WASHINGTON, D.C. 20549

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

AMCOL INTERNATIONAL CORPORATION

2870 Forbs Avenue

Hoffman Estates, Illinois 60192

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On May 16, 2013

To Our Shareholders:

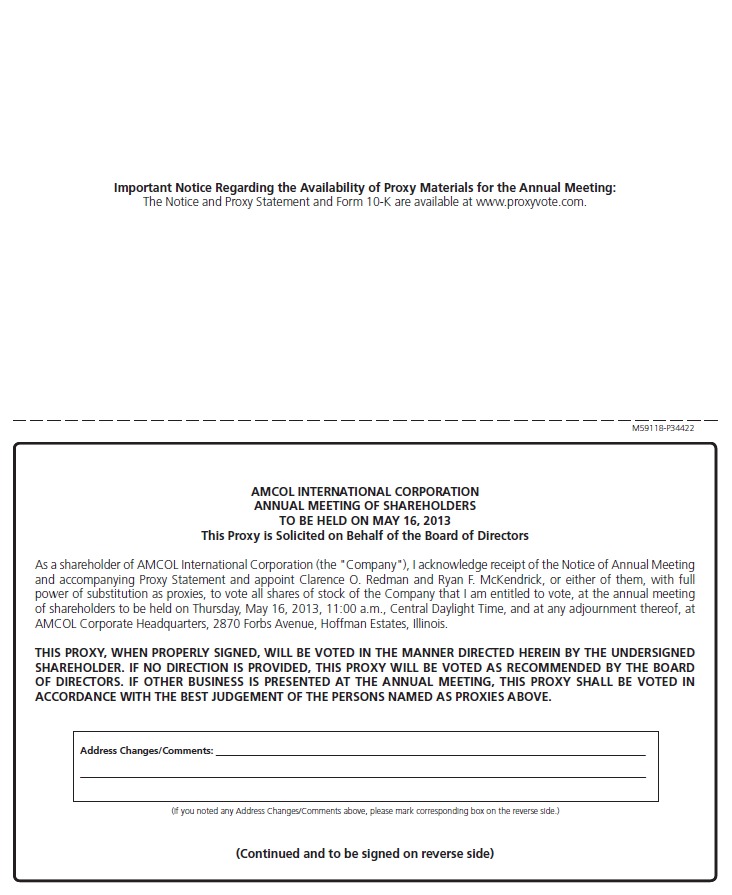

The annual meeting of shareholders of AMCOL International Corporation (the “Company” or “AMCOL”) will take place on Thursday, May 16, 2013, at 11:00 AM, Central Daylight Time, at AMCOL Corporate Headquarters, 2870 Forbs Avenue, Hoffman Estates, Illinois. At the annual meeting, you will be asked to do the following:

| 1. | Elect three (3) Class III directors for a three-year term expiring in 2016; |

| 2. | Ratify the Audit Committee’s appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2013; |

| 3. | Approve, on a non-binding, advisory basis, AMCOL’s executive compensation; and |

| 4. | Transact any other business which properly comes before the annual meeting or any adjournment or postponement thereof. |

The Board of Directors recommends that you vote “FOR” each of AMCOL’s nominees for director, “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm and “FOR” advisory approval of AMCOL’s executive compensation.

Only shareholders of record of AMCOL’s common stock as of the close of business on March 19, 2013 are entitled to notice of and to vote at the annual meeting and at any adjournments of the annual meeting.

It is important that your shares be represented at the annual meeting. Whether or not you plan to attend the annual meeting in person, please complete, sign, date and mail the proxy card in the enclosed self-addressed, postage-paid envelope, or vote by telephone or the Internet in accordance with the instructions provided. Please do not submit a proxy card if you have voted by telephone or the Internet. If you attend the annual meeting, you may revoke your proxy and, if you wish, vote your shares in person. Thank you for your interest and cooperation.

By Order of the Board of Directors,

James W. Ashley, Jr.

Vice President, General Counsel andSecretary

Hoffman Estates, Illinois

April 16, 2013

AMCOL INTERNATIONAL CORPORATION

2870 Forbs Avenue

Hoffman Estates, Illinois 60192

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To Be Held On May 16, 2013

INTRODUCTION

We are furnishing this proxy statement to you in connection with the solicitation of proxies by the Board of Directors of AMCOL International Corporation (the “Company” or “AMCOL”), for use at our annual meeting of shareholders to be held on Thursday, May 16, 2013 at 11:00 AM, Central Daylight Time, at AMCOL Corporate Headquarters, 2870 Forbs Avenue, Hoffman Estates, Illinois, and at any adjournment of the annual meeting. This proxy statement and the accompanying proxy card are first being mailed or delivered to shareholders of AMCOL on or about April 16, 2013.

At the annual meeting, you will be asked to do the following:

| 1. | Elect three (3) Class III directors for a three-year term expiring in 2016; |

| 2. | Ratify the Audit Committee’s appointment of Ernst & Young LLP (“Ernst & Young”) as our independent registered public accounting firm for the year ending December 31, 2013; |

| 3. | Approve, on a non-binding, advisory basis, approval of AMCOL’s executive compensation; and |

| 4. | Transact any other business which properly comes before the annual meeting or any adjournment or postponement thereof. |

The Board of Directors recommends that you vote “FOR” each of AMCOL’s nominees for director, “FOR” the ratification of the appointment of Ernst & Young as our independent registered public accounting firm and “FOR” advisory approval of AMCOL’s executive compensation.

It is important that your shares be represented at the annual meeting. Whether or not you plan to attend the annual meeting in person, please complete, sign, date and mail the proxy card in the enclosed self-addressed, postage-paid envelope, or vote by telephone or the Internet in accordance with the instructions provided. Please do not submit a proxy card if you have voted by telephone or the Internet. If you attend the annual meeting, you may revoke your proxy and, if you wish, vote your shares in person.

The date of this proxy statement is April 16, 2013.

THE ANNUAL MEETING

General

This proxy statement is being furnished in connection with the solicitation of proxies by the Board of Directors of AMCOL for use at the annual meeting of shareholders to be held on Thursday, May 16, 2013, at 11:00 AM, Central Daylight Time, at AMCOL Corporate Headquarters, 2870 Forbs Avenue, Hoffman Estates, Illinois, and at any adjournment of the annual meeting.

Record Date

The Board of Directors has fixed the close of business on March 19, 2013 as the record date for the determination of shareholders entitled to notice of, and to vote at, the annual meeting or any adjournment. Accordingly, only holders of record of AMCOL’s common stock at the close of business on the record date will be entitled to vote at the annual meeting, either by proxy or in person. As of the record date, there were 32,287,200 shares of AMCOL’s common stock issued and outstanding.

Purpose of the Annual Meeting; Recommendations of the Board of Directors

At the annual meeting, AMCOL’s shareholders will be asked to do the following:

| 1. | Elect three (3) Class III directors for a three-year term expiring in 2016; |

| 2. | Ratify the Audit Committee’s appointment of Ernst & Young as our independent registered public accounting firm for the year ending December 31, 2013; |

| 3. | Approve, on a non-binding, advisory basis, AMCOL’s executive compensation; and |

| 4. | Transact any other business which properly comes before the annual meeting or any adjournment or postponement thereof. |

The Board of Directors recommends that you vote “FOR” each of AMCOL’s nominees for director, “FOR” the ratification of the appointment of Ernst & Young as our independent registered public accounting firm and “FOR” advisory approval of AMCOL’s executive compensation.

Proxies; Vote Required

In deciding all questions presented to shareholders, a holder of AMCOL’s common stock is entitled to one vote, in person or by proxy, for each share held in such holder’s name on the record date. The presence, in person or by proxy, of the holders of a majority of the outstanding shares of AMCOL’s common stock is necessary to constitute a quorum at the annual meeting. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum at the annual meeting. Generally, broker non-votes occur when shares held by a broker or nominee for a beneficial owner are not voted with respect to a particular proposal because the broker or nominee lacks discretionary power to vote such shares.

With respect to all matters to be considered at the annual meeting, shareholders may: (1) vote in favor; (2) vote against; or (3) abstain from voting. Each of the nominees for director receiving a majority of the votes cast at the meeting in person or by proxy shall be elected (meaning the number of votes cast “for” a given director exceeds the number of votes cast “against” that director). Shares voting “abstain” on any nominee for director will be excluded entirely from the vote and will have no effect on the election of directors. Under Delaware law, if any director is not re-elected at the annual meeting, the director will continue to serve on the Board as a “holdover director.” As required by the Company’s Corporate Governance Guidelines, each director has submitted an irrevocable letter of resignation as director that becomes effective if he or she is not elected by the shareholders and if the Board accepts the resignation. If a director is not elected, the Nominating and Governance Committee will act on an expedited basis to consider the director’s resignation and recommend to the Board whether to accept or reject the resignation. The Board will decide whether to accept or reject the resignation and publicly disclose its decision.

The ratification of the appointment of Ernst & Young as our independent registered public accounting firm and the advisory approval of AMCOL’s executive compensation each require the affirmative vote of a majority of the shares of common stock represented at the annual meeting and entitled to vote thereon. Shares voting “abstain” on the ratification of the appointment of Ernst & Young and the advisory approval of AMCOL’s executive compensation will be counted as present at the annual meeting for purposes of that proposal and an abstention will have the effect of a vote against the applicable matter. Broker non-votes will be considered as present but will not be considered as votes in favor of any matter and will be excluded from the “for,” “against” and “abstain” counts, and instead are reported as simply “broker non-votes.” Consequently, broker non-votes have no effect on the outcome of any matter.

Under New York Stock Exchange rules, the proposal to ratify the appointment of Ernst & Young is considered a “discretionary” item. Therefore, brokers may vote in their discretion on this matter on behalf of clients who have not furnished voting instructions to the broker. In contrast, the election of directors and the advisory approval of AMCOL’s executive compensation are “non-discretionary” items, and brokers who have not received voting instructions from their clients may not vote on these matters.

All properly executed proxies received by AMCOL prior to the annual meeting and not revoked will be voted in accordance with the instructions provided. Unless contrary instructions are indicated, proxies will be voted “FOR” each of AMCOL’s nominees for director, “FOR” the ratification of the appointment of Ernst & Young and “FOR” advisory approval of AMCOL’s executive compensation. The Board of Directors knows of no other business that will be presented for consideration at the annual meeting. ��If any other matter is properly presented, it is the intention of the persons named in the enclosed proxy to vote in accordance with their best judgment.

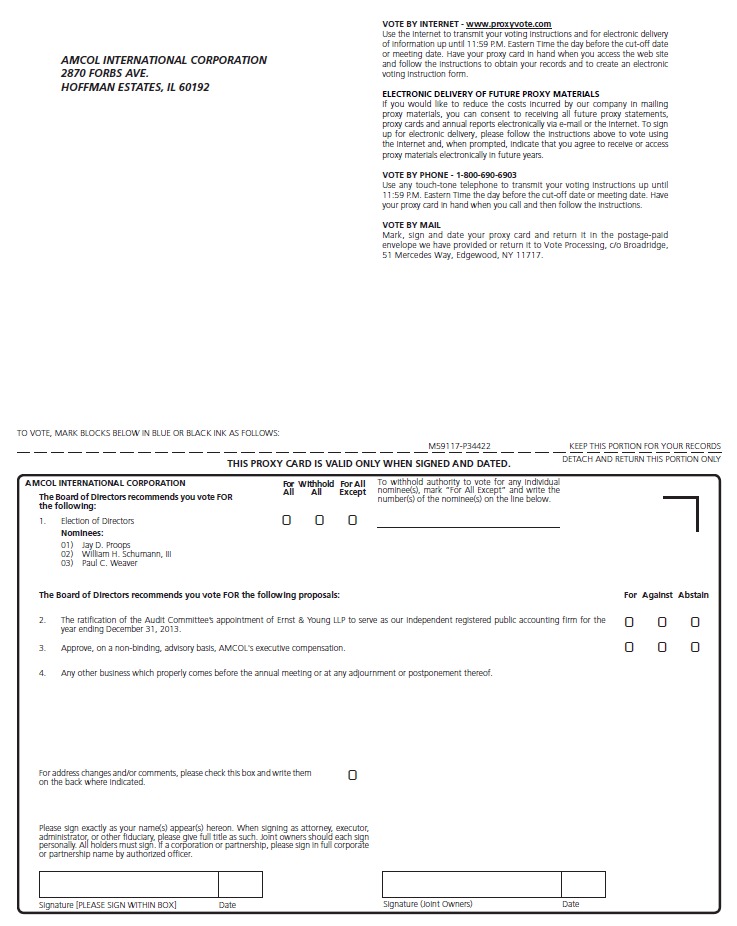

How to Vote

You may vote your shares over the Internet, by a toll-free telephone number or you may sign, date and mail the proxy card in the enclosed self-addressed, postage-paid envelope. Please do not submit a proxy card if you have voted by telephone or the Internet. If you attend the annual meeting, you may revoke your proxy and, if you wish, vote your shares in person.

Revocation of Proxies

Any shareholder may revoke his or her proxy at any time prior to or at the annual meeting by doing any of the following:

| · | voting by telephone or the Internet on a later date; |

| · | submitting a duly executed proxy bearing a later date; |

| · | giving written notice to the Secretary of AMCOL at 2870 Forbs Avenue, Hoffman Estates, Illinois 60192; or |

| · | attending the annual meeting and voting in person. |

Attendance at the annual meeting will not, in itself, constitute revocation of a proxy.

Proxy Solicitation and Expenses

The accompanying proxy is being solicited on behalf of the Board of Directors of AMCOL. All expenses of this solicitation, including the costs of preparing and mailing this proxy statement, will be paid by AMCOL. Solicitation of holders of AMCOL’s common stock by mail, telephone, facsimile, e-mail or by personal solicitation may be done by directors, officers and regular employees of AMCOL, for which they will receive no additional compensation. Brokerage houses and other nominees, fiduciaries and custodians nominally holding shares of AMCOL’s common stock as of the record date will be requested to forward proxy soliciting material to the beneficial owners of such shares and will be reimbursed by AMCOL for their reasonable out-of-pocket expenses.

AGENDA ITEM ONE:

ELECTION OF DIRECTORS

AMCOL’s Certificate of Incorporation divides the Board of Directors into three classes, with the members of one class elected each year for a three-year term. The Board is currently comprised of twelve (12) directors, divided into three classes. The terms of the Class III directors will expire at the annual meeting.

Pursuant to our Corporate Governance Guidelines, which may be found on our website at www.amcol.com, directors are expected to resign from the Board effective as of the annual shareholders meeting following the date on which they reach the age of 72. Mr. Arthur Brown, age 72, currently serves as a Class III director and is retiring from the Board effective at the annual meeting in accordance with the Corporate Governance Guidelines. In connection with Mr. Brown’s retirement, the Board intends to reduce the size of the board to eleven (11) directors.

The names of the Class III nominees and the current Class I and Class II directors are set forth below, along with certain biographical information, the year first elected as a director and the experience, qualifications, attributes or skills that caused the Nominating and Governance Committee and the Board to determine that the person should serve as an AMCOL director.

Information Concerning Nominees

Class III

(If elected, term to expire in 2016)

| Name | Age | Director Since | Principal Occupation for Last Five Years and Experience and Qualifications |

| Jay D. Proops | 71 | 1995 | Private investor since 1995. Prior thereto, Vice Chairman and co-founder of The Vigoro Corporation, a manufacturer and distributor of fertilizers and related products. Mr. Proops has financial expertise as well as business operations and investment experience. Mr. Proops has notified the Board that he intends to resign from the Board effective as of AMCOL’s 2014 annual shareholders meeting in accordance with the provision of AMCOL’s Corporate Governance Guidelines. |

| William H. Schumann, III | 62 | 2012 | Chairman of the Board of Directors of Avnet, Inc., a distributor of electronic components, since November 2012. Prior thereto, Executive Vice President of FMC Technologies, Inc., a provider of technology solutions for the energy industry, from 2007 to August 2012, and Chief Financial Officer from 2007 to 2011. Also a member of the Board of Directors of McDermott International, Inc., an engineering and construction company, since September 2012. Mr. Schumann has valuable experience in the energy industry as well as financial, international and business operations expertise. |

| Paul C. Weaver* | 50 | 1995 | Private investor since 2006. Prior thereto, Vice President of Information Resources, Inc. from 2002 to 2006 and Managing Partner of Consumer Aptitudes, Inc. from 1997 to 2002 (both companies engage in marketing research). Mr. Weaver has marketing/sales expertise, as well as experience analyzing consumer preferences and purchasing patterns. |

* Paul C. Weaver and Audrey L. Weaver are first cousins.

The Board of Directors recommends that AMCOL’s shareholders vote “FOR” each of the nominees named above.

Information Concerning Continuing Members of the Board

Class I

(Term expiring in 2014)

| Name | Age | Director Since | Principal Occupation for Last Five Years and Experience and Qualifications |

| Donald J. Gallagher | 60 | 2012 | Executive Vice President and President – Global Commercial of Cliffs Natural Resources Inc., a mining company, since January 2011. Prior thereto, Mr. Gallagher served in a variety of management positions during his 32 year career at Cliffs Natural Resources, including President – North American Business Unit from 2009 to 2011 and President – North American Iron Ore from 2006 to 2009. Mr. Gallagher has valuable experience in the mining industry as well as financial, international and business operations expertise. |

| John Hughes | 70 | 1984 | Chairman of the Board; Chief Executive Officer of AMCOL from 1985 until 2000. Mr. Hughes, while Chief Executive Officer of AMCOL, developed a special understanding of the workings of AMCOL and the industries we serve and also possesses talent management expertise. |

| Clarence O. Redman | 70 | 1989 | Retired. Previously, of counsel to Locke Lord LLP from 1997 to 2007, the law firm that serves as corporate counsel to AMCOL. Secretary of AMCOL from 1982 to 2007. Mr. Redman has operations and corporate governance expertise as well as risk management experience. |

| Audrey L. Weaver* | 58 | 1997 | Private investor for at least the last 5 years. Ms. Weaver continues to use her knowledge of the Company and Board experience to contribute to the Board. |

* Paul C. Weaver and Audrey L. Weaver are first cousins.

Class II

(Term expiring in 2015)

| Name | Age | Director Since | Principal Occupation for Last Five Years and Experience and Qualifications |

| Daniel P. Casey | 70 | 2002 | Private investor since 2002. Retired Chief Financial Officer and Vice Chairman of the Board of Gaylord Container Corporation, a manufacturer and distributor of brown paper and packaging products. Also retired Chairman of the Board of Caraustar Industries, Inc., a recycled packaging company. Mr. Casey has financial expertise as well as risk management and capital allocation experience. |

| Ryan F. McKendrick | 61 | 2011 | President and Chief Executive Officer of the Company since January 2011. Prior thereto, Chief Operating Officer of AMCOL since January 2010, Senior Vice President of AMCOL and President of CETCO since 1998. Mr. McKendrick has an extensive knowledge of AMCOL developed throughout his service in various positions with the Company. |

| Frederick J. Palensky, Ph.D. | 63 | 2011 | Executive Vice President, Research and Development and Chief Technology Officer of 3M Company, a diversified technology company, since 2006. Prior thereto, Dr. Palensky served in a variety of management positions during his 35 year career at 3M. From 2004 through 2011, Dr. Palensky served as a director of Shigematsu Works Co. LTD, a manufacturer of particulate and chemical cartridge respirators in Japan. Dr. Palensky’s has technical expertise and business ethics and business operations experience. |

| Dale E. Stahl | 65 | 1995 | Executive Chairman of Port Townsend Holdings Company, Inc., a manufacturer of containerboard and corrugated packaging, since January 2011. Mr. Stahl served as President, Chief Executive Officer and Chief Operating Officer from 2000 through 2003 of Inland Paperboard and Packaging, Inc., a manufacturer of containerboard and corrugated boxes. Prior thereto, Mr. Stahl served as President and Chief Operating Officer of Gaylord Container Corporation. Mr. Stahl has financial expertise as well as business operations and risk management experience. |

AGENDA ITEM TWO:

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our Board of Directors has appointed Ernst & Young to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2013. Ernst & Young has served as our independent registered public accounting firm for several years and is considered to be well qualified.

Additional information regarding Ernst & Young can be found below in the sections entitled “Report of the Audit Committee” and “Independent Registered Public Accounting Firm.”

If our shareholders do not ratify the appointment of Ernst & Young, our Audit Committee will reconsider the appointment. Even if the appointment is ratified, our Audit Committee may appoint a different independent registered public accounting firm at any time during the year if it determines that a change would be in the best interests of AMCOL and our shareholders.

Representatives from Ernst & Young will be present at the annual meeting, will be afforded the opportunity to make a statement, and will be available to respond to appropriate questions.

The Board of Directors recommends that AMCOL’s shareholders vote “FOR” the ratification of our Audit Committee’s appointment of Ernst & Young as our independent registered public accounting firm.

AGENDA ITEM THREE:

ADVISORY APPROVAL OF AMCOL’S EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act requires that we provide our shareholders with the opportunity to vote to approve, on a nonbinding, advisory basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the SEC’s compensation disclosure rules.

As described under “Executive Compensation — Compensation Discussion and Analysis,” we seek to reward performance and closely align the interests of our executives with the interests of our shareholders. Our executive compensation program is designed to reward profitable growth and increased shareholder returns, tie pay to performance and retain talented executives.

The vote on this resolution is not intended to address any specific element of compensation, but rather the overall compensation of our named executive officers as disclosed in this proxy statement. The vote is advisory, which means that the vote is not binding on the Company, our Board of Directors or our Compensation Committee.

Shareholders may vote for or against the following resolution, or may abstain from voting. The affirmative vote of a majority of the shares present or represented and entitled to vote is required to approve this proposed resolution. Accordingly, we ask our shareholders to vote on the following resolution at the annual meeting:

“RESOLVED, that the Company’s shareholders approve the compensation of the Company’s named executive officers for 2012, as disclosed in the Company’s Proxy Statement for the 2013 Annual Meeting of Shareholders pursuant to the SEC’s compensation disclosure rules, including the Compensation Discussion and Analysis, the 2012 Summary Compensation Table and the other related tables and disclosure.”

While this vote is advisory and not binding on AMCOL, the Board of Directors and the Compensation Committee will consider the outcome of the vote, along with other relevant information, in making future executive compensation decisions.

The Board of Directors recommends that AMCOL’s shareholders vote “FOR” the approval of the foregoing resolution.

SECURITY OWNERSHIP

Security Ownership of Five Percent Beneficial Owners

The following table sets forth all persons known by the Company to be the beneficial owner of more than five percent of AMCOL’s outstanding common stock.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | Percent of Class (%) |

Audrey L. Weaver c/o AMCOL International Corporation 2870 Forbs Avenue Hoffman Estates, Illinois 60192 | 1,836,584 (2) | 5.68 |

Lesley A. Weaver 1780 Happ Road Northbrook, Illinois 60062 | 4,246,657 (3) | 13.40 |

Vanguard Specialized Funds Vanguard Precious Metals and Mining Fund 100 Vanguard Blvd. Malvern, Pennsylvania 19355 | 3,080,000 (4) | 9.63 |

M&G Investment Funds 1 Governor’s House Laurence Pountney Hill London, England EC4R 0HH | 6,144,400 (5) | 19.00 |

EARNEST Partners, LLC 1180 Peachtree Street NE Suite 2300 Atlanta, GA 30309 | 2,088,831 (6) | 6.46 |

T. Rowe Price Associates, Inc. 100 E. Pratt St. Baltimore, MD 21202 | 2,440,672 (7) | 7.55 |

BlackRock, Inc. 40 East 52nd Street New York, New York 10022 | 1,933,699 (8) | 5.98 |

(1) Nature of beneficial ownership is direct unless otherwise indicated by footnote. Beneficial ownership as shown in the table arises from sole voting and investment power unless otherwise indicated by footnote.

(2) Based on a Schedule 13D filed with the SEC on March 19, 2013. The Schedule 13D states that Ms. Weaver has shared voting power and shared dispositive power with respect to 39,816 shares.

(3) This information is based solely on an amendment to Schedule 13G filed by Leslie Weaver with the SEC on February 9, 2012. Ms. Weaver did not file an amendment to the Schedule 13G in 2013. Based on the 2012 Schedule 13G/A, the shares reported include 3,151,751 shares held in the Paul Bechtner Trust for which Ms. L. Weaver was a co-trustee (the “Bechtner Trust”); 24,421 shares held as trustee of GST Marital trust; 178,231 shares held as a director of a foundation; 45,216 shares held by Ms. Weaver’s spouse; and 131,668 shares held by Ms. Weaver’s children. According to the 2012 Schedule 13G/A, 3,496,866 shares have shared voting and investment power. The Company was notified that the Bechtner Trust was dissolved in 2012 and that the 3,151,751 shares of AMCOL stock held in the Bechtner Trust were distributed to the beneficiaries.

(4) Based on an amendment to Schedule 13G filed by Vanguard Specialized Funds – Vanguard Precious Metals and Mining Fund with the SEC on February 14, 2013. The Schedule 13G/A states that the filer has sole voting power for all shares. See footnote 3 below.

(5) Based on an amendment to Schedule 13G filed with the SEC on February 11, 2013, by M&G Investment Management Limited (“MAGIM”). The Schedule 13G/A states that MAGIM beneficially owns, and exercises shared dispositive power with respect to, 6,144,400 shares, 19.23%, of AMCOL’s common stock. This amount includes shares owned by Vanguard Precious Metals and Mining Fund, MAGIM’s investment advisory client. The Schedule 13G/A further states that MAGIM exercises shared voting power with respect to 3,064,400 shares. The Schedule 13G/A states that all of the shares covered by the report are legally owned by MAGIM’s investment advisory clients, and none are owned directly by MAGIM. The Schedule 13G/A states that M&G Investment Funds 1 exercises shared voting and dispositive power with respect to 2,986,600 shares. See footnote 2 above.

(6) Based on an amendment to Schedule 13G filed with the SEC on February 13, 2013. The Schedule 13G/A states that the filer has sole voting power for 745,097 shares, and shared voting power for 250,978 shares.

(7) Based on an amendment to Schedule 13G filed with the SEC on February 8, 2013. The Schedule 13G/A states that the filer has sole voting power for 600,276 shares. The securities are owned by various individual and institutional investors for which T. Rowe Price Associates, Inc. (“Price Associates”) serves as investment adviser with power to direct investments and/or sole power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities.

(8) Based on an amendment to Schedule 13G filed by BlackRock, Inc. with the SEC on February 6, 2013. The Schedule 13G/A states that the filer has sole voting power for all shares.

Security Ownership of Directors and Executive Officers

The following table sets forth, as of February 14, 2013, shares of AMCOL common stock beneficially owned by: (i) each director and nominee; (ii) the named executive officers; and (iii) all directors and executive officers as a group.

| Beneficial Owner | Number of Shares and Nature of Beneficial Ownership (1) | Percent of Class (%) |

| Arthur Brown | 34,462 | * |

| Daniel P. Casey | 32,000 | * |

| Donald J. Gallagher | - - | * |

| John Hughes | 316,728 | 1.2 |

| Ryan F. McKendrick | 220,357 | * |

| Frederick J. Palensky | 8,334 | * |

| Jay D. Proops | 54,068 | * |

| Clarence O. Redman | 53,146 | * |

| William H. Schumann, III | - - | * |

| Dale E. Stahl | 45,000 | * |

| Audrey L. Weaver | 1,851,584 | 5.7 |

| Paul C. Weaver | 763,588 | 2.4 |

| James W. Ashley | 9,799 | * |

| Gary L. Castagna | 212,509 | * |

| Michael Johnson | 73,724 | * |

| Donald W. Pearson | 112,692 | * |

| All Current Directors and Executive Officers (17 people) | 3,767,006 | 12.1 |

* Percentage represents less than 1% of the total shares of common stock outstanding as of February 14, 2013.

(1) Nature of beneficial ownership is set forth on the next page.

| Nature of Beneficial Ownership as of February 14, 2013 |

| Beneficial Owner | Directly or With Spouse (1) (2) | In Retirement Savings Plans (3) | In Family Limited Partnership (4) | As Trustee, Co-Trustee or Director | By Family Members | As Trustee of AMCOL’s Pension Plan (5) | Subject to Options Exercisable in 60 Days |

| Arthur Brown | 21,461 | -- | -- | -- | -- | -- | 13,001 |

| Daniel P. Casey | 15,000 | -- | -- | -- | -- | -- | 17,000 |

| Donald J. Gallagher | -- | -- | -- | -- | -- | -- | -- |

| John Hughes | -- | -- | -- | 243,890 | 55,838 | -- | 17,000 |

| Ryan F. McKendrick | 56,587 | 33,770 | -- | -- | -- | 70,000 | 60,000 |

| Frederick J. Palensky | 5,000 | -- | -- | -- | -- | -- | 3,334 |

| Jay D. Proops | 27,068 | -- | 10,000 | -- | -- | -- | 17,000 |

| Clarence O. Redman | 9,170 | 26,976 | -- | -- | -- | -- | 17,000 |

| William H. Schumann, III | -- | -- | -- | -- | -- | -- | -- |

| Dale E. Stahl | 28,000 | -- | -- | -- | -- | -- | 17,000 |

| Audrey L. Weaver | 1,595,116 | -- | -- | 199,652 | 39,816 | -- | 17,000 |

| Paul C. Weaver | 380,508 | -- | -- | 135,701 | 230,379 | -- | 17,000 |

| James W. Ashley | 6,100 | 365 | -- | -- | -- | -- | 3,334 |

| Gary L. Castagna | 63,432 | 9,077 | -- | -- | -- | 70,000 | 70,000 |

| Michael R. Johnson | 22,297 | 4,760 | -- | -- | -- | -- | 46,667 |

| Donald W. Pearson | 40,708 | 1,984 | -- | -- | -- | 70,000 | 70,000 |

All Current Directors and Executive Officers (17 people) | 2,279,952 | 87,308 | 10,000 | 579,243 | 326,033 | 70,000 | 414,470 |

(1) Includes shares held with spouses for which voting rights may be shared. For Mr. Weaver, includes 15,453 shares of phantom stock held in AMCOL’s Deferred Compensation Plan.

(2) Includes shares of restricted stock as follows: Mr. Castagna, 3,333 shares; Mr. Johnson, 3,333 shares; Mr. McKendrick, 6,667 shares; Mr. Pearson, 8,333 shares; and the current executive officers as a group 21,666 shares.

(3) Shares are held in AMCOL’s Savings Plan, with the exception of Mr. Redman’s shares, which are held in individual retirement accounts.

(4) The named person is a general partner.

(5) Messrs. Castagna, Pearson and McKendrick share voting rights.

Compensation Discussion and Analysis

This Compensation Discussion and Analysis describes the material elements of compensation earned by or awarded or paid to each of our named executive officers during AMCOL’s 2012 fiscal year. For 2012, our named executive officers included Ryan McKendrick, Chief Executive Officer; Donald Pearson, Chief Financial Officer; James Ashley, General Counsel; Gary Castagna, President of our Performance Materials segment; and Michael Johnson, President of our Energy Services segment.

Executive Summary

AMCOL’s Compensation Committee has designed a competitive program that rewards performance and aligns executives’ interests with those of AMCOL’s shareholders. Our named executive officers’ compensation is comprised of a mix of base salary, annual performance-based cash bonuses, long-term incentives and other customary benefits. AMCOL’s executive compensation program provides both short-term and long-term compensation. In the short-term, 2012 annual bonuses were directly linked to earnings per share, return on capital employed and, for Messrs. Castagna and Johnson, the performance of their respective segment. Executive compensation is linked to the long-term performance of AMCOL through our equity award program and, for Mr. Johnson, a performance-based cash incentive opportunity.

Our executive compensation program contains components and features that are designed to further align the interests of our named executive officers with our shareholders’ interests. For example:

| · | Our executive compensation program is structured so that a significant amount of each of our named executive officer’s compensation is variable compensation and “at risk” for non-payment if we fail or the executive fails to meet performance objectives. |

| · | We maintain “double-trigger” change of control agreements and the executives are only entitled to a payment following termination of employment subsequent to a change in control. |

| · | A significant portion of our outstanding long-term incentive awards are composed of performance-based RSAs, RSUs and stock options. |

| · | Our annual bonuses are performance based, and none of our named executive officers received a discretionary bonus in fiscal 2012. |

| · | We provide no special or supplemental health benefits to our executive officers. |

| · | We require all of our executive officers to hold substantial amounts of our common stock. |

| · | Pursuant to our Clawback Policy, in the event we are required to restate our financial statements due to material noncompliance with any SEC financial reporting requirement, AMCOL is entitled to recover certain compensation from current or former executive officers. |

| | ● | Our Insider Trading Policy prohibits our executive officers from engaging in short-term or speculative trading in our common stock, as well as hedging and other derivative transactions. |

In 2012, we made the following significant changes to our executive compensation program in order to remain competitive and further align executives’ interests with those of AMCOL’s shareholders:

| | ● | The Compensation Committee increased the base salaries for Messrs. McKendrick, Pearson, Castagna and Johnson. |

| | ● | The Compensation Committee included additional annual bonus performance measures for Mr. Castagna (improved yield at our South African plant and inventory and accounts receivable objectives) and for Mr. Johnson (accounts receivable objectives). |

| | ● | At the suggestion of Mr. McKendrick, the 2012 equity awards to our executive officers were limited to stock options and did not include restricted stock. In general, the number of options granted to each executive officer was similar to the number of option shares granted in 2011. |

| | ● | The Compensation Committee approved a performance-based, long-term cash incentive award opportunity for Mr. Johnson and other members of senior management of the Energy Services segment. The performance period commenced on January 1, 2012 and terminates on December 31, 2015. Mr. Johnson has the opportunity to earn a portion of the cumulative adjusted annual increase in operating profit of the Energy Services segment, provided this segment achieves a minimum return on capital employed and he is employed by AMCOL on December 31, 2015. Any amounts earned pursuant to this long-term cash incentive award opportunity will be offset by any amounts paid in February 2014 pursuant to the 2010 cash incentive award. This award is designed to provide an additional incentive to motivate and retain certain key employees in the high-growth and sophisticated businesses included within the Energy Services segment. |

Our named executives earned the following amounts under outstanding cash and equity awards based on our 2012 performance:

| | ● | Messrs. McKendrick, Pearson and Ashley earned approximately 94% of their target bonus and Messrs. Castagna and Johnson earned 129% and 138%, respectively, of their target bonus. |

| | ● | Messrs. McKendrick, Pearson, Castagna and Johnson became fully vested in the portion of the 2011 restricted stock awards for which vesting is based on 2012 performance (representing one-third of the total award). |

| | ● | Messrs. McKendrick and Castagna forfeited their 2009 restricted stock awards because AMCOL’s 2012 return on capital employed did not meet the performance threshold. |

In July 2012, our Compensation Committee engaged Meridian Compensation Partners, LLC, an executive compensation consulting firm (“Meridian”) to provide compensation consulting services. Over the next several months, Meridian provided the following executive compensation consulting services to the Compensation Committee: (i) “auditing” and benchmarking AMCOL’s executive compensation programs relative to prevailing market practices; (ii) reviewing AMCOL’s peer group and assessing potential peer companies; and (iii) developing a strawman long-term equity incentive proposal.

Our Compensation Committee has reviewed our executive compensation program after considering the Meridian reports and certain other factors, and made certain key decisions regarding compensation in February 2013, as described below.

● The Compensation Committee adopted a new peer group to be used in executive benchmarking for 2013. This peer group consists of 20 companies, 8 of which were included in our 2012 peer group of 13 companies.

● The 2013 equity awards to our executive officers include stock options as well as performance-based restricted stock units. The restricted stock units only vest if AMCOL achieves a target return on capital employed in fiscal 2013, 2014 and 2015, subject to a “catch-up” provision. The Compensation Committee believes that awarding both restricted stock units and stock options will provide competitive long-term incentive award opportunities.

● In addition, the Compensation Committee awarded Messrs. McKendrick and Castagna restricted stock units that vest in 2016 and awarded Mr. Pearson restricted stock units that vest May 1, 2013.

● In connection with our restatement of our audited consolidated financial statements for the years ended December 31, 2009, 2010 and 2011, our Compensation Committee determined that the Company is entitled to recover approximately $32,000 from Mr. Castagna. All such amounts have been paid to the Company.

We encourage you to read this Compensation Discussion and Analysis for a detailed discussion of our executive compensation program.

The Compensation Committee Process

Although most decisions regarding executive compensation are made in the first quarter of our fiscal year, management and the Compensation Committee continue to monitor developments during the year.

Consideration of Say-on-Pay Vote Results. In 2011 and 2012, we sought advisory votes from our shareholders regarding our executive compensation program. Our shareholders overwhelmingly approved our 2010 and 2011 executive compensation, with approximately 97% and 98%, respectively, of voted shares cast in favor of the say-on-pay resolution. The Compensation Committee considers the results of the advisory votes as it completes its annual review of each pay element and the compensation packages provided to our executive officers.

Management’s Role in the Process. In determining 2012 compensation, AMCOL’s Chief Executive Officer, Ryan McKendrick, and, where appropriate, Chief Financial Officer, Donald Pearson, played an advisory role in designing our executive compensation program. Mr. McKendrick evaluated all other executive’s individual accomplishments and the performance of the Company and the various segments and made recommendations regarding performance targets and objectives, salary levels and equity awards for these other executive officers.

Peer Review and Benchmarking. The Compensation Committee periodically reviews and evaluates AMCOL’s executive compensation program to verify that it provides reasonable compensation at appropriate levels and remains market competitive by engaging compensation consultants and/or utilizing survey or custom data. In 2012, the Compensation Committee reviewed compensation information for companies included in a custom peer group. The peer group consisted of the following thirteen companies: Calgon Carbon Corporation; Compass Minerals International, Inc.; Dycom Industries, Inc.; Lufkin Industries, Inc.; Martin Marietta Materials Inc.; Materion Corporation; Minerals Technologies Inc.; Nalco Holdings Company; Oil Dri Corporation; Rockwood Holdings Inc.; RPM International Inc.; Superior Energy Services Inc.; and Tetra Technologies Inc. In addition, the Compensation Committee considers the collective experience of its members, as well as the other independent board members, in assuring that AMCOL’s compensation program remains reasonable and competitive.

Total cash compensation, consisting of annual salary and the performance-based annual bonus, is targeted at approximately the median pay level of the custom peer group assuming the executive performs as expected and is paid the target annual bonus. In general, if performance is outstanding and an executive receives the maximum annual bonus, total cash compensation will exceed the median pay level, and may approach or exceed the 75th percentile. AMCOL does not establish a target level for equity incentives, long-term cash incentives or total executive officer compensation. The Compensation Committee periodically reviews these elements as compared to a peer group and survey data to ensure that AMCOL remains competitive.

Compensation Program Philosophy and Policies

Compensation Philosophy. AMCOL’s success requires a management team that is able to develop and execute a worldwide business plan for the complex mix of slow-growth and high-growth, basic and sophisticated businesses operated by AMCOL. Historically, a significant portion of our senior management team has been promoted from within the Company. In addition to possessing valuable knowledge about AMCOL and a diverse skill set, our executive officers are often recognized as industry leaders. AMCOL’s compensation program is designed to attract and retain officers with the skills necessary to achieve our business objectives, to reward those individuals over time and to closely align the compensation of those individuals with AMCOL’s performance on both a short-term and a long-term basis. The various components of executive compensation are related but are designed for different purposes, and are evaluated separately for effectiveness.

A substantial portion of executive compensation is comprised of at-risk, variable compensation whose payout is dependent upon the achievement of specific performance objectives. The annual performance-based cash bonuses under the Cash Incentive Plan represent this type of “pay for performance” compensation. In setting the performance objectives for the annual bonuses, the Compensation Committee consults with management and considers market conditions, the prior-year performance and various elements of AMCOL’s operating plan. For 2012, the performance measures included earnings per share, return on capital employed and, for Messrs. Castagna and Johnson, their respective segment’s operating profit and return on capital employed. Also, Mr. Castagna’s 2012 annual bonus included performance measures related to the output at our South African minerals plant and the Performance Materials segment’s accounts receivable, and Mr. Johnson’s 2012 annual bonus included a performance measure related to the Energy Services segment’s accounts receivable. In addition, the 2010 and 2012 performance-based, long-term cash incentive opportunities provided to Mr. Johnson represents “pay for performance” compensation.

The awards of stock options, performance-based restricted stock and performance-based restricted stock units also constitute at-risk compensation and are designed to provide appropriate linkage between executive performance and shareholder interests.

Stock Ownership Guidelines and Prohibition on Short-Term Trading. The Compensation Committee considers stock ownership by management to be an important means of linking their interests with those of our shareholders. AMCOL maintains stock ownership guidelines for its officers. The minimum stock ownership requirement increases with the level of responsibility. Our Chief Executive Officer is expected to own stock with a value at least equal to four times base salary. Our other executive officers are expected to own stock with a value at least equal to three times base salary and our non-executive officers are expected to own stock with a value at least equal to two times base salary. The requirements are subject to a five year phase-in period. Neither option shares, unvested restricted stock nor unvested restricted stock units are included in the calculation of stock ownership for purposes of these guidelines. Considering the applicable phase-in periods, all of our officers are in compliance with our stock ownership guidelines. Our Insider Trading Policy prohibits our executive officers from engaging in short-term or speculative trading in our common stock, as well as hedging and other derivative transactions.

Clawback Policy. We adopted our Clawback Policy in 2010. Pursuant to our Clawback Policy, in the event we are required to restate our financial statements due to material noncompliance with any financial reporting requirement, AMCOL is entitled to recover certain compensation from current or former executive officers. The type of compensation to be recovered is limited to incentive-based compensation (including stock options) received during the 3-year period preceding the date of the restatement (commencing in 2010). The amount recoverable is limited to the difference between the amounts actually paid to these current or former executive officers based on the previously reported financial statements and the amounts which would have been earned based on the restated financial statements.

On April 3, 2013, we filed an amendment to our 2011 Form 10-K in order to restate our audited consolidated financial statements for the years ended December 31, 2009, 2010 and 2011. The restatements were required in order to correct a variety of errors, including accounting for inventory, long-term contracts and bad debts within the European operations of our Construction Technologies segment. Based on these restatements, our Compensation Committee determined that the Company is entitled to recover approximately $32,000 from Mr. Castagna. All such amounts have been paid to the Company.

Equity Award Practices. The Compensation Committee approves all annual equity awards in February. These equity awards are generally made more than two weeks after AMCOL issues its annual earnings press release. The grant date for equity awards is the date the Compensation Committee meets to consider the grants. The exercise price for stock options is the closing price of the common stock on the New York Stock Exchange on the grant date. Options or other equity awards are granted in certain other circumstances, including, without limitation, upon the hiring or promotion of an employee.

Policy Regarding Internal Revenue Code Section 162(m). Under Section 162(m) of the Code, AMCOL may not deduct annual compensation in excess of $1 million paid to certain employees, generally the Chief Executive Officer and the three other most highly compensated executive officers other than the Chief Financial Officer, unless that compensation qualifies as performance-based compensation under a shareholder approved plan and meets certain other requirements. In the event that AMCOL would not be entitled to a tax deduction, the Compensation Committee has in place a policy that AMCOL will defer payment of a portion of salary and bonus payments equal to such excess until such time or times as AMCOL is entitled to a tax deduction. This policy has been waived in the past. With certain exceptions, awards under both the 2010 Long-Term Incentive Plan and the Cash Incentive Plan are expected to qualify as performance-based compensation under Section 162(m). The restricted stock units awarded to Messrs. McKendrick, Castagna and Pearson in 2013 do not qualify as performance-based compensation under Section 162(m).

While the Compensation Committee considers the impact of Section 162(m) in structuring AMCOL’s compensation plans and programs, the Compensation Committee has, and may continue to, approve awards which would not qualify as performance-based compensation under Section 162(m). Such awards may include discretionary cash bonuses under the Annual Discretionary Cash Incentive Plan or restricted stock units under the 2010 Long-Term Incentive Plan that vest over time. The Compensation Committee reserves the flexibility and authority to make decisions that are in the best interest of AMCOL and its shareholders, even if those decisions do not result in full deductibility under Section 162(m).

Elements of 2012 Compensation

The principal elements of our 2012 executive compensation program are annual salary, annual performance-based cash bonuses, long-term equity incentives, other customary benefits and limited perquisites, and, in certain circumstances, severance and other benefits upon termination and/or a change in control. Our Compensation Committee believes that these elements of compensation are generally typical in our industries, and they are provided by AMCOL in order to remain competitive with our peer companies in attracting, motivating and retaining superior executive talent.

Annual Salary. In February 2012, the Compensation Committee reviewed the annual salary for each of our named executive officers. After considering levels of responsibility, prior experience and breadth of knowledge, past performance, internal equity issues and external pay practices, the Compensation Committee approved increasing annual salaries for the following named executive officers: Mr. McKendrick, $500,000 to $525,000; Mr. Pearson, $330,000 to $346,000; Mr. Castagna, $347,000 to $361,000; and Mr. Johnson, $274,000 to $340,000. In connection with determining the base salary for Mr. Johnson, the Compensation Committee also considered his 2010 and 2012 performance-based, long-term cash incentive awards. After noting the recent hiring of Mr. Ashley, the Compensation Committee elected to maintain Mr. Ashley’s base salary at $280,000.

Annual Performance-Based Cash Bonus. In February 2012, the Compensation Committee granted each of our named executive officers an annual cash bonus payable upon the achievement of performance goals established by the Compensation Committee. These awards are made pursuant to AMCOL’s 2010 Cash Incentive Plan. In setting the performance measures and the relative importance of each measure, the Compensation Committee considered each individual’s and AMCOL’s past performance, the 2012 operating plan and general economic conditions. The Compensation Committee does not have authority to grant a waiver if the established performance measures are not achieved, or to increase any amounts payable under the Cash Incentive Plan. Under the terms of the Cash Incentive Plan, the Compensation Committee may exercise negative discretion and determine that such a bonus will not be paid, even if the performance criteria were satisfied.

The 2012 performance measures and the threshold, target and maximum performance objectives are set forth in the charts below.

| | AMCOL Corporate Metrics | Performance Materials Segment | Energy Services Segment |

| EPS(1) | ROCE(2) | Operating Profit | Operating Profit | ROCE(2) |

| Threshold | $1.84 | 14.0% | $70.4M | $20.9M | 13.0% |

| Target | $2.02 | 15.5% | $74.0M | $26.1M | 15.0% |

| Maximum | $2.23 | 16.5% | $77.7M | $28.7M | 16.0% |

| Actual | $2.06 | 14.8% | $76.7M | $28.8M | 16.1% |

(1) EPS means earnings per share.

(2) ROCE means return on capital employed calculated using operating profit.

| | Additional Segment Metrics |

| Performance Materials | Energy Services |

| SA Plant Production (1) | AR and Inventory as % Sales (2) | Annual DSO(3) |

| Threshold | 29 | 38.0% | 106 |

| Target | 31 | 37.1% | 101 |

| Maximum | 35 | 36.3% | 97 |

| Actual | 35 | 37.6% | 105 |

(1) Requires sustainable 24 hours of production at our South African chromite plant, at a minimum yield of 75%.

(2) Refers to year-end accounts receivable plus inventory as a percentage of annual sales.

(3) Refers to average accounts receivable divided by annual sales, multiplied by 360.

The chart below sets forth the weight assigned to each such measure (assuming the target performance objective is achieved in all measures).

| Executive | EPS(1) | Corporate ROCE(2) | Segment Operating Profit (3) | Segment ROCE(2) | SA Plant Production(4) | AR and Inventory as % Sales (5) | Annual DSO(6) |

| Ryan McKendrick | 60.0% | 40.0% | -- | -- | -- | -- | -- |

| Donald Pearson | 60.0% | 40.0% | -- | -- | -- | -- | -- |

| James Ashley | 60.0% | 40.0% | -- | -- | -- | -- | -- |

| Gary Castagna | 20.0% | 13.3% | 33.3% | -- | 16.7% | 16.7% | -- |

| Michael Johnson | 20.0% | 13.3% | 33.3% | 16.7% | -- | -- | 16.7% |

(1) EPS means earnings per share.

(2) ROCE means return on capital employed calculated using operating profit.

(3) The relevant segment for each executive was as follows: Mr. Castagna, Performance Materials; and Mr. Johnson, Energy Services.

(4) Requires sustainable 24 hours of production at our South African chromite plant, at a minimum yield of 75%.

(5) Refers to year-end accounts receivable plus inventory as a percentage of annual sales.

(6) Refers to average accounts receivable divided by annual sales, multiplied by 360.

The chart below sets forth the 2012 threshold payments, target payments, maximum payments (assuming the same level of performance achieved in all measures) and actual bonus payments for each of our named executive officers. Payouts are interpolated for performance falling in between established threshold and target or target and maximum performance objectives.

| Executive | Threshold Bonus Payment | Target Bonus Payment | Maximum Bonus Payment | 2012 Earned Bonus |

| Ryan McKendrick | $131,250 | $525,000 (100%*) | $787,500 (150 %*) | $496,000 |

| Donald Pearson | $51,900 | $207,600 (60%*) | $346,000 (100%*) | $196,000 |

| James Ashley | $42,000 | $168,000 (60%*) | $280,000 (100%*) | $159,000 |

| Gary Castagna | $54,000 | $216,600 (60%*) | $361,000 (100%*) | $279,000 |

| Michael Johnson | $51,000 | $204,000 (60%*) | $340,000(100%*) | $281,000 |

*Percentage of salary

Discretionary Bonuses. AMCOL may grant discretionary cash bonus awards that are not subject to satisfaction of any performance criteria under the Annual Discretionary Cash Incentive Plan. The Compensation Committee did not grant any discretionary cash bonus awards to named executive officers in 2012.

Long-Term Incentive – Equity Based Compensation. The Compensation Committee believes that equity-based compensation is an effective means of ensuring that our executive officers have a continuing stake in AMCOL’s long-term success. The 2012 equity awards to our executive officers were stock options. The Compensation Committee believes that awarding stock options provides competitive long-term incentive award opportunities. The Compensation Committee believes that stock options serve the following purposes: (i) reward executive officers for long-term shareholder value creation; (ii) provide competitive long-term incentive award opportunities; (iii) retain employees through wealth accumulation opportunities; and (iv) focus executive officers on long-term, sustained performance. In structuring equity awards, the Compensation Committee targets an annual share utilization of up to 1.5% of our outstanding shares.

2012 Stock Options. In determining the number of stock options granted to each of our named executive officers in 2012, our Compensation Committee considered AMCOL’s performance, the executive officer’s individual performance, competitive compensation practices, historical awards to the individual, AMCOL’s historical stock price performance as compared to competitors and the recommendations of Mr. McKendrick. The Compensation Committee did not assign particular weights to any of these factors. In keeping with AMCOL’s commitment to provide a compensation package that focuses on at-risk pay components, the executive officers are awarded stock options with an exercise price equal to the closing price of AMCOL’s common stock on the date of grant and these options will have value to our executive officers only if the market price of our common stock increases after the date of grant. Typically, our stock options vest 33% after one year, 66% after two years and 100% after three years.

2011 RSAs. In 2011, the Compensation Committee granted performance-based restricted stock awards to the executive officers (other than Mr. Ashley who was not an employee at that time). Pursuant to the 2011 awards, the number of RSAs that will vest depends on AMCOL’s return on capital employed and cost of capital in 2011, 2012 and 2013. For each executive officer, one-third of the award is eligible for vesting with respect to performance in each year in the three-year performance period, subject to a “catch-up” in each of the following years. Dividends will not be paid on the RSAs until the shares have vested. At such time as the RSA vests, the executive is entitled to a payment based on the cumulative amount of dividends declared during the restricted period and the number of vested shares. Previously, each of our named executive officers became fully vested in the portion of the 2011 RSAs for which vesting was based on 2011 performance (representing one-third of the total award).

In order for the second third of the RSAs to vest for each officer other than Mr. Pearson, AMCOL’s 2012 return on capital employed must be at least 14%. In order for the second third of the RSAs to vest for Mr. Pearson, AMCOL’s 2012 return on capital employed must be at least 14% (weighted at 60% of the award) and AMCOL’s 2012 return on capital employed must equal or exceed AMCOL’s cost of capital (weighted at 40% of the award). AMCOL’s 2012 return on capital employed was 14.8% and cost of capital was 10.6%. As such, each of our named executive officers became fully vested in the portion of the 2011 RSAs for which vesting is based on 2012 performance (representing one-third of the total award).

2009 RSAs. In 2009, the Compensation Committee granted to Messrs. Castagna and McKendrick an award of 20,000 shares of performance-based restricted stock. The Compensation Committee granted these awards in connection with Mr. McKendrick’s promotion to Chief Operating Officer and other senior management changes. These awards were effective January 1, 2010 and carry a three-year term. Messrs. Castagna and McKendrick were entitled to the right to vote and the right to receive cash dividends with respect to their outstanding shares of unvested restricted stock. In order for these RSAs to vest, AMCOL’s 2012 return on capital employed must be at least 15%. AMCOL’s 2012 return on capital employed was 14.8% and as such, these RSAs did not vest and were forfeited.

Long-Term Incentive – Awards of Cash Based Compensation. In 2010, the Compensation Committee approved performance-based, long-term cash incentive award opportunities for members of senior management of our Energy Services segment, including Mr. Johnson. The performance period commenced on January 1, 2010 and terminates on December 31, 2013. Mr. Johnson has the opportunity to earn a portion of the cumulative adjusted annual increase in operating profit of the Energy Services segment during this period, provided this segment achieves a minimum return on capital employed. Any amounts earned pursuant to this long-term cash incentive opportunity will be paid on February 15, 2014, provided Mr. Johnson remains employed by AMCOL. No amounts were accrued under the 2010 award for 2010, 2011 or 2012.

In February 2012, the Compensation Committee approved similar performance-based, long-term cash incentive award opportunities for members of senior management of our Energy Services segment, including Mr. Johnson. The performance period commenced on January 1, 2012 and terminates on December 31, 2015. Any amounts earned pursuant to the 2012 award will be offset by any amounts paid in February 2014 pursuant to the 2010 cash incentive award. Based on 2012 performance, the Company accrued $274,600 with respect to Mr. Johnson’s 2012 cash incentive award.

The Compensation Committee approved these awards based on the recommendation of senior management. In structuring and approving these opportunities, the Compensation Committee recognized that the Energy Services segment includes high-growth and sophisticated businesses whose success requires experienced and dedicated senior managers. These opportunities are intended to provide an additional incentive to motivate and retain certain key employees.

Other Benefits and Perquisites. Executive officers are eligible to participate in all of our employee benefit plans, such as medical, dental, group life, disability and our 401(k) savings plan (with a company match), in each case on the same basis as other employees, subject to applicable law. AMCOL sponsors two defined benefit pension plans in which certain of our executive officers participate. Our Pension Plan is available to employees hired prior to January 1, 2004. All of our named executive officers other than Mr. Pearson and Mr. Ashley participate in the Pension Plan. The executive officers participating in our Pension Plan also participate in our Supplementary Pension Plan, or SERP. The SERP provides for the portion of the Pension Plan benefit which cannot be paid to these participants due to compensation or benefit limitations under the tax laws.

Since neither Mr. Pearson nor Mr. Ashley participate in the Pension Plan or the SERP, each of them is entitled to a contribution to our 401(k) savings plan of an amount equal to 3% of his annual compensation, subject to a maximum of $7,350.

All of our named executive officers are provided deferred compensation opportunities through a non-qualified Deferred Compensation Plan. In addition to employee directed deferrals, AMCOL annually credits each participant’s Deferred Compensation Plan account with an amount equal to the amount that would have been contributed to the 401(k) savings plan, without regard to any qualified plan limits, if the amount had not been deferred. AMCOL also matches each participant’s deferral, dollar for dollar, up to 4% of the participant’s compensation that exceeds the qualified pay limitations under AMCOL’s 401(k) Savings Plan, provided that the participant has elected to defer an amount equal to or greater than such AMCOL match amount. For a description of the Pension Plan, the SERP and the Deferred Compensation Plan, please see the sections entitled “Executive Compensation -- Pension Benefits” and “-- Nonqualified Deferred Compensation” below, respectively.

Consistent with the philosophy and culture of AMCOL, a few perquisites are provided to the named executive officers. Perquisites include a company car allowance or company car, excess private liability insurance coverage and executive life insurance coverage.

Change of Control Agreements and Executive Severance Plan. Effective in June 2011, AMCOL entered into new Change of Control Agreements with the named executive officers. Under the double-trigger Change of Control Agreements, if the executive is terminated without cause (or the executive resigns with good reason) within 120 days prior to or within 12 months following a change of control, the executive will receive a payment equal to a multiple of his salary and target annual bonus amount. In such event, Mr. McKendrick would be entitled to three times his salary and bonus amount and our other named executive officers would be entitled to two times their salary and bonus amount. These Change of Control Agreements terminate in June 2014.

Effective in June 2011, AMCOL adopted an Executive Severance Plan. Under the Executive Severance Plan, if the executive is terminated without cause he is entitled to severance for a set period (two years for Mr. McKendrick, twelve months for Mr. Ashley and eighteen months for the other named executive officers) and payment of the executive’s COBRA premium for eighteen months (twelve months for Mr. Ashley). The Compensation Committee may terminate or modify the Executive Severance Plan at any time. These agreements and plans and the benefits thereunder are summarized below under “Executive Compensation -- Summary Compensation Table -- Change of Control Agreements, and -- Executive Severance Plan” and “Executive Compensation -- Potential Payments Upon Termination or Change of Control.”

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis with management and, based on such review and discussions, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement.

| | THE COMPENSATION COMMITTEE |

Summary Compensation Table

The following table sets forth certain summary information regarding the compensation awarded to, earned by or paid by AMCOL to or for the account of our Chief Executive Officer, our Chief Financial Officer and our three other most highly compensated executive officers serving as of December 31, 2012, the named executive officers.

Name and Principal Position | Year | Salary ($) | Stock Awards ($)(1) | Option Awards ($)(1) | Non-Equity Incentive Plan Compensation ($)(2) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(3) | All Other Compensation ($)(4) | Total($) |

Ryan F. McKendrick Chief Executive Officer | 2012 2011 2010 | 525,000 500,000 408,333 | -- 613,200 -- | 370,800 342,600 258,600 | 496,000 601,786 65,000 | 653,540 363,203 238,715 | 36,011 35,644 21,894 | 2,081,351 2,456,433 992,542 |

Donald W. Pearson Chief Financial Officer | 2012 2011 2010 | 346,000 330,000 260,000 | -- 766,500 -- | 185,400 171,300 215,500 | 196,000 238,307 32,000 | -- -- -- | 47,259 38,162 34,509 | 774,659 1,544,269 542,009 |

James W. Ashley General Counsel(5) | 2012 | 280,000 | -- | 123,600 | 159,000 | -- | 33,606 | 596,206 |

Gary L. Castagna President of the Performance Materials Segment | 2012 2011 2010 | 361,000 347,000 335,000 | -- 306,600 -- | 185,400 171,300 215,500 | 279,000 277,434 265,000 | 123,947 142,246 66,970 | 26,413 26,180 25,927 | 975,760 1,270,760 908,397 |

Michael R. Johnson President of the Energy Services Segment | 2012 2011 2010 | 340,000 274,000 265,566 | -- 306,600 -- | 185,400 114,200 129,300 | 281,000 123,776 36,000 | 143,770 144,218 97,189 | 22,463 14,802 14,530 | 972,633 977,596 542,285 |

(1) Reflects the fair value at the date of grant calculated in accordance with the Financial Accounting Standards Board’s Accounting Standards Codification Topic 718, or ASC 718. Assumptions used in the calculation of these amounts are disclosed in Note 15 to our audited financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2012. The values of the performance-based stock awards have been calculated taking into consideration the probable outcome of the respective performance conditions as of the grant date.

(2) These performance-based annual cash bonuses were granted and paid pursuant to our Cash Incentive Plan. These performance-based incentive awards are earned based on annual performance and, if applicable, these amounts were paid to the officers in March of the following year.

(3) Amounts reflect the aggregate change in actuarial present value of accumulated benefits under the Pension Plan and the SERP from December 31, 2011 to December 31, 2012, from December 31, 2010 to December 31, 2011 and from December 31, 2009 to December 31, 2010.

(4) The amounts reflect the following for each officer: matching contributions allocated by AMCOL pursuant to AMCOL’s 401(k) Savings Plan; the value attributable to personal use of company-provided automobiles; premiums paid for excess personal liability insurance coverage; and premiums paid for life insurance coverage. For Messrs. Pearson and Ashley, this figure also reflects a $7,500 contribution to the 401(k) Savings Plan that was not paid to executive officers that participate in our Pension Plan. For Messrs. Pearson and Johnson, this figure also includes credits to AMCOL’s Deferred Compensation Plan in amounts equal to the amount that would have been contributed by AMCOL to the executive’s account in the 401(k) Savings Plan with respect to compensation voluntarily deferred into such plan, without regard to any qualified plan limits as well as a company match for up to 4% of the executive’s compensation that exceeds the qualified pay limitations under the 401(k) Savings Plan. These officers were credited with the following amounts: Mr. Pearson, $13,388, $4,680 and $1,349 in 2012, 2011 and 2010, respectively; and Mr. Johnson, $8,551, $2,600 and $2,456 in 2012, 2011 and 2010, respectively.

(5) Mr. Ashley joined the Company on January 2, 2012.

Change of Control Agreements

AMCOL has entered into double-trigger Change of Control Agreements with each of our executive officers. These agreements terminate on June 11, 2014.

If within 120 days prior to, or twelve months following, a change of control, AMCOL terminates an executive without cause or the executive terminates his employment for good reason, the executive is entitled to receive a lump sum cash payment equal to three times (in the case of Mr. McKendrick) or two times (in the case of Messrs. Pearson, Ashley, Castagna and Johnson) the sum of his salary and target bonus. If a change of control occurs, the executive will be paid a prorated portion of his performance-based annual bonus based on performance to date and all outstanding stock options, restricted stock and other equity compensation awards become fully vested and exercisable unless otherwise required under Internal Revenue Code section 162(m).

A change of control of AMCOL shall be deemed to have occurred on the first to occur of any of the following, subject to certain exceptions: (1) any person (other than certain AMCOL affiliates) acquires 50.1% or more of AMCOL’s common stock; (2) the AMCOL directors serving as of the end of the prior fiscal year cease to constitute at least one-half of AMCOL’s directors; or (3) AMCOL consummates a merger, reorganization, consolidation, or similar transaction, or sale or other disposition of 50.1% of the consolidated assets of AMCOL. In addition, for Messrs. Castagna and Johnson, a change of control will be deemed to have occurred if AMCOL sells a majority of the stock or assets of Performance Materials or Energy Services segment, respectively, and such officer oversees the operation of such segment at such time.

The Change of Control Agreements incorporate by reference the confidentiality and non-compete provisions of previously executed Confidentiality Agreements and Covenants Not to Compete which contain confidentiality and one year non-competition and non-solicitation covenants in favor of AMCOL.

Good reason is defined, subject to notice requirements and an opportunity for AMCOL to remedy the condition, as the occurrence of any of the following events: (1) any material reduction in the executive’s duties and responsibilities; (2) any material reduction in the executive’s base salary, target bonus opportunity or equity compensation; or (3) any relocation of the executive without consent to a facility more than fifty miles away. Cause is defined as the occurrence of any of the following events: (A) the executive’s commission of a felony or misdemeanor that involves fraud, dishonesty or moral turpitude; (B) subject to a notice and cure provision, the executive’s material breach of the Change of Control Agreement or Confidentiality Agreement and Covenant Not to Compete; (C) willful or intentional material misconduct by the executive in the performance of his duties; (D) the executive performs his duties in a manner that is grossly negligent; and/or (E) the executive fails to cooperate in any governmental investigations or proceedings.

Executive Severance Plan

All of our executive officers participate in AMCOL’s Executive Severance Plan. The Compensation Committee can terminate or amend the Executive Severance Plan at any time. Any such termination shall not affect those employees previously terminated and receiving payments.

Pursuant to the Executive Severance Plan, if an executive is involuntarily terminated in certain circumstances, AMCOL will provide for base salary for twenty-four months (in the case of Mr. McKendrick), for eighteen months (in the case of Messrs. Pearson, Castagna and Johnson), or for twelve months (in the case of Mr. Ashley). In such event, the executives are also entitled to payment of the executive’s COBRA premium for a period of eighteen months (in the case of Messrs. McKendrick, Pearson, Castagna and Johnson) or for twelve months (in the case of Mr. Ashley). No such amounts will be paid under the Executive Severance Plan if the executive is entitled to any severance benefits pursuant to a Change of Control Agreement.

Grants of Plan-Based Awards

The following table sets forth certain information regarding grants of plan-based awards to our named executive officers during the fiscal year ended December 31, 2012.

| Name | Grant Date | Estimated Future Payouts Under Non-Equity Incentive Plan Awards | All Other Option Awards: Number of Securities Underlying Options (#) (2) | Exercise or Base Price of Option Awards ($/Sh) (3) | Grant Date Fair Value of Stock and Option Awards ($) (4) |

| | | Threshold ($) | Target ($) | Maximum ($) | | | |

| Ryan F. McKendrick | 2/13/2012 | 131,250(1) | 525,000(1) | 787,500(1) | 30,000 | 29.80 | 370,800 |

| Donald W. Pearson | 2/13/2012 | 51,900(1) | 207,600(1) | 346,000(1) | 15,000 | 29.80 | 185,400 |

| James W. Ashley | 2/13/2012 | 42,000(1) | 168,000(1) | 280,000(1) | 10,000 | 29.80 | 123,600 |

| Gary L. Castagna | 2/13/2012 | 54,000(1) | 216,600(1) | 361,000(1) | 15,000 | 29.80 | 185,400 |

| Michael R. Johnson | 2/13/2012 2/13/2012 | 51,000(1) | 204,000(1) 1,098,000(5) | 340,000(1) | 15,000 | 29.80 | 185,400 |

(1) These incentive cash awards were granted under the Cash Incentive Plan. These are cash incentive awards for the 2012 fiscal year and are payable for 2012 performance if certain performance goals are achieved. These amounts assume the same level of performance is achieved in all performance measures.

(2) These options vest at a rate of 33% after one year, 66% after two years and 100% after three years. The options have a ten-year term.

(3) The exercise price of these options is the closing price of our common stock on the New York Stock Exchange on the grant date.

(4) Amounts represent the total fair value of stock options and stock awards granted in 2012 under ASC 718. Details of the assumptions used in valuing these stock awards are set forth in Note 15 to our audited financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2012.

(5) This performance-based, long-term cash incentive award was granted to Mr. Johnson under the Cash Incentive Plan. The performance period commenced on January 1, 2012 and terminates on December 31, 2015. Mr. Johnson has the opportunity to earn a portion of the cumulative adjusted annual increase in operating profit of the Energy Services segment, provided this segment achieves a minimum return on capital employed and he is employed by AMCOL on December 31, 2015. The amount shown reflects a possible award opportunity amount in the aggregate for the four-year term based on 2012 performance. The award does not include a threshold or maximum amount payable (other than the annual maximum amount payable pursuant to the terms of the 2010 Cash Incentive Plan).

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth certain information regarding the outstanding equity awards at December 31, 2012 of our named executive officers.

| Option Awards(1) | Stock Awards(2) |

| | |

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | Equity Inventive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(3) |

| Ryan F. McKendrick | 10,000 | -- | 15.11 | 02/09/2019 | -- | -- |

| | 10,000 | 10,000 | 23.24 | 02/08/2020 | -- | -- |

| | 10,000 | 20,000 | 30.66 | 02/08/2021 | -- | -- |

| | -- | 30,000 | 29.80 | 02/13/2022 | 13,333 | 409,056 |

| Donald W. Pearson | 10,000 | -- | 30.89 | 05/09/2014 | -- | -- |

| | 20,000 | -- | 15.11 | 02/09/2019 | -- | -- |

| | 16,667 | 8,333 | 23.24 | 02/08/2020 | -- | -- |

| | 5,000 | 10,000 | 30.66 | 02/08/2021 | -- | -- |

| | -- | 15,000 | 29.80 | 02/13/2022 | 16,666 | 511,313 |

| James W. Ashley | -- | 10,000 | 29.80 | 02/13/2022 | -- | -- |

| Gary L. Castagna | 15,000 | -- | 29.95 | 02/13/2013 | -- | -- |

| | 15,000 | -- | 24.25 | 02/11/2014 | -- | -- |

| | 15,000 | -- | 15.11 | 02/09/2019 | -- | -- |

| | 16,667 | 8,333 | 23.24 | 02/08/2020 | -- | -- |

| | 5,000 | 10,000 | 30.66 | 02/08/2021 | -- | -- |

| | -- | 15,000 | 29.80 | 02/13/2022 | 6,666 | 204,513 |

| Michael R. Johnson | 10,000 | -- | 29.95 | 02/13/2013 | -- | -- |

| | 10,000 | -- | 24.25 | 02/11/2014 | -- | -- |

| | 10,000 | -- | 15.11 | 02/09/2019 | -- | -- |

| | 10,000 | 5,000 | 23.24 | 02/08/2020 | -- | -- |

| | 3,334 | 6,666 | 30.66 | 02/08/2021 | -- | -- |

| | -- | 15,000 | 29.80 | 02/13/2022 | 6,666 | 204,513 |

(1) All options granted prior to 2003 vest at a rate of 20% per year over five years. All options granted during or after 2003 vest at a rate of 33% after one year, 66% after two years and 100% after three years.

(2) Represents restricted stock awards that only vest if certain performance objectives are achieved.

(3) Calculated using the closing price of AMCOL common stock on December 31, 2012 ($30.68).

Option Exercises and Stock Vested