- PARA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Paramount Global (PARA) 425Business combination disclosure

Filed: 8 Jul 24, 8:39pm

Filed by Paramount Global pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended Subject Company: Paramount Global (SEC File No.: 001-09553) Date: July 8, 2024 Creating a Next Generation Leading Entertainment Company July 8, 2024

Disclaimer Cautionary Note Regarding Forward-Looking Statements This presentation contains both historical and forward-looking statements. Statements that describe objectives, plans or goals of Paramount Global (“Paramount”), Skydance Media, LLC (“Skydance”), and New Paramount (“New Paramount” and together with Paramount and Skydance, the “Companies”) are or may be forward-looking statements. These forward-looking statements reflect current expectations concerning future results and events and generally can be identified by the use of statements that include phrases such as believe, expect, anticipate, intend, plan, foresee, likely, will, may, could, estimate or other similar words or phrases. Such statements include, without limitation, statements regarding the expected timeline for the acquisition of National Amusements, Inc., the merger transactions among the Companies and the related transactions, in each case, as described herein (collectively, the “Transactions”); the proposed business plan for the combined Companies following the Transactions; the expected benefits resulting to the Companies and to stockholders from the Transactions; expected sources of funding for the Transactions; provisions contained in the Companies' outstanding debt agreements; certain pro forma financial forecasts and projected financial information for the combined Companies; expected synergies and other efficiencies resulting from the Transactions; and the response of investors and ratings agencies to the Transactions and to the going-forward business of the combined Companies. Forward-looking statements involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause actual results, performance or achievements to be different from any future results, performance or achievements expressed or implied by these statements. These risks, uncertainties and other factors include, among others: the satisfaction of the conditions precedent to the consummation of the Transactions, including without limitation the receipt of required regulatory approvals (including the approval of the FCC and Department of Justice); failure to achieve the expected synergies and operating efficiencies attributable to the Transactions within the expected timeframes or at all; the diversion of management’s time and attention to issues relating to the Transactions and integration; significant transaction costs and integration costs in connection with the Transactions; unanticipated difficulties or expenditures relating to the Transactions; legal proceedings, judgments or settlements, including those that may be instituted against the Companies and their boards of directors and executive officers and others following the announcement of the Transactions; disruptions of current plans and operations caused by the announcement and pendency of the Transactions; potential difficulties in employee retention due to the announcement and pendency of the Transactions; the response of business partners, customers and regulators to the announcement of the Transactions; other risks that may imperil the consummation of the Transactions, which may result in the Transactions not being consummated within the expected timeframe or at all; risks related to Paramount's streaming business; the adverse impact on Paramount's advertising revenues as a result of advertising market conditions, changes in consumer viewership and deficiencies in audience measurement; risks related to operating in highly competitive and dynamic industries, including cost increases; the unpredictable nature of consumer behavior, as well as evolving technologies and distribution models; risks related to ongoing changes in business strategy, including investments in new businesses, products, services, technologies and other strategic activities; the potential for loss of carriage or other reduction in or the impact of negotiations for the distribution of content; damage to the Companies' reputation or brands; losses due to asset impairment charges for goodwill, intangible assets, FCC licenses and content; liabilities related to discontinued operations and former businesses; risks related to environmental, social and governance (ESG) matters; evolving business continuity, cybersecurity, privacy and data protection and similar risks; content infringement; domestic and global political, economic and regulatory factors affecting the Companies' businesses generally; disruptions to our operations as a result of labor disputes; the inability to hire or retain key employees or secure creative talent; volatility in the prices of Paramount's common stock; potential conflicts of interest arising from Paramount's ownership structure with a controlling stockholder; and other factors described in Paramount’s news releases and filings with the Securities and Exchange Commission, including but not limited to Paramount’s most recent Annual Report on Form 10-K and reports on Form 10-Q and Form 8-K. There may be additional risks, uncertainties and factors that the Companies’ do not currently view as material or that are not necessarily known. The forward-looking statements included in this communication are made only as of the date of this communication and the Companies do not undertake any obligation to publicly update any forward-looking statements to reflect subsequent events or circumstances. 1

Disclaimer (Cont’d) Use of Projections This presentation contains financial forecasts, including those presented on a pro forma basis giving effect to the Transactions. Neither Skydance’s nor Paramount’s independent auditors have studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, no auditor has expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Projections are inherently uncertain due to a number of factors outside of the Companies’ control. Accordingly, there can be no assurance that the prospective results are indicative of future performance of Paramount, Skydance or the combined Companies after the Transactions or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Non-GAAP Financial Measures This presentation includes certain non GAAP financial measures, including EBITDA and Adjusted OIBDA. EBITDA is defined as net income plus income tax expense (benefit), interest expense and depreciation and amortization. Adjusted OIBDA is defined as operating income excluding depreciation and amortization, stock-based compensation, restructuring charges, and programming charges, each where applicable. These financial measures are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and may be different from non-GAAP financial measures used by other companies. The Companies believe that the use of these non-GAAP financial measures provides an additional tool for management and investors to use in evaluating ongoing operating results and trends. Non-GAAP measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP. This presentation includes certain forward looking non-GAAP financial measures. To the extent a reconciliation of these forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures is not provided in this presentation, it is because the Companies are not able to provide such reconciliation without unreasonable effort. Important Information for Investors and Stockholders This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any issuance or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933. In connection with the Transactions, New Paramount expects to file a registration statement on Form S-4 with the Securities and Exchange Commission (the “SEC”), which will include an information statement of Paramount and a preliminary prospectus of New Paramount. After the registration statement is declared effective, Paramount will mail to its stockholders a definitive information statement that will form part of the registration statement on Form S-4. This communication is not a substitute for any other document that Paramount or New Paramount may file with the SEC or send to its stockholders in connection with the Transactions. INVESTORS AND SECURITY HOLDERS OF THE COMPANIES ARE URGED TO READ ANY OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of the information statement/prospectus (when available) and other documents filed with the SEC by Paramount and New Paramount through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Paramount and New Paramount will be available free of charge on Paramount’s website at http://ir.paramount.com. 2

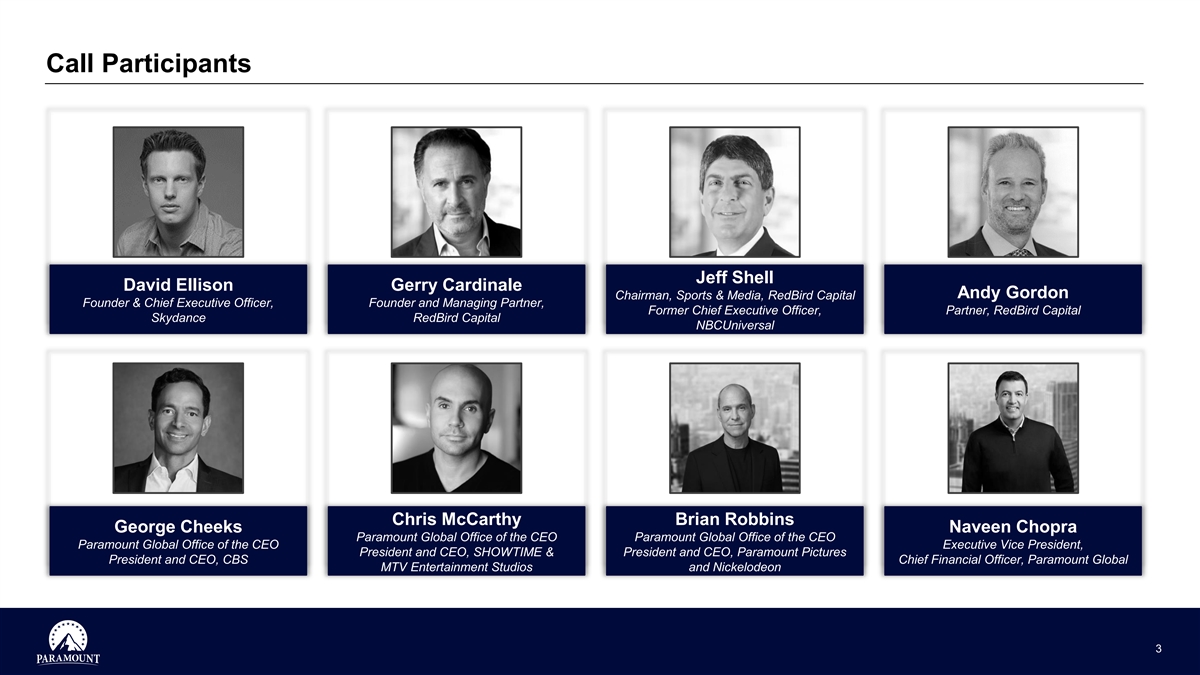

Call Participants Jeff Shell David Ellison Gerry Cardinale Andy Gordon Chairman, Sports & Media, RedBird Capital Founder & Chief Executive Officer, Founder and Managing Partner, Former Chief Executive Officer, Partner, RedBird Capital Skydance RedBird Capital NBCUniversal Chris McCarthy Brian Robbins George Cheeks Naveen Chopra Paramount Global Office of the CEO Paramount Global Office of the CEO Paramount Global Office of the CEO Executive Vice President, President and CEO, SHOWTIME & President and CEO, Paramount Pictures President and CEO, CBS Chief Financial Officer, Paramount Global MTV Entertainment Studios and Nickelodeon 3

Table of Contents New Paramount: Transaction Overview & Highlights 1 Paramount Overview 2 The Skydance Story 3 New Paramount Plan 4 Transaction Detail 5 Financial Highlights 6 4

1. New Paramount: Transaction Overview and Highlights

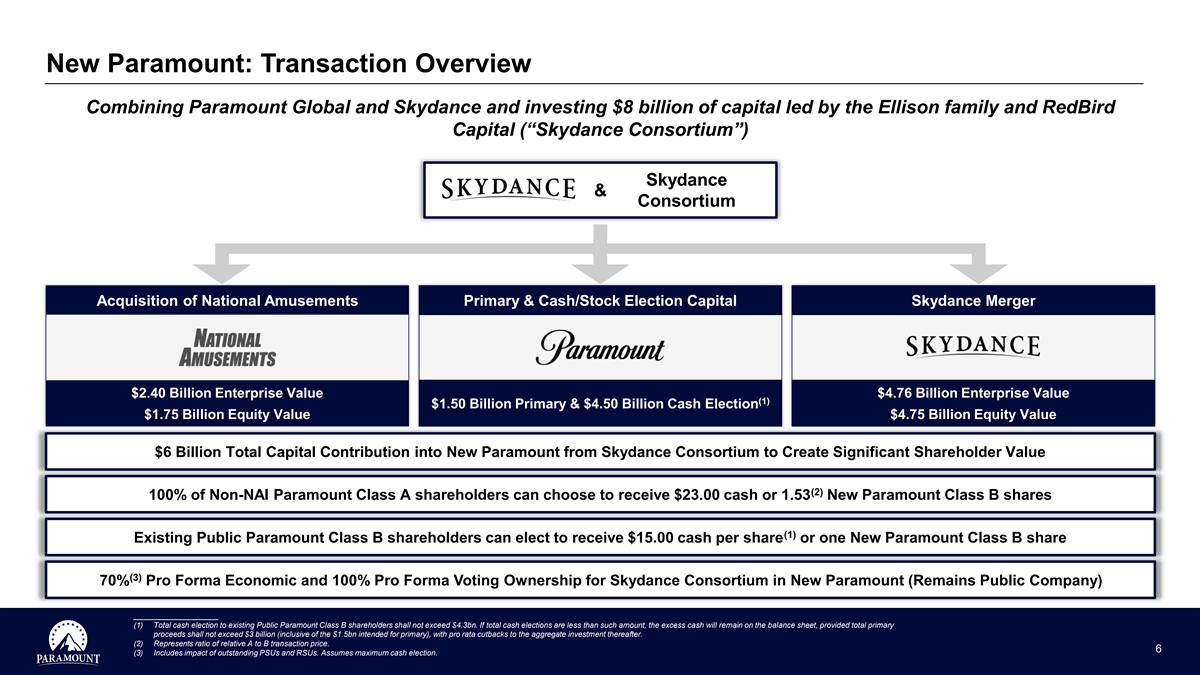

New Paramount: Transaction Overview Combining Paramount Global and Skydance and investing $8 billion of capital led by the Ellison family and RedBird Capital (“Skydance Consortium”) Skydance & Consortium Acquisition of National Amusements Primary & Cash/Stock Election Capital Skydance Merger $2.40 Billion Enterprise Value $4.76 Billion Enterprise Value (1) $1.50 Billion Primary & $4.50 Billion Cash Election $1.75 Billion Equity Value $4.75 Billion Equity Value $6 Billion Total Capital Contribution into New Paramount from Skydance Consortium to Create Significant Shareholder Value (2) 100% of Non-NAI Paramount Class A shareholders can choose to receive $23.00 cash or 1.53 New Paramount Class B shares (1) Existing Public Paramount Class B shareholders can elect to receive $15.00 cash per share or one New Paramount Class B share (3) 70% Pro Forma Economic and 100% Pro Forma Voting Ownership for Skydance Consortium in New Paramount (Remains Public Company) ____________________ (1) Total cash election to existing Public Paramount Class B shareholders shall not exceed $4.3bn. If total cash elections are less than such amount, the excess cash will remain on the balance sheet, provided total primary proceeds shall not exceed $3 billion (inclusive of the $1.5bn intended for primary), with pro rata cutbacks to the aggregate investment thereafter. (2) Represents ratio of relative A to B transaction price. 6 (3) Includes impact of outstanding PSUs and RSUs. Assumes maximum cash election.

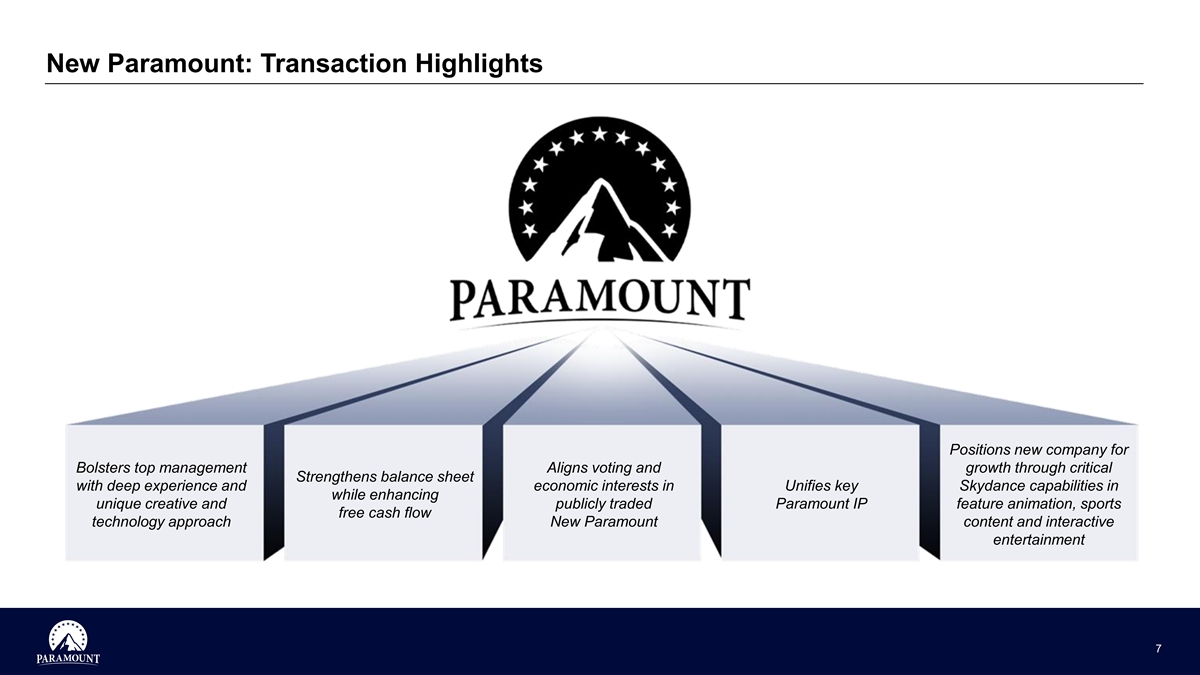

New Paramount: Transaction Highlights Positions new company for Bolsters top management Aligns voting and growth through critical Strengthens balance sheet with deep experience and economic interests in Unifies key Skydance capabilities in while enhancing unique creative and publicly traded Paramount IP feature animation, sports free cash flow technology approach New Paramount content and interactive entertainment 7

2. Paramount Overview

Paramount: A Leading Global Media Company GLOBAL PRODUCTION #1 BROADCAST A LEADING PORTFOLIO PREMIUM ICONIC CAPABILITIES NETWORK FAST OF DIVERSE STREAMING HOLLYWOOD ON 5 FOR 16 CONSECUTIVE SERVICE CABLE NETS SERVICE STUDIO (1) CONTINENTS YEARS ENTERTAINMENT SPORTS KIDS FILM NEWS ONE OF THE LARGEST LIBRARIES OF ICONIC & IRREPLACEABLE IP 200K+ TV EPISODES 4K+ FILMS ____________________ (1) For ’23-’24 season. 9

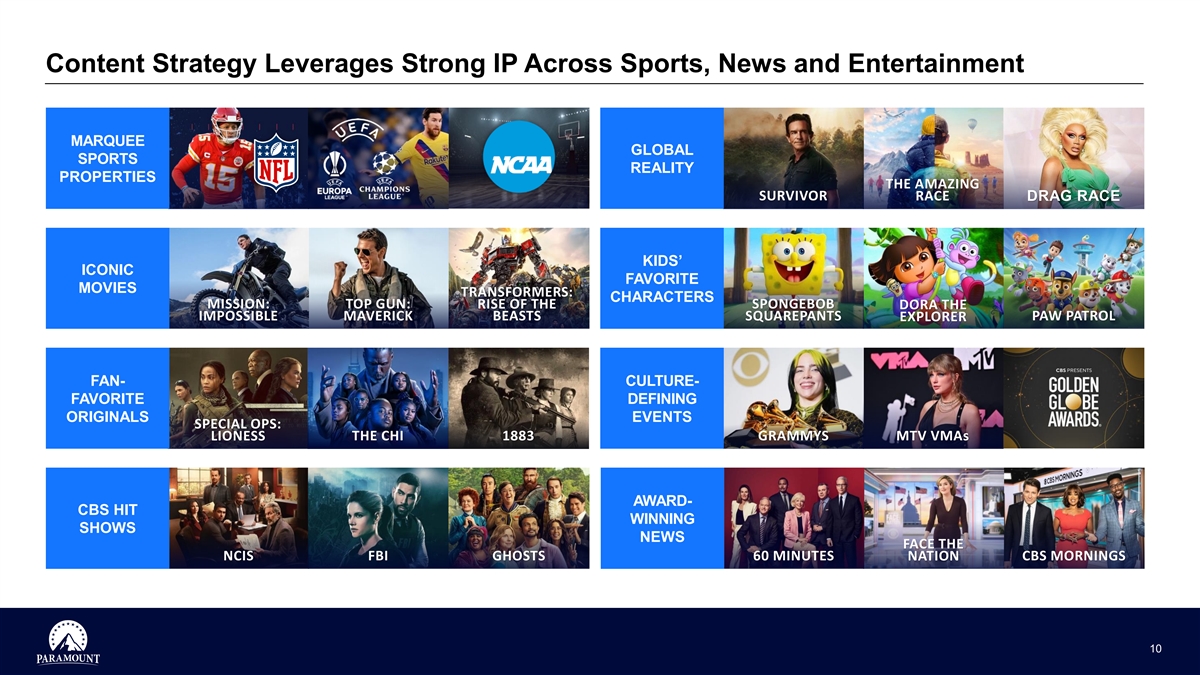

Content Strategy Leverages Strong IP Across Sports, News and Entertainment MARQUEE GLOBAL SPORTS REALITY PROPERTIES THE AMAZING SURVIVOR RACE DRAG RACE KIDS’ ICONIC FAVORITE MOVIES TRANSFORMERS: CHARACTERS MISSION: TOP GUN: RISE OF THE SPONGEBOB DORA THE PAW PATROL IMPOSSIBLE MAVERICK BEASTS SQUAREPANTS EXPLORER FAN- CULTURE- FAVORITE DEFINING ORIGINALS EVENTS SPECIAL OPS: THE CHI 1883 GRAMMYS MTV VMAs LIONESS AWARD- CBS HIT WINNING SHOWS NEWS FACE THE NCIS FBI GHOSTS 60 MINUTES CBS MORNINGS NATION 10

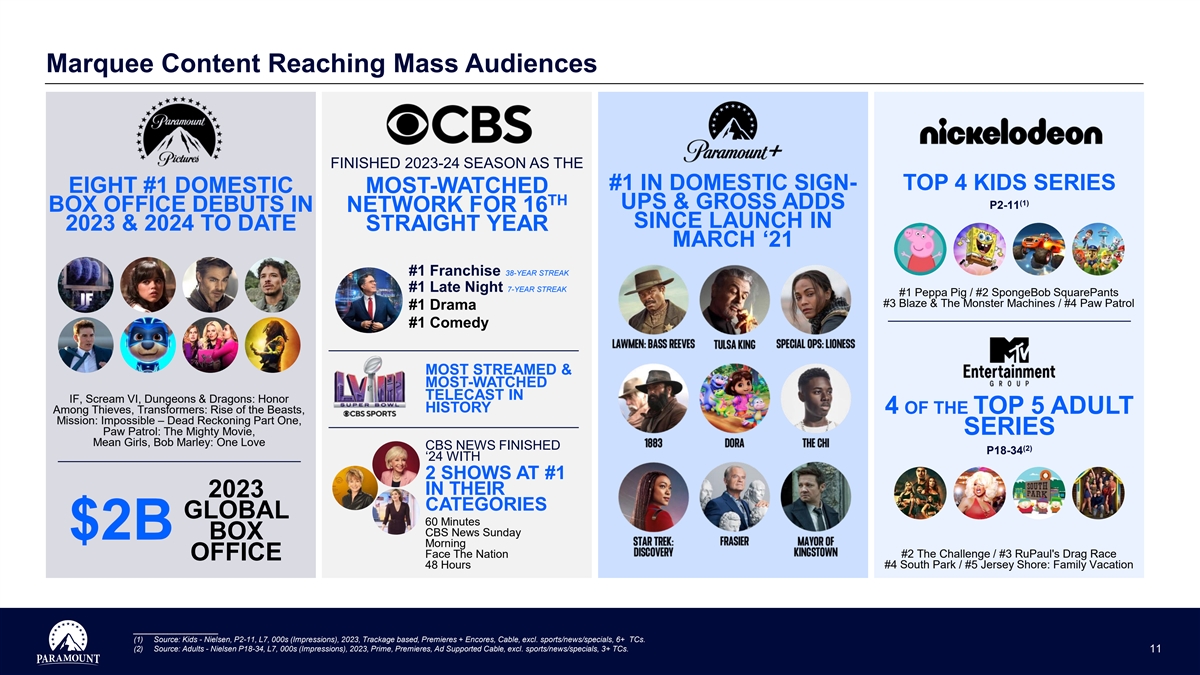

Marquee Content Reaching Mass Audiences FINISHED 2023-24 SEASON AS THE #1 IN DOMESTIC SIGN- TOP 4 KIDS SERIES EIGHT #1 DOMESTIC MOST-WATCHED TH (1) UPS & GROSS ADDS P2-11 BOX OFFICE DEBUTS IN NETWORK FOR 16 SINCE LAUNCH IN 2023 & 2024 TO DATE STRAIGHT YEAR MARCH ‘21 #1 Franchise 38-YEAR STREAK #1 Late Night 7-YEAR STREAK #1 Peppa Pig / #2 SpongeBob SquarePants #3 Blaze & The Monster Machines / #4 Paw Patrol #1 Drama #1 Comedy MOST STREAMED & MOST-WATCHED TELECAST IN IF, Scream VI, Dungeons & Dragons: Honor HISTORY Among Thieves, Transformers: Rise of the Beasts, 4 OF THE TOP 5 ADULT Mission: Impossible – Dead Reckoning Part One, Paw Patrol: The Mighty Movie, SERIES Mean Girls, Bob Marley: One Love CBS NEWS FINISHED (2) P18-34 ‘24 WITH 2 SHOWS AT #1 IN THEIR 2023 CATEGORIES GLOBAL 60 Minutes CBS News Sunday $2B BOX Morning Face The Nation #2 The Challenge / #3 RuPaul's Drag Race OFFICE 48 Hours #4 South Park / #5 Jersey Shore: Family Vacation ____________________ (1) Source: Kids - Nielsen, P2-11, L7, 000s (Impressions), 2023, Trackage based, Premieres + Encores, Cable, excl. sports/news/specials, 6+ TCs. (2) Source: Adults - Nielsen P18-34, L7, 000s (Impressions), 2023, Prime, Premieres, Ad Supported Cable, excl. sports/news/specials, 3+ TCs. 11

3. The Skydance Story

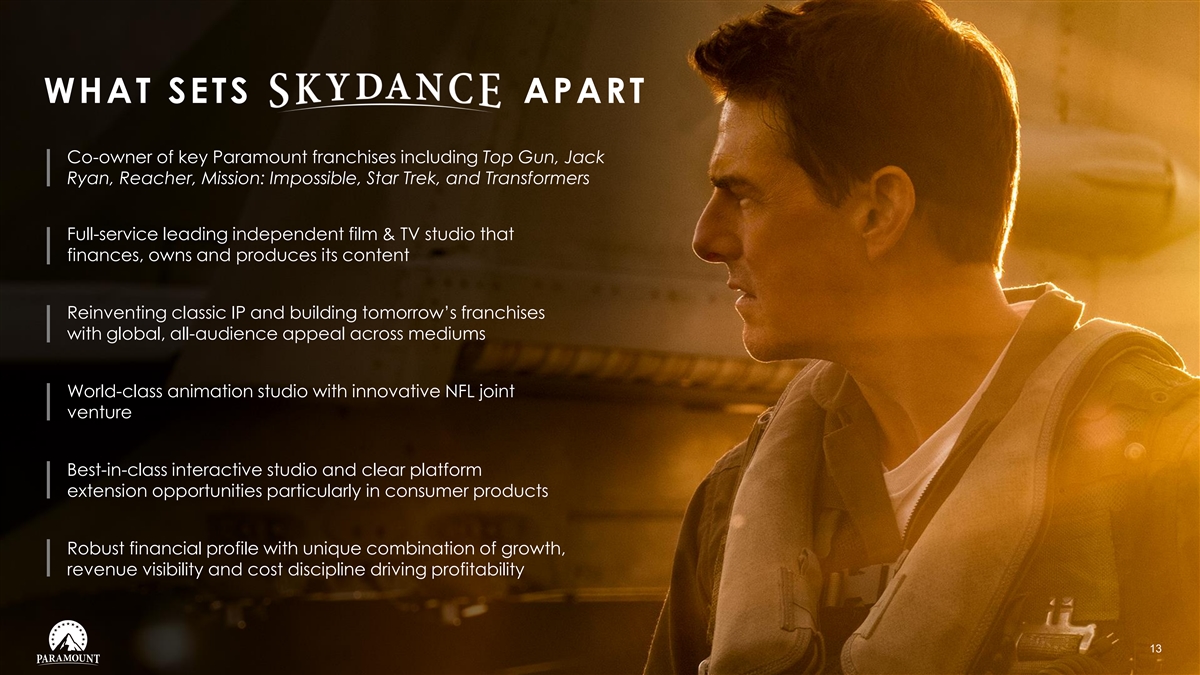

WHAT SETS APART Co-owner of key Paramount franchises including Top Gun, Jack Ryan, Reacher, Mission: Impossible, Star Trek, and Transformers Full-service leading independent film & TV studio that finances, owns and produces its content Reinventing classic IP and building tomorrow’s franchises with global, all-audience appeal across mediums World-class animation studio with innovative NFL joint venture Best-in-class interactive studio and clear platform extension opportunities particularly in consumer products Robust financial profile with unique combination of growth, revenue visibility and cost discipline driving profitability 13

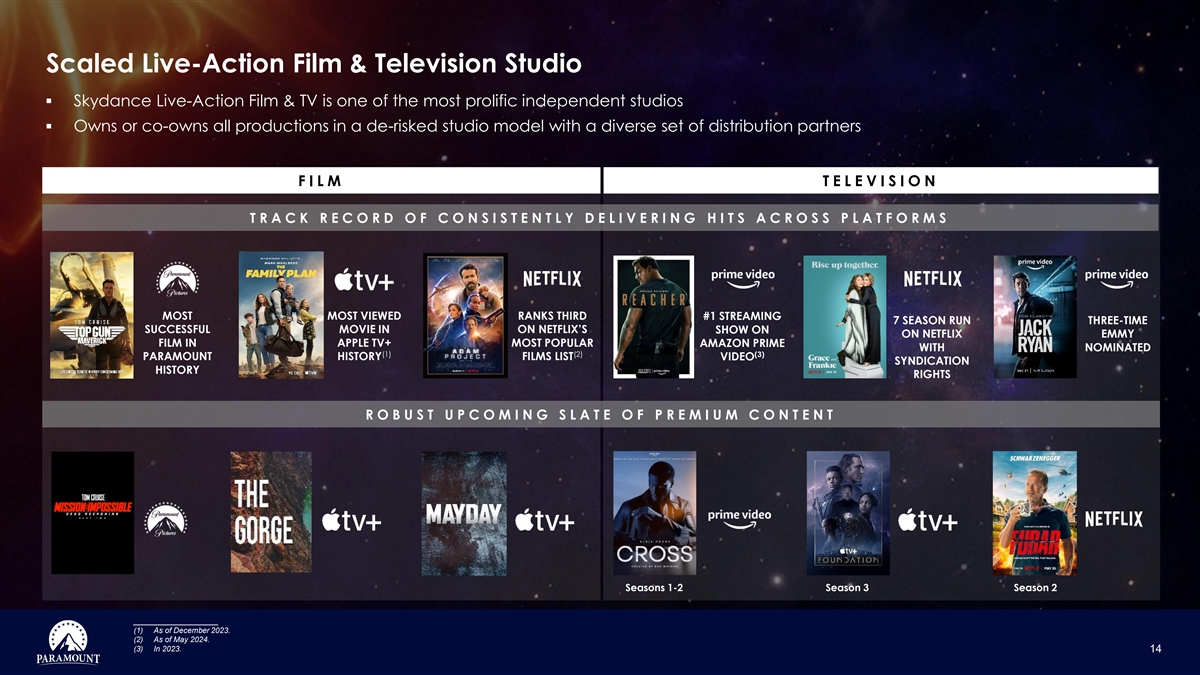

Scaled Live-Action Film & Television Studio ▪ Skydance Live-Action Film & TV is one of the most prolific independent studios ▪ Owns or co-owns all productions in a de-risked studio model with a diverse set of distribution partners FILM TELEVISION T R A C K R E C O R D O F C O N S I S T E N T L Y D E L I V E R I N G H I T S A C R O S S P L A T F O R M S MOST MOST VIEWED RANKS THIRD #1 STREAMING 7 SEASON RUN THREE-TIME SUCCESSFUL MOVIE IN ON NETFLIX’S SHOW ON ON NETFLIX EMMY FILM IN APPLE TV+ MOST POPULAR AMAZON PRIME WITH NOMINATED (1) (2) (3) PARAMOUNT HISTORY FILMS LIST VIDEO SYNDICATION HISTORY RIGHTS R O B U S T U P C O M I N G S L A T E O F P R E M I U M C O N T E N T Seasons 1-2 Season 3 Season 2 ____________________ (1) As of December 2023. (2) As of May 2024. (3) In 2023. 14

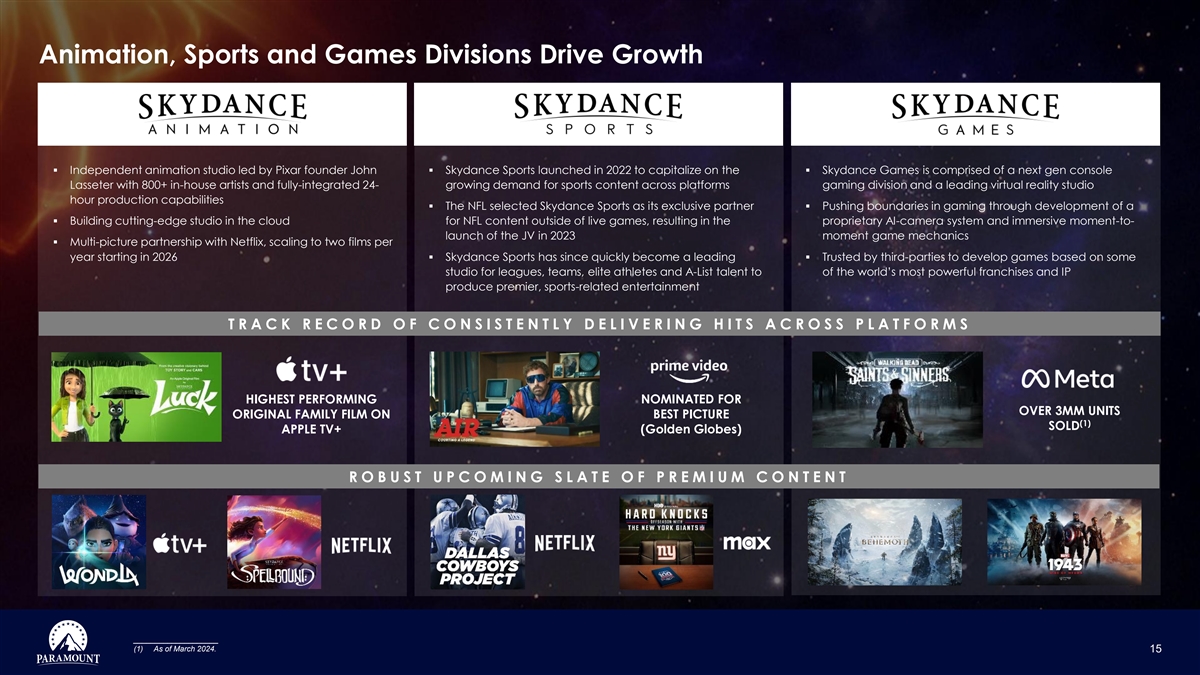

Animation, Sports and Games Divisions Drive Growth ▪ Independent animation studio led by Pixar founder John ▪ Skydance Sports launched in 2022 to capitalize on the ▪ Skydance Games is comprised of a next gen console Lasseter with 800+ in-house artists and fully-integrated 24- growing demand for sports content across platforms gaming division and a leading virtual reality studio hour production capabilities ▪ The NFL selected Skydance Sports as its exclusive partner ▪ Pushing boundaries in gaming through development of a ▪ Building cutting-edge studio in the cloud for NFL content outside of live games, resulting in the proprietary AI-camera system and immersive moment-to- launch of the JV in 2023 moment game mechanics ▪ Multi-picture partnership with Netflix, scaling to two films per year starting in 2026▪ Skydance Sports has since quickly become a leading ▪ Trusted by third-parties to develop games based on some studio for leagues, teams, elite athletes and A-List talent to of the world’s most powerful franchises and IP produce premier, sports-related entertainment T R A C K R E C O R D O F C O N S I S T E N T L Y D E L I V E R I N G H I T S A C R O S S P L A T F O R M S HIGHEST PERFORMING NOMINATED FOR OVER 3MM UNITS ORIGINAL FAMILY FILM ON BEST PICTURE (1) SOLD APPLE TV+ (Golden Globes) ROBUST UPCOMING SLATE OF PREMIUM CONTENT ____________________ (1) As of March 2024. 15

4. New Paramount Plan

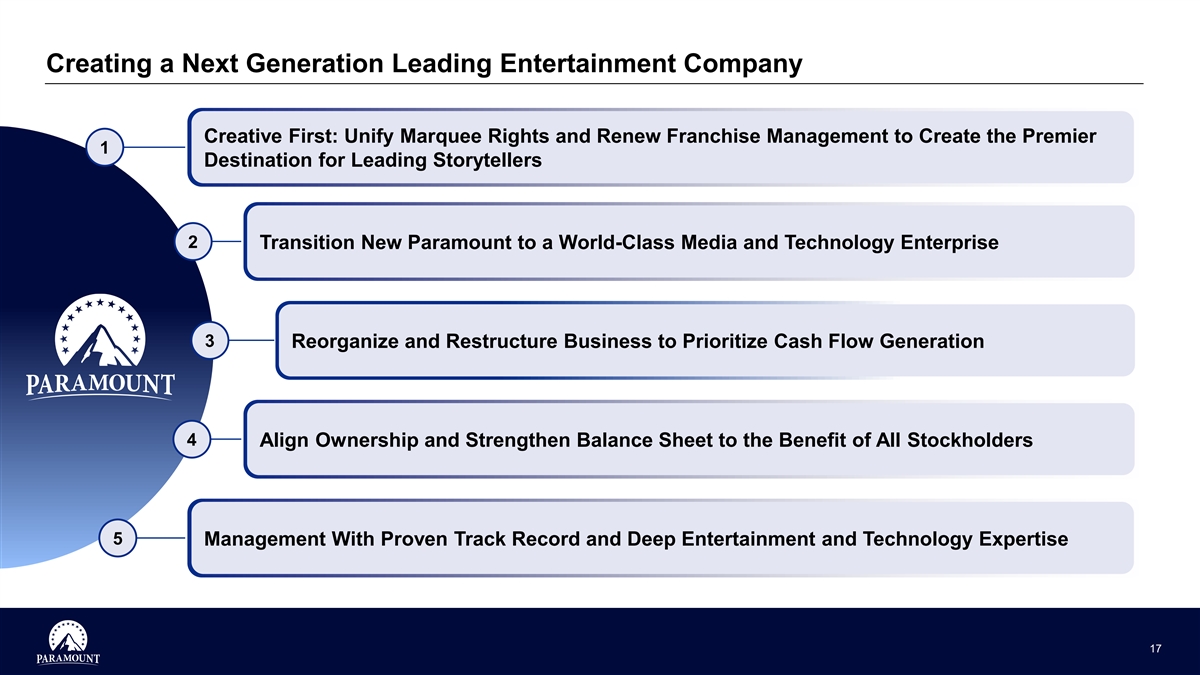

Creating a Next Generation Leading Entertainment Company Creative First: Unify Marquee Rights and Renew Franchise Management to Create the Premier 1 Destination for Leading Storytellers 2 Transition New Paramount to a World-Class Media and Technology Enterprise 3 Reorganize and Restructure Business to Prioritize Cash Flow Generation 4 Align Ownership and Strengthen Balance Sheet to the Benefit of All Stockholders 5 Management With Proven Track Record and Deep Entertainment and Technology Expertise 17

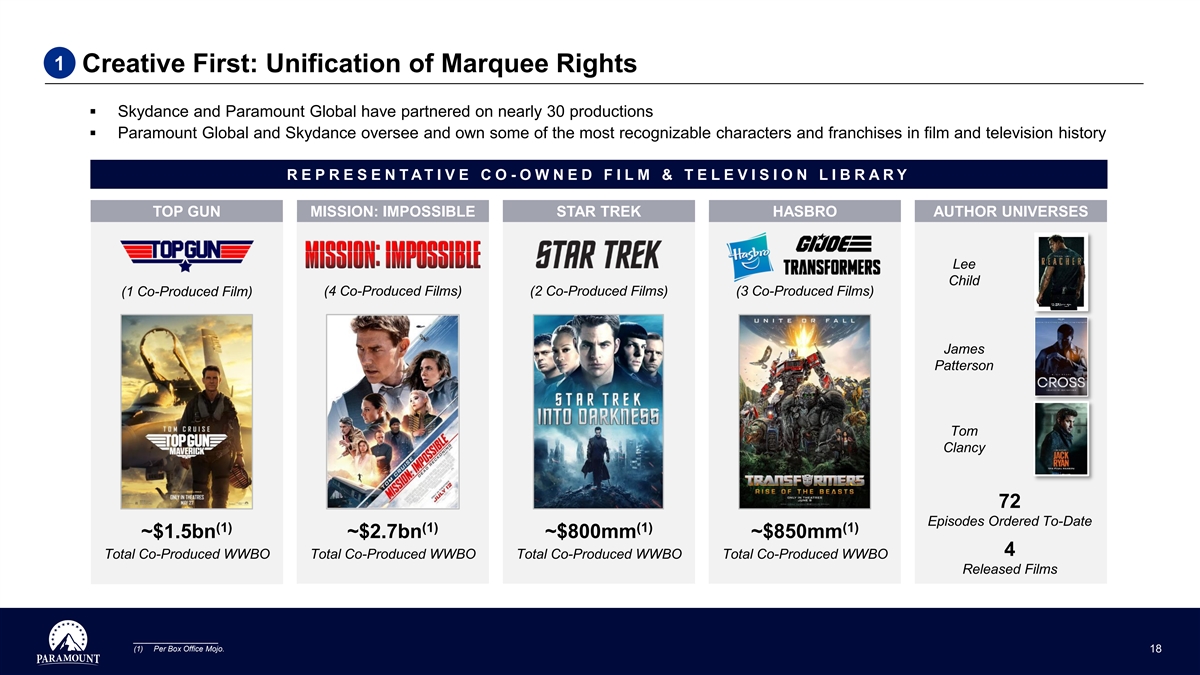

1 Creative First: Unification of Marquee Rights ▪ Skydance and Paramount Global have partnered on nearly 30 productions ▪ Paramount Global and Skydance oversee and own some of the most recognizable characters and franchises in film and television history R E P R E S E N T A T I V E C O - O W N E D F I L M & T E L E V I S I O N L I B R A R Y TOP GUN MISSION: IMPOSSIBLE STAR TREK HASBRO AUTHOR UNIVERSES Lee Child (1 Co-Produced Film) (4 Co-Produced Films) (2 Co-Produced Films) (3 Co-Produced Films) James Patterson Tom Clancy 72 Episodes Ordered To-Date (1) (1) (1) (1) ~$1.5bn ~$2.7bn ~$800mm ~$850mm 4 Total Co-Produced WWBO Total Co-Produced WWBO Total Co-Produced WWBO Total Co-Produced WWBO Released Films ____________________ (1) Per Box Office Mojo. 18

1 Creative First: Franchise Management Unlocks Significant Value Across IP ▪ Renewed focus on franchise management across all lines of business Determine creative approach and Build interconnected, cross-platform Reevaluate core brand attributes 2 optimal storyline sequencing across 3 universe that engages consumers 1 of franchises distribution platforms in new ways F U E L I N G A P O W E R F U L A N D R E P E AT A B L E I P E C O S Y S T E M F E A T U R E F I L M S T E L E V I S I O N Severance C P, L B E , & O T H E R I N T E R A C T I V E 19

1 Creative First: New Paramount will be the Premier Destination for Leading Storytellers Amplifying Sports Unlocking Interactive Accelerating Animation Expanding Quality Scripted Unifying Franchise IP 20

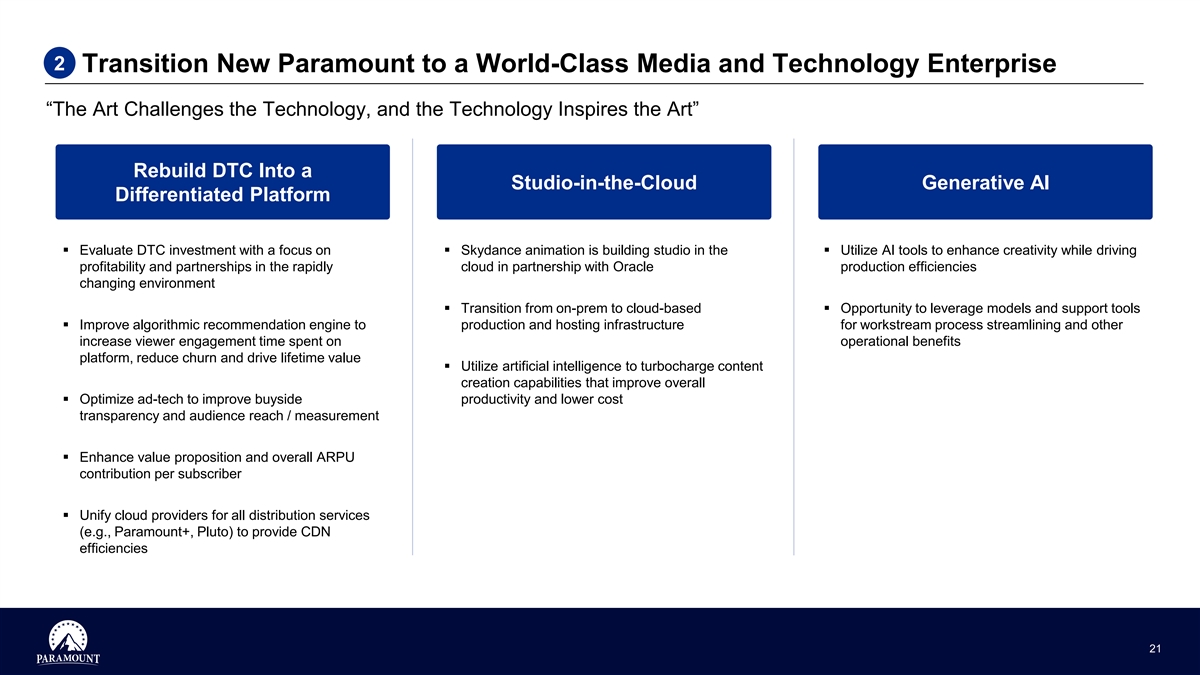

2 Transition New Paramount to a World-Class Media and Technology Enterprise “The Art Challenges the Technology, and the Technology Inspires the Art” Rebuild DTC Into a Studio-in-the-Cloud Generative AI Differentiated Platform ▪ Evaluate DTC investment with a focus on ▪ Skydance animation is building studio in the ▪ Utilize AI tools to enhance creativity while driving profitability and partnerships in the rapidly cloud in partnership with Oracle production efficiencies changing environment ▪ Transition from on-prem to cloud-based ▪ Opportunity to leverage models and support tools ▪ Improve algorithmic recommendation engine to production and hosting infrastructure for workstream process streamlining and other increase viewer engagement time spent on operational benefits platform, reduce churn and drive lifetime value ▪ Utilize artificial intelligence to turbocharge content creation capabilities that improve overall ▪ Optimize ad-tech to improve buyside productivity and lower cost transparency and audience reach / measurement ▪ Enhance value proposition and overall ARPU contribution per subscriber ▪ Unify cloud providers for all distribution services (e.g., Paramount+, Pluto) to provide CDN efficiencies 21

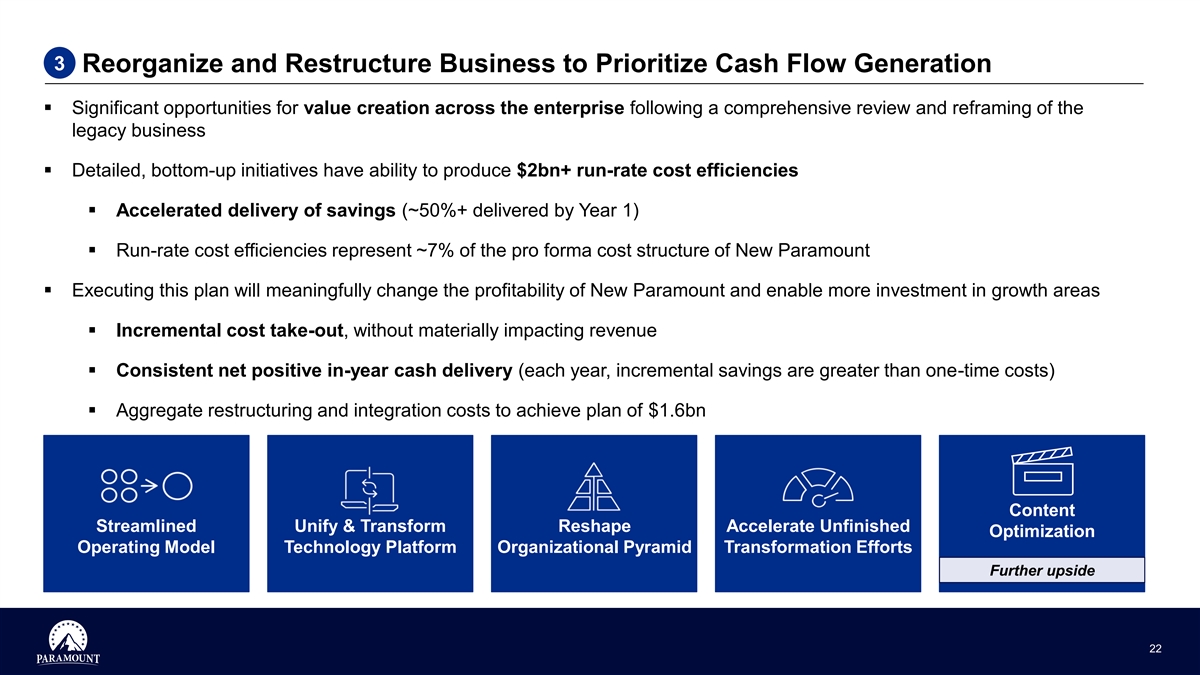

3 Reorganize and Restructure Business to Prioritize Cash Flow Generation ▪ Significant opportunities for value creation across the enterprise following a comprehensive review and reframing of the legacy business ▪ Detailed, bottom-up initiatives have ability to produce $2bn+ run-rate cost efficiencies ▪ Accelerated delivery of savings (~50%+ delivered by Year 1) ▪ Run-rate cost efficiencies represent ~7% of the pro forma cost structure of New Paramount ▪ Executing this plan will meaningfully change the profitability of New Paramount and enable more investment in growth areas ▪ Incremental cost take-out, without materially impacting revenue ▪ Consistent net positive in-year cash delivery (each year, incremental savings are greater than one-time costs) ▪ Aggregate restructuring and integration costs to achieve plan of $1.6bn Content Streamlined Unify & Transform Reshape Accelerate Unfinished Optimization Operating Model Technology Platform Organizational Pyramid Transformation Efforts Further upside 22

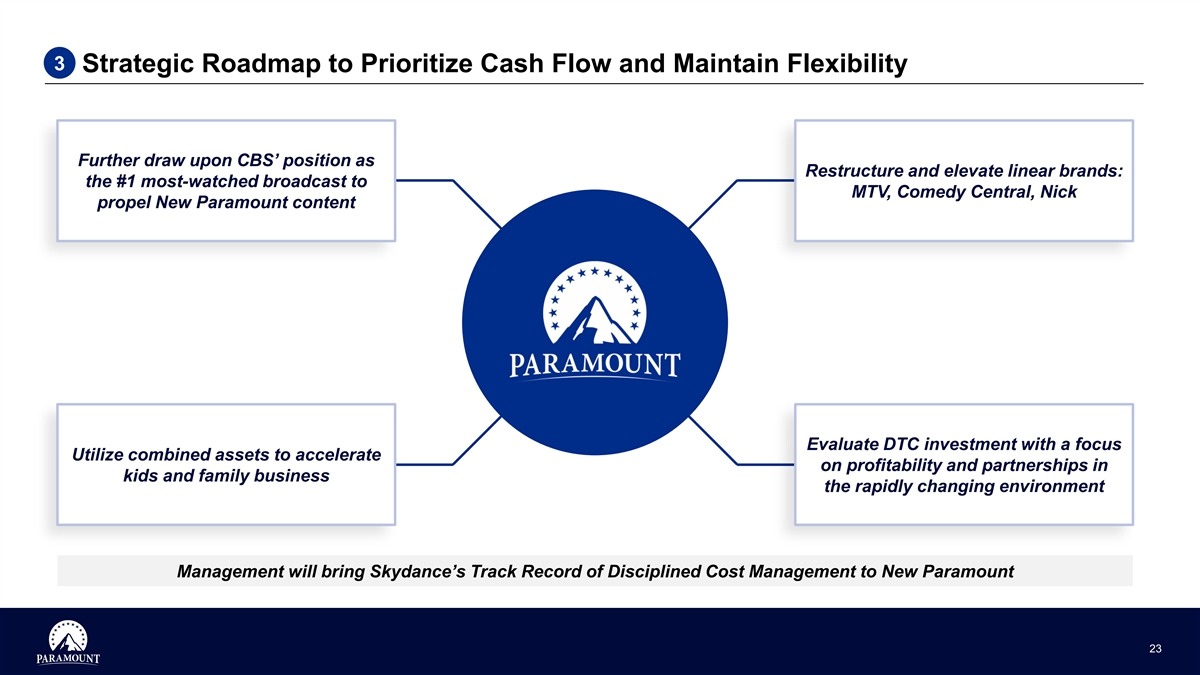

3 Strategic Roadmap to Prioritize Cash Flow and Maintain Flexibility Further draw upon CBS’ position as Restructure and elevate linear brands: the #1 most-watched broadcast to MTV, Comedy Central, Nick propel New Paramount content Evaluate DTC investment with a focus Utilize combined assets to accelerate on profitability and partnerships in kids and family business the rapidly changing environment Management will bring Skydance’s Track Record of Disciplined Cost Management to New Paramount 23

DRAFT - SUBJECT TO ATTORNEY REVIEW Consider adding P+ subs / breakeven. Consider adding content cost review, re-allocation and reduction? 5. Transaction Detail

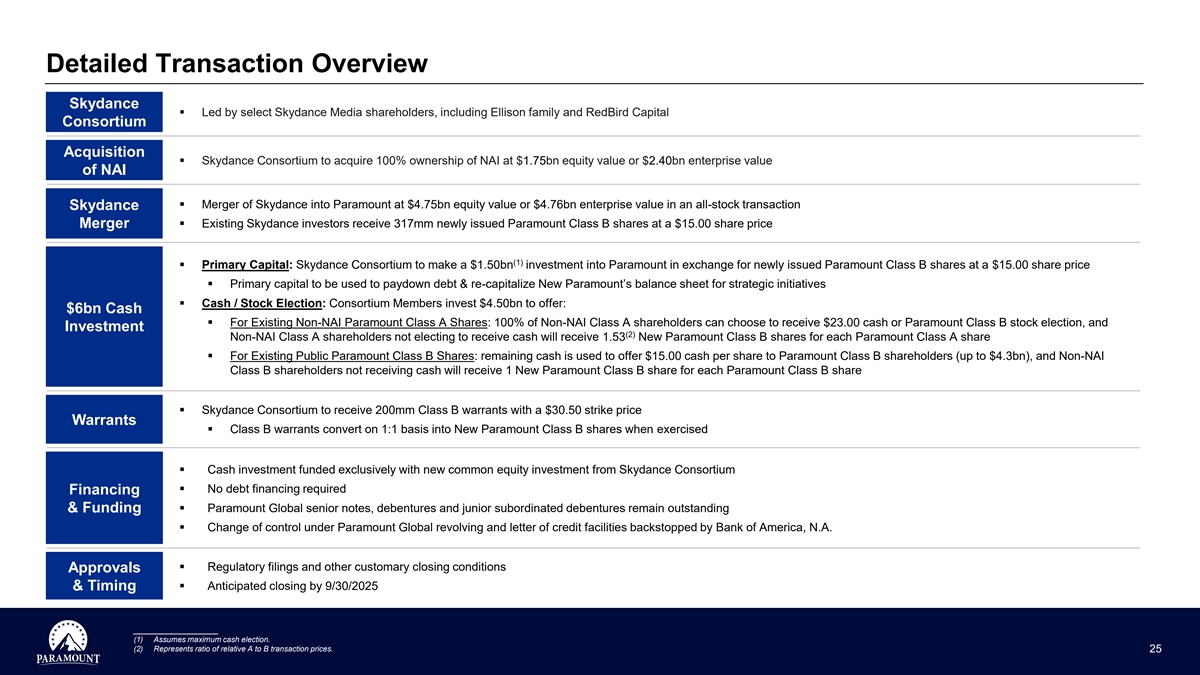

Detailed Transaction Overview Skydance ▪ Led by select Skydance Media shareholders, including Ellison family and RedBird Capital Consortium Acquisition ▪ Skydance Consortium to acquire 100% ownership of NAI at $1.75bn equity value or $2.40bn enterprise value of NAI ▪ Merger of Skydance into Paramount at $4.75bn equity value or $4.76bn enterprise value in an all-stock transaction Skydance ▪ Existing Skydance investors receive 317mm newly issued Paramount Class B shares at a $15.00 share price Merger (1) ▪ Primary Capital: Skydance Consortium to make a $1.50bn investment into Paramount in exchange for newly issued Paramount Class B shares at a $15.00 share price ▪ Primary capital to be used to paydown debt & re-capitalize New Paramount’s balance sheet for strategic initiatives ▪ Cash / Stock Election: Consortium Members invest $4.50bn to offer: $6bn Cash ▪ For Existing Non-NAI Paramount Class A Shares: 100% of Non-NAI Class A shareholders can choose to receive $23.00 cash or Paramount Class B stock election, and Investment (2) Non-NAI Class A shareholders not electing to receive cash will receive 1.53 New Paramount Class B shares for each Paramount Class A share ▪ For Existing Public Paramount Class B Shares: remaining cash is used to offer $15.00 cash per share to Paramount Class B shareholders (up to $4.3bn), and Non-NAI Class B shareholders not receiving cash will receive 1 New Paramount Class B share for each Paramount Class B share ▪ Skydance Consortium to receive 200mm Class B warrants with a $30.50 strike price Warrants ▪ Class B warrants convert on 1:1 basis into New Paramount Class B shares when exercised ▪ Cash investment funded exclusively with new common equity investment from Skydance Consortium ▪ No debt financing required Financing & Funding▪ Paramount Global senior notes, debentures and junior subordinated debentures remain outstanding ▪ Change of control under Paramount Global revolving and letter of credit facilities backstopped by Bank of America, N.A. ▪ Regulatory filings and other customary closing conditions Approvals ▪ Anticipated closing by 9/30/2025 & Timing ____________________ (1) Assumes maximum cash election. (2) Represents ratio of relative A to B transaction prices. 25

DRAFT - SUBJECT TO ATTORNEY REVIEW 6. Financial Highlights

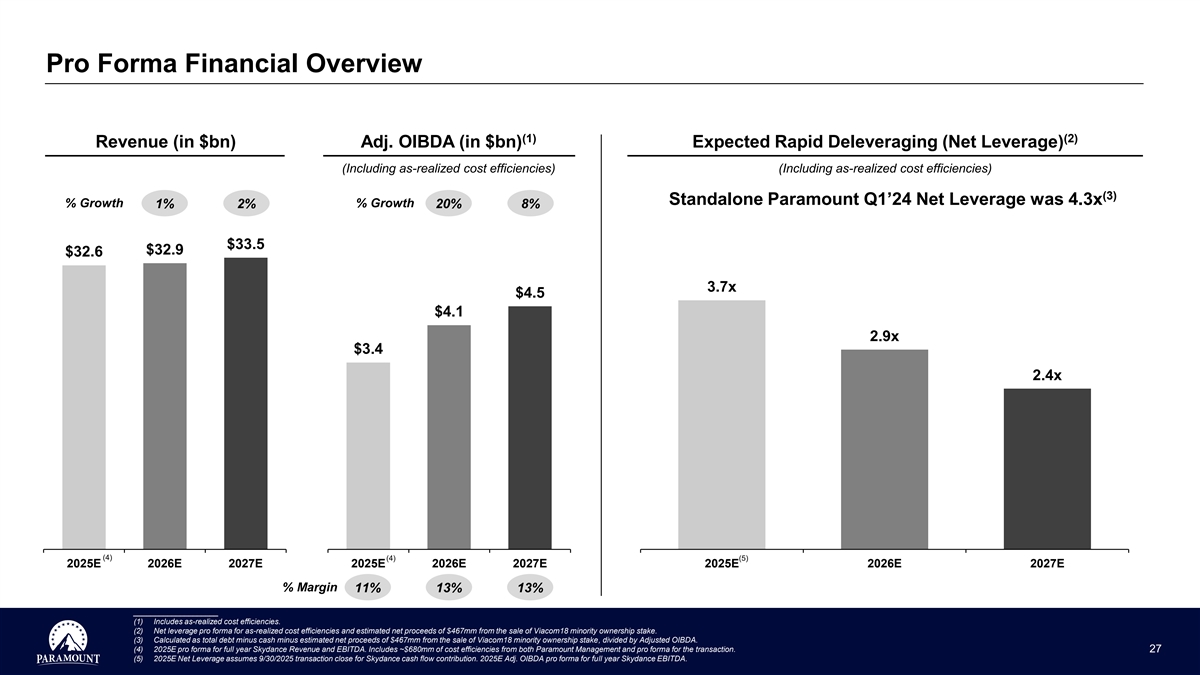

Pro Forma Financial Overview (1) (2) Revenue (in $bn) Adj. OIBDA (in $bn) Expected Rapid Deleveraging (Net Leverage) (Including as-realized cost efficiencies) (Including as-realized cost efficiencies) (3) Standalone Paramount Q1’24 Net Leverage was 4.3x % Growth % Growth 1% 2% 20% 8% $33.5 $32.9 $32.6 3.7x $4.5 $4.1 2.9x $3.4 2.4x (4) (4) (5) 2025E 2026E 2027E 2025E 2026E 2027E 2025E 2026E 2027E % Margin 11% 13% 13% ____________________ (1) Includes as-realized cost efficiencies. (2) Net leverage pro forma for as-realized cost efficiencies and estimated net proceeds of $467mm from the sale of Viacom18 minority ownership stake. (3) Calculated as total debt minus cash minus estimated net proceeds of $467mm from the sale of Viacom18 minority ownership stake, divided by Adjusted OIBDA. (4) 2025E pro forma for full year Skydance Revenue and EBITDA. Includes ~$680mm of cost efficiencies from both Paramount Management and pro forma for the transaction. 27 (5) 2025E Net Leverage assumes 9/30/2025 transaction close for Skydance cash flow contribution. 2025E Adj. OIBDA pro forma for full year Skydance EBITDA.

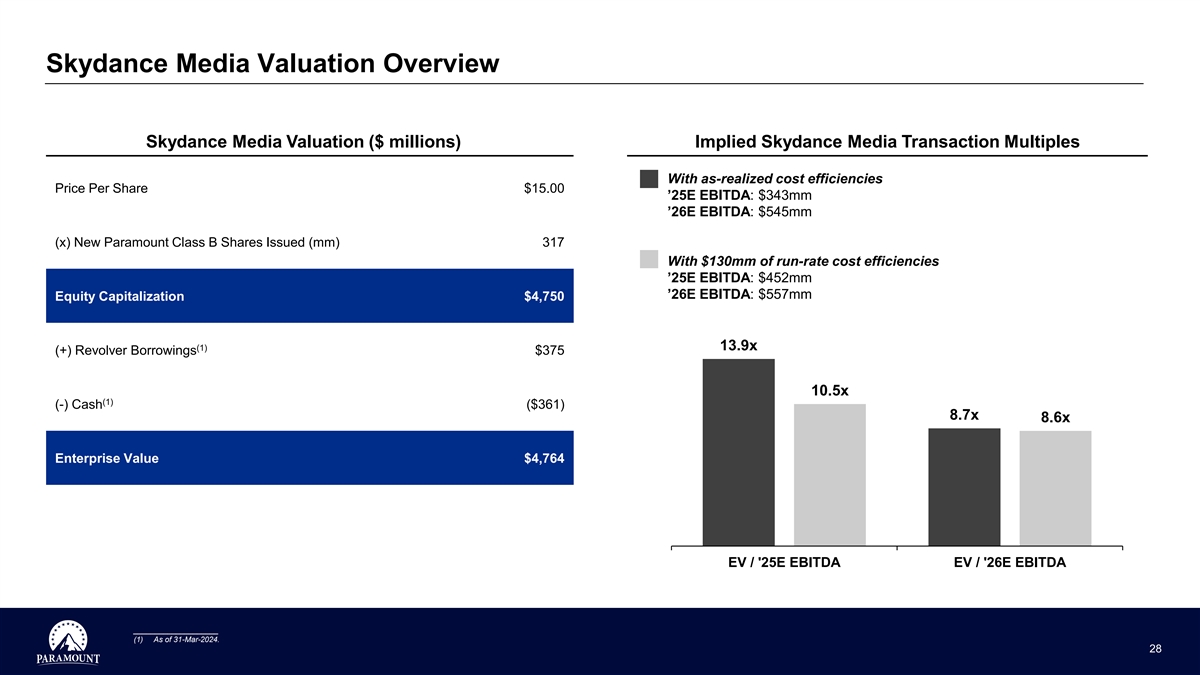

Skydance Media Valuation Overview Skydance Media Valuation ($ millions) Implied Skydance Media Transaction Multiples With as-realized cost efficiencies Price Per Share $15.00 ’25E EBITDA: $343mm ’26E EBITDA: $545mm (x) New Paramount Class B Shares Issued (mm) 317 With $130mm of run-rate cost efficiencies ’25E EBITDA: $452mm ’26E EBITDA: $557mm Equity Capitalization $4,750 13.9x (1) (+) Revolver Borrowings $375 10.5x (1) (-) Cash ($361) 8.7x 8.6x Enterprise Value $4,764 EV / '25E EBITDA EV / '26E EBITDA ____________________ (1) As of 31-Mar-2024. 28

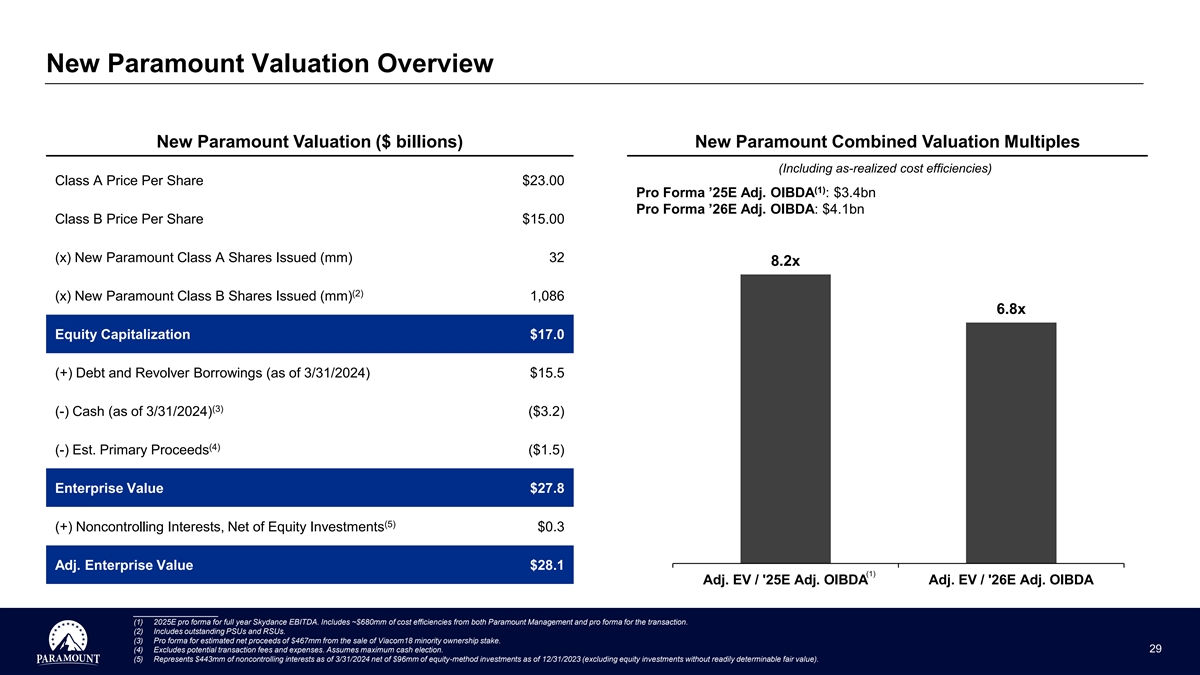

New Paramount Valuation Overview New Paramount Valuation ($ billions) New Paramount Combined Valuation Multiples (Including as-realized cost efficiencies) Class A Price Per Share $23.00 (1) Pro Forma ’25E Adj. OIBDA : $3.4bn Pro Forma ’26E Adj. OIBDA: $4.1bn Class B Price Per Share $15.00 (x) New Paramount Class A Shares Issued (mm) 32 8.2x (2) (x) New Paramount Class B Shares Issued (mm) 1,086 6.8x Equity Capitalization $17.0 (+) Debt and Revolver Borrowings (as of 3/31/2024) $15.5 (3) (-) Cash (as of 3/31/2024) ($3.2) (4) (-) Est. Primary Proceeds ($1.5) Enterprise Value $27.8 (5) (+) Noncontrolling Interests, Net of Equity Investments $0.3 Adj. Enterprise Value $28.1 (1) Adj. EV / '25E Adj. OIBDA Adj. EV / '26E Adj. OIBDA ____________________ (1) 2025E pro forma for full year Skydance EBITDA. Includes ~$680mm of cost efficiencies from both Paramount Management and pro forma for the transaction. (2) Includes outstanding PSUs and RSUs. (3) Pro forma for estimated net proceeds of $467mm from the sale of Viacom18 minority ownership stake. (4) Excludes potential transaction fees and expenses. Assumes maximum cash election. 29 (5) Represents $443mm of noncontrolling interests as of 3/31/2024 net of $96mm of equity-method investments as of 12/31/2023 (excluding equity investments without readily determinable fair value).

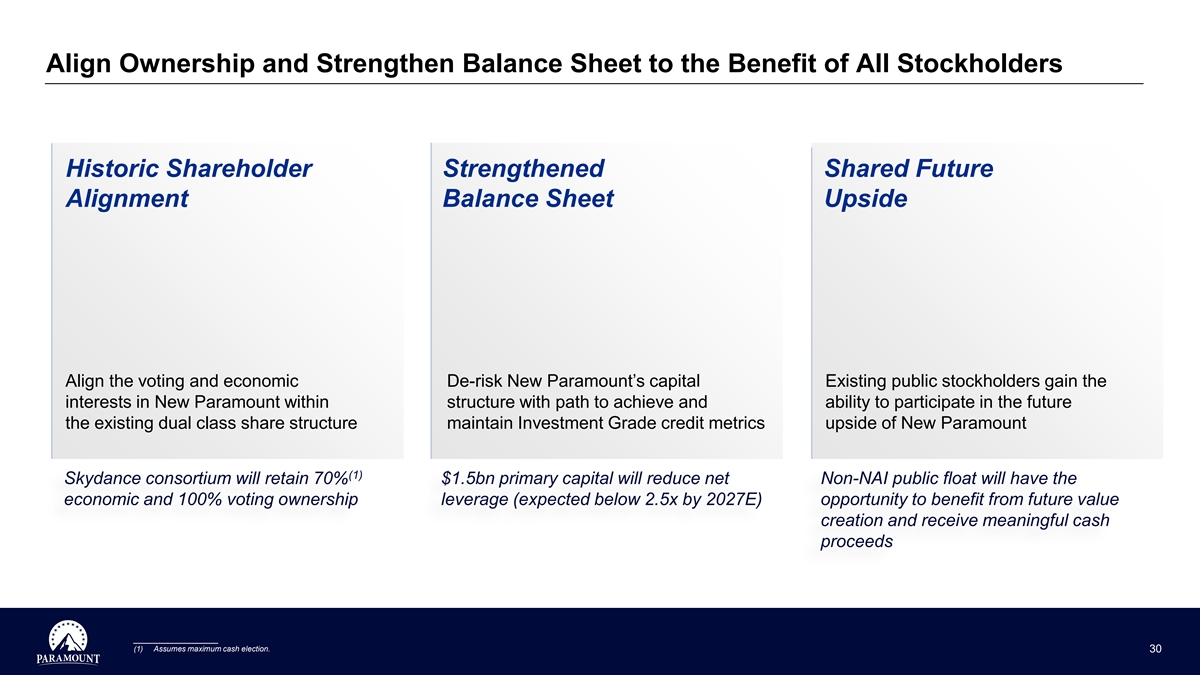

Align Ownership and Strengthen Balance Sheet to the Benefit of All Stockholders Historic Shareholder Strengthened Shared Future Alignment Balance Sheet Upside Align the voting and economic De-risk New Paramount’s capital Existing public stockholders gain the interests in New Paramount within structure with path to achieve and ability to participate in the future the existing dual class share structure maintain Investment Grade credit metrics upside of New Paramount (1) Skydance consortium will retain 70% $1.5bn primary capital will reduce net Non-NAI public float will have the economic and 100% voting ownership leverage (expected below 2.5x by 2027E) opportunity to benefit from future value creation and receive meaningful cash proceeds ____________________ (1) Assumes maximum cash election. 30

Creating a Next Generation Leading Entertainment Company Q&A