| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-02608) |

| | |

| Exact name of registrant as specified in charter: | Putnam Money Market Fund |

| | |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

One Post Office Square

Boston, Massachusetts 02109 |

| | |

| Copy to: | John W. Gerstmayr, Esq.

Ropes & Gray LLP

800 Boylston Street

Boston, Massachusetts 02199-3600 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | September 30, 2012 |

| | |

| Date of reporting period: | October 1, 2011 — September 30, 2012 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam

Money Market

Fund

Annual report

9 | 30 | 12

| | | |

| Message from the Trustees | 1 | | |

| | |

| About the fund | 2 | | |

| | |

| Performance snapshot | 4 | | |

| | |

| Interview with your fund’s portfolio managers | 5 | | |

| | |

| Your fund’s performance | 10 | | |

| | |

| Your fund’s expenses | 11 | | |

| | |

| Terms and definitions | 13 | | |

| | |

| Other information for shareholders | 14 | | |

| | |

| Trustee approval of management contract | 15 | | |

| | |

| Financial statements | 20 | | |

| | |

| Federal tax information | 41 | | |

| | |

| About the Trustees | 42 | | |

| | |

| Officers | 44 | | |

| | |

Consider these risks before investing: Money market funds are not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other governmental agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in this fund.

Message from the Trustees

Dear Fellow Shareholder:

Coordinated action by central banks on both sides of the Atlantic helped lift both equity and fixed-income markets this year. Global markets continue to show signs of vulnerability, however, with investors growing more concerned about economic slowdowns in the United States, Europe, and emerging markets, particularly China. The outcome of the U.S. presidential election and the impending “fiscal cliff” are additional sources of potential volatility.

Putnam’s veteran investment team relies on fundamental research and experienced judgment to seek opportunities and manage risk in this environment. In the same way, it is prudent for long-term investors to rely on the expertise of a trusted financial advisor, who can help you work toward your financial goals.

We would like to take this opportunity to announce the arrival of two new Trustees, Liaquat Ahamed and Katinka Domotorffy, CFA, to your fund’s Board of Trustees. Mr. Ahamed, who in 2010 won the Pulitzer Prize for History with his book, Lords of Finance: The Bankers Who Broke the World, also serves on the Board of Aspen Insurance and the Board of the Rohatyn Group, an emerging-market fund complex that manages money for institutional investors.

Ms. Domotorffy, who until year-end 2011 was a Partner, Chief Investment Officer, and Global Head of Quantitative Investment Strategies at Goldman Sachs Asset Management, currently serves as a member of the Anne Ray Charitable Trust’s Investment Committee, Margaret A. Cargill Philanthropies, and director for Reach Out and Read of Greater New York, an organization dedicated to promoting early childhood literacy.

We would also like to extend a welcome to new shareholders of the fund and to thank all of our investors for your continued confidence in Putnam.

About the fund

Seeking to offer accessibility and current income with relatively low risk

For most people, keeping part of their savings in an easily accessible place is an essential part of an investment plan. Putnam Money Market Fund can play a valuable role in many investors’ portfolios because it seeks to provide stability of principal and liquidity to meet short-term needs. In addition, the fund aims to provide investors with current income at short-term rates.

Because it invests in high-quality short-term money market instruments, the fund’s risk of losing principal may be lower than that of other funds. It typically invests in securities that are rated in the highest or second-highest category of at least one nationally recognized rating service. The fund seeks as high a rate of current income as Putnam Management believes is consistent with preservation of capital and maintenance of liquidity. Money market fund yields typically rise and fall along with short-term interest rates. Money market funds may not track rates exactly, however, as securities in these funds mature and are replaced with newer instruments earning the most current interest rates.

Whether you want to earmark money for near-term expenses or future investment opportunities, or just stow away cash for an unforeseen “rainy day,” this fund can be an appropriate choice.

Types of money market securities

Money market securities are issued by governments, government agencies, financial institutions, and established non-financial companies. Securities your fund invests in include:

Commercial paper Short-term unsecured loans issued by large corporations, typically for financing accounts receivable and inventories

Bank certificates of deposit Direct obligations of the issuing commercial bank or savings and loan association

Repurchase agreements (repos) Contracts in which one party sells a security to another party and agrees to buy it back later at a specified price; acts in economic terms as a secured loan

Government securities Direct short-term obligations of governments or government agencies; for example, U.S. Treasury bills

Variable-rate demand notes (VRDNs) Floating-rate securities with a long-term maturity, usually 20 or 30 years, that carry a coupon that resets every one or seven days, making them eligible for purchase by money market mutual funds

| | |

| 2 | Money Market Fund | Money Market Fund | 3 |

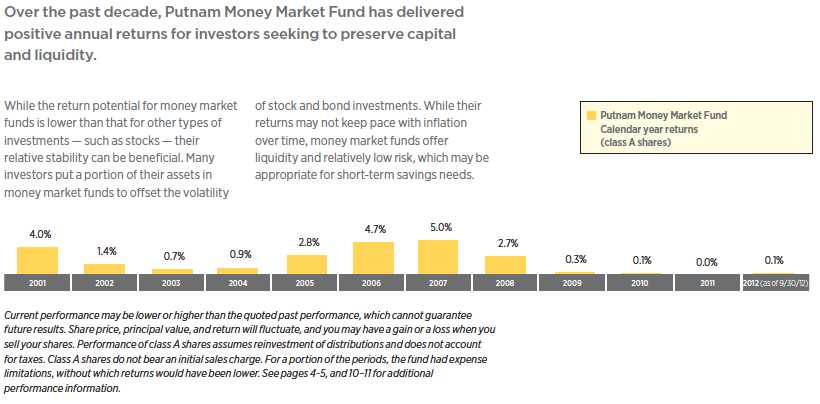

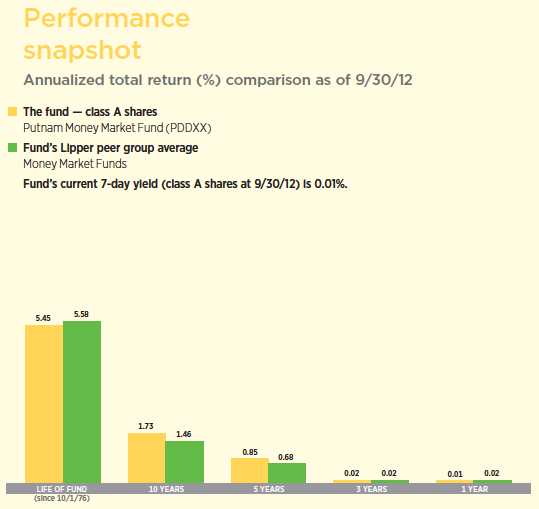

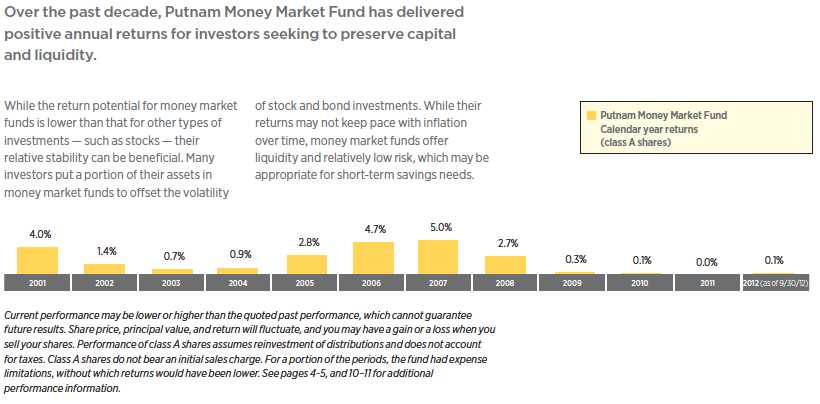

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Class A shares do not bear an initial sales charge. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. Yield reflects current performance more closely than total return. Due to market volatility, current performance may be higher or lower than performance shown. See pages 2–3, 5, and 10–11 for additional performance information. To obtain the most recent month-end performance, visit putnam.com.

Interview with your fund’s portfolio managers

How would you characterize the market environment for the 12 months ended September 30, 2012?

Joanne: The period was marked by great volatility, driven in large measure by macroeconomic events that created a “risk-on” or “risk-off” investor psychology. Consequently, asset classes moved in and out of favor, depending on market conditions. During periods of improving investor confidence, riskier asset classes, such as lower-quality and economically sensitive assets, rallied. When uncertainty was high, the more resilient lower-risk asset classes outperformed, including defensive stocks and U.S. Treasuries.

How did money market funds fare amid this volatility?

Jonathan: During the period, there was limited volatility in money market sectors, as the Federal Reserve’s efforts to keep short-term rates low kept money market rates steady. Total assets of money market funds, as measured by Crane Data, fell by little more than one percent, which is quite remarkable given the historically low rates offered by these relatively safe, low-risk investments.

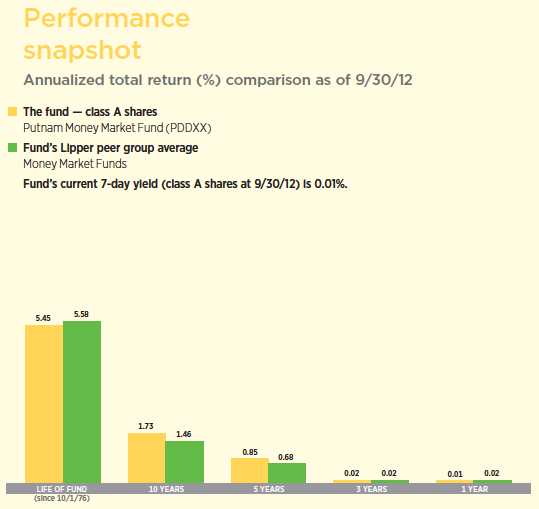

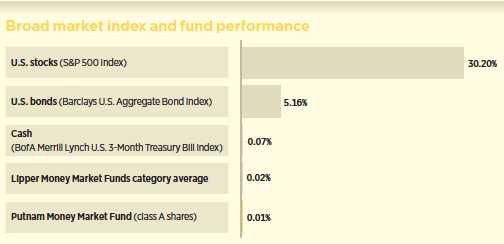

For the 12 months ended September 30, 2012, Putnam Money Market Fund delivered performance that was in line with the interest-rate environment and the average return for its Lipper peer group. At period-end, the fund’s

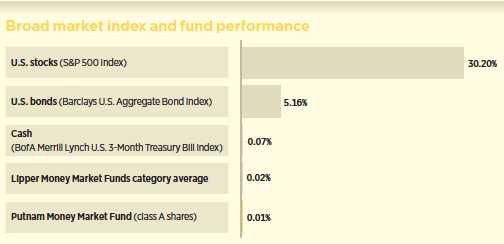

This comparison shows your fund’s performance in the context of broad market indexes for the 12 months ended 9/30/12. See pages 2–4 and 10–11 for additional fund performance information. Index descriptions can be found on pages 13–14.

weighted average days to maturity stood at 44 days.

What were the major issues facing money market investors?

Joanne: Low interest rates, the eurozone debt crisis, and discussions about additional reforms for money market funds preoccupied investors during the reporting period.

In the closing weeks of the period, the Federal Reserve announced its third round of quantitative easing, dubbed “QE3,” which is designed to lower borrowing costs and encourage consumption. Fed Chairman Ben Bernanke said that the stimulus would continue until the central bank saw “sustained improvement” in the labor market. The Fed also pledged to keep interest rates at their historic lows through 2015 given their outlook for U.S. growth. Persistently low rates offer little opportunity for income investors. However, money market funds have proven resilient over the past several years and, we believe, remain a relatively stable and liquid investment alternative with nearly $2.5 trillion in assets as of September 30, 2012.

Concerns over economic issues in Europe also weighed on investors. Toward the end of July, European Central Bank [ECB] President Mario Draghi pledged that the ECB would do “whatever it takes” to preserve the 17-nation eurozone. In September, the ECB unveiled its unlimited bond-buying program known as the European Stability Mechanism, which was quickly approved by the German parliament. The latest measures adopted by the ECB to support peripheral bond markets are a major step forward and come after significant progress was made on common banking supervision. While the economic difficulties are far from over, the ECB has, in our view, achieved its objective of reducing the probability of the collapse of the eurozone. The trajectory from here is not likely to be smooth, given the nature of political processes in Europe. Setbacks cannot be ruled out, but we do believe the worst of the crisis is now behind us.

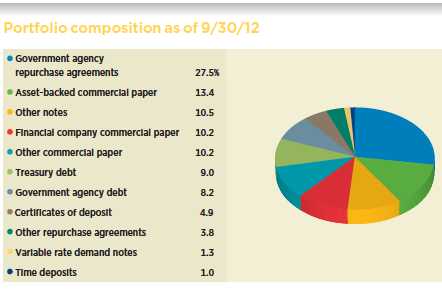

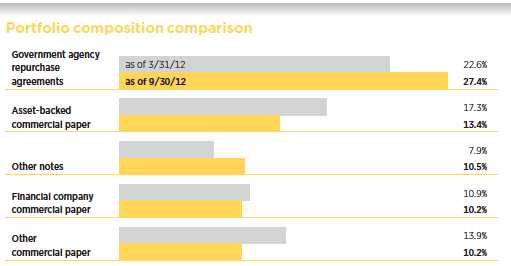

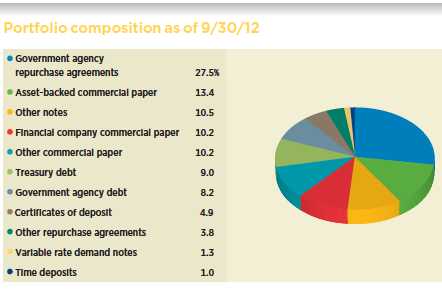

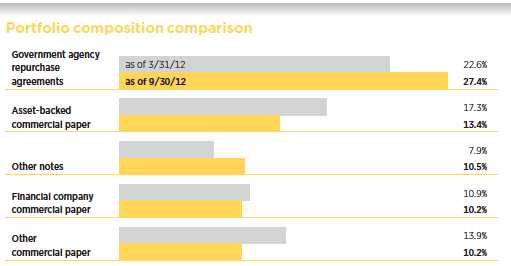

Allocations are represented as a percentage of portfolio value. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings and allocations may vary over time.

Finally, there was increased discussion about the Securities and Exchange Commission [SEC] proposing additional regulations to reduce the susceptibility of money market funds to liquidity runs. These new proposals included requirements for capital buffers, redemption restrictions, and possibly variable-rate net asset values. Following heavy industry lobbying, SEC Chairman Mary Schapiro abandoned her plan to tighten rules for the industry in August because three out of the SEC’s five members told her they wouldn’t vote for her proposal. Changes to money market funds are not off the table, however, as the Financial Stability Oversight Council has urged the SEC to consider proposing new rules for money market funds to get around the SEC impasse. This is something that we will closely monitor in the coming months.

How have the central banks’ accommodative policies affected your strategy to find income?

Jonathan: The Fed’s multi-year accommodative policies and the ECB’s massive Long-Term Refinancing Operation have added much-needed liquidity to the global banking system — easing market fears — but short-term rates remain close to zero. Despite this challenge, we have found investments further out on the money market yield curve, which has allowed us to extend maturities in the portfolio to lock in attractive rates for longer periods of time.

The fund’s overall strategy remains focused on pursuing stability and liquidity by investing in commercial paper, repurchase agreements, and U.S. Treasury securities. With the credit

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of portfolio value. Current summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings will vary over time.

picture improving for several issuers, we felt comfortable selectively adding to the fund’s credit exposure by investing in corporate notes issued in Canada, Australia, and the more economically viable Nordic countries in northern Europe. In addition, we increased the fund’s exposure to repurchase agreements collateralized by U.S. government agency mortgage-backed securities. Repurchase agreements typically are executed with high-quality counterparties and are collateralized by agency mortgage-backed securities and investment-grade corporate bonds. These securities offered higher yields during the period due to increased supply and the Fed’s Operation Twist, a large-scale fixed-income asset purchase program designed to keep downward pressure on longer-term interest rates to provide economic stimulus. As always, we remained diligent in our fundamental credit research process to avoid exposure to securities that might pose a risk to the fund.

Which fund holdings exemplified your strategy during the period?

Joanne: We think that the underlying bank fundamentals continue to improve, and have invested in large, creditworthy banks, such as Wells Fargo & Co., Royal Bank of Canada, and Australia & New Zealand Banking Group. Asset-quality measures are showing improving trends. Profits are being retained and are helping to build capital. In our opinion, these positive developments are somewhat offset by the banks’ underlying revenue weakness with soft loan demand, pressured interest margins, lower capital markets volume, and ongoing regulatory pressure on fee business. Given the ongoing sovereign debt stress in Europe, we have limited the fund’s exposure to these markets.

What do you see on the horizon that could influence your management of the fund?

Jonathan: Generally speaking, the major macro risks — the pace of economic growth in the United States and China and the restructuring of European sovereign debt — have diminished, but they still require close monitoring since they have implications for the direction of interest rates. Political gridlock in the United States and the potential for a destabilizing “fiscal cliff” on January 1, 2013, is a growing concern, as the across-the-board cuts to the budget may have repercussions for U.S. growth, which is far from robust. And while the SEC’s proposed structural reforms of money markets didn’t gain enough support to pass, we fully expect the debate to continue, and will be actively monitoring the impact of changes on our shareholders.

With so many crosscurrents, we expect the financial markets to remain volatile and headline-driven as investors digest developments relating to the uncertainty of the global economic recovery. We will continue to maintain the fund’s conservative positioning — focusing on safety and liquidity — while looking for attractive income further out on the money market yield curve.

Thank you, Joanne and Jonathan, for bringing us up to date.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Portfolio Manager Joanne M. Driscoll has an M.B.A. from the Northeastern College of Business Administration and a B.S. from Westfield State College. A CFA charterholder, Joanne joined Putnam in 1995 and has been in the investment industry since 1992.

Portfolio Manager Jonathan M. Topper has a B.A. from Northeastern University. He has been in the investment industry since he joined Putnam in 1990.

IN THE NEWS

Global economic growth is losing steam, according to the International Monetary Fund (IMF), with the majority of the world’s advanced economies expected to contract in 2012, or expand at anemic rates of less than 2%. Several issues are challenging economic growth, including Europe’s sovereign debt troubles, the impending “fiscal cliff” in the United States, and high unemployment in various economies. Unless leaders take meaningful steps to address these issues, the current global economic expansion may slow to the weakest level since 2009’s Great Recession. These issues are weighing increasingly on the global economy. In July, the IMF predicted that global growth would be 3.5% in 2012, rising to 3.9% in 2013, but now, in its recently released World Economic Outlook, the IMF has revised its growth forecasts downwards, to growth of just 3.3% this year, and 3.6% in 2013.

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended September 30, 2012, the end of its most recent fiscal year. In accordance with regulatory requirements for mutual funds, we also include expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 9/30/12

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class T |

| (inception dates) | (10/1/76) | (4/27/92) | (2/1/99) | (12/8/94) | (1/21/03) | (12/31/01) |

|

| | Net | | | | | Net | Net | Net |

| | asset | Before | After | Before | After | asset | asset | asset |

| | value | CDSC | CDSC | CDSC | CDSC | value | value | value |

|

| Annual average (life of fund) | 5.45% | 4.98% | 4.98% | 4.98% | 4.98% | 5.31% | 4.97% | 5.22% |

|

| 10 years | 18.72 | 14.86 | 14.86 | 14.86 | 14.86 | 17.52 | 15.07 | 16.73 |

| Annual average | 1.73 | 1.40 | 1.40 | 1.40 | 1.40 | 1.63 | 1.41 | 1.56 |

|

| 5 years | 4.31 | 3.45 | 1.45 | 3.45 | 3.45 | 4.03 | 3.45 | 3.85 |

| Annual average | 0.85 | 0.68 | 0.29 | 0.68 | 0.68 | 0.79 | 0.68 | 0.76 |

|

| 3 years | 0.07 | 0.07 | –2.93 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 |

| Annual average | 0.02 | 0.02 | –0.99 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 |

|

| 1 year | 0.01 | 0.01 | –4.99 | 0.01 | –0.99 | 0.01 | 0.01 | 0.01 |

|

| | Net | | | | | Net | Net | Net |

| Current yield | asset | Before | After | Before | After | asset | asset | asset |

| (end of period)* | value | CDSC | CDSC | CDSC | CDSC | value | value | value |

|

| Current 7-day yield | | | | | | | | |

| (with expense limitation) | 0.01% | 0.01% | — | 0.01% | — | 0.01% | 0.01% | 0.01% |

|

| Current 7-day yield | | | | | | | | |

| (without expense limitation) | –0.27 | –0.77 | — | –0.77 | — | –0.42 | –0.77 | –0.52 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. None of the share classes carry an initial sales charge. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns reflect a 1% CDSC for the first year that is eliminated thereafter. Class A, M, R, and T shares generally have no CDSC. Performance for class B, C, M, R, and T shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares.

* The 7-day yield is the most common gauge for measuring money market mutual fund performance. Yield reflects current performance more closely than total return.

For a portion of the periods, the fund had expense limitations, without which returns and yields would have been lower.

Class B share performance does not reflect conversion to class A shares.

Comparative Lipper returns For periods ended 9/30/12

| |

| | Lipper Money Market Funds category average* |

|

| Annual average (life of fund) | 5.58% |

|

| 10 years | 15.65 |

| Annual average | 1.46 |

|

| 5 years | 3.46 |

| Annual average | 0.68 |

|

| 3 years | 0.07 |

| Annual average | 0.02 |

|

| 1 year | 0.02 |

|

Lipper results should be compared to fund performance at net asset value.

* Over the 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 9/30/12, there were 245, 233, 222, 182, and 14 funds, respectively, in this Lipper category.

Fund distribution information For the 12-month period ended 9/30/12

| | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class T |

|

| Number | 12 | 12 | 12 | 12 | 12 | 12 |

|

| Income | $0.000100 | $0.000100 | $0.000100 | $0.000100 | $0.000100 | $0.000100 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.000100 | $0.000100 | $0.000100 | $0.000100 | $0.000100 | $0.000100 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund’s expenses were limited; had expenses not been limited, they would have been higher. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class T |

|

| Total annual operating expenses | | | | | | |

| for the fiscal year ended 9/30/11 | 0.50% | 1.00% | 1.00% | 0.65% | 1.00% | 0.75% |

|

| Annualized expense ratio for | | | | | | |

| the six-month period ended | | | | | | |

| 9/30/12*† | 0.25% | 0.25% | 0.25% | 0.25% | 0.25% | 0.25% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

* For the fund’s most recent fiscal half year; may differ from expense ratios based on one-year data in the financial highlights.

† Reflects a voluntary waiver of certain fund expenses.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from April 1, 2012, to September 30, 2012. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class T |

|

| Expenses paid per $1,000*† | $1.25 | $1.25 | $1.25 | $1.25 | $1.25 | $1.25 |

|

| Ending value (after expenses) | $1,000.03 | $1,000.03 | $1,000.03 | $1,000.03 | $1,000.03 | $1,000.03 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 9/30/12. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended September 30, 2012, use the following calculation method. To find the value of your investment on April 1, 2012, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class T |

|

| Expenses paid per $1,000*† | $1.26 | $1.26 | $1.26 | $1.26 | $1.26 | $1.26 |

|

| Ending value (after expenses) | $1,023.75 | $1,023.75 | $1,023.75 | $1,023.75 | $1,023.75 | $1,023.75 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 9/30/12. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. Net asset values fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares generally are fund shares purchased with an initial sales charge. In the case of your fund, which has no sales charge, the reference is to shares purchased or acquired through the exchange of class A shares from another Putnam fund. Exchange of your fund’s class A shares into another fund may involve a sales charge, however.

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares generally are fund shares that have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC. In the case of your fund, which has no sales charge, the reference is to shares purchased or acquired through the exchange of class M shares from another Putnam fund. Exchange of your fund’s class M shares into another fund may involve a sales charge, however.

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class T shares are not subject to an initial sales charge or CDSC (except on certain redemptions of shares acquired by exchange of shares of another Putnam fund bought without an initial sales charge); however, they are subject to a 12b-1 fee.

Comparative indexes

Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

Lipper Money Market Funds category average is an arithmetic average of the total return of all money market mutual funds tracked by Lipper.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value

relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

Other information for shareholders

Important notice regarding Putnam’s privacy policy

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ names, addresses, Social Security numbers, and dates of birth. Using this information, we are able to maintain accurate records of accounts and transactions.

It is our policy to protect the confidentiality of our shareholder information, whether or not a shareholder currently owns shares of our funds. In particular, it is our policy not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use.

Under certain circumstances, we must share account information with outside vendors who provide services to us, such as mailings and proxy solicitations. In these cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. Finally, it is our policy to share account information with your financial representative, if you’ve listed one on your Putnam account.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2012, are available in the Individual Investors section at putnam.com, and on the Securities and Exchange Commission (SEC) website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of September 30, 2012, Putnam employees had approximately $342,000,000 and the Trustees had approximately $81,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”) and the sub-management contract with respect to your fund between Putnam Management and its affiliate, Putnam Investments Limited (“PIL”).

The Board of Trustees, with the assistance of its Contract Committee, requests and evaluates all information it deems reasonably necessary under the circumstances in connection with its annual contract review. The Contract Committee consists solely of Trustees who are not “interested persons” (as this term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Putnam funds (“Independent Trustees”).

At the outset of the review process, members of the Board’s independent staff and independent legal counsel met with representatives of Putnam Management to review the annual contract review materials furnished to the Contract Committee during the course of the previous year’s review and to discuss possible changes in these materials that might be necessary or desirable for the coming year. Following these discussions and in consultation with the Contract Committee, the Independent Trustees’ independent legal counsel requested that Putnam Management furnish specified information, together with any additional information that Putnam Management considered relevant, to the Contract Committee. Over the course of several months ending in June 2012, the Contract Committee met on a number of occasions with representatives of Putnam Management, and separately in executive session, to consider the information that Putnam Management provided. Throughout this process, the Contract Committee was assisted by the members of the Board’s independent staff and by independent legal counsel for the Putnam funds and the Independent Trustees.

In May 2012, the Contract Committee met in executive session with the other Independent Trustees to discuss the Contract Committee’s preliminary recommendations with respect to the continuance of the contracts. At the Trustees’ June 22, 2012 meeting, the Contract Committee met in executive session with the other Independent Trustees to review a summary of the key financial data that the Contract Committee considered in the course of its review. The Contract Committee then presented its written report, which summarized the key factors that the Committee had considered and set forth its final recommendations. The Contract Committee then recommended, and the Independent Trustees approved, the continuance of your fund’s management and sub-management contracts, effective July 1, 2012. (Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not evaluated PIL as a separate entity, and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context.)

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds, and the costs incurred by Putnam Management in providing services, and

• That the fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the management arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that some aspects of the arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of fee arrangements in previous years.

Management fee schedules and total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints. In reviewing management fees, the Trustees generally focus their attention on material changes in circumstances — for example, changes in assets under management, changes in a fund’s investment style, changes in Putnam Management’s operating costs, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund.

Most of the open-end Putnam funds, including your fund, have relatively new management contracts, which introduced fee schedules that reflect more competitive fee levels for many funds, complex-wide breakpoints for the open-end funds, and performance fees for some funds. These new management contracts have been in effect for two years — since January or, for a few funds, February 2010. The Trustees approved the new management contracts on July 10, 2009, and fund shareholders subsequently approved the contracts by overwhelming majorities of the shares voted.

Under its management contract, your fund has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale in the form of reduced fee levels as assets under management in the Putnam family of funds increase. The Contract Committee observed that the complex-wide breakpoints of the open-end funds had only been in place for two years, and the Trustees will continue to examine the operation of this new breakpoint structure in future years in light of further experience.

As in the past, the Trustees also focused on the competitiveness of each fund’s total expense ratio. In order to ensure that expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees and Putnam Management agreed in 2009 to implement certain expense limitations. These expense limitations serve in particular to maintain competitive expense levels for funds with large numbers of small shareholder accounts and funds with relatively small net assets. Most funds, including your fund, had sufficiently low expenses that these expense limitations did not apply. The expense limitations were: (i) a contractual expense limitation applicable to all retail open-end funds of 37.5 basis points (effective March 1, 2012, this expense limitation was reduced to 32 basis points) on investor servicing fees and expenses and (ii) a contractual expense limitation applicable to all open-end funds of 20 basis points on so-called “other expenses” (i.e., all expenses exclusive of management fees, investor servicing fees, distribution fees, investment-related expenses, interest, taxes, brokerage commissions, extraordinary expenses and acquired fund fees and expenses). In addition, Putnam Management voluntarily waived certain fees in order to enhance your fund’s annualized net yield during its fiscal year ending in 2011. The Trustees noted that this fee waiver was voluntary and

may be modified or discontinued at any time without notice. Putnam Management’s support for these expense limitations, including its agreement to reduce the expense limitation applicable to the open-end funds’ investor servicing fees and expenses as noted above, was an important factor in the Trustees’ decision to approve the continuance of your fund’s management and sub-management contracts.

The Trustees reviewed comparative fee and expense information for a custom group of competitive funds selected by Lipper Inc. This comparative information included your fund’s percentile ranking for effective management fees and total expenses (excluding any applicable 12b-1 fee), which provides a general indication of your fund’s relative standing. In the custom peer group, your fund ranked in the 1st quintile in effective management fees (determined for your fund and the other funds in the custom peer group based on fund asset size and the applicable contractual management fee schedule) and in the 2nd quintile in total expenses (excluding any applicable 12b-1 fees) as of December 31, 2011 (the first quintile representing the least expensive funds and the fifth quintile the most expensive funds). The fee and expense data reported by Lipper as of December 31, 2011 reflected the most recent fiscal year-end data available in Lipper’s database at that time.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services provided and the profits realized by Putnam Management and its affiliates from their contractual relationships with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management, investor servicing and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability, allocated on a fund-by-fund basis, with respect to the funds’ management, distribution, and investor servicing contracts. For each fund, the analysis presented information about revenues, expenses and profitability for each of the agreements separately and for the agreements taken together on a combined basis. The Trustees concluded that, at current asset levels, the fee schedules in place represented reasonable compensation for the services being provided and represented an appropriate sharing of such economies of scale as may exist in the management of the funds at that time.

The information examined by the Trustees as part of their annual contract review for the Putnam funds has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, and the like. This information included comparisons of those fees with fees charged to the funds, as well as an assessment of the differences in the services provided to these different types of clients. The Trustees observed that the differences in fee rates between institutional clients and mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients may reflect historical competitive forces operating in separate markets. The Trustees considered the fact that in many cases fee rates across different asset classes are higher on average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to its institutional clients. The Trustees did not rely on these comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality

of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the investment oversight committees of the Trustees, which meet on a regular basis with the funds’ portfolio teams and with the Chief Investment Officer and other members of Putnam Management’s Investment Division throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — based on the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to them, and in general Putnam Management’s ability to attract and retain high-quality personnel — but also recognized that this does not guarantee favorable investment results for every fund in every time period.

The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and, where applicable, with the performance of competitive funds or targeted annualized return. They noted that since 2009, when Putnam Management began implementing major changes to strengthen its investment personnel and processes, there has been a steady improvement in the number of Putnam funds showing above-median three-year performance results. They also noted the disappointing investment performance of some funds for periods ended December 31, 2011 and considered information provided by Putnam Management regarding the factors contributing to the underperformance and actions being taken to improve the performance of these particular funds. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these efforts and to evaluate whether additional actions to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that its class A share cumulative total return performance at net asset value was in the following quartiles of its Lipper Inc. peer group (Lipper Money Market Funds) for the one-year, three-year and five-year periods ended December 31, 2011 (the first quartile representing the best-performing funds and the fourth quartile the worst-performing funds):

| | | |

| One-year period | 2nd | | |

| | |

| Three-year period | 1st | | |

| | |

| Five-year period | 1st | | |

| | |

Over the one-year, three-year and five-year periods ended December 31, 2011, there were 264, 249 and 229 funds, respectively, in your fund’s Lipper peer group. (When considering performance information, shareholders should be mindful that past performance is not a guarantee of future results.)

Brokerage and soft-dollar allocations; investor servicing

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage allocation and the use of soft dollars, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that are expected to be useful to Putnam Management in managing the assets of the fund and of other clients. Subject to policies established by the Trustees, soft-dollar credits acquired through these means are used primarily to acquire research services that supplement Putnam Management’s internal research efforts. However, the Trustees noted that a portion of available soft-dollar credits continues to be allocated to the payment of fund expenses. The Trustees indicated their continued intent to monitor regulatory developments in this area with the assistance of their Brokerage Committee and also indicated their continued intent to monitor the potential benefits associated with fund brokerage and

soft-dollar allocations and trends in industry practices to ensure that the principle of seeking best price and execution remains paramount in the portfolio trading process.

Putnam Management may also receive benefits from payments that the funds make to Putnam Management’s affiliates for investor or distribution services. In conjunction with the annual review of your fund’s management and sub-management contracts, the Trustees reviewed your fund’s investor servicing agreement with Putnam Investor Services, Inc. (“PSERV”) and its distributor’s contracts and distribution plans with Putnam Retail Management Limited Partnership (“PRM”), both of which are affiliates of Putnam Management. The Trustees concluded that the fees payable by the funds to PSERV and PRM, as applicable, for such services are reasonable in relation to the nature and quality of such services.

Financial statements

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal year.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

Report of Independent Registered Public Accounting Firm

To the Trustees and Shareholders of

Putnam Money Market Fund:

In our opinion, the accompanying statement of assets and liabilities, including the portfolio, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Putnam Money Market Fund (the “fund”) at September 30, 2012, and the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of investments owned at September 30, 2012 by correspondence with the custodian, brokers, and transfer agent provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

November 8, 2012

The fund’s portfolio 9/30/12

| | |

| REPURCHASE AGREEMENTS (32.3%)* | Principal amount | Value |

|

| Interest in $283,000,000 joint tri-party repurchase agreement dated | | |

| 9/28/12 with Citigroup Global Markets, Inc. due 10/1/12 — maturity | | |

| value of $91,691,910 for an effective yield of 0.25% (collateralized by | | |

| various mortgage backed securities with coupon rates ranging from | | |

| 2.717% to 5.50% and due dates ranging from 8/1/23 to 10/1/42, | | |

| valued at $288,660,000) | $91,690,000 | $91,690,000 |

|

| Interest in $70,400,000 joint tri-party repurchase agreement dated | | |

| 9/28/12 with Credit Suisse First Boston due 10/1/12 — maturity | | |

| value of $16,400,246 for an effective yield of 0.18% (collateralized by | | |

| various corporate bonds and notes with coupon rates ranging from | | |

| 2.5365% to 8.75% and due dates ranging from 5/15/13 to 9/1/66, | | |

| valued at $73,920,560) | 16,400,000 | 16,400,000 |

|

| Interest in $101,590,000 joint tri-party repurchase agreement dated | | |

| 9/28/12 with Deutsche Bank Securities, Inc. due 10/1/12 — maturity | | |

| value of $91,691,910 for an effective yield of 0.25% (collateralized by | | |

| a U.S. Treasury bond with a coupon rate of 11.25% and a due date of | | |

| 2/15/15, valued at $103,621,917) | 91,690,000 | 91,690,000 |

|

| Interest in $308,000,000 joint tri-party repurchase agreement dated | | |

| 9/28/12 with JPMorgan Securities, Inc. due 10/1/12 — maturity | | |

| value of $91,691,910 for an effective yield of 0.25% (collateralized by | | |

| various mortgage backed securities with coupon rates ranging from | | |

| 2.50% to 4.50% and due dates ranging from 9/1/22 to 9/1/42, valued | | |

| at $314,165,123) | 91,690,000 | 91,690,000 |

|

| Interest in $51,000,000 joint tri-party repurchase agreement dated | | |

| 9/28/12 with JPMorgan Securities, Inc. due 10/1/12 — maturity | | |

| value of $26,500,397 for an effective yield of 0.18% (collateralized by | | |

| various corporate bonds and notes with coupon rates ranging from | | |

| 3.625% to 6.50% and due dates ranging from 9/15/15 to 9/15/20, | | |

| valued at $53,553,491) | 26,500,000 | 26,500,000 |

|

| Interest in $450,000,000 joint tri-party repurchase agreement dated | | |

| 9/28/12 with Royal Bank of Canada due 10/1/12 — maturity | | |

| value of $91,688,910 for an effective yield of 0.25% (collateralized by | | |

| various mortgage backed securities with a coupon rate of 3.50% and | | |

| due dates ranging from 6/1/42 to 8/1/42, valued at $459,009,563) | 91,687,000 | 91,687,000 |

|

| Interest in $293,500,000 joint tri-party term repurchase agreement | | |

| dated 9/25/12 with Citigroup Global Markets, Inc. due 10/2/12, | | |

| maturity value of $31,301,522 for an effective yield of 0.25% | | |

| (collateralized by various mortgage backed securities with | | |

| coupon rates ranging from 2.858% to 5.68% and due dates | | |

| ranging from 12/1/23 to 9/15/42, valued at $299,370,000) | 31,300,000 | 31,300,000 |

|

| Interest in $243,500,000 joint tri-party term repurchase agreement | | |

| dated 9/25/12 with Deutsche Bank Securities, Inc. due 10/2/12, | | |

| maturity value of $31,301,217 for an effective yield of 0.20% | | |

| (collateralized by various mortgage backed securities with | | |

| coupon rates ranging from 3.50% to 4.00% and due dates | | |

| ranging from 6/1/31 to 8/1/42, valued at $248,455,796) | 31,300,000 | 31,300,000 |

|

| Interest in $68,700,000 joint tri-party term repurchase agreement | | |

| dated 9/28/12 with JPMorgan Securities, Inc. due 10/22/12, | | |

| maturity value of $16,604,288 for an effective yield of 0.30% | | |

| (collateralized by various corporate bonds and notes with | | |

| coupon rates ranging from 2.95% to 10.375% and due dates | | |

| ranging from 2/15/13 to 9/1/42, valued at $72,140,172) | 16,600,000 | 16,600,000 |

|

| Total repurchase agreements (cost $488,857,000) | | $488,857,000 |

| | | | |

| COMMERCIAL PAPER (14.7%)* | Yield (%) | Maturity date | Principal amount | Value |

|

| Australia & New Zealand Banking Group, Ltd. | | | | |

| (Australia) | 0.195 | 11/8/12 | $13,300,000 | $13,297,262 |

|

| Australia & New Zealand Banking Group, Ltd. | | | | |

| 144A (Australia) | 0.638 | 1/10/13 | 10,400,000 | 10,400,000 |

|

| COFCO Capital Corp. (Rabobank Nederland NV, | | | | |

| NY (LOC)) | 0.390 | 10/4/12 | 15,500,000 | 15,499,496 |

|

| Commonwealth Bank of Australia 144A | | | | |

| (Australia) | 0.180 | 10/18/12 | 3,100,000 | 3,099,995 |

|

| Commonwealth Bank of Australia 144A | | | | |

| (Australia) | 0.000 | 12/20/12 | 13,500,000 | 13,500,000 |

|

| DnB Bank ASA (Norway) | 0.351 | 1/28/13 | 9,600,000 | 9,588,893 |

|

| DnB Bank ASA (Norway) | 0.350 | 1/4/13 | 14,000,000 | 13,987,069 |

|

| Export Development Canada (Canada) | 0.160 | 2/14/13 | 15,850,000 | 15,840,420 |

|

| General Electric Capital Corp. | 0.240 | 10/23/12 | 4,175,000 | 4,174,388 |

|

| General Electric Capital Corp. | 0.220 | 1/22/13 | 10,500,000 | 10,492,749 |

|

| HSBC USA, Inc. (United Kingdom) | 0.340 | 11/21/12 | 9,200,000 | 9,195,569 |

|

| HSBC USA, Inc. (United Kingdom) | 0.310 | 10/29/12 | 5,750,000 | 5,748,614 |

|

| Lloyds TSB Bank PLC (United Kingdom) | 0.200 | 10/11/12 | 7,000,000 | 6,999,611 |

|

| Nordea North America, Inc./DE (Sweden) | 0.401 | 12/26/12 | 8,000,000 | 7,992,356 |

|

| Nordea North America, Inc./DE (Sweden) | 0.315 | 3/12/13 | 15,600,000 | 15,577,887 |

|

| Standard Chartered Bank/New York 144A | 0.775 | 12/10/12 | 8,900,000 | 8,893,078 |

|

| Standard Chartered Bank/New York 144A | 0.640 | 11/14/12 | 6,700,000 | 6,697,380 |

|

| State Street Corp. | 0.230 | 11/9/12 | 9,100,000 | 9,097,733 |

|

| State Street Corp. | 0.220 | 11/15/12 | 7,000,000 | 6,998,075 |

|

| Sumitomo Mitsui Banking Corp. (Japan) | 0.310 | 12/11/12 | 2,000,000 | 1,998,777 |

|

| Toronto-Dominion Holdings (USA), Inc. | | | | |

| 144A (Canada) | 0.290 | 2/4/13 | 1,800,000 | 1,798,173 |

|

| Toyota Credit Canada, Inc. (Canada) | 0.180 | 11/13/12 | 7,800,000 | 7,798,323 |

|

| Toyota Motor Credit Corp. | 0.240 | 11/19/12 | 8,100,000 | 8,097,354 |

|

| Westpac Banking Corp./NY (Australia) | 0.330 | 11/14/12 | 15,000,000 | 14,993,950 |

|

| Total commercial paper (cost $221,767,152) | | | | $221,767,152 |

| |

| |

| ASSET-BACKED COMMERCIAL PAPER (13.9%)* | Yield (%) | Maturity date | Principal amount | Value |

|

| Alpine Securitization Corp. (Switzerland) | 0.200 | 10/4/12 | $4,250,000 | $4,249,929 |

|

| Bryant Park Funding, LLC | 0.180 | 10/15/12 | 4,000,000 | 3,999,720 |

|

| Bryant Park Funding, LLC 144A | 0.180 | 10/9/12 | 11,650,000 | 11,649,534 |

|

| Chariot Funding, LLC | 0.250 | 12/11/12 | 10,900,000 | 10,894,626 |

|

| Chariot Funding, LLC | 0.220 | 10/12/12 | 4,600,000 | 4,599,691 |

|

| CHARTA, LLC | 0.210 | 10/15/12 | 7,000,000 | 6,999,428 |

|

| Fairway Finance, LLC 144A (Canada) | 0.220 | 10/2/12 | 8,803,000 | 8,802,946 |

|

| Gotham Funding Corp. (Japan) | 0.280 | 12/10/12 | 7,600,000 | 7,595,862 |

|

| Gotham Funding Corp. (Japan) | 0.270 | 12/3/12 | 16,000,000 | 15,992,440 |

|

| Jupiter Securitization Co., LLC | 0.210 | 12/10/12 | 4,800,000 | 4,798,040 |

|

| Jupiter Securitization Co., LLC | 0.210 | 12/4/12 | 11,100,000 | 11,095,856 |

|

| Liberty Street Funding, LLC (Canada) | 0.220 | 10/25/12 | 18,000,000 | 17,997,360 |

|

| Manhattan Asset Funding Co., LLC (Japan) | 0.250 | 10/1/12 | 5,000,000 | 5,000,000 |

|

| Manhattan Asset Funding Co., LLC (Japan) | 0.230 | 10/12/12 | 2,993,000 | 2,992,790 |

|

| | | | |

| ASSET-BACKED COMMERCIAL PAPER (13.9%)* cont. | Yield (%) | Maturity date | Principal amount | Value |

|

| Old Line Funding, LLC | 0.200 | 11/26/12 | $3,300,000 | $3,298,973 |

|

| Old Line Funding, LLC 144A | 0.500 | 10/29/12 | 8,500,000 | 8,498,347 |

|

| Old Line Funding, LLC 144A | 0.190 | 12/10/12 | 3,900,000 | 3,898,559 |

|

| Straight-A Funding, LLC | 0.180 | 10/22/12 | 17,000,000 | 16,998,215 |

|

| Straight-A Funding, LLC 144A, Ser. 1 | 0.180 | 12/7/12 | 19,750,000 | 19,743,384 |

|

| Straight-A Funding, LLC 144A, Ser. 1 | 0.180 | 11/5/12 | 3,000,000 | 2,999,475 |

|

| Straight-A Funding, LLC 144A, Ser. 1 | 0.180 | 10/12/12 | 7,500,000 | 7,499,588 |

|

| Thunder Bay Funding, LLC | 0.220 | 10/15/12 | 7,600,000 | 7,599,350 |

|

| Variable Funding Capital Co., LLC 144A | 0.160 | 10/22/12 | 15,000,000 | 14,998,600 |

|

| Working Capital Management Co. (Japan) | 0.240 | 10/10/12 | 7,900,000 | 7,899,526 |

|

| Total asset-backed commercial paper (cost $210,102,239) | | | $210,102,239 |

| |

| |

| U.S. GOVERNMENT | | Maturity | Principal | |

| AGENCY OBLIGATIONS (12.0%)* | Yield (%) | date | amount | Value |

|

| Citigroup Funding, Inc. FDIC | | | | |

| guaranteed notes k | 1.875 | 10/22/12 | $15,325,000 | $15,340,108 |

|

| Citigroup Funding, Inc. FDIC | | | | |

| guaranteed sr. notes k | 2.250 | 12/10/12 | 28,776,000 | 28,888,715 |

|

| Federal Farm Credit Bank unsec. | | | | |

| notes FRN, Ser. 1 | 0.220 | 1/14/13 | 24,300,000 | 24,300,000 |

|

| Federal Home Loan Bank | | | | |

| unsec. discount notes | 0.155 | 12/31/12 | 19,000,000 | 18,992,556 |

|

| Federal Home Loan Bank | | | | |

| unsec. discount notes | 0.150 | 12/5/12 | 28,400,000 | 28,392,308 |

|

| Federal Farm Credit Bank | | | | |

| unsec. discount notes | 0.140 | 11/5/12 | 4,625,000 | 4,624,370 |

|

| Federal Home Loan Mortgage Corp. | | | | |

| unsec. discount notes | 0.163 | 12/17/12 | 4,000,000 | 3,998,605 |

|

| Federal Home Loan Mortgage Corp. | | | | |

| unsec. discount notes | 0.161 | 12/24/12 | 28,801,000 | 28,790,211 |

|

| Federal National Mortgage Association | | | | |

| unsec. discount notes, Ser. BB | 0.170 | 12/20/12 | 6,500,000 | 6,497,544 |

|

| Federal National Mortgage Association | | | | |

| unsec. discount notes | 0.160 | 12/12/12 | 4,050,000 | 4,048,704 |

|

| Federal National Mortgage Association | | | | |

| unsec. discount notes | 0.140 | 10/15/12 | 4,050,000 | 4,049,780 |

|

| Federal National Mortgage Association | | | | |

| unsec. discount notes | 0.110 | 10/16/12 | 5,000,000 | 4,999,771 |

|

| General Electric Capital Corp. FDIC | | | | |

| guaranteed sr. notes k | 2.125 | 12/21/12 | 8,439,000 | 8,475,167 |

|

| Total U.S. government agency obligations (cost $181,397,839) | | $181,397,839 |

| |

| |

| U.S. TREASURY OBLIGATIONS (9.3%)* | Yield (%) | Maturity date | Principal amount | Value |

|

| U.S. Treasury Bills | 0.139 | 4/4/13 | $35,000,000 | $34,974,819 |

|

| U.S. Treasury Notes k | 3.500 | 5/31/13 | 16,000,000 | 16,352,016 |

|

| U.S. Treasury Notes k | 1.375 | 10/15/12 | 33,300,000 | 33,315,429 |

|

| U.S. Treasury Notes k | 0.625 | 4/30/13 | 18,250,000 | 18,299,654 |

|

| U.S. Treasury Notes k | 0.625 | 1/31/13 | 18,000,000 | 18,025,564 |

|

| U.S. Treasury Notes k | 0.500 | 11/30/12 | 20,000,000 | 20,011,216 |

|

| Total U.S. treasury obligations (cost $140,978,698) | | | $140,978,698 |

| | | | | |

| MUNICIPAL BONDS | | Maturity | | Principal | |

| AND NOTES (7.8%)* | Yield (%) | date | Rating** | amount | Value |

|

| California (0.8%) | | | | | |

| Board of Trustees of the Leland Stanford | | | | | |

| Junior University Commercial Paper | 0.170 | 12/14/12 | P-1 | $12,000,000 | $11,995,807 |

|

| | | | | | 11,995,807 |

| District of Columbia (0.2%) | | | | | |

| American University Commercial | | | | | |

| Paper, Ser. A | 0.350 | 12/12/12 | A-1 | 3,400,000 | 3,397,620 |

|

| | | | | | 3,397,620 |

| Indiana (0.7%) | | | | | |

| Indiana Finance Authority Commercial | | | | | |

| Paper VRDN (Trinity Health Credit | | | | | |

| Group), Ser. 08D-2 M | 0.180 | 12/17/12 | VMIG1 | 3,500,000 | 3,500,000 |

|

| Saint Joseph County Commercial Paper | | | | | |

| (University of Notre Dame Du Lac) | 0.180 | 12/4/12 | P-1 | 6,600,000 | 6,597,888 |

|

| | | | | | 10,097,888 |

| Kentucky (1.0%) | | | | | |

| Catholic Health Initiatives Commercial | | | | | |

| Paper, Ser. A | 0.200 | 11/8/12 | P-1 | 4,700,000 | 4,700,000 |

|

| Kentucky Economic Development | | | | | |

| Finance Authority VRDN (Catholic | | | | | |

| Health Initiatives), Ser. C M | 0.180 | 5/1/34 | VMIG1 | 11,000,000 | 11,000,000 |

|

| | | | | | 15,700,000 |

| Maryland (1.5%) | | | | | |

| Johns Hopkins University Commercial | | | | | |

| Paper, Ser. A | 0.180 | 12/18/12 | P-1 | 12,250,000 | 12,250,000 |

|

| Johns Hopkins University Commercial | | | | | |

| Paper, Ser. A | 0.180 | 11/14/12 | P-1 | 3,250,000 | 3,250,000 |

|

| Johns Hopkins University Commercial | | | | | |

| Paper, Ser. C | 0.180 | 10/25/12 | P-1 | 2,000,000 | 2,000,000 |

|

| Johns Hopkins University Commercial | | | | | |

| Paper, Ser. C | 0.180 | 10/18/12 | P-1 | 6,000,000 | 6,000,000 |

|

| | | | | | 23,500,000 |

| Michigan (1.2%) | | | | | |

| Trinity Health Corporation | | | | | |

| Commercial Paper | 0.170 | 10/3/12 | P-1 | 17,700,000 | 17,699,833 |

|

| | | | | | 17,699,833 |

| North Carolina (1.3%) | | | | | |

| Duke University Commercial Paper, | | | | | |

| Ser. B-98 | 0.180 | 12/10/12 | P-1 | 18,860,000 | 18,853,399 |

|

| Wake County, VRDN, Ser. B M | 0.170 | 3/1/24 | VMIG1 | 1,500,000 | 1,500,000 |

|

| | | | | | 20,353,399 |

| Texas (0.8%) | | | | | |

| Harris County, Health Facilities | | | | | |

| Development Authority VRDN | | | | | |

| (Texas Childrens Hospital), Ser. B-1 M | 0.190 | 10/1/29 | VMIG1 | 3,665,000 | 3,665,000 |

|

| Texas Public Finance Authority | | | | | |

| Commercial Paper, Ser. 08 | 0.180 | 11/6/12 | P-1 | 7,800,000 | 7,800,000 |

|

| | | | | | 11,465,000 |

| Wisconsin (0.3%) | | | | | |

| Wisconsin State Health & Educational | | | | | |

| Facilities Authority VRDN (Wheaton | | | | | |

| Franciscan Services), Ser. B (U.S. | | | | | |

| Bank NA (LOC)) M | 0.180 | 8/15/33 | VMIG1 | 4,100,000 | 4,100,000 |

|

| | | | | | 4,100,000 |

| | | | | | |

| Total municipal bonds and notes (cost $118,309,547) | | | $118,309,547 |

| | | | |

| CORPORATE BONDS AND NOTES (7.4%)* | Interest | Maturity | Principal | |

| | rate (%) | date | amount | Value |

|

| Commonwealth Bank of Australia 144A | | | | |

| sr. unsec. notes FRN (Australia) | 0.931 | 3/19/13 | $7,850,000 | $7,866,915 |

|

| HSBC Bank PLC 144A sr. unsec. unsub. notes | | | | |

| FRN (United Kingdom) | 0.855 | 1/18/13 | 8,650,000 | 8,656,696 |

|

| JPMorgan Chase & Co. sr. unsec. unsub. notes | | | | |

| FRN, MTN | 1.077 | 2/26/13 | 7,000,000 | 7,018,672 |

|

| National Australia Bank, Ltd. 144A sr. unsec. | | | | |

| notes FRN (Australia) | 0.940 | 1/8/13 | 1,109,000 | 1,110,033 |

|

| National Australia Bank, Ltd. 144A sr. unsec. | | | | |

| unsub. notes (Australia) | 2.350 | 11/16/12 | 15,275,000 | 15,308,332 |

|

| Royal Bank of Canada 144A sr. unsec. notes | | | | |

| FRN (Canada) M | 0.701 | 5/15/14 | 29,425,000 | 29,426,488 |

|

| Svenska Handelsbanken/New York, NY 144A | | | | |

| unsec. notes FRN (Sweden) | 0.448 | 1/7/13 | 23,500,000 | 23,500,000 |

|

| Wells Fargo & Co. sr. unsec. unsub. notes | 5.250 | 10/23/12 | 9,400,000 | 9,427,591 |

|

| Westpac Banking Corp. 144A sr. unsec. | | | | |

| notes FRN (Australia) | 0.814 | 6/14/13 | 10,000,000 | 10,023,816 |

|

| Total corporate bonds and notes (cost $112,338,543) | | | $112,338,543 |

| |

| |

| CERTIFICATES OF DEPOSIT (5.0%)* | Interest | Maturity | Principal | |

| | rate (%) | date | amount | Value |

|

| Bank of America, NA, Ser. GLOB | 0.350 | 10/1/12 | $8,400,000 | $8,400,000 |

|

| Bank of Montreal/Chicago, IL FRN (Canada) | 0.439 | 6/21/13 | 9,250,000 | 9,250,000 |

|

| Bank of Nova Scotia/Houston FRN | 0.739 | 9/17/13 | 5,500,000 | 5,516,994 |

|

| Canadian Imperial Bank of Commerce/ | | | | |

| New York, NY FRN (Canada) | 0.598 | 12/11/12 | 7,550,000 | 7,556,127 |

|

| Canadian Imperial Bank of Commerce/ | | | | |

| New York, NY FRN (Canada) | 0.468 | 4/26/13 | 15,000,000 | 15,000,000 |

|

| National Australia Bank, Ltd./New York | | | | |

| FRN (Australia) | 0.532 | 4/24/13 | 8,350,000 | 8,350,000 |

|

| Toronto-Dominion Bank/NY (Canada) | 0.300 | 1/18/13 | 8,300,000 | 8,302,836 |

|

| Toronto-Dominion Bank/NY FRN (Canada) | 0.475 | 10/19/12 | 13,400,000 | 13,400,000 |

|

| Total certificates of deposit (cost $75,775,957) | | | | $75,775,957 |

| |

| |

| TIME DEPOSITS (1.1%)* | Interest | Maturity | Principal | |

| | rate (%) | date | amount | Value |

|

| U.S. Bank NA/Cayman Islands | 0.180 | 10/1/12 | $16,000,000 | $16,000,000 |

|

| Total time deposits (cost $16,000,000) | | | | $16,000,000 |

| |

| |

| SHORT-TERM INVESTMENT FUND (—%)* | | | Shares | Value |

|

| Putnam Money Market Liquidity Fund 0.14% L | | | 171 | $171 |

|

| Total short-term investment fund (cost $171) | | | | $171 |

| |

| |

| TOTAL INVESTMENTS | | | | |

|

| Total investments (cost $1,565,527,146) | | | | $1,565,527,146 |

Key to holdings abbreviations

| | |

| FDIC guaranteed | | Federal Deposit Insurance Corp. Guaranteed |

| FRN | | Floating Rate Notes: the rate shown is the current interest rate at the close of the reporting period |

| LOC | | Letter of Credit |

| MTN | | Medium Term Notes |

| VRDN | | Variable Rate Demand Notes, which are floating-rate securities with long-term maturities, that carry coupons that reset every one or seven days. The rate shown is the current interest rate at the close of the reporting period. |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from October 1, 2011 through September 30, 2012 (the reporting period). Within the following notes to the portfolio, references to “ASC 820” represent Accounting Standards Codification ASC 820 Fair Value Measurements and Disclosures.

* Percentages indicated are based on net assets of $1,512,965,655.

** The Moody’s, Standard & Poor’s or Fitch ratings indicated are believed to be the most recent ratings available at the close of the reporting period for the securities listed. Ratings are generally ascribed to securities at the time of issuance. While the agencies may from time to time revise such ratings, they undertake no obligation to do so, and the ratings do not necessarily represent what the agencies would ascribe to these securities at the close of the reporting period. The rating of an insured security represents what is believed to be the most recent rating of the insurer’s claims-paying ability available at the close of the reporting period, if higher than the rating of the direct issuer of the bond, and does not reflect any subsequent changes. Ratings are not covered by the Report of Independent Registered Public Accounting Firm. Security ratings are defined in the Statement of Additional Information.

k The rates shown are the current interest rates at the close of the reporting period.

L Affiliated company (Note 5). The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

M The security’s effective maturity date is less than one year.

Debt obligations are considered secured unless otherwise indicated.

144A after the name of an issuer represents securities exempt from registration under Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

The dates shown on debt obligations are the original maturity dates.

|

| DIVERSIFICATION BY COUNTRY |

|

Distribution of investments by country of risk at the close of the reporting period, excluding collateral received, if any (as a percentage of Portfolio Value):

| | | | |

| United States | 75.7% | | Japan | 2.6% |

| |

|

| Canada | 8.6 | | United Kingdom | 2.0 |

| |

|

| Australia | 6.3 | | Norway | 1.5 |

| |

|

| Sweden | 3.0 | | Switzerland | 0.3 |

| |

|

| | | | Total | 100.0% |

ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1: Valuations based on quoted prices for identical securities in active markets.

Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| | | |

| | | Valuation inputs | |

|

| Investments in securities: | Level 1 | Level 2 | Level 3 |

|

| Asset-backed commercial paper | $— | $210,102,239 | $— |

|

| Certificates of deposit | — | 75,775,957 | — |

|

| Commercial paper | — | 221,767,152 | — |

|

| Corporate bonds and notes | — | 112,338,543 | — |

|

| Municipal bonds and notes | — | 118,309,547 | — |

|

| Repurchase agreements | — | 488,857,000 | — |

|

| Short-term investment fund | 171 | — | — |

|

| Time deposits | — | 16,000,000 | — |

|

| U.S. government agency obligations | — | 181,397,839 | — |

|

| U.S. treasury obligations | — | 140,978,698 | — |

|

| Totals by level | $171 | $1,565,526,975 | $— |

The accompanying notes are an integral part of these financial statements.

Statement of assets and liabilities 9/30/12

| |

| ASSETS | |

|

| Investment in securities, at value (Note 1): | |

| Unaffiliated issuers (at amortized cost) | $1,076,669,975 |

| Affiliated issuers (identified cost $171) (Note 5) | 171 |

| Repurchase agreements (identified cost $488,857,000) | 488,857,000 |

|

| Cash | 2,938 |

|

| Interest and other receivables | 1,550,411 |

|

| Receivable for shares of the fund sold | 3,274,559 |

|

| Receivable for investments sold | 130,000 |

|