Quaker Houghton Third Quarter 2024 Results Investor Conference Call

Regulation G The attached charts include Company information that does not conform to generally accepted accounting principles (“GAAP”). Management believes that an analysis of this data is meaningful to investors because it provides insight with respect to ongoing operating results of the Company and helps investors to evaluate the financial results of the Company. These measures should not be viewed as an alternative to GAAP measures of performance. Furthermore, these measures may not be consistent with similar measures provided by other companies. This data should be read in conjunction with the third quarter earnings news release, dated October 31, 2024, which has been furnished to the Securities and Exchange Commission (“SEC”) on Form 8-K. Forward-Looking Statements This presentation contains “forward-looking statements” that fall under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and the Securities Act of 1933, as amended. These statements can be identified by the fact that they do not relate strictly to historical or current facts. We have based these forward-looking statements on assumptions, projections and expectations about future events that we believe are reasonable based on currently available information, including statements regarding the potential effects of the conflicts in Ukraine and the Middle East; inflation and global supply chain constraints on the Company’s business, results of operations, and financial condition; our expectation that we will maintain sufficient liquidity and remain in compliance with the terms of the Company’s credit facility; expectations about future demand and raw material costs; and statements regarding the impact of increased raw material costs and pricing initiatives. These forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, intentions, financial condition, results of operations, future performance, and business, which may differ materially from our actual results, including but not limited to the potential benefits of acquisitions and divestitures, the impacts on our business as a result of global supply chain constraints, and our current and future results and plans and statements that include the words “may,” “could,” “should,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “outlook, “target”, “possible”, “potential”, “plan” or similar expressions. A major risk is that demand for the Company's products and services is largely derived from the demand for its customers' products, which subjects the Company to uncertainties related to downturns in a customer's business and unanticipated customer production slowdowns and shutdowns. Other major risks and uncertainties include, but are not limited to inflationary pressures, including the potential for significant increases in raw material costs; supply chain disruptions; customer financial instability; high interest rates and the possibility of economic recession; economic and political disruptions particularly in light of numerous elections globally and the possibility of regime changes, and including the impacts of the military conflicts between Russia and Ukraine and in the Middle East; legislative and regulatory developments including changes to existing laws and regulations, or the way they are interpreted, applied or enforced; tariffs, trade restrictions, and the economic and other sanctions imposed by other nations on Russia and Belarus and/or other government organizations; suspensions of activities in Russia by many multinational companies and the potential expansion of military activity; foreign currency fluctuations; significant changes in applicable tax rates and regulations; future terrorist attacks and other acts of violence; the impacts of consolidation in our industry, including loss or consolidation of a major customer; and the potential occurrence of cyber-security breaches, cyber-security attacks and other technology outages and security incidents. Furthermore, the Company is subject to the same business cycles as those experienced by our customers in the steel, automobile, aircraft, industrial equipment, aluminum and durable goods industries. Our forward-looking statements are subject to risks, uncertainties and assumptions about the Company and its operations that are subject to change based on various important factors, some of which are beyond our control. These risks, uncertainties, and possible inaccurate assumptions relevant to our business could cause our actual results to differ materially from expected and historical results. All forward-looking statements included in this press release, including expectations about business conditions during 2024 and future periods, are based upon information available to the Company as of the date of this press release, which may change. Therefore, we caution you not to place undue reliance on our forward-looking statements. For more information regarding these risks and uncertainties as well as certain additional risks that we face, refer to the Risk Factors section, which appears in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023 and in subsequent reports filed from time to time with the Securities and Exchange Commission. We do not intend to, and we disclaim any duty or obligation to, update or revise any forward-looking statements to reflect new information or future events or for any other reason. This discussion is provided as permitted by the Private Securities Litigation Reform Act of 1995. ©2024 Quaker Houghton. All Rights Reserved 2 Forward-Looking Statements

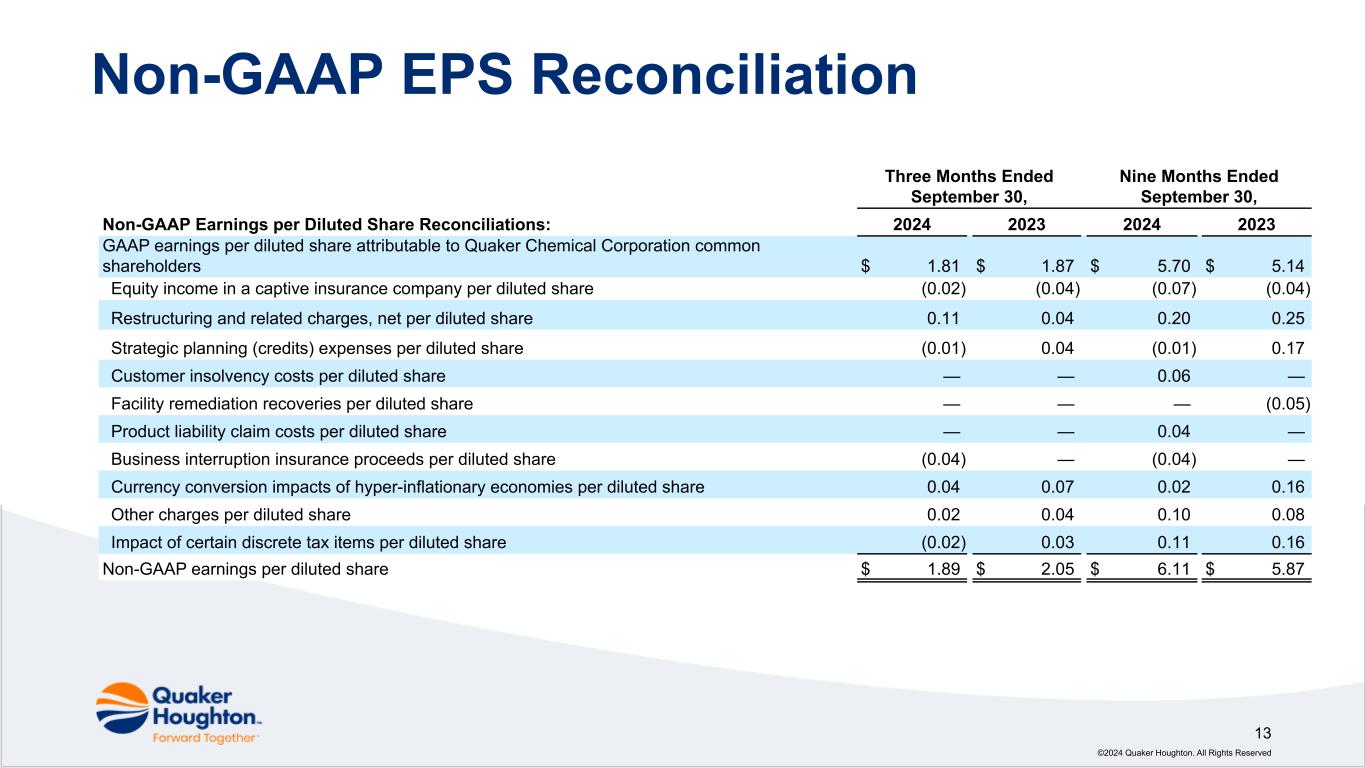

The information included in this presentation includes non-GAAP (unaudited) financial information that includes EBITDA, adjusted EBITDA, adjusted EBITDA margin, non-GAAP operating income, non-GAAP operating margin, non-GAAP net income and non-GAAP earnings per diluted share. The Company believes these non-GAAP financial measures provide meaningful supplemental information as they enhance a reader’s understanding of the financial performance and facilitate a comparison among fiscal periods, as the non-GAAP financial measures exclude items that are not indicative of future operating performance or not considered core to the Company’s operations. Non-GAAP results are presented for supplemental informational purposes only and should not be considered a substitute for the financial information presented in accordance with GAAP. In addition, our definitions of EBITDA, adjusted EBITDA, adjusted EBITDA margin, non-GAAP operating income, non-GAAP operating margin, non-GAAP net income and non-GAAP earnings per diluted share as discussed and reconciled below to the most comparable respective GAAP measures, may not be comparable to similarly named measures reported by other companies. The Company presents EBITDA which is calculated as net income attributable to the Company before depreciation and amortization, interest expense, net, and taxes on income before equity in net income of associated companies. The Company also presents adjusted EBITDA which is calculated as EBITDA plus or minus certain items that are not indicative of future operating performance or not considered core to the Company’s operations. In addition, the Company presents non-GAAP operating income which is calculated as operating income plus or minus certain items that are not considered indicative of future operating performance or not considered core to the Company’s operations. Adjusted EBITDA margin and non-GAAP operating margin are calculated as the percentage of adjusted EBITDA and non-GAAP operating income to consolidated net sales, respectively. The Company believes these non-GAAP measures provide transparent and useful information and are widely used by investors, analysts, and peers in our industry as well as by management in assessing the operating performance of the Company on a consistent basis. Additionally, the Company presents non-GAAP net income and non-GAAP earnings per diluted share as additional performance measures. Non-GAAP net income is calculated as adjusted EBITDA, defined above, less depreciation and amortization, interest expense, net, and taxes on income before equity in net income of associated companies, in each case adjusted, as applicable, for any depreciation, amortization, interest or tax impacts resulting from the non-core items identified in the reconciliation of net income attributable to the Company to adjusted EBITDA. Non-GAAP earnings per diluted share is calculated as non-GAAP net income per diluted share as accounted for under the “two-class share method.” The Company believes that non-GAAP net income and non-GAAP earnings per diluted share provide transparent and useful information and are widely used by investors, analysts, and competitors in our industry as well as by management in assessing the operating performance of the Company on a consistent basis. As it relates to 2024 projected adjusted EBITDA growth for the Company, the Company has not provided guidance for comparable GAAP measures or a quantitative reconciliation of forward-looking non-GAAP financial measures to the most directly comparable U.S. GAAP measure because it is unable to determine with reasonable certainty the ultimate outcome of certain significant items necessary to calculate such measures without unreasonable effort. These items include, but are not limited to, certain non-recurring or non-core items the Company may record that could materially impact net income. These items are uncertain, depend on various factors, and could have a material impact on the U.S. GAAP reported results for the guidance period. The following charts should be read in conjunction with the Company’s third quarter earnings news release dated October 31, 2024, which has been furnished to the Securities and Exchange Commission on Form 8-K, the Company’s Annual Report for the year ended December 31, 2023, and the Company’s 10-Q for the period ended September 30, 2024. These documents may contain additional explanatory language and information regarding certain of the items included in the following reconciliations. ©2024 Quaker Houghton. All Rights Reserved 3 Non-GAAP Measures

Andy Tometich Chief Executive Officer, President Tom Coler Executive Vice President, Chief Financial Officer Robert T. Traub Senior Vice President, General Counsel & Corporate Secretary Jeffrey Schnell Vice President, Investor Relations ©2024 Quaker Houghton. All Rights Reserved 4 Speakers

©2024 Quaker Houghton. All Rights Reserved 5 Q3’24 Highlights 1 This is a non-GAAP measure, refer to the reconciliations of our non-GAAP measures to their most comparable GAAP measures provided within this presentation and in our SEC filings 2 Defined as net debt (gross debt less cash and cash equivalents) divided by trailing twelve months adjusted EBITDA Net sales of $462m declined 6% Y/Y due to continuation of soft end market conditions Gross margins remained consistent with the prior year at 37.3% Delivered $79m of adj. EBITDA1, a 7% decrease Y/Y reflecting the impact of lower sales Generated operating cash flow of $142m YTD; Balance sheet strong with net leverage2 of 1.6x Continue to advance our enterprise strategy aimed at long-term value creation

©2024 Quaker Houghton. All Rights Reserved 6 Financial Snapshot (Unaudited; Dollars in millions, unless otherwise noted) (1) Certain amounts may not calculate due to rounding Q3 2024 Q3 2023 Variance(1) Q2 2024 Variance(1) YTD 2024 YTD 2023 Variance(1) GAAP Net sales $ 462.3 $ 490.6 $ (28.3) (5.8%) $ 463.6 $ (1.3) (0.3%) $ 1,395.6 $ 1,486.2 $ (90.6) (6.1%) Gross profit 172.5 183.3 (10.8) (5.9%) 175.7 (3.2) (1.8%) 529.8 534.5 (4.7) (0.9%) Gross margin (%) 37.3% 37.4% (0.1%) (0.3%) 37.9% (0.6%) (1.5%) 38.0% 36.0% 2.0% 5.6% Operating income 51.7 59.5 (7.8) (13.1%) 58.4 (6.7) (11.5%) 165.7 166.2 (0.5) (0.3%) Net income 32.4 33.7 (1.3) (3.9%) 34.9 (2.5) (7.3%) 102.5 92.6 9.9 10.7% Earnings per diluted share 1.81 1.87 (0.06) (3.2%) 1.94 (0.13) (6.7%) 5.70 5.14 0.56 10.9% Non-GAAP Non-GAAP operating income $ 54.2 $ 61.8 $ (7.6) (12.4%) $ 59.8 $ (5.6) (9.4%) $ 173.2 $ 176.9 $ (3.6) (2.1%) Non-GAAP operating margin (%) 11.7% 12.6% (0.9%) (7.0%) 12.9% (1.2%) (9.2%) 12.4% 11.9% 0.5% 4.3% Adjusted EBITDA 78.6 84.4 (5.8) (6.9%) 84.3 (5.7) (6.8%) 246.1 243.4 2.7 1.1% Adjusted EBITDA margin (%) 17.0% 17.2% (0.2%) (1.2%) 18.2% (1.2%) (6.5%) 17.6% 16.4% 1.3% 7.7% Non-GAAP earnings per diluted share 1.89 2.05 (0.16) (7.8%) 2.13 (0.24) (11.3%) 6.11 5.87 0.24 4.1%

Sales volumes in Q3’24 declined slightly compared to Q3’23, primarily due to softer end market conditions Total Company Volume Trend1 (kilograms, in thousands) 7 ©2024 Quaker Houghton. All Rights Reserved Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 — 25,000 50,000 75,000 100,000 125,000 150,000 T The total company volume trend excludes volumes in the prior periods that are related to the tolling agreement for products previously divested related to the Combination, volumes related to business impacted due to the War in Ukraine, and volumes relating to the Sutai acquisition.

©2024 Quaker Houghton. All Rights Reserved 8 Adjusted EBITDA1 (dollars in millions) Generated $79m of adjusted EBITDA in Q3’24, a 7% decrease Y/Y, primarily due to softer market conditions 1 This is a non-GAAP measure, refer to the reconciliations of our non-GAAP measures to their most comparable GAAP measures provided within this presentation and in our SEC filings $222 $274 $257 $320 $323 2020 2021 2022 2023 Q3'24 LTM $84 $79 Q3 2023 Q3 2024

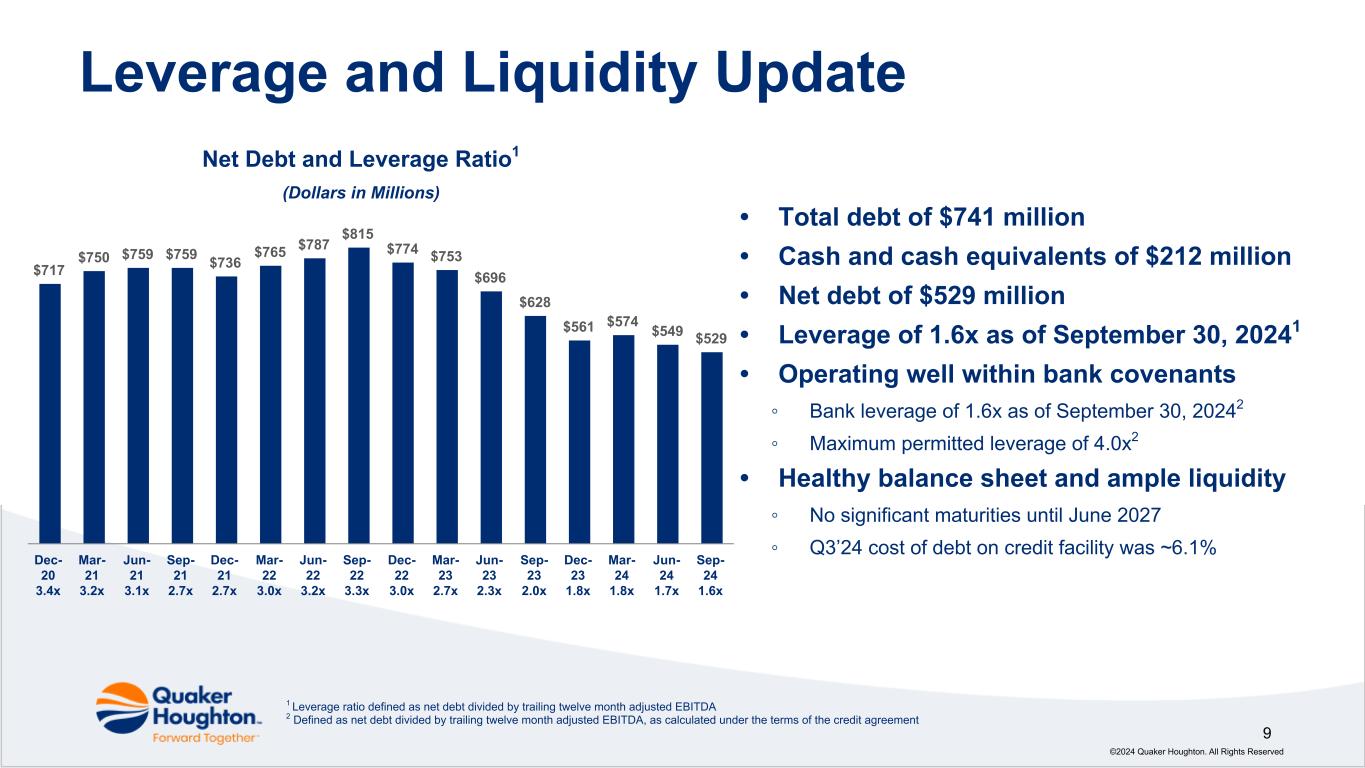

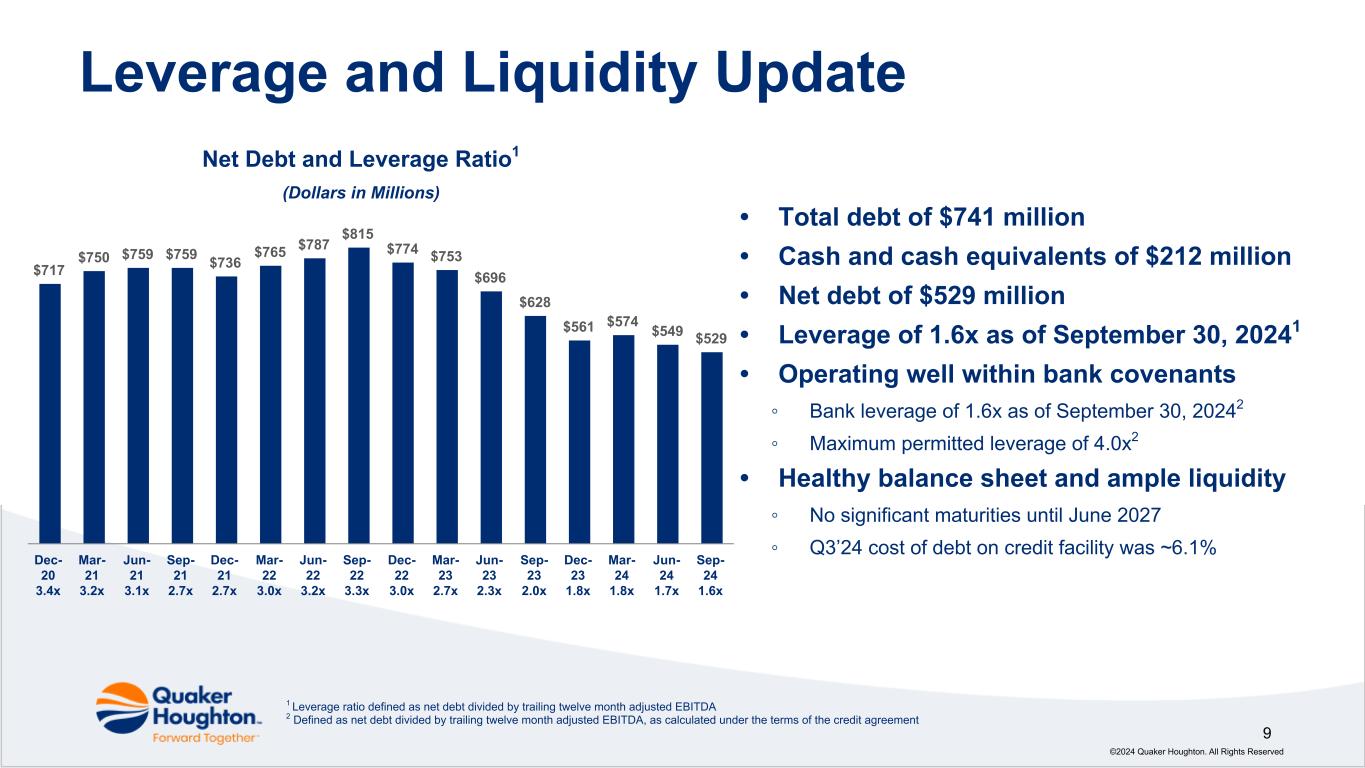

• Total debt of $741 million • Cash and cash equivalents of $212 million • Net debt of $529 million • Leverage of 1.6x as of September 30, 20241 • Operating well within bank covenants ◦ Bank leverage of 1.6x as of September 30, 20242 ◦ Maximum permitted leverage of 4.0x2 • Healthy balance sheet and ample liquidity ◦ No significant maturities until June 2027 ◦ Q3’24 cost of debt on credit facility was ~6.1% Leverage and Liquidity Update 9 ©2024 Quaker Houghton. All Rights Reserved 1 Leverage ratio defined as net debt divided by trailing twelve month adjusted EBITDA 2 Defined as net debt divided by trailing twelve month adjusted EBITDA, as calculated under the terms of the credit agreement $717 $750 $759 $759 $736 $765 $787 $815 $774 $753 $696 $628 $561 $574 $549 $529 Dec- 20 3.4x Mar- 21 3.2x Jun- 21 3.1x Sep- 21 2.7x Dec- 21 2.7x Mar- 22 3.0x Jun- 22 3.2x Sep- 22 3.3x Dec- 22 3.0x Mar- 23 2.7x Jun- 23 2.3x Sep- 23 2.0x Dec- 23 1.8x Mar- 24 1.8x Jun- 24 1.7x Sep- 24 1.6x Net Debt and Leverage Ratio1 (Dollars in Millions)

Appendix Actual and Non-GAAP Results

©2024 Quaker Houghton. All Rights Reserved 11 Non-GAAP Operating Reconciliation (Unaudited; Dollars in thousands, unless otherwise noted) Three Months Ended September 30, Nine Months Ended September 30, Non-GAAP Operating Income and Margin Reconciliations: 2024 2023 2024 2023 Operating income $ 51,718 $ 59,518 $ 165,693 $ 166,242 Restructuring and related charges, net 2,610 1,019 4,787 6,034 Strategic planning (credits) expenses (181) 1,093 (290) 3,759 Customer insolvency costs — — 1,522 — Other charges 43 206 1,535 855 Non-GAAP operating income $ 54,190 $ 61,836 $ 173,247 $ 176,890 Non-GAAP operating margin (%) 11.7 % 12.6 % 12.4 % 11.9 %

©2024 Quaker Houghton. All Rights Reserved 12 Adjusted EBITDA & Non-GAAP Net Income Reconciliation (Unaudited; Dollars in thousands, unless otherwise noted) EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin and Non-GAAP Net Income Reconciliations: Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Net income attributable to Quaker Chemical Corporation $ 32,346 $ 33,670 $ 102,458 $ 92,550 Depreciation and amortization 21,423 20,866 63,907 62,210 Interest expense, net 10,347 12,781 31,925 38,744 Taxes on income before equity in net income of associated companies 12,167 13,593 40,453 36,956 EBITDA 76,283 80,910 238,743 230,460 Equity income in a captive insurance company (285) (756) (1,266) (748) Restructuring and related charges, net 2,610 1,019 4,787 6,034 Strategic planning (credits) expenses (181) 1,093 (290) 3,759 Customer insolvency costs — — 1,522 — Facility remediation recoveries — — — (1,014) Product liability claim costs — — 896 — Business interruption insurance proceeds (1,000) 0 — (1,000) — Currency conversion impacts of hyper-inflationary economies 624 1,229 333 2,869 Other charges 511 886 2,410 2,054 Adjusted EBITDA $ 78,562 $ 84,381 $ 246,135 $ 243,414 Adjusted EBITDA margin (%) 17.0 % 17.2 % 17.6 % 16.4 % Adjusted EBITDA $ 78,562 $ 84,381 $ 246,135 $ 243,414 Less: Depreciation and amortization - adjusted 21,423 20,866 63,907 62,210 Less: Interest expense, net 10,347 12,781 31,925 38,744 Less: Taxes on income before equity in net income of associated companies - adjusted 12,811 13,806 40,417 36,766 Non-GAAP net income $ 33,981 $ 36,928 $ 109,886 $ 105,694

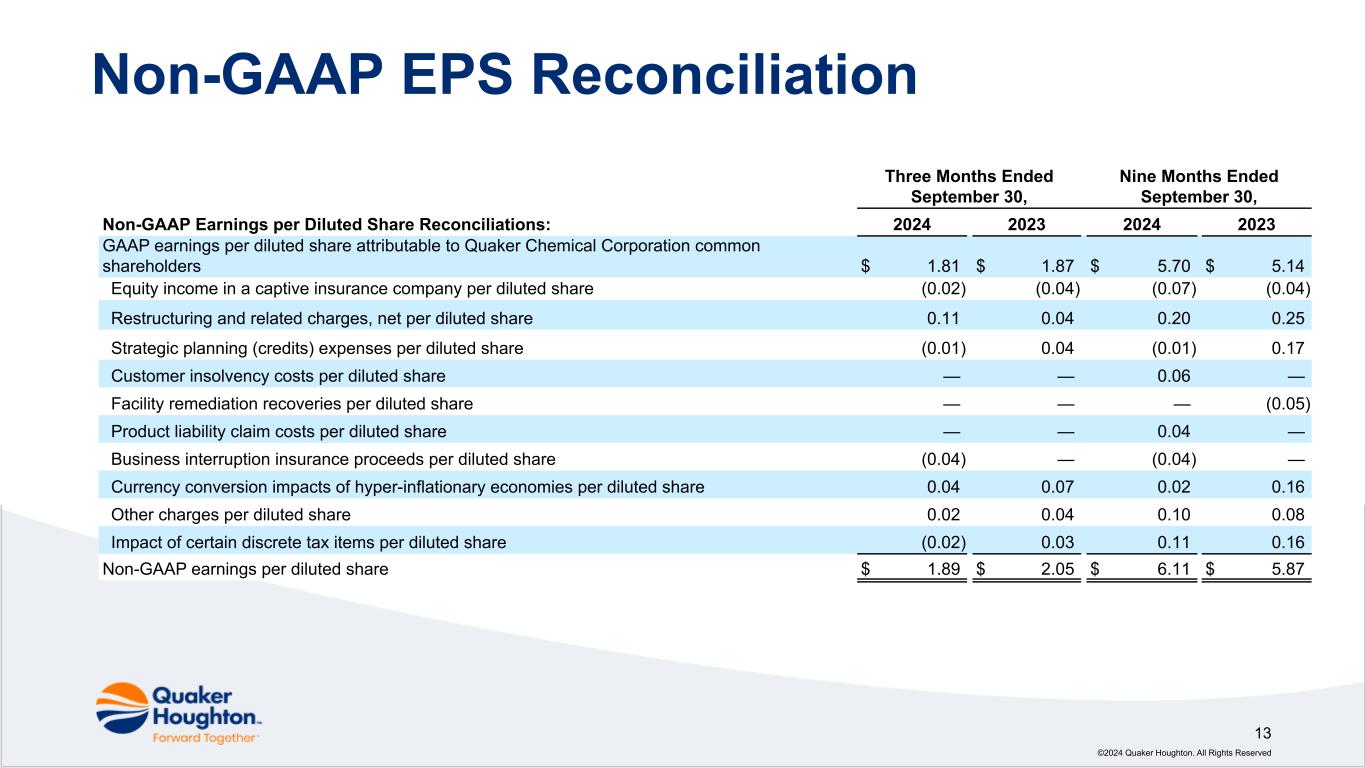

©2024 Quaker Houghton. All Rights Reserved 13 Non-GAAP EPS Reconciliation Three Months Ended September 30, Nine Months Ended September 30, Non-GAAP Earnings per Diluted Share Reconciliations: 2024 2023 2024 2023 GAAP earnings per diluted share attributable to Quaker Chemical Corporation common shareholders $ 1.81 $ 1.87 $ 5.70 $ 5.14 Equity income in a captive insurance company per diluted share (0.02) (0.04) (0.07) (0.04) Restructuring and related charges, net per diluted share 0.11 0.04 0.20 0.25 Strategic planning (credits) expenses per diluted share (0.01) 0.04 (0.01) 0.17 Customer insolvency costs per diluted share — — 0.06 — Facility remediation recoveries per diluted share — — — (0.05) Product liability claim costs per diluted share — — 0.04 — Business interruption insurance proceeds per diluted share (0.04) — (0.04) — Currency conversion impacts of hyper-inflationary economies per diluted share 0.04 0.07 0.02 0.16 Other charges per diluted share 0.02 0.04 0.10 0.08 Impact of certain discrete tax items per diluted share (0.02) 0.03 0.11 0.16 Non-GAAP earnings per diluted share $ 1.89 $ 2.05 $ 6.11 $ 5.87

©2024 Quaker Houghton. All Rights Reserved 14 Segment Performance (Unaudited; Dollars in thousands, except per share amounts) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Net sales Americas $ 220,275 $ 245,899 $ 673,546 $ 750,531 EMEA 134,135 139,620 410,558 435,602 Asia/Pacific 107,864 105,093 311,496 300,071 Total net sales $ 462,274 $ 490,612 $ 1,395,600 $ 1,486,204 Segment operating earnings Americas $ 62,121 $ 69,148 $ 193,027 $ 204,280 EMEA 24,644 27,922 80,867 81,076 Asia/Pacific 30,656 30,963 92,033 86,604 Total segment operating earnings 117,421 128,033 365,927 371,960 Restructuring and related charges, net (2,610) (1,019) (4,787) (6,034) Non-operating and administrative expenses (47,778) (52,280) (149,538) (154,001) Depreciation of corporate assets and amortization (15,315) (15,216) (45,909) (45,683) Operating income 51,718 59,518 165,693 166,242 Other income (expense), net 783 (2,713) 2,285 (8,558) Interest expense, net (10,347) (12,781) (31,925) (38,744) Income before taxes and equity in net income of associated companies $ 42,154 $ 44,024 $ 136,053 $ 118,940

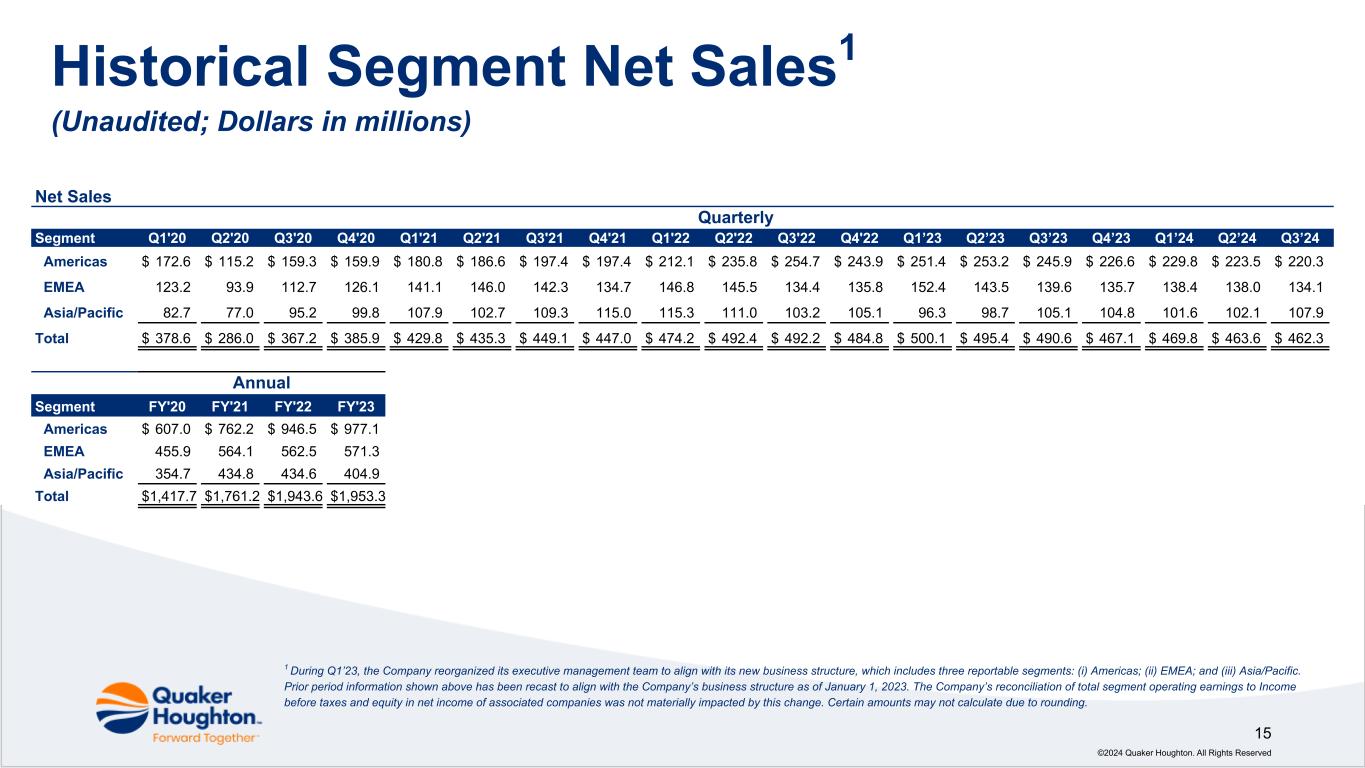

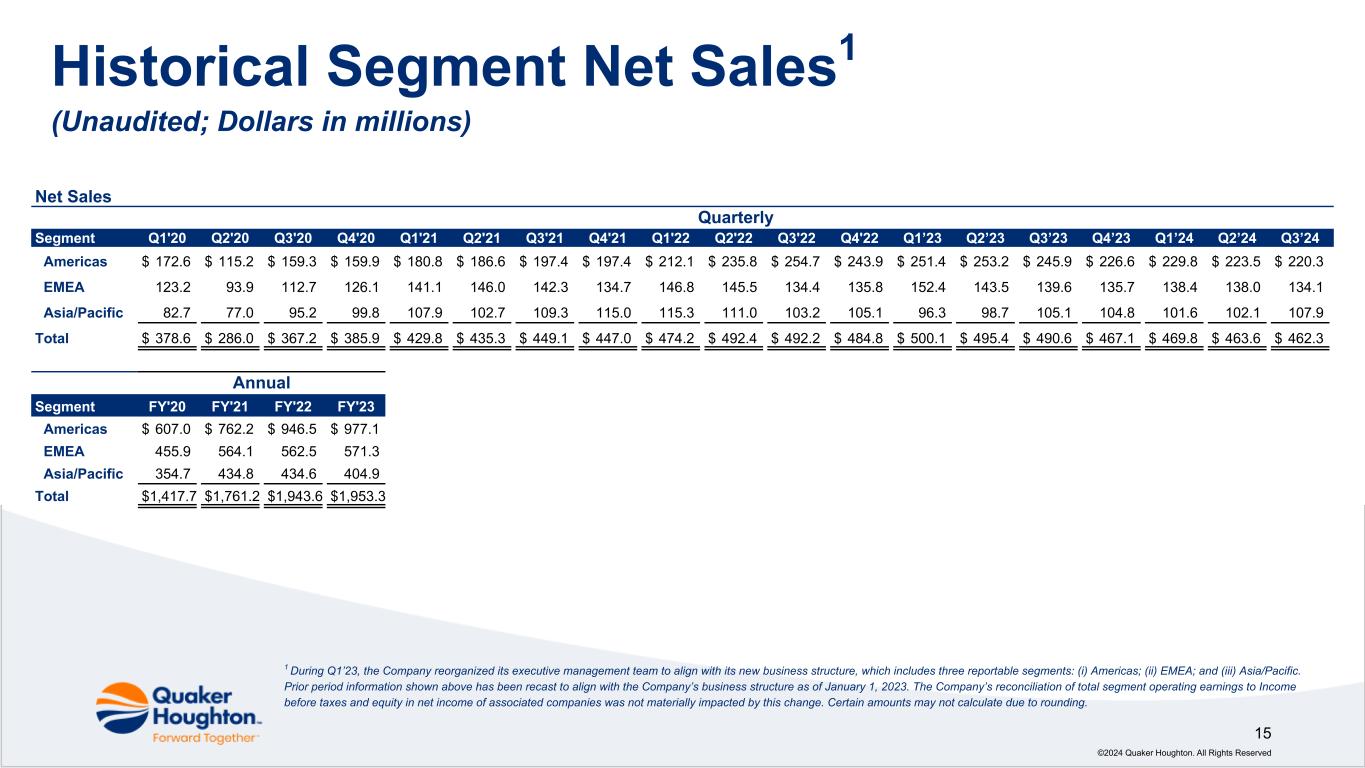

Historical Segment Net Sales1 (Unaudited; Dollars in millions) 15 ©2024 Quaker Houghton. All Rights Reserved 1 During Q1’23, the Company reorganized its executive management team to align with its new business structure, which includes three reportable segments: (i) Americas; (ii) EMEA; and (iii) Asia/Pacific. Prior period information shown above has been recast to align with the Company’s business structure as of January 1, 2023. The Company’s reconciliation of total segment operating earnings to Income before taxes and equity in net income of associated companies was not materially impacted by this change. Certain amounts may not calculate due to rounding. Net Sales Quarterly Segment Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1’23 Q2’23 Q3’23 Q4’23 Q1’24 Q2’24 Q3’24 Americas $ 172.6 $ 115.2 $ 159.3 $ 159.9 $ 180.8 $ 186.6 $ 197.4 $ 197.4 $ 212.1 $ 235.8 $ 254.7 $ 243.9 $ 251.4 $ 253.2 $ 245.9 $ 226.6 $ 229.8 $ 223.5 $ 220.3 EMEA 123.2 93.9 112.7 126.1 141.1 146.0 142.3 134.7 146.8 145.5 134.4 135.8 152.4 143.5 139.6 135.7 138.4 138.0 134.1 Asia/Pacific 82.7 77.0 95.2 99.8 107.9 102.7 109.3 115.0 115.3 111.0 103.2 105.1 96.3 98.7 105.1 104.8 101.6 102.1 107.9 Total $ 378.6 $ 286.0 $ 367.2 $ 385.9 $ 429.8 $ 435.3 $ 449.1 $ 447.0 $ 474.2 $ 492.4 $ 492.2 $ 484.8 $ 500.1 $ 495.4 $ 490.6 $ 467.1 $ 469.8 $ 463.6 $ 462.3 Annual Segment FY'20 FY'21 FY'22 FY'23 Americas $ 607.0 $ 762.2 $ 946.5 $ 977.1 EMEA 455.9 564.1 562.5 571.3 Asia/Pacific 354.7 434.8 434.6 404.9 Total $ 1,417.7 $ 1,761.2 $ 1,943.6 $ 1,953.3

Historical Segment Operating Earnings1 (Unaudited; Dollars in millions) 16 ©2024 Quaker Houghton. All Rights Reserved 1 During Q1’23, the Company reorganized its executive management team to align with its new business structure, which includes three reportable segments: (i) Americas; (ii) EMEA; and (iii) Asia/Pacific. Prior period information shown above has been recast to align with the Company’s business structure as of January 1, 2023. The Company’s reconciliation of total segment operating earnings to Income before taxes and equity in net income of associated companies was not materially impacted by this change. Certain amounts may not calculate due to rounding. Segment Operating Earnings Quarterly Segment Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1’23 Q2’23 Q3’23 Q4’23 Q1’24 Q2’24 Q3’24 Americas $ 41.3 $ 19.7 $ 43.8 $ 37.1 $ 44.7 $ 47.7 $ 43.4 $ 40.5 $ 45.0 $ 52.1 $ 66.8 $ 59.5 $ 66.1 $ 69.0 $ 69.1 $ 61.8 $ 66.8 $ 64.1 $ 62.1 EMEA 24.3 15.4 22.9 29.8 32.7 30.6 25.8 22.0 23.2 20.1 15.5 17.6 27.6 25.6 27.9 23.7 29.6 26.7 24.6 Asia/Pacific 22.3 21.3 30.6 26.0 31.1 26.3 26.3 25.6 24.5 24.9 26.7 29.7 27.7 28.0 31.0 31.9 30.4 31.0 30.7 Total $ 87.9 $ 56.4 $ 97.3 $ 93.0 $ 108.4 $ 104.6 $ 95.4 $ 88.1 $ 92.8 $ 97.1 $ 109.0 $ 106.8 $ 121.3 $ 122.6 $ 128.0 $ 117.3 $ 126.8 $ 121.8 $ 117.4 Annual Segment FY'20 FY'21 FY'22 FY'23 Americas $ 141.9 $ 176.3 $ 223.4 $ 266.0 EMEA 92.5 111.0 76.4 104.8 Asia/Pacific 100.2 109.2 105.8 118.5 Total $ 334.6 $ 396.5 $ 405.6 $ 489.3