Exhibit 13.1

2 0 0 2 A N N U A L R E P O R T

SAKS

INCORPORATED

Intent. On Strategy.

2002

Intent. On Strategy.

F I N A N C I A L H I G H L I G H T S

SAKS INCORPORATED FINANCIAL HIGHLIGHTS

| | | Year Ended | | |

|

| |

(In Thousands, except per share amounts) | | February 1, 2003 | | | February 2, 2002 | | | February 3, 2001 | | |

| |

| | | | | |

Net Sales | | $ | 5,911,122 | | | $ | 6,070,568 | | | $ | 6,581,236 | | |

Income Before Accounting Change | | $ | 69,837 | | | $ | 322 | | | $ | 75,216 | | |

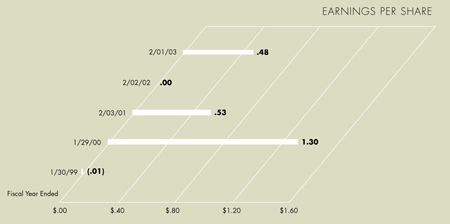

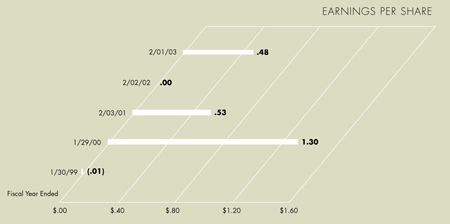

Diluted Earnings Per Common Share Before Accounting Change | | $ | 0.48 | | | $ | 0.00 | | | $ | 0.53 | | |

Diluted Weighted Average Common Shares | | | 146,707 | | | | 144,498 | | | | 142,718 | | |

Total Assets | | $ | 4,579,356 | | | $ | 4,595,521 | | | $ | 5,050,611 | | |

Shareholders’ Equity | | $ | 2,267,272 | | | $ | 2,271,437 | | | $ | 2,293,829 | | |

| |

Management excludes certain items from its view of ongoing core operations. Below is a summary of these items and their effect on net income. | |

Income Before Certain Items | | $ | 90,416 | | | $ | 23,868 | | | $ | 132,710 | | |

Diluted Earnings Per Common Share Before Certain Items | | $ | 0.62 | | | $ | 0.17 | | | $ | 0.93 | | |

| |

Certain Items: | | | | | | | | | | | | | |

Losses from long-lived assets | | $ | 19,547 | | | $ | 32,621 | | | $ | 73,572 | | |

Integration charges | | | 9,981 | | | | 1,539 | | | | 19,886 | | |

Reorganization charges | | | 763 | | | | 20,049 | | | | 7,652 | | |

Gains on extinguishment of debt | | | (709 | ) | | | (26,110 | ) | | | — | | |

Other | | | 2,820 | | | | 9,897 | | | | (925 | ) | |

| |

Total certain items, before income taxes | | | 32,402 | | | | 37,996 | | | | 100,185 | | |

Tax benefit from real estate investment | | | — | | | | — | | | | (4,120 | ) | |

Tax effect of certain items | | | (11,823 | ) | | | (14,450 | ) | | | (38,571 | ) | |

| |

Total Certain Items | | $ | 20,579 | | | $ | 23,546 | | | $ | 57,494 | | |

|

|

|

2

| | L E T T E R T O O U R S H A R E H O L D E R S Intent. On Strategy. |

| | | TO OUR SHAREHOLDERS During the past year, Saks achieved gains in operating profits and return on invested capital in an extremely difficult retail environment. Earnings per share increased from the depressed 2001 level to $.48 in 2002 despite a comparable store sales decrease of 1.4%. Profit improvement was the result of increased merchandise margins and a reduction in operating expenses. During the year, we generated $276 million in cash flow from operations. |

| |

|

| | |

IMPROVED OPERATING PERFORMANCE

3

L E T T E R T O O U R S H A R E H O L D E R S

Intent. On Strategy.

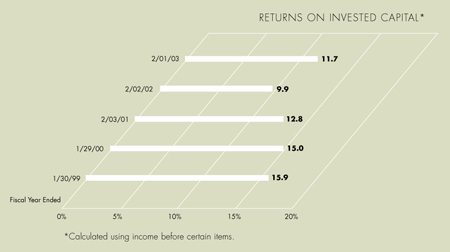

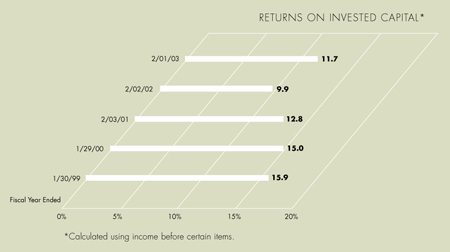

RETURNS ON INVESTED CAPITAL*

We manage Saks Incorporated and report the results of the Company in two business segments, Saks Department Store Group (SDSG) and Saks Fifth Avenue Enterprises (SFAE). SDSG’s 2002 operating income declined from the 2001 level by 12% to $197 million. Comparable store sales decreased 1.6%. The entire decline in operating income occurred in the fourth quarter of the year when holiday selling did not materialize at planned levels. While these results were disappointing, SDSG did execute a number of important strategic merchandising and service initiatives in 2002 to ensure that our SDSG stores are indeed “the best place to shop in your hometown.” We will update you on a number of these initiatives later in this report. Consistent with our focus on productivity and efficiency, we consolidated the home office of our Younkers department store division into our Carson Pirie Scott Milwaukee headquarters at the end of the fiscal year. Beginning in 2003, this action will save approximately $12 million of pre-tax expense annually. | |

|

| |

| |

4

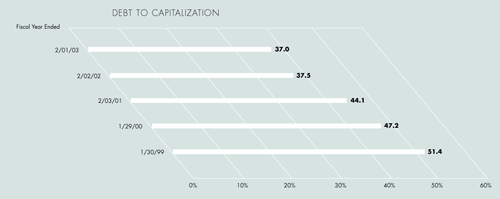

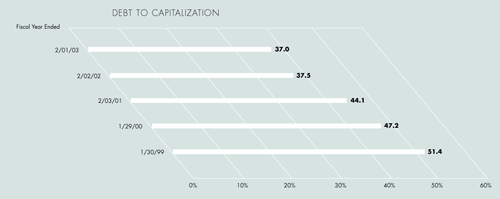

| | LE T T E R T O O U R S H A R E H O L D E R S Intent. On Strategy. A STRONGER BALANCE SHEET At SFAE, 2002 operating income climbed by nearly $125 million to $101.5 million from the depressed post–September 11th levels of 2001. This occurred through a substantial improvement in merchandise margins resulting from disciplined inventory control and lower operating expenses. SFAE made strategic advancements in merchandising, customer service, store operations, and marketing strategies in 2002, all designed to deliver to our customers “the most inviting luxury shopping experience.” Details are outlined later in this report as well. We made strategic investments and achieved important objectives during the year which will position Saks Incorporated for long-term growth. In 2002, we: • Strengthened our balance sheet. During 2002, we lowered our total debt to $1.33 billion in spite of the difficult external environment. Over the past two years, we have reduced debt by nearly $500 million and our year-end debt-to-capitalization ratio to 37%. We ended the year with more than $200 million in cash and no outstanding debt on our $700 million revolving credit facility. Through careful management, we were able to finish the year with comparable store inventories essentially unchanged from prior year levels. |

| |

| |

5

L E T T E R T O O U R S H A R E H O L D E R S

Intent. On Strategy.

| | SAKS FIFTH AVENUE LAS VEGAS | |

|

| | • We further enhanced our store base. During the year, we opened four new stores and four replacement stores while closing four underproductive units. Our store base is in excellent condition. We improved productivity and reduced costs. • We reduced Selling, General, and Administrative SG&A expenses by $58 million in 2002 through the integration of our Saks Direct business and diligent expense management, in spite of an environment of rising health care and insurance costs. • We invested in strategic systems improvements. We completed the installation of common merchandising systems, web-enablement tools, and logistics systems, all designed to improve productivity. |

| | ENHANCED STORE BASE | |

|

| | |

6

| | L E T T E R T O O U R S H A R E H O L D E R S Intent. On Strategy. |

| | | During the 2002 calendar year, our stock price increased by 20% reflecting the quality of our assets and improved operating results. Subsequent to calendar year-end, the share price has fallen substantially, along with those of many other general merchandise retailers, as our outlook for 2003 is very cautious given the volatility of the financial markets, higher oil prices, general economic weakness, and geopolitical concerns. We have built our short-term business plans to reflect this difficult environment and will continue with a conservative operating bias until we see more robust general conditions. While managing very carefully in the short-term, we will continue to make the strategic investments and operating transformations necessary to respond to the longer-term opportunities in this business. We will continue to be innovative in our product offerings and service strategies while remaining steadfastly focused on delivering within SDSG on our promise to be “the best place to shop in your hometown” and at SFAE to deliver on the promise of being “the most inviting luxury shopping experience.” We intend to do so while generating free cash flow and continued improvement in returns on invested capital. We welcome any suggestions you might have to help us to do so. Thank you for your interest and your investment. |

|

| | |

| | | |

|

| | | R. Brad Martin | | | | Stephen I. Sadove |

| | | Chairman and Chief Executive Officer | | Vice Chairman |

| | | | | |

| | | | | |

| | | | | |

|

STEADFASTLY FOCUSED |

7

L E T T E R T O O U R S H A R E H O L D E R S

Intent. On Strategy.

SAKS DEPARTMENT STORE GROUP

SDSG operates 241 department stores in 24 states with 26.5 million square feet under the nameplates of Parisian, Proffitt’s, McRae’s, Younkers, Herberger’s, Carson Pirie Scott, Bergner’s, and Boston Store. We are the “hometown” store with the number one or number two department store market share in approximately 90% of our trade areas. We are delivering on our promise to be “the best place to shop in your hometown” through the execution of our merchandising and service strategies.

Our merchandising strategy is focused on franchise businesses, key items, and product differentiation.

| | • | | Our franchise businesses—cosmetics, women’s shoes, women’s sportswear, women’s special sizes, social occasion dressing, and gifts—are clearly becoming “top of mind” when our customers shop. These categories generated comparable store sales increases in 2002 and comprised one-third of our department store revenues. |

| | • | | Our key item strategy is delivered with authoritative presentations of “must-have” selections in meaningful quantities on our sales floor, supported by compelling fixturing and signing. Revenues from key items exceeded 13% of total sales in 2002, up from 11% in 2001. |

THE BEST PLACE TO SHOP IN YOUR HOMETOWN

9

L E T T E R T O O U R S H A R E H O L D E R S

Intent. On Strategy.

JANE SEYMOUR HOME PRODUCTS

RUFF HEWN WOMEN’S APPAREL

| | • We progressed in product differentiation, increasing our sales from differentiated products (including private brands) to over 23% of sales in 2002 from 17% in 2001. Our existing twelve proprietary brands, including Relativity in women’s, Consensus in men’s, and LivingQuarters in home, continue to gain momentum. Our exclusive Laura Ashley private brand women’s apparel merchandise debuted in July 2002, and we acquired the exclusive license for Ruff Hewn men’s and women’s apparel and Jane Seymour home products and children’s apparel during the year. These unique offerings will be introduced into SDSG stores in the second half of 2003. Consistent with this strategic direction of differentiation, we announced our planned partnership with FAO, Inc. to add FAO Schwarz, The Right Start, and/or Zany Brainy Kids boutiques in the majority of our department stores beginning in the second half of 2003. These brands are synonymous with high-quality toys and educational and developmental products for children, and this merchandise will be an attractive category expansion for our stores. Additionally, we anticipate the placement of seasonal Zany Brainy Kids and FAO Express shops in most SDSG stores for the 2003 holidays. | |

|

FAO SCHWARZ BOUTIQUES

| |

| |

| | | | |

FOCUSED MERCHANDISING AND SERVICE STRATEGIES | | |

10

L E T T E R T O O U R S H A R E H O L D E R S

Intent. On Strategy.

| | We continued to improve the shopping experience for our customers and in 2002 implemented various innovative service features in our stores, including: • High-visibility directional signing in all SDSG stores. • A “Wrap-it Express” program in all stores where customers can leave their packages and receive a specific time their gifts will be wrapped and ready, allowing customers to continue shopping. In select stores, customers are notified by a personal pager that their packages are wrapped and ready. • “Comfort zones” and “living room” areas in over 60 stores. • Headsets in the high-traffic shoe departments of over 50 stores, allowing sales associates to remain on the selling floor while stockroom attendants deliver requested shoes to the floor. • A myriad of other features in key stores ranging from valet parking to personal shoppers to fitting room technology. As we enter 2003, we will: • Continue to strengthen our franchise businesses, expand key items to over 14% of revenues, and increase differentiated product to over 26% of sales. • Enhance the customers’ shopping experience through the implementation of in-store service initiatives to additional stores and improved training programs. • Demonstrate our local focus through more “hometown” marketing initiatives and an increased emphasis on customer relationship management as a sustainable competitive advantage. | |

SDSG COMFORT ZONES |

LOCAL FOCUS AND “HOMETOWN” MARKETING |

11

L E T T E R T O O U R S H A R E H O L D E R S

Intent. On Strategy.

SAKS FIFTH AVENUE ENTERPRISES

SFAE operates 60 Saks Fifth Avenue luxury department stores in 24 states with 6.3 million square feet of space, and 53 Saks Off 5th stores in 23 states with 1.4 million square feet.

Saks Fifth Avenue is the most powerful name in luxury retailing, and as an emporium for world-class luxury brands, we are an authority on “style.” The mission of Saks Fifth Avenue is to be “the most inviting luxury shopping experience.” We provide our customers “inviting luxury” with differentiated merchandise and special service strategies.

In merchandising, we have identified certain focus categories including contemporary women’s sportswear, “Gold Range” women’s apparel, fine jewelry, footwear, and handbags. These businesses generated mid-single digit comparable store sales growth in 2002, resulting from our differentiated luxury assortments and marketing efforts. Our renovated New York flagship store clearly reflects our commitment to these growth businesses.

SAKS FIFTH AVENUE

NEW YORK CITY

THE MOST INVITING LUXURY SHOPPING EXPERIENCE

13

L E T T E R T O O U R S H A R E H O L D E R S

Intent. On Strategy.

SAKS.COM ON-LINE SHOPPING

ONE-ON-ONE BRIDAL REGISTRY

SFA COMFORT ZONE SEATING CORPORTATE GIFT CATALOG

| | We enhanced our marketing and improved the customer experience in 2002. Customer satisfaction continually improved throughout the year as evidenced by the scores from our independent monitoring service. In 2002, we: • IntegratedSaks Direct into the Saks Fifth Avenue organization, resulting in a more consistent customer experience across multiple channels. • Strengthenedhiring and training procedures to ensure that customers are offered the “inviting luxury” experience they expect. • Introducedour one-on-one bridal registry in the New York flagship store. • Introducedvarious distinctive service initiatives, including concierge services, “one-on-one” walk-in personal shopping, and multiple seating/comfort zones in our new Saks Fifth Avenue store in Las Vegas. This store serves as the prototype for our innovative service initiatives. • Launchedour “Make It Your Own” marketing campaign, designed to reinforce our positioning of “inviting luxury.” • Launchedour Saks Fifth Avenue corporate gift program and catalog. • Strengthenedour strategic affiliations with world-class partners including Mercedes-Benz, Ritz-Carlton, Continental Airlines, and American Express.

IMPROVED CUSTOMER EXPERIENCE |

14

| | | L E T T E R T O O U R S H A R E H O L D E R S Intent. On Strategy. |

| | In 2003, we will: • Continueto increase the sales penetration of our focus businesses through our differentiated merchandise offerings supported by service, store design, visual elements, and marketing. We also will continue to add unique merchandise from additional exclusive vendors. • Furtherenhance the store experience by implementing key service initiatives found in the Las Vegas prototype store into other stores, incorporating our bridal registry into additional stores, launching our nationwide on-line Saks Fifth Avenue gift registry, and adding new in-store product categories to create excitement. |

| | | | |

| | | |

|

15

| | L E T T E R T O O U R S H A R E H O L D E R S Intent. On Strategy. |

| | In 2003, we will heighten our emphasis on customer relationship management (CRM), which will foster engagement, repeat visits, and loyalty through marketing and clienteling efforts. Through sophisticated segmentation of our customer database, we are able to create relevant and motivating marketing and communications strategies to discrete groups of similar customers. Clienteling ensures our associates are the “personal connection” between our customers and SFA. Our CRM strategies provide sales associates with training to better understand and identify different customer segments and their potential needs, as well as with tools and incentives at point-of-service personalized to specific customers. In 2003, we will also continue to strengthen our SaksFirst loyalty program and our strategic third-party alliances and to develop our corporate gift business. The Saks Off 5th business has been repositioned to ensure that we deliver on our commitment to offer a selection of Saks Fifth Avenue products for a “gem of a deal.” By upgrading the merchandise mix to a higher designer penetration and prominently displaying and signing merchandise direct from Saks Fifth Avenue, the operating contribution of this business substantially improved during 2002. In 2003, we will continue to upgrade the merchandise mix, improve customer service, and execute our key item gift strategy. |

| | HEIGHTENED EMPHASIS ON CRM |

16

| | L E T T E R T O O U R S H A R E H O L D E R S Intent. On Strategy. |

| | LOOKING AHEAD Our real estate strategy remains focused on entering certain strategic markets and enhancing our position in existing core markets. Consistent with that focus, we plan to open six new units in 2003, totaling nearly 650,000 square feet. We will add a Bergner’s replacement store in Peoria, Illinois; a second Younkers unit in the Lansing, Michigan market; an additional Younkers store in the metropolitan Green Bay, Wisconsin area; Saks Fifth Avenue stores in Richmond, Virginia and Indianapolis, Indiana; and an Off 5th store in St. Louis, Missouri. We are continuing to enhance merchandising systems, such as size allocation by store and markdown optimization, and service technology including customer relationship management and improved point-of-service clienteling. We believe these advanced tools will contribute to improved sales and merchandise margins in the future. We are confident that we have the merchandising and service strategies in place at both SDSG and SFAE to further differentiate from our competitors, generate increased customer traffic, create a more exciting and appealing shopping experience, and enhance store productivity. |

| | This letter and the SDSG and SFAE information on pages 3 through 17 of this report contain “forward-looking” information within the definition of the Federal securities laws. For a discussion of risk factors, please refer to “Forward-Looking Information” contained in Management’s Discussion and Analysis appearing on page 35 of this annual report. |

17

SAKS INCORPORATED & SUBSIDIARIES

FIVE-YEAR FINANCIAL SUMMARY

(In Thousands, except per share amounts) | | February 1, 2003 | | | February 2, 2002 | | | February 3, 2001 | | | January 29, 2000 | | | January 30, 1999 | |

| | | | | |

|

CONSOLIDATED INCOME STATEMENT DATA: | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 5,911,122 | | | $ | 6,070,568 | | | $ | 6,581,236 | | | $ | 6,434,167 | | | $ | 5,963,813 | |

|

Cost of sales (excluding depreciation and amortization) | | | 3,739,247 | | | | 3,960,129 | | | | 4,211,707 | | | | 4,028,779 | | | | 3,794,340 | |

|

Gross margin | | | 2,171,875 | | | | 2,110,439 | | | | 2,369,529 | | | | 2,405,388 | | | | 2,169,473 | |

Selling, general and administrative expenses | | | 1,331,137 | | | | 1,389,287 | | | | 1,433,357 | | | | 1,359,386 | | | | 1,332,275 | |

Other operating expenses | | | 578,111 | | | | 582,623 | | | | 580,853 | | | | 535,670 | | | | 498,733 | |

Losses from long-lived assets | | | 19,547 | | | | 32,621 | | | | 73,572 | | | | 12,547 | | | | 61,785 | |

Integration and year 2000 charges | | | 9,981 | | | | 1,539 | | | | 19,886 | | | | 41,577 | | | | 121,744 | |

|

OPERATING INCOME | | | 233,099 | | | | 104,369 | | | | 261,861 | | | | 456,208 | | | | 154,936 | |

Interest expense | | | (124,052 | ) | | | (131,039 | ) | | | (149,995 | ) | | | (138,968 | ) | | | (110,971 | ) |

Gain (loss) on extinguishment of debt | | | 709 | | | | 26,110 | | | | — | | | | (15,182 | ) | | | (42,369 | ) |

Other income (expense), net | | | 229 | | | | 1,083 | | | | 3,733 | | | | 140 | | | | 22,201 | |

|

INCOME BEFORE INCOME TAXES AND CUMULATIVE EFFECT OF ACCOUNTING CHANGE | | | 109,985 | | | | 523 | | | | 115,599 | | | | 302,198 | | | | 23,797 | |

Provision for income taxes | | | 40,148 | | | | 201 | | | | 40,383 | | | | 112,555 | | | | 24,693 | |

|

INCOME BEFORE CUMULATIVE EFFECT OF ACCOUNTING CHANGE | | | 69,837 | | | | 322 | | | | 75,216 | | | | 189,643 | | | | (896 | ) |

Cumulative effect of a change in accounting principle, net of taxes | | | (45,593 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | |

|

NET INCOME | | $ | 24,244 | | | $ | 322 | | | $ | 75,216 | | | $ | 189,643 | | | $ | (896 | ) |

|

Basic earnings per common share: | | | | | | | | | | | | | | | | | | | | |

Before cumulative effect of accounting change | | $ | 0.49 | | | $ | 0.00 | | | $ | 0.53 | | | $ | 1.32 | | | $ | (0.01 | ) |

After cumulative effect of accounting change | | $ | 0.17 | | | $ | 0.00 | | | $ | 0.53 | | | $ | 1.32 | | | $ | (0.01 | ) |

Diluted earnings per common share: | | | | | | | | | | | | | | | | | | | | |

Before cumulative effect of accounting change | | $ | 0.48 | | | $ | 0.00 | | | $ | 0.53 | | | $ | 1.30 | | | $ | (0.01 | ) |

After cumulative effect of accounting change | | $ | 0.17 | | | $ | 0.00 | | | $ | 0.53 | | | $ | 1.30 | | | $ | (0.01 | ) |

Weighted average common shares: | | | | | | | | | | | | | | | | | | | | |

Basic | | | 142,750 | | | | 141,988 | | | | 141,656 | | | | 144,174 | | | | 142,856 | |

Diluted | | | 146,707 | | | | 144,498 | | | | 142,718 | | | | 146,056 | | | | 146,383 | |

CONSOLIDATED BALANCE SHEET DATA: | | | | | | | | | | | | | | | | | | | | |

Working capital | | $ | 1,123,833 | | | $ | 983,151 | | | $ | 1,085,956 | | | $ | 1,110,976 | | | $ | 887,875 | |

Total assets | | $ | 4,579,356 | | | $ | 4,595,521 | | | $ | 5,050,611 | | | $ | 5,098,952 | | | $ | 5,188,981 | |

Long-term debt, less current portion | | $ | 1,327,381 | | | $ | 1,356,580 | | | $ | 1,801,657 | | | $ | 1,966,802 | | | $ | 2,114,647 | |

Shareholders’ equity | | $ | 2,267,272 | | | $ | 2,271,437 | | | $ | 2,293,829 | | | $ | 2,208,343 | | | $ | 2,007,575 | |

18

M A N A G E M E N T’ S D I S C U S S I O N A N D A N A L Y S I S

Saks Incorporated (hereinafter the “Company”) is a national retailer currently operating, through subsidiaries, 354 traditional and luxury department stores. The Company operates the Saks Department Store Group (“SDSG”), which consists of 241 traditional department stores under the names of Parisian, Proffitt’s, McRae’s, Younkers, Herberger’s, Carson Pirie Scott, Bergner’s and Boston Store. The Company also operates Saks Fifth Avenue Enterprises (“SFAE”), which consists of 60 luxury Saks Fifth Avenue stores and 53 Saks Off 5th stores.

Since 1994, the Company has experienced significant growth principally through a series of acquisitions, the construction of new units and through the acquisition of select store locations.

Name | | Headquarters | | Number of Stores Acquired | | Locations | | Date Acquired | | Accounting Treatment |

|

McRae’s | | Jackson, MS | | 31 | | Southeast | | March 31, 1994 | | Purchase |

Younkers | | Des Moines, IA | | 50 | | Midwest | | February 3, 1996 | | Pooling |

Parisian | | Birmingham, AL | | 40 | | Southeast/Midwest | | October 11, 1996 | | Purchase |

Herberger’s | | St. Cloud, MN | | 37 | | Midwest | | February 1, 1997 | | Pooling |

Carson Pirie Scott (“Carson’s”) | | Milwaukee, WI | | 55 | | Midwest | | January 31, 1998 | | Pooling |

Saks Fifth Avenue | | New York, NY | | 95 | | National | | September 17, 1998 | | Pooling |

The following table sets forth, for the periods indicated, selected items from the Company’s consolidated statements of income, expressed as percentages of net sales (numbers may not total due to rounding):

| | | Year Ended | |

|

| | | February 1, 2003 (“2002”) | | | February 2, 2002 (“2001”) | | | February 3, 2001 (“2000”) | |

|

Net sales | | 100.0 | % | | 100.0 | % | | 100.0 | % |

Cost of sales (excluding depreciation and amortization) | | 63.3 | | | 65.2 | | | 64.0 | |

|

Gross margin | | 36.7 | | | 34.8 | | | 36.0 | |

Selling, general and administrative expenses | | 22.5 | | | 22.9 | | | 21.8 | |

Other operating expenses | | 9.8 | | | 9.6 | | | 8.8 | |

Losses from long-lived assets | | 0.3 | | | 0.5 | | | 1.1 | |

Integration charges | | 0.2 | | | 0.0 | | | 0.3 | |

|

Operating income | | 3.9 | | | 1.7 | | | 4.0 | |

Interest expense | | (2.1 | ) | | (2.2 | ) | | (2.3 | ) |

Gain on extinguishment of debt | | 0.0 | | | 0.4 | | | 0.0 | |

Other income expense, net | | 0.0 | | | 0.0 | | | 0.1 | |

|

Income before income taxes and cumulative effect of accounting change | | 1.9 | | | 0.0 | | | 1.8 | |

Provision for income taxes | | 0.7 | | | 0.0 | | | 0.6 | |

|

Income before cumulative effect of accounting change | | 1.2 | | | 0.0 | | | 1.1 | |

Cumulative effect of a change in accounting principle, net of taxes | | (0.8 | ) | | 0.0 | | | 0.0 | |

|

Net income | | 0.4 | % | | 0.0 | % | | 1.1 | % |

|

19

M A N A G E M E N T’ S D I S C U S S I O N A N D A N A L Y S I S

FISCAL YEAR ENDED FEBRUARY 1, 2003 COMPARED TO FISCAL YEAR ENDED FEBRUARY 2, 2002

MANAGEMENT’S DISCUSSION OF OPERATIONS

Operating income increased to $233.1 million in 2002 from $104.4 million in 2001. The increase in operating income of $128.7 million was largely attributable to an increase in SFAE’s operating income of $124.2 million, the absence of charges associated with the reorganization of Saks Direct (SFAE’s catalog and e-commerce operations) of $35.1 million in 2001 and a decrease of $9.0 million in charges associated with store closings and dispositions. These improvements were partially offset by a decrease in SDSG’s operating income of $25.7 million and $13.9 million of charges associated with the consolidation of the Younkers home office into Carson’s.

The decrease in operating income at SDSG was primarily due to a 1.6% decrease in comparable store sales, which contributed to a $17.3 million reduction in gross margin. Increased insurance and retirement expenses of $10.6 million and increased store selling payroll of $9.3 million were partially offset by decreased amortization expense of $10.2 million. Although comparable store sales at SFAE declined 1.1%, significantly lower levels of merchandise allowed for a significant reduction in markdowns and contributed to an $82.5 million improvement in gross margin. SFAE’s store operating expenses were reduced by $18.3 million, and the reorganization of Saks Direct contributed to a year-over-year improvement of approximately $30 million in operating contribution.

The 2002 charges associated with the Younkers consolidation, store closings and impairments and other expense reduction efforts aggregated $33.1 million. Charges associated with the consolidation of Younkers totaled $13.9 million, which consisted primarily of property write-downs and employee severance costs. An additional $15.6 million of property write-downs were associated with the impairment and closure of underproductive stores, and $3.6 million of other charges related primarily to other expense reduction efforts.

The Company believes that current economic conditions and geopolitical risks create an environment of uncertainty making the forecasting of near-term operating results particularly difficult. However, based on prevailing trends and conditions, management believes that there may be a decline in 2003 comparable store sales in the low-single digits, accompanied by continued improvements in the gross margin rate driven by enhanced merchandise mix, inventory control and benefits related to the Younkers consolidation.

NET SALES

Net sales decreased $159.4 million or 2.6% in 2002 over 2001. Approximately one-half of the decrease was due to a consolidated comparable store sales decrease of 1.4%, consisting of a 1.6% decrease at SDSG and a 1.1% decrease at SFAE. The decline in comparable store sales was primarily attributable to a poor fourth quarter holiday selling season as a result of continued geopolitical and economic uncertainty. In addition to the comparable store sales decrease, year-over-year sales were approximately $58 million less due to the sale or closure of underproductive stores and approximately $80 million less due to the cessation of SFAE’s catalog operations. These decreases were partially offset by sales generated from new store additions of $62.5 million.

GROSS MARGIN

Gross margin increased $61.4 million or 2.9% in 2002 over 2001. Approximately $65 million of the improvement was in comparable stores and was the result of fewer year-over-year markdowns, particularly at SFAE. Approximately $23 million of margin contribution related to new stores. These increases were partially offset by the loss of approximately $10 million in margin from the reorganization of the Saks Direct operations and the loss of $16.5 million in margin from the sale or closure of stores.

Gross margin as a percentage of net sales was 36.7% in 2002 compared to 34.8% in 2001. The increase in gross margin percent in 2002 was attributable to the decline in year-over-year markdowns taken to clear inventory, principally at SFAE. The 2001 markdowns were due to the weakness in the luxury sector, particularly following September 11th, in addition to markdowns associated with the reorganization of Saks Direct and store closings. Amounts received from vendors as partial reimbursement for excessive markdowns in 2002 were proportionate to the amounts realized in 2001 and did not materially alter the year-over-year improvement in gross margin as a percentage of net sales.

20

M A N A G E M E N T’ S D I S C U S S I O N A N D A N A L Y S I S

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

Selling, general and administrative expenses (“SG&A”) decreased $58.2 million or 4.2% in 2002 over 2001, due primarily to a reduction of approximately $40 million in operating expenses related to the reorganization of the Saks Direct business. Additionally, comparable store expense reductions of approximately $2 million were achieved in spite of an $11.9 million increase in insurance and retirement expenses. There was also a year-over-year decline of $12.7 million in severance costs and other certain items, principally related to fewer reorganization and other expense reduction initiatives. Amounts received from vendors in conjunction with compensation programs and cooperative advertising were consistent with the related gross compensation and cooperative advertising expenditures and therefore had no impact on SG&A expense, in dollars or as a percentage of net sales. Amounts received from vendors related to compensation programs were $76.1 million and $67.7 million in 2002 and 2001, respectively. Amounts received from vendors related to cooperative advertising programs were $78.4 million and $85.4 million in 2002 and 2001, respectively.

SG&A as a percentage of net sales decreased to 22.5% in 2002 from 22.9% in 2001. The rate decrease reflected the effect of targeted expense reduction initiatives in excess of the decline in sales.

OTHER OPERATING EXPENSES

Other operating expenses in 2002 decreased slightly from 2001 as the discontinuation of $12.7 million of goodwill amortization was partially offset by $8.2 million of expense increases, principally related to increased depreciation and rental expenses associated with the remodel and expansion of comparable stores and infrastructure capital spending.

Other operating expenses as a percentage of net sales were 9.8% in 2002 compared to 9.6% in 2001. The increase was primarily due to (1) the inability to leverage increased depreciation and rental expenses during a period of comparable store sales decline and (2) the inability to reduce non-store rent and depreciation commensurate with the loss of sales associated with disposed stores and the discontinued catalog operations.

INTEGRATION CHARGES

The Company incurred certain costs to integrate and combine its operations to further enhance the efficiency of back office functions and processes. These charges are primarily comprised of severance benefits, relocation and systems conversion costs. The 2002 charges of $10.0 million related to the consolidation of Younkers into Carson’s. The 2001 charges of $1.5 million related to costs incurred to complete the consolidation of three SDSG southern distribution centers.

LOSSES FROM LONG-LIVED ASSETS

Losses from long-lived assets in 2002 of $19.5 million were comprised of the impairment or closure of underproductive stores totaling $15.6 million and $3.9 million of property write-downs associated with the Younkers consolidation. Losses from long-lived assets of $32.6 million in 2001 consisted of the write-off of goodwill and property and equipment related to Saks Direct of $22.6 million and the impairment or closure of underproductive stores of $10.0 million.

INTEREST EXPENSE

Interest expense declined to $124.1 million in 2002 from $131.0 million in 2001 and as a percentage of net sales decreased to 2.1% in 2002 from 2.2% in 2001. The decrease was due principally to lower average borrowing rates on floating rate debt and lower average debt levels.

21

M A N A G E M E N T’ S D I S C U S S I O N A N D A N A L Y S I S

GAIN ON EXTINGUISHMENT OF DEBT

The gain on extinguishment of debt in 2002 related primarily to the recognition of gains related to the prior termination of a related interest rate swap agreement that resulted from the repurchase of senior notes. The 2001 gain was primarily the result of the repurchase of senior notes at a discount to the carrying value.

INCOME TAXES

For 2002 and 2001, the effective income tax rate differs from the federal statutory tax rate due to state income taxes and non-deductible goodwill amortization. The decline in the effective income tax rate was attributable to the discontinuation of non-deductible goodwill amortization and the favorable conclusion to a number of state tax examinations, partially offset by increasing the valuation allowance against deferred income tax assets. Management anticipates that income tax rates in future years will approximate the 2002 rate of 36.5%.

CUMULATIVE EFFECT OF A CHANGE IN ACCOUNTING PRINCIPLE

The cumulative effect of a change in accounting principle is the result of the 2002 adoption of SFAS No. 142, “Goodwill and Other Intangible Assets,” in which the Company recorded a non-cash charge of $45.6 million for the write-off of non-deductible SFAE goodwill.

NET INCOME

Net income in 2002 improved to $24.2 million from $0.3 million in 2001 primarily due to the improvement in operating income and the decline in interest expense, partially offset by lower gains on debt extinguishment and the 2002 cumulative effect of accounting change.

22

M A N A G E M E N T’ S D I S C U S S I O N A N D A N A L Y S I S

FISCAL YEAR ENDED FEBRUARY 2, 2002 COMPARED TO FISCAL YEAR ENDED FEBRUARY 3, 2001

MANAGEMENT’S DISCUSSION OF OPERATIONS

Operating income decreased to $104.4 million in 2001 from $261.9 million in 2000. The decrease in operating income of $157.5 million was attributable to a decrease in SDSG’s operating income of $54.5 million, a decrease in SFAE’s operating income of $138.5 million and $35.1 million in charges associated with the reorganization of Saks Direct, partially offset by a decrease in integration costs of $18.3 million and a decrease in charges from the impairment or disposition of stores totaling $52.8 million.

The decrease in operating income at SDSG was due to a 2.1% decrease in comparable store sales, which contributed to an $11.8 million reduction in gross margin, and the effect of the sale or closure of underproductive stores totaling $16.4 million. The decrease in operating income at SFAE resulted principally from a 7.8% decrease in comparable store sales, which contributed significantly to a $126.6 million reduction in gross margin. During 2001, both segments took aggressive actions to control operating expenses; however, these actions only partially offset the effect of the comparable store sales decline. Fiscal year 2001 included 52 weeks while fiscal year 2000 included 53 weeks, which is consistent with the retail calendar. The year-over-year effect of the incremental week on operating income was minimal.

The 2001 charges associated with the reorganization of Saks Direct, several store closings, the impairment of several stores and other expense reduction efforts aggregated $64.1 million. Charges associated with the reorganization of the Saks Direct business totaling $35.1 million consisted of a write-down of goodwill, property and equipment and inventory in addition to employee severance costs. Charges associated with store closings and store impairments of $19.9 million were lower in 2001 principally due to charges of $50.9 million in 2000 related to nine SDSG stores sold to the May Department Stores Company. Charges associated with other reorganization and expense reduction efforts of $9.2 million consisted principally of employee severance costs.

NET SALES

Net sales decreased 7.8% in 2001 over 2000 primarily due to a comparable store sales decrease of 4.5%, consisting of a 2.1% decrease at SDSG and a 7.8% decrease at SFAE. The decline in comparable store sales was primarily attributable to the weakness in the luxury goods sector, particularly following the events of September 11th, and the effects of general recessionary economic conditions. Additionally, year-over-year sales were $194.5 million less due to the sale or closure of underproductive stores and $83.8 million less due to the sales from the 53rd week in 2000, partially offset by sales generated from new store additions of $64.5 million.

GROSS MARGIN

Gross margin decreased $259.1 million to $2,110.4 million in 2001. A decrease of $170.2 million was attributable to the negative comparable store sales and related markdowns, the effect of the sale or closure of underproductive stores of $77.3 million, and the 53rd week in 2000, partially offset by new store additions of $20.0 million.

Gross margin as a percentage of net sales was 34.8% in 2001 compared to 36.0% in 2000. The decrease in gross margin percent in 2001 was primarily attributable to markdowns taken to clear inventory, principally at SFAE. These markdowns were principally due to the weakness in the luxury sector, particularly following the events of September 11th, and included markdowns associated with the reorganization of Saks Direct and store closings of ($13.7 million). Amounts received from vendors as partial reimbursement for excessive markdowns were proportionate to the amount of excessive markdowns realized in 2001 and 2000 and did not materially alter the year-over-year decline in gross margin as a percentage of net sales.

23

M A N A G E M E N T’ S D I S C U S S I O N A N D A N A L Y S I S

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

SG&A decreased $44.1 million to $1,389.3 million in 2001 due to the absence of expenses associated with the sale or closure of underproductive stores totaling $44.5 million, decreased operating expenses of $24.7 million related to Saks Direct and the effect of the 53rd week in 2000. These decreases were partially offset by an increase in expenses associated with new store additions of $14.3 million and $16.3 million in other items, primarily related to the reorganization of Saks Direct and other expense reduction initiatives. Comparable store SG&A expenses increased $7.0 million, which is relatively constant as a percent of sales (0.1%). Reductions in media spending were offset by increased maintenance, insurance and other employee costs. Amounts received from vendors in conjunction with compensation programs and cooperative advertising were consistent with the related gross compensation and cooperative advertising expenditures and therefore had no impact on SG&A expense or SG&A expense as a percentage of net sales. Amounts received from vendors related to compensation programs were $67.7 million and $56.8 million in 2001 and 2000, respectively. Amounts received from vendors related to cooperative advertising programs were $85.4 million and $101.6 million in 2001 and 2000, respectively.

SG&A as a percentage of net sales increased to 22.9% in 2001 from 21.8% in 2000. The rate increase reflected the inability to reduce operating expenses commensurate with the comparable store sales decline at both SDSG and SFAE.

OTHER OPERATING EXPENSES

Other operating expenses in 2001 were relatively constant with 2000 as increased depreciation and rental expenses associated with the remodel and expansion of comparable stores and increased infrastructure capital (spending principally information technology) of $16.1 million were offset by the decreased depreciation, goodwill amortization and rent associated with disposed stores and reduced property taxes totaling $14.4 million.

Other operating expenses as a percentage of net sales were 9.6% in 2001 compared to 8.8% in 2000. The increase was primarily due to (1) the inability to leverage increased depreciation and rental expenses during a period of comparable store sales decline and (2) the inability to reduce non-store rent and depreciation commensurate with the loss of sales associated with disposed stores.

INTEGRATION CHARGES

The Company incurred certain costs to integrate and combine the operations of previously acquired companies. The 2001 charges of $1.5 million and the 2000 charges of $19.9 million were primarily comprised of severance benefits, relocation and systems conversions related to the consolidation of the McRae’s and Herberger’s operating divisions into Proffitt’s and Carson’s, respectively, and the consolidation of three SDSG southern distribution centers.

LOSSES FROM LONG-LIVED ASSETS

Losses from long-lived assets in 2001 of $32.6 million were comprised of the non-cash write-off of goodwill and property and equipment related to Saks Direct totaling $22.6 million and the impairment or closure of underproductive stores of $10.0 million. Losses from long-lived assets in 2000 of $73.6 million were primarily comprised of the non-cash write-off of goodwill associated with the sale of nine SDSG stores to the May Department Stores Company and, to a lesser extent, impairments on abandoned software and underproductive stores.

INTEREST EXPENSE

Interest expense declined to $131.0 million in 2001 from $150.0 million in 2000 and as a percentage of net sales decreased to 2.2% in 2001 from 2.3% in 2000. The decrease was due principally to lower average borrowing rates on floating rate debt and lower average debt levels.

24

M A N A G E M E N T’ S D I S C U S S I O N A N D A N A L Y S I S

GAIN ON EXTINGUISHMENT OF DEBT

The gain on extinguishment of debt in 2001 related primarily to the repurchase of senior notes at a discount to the carrying value.

INCOME TAXES

For 2001, the effective income tax rate differs from the federal statutory tax rate due to state income taxes and non-deductible goodwill amortization. In 2000, the effective income tax rate differs from the federal statutory tax rate due to state income taxes and non-deductible goodwill amortization, offset by the favorable effect of the disposal of a real estate investment ($4.1 million). The change in year-over-year effective income tax rates was due to the favorable effect of the real estate disposition in 2000.

NET INCOME

Net income in 2001 decreased to $0.3 million from $75.2 million in 2000 primarily due to the decline in operating income, partially offset by lower interest expense and a gain on extinguishment of debt.

LIQUIDITY AND CAPITAL RESOURCES

CASH FLOW

The primary needs for cash are to acquire or construct new stores, renovate and expand existing stores, provide working capital for new and existing stores and service debt. The Company anticipates that cash generated from operating activities, borrowings under its revolving credit agreement and maintaining a proprietary credit card securitization program (until the closing of the transaction with Household Bank (SB), N.A. discussed in “Proprietary Credit Card Receivables Securitization”) will be sufficient to meet its financial commitments and provide opportunities for future growth.

Cash provided by operating activities was $276.3 million in 2002, $374.0 million in 2001 and $485.5 million in 2000. Cash provided by operating activities principally represents income before depreciation and amortization charges and losses from long-lived assets and also includes changes in working capital. The decrease in 2002 from 2001 was primarily due to an increase in invested working capital, resulting from depressed 2001 inventory levels and the use of operating cash to fund pensions. The decrease in 2001 from 2000 was related to a reduction in operating cash flow attributable to the year-over-year earnings decline and was partially offset by a reduction in invested working capital, principally through managing inventory levels down.

Cash provided by used in investing activities was $(139.9) million in 2002, $85.6 million in 2001 and $(248.7) million in 2000. Cash used in investing activities principally consists of construction of new stores and renovation and expansion of existing stores and investments in support areas (e.g. technology, distribution centers, e-business infrastructure). The “net cash provided” in 2001 was largely attributable to $308.0 million of proceeds ($275.5 million after the repurchase of sold receivables) from the sale of nine SDSG stores in early 2001. Additionally, there was a $77.5 million decrease in capital spending from 2001 to 2002. While capital expenditures for distributions centers, e-business and other non-store areas were relatively constant in 2002, the Company significantly decreased the capital expended for new stores, remodels and expansions.

Cash used in financing activities was $(25.9) million in 2002, $(425.1) million in 2001 and $(191.6) million in 2000. The decrease in 2002 from 2001 and the increase in 2001 from 2000 were both attributable primarily to the use of the cash received from the sale of the nine SDSG stores to pay down debt in 2001.

25

M A N A G E M E N T’ S D I S C U S S I O N A N D A N A L Y S I S

CASH BALANCES AND LIQUIDITY

The Company’s primary sources of short-term liquidity are comprised of cash on hand and availability under its $700 million revolving credit facility. At February 1, 2003 and February 2, 2002, the Company maintained cash and cash equivalent balances of $209.6 million and $99.1 million, respectively. These amounts consisted principally of invested cash and approximately $30 million of store operating cash. At February 1, 2003 the Company’s utilization of its capacity under the $700 million revolving credit facility consisted of $106.0 million in unfunded letters of credit leaving unutilized availability under the facility of $594.0 million. The amount of cash on hand and borrowings under the facility are influenced by a number of factors, including sales, retained accounts receivable, inventory levels, vendor terms, the level of capital expenditures, cash requirements related to financing instruments, and the Company’s tax payment obligations, among others.

Another source of liquidity for the Company has been the securitization of proprietary credit card receivables generated by National Bank of the Great Lakes (“NBGL”), the Company’s national credit card bank subsidiary, in the asset-backed securitization market. At February 1, 2003, the Company had $1,080.2 million of receivables sold, $434.3 million of which represents a fixed amount series due to mature in 2006, and $645.9 million of which represents outstanding amounts under committed bank-sponsored conduit programs maturing in April 2003. The bank-sponsored conduit programs provide for funding of up to $865 million of receivables, which can be amortized with customer payments at any time. The Company has announced that it and NBGL will sell the Company’s proprietary credit card program to Household Bank (SB), N.A., which will eliminate the need for the securitization facility. If the consummation of that transaction is delayed or does not occur, the Company will continue to utilize the securitization facility to extend the funding under its bank-sponsored conduits or sell new asset-backed instruments, which is discussed in the following capital structure discussion under the heading “Proprietary Credit Cards Receivable Securitization.”

CAPITAL STRUCTURE

The Company’s capital and financing structure is comprised of a revolving credit agreement, senior unsecured notes, the sale of beneficial interests in a trust that owns NBGL’s proprietary credit card receivables, capital and operating leases and real estate mortgage financing.

At February 1, 2003, the Company maintained a $700 million senior revolving credit facility maturing in 2006, which is secured by eligible inventory, the capital stock of all material subsidiaries, and certain intangibles. Borrowings are limited to a prescribed percentage of eligible inventories. There are no debt ratings-based provisions in the facility. The facility includes a fixed-charge coverage ratio requirement of 1:1 that the Company is subject to only if availability under the facility becomes less than $100 million. The facility contains default provisions that are typical for this type of financing, including a provision that would trigger a default of the facility if a default were to occur in another instrument resulting in the acceleration of principal of more than $20 million in that other instrument.

The Company had $1,185.8 million of unsecured senior notes outstanding as of February 1, 2003 comprised of six separate series having maturities ranging from 2004 to 2019. The terms of each senior note call for all principal to be repaid at maturity. The senior notes have substantially identical terms except for the maturity dates and the interest coupons payable to investors. Each senior note contains limitations on the amount of secured indebtedness the Company may incur. During 2002, the Company used cash from operations to repurchase $24.3 million in senior notes. During 2001, certain of the proceeds from the sale of the nine SDSG store locations in March 2001 were used to repurchase $298.4 million of senior notes. During 2001, the Company also exchanged $141.6 million of cash and $141.6 million of new 9.875% notes due 2011 for $283.1 million of the 2004 notes.

At February 1, 2003 the Company had $135 million in capitalized leases covering various properties and pieces of equipment. The terms of the capitalized leases provide the lessor with a security interest in the asset being leased and require the Company to make periodic lease payments, aggregating between $4 million and $7 million per year.

26

M A N A G E M E N T’ S D I S C U S S I O N A N D A N A L Y S I S

The contractual cash obligations at February 1, 2003 associated with this capital and financing structure are illustrated in the following table:

| | | Payments Due by Period (excluding interest) |

|

| | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | After 2007 | | Total |

|

| | | (Dollars in Millions) |

Senior unsecured notes | | $ | — | | $ | 143 | | $ | — | | $ | — | | $ | — | | $ | 1,043 | | $ | 1,186 |

Revolving credit agreement | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

Capital leases | | | 4 | | | 5 | | | 5 | | | 5 | | | 7 | | | 113 | | | 139 |

Operating leases | | | 140 | | | 132 | | | 125 | | | 115 | | | 105 | | | 669 | | | 1,286 |

Real estate mortgages | | | 1 | | | 5 | | | 1 | | | — | | | — | | | — | | | 7 |

Other licensing fees | | | 4 | | | 4 | | | 4 | | | 4 | | | 4 | | | — | | | 20 |

|

Total contractual cash obligations | | $ | 149 | | $ | 289 | | $ | 135 | | $ | 124 | | $ | 116 | | $ | 1,825 | | $ | 2,638 |

|

The Company’s other principal commercial commitments are comprised of the guarantee of $20 million residual value of leased transportation equipment expiring in 2003, pension funding obligations, short-term merchandise purchase commitments, short-term construction commitments, common area maintenance costs and contingent rent payments. Substantially all of the Company’s merchandise purchase commitments are cancelable several weeks prior to a date that precedes the vendor’s scheduled shipment date.

The Company is obligated to fund two cash balance pension plans. At November 1, 2002 (the most recent measurement date), the projected benefit obligation of these plans was $346.4 million, and the fair value of the pension plans’ assets was $195.9 million resulting in an underfunded status of $150.5 million. During January 2003, the Company voluntarily contributed approximately $47 million to the plans to reduce the underfunding and expects no further contributions in 2003. While the Company’s contributions exceed the minimum funding requirements under ERISA and IRS rules and regulations, the significant decrease in the U.S. stock market during recent years contributed substantially to the underfunded status. This increased funding coupled with a recovery in the U.S. stock market should begin to contribute to correcting the funded status of the plans. To the extent the U.S. stock market does not recover or continues to deteriorate, the Company’s cash funding requirements will increase. The Company expects to generate adequate cash flows from operating activities combined with borrowings under its revolving credit agreement in order to meet the pension funding requirements.

PROPRIETARY CREDIT CARDS RECEIVABLE SECURITIZATION

The Company’s proprietary credit cards are issued by NBGL, a wholly owned subsidiary of the Company. Receivables generated from the sale of merchandise on these credit cards are sold by NBGL to another wholly owned subsidiary, Saks Credit Corporation (“SCC”). SCC transfers the receivables to a trust, Saks Credit Card Master Trust (“SCCMT”), which sells to third-party investors, certificates representing an undivided beneficial interest in the pool of receivables held in SCCMT. The certificates have maturity dates and represent an ownership in the cash generated by the credit card receivables. The Company retains an interest in the receivables held in SCCMT, which interest is subordinate to the rights of the third-party investors to the cash flows of the receivables held in SCCMT.

At February 1, 2003, SCCMT held credit card receivables aggregating $1,270.8 million, while certificates of ownership aggregating $1,080.2 million had been sold to third-party investors. Prior to maturity of the certificates, the Company has access to the cash generated by the receivables net of allocations of cash to investors representing the coupon interest rate on their beneficial interests. Upon maturity, the third-party investors are repaid in full with cash collections of payments made by customers, after which the Company will receive all remaining cash to recover its residual ownership interest in the pool of receivables.

27

M A N A G E M E N T’ S D I S C U S S I O N A N D A N A L Y S I S

During 2002, the Company and Household Bank (SB), N.A. (“Household”), an affiliate of Household International, entered into an agreement pursuant to which Household and its affiliates will acquire all of the Company’s proprietary credit card business, consisting of the proprietary credit card accounts owned by NBGL and the Company’s ownership interest in the assets of SCCMT. On March 31, 2003, the transaction was approved by the U.S. Comptroller of the Currency subject to certain conditions. The principal condition is for the Company and NBGL to enter into consent orders that require the Company and NBGL to implement and monitor policies and procedures to ensure compliance with the provisions of the Bank Secrecy Act. It is expected that the transaction will close in April 2003. Any of the parties to the transaction may terminate the agreement if the transaction has not been consummated by August 15, 2003, unless such date is otherwise extended by mutual agreement.

As part of the transaction, for a term of ten years following the closing and pursuant to a program agreement, Household will establish and own proprietary credit card accounts for customers of the Company’s operating subsidiaries. Household will retain the benefits and risks associated with the ownership of the accounts, will receive the finance charge income and incur the bad debts associated with those accounts, and will pay a portion of the finance charge income to the Company. During the ten-year term, pursuant to a servicing agreement, the Company will continue to provide key customer service functions, including new account opening, transaction authorization, billing adjustments and customer inquiries, and will receive compensation from Household for these services.

At the closing of the transaction, the Company will receive an amount in cash equal to the difference of (1) the sum of 100% of the outstanding accounts receivable balances, a premium, the value of investments held in securitization accounts, the value of miscellaneous consumable inventory, minus (2) the outstanding principal balance, together with unpaid accrued interest, of specified certificates issued by SCCMT held by public investors, which certificates will be assumed by Household at the closing. The Company plans to use a portion of the cash received at closing to repay amounts due under the SCCMT certificates and related obligations held at the time of the closing by bank-sponsored commercial paper conduit investors, which certificates and obligations will not be assumed by Household. After deducting these repayment amounts and transaction fees and expenses, the Company expects that its net cash proceeds resulting from the transaction at closing will total approximately $300 million. After allocating the cash proceeds to the sold accounts, the program agreement and the servicing agreement, the Company expects to realize a gain of less than $10 million in 2003. The cash proceeds allocated to the ongoing program agreement and to the servicing agreement will be reflected in income over the lives of the agreements.

The Company anticipates utilizing the approximate $300 million in net proceeds to repurchase common stock, reduce debt and to make strategic investments in its core business. With the exception of depreciation expense, all components of the credit operation have been included in the SG&A line item of the income statement (e.g. finance charge income plus securitization gains, less interest cost on the sold receivables, less bad debt expense and less credit administration expenses). The inclusion of the credit operation has historically generated a positive financial contribution, resulting in a net decrease to the SG&A line item. Upon the consummation of the Household transaction, the components of the credit operation will continue to be included in SG&A (e.g. program compensation plus servicing compensation, less servicing expenses). The credit operations are expected to continue producing a positive financial contribution and net reduction to SG&A, but to a lesser degree than historically. Therefore, SG&A is expected to increase after closing. A portion of this increase will be offset by lower interest expense attributable to the planned debt reduction as well as the contribution of any strategic investments made with the net proceeds from closing.

Prior to the closing of the Household transaction, the Company will continue to obtain funding through its existing accounts receivable securitization program. The certificates held by the bank-sponsored commercial paper conduit investors mature on April 15, 2003. If the Company is not able to close the transaction with Household by April 15, 2003, then the Company believes that it will be able to successfully extend the current funding availability with the bank-sponsored conduits or refinance the maturing certificates in the asset-backed securitization market. However, to extend availability of the conduits, the Company would be required to obtain an extension of the maturity of the SCCMT certificates held by the bank-sponsored commercial paper conduit investors to arrange for, negotiate the terms of and implement the refinancing. Should the Company choose to refinance maturing certificates in the asset-backed securitization market, it is expected that the refinancing would take place

28

M A N A G E M E N T’ S D I S C U S S I O N A N D A N A L Y S I S

over a three to six-month period, during which customer payments on receivables would be utilized to pay down the certificate holders’ ownership interest. During this period, the Company believes that it would have sufficient cash on hand and availability under its revolving credit agreement to fund working capital needs. Any refinancing of these certificates could be subject to higher pricing or more restrictive terms than those carried by the outstanding certificates. The Company believes that it will be successful in meeting the capital needs of the Company by either obtaining the extensions on the bank-sponsored conduits or selling sufficient replacement certificates into the asset-backed securities market.

CAPITAL NEEDS

The Company estimates capital expenditures for 2003 will approximate $200 million, primarily for the construction of new stores opening in 2003, initial construction work on stores expected to open in 2004, store expansions and renovations, enhancements to management information systems and replacement capital expenditures.

The Company anticipates that working capital requirements related to new and existing stores and capital expenditures will be funded through cash provided by operations and the revolving credit agreement. Maximum availability under the revolving credit agreement is $700 million. There is no debt rating trigger. During periods in which availability under the agreement exceeds $100 million, the Company is not subject to financial covenants. If availability under the agreement were to decrease to less than $100 million, the Company would be subject to a minimum fixed charge coverage ratio of 1 to 1. During 2002, weighted average borrowings and letters of credit issued under this credit agreement were $123.5 million. The highest amount of borrowings and letters of credit outstanding under the agreement during 2002 was $235.4 million. The Company expects to generate adequate cash flows from operating activities combined with borrowings under its revolving credit agreement in order to sustain its current levels of operations.

Until the Household transaction is consummated, the most significant requirement for new or replacement financing in 2003 is the accounts receivable securitization program. On April 15, 2003, certificates representing $645.9 million in sold receivables (at February 1, 2003) and availability of up to $865 million under bank sponsored conduits will mature. As discussed under the previous heading, “Proprietary Credit Cards Receivable Securitization,” management believes that the Company’s near-term financial risk is minimal with respect to the maturing certificates as the Company believes that it will be able to successfully extend its existing bank-sponsored conduits or refinance the maturing certificates in the asset-backed securitization market. Factors that affect the Company’s ability to sell new certificates include continued high quality in the receivables portfolio and the capacity of the U.S. securitization markets. The Company does expect that the coupon interest rate of the certificate holders will increase over current levels. However, the Company does not believe the increase will significantly affect cash flows or operating results.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The Company’s critical accounting policies and estimates are discussed in the notes to the consolidated financial statements. Certain judgments and estimates utilized in implementing these accounting policies are likewise discussed in each of the notes to the consolidated financial statements. The following discussion aggregates the judgments and uncertainties affecting the application of these policies and estimates and the likelihood that materially different amounts would be reported under varying conditions and assumptions.

Revenue Recognition. Sales and the related gross margin are recorded at the time customers provide a satisfactory form of payment and take ownership of the merchandise or direct its shipment. There are minimal accounting judgments and uncertainties affecting the application of this policy. The Company estimates the amount of goods that will be returned for a refund and reduces sales and gross margin by that amount. However, given that approximately 15% of merchandise sold is later returned and that the vast majority of merchandise returns are affected within a matter of days of the selling transaction, the risk of the Company realizing a materially different amount for sales and gross margin than reported in the consolidated financial statements is minimal.

Cost of Sales and Inventory Valuation. The Company’s inventory is stated at the lower of LIFO cost or market using the retail method. Under the retail method, the valuation of inventories at cost and the resulting gross margins are determined by applying a calculated cost-to-retail ratio to the retail value of inventories. The cost of the inventory reflected on the consolidated balance sheet is decreased with a charge to Cost of Sales contemporaneous with the lowering of the retail value of the

29

M A N A G E M E N T’ S D I S C U S S I O N A N D A N A L Y S I S

inventory on the sales floor through the use of markdowns. Hence, earnings are negatively impacted as the merchandise is being devalued with markdowns prior to the sale of the merchandise. The areas requiring significant management judgment include (1) setting the original retail value for the merchandise held for sale, (2) recognizing merchandise for which the customer’s perception of value has declined and appropriately marking the retail value of the merchandise down to the perceived value and (3) estimating the shrinkage that has occurred through theft during the period between physical inventory counts. These judgments and estimates, coupled with the averaging processes within the retail method can, under certain circumstances, produce varying financial results. Factors that can lead to different financial results include (1) setting original retail values for merchandise held for sale at too high a level, (2) failure to identify a decline in perceived value of inventories and process the appropriate retail value markdowns and (3) overly optimistic or overly conservative shrinkage estimates. The Company believes it has the appropriate merchandise valuation and pricing controls in place to minimize the risk that its inventory values would be materially undervalued or overvalued.

Credit Card Income and Expenses. The carrying value of the Company’s retained interest in credit card receivables requires a substantial amount of management judgment and estimates. At the time credit card receivables are sold to third-party investors through the securitization program, generally accepted accounting principles require that the Company recognize a gain or loss equal to the excess of the estimated fair value of the consideration to be received from the credit card receivables sold over their cost. As the receivables are collected, the estimated gains and losses are reconciled to the actual gains and losses. Given that the Company generates credit card receivables of approximately $3 billion per year and average outstanding sold receivables are generally $1.0 billion to $1.2 billion, a substantial majority of the annual estimated credit gains and losses have been reconciled to actual gains and losses. Only that portion of the gains and losses attributable to the outstanding securitized portfolio at year end remains subject to estimating risk. At February 1, 2003, the net gain recognized within the “Retained Interest in Accounts Receivable” asset was $48.2 million.

Determining the fair value of the consideration to be received from the credit card receivables sold includes estimates of the following associated amounts: (1) the gross finance charge income to be generated by the receivables that requires estimates of payment rates, (2) the coupon interest rate due to the third-party investors, (3) bad debts, (4) cost of servicing the receivables and (5) assumed cash flow discount rates. The notes to the consolidated financial statements reflect the critical estimates and assumptions utilized during the two most recent fiscal years. Items that were considered in making judgments and preparing estimates and factors that can lead to variations in the consolidated financial results are as follows:

| | • | | Finance charge income is billed at a contractual rate monthly and warrants little judgment or estimates. The expected credit card customer payment rate is based on historical payment rates weighted to recent payment rate trends. To the extent credit card customers pay off their balances sooner than estimated, this net gain is reduced. Conversely, should the credit card customers pay off balances over a longer period of time, the net gain is increased. |

| | • | | The future coupon interest rate due to the third-party investors is estimated using the fixed interest rates in place and estimated floating interest rates over the estimated life of the receivables. To the extent floating interest rates increase beyond the increase embedded in the estimates, the net gain will be reduced. To the extent floating interest rates do not increase to the level embedded in the estimates, the net gain will be increased. |

| | • | | Bad debts expected from the sold receivables are based on historical write-off rates, weighted to recent write-off trends and increased or decreased to reflect management’s outlook for trends to develop over the next 12 to 24 months. To the extent there are positive or negative factors on the credit card customers’ ability or intent to pay off the outstanding balance (e.g. unemployment rates, level of consumer debt, bankruptcy legislation), the actual bad debt to be realized could exceed or be less than the amount estimated. Bad debts in excess of those embedded in the estimates reduce the net gain. Conversely, bad debts less than those embedded increase the net gain. |

| | • | | Delinquent credit card accounts are written off automatically after the passage of seven months without receiving a monthly payment equal to 80% of the minimum contractual payment. Minimum monthly contractual payments range from 5% to 10%. Accounts are written off sooner in the event of customer bankruptcy, customer death or fraud. |

| | • | | The cost of servicing the receivables is estimated using our historical operating costs. This estimate is subject to minimal risk of deviation. |

30

M A N A G E M E N T’ S D I S C U S S I O N A N D A N A L Y S I S

| | • | | The assumed cash flow discount rates are based on the weighted average cost of debt and are subject to typical interest rate volatility in the debt markets. |

The most sensitive assumptions in calculating the gain on sold credit card receivables are the credit card customers’ payment rate, the estimate for bad debts and the assumed cash flow discount rates.

The following table represents the Company’s assumptions in measuring the fair value of retained interests in accounts receivable in 2002, 2001 and 2000:

| | | 2002 | | | 2001 | | | 2000 | |

|

Weighted average interest rates applied to credit card balances | | 21.6 | % | | 21.6 | % | | 21.6 | % |

Weighted average payment rate | | 14.4 | % | | 14.4 | % | | 18.0 | % |

Credit losses expected from the principal amount of receivables sold | | 3.3 | % | | 3.4 | % | | 3.3 | % |

Weighted average cost of funding | | 2.8 | % | | 4.2 | % | | 6.1 | % |

|

Depreciation and Recoverability of Capital Assets. Over one-half of the Company’s assets at February 1, 2003 are represented by investments in Property and Equipment and Goodwill and Intangible Assets. Determining appropriate depreciable lives and reasonable assumptions for use in evaluating the carrying value of capital assets requires judgments and estimates.

| | • | | The Company utilizes the straight-line depreciation method and a variety of depreciable lives. Land is not depreciated. Buildings and improvements are depreciated over 20 to 40 years. Store fixtures are depreciated over 10 years. Equipment utilized in stores (e.g. escalators) and in support areas (e.g. distribution centers, technology) and fixtures in support areas are depreciated over 3 to 15 years. Leasehold improvements are amortized over the shorter of their estimated useful lives or their related lease terms, generally ranging from 10 to 20 years. Internally generated computer software is amortized over 3 to 10 years. Generally, no estimated salvage value at the end of the useful life of the assets is considered. |

| | • | | To the extent the Company remodels or otherwise replaces or disposes of property and equipment prior to the end of their assigned depreciable lives, the Company could realize a loss or gain on the disposition. To the extent assets continue to be used beyond their assigned depreciable lives, no depreciation expense is being realized. The Company reassesses the depreciable lives in an effort to reduce the risk of significant losses or gains at disposition and utilization of assets with no depreciation charges. The reassessment of depreciable lives involves utilizing historical remodel and disposition activity and forward-looking capital expenditure plans. |

| | • | | Recoverability of the carrying value of store assets is assessed upon the occurrence of certain events (e.g., opening a new store near an existing store or announcing plans for a store closing) and absent certain events, annually. The recoverability assessment requires judgment and estimates for future store generated cash flows. The underlying estimates for cash flows include estimates for future sales, gross margin rates, inflation and store expense increases and decreases. During 2002, the Company recorded $11.0 million in impairment charges associated with stores in which the estimated discounted cash flows would be less than the carrying value of the store assets. There are other stores in which current cash flows are not adequate to recover the carrying value of the store assets. However, the Company believes that estimated sales growth and gross margin improvement will enhance the cash flows of these stores such that the carrying value of the store assets will be recovered. Generally these stores were recently opened and require a two to five-year period to develop the customer base to attain the required cash flows. To the extent management’s estimates for sales growth and gross margin improvement are not realized, future annual assessments could result in impairment charges. |

| | • | | Recoverability of goodwill and intangible assets is assessed annually and upon the occurrence of certain events. The recoverability assessment requires management to make judgements and estimates regarding the fair values of its defined reporting units, SDSG and SFAE. The fair values of these units are determined using estimated future cash flows including growth assumptions for future sales, gross margin rates, the effects of inflation and other estimates. To the extent that management’s estimates are not realized, future assessments could result in impairment charges. |

31

M A N A G E M E N T’ S D I S C U S S I O N A N D A N A L Y S I S

Income Taxes. The majority of the Company’s deferred tax assets at February 1, 2003 consist of federal net operating loss carryforwards that will expire between 2004 and 2018. At February 1, 2003, the Company believes that it will be profitable during the periods 2003 through 2018, allowing it to sufficiently utilize the carrying value of the benefit of the federal net operating loss carryforwards. During 2002, the Company concluded a number of state tax examinations, many of which had addressed corporate organization changes that had occurred over the previous five years in conjunction with the Company’s multiple acquisitions. As a result of these examinations, the Company decreased the tax benefit associated with the state net operating loss carryforwards of certain taxing jurisdictions, reduced the deferred state tax rate associated with the Company’s tax basis differences, and reduced the liability representing exposures associated with various state tax positions. To the extent management’s estimates of future taxable income by jurisdiction is greater than or less than management’s current estimates, future increases or decreases in the benefit of net operating loss carryforwards could occur.

The Company is routinely under audit by federal, state or local authorities in the areas of income taxes and the remittance of sales and use taxes. These audits include questioning the timing and amount of deductions, the nexus of income among various tax jurisdictions and compliance with federal, state and local tax laws. In evaluating the exposure associated with various tax filing positions, the Company often accrues charges for probable exposures. During 2002, the Company concluded a number of state tax examinations with favorable results. Therefore, during the annual evaluation of tax positions for 2002, the Company decreased the amount previously accrued for probable exposures. At February 1, 2003, the Company believes it has appropriately accrued for probable exposures. To the extent the Company were to prevail in matters for which accruals have been established or be required to pay amounts in excess of reserves, the Company’s effective tax rate in a given financial statement period could be materially affected. At February 1, 2003, two of the Company’s five open tax years were undergoing examination by the Internal Revenue Service.