SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [x] Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

[ ] Definitive Proxy Statement

[X] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Section 240.14a-12

National Medical Health Card Systems, Inc.

--------------------------------------------------

(Name of Registrant as Specified In Its Charter)

--------------------------------------------------

(Name of Person(s) Filing Proxy Statement

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[x] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6 (i)(1) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee

is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

[ ] Fee paid previously with preliminary materials:

[ ] Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

1) Amount previously paid:______________________

2)Form, Schedule or Registration Statement No.:____________________

3)Filing Party:_________________________

4)Date Filed:___________________________

Notes:__________________________

EXHIBIT INDEX

EXHIBIT 99 Presentation at Lehman Brothers Seventh Annual Global

Healthcare Conference on March 5, 2004

EXHIBIT 99

NATIONAL MEDICAL HEALTH CARD SYSTEMS, INC.

(NASDAQ: NMHC)

LEHMAN BROTHERS

SEVENTH ANNUAL GLOBAL HEALTHCARE CONFERENCE

MIAMI, FL

MARCH 2004

NMHC

----

SAFE HARBOR STATEMENT

THIS SLIDE PRESENTATION CONTAINS FORWARD-LOOKING PROJECTIONS WHICH INVOLVE

KNOWN AND UNKNOWN RISKS AND UNCERTAINTIES OR OTHER FACTORS THAT MAY CAUSE ACTUAL

RESULTS, PERFORMANCE OR ACHIEVEMENTS TO BE MATERIALLY DIFFERENT FROM ANY FUTURE

RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY SUCH

FORWARD-LOOKING STATEMENTS. FOR A DISCUSSION OF SUCH RISKS AND UNCERTAINTIES,

INDCLUDING BUT NOT LIMITED TO RISKS RELATING TO DEMAND, PRICING, GOVERNMENT

REGULATION, ACQUISITIONS AND AFFILIATIONS, THE MARKET FOR PBM SERVICES,

COMPETITION AND OTHER FACTORS, READERS ARE URGED TO CAREFULLY REVIEW AND

CONSIDER VARIOUS DISCLOSURES MADE BY NMHC IN THE COMPANY'S ANNUAL REPORT ON FORM

10K FOR THE FISCAL YEAR ENDED JUNE 30, 2003 AND OTHER SECURITIES AND EXCHANGE

COMMISSION FILINGS.

NMHC FAMILY

------------ ---------- --------- ----------------

/NMHC ASCEND/ /NMHC MAIL/ / NMHC RX/ / NMHC INTEGRAIL/

------------ ---------- --------- ----------------

Mission Statement

The mission of NMHC is to improve our members' health through the timely

delivery of effective pharmaceutical care and health information management

solutions.

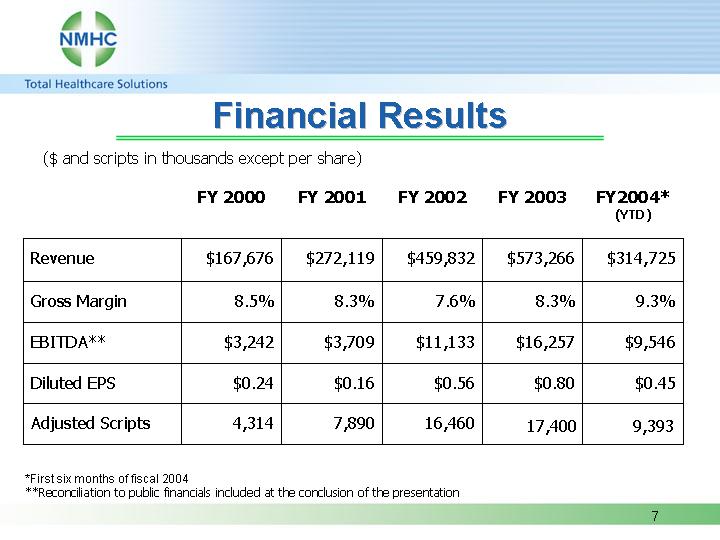

NMHC PERFORMANCE

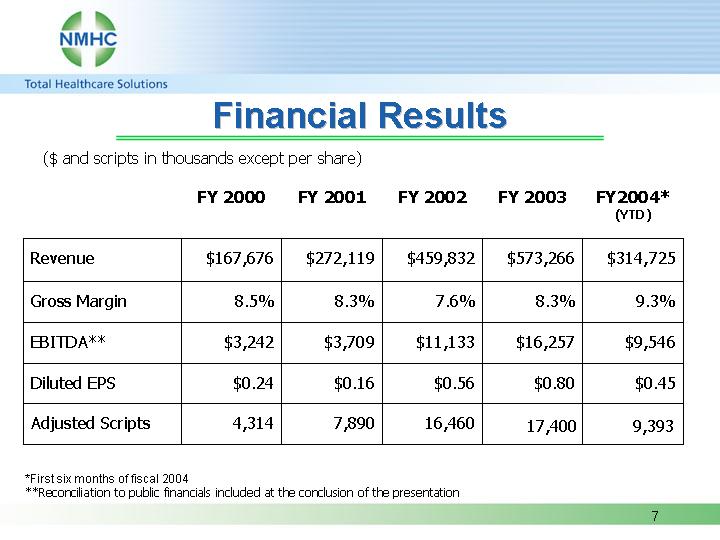

o > 25% FY '04 Earnings Growth Guidance

o Returns on Assets 4.5%

o Returns on Equity 24.1%

o Capital Expenditures 1.2% of Revenue *

o Net Income Up 35% Year Over Year*

o Free Cash Flow ** $8.2 million *

______

* 1st six months of fiscal year 2004

** Defined as operating cash flow less capital expenditures and dividends

INDUSTRY DYNAMICS

-----------------

o 100+ PBMs (Oligopoly Industry)

o $182.7 Billion Drug Spend in 2002

o $20 Billion Estimated Specialty Drug Spend in 2002, and is Expected

to Double in the Next Three to Five Years*

o $33.5 Billion Mail Order Drug Spend in 2002, up 21.7%*

o Pending Acquisitions

o Continued Legal and Regulatory Scrutiny

o Changing Business Practices

o Expansion into New Service Areas (e.g., Medicare)

____________

* IMS Health, NACDS

MARKET REQUIREMENTS

o Brand Recognition (Safety/Accountability)

o Service

- Access

- One-Stop Shopping

- Solid Execution

- Outstanding Reporting

- Flexible and Customizable

o Cost

- Price versus Cost

- Effect of Scale

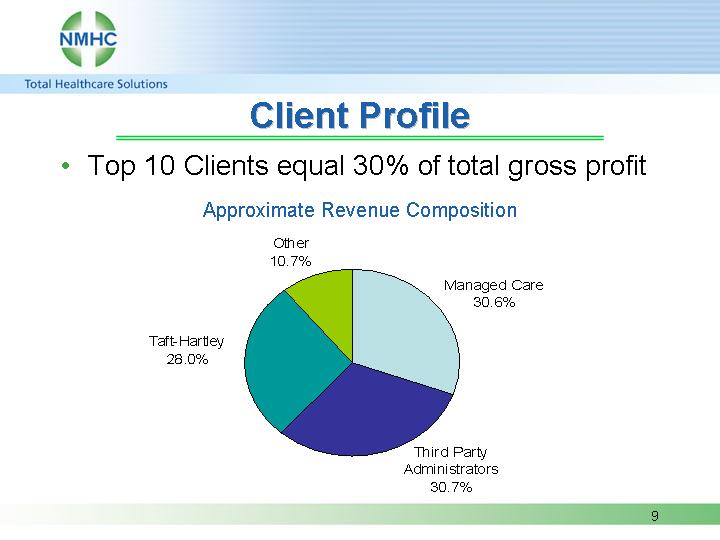

MARKET NICHE

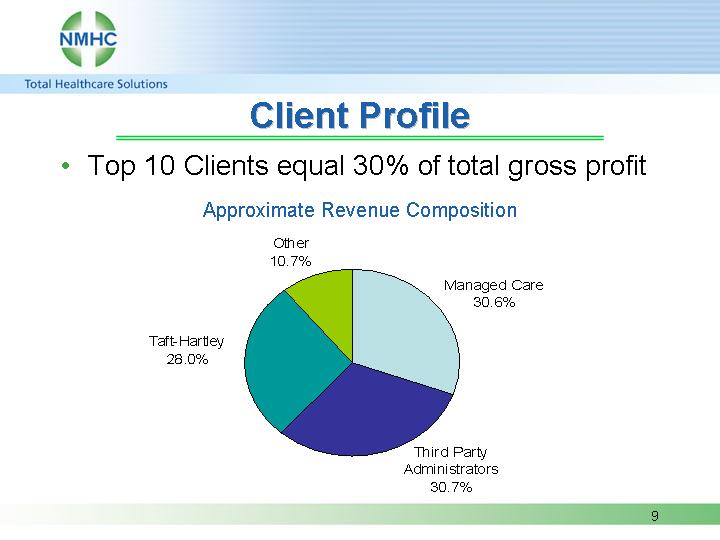

o Multi-Employer Trust Funds/Unions

o Third Party Administrators

o Regional/Local Managed Care Organizations

COMPETITIVE ADVANTAGES

o Service Levels

o Relationships

o Risk Management - Managing Cost

o Actionable Information

o Technology Infrastructure

o Targeted and Customized Business Model

o Contracting Model(s)

o Pricing

FAST FACTS

Founded in 1981

Nationwide Service Center Support Network

94.5% of ALL Retail Pharmacies Nationwide

Five-year Organic Growth Rate of 30%

Profitable Every Year Since 1996

Five Acquisitions in Three+ Years

Leading Edge Technology (Scaleable, Robust, Reliable and Redundant)

Full Service Provider

Over 300 Employees

Service Over 6.4 Million Members Nationwide

SAS 70 Certified

Portland Maine. NMHC Ascend Specialty Pharmacy. Supports infertility,

growth hormone, HIV/AIDS, RSV, transplant and compounding. Upcoming therapy

areas include MS, Hepatitis C, Hemophilia, Rheumatoid Arthiritis, Crohn's

Disease, Oncology and Gaucher's Disease, Strong contracts and an outstanding

service reputation.

Miramar, Florida. NMHC Mail. State-of-the-art imaging, electronic pill

counting and conveyor based system capable of handling at least three times our

current volume. Move of captive business expected to be complete by July 1,

2004.

Latham, NY. NMHC Integrail, Corporate Call Center, Clinical, and Account

Services.

Little Rock, Arkansas. Corporate Call Center, Disaster Avoidance Center,

Member Communication Center, Clinical, and Account Services.

Port Washington, NY. Headquarters, Clinical, Account Services, Accounting,

Data Center, Information Services, Legal, and Human Resources.

MAJOR INITIATIVES

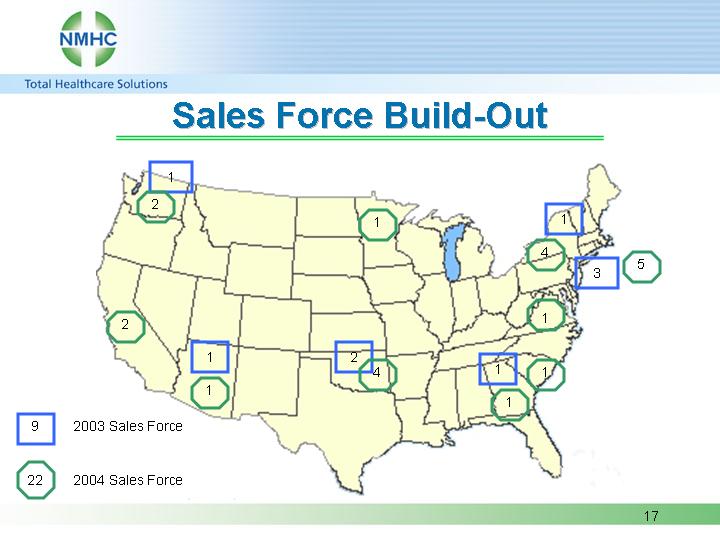

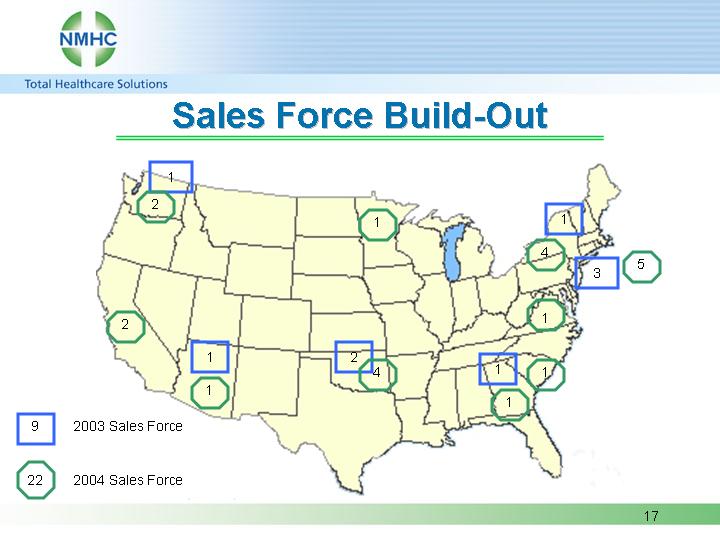

o Sales Force Build-Out (Pipeline Growth)

o Mail Order Move

o Specialty Pharmacy

o Inegrail - Expansion of Risk Management Services

> Acquisitions

INVESTMENT PARTNER

o New Mountain Capital

o $80 million, 5.25% Average 10-Year Preferred Stock,

$50 million Company self-tender

o Will resolve Brodsky family overhang, bring new capital

($30 million), and add significant quality institutional sponsorship

and rsources

o Shareholder Meeting March 18. Tender offer closes March 19.

INVESTMENT THESIS FORTUNE'S 27th

FASTEST GROWING

COMPANY

o Strong Industry Characteristics

o Attractive and Defensible Niche Markets

o Flexible and Powerful Business Model

o Substantial and Sustainable Competitive Advantages

o Scale and Scalability

o Proven Management and Track Record

EBITDA RECONCILIATION

Three of the Company's financial covenants under its revolving credit

facility ("Facility") are based upon the EBITDA (earnings before interest,

taxes, depreciation and amortization) generated by the Company over specified

periods of time. These covenants, EBITDA for the current fiscal quarter,

interest coverage ratio, and debt service coverage for the previous twelve

months, are evaluated by the Lender as a measure of the Company's liquidity and

its ability to meet all of its operations plus or minus the net changes in

assets and liabilities and the changs in certain non-cash reconciling items from

net cash from operations to net income over the reported periods. While EBITDA

is not a measure of financial performance nor liquidity under generally accepted

accounting principles, it is provided as information for investors for analysis

purposes in light of the financial covenants referred to above. EBITDA is not

meant to be considered a substitute or replacement for net income as prepared in

accordance with accounting principles generally accepted in the United States.