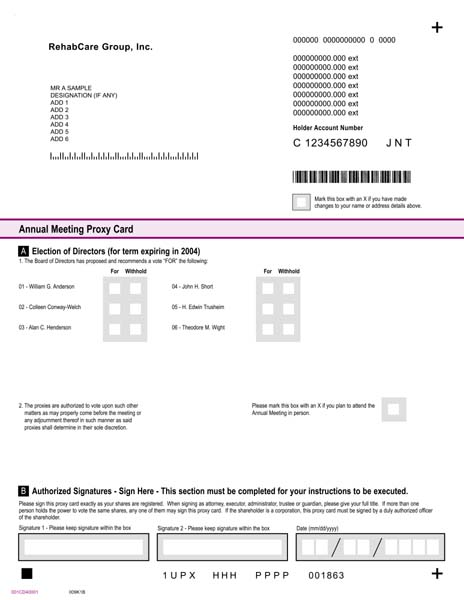

ELECTION OF DIRECTORS

At the annual meeting, our stockholders will vote on the election of six directors to serve a term of one year until the 2004 annual meeting or until their successors shall have been duly elected and qualified. Richard E. Ragsdale, a director of the company since 1993, recently informed the company of his decision to retire as a member of the board effective with the expiration of his term at the 2003 annual meeting. The remaining board members and management of the company thank Mr. Ragsdale for his ten years of service to the company and its stockholders.

The Compensation and Nominating Committee has begun the process of identifying and selecting a new independent director to replace Mr. Ragsdale but the committee determined that the process would require more time than was available prior to the mailing of this proxy statement. The board has, therefore, determined to reduce the number of directors from seven to six, effective as of the call to order of the annual meeting on April 30, 2003. When the committee recommends a suitable candidate to the full board, the board will increase the number of directors to seven to allow the board to elect the candidate to the board for a term that will end at the 2004 annual meeting of stockholders.

The persons named as proxies on the accompanying proxy card intend to vote all duly executed proxies received by our board of directors for the election of the six directors listed below, except as otherwise directed by the stockholder on the proxy card. If for any reason any nominee becomes unavailable for election, which is not now anticipated, the persons named in the accompanying proxy card will vote for a substitute nominee as designated by our board of directors. The six nominees receiving the highest number of votes will be elected as our directors. Each nominee currently serves as one of our directors.Our board of directors recommends a vote “FOR” the election of each of the nominees.

The name, age, principal occupation or position, business experience and other directorships for each of the directors is set forth below.

H. Edwin Trusheim, 75, has been our chairman of the board of directors since 1998 and has served as a director since 1992. Prior to his retirement, Mr. Trusheim served as chairman of the board of directors and chief executive officer of General American Life Insurance Company.

Alan C. Henderson, 57, has been our president and chief executive officer and a director since 1998. Prior to becoming president and chief executive officer, Mr. Henderson was our executive vice president, chief financial officer and secretary from 1991 to May 1998. Mr. Henderson also serves as a director of General American Capital Corp., Angelica Corporation and Reinsurance Group of America, Inc.

William G. Anderson, CPA, 70, has been a director since 1991. Prior to his retirement, Mr. Anderson served as vice chairman of Ernst & Young, a public accounting firm.

Colleen Conway-Welch, Ph.D., R.N., 58, has been a director since September 2000. Dr. Conway-Welch serves as the dean and a professor at Vanderbilt University’s School of Nursing,

4

where she has been employed since 1984. Dr. Conway-Welch also serves on the board of directors of Pinnacle Bank in Nashville, Tennessee, Nurses for Newborns of Tennessee, Ardent Health Services and Caremark RX, Inc.

John H. Short, Ph.D., 58, has been a director since 1991. Dr. Short also serves as managing partner of Phase 2 Consulting, a healthcare consulting business.

Theodore M. Wight, 60, has been a director since 1991. Mr. Wight serves as a general partner of the general partners of Walden Investors, a venture capital business, and Pacific Northwest Partners SBIC, L.P., a venture capital business, and also serves as a director of various privately-held companies.

BOARD OF DIRECTORS AND COMMITTEES

During the year ended December 31, 2002, our board of directors met seven times. Each director attended not less than 75% of the meetings of our board of directors and committees of which such director was a member during 2002. Our board of directors has standing Audit, Compensation and Nominating and Compliance Committees. Each of the committees of our board of directors is comprised of independent non-employee directors.

Mr. Anderson and Drs. Short and Conway-Welch comprise the Audit Committee. The Audit Committee met five times during 2002. The duties of the Audit Committee include:

- selecting our independent auditors and negotiating the scope and cost of the audit and other services rendered to us by such auditors,

- meeting periodically with our independent auditors and management to review the work of each and to ensure that each is properly discharging its responsibilities, and

- reviewing our accounting policies and internal controls to determine whether our policies and controls are adequate and are being followed.

Our board of directors has historically maintained a Nominating Committee and a separate Compensation Committee. In August 2002, our board of directors combined the two committees into a single Compensation and Nominating Committee. The members of the Compensation and Nominating Committee are Messrs. Ragsdale, Trusheim and Wight. The combined Compensation and Nominating Committee met one time during 2002. The duties of the new Compensation and Nominating Committee are the same as the duties that were performed by the separate committees. They include:

- reviewing and recommending to our board of directors the salaries of all our executive officers and authorizing all other forms of executive compensation,

- administering all aspects of our stock-based incentive plans,

- recommending to our board of directors nominees for directors, nominees for members of all committees of our board and candidates for appointment as executive officers, and

- considering nominees for directors recommended by our stockholders.

5

Prior to the combination, the Compensation Committee met separately three times during 2002. Its members were Messrs. Trusheim, Ragsdale and Wight. The Nominating Committee, which prior to the combination met separately one time during 2002, had Messrs. Ragsdale, Wight and Henderson as its members.

The Compliance Committee members are Mr. Ragsdale and Drs. Short and Conway-Welch. The Compliance Committee oversees the implementation and operation of our ongoing regulatory compliance program, including the enforcement of appropriate disciplinary mechanisms to ensure that all reasonable steps are taken to respond to a regulatory offense and to prevent future offenses of a similar kind. The Compliance Committee met four times during 2002.

DIRECTORS’ FEES

Directors who are not also our employees were paid $4,000 for each meeting of our board of directors that he or she attended in person on or before August 2002. Commencing in August 2002, meeting fees for our non-employee directors were increased to $5,000 for each meeting attended. In addition, our non-employee directors are paid $2,500 for attending the meeting at which our annual budget is presented. We also reimburse our directors for expenses incurred in connection with their attendance at board meetings.

Each of the non-employee directors also receive annual stock option grants under our 1994 Directors’ Stock Option Plan and/or 1999 Non-Employee Director Stock Plan. In January 2002, we granted options to acquire 7,000 shares of our common stock at an exercise price of $25.09 per share, the fair market value of our common stock on the date of grant, to each of our non-employee directors. In addition, in March 2002, we granted an option to acquire 2,200 shares of our common stock at an exercise price of $22.63 per share, the fair market value of our common stock on the date of grant, to Mr. Trusheim for his services as chairman of the board.

REPORT OF COMPENSATION AND NOMINATING COMMITTEE

REGARDING EXECUTIVE COMPENSATION

General

The Compensation and Nominating Committee of our board of directors administers our executive compensation program. During the year ended December 31, 2002, the committee was composed of three non-employee directors, Messrs. Ragsdale (chairman), Trusheim and Wight.

Our executive compensation policy is designed and administered to provide a competitive compensation program that enables us to attract, motivate, reward and retain executives who have the skills, education, experience and capabilities required to discharge their duties in a competent and efficient manner. We base our compensation policy on the principle that the financial rewards to the executive are aligned with the financial interests of our stockholders. We believe that through this principle we will meet our ultimate responsibility to our stockholders by striving to give a suitable long-term return on their investment through earnings from operations and prudent management of our business and operations.

Our executive compensation strategy consists of three separate elements, including base salary, annual incentive compensation and long-term incentive compensation. The following is a summary of the policies underlying each element.

6

Base Salary

The Compensation and Nominating Committee determined the salary ranges for each of our executive officer positions based upon the level and scope of the responsibilities of the office, the pay levels of similarly positioned executive officers among companies competing for the services of these types of executives and a consideration of the level of experience and performance profile of the particular executive officer. In considering the competitors in the market, we emphasize privately-held and publicly-traded healthcare outsourcing companies with similar revenue, earnings and market capitalization profiles to us.

The committee’s recent practice has been to establish a range of base salaries for particular executive officers within the range offered by the comparison group of companies so as to be able to attract and retain high quality people. The data utilized in determining such ranges is compiled from publicly available information for the comparison group of companies and from various salary surveys that are made available to the public by trade and industry associations, accounting firms, compensation consultants and professional groups.

Salary increases for each of the executive officers are considered annually by the committee and are based upon individual performance evaluations conducted by the committee. In the case of all executive officers other than Mr. Henderson, the committee also receives and considers the recommendations of the chief executive officer.

On the basis of the committee’s 2002 review of our executive officers, the committee increased the salary of Mr. Henderson by 4.5% and the salaries of Messrs. Bellomy and Davis and Ms. Henry by between 2.1% and 5%. Mr. Douthitt received an increase of approximately 37.5% in recognition of his increased responsibilities and duties during the year.

Annual Incentive Compensation

For services rendered during the year ended December 31, 2002, certain of our executive officers received cash bonuses based on performance-based criteria. Mr. Henderson has a performance-based annual cash bonus compensation component set forth in his employment agreement with us. Under the contractual provisions, the cash bonus for Mr. Henderson is determined by the achievement of certain year-over-year growth targets in our earnings per share (excluding extraordinary items). Mr. Henderson receives a cash bonus only if we have at least a 9% increase in earnings per share from the previous year. Mr. Henderson can earn between 0% and 100% of his annual salary, with the maximum bonus being achieved for a 31% annual year-to-year increase in earnings per share. For the year ended December 31, 2002, Mr. Henderson received a performance-based cash bonus of $178,581.

Messrs. Bellomy and Davis and Ms. Henry received performance-based cash bonuses based upon a formula approved by the committee annually. The bonus for each of these officers is computed based upon the achievement of year-to-year growth in operating earnings and revenue by the particular officer’s division and in earnings per share by the whole company. Each of the criteria is assigned a specific weighting for purposes of the bonus computation. For 2002, the following cash bonuses were paid under the formula: Mr. Bellomy, $19,719, Mr. Davis, $54,251 and Ms. Henry, $107,008. Mr. Douthitt was not part of the performance-based bonus plan for 2002 and was paid a discretionary bonus of $100,000 for the year in recognition of his increased responsibilities as interim chief financial officer along with his existing role as chief accounting officer.

7

Long-Term Incentive Compensation

The committee believes that long-term incentive compensation is the most direct way of tying the executive compensation to increases in stockholder value. Our long-term incentive programs are stock-based, thereby providing executive officers with an incentive to continue high quality performance with us over a long period of time while building a meaningful investment in common stock.

Under the plans, we grant our executive officers and other eligible employees options to purchase shares of our common stock from time to time based upon their respective levels of duties. Our board of directors, upon the recommendation of the committee, has given the chief executive officer the authority to grant newly hired employees options to purchase up to 10,000 shares of our common stock. Each option has an exercise price equal to the fair market value of common stock on the date of grant and has a term of 10 years.

The committee periodically evaluates the level of long-term incentives provided to each of our executive officers and each officer’s relative contributions to corporate performance. Based on such evaluation, during the year ended December 31, 2002, the committee approved grants of additional options to certain executive officers in recognition of their increases in authority, responsibility and contributions toward improvements in our operating performance. During the year ended December 31, 2002, Mr. Henderson received no option grants and Messrs. Bellomy, Davis and Douthitt and Ms. Henry received option grants of 30,000, 20,000, 20,000 and 60,000 shares, respectively.

The committee believes that the long-term incentive program gives the participating officers a meaningful opportunity for equity appreciation incentives from the stock-based grants.

Compensation of Chief Executive Officer

Mr. Henderson’s base salary, annual incentive compensation and long-term incentive compensation are determined by the committee in the same manner as is used by the committee for executive officers generally as well as by reference to Mr. Henderson’s employment agreement with us. The total compensation package of Mr. Henderson is designed to be competitive within the industry while creating awards for short- and long-term performance in line with the financial interests of the stockholders. A substantial portion of Mr. Henderson’s cash compensation for the year is incentive-based and is therefore at risk to the extent that we do not meet or exceed the pre-established growth objectives included in his employment agreement.

COMPENSATION AND NOMINATING COMMITTEE OF THE BOARD OF DIRECTORS

H. EDWIN TRUSHEIM RICHARD E. RAGSDALE THEODORE M. WIGHT

8

COMPENSATION OF EXECUTIVE OFFICERS

Summary Compensation Table

For the years ended December 31, 2002, 2001 and 2000, the following table presents summary information concerning compensation awarded, paid to or earned by our chief executive officer and each of our other four most highly compensated executive officers for the year ended December 31, 2002 for services rendered to us.

| | Annual Compensation | Long Term

Compensation |

|---|

| Name and Principal Position | Year | | Salary ($) | Bonus ($) | Securities Underlying

Options (#) | All Other

Compensation ($)(1) |

|---|

| Alan C. Henderson | | 2002 | | 455,837 | | 178,581 | | — | | 4,000 | |

| President and Chief | | 2001 | | 431,680 | | — | | 200,000 | | 3,400 | |

| Executive Officer | | 2000 | | 394,593 | | 400,000 | | — | | 3,400 | |

|

| |

| Gregory F. Bellomy | | 2002 | | 262,917 | | 19,719 | | 30,000 | | 3,000 | |

| President, StarMed Staffing | | 2001 | | 211,478 | | 137,461 | | 55,000 | | 3,400 | |

| | | 2000 | | 198,749 | | 169,150 | | 10,000 | | 3,400 | |

|

| |

| Tom E. Davis | | 2002 | | 238,958 | | 54,251 | | 20,000 | | 4,000 | |

| President, Hospital Rehabilitation | | 2001 | | 230,833 | | 41,781 | | — | | 3,400 | |

| Services | | 2000 | | 211,875 | | 173,290 | | 15,000 | | 3,400 | |

|

| |

| Patricia M. Henry | | 2002 | | 207,917 | | 107,008 | | 60,000 | | 4,000 | |

| President, Contract Therapy(2) | | 2001 | | 155,682 | | 90,000 | | — | | 3,400 | |

| | | 2000 | | 146,517 | | 23,640 | | 8,000 | | 3,400 | |

|

| |

| James M. Douthitt | | 2002 | | 187,500 | | 100,000 | | 20,000 | | 4,000 | |

| Senior Vice President, | | 2001 | | 153,750 | | 65,000 | | — | | 3,400 | |

| Chief Accounting Officer | | 2000 | | 132,438 | | 30,000 | | 15,000 | | 3,400 | |

| and Treasurer(3) | | | | | | | | | | | |

| (1) | Except as otherwise indicated, totals include amounts contributed by us pursuant to the matching portion of our 401(k) plan. |

| (2) | Ms. Henry became one of our executive officers in November 2001. Prior to November 2001, Ms. Henry served as Senior Vice President of Operations of our contract therapy division. |

| (3) | Mr. Douthitt became one of our executive officers in July 2000. Prior to July 2000, Mr. Douthitt served as Vice President of Finance of our healthcare staffing division. |

Employment, Termination of Employment and Change of Control Arrangements

We currently have an employment agreement with Alan C. Henderson. Mr. Henderson’s employment agreement automatically renews for successive one-year terms unless terminated by either party. The employment agreement contains Mr. Henderson’s annual cash bonuses formula as described earlier in the “Report of Compensation and Nominating Committee Regarding Executive Compensation.” The agreement also provides for a payment of one year of salary and a pro rated bonus through the date of termination if we terminate Mr. Henderson’s employment involuntarily. The agreement also contains a one-year covenant not to compete after termination.

Mr. Henderson also has a separate termination compensation agreement with us that will pay him benefits upon certain terminations of his employment within the first three years after a change in control transaction. Under this agreement, Mr. Henderson will be entitled to receive a lump-sum cash payment equal to 2.99 times his average annual compensation for the five years prior to the year of termination plus a continuation of certain health and welfare benefits for up to one year after termination.

9

The agreement is subject to automatic extension each year for an additional year unless either party gives the required notice of non-extension.

Messrs. Bellomy and Davis and Ms. Henry have separate termination compensation agreements as well. Each of these agreements generally provides the named executive with benefits upon termination of his or her employment without cause prior to a change in control transaction equal to his or her then-current salary and bonus for the 12 months following termination. If the executive officer’s employment is terminated within three years after a change in control transaction without cause or for good reason, he or she will be entitled to a lump-sum cash payment equal to 1.5 times his or her annual compensation, including a bonus based upon his or her five-year average bonus percentage. In each case, the terminated officer will also be entitled to the continuation of his or her health and welfare benefits for up to one year after the date of termination and the vesting of all stock-based awards that would have become exercisable within six months of the termination date.

If the value of the cash payments and the continuation or acceleration of benefits upon termination under any of the termination compensation agreements would subject the executive officer to the payment of a federal excise tax as “excess parachute payments,” we will be required to make an additional “gross-up” payment to cover the additional taxes owed by the officer.

A change in control transaction is generally:

- an acquisition by any one person or group of 25% or more of our outstanding common stock (20% or more under Mr. Henderson's agreement);

- the replacement of the majority of our directors;

- stockholder approval of a reorganization, merger or consolidation that changes the stock ownership or the board; or

- approval by the stockholders of a complete liquidation or dissolution of us or the sale of substantially all of our assets.

“Cause” generally means the executive officer’s failure to substantially perform his or her assigned duties or willful misconduct materially injurious to us. “Good reason” generally means the assignment of the executive officer to lesser duties, a reduction in or cancellation of his or her salary, bonus, compensation or other benefit plans, his or her relocation to a new metropolitan area, or any breach of the agreement by us.

10

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth information with respect to the exercise of stock options by the executive officers named in the Summary Compensation Table during the year ended December 31, 2002, and the number of exercisable and unexercisable stock options at December 31, 2002, as well as the value of such stock options having an exercise price lower than the last reported trading price on December 31, 2002 (“in-the-money” options) held by the executive officers named in the Summary Compensation Table.

| Name | Shares

Acquired

on

Exercise

(#) | Value

Realized ($) | Number of Securities

Underlying

Unexercised

Options at Fiscal

Year-End(#)

Exercisable/

Unexercisable | | Value of

Unexercised

In-the-Money

Options at Fiscal

Year-End ($)(1)

Exercisable/

Unexercisable |

|---|

| | |

| Alan C. Henderson | | 11,944 | | $148,910 | | 433,908/ | 185,000 | | $4,433,941/ | $147,919 | |

| |

| Gregory F. Bellomy | | — | | — | | 68,750/ | 76,250 | | 547,750/ | — | |

| |

| Tom E. Davis | | — | | — | | 123,354/ | 37,500 | | 1,163,426/ | 98,613 | |

| |

| Patricia M. Henry | | — | | — | | 23,500/ | 65,500 | | 243,389/ | 14,792 | |

| |

| James M. Douthitt | | — | | — | | 18,000/ | 29,000 | | 123,231/ | 14,792 | |

| (1) | Based on a price per share of $19.08, the last reported sale price of our common stock on December 31, 2002. |

11

Option Grants In Last Year

The following table sets forth information concerning stock option grants made in the year ended December 31, 2002, to the executive officers named in the Summary Compensation Table.

| | Individual Grant | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term(3) |

|---|

| Name | Number of

Securities

Underlying

Options

Granted (#)(1) | Percent of

Total Options

Granted to

Employees in

Fiscal

Year (%) | Exercise or

Base Price

($/Sh) | Expiration

Date(2) | | 5% ($) | | 10% ($) |

|---|

| Alan C. Henderson | | — | | | — | | | — | | — | | — | | — | |

| Gregory F. Bellomy | | 30,000 | | 4 | .87% | | $22 | .15 | | 8/28/2012 | | $1,082,400 | | $1,723,542 | |

| Tom E. Davis | | 20,000 | | 3 | .25 | | 22 | .15 | | 8/28/2012 | | 721,600 | | 1,149,028 | |

| Patricia M. Henry | | 60,000 | | 9 | .75 | | 22 | .63 | | 3/6/2012 | | 2,211,713 | | 3,521,784 | |

| James M. Douthitt | | 20,000 | | 3 | .25 | | 22 | .15 | | 8/28/2012 | | 721,600 | | 1,149,028 | |

| (1) | The option becomes exercisable with respect to 25%, 50%, 75% and 100% of the total number of shares subject to the option on each of the first, second, third and fourth anniversaries, respectively, of the date of award. |

| (2) | The options terminate on the earlier of ten years after grant; three months after termination of employment, except in the case of retirement, death or total disability; or 24 months after termination of employment in the case of retirement, death or total disability. |

| (3) | The indicated 5% and 10% rates of appreciation are provided to comply with Securities and Exchange Commission regulations and do not necessarily reflect our views as to the likely trend in our common stock price. Actual gains, if any, on stock option exercises and common stock holdings will be dependent on, among other things, the future performance of our common stock and overall market conditions. There can be no assurance that the amounts reflected above will be achieved. Additionally, these values do not take into consideration the provisions of the options providing for nontransferability or delayed exercisability. |

REPORT OF THE AUDIT COMMITTEE

The Audit Committee oversees our financial reporting process on behalf of our board of directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. The committee operates pursuant to a written charter, which was approved and adopted by our board of directors on May 10, 2000. Our board of directors has determined that each of the members of the committee are independent within the meaning of the listing standards of the New York Stock Exchange. Our independent auditors, KPMG LLP, are responsible for expressing an opinion on the conformity of our audited financial statements to generally accepted accounting principles.

In fulfilling its oversight responsibilities, the committee reviewed the audited financial statements in our Annual Report on Form 10-K with management. In connection with its review of the financial statements, the committee discussed with management the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The committee meets with the independent auditors, with and without management present, to discuss the scope and plans for the audit, results of their examinations, their evaluations of our internal controls and the overall quality of our financial reporting. The committee reviewed with the

12

independent auditors the acceptability of our accounting principles and such other matters as are required to be discussed with the committee under generally accepted auditing standards, including, but not limited to, those matters under SAS 61 (Codification of Statements on Auditing Standards). The committee has received from the independent auditors the written disclosure and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). In connection with this disclosure, the committee has discussed with the independent auditors the auditors’ independence from management and us.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to our board of directors that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2002, for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

WILLIAM G. ANDERSON, CPA COLLEEN CONWAY-WELCH, PH.D., R.N. JOHN H. SHORT, PH.D.

13

STOCKHOLDER RETURN PERFORMANCE GRAPH

The following graph compares the cumulative stockholder returns, assuming the reinvestment of dividends, of our common stock on an indexed basis with the New York Stock Exchange (“NYSE”) Market Index and the Dow Jones Industry Group-Index of Health-Care Providers (“HEA”) for the period beginning December 31, 1997 and ending December 31, 2002:

Comparison of Five-Year Cumulative Total Return Among RehabCare Group, Inc.,

NYSE Market Index and HEA Index

Assumes $100 invested on December 31, 1997 in

RehabCare Group, Inc. common stock,

the HEA Index and the NYSE Market Index

| | Dec. 31, 1997 | Dec. 31, 1998 | Dec. 31, 1999 | Dec. 31, 2000 | Dec. 31, 2001 | Dec. 31, 2002 |

| RehabCare Group, Inc. | | 100 | | 70 | .52 | 80 | .19 | 387 | .74 | 223 | .40 | 144 | .00 |

| HEA Index | | 100 | | 93 | .55 | 81 | .43 | 141 | .22 | 133 | .97 | 120 | .22 |

| NYSE Market Index | | 100 | | 118 | .99 | 130 | .30 | 133 | .40 | 121 | .52 | 99 | .27 |

14

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires that our executive officers and directors, and persons who own more than 10% of our outstanding stock, file reports of ownership and changes in ownership with the Securities and Exchange Commission. Based solely on a review of the reports furnished to us and written representations from our directors and executive officers, we believe that our directors and executive officers complied with all applicable Section 16(a) filing requirements during the year ended December 31, 2002, with the exception of several small transactions totaling 187 shares in the aggregate by Ms. Henry in her 401(k) plan account. All of Ms. Henry’s 401(k) transactions were reported to the SEC on a Form 5 filed February 12, 2003. Ms. Henry is no longer purchasing shares of our common stock in her 401(k) plan account.

INDEPENDENT AUDITORS

Our board of directors has appointed KPMG LLP as our independent auditors for the year ending December 31, 2003. A representative of KPMG LLP is expected to be present at the annual meeting to respond to appropriate questions from our stockholders and to make statements to the stockholders if he or she so desires.

Audit Fees.We paid KPMG LLP $297,000 for the audit and review of our financial statements included in our Forms 10-K and 10-Qs during the year ended December 31, 2002.

Financial Information Systems Design and Implementation Fees.We did not pay any fees to KPMG LLP during the year ended December 31, 2002, for services relating to financial information system design or implementation.

All Other Fees.We paid KPMG LLP $1,036,307 for all other services during the year ended December 31, 2002, of which $38,943 were audit-related and $997,364 were for non-audit services. Audit-related services consisted primarily of an audit of the employee benefit plan and audit procedures requested by management at a specific branch location. Non-audit services consisted primarily of tax compliance services, assistance provided to manage the implementation of a new payroll system and the development of a charter with respect to the Health Insurance Portability and Accountability Act.

Prior to retaining KPMG LLP to provide any non-audit services, the Audit Committee considered whether KPMG LLP’s provision of all these services was compatible with maintaining the independence of KPMG LLP and determined that the provision of these services would not interfere with KPMG LLP’s independence.

15

PROPOSALS OF STOCKHOLDERS

Proposals of stockholders and nominations for directors intended to be presented at the 2004 annual meeting of stockholders must be received by our corporate secretary, 7733 Forsyth Boulevard, 17th Floor, St. Louis, Missouri 63105, by not later than November 27, 2003, for consideration for inclusion in the proxy statement and proxy card for that meeting. Upon receipt of any such proposal, we will determine whether or not to include such proposal in the proxy statement and proxy card in accordance with regulations governing the solicitation of proxies. Stockholder proposals and nominations for directors that do not appear in the proxy statement may be considered at the 2004 annual meeting of stockholders only if written notice of the proposal is received by us by not earlier than January 30, 2004 and not later than March 1, 2004.

ANNUAL REPORT

We simultaneously mailed our annual report for the year ended December 31, 2002, to our stockholders.

A copy of our Annual Report on Form 10-K for the year ended December 31, 2002, as filed with the Securities and Exchange Commission (excluding exhibits), may be obtained by any stockholder, without charge, upon making a written or telephone request to Betty Cammarata, Investor Relations, 7733 Forsyth Boulevard, 17th Floor, St. Louis, Missouri 63105, telephone (314) 863-7422.

OTHER MATTERS

As of the date of this proxy statement, our board of directors does not intend to present, nor has it been informed that other persons intend to present, any matters for action at the annual meeting other than those specifically referred to herein. If, however, any other matters should properly come before the annual meeting, it is the intention of the persons named as proxies to vote the shares represented by proxy cards granting such proxies discretionary authority to vote on such other matters in accordance with their judgment as to our best interest on such matters.

| | Vincent L. Germanese

Senior Vice President, Chief Financial Officer and

Secretary |

March 26, 2003

16