Exhibit A

September 2005

The CMRG Story

Undisputed leader within a $6 billion men’s big & tall apparel arena

Dominant player within specialty big & tall store with 65% market share

Increased opportunity to consolidate a fragmented market by focused merchandising initiatives and advanced marketing techniques

Focused our growth & profitability on both of our big & tall brands—Casual Male and Rochester.

2

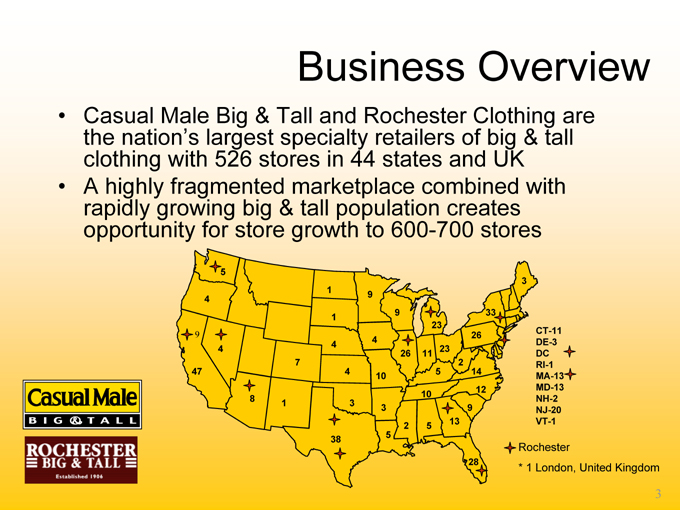

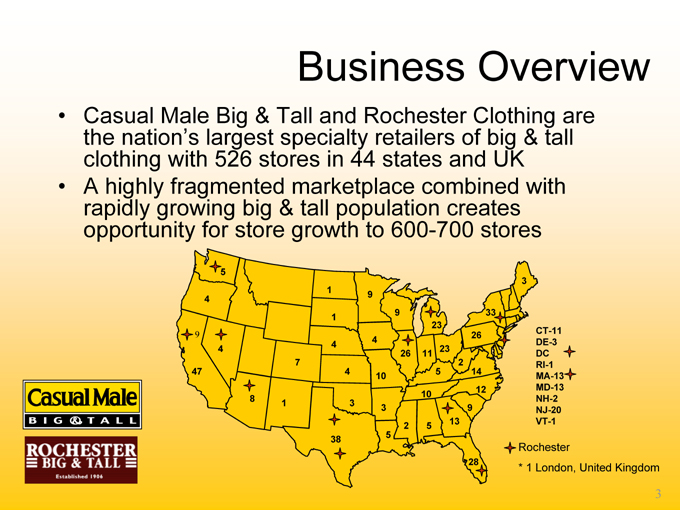

Business Overview

Casual Male Big & Tall and Rochester Clothing are the nation’s largest specialty retailers of big & tall clothing with 526 stores in 44 states and UK

A highly fragmented marketplace combined with rapidly growing big & tall population creates opportunity for store growth to 600-700 stores

5

4

9

47

4

8

7

1

1

1

4

4

3

38

9

4

10

3

5

9

26

2

23

11

10

5

23

5

13

9

2

26

33

3

14

12

28

CT-11

DE-3

DC

RI-1

MA-13

MD-13

NH-2

NJ-20

VT-1

Rochester

* 1 London, United Kingdom

3

Fall 2005

ROCHESTER

BIG & TALL

4

Rochester Brands

5

Benefits to CMRG

Combined entities give CMRG 65% market share of specialty retail sector

Not a turn around – accretive to earnings in year one

Senior management continues with incentive contracts

Synergies will increase gross margin, reduce overhead costs (warehouse, administration, insurance, etc.)

Comparable multi-channel opportunities to Casual Male

Internet/catalog over 20% of sales in less than 3 years

Store growth opportunities

Underserved markets

Growth of 5 – 7 stores/yr

International opportunities

6

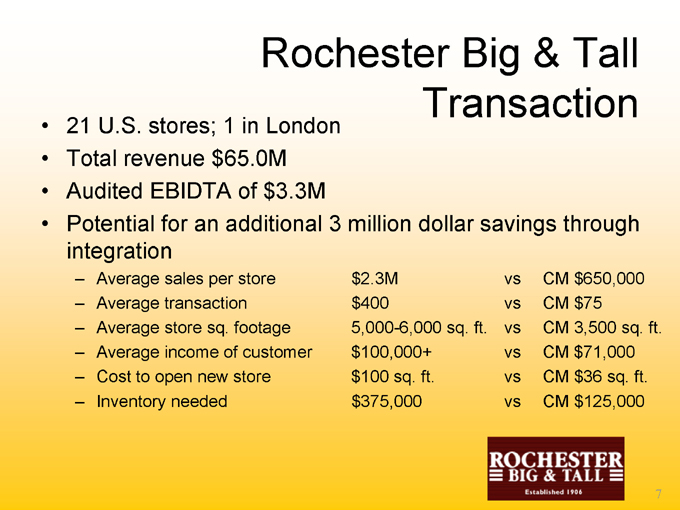

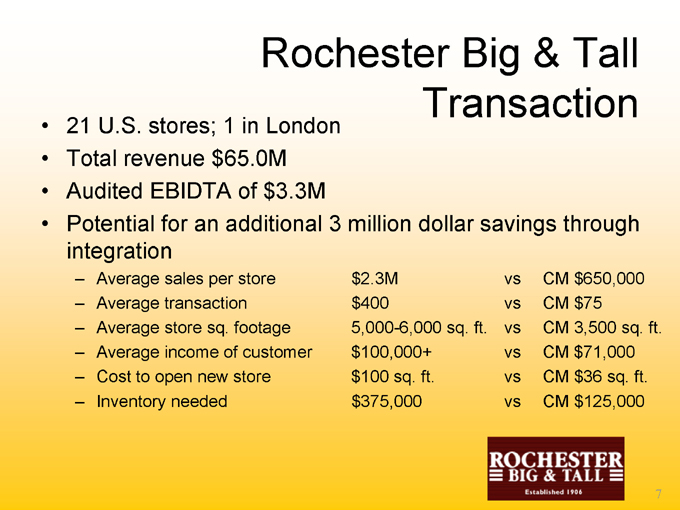

Rochester Big & Tall Transaction

21 U.S. stores; 1 in London

Total revenue $65.0M

Audited EBIDTA of $3.3M

Potential for an additional 3 million dollar savings through integration

Average sales per store $2.3M vs CM $650,000

Average transaction $400 vs CM $75

Average store sq. footage 5,000-6,000 sq. ft. vs CM 3,500 sq. ft.

Average income of customer $100,000+ vs CM $71,000

Cost to open new store $100 sq. ft. vs CM $36 sq. ft.

Inventory needed $375,000 vs CM $125,000

7

fall 2005

exclusive —

626 Blue!

Nyne shirt sold on page 39

Casual Male

BIG & TALL

1.800.767.0319

casualmale.com

8

Comp Store Trend

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

-2.0%

-4.0%

-6.0%

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

2003

2004

2005

9.2%

Launch of George Foreman collection and TV campaign

4.8%

2.4%

Stores change to lifestyle presentation

1.6%

2.0%

2.3%

2.5%

-1.1%

-2.3%

-5.0%

9

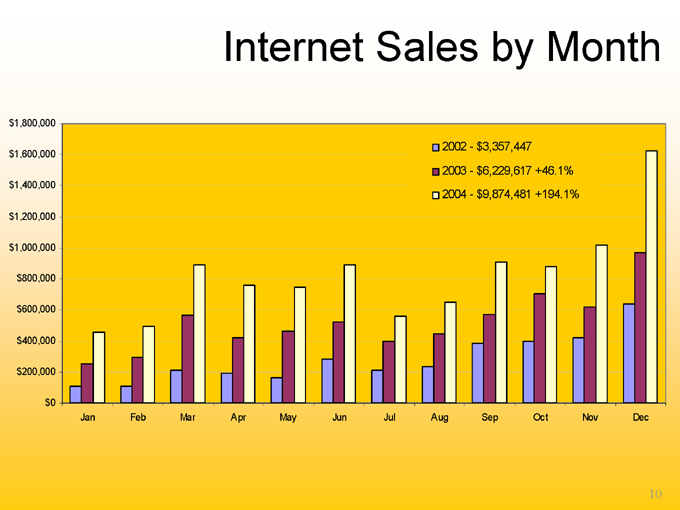

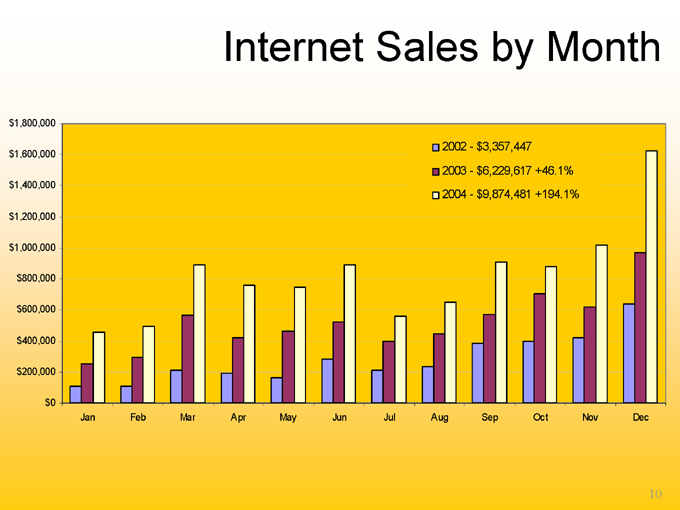

Internet Sales by Month

2002 - $3,357,447

2003 - $6,229,617 +46.1%

2004 - $9,874,481 +194.1%

$1,800,000

$1,600,000

$1,400,000

$1,200,000

$1,000,000

$800,000

$600,000

$400,000

$200,000

$0

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

10

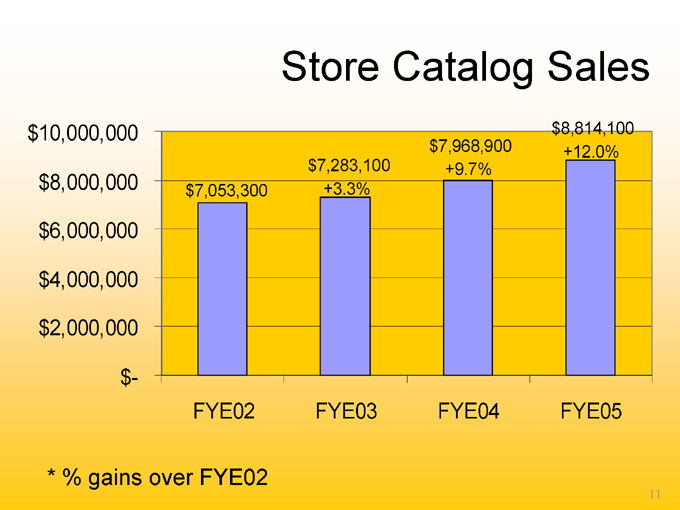

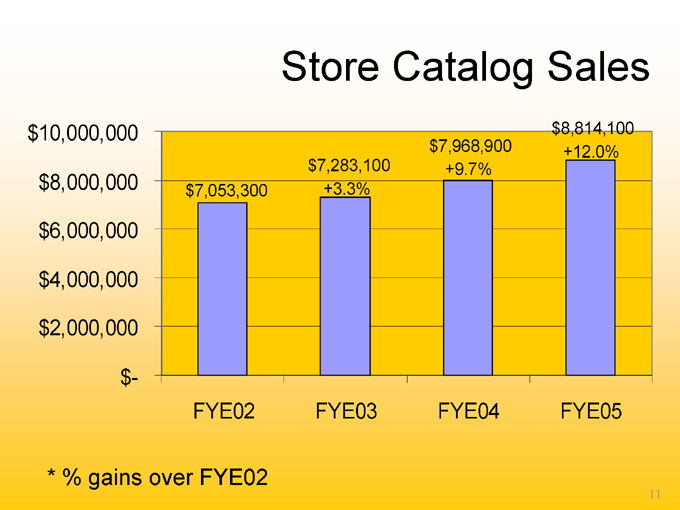

Store Catalog Sales $10,000,000 $8,000,000 $6,000,000 $4,000,000 $2,000,000 $- $7,053,300 $7,283,100 +3.3% $7,968,900 +9.7% $8,814,100 +12.0%

FYE02 FYE03 FYE04 FYE05

* % gains over FYE02

11

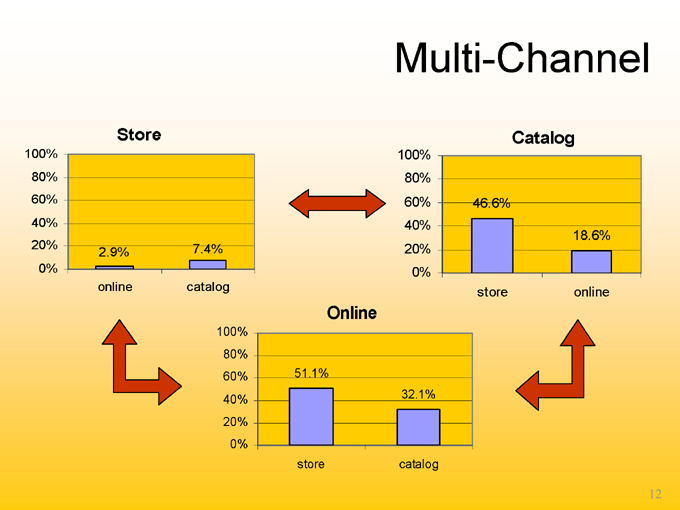

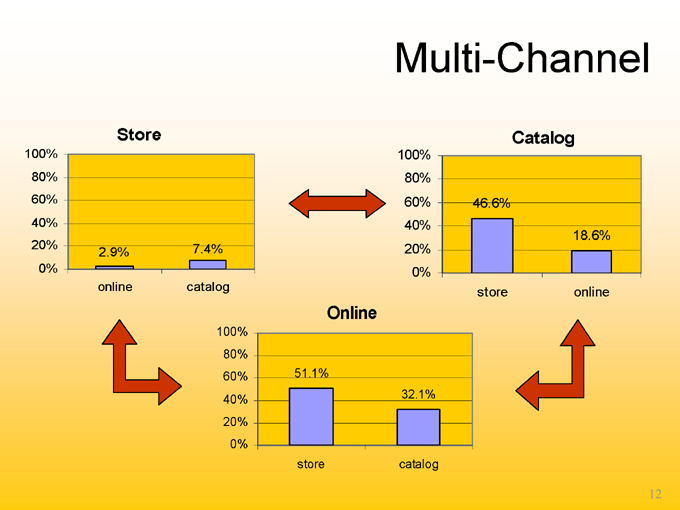

Multi-Channel

Store

100%

80%

60%

40%

20%

0%

2.9%

7.4%

online

catalog

Catalog

100%

80%

60%

40%

20%

0%

46.6%

18.6%

store online

Online

100%

80%

60%

40%

20%

0%

51.1%

32.1% store catalog

12

Customer Sales by Channel

Retail only 100

Catalog Only 123

E-commerce Only 104

Retail & Catalog 276

Retail & E-commerce 290

Catalog & E-commerce 286

Retail & Catalog & E-commerce 455

* Indexed to retail only shoppers

13

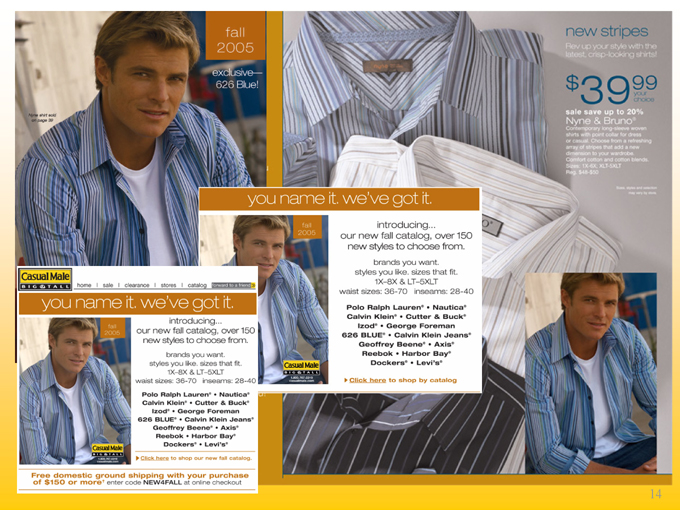

Introducing our new Fall 2005 collection

14

Brand Strategy

2002 IMU (initial mark-up) under 65%

Levis/Dockers & Harbor Bay/Menswear

2005 IMU now over 67%

George Foreman, Levis/Dockers, Reebok, Polo Jeans, Nautica Jeans, Izod, Perry Ellis, Calvin Klein, Geoffrey Beene, Henry Grethel, Harbor Bay

Result – Better sourcing (reduction of # of vendors)

Anticipate continued improvement in 2006

Direct sourcing Li & Fung

China Pricing

15

52 page retail catalog Mailing Aug, Nov, & Dec 500,000 pieces per mailing

16

Introducing 626 Blue® Vintage Surplus

17

626 Blue® today’s classics

18

626 Blue® new classic options

19

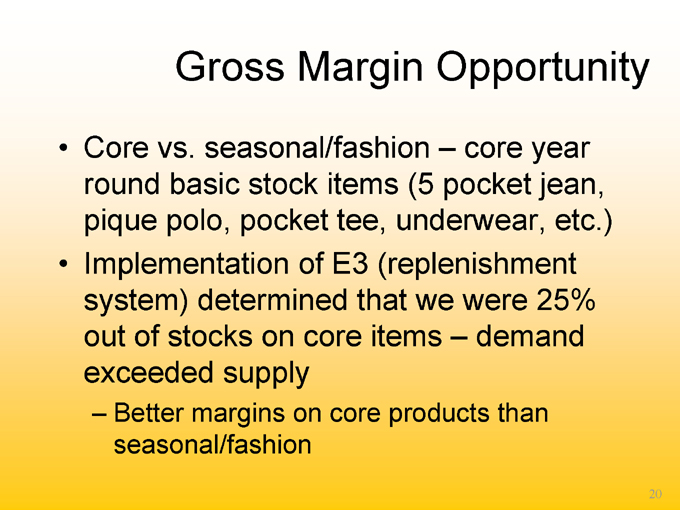

Gross Margin Opportunity

Core vs. seasonal/fashion – core year round basic stock items (5 pocket jean, pique polo, pocket tee, underwear, etc.)

Implementation of E3 (replenishment system) determined that we were 25% out of stocks on core items – demand exceeded supply

Better margins on core products than seasonal/fashion

20

Guaranteed In-stock Program

7 key items

Guaranteed In Stock Program – Bottoms 49 sizes, delivery in 5 working days or FREE

August 10 chain rollout

21

“Your Size In-Stock-Guaranteed” Program

22

Merchandise included in the “Your Size In-Stock-Guaranteed” Program

23

New Design

CASUAL MALE XL

Big & Tall

CASUAL MALE

CASUAL MALE XL

25

Objectives

Change the consumer perception of Casual Male to increase awareness of brands, sizes and comfort carried in all channels and appeal to the younger, smaller and taller B&T consumers.

Re-engineer the look and feel of the Casual Male brand in all communications including in-store experience, web & catalog

Test an alternative to a high POS marketing strategy to include: loyalty program, to stop the dependency on always being a promotion.

Develop and advance MGI and personal guest relationship marketing

26

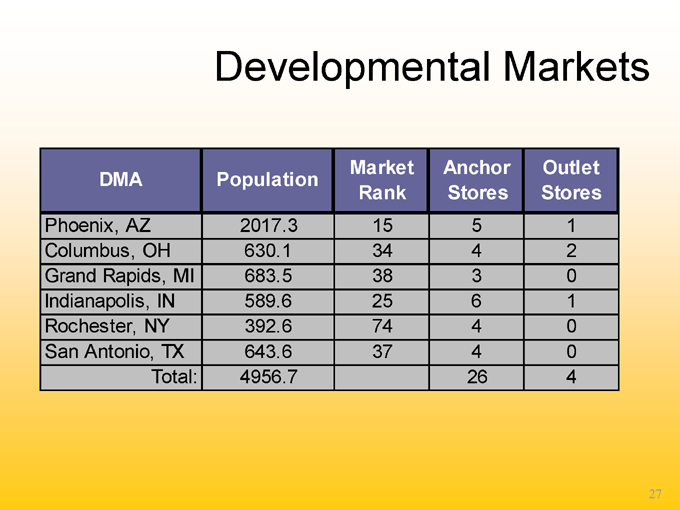

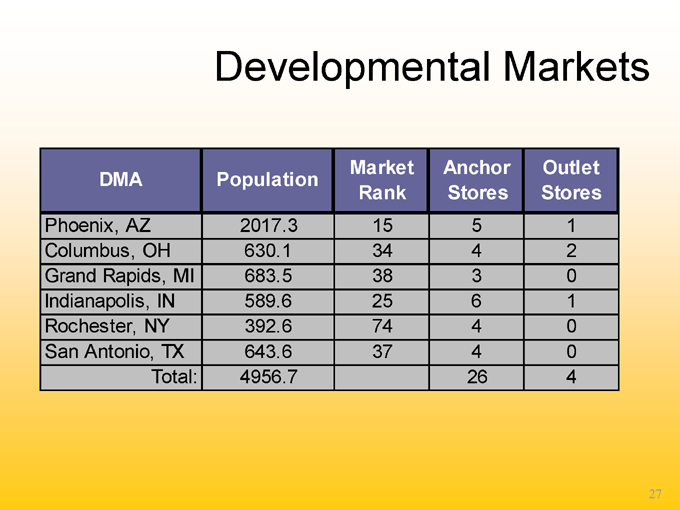

Developmental Markets

DMA Population Market Rank Anchor Stores Outlet Stores

Phoenix, AZ 2017.3 15 5 1

Columbus, OH 630.1 34 4 2

Grand Rapids, MI 683.5 38 3 0

Indianapolis, IN 589.6 25 6 1

Rochester, NY 392.6 74 4 0

San Antonio, TX 643.6 37 4 0

Total: 4956.7 26 4

27

Effected Change

Exterior store

Interior of store, visual presentation, signage, POS package

Bags

All communications

Direct mail

Email

Catalog version

Website

New Private label credit card

Associate training

28

YOU NAME IT

WE’VE got it

IN BIG & TALL SIZES

29

New in-store price signage

30

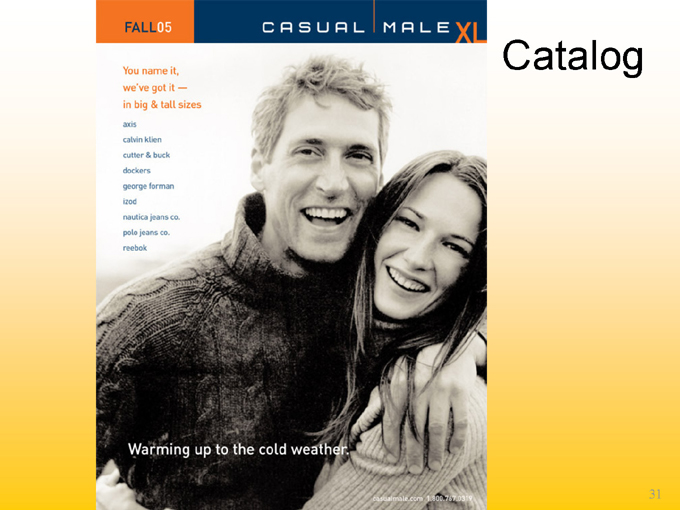

FALL05

You name it, we’ve got it —

in big & tall sizes

axis

calvin klein

cutter & buck

dockers

george forman

izod

nautica jeans co.

polo jeans co.

reebok

Catalog

Warming up to the cold weather.

casualmale.com 1.800.767.0319

31

Sale flyer with new logo

casualmale.com

http://www.casualmale.com/

Google

CASUAL MALE XL

OUR STORY

SHOP BY CATALOG

STORES

WISH LIST

MY ACCOUNT

SHOPPING BAG

BIG & TALL

FALL05

You name it,

we’ve got it.

REQUEST CATALOG

GIFT CERTIFICATES

CM REWARDS

ABOUT US

CONTACT US

HELP

YOUR PRIVACY RIGHTS

EMPLOYMENT

INVESTOR RELATIONS

All Contents ©2000-2005 Casual Male Retail Group, inc. All rights reserved.

33

Bags

CASUAL MALE XL

casualmale.com

34

Gift Card

A GIFT FOR YOU

TO:

FROM:

GIFTCARD

CASUAL MALE XL

GIFTCARD

CASUAL MALE XL

35

Private Label Charge

CASUAL MALE XL

5678 9123 4567 8912

Michael B. Maheropolous

36

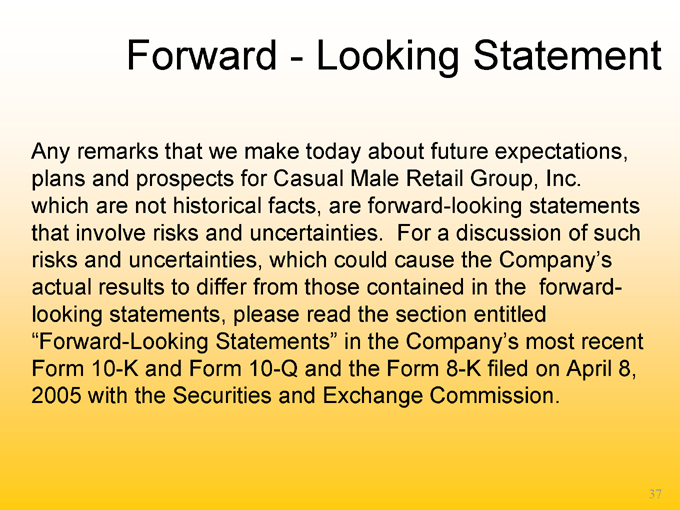

Forward—Looking Statement

Any remarks that we make today about future expectations, plans and prospects for Casual Male Retail Group, Inc. which are not historical facts, are forward-looking statements that involve risks and uncertainties. For a discussion of such risks and uncertainties, which could cause the Company’s actual results to differ from those contained in the forward-looking statements, please read the section entitled “Forward-Looking Statements” in the Company’s most recent Form 10-K and Form 10-Q and the Form 8-K filed on April 8, 2005 with the Securities and Exchange Commission.

37

Casual Male Retail Group

555 Turnpike Street

Canton, MA 02021

(781) 828-9300 x 2004

jeffunger@usa.net

clinsky@cmal.com

38