UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-5141

Pacific Select Fund

(Exact name of registrant as specified in charter)

700 Newport Center Drive, P.O. Box 7500, Newport Beach, CA 92660

(Address of principal executive offices)

Robin S. Yonis

Vice President and General Counsel of Pacific Select Fund

700 Newport Center Drive

Post Office Box 9000

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Anthony Zacharski, Esq

Dechert LLP

90 State House Square

Hartford, CT 06103-3702

Registrant’s telephone number, including area code: (949) 219-6767

Date of fiscal year end: December 31

Date of reporting period: January 1, 2012–December 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

TABLE OF CONTENTS

PACIFIC SELECT FUND

The 2012 Annual Report for the American Funds® Insurance Series (“AFIS”) will be mailed separately to all Pacific Life Insurance Company and Pacific Life & Annuity Company variable life insurance policyholders and variable annuity contract owners with allocations to the American Funds Growth, American Funds Growth-Income and American Funds Asset Allocation Portfolios of the Pacific Select Fund (“PSF”). For those policyholders and contract owners, the AFIS Annual Report should be read in conjunction with the PSF Annual Report included herein.

PACIFIC SELECT FUND

Dear Shareholders:

We are pleased to share with you the Pacific Select Fund (Fund) Annual Report dated December 31, 2012. The Fund is the underlying investment vehicle for variable life insurance policies and variable annuity contracts offered by Pacific Life Insurance Company (Pacific Life) or its subsidiaries. Pacific Life Fund Advisors LLC (PLFA) is the adviser to the Fund and supervises the management of all of the Fund’s portfolios. As Adviser to the Fund, PLFA manages the Portfolio Optimization Conservative, Portfolio Optimization Moderate-Conservative, Portfolio Optimization Moderate, Portfolio Optimization Growth, and Portfolio Optimization Aggressive-Growth Portfolios (Portfolio Optimization Portfolios), each of which is an asset allocation “fund of funds” and which invests in certain other Fund portfolios.

PLFA also manages the Pacific Dynamix-Conservative Growth, Pacific Dynamix-Moderate Growth and Pacific Dynamix-Growth Portfolios (Pacific Dynamix Portfolios) each of which is an asset allocation “fund of funds” and which invests in certain other Fund portfolios (Pacific Dynamix Underlying Portfolios) that are only available for investment by the three Pacific Dynamix Portfolios and are included in a separate Annual Report. Please see “Where to Go for More Information” for instructions on how to obtain the Pacific Dynamix Underlying Portfolios’ Annual Report.

Additionally, PLFA does business under the name “Pacific Asset Management” and manages the Cash Management and the High Yield Bond Portfolios under that name. For the other portfolios, with the exception of the American Funds® Growth, the American Funds® Growth-Income and the American Funds® Asset Allocation Portfolios, the Adviser has retained other firms to serve as portfolio managers under its supervision. Each of the American Funds Growth, the American Funds Growth-Income and the American Funds Asset Allocation Portfolios (the master-feeder portfolios) invests all of its assets in a master fund; and consequently, the Adviser has not retained other portfolio managers to manage assets of these portfolios. The portfolio managers and their portfolios as of December 31, 2012 are listed below:

| | |

| Portfolio | | Portfolio Manager |

| Cash Management | | Pacific Asset Management |

| Diversified Bond | | Western Asset Management Company (Western Asset) |

| Floating Rate Loan | | Eaton Vance Management (Eaton Vance) |

| High Yield Bond | | Pacific Asset Management |

| Inflation Managed | | Pacific Investment Management Company LLC (PIMCO) |

| Inflation Protected | | Western Asset Management Company (Western Asset) |

| Managed Bond | | Pacific Investment Management Company LLC (PIMCO) |

| Short Duration Bond | | T. Rowe Price Associates, Inc. (T. Rowe Price) |

| Emerging Markets Debt | | Ashmore Investment Management Limited (Ashmore) |

American Funds® Growth American Funds® Growth-Income | | Capital Research and Management Company (Capital Research)–adviser to the Master Growth and Growth-Income Funds |

| Comstock | | Invesco Advisers, Inc. (Invesco) |

| Dividend Growth | | T. Rowe Price Associates, Inc. (T. Rowe Price) |

| Equity Index | | BlackRock Investment Management, LLC (BlackRock) |

Focused 30

Growth LT | | Janus Capital Management LLC (Janus) |

| Large-Cap Growth | | UBS Global Asset Management (Americas) Inc. (UBS) |

| Large-Cap Value | | ClearBridge Advisors, LLC (ClearBridge) |

| Long/Short Large-Cap | | J.P. Morgan Investment Management Inc. (JP Morgan) |

| Main Street® Core | | OppenheimerFunds, Inc. (Oppenheimer) |

| Mid-Cap Equity | | Lazard Asset Management LLC (Lazard) |

| Mid-Cap Growth | | Morgan Stanley Investment Management Inc. (Morgan Stanley) |

| Mid-Cap Value | | BlackRock Capital Management, Inc. (BlackRock Capital) |

| Small-Cap Equity | | BlackRock Investment Management, LLC (BlackRock)/ Franklin Advisory Services, LLC (Franklin) |

| Small-Cap Growth | | Fred Alger Management, Inc. (Alger) |

| Small-Cap Index | | BlackRock Investment Management, LLC (BlackRock) |

| Small-Cap Value | | NFJ Investment Group LLC (NFJ) |

| Health Sciences | | Jennison Associates LLC (Jennison) |

| Real Estate | | Morgan Stanley Investment Management Inc. (Morgan Stanley) |

| Technology | | Columbia Management Investment Advisers, LLC (Columbia) |

| Emerging Markets | | OppenheimerFunds, Inc. (Oppenheimer) |

| International Large-Cap | | MFS Investment Management (MFS) |

| International Small-Cap | | Batterymarch Financial Management, Inc. (Batterymarch) |

| International Value | | J.P. Morgan Investment Management Inc. (JP Morgan) |

A-1

PACIFIC SELECT FUND

| | |

| Portfolio | | Portfolio Manager |

| Currency Strategies | | UBS Global Asset Management (Americas) Inc. (UBS) |

| Global Absolute Return | | Eaton Vance Management (Eaton Vance) |

| Precious Metals | | Wells Capital Management Incorporated (Wells Capital) |

| American Funds® Asset Allocation | | Capital Research and Management Company (Capital Research)– adviser to the Master Asset Allocation Fund |

Pacific Dynamix-Conservative Growth Pacific Dynamix-Moderate Growth Pacific Dynamix-Growth Portfolio Optimization Conservative Portfolio Optimization Moderate-Conservative Portfolio Optimization Moderate Portfolio Optimization Growth Portfolio Optimization Aggressive-Growth | | Pacific Life Fund Advisors LLC (PLFA) |

Each of the portfolio managers, or in the case of the master-feeder portfolios, the adviser to the master funds, has prepared a discussion regarding the performance of the portfolios that they manage, including commentary discussing positive and negative factors affecting performance for the past twelve months.

We appreciate your confidence in the Fund and look forward to serving your financial needs in the years to come.

Sincerely,

| | |

| |  |

James T. Morris Chairman of the Board Pacific Select Fund | | Mary Ann Brown Chief Executive Officer Pacific Select Fund |

A-2

PACIFIC SELECT FUND PERFORMANCE DISCUSSION

This Annual Report is provided for the general information of investors with beneficial interests in the Fund. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Fund prospectus, as supplemented, which contains information about the Fund and each of its portfolios, including their investment objectives, risks, charges and expenses. You should read the prospectus carefully before investing. There is no assurance that a portfolio will achieve its investment objective. Each portfolio is subject to market risk. The value of a portfolio changes as its asset values go up or down. The value of a portfolio’s shares will fluctuate, and when redeemed, may be worth more or less than their original cost. The total return for each portfolio of the Fund includes reinvestment of all dividends and capital gain distributions, if any. The total returns and seven-day yield (Cash Management Portfolio only) do not include deductions at the separate account or contract level for cost of insurance charges, premium loads, administrative charges, maintenance fees, premium tax charges, mortality and expense risk charges, or other charges that may be incurred under a contract which, if incurred, would have resulted in lower returns. Past performance is not predictive of future performance. This report shows you the performance of the Fund’s portfolios compared to benchmark indices. Index performance is provided for illustrative and comparative purposes only and does not predict or depict the performance of the portfolios. Indices are unmanaged, do not incur transaction costs and cannot be purchased directly by investors. Index returns include reinvested dividends.

PLFA supervises the management of all of the portfolios of the Fund (subject to the review of the Fund’s Board) and directly manages, under the name Pacific Asset Management, the Cash Management and High Yield Bond Portfolios. PLFA also manages the Pacific Dynamix Portfolios and the Portfolio Optimization Portfolios. PLFA has written the general market conditions commentary which expresses PLFA’s opinions and views on how the market generally performed for the year ended December 31, 2012.

For the other portfolios, with the exception of the American Funds® Growth, American Funds® Growth-Income, and American Funds® Asset Allocation Portfolios (managed by Capital Research), PLFA has retained other firms to serve as portfolio managers under its supervision. Each of the portfolio managers (including Capital Research) has written a separate commentary specific to the portfolio(s) that they manage and as such, is based on their opinions of how their portfolio(s) performed during the year. The views expressed in the commentaries reflect those of the portfolio managers for the year ended December 31, 2012.

All views are subject to change at any time based upon market or other conditions, and the Fund, its adviser and the portfolio managers disclaim any responsibility to update such views. Any references to “we,” “I,” or “ours” are references to the portfolio manager or adviser, as applicable. The adviser and portfolio managers may include statements that constitute “forward-looking statements” under the United States (U.S.) securities laws. Forward-looking statements include information concerning possible or assumed future results of the Fund’s investment operations, asset levels, earnings, expenses, industry or market conditions, regulatory developments and other aspects of the Fund’s operations or general economic conditions. In addition, when used in this report, words such as “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “projects” and future or conditional verbs such as “will,” “may,” “could,” “should” and “would,” or any other statement that necessarily depends on future events, are intended to identify forward-looking statements. Forward-looking statements are not guarantees of performance or economic results. They involve risks, uncertainties and assumptions. Although such statements are based on expectations that the adviser or a portfolio manager believes to be reasonable, actual results may differ materially from expectations. Investors must not rely on any forward-looking statements.

In connection with any forward-looking statements and any investment in the Fund, investors should carefully consider the investment objectives, policies and risks described in the Fund’s current prospectus, as supplemented, and the Statement of Additional Information, as supplemented.

Market Conditions (for the year ended December 31, 2012)

Executive Summary

In 2012, financial markets experienced pockets of volatility but finished the calendar year with solid gains. While the geopolitical and economic uncertainty that overwhelmed investors in 2011 lingered in 2012, no major disruptions caused the markets to veer off-course for a prolonged period. Nonetheless, the short-term “risk-on” and “risk-off” trend persisted with macro headlines primarily driving market sentiments.

Several key events caused volatility to rise in the first-half of the year. Without a solid economic foundation, markets continue to rely on support from policy actions. In order for the Federal Reserve (Fed) to continue with its low interest rate policies (toward which markets have reacted positively), inflation had to remain tamed. Earlier in the year, tensions over Iran’s nuclear program pushed oil prices higher, which created some concerns over inflation and the ability of the central bank to maintain its support. Additionally, the euro crisis appeared to have reached peak levels around the start of the reporting period. Amid this challenging environment, European countries saw changes in their political landscape. This included France electing a new president, as its citizens voted in favor of François Hollande’s anti-austerity push. The backlash from anti-austerity supporters (a united front against rampant unemployment and government spending cuts accompanied by strikes and demonstrations) caused additional concerns of unwinding the progress in Europe. Additionally, the economic drag from Europe had global implications that caused global economic growth projections to be revised downward. Concerns over China and its exports to Europe also weighed on its ability to sustain its dominant growth.

Despite the headwinds around the globe, financial markets marched higher over the second-half of the year. Although oil prices fluctuated since the sanctions against Iranian oil began, a dramatic impact on world oil supply and prices did not materialize. Without the threat of uncontrolled inflation, the Fed continued to provide further support by extending “Operation Twist” (its program to keep long-term rates low by selling its short-term assets and buying long-term Treasuries). The Fed also launched a third round of quantitative easing in September to purchase an additional

| | |

| | See explanation of symbol and benchmark definitions on A-56 through A-57 |

A-3

PACIFIC SELECT FUND PERFORMANCE DISCUSSION (Continued)

$40 billion in mortgage-backed securities (MBS) per month. From abroad, the political and economic disturbances in Europe finally led to the European Central Bank (ECB) to pledge full support to preserve the euro, which helped unfreeze capital flow throughout the European banking system.

Throughout the reporting period, central banks continued to play a vital role in sustaining the financial market recovery by providing unprecedented liquidity in the global banking system. While such efforts may have helped rejuvenate financial markets, political upheaval introduced uncertainty in the marketplace. Both U.S. and European politicians continued to muddle through their respective fiscal and economic issues. In the U.S., fears of the “fiscal cliff” scenario developed from the inability of Congress to promptly settle budgetary disagreements. In the eurozone, European politicians have struggled to agree and settle on the appropriate policy actions to recover their economies.

The global economy maintained a steady but slow recovery throughout the reporting period. Various risks continued to linger and influenced markets to varying degrees. The following sections highlight how specific market segments responded to the events that unfolded over the year.

Fixed Income

As the overall market sentiment improved relative to the prior reporting period, the broad, fixed income segment fell behind the broad, equity market. For the 2012 calendar year, the overall fixed income market (as measured by the Barclays U.S. Aggregate Bond Index) gained 4.21%. Short-term Treasuries and credits barely budged in 2012 as the Fed continued to maintain a near zero interest rate policy for the Federal Funds (Fed Funds). Long-term Treasuries benefited moderately from the Fed’s efforts to keep long-term yields low. Treasury yields (which have an inverse relationship to prices) continued to hit historic low levels, as the 10-Year Treasury yield dipped below 1.50% during the reporting period. The Barclays Long Term U.S. Treasury Index increased 3.56% for the calendar year.

In this environment, the riskier sectors within the fixed income segment performed relatively well. Emerging markets debt delivered strong results over the reporting period, as the J.P. Morgan Emerging Markets Bond Index Global Diversified Index returned 17.44% for the calendar year. The high yield market also experienced a strong rally with lower-rated credits outpacing those in the investment grade tiers. Additionally, the collateralized loan obligation market showed some revival throughout the calendar year, which boded well for bank loans. Throughout this low, Treasury yield environment, investors looked across the riskier spectrum to obtain yields.

Domestic Equity

The broad, domestic equity market experienced modest swings throughout the year but managed to finish the reporting period with a gain of 16.00% for the S&P 500 Index. Results were relatively mixed for the various categories within the domestic equities segment. One common theme among domestic equities was the double-digit returns across the market capitalization and style groups. With respect to market capitalization, mid-capitalization stocks outpaced those of large- and small-capitalizations. Value styles outperformed those of growth, which were primarily driven by the strong performances of the financials sector over the calendar year. The sector’s strong performance followed a dismal year in 2011, which then recovered as the central banks moved aggressively to support the global banking system. For the year, cyclical sectors (e.g. consumer discretionary) generally outpaced those of the defensive sectors (e.g. utilities). High dividend-paying sectors that typically include utilities stocks lost momentum during the reporting period after a strong rally in the prior year.

For the majority of the year, equity investors appeared to have focused more on the potential for capital appreciation. During uncertain environments (as in the second quarter of 2012), investors may lean toward capital protection where more conservative stocks such as those paying dividends and/or in defensive sectors tend to hold well. Over the past couple of years, real estate investment trusts (REITs) have displayed some hybrid characteristics for capital appreciation and capital protection. REITs have generally kept up with the overall equity market and maintained their gains during turbulent moments, delivering positive returns for all four quarters of the reporting period, which helped the Financial Times Stock Exchange National Association of Real Estate Investment Trust (FTSE NAREIT) Equity REITs Index gain 18.06% for the calendar year.

International Equity

After a difficult year for foreign stocks in 2011, international stocks (both developed and emerging markets) experienced a strong recovery over the reporting period. The Morgan Stanley Capital International Europe, Australasia, and Far East (MSCI EAFE) Index and the MSCI Emerging Markets Index returned 17.32% and 18.22%, respectively. In the foreign equity market, smaller-capitalization stocks outperformed their larger counterparts. Similar to the U.S. equity market, financials led the pace among the sector groups. Performances were largely boosted by the ECB’s vow to aggressively intervene to support the euro.

Europe’s troubles have impacted many of its trading partners, which led to concerns over countries such as China that exports to those regions. Many economists and market participants had considered the probability of a hard-landing scenario where China’s economic growth would experience a significant drop. However, China has displayed some resiliency despite the impact on their exports, which have eased some concerns.

Concluding Remarks

Economic reports indicated that, the world economy grew at approximately 3.20% in 2012 (International Monetary Fund–World Economic Outlook Update–January 2013). Emerging markets, particularly China, contributed to that growth. Developed nations, on the other hand, crawled at a sluggish pace or contracted. Despite the dismal economic indicators, equity markets thrived over the calendar year. Perhaps, this was driven more out of relief of avoiding meltdown scenarios that markets had feared rather than reactions to signs of a strong and prosperous fundamental outlook.

| | |

| | See explanation of symbol and benchmark definitions on A-56 through A-57 |

A-4

PACIFIC SELECT FUND PERFORMANCE DISCUSSION (Continued)

The question remains on the sustainability of the market rise. Heading into 2013, equity valuations indicate that stock markets are trading near their three-year fair value range. However, these valuation levels remain below their long-term historical levels (e.g. 10-year averages). These trading ranges may be a reflection of the general market environment. Over the past few years, the world has been dealing with various crises, which may be causing a hesitation to push valuations back to longer-term historic levels.

More clarity has developed in 2013, but challenges still linger. The crisis level in the eurozone appears to have dwindled, but economic activity is expected to remain weak in the region. Although the situation in the U.S. is relatively better than its developed counterparts in Europe, economic growth is expected to remain modest. The benign economic activity in developed nations is anticipated to dampen demand for exports from emerging markets. This may have some varying implications to these emerging markets nations. Nonetheless, growth in countries such as China is expected to remain solid.

Performances in 2012 showed investors that markets can diverge from economic fundamentals. The level of uncertainty and risks throughout the globe may have caused some investors to reduce or avoid equity exposure in 2012. Those investors would have missed out on the impressive performance delivered from equities. This validates the importance of proper asset allocation to navigate through various market conditions.

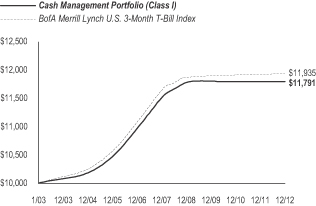

Cash Management Portfolio (managed by Pacific Asset Management)

Q. How did the portfolio perform for the year ended December 31, 2012?

A. For the year ended December 31, 2012, the Cash Management Portfolio’s Class I returned 0.00%, compared to a 0.11% return for its benchmark, the BofA Merrill Lynch U.S. 3-Month T-Bill Index. The current yield measured during the seven-day period ended December 31, 2012 was 0.00%.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the portfolio to its benchmark for the ten-year period ended December 31, 2012. For comparison purposes, the performance of Class P shares and its benchmark for the period from inception of Class P on May 2, 2011 through December 31, 2012 are also shown in the table below. The portfolio’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| | | | | | | | | | | | |

| Average Annual Total Returns for the periods ended December 31, 2012 | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | |

Portfolio’s Class I | | | 0.00% | | | | 0.49% | | | | 1.66% | |

BofA Merrill Lynch U.S.

3-Month T-Bill Index | | | 0.11% | | | | 0.52% | | | | 1.78% | |

| | | 1 Year | | | Since

Inception

(5/2/11)~ | | | | |

| | | |

Portfolio’s Class P | | | 0.00% | | | | 0.00% | | | | | |

BofA Merrill Lynch U.S.

3-Month T-Bill Index | | | 0.11% | | | | 0.09% | | | | | |

Performance data quoted represents past performance. Investment return and principal value will fluctuate so that shares of the portfolio when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. | |

Q. Discuss both positive and negative factors that materially affected the portfolio’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the portfolio’s Class I underperformed the benchmark. We at Pacific Asset Management continue to manage the portfolio with a focus on stability, liquidity, and current income through a consistent, disciplined investment approach emphasizing industry and asset type diversification. A low Fed Funds target rate and a shrinking supply of commercial paper constrained the absolute return environment for the portfolio. This environment generated relative outperformance by the longer duration assets in the portfolio. Citing the slack in the economy and the weakness in the labor force, the Fed remained accommodative throughout the year. The Fed Funds target rate was unchanged, remaining at the range between 0.00% and 0.25 percent. The three-month London Interbank Offered Rate (LIBOR) was very stable finishing at 0.31% on December 31, 2012. Fewer companies utilized the commercial paper market during the year which reduced supply and further lowered available yields.

Although the employment picture has started to improve and the economy is strengthening, we believe the Fed is going to remain cautious through the next few years and will want to ensure the recovery is on very solid footing before any tightening of monetary policy. We expect any tightening to be well forecasted to the market and would expect to shorten the fund’s weighted average maturity heading into a rate increase.

Diversified Bond Portfolio (managed by Western Asset Management Company)

Q. How did the portfolio perform for the year ended December 31, 2012?

A. For the year ended December 31, 2012, the Diversified Bond Portfolio’s Class I returned 8.37%, compared to a 4.21% return for its benchmark, the Barclays U.S. Aggregate Bond Index.

| | |

| | See explanation of symbol and benchmark definitions on A-56 through A-57 |

A-5

PACIFIC SELECT FUND PERFORMANCE DISCUSSION (Continued)

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the portfolio to its benchmark for the period from inception on May 1, 2006 through December 31, 2012. For comparison purposes, the performance of Class P shares and its benchmark for the period from inception of Class P on May 2, 2011 through December 31, 2012 are also shown in the table below. The portfolio’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| | (1) | Western Asset Management Company began managing the portfolio on February 2, 2009, and some investment policies changed at that time. Another firm managed the portfolio before that date. |

| | | | | | | | | | | | |

Average Annual Total Returns for the periods ended December 31, 2012(1) | |

| | | 1 Year | | | 5 Years | | | Since

Inception

(5/1/06) | |

| | | |

Portfolio’s Class I | | | 8.37% | | | | 5.47% | | | | 5.07% | |

Barclays U.S. Aggregate

Bond Index | | | 4.21% | | | | 5.95% | | | | 6.29% | |

| | | 1 Year | | | Since

Inception

(5/2/11)~ | | | | |

| | | |

Portfolio’s Class P | | | 8.58% | | | | 7.46% | | | | | |

Barclays U.S. Aggregate

Bond Index | | | 4.21% | | | | 6.18% | | | | | |

Performance data quoted represents past performance. Investment return and principal value will fluctuate so that shares of the portfolio when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. | |

Q. Discuss both positive and negative factors that materially affected the portfolio’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the portfolio’s Class I outperformed the benchmark. When selecting securities, Western Asset employs a team-oriented investment process which considers sector allocation, issue selection, duration exposure, term structure weighting and country/currency allocations. Generally, the manager expects the portfolio’s average duration to be within a range of 2.5 to 7 years. Duration is often used to measure a bond’s sensitivity to interest rates. The longer a portfolio’s duration, the more sensitive it is to interest rate risk. The shorter a portfolio’s duration, the less sensitive it is to interest rate risk.

Despite the backdrop of a sluggish U.S. recovery and global uncertainties, spread sectors ended the reporting period meaningfully tighter which drove the portfolio’s strong performance. The portfolio’s non-Agency MBS allocation was the single largest contributor to portfolio performance as the sector benefited from positive carry, advantageous market technicals as well as from continued coupon and principal payments. Home default rates fell, and the nationwide home prices, as measured by the Case-Shiller Home Price Index, improved. We continue to believe that potential returns for non-Agency mortgages remain more heavily skewed to the upside, especially as delinquency rates have improved. An overweight exposure to high yield bonds was also a contributor to portfolio performance as default rates remained low and spreads tightened. Investment grade credit spreads also tightened by almost 90 basis points (bps), and the portfolio’s allocation to financials and industrials aided performance. We continue to favor financials, which remain discounted by the market, albeit currently to a lesser degree than in recent months. In-line with other spread sectors, commercial mortgage-backed securities (CMBS) outperformed during the year. The portfolio’s underweight positions to this sector resulted in this allocation detracting from portfolio performance. The portfolio’s Agency mortgage allocation, however, was a contributor to its performance. Throughout the year, we focused on selecting certain mortgage pools and coupons which avoided exaggerated risk of government-sponsored mortgage refinancing, thus decreasing prepayment risk. This strategic issue selection aided performance, and we brought the portfolio’s allocation down later during the reporting period due to elevated valuation and in favor of opportunities in the high yield space. The portfolio’s overall tactical duration positioning had a relatively small, positive impact on its performance as rates ended the year lower on the whole. Yield curve positioning, on the other hand, with a bias toward longer-dated yields detracted as the curve steepened over the year (as measured by the steepness between the 5-year and 30-year Treasury yields).

Continued mild gross domestic product (GDP) growth supports our view that the economic recovery is proceeding along a subdued, yet positive, trajectory. Barring a sudden contagion, we expect a continuation of positive, domestic economic growth. We continue to favor spread sectors. We are maintaining our exposure to the high yield sector given increased support from the Fed, stable-to-improving fundamentals and advantageous technicals. In Agency mortgages, we will continue to emphasize coupon selection to reduce prepayment risk as opposed to focusing on the overall sector weight. We believe that potential returns for the non-Agency mortgage sector remain more heavily skewed to the upside, especially as delinquency rates and home prices improve. We will maintain a short duration position, which we may tactically adjust. We will continue to favor an overweight to the back end of the yield curve as a hedge against periodic flights-to-safety.

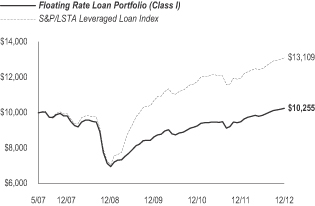

Floating Rate Loan Portfolio (managed by Eaton Vance Management)

Q. How did the portfolio perform for the year ended December 31, 2012?

A. For the year ended December 31, 2012, the Floating Rate Loan Portfolio’s Class I returned 8.10%, compared to a 9.66% return for its benchmark, the S&P/LSTA Leveraged Loan Index.

| | |

| | See explanation of symbol and benchmark definitions on A-56 through A-57 |

A-6

PACIFIC SELECT FUND PERFORMANCE DISCUSSION (Continued)

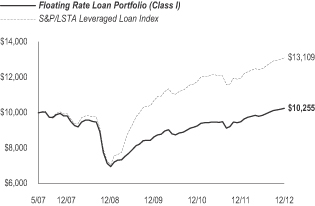

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the portfolio to its benchmark for the period from inception on May 1, 2007 through December 31, 2012. For comparison purposes, the performance of Class P shares and its benchmark for the period from inception of Class P on May 2, 2011 through December 31, 2012 are also shown in the table below. The portfolio’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| | (1) | Eaton Vance Management began managing the portfolio on May 1, 2010, and some investment policies changed at that time. Another firm managed the portfolio before that date. |

| | | | | | | | | | | | |

Average Annual Total Returns for the periods ended December 31, 2012(1) | |

| | | 1 Year | | | 5 Years | | | Since

Inception

(5/1/07) | |

| | | |

Portfolio’s Class I | | | 8.10% | | | | 0.88% | | | | 0.44% | |

S&P/LSTA Leveraged Loan Index | | | 9.66% | | | | 5.68% | | | | 4.89% | |

| | | 1 Year | | | Since

Inception

(5/2/11)~ | | | | |

| | | |

Portfolio’s Class P | | | 8.31% | | | | 5.10% | | | | | |

S&P/LSTA Leveraged Loan Index | | | 9.66% | | | | 4.73% | | | | | |

Performance data quoted represents past performance. Investment return and principal value will fluctuate so that shares of the portfolio when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. | |

Q. Discuss both positive and negative factors that materially affected the portfolio’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the portfolio’s Class I underperformed the benchmark. Relative to the benchmark, the portfolio maintains a greater focus on higher-quality loans. As loan prices for the higher-quality segments of the loan market began the year near par ($98.98 for BBB loans and $97.88 for BB loans), they possessed less price appreciation potential than their lower-quality counterparts, so investment income made up a significant portion of their returns during the reporting period. In comparison, the average price of the more speculative CCC loan segment ended the year at $79.25, up from $69.44 a year earlier. As a result, lower-quality loans outperformed higher-quality loans by a meaningful margin. CCC loans notched a18.35% gain, outpacing the 7.17% and 5.13% returns for BB and BBB loans respectively. Loans in default within the benchmark were the biggest gainers over the reporting period, rising 25.77%.

The portfolio’s underweight to CCC loans, overweight to BB loans, and avoidance of any defaulted loans all detracted from the portfolio’s relative performance during the reporting period. While higher risk can be rewarded over short periods, such as the market environment in 2012, it is Eaton Vance’s experience that a higher-quality stance has generally resulted in better risk-adjusted results over time. We believe the optimal risk/return profile can be achieved predominately through interest income realized through investments of higher-quality loans, rather than focusing largely on capital gains associated with distressed loans.

The portfolio management team employs a rigorous, bottom-up credit research process where loan selection drives portfolio performance. With that said, deconstructing results from the perspective of industry exposures can be instructive. Publishing and utilities, two of the worst-performing industry groups in 2011, rebounded in 2012, posting strong returns of 20.3% and 12.0% respectively. The portfolio’s material underweight exposure to these industries weighed on the portfolio’s relative performance results.

Contributing to portfolio relative performance were underweight exposures to the aerospace & defense and telecommunications industries, which both lagged the broader market, delivering returns of 2.1% and 7.4% respectively.

As of December 31, 2012, the portfolio was well diversified with 357 loan issuer positions across 35 industries. The portfolio’s higher-quality positioning is exhibited in its average loan price of $99.49 compared to a $97.51 average loan price for the benchmark as of December 31, 2012. Additionally, given the floating rate nature of the asset class, the loans in the portfolio reset their coupons every 49 days on average as of December 31, 2012, resulting in a limited interest rate risk exposure for the portfolio as compared to longer duration fixed income funds.

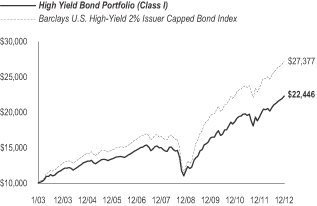

High Yield Bond Portfolio (managed by Pacific Asset Management)

Q. How did the portfolio perform for the year ended December 31, 2012?

A. For the year ended December 31, 2012, the High Yield Bond Portfolio’s Class I returned 15.30%, compared to a 15.78% return for its benchmark, the Barclays U.S. High-Yield 2% Issuer Capped Bond Index.

| | |

| | See explanation of symbol and benchmark definitions on A-56 through A-57 |

A-7

PACIFIC SELECT FUND PERFORMANCE DISCUSSION (Continued)

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the portfolio to its benchmark for the ten-year period ended December 31, 2012. For comparison purposes, the performance of Class P shares and its benchmark for the period from inception of Class P on May 2, 2011 through December 31, 2012 are also shown in the table below. The portfolio’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| | | | | | | | | | | | |

Average Annual Total Returns for the periods ended December 31, 2012 | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | |

Portfolio’s Class I | | | 15.30% | | | | 8.24% | | | | 8.42% | |

Barclays U.S. High-Yield 2% Issuer Capped Bond Index | | | 15.78% | | | | 10.45% | | | | 10.60% | |

| | | 1 Year | | | Since

Inception

(5/2/11)~ | | | | |

| | | |

Portfolio’s Class P | | | 15.53% | | | | 7.86% | | | | | |

Barclays U.S. High-Yield 2% Issuer Capped Bond Index | | | 15.78% | | | | 8.85% | | | | | |

Performance data quoted represents past performance. Investment return and principal value will fluctuate so that shares of the portfolio when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. | |

Q. Discuss both positive and negative factors that materially affected the portfolio’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the portfolio’s Class I underperformed the benchmark. The portfolio seeks a high level of current income by investing in non-investment grade debt instruments. Using a fundamental credit approach with a top-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts.

The portfolio’s overweight to B rated securities and underweight to BB rated securities was a benefit to portfolio performance, while the equal weighting to CCC rated securities was neutral to its performance. The portfolio’s underweight to refining and overweight to consumer cyclicals helped its performance while the portfolio’s underweight to homebuilders and banking detracted from portfolio performance. The portfolio duration was higher than the benchmark during the year, which was a positive contributor to its performance as longer duration securities benefited from spread compression.

Inflation Managed Portfolio (managed by Pacific Investment Management Company LLC)

Q. How did the portfolio perform for the year ended December 31, 2012?

A. For the year ended December 31, 2012, the Inflation Managed Portfolio’s Class I returned 9.87%, compared to a 6.98% return for its benchmark, the Barclays U.S. TIPS Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the portfolio to its benchmark for the ten-year period ended December 31, 2012. For comparison purposes, the performance of Class P shares and its benchmark for the period from inception of Class P on May 2, 2011 through December 31, 2012 are also shown in the table below. The portfolio’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| | | | | | | | | | | | |

Average Annual Total Returns for the periods ended December 31, 2012 | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | |

Portfolio’s Class I | | | 9.87% | | | | 7.92% | | | | 6.96% | |

Barclays U.S. TIPS Index | | | 6.98% | | | | 7.04% | | | | 6.65% | |

| | | 1 Year | | | Since

Inception

(5/2/11)~ | | | | |

| | | |

Portfolio’s Class P | | | 10.09% | | | | 10.27% | | | | | |

Barclays U.S. TIPS Index | | | 6.98% | | | | 9.37% | | | | | |

Performance data quoted represents past performance. Investment return and principal value will fluctuate so that shares of the portfolio when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. | |

| | |

| | See explanation of symbol and benchmark definitions on A-56 through A-57 |

A-8

PACIFIC SELECT FUND PERFORMANCE DISCUSSION (Continued)

Q. Discuss both positive and negative factors that materially affected the portfolio’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the portfolio’s Class I outperformed the benchmark. We at PIMCO implemented the portfolio’s investment strategies by investing in bonds and derivative instruments. During the reporting period, an underweight position to treasury inflation protected securities (TIPS) through cash bonds and interest rate swaps was a negative influence on the portfolio’s performance as real yields rallied during the reporting period. However, favoring the intermediate portion of the TIPS curve to capture higher real yields helped the portfolio’s performance. The portfolio was short Australian dollar holdings for part of the reporting period which detracted from its performance as this currency appreciated versus the U.S. dollar.

A position in bonds of financial companies outperformed the broader, corporate market and added to portfolio performance, amid an accommodative monetary policy and improving housing data. Exposure to non-Agency MBS was a positive influence on the portfolio’s performance supported by positive supply technicals. Exposure to non-U.S. developed interest rates through inflation-linked bonds and interest rate swaps added to portfolio performance as these countries have stronger sovereign balance sheets and higher real yields that leave room to respond to continued global economic growth pressures. The portfolio’s exposure to emerging markets local debt denominated in Brazilian real, achieved through zero coupon swaps, added to the portfolio’s performance as the Monetary Policy Committee cut the policy rate.

We expect the global economy to grow at a real rate of 1.50 to 2.00 % in 2013. Real growth will be moderated by efforts to resolve debt overhangs through fiscal restraint as evidenced by the slowing in corporate profits, capital expenditures and global trade. Simultaneously, inflation will decrease in the near-term. Households will continue to de-lever their balance sheets while the corporate sector remains reluctant to engage its own. Nominal growth could, however, be bolstered by the continued resolve of central banks. The balance of these forces will determine if GDP growth has slowed to stall speed or if a coordinated global slowdown can be averted.

With regard to portfolio strategy, we look to reduce risk while preferring high quality income, over price appreciation, as risk premiums still appear richly priced relative to our outlook. We plan to maintain an overall neutral duration position with a focus on intermediate maturity TIPS that offer higher real yields and potential for price appreciation as the maturity rolls down. We will remain underweight both long-dated TIPS and nominals due to unfavorable risk/return characteristics. With low real yields in the U.S., we plan to continue holding inflation-linked bonds (ILBs) from Australia and Mexico that are linked to stronger sovereign balance sheets. To take advantage of the country’s persistent inflation and the exaggerated reaction to potential methodology changes to its inflation calculation, we plan to tactically hold United Kingdom (U.K.) ILBs. We look to allocate Italian ILBs to benefit from attractive valuations from recent market dislocations along with the potential for ECB purchases. We plan to maintain exposure to interest rates in countries such as Brazil, which have relatively high nominal and real local interest rates and steep yield curves with the potential to capture roll-down.

Inflation Protected Portfolio (managed by Western Asset Management Company)

Q. How did the portfolio perform for the year ended December 31, 2012?

A. For the year ended December 31, 2012, the Inflation Protected Portfolio’s Class I returned 5.51%, compared to a 6.98% return for its benchmark, the Barclays U.S. TIPS Index.

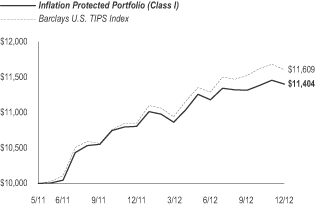

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the portfolio to its benchmark for the period from inception on May 2, 2011 through December 31, 2012. For comparison purposes, the performance of Class P shares and its benchmark for the period from inception of Class P on May 2, 2011 through December 31, 2012 are also shown in the table below. The portfolio’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| | | | | | | | |

Average Annual Total Returns for the periods ended December 31, 2012 | |

| | | 1 Year | | | Since

Inception

(5/2/11)~ | |

| | |

Portfolio’s Class I | | | 5.51% | | | | 8.19% | |

Barclays U.S. TIPS Index | | | 6.98% | | | | 9.37% | |

| | | 1 Year | | | Since

Inception

(5/2/11)~ | |

| | |

Portfolio’s Class P | | | 5.72% | | | | 8.33% | |

Barclays U.S. TIPS Index | | | 6.98% | | | | 9.37% | |

Performance data quoted represents past performance. Investment return and principal value will fluctuate so that shares of the portfolio when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. | |

Q. Discuss both positive and negative factors that materially affected the portfolio’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the portfolio’s Class I underperformed the benchmark. Western Asset maintains the portfolio’s strategy of holding a mixture of TIPS, total return swaps on TIPS, and inflation-linked bonds issued by foreign governments. Non-U.S. dollar-denominated inflation linked securities were chosen based on value relative to TIPS of a corresponding maturity.

| | |

| | See explanation of symbol and benchmark definitions on A-56 through A-57 |

A-9

PACIFIC SELECT FUND PERFORMANCE DISCUSSION (Continued)

Market expectations of inflation ended 2012 significantly higher, despite the considerable volatility over the reporting period. Beginning the reporting period at a level of 1.95%, the 10-year breakeven inflation rate rose to 2.45% in March 2012 as the Fed extended its commitment to keep rates low. But once again Europe’s problems spilled over into global markets in April and May, this time focused on Spain, lowering inflation expectations and risky asset prices. June saw the ECB combine with politicians to stem the Spanish problems, and together with further action from the Fed, drove break evens and risk asset prices up throughout the remainder of 2012, closing the year near their recent highs. All of the above culminated in a strong performance from TIPS with the benchmark returning 6.98%.

For the year as a whole, the portfolio lagged the benchmark as TIPS rallied strongly and outperformed the selected foreign issues that detracted from performance. Most notable was the turbulence in the U.K. inflation-linked market caused by the U.K government’s decision to review the Retail Price Index (RPI) inflation measure, which had they gone ahead, would have damaged both value and reputation of the market.

Our expectations for a continued economic recovery, albeit at a subdued pace, are supported by ongoing, modest GDP growth. We expect a continuation of mildly positive domestic economic growth and for inflation linked assets to perform modestly well into 2013. However, caution is the watchword as we head into 2013. We remain cognizant of potential negative spillover effects should a contagion erupt overseas and of the impact of domestically driven events such as the impending debt ceiling debates. Still, the Fed remains highly accommodative and continues to implement non-traditional easing programs. Corporate balance sheets remain strong. Overseas, the European sovereign debt crisis has moderated and the Chinese economy appears to be picking up. Therefore, we expect real yields to rise moderately, especially in maturities under five-to-seven years, and we continue to look to hold inflation-linked securities from commodity-driven economies, such as Australia and Canada, or in the U.K. where inflation protection is cheaper than in the U.S. instead of equivalent TIPS.

Managed Bond Portfolio (managed by Pacific Investment Management Company LLC)

Q. How did the portfolio perform for the year ended December 31, 2012?

A. For the year ended December 31, 2012, the Managed Bond Portfolio’s Class I returned 10.72%, compared to a 4.21% return for its benchmark, the Barclays U.S. Aggregate Bond Index.

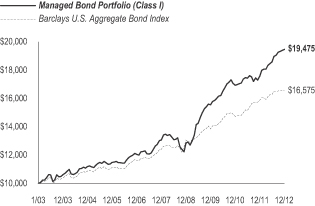

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the portfolio to its benchmark for the ten-year period ended December 31, 2012. For comparison purposes, the performance of Class P shares and its benchmark for the period from inception of Class P on May 2, 2011 through December 31, 2012 are also shown in the table below. The portfolio’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| | | | | | | | | | | | |

| Average Annual Total Returns for the periods ended December 31, 2012 | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | |

Portfolio’s Class I | | | 10.72% | | | | 8.30% | | | | 6.89% | |

Barclays U.S. Aggregate

Bond Index | | | 4.21% | | | | 5.95% | | | | 5.18% | |

| | | 1 Year | | | Since

Inception

(5/2/11)~ | | | | |

| | | |

Portfolio’s Class P | | | 10.94% | | | | 7.31% | | | | | |

Barclays U.S. Aggregate

Bond Index | | | 4.21% | | | | 6.18% | | | | | |

Performance data quoted represents past performance. Investment return and principal value will fluctuate so that shares of the portfolio when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. | |

Q. Discuss both positive and negative factors that materially affected the portfolio’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the portfolio’s Class I outperformed the benchmark. We at PIMCO implemented the portfolio’s investment strategies by investing in bonds and derivative instruments. Tactical duration positioning in the U.S. through the use of cash bonds and interest rate swaps was positive for the portfolio’s performance. Within investment grade credit, a focus on financials added to portfolio performance returns as this sector outperformed the broader corporate market amid an accommodative monetary policy and improving housing data. Additionally, holdings of Agency MBS during the reporting period impacted the portfolio’s performance positively as this sector outperformed like-duration Treasuries. An allocation to non-Agency MBS, which was supported by positive supply technicals, also contributed to performance.

Beyond core sectors, exposure to non-U.S. developed interest rates, particularly core Europe, through cash bonds and interest rate swaps, added to portfolio performance as rates declined in this region on renewed confidence in the ECB. Exposure to high yield, through the use of cash bonds and interest rate swaps, also added to portfolio performance as spreads tightened. Exposure to emerging markets local interest rates in Brazil through cash bonds and interest rate swaps added to portfolio performance as the Monetary Policy Committee cut the policy rate. Holdings of Build America Bonds (BABs) were positive for portfolio performance, as this sector continued to offer attractive valuations relative to similarly rated corporates.

| | |

| | See explanation of symbol and benchmark definitions on A-56 through A-57 |

A-10

PACIFIC SELECT FUND PERFORMANCE DISCUSSION (Continued)

We expect the global economy to grow at a real rate of 1.50 to 2.0 % in 2013. Real growth will be moderated by efforts to resolve debt overhangs through fiscal restraint as evidenced by the slowing in corporate profits, capital expenditures and global trade. Simultaneously, inflation will decrease in the near-term. Households will continue to de-lever their balance sheets while the corporate sector remains reluctant to engage its own. Nominal growth could, however, be bolstered by the continued resolve of central banks. The balance of these forces will determine if GDP growth has slowed to stall speed or if a coordinated global slowdown can be averted.

With regard to portfolio strategy, we plan to continue to reduce risk while preferring high quality income, over price appreciation, as risk premiums still appear richly priced relative to our outlook. We will remain focused on sectors that will benefit from central bank actions that have increased liquidity and suppressed volatility. We look to selectively add high quality duration in countries with healthier balance sheets and independent monetary policy, including, Australia, Canada, Brazil, and Mexico. We plan to reduce holdings in Agency MBS to benchmark weightings as Agency MBS appear fully priced with limited upside following recent central bank actions. We will continue to hold non-Agency MBS and commercial MBS that have senior positions in the capital structure as another source of yield. Within credit, we aim to shift credit exposure toward securities higher in the capital structure and remain cautious on the bonds of companies with economic exposure to Europe. We also look to retain exposure to select corporate and quasi-sovereign bonds in countries with strong initial conditions and strong balance sheets such as Brazil and Mexico. We will continue to hold high quality municipal bonds which have reverted to fair value and will also retain longer-dated TIPS positions to protect against potentially higher long-term inflation. Finally, we will maintain an overall neutral currency stance with slight overweight positions in high quality, emerging markets currencies such as the Brazilian real, Chinese yuan, and Mexican peso.

Short Duration Bond Portfolio (managed by T. Rowe Price Associates, Inc.)

Q. How did the portfolio perform for the year ended December 31, 2012?

A. For the year ended December 31, 2012, the Short Duration Bond Portfolio’s Class I returned 3.19%, compared to a 1.26% return for its benchmark, the Barclays 1-3 Year U.S. Government Credit/Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the portfolio to its benchmark for the period from inception on May 1, 2003 through December 31, 2012. For comparison purposes, the performance of Class P shares and its benchmark for the period from inception of Class P on May 2, 2011 through December 31, 2012 are also shown in the table below. The portfolio’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| | (1) | T. Rowe Price Associates, Inc. began managing the portfolio on May 1, 2011, and some investment policies changed at that time. Another firm managed the portfolio before that date. |

| | | | | | | | | | | | |

| Average Annual Total Returns for the periods ended December 31, 2012(1) | |

| | | 1 Year | | | 5 Years | | | Since

Inception

(5/1/03) | |

| | | |

Portfolio’s Class I | | | 3.19% | | | | 2.11% | | | | 2.38% | |

Barclays 1-3 Year U.S. Government Credit/Bond Index | | | 1.26% | | | | 2.88% | | | | 3.10% | |

| | | 1 Year | | | Since

Inception

(5/2/11)~ | | | | |

| | | |

Portfolio’s Class P | | | 3.40% | | | | 2.23% | | | | | |

Barclays 1-3 Year U.S. Government Credit/Bond Index | | | 1.26% | | | | 1.31% | | | | | |

Performance data quoted represents past performance. Investment return and principal value will fluctuate so that shares of the portfolio when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. | |

Q. Discuss both positive and negative factors that materially affected the portfolio’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the portfolio’s Class I outperformed the benchmark. We at T. Rowe Price invest the portfolio’s assets in fixed income securities (including derivatives on such securities). Normally the portfolio will focus on high quality, investment grade securities. Generally, we expect to track the duration of the benchmark (plus or minus a half-year), although the securities held may have short-, intermediate-, and long-terms to maturity. In addition to making active sector allocations and security selection decisions, the management team monitors portfolio duration as part of the management for the portfolio.

Sector allocations were the primary driver of relative returns. The portfolio’s overweight allocation to short-term, investment-grade corporate bonds with a corresponding underweight to Treasuries benefited the portfolio’s performance returns the most. Despite intermittent pressure stemming from macro-economic concerns, corporate bonds proved resilient. The sector generated strong returns as demand increased significantly as investors sought an incremental yield advantage in a low-rate environment. In addition to the portfolio’s corporate allocation, its out-of-benchmark exposure to high yield bonds and CMBS also drove performance to a lesser extent. For similar reasons as the corporate sector, investors continued to reach for yield in these higher beta (risk) sectors, as rates remain at absolute lows.

| | |

| | See explanation of symbol and benchmark definitions on A-56 through A-57 |

A-11

PACIFIC SELECT FUND PERFORMANCE DISCUSSION (Continued)

Our strategic underweight to Treasuries also contributed to portfolio performance returns relative to the benchmark. Although Treasury issues posted positive absolute returns for the reporting period, spread sectors such as corporate and securitized holdings outperformed due to insatiable demand for incremental yield, several periods of optimism regarding global economic conditions, and monetary policy support by the ECB and the Fed. Therefore, the portfolio’s underweight exposure to Treasuries benefited the portfolio.

Positioning on the yield curve was also a driver of relative performance as rates along the intermediate portion of the curve experienced declines during the reporting period—driven lower in part by significant investor concerns over global economic conditions, the sovereign debt crisis in the eurozone, and continued support for the Treasury market via Fed policy. The portfolio’s modest exposure to intermediate maturities mostly through MBS and investment-grade corporates, contributed to portfolio performance.

There were only a few very minor detractors for the reporting period. The portfolio’s allocations in several Money Center Banks detracted as the portfolio’s holdings were floating rate securities and those with shorter-duration. The fixed-rate, longer-duration banking names in the benchmark outperformed. The portfolio’s exposure to Telecom Italia S.P.A. detracted from its performance for similar reasons as the short-duration bonds from the issuer did not perform as well as the longer-duration bonds in the benchmark.

Emerging Markets Debt Portfolio (managed by Ashmore Investment Management Limited)

Q. How did the portfolio perform for the period ended December 31, 2012?

A. The portfolio commenced operations on April 30, 2012. For the period from inception through December 31, 2012, the Emerging Markets Debt Portfolio’s Class I returned 10.60%, compared to a 10.85% return for its benchmark, the J.P. Morgan Emerging Markets Bond Index (EMBI) Global Diversified Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the portfolio to its benchmark for the period from inception on April 30, 2012 through December 31, 2012. For comparison purposes, the performance of Class P shares and its benchmark for the period from inception of Class P on April 30, 2012 through December 31, 2012 are also shown in the table below. The portfolio’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| | | | | | |

Total Returns for the period from Inception through December 31, 2012 | |

| | | | | Since

Inception

(4/30/12)~ | |

| | |

Portfolio’s Class I | | | | | 10.60% | |

J.P. Morgan EMBI Global Diversified Index | | | | | 10.85% | |

| | | | | Since

Inception

(4/30/12)~ | |

| | |

Portfolio’s Class P | | | | | 10.74% | |

J.P. Morgan EMBI Global Diversified Index | | | | | 10.85% | |

Performance data quoted represents past performance. Investment return and principal value will fluctuate so that shares of the portfolio when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. | |

Q. Discuss both positive and negative factors that materially affected the portfolio’s performance during the period, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the period since inception through December 31, 2012, the portfolio’s Class I underperformed the benchmark. We at Ashmore tactically manage exposure to external debt, local currency and corporate debt. The portfolio invests its assets in debt instruments that are economically tied to emerging market countries, which are issued by governments (sovereigns), government-guaranteed or majority government-owned entities (quasi-sovereigns), government agencies and corporate issuers, and may be denominated in any currency, including the local currency of the issuer.

The portfolio’s allocation to external debt during the reporting period was just over 60% of the portfolio, peaking in August before dropping back to original levels. The portfolio’s underweight allocation to external debt detracted from performance over the reporting period, as sovereign external debt performed better than local currency and corporate bonds in 2012. However, within this theme, our country/security selection contributed positively to portfolio performance. During the reporting period, Venezuela, Russia and Brazil performed the best within external debt markets.

The portfolio’s exposure to local currency instruments was managed dynamically during the reporting period. The exposure was increased significantly during the third quarter, when we expected local currency-denominated bonds and currencies to respond well to ongoing policy action by global central banks. First, local currency bonds rallied as emerging market central banks’ cut their domestic interest rates and attracted inflows. Additionally, in September, emerging markets currencies benefited from a new round of quantitative easing by the Fed. Over the reporting period, the portfolio’s exposure to local currency bonds was a positive contributor to performance, principally because the portfolio was invested in local markets where interest rates markets performed very well (Brazil, Russia).

| | |

| | See explanation of symbol and benchmark definitions on A-56 through A-57 |

A-12

PACIFIC SELECT FUND PERFORMANCE DISCUSSION (Continued)

During the reporting period, we increased and then maintained the portfolio’s exposure to corporate bonds, as their value relative to sovereigns has represented one of the best opportunities in emerging markets fixed income. Value was added to the portfolio as a result of the portfolio’s overweight positions in Chinese corporate bonds, notably in the real estate sector.

Considering the portfolio’s country-level attribution across all three themes (external debt, local debt and corporate debt), China, Brazil and Mexico were the three, largest contributors to performance relative to the benchmark. The portfolio was overweight relative to the benchmark in all three countries. In Brazil, the portfolio benefited particularly from positions in local currency government bonds, which rallied as the central bank cut interest rates aggressively. In China, the portfolio’s corporate bond positions performed very well as fears of economic slowdown gave way to solid growth and a market recovery. In Mexico, the portfolio benefited from overweight positions in all three themes, helped by a solid macroeconomic performance in 2012. Conversely, the top detractors relative to the benchmark were Turkey, Peru and Hungary; three countries where the portfolio has been underweight, and which performed quite well for different reasons. Turkey delivered a better-than-expected economic performance in 2012. In Peru, we have felt for some time that the assets were expensive, and we have maintained an underweight position as we saw better opportunities in other markets. Hungary managed to recover the support of investors despite accumulating significant economic challenges since the previous year.

American Funds Growth Portfolio (Capital Research and Management Company manages the Master Growth Fund)

Q. How did the portfolio perform for the year ended December 31, 2012?

A. For the year ended December 31, 2012, the American Funds Growth Portfolio’s Class I returned 17.45%, compared to a 16.00% return for its benchmark, the S&P 500 Index. The American Funds Growth Portfolio (Feeder Growth Portfolio) invests all of its assets in Class 1 shares of the Growth Fund, a series of the American Funds Insurance Series®, a registered open-end investment company (Master Growth Fund). The Master Growth Fund returned 18.19% for the same period. The performance for the Feeder Growth Portfolio was lower than the Master Growth Fund due to expenses incurred by the Feeder Growth Portfolio.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the portfolio to its benchmark for the period from inception on May 2, 2005 through December 31, 2012. For comparison purposes, the performance of Class P shares and its benchmark for the period from inception of Class P on May 2, 2011 through December 31, 2012 are also shown in the table below. The portfolio’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| | | | | | | | | | | | |

Average Annual Total Returns for the periods ended December 31, 2012 | |

| | | 1 Year | | | 5 Years | | | Since

Inception

(5/2/05)~ | |

| | | |

Portfolio’s Class I | | | 17.45% | | | | 0.52% | | | | 5.52% | |

S&P 500 Index | | | 16.00% | | | | 1.66% | | | | 4.96% | |

| | | 1 Year | | | Since

Inception

(5/2/11)~ | | | | |

| | | |

Portfolio’s Class P | | | 17.68% | | | | 1.71% | | | | | |

S&P 500 Index | | | 16.00% | | | | 5.08% | | | | | |

Performance data quoted represents past performance. Investment return and principal value will fluctuate so that shares of the portfolio when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. | |

Q. Discuss both positive and negative factors that materially affected the portfolio’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. The discussion that follows relates to the master fund. For the reporting period, the portfolio’s Class I outperformed the benchmark. The Master Growth Fund (the “fund”) invests primarily in common stocks and seeks to invest in companies that appear to offer superior opportunities for growth of capital. The health care sector continued to be one of the main contributors to the fund’s results, with several biotechnology companies recording strong gains. Increasing consumer confidence helped lift companies in the consumer discretionary sector, including several of the fund’s largest holdings. Information technology and financial holdings also contributed to results.

The fund’s weakest sectors were materials and energy, which have experienced lower demand in recent months as economic growth has stalled in China and other key economies.

Outside the U.S., the fund’s best performance results again came from holdings in Spain, India and the Netherlands — holdings in Brazil and South Africa detracted from is performance.

As global uncertainty persists, Capital Research’s portfolio counselors continue to search for companies with good valuations and accelerating growth prospects.

| | |

| | See explanation of symbol and benchmark definitions on A-56 through A-57 |

A-13

PACIFIC SELECT FUND PERFORMANCE DISCUSSION (Continued)

American Funds Growth-Income Portfolio (Capital Research and Management Company manages the Master Growth-Income Fund)

Q. How did the portfolio perform for the year ended December 31, 2012?

A. For the year ended December 31, 2012, the American Funds Growth-Income Portfolio’s Class I returned 17.06%, compared to a 16.00% return for its benchmark, the S&P 500 Index. The American Funds Growth-Income Portfolio (Feeder Growth-Income Portfolio) invests all of its assets in Class 1 shares of the Growth-Income Fund, a series of the American Funds Insurance Series®, a registered open-end investment company (Master Growth-Income Fund). The Master Growth-Income Fund returned 17.79% for the same period. The performance for the Feeder Growth-Income Portfolio was lower than the Master Growth-Income Fund due to expenses incurred by the Feeder Growth-Income Portfolio.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the portfolio to its benchmark for the period from inception on May 2, 2005 through December 31, 2012. For comparison purposes, the performance of Class P shares and its benchmark for the period from inception of Class P on May 2, 2011 through December 31, 2012 are also shown in the table below. The portfolio’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| | | | | | | | | | | | |

Average Annual Total Returns for the periods ended December 31, 2012 | |

| | | 1 Year | | | 5 Years | | | Since

Inception

(5/2/05)~ | |

| | | |

Portfolio’s Class I | | | 17.06% | | | | 0.57% | | | | 4.06% | |

S&P 500 Index | | | 16.00% | | | | 1.66% | | | | 4.96% | |

| | | |

| | | 1 Year | | | Since

Inception

(5/2/11)~ | | | | |

| | | |

Portfolio’s Class P | | | 17.30% | | | | 4.24% | | | | | |

S&P 500 Index | | | 16.00% | | | | 5.08% | | | | | |

Performance data quoted represents past performance. Investment return and principal value will fluctuate so that shares of the portfolio when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. | |

Q. Discuss both positive and negative factors that materially affected the portfolio’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. The discussion that follows relates to the master fund. For the reporting period, the portfolio’s Class I outperformed the benchmark. The Master Growth-Income Fund (the “fund”) invests primarily in common stocks or other securities that demonstrate the potential for appreciation and/or dividends. Growing consumer confidence and an improved housing market in the U.S. helped companies in the consumer discretionary sector perform well, benefiting the fund’s performance. Stock selection was a key factor, with holdings in the media industry, particularly two cable television companies, having the most positive impact on the performance of the fund.

Good stock selection also helped in other sectors, including health care, where several of the fund’s investments in U.S. biotechnology companies were performing well, as well as telecommunication services and information technology.

The fund’s weakest sector was energy, where companies were hurt by falling oil prices and lower demand. A relatively underweight to financial companies also held back portfolio performance results. Because of ongoing macro concerns, Capital Research’s portfolio counselors held a sizable portion of assets in cash. This cautionary measure helped the fund when stocks declined in the second quarter, but proved a drag on the full-year return.

While problems in Europe, China and the U.S. persist, there have recently been encouraging developments, and we remain confident that the fund’s holdings can prosper over the long-term.

Comstock Portfolio (managed by Invesco Advisers, Inc.)

Q. How did the portfolio perform for the year ended December 31, 2012?

A. For the year ended December 31, 2012, the Comstock Portfolio’s Class I returned 18.54%, compared to a 17.51% return for its benchmark, the Russell 1000 Value Index.

| | |

| | See explanation of symbol and benchmark definitions on A-56 through A-57 |

A-14

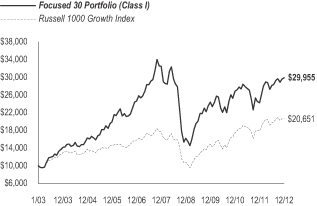

PACIFIC SELECT FUND PERFORMANCE DISCUSSION (Continued)

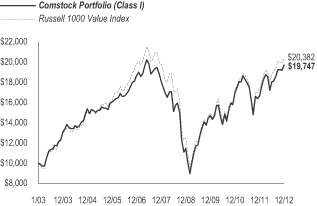

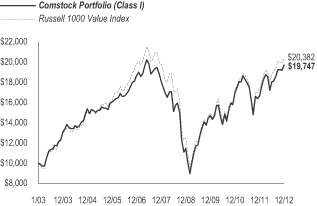

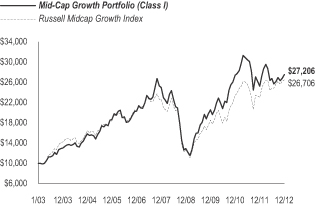

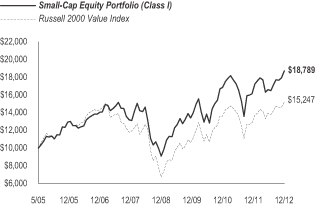

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the portfolio to its benchmark for the ten-year period ended December 31, 2012. For comparison purposes, the performance of Class P shares and its benchmark for the period from inception of Class P on May 2, 2011 through December 31, 2012 are also shown in the table below. The portfolio’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| | (1) | Invesco Advisers, Inc. began managing the portfolio on June 1, 2010. Another firm managed the portfolio before that date. |

| | | | | | | | | | | | |

Average Annual Total Returns for the periods ended December 31, 2012(1) | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | |

Portfolio’s Class I | | | 18.54% | | | | 1.73% | | | | 7.04% | |

Russell 1000 Value Index | | | 17.51% | | | | 0.59% | | | | 7.38% | |

| | | |

| | | 1 Year | | | Since

Inception

(5/2/11)~ | | | | |

| | | |

Portfolio’s Class P | | | 18.78% | | | | 3.69% | | | | | |

Russell 1000 Value Index | | | 17.51% | | | | 4.69% | | | | | |

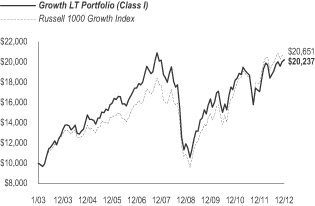

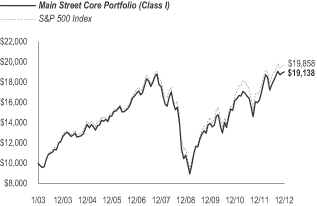

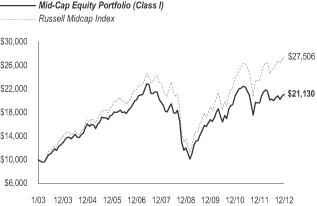

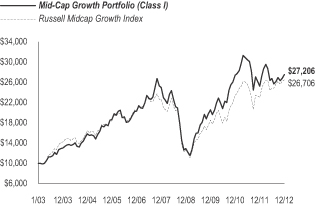

Performance data quoted represents past performance. Investment return and principal value will fluctuate so that shares of the portfolio when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. | |