May 2009 Exhibit 99.1 |

2 Big & Tall Market • Market defined as: – big = waist size between 40” and 70” – tall = height over 6’2” • Big and tall men account for approximately 11% of the male population. • Big and tall market size is approximately $6 billion and growing at almost twice the rate of the regular size men’s apparel market. – Big & tall apparel market is highly fragmented; characterized by many small, local operators. |

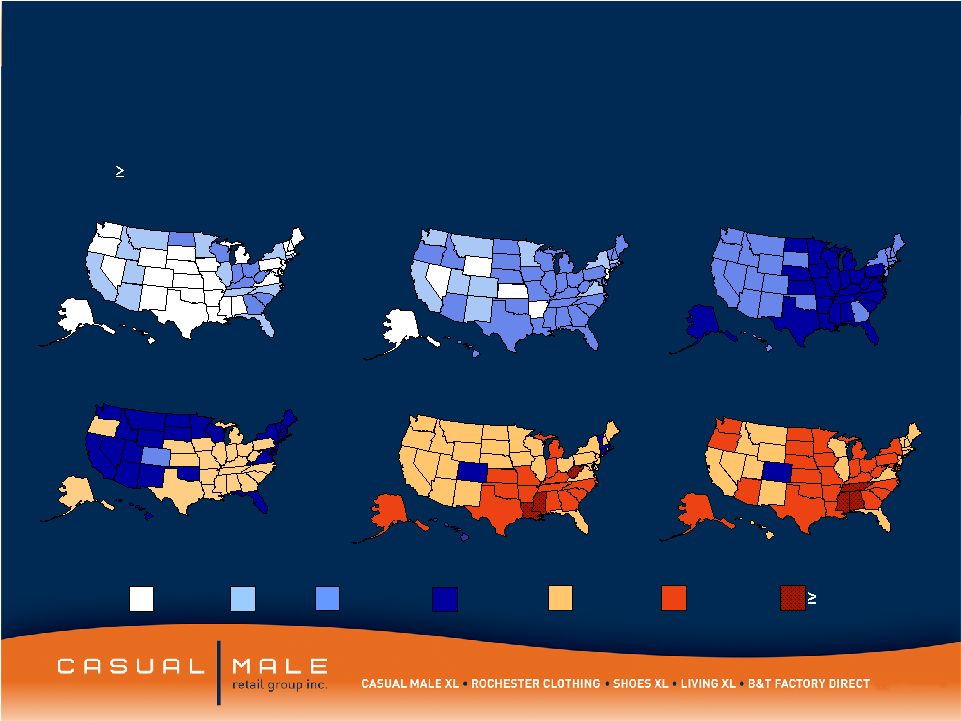

3 Market is growing as a percent to total menswear sales Obesity Trends* Among U.S. Adults (*BMI 30, or about 30 lbs overweight) No Data <10% 10%–14% 15%–19% 20%–24% 25%–29% 30% 1985 2005 2000 1995 1990 2007 Source: CDC |

4 2009 Goals • Improving Free Cash Flow to a projected $25 million • Maximizing Credit Facility availability and paying down bank debt to $20-$25 million at year-end • Managing inventory levels and reducing by 10% or $10 million • Reducing SG&A by 15% to $151 million • Cutting Capital Expenditures to $5 million • Improving Merchandise Margins by 275 to 325 bps • Creating an enhanced customer experience by providing better sales training and development tools to our store sales associates and managers |

5 Selected Balance Sheet Information 17.3 12.5 7.6 Fixed Term Loan 41.0 38.7 12.5 – 18.0 Borrowing Under Revolver 117.8 98.6 88.6 Inventory 2007 2008 2009 Projected |

6 Selected Income Statement Information 33.9 34.1 21.6 Marketing Expense 4.3 3.0 1.5 Interest Expense 44.4% 42.7% 44.0 % – 44.5% Gross Margin 178.1 178.1 151.0 SG&A 464.1 444.2 400.0 Sales 2007 2008 2009 Projected |

Our Store Concepts |

8 Casual Male Stores • Casual Male XL is the nation’s largest specialty retailer of big & tall clothing with 401 full price stores and 65 outlet stores in 47 states CT-10 DE-3 RI-1 MA-13 MD-13 NH-3 NJ-20 VT-1 4 2 10 55 5 29 10 4 23 12 3 5 5 2 20 8 10 2 11 1 4 2 6 33 19 3 5 25 5 1 8 39 13 7 8 1 1 1 3 Long term potential – additional 100-130 more stores |

9 Rochester • Targets the higher income consumer within the big and tall market – $100,000 per year average salary • 22 store locations in downtown major metropolitan areas and upscale suburbs • Average store size: 8,156 square ft • Average sales / square foot: $256 – Stores carry higher-end designer product – Average transaction size: $300 Rochester * 1 London, United Kingdom Ma-1 CT-1 DC-1 1 5 1 2 1 1 2 3 1 Locations |

Hybrid Stores |

1 Concept The Hybrid store, as conceived, is a combination Casual Male, Rochester store featuring the lifestyle sportswear apparel wardrobe needs offered by Casual Male, but with an added lifestyle of higher end fashion apparel offered by Rochester and an enhanced Clothing section featuring the quality and fashion of Rochester Clothing and the price points of Casual Male clothing |

2 Hybrids • Eliminated duplicative accessories/furnishings between combined Rochester and Casual Male. • Good, better, best tiered offering with most of best coming from Rochester’s good and better assortment. • Edited assortment for brands carried in both companies i.e. Polo, CK Jeans. Assortment will be merged presenting a broader range of price points and looks without duplication • Store will be merchandised separately by brand except: – Denim will be presented as a combined shop – Sportswear will be presented by Brand – Clothing/Furnishings will be merchandised as a combined shop – Shoes will be set up as a service environment. |

3 OPERATIONAL MODELS Full Service Tailoring Full Service Tailoring No Tailoring Service Offered Tailoring Leaning Towards Full Service Full Service Semi Self Service Service Mid-High Moderate High End Moderate Pricing $45.00 $74.90 $32.10 Average Unit Retail 9,045 8,156 3,515 Square Footage Hybrid Store Rochester Casual Male |

4 OAKBROOK, IL • Existing Locations |

5 OAKBROOK, IL • Hybrid Store Front |

6 TYPICAL HYBRID STORE LAYOUT PROPOSAL |

7 TYPICAL HYBRID STORE SHOP IDENTITY LIGHT WOOD vs. DARK WOOD |

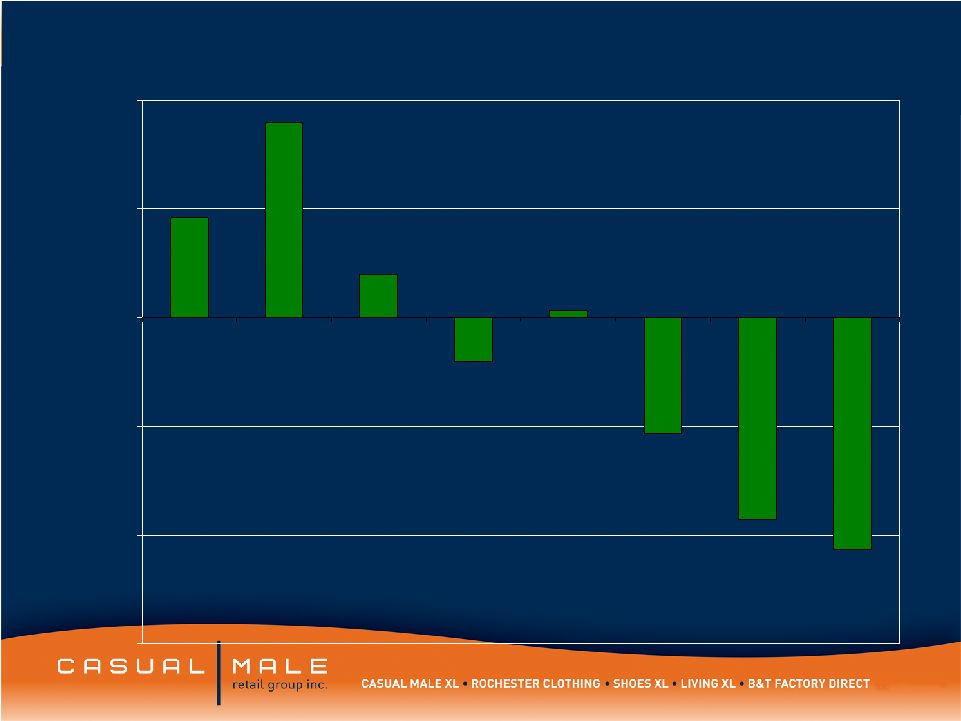

8 CMRG Comp Sales Trend -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% 2005 2006 2007 Q1 Q2 Q3 Q4 Q1 2008 2009 |

9 Our Direct to Consumer Brands CasualmaleXL.com Rochesterclothing.com Livingxl.com BTDirect.com ShoesXL.com |

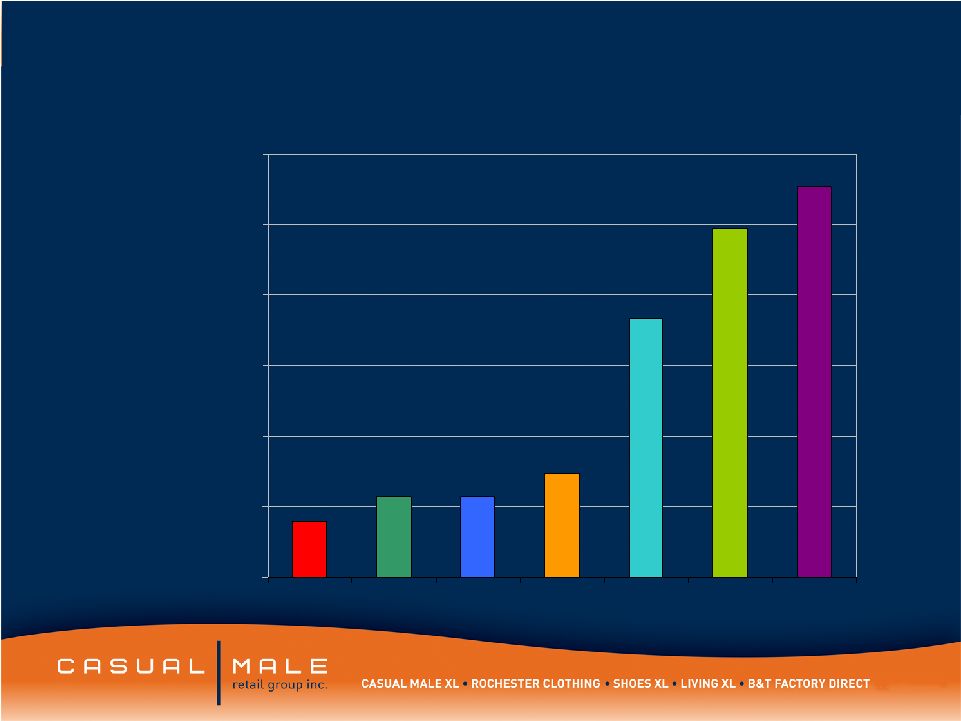

10 CMRG Internet Sales by Year $0 $10,000,000 $20,000,000 $30,000,000 $40,000,000 $50,000,000 $60,000,000 2002 2003 2004 2005 2006 2007 2008 |

1 |

2 |

3 |

4 |

1 |

2 |

3 Obesity in Europe • 135 million adults are affected by obesity • Many countries more than half the adult population is overweight and 30% defined as clinically obese • In most European countries 1 in 4 children are obese which is over 80 million children |

4 Casual Male XL Loyalty Program Rewards Current Program Performance: • 2.2MM customers have been enrolled to date • Of the 1.43MM retail customers, 1.18 or 83% are enrolled • 83% of new customers captured in POS are being enrolled • 88% of transactions involved an XL Rewards member • Loyalty members average spend per transaction is 17% or $15 higher than non-members • March 2009 Launched Prestige XL rewards for highest spending customers, spend over $1,000 per year |

5 Forward Looking Statements: This presentation contains certain forward-looking statements concerning the Company's operations, performance, and financial condition. Such forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from those indicated. Such risks and uncertainties may include, but are not limited to: the failure to implement the Company's business plan for increased profitability and growth in the Company's retail stores sales and direct-to-consumer segments, the failure of management to develop the Company’s new direct to consumer businesses, the failure of changes in management to achieve improvement in the Company's competitive position, adverse changes in costs vital to catalog operations, such as postage, paper and acquisition of prospects, declining response rates to catalog offerings, failure to maintain efficient and uninterrupted order-taking and fulfillment in our direct-to-consumer business, changes in or miscalculation of fashion trends, extreme or unseasonable weather conditions, economic downturns, escalation of energy costs, a weakness in overall consumer demand, increases in wage rates, the ability to hire and train associates, trade and security restrictions and political or financial instability in countries where goods are manufactured, increases in raw material costs from inflation and other factors, the interruption of merchandise flow from the Company's centralized distribution facilities, competitive pressures, and the adverse effects of natural disasters, war, acts of terrorism or threats of either, or other armed conflict, on the United States and international economies. These, and other risks and uncertainties, are detailed in the Company's filings with the Securities and Exchange Commission, including the Company's Annual Report on Form 10-K for the fiscal year ended January 31, 2009 filed on March 23, 2009 and other Company filings with the Securities and Exchange Commission. Casual Male assumes no duty to update or revise its forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. |