September 2006 Exhibit 99.1 |

Casual Male Retail Group properly positioned to increase market share to 12% of the big & tall market |

Big & Tall Market • Market defined as: – big = waist size between 40” and 70” – tall = height over 6’2” • Big and tall men account for approximately 11% of the male population. • Big and tall market size is approximately $6 billion and growing at almost twice the rate of the regular size men’s apparel market. – Big & tall apparel market is highly fragmented; characterized by many small, local operators. |

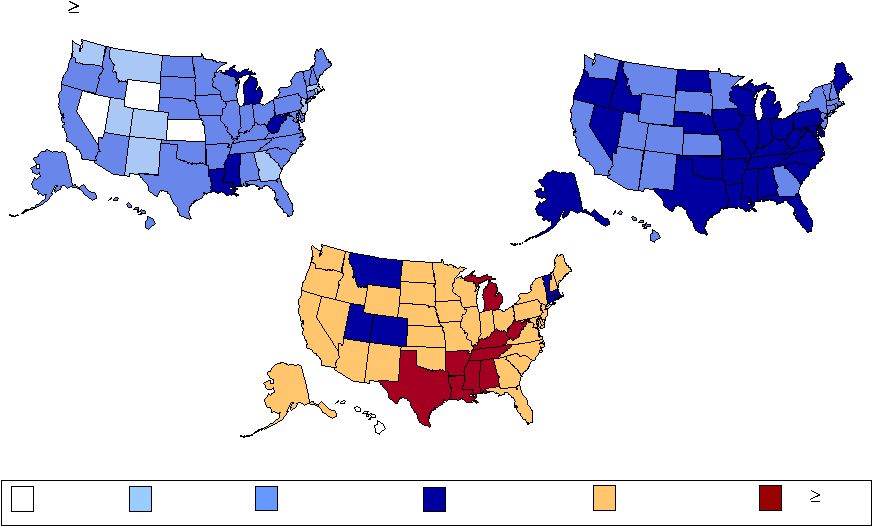

1991 Market is growing as a percent to total menswear sales Obesity Trends* Among U.S. Adults 1996 (*BMI 30, or about 30 lbs overweight) No Data <10% 10%–14% 15%–19% 20%–24% 25% 2004 In 2004, 7 states had obesity prevalence rates of 15–19 percent; 33 states had rates of 20–24 percent; and 9 states had rates more than 25 percent |

Casual Male Retail Group has divisions which support all demographics within the big & tall market |

Jared M. • Custom clothing continues to be growing in the higher-end men’s business • Spring ’07 launch – Jared M. shops in high profile Rochester markets – Jared M. catalog – Jared M. website |

Jared M. Three areas of opportunity for growth of Jared M. concept • Custom Clothing – Rochester is underdeveloped in custom clothing (3.5% of sales) – Jared M. custom shops will contribute to the contemporary portion of this opportunity – New Showroom/Production facility in lower Manhattan will also support custom clothing • Athlete clientele growth – Jared M. has solid NBA athlete clientele – Project other athlete clientele opportunities in NFL, MLB, NHL, etc. • Exclusive Collection for Rochester Big & Tall – Store, catalog and web channels |

Rochester Overview • Rochester currently with 23 US stores • 1 store in United Kingdom. Rochester * 1 London, United Kingdom 8 3 2 |

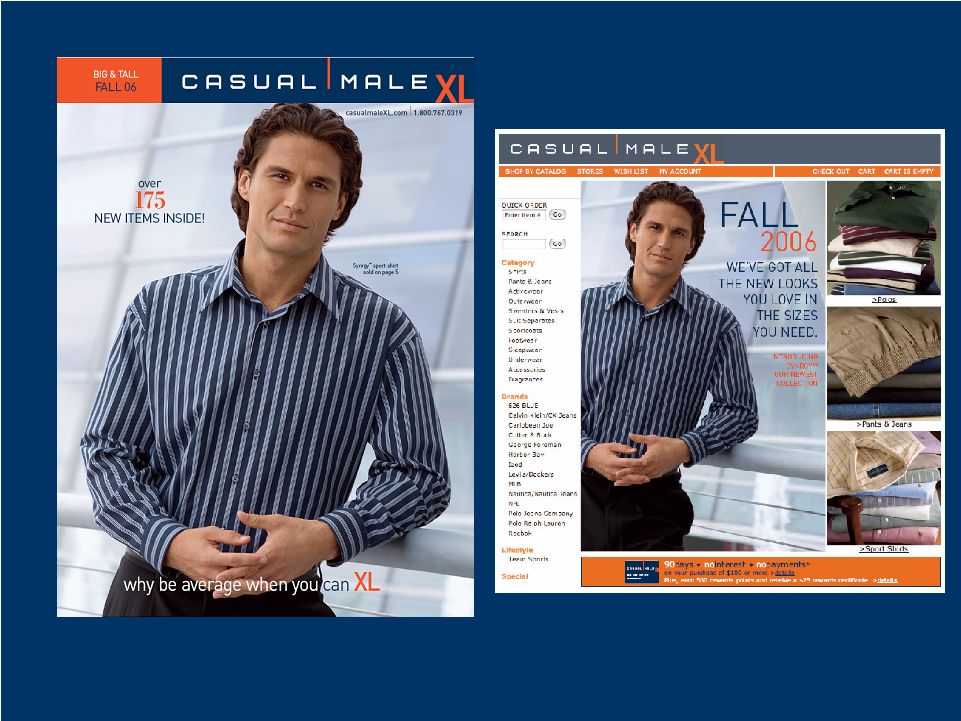

Casual Male Objectives to Increase Market Share • Raise productivity sales per square foot • Increasing sales of “smaller” sizes • Attract “younger” big and tall customers to Casual Male XL • Grow multi channel • New marketing efforts – Loyalty |

Comp Store Trend -5.0% -2.3% -1.1% 2.4% 9.2% 4.8% 1.6% 2.0% 2.3% 2.5% 3.70% 7.90% 5.40% 10.60% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2004 2003 Stores change to lifestyle presentation Launch of George Foreman collection and TV campaign 2005 2006 |

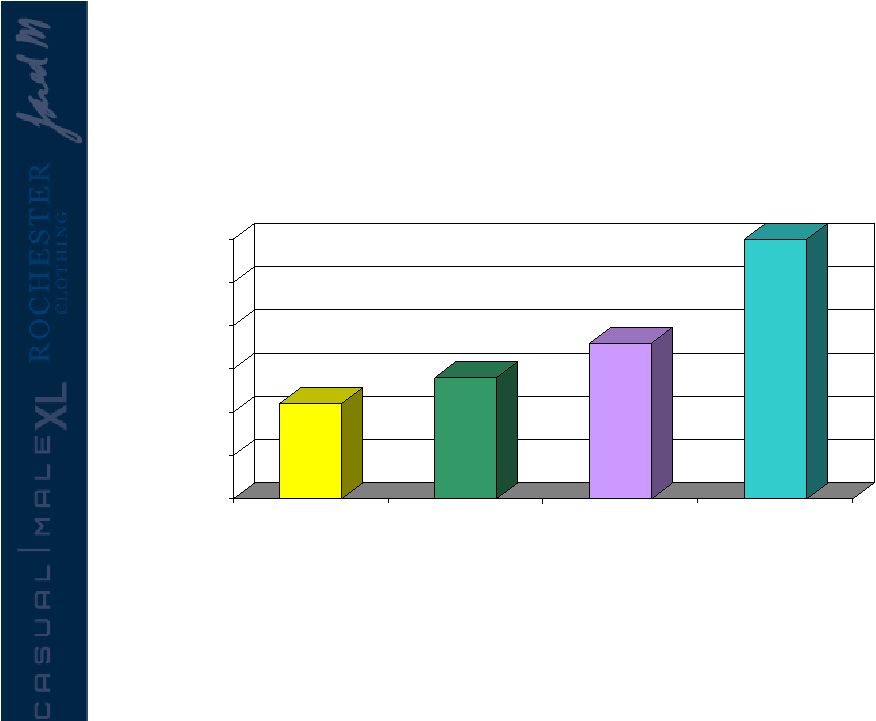

Sales Per Square Foot 181 184 188 200 170 175 180 185 190 195 200 2003 2004 2005 2006 Forecasted |

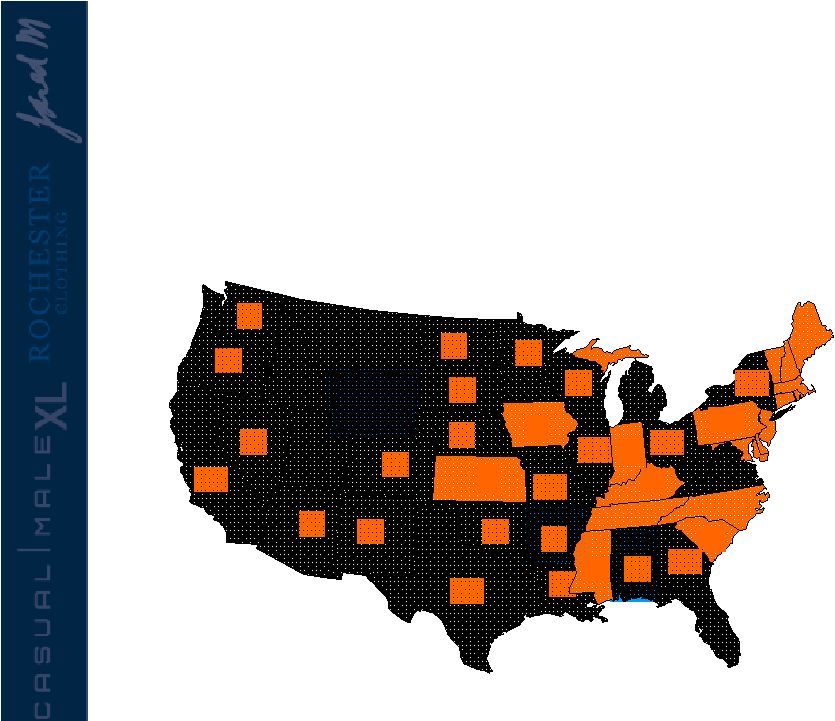

Casual Male Stores • Casual Male XL is the nation’s largest specialty retailer of big & tall clothing with 485 stores in 44 states CT-11 DE-3 RI-1 MA-14 MD-13 NH-3 NJ-21 VT-1 5 3 8 55 6 27 11 4 28 12 4 5 5 3 23 9 12 2 11 1 4 2 5 31 22 3 5 26 7 1 9 37 14 7 9 2 Long term potential – additional 100-130 more stores |

Annual Relocation Plan 2008 2007 2006 Calendar Year 26 28 11 Number of Stores Relocation of lower performing store will improve $ per square foot Relocation Potential |

9064 Utica, MI to Sterling Heights, MI ¼ mile apart / Cost $41,975 Old Location: In-Line Strip Center with Vacant Anchor No Street Visibility 4000 Sq. Ft 05 sales: $817,000 05 cash flow: $194,000 New Location: End-Cap Multi-Tenant Building Mall Pad 3500 Sq. Ft Trend prior to relocation: -1.61% Trend after relocation: 22.89% |

9612 Katy, TX 8 miles apart / Cost $126,194 Old Location: Power Center Multi-Tenant Pad 2500 Sq. Ft 05 sales: $439,000 05 cash flow: $90,000 New Location: Duplex Pad End Cap within Regional Power Center 3700 Sq. Ft Trend prior to relocation : 6.12% Trend after relocation 03/30/06: 29.41% |

Increasing sales of smaller sizes within big & tall |

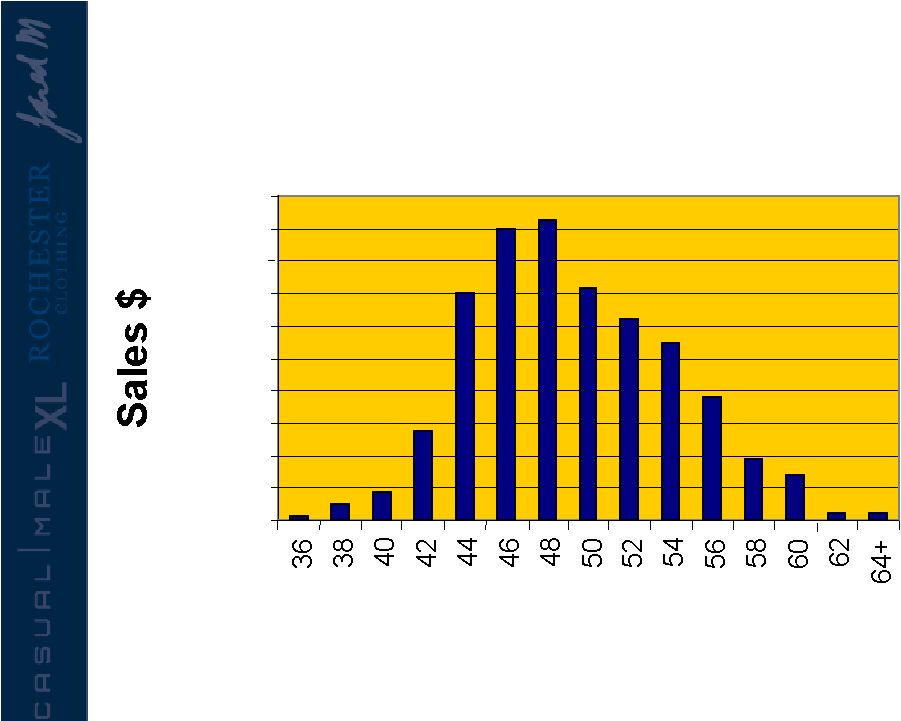

National Sales by Size $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 $1,600,000 $1,800,000 $2,000,000 30 32 34 36 38 40 42 44 46-60 Waist |

Market Share Size Opportunity Casual Male Sales by Size Data based on ’04 sales of Casual Pants, Dress Pants and Jeans $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 $200,000 Waist Size |

Customer Research • Least favorite aspect of clothing shopping was “difficulty finding items in my size” – They were shopping at “the end of the rack” – Stigma with “big and tall” store – “big and tall” stores were consistently referred to as places where “fat guys” shop • Current image associated with Casual Male – A degree of discomfort with shopping at the store for “big and tall” – Belief that the clothing started around a 48” waist – Merchandise and selection lacked a sense of style – Had unattractive, inconvenient locations – Casual Male was a place of necessity rather than a destination of choice |

50% of customers refer to Casual Male as the “Big & Tall” store |

Attracting “Younger” Big & Tall Customers to Casual Male Brand |

Obesity in Young Men • Opportunity to increase penetration of under 30 demographic – Among American men ages 20 - 34, prevalence of obesity has increased dramatically since 1976 • CM indexes low in young men’s demo- identifies opportunity for growth Men Age 20 - 34 8.9 14.1 21.7 0 5 10 15 20 25 1976-1980 1988-1994 1999-2002 |

Customer Lifestyles Synrgy Age 18-35 Harbor Bay Age 30-50 626 Blue Age 18-35 |

Multi Channel Shopping In-store, Catalog & Online |

Customer Sales by Channel * Indexed to retail only shoppers 100 123 104 276 290 286 455 0 50 100 150 200 250 300 350 400 450 500 Retail only Catalog Only E-commerce Only Retail & Catalog Retail & E- commerce Catalog & E- commerce Retail & Catalog & E- commerce |

Casual Male Direct Growth • Penetration of Casual Male’s direct business continues to grow… $0 $5,000,000 $10,000,000 $15,000,000 $20,000,000 $25,000,000 $30,000,000 $35,000,000 $40,000,000 $45,000,000 $50,000,000 2004 2005 2006 Forecast |

Casual Male Internet Sales by Year $0 $5,000,000 $10,000,000 $15,000,000 $20,000,000 $25,000,000 2002 2003 2004 2005 2006 Forecast |

Loyalty Program Launch Mailer • Mail date: October 15 th / Circulation: 1M • Creative: 24 page mailer with wrap • Free gift in store for top 15K customers • Top 300K customers will be auto-enrolled and will receive loyalty card & populated application with brand mailer • ~600K customers will receive populated customer application with brand mailer |

B & T Factory Direct • Launching a new Direct venture which addresses the lower end big & tall shopper • Strategy is to take market share from King Size, largest direct business in bit & tall • Initial phase is web launch in mid-September with B&T Factory Direct site;www.btdirect.com • Launch 68 page catalog in Spring ‘07 |