Exhibit 99.2

July 2005

The CMRG Story

Undisputed leader within a $6 billion men’s specialty big & tall apparel arena

Dominant player within specialty big & tall space with 65% market share

Increased opportunity to consolidate a fragmented market by focused merchandising initiatives and advanced marketing techniques

Focused growth & profitability for Casual Male Big & Tall and Rochester Big & Tall Businesses.

2

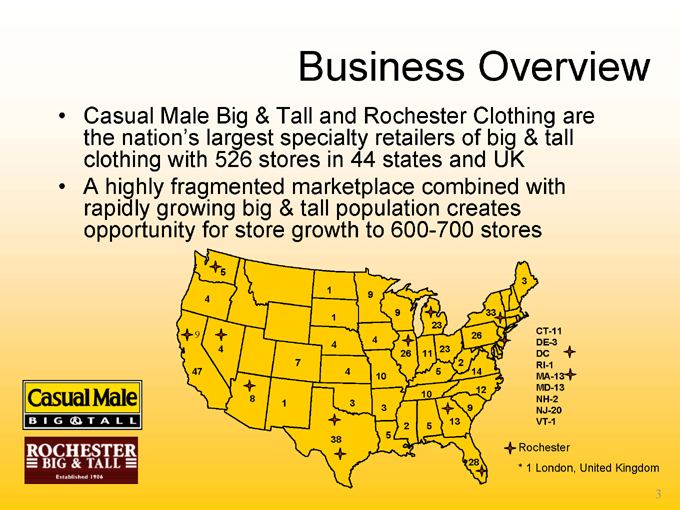

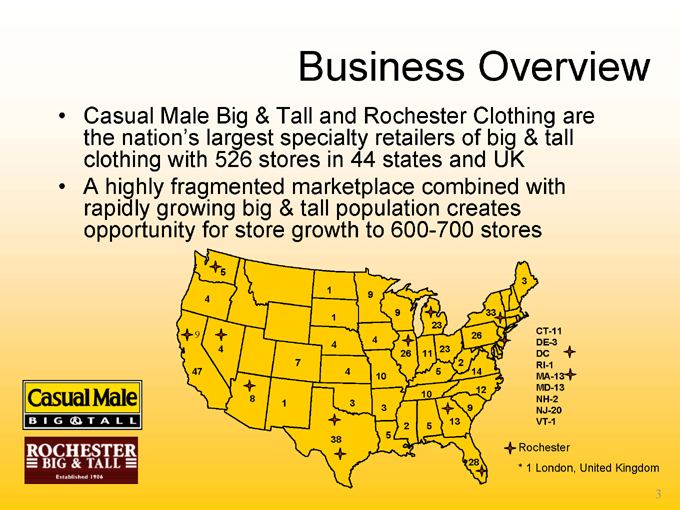

Business Overview

Casual Male Big & Tall and Rochester Clothing are the nation’s largest specialty retailers of big & tall clothing with 526 stores in 44 states and UK

A highly fragmented marketplace combined with rapidly growing big & tall population creates opportunity for store growth to 600-700 stores

5

3 1 9 4

9 33 1 23

9 26 4 4

4 23

26 11

7 2

47 4 5 14 10 12 10 8

1 3

3 9 13

2 5 5 38

CT-11 DE-3 DC RI-1 MA-13 MD-13 NH-2 NJ-20 VT-1

28

Rochester

* 1 London, United Kingdom

3

Spring

2005

ROCHESTER

Big & Tall

Don’t miss our Cutter & Buck insert inside

Polo Ralph Lamen Pan Stripe Mesh Poloroide on Page 3.

4

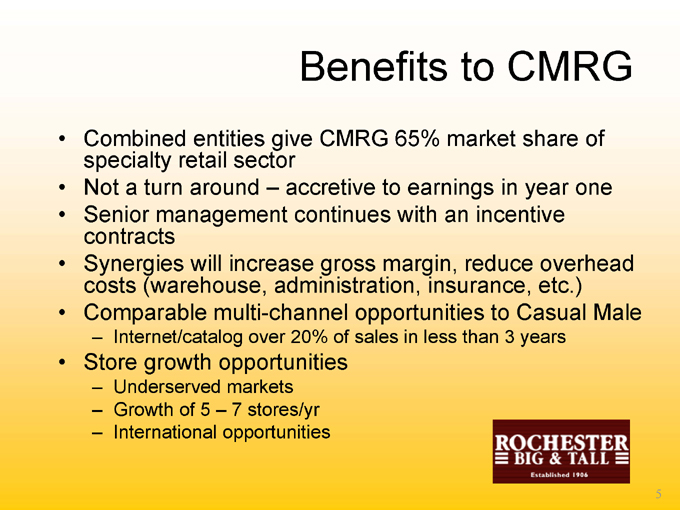

Benefits to CMRG

Combined entities give CMRG 65% market share of specialty retail sector Not a turn around – accretive to earnings in year one Senior management continues with an incentive contracts Synergies will increase gross margin, reduce overhead costs (warehouse, administration, insurance, etc.) Comparable multi-channel opportunities to Casual Male

Internet/catalog over 20% of sales in less than 3 years

Store growth opportunities

Underserved markets Growth of 5 – 7 stores/yr International opportunities

5

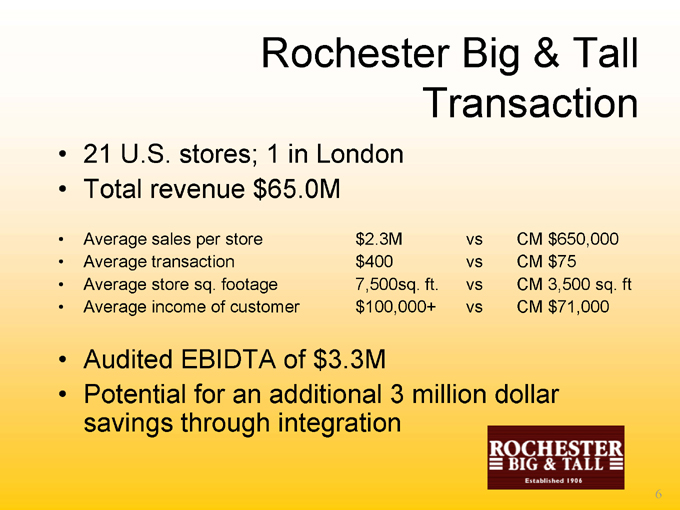

Rochester Big & Tall Transaction

21 U.S. stores; 1 in London Total revenue $65.0M

Average sales per store $2.3M vs CM $650,000

Average transaction $400 vs CM $75

Average store sq. footage 7,500sq. ft. vs CM 3,500 sq. ft

Average income of customer $100,000+ vs CM $71,000

Audited EBIDTA of $3.3M

Potential for an additional 3 million dollar savings through integration

6

Rochester Brands

Claiborne

CANALI

BURBERRY

KENNETH COLE new york

VERSACE

RALPH LAUREN

DKNY

Cloth by

Ermenegildo Zegna

7

Fall

2005

Exclusive 626 Blue!

Nyne shirt on page 39

1.800.767.0319

casualmale.com

8

Comp Store Trend

10.0% 8.0% 6.0% 4.0% 2.0% 0.0% -2.0% -4.0% -6.0%

-1.0%

-5.0%

-2.3%

-1.1%

2.4%

9.2%

4.8%

1.6%

2.0%

2.3%

Launch of George Foreman collection and TV campaign

Stores change to lifestyle presentation

Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2002

2003

2004

2005

9

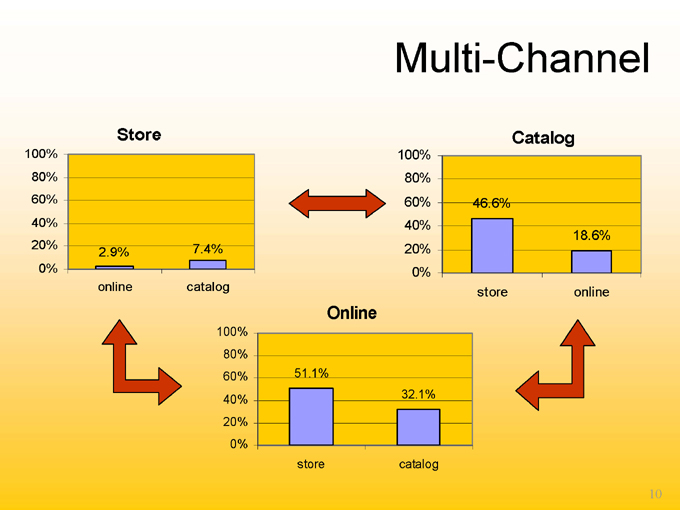

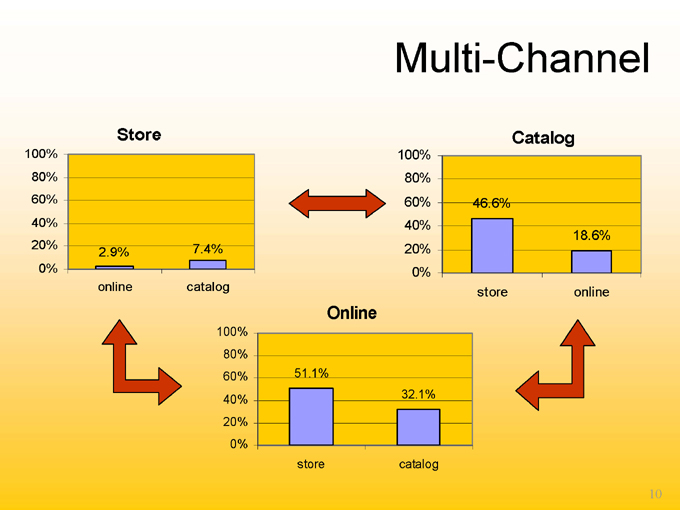

Multi-Channel

Store

100% 80% 60% 40% 20% 0%

2.9%

7.4% online catalog

Catalog

100% 80% 60% 40% 20% 0%

46.6%

18.6% store online

Online

100% 80% 60% 40% 20% 0%

51.1%

32.1% store catalog

10

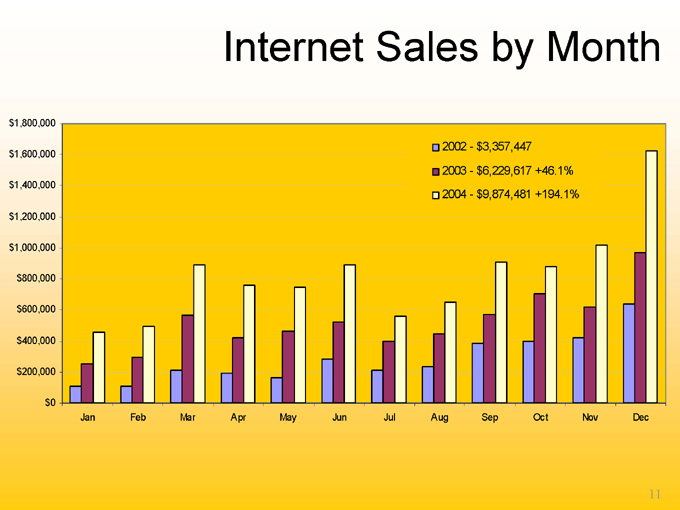

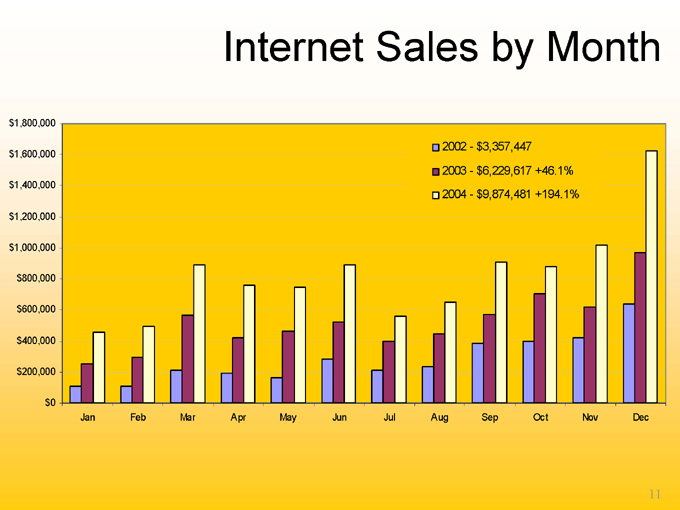

Internet Sales by Month

$1,800,000 $1,600,000 $1,400,000 $1,200,000 $1,000,000 $800,000 $600,000 $400,000 $200,000 $0

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2002—$3,357,447 2003—$6,229,617 +46.1% 2004—$9,874,481 +194.1%

11

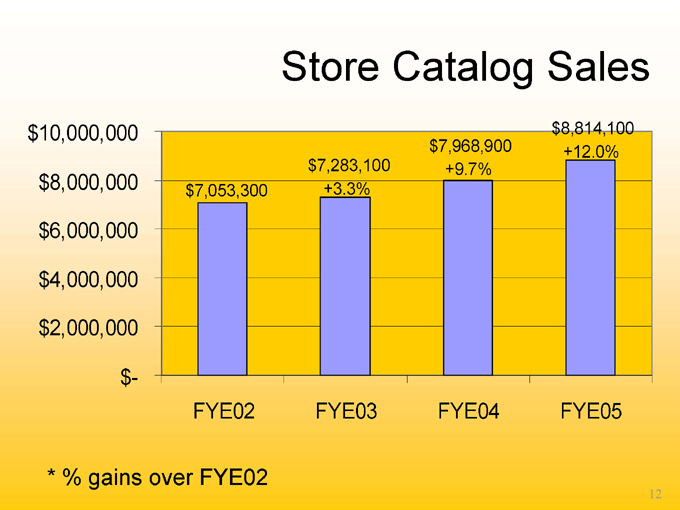

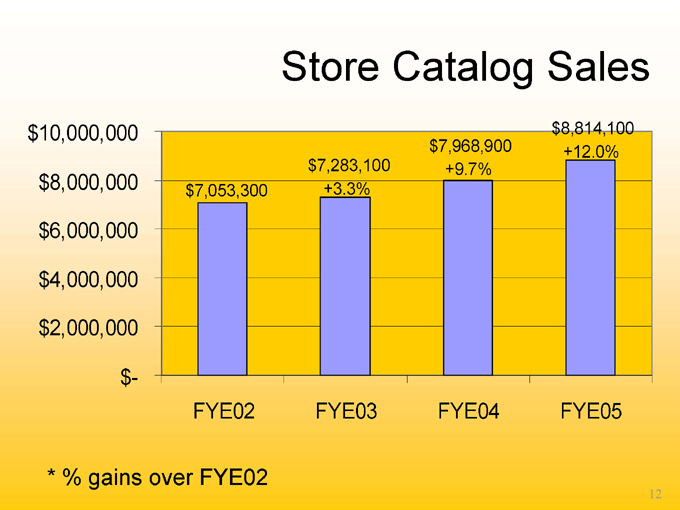

Store Catalog Sales $10,000,000 $8,000,000 $6,000,000 $4,000,000 $2,000,000 $- $7,053,300 $7,283,100 +3.3% $7,968,900 +9.7% $8,814,100 +12.0%

FYE02

FYE03

FYE04

FYE05

*% gains over FYE02

12

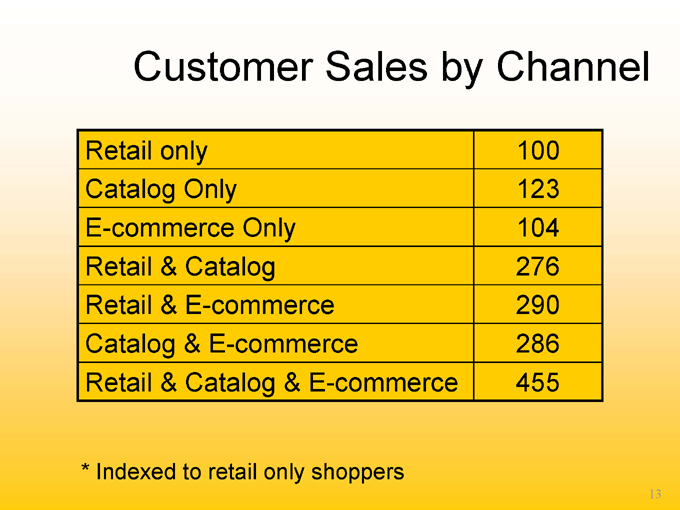

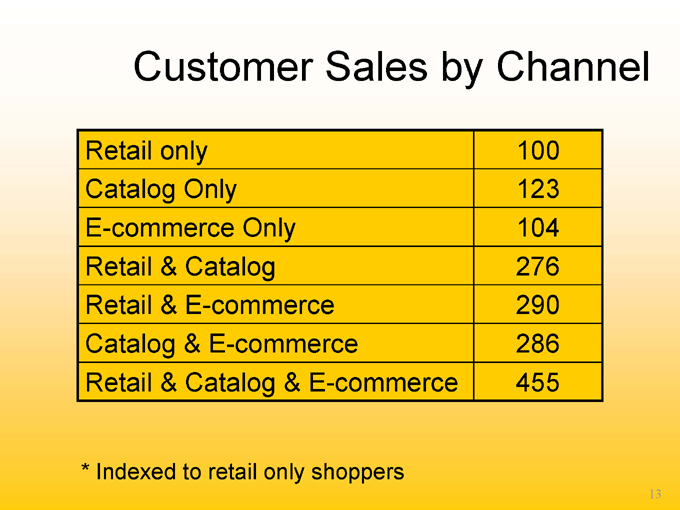

Customer Sales by Channel

Retail only 100

Catalog Only 123

E-commerce Only 104

Retail & Catalog 276

Retail & E-commerce 290

Catalog & E-commerce 286

Retail & Catalog & E-commerce 455

* Indexed to retail only shoppers

13

summer 2005

polo ralph lauren nautioa jeans co.cutter & buck reebock izod levis dockers george foreman polo jeans co. nautica

14

Fall 2005

You name it. we’ve got it

brands you want. styles one you like. sizes that fit

52 page retail catalog Mailing Aug, Nov, & Dec 500,000 pieces per mailing

15

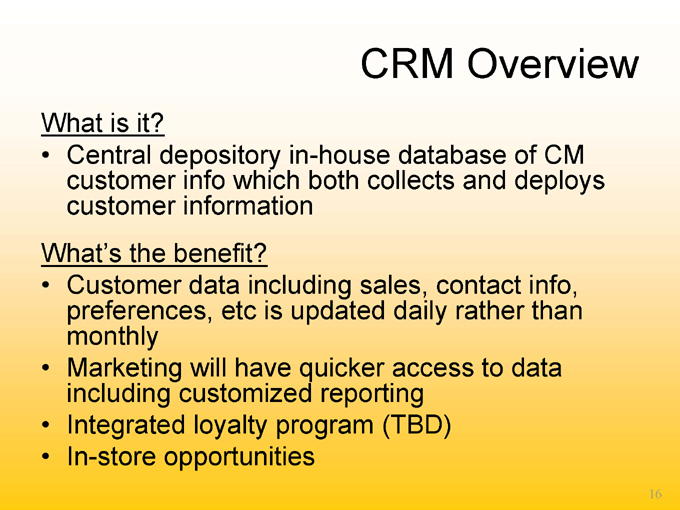

CRM Overview

What is it?

Central depository in-house database of CM customer info which both collects and deploys customer information

What’s the benefit?

Customer data including sales, contact info, preferences, etc is updated daily rather than monthly

Marketing will have quicker access to data including customized reporting

Integrated loyalty program (TBD)

In-store opportunities

16

In-store Opportunities

Customer lookup- will be able to view a customer’s detailed purchase history and transactional data by channel

Attributes- will be able to view customer provided information: size, favorite color, brand, sports team, etc.

Triggers- reminders on POS screen based on attributes. Example include:

$ threshold—$25.00 or $50.00 away from getting the 5% disc. loyalty award brand promotion reminder – customer’s favorite brand, Polo Ralph Lauren is on sale

Handheld device- can perform customer lookup and view customer attribute with mobility around store

17

Gross Margin Opportunity

Core vs. seasonal/fashion – core year round basic stock items (5 pocket jean, pique polo, pocket tee, underwear, etc.)

Implementation of E3 (replenishment system) determined that we were 25% out of stocks on core items – demand exceeded supply

Better margins on core products than seasonal/fashion

18

Guaranteed In-stock Program

7 key items

Tested 20 stores in 4th quarter

Guaranteed In Stock Program –Bottoms 49 sizes, delivery in 5 working days or FREE

Fall launch

We’ve got it. You’ll find your size or it’s free.

19

FREE

$10

gift card

25% off

entire stock of

athletic footwear

Reebok Now Babree Slechers

Choose from a greet and action of your favourite styles.

Sdel 11-18 W

Reg.$eo-$jo Sale $37 50-$52.50

we’ve got it.

Find your size or it’s free:

YOUR SIZE IN-STOCK

All featured items

guaranteed.

IN-STORE FOR YOU EVERY DAY

You’ll never leave empty-handed when you shop at Casual Male—period.

We guarantee you’ll find your size in your fundamental favorites and If you don’t you’ll get the item free:

This is just one more reason why you can rely on Casual Male—we’re for you!

* Applies to sizes and colors for items shown only. If we don’t have your item in stock, then we’ll shop it to you for free. If you don’t receive the item within the business days, then you’ll get the item free. Limit one free item per customer.

YOUR SIZE IN-STOCK

All featured items

guaranteed.

IN-STORE FOR YOU EVERY DAY

our best items are on sale Wednesday , Aug. 10th thru Sunday, Aug. 21st

Find your size or it’s free.

20

Great sale prices on your favourites!

Stock up now on everyday basics.

In –stock or it’s free:

Guaranteed!

sale 21

sale 39

sale 39

sale 16

sale 44

sale 34

21

Customer Lifestyles

Joe Jock Age 18-50 Functional Active

Cool Jay Age 18-35 Urban

Laid Back Kyle Age 18-35 Contemporary

Mainstream Mike Age 30-50 Traditional

Newman Age 50+ Older Traditional

Professor Paul Age 45+ Dress & Designer

Gift Giver Age 25+ All Classifications

22

Brand Strategy

2002 IMU (initial mark-up) under 65%

Levis/Dockers & Harbor Bay/Menswear

2005 IMU now over 67%

George Foreman, Levis/Dockers, Reebok, Polo Jeans, Nautica Jeans, Izod, Perry Ellis, Calvin Klein, Geoffrey Beene, Henry Grethel, Harbor Bay

Result – Better sourcing (reduction of # of vendors) Anticipate continued improvement

Direct sourcing Li & Fung

China Pricing

23

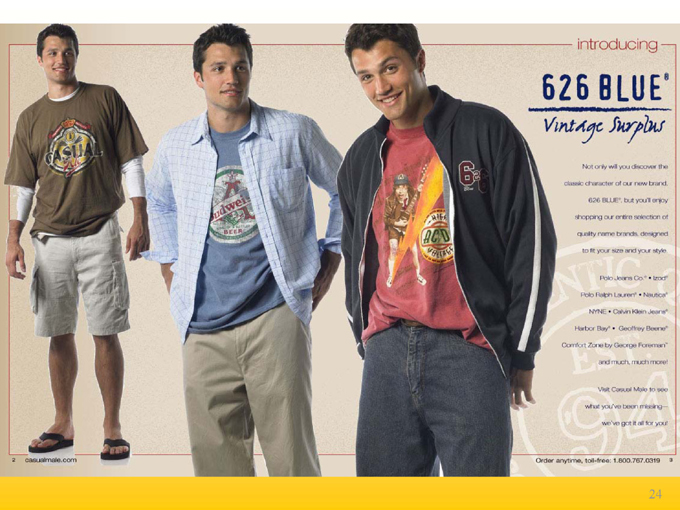

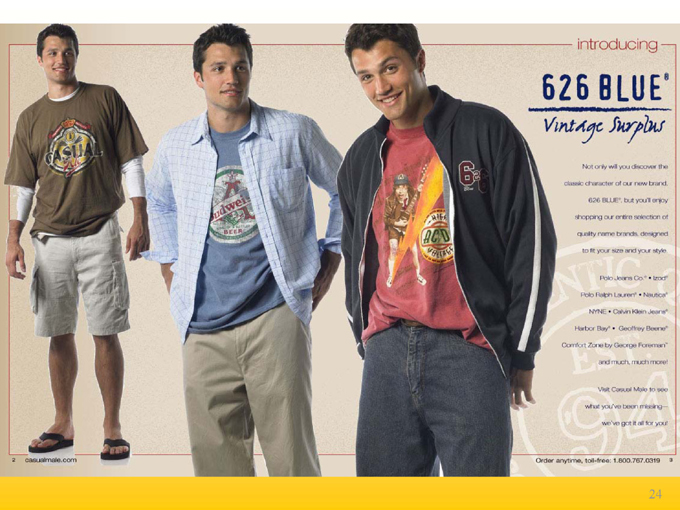

Introducing

Not only will you discover the classic character of our new brand.

626 BLUE, but you’ll enjoy shopping our entire selection of quality name brands, designed to fit your size and your style.

Polo Jeans Co. Izod

Polo Ralph Lauren Nautica

NYNE Calvin klein Jeans

Harbor Bay Geoffrey Beene

Comfort Zone by George Foreman

and much, much more!

Visit Casual Male to see what you’ve been missing – we’ve got it all for you!

2. Casualmale.com

Order anytime, toll-free: 1.800.767.0319

24

Introducing today’s classics

Define your style with the attitude reflected on vintage apparel!

4. casualmale.com

Order anytime, toll-free: 1.800.767.0319

25

today’s new classic options

Discover your favorites in timeless styles, fits and washes!

6. casualmale.com to more!

Order anytime, toll-free: 1.800.767.0319

26

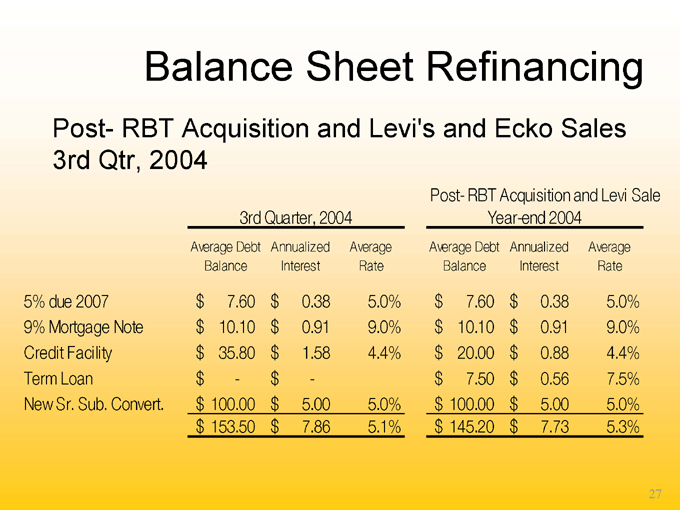

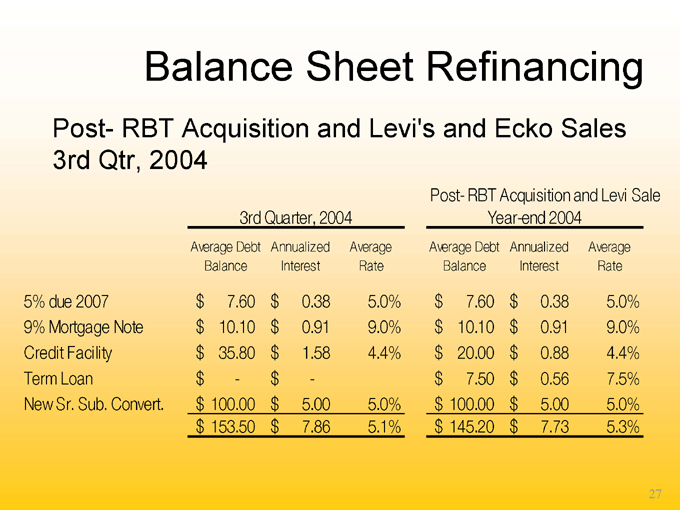

Balance Sheet Refinancing

Post- RBT Acquisition and Levi’s and Ecko Sales 3rd Qtr, 2004

Post- RBT Acquisition and Levi Sale

3rd Quarter, 2004 Year-end 2004

Average Debt Balance Annualized Interest Average Rate Average Debt Annualized Average Balance Interest Rate

5% due 2007 $7.60 $0.38 5.0% $7.60 $0.38 5.0%

9% Mortgage Note $10.10 $0.91 9.0% $10.10 $0.91 9.0%

Credit Facility $35.80 $1.58 4.4% $20.00 $0.88 4.4%

Term Loan $- $- $7.50 $ 0.56 7.5%

New Sr. Sub. Convert. $100.00 $5.00 5.0% $100.00 $5.00 5.0%

$153.50 $7.86 5.1% $145.20 $7.73 5.3%

27

Forward - Looking Statement

Any remarks that we make today about future expectations, plans and prospects for Casual Male Retail Group, Inc. which are not historical facts, are forward-looking statements that involve risks and uncertainties. For a discussion of such risks and uncertainties, which could cause the Company’s actual results to differ from those contained in the forward-looking statements, please read the section entitled “Forward-Looking Statements” in the Company’s most recent Form 10-K and Form 10-Q and the Form 8-K filed on April 8, 2005 with the Securities and Exchange Commission.

28

Casual Male Retail Group 555 Turnpike Street Canton, MA 02021 (781) 828-9300 x 2004 jeffunger@usa.net clinsky@cmal.com

29