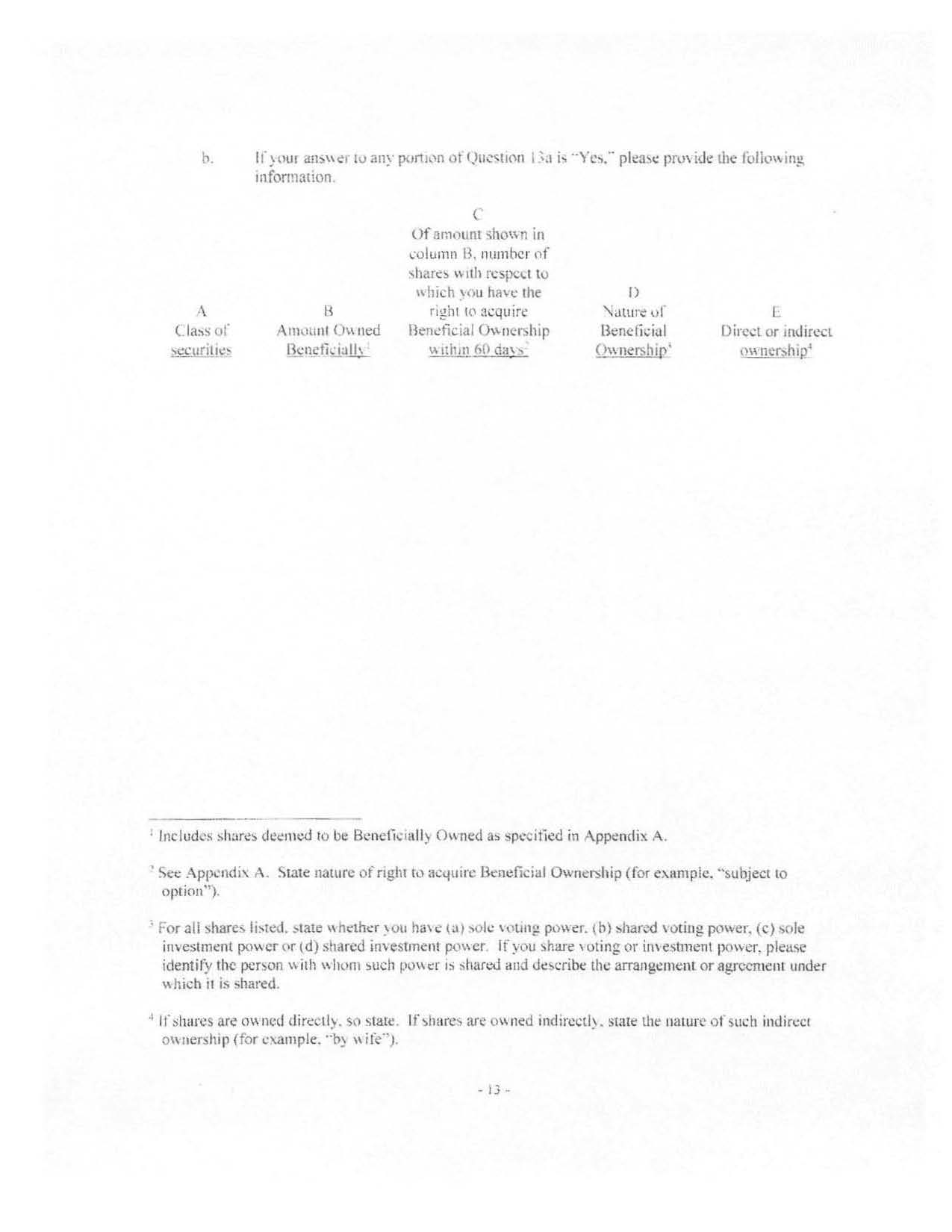

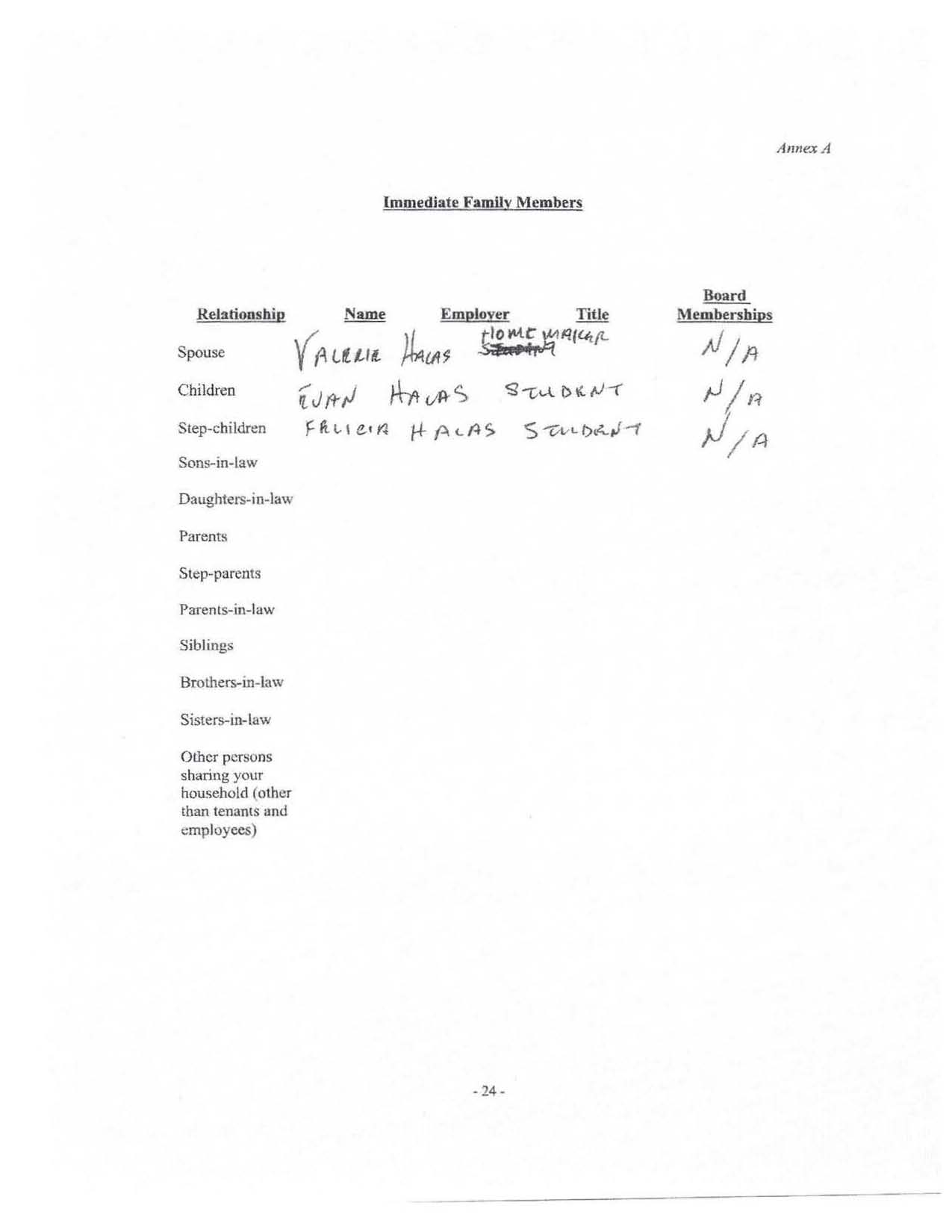

Appendix A Definition of “Beneficial Ownership’’ The SEC has adopted a definition of “beneficial ownership,” as used in this Questionnaire, that is different from the one with which you may be familiar in the context of insider trading. Securities owned“beneficially” would include not only securities held by you for your own benefit, whether in bearer formor registered in your own name or otherwise, but also securities held by others for your benefit (regardlessof whether or how they are registered) such as, for example, securities held for you by custodians,brokers, relatives, executors, administrators, or trustees, and securities held for your account by pledgees,securities owned by a partnership in which you are a member, and securities owned by any corporationwhich is or should be regarded as a personal holding corporation of yours. The SEC’s definition of “beneficial ownership” provides generally that: (a) A person “beneficially owns” a security if he or she, directly or indirectly, has or shares votingpower (i.e., the power to vote, or to direct the voting of such security) and/or investment power (i.e., thepower to dispose or to direct the disposition of such security) whether through any contract, arrangement,understanding, relationship or otherwise. (b) A person is also deemed to be the beneficial owner of a security if he or she has the right to acquire such security within 60 days including any right to acquire such a security during that time period (a) through the exercise of any option, warrant or right; (b) through the conversion of a security; (c) pursuant to the power to revoke a trust, discretionary account or similar arrangement; or (d) pursuant tothe automatic termination of a trust, discretionary account or similar arrangement. In the view of the SEC, any person or entity that controls, or has tbe power to control, a beneficial owneris itself a beneficial owner with respect to the securities owned by the controlled person or entity. Thus,for example, a parent company would be the beneficial owner of securities owned by a subsidiary overwhich it has control. The term “control” means the possession, direct or indirect, of the power to direct orcause the direction of tbe management and policies of the Company, whether through the ownership ofvoting securities, by contract or otherwise. Please note that under the definitions set forth above, there may be more than one beneficial owner of thesame security, such as when a person places securities in a revocable discretionary account with a trusteeor investment adviser who can vote or dispose of the securities; in that case, the individual would haveinvestment power since he or she could revoke the arrangement and the trustee or investment adviserwould have voting power and investment power. Thus, both the individual and the investment adviserwould have beneficial ownership of the same securities. Definition of “Executive Officer” When used in reference to any company or business entity, “executive officer” means the chief executiveofficer, president, any vice president in charge of a principal business unit, division or function (such assales, administration or finance), any other officer who performs a policy making function or any otherperson who performs similar policy making functions for the company.(Executive officers ofsubsidiaries may be deemed executive officers of the company if they perform such policy makingfunctions for the company.) Definition of “Immediate Family” -22-