Investor Presentation June 2014 Investor Road Show Presentation Filed by: CBS Corporation Pursuant to Rule 425 under the Securities Act of 1933, as amended Subject Company: CBS Corporation Commission File No.: 333-196652 |

2 Disclaimer Non-GAAP Financial Measures This presentation may include certain non-GAAP measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of these non-GAAP measures to GAAP measures can be found in the Appendix of this presentation. Numbers in this presentation may not sum due to rounding. Forward-Looking Statements This presentation may include forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “could,” “may,” “might,” “will,” “should,” “seeks,” “likely,” “intends,” “plans,” “predicts,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward- looking statements by discussions of strategy, plans or intentions. In particular, statements pertaining to our capital resources, portfolio performance and results of operations contain forward-looking statements. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and we may not be able to realize them. Neither we nor CBS Corporation (“CBS”) guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: declines in advertising and general economic conditions; competition; government regulation; our inability to increase the number of digital advertising displays in our portfolio; taxes, fees and registration requirements; our ability to obtain and renew key municipal concessions on favorable terms; decreased government compensation for the removal of lawful billboards; content-based restrictions on outdoor advertising; environmental, health and safety laws and regulations; seasonal variations; future acquisitions and other strategic transactions; time and resources to comply with rules and regulations as a stand-alone public company; charges in connection with the separation and incremental costs as a stand-alone public company; dependence on our management team and advertising executives; the ability of our board of directors to cause us to issue additional shares of stock without stockholder approval; certain provisions of Maryland law may limit the ability of a third party to acquire control of us; our rights and the rights of our stockholders to take action against our directors and officers are limited; we may not realize the expected benefits from the separation of our business from CBS; we have substantial indebtedness, which could adversely affect our financial condition; the terms of the credit agreement and the indenture governing our debt restrict our current and future operations, particularly our ability to incur additional debt that we may need to fund initiatives in response to changes in our business, the industries in which we operate, the economy and governmental regulations; incurrence of additional debt; interest rate risk exposure from our variable-rate indebtedness; hedging transactions; establishing an operating partnership; asset impairment charges for goodwill; diverse risks in our international business; breach of security measures; we have a limited right to use the CBS mark and logo; our current financial information may not be a reliable indicator of our future results; cash available for distributions; legislative, administrative, regulatory or other actions affecting real estate investment trusts (“REITs”), including positions taken by the IRS; our failure to qualify, or remain qualified, to be taxed as a REIT; REIT ownership limits; dividends payable by REITs do not qualify for the reduced tax rates available for some dividends; REIT distribution requirements; availability of external sources of capital; we may face other tax liabilities that reduce our cash flows; complying with REIT requirements may cause us to liquidate investments or forgo otherwise attractive opportunities; our ability to contribute certain contracts to a taxable REIT subsidiary (“TRS”); our planned use of TRSs may cause us to fail to qualify to be taxed as a REIT; our ability to hedge effectively; paying the cash portion of the earnings and profits allocated to us by CBS as a distribution and/or taxable dividends in common stock and cash; failure to meet the REIT income tests as a result of receiving non-qualifying rental income; even if we qualify to be taxed as a REIT, and we sell assets, we could be subject to tax on any unrealized net built- in gains in the assets held before electing to be treated as a REIT; the IRS may deem the gains from sales of our outdoor advertising assets to be subject to a 100% prohibited transaction tax; our lack of an operating history as a REIT; a substantial amount of our common stock will enter the market as a result of the exchange offer and related transactions; the trading prices of shares of CBS Class B common stock and our common stock will fluctuate and the final per-share values used in determining the exchange ratio may not be indicative of future trading prices; tendering CBS stockholders may receive our common stock at a reduced discount or may not receive any discount in the exchange offer; participating CBS stockholders will experience some delay in receiving shares of our common stock (and cash in lieu of fractional shares of our common stock, if any) for shares of CBS Class B common stock that are accepted in the exchange offer; market prices for shares of CBS Class B common stock may be impacted by the exchange offer; if the split-off, including the exchange offer, together with certain related transactions, does not qualify as a transaction that is generally tax-free for U.S. federal income tax purposes, CBS, us, and CBS stockholders could be subject to significant tax liabilities and, in certain circumstances, we could be required to indemnify CBS for material taxes pursuant to indemnification obligations under the tax matters agreement; we may not be able to engage in desirable strategic or capital-raising transactions following the split-off, and we could be liable for adverse tax consequences resulting from engaging in significant strategic or capital-raising transactions; if the exchange offer is not fully subscribed, CBS may continue to control us, which could prevent our stockholders from influencing significant decisions; and other factors described in our filings with the Securities and Exchange Commission (the “SEC”), including but not limited to the section entitled “Risk Factors” of our Registration Statement on Form S-4, filed with the SEC on June 11, 2014. All forward-looking statements in this presentation apply as of the date of this presentation or as of the date they were made and, except as required by applicable law, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors of new information, data or methods, future events or other changes. Additional Information CBS Outdoor has filed a Registration Statement on Form S-4 (File No. 333-196652) with the SEC. The terms and conditions of the exchange offer are more fully described in the Registration Statement on Form S-4 and a Schedule TO filed by CBS Corporation with the SEC. The prospectus, which is included in the Registration Statement on Form S-4, contains important information about CBS Corporation, CBS Outdoor, the exchange offer, the separation and related matters. CBS Corporation has delivered the prospectus to its stockholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ CAREFULLY AND IN ITS ENTIRETY THE PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BY CBS CORPORATION AND CBS OUTDOOR WHEN THEY BECOME AVAILABLE AND BEFORE MAKING ANY INVESTMENT DECISION. None of CBS Corporation, CBS Outdoor or their respective directors or officers or any dealer manager appointed with respect to the exchange offer makes any recommendation as to whether any investors should participate in the exchange offer. This presentation is for informational purposes only and is neither an offer to sell nor an offer to buy any securities, nor is it a recommendation as to whether investors should participate in the exchange offer. The offer is made solely by means of the prospectus. Investors may obtain a free copy of the prospectus and other related documents filed with the SEC by CBS Corporation and CBS Outdoor at the SEC’s web site at www.sec.gov, and those documents may also be obtained for free, as applicable, from CBS at www.cbscorporation.com or CBS Outdoor at www.cbsoutdoor.com. |

3 Exchange Offer Summary Offer to Exchange Up to 97,000,000 shares 1 of CBS Outdoor Americas Inc. (“CBSO”) common stock for outstanding shares of CBS Corp (“CBS”) Class B common stock Target Discount on CBSO 7% based on average of Volume Weighted Average Prices of CBS and CBSO during the Pricing Period (subject to the Upper Limit Exchange Ratio) Upper Limit Exchange Ratio 2.1917 shares of CBSO per share of CBS tendered (represents a 13% discount to CBSO based on June 10 closing prices) Pricing Period Currently expected to be July 7, 8, and 9 Expiration Currently expected July 9, 2014 at 12:00 midnight EDT Exchange / Ticker NYSE / CBSO, NYSE / CBS (Class B) Dealer Managers Goldman Sachs, Morgan Stanley Minimum Amount 58,200,000 shares of CBSO distributed (60% of shares held by CBS as of June 10, 2014) 1 Representing CBS Corporation’s entire remaining interest in CBS Outdoor Americas Inc. |

4 Agenda CBSO Highlights Growth Dynamics Company Overview Financial Summary |

$ 1,303 $ 415 $ 60 Revenue OIBDA Capex Financial Profile 3 5 Highlights Large Market Focus Leading presence in the U.S. Top 25 DMAs Strong operations in Canada and Latin America Hard-to-Replicate Portfolio of Assets Reinvigorated Organization Poised for Continued Growth 3 LTM March 31, 2014. Reflects Adjusted OIBDA. See page 45 for a reconciliation of Adjusted OIBDA to Operating Income. 4 As of March 31, 2014. 1 As of 12/31/13. Source: OAAA 2013 U.S.; Company reports. CBSO includes the US; Clear Channel represents the Americas including Canada; Lamar and JCDecaux include the U.S. A Leader in a Fragmented Industry 2 CBSO 19% Other 36% CCO 21% LAMR 21% JCD 4% Innovative Marketing Solutions Provider 20,300 clients 4 Local and national strength 356,000+ displays 1 2 CBSO: A Market LEADER in a GROWTH Industry |

6 Investment HIGHLIGHTS Attractive Industry Fundamentals Superior and Hard-to-Replicate Real Estate Portfolio Multiple Levers to Enhance Growth – Digital Conversion, Yield Management, Select Acquisitions Energized Management Team and Sales Force Consistent Revenue Growth, High Incremental Margins, Powerful Free Cash Flow Strong and Efficient Balance Sheet with Financial Flexibility Growth + Sustainable Dividends |

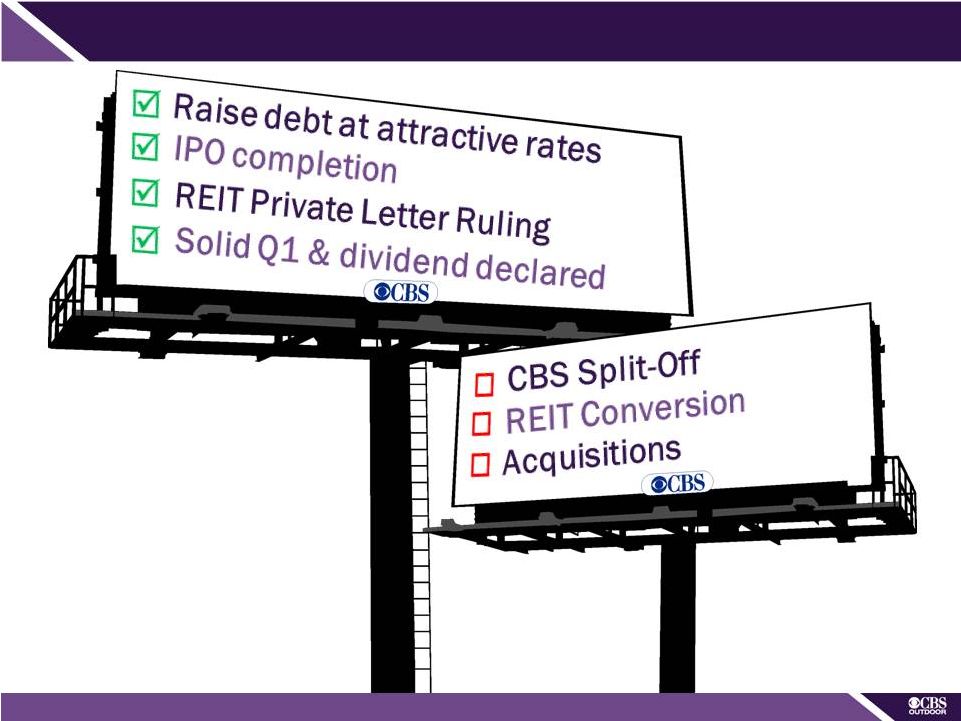

7 EXECUTING on Stated Business Objectives |

8 SOLID First Quarter Results Notes: All changes refer to the three months ended March 31, 2014 compared to the same prior-year period. ¹Revenue comparison is on a constant dollar basis. ²Adjusted OIBDA and AFFO are presented on a comparable basis for 2013; please see Non-GAAP Reconciliations in the Appendix of this presentation. |

GROWTH Dynamics |

10 Outdoor is a POWERFUL Medium |

11 Historical and Future Top-Line Industry OUTPERFORMANCE 2013-2016E CAGR …And Strong Growth Forecast 1 Consistent Historical Growth… 1 $2.6 $4.9 $7.9 $9.1 '90 '00 '13 '16E 3.1% 3.1% 4.7% 4.8% 8.0% Outdoor as a % of Total U.S. Advertising Spend U.S. Outdoor Ad Spend Digital 17.2% Outdoor 4.8% TV 2.9% Radio 1.0% Print (4.8%) All Media 4.6% 1 Outdoor as a % of Total Non-U.S. Ad Spend Source: Zenith Optimedia - April 2014. |

12 Growing MEASURABLE Audience |

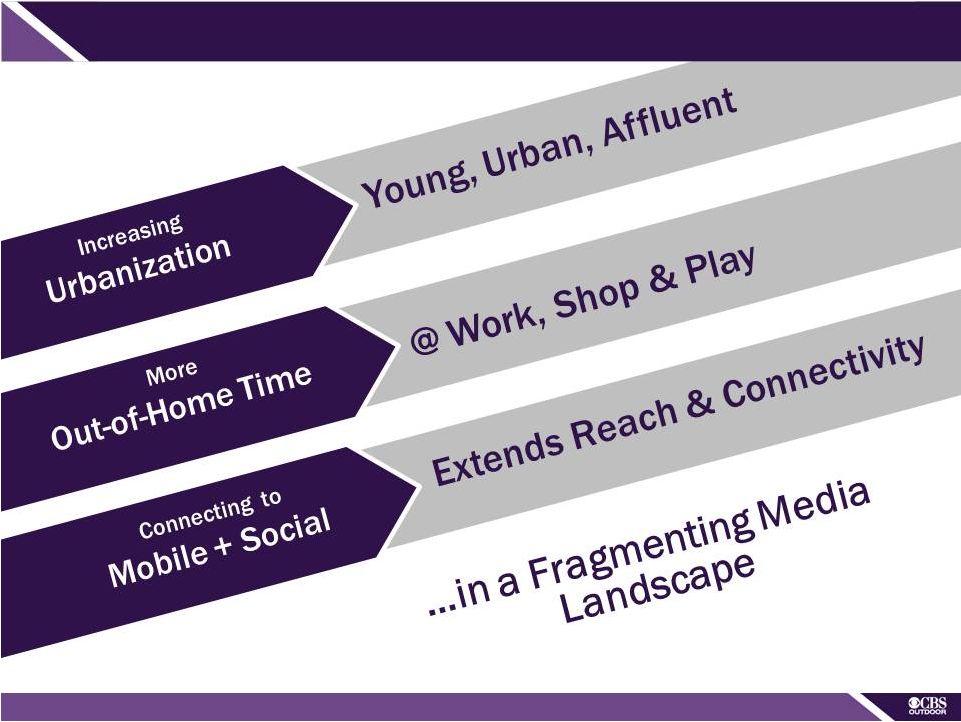

13 Ignites SOCIAL & MOBILE Drives to Search Mobile Commerce Connects with Social |

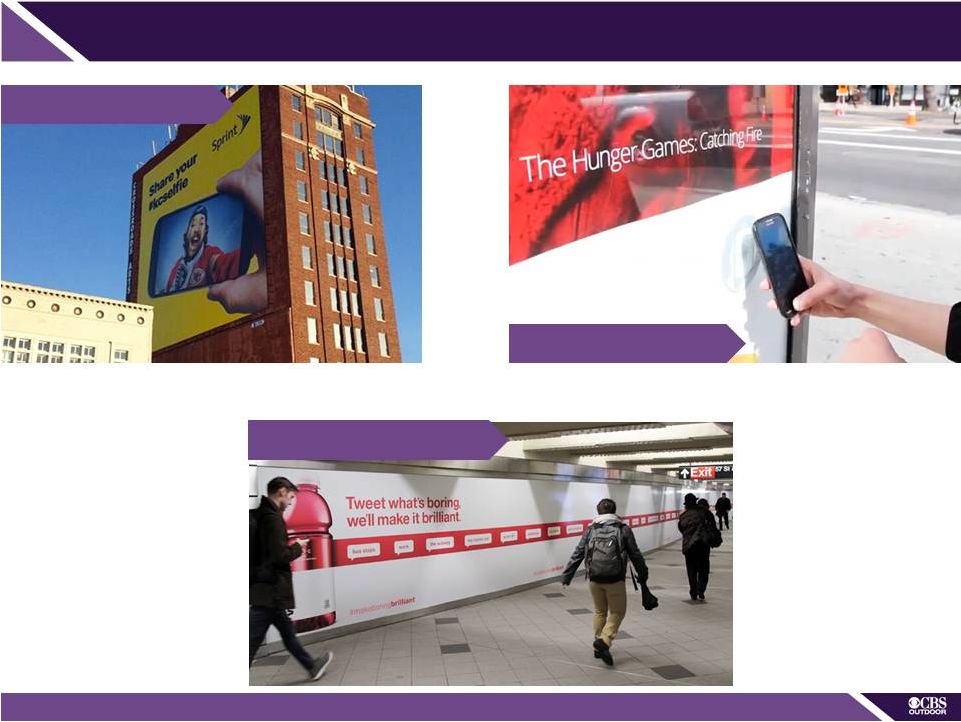

14 DRIVING Online Search Absolut Cocktail Campaign Results A significant spike in search for “ABSOLUT Greyhound” during campaign flights Stimulated significant interest on Twitter – 92% of Absolut-related tweets were related to the campaign Earned media exceeded ABSOLUT’s expectations Absolut Case Study OOH Drives Consumer Interest 1 Absolut OOH Media 15 of the Top 25 markets Multiple high profile formats 100 80 60 40 20 0 Dec 2012 Jan 2013 Feb 2013 Mar 2013 OOH Flight OOH Flight 1 Source: Google Analytics indexed peak total search volume during Absolut’s multi-media campaign; Posterscope. |

15 Industry Measurement: TAB OOH Audience Ratings 20x60 Bulletin Right Read, 400 feet, Head-On Weekly Impressions: 343,570 TAB Data on Every Billboard |

Company Overview |

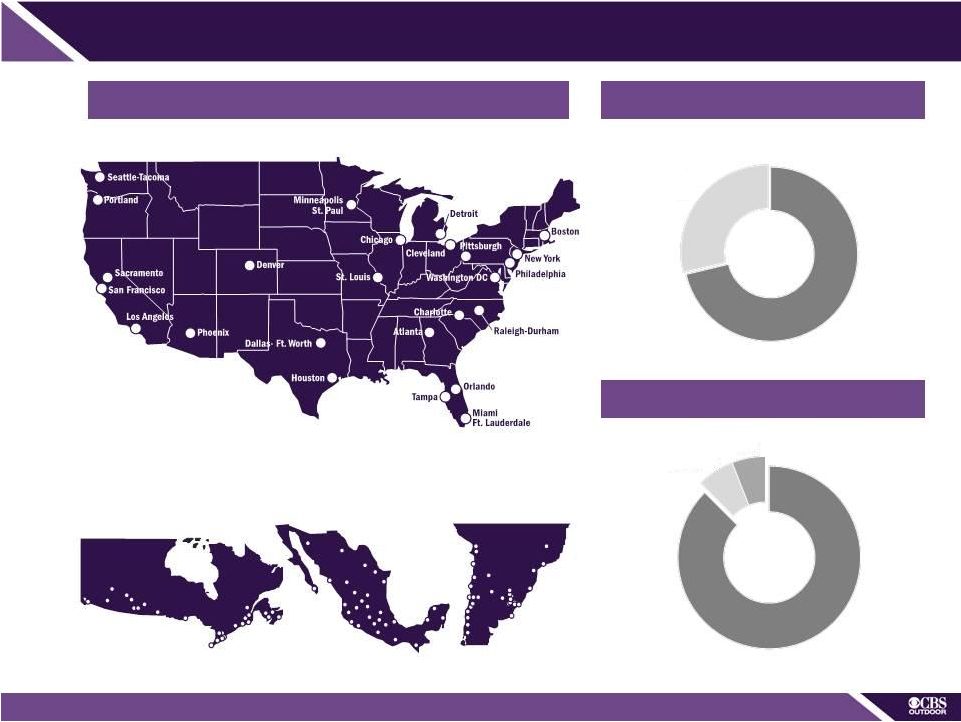

17 Canada Mexico South America Strategic Locations in Large Markets Revenue Mix by Product 1 Revenue Mix by Geography 1 1 For the 12 month period ending March 31, 2014. CBSO: Superior and Hard-to-Replicate Assets Billboard 71% Transit & Other 29% United States Canada Latin America 88% 6% 7% |

18 Strong Presence in Key STRATEGIC LOCATIONS Retail Districts Transit Centers High Traffic Areas Iconic Locations |

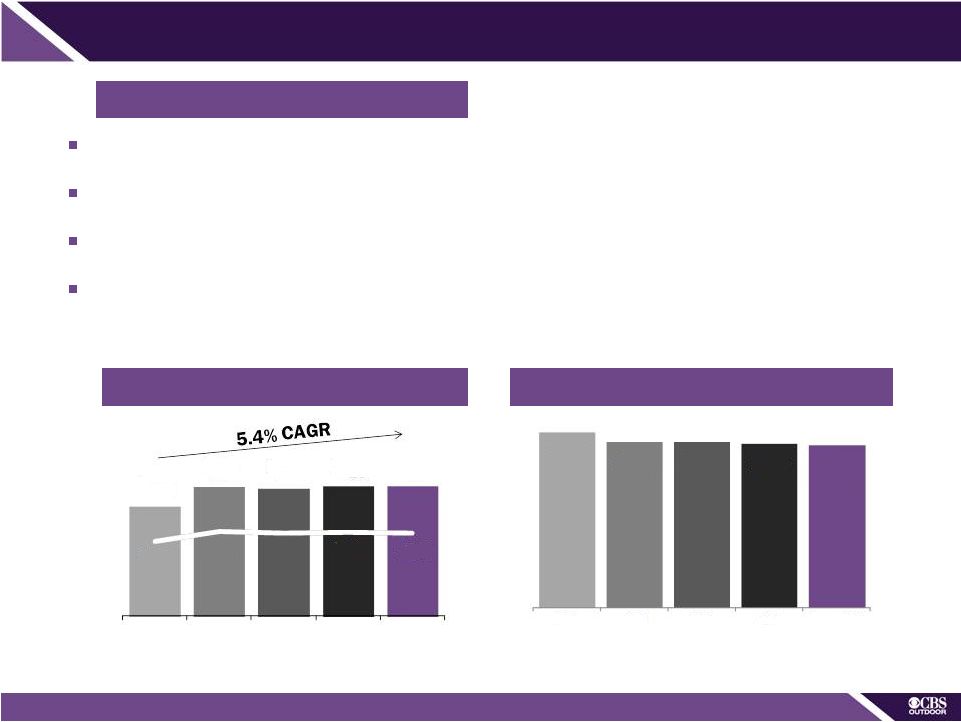

19 Business Profile: UNITED STATES Revenue Mix 1 Revenue 1 Adjusted OIBDA and Margin 2 1 For the 12 month period ending December 31, 2010-2013 and March 31, 2014. 2 Adjusted OIBDA margin is defined as Adjusted OIBDA divided by revenues and presented in this table for the US segment. |

20 We Give our Customers NATIONAL REACH & LOCAL STRENGTH National Hyper Local Covers ~ 50% of the U.S. Population Top 25 DMA Presence Blue Chip Customer Base 50 U.S. Account National Executives Sales People in 38 Regional Offices Local Knowledge with 315 Local Executives… …in Every Location Embedded in Local Communities Strong, Client Centric Approach Regional Note: Information as of March 31, 2014. National Revenue Local Revenue ~60% ~40% |

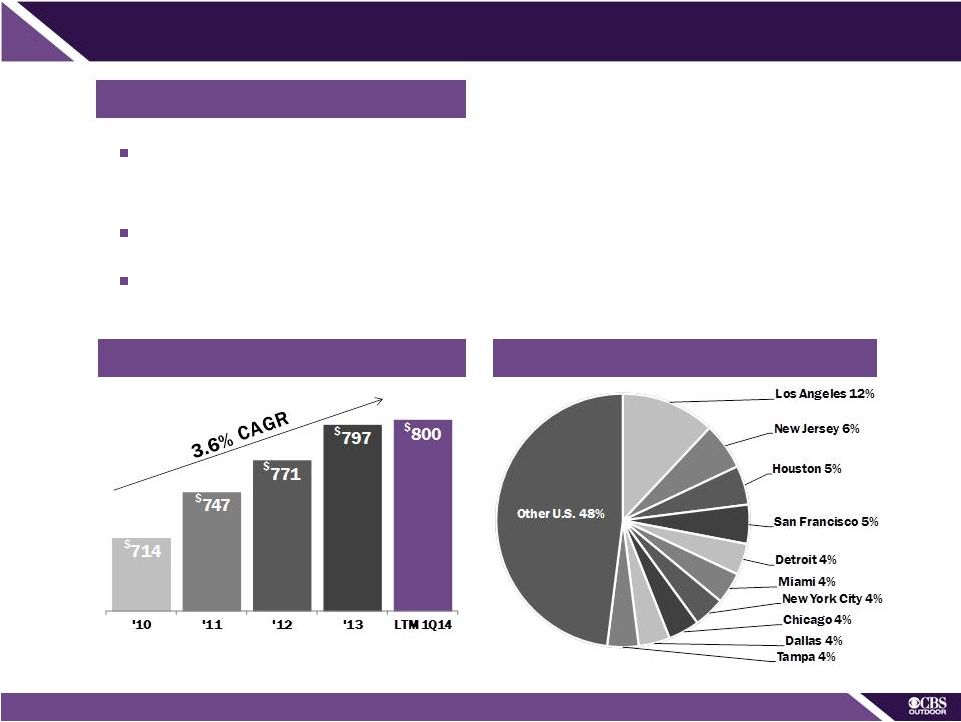

21 Business Profile: U.S. BILLBOARD Stable, high margin business. Lease expense 29% of 2013 billboard revenues High customer renewal rates Growing digital footprint - national and local Highlights Revenue Top Market Focus 1 1 Revenue by geographic area for the twelve months ended December 31, 2013. |

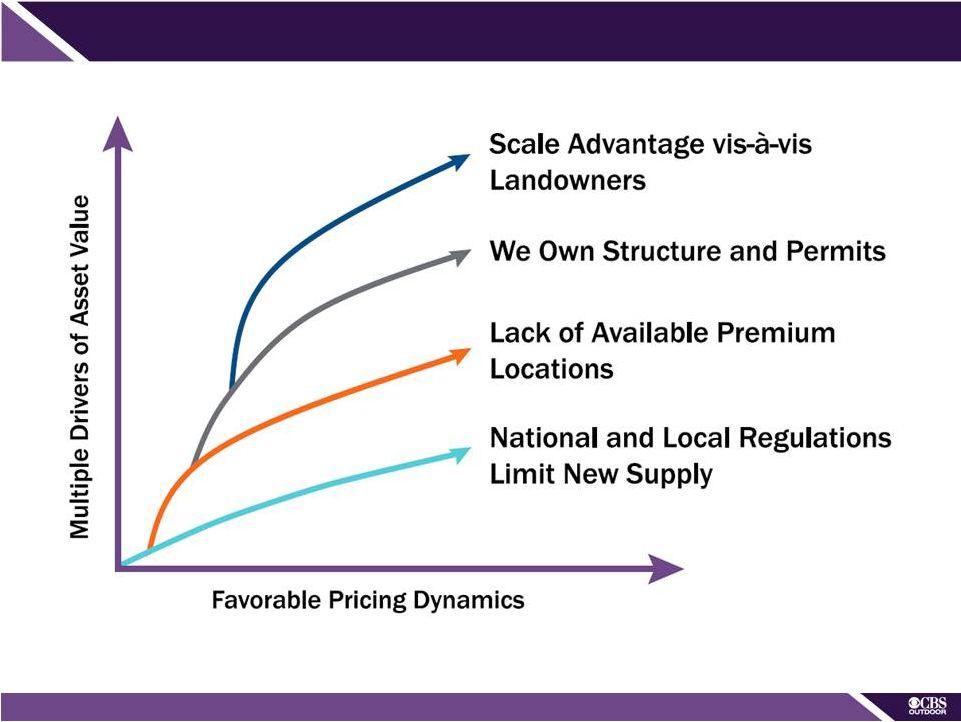

22 Attractive Drivers of BILLBOARD VALUE |

23 Business Profile: U.S. TRANSIT Revenue 1 Large Market Focus 2 Top market strategy Makes us “Must Buy” media Disciplined approach to contracts–2013 lease expense 64% of transit revenues Contracts typically the greater of revenue share or minimum guaranteed payments Minimal CapEx requirements 2 Transit and Other revenue by geographic area for the twelve months ended December 31, 2013. Highlights 1 Transit & Other revenue for the twelve months ending December 31, 2010-2013 and March 31, 2014. $ 282 $ 305 $ 328 $ 334 $ 340 '10 '11 '12 '13 LTM 1Q14 New York City 57% Other U.S. 18% Washington D.C. 11% Los Angeles 14% |

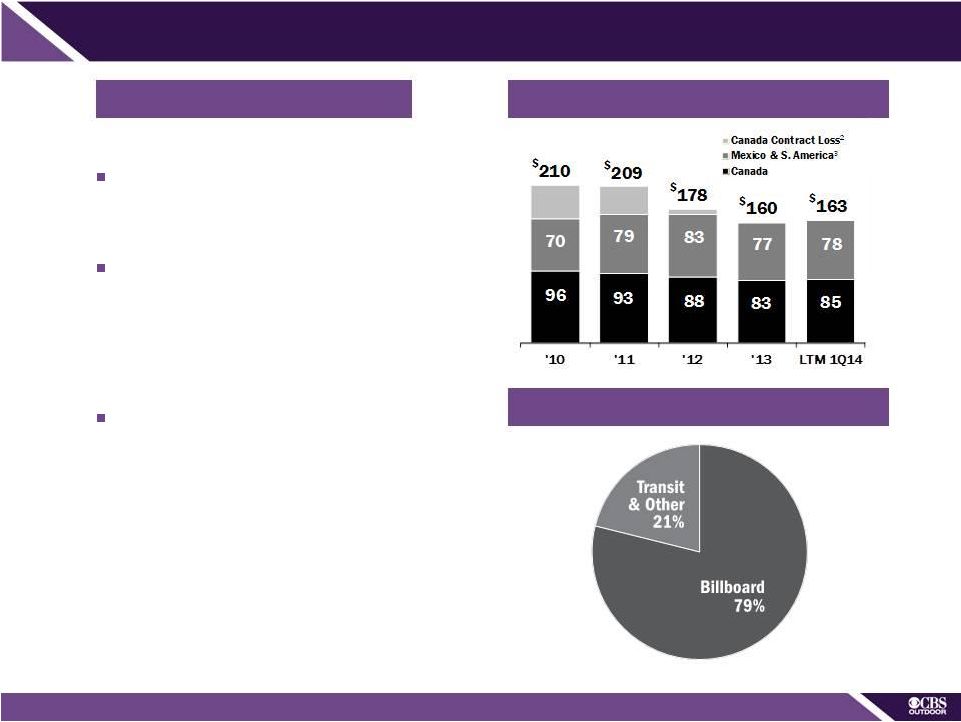

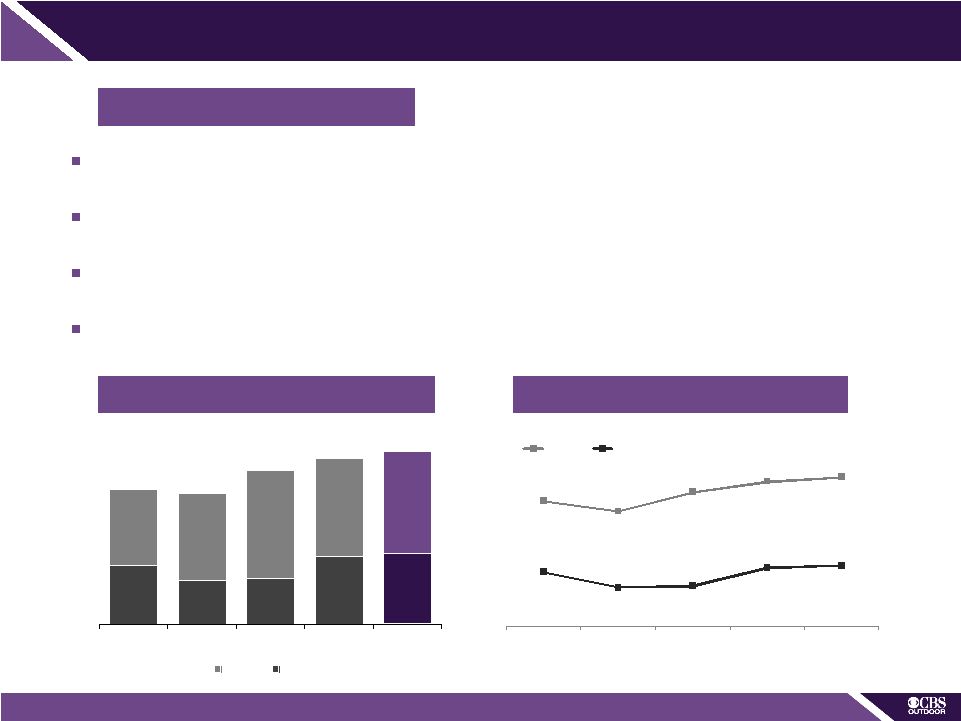

24 International Revenues 1 One of the largest in Canada and Mexico Niche, high growth position in Brazil, Argentina, Chile and Uruguay Revenues and Adjusted OIBDA stabilized in the first quarter of 2014 Revenue Mix 4 4 For the twelve months ended March 31, 2014. Business Profile: INTERNATIONAL Highlights 1 $ Millions. Last twelve months ending December 31, 2010-2013 and March 31, 2014. Revenue comparison is on a constant dollar basis. Reported total International revenues were: $218M (2010), $226M (2011), 186M (2012), and $164M (2013). 2 Reflects lost Canadian contracts of $44M (2010), $37M (2011) and $7M (2012); 3 Includes impact of $6M of political advertising in 2012. |

25 20,300 Customers 91 of Top 100 Advertisers are Customers 1.6% Maximum Revenue Contribution from Single Customer Highlights Blue Chip Customers Highly DIVERSIFIED Customer Base US Revenue % by Industry 1 Source: Kantar Media for 12 months ended March 31, 2014. 2 For the 12 months ended March 31, 2014. 3 For the 12 months ended December 31, 2013. 2 1 2 3 |

Point Chg. 2007 2008 2009 2010 2011 2012 2013 '07-'13 Retail 9% 9% 9% 9% 9% 10% 10% 0 Television 5 6 5 7 7 7 8 2 Entertainment 7 6 6 6 6 7 7 0 Health/Pharma 5 5 6 6 7 7 7 3 Restaurants/Fast Food 5 6 7 7 7 7 7 2 Other 8 8 8 8 7 7 7 (1) Professional Services 7 6 6 6 7 6 7 0 Telephone/Utilities 9 8 8 7 7 7 6 (3) Auto 8 7 6 5 5 5 5 (3) Financial Services 7 7 7 7 7 6 5 (1) Casinos/Lottery 4 5 5 5 5 5 5 0 Beer/Liquor 5 5 5 5 5 4 5 (1) Education 2 3 4 4 5 4 4 2 Movies 4 5 4 5 5 5 4 0 Travel/Leisure 5 5 5 5 5 5 4 (1) Computers/Internet 1 1 1 2 2 3 3 2 Food/Beverage 2 3 4 3 3 3 3 0 Government 1 1 1 1 1 1 2 1 Real Estate 4 3 2 1 1 1 1 (3) Household Products 1 1 1 1 1 1 1 0 Total CBSO 100% 100% 100% 100% 100% 100% 100% TV, Ent. & Movies 17% 17% 15% 18% 19% 19% 19% 3 26 High Diversification and Customer STABILITY Over Time Note: Numbers may not sum due to rounding CBSO US Revenue Mix by Advertising Category |

27 2013 – iPhone 5 Longstanding Customer Multiple formats, Integral to launch strategy Customer Case Study: KEY MEDIA for APPLE 2008 – iPod 2009 – iPod Touch 2007 – iPod 2011 – iPad 2 multiple markets |

28 Strong focus on pricing – increase Revenue per Display Optimize inventory management Improved data to identify opportunities Network-focused approach Top DMAs + transit franchises Improved analytics/audience measurement Increased focus on operational efficiencies Lease expense rationalization Less than 1% of CBSO total billboards are digital 1 Continued strategic, ROI-focused conversions Fragmented market ~36% of share held by independents Strategic market opportunities to acquire complementary assets at attractive multiples Drive returns through scalable infrastructure Key GROWTH DRIVERS Yield Management Emphasis on Large National Advertisers Cost Optimization Digital Deployment Acquisitions As of March 31, 2014. 1 |

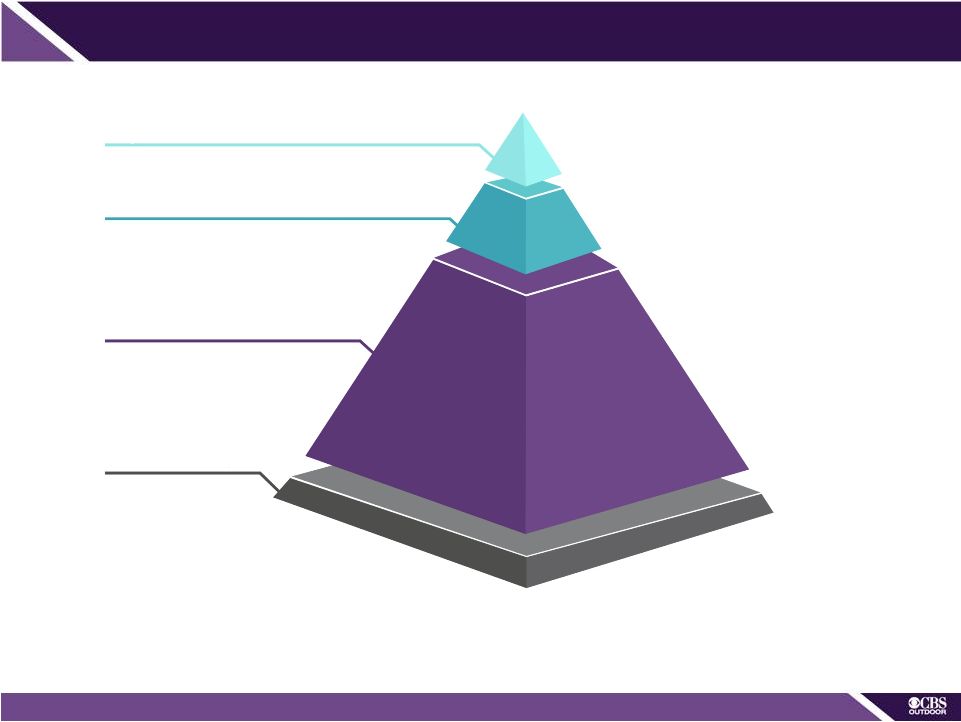

29 The Pyramid of Quality – AUDIENCE, DMA, & LOCATION Digital Investment Strategic Enhancement Focus on Yield Rationalize = Maximize Profit Per Display |

30 Digital Provides Additional OPPORTUNITIES Benefits to Advertisers Richer Content Interactivity with Audience Location & Day Parting Deployment Flexibility Minimizes Production Costs Benefits to CBSO Enhances Value Proposition Revenue Opportunities Enhances Yield Ability to Attract New Advertisers Inventory Optimization |

31 Significant Digital UPSIDE Iconic Locations – “Premium” Offerings Top DMAs Selective & Measured Deployment Maximize Overall Yield IRR benefits from lower cost per digital billboard Strategic Approach to Digital Billboards Cost per Digital Billboard As of December 31 2010-2013 and as of March 31, 2014. Average CBSO cost as of December 31. 97 173 277 373 411 '10 '11 '12 '13 1Q14 # of CBSO US Digital Billboards 1 1 2 '09 '13 2 |

Financial Summary Financial Summary |

33 KEY FINANCIAL Highlights |

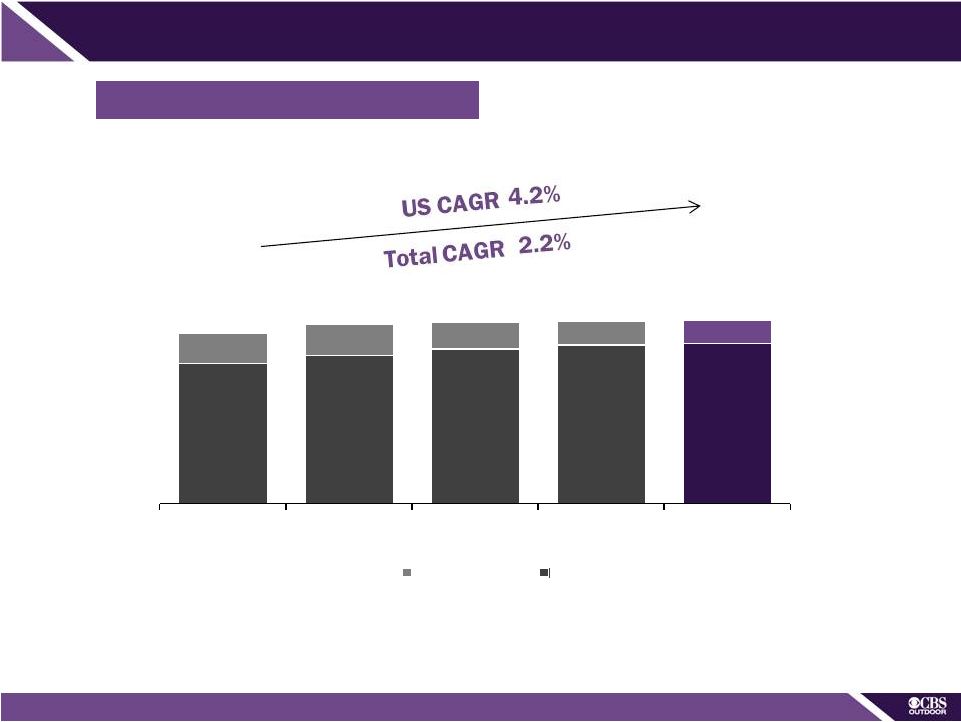

34 Consistent REVENUE Stream Stable and Growing Revenue Base 1 For the twelve months ended December 31, 2010-2013 and March 31, 2014. 996 1,052 1,099 1,130 1,140 218 226 186 164 163 '10 '11 '12 '13 LTM 1Q14 International US $1,214 $1,277 $1,285 $1,294 $1,303 1 |

Opportunities 35 Improve Yield Management Lower Billboard Site Related Expenses More Profitable Mix of Transit Contracts Drive Results from Lease Negotiations Adjusted OIBDA and Margin 1,3 Lease Costs as % of Revenue 2,3 Attractive MARGIN PROFILE and OPERATING LEVERAGE $ 415 $ 415 $ 408 $ 414 $ 350 29% 32% 32% 32% 32% LTM 1Q14 '13 '12 '11 '10 40% 38% 38% 37% 37% '10 '11 '12 '13 LTM 1Q14 See page 45 for a reconciliation of Adjusted OIBDA to Operating Income. Adjusted OIBDA margin is defined as Adjusted OIBDA divided by revenues. Lease costs include billboard property lease costs and transit franchise costs. For the twelve months ended December 31, 2010-2013 and March 31, 2014. 1 3 2 |

36 ~ 23,000 Leases ~ 18,500 Landlords Low, generally fixed cost billboard leases 8% of real estate locations owned Results in long-term relationships 75% Legal Non-conforming Favorable pricing dynamics Highly Diversified Attractive Terms Built-in Flexibility Permit Ownership ATTRACTIVE LEASE Portfolio Based on total revenues CAGR December 31, 2010 – LTM March 31, 2014. Majority of billboard leases have abate and/or termination clauses Important cost lever Through negotiation, lease costs declined 0.1% vs. revenue growth of 2.2% 1 1 |

37 Low Ongoing Capital Intensity with OPPORTUNITY to INVEST Minimal Maintenance CapEx Nominal Transit CapEx Stringent ROI Thresholds Opportunity to invest in Growth CapEx Disciplined CapEx Capital Expenditures 1 CapEx as % of Total Revenue 1 3.9% 3.6% 4.2% 4.5% 4.6% 1.7% 1.2% 1.2% 1.8% 1.9% '10 '11 '12 '13 LTM 1Q14 Total Maintenance 1 For the twelve months ended December 31, 2010-2013 and March 31, 2014. 20 15 16 24 25 27 30 38 35 36 $ 47 $ 46 $ 54 $ 58 $ 60 '10 '11 '12 '13 LTM 1Q14 Growth Maintenance |

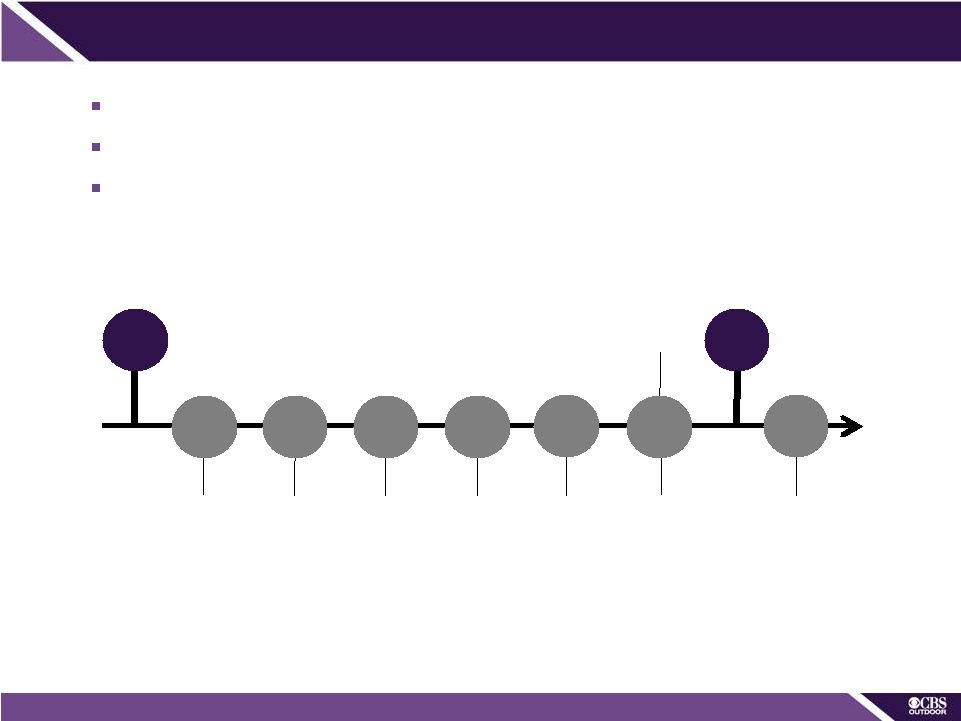

Split-Off Exchange Offer Launched 38 Transaction SUMMARY and TIMELINE Exchange offer expiration date of July 9, 2014 Targeted split-off separation from CBS mid-July, 2014 Earnings & Profits (E&P) purge announced after July 2014 and paid before January 31, 2015 E&P Purge expected to be paid by Jan 31, 2015 Intend to operate as a REIT going forward First quarter earnings PLR received CBSO IPO Targeted complete separation from CBS CBSO debt financing Apr 16 Jan 31 May 8 Mar 28 Mid- July Jan 31 2015 2014 Jun 11 |

39 Expected REIT Structure International operations U.S. mobile transit assets (i.e., train cars, buses) Residual cash may be used for reinvestment in business or for debt repayment U.S. Billboards U.S. fixed transit assets (i.e., station structures) 100% of taxable income to be distributed to shareholders Qualified REIT Subsidiary (“QRS”) Taxable REIT Subsidiary (“TRS”) |

40 Balance Sheet Highlights $539 million of liquidity – $114 million cash – $100 million IPO proceeds on April 2, 2014 for cash portion of E&P purge – $425 million undrawn revolving credit facility Long dated and staggered maturity profile – 8 year average maturity Target leverage range 3.5x-4.0x Dividend plans in line with REIT structure – 100% of QRS taxable income distributed to shareholders – Cash balance builds via TRS EFFICIENT Balance Sheet 1 As of March 31, 2014; except that $100 million in IPO Proceeds was received on April 2, 2014. 2 As defined in the Credit Agreement governing our senior credit facilities; calculated on total debt. Capitalization 1 ($ in millions) Cash $114 IPO Proceeds for cash E&P Purge 100 $425M Revolving Credit Facility due 2019 0 Senior Secured Term Loan due 2021 798 5.250% Senior Notes due 2022 400 5.625% Senior Notes due 2024 400 Total Debt $1,598 Weighted Average Cost of Debt 4.2% Consolidated Total Leverage Ratio 2 3.8x |

41 Strong OIBDA Conversion and a Sustainable Dividend OIBDA AFFO and FCF 1 DIVIDENDS 1 Adjusted Funds From Operations (“AFFO”) is described in the Appendix of this presentation. Free Cash Flow (“FCF”) is defined as Net Cash Flow Provided by Operating Activities, less total Capital Expenditures, from the Statement of Cash Flows. |

42 Investment HIGHLIGHTS Attractive Industry Fundamentals Superior and Hard-to-Replicate Real Estate Portfolio Multiple Levers to Enhance Growth – Digital Conversion, Yield Management, Select Acquisitions Energized Management Team and Sales Force Consistent Revenue Growth, High Incremental Margins, Powerful Free Cash Flow Strong and Efficient Balance Sheet with Financial Flexibility Growth + Sustainable Dividends |

Appendix |

44 Non-GAAP Reconciliations Non-GAAP Financial Measures In addition to the results prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) provided throughout this presentation, this presentation and the accompanying tables include non-GAAP measures as described below. We calculate revenues on a constant dollar basis as reported revenues excluding the impact of foreign currency exchange rates between periods. We provide constant dollar revenues to understand the underlying growth rate of revenue excluding the impact of changes in foreign currency exchange rates between periods, which are not under management’s direct control. Our management believes constant dollar revenues are useful to users because it enables them to better understand the level of growth of our business period to period. We calculate Adjusted OIBDA as operating income before depreciation, amortization, net gains (losses) on dispositions, stock-based compensation and restructuring charges. We calculate Adjusted OIBDA margin by dividing Adjusted OIBDA by total revenues. We use Adjusted OIBDA and Adjusted OIBDA margin to evaluate our operating performance. Adjusted OIBDA and Adjusted OIBDA margin are among the primary measures we use for managing our business, and for planning and forecasting future periods, as each is an important indicator of our operational strength and business performance. Our management believes users are best served if the information that is made available to them allows them to align their analysis and evaluation of our operating results along the same lines that our management uses in managing, planning and executing our business strategy. Our management also believes that the presentations of Adjusted OIBDA and Adjusted OIBDA margin, as supplemental measures, are useful in evaluating our business because eliminating certain noncomparable items highlights underlying operational trends in our business that may not otherwise be apparent when relying solely on GAAP financial measures. It is our management’s opinion that these supplemental measures provide users with an important perspective on our operating performance and also make it easier for users to compare our results to other companies that have different financing and capital structures or tax rates. We calculate FFO in accordance with the definition established by the National Association of Real Estate Investment Trusts (“NAREIT”). FFO reflects net income adjusted to exclude gains and losses from the sale of real estate assets, depreciation and amortization of real estate assets and amortization of direct lease acquisition costs, as well as the same adjustments for our equity based investments, as applicable. We calculate AFFO as FFO adjusted to include cash paid for direct lease acquisition costs as such costs are generally amortized over a period ranging from four weeks to one year and therefore are incurred on a regular basis. AFFO also includes cash paid for maintenance capital expenditures since these are routine uses of cash that are necessary for our operations. In addition, AFFO excludes certain non-cash items, including non-real estate depreciation and amortization, deferred income taxes, stock-based compensation expense, accretion expense, the noncash effect of straight-line rent and amortization of deferred financing costs. We believe that adjusting for these items provides a better measure of our operating performance. We use FFO and AFFO measures for managing our business and for planning and forecasting future periods, and each is an important indicator of our operational strength and business performance, especially compared to other REITs. Our management believes users are best served if the information that is made available to them allows them to align their analysis and evaluation of our operating results along the same lines that our management uses in managing, planning and executing our business strategy. Our management also believes that the presentations of FFO, AFFO, and FFO and AFFO per adjusted weighted average share, as supplemental measures, are useful in evaluating our business because adjusting results to reflect items that have more bearing on the operating performance of REITs highlights trends in our business that may not otherwise be apparent when relying solely on GAAP financial measures. It is management’s opinion that these supplemental measures provide users with an important perspective on our operating performance and also make it easier to compare our results to other companies in our industry, as well as to REITs. We present weighted average shares on an adjusted basis of 120,000,000 shares to give effect to 23,000,000 shares issued on April 2, 2014, from the IPO in addition to the 97,000,000 shares outstanding as of March 31, 2014, for basic and diluted earnings per share (“EPS”). We also present FFO, AFFO and net income per adjusted weighted average share. Our management believes that these presentations are useful in evaluating our business because they allow users to evaluate our per share results after giving effect to the issuance of shares of our common stock in connection with our initial public offering, which increased our outstanding shares of common stock. We calculate operating income, net income, Adjusted OIBDA, FFO and AFFO, and related per adjusted weighted average share amounts, for the three months ended March 31, 2013, on a comparable basis by adjusting to exclude a significant net gain of $9.8 million incurred in the first quarter of 2013 on the disposition of most of our billboards in Salt Lake City in exchange for billboards in New Jersey, and to include $3.8 million of incremental costs associated with operating as a stand-alone public company incurred in the first quarter of 2014 and $12.4 million of interest expense relating to our entry into the senior credit facilities and the issuance of our senior notes, which were also incurred in the first quarter of 2014. Our management believes these adjusted presentations are useful in evaluating our business because they allow users to compare our operating performance for the first quarter of 2013 against the operating performance of the first quarter of 2014 including certain significant costs arising as a result of our separation from CBS. Since adjusted weighted average shares, Adjusted OIBDA, Adjusted OIBDA margin, FFO, AFFO, FFO and AFFO per adjusted weighted average share, constant dollar revenues and, on a comparable basis for 2013, operating income, net income, Adjusted OIBDA, FFO and AFFO and related per adjusted weighted average share amounts, are not measures calculated in accordance with GAAP, they should not be considered in isolation of, or as a substitute for, weighted average shares outstanding for basic and diluted EPS, operating income, net income and revenues, and the related weighted average per share amounts, the most directly comparable GAAP financial measures, as indicators of operating performance. These measures, as we calculate them, may not be comparable to similarly titled measures employed by other companies. In addition, these measures do not necessarily represent funds available for discretionary use and are not necessarily a measure of our ability to fund our cash needs. |

45 Non-GAAP Reconciliations Last Twelve Months (LTM) Ended: (in $ millions) 2010 2011 2012 2013 1Q13 2Q13 3Q13 4Q13 1Q14 1Q14 Total Revenues $1,214.1 $1,277.1 $1,284.6 $1,294.0 $279.2 $332.7 $338.2 $343.9 $287.9 $1,302.7 Operating Income 126.5 192.4 201.2 238.8 34.7 62.8 64.6 76.7 26.7 230.8 Depreciation 107.6 109.0 105.9 104.5 26.0 25.9 26.4 26.2 26.1 104.6 Amortization 106.6 102.9 90.9 91.3 22.9 22.7 22.6 23.1 21.9 90.3 Net (Gain) Loss on Dispositions 1.1 2.0 2.2 (27.3) (9.8) 0.1 (0.1) (17.5) (0.9) (18.4) Restructuring Charges 3.9 3.0 2.5 - - - - - - - Stock Based Compensation 4.3 5.0 5.7 7.5 1.6 1.6 2.6 1.7 1.8 7.7 Adjusted OIBDA 350.0 414.3 408.4 414.8 75.4 113.1 116.1 110.2 75.6 415.0 Adjusted OIBDA Margin 28.8% 32.4% 31.8% 32.1% 27.0% 34.0% 34.3% 32.0% 26.3% 31.9% Capital Expenditures 47.2 45.6 53.6 58.2 6.0 8.9 12.8 30.5 8.2 60.4 Twelve Months Ended December 31: Three Months Ended: |

46 Non-GAAP Reconciliations (a) No restructuring charges were incurred for the three months ended March 31, 2013 and 2014. Three Months Ended March 31, 2013 (in millions) U.S. International Corporate Consolidated Revenues $ 245.2 $ 34.0 $ — $ 279.2 Operating income (loss) $ 48.2 $ (6.6) $ (6.9) $ 34.7 Net gains on dispositions (9.9 ) 0.1 — (9.8 ) Depreciation and amortization 41.8 7.1 — 48.9 Stock-based compensation — — 1.6 1.6 Adjusted OIBDA (a) 80.1 0.6 (5.3) 75.4 Incremental stand-alone costs (1.7 ) — (2.1) (3.8 ) Adjusted OIBDA, on a comparable basis $ 78.4 $ 0.6 $ (7.4) $ 71.6 Adjusted OIBDA margin 32.7 % 1.8 % * 27.0 % Adjusted OIBDA margin, on a comparable basis 32.0 % 1.8 % * 25.6 % Capital expenditures $ 5.3 $ 0.7 $ — $ 6.0 Three Months Ended March 31, 2014 (in millions) U.S. International Corporate Consolidated Revenues $ 255.0 $ 32.9 $ — $ 287.9 Operating income (loss) $ 40.0 $ (5.7) $ (7.6) $ 26.7 Net gains on dispositions (0.8 ) (0.1) — (0.9 ) Depreciation and amortization 41.1 6.9 — 48.0 Stock-based compensation — — 1.8 1.8 Adjusted OIBDA (a) $ 80.3 $ 1.1 $ (5.8) $ 75.6 Adjusted OIBDA margin 31.5 % 3.3 % * 26.3 % Capital expenditures $ 7.0 $ 1.2 $ — $ 8.2 * calculation is not meaningful. |

47 Non-GAAP Reconciliations Three Months Ended March 31, 2013 2014 (in millions, except per share amounts) Reported Net Gain on Dispositions (a) Stand - Alone Costs (b) Interest Expense (c) Comparable to 2014 Reported (f) Revenues $ 279.2 — — — $ 279.2 $ 287.9 Operating 162.2 162.2 163.5 Selling, general and administrative 43.2 3.8 47.0 50.6 Net gain on dispositions (9.8) 9.8 — (0.9) Depreciation 26.0 26.0 26.1 Amortization 22.9 22.9 21.9 Operating income 34.7 (9.8) (3.8) — 21.1 26.7 Interest expense (0.1) (12.4) (12.5) (12.5) Other expense, net (0.1) (0.1) (0.5) Income before provision for income taxes and equity in earnings of investee companies 34.5 (9.8) (3.8) (12.4) 8.5 13.7 Provision for income taxes (14.9) 4.1 1.6 5.4 (3.8) (5.9) Equity in earnings in investee companies, net of tax 0.3 0.3 0.6 Net income $ 19.9 $ (5.7) $ (2.2) $ (7.0) $ 5.0 $ 8.4 Net income per common share: Basic $ 0.21 $ 0.05 $ 0.09 Diluted $ 0.21 $ 0.05 $ 0.09 Weighted average shares outstanding (d) : Basic 97.0 97.0 97.0 Diluted 97.0 97.0 97.0 Net income per adjusted weighted average share $ 0.04 $ 0.07 Adjusted weighted average shares (e) 120.0 120.0 Net income, excluding Net gain on dispositions, net of tax, for the three months ended March 31, 2014, is $7.9 million. Adjusted weighted average shares of 120.0 million includes shares issued on April 2, 2014, from the IPO in addition to the 97.0 million shares outstanding as of March 31, 2014, for basic and diluted EPS. On March 14, 2014, our board of directors declared a 970,000 to 1 stock split. As a result of the stock split, the 100 shares of our common stock then outstanding were converted into 97,000,000 shares of our common stock. The effects of the stock split have been applied retroactively to all reported periods for EPS purposes. Adjustment to reflect incremental interest expense at 2014 level. Adjustment to reflect incremental stand- alone costs at 2014 level. Adjustment to exclude Net gain on dispositions. (a) (b) (c) (d) (e) (f) |

48 Non-GAAP Reconciliations (a) Adjustment to reflect incremental costs to operate as a stand-alone company, net of tax, at the same level as 2014. Three Months Ended March 31, (in millions, except per share amounts) 2013 2014 Net income $ 19.9 8.4 Depreciation of billboard advertising structures 24.2 24.2 Amortization of real estate related intangible assets 10.7 10.7 Amortization of direct lease acquisition costs 7.8 7.0 Net gain on disposition of billboard advertising structures, net of tax (5.7) (0.2) Adjustment related to equity based investments 0.2 0.2 FFO 57.1 50.3 Incremental stand-alone costs, net of tax (a) (2.2) — Incremental interest expense, net of tax (b) (7.0) — FFO, 2013 on a comparable basis $ 47.9 50.3 FFO $ 57.1 50.3 Adjustment for deferred income taxes (7.8) (6.9) Cash paid for direct lease acquisition costs (9.4) (8.5) Maintenance capital expenditures (2.0) (3.0) Other depreciation 1.8 1.9 Other amortization 4.4 4.2 Stock-based compensation 1.6 1.8 Non-cash effect of straight-line rent 0.2 (0.2) Accretion expense 0.6 0.5 Amortization of deferred financing costs 0.7 AFFO 46.5 40.8 Incremental stand-alone costs, net of tax (a) (2.2) — Incremental interest expense, net of tax (b) (7.0) — Amortization of deferred financing costs 0.7 — AFFO, 2013 on a comparable basis $ 38.0 40.8 FFO, 2013 on a comparable basis, per adjusted weighted average share (c) $ 0.40 0.42 AFFO, 2013 on a comparable basis, per adjusted weighted average share (c) $ 0.32 0.34 Adjusted weighted average shares (c) 120.0 120.0 Weighted average shares for basic and diluted EPS (d) 97.0 97.0 — (b) Adjustment to reflect incremental interest expense, net of tax, at the same level as 2014. (c) Adjusted weighted average shares of 120.0 million includes 23.0 million shares issued on April 2, 2014, from the IPO in addition to the 97.0 million shares outstanding as of March 31, 2014, for basic and diluted EPS. (d) On March 14, 2014, our board of directors declared a 970,000 to 1 stock split. As a result of the stock split, the 100 shares of our common stock then outstanding were converted into 97,000,000 shares of our common stock. The effects of the stock split have been applied retroactively to all reported periods for EPS purposes. $ $ $ $ $ $ |

About CBS Outdoor Americas Inc. CBS Outdoor Americas Inc. (NYSE: CBSO) is one of the largest lessors of advertising space on out-of-home advertising structures and sites across the U.S., Canada and Latin America. Our portfolio primarily consists of billboard displays, which are predominantly located in densely populated major metropolitan areas and along high-traffic expressways and major commuting routes. In addition, we have a number of exclusive multi-year contracts that allow us to operate advertising displays in municipal transit systems where our customers are able to reach millions of commuters on a daily basis. We have displays in all of the 25 largest markets in the U.S. and over 180 markets in the U.S., Canada and Latin America, including in some of the most heavily trafficked locations, such as the Bay Bridge in San Francisco, Sunset Boulevard in Los Angeles and Grand Central Station and Times Square in New York City. |