| | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number: (811-01561) |

| |

| Exact name of registrant as specified in charter: | Putnam Vista Fund | |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

| |

| Name and address of agent for service: | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| | |

| Copy to: | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | One International Place |

| | Boston, Massachusetts 02110 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 | |

| | | | |

| Date of fiscal year end: July 31, 2010 | |

| | |

| Date of reporting period: August 1, 2009—July 31, 2010 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

Putnam

Vista

Fund

Annual report

7 | 31 | 10

| | | |

| Message from the Trustees | 1 | | |

| | |

| Performance snapshot | 2 | | |

| | |

| Interview with your fund’s portfolio manager | 3 | | |

| | |

| Your fund’s performance | 8 | | |

| | |

| Your fund’s expenses | 10 | | |

| | |

| Terms and definitions | 12 | | |

| | |

| Trustee approval of management contract | 13 | | |

| | |

| Other information for shareholders | 18 | | |

| | |

| Financial statements | 19 | | |

| | |

| Federal tax information | 46 | | |

| | |

| Shareholder meeting results | 47 | | |

| | |

| About the Trustees | 48 | | |

| | |

| Officers | 50 | | |

| | |

Message from the Trustees

Dear Fellow Shareholder:

The U.S. economic recovery continues to face head winds, constrained by a lack of new jobs, weak housing sales, and tight credit markets. While fixed-income securities have enjoyed strong performance so far in 2010, volatility has returned to the equity markets. Patient investors understand that such periods of uncertainty can also present opportunities. In July, for instance, the S&P 500 Index rebounded 6.9%, delivering its best monthly performance in a year and reversing two straight months of declines.

Compared with 2009’s bull market, today’s investment climate requires a greater degree of investment skill, innovation, and expertise. We believe Putnam’s risk-focused, active-management approach is well-suited for conditions like these.

In developments affecting oversight of your fund, Barbara M. Baumann has been elected to the Board of Trustees of the Putnam Funds, effective July 1, 2010. Ms. Baumann is president and owner of Cross Creek Energy Corporation of Denver, Colorado, a strategic consultant to domestic energy firms and direct investor in energy assets. We also want to thank Elizabeth T. Kennan, who has retired from the Board of Trustees, for her many years of dedicated and thoughtful leadership.

Lastly, we would like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam.

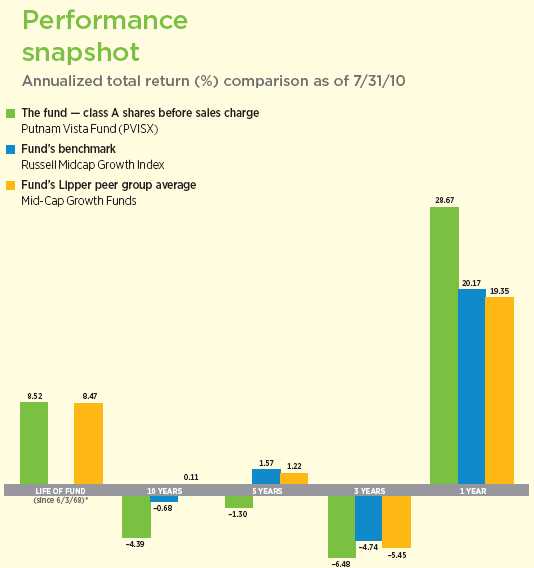

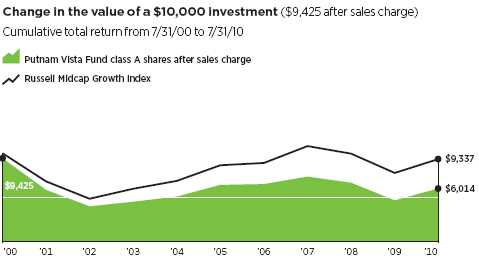

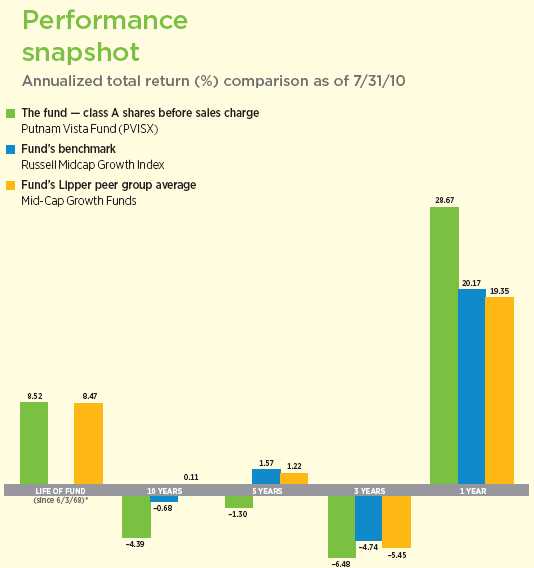

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See pages 3 and 8–10 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

* The fund’s benchmark, the Russell Midcap Growth Index, was introduced on 12/31/85, which post-dates the inception of the fund’s class A shares.

2

Interview with your fund’s portfolio manager

Robert Brookby

Rob, how did the fund perform for the year ended July 31, 2010?

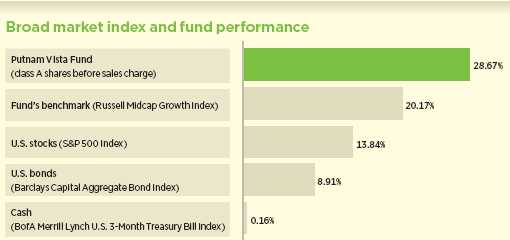

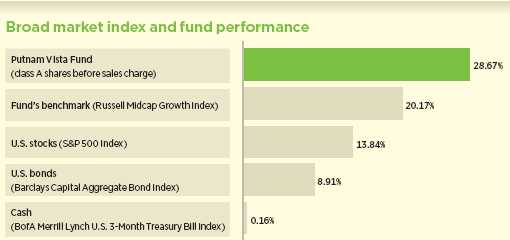

I took over as manager in April 2010, and I’m pleased to report that Putnam Vista Fund significantly outperformed both its benchmark, the Russell Midcap Growth Index, and the average return of its peer group, Lipper Mid-Cap Growth Funds. Specifically, the fund’s class A shares returned 28.67%, the benchmark rose 20.17%, and the peer group average finished at 19.35%.

The dynamics of the equity markets changed pretty dramatically during the period. How would you characterize the environment?

The dynamics certainly did change. During the first half of the period, global economies continued to rebound from the darkest days of the recession. The factors driving this rebound included extraordinary monetary policy maneuvers by the Federal Reserve Board; substantial fiscal stimulus; a series of programs designed to stimulate the economy, such as Cash for Clunkers and the first-time homebuyer’s tax credit; and corporations restocking depleted inventories.

Stocks rallied during the first few months of the period, pulled back from mid January to early February, and then resumed their upward climb until late April. It was at this point that investors became more concerned about the consequences of what I refer to as the “great swap”: the federal government acquiring the toxic assets of the private sector — primarily banks and insurance companies. In addition, concerns about Europe’s sovereign debt sent riskier asset classes spiraling downward. U.S. equities struggled in the face of weak employment and housing data, as well as a sharp decline in investor sentiment. As the

This comparison shows your fund’s performance in the context of broad market indexes for the 12 months ended 7/31/10. See pages 2 and 8–10 for additional fund performance information. Index descriptions can be found on page 12.

3

period ended, U.S. corporations were grappling with the uncertainties introduced by Washington’s policies for health-care reform and financial industry regulatory reform, and were questioning the strength of the domestic recovery.

For the period, mid- and small-cap stocks outperformed their large-cap counterparts, and consistent with the trend that characterized the period as a whole, mid- and small-cap stocks held up better than large-cap stocks during the late-period downturn.

What factors helped the fund versus its benchmark and peer group?

From a sector perspective, security selection in consumer discretionary was the biggest contributor by far, thanks in large part to standout contributions from two holdings: Las Vegas Sands and Gannett. Las Vegas Sands operates casinos in Macao, China, and Singapore. Its stock advanced strongly following the January–February pullback, reflecting investors’ convictions that the company is exceptionally well-positioned to capitalize on the rapid growth of casino gambling in Southeast Asia.

Gannett is a leading international news organization and publisher of USA Today. The improving economic outlook and prospects for better advertising revenues helped its stock rebound from depressed levels. The fund’s previous manager sold the stock before it began drifting downward during the last few months of the period.

Stock choices in information technology were the second-largest contributor to returns. Top picks in this category included an out-of-benchmark position in VMware, and overweight exposure to SanDisk. VMware is a leading supplier of server virtualization software for use in information technology [IT] infrastructure, and is 80% owned by EMC, one of the world’s largest suppliers of enterprise storage systems. As corporations focus on improving the performance of their IT infrastructures, they are increasingly adopting VMware’s solutions. The stock moved steadily higher over the course of the period.

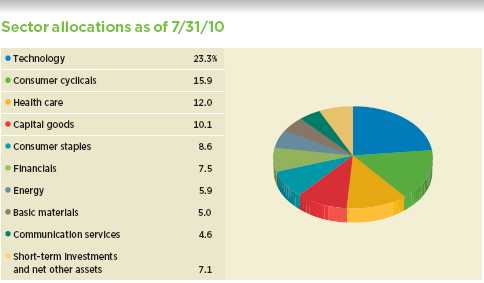

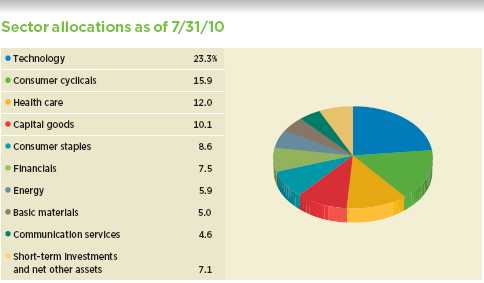

Allocations are represented as a percentage of the fund’s net assets. Holdings and allocations may vary over time.

Within the past six months, the methodology used for the calculation and disclosure of this data has changed.

4

Flash memory storage maker SanDisk benefited from greater demand for new mobile phones and tablet computing devices, such as Apple’s iPad. What’s more, investors believe SanDisk is poised to capitalize on new applications for flash memory.

Two additional holdings, Salesforce.com, a leading provider of on-demand customer relationship management software, and women’s apparel retailer Talbots, rounded out the top contributors.

Which investments weren’t as productive?

Positioning in health care and industrials detracted the most. Out-of-benchmark holdings in Affymetrix, a company in the life sciences tools and services industry, and InterMune, a biotechnology developer, were the two primary culprits in health care. Affymetrix produces DNA chip systems used to analyze genetic data that may lead to drug discoveries. Investors concluded that Affymetrix will face growing challenges from recently introduced competing products that are likely to erode the company’s market share.

InterMune’s stock rose dramatically in March only to come crashing back to earth in May, when the U.S. Food and Drug Administration refused to approve its experimental lung drug pirfenidone and requested a new clinical trial to prove that it works.

Affymetrix and InterMune were both sold during the period.

Switzerland-based engineering, construction, and project management contractor Foster Wheeler also dampened returns. The firm’s business backlog shrank as a number of projects were put on hold because of

This table shows the fund’s top 10 holdings and the percentage of the fund’s net assets that each represented as of 7/31/10. Short-term holdings are excluded. Holdings will vary over time.

5

global economic uncertainty, hurting the stock’s performance.

Finally, Canadian gold-mining company Agnico-Eagle Mines was another detractor. After several years of outstanding performance, the company ran into operational issues at its Finland mine in late 2009. With the mine shut down for an extended period of time to correct problems, and the company’s earnings guidance suggesting that revenues would fall, the fund’s previous manager sold the stock during the first half of the period.

What role do derivatives play, if any, in the fund?

Derivatives generally don’t contribute materially to the fund’s performance, but occasionally I will use them in the portfolio as a risk control tool. For example, if I like a company but there is a chance some pending news might hurt the stock — an FDA rejection or the outcome of a lawsuit, for instance — I might buy a put option to help establish a floor price for my investment and in doing so, limit the fund’s downside risk. During the period, we used this strategy with our InterMune holding, which helped mitigate the stock’s negative impact on the fund’s return.

What is your outlook for the economy and U.S. equity markets in the coming months, and how do you plan to position the fund?

In my view, the economy should continue to improve, albeit very slowly. Consequently, I believe U.S. equities may stay in a trading range for some time and will move up and down based on investors’ assessments of economic data.

Unemployment remains a major concern. I hold the view that the U.S. economy needs to create about 125,000 new jobs per month, on average, to absorb the people who are looking for jobs and keep the unemployment rate constant. However, the economy isn’t creating near that level of jobs, and the unemployment rate has remained steady at around 9.5% because many people have simply stopped looking for jobs. So, the real unemployment rate is considerably higher.

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of net assets. Holdings will vary over time.

Within the past six months, the methodology used for the calculation and disclosure of this data has changed. Prior period figures shown in this chart have been restated based on the updated methodology.

6

Companies are uncertain about the economic recovery and are therefore reticent to hire, preferring instead to get maximum productivity out of their current work forces. This situation can’t go on indefinitely. But, I believe businesses are unlikely to resume significant hiring until they see more-convincing signs of sustained economic growth and develop a clearer sense of how government regulatory policies are likely to affect their costs.

As for positioning the fund, I want our investors to be able to capitalize on improving conditions, but I don’t want to expose them to too much risk in an uncertain environment. Therefore, I plan to continue adding stocks with high growth potential while also including investments with more defensive characteristics.

Thanks for bringing us up to date, Rob.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Of special interest

In June 2010, the Board of Trustees of the Putnam Funds approved a plan to merge Putnam Vista Fund into Putnam Multi-Cap Growth Fund, formerly known as Putnam New Opportunities Fund. Putnam Vista Fund is closed to new investors, effective July 15, 2010. The proposed merger is expected to occur in late September 2010, but no later than December 31, 2010.

Portfolio Manager Robert Brookby has an M.B.A. from Harvard Business School and a B.A. from Northwestern University. Rob joined Putnam in 2008 and has been in the investment industry since 1999.

IN THE NEWS

Despite headlines about market volatility and a slow economic recovery, cash on U.S. corporate balance sheets has hit a record high. In June, the Federal Reserve reported that non-financial companies were holding nearly $2 trillion in cash and other liquid assets. The amount of cash is up 26% from a year ago, the largest increase on record, according to the central bank. Many firms implemented cost-cutting measures and other efficiencies in 2009. Concerned about the strength of the economic recovery and the debt crisis in Europe, companies have been reluctant to spend in recent months. Ultimately, that cash may be deployed on hiring, dividends, mergers, stock repurchases, and other shareholder-friendly activities.

7

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended July 31, 2010, the end of its most recent fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Pu tnam at 1-800-225-1581. Class Y shares are generally only available to corporate and institutional clients and clients in other approved programs. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 7/31/10

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (6/3/68) | (3/1/93) | (7/26/99) | (12/8/94) | (1/21/03) | (3/28/95) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 8.52% | 8.37% | 7.56% | 7.56% | 7.71% | 7.71% | 7.84% | 7.75% | 8.26% | 8.62% |

|

| 10 years | –36.17 | –39.86 | –40.77 | –40.77 | –40.72 | –40.72 | –39.21 | –41.35 | –37.63 | –34.56 |

| Annual average | –4.39 | –4.96 | –5.10 | –5.10 | –5.09 | –5.09 | –4.86 | –5.20 | –4.61 | –4.15 |

|

| 5 years | –6.33 | –11.74 | –9.74 | –11.55 | –9.66 | –9.66 | –8.62 | –11.81 | –7.46 | –5.14 |

| Annual average | –1.30 | –2.47 | –2.03 | –2.42 | –2.01 | –2.01 | –1.79 | –2.48 | –1.54 | –1.05 |

|

| 3 years | –18.22 | –22.95 | –20.06 | –22.46 | –19.96 | –19.96 | –19.42 | –22.26 | –18.83 | –17.62 |

| Annual average | –6.48 | –8.32 | –7.19 | –8.13 | –7.15 | –7.15 | –6.94 | –8.05 | –6.72 | –6.26 |

|

| 1 year | 28.67 | 21.26 | 27.72 | 22.72 | 27.94 | 26.94 | 28.02 | 23.60 | 28.41 | 29.02 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns (public offering price, or POP) for class A and M shares reflect a maximum 5.75% and 3.50% load, respectively. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and, except for class Y shares, the higher operating expenses for such shares.

Class B share performance does not assume conversion to class A shares.

8

Comparative index returns For periods ended 7/31/10

| | |

| | | Lipper Mid-Cap Growth Funds |

| | Russell Midcap Growth Index | category average* |

|

| Annual average (life of fund) | —† | 8.47% |

|

| 10 years | –6.63% | 6.20 |

| Annual average | –0.68 | 0.11 |

|

| 5 years | 8.09 | 6.90 |

| Annual average | 1.57 | 1.22 |

|

| 3 years | –13.54 | –15.11 |

| Annual average | –4.74 | –5.45 |

|

| 1 year | 20.17 | 19.35 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* Over the 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 7/31/10, there were 434, 382, 328, 187, and 6 funds, respectively, in this Lipper category.

† The fund’s benchmark, the Russell Midcap Growth Index, was introduced on 12/31/85, which post-dates the inception of the fund’s class A shares.

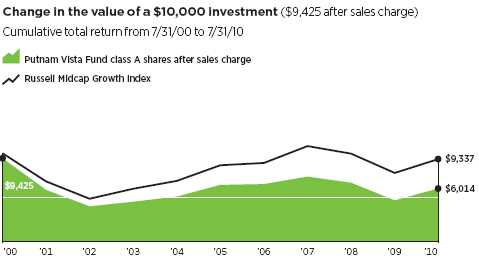

Past performance does not indicate future results. At the end of the same time period, a $10,000 investment in the fund’s class B and class C shares would have been valued at $5,923 and $5,928, respectively, and no contingent deferred sales charges would apply. A $10,000 investment in the fund’s class M shares ($9,650 after sales charge) would have been valued at $5,865 at public offering price. A $10,000 investment in the fund’s class R and class Y shares would have been valued at $6,237 and $6,544, respectively.

Fund price and distribution information For the 12-month period ended 7/31/10

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Share value | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| 7/31/09 | $7.36 | $7.81 | $6.24 | $6.80 | $6.71 | $6.95 | $7.25 | $7.72 |

|

| 7/31/10 | 9.47 | 10.05 | 7.97 | 8.70 | 8.59 | 8.90 | 9.31 | 9.96 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

The fund made no distributions during the period.

9

Fund performance as of most recent calendar quarter

Total return for periods ended 6/30/10

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (6/3/68) | (3/1/93) | (7/26/99) | (12/8/94) | (1/21/03) | (3/28/95) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 8.32% | 8.16% | 7.36% | 7.36% | 7.50% | 7.50% | 7.63% | 7.54% | 8.05% | 8.42% |

|

| 10 years | –45.06 | –48.22 | –49.03 | –49.03 | –48.96 | –48.96 | –47.68 | –49.50 | –46.28 | –43.65 |

| Annual average | –5.81 | –6.37 | –6.52 | –6.52 | –6.50 | –6.50 | –6.27 | –6.60 | –6.02 | –5.57 |

|

| 5 years | –8.54 | –13.80 | –11.93 | –13.69 | –11.82 | –11.82 | –10.66 | –13.79 | –9.63 | –7.40 |

| Annual average | –1.77 | –2.93 | –2.51 | –2.90 | –2.48 | –2.48 | –2.23 | –2.92 | –2.00 | –1.53 |

|

| 3 years | –27.79 | –31.92 | –29.44 | –31.56 | –29.32 | –29.32 | –28.82 | –31.30 | –28.30 | –27.25 |

| Annual average | –10.28 | –12.03 | –10.97 | –11.87 | –10.92 | –10.92 | –10.71 | –11.76 | –10.50 | –10.06 |

|

| 1 year | 26.72 | 19.40 | 25.82 | 20.82 | 25.87 | 24.87 | 26.28 | 21.79 | 26.52 | 27.16 |

|

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual operating expenses for the fiscal year | | | | | | |

| ended 7/31/09* | 1.31% | 2.06% | 2.06% | 1.81% | 1.56% | 1.06% |

|

| Annualized expense ratio for the six-month period | | | | | | |

| ended 7/31/10† | 1.39% | 2.14% | 2.14% | 1.89% | 1.64% | 1.14% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

* Reflects projected expenses based on a new expense arrangement.

† For the fund’s most recent fiscal half year; may differ from expense ratios based on one-year data in the financial highlights.

10

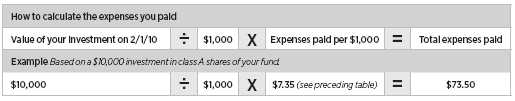

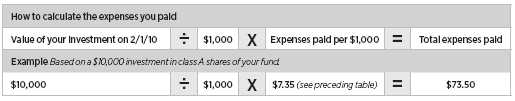

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in Putnam Vista Fund from February 1, 2010, to July 31, 2010. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $7.35 | $11.30 | $11.30 | $9.98 | $8.67 | $6.03 |

|

| Ending value (after expenses) | $1,132.80 | $1,128.90 | $1,129.90 | $1,130.30 | $1,131.20 | $1,134.40 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 7/31/10. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended July 31, 2010, use the following calculation method. To find the value of your investment on February 1, 2010, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $6.95 | $10.69 | $10.69 | $9.44 | $8.20 | $5.71 |

|

| Ending value (after expenses) | $1,017.90 | $1,014.18 | $1,014.18 | $1,015.42 | $1,016.66 | $1,019.14 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 7/31/10. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

11

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays Capital Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

Russell Midcap Growth Index is an unmanaged index of those companies in the Russell Midcap Index chosen for their growth orientation.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

12

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”) and the sub-management contract with respect to your fund between Putnam Management and its affiliate, Putnam Investments Limited (“PIL”).

In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as this term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2010, the Contract Committee met several times with representatives of Putnam Management and in executive session to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. At the Trustees’ June 11, 2010 meeting, the Contract Committee recommended, and the Independent Trustees approved, the co ntinuance of your fund’s management and sub-management contracts, effective July 1, 2010. (Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not evaluated PIL as a separate entity, and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context.)

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds, and the costs incurred by Putnam Management in providing such services, and

• That the fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of the arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of fee arrangements in prior years.

Consideration of implementation of

strategic pricing initiative

The Trustees were mindful that new management contracts had been implemented for all but a few funds at the beginning of 2010 as part of Putnam Management’s strategic pricing initiative. These new management contracts reflected the implementation of more competitive fee levels for many funds, complex-wide

13

breakpoints for the open-end funds and performance fees for certain funds. The Trustees had approved these new management contracts on July 10, 2009 and submitted them to shareholder meetings of the affected funds in late 2009, where the contracts were in all cases approved by overwhelming majorities of the shares voted.

Because the management contracts had been implemented only recently, the Contract Committee had limited practical experience with the operation of the new fee structures. The financial data available to the Committee reflected actual operations under the prior contracts; information was also available on a pro forma basis, adjusted to reflect the fees payable under the new management contracts. In light of the limited information available regarding operations under the new management contracts, in recommending the continuation of the new management contracts in June 2010, the Contract Committee relied to a considerable extent on its review of the financial information and analysis that formed the basis of the Board’s approval of the new management contracts on July 10, 2009.

Management fee schedules and categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints. In reviewing management fees, the Trustees generally focus their attention on material changes in circumstances — for example, changes in assets under management or investment style, changes in Putnam Management’s operating costs, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund.

As in the past, the Trustees continued to focus on the competitiveness of the total expense ratio of each fund. In order to ensure that expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees and Putnam Management agreed in 2009 to implement: (i) a contractual expense limitation applicable to all retail open-end funds of 37.5 basis points on investor servicing fees and expenses and (ii) a contractual expense limitation applicable to all open-end funds of 20 basis points on so-called “other expenses” (i.e., all expenses exclusive of management fees, investor servicing fees, distribution fees, taxes, brokerage commissions and extraordinary expenses). These expense limitations serve in particular to maintain competitive expense levels for funds with large numbers of small shareholder accounts and f unds with relatively small net assets.

The Trustees reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 17th percentile in effective management fees (determined for your fund and the other funds in the custom peer group based on fund asset size and the applicable contractual management fee schedule) and in the 45th percentile in total expenses (less any applicable 12b-1 fees) as of December 31, 2009 (the first percentile representing the least expensive funds and the 100th percentile the most expensive funds). The Trustees also considered that your fund ranked in the 17th percentile in effective management fees, on a pro forma basis adjusted to reflect the impact of the strategic pricing initiative discussed above, as of December 31, 2009.

Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale in the form of reduced fee levels as assets under management in the Putnam family of funds increase. The Contract Committee observed that the complex-wide breakpoints

14

of the open-end funds have only been in place for a short while, and the Trustees will examine the operation of this new breakpoint structure in future years in light of actual experience.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services provided and profits realized by Putnam Management and its affiliates from their contractual relationships with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management, investor servicing and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability, allocated on a fund-by-fund basis, with respect to the funds’ management, distribution, and investor servicing contracts. For each fund, the analysis presented information about revenues, expenses and profitability for each of the agreements separately and for the agreements taken together on a combined basis. The Trustees concluded that, at curre nt asset levels, the fee schedules currently in place represented an appropriate sharing of economies of scale at that time.

The information examined by the Trustees as part of their annual contract review for the Putnam funds has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, and the like. This information included comparisons of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients may reflect historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across different as set classes are typically higher on average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, and did not rely on these comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Oversight Coordinating Committee of the Trustees and the Investment Oversight Committees of the Trustees, which met on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel — but also recognized that this does not gu arantee favorable investment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

15

The Committee noted the substantial improvement in the performance of most Putnam funds during 2009. The Committee also noted the disappointing investment performance of a number of the funds for periods ended December 31, 2009 and considered information provided by Putnam Management regarding the factors contributing to the underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has taken steps to strengthen its investment personnel and processes to address areas of underperformance, including Putnam Management’s continuing efforts to strengthen the equity research function, recent changes in portfolio managers, increased accountability of individual managers rather than teams, recent changes in Putnam Management’s approach to incentive compensation, including emphasis on top quartile performance over a rolling three-year period, and the recent arrival of a new chief i nvestment officer. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these efforts and to evaluate whether additional changes to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group (Lipper Mid-Cap Growth Funds) for the one-year, three-year and five-year periods ended December 31, 2009 (the first percentile representing the best-performing funds and the 100th percentile the worst-performing funds):

| | | |

| One-year period | 64th | | |

| | |

| Three-year period | 89th | | |

| | |

| Five-year period | 88th | | |

| | |

Over the one-year, three-year and five-year periods ended December 31, 2009, there were 474, 425 and 353 funds, respectively, in your fund’s Lipper peer group. (When considering performance information, shareholders should be mindful that past performance is not a guarantee of future results.)

The Trustees took note of your fund’s 4th quartile performance for the three-year and five-year periods ended December 31, 2009 and considered the circumstances that may have contributed to the disappointing performance as well as any actions taken by Putnam Management intended to improve performance, including that in April 2010, a new portfolio manager took over sole responsibility for managing the fund’s investments. The Trustees also considered that Putnam Management has taken the following actions:

• Increased accountability and reduced complexity in the portfolio management process for the Putnam equity funds by replacing a team management structure with a decision-making process that vests full authority and responsibility with individual portfolio managers. Putnam Management has also taken other steps, such as eliminating sleeves in certain Putnam equity funds, to reduce process complexity in the portfolio management of these funds;

• Clarified its investment process by affirming a fundamental-driven approach to investing, with quantitative analysis providing additional input for investment decisions;

• Strengthened its large-cap equity research capability by adding multiple new investment personnel to the team and by bringing U.S. and international research under common leadership; and

• Realigned the compensation structure for portfolio managers and research analysts so that only those who achieve top-quartile returns over a rolling three-year basis are eligible for full bonuses.

As a general matter, the Trustees believe that cooperative efforts between the Trustees and Putnam Management represent the most

16

effective way to address investment performance problems. The Trustees noted that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees concluded that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of engaging a new investment adviser for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations; investor servicing; distribution

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that are expected to be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees considered a change made, at Putnam Management’s request, to the Putnam funds’ brokerage allocation policies commencing in 2010, which increased the permitted soft dollar allocation to third-party services over what had been authorized in previous years. The Trustees noted that a portion of available soft dollars continues to be allocated to the payment of fund expenses. The Trustees indicated their continued intent to monitor regulatory developments in this area with the assistance of their Brokerage Committee and also indicated their continued intent to monitor the potential benefits associated with fund brokerage and soft-dollar allocations and trends in industry practices to ensure that the principle of seeking best price and execution remains paramount in the portfolio trading process.

Putnam Management may also receive benefits from payments that the funds make to Putnam Management’s affiliates for investor or distribution services. In conjunction with the annual review of your fund’s management contract, the Trustees reviewed your fund’s investor servicing agreement with Putnam Investor Services, Inc. (“PSERV”) and its distributor’s contracts and distribution plans with Putnam Retail Management Limited Partnership (“PRM”), both of which are affiliates of Putnam Management. The Trustees concluded that the fees payable by the funds to PSERV and PRM, as applicable, for such services are reasonable in relation to the nature and quality of such services.

17

Other information for shareholders

Important notice regarding Putnam’s privacy policy

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ names, addresses, Social Security numbers, and dates of birth. Using this information, we are able to maintain accurate records of accounts and transactions.

It is our policy to protect the confidentiality of our shareholder information, whether or not a shareholder currently owns shares of our funds. In particular, it is our policy not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use.

Under certain circumstances, we must share account information with outside vendors who provide services to us, such as mailings and proxy solicitations. In these cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. Finally, it is our policy to share account information with your financial representative, if you’ve listed one on your Putnam account.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2010, are available in the Individual Investors section at putnam.com, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of July 31, 2010, Putnam employees had approximately $315,000,000 and the Trustees had approximately $58,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

18

Financial statements

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal year.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

19

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders

Putnam Vista Fund:

We have audited the accompanying statement of assets and liabilities of Putnam Vista Fund (the fund), including the fund’s portfolio, as of July 31, 2010, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform our audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of July 31, 2010 by correspondence with the custodian and brokers or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Putnam Vista Fund as of July 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

September 16, 2010

20

The fund’s portfolio 7/31/10

| | |

| COMMON STOCKS (96.7%)* | Shares | Value |

|

| Advertising and marketing services (0.6%) | | |

| Omnicom Group, Inc. | 171,000 | $6,371,460 |

|

| | | 6,371,460 |

| Aerospace and defense (2.8%) | | |

| BE Aerospace, Inc. † | 214,800 | 6,315,120 |

|

| Goodrich Corp. | 104,800 | 7,636,776 |

|

| L-3 Communications Holdings, Inc. | 69,700 | 5,090,888 |

|

| MTU Aero Engines Holding AG (Germany) | 111,000 | 6,457,212 |

|

| Precision Castparts Corp. | 38,678 | 4,726,065 |

|

| | | 30,226,061 |

| Automotive (0.7%) | | |

| Lear Corp. † | 94,300 | 7,371,431 |

|

| | | 7,371,431 |

| Banking (2.4%) | | |

| Fifth Third Bancorp | 805,600 | 10,239,176 |

|

| Huntington Bancshares, Inc. | 1,458,700 | 8,839,722 |

|

| SVB Financial Group † | 156,600 | 6,763,554 |

|

| | | 25,842,452 |

| Biotechnology (3.7%) | | |

| Alexion Pharmaceuticals, Inc. † | 197,900 | 10,757,844 |

|

| Amylin Pharmaceuticals, Inc. † | 335,300 | 6,343,876 |

|

| BioMarin Pharmaceuticals, Inc. † | 423,700 | 9,257,845 |

|

| Dendreon Corp. † | 196,200 | 6,456,942 |

|

| Human Genome Sciences, Inc. † | 145,000 | 3,761,300 |

|

| United Therapeutics Corp. † | 51,300 | 2,508,057 |

|

| | | 39,085,864 |

| Broadcasting (1.1%) | | |

| CBS Corp. Class B | 261,700 | 3,867,926 |

|

| DISH Network Corp. Class A | 414,100 | 8,315,128 |

|

| | | 12,183,054 |

| Building materials (1.5%) | | |

| Lennox International, Inc. | 174,400 | 7,616,048 |

|

| Masco Corp. | 829,107 | 8,523,220 |

|

| | | 16,139,268 |

| Cable television (1.2%) | | |

| Liberty Global, Inc. Class A † | 456,100 | 13,340,925 |

|

| | | 13,340,925 |

| Chemicals (2.0%) | | |

| Albemarle Corp. | 99,900 | 4,357,638 |

|

| Celanese Corp. Ser. A | 163,900 | 4,603,951 |

|

| Cytec Industries, Inc. | 123,300 | 6,155,136 |

|

| Huntsman Corp. | 550,600 | 5,764,782 |

|

| | | 20,881,507 |

| Coal (0.7%) | | |

| Alpha Natural Resources, Inc. † | 201,000 | 7,704,330 |

|

| | | 7,704,330 |

| Combined utilities (0.6%) | | |

| El Paso Corp. | 558,300 | 6,878,256 |

|

| | | 6,878,256 |

| Commercial and consumer services (1.7%) | | |

| Expedia, Inc. | 149,300 | 3,386,124 |

|

| Plexus Corp. † | 139,000 | 4,058,800 |

|

21

| | |

| COMMON STOCKS (96.7%)* cont. | Shares | Value |

|

| Commercial and consumer services cont. | | |

| Priceline.com, Inc. † | 27,600 | $6,193,440 |

|

| Sotheby’s Holdings, Inc. Class A | 187,500 | 5,086,875 |

|

| | | 18,725,239 |

| Communications equipment (0.6%) | | |

| F5 Networks, Inc. † | 67,100 | 5,893,393 |

|

| | | 5,893,393 |

| Computers (4.4%) | | |

| Hewlett-Packard Co. | 222,300 | 10,234,692 |

|

| IBM Corp. | 91,800 | 11,787,120 |

|

| Polycom, Inc. † | 352,999 | 10,477,010 |

|

| Riverbed Technology, Inc. † | 116,200 | 4,309,858 |

|

| SMART Technologies, Inc. Class A (Canada) † | 96,901 | 1,491,306 |

|

| Xerox Corp. | 901,600 | 8,781,584 |

|

| | | 47,081,570 |

| Conglomerates (0.8%) | | |

| 3M Co. | 55,900 | 4,781,686 |

|

| Danaher Corp. | 93,800 | 3,602,858 |

|

| | | 8,384,544 |

| Consumer goods (2.3%) | | |

| Estee Lauder Cos., Inc. (The) Class A | 97,700 | 6,081,825 |

|

| Fortune Brands, Inc. | 256,104 | 11,237,844 |

|

| Newell Rubbermaid, Inc. | 495,100 | 7,674,050 |

|

| | | 24,993,719 |

| Consumer services (1.6%) | | |

| Avis Budget Group, Inc. † | 712,400 | 8,791,016 |

|

| Netflix, Inc. † | 34,881 | 3,577,047 |

|

| WebMD Health Corp. Class A † | 99,500 | 4,603,865 |

|

| | | 16,971,928 |

| Electric utilities (0.1%) | | |

| EnerNOC, Inc. † | 47,200 | 1,573,648 |

|

| | | 1,573,648 |

| Electrical equipment (0.2%) | | |

| GrafTech International, Ltd. † | 163,900 | 2,569,952 |

|

| | | 2,569,952 |

| Electronics (6.2%) | | |

| Altera Corp. | 441,700 | 12,243,924 |

|

| Gentex Corp. | 463,600 | 8,933,572 |

|

| Jabil Circuit, Inc. | 384,600 | 5,580,546 |

|

| Marvell Technology Group, Ltd. † | 456,700 | 6,813,964 |

|

| SanDisk Corp. † | 228,800 | 9,998,560 |

|

| Sensata Technologies Holding NV (Netherlands) † | 233,100 | 3,776,220 |

|

| Silicon Laboratories, Inc. † | 220,300 | 8,823,015 |

|

| Texas Instruments, Inc. | 168,600 | 4,162,734 |

|

| Trimble Navigation, Ltd. † | 221,000 | 6,269,770 |

|

| | | 66,602,305 |

| Energy (oil field) (2.0%) | | |

| Cameron International Corp. † | 116,500 | 4,612,235 |

|

| Core Laboratories NV (Netherlands) | 50,200 | 3,877,950 |

|

| Dril-Quip, Inc. † | 78,000 | 4,077,840 |

|

| National Oilwell Varco, Inc. | 86,000 | 3,367,760 |

|

| Oceaneering International, Inc. † | 98,400 | 4,868,832 |

|

| Petroleum Geo-Services ASA (Norway) † | 117,900 | 1,059,963 |

|

| | | 21,864,580 |

22

| | |

| COMMON STOCKS (96.7%)* cont. | Shares | Value |

|

| Engineering and construction (0.7%) | | |

| Foster Wheeler AG (Switzerland) † | 135,500 | $3,119,210 |

|

| Shaw Group, Inc. † | 150,600 | 4,825,224 |

|

| | | 7,944,434 |

| Financial (2.5%) | | |

| AerCap Holdings NV (Netherlands) † | 452,649 | 5,893,490 |

|

| Assurant, Inc. | 352,500 | 13,144,725 |

|

| NYSE Euronext | 250,700 | 7,262,779 |

|

| | | 26,300,994 |

| Food (0.5%) | | |

| Corn Products International, Inc. | 129,100 | 4,304,194 |

|

| Smithfield Foods, Inc. † | 81,865 | 1,166,576 |

|

| | | 5,470,770 |

| Forest products and packaging (1.0%) | | |

| International Paper Co. | 131,600 | 3,184,720 |

|

| Sino-Forest Corp. (Hong Kong) † | 487,700 | 7,503,077 |

|

| | | 10,687,797 |

| Gaming and lottery (1.7%) | | |

| Las Vegas Sands Corp. † | 681,555 | 18,306,567 |

|

| | | 18,306,567 |

| Health-care services (3.1%) | | |

| AmerisourceBergen Corp. | 257,400 | 7,714,278 |

|

| Cerner Corp. † | 95,800 | 7,419,710 |

|

| Coventry Health Care, Inc. † | 389,300 | 7,719,819 |

|

| Lincare Holdings, Inc. | 140,400 | 3,335,904 |

|

| Universal Health Services, Inc. Class B | 199,100 | 7,161,627 |

|

| | | 33,351,338 |

| Insurance (0.2%) | | |

| Lincoln National Corp. | 99,889 | 2,601,110 |

|

| | | 2,601,110 |

| Investment banking/Brokerage (0.4%) | | |

| Waddell & Reed Financial, Inc. Class A | 166,100 | 3,958,163 |

|

| | | 3,958,163 |

| Lodging/Tourism (1.0%) | | |

| Wyndham Worldwide Corp. | 439,169 | 11,211,985 |

|

| | | 11,211,985 |

| Machinery (3.6%) | | |

| AGCO Corp. † | 358,100 | 12,447,556 |

|

| Cummins, Inc. | 76,300 | 6,074,243 |

|

| Joy Global, Inc. | 109,199 | 6,483,145 |

|

| Lincoln Electric Holdings, Inc. | 100,000 | 5,522,000 |

|

| Parker Hannifin Corp. | 122,600 | 7,615,912 |

|

| | | 38,142,856 |

| Manufacturing (0.4%) | | |

| Ingersoll-Rand PLC | 102,100 | 3,824,666 |

|

| | | 3,824,666 |

| Media (1.4%) | | |

| Dolby Laboratories, Inc. Class A † | 139,000 | 8,822,330 |

|

| Time Warner, Inc. | 179,600 | 5,650,216 |

|

| | | 14,472,546 |

| Medical technology (4.9%) | | |

| Align Technology, Inc. † | 123,220 | 2,137,867 |

|

| Baxter International, Inc. | 25,800 | 1,129,266 |

|

| Bruker BioSciences Corp. † | 397,998 | 5,241,634 |

|

| Covidien PLC (Ireland) | 138,100 | 5,153,892 |

|

23

| | |

| COMMON STOCKS (96.7%)* cont. | Shares | Value |

|

| Medical technology cont. | | |

| Hologic, Inc. † | 644,500 | $9,113,230 |

|

| Kinetic Concepts, Inc. † | 183,000 | 6,498,330 |

|

| Life Technologies Corp. † | 108,900 | 4,681,611 |

|

| Mettler-Toledo International, Inc. † | 58,300 | 6,809,440 |

|

| PerkinElmer, Inc. | 303,100 | 5,898,326 |

|

| ResMed, Inc. † | 39,400 | 2,588,186 |

|

| Thermo Fisher Scientific, Inc. † | 66,600 | 2,987,676 |

|

| | | 52,239,458 |

| Metals (2.1%) | | |

| Carpenter Technology Corp. | 156,100 | 5,455,695 |

|

| Cliffs Natural Resources, Inc. | 85,400 | 4,831,078 |

|

| Goldcorp, Inc. (Toronto Exchange) (Canada) | 110,700 | 4,332,798 |

|

| Molycorp, Inc. † | 185,500 | 2,289,070 |

|

| U.S. Steel Corp. | 125,000 | 5,541,250 |

|

| | | 22,449,891 |

| Office equipment and supplies (0.4%) | | |

| Avery Dennison Corp. | 119,700 | 4,291,245 |

|

| | | 4,291,245 |

| Oil and gas (3.2%) | | |

| Anadarko Petroleum Corp. | 124,300 | 6,110,588 |

|

| Atlas Energy, Inc. † | 146,734 | 4,341,859 |

|

| EOG Resources, Inc. | 70,100 | 6,834,750 |

|

| Oil States International, Inc. † | 127,256 | 5,846,141 |

|

| QEP Resources, Inc. † | 190,600 | 6,560,452 |

|

| SM Energy Co. | 99,200 | 4,108,864 |

|

| | | 33,802,654 |

| Pharmaceuticals (0.3%) | | |

| Shire PLC ADR (Ireland) | 46,300 | 3,188,681 |

|

| | | 3,188,681 |

| Power producers (0.4%) | | |

| AES Corp. (The) † | 447,400 | 4,612,694 |

|

| | | 4,612,694 |

| Railroads (1.2%) | | |

| Kansas City Southern † | 336,358 | 12,344,339 |

|

| | | 12,344,339 |

| Real estate (2.1%) | | |

| Apartment Investment & Management Co. Class A R | 261,190 | 5,607,749 |

|

| Brookfield Properties Corp. | 725,051 | 10,904,767 |

|

| Jones Lang LaSalle, Inc. | 29,429 | 2,279,570 |

|

| SL Green Realty Corp. R | 53,500 | 3,222,840 |

|

| | | 22,014,926 |

| Restaurants (1.6%) | | |

| Darden Restaurants, Inc. | 199,400 | 8,352,866 |

|

| McDonald’s Corp. | 118,500 | 8,263,005 |

|

| | | 16,615,871 |

| Retail (6.6%) | | |

| Bed Bath & Beyond, Inc. † | 261,187 | 9,893,764 |

|

| Big Lots, Inc. † | 109,500 | 3,756,945 |

|

| Coach, Inc. | 139,200 | 5,146,224 |

|

| Costco Wholesale Corp. | 156,200 | 8,858,102 |

|

| Dick’s Sporting Goods, Inc. † | 80,900 | 2,128,479 |

|

| Kohl’s Corp. † | 89,700 | 4,277,793 |

|

24

| | |

| COMMON STOCKS (96.7%)* cont. | Shares | Value |

|

| Retail cont. | | |

| O’Reilly Automotive, Inc. † | 70,700 | $3,484,096 |

|

| Saks, Inc. † | 1,224,054 | 10,049,483 |

|

| Steven Madden, Ltd. † | 78,276 | 3,023,802 |

|

| Talbots, Inc. (The) † | 334,149 | 3,839,372 |

|

| TJX Cos., Inc. (The) | 106,330 | 4,414,822 |

|

| Urban Outfitters, Inc. † | 156,100 | 5,020,176 |

|

| Whole Foods Market, Inc. † | 180,500 | 6,853,585 |

|

| | | 70,746,643 |

| Schools (0.4%) | | |

| Apollo Group, Inc. Class A † | 98,400 | 4,539,192 |

|

| | | 4,539,192 |

| Semiconductor (1.1%) | | |

| Atmel Corp. † | 201,239 | 1,052,480 |

|

| KLA-Tencor Corp. | 102,400 | 3,243,008 |

|

| Lam Research Corp. † | 175,000 | 7,383,250 |

|

| | | 11,678,738 |

| Shipping (0.6%) | | |

| United Parcel Service, Inc. Class B | 100,700 | 6,545,500 |

|

| | | 6,545,500 |

| Software (6.2%) | | |

| Autodesk, Inc. † | 399,900 | 11,813,046 |

|

| BMC Software, Inc. † | 189,900 | 6,756,642 |

|

| Intuit, Inc. † | 341,200 | 13,562,700 |

|

| Oracle Corp. | 227,700 | 5,382,828 |

|

| Red Hat, Inc. † | 358,866 | 11,537,542 |

|

| VMware, Inc. Class A † | 216,750 | 16,804,628 |

|

| | | 65,857,386 |

| Staffing (0.7%) | | |

| Robert Half International, Inc. | 278,600 | 7,015,148 |

|

| | | 7,015,148 |

| Technology services (4.9%) | | |

| Check Point Software Technologies, Ltd. (Israel) † | 434,700 | 14,788,494 |

|

| Salesforce.com, Inc. † | 232,500 | 23,005,875 |

|

| Unisys Corp. † | 307,158 | 8,296,338 |

|

| VeriSign, Inc. † | 114,000 | 3,209,100 |

|

| Western Union Co. (The) | 204,800 | 3,323,904 |

|

| | | 52,623,711 |

| Telecommunications (3.3%) | | |

| Aruba Networks, Inc. † | 670,100 | 11,378,298 |

|

| Iridium Communications, Inc. † | 422,000 | 4,350,820 |

|

| NII Holdings, Inc. † | 422,100 | 15,811,866 |

|

| Sprint Nextel Corp. † | 893,200 | 4,081,924 |

|

| | | 35,622,908 |

| Textiles (1.0%) | | |

| Hanesbrands, Inc. † | 158,000 | 3,957,900 |

|

| VF Corp. | 81,300 | 6,449,529 |

|

| | | 10,407,429 |

| Trucks and parts (2.0%) | | |

| Autoliv, Inc. (Sweden) † | 140,800 | 8,087,552 |

|

| WABCO Holdings, Inc. † | 349,200 | 13,507,053 |

|

| | | 21,594,605 |

| | | |

| Total common stocks (cost $958,498,045) | | $1,035,149,731 |

25

| | | |

| PURCHASED OPTIONS | Expiration date/ | Contract | |

| OUTSTANDING (—%)* | strike price | amount | Value |

|

| Health Management Associates, Inc. Class A (Call) | Jan-11/$30.00 | 402,671 | $257,750 |

|

| Total purchased options outstanding (cost $1,052,985) | | | $257,750 |

| |

| |

| CONVERTIBLE PREFERRED STOCKS (—%)* | | Shares | Value |

|

| UNEXT.com, LLC zero % cv. pfd. (acquired 4/14/00, | | | |

| cost $10,451,238) (Private) F ‡ † | | 125,000 | $1,250 |

|

| Total convertible preferred stocks (cost $10,451,238) | | | $1,250 |

| |

| |

| SHORT-TERM INVESTMENTS (3.0%)* | Principal amount/shares | Value |

|

| Putnam Money Market Liquidity Fund 0.12% e | | 26,729,696 | $26,729,696 |

|

| SSgA Prime Money Market Fund 0.20% i P | | 269,000 | 269,000 |

|

| U.S. Treasury Bills, for effective yields ranging from 0.26% to 0.28%, | | |

| December 16, 2010 ## | | $1,420,000 | 1,418,253 |

|

| U.S. Treasury Bills, for effective yields ranging from 0.26% to 0.31%, | | |

| March 10, 2011 | | 2,085,000 | 2,083,686 |

|

| U.S. Treasury Bills, for effective yields ranging from 0.23% to 0.25%, | | |

| November 18, 2010 # | | 1,693,000 | 1,692,222 |

|

| U.S. Treasury Bill for an effective yield of 0.24%, August 26, 2010 # | 140,000 | 139,976 |

|

| Total short-term investments (cost $32,330,834) | | | $32,332,833 |

| |

| |

| TOTAL INVESTMENTS | | | |

|

| Total investments (cost $1,002,333,102) | | | $1,067,741,564 |

Key to holding’s abbreviations

| |

| ADR | American Depository Receipts |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from August 1, 2009 through July 31, 2010 (the reporting period).

* Percentages indicated are based on net assets of $1,070,236,395.

�� Non-income-producing security.

‡ Restricted, excluding 144A securities, as to public resale. The total market value of restricted securities held at the close of the reporting period was $1,250, or less than 0.1% of net assets.

# These securities, in part or in entirety, were pledged and segregated with the broker to cover margin requirements for futures contracts at the close of the reporting period.

## This security, in part or in entirety, was pledged and segregated with the custodian for collateral on certain derivatives contracts at the close of the reporting period.

e See Note 6 to the financial statements regarding investments in Putnam Money Market Liquidity Fund. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

F Is valued at fair value following procedures approved by the Trustees. Securities may be classified as Level 2 or Level 3 for Accounting Standards Codification ASC 820 Fair Value Measurements and Disclosures (ASC 820) based on the securities valuation inputs (Note 1).

i Security purchased with cash or security received, that was pledged to the fund for collateral on certain derivatives contracts (Note 1).

26

P The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

R Real Estate Investment Trust.

At the close of the reporting period, the fund maintained liquid assets totaling $21,228,474 to cover certain derivatives contracts.

ADR after the name of a foreign holding represents ownership of foreign securities on deposit with a custodian bank.

| | | | | | |

| FORWARD CURRENCY CONTRACTS at 7/31/10 (aggregate face value $3,029,980) | | |

| |

| | | Contract | Delivery | | Aggregate | Unrealized |

| Counterparty | Currency | type | date | Value | face value | depreciation |

|

| UBS AG | | | | | | |

|

| Euro | Sell | 8/18/10 | $3,125,580 | $3,029,980 | $(95,600) |

|

| Total | | | | | | $(95,600) |

| | | | | | |

| FUTURES CONTRACTS OUTSTANDING at 7/31/10 | | | | |

| |

| | Number of | | | Expiration | Unrealized |

| | contracts | Value | | date | appreciation |

|

| NASDAQ 100 Index E-Mini (Long) | 19 | $707,655 | | Sep-10 | $1,326 |

|

| Russell 2000 Index Mini (Long) | 1 | 64,960 | | Sep-10 | 88 |

|

| S&P 500 Index (Long) | 1 | 274,575 | | Sep-10 | 21 |

|

| S&P Mid Cap 400 Index E-Mini (Long) | 31 | 2,352,280 | | Sep-10 | 10,839 |

|

| Total | | | | | $12,274 |

| | | | | |

| WRITTEN OPTIONS OUTSTANDING at 7/31/10 (premiums received $509,328) | | | |

|

| | Contract | | Expiration date/ | |

| | amount | | strike price | Value |

|

| F5 Networks, Inc. (Call) F | 67,100 | | Aug-10/$75.00 | $885,858 |

|

| Health Management Associates, Inc. Class A (Call) | 402,671 | | Jan-11/40.00 | 27,583 |

|

| Total | | | | $913,441 |

F Is valued at fair value following procedures approved by the Trustees. Securities may be classified as Level 2 or Level 3 for Accounting Standards Codification ASC 820 based on the securities valuation inputs.

| | | | | | |

| TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 7/31/10 | | |

|

| | | | Fixed payments | Total return | |

| Swap counterparty/ | Termination | | received (paid) by | received by | Unrealized |

| Notional amount | date | | fund per annum | or paid by fund | appreciation |

|

| Goldman Sachs International | | | | | |

| baskets 118,111 | 4/12/11 | | (3 month USD- | A basket | $757,279 |

| | | | LIBOR-BBA) | (GSCBRETE) of | |

| | | | | common stocks | |

|

| Total | | | | | $757,279 |

27

ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1 — Valuations based on quoted prices for identical securities in active markets.

Level 2 — Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3 — Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| | | | |

| | | |

| | | Valuation inputs | |

|

| Investments in securities: | Level 1 | Level 2 | Level 3 |

|

| Common stocks: | | | |

|

| Basic materials | $54,019,195 | $— | $— |

|

| Capital goods | 108,593,819 | — | — |

|

| Communication services | 48,963,833 | — | — |

|

| Conglomerates | 8,384,544 | — | — |

|

| Consumer cyclicals | 170,223,935 | — | — |

|

| Consumer staples | 91,318,315 | — | — |

|

| Energy | 63,371,564 | — | — |

|

| Financial | 80,717,645 | — | — |

|

| Health care | 127,865,341 | — | — |

|

| Technology | 249,737,103 | — | — |

|

| Transportation | 18,889,839 | — | — |

|

| Utilities and power | 13,064,598 | — | — |

|

| Total common stocks | 1,035,149,731 | — | — |

| Convertible preferred stocks | — | — | 1,250 |

|

| Purchased options outstanding | — | 257,750 | — |

|

| Short-term investments | 26,998,696 | 5,334,137 | — |

|

| Totals by level | $1,062,148,427 | $5,591,887 | $1,250 |

| | | | |

| | | Valuation inputs | |

|

| Other financial instruments: | Level 1 | Level 2 | Level 3 |

|

| Forward currency contracts | $— | $(95,600) | $— |

|

| Futures contracts | 12,274 | — | — |

|

| Written options | — | (913,441) | — |

|

| Total return swap contracts | — | 757,279 | — |

|

| Totals by level | $12,274 | $(251,762) | $— |

At the start and/or close of the reporting period, Level 3 investments in securities were not considered a significant portion of the fund’s portfolio.

The accompanying notes are an integral part of these financial statements.

28

Statement of assets and liabilities 7/31/10

| |

| ASSETS | |

|

| Investment in securities, at value (Note 1): | |

| Unaffiliated issuers (identified cost $975,603,406) | $1,041,011,868 |

| Affiliated issuers (identified cost $26,729,696) (Note 6) | 26,729,696 |

|

| Cash | 145,760 |

|

| Dividends, interest and other receivables | 663,674 |

|

| Receivable for shares of the fund sold | 107,126 |

|

| Receivable for investments sold | 10,515,132 |

|

| Unrealized appreciation on swap contracts (Note 1) | 757,279 |

|

| Receivable for variation margin (Note 1) | 13,885 |

|

| Total assets | 1,079,944,420 |

| |

| LIABILITIES | |

|

| Payable for investments purchased | 4,611,000 |

|

| Payable for shares of the fund repurchased | 1,395,081 |

|

| Payable for compensation of Manager (Note 2) | 526,202 |

|

| Payable for investor servicing fees (Note 2) | 214,277 |

|

| Payable for custodian fees (Note 2) | 18,182 |

|

| Payable for Trustee compensation and expenses (Note 2) | 646,510 |

|

| Payable for administrative services (Note 2) | 7,036 |

|

| Payable for distribution fees (Note 2) | 267,942 |

|

| Unrealized depreciation on forward currency contracts (Note 1) | 95,600 |

|

| Written options outstanding, at value (premiums received $509,328) (Notes 1 and 3) | 913,441 |

|

| Collateral on certain derivative contracts, at value (Note 1) | 269,000 |

|

| Other accrued expenses | 743,754 |

|

| Total liabilities | 9,708,025 |

| |

| Net assets | $1,070,236,395 |

|

| REPRESENTED BY | |

|

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $2,926,287,037 |

|

| Accumulated net investment loss (Note 1) | (661,679) |

|