- PARA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Paramount Global (PARA) 425Business combination disclosure

Filed: 13 Aug 19, 3:48pm

Filed by CBS Corporation Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Viacom Inc. Commission File No. 001-32686 Date: August 13, 2019 AUGUST 13, 2019 BOB BAKISH JOE IANNIELLO President and CEO, Viacom President and Acting CEO, CBS Corporation CHRISTINA SPADE EVP and CFO, CBS CorporationFiled by CBS Corporation Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Viacom Inc. Commission File No. 001-32686 Date: August 13, 2019 AUGUST 13, 2019 BOB BAKISH JOE IANNIELLO President and CEO, Viacom President and Acting CEO, CBS Corporation CHRISTINA SPADE EVP and CFO, CBS Corporation

DISCLAIMER Important Information About the Transaction and Where To Find It In connection with the proposed transaction, CBS and Viacom will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 that will include a joint consent solicitation statement of CBS and Viacom and that will also constitute a prospectus of CBS. CBS and Viacom may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint consent solicitation statement/prospectus or registration statement or any other document which CBS or Viacom may file with the SEC. INVESTORS AND SECURITY HOLDERS OF CBS AND VIACOM ARE URGED TO READ THE REGISTRATION STATEMENT, WHICH WILL INCLUDE THE JOINT CONSENT SOLICITATION STATEMENT / PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement on Form S-4 (when available), which will include the joint consent solicitation statement / prospectus, and other documents filed with the SEC by CBS and Viacom through the website maintained by the SEC at www.sec.gov or by contacting the investor relations department of CBS (+1-212-975-4321 or +1-877-227-0787; investorrelations@CBS.com) or Viacom (+1-212-846-6700 or +1-800-516-4399; investor.relations@Viacom.com). Participants in the Solicitation CBS and Viacom and their respective directors and executive officers may be deemed to be participants in the solicitation of consents in respect of the proposed transaction. Information regarding CBS’ directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in CBS’ Form 10-K for the fiscal year ended December 31, 2018 and its proxy statement filed on April 12, 2019, both of which are filed with the SEC. Information regarding Viacom’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in Viacom’s Form 10-K for the fiscal year ended September 30, 2018 and its proxy statement filed on January 25, 2019, both of which are filed with the SEC. A more complete description and information regarding directors and executive officers will be included in the registration statement on Form S-4 or other documents filed with the SEC when they become available. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov. No Offer or Solicitation This communication is for informational purposes only and is not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, invitation, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

DISCLAIMER Cautionary Notes on Forward Looking Statements This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “may,” “target,” similar expressions and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. These and other forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements, including the failure to consummate the proposed transaction or to make any filing or take other action required to consummate such transaction in a timely matter or at all. Important risk factors that may cause such a difference include, but are not limited to: (i) the proposed transaction may not be completed on anticipated terms and timing, (ii) a condition to closing of the transaction may not be satisfied, including obtaining regulatory approvals, (iii) the anticipated tax treatment of the transaction may not be obtained, (iv) the potential impact of unforeseen liabilities, future capital expenditures, revenues, costs, expenses, earnings, synergies, economic performance, indebtedness, financial condition and losses on the future prospects, business and management strategies for the management, expansion and growth of the combined business after the consummation of the transactions, (v) potential litigation relating to the proposed transaction that could be instituted against CBS, Viacom or their respective directors, (vi) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transactions, (vii) any negative effects of the announcement, pendency or consummation of the transactions on the market price of CBS’ or Viacom’s common stock and on CBS’ or Viacom’s operating results, (viii) risks associated with third party contracts containing consent and/or other provisions that may be triggered by the proposed transaction, (ix) the risks and costs associated with the integration of, and the ability of CBS and Viacom to integrate, the businesses successfully and to achieve anticipated synergies, (x) the risk that disruptions from the proposed transaction will harm CBS’ or Viacom’s business, including current plans and operations, (xi) the ability of CBS or Viacom to retain and hire key personnel and uncertainties arising from leadership changes, (xii) legislative, regulatory and economic developments, (xiii) the other risks described in CBS’ and Viacom’s most recent annual reports on Form 10-K and quarterly reports on Form 10-Q, and (xiv) management’s response to any of the aforementioned factors. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the joint consent solicitation statement / prospectus that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on CBS’ or Viacom’s consolidated financial condition, results of operations, credit rating or liquidity. Neither CBS nor Viacom assumes any obligation to publicly provide revisions or updates to any forward looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Non-GAAP Financial Measures The financial information in this communication includes financial information that is not presented in accordance with U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial measures, including adjusted operating income and adjusted OIBDA, may be considered in addition to GAAP financial information, but should not be used as substitutes for the corresponding GAAP measures. Non-GAAP measures in this communication may be calculated in a way that is not comparable to similarly titled measures reported by other companies.

AUDIENCE REACH DIRECT-TO-CONSUMER PLATFORMS DIGITAL VALUABLE LIBRARIES GLOBAL FOOTPRINT POWERFUL BRANDS ADVANCED ADVERTISING CAPABILITIES DATA AVOD ATTRACTIVE DEMOGRAPHICS ICONIC IP ANALYTICS 1

TRANSACTION RATIONALE PREMIUM CONTENT SCALE Amasses portfolio of powerful consumer brands Scales world class premium content production and library ROBUST FINANCIAL PROFILE Generates significant synergy value Increases financial strength POWERFUL GROWTH STRATEGY Accelerates and enhances DTC strategy Drives affiliate and advertising opportunities Creates leading producer and licensor of premium content to 3rd party platforms GLOBAL LEADERSHIP POSITIONS Unites global production and distribution capabilities Aggregates broad reach and cornerstones on five continents 2

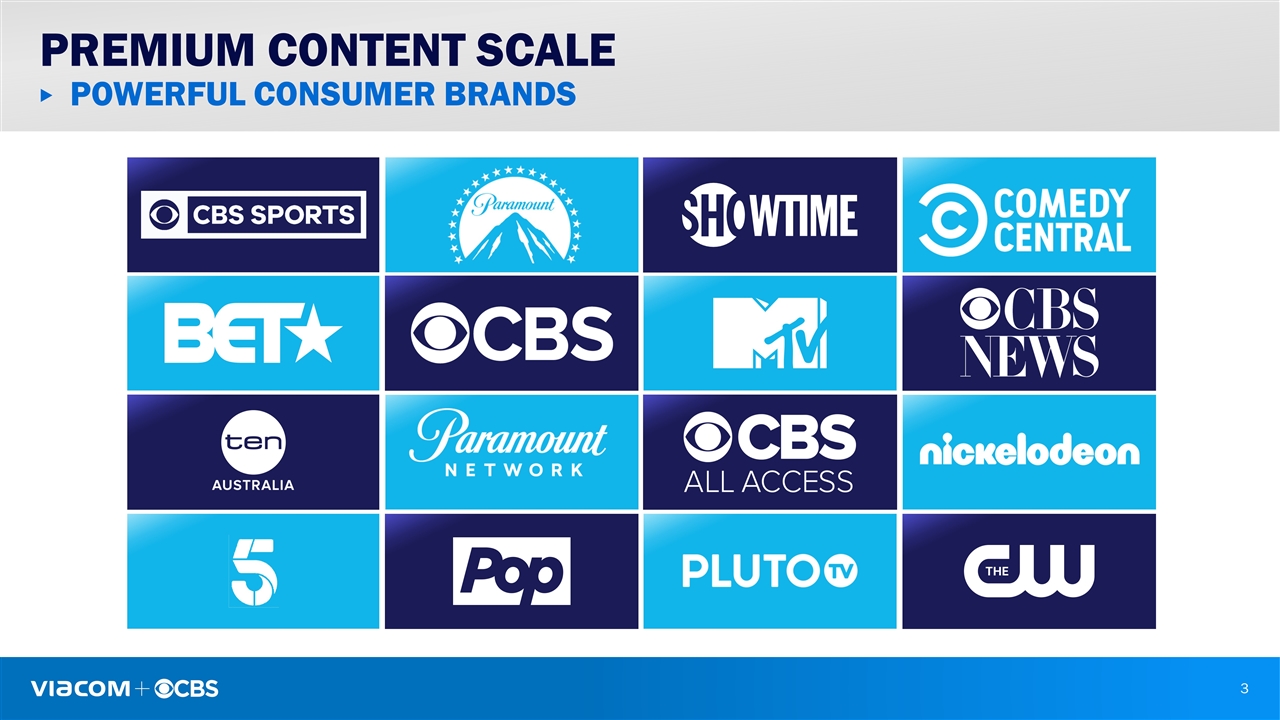

Powerful Consumer Brands Premium Content Scale 3

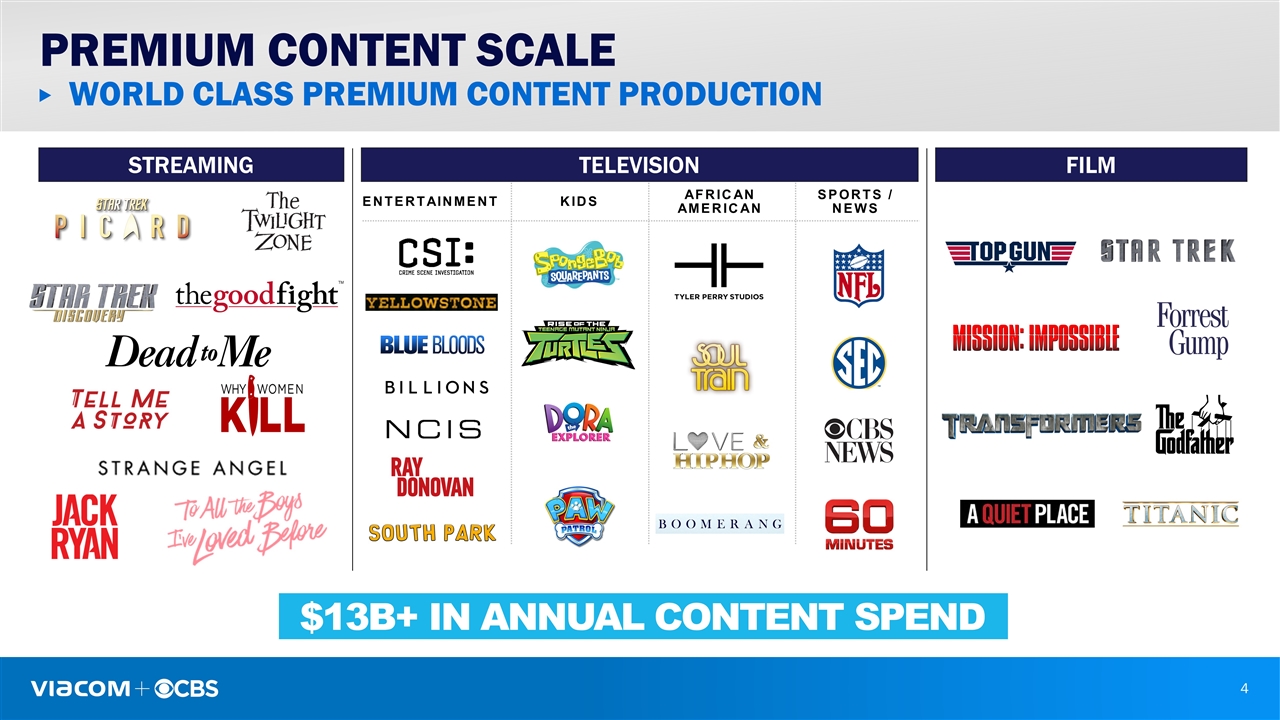

world class premium content production ENTERTAINMENT SPORTS / NEWS $13B+ IN ANNUAL CONTENT SPEND KIDS AFRICAN AMERICAN TELEVISION FILM STREAMING Premium Content Scale 4

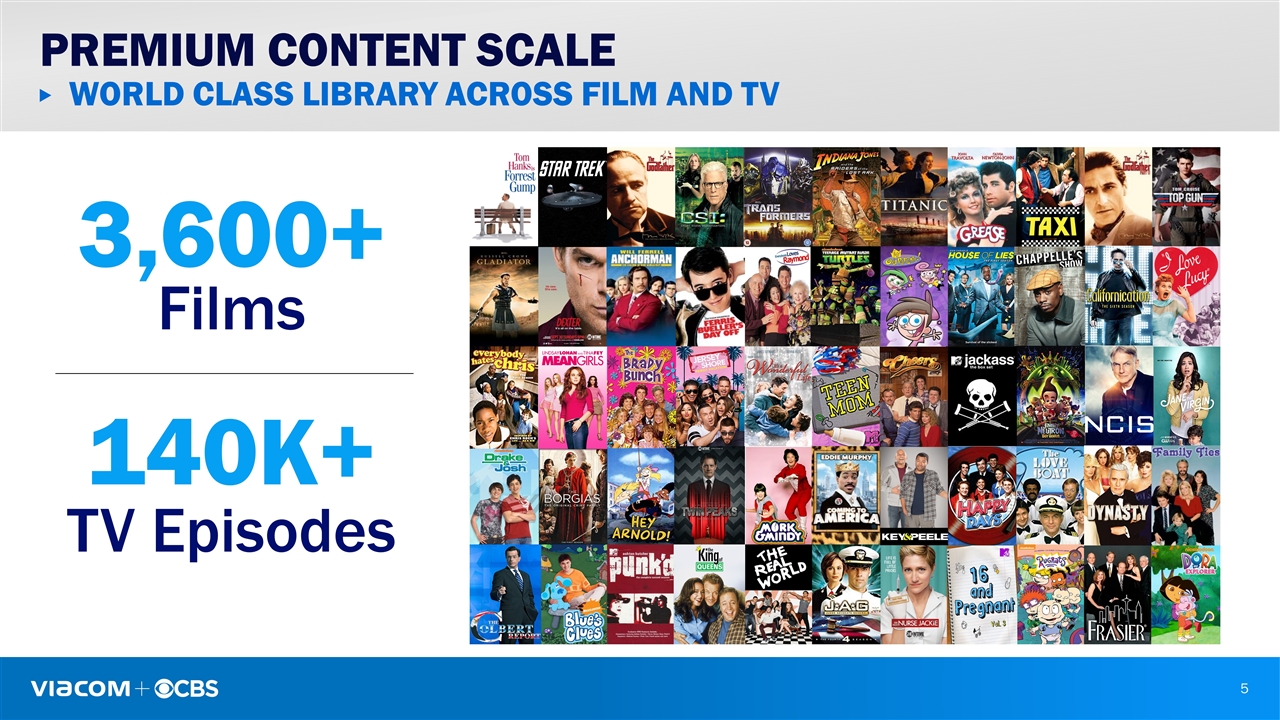

WORLD CLASS LIBRARY ACROSS FILM and tv 3,600+ Films 140K+ TV Episodes Premium Content Scale 5

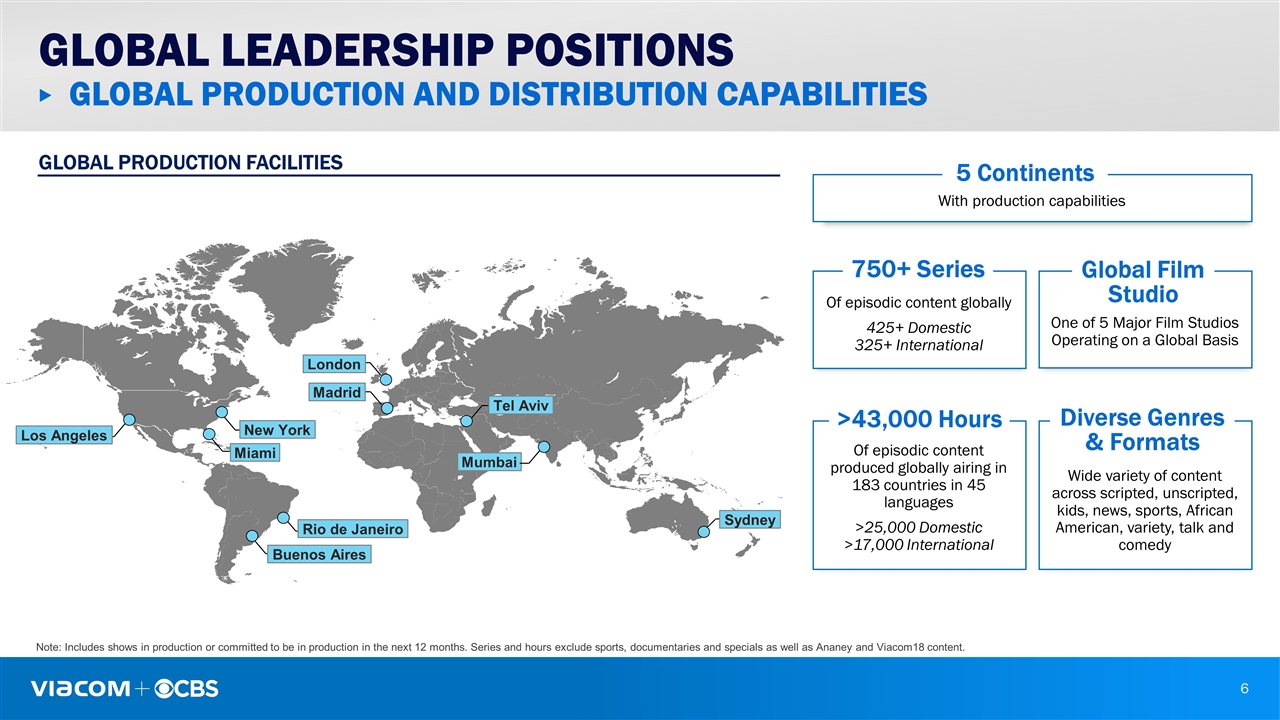

Global Production and distribution capabilities Global LEADERSHIP POSITIONS >43,000 Hours Of episodic content produced globally airing in 183 countries in 45 languages >25,000 Domestic >17,000 International Note: Includes shows in production or committed to be in production in the next 12 months. Series and hours exclude sports, documentaries and specials as well as Ananey and Viacom18 content. GLOBAL PRODUCTION FACILITIES Buenos Aires Rio de Janeiro New York Miami Los Angeles Madrid London Tel Aviv Sydney Mumbai 750+ Series Of episodic content globally 425+ Domestic 325+ International Diverse Genres & Formats Wide variety of content across scripted, unscripted, kids, news, sports, African American, variety, talk and comedy Global Film Studio One of 5 Major Film Studios Operating on a Global Basis 5 Continents With production capabilities 6

Broad reach and cornerstones in the u.s., Europe, Latin America, Australia & Asia Notes: CW Network 50% owned by CBS. Nick metrics Include Nick Jr. Viacom owns 49% of Colors / Viacom18 JV. In some countries, Paramount Network is Paramount Channel Domestic Premium BROADCAST PAY TV International Basic 4.3+ Billion Cumulative Subscribers in 180+ Countries Countries >175 >175 >145 >115 >75 Global LEADERSHIP POSITIONS 7

Accelerate DTC Platform Growth Drive Strengthened Affiliate and Advertising Partnerships Feed Growing Global 3rd Party Content Demand Powerful growth strategy 8

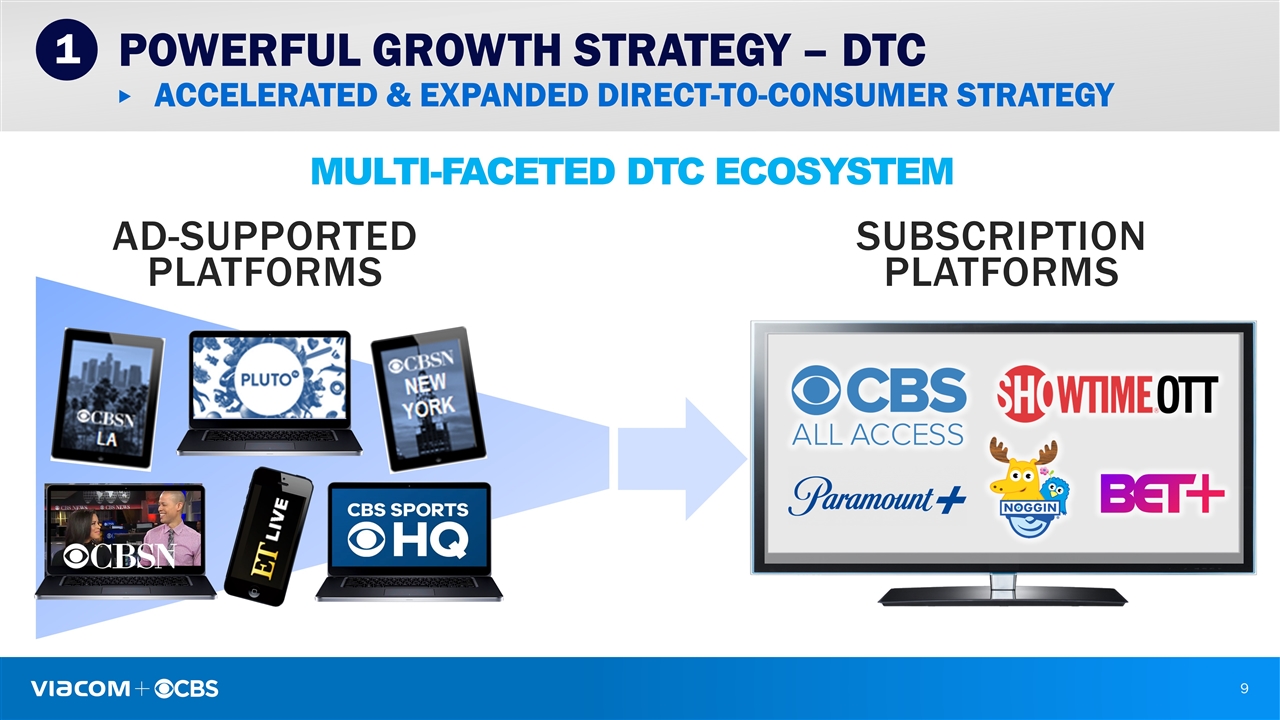

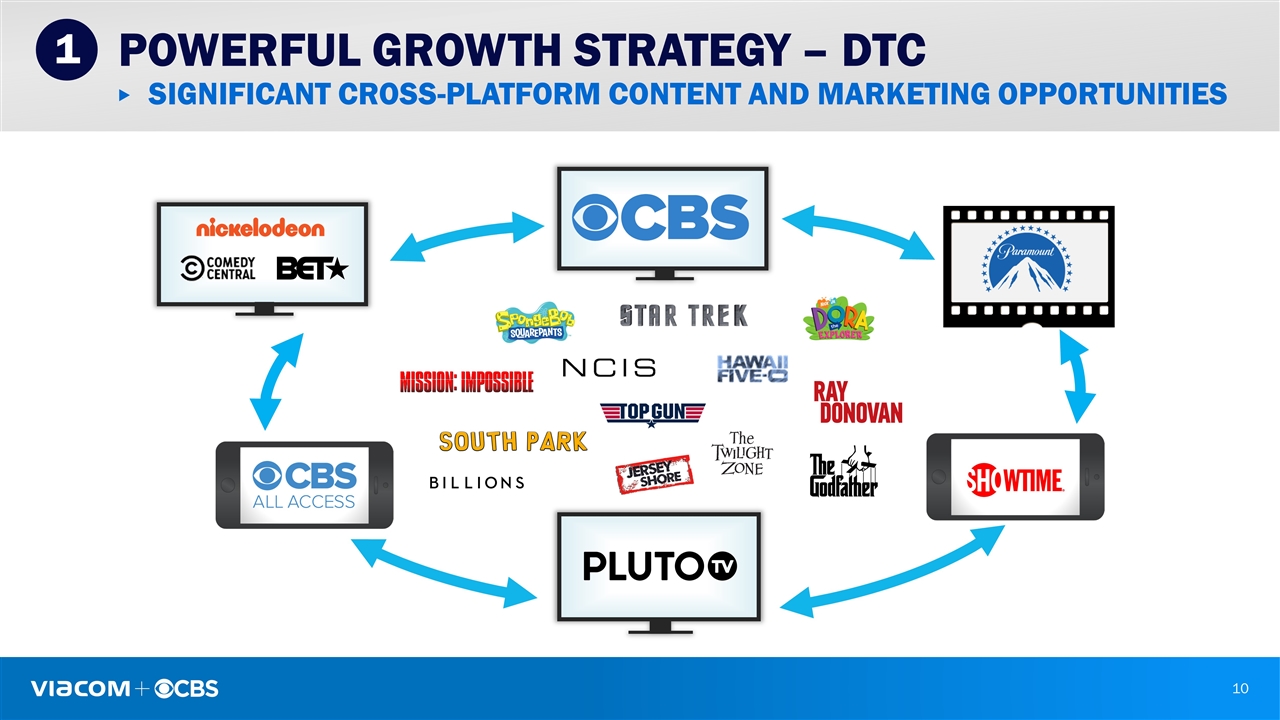

SUBSCRIPTION PLATFORMS AD-SUPPORTED PLATFORMS Accelerated & expanded Direct-To-Consumer strategy 1 Powerful growth strategy – DTC multi-faceted DTC ecosystem 9

Significant cross-platform content and marketing opportunities 1 Powerful growth strategy – DTC 10

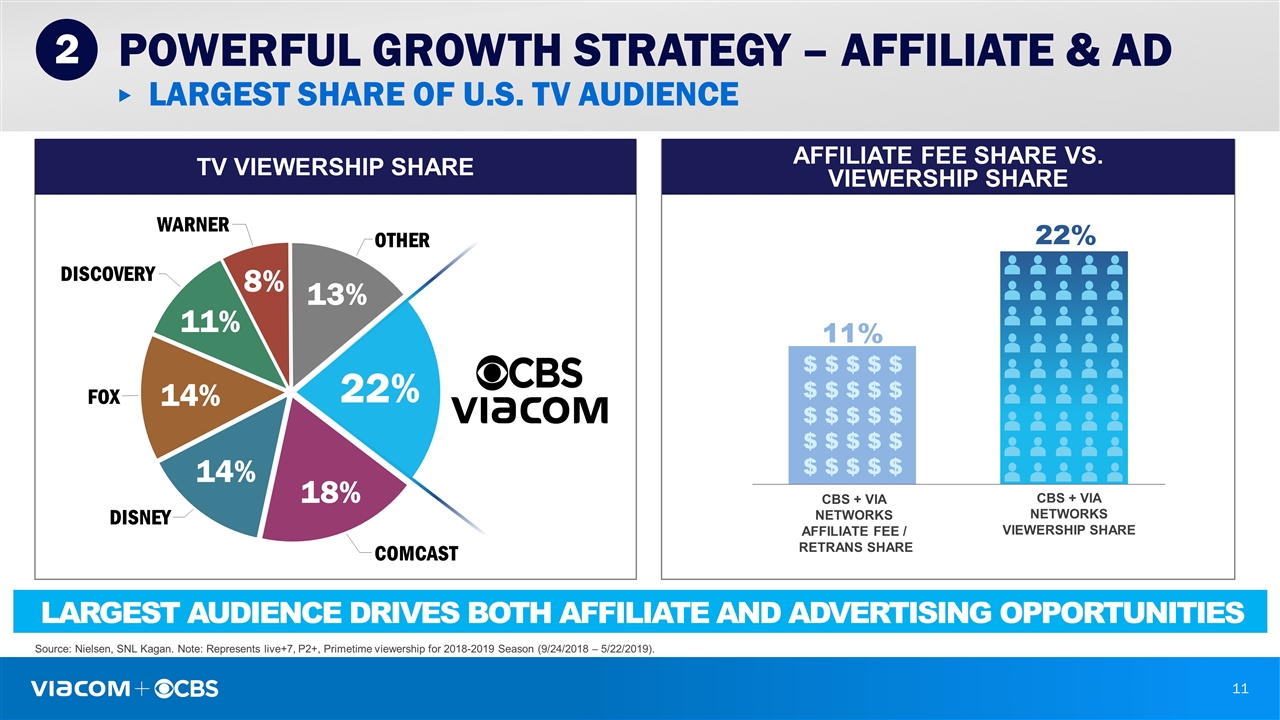

LARGEST SHARE OF U.S. TV AUDIENCE 2 LARGEST AUDIENCE DRIVES BOTH AFFILIATE AND ADVERTISING OPPORTUNITIES Powerful growth strategy – Affiliate & AD TV VIEWERSHIP SHARE AFFILIATE FEE SHARE VS. VIEWERSHIP SHARE $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ CBS + VIA NETWORKS AFFILIATE FEE / RETRANS SHARE CBS + VIA NETWORKS VIEWERSHIP SHARE 22% 11% Source: Nielsen, SNL Kagan. Note: Represents live+7, P2+, Primetime viewership for 2018-2019 Season (9/24/2018 – 5/22/2019). 14% 11% 8% 13% 18% 14% WARNER 22% DISCOVERY DISNEY OTHER COMCAST FOX 11

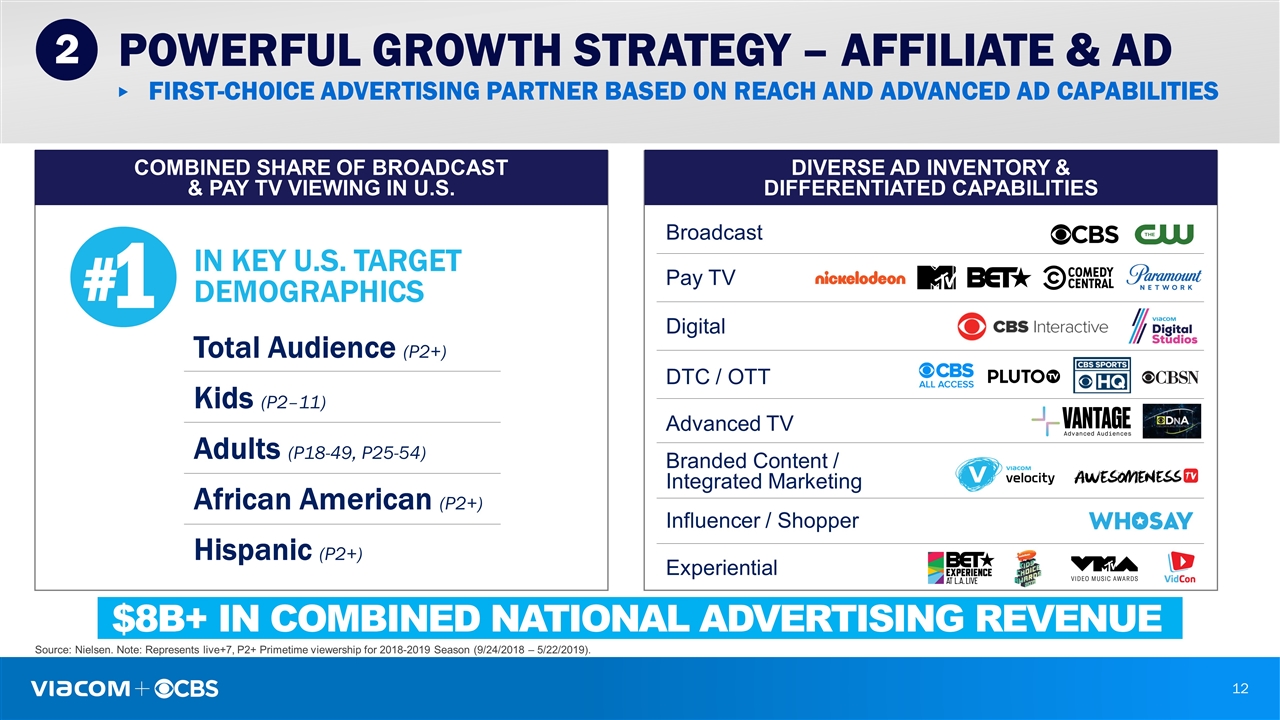

2 Powerful growth strategy – Affiliate & AD DTC / OTT Advanced TV Branded Content / Integrated Marketing Broadcast Pay TV Digital Influencer / Shopper Experiential $8B+ IN COMBINED NATIONAL ADVERTISING REVENUE COMBINED SHARE OF BROADCAST & PAY TV VIEWING IN U.S. DIVERSE AD INVENTORY & DIFFERENTIATED CAPABILITIES Source: Nielsen. Note: Represents live+7, P2+ Primetime viewership for 2018-2019 Season (9/24/2018 – 5/22/2019). First-choice advertising partner based on reach and advanced ad capabilities IN KEY U.S. TARGET DEMOGRAPHICS 1 # Total Audience (P2+) Kids (P2–11) Adults (P18-49, P25-54) African American (P2+) Hispanic (P2+) 12

STUDIOS SCALED STUDIOS OWNED PLATFORMS BROADCAST / PAY TV SVOD / AVOD MVPD / vMVPD SOCIAL / MOBILE $13B+ IN COMBINED AFFILIATE AND LICENSING REVENUE 3rd PARTY PLATFORMS PREMIUM PAY TV 3 Scaled premium content provider Powerful growth strategy – Production & Licensing 13

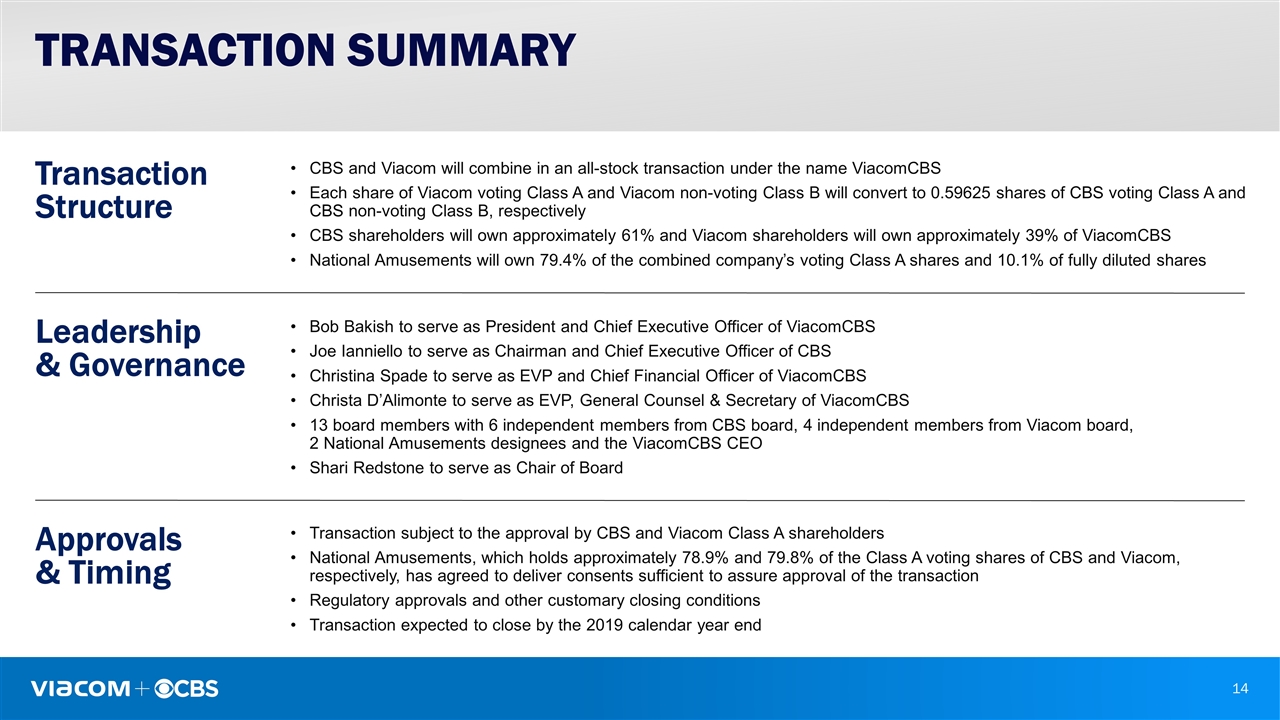

CBS and Viacom will combine in an all-stock transaction under the name ViacomCBS Each share of Viacom voting Class A and Viacom non-voting Class B will convert to 0.59625 shares of CBS voting Class A and CBS non-voting Class B, respectively CBS shareholders will own approximately 61% and Viacom shareholders will own approximately 39% of ViacomCBS National Amusements will own 79.4% of the combined company’s voting Class A shares and 10.1% of fully diluted shares Bob Bakish to serve as President and Chief Executive Officer of ViacomCBS Joe Ianniello to serve as Chairman and Chief Executive Officer of CBS Christina Spade to serve as EVP and Chief Financial Officer of ViacomCBS Christa D’Alimonte to serve as EVP, General Counsel & Secretary of ViacomCBS 13 board members with 6 independent members from CBS board, 4 independent members from Viacom board, 2 National Amusements designees and the ViacomCBS CEO Shari Redstone to serve as Chair of Board Transaction subject to the approval by CBS and Viacom Class A shareholders National Amusements, which holds approximately 78.9% and 79.8% of the Class A voting shares of CBS and Viacom, respectively, has agreed to deliver consents sufficient to assure approval of the transaction Regulatory approvals and other customary closing conditions Transaction expected to close by the 2019 calendar year end Transaction Structure Leadership & Governance Approvals & Timing TRANSACTION SUMMARY 14

Robust financial profile Attractive Growth Outlook $500MM in Annual Cost Synergies Within 12 - 24 Months of Closing Highly Cash Flow Generative Increased Financial Scale for Significant Investment in Programming & Innovation EPS Accretive Transaction Commitment to Investment Grade Credit Rating and Modest Dividend Payment 15

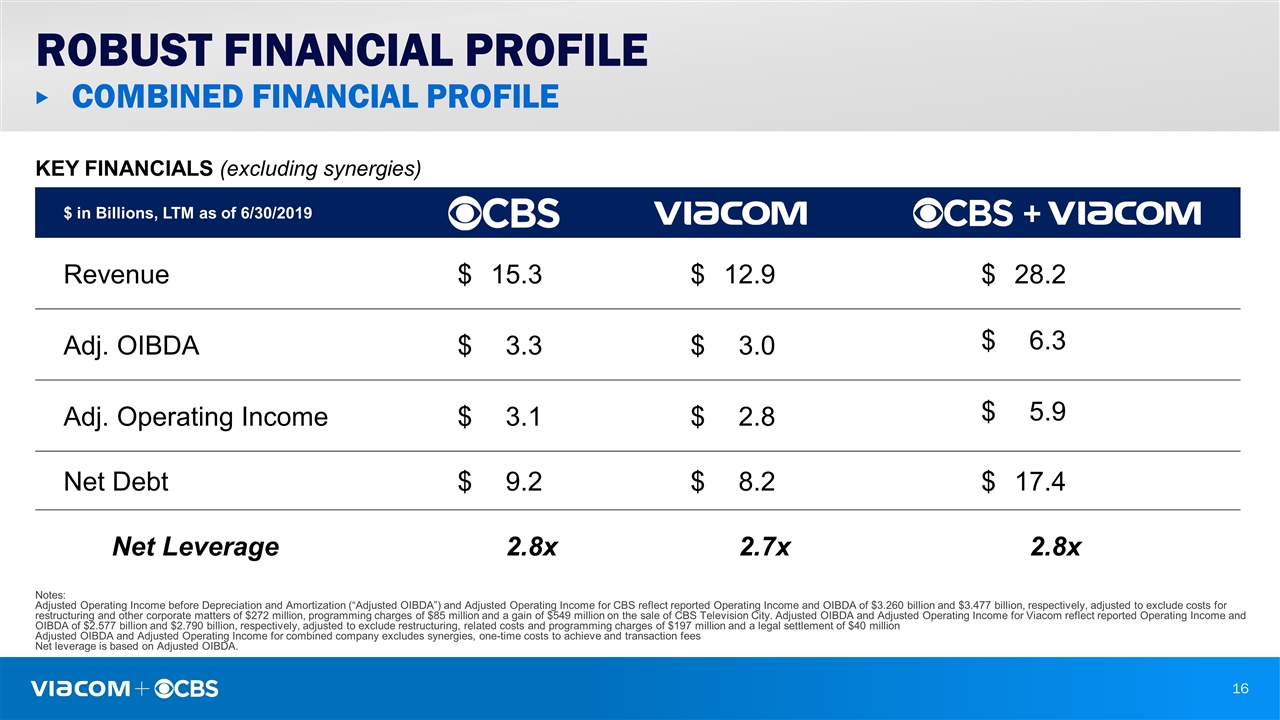

Robust financial profile Combined FINANCIAL PROFILE KEY FINANCIALS (excluding synergies) $ in Billions, LTM as of 6/30/2019 Revenue $15.3 $12.9 $28.2 Adj. OIBDA $3.3 $3.0 $6.3 Adj. Operating Income $3.1 $2.8 $5.9 Net Debt $9.2 $8.2 $17.4 Net Leverage 2.8x 2.7x 2.8x + Notes: Adjusted Operating Income before Depreciation and Amortization (“Adjusted OIBDA”) and Adjusted Operating Income for CBS reflect reported Operating Income and OIBDA of $3.260 billion and $3.477 billion, respectively, adjusted to exclude costs for restructuring and other corporate matters of $272 million, programming charges of $85 million and a gain of $549 million on the sale of CBS Television City. Adjusted OIBDA and Adjusted Operating Income for Viacom reflect reported Operating Income and OIBDA of $2.577 billion and $2.790 billion, respectively, adjusted to exclude restructuring, related costs and programming charges of $197 million and a legal settlement of $40 million Adjusted OIBDA and Adjusted Operating Income for combined company excludes synergies, one-time costs to achieve and transaction fees Net leverage is based on Adjusted OIBDA. 16

AUDIENCE REACH DIRECT-TO-CONSUMER PLATFORMS DIGITAL VALUABLE LIBRARIES GLOBAL FOOTPRINT POWERFUL BRANDS ADVANCED ADVERTISING CAPABILITIES DATA AVOD ATTRACTIVE DEMOGRAPHICS ICONIC IP ANALYTICS A LEADING Global, MULTIPLATFORM, Premium Content Company 17