Table of Contents

As filed with the Securities and Exchange Commission on October 10, 2006.

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EXIDE TECHNOLOGIES

(Exact name of registrant as specified in its charter)

| Delaware | 3691 | 23-0552730 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Number) | (I.R.S. Employer Identification No.) |

13000 Deerfield Parkway

Building 200

Alpharetta, GA 30004

(678) 566-9000

(Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices)

Barbara A. Hatcher

Executive Vice President and General Counsel

Exide Technologies

13000 Deerfield Parkway

Building 200

Alpharetta, GA 30004

(678) 566-9000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Carter W. Emerson, P.C.

Kirkland & Ellis LLP

200 East Randolph Drive

Chicago, Illinois 60601

(312) 861-2000

Approximate date of commencement of proposed sale of the securities to the public: The exchange will occur as soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Note | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | |||||||

10 1/2% Senior Secured Notes due 2013 | $ | 290,000,000(1) | 100%(2)(3) | $ | 290,000,000(1)(2) | $ | 31,030 | ||||

| (1) | Represents the aggregate principal amount of the 10½% Senior Secured Notes due 2013 issued by Exide Technologies prior to the date of this Registration Statement. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457 under the Securities Act of 1933, as amended. |

| (3) | Exclusive of accrued interest, if any. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

SUBJECT TO COMPLETION, DATED OCTOBER 10, 2006

PROSPECTUS

EXIDE TECHNOLOGIES

EXCHANGE OFFER FOR

$290,000,000

10 1/2% SENIOR SECURED NOTES DUE 2013

We are offering to exchange:

up to $290,000,000 of our new 10 1/2% Senior Secured Notes due 2013, Series B

for

a like amount of our outstanding 10 1/2% Senior Secured Notes due 2013.

Material Terms of Exchange Offer

• The terms of the exchange notes to be issued in the exchange offer are substantially identical to the outstanding notes, except that the transfer restrictions and registration rights relating to the outstanding notes will not apply to the exchange notes. • There is no existing public market for the outstanding notes or the exchange notes. We do not intend to list the exchange notes on any securities exchange or seek approval for quotation through any automated trading system. • You may withdraw your tender of notes at any time before the expiration of the exchange offer. We will exchange all of the outstanding notes that are validly tendered and not withdrawn. | • The exchange offer expires at 5:00 p.m., New York City time, on , 2006, unless extended. • The exchange of notes will not be a taxable event for U.S. federal income tax purposes. • The exchange offer is not subject to any condition other than that it not violate applicable law or any applicable interpretation of the Staff of the SEC. • We will not receive any proceeds from the exchange offer. • You may tender your notes in integrals of $1,000. |

For a discussion of certain factors that you should consider before participating in this exchange offer, see “Risk Factors” beginning on page 11 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these notes or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

October 10, 2006

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the SEC is effective. This prospectus is not an offer to sell nor is it an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Table of Contents

We have not authorized anyone to give any information or represent anything to you other than the information contained in this prospectus. You must not rely on any unauthorized information or representations.

Until , 2006, all dealers that, buy, sell or trade the exchange notes, whether or not participating in the exchange offer, may be required to deliver a prospectus. This requirement is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments and subscriptions.

| 1 | ||

| 11 | ||

| 26 | ||

| 28 | ||

| 36 | ||

| 37 | ||

| 38 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 40 | |

| 70 | ||

| 90 | ||

| 100 | ||

| 102 | ||

| 103 | ||

| 106 | ||

| 147 | ||

| 149 | ||

| 154 | ||

| 156 | ||

| 156 | ||

| 156 |

i

Table of Contents

TRADEMARKS

We own various trademarks under which our products are marketed globally that are valuable to our business, including Exide®, Exide Select Orbital®, Absolyte®, Centra™, Classic®, DETA��, Formula™, Fulmen®, Leader™, Liberator™, Marathon®, Mega Cycle®, Millennium 3™, Nautilus®, Sonnenschein®, Sprinter®, Stowaway Nautilus®, Stowaway Powercycler®, STR/STE™, Top Start Plus™, Tudor® and Ultra™. We also license the right to use various trademarks, including the Champion® and Champion Trailblazer® marks, which we license from Federal-Mogul Corporation, and the NASCAR® and Exide NASCAR Select® marks, which we license from the National Association for Stock Car Auto Racing, Inc. (“NASCAR”).

ii

Table of Contents

The following summary contains basic information about us and this exchange offer. It likely does not contain all the information that is important to you. For a more complete understanding of this exchange offer, we encourage you to read this entire document. In this prospectus, except as otherwise indicated or as the context may otherwise require, the words “the Company” refer to Exide Technologies and not any of its subsidiaries and the words “we,” “our” and “us” refer to Exide Technologies and its consolidated subsidiaries, collectively. Our fiscal year end is March 31. We refer to the fiscal year ended March 31, 2007 as “fiscal 2007,” the fiscal year ended March 31, 2006 as “fiscal 2006,” the fiscal year ended March 31, 2005 as “fiscal 2005,” and the fiscal year ended March 31, 2004 as “fiscal 2004.”

As a result of our emergence from Chapter 11 bankruptcy and our adoption of fresh start accounting, our financial information as of and for any period prior to May 5, 2004 is not comparable to the financial information for the periods after that date. Our emergence from bankruptcy resulted in a new reporting entity, which we refer to as the “Successor Company,” as of the effective date. All financial information as of and for all periods prior to May 5, 2004 is presented as pertaining to our predecessor reporting company, which we refer to as the “Predecessor Company.” In order to provide a meaningful comparison for purposes of discussion of results of operations for the twelve months ended March 31, 2005, the period April 1, 2004 through May 5, 2004 (Predecessor Company) has been combined with the period May 6, 2004 through March 31, 2005 (Successor Company). This combined twelve-month period represents only supplemental information in that it combines information from two different reporting entities. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Fresh Start Accounting.”

Our Company

We are a global producer and recycler of lead-acid batteries. We provide a comprehensive range of stored electrical energy products and services for transportation and industrial applications. Transportation markets include original-equipment and aftermarket automotive, heavy-duty truck, agricultural and marine applications, and new technologies for hybrid vehicles and 42-volt automotive applications. Industrial markets include batteries for telecommunications systems, fuel-cell load leveling, electric utilities, railroads, uninterruptible power supply (UPS), lift trucks, mining and other commercial vehicles. We report our results for four business segments, Transportation North America, Transportation Europe and Rest of World (“ROW”), Industrial Energy North America and Industrial Energy Europe and ROW. Our many brands includeExide, Absolyte, Centra, Classic, DETA, Fulmen, GNB, Liberator, Marathon, Sonnenscheinand Tudor.

We are a Delaware corporation organized in 1966 to succeed to the business of a New Jersey corporation founded in 1888. Our principal executive offices are located at 13000 Deerfield Parkway, Building 200, Alpharetta, Georgia 30004. Our phone number is (678) 566-9000. More comprehensive information about us and our products is available through our Internet website at www.exide.com. The information contained on our website, or other sites linked to it, is not incorporated by reference into this prospectus.

1

Table of Contents

Corporate Structure

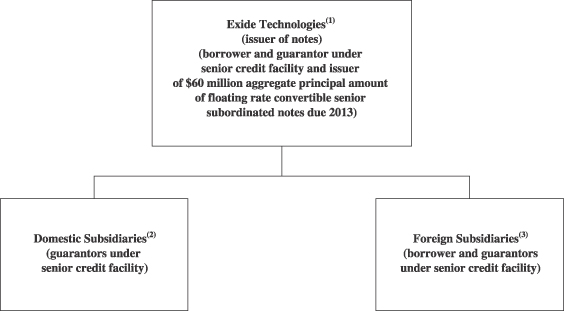

The chart below illustrates our basic corporate and debt structure.

| (1) | As of and for the three months ended June 30, 2006, Exide Technologies accounted for approximately 32% of our consolidated assets and approximately 39% of our consolidated net sales. Exide Technologies is a borrower of, or guarantor with respect to, all of our senior credit facility borrowings and the issuer of our floating rate convertible senior subordinated notes due 2013. |

| (2) | The outstanding notes and the notes exchanged therefor will be guaranteed by any of our domestic subsidiaries that have significant assets or operations. As of the date of this prospectus, none of our domestic subsidiaries has significant assets or operations and none of our domestic subsidiaries guarantee the notes. All our domestic subsidiaries guarantee borrowings under our senior credit facility. |

| (3) | As of and for the three months ended June 30, 2006, our foreign subsidiaries accounted for approximately 68% of our consolidated assets and approximately 61% of our consolidated net sales. None of our foreign subsidiaries will guarantee the outstanding notes or the notes exchanged therefor. One of our foreign subsidiaries is a borrower under our senior credit facility and lends borrowed funds to other foreign subsidiaries. Certain of our foreign subsidiaries guarantee the foreign borrowings under the senior credit facility. |

2

Table of Contents

Summary of the Exchange Offer

The Initial Offering of Outstanding Notes | We sold the outstanding notes on March 18, 2005 to Deutsche Bank Securities Inc., Credit Suisse First Boston LLC, Banc of America Securities LLC and UBS Securities LLC. We refer to these parties in this prospectus as the “initial purchasers.” The initial purchasers subsequently resold the outstanding notes: (i) to qualified institutional buyers pursuant to Rule 144A; or (ii) outside the United States in compliance with Regulation S, each as promulgated under the Securities Act of 1933, as amended (the “Securities Act”). |

Registration Rights Agreement | Simultaneously with the initial sale of the outstanding notes, we entered into a registration rights agreement for the exchange offer. In the registration rights agreement, we agreed, among other things, to use reasonable best efforts to file a registration statement with the SEC and to commence and complete this exchange offer within 285 days of issuing the outstanding notes. The exchange offer is intended to satisfy your rights under the registration rights agreement. After the exchange offer is complete, you will no longer be entitled to any exchange or registration rights with respect to your outstanding notes. |

The Exchange Offer | We are offering to exchange the exchange notes, which have been registered under the Securities Act, for your outstanding notes, which were issued on March 18, 2005. In order to be exchanged, an outstanding note must be properly tendered and accepted. All outstanding notes that are validly tendered and not validly withdrawn will be exchanged. We will issue exchange notes promptly after the expiration of the exchange offer. |

Resales | We believe that the exchange notes issued in the exchange offer may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act provided that: |

| • | the exchange notes are being acquired in the ordinary course of your business; |

| • | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the exchange notes issued to you in the exchange offer; and |

| • | you are not an affiliate of ours. |

If any of these conditions are not satisfied and you transfer any exchange notes issued to you in the exchange offer without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from registration of your exchange notes from these requirements, you may incur liability under the Securities Act. We will not assume, nor will we indemnify you against, any such liability. |

3

Table of Contents

Each broker-dealer that is issued exchange notes in the exchange offer for its own account in exchange for outstanding notes that were acquired by that broker-dealer as a result of market-making or other trading activities, must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the exchange notes. A broker-dealer may use this prospectus for an offer to resell, resale or other retransfer of the exchange notes issued to it in the exchange offer. |

Record Date | We mailed this prospectus and the related exchange offer documents to registered holders of outstanding notes as of , 2006, which is the record date for the exchange offer. |

Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, , 2006, unless we decide to extend the expiration date. |

Conditions to the Exchange Offer | The exchange offer is not subject to any condition other than that the exchange offer not violate applicable law or any applicable interpretation of the staff of the SEC. |

Procedures for Tendering Outstanding Notes | If you wish to tender your notes for exchange in this exchange offer, you must transmit to the exchange agent on or before the expiration date either: |

| • | an original or a facsimile of a properly completed and duly executed copy of the letter of transmittal, which accompanies this prospectus, together with your outstanding notes and any other documentation required by the letter of transmittal, at the address provided on the cover page of the letter of transmittal; or |

| • | if the notes you own are held of record by The Depository Trust Company, or “DTC,” in book-entry form and you are making delivery by book-entry transfer, a computer-generated message transmitted by means of the Automated Tender Offer Program System of DTC, or “ATOP,” in which you acknowledge and agree to be bound by the terms of the letter of transmittal and which, when received by the exchange agent, forms a part of a confirmation of book-entry transfer. As part of the book-entry transfer, DTC will facilitate the exchange of your notes and update your account to reflect the issuance of the exchange notes to you. ATOP allows you to electronically transmit your acceptance of the exchange offer to DTC instead of physically completing and delivering a letter of transmittal to the exchange agent. |

In addition, you must deliver to the exchange agent on or before the expiration date: |

| • | a timely confirmation of book-entry transfer of your outstanding notes into the account of the exchange agent at DTC if you are making delivery by book-entry transfer; or |

4

Table of Contents

| • | if necessary, the documents required for compliance with the guaranteed delivery procedures. |

Special Procedures for Beneficial Owners | If you are the beneficial owner of book-entry interests and your name does not appear on a security position listing of DTC as the holder of the book-entry interests or if you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender the book-entry interest or outstanding notes in the exchange offer, you should contact the person in whose name your book-entry interests or outstanding notes are registered promptly and instruct that person to tender on your behalf. |

Withdrawal Rights | You may withdraw the tender of your outstanding notes at any time prior to 5:00 p.m., New York City time on , 2006. |

Federal Income Tax Considerations | The exchange of outstanding notes will not be a taxable event for United States federal income tax purposes. |

Use of Proceeds | We will not receive any proceeds from the issuance of exchange notes pursuant to the exchange offer. We will pay all of our expenses incident to the exchange offer. |

Exchange Agent | U.S. Bank National Association is serving as the exchange agent in connection with the exchange offer. |

Summary of Terms of the Exchange Notes

The form and terms of the exchange notes are the same as the form and terms of the outstanding notes, except that the exchange notes will be registered under the Securities Act. As a result, the exchange notes will not bear legends restricting their transfer and will not contain the registration rights and liquidated damage provisions contained in the outstanding notes. The exchange notes represent the same debt as the outstanding notes. Both the outstanding notes and the exchange notes are governed by the same indenture. Unless the context otherwise requires, we use the term “notes” in this prospectus to collectively refer to the outstanding notes and the exchange notes.

Issuer | Exide Technologies. |

Securities | $290,000,000 in aggregate principal amount of 10 1/2% senior secured notes due 2013. |

Maturity | March 15, 2013. |

Interest Rate | 10 1/2% per year (calculated using a 360-day year). |

Interest Payment Dates | March 15 and September 15. |

Ranking | The notes are our senior secured obligations, secured on a junior lien basis. The notes rank: |

| • | equally with all of our and the guarantors’, if any, existing and future senior indebtedness; and |

5

Table of Contents

| • | senior to all of our and the guarantors’, if any, future subordinated indebtedness. |

In addition, the notes are structurally subordinated to the existing and future liabilities of our subsidiaries that do not guarantee the notes and are effectively subordinated to our existing and future senior priority lien obligations, including the indebtedness under our senior credit facility and a lien we granted to the Pension Benefit Guaranty Corporation (the “PBGC”) to secure our minimum future cash contributions to our currently underfunded U.S. pension plans, to the extent of the assets securing such debt. |

As of June 30, 2006, we had $658.8 million of senior debt (including the notes), of which $333.6 million was senior priority debt, excluding approximately $16.4 million of additional available borrowing capacity under our senior credit facility. |

As of June 30, 2006, the notes were structurally subordinated to approximately$1,037.3 million of liabilities (including trade payables) of our subsidiaries. |

Security | The notes are secured by a junior lien on all of the assets that secure our obligations and those of our domestic subsidiaries under the senior credit facility (other than our and our domestic subsidiaries’ guarantee of foreign subsidiary obligations). These assets do not include assets located outside of the United States, assets or stock of our foreign subsidiaries (other than a pledge of 65% of the stock of certain of our foreign subsidiaries), and certain other excluded collateral as provided in the indenture that will govern the notes. The notes are effectively subordinated to our existing and future senior priority lien obligations, including the indebtedness under our senior credit facility and a lien we granted to the PBGC to secure our minimum future cash contributions to our currently underfunded U.S. pension plans, to the extent of the assets securing such debt. |

Guarantees | The notes will be guaranteed by any of our domestic subsidiaries that have significant assets or operations. As of the date of this prospectus, none of our domestic subsidiaries has significant assets or operations and none of our domestic subsidiaries guarantee the notes. None of our foreign subsidiaries guarantee the notes. |

Optional Redemption on or after March 15, 2009 | On or after March 15, 2009, we may redeem some or all of the notes at the redemption prices listed in the “Description of the Notes” section under the heading “Optional Redemption,” plus accrued interest to, but not including the date of redemption. |

6

Table of Contents

Optional Redemption upon Qualified Equity Offerings | At any time (which may be more than once) before March 15, 2008, we may choose to redeem up to 35% of the outstanding notes with money that we raise in one or more qualified equity offerings, as long as: |

| • | we pay 110.5% of the face amount of the notes, plus interest; |

| • | we issue a redemption notice not more than 60 days after the qualified equity offering; and |

| • | at least 65% of the aggregate principal amount of notes issued remains outstanding afterwards. |

Optional Redemption with Make-Whole Payment | At any time before March 15, 2009, we may redeem some or all of the notes at a redemption price equal to the sum of (i) 100% of the principal amount of the notes, plus (ii) a make-whole premium, plus (iii) accrued interest to, but not including, the date of redemption. |

Change of Control Offer | If a change in control of the Company occurs, we must give holders of the notes the opportunity to sell us their notes at 101% of their face amount, plus accrued interest to, but not including, the date of purchase. We might not be able to pay you the required price for notes you present to us at the time of a change of control, because: |

| • | we might not have enough funds at that time; or |

| • | the terms of our senior credit facility may prevent us from making such payments. |

Asset Sale Proceeds | If we or our subsidiaries engage in certain asset sales, we generally must either invest the net cash proceeds from such sales in our business within a period of time, prepay senior debt or make an offer to purchase a principal amount of the notes equal to the excess net cash proceeds. The purchase price of the notes will be 100% of their principal amount, plus accrued interest. |

Certain Indenture Provisions | The indenture under which the outstanding notes were issued will govern the exchange notes. The indenture contains covenants limiting our (and most or all of our subsidiaries’) ability to: |

| • | incur additional debt or enter into sale and leaseback transactions; |

| • | pay dividends or distributions on our capital stock or repurchase our capital stock; |

| • | issue stock of subsidiaries; |

| • | make certain investments; |

| • | create liens on our assets to secure debt; |

| • | enter into transactions with affiliates; |

| • | merge or consolidate with another company; |

7

Table of Contents

| • | transfer and sell assets; and |

| • | create dividend or other payment restrictions affecting our subsidiaries. |

These covenants are subject to a number of important limitations and exceptions. |

Risk Factors

Investing in the notes involves substantial risks. See “Risk Factors” for a description of certain of the risks you should consider before deciding to exchange your notes.

8

Table of Contents

Summary Historical Consolidated Financial Data

The following table sets forth selected financial data for the Company. The reader should read this information in conjunction with the Company’s Consolidated Financial Statements (audited) and Condensed Consolidated Financial Statements (unaudited) and Notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” that appear elsewhere in this prospectus. See Note 1 to the Consolidated Financial Statements regarding the Predecessor Company and the Successor Company.

| Predecessor Company | Successor Company | |||||||||||||||||||||||||||||||

Fiscal Year Ended March 31, | Period from April 1, 2004 May 5, 2004 | Period From to March 31, 2005 | Fiscal | Three Months Ended June 30, | ||||||||||||||||||||||||||||

| 2002 | 2003 | 2004 | 2005 | 2006 | ||||||||||||||||||||||||||||

(in thousands, except per | ||||||||||||||||||||||||||||||||

Statement of Operations Data | ||||||||||||||||||||||||||||||||

Net sales | $ | 2,428,550 | $ | 2,361,101 | $ | 2,500,493 | $ | 214,607 | $ | 2,476,259 | $ | 2,819,876 | $ | 669,332 | $ | 683,190 | ||||||||||||||||

Gross profit | 463,919 | 516,541 | 509,325 | 35,470 | 377,502 | 406,831 | 102,216 | 109,679 | ||||||||||||||||||||||||

Selling, marketing and advertising expenses | 290,957 | 261,299 | 264,753 | 24,504 | 251,085 | 271,059 | 71,073 | 68,506 | ||||||||||||||||||||||||

General and administrative expenses | 178,842 | 175,177 | 161,271 | 17,940 | 150,871 | 190,993 | 43,738 | 45,994 | ||||||||||||||||||||||||

Restructuring and impairment | 33,122 | 25,658 | 52,708 | 602 | 42,479 | 21,714 | 2,901 | 8,884 | ||||||||||||||||||||||||

Goodwill impairment charge | 105,000 | 37,000 | — | — | 388,524 | — | — | — | ||||||||||||||||||||||||

Other (income) expense net | 24,554 | (11,035 | ) | (40,724 | ) | 6,222 | (56,898 | ) | 3,684 | 3,400 | (3,492 | ) | ||||||||||||||||||||

Interest expense, net | 136,241 | 105,788 | 99,027 | 8,870 | 42,636 | 69,464 | 16,100 | 22,287 | ||||||||||||||||||||||||

Loss before reorganization items, income tax, minority interest and cumulative effect of change in accounting principle | (304,797 | ) | (77,346 | ) | (27,710 | ) | (22,668 | ) | (441,195 | ) | (150,083 | ) | (34,996 | ) | (32,500 | ) | ||||||||||||||||

Reorganization items, net | — | 36,370 | 67,042 | 18,434 | 11,527 | 6,158 | 1,372 | 1,607 | ||||||||||||||||||||||||

Fresh start accounting | — | — | — | (228,371 | ) | — | — | — | — | |||||||||||||||||||||||

Gain on discharge | — | — | — | (1,558,839 | ) | — | — | — | — | |||||||||||||||||||||||

Minority interest | 211 | 200 | 467 | 26 | (18 | ) | 529 | 95 | 211 | |||||||||||||||||||||||

Income tax provision (benefit) | (1,422 | ) | 26,969 | 3,271 | (2,482 | ) | 14,219 | 15,962 | (754 | ) | 3,578 | |||||||||||||||||||||

Income (Loss) before cumulative effect of change in accounting principle | (303,586 | ) | (140,885 | ) | (98,490 | ) | 1,748,564 | (466,923 | ) | (172,732 | ) | (35,709 | ) | (37,896 | ) | |||||||||||||||||

Cumulative effect of change in accounting principle(1) | (496 | ) | — | (15,593 | ) | — | — | — | — | — | ||||||||||||||||||||||

Net income (loss) | $ | (304,082 | ) | $ | (140,885 | ) | $ | (114,083 | ) | $ | 1,748,564 | $ | (466,923 | ) | $ | (172,732 | ) | $ | (35,709 | ) | $ | (37,896 | ) | |||||||||

Basic and diluted net income (loss) per share | $ | (11.35 | ) | $ | (5.14 | ) | $ | (4.17 | ) | $ | 63.86 | $ | (18.68 | ) | $ | (6.91 | ) | $ | (1.43 | ) | $ | (1.51 | ) | |||||||||

Balance Sheet Data | ||||||||||||||||||||||||||||||||

Working capital (deficit)(2) | $ | (951,866 | ) | $ | (15,876 | ) | $ | (270,394 | ) | $ | 402,076 | $ | (180,172 | ) | $ | 431,570 | $ | 395,674 | $ | 439,725 | ||||||||||||

Property, plant and equipment, net | 530,220 | 533,375 | 543,124 | 826,900 | 799,763 | 685,842 | 752,668 | 684,717 | ||||||||||||||||||||||||

Total assets | 1,915,868 | 2,372,691 | 2,471,808 | 2,729,404 | 2,290,780 | 2,082,909 | 2,153,374 | 2,083,733 | ||||||||||||||||||||||||

Total debt | 1,413,272 | 1,804,903 | 1,847,656 | 547,549 | 653,758 | 701,004 | 665,834 | 718,830 | ||||||||||||||||||||||||

Total stockholders’ equity (deficit) | (555,742 | ) | (695,369 | ) | (769,769 | ) | 888,391 | 427,259 | 224,739 | 371,015 | 209,012 | |||||||||||||||||||||

Other Financial Data | ||||||||||||||||||||||||||||||||

Cash provided by (used in): | ||||||||||||||||||||||||||||||||

Operating activities(3) | $ | (6,665 | ) | $ | (239,858 | ) | $ | 40,551 | $ | (7,186 | ) | $ | (9,691 | ) | $ | (44,348 | ) | $ | (15,506 | ) | $ | 634 | ||||||||||

Investing activities | (58,462 | ) | (39,095 | ) | (38,411 | ) | (4,352 | ) | (44,013 | ) | (32,817 | ) | (1,563 | ) | (7,870 | ) | ||||||||||||||||

Financing activities | 73,720 | 278,882 | (9,667 | ) | 35,168 | 68,925 | 34,646 | 9,001 | 11,170 | |||||||||||||||||||||||

Capital expenditures | 61,323 | 45,878 | 65,128 | 7,152 | 69,114 | 58,133 | 11,545 | 7,967 | ||||||||||||||||||||||||

Ratio of earnings to fixed charges(4) | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||

Cash dividends per share | 0.04 | — | — | — | — | — | — | — | ||||||||||||||||||||||||

9

Table of Contents

| (1) | The cumulative effect of change in accounting principle in fiscal 2002 resulted from the adoption of SFAS 133 on April 1, 2001 and in fiscal 2004 resulted from the adoption of SFAS 143 on April 1, 2003. |

| (2) | Working capital (deficit) is calculated as current assets less current liabilities, which at March 31, 2005 and March 31, 2002 reflects the reclassification of certain long-term debt as current. At March 31, 2003 and March 31, 2004, working capital (deficit) excludes liabilities of the Debtors classified as subject to compromise. |

| (3) | Cash used in operating activities in fiscal 2003 includes the repurchase of uncollected securitized accounts receivable under the terminated U.S. and European securitization programs of $117.5 million and $124.8 million, respectively. |

| (4) | For purposes of computing the ratios of earnings to fixed charges, earnings consist of income before provision for fixed charges, amortization of capitalized interest and unremitted earnings from equity investments, less interest capitalized and minority interest. Fixed charges include interest expense, amortization of deferred financing costs, amortization of original issue discount on notes and the portion of rental expense under operating leases deemed by us to be representative of the interest factor. The ratio of earnings to fixed charges was less than 1.00x for all periods presented in the table above. Earnings available for fixed charges were inadequate to cover fixed charges for the years ended March 31, 2002, 2003, and 2004 and the period from April 1, 2004 to May 5, 2004, period from May 6, 2004 to March 31, 2005, year ended March 31, 2006 and the three months ended June 30, 2006 by $303.2 million, $111.5 million, $92.4 million, $41.0 million, $452.9 million, $157.1 million and $34.3 million, respectively. |

10

Table of Contents

You should carefully consider the risks described below, together with the other information contained in this prospectus, when deciding whether to participate in the exchange offer. The risks described below are not the only risks we face additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business operations. Any of the following risks could materially adversely affect our business, financial condition or results of operations which may result in the loss of all or part of your original investment.

Risks Associated with the Exchange Offer

Because there is no public market for the notes, you may not be able to resell your notes.

The exchange notes will be registered under the Securities Act, but will constitute a new issue of securities with no established trading market, and there can be no assurance as to:

| • | the liquidity of any trading market that may develop; |

| • | the ability of holders to sell their exchange notes; or |

| • | the price at which the holders would be able to sell their exchange notes. |

If a trading market were to develop, the exchange notes might trade at higher or lower prices than their principal amount or purchase price, depending on many factors, including prevailing interest rates, the market for similar debentures and our financial performance.

We understand that the initial purchasers presently intend to make a market in the notes. However, they are not obligated to do so, and any market-making activity with respect to the notes may be discontinued at any time without notice. In addition, any market-making activity will be subject to the limits imposed by the Securities Act and the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and may be limited during the exchange offer or the pendency of an applicable shelf registration statement. There can be no assurance that an active trading market will exist for the notes or that any trading market that does develop will be liquid.

In addition, any holder of outstanding notes who tenders in the exchange offer for the purpose of participating in a distribution of the exchange notes may be deemed to have received restricted securities, and if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction. For a description of these requirements, see “Exchange Offer.”

Your outstanding notes will not be accepted for exchange if you fail to follow the exchange offer procedures and, as a result, your notes will continue to be subject to existing transfer restrictions and you may not be able to sell your outstanding notes.

We will not accept your notes for exchange if you do not follow the exchange offer procedures. We will issue exchange notes as part of this exchange offer only after a timely receipt of your outstanding notes, a properly completed and duly executed letter of transmittal and all other required documents. Therefore, if you want to tender your outstanding notes, please allow sufficient time to ensure timely delivery. If we do not receive your notes, letter of transmittal and other required documents by the expiration date of the exchange offer, we will not accept your notes for exchange. We are under no duty to give notification of defects or irregularities with respect to the tenders of outstanding notes for exchange. If there are defects or irregularities with respect to your tender of notes, we may not accept your notes for exchange. For more information, see “Exchange Offer.”

If you do not exchange your outstanding notes, your outstanding notes will continue to be subject to the existing transfer restrictions and you may not be able to sell your outstanding notes.

We did not register the outstanding notes, nor do we intend to do so following the exchange offer. Outstanding notes that are not tendered will therefore continue to be subject to the existing transfer restrictions

11

Table of Contents

and may be transferred only in limited circumstances under the securities laws. If you do not exchange your outstanding notes, you will lose your right to have your outstanding notes registered under the federal securities laws. As a result, if you hold outstanding notes after the exchange offer, you may not be able to sell your outstanding notes.

If you exchange your outstanding notes, you may not be able to resell the exchange notes you receive in the exchange offer without registering them and delivering a prospectus.

You may not be able to resell exchange notes you receive in the exchange offer without registering those exchange notes or delivering a prospectus. Based on interpretations by the SEC in no-action letters, we believe, with respect to exchange notes issued in the exchange offer, that:

| • | holders who are not “affiliates” of the Company within the meaning of Section 405 of the Securities Act; |

| • | holders who acquire their exchange notes in the ordinary course of business; |

| • | holders who do not engage in, intend to engage in, or have arrangements to participate in a distribution (within the meaning of the Securities Act) of the exchange notes; and |

| • | holders who are not broker-dealers |

do not have to comply with the registration and prospectus delivery requirements of the Securities Act.

Holders described in the preceding sentence must tell us in writing at our request that they meet these criteria. Holders that do not meet these criteria cannot rely on interpretations of the SEC in no-action letters, and will have to register the exchange notes they receive in the exchange offer and deliver a prospectus for them. In addition, holders that are broker-dealers may be deemed “underwriters” within the meaning of the Securities Act in connection with any resale of exchange notes acquired in the exchange offer. Holders that are broker-dealers must acknowledge that they acquired their outstanding exchange notes in market-making activities or other trading activities and must deliver a prospectus when they resell exchange notes they acquire in the exchange offer in order not to be deemed an underwriter.

Risks Related to Our Business

We have experienced significant increases in raw material prices, particularly lead, and further changes in the prices of raw materials or in energy costs could have a material adverse impact on our business and financial condition.

Lead is the primary material by weight used in the manufacture of lead-acid batteries, representing approximately one-third of our cost of goods sold. Average lead prices quoted on the London Metal Exchange (the “LME”) have risen dramatically, increasing from $920.00 per metric tonne for fiscal 2005 to $1,041.00 per metric tonne for fiscal 2006. As of September 20, 2006, lead prices quoted on the LME were $1,345.00 per metric tonne. If we are unable to increase the prices of our products proportionate to the increase in raw material costs, our gross margins will decline. We cannot provide assurance that we will be able to hedge our lead requirements at reasonable costs or that we will be able to pass on these costs to our customers. Increases in our prices could also cause customer demand for our products to be reduced and net sales to decline. The rising cost of lead requires us to make significant investments in inventory and accounts receivable, which reduces amounts of cash available for other purposes, including making payments on our notes and other indebtedness. We also consume significant amounts of steel and other materials in our manufacturing process and incur energy costs in connection with manufacturing and shipping of our products. The market prices of these materials are also subject to fluctuation, which could further reduce our available cash.

12

Table of Contents

The going concern modification received from our independent registered public accounting firm for the fiscal year ended March 31, 2006 could cause adverse reactions from our creditors, vendors, customers and others.

Our financial statements for our fiscal year ended March 31, 2006 contain an audit report from our independent registered public accounting firm PricewaterhouseCoopers LLP that contains a “going concern modification,” stating that the uncertainty with respect to our ability to maintain compliance with our financial covenants through fiscal 2007 raises substantial doubt about our ability to continue as a going concern. This going concern modification was based on our suffering recurring losses and negative cash flows from operations and our inability to comply with one or more of the covenants of our senior secured credit facility during fiscal 2005 and fiscal 2006. There is no assurance that we will be able to meet our fiscal 2007 business plan and be in compliance with our senior secured credit facility through March 31, 2007. This going concern modification could create concerns on the part of our creditors, vendors, customers and others about whether we will be able to fulfill our contractual obligations and otherwise continue to operate our business, which could result in a tightening of our liquidity. The going concern modification could also be perceived negatively by the capital markets, which could adversely affect the prices of our common stock as well as our ability to raise capital.

We are subject to a preliminary SEC inquiry.

On July 1, 2005 we were informed by the Enforcement Division of the SEC that it has commenced a preliminary inquiry into statements we made during fiscal 2006 about our ability to comply with fiscal 2005 loan covenants and the going concern modification in the audit report in our annual report on Form 10-K for fiscal 2005, which we filed with the SEC in June 2005. If the preliminary inquiry results in a formal investigation, it could have a material adverse effect on our financial position, results of operations and cash flows.

We are subject to fluctuations in exchange rates and other risks associated with our non-U.S. operations which could adversely affect our results of operations.

We have significant manufacturing operations in, and export to, several countries outside the United States. Approximately 58% of our net sales for fiscal 2006 were generated in Europe and ROW, with the vast majority generated in Europe in Euros and British Pounds. Because such a significant portion of our operations is based overseas, we are exposed to foreign currency risk, resulting in uncertainty as to future assets and liability values, and results of operations that are denominated in foreign currencies. We invoice foreign sales and service transactions in local currencies, using actual exchange rates during the period, and translate these revenues and expenses into U.S. dollars at average monthly exchange rates. Because a significant portion of our net sales and expenses are denominated in foreign currencies, the depreciation of these foreign currencies in relation to the U.S. dollar could adversely affect our reported net sales and operating margins. We translate our non-U.S. assets and liabilities into U.S. dollars using current rates as of the balance sheet date. Therefore, foreign currency depreciation against the U.S. dollar would result in a decrease of our net investment in foreign subsidiaries.

In addition, foreign currency depreciation, particularly depreciation of the Euro, would make it more expensive for our non-U.S. subsidiaries to purchase certain of our raw material commodities that are priced globally in U.S. dollars, such as lead, which is quoted on the LME in U.S. dollars. We do not engage in significant hedging of our foreign currency exposure and cannot assure that we will be able to hedge our foreign currency exposures at a reasonable cost.

There are other risks inherent in our non-U.S. operations, including:

| • | changes in local economic conditions, including disruption of markets; |

| • | changes in laws and regulations, including changes in import, export, labor and environmental laws; |

| • | exposure to possible expropriation or other government actions; and |

| • | unsettled political conditions and possible terrorist attacks against American interests. |

These and other factors may have a material adverse effect on our non-U.S. operations or on our results of operations and financial condition.

13

Table of Contents

Our liquidity is affected by the seasonality of our business. Warm winters and cool summers adversely affect us.

We sell a disproportionate share of our automotive aftermarket batteries during the fall and early winter. Resellers buy automotive batteries during these periods so they will have sufficient inventory for cold weather periods. In addition, many of our industrial battery customers in Europe do not place their battery orders until the end of the calendar year. This seasonality increases our working capital requirements and makes us more sensitive to fluctuations in the availability of liquidity. Unusually cold winters or hot summers may accelerate battery failure and increase demand for automotive replacement batteries. Mild winters and cool summers may have the opposite effect. As a result, if our sales are reduced by an unusually warm winter or cool summer, it is not possible for us to recover these sales in later periods. Further, if our sales are adversely affected by the weather, we cannot make offsetting cost reductions to protect our liquidity and gross margins in the short-term because a large portion of our manufacturing and distribution costs are fixed.

Decreased demand in the industries in which we operate may adversely affect our business.

Our financial performance depends, in part, on conditions in the automotive, material handling and telecommunications industries, which, in turn, are generally dependent on the U.S. and global economies. As a result, economic and other factors adversely affecting production by original equipment manufacturers (“OEMs”) and their customers’ spending could adversely impact our business. Relatively modest declines in customer purchases from us could have a significant adverse impact on our profitability because we have substantial fixed production costs. If our OEM and large aftermarket customers reduce their inventory levels, and reduce their orders, our performance would be significantly adversely impacted. In this environment, we cannot predict future production rates or inventory levels or the underlying economic factors. Continued uncertainty and unexpected fluctuations may have a significant negative impact on our business.

The remaining portion of our battery sales are of aftermarket batteries. The factors influencing demand for automotive replacement batteries include: (1) the number of vehicles in use; (2) average battery life; (3) the average age of vehicles and their operating environment; (4) weather conditions; and (5) population growth and overall economic conditions. Any significant adverse change in any one of these factors may have a significant negative impact on our business.

The loss of our sole supplier of polyethylene battery separators would have a material adverse effect on our business.

We rely exclusively on a single supplier to fulfill our needs for polyethylene battery separators—a critical component to many of our products. There is no second source that could readily provide the volume of polyethylene separators used by us. As a result, any major disruption in supply from this supplier would have a material adverse impact on us. If we are not able to maintain a good relationship with this supplier, or if for reasons beyond our control the supplier’s service were disrupted, our business may experience a significant negative impact.

Many of the industries in which we operate are cyclical.

Our operating results are affected by the general cyclical pattern of the industries in which our major customer groups operate. Any decline in the demand for new automobiles, light trucks, and sport utility vehicles could have a material adverse impact on the financial condition and results of operations of our transportation battery divisions. A weak capital expenditure environment in the telecommunications, uninterruptible power systems and electric industrial forklift truck markets could have a material adverse impact on the financial condition and results of operations of our industrial energy divisions.

14

Table of Contents

We are subject to pricing pressure from our larger customers.

We face significant pricing pressures in all of our business segments from our larger customers. Because of our customers’ purchasing size, our larger customers can influence market participants to compete on price and other terms. Such customers also use their buying power to negotiate lower prices. If we are not able to offset pricing reductions resulting from these pressures by improved operating efficiencies and reduced expenditures, those price reductions may have an adverse impact on our business.

We face increasing competition and pricing pressure from other companies in our industries, and if we are unable to compete effectively with these competitors, our sales and profitability could be adversely affected.

We compete with a number of major domestic and international manufacturers and distributors of lead acid batteries, as well as a large number of smaller, regional competitors. Due to excess capacity in some sectors of our industry and consolidation among industrial purchasers, we have been subjected to continual and significant pricing pressures. The North American, European and Asian lead acid battery markets are highly competitive. The manufacturers in these markets compete on price, quality, technical innovation, service and warranty. In addition, we are experiencing heightened competitive pricing pressure as Asian producers, able to employ labor at significantly lower costs than producers in the U.S. and Western Europe, expand their export capacity and increase their marketing presence in our major markets.

If we are not able to develop new products or improve upon our existing products on a timely basis, our business and financial condition could be adversely affected.

We believe that our future success depends, in part, on the ability to develop, on a timely basis, new technologically advanced products or improve on our existing products in innovative ways that meet or exceed our competitors’ product offerings. Maintaining our market position will require continued investment in research and development and sales and marketing. Industry standards, customer expectations, or other products may emerge that could render one or more of our products less desirable or obsolete. We may be unsuccessful in making the technological advances necessary to develop new products or improve our existing products to maintain our market position. If any of these events occur, it could cause decreases in sales and have an adverse effect on our business and financial condition.

We may be adversely affected by the instability and uncertainty in the world financial markets and the global economy, including the effects of turmoil in the Middle East.

Instability in the world financial markets and the global economy, including (and as a result of) the turmoil in the Middle East, may create uncertainty in the industries in which we operate, and may adversely affect our business. In addition, terrorist activities may cause unpredictable or unfavorable economic conditions and could have a material adverse impact on our operating results and financial condition.

We may be unable to successfully implement our business strategy, which could adversely affect our results of operations and financial condition.

Our ability to achieve our business and financial objectives is subject to a variety of factors, many of which are beyond our control. For example, we may not be successful in increasing our manufacturing and distribution efficiency through productivity, process improvements and cost reduction initiatives. Further, we may not be able to realize the benefits of these improvements and initiatives within the time frames we currently expect. In addition, we may not be successful in increasing our percentage of captive arrangements and spent battery collections or in hedging our lead requirements, leaving us exposed to fluctuations in the price of lead. Additionally, our implementation of these strategies could be delayed due to our limited liquidity. Any failure to successfully implement our business strategy could adversely affect results of operations and financial condition, and could further impair our ability to make certain strategic capital expenditures and meet our restructuring objectives.

15

Table of Contents

We are subject to costly regulation in relation to environmental, health and safety matters, which could adversely affect our business and results of operations.

In the manufacture of our products throughout the world, we manufacture, distribute, recycle and otherwise use large amounts of potentially hazardous materials, especially lead and acid. As a result, we are subject to a substantial number of costly regulations, including limits on employee blood lead levels. In particular, we are required to comply with increasingly stringent requirements of federal, state and local environmental and occupational safety and health laws and regulations in the United States and other countries, including those governing emissions to air, discharges to water, noise and odor emissions; the generation, handling, storage, transportation, treatment and disposal of waste materials; and the cleanup of contaminated properties and human health and safety. Compliance with these laws and regulations results in ongoing costs. We could also incur substantial costs, including cleanup costs, fines and civil or criminal sanctions, third party property damage or personal injury claims, or costs to upgrade or replace existing equipment, as a result of violations of or liabilities under environmental laws or non-compliance with environmental permits required at our facilities. In addition, many of our current and former facilities are located on properties with histories of industrial or commercial operations. Because some environmental laws can impose liability for the entire cost of cleanup upon any of the current or former owners or operators, regardless of fault, we could become liable for the cost of investigating or remediating contamination at these properties if contamination requiring such activities is discovered in the future. We may become obligated to pay material remediation-related costs at our Tampa, Florida facility in the amount of approximately $12.5 million to $20.5 million, at the Columbus, Georgia facility in the amount of approximately $6.0 million to $9.0 million and at the Sonalur, Portugal facility in the amount of $3.5 million to $7.0 million.

We cannot be certain that we have been, or will at all times be, in complete compliance with all environmental requirements, or that we will not incur additional material costs or liabilities in connection with these requirements in excess of amounts we have reserved. Private parties, including current or former employees, could bring personal injury or other claims against us due to the presence of, or exposure to, hazardous substances used, stored or disposed of by us, or contained in our products, especially lead. Environmental requirements are complex and have tended to become more stringent over time. These requirements or their enforcement may change in the future in a manner that could have a material adverse effect on our business, results of operations and financial condition. We have made and will continue to make expenditures to comply with environmental requirements. These requirements, responsibilities and associated expenses and expenditures, if they continue to increase, could have a material adverse effect on our business and results of operations. While our costs to defend and settle claims arising under environmental laws in the past have not been material, we cannot provide assurance that this will remain so in the future.

16

Table of Contents

The EPA or state environmental agencies could take the position that we have liability under environmental laws that were not discharged in bankruptcy. To the extent these authorities are successful in disputing the pre-petition nature of these claims, we could be required to perform remedial work that has not yet been performed for alleged pre-petition contamination, which would have a material adverse effect on our financial condition, cash flows or results of operations.

The EPA or state environmental agencies could take the position that we have liability under environmental laws that were not discharged in bankruptcy. To the extent these authorities are successful in disputing the pre-petition nature of these claims, we could be required to perform remedial work that has not yet been performed for alleged pre-petition contamination, which would have a material adverse effect on our financial condition, cash flows or results of operations. We have previously been advised by the EPA or state agencies that we are a “Potentially Responsible Party” under the Comprehensive Environmental Response, Compensation and Liability Act or similar state laws at 97 federally defined Superfund or state equivalent sites. At 45 of these sites, we have paid our share of liability and believe that it is probable that our liability for most of the remaining sites will be treated as disputed unsecured claims under our Joint Plan of Reorganization (the “Plan”). However, there can be no assurance that these matters will be discharged. In addition, the EPA, in the course of negotiating this pre-petition claim, had notified us of the possibility of additional clean-up costs associated with Hamburg, Pennsylvania properties of approximately $35.0 million. To date, the EPA has not made a formal claim for this amount or provided any support for this estimate. To the extent the EPA or other environmental authorities disputed the pre-petition nature of these claims, we would intend to resist any such effort to evade the bankruptcy law’s intended result, and believe there are substantial legal defenses to be asserted in that case. However, there can be no assurance that we would be successful in challenging any such actions.

We may be adversely affected by legal proceedings to which we are, or may become, a party.

We are subject to a number of litigation and regulatory proceedings, the results of which could have a material adverse effect on our business, financial condition or results of operations. No assurances can be given that we will be able to successfully defend any such litigation and regulatory proceedings, and adverse results in one or more of such litigation and regulatory proceedings could have a material adverse effect on our business or operations.

The cost of resolving our pre-petition disputed claims, including legal and other professional fees involved in settling or litigating these matters, could have a material adverse effect on our financial condition, cash flows and results of operations.

At March 31, 2006, there were approximately 1,400 pre-petition disputed unsecured claims on file in the bankruptcy case that remain to be resolved through our 2004 plan of reorganization’s claims reconciliation and allowance procedures. We established a reserve of common stock and warrants to purchase common stock for issuance to holders of these disputed unsecured claims as the claims are allowed by the bankruptcy court. Although these claims are generally resolved through the issuance of common stock and warrants from the reserve rather than the payment of money, the process of resolving these claims through settlement or litigation requires considerable resources, including expenditures for legal and professional fees and the attention of our personnel. These costs could have a material adverse effect on our financial condition, cash flows and results of operations. We are unable to predict how the recent declines in our stock price will impact this process given that our common stock is the currency in which these claims are resolved. On the one hand, lower stock prices may make some plaintiffs less willing to litigate but, on the other hand, may make some plaintiffs less willing to settle for less than the full amount of their claims depending on a variety of factors, including the strength of the plaintiff’s claims and the size of the plaintiff’s anticipated ultimate award.

17

Table of Contents

Work stoppages or other labor issues at our facilities or our customers’ or suppliers’ facilities could adversely affect our operations.

At March 31, 2006, approximately 20% of our North American and many of our non-U.S. employees were unionized. It is likely that a significant portion of our workforce will remain unionized for the foreseeable future. It is also possible that the portion of our workforce that is unionized may increase in the future. Contracts covering approximately 591 of our domestic employees will expire in 2007, and the remainder thereafter. In addition, contracts covering most of our union employees in Europe and the rest of the world expire on various dates through fiscal 2007. Although we believe that our relations with employees are generally good, if conflicts develop between us and our employees’ unions in connection with the renegotiation of these contracts or otherwise, work stoppages or other labor disputes could result. A work stoppage at one or more of our plants, or a material increase in our costs due to unionization activities, may have a material adverse effect on our business. Work stoppages at the facilities of our customers or suppliers may also negatively affect our business. If any of our customers experience a material work stoppage, that customer may halt or limit the purchase of our products. This could require us to shut down or significantly reduce production at facilities relating to those products. Moreover, if any of our suppliers experience a work stoppage, our operations could be adversely affected if an alternative source of supply is not readily available.

Our ability to operate our business effectively could be impaired if we fail to attract and retain experienced key personnel.

Our success depends, in part, on the continued contributions and experience of our senior officers and other key personnel. Certain of our senior officers are relatively new. The fact that certain of our key senior officers are recent additions to our staff and may not possess knowledge of our historical operations could adversely affect the operation of our business. Moreover, if in the future we lose or suffer an extended interruption in the service of one or more of our other senior officers or key employees, our financial condition and operating results may be adversely affected.

Our internal control over financial reporting was not effective as of March 31, 2006.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, and the rules and regulations promulgated thereunder, our management was required to furnish a report on, and our independent registered public accounting firm attested to, our internal controls over financial reporting in our Annual Report on Form 10-K for the fiscal year ended March 31, 2006. In connection with the preparation of this report, our management assessed the effectiveness of our internal control over financial reporting as of March 31, 2006, and this assessment identified several material weaknesses relating to ineffective controls over accounting for inventories and investments in affiliates, lack of sufficient resources in accounting and finance, lack of segregation of duties and ineffective controls over period-end accounting for income taxes. Because of these material weaknesses, our management concluded that our internal controls over financial reporting were not effective as of March 31, 2006 based on the criteria in theInternal Control Integrated Frameworkissued by the Committee of Sponsoring Organizations of the Treadway Commission. In an effort to remediate the material weaknesses and other deficiencies, we are currently implementing a number of changes to our internal controls including hiring additional personnel to focus on ongoing remediation initiatives. However, there can be no assurance that such remediation steps will be successful, that we will not have significant deficiencies or other material weaknesses in the future or that, when next evaluated, our management will conclude, and our auditors will determine, that our internal control over financial reporting is effective. Any failure to implement effective internal controls could harm our operating results or cause us to fail to meet our reporting obligations. Inadequate internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our common stock, and may require us to incur additional costs to improve our internal control system.

18

Table of Contents

Our substantial indebtedness could adversely affect our financial condition.

We have a significant amount of indebtedness. As of June 30, 2006, we had total indebtedness, including capital leases, of approximately $718.8 million. Our level of indebtedness could have significant consequences. For example, it could:

| • | limit our ability to borrow money or sell stock to fund our working capital, capital expenditures, acquisitions and debt service requirements; |

| • | substantially increase our vulnerability to changes in interest rates, because a substantial portion of our indebtedness bears interest at floating rates; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and future business opportunities; |

| • | make us more vulnerable to a downturn in our business or in the economy; |

| • | place us at a disadvantage to some of our competitors, who may be less highly leveraged than us; and |

| • | require a substantial portion of our cash flow from operations to be used for debt payments, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions and other general corporate purposes. |

One or a combination of these factors could adversely affect our financial condition. Subject to restrictions in the indenture governing our convertible notes and our senior secured credit facility, we may incur additional indebtedness, which could increase the risks associated with our already substantial indebtedness.

Restrictive covenants restrict our ability to operate our business and to pursue our business strategies, and our failure to comply with these covenants could result in an acceleration of our indebtedness.

Our senior credit facility and the indenture governing our senior secured notes contain covenants that restrict our ability to finance future operations or capital needs, to respond to changing business and economic conditions or to engage in other transactions or business activities that may be important to our growth strategy or otherwise important to us. The credit agreement and the indenture governing our senior secured notes restrict, among other things, our ability and the ability of our subsidiaries to:

| • | incur additional indebtedness or enter into sale and leaseback transactions; |

| • | pay dividends or make distributions on our capital stock or certain other restricted payments or investments; |

| • | purchase or redeem stock; |

| • | issue stock of our subsidiaries; |

| • | make investments and extend credit; |

| • | engage in transactions with affiliates; |

| • | transfer and sell assets; |

| • | effect a consolidation or merger or sell, transfer, lease or otherwise dispose of all or substantially all of our assets; and |

| • | create liens on our assets to secure debt. |

In addition, our senior credit facility requires us to maintain minimum consolidated earnings before interest, taxes, depreciation, amortization and restructuring costs (“Adjusted EBITDA”) and requires us to repay outstanding borrowings with portions of the proceeds we receive from certain sales of property or assets and specified future debt offerings. Our ability to comply with the covenants in our senior credit facility may be affected by events beyond our control, and we may not be able to meet the financial ratios.

Any breach of the covenants in our senior secured credit agreement or the indenture governing our senior secured notes could cause a default under our senior secured credit agreement and other debt (including our

19

Table of Contents

notes), which would restrict our ability to borrow under our credit facility, thereby significantly impacting our liquidity. If there were an event of default under any of our debt instruments that was not cured or waived, the holders of the defaulted debt could cause all amounts outstanding with respect to the debt instrument to be due and payable immediately. Our assets and cash flow may not be sufficient to fully repay borrowings under our outstanding debt instruments if accelerated upon an event of default. If, as or when required, we are unable to repay, refinance or restructure our indebtedness under, or amend the covenants contained in, our senior credit facility, the lenders under our senior credit facility could institute foreclosure proceedings against the assets securing borrowings under the senior credit facility.

In fiscal 2005 and 2006, we were unable to comply with certain financial and other covenants in our senior credit facility at various times. In order to avoid an event of default, we were required to obtain waivers and amendments of such covenants from the lenders. This resulted in the payment of amendment fees as well as legal fees and other costs associated with the amendments, adversely affected our ability to maintain trade credit terms and contributed to our independent auditors including a going concern modification in their reports on our fiscal 2005 and 2006 financial statements.

We have entered into a plea agreement with the U.S. Attorney for the Southern District of Illinois under which we are required to pay a fine of $27.5 million over five years. If we are unable to post adequate security for this fine by February 2007 and the U.S. District Court is unwilling to modify the plea agreement, we could be unable to remain in compliance with the provisions of our senior credit facility and the indenture governing our senior secured notes, which could have a material adverse effect on our business and financial condition.

In 2001, we reached a plea agreement with the U.S. Attorney for the Southern District of Illinois (the “U.S. Attorney”) resolving an investigation into a scheme by former officers and certain corporate entities involving fraudulent representations and promises in connection with the distribution, sale and marketing of automotive batteries between 1994 and 1997. We agreed to pay a fine of $27.5 million over five years, to five-years probation and to cooperate with the U.S. Attorney in its prosecution of the former officers. We filed for bankruptcy in April 2002 and did not pay any installments of the criminal fine before or during our bankruptcy proceedings, nor did we pay any installments of the criminal fine after we emerged from bankruptcy in May 2004. In 2002, the U.S. Attorney filed a claim against us as a general unsecured creditor and on May 31, 2006, the District Court approved a Joint Agreement and Proposed Joint Resolution of Issues Raised in the Government’s Motion Filed on November 18, 2005 Regarding the Payment of Criminal Fine and modified our schedule to pay the $27.5 million fine through quarterly payments over the next five years, ending in 2011. Under the order, we must provide security in a form acceptable to the court and to the government by February 26, 2007 for its guarantee of any remaining unpaid portion of the fine, but may petition the court if we believe our financial viability would be jeopardized by providing such security. If we are not able to provide security in a form acceptable to the court and to the government by February 26, 2007 and the district court is unwilling to modify the plea agreement, then the resulting obligation to provide such security could result in our inability to maintain compliance with our senior credit facility and the indenture governing our senior secured notes, which could have a material adverse effect on our business and financial condition.

We have large pension contributions required over the next several years.

Cash contributions to our pension plans are generally made in accordance with minimum regulatory requirements. Our U.S. plans are currently significantly under-funded. Based on current assumptions and regulatory requirements, our minimum future cash contribution requirements for our U.S. plans are expected to remain relatively high for the next few fiscal years. On November 17, 2004, we received written notification of a tentative determination from the Internal Revenue Service (“IRS”) granting a temporary waiver of its minimum funding requirements for our U.S. plans for calendar years 2003 and 2004, amounting to approximately $50.0 million, net, under Section 412(d) of the Internal Revenue Code, subject to providing a lien satisfactory to the Pension Benefit Guaranty Corporation (“PBGC”). Based upon the temporary waiver and sensitivity to varying

20

Table of Contents

economic scenarios, we expect our cumulative minimum future cash contributions to our U.S. pension plans will total approximately $115.0 million to $165.0 million from fiscal 2007 to fiscal 2011, including $46.7 million in fiscal 2007. We expect that cumulative contributions to our non U.S. pension plans will total approximately $84.0 million from fiscal 2007 to fiscal 2011, including $16.1 million in fiscal 2007. In addition, we expect that cumulative contributions to our other post-retirement benefit plans will total approximately $13.0 million from fiscal 2007 to fiscal 2011, including $2.8 million in fiscal 2007.

Risks Related to the Notes

As of the date of this prospectus, none of our subsidiaries guarantee our obligations under the notes and they do not have any obligations with respect to the notes, and therefore the notes are structurally subordinated to the debt and liabilities of our subsidiaries.

For fiscal 2006, our subsidiaries accounted for approximately 61% of our consolidated net sales and 68% of our consolidated assets. As of the date of this prospectus, none of our subsidiaries guarantee our obligations under the notes and they will not have any obligation with respect to the notes. Consequently, we will be dependent on dividends and other payments from our subsidiaries, none of which have guaranteed the notes, to make payments of principal and, when they elect to or are required to pay interest in cash, interest on the notes. Our subsidiaries are separate and distinct legal entities, and they have no obligation, contingent or otherwise, to pay those amounts, whether by dividend, distribution, loan or other payments. You will not have any direct claim on the cash flows or assets of our subsidiaries unless they become guarantors of the notes.

Generally, claims of creditors of a subsidiary, including trade creditors, will have priority with respect to the assets and earnings of such subsidiary over the claims of creditors of its parent company. Your rights under the notes, therefore, will be structurally subordinated to those of the creditors of our subsidiaries. In the event of bankruptcy or insolvency, you may receive less, ratably, than holders of debt of our subsidiaries. As of June 30, 2006, our subsidiaries had$1,037.3 million of indebtedness and other liabilities, including trade payables, and the notes were structurally subordinated to all such indebtedness and other liabilities.

The notes are effectively subordinated to our secured debt that is secured by a senior priority lien to the extent of the value of the assets securing that debt.