2 ’06 & ’07 Initiatives • Redefine Casual Male image to increase market share • Store growth – expansion of Rochester Clothing • Jared M. Acquisition • Continued accelerated growth of internet and catalog • Gross margin improvement |

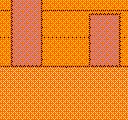

3 Redefine Casual Male Image |

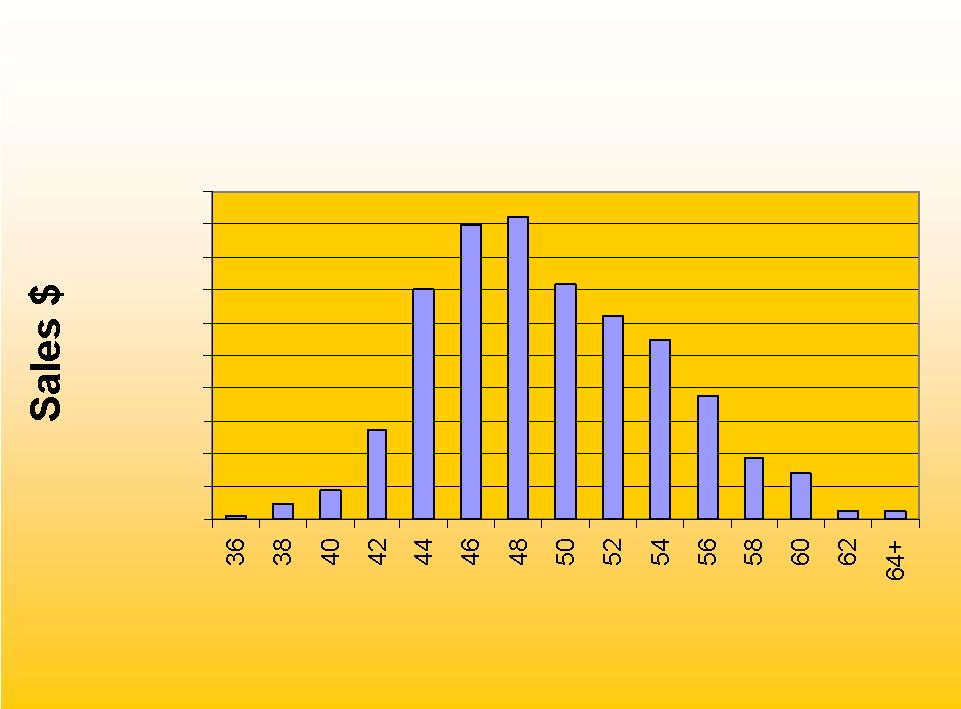

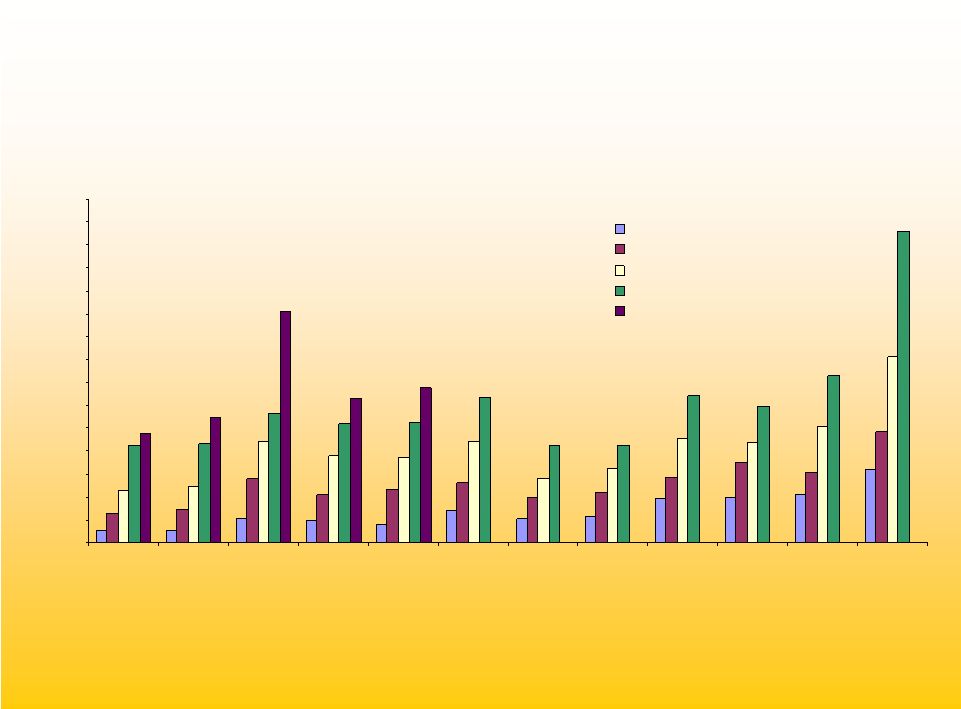

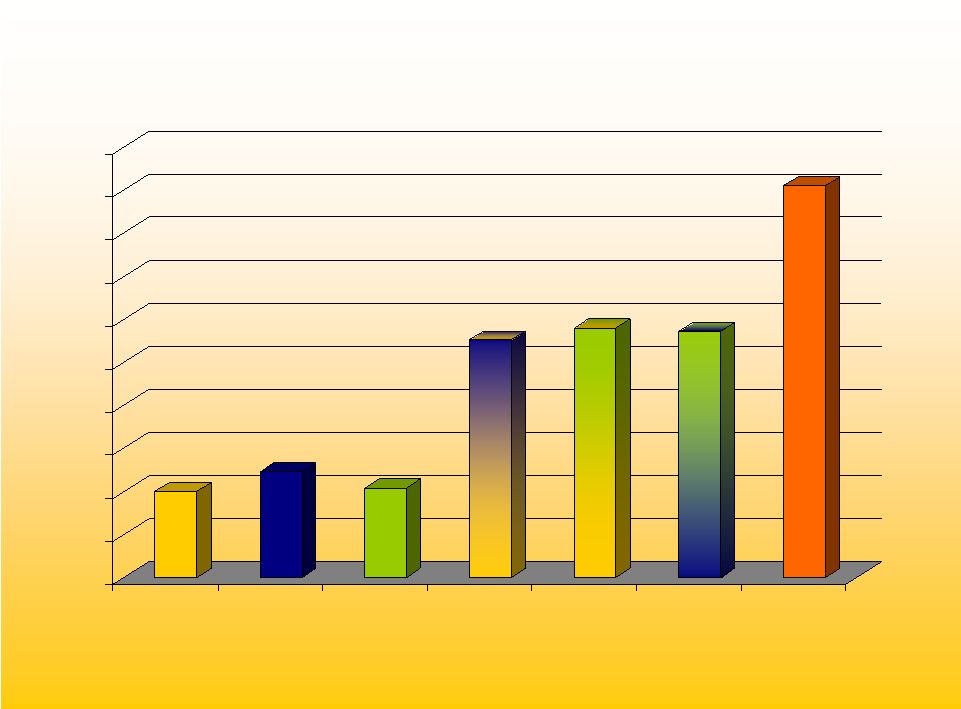

4 Market Share Size Opportunity Casual Male Sales by Size $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 $200,000 Waist Size Data based on ’04 sales of Casual Pants, Dress Pants and Jeans |

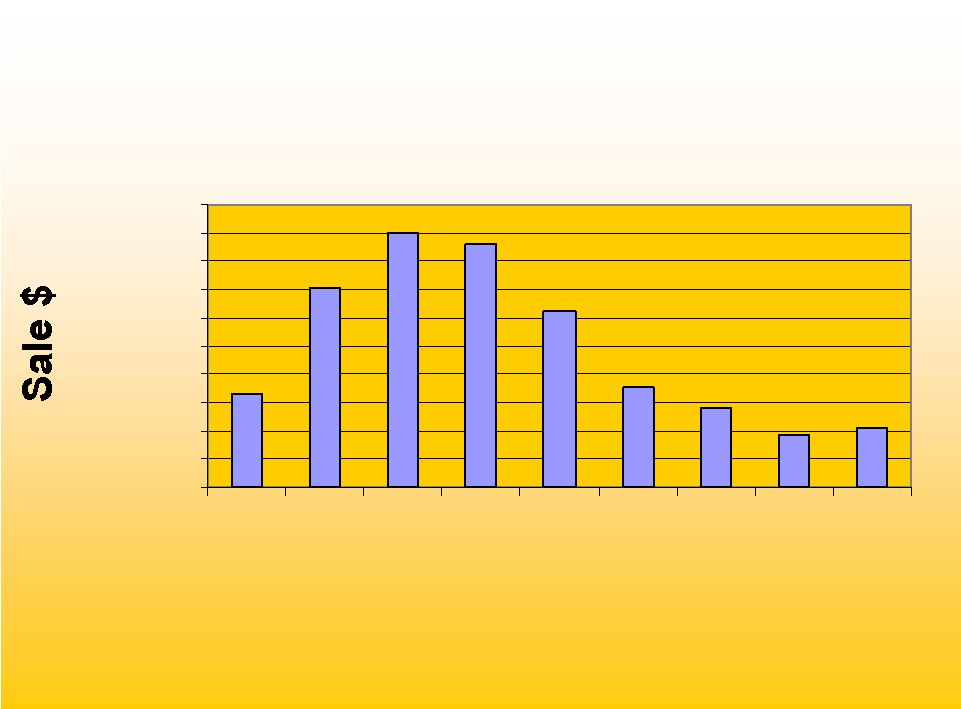

5 National Sales by Size $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 $1,600,000 $1,800,000 $2,000,000 30 32 34 36 38 40 42 44 46+ Waist |

6 Customer Research Least favorite aspect of clothing shopping was “difficulty finding items in my size” – They were shopping at “the end of the rack” – Stigma with “big and tall” store – “big and tall” stores were consistently referred to as places where “fat guys” shop Current image associated with Casual Male – A degree of discomfort with shopping at the store for “big and tall” – Belief that the clothing started around a 48” waist – Merchandise and selection lacked a sense of style – Had unattractive, inconvenient locations – Casual Male was a place of necessity rather than a destination of choice |

7 50% of customers refer to Casual Male as the “Big & Tall” store |

14 Rochester vs. Casual Male Metrics Average sales per store $2.3M vs CM $650,000 Average transaction $400 vs CM $75 Average store sq. footage 5,000-6,000 sq. ft. vs CM 3,500 sq. ft. Average income of customer $100,000+ vs CM $71,000 Cost to open new store $100 sq. ft. vs CM $36 sq. ft. Inventory needed $375,000 vs CM $125,000 |

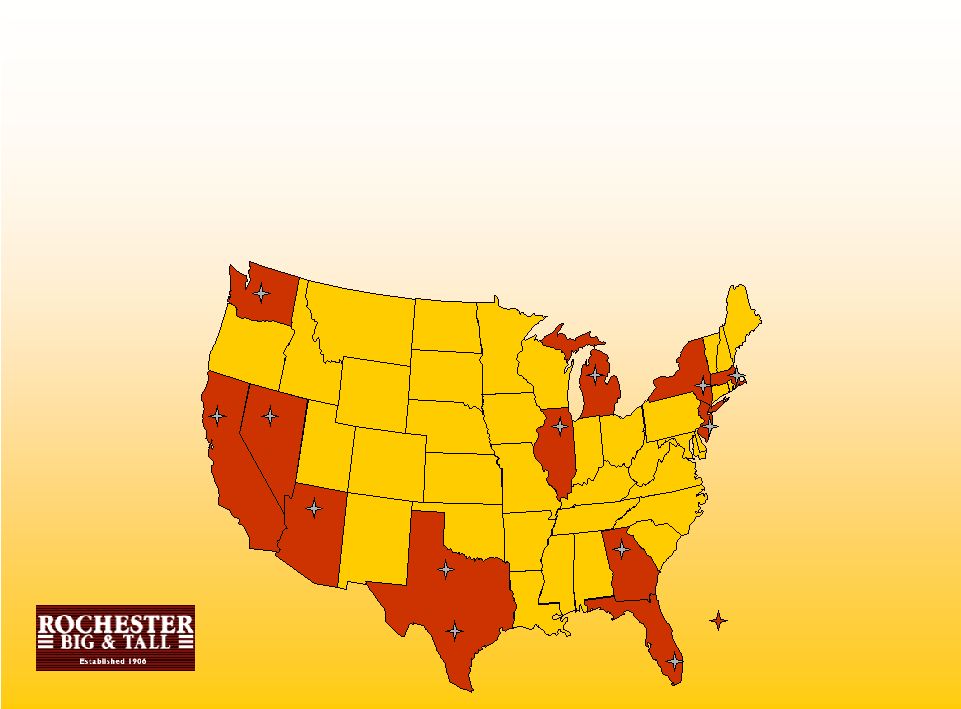

15 Rochester Overview • Major growth for next 5 years. We will be in expanding Rochester from 24 stores to 40 more stores Rochester * 1 London, United Kingdom 9 2 2 |

19 Jared M. Acquisition • Custom clothing continues to be growing in the higher end men’s business • Rochester is underdeveloped in custom clothing (3.5% of sales) • Jared M. $3.0M company catering to professional athletes • Utilized CMRG infrastructure for multi-channeled opportunities • Spring ’07 launch – Jared M. shops in several high profile Rochester markets – Jared M. catalog – Jared M. website |

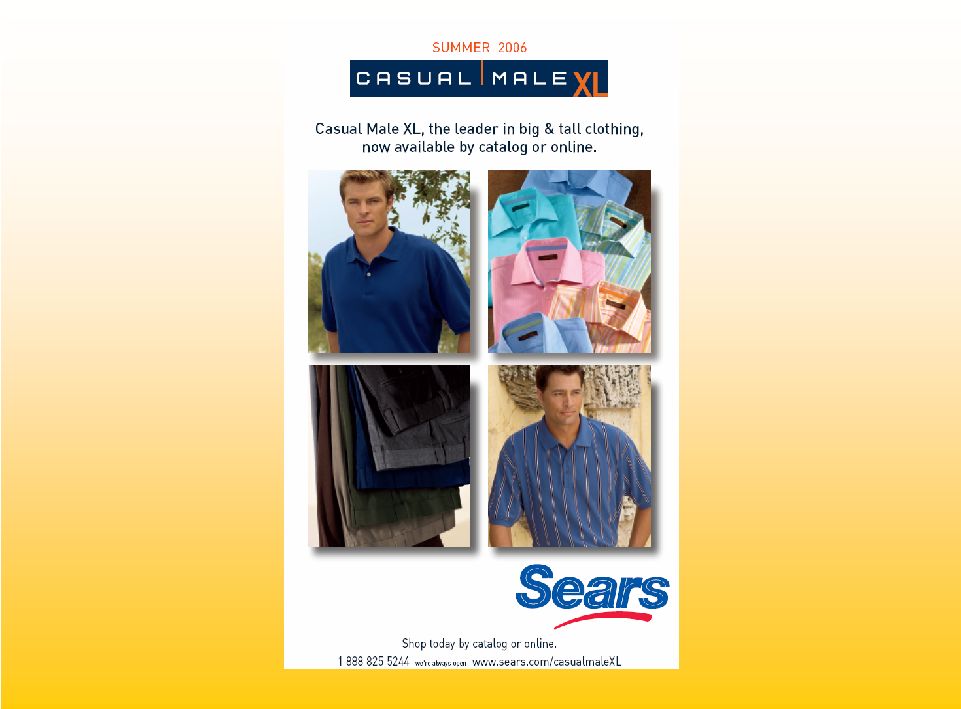

21 Continued accelerated growth of internet and catalog |

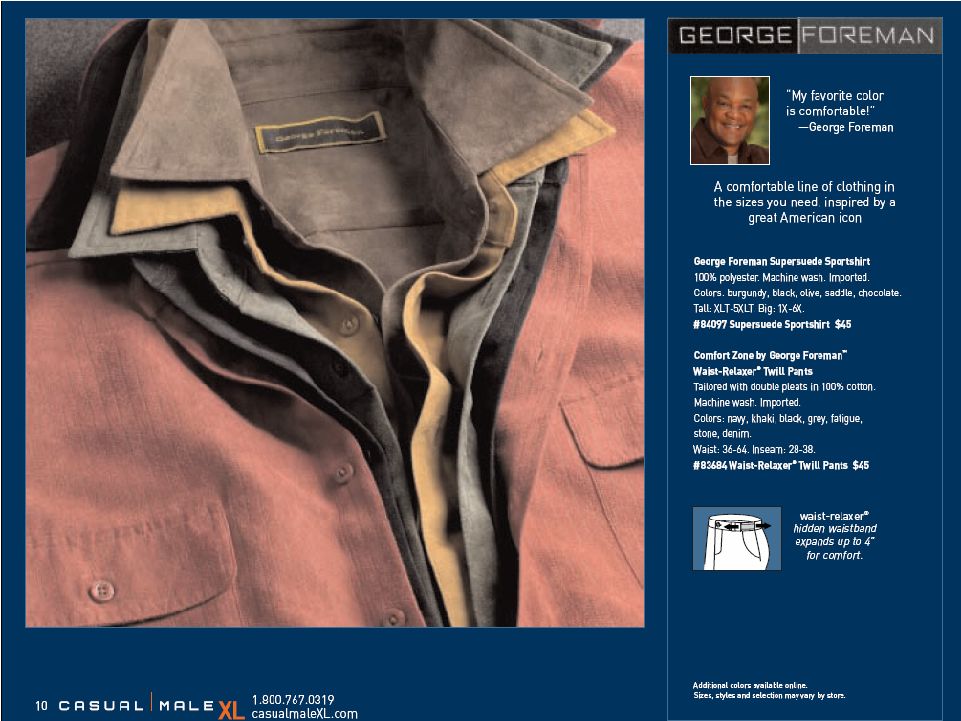

22 Comp Store Trend 2004 2003 Stores change to lifestyle presentation Launch of George Foreman collection and TV campaign 2005 2006 -5.0% -2.3% -1.1% 2.4% 9.2% 4.8% 1.6% 2.0% 2.3% 2.5% 3.70% 7.90% 5.40% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 |

23 CM 2005 Internet Sales by Month $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 $1,600,000 $1,800,000 $2,000,000 $2,200,000 $2,400,000 $2,600,000 $2,800,000 $3,000,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2002 - $3,357,447 2003 - $6,229,617 2004 - $9,874,481 2005 - 14,559,045 2006 |

24 Customer Sales by Channel * Indexed to retail only shoppers 100 123 104 276 290 286 455 0 50 100 150 200 250 300 350 400 450 500 Retail only Catalog Only E-commerce Only Retail & Catalog Retail & E- commerce Catalog & E- commerce Retail & Catalog & E- commerce |

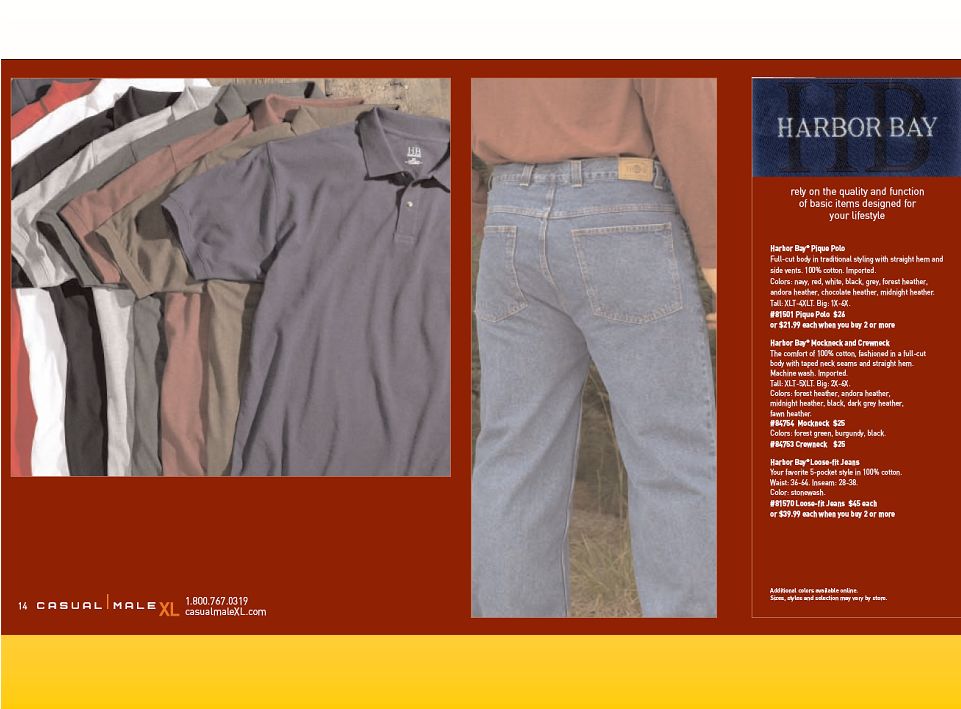

29 Gross Margin Improvements • Inventory management • Direct sourcing • Building proprietary brands |

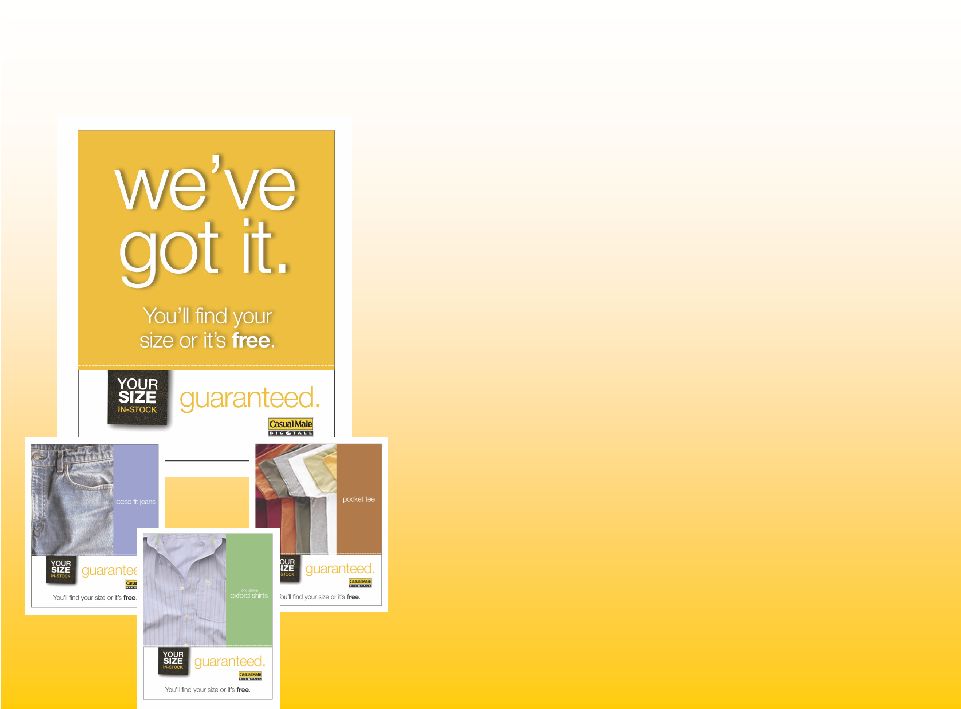

30 Gross Margin Opportunity • Core vs. seasonal/fashion – core year round basic stock items (5 pocket jean, pique polo, pocket tee, underwear, etc.) • Implementation of E3 (replenishment system) determined that we were 25% out of stocks on core items – demand exceeded supply – Better margins on core products than seasonal/fashion |

31 Guaranteed In-stock Program • 7 key items • GIS Program – Bottoms 49 sizes, delivery in 5 working days or FREE • 8/21 launch • Sold 449,405 units • Units 26% increase • 4,623 units fulfilled through catalog • 13 pieces of free items given away |

32 Direct Sourcing • Direct Sourcing of goods through Li & Fung, as agent beginning in 2006 • New Department created, hiring of industry veteran • Potential for 40% of Casual Male Inventory to go Direct • Cost saving of up to 15% • Better sourcing (reduction of # of Vendors) • Rochester has very little private label, potential for 20% • Cost savings of up to 20% for Rochester |

37 Collection will consist of Wovens, Casual Pant, and Knits Assortment will reflect items/attitude and overall look of successful contemporary brands such as George Foreman Signature, Perry Ellis, I.N.C., etc. |

39 Any remarks that we make today about future expectations, plans and prospects for Casual Male Retail Group, Inc. which are not historical facts, are forward-looking statements that involve risks and uncertainties. For a discussion of such risks and uncertainties, which could cause the Company’s actual results to differ from those contained in the forward- looking statements, please read the section entitled “Forward-Looking Statements” in the Company’s most recent Form 10-K and Form 10-Q and the Form 8-K filed on April 8, 2005 with the Securities and Exchange Commission. Forward - Looking Statement |

40 Casual Male Retail Group 555 Turnpike Street Canton, MA 02021 (781) 828-9300 x 2004 jeffunger@usa.net clinsky@cmal.com |