Our ordinary shares, nominal value 1.00 euro per share, are currently listed on each of the Madrid, Barcelona, Bilbao and Valencia stock exchanges and are quoted through the Automated Quotation System under the symbol “TEF.” They are also listed on various foreign stock exchanges such as the London and Buenos Aires stock exchanges. American Depositary Shares (“ADSs”), each representing the right to receive one ordinary share, are listed on the New York Stock Exchange and on the Lima Stock Exchange. ADSs are evidenced by American Depositary Receipts (“ADRs”) issued under a Deposit Agreement with Citibank, N.A., as Depositary.

As used herein, “Telefónica,” “Telefónica Group,” “Group”, the “Company” and terms such as “we,” “us” and “our” mean Telefónica, S.A. and its consolidated subsidiaries, unless the context requires otherwise.

As used herein, “Atento” means Atento Holding, Inversiones y Teleservicios, S.A. and its consolidated subsidiaries, unless the context requires otherwise.

Below are definitions of certain technical terms used in this Annual Report:

| · | “Access” refers to a connection to any of the telecommunications services offered by us. We present our customer base using this model because the integration of telecommunications services in bundled service packages has changed the way residential and corporate customers contract for our services. Because a single fixed customer may contract for multiple services, we believe it is more accurate to count the number of accesses, or services a customer has contracted for, as opposed to only counting the number of our customers. For example, a customer that has fixed line telephony service and broadband service represents two accesses rather than a single customer. For mobile customers, we count each active SIM as an access regardless of the number of services actually contracted through the SIM, e.g. voice and data. In addition, we count all of the accesses of all companies over which we exercise control. The following are the main categories of accesses: |

| | · | Fixed telephony accesses: includes public switched telephone network, or PSTN, lines (including public use telephony), and integrated services digital network, or ISDN, lines and circuits. For purposes of calculating our number of fixed line accesses, we multiply our lines in service as follows: PSTN (x1); basic ISDN (x1); primary ISDN (x30, x20 or x10); 2/6 digital accesses (x30). |

| | · | Internet and data accesses: includes broadband accesses (retail asymmetrical digital subscriber line “ADSL,” very high bit-rate digital subscriber line “VDSL”, satellite, fiber optic and circuits over 2 Mbps), narrowband accesses (Internet service through the PSTN lines) and other accesses, including the remaining non-broadband final client circuits. “Naked ADSL” allows customers to subscribe for a broadband connection without a monthly fixed line fee. |

| | · | Pay TV: includes cable TV, direct to home satellite TV, or DTH, and Internet Protocol TV, or IPTV. |

| | · | Mobile accesses: includes accesses to mobile network for voice and/or data services (including connectivity). Mobile broadband includes Mobile Internet (internet access from devices also used to make voice calls e.g. smartphones-), and Mobile Connectivity (internet access from devices that complement fixed broadband, such as PC Cards/dongles, which enable large amounts of data to be downloaded on the move). Mobile accesses are categorized into contract and prepay accesses. |

| | · | Unbundled local loop, or ULL: includes accesses to both ends of the copper local loop leased to other operators to provide voice and DSL services (fully unbundled loop, fully UL) or only DSL service (shared unbundled loop, “shared UL”). |

| | · | Wholesale ADSL: means wholesale asymmetrical digital subscriber line. |

| | · | Other: includes other circuits for other operators. |

Certain technical terms used with respect to our business are as follows:

| · | “ARPU” is the average revenues per user per month. ARPU is calculated by dividing total gross service revenues (excluding inbound roaming revenues) from sales to customers for the preceding 12 months by the weighted average number of accesses for the same period, and then divided by 12 months. |

| · | “CDMA” means Code Division Multiple Access, which is a type of radio communication technology. |

| · | “Cloud computing” is the delivery of computing as a service rather than a product, whereby shared resources, software, and information are provided to computers and other devices as a utility over a network (typically the Internet). |

| · | “Commercial activity” includes the addition of new lines, replacement of handsets, migrations and changes in types of contracts. |

| · | “Customer revenue” means service revenues less interconnection revenues. |

| · | “Digital Dividend” refers to the amount of spectrum that will be freed up in the switchover from analogue to digital terrestrial TV. |

| · | “Duo bundle” means broadband plus voice and/or TV service. We measure “duo bundles” in terms of units, where each bundle of broadband and voice service counts as one unit. |

| · | “Final client accesses” means accesses provided to residential and corporate clients. |

| · | “FTTx” is a generic term for any broadband network architecture that uses optical fiber to replace all or part of the metal local loop typically used for the last mile of telecommunications wiring. |

| · | “Gross adds” means the gross increase in the customer base measured in terms of accesses in a period. |

| · | “HSDPA” means High Speed Downlink Packet Accesses, which is a 3G mobile telephony communications protocol in the High-Speed Packet Access (HSPA) family, which allows networks based on UMTS to have higher data transfers speeds and capacity. |

| · | “Interconnection revenues” means revenues received from other operators which use our networks to connect to our customers. |

| · | “ISP” means Internet service provider. |

| · | “IT”, or information technology, is the acquisition, processing, storage and dissemination of vocal, pictorial, textual and numerical information by a microelectronics-based combination of computing and telecommunications. |

| · | “LMDS” means local multipoint distribution service. |

| · | “Local loop” means the physical circuit connecting the network termination point at the subscriber’s premises to the main distribution frame or equivalent facility in the fixed public telephone network. |

| · | “LTE” means Long Term Evolution, a 4G mobile access technology. |

| · | “M2M”, or machine to machine, refers to technologies that allow both mobile and wired systems to communicate with other devices of the same ability. |

| · | “MTR” means mobile termination rate, which is the charge per minute paid by a telecommunications network operator when a customer makes a call to another network operator. |

| · | “MVNO” means mobile virtual network operator, which is a mobile operator that is not entitled to use spectrum for the provision of mobile services. Consequently, an MVNO must subscribe to an access agreement with a mobile network operator in order to provide mobile access to their customers. An MVNO pays such mobile network operator for using the infrastructure to facilitate coverage to their customers. |

| · | “Net adds” means the difference between the customer base measured in terms of accesses at the end of the period and the beginning of the period. |

| · | “Non SMS data revenues” means data revenues excluding SMS revenues. |

| · | “OTT services” or “over the top services” means services provided through the Internet (such as television). |

| · | “P2P SMS” means person to person short messaging service (usually sent by mobile customers). |

| · | “Push to talk” is a method of conversing over half-duplex communication lines, including two-way radio, using a button to switch from voice reception mode to transmit mode. |

| · | “Revenues” means net sales and revenues from rendering of services. |

| · | “Service revenues” means revenues less revenues from handset sales. |

| · | “SIM” means subscriber identity module, a removable intelligent card used in mobile handsets, USB modems, etc. to identify the user in the network. |

| · | “Traffic” means voice minutes used by our customers over a given period, both outbound and inbound. On-net traffic is only included once (outbound), and promotional traffic (free minutes included in commercial promotions) is included. Traffic not associated with our mobile customers (roaming-in; MVNOs; interconnection of third parties and other business lines) is excluded. To arrive at the aggregate traffic for a given period, the individual components of traffic are not rounded. |

| · | “Trio bundle” means broadband plus voice service plus TV. We measure “trio bundles” in terms of units, where each bundle of broadband, voice service and TV counts as one unit. |

| · | “UMTS” means Universal Mobile Telecommunications System. |

| · | “VoIP” means voice over Internet protocol. |

| · | “Wholesale accesses” means accesses we provide to our competitors, who then sell services over such accesses to their residential and corporate clients. |

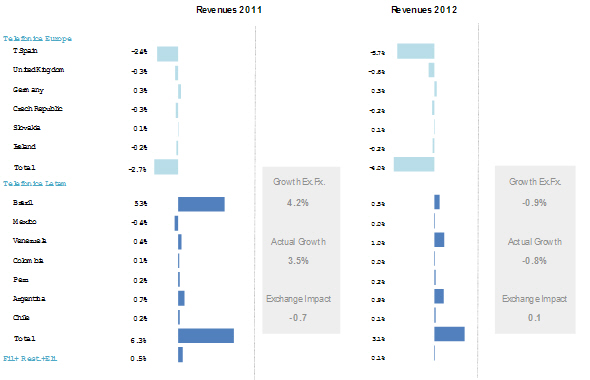

In this Annual Report we make certain comparisons in local currency or on a “constant euro basis” or “excluding foreign exchange rate effects” in order to present an analysis of the development of our results of operations from year-to-year without the effects of currency fluctuations. To make comparisons on a local currency basis, we compare financial items in the relevant local currency for the periods indicated as recorded in the relevant local currency for such periods. To make comparisons on a “constant euro basis” or “excluding foreign exchange rate effects,” we convert the relevant financial item into euro using the prior year’s average euro to relevant local currency exchange rate. In addition, we present certain financial information excluding the effects of Venezuela being considered a hyperinflationary economy in 2010, 2011 and 2012 by eliminating all adjustments made as a result of such consideration.

In this Annual Report, references to “U.S. dollars,” “dollars” or “$,” are to United States dollars, references to “pounds sterling,” “sterling” or “£” are to British pounds sterling, references to “reais” refer to Brazilian reais and references to “euro”, “euros” or “€” are to the single currency of the participating member states in the Third Stage of the European Economic and Monetary Union pursuant to the treaty establishing the European Community, as amended from time to time.

Our consolidated financial statements as of December 31, 2011 and 2012, and for the years ended December 31, 2010, 2011 and 2012 included elsewhere in this Annual Report including the notes thereto (the “Consolidated Financial Statements”), are prepared in conformity with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

Not applicable.

Not applicable.

Not applicable.

Not applicable.

The following table presents certain selected consolidated financial data. It is to be read in conjunction with “Item 5. Operating and Financial Review and Prospects” and the Consolidated Financial Statements. The consolidated income statement and cash flow data for the years ended December 31, 2010, 2011 and 2012 and the consolidated statement of financial position data as of December 31, 2011 and 2012 set forth below are derived from, and are qualified in their entirety by reference to the Consolidated Financial Statements. The consolidated income statement and cash flow data for the years ended December 31, 2008 and 2009 and the consolidated statement of financial position data as of December 31, 2008, 2009 and 2010 set forth below are derived from Telefónica, S.A.’s consolidated financial statements for such years, which are not included herein.

Our Consolidated Financial Statements have been prepared in accordance with IFRS as issued by the IASB.

The basis of presentation and principles of consolidation are described in detail in Notes 2 and 3(q), respectively, to our Consolidated Financial Statements.

| Millions of euros | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

| Revenues | | | 57,946 | | | | 56,731 | | | | 60,737 | | | | 62,837 | | | | 62,356 | |

| Other income | | | 1,865 | | | | 1,645 | | | | 5,869 | | | | 2,107 | | | | 2,323 | |

| Supplies | | | (17,818 | ) | | | (16,717 | ) | | | (17,606 | ) | | | (18,256 | ) | | | (18,074 | ) |

| Personnel expenses | | | (6,762 | ) | | | (6,775 | ) | | | (8,409 | ) | | | (11,080 | ) | | | (8,569 | ) |

| Other expenses | | | (12,312 | ) | | | (12,281 | ) | | | (14,814 | ) | | | (15,398 | ) | | | (16,805 | ) |

| Depreciation and amortization | | | (9,046 | ) | | | (8,956 | ) | | | (9,303 | ) | | | (10,146 | ) | | | (10,433 | ) |

| OPERATING INCOME | | | 13,873 | | | | 13,647 | | | | 16,474 | | | | 10,064 | | | | 10,798 | |

| | | | | | | | | | | | | | | | | | | | | |

| Share of (loss) profit of associates | | | (161 | ) | | | 47 | | | | 76 | | | | (635 | ) | | | (1,275 | ) |

| Net finance expense | | | (2,821 | ) | | | (2,767 | ) | | | (2,537 | ) | | | (2,782 | ) | | | (3,062 | ) |

| Net exchange differences | | | 24 | | | | (540 | ) | | | (112 | ) | | | (159 | ) | | | (597 | ) |

| Net financial expense | | | (2,797 | ) | | | (3,307 | ) | | | (2,649 | ) | | | (2,941 | ) | | | (3,659 | ) |

| PROFIT BEFORE TAX FROM CONTINUING OPERATIONS | | | 10,915 | | | | 10,387 | | | | 13,901 | | | | 6,488 | | | | 5,864 | |

| Corporate income tax | | | (3,089 | ) | | | (2,450 | ) | | | (3,829 | ) | | | (301 | ) | | | (1,461 | ) |

| PROFIT FOR THE YEAR FROM CONTINUING OPERATIONS | | | 7,826 | | | | 7,937 | | | | 10,072 | | | | 6,187 | | | | 4,403 | |

| Profit after taxes from discontinued operations | | | − | | | | − | | | | − | | | | − | | | | − | |

| PROFIT FOR THE YEAR | | | 7,826 | | | | 7,937 | | | | 10,072 | | | | 6,187 | | | | 4,403 | |

| Non-controlling interests | | | (234 | ) | | | (161 | ) | | | 95 | | | | (784 | ) | | | (475 | ) |

| PROFIT FOR THE YEAR ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT | | | 7,592 | | | | 7,776 | | | | 10,167 | | | | 5,403 | | | | 3,928 | |

| Weighted average number of shares (thousands) | | | 4,720,845 | | | | 4,626,134 | | | | 4,595,215 | | | | 4,583,974 | | | | 4,495,914 | |

| Basic and diluted earnings per share from continuing operations attributable to equity holders of the parent (euro)(1) | | | 1.61 | | | | 1.68 | | | | 2.21 | | | | 1.18 | | | | 0.87 | |

| Basic and diluted earnings per share attributable to equity holders of the parent (euro)(1) | | | 1.61 | | | | 1.68 | | | | 2.21 | | | | 1.18 | | | | 0.87 | |

| Earnings per ADS (euro)(1)(2) | | | 1.61 | | | | 1.68 | | | | 2.21 | | | | 1.18 | | | | 0.87 | |

| Weighted average number of ADS (thousands)(2) | | | 4,720,845 | | | | 4,626,134 | | | | 4,595,215 | | | | 4,583,974 | | | | 4,495,914 | |

| Cash dividends per ordinary share (euro) | | | 0.90 | | | | 1.00 | | | | 1.30 | | | | 1.52 | | | | 0.82 | |

| Consolidated Statement of Financial Position Data | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | | 4,277 | | | | 9,113 | | | | 4,220 | | | | 4,135 | | | | 9,847 | |

| Property, plant and equipment | | | 30,545 | | | | 31,999 | | | | 35,797 | | | | 35,463 | | | | 35,019 | |

| Total assets | | | 99,896 | | | | 108,141 | | | | 129,775 | | | | 129,623 | | | | 129,773 | |

| Non-current liabilities | | | 55,202 | | | | 56,931 | | | | 64,599 | | | | 69,662 | | | | 70,601 | |

| Equity (net) | | | 19,562 | | | | 24,274 | | | | 31,684 | | | | 27,383 | | | | 27,661 | |

| Capital stock | | | 4,705 | | | | 4,564 | | | | 4,564 | | | | 4,564 | | | | 4,551 | |

| Consolidated Cash Flow Data | | | | | | | | | | | | | | | | | | | | |

| Net cash from operating activities | | | 16,366 | | | | 16,148 | | | | 16,672 | | | | 17,483 | | | | 15,213 | |

| Net cash used in investing activities | | | (9,101 | ) | | | (9,300 | ) | | | (15,861 | ) | | | (12,497 | ) | | | (7,877 | ) |

| Net cash used in financing activities | | | (7,765 | ) | | | (2,281 | ) | | | (5,248 | ) | | | (4,912 | ) | | | (1,243 | ) |

| (1) | The per share and per ADS computations for all periods presented have been presented using the weighted average number of shares and ADSs, respectively, outstanding for each period, and have been adjusted to reflect the stock dividends which occurred during the periods presented, as if these had occurred at the beginning of the earliest period presented. In accordance with IAS 33 (“Earnings per share”), the weighted average number of ordinary shares and ADSs outstanding for each of the periods covered has been restated to reflect the issuance of shares pursuant to Telefónica’s scrip dividend in June 2012. As a consequence, basic and diluted earnings per share have also been restated. |

| (2) | Until January 20, 2011, each ADS represented the right to receive three ordinary shares. Since January 21, 2011, each ADS represents the right to receive one ordinary share. The above figures have been restated accordingly. Figures do not include any charges of the ADS Depositary. |

Exchange Rate Information

As used in this Annual Report, the term “Noon Buying Rate” refers to the rate of exchange for euro, expressed in U.S. dollars per euro, in the City of New York for cable transfers payable in foreign currencies as certified by the Federal Reserve Bank of New York for customs purposes. The Noon Buying Rate certified by the New York Federal Reserve Bank for the euro on March 15, 2013 was $1.3076 = 1.00 euro. The following tables describe, for the periods and dates indicated, information concerning the Noon Buying Rate for the euro. Amounts are expressed in U.S. dollars per 1.00 euro.

| Noon Buying Rate | | | | | | | | | | | | |

| Year ended December 31, | | Period end | | | Average (1) | | | High | | | Low | |

| 2008 | | | 1.3919 | | | | 1.4695 | | | | 1.6010 | | | | 1.2446 | |

| 2009 | | | 1.4332 | | | | 1.3955 | | | | 1.5100 | | | | 1.2547 | |

| 2010 | | | 1.3269 | | | | 1.3218 | | | | 1.4536 | | | | 1.1959 | |

| 2011 | | | 1.2973 | | | | 1.4002 | | | | 1.4875 | | | | 1.2926 | |

| 2012 | | | 1.3186 | | | | 1.2909 | | | | 1.3463 | | | | 1.2062 | |

| 2013 (through March 15, 2013) | | | 1.3076 | | | | 1.3011 | | | | 1.3098 | | | | 1.2949 | |

Source: Federal Reserve Bank of New York.

| (1) | The average of the Noon Buying Rates for the euro on the last day reported of each month during the relevant period. |

| Noon Buying Rate | | | | | | |

| Month ended | | High | | | Low | |

| September 30, 2012 | | | 1.3142 | | | | 1.2566 | |

| October 31, 2012 | | | 1.3133 | | | | 1.2876 | |

| November 30, 2012 | | | 1.3010 | | | | 1.2715 | |

| December 31, 2012 | | | 1.3260 | | | | 1.2930 | |

| January 31, 2013 | | | 1.3584 | | | | 1.3047 | |

| February 28, 2013 | | | 1.3692 | | | | 1.3054 | |

| March 31, 2013 (through March 15, 2013) | | | 1.3098 | | | | 1.2949 | |

Source: Federal Reserve Bank of New York.

Monetary policy within the member states of the euro zone is set by the European Central Bank. The European Central Bank has set the objective of containing inflation and will adjust interest rates in line with this policy without taking account of other economic variables such as the rate of unemployment. It has further declared that it will not set a target exchange rate for the euro.

Our ordinary shares are quoted on the Spanish stock exchanges in euro. Currency fluctuations may affect the dollar equivalent of the euro price of our shares listed on the Spanish stock exchanges and, as a result, the market price of our ADSs, which are listed on the New York Stock Exchange. Currency fluctuations may also affect the dollar amounts received by holders of ADSs on conversion by the depositary of any cash dividends paid in euro on the underlying shares.

Our consolidated results are affected by fluctuations between the euro and the currencies in which the revenues and expenses of some of our consolidated subsidiaries are denominated and recorded (principally the Brazilian real, the pound sterling, the Venezuelan Bolivar fuerte, the Argentine peso, the Chilean peso, the Czech koruna (crown), the Peruvian nuevo sol, the Mexican peso and the Colombian peso). See Note 3 (a) to our Consolidated Financial Statements for the exchange rates we used in preparing our consolidated financial information.

Not applicable.

Not applicable.

The Telefónica Group's business is conditioned by a series of intrinsic risk factors that affect exclusively the Group, as well as a series of external factors that are common to businesses of the same sector. The main risks and uncertainties facing the Company which could affect its business, financial position and results, are as follows:

Risks Relating to Our Business

A material portion of our operations and investments are located in Latin America, and we are therefore exposed to risks inherent in operating and investing in Latin America.

At December 31, 2012, approximately 48.9% of the Telefónica Group's revenue (approximately 49.6% of its assets) is generated by the Latin American segment (primarily in Brazil, Argentina, Venezuela, Chile and Peru); 78.3% of those assets are generated in countries classified as investment grade (Brazil, Chile, Peru, Colombia, Mexico, Uruguay and Panama) by some of the credit rating agencies. The Telefónica business is especially sensitive to any of the risks related to Latin America described in this section, particularly if they affect or arise in Brazil, which at December 31, 2012 accounted for 50.6% of assets and 44.6% of revenue from Latin American operations.

The Group’s investments and operations in Latin America could be affected by a series of risks related to economic, political and social factors in these countries, collectively denominated “country risk,” including risks related to the following:

| | · | government regulation or administrative polices may change unexpectedly, including changes that modify the terms and conditions of licenses and concessions and their renewal (or delay their approvals) which could negatively affect the Group’s interests in such countries. See Appendix VI to our Consolidated Financial Statements — “Key Regulatory Issues and Concessions and Licences held by the Telefónìca Group”; |

| | · | the effects of inflation, currency depreciation or currency restrictions and other restraints on transfer of funds may be imposed. For example, in Venezuela, the official U.S. Dollar to Bolivar fuerte exchange rate is established by the Central Bank of Venezuela and the Minister of Finance. Additionally, the acquisition of foreign currencies by Venezuelan companies to pay foreign debt or dividends is subject to the pre-authorization of the relevant Venezuelan authorities; |

| | · | governments may expropriate or nationalize assets or increase their participation in the economy and companies; and |

| | · | economic downturns, political instability and civil disturbances may negatively affect the Telefónica Group’s operations in such countries. |

Our financial condition and results of operations may be adversely affected if we do not effectively manage our exposure to foreign currency exchange rate, interest rate or financial investment risks.

The Telefónica Group’s business is exposed to various types of market risks, above all the impact of changes in interest rates or foreign currency exchange rates.

At December 31, 2012, 23% of the Group’s net debt was at floating rates, while 20% was denominated in a currency other than the euro.

To illustrate the sensitivity of financial expenses to a change in short-term interest rates at December 31, 2012: (i) a 100 basis points increase in interest rates in all currencies in which Telefónica has a financial position at that date would lead to an increase in financial expenses of 96 million euros, (ii) whereas a 100 basis points decrease in interest rates in all currencies except the euro, dollar and the pound sterling, in order to avoid negative rates, would lead to a reduction in financial expenses of 36 million euros. These calculations were made assuming a constant currency and balance position equivalent to the position at that date and bearing in mind the derivative financial instruments arranged.

As for the impact on the income statement, specifically exchange gains and losses in the financial result at December 31, 2012, the impact of a 10% increase or decrease in the exchange rate would be 159 million euros (assuming a constant currency position with an impact on profit or loss at that date including derivative instruments arranged and that Latin American currencies would fall against the U.S. dollar and the rest of the currencies against the euro by 10%).

The Telefónica Group uses a variety of strategies to manage this risk, mainly through the use of financial derivatives, which themselves are also exposed to risk, including counterparty risk. Furthermore, the Group’s risk management strategies may not achieve the desired effect, which could adversely affect the Group’s business, financial condition, results of operations and cash flows.

Existing or worsening conditions in the international financial markets may limit our ability to carry out our business plan.

The performance, expansion and improvement of networks, the development and distribution of the Telefónica Group’s services and products, as well as the development and implementation of new technologies or the renewal of licenses require a substantial amount of financing.

The performance of financial markets in terms of liquidity, cost of credit, access and volatility, continues to be overshadowed by persisting uncertainty regarding certain factors such as the pace of economic recovery, the health of the international banking system or the concerns regarding the burgeoning deficits of some European countries. The worsening international financial market conditions caused by some of these factors could make it more difficult and more expensive to refinance existing financial debt (at December 31, 2012, gross maturities in 2013, including the net position in derivative financial instruments, certain current payables and expected early redemptions amounted to around 10,074 million euros, or 9,574 million euros should Telefónica elect not to exercise expected early redemptions, and in 2014 to 7,850 million euros) or arrange new debt if necessary, and more difficult and costly to raise funds from our shareholders.

Furthermore, obtaining financing on the international capital markets could also be restricted (in terms of access and cost) if Telefónica's credit ratings are revised downwards, either due to lower solvency or operating performance, or as a result of a downgrade in the rating for Spanish sovereign risk by rating agencies. Any of these situations could have a negative impact on our ability to honor our debts.

Moreover, market conditions could make it harder to renew existing undrawn bilateral credit lines, 18% of which, at December 31, 2012, initially mature prior to December 31, 2013.

Risks Relating to Our Industry

Adverse economic conditions could reduce purchases of our products and services.

The Telefónica Group’s business is impacted by general economic conditions in each of the countries in which it operates. The uncertainty about whether economic recovery will continue may negatively affect the level of demand from existing and prospective customers, as customers may no longer deem critical the services offered by the Group. The main macroeconomic factors that could have an adverse impact on consumption and, accordingly, demand for our services and the Telefónica Group’s results include the dearth of credit as banks adjust their balance sheets, trends in the labor market, further erosion of consumer confidence, with an immediate increase in saving rates, or needs for greater fiscal adjustment, which would undermine household income levels. This risk is higher in Europe, but less relevant in other countries where the Telefónica Group operates.

Similarly, the sovereign debt crisis in certain euro-area countries and rating downgrades in some of these countries should be taken into account. Any further deterioration in sovereign debt markets or greater restrictions on credit in the banking sector could have an adverse impact on Telefónica’s ability to raise financing and/or obtain liquidity. This could have a negative effect on the Group’s business, financial condition, results of operations or cash flows. In addition, there could be other possible follow-on effects from the economic crisis on the Group’s business, including insolvency of key customers or suppliers.

Lastly, in Latin America, the exchange rate risk in Venezuela (as reflected by the recent currency devaluation in February 2013) and Argentina (with a constant devaluation of the Argentinean peso against U.S. dollar) exists in relation to the negative impact any unexpected weakening in their currencies could have on cash flows from these countries. On February 8, 2013, the Venezuelan bolivar fuerte was devalued from 4.3 bolivar fuertes per U.S. dollar to 6.3 bolivar fuertes per U.S. dollar. The exchange-rate situation of the Bolivar fuerte affects the estimates made by the Group of the liquidation value of the net foreign currency position related to investments in Venezuela, which translates to an approximate pre-tax loss of 438 million euros on the 2012 financial statements.

We operate in a highly regulated industry, which could adversely affect our businesses, and we depend on government concessions.

As a multinational telecommunications company that operates in regulated markets, the Telefónica Group is subject to different laws and regulations in each of the jurisdictions in which it provides services and in which supranational regulators such as the European Union and national, state, regional and local authorities intervene to varying degrees and as appropriate. This regulation is strict in the countries in which the Company holds a significant market power position.

In Europe, wholesale mobile network termination rates came down in 2011. There were considerable reductions in many of the countries where the Group operates, notably in the UK (with a final reduction scheduled for 2015 and a decrease in prices of over 83% compared to the end of 2010) and Germany (cuts of over 50% since December 2010). In Spain, the schedule for reducing mobile call termination rates came into play on April 16, 2012, and the target price (1.09 euros) will be attained in July 2013, with a decrease of approximately 75% in wholesale prices. Other countries where rates will fall as from 2012 are the Czech Republic (slightly more than 49%), Ireland (approximately 72%) and Slovakia (approximately 58%).

Other services with regulated prices in Europe include call roaming, SMS and data services. The European Parliament and Council has approved the new Roaming III regulation which replaces all previous regulations. The objective of this Regulation is to set maximum prices for voice and SMS retail and wholesale services between July 2012 and July 2014, which will then be progressively reduced. It also regulates retail and wholesale data roaming charges for the first time.

Additionally, according to Roaming III, from July 2014, mobile operators would be forced to separate the sale of roaming services from their domestic services. This would allow users to choose a different operator for calls made in other Member States. Lastly, in relation to net neutrality, the new European regulatory framework establishes as a general principle the importance of ensuring European citizens have free internet access. Nevertheless, regulators could also adopt at any time measures or additional requirements to reduce roaming prices and fixed and/or mobile termination rates, and force Telefónica to provide third-party access to its networks.

Moreover, in Latin America there is tendency to review –and reduce– mobile network termination rates. For instance, reductions of 61% and 60% have been approved in Mexico and Chile, respectively. In Brazil, in October 2011, the regulator (Anatel) approved the fixed-mobile rate adjustment regulation, which entails a gradual reduction of these rates through to 2014 by applying a CPI-factor, which results in a reduction of approximately 29% in 2012-2014. The absolute decrease in public rates must be passed on to mobile interconnection rates (VU-M). In addition, there is a trend towards reductions in termination rates in Peru, Venezuela and Colombia.

The new regulatory principles established in Europe's common regulatory framework, adopted in 2009 and transposed in the national legislation of each Member State in which Telefónica operated during 2011 and 2012 could result in increased regulatory pressure on the local competitive environment. Specifically, this framework supports the possibility of national regulators, in specific cases and under exceptional conditions, establishing the functional separation between the wholesale and retail businesses of operators with significant market power and vertically integrated operators, whereby they would be required to offer equal wholesale terms to third-party operators that acquire these products.

The recommendation on the application of the European regulatory policy to next-generation broadband networks drawn up by the European Commission (EC) could also play a key role in the incentives for operators to invest in net fixed broadband networks in the short-term and medium-term, thus affecting the outlook for the business and competition in this market segment. Nonetheless, the EC is currently drafting respective recommendations on cost accounting and non-discrimination, and it is expected that these recommendations, which will affect the earlier recommendation, will be approved in mid-2013. According to statements by Commissioner Kroes, initial evaluations are that the Commission could make the regulation for new generation networks more flexible in exchange for stricter measures on new operators concerning non-discrimination.

Meanwhile, as the Group provides most of its services under licenses, authorizations or concessions, it is vulnerable to economic fines for serious breaches and, ultimately, revocation or failure to renew these licenses, authorizations or concessions or the granting of new licenses to competitors for the provisions of services in a specific market.

The Telefónica Group pursues their renewal to the extent provided by the contractual conditions, though it cannot guarantee that it will always complete this process successfully or under the most beneficial terms for the Group. In many cases it must satisfy certain obligations, including, among others, minimum specified quality standards, service and coverage conditions and capital investment. Failure to comply with these obligations could result in fines or even revocation or forfeiture of the license, authorization or concession.

Additionally, the Telefónica Group could be affected by regulatory actions carried out by antitrust of competition authorities. These authorizations could prohibit certain actions, such as new acquisitions or specific practices, create obligations or lead to heavy fines. Any such measures implemented by the competition authorities could results in economic and/or reputational loss for the Group, in addition to a loss of market share and/or in harm to the future growth of certain businesses.

We operate in highly competitive markets and the industry in which we operate is subject to continuous technological changes, which requires us to continuously adapt to such changes and to upgrade our existing networks.

The Telefónica Group operates in markets that are highly competitive and subject to constant technological development. Therefore, it is subject to the effects of actions by competitors in these markets and its ability to anticipate and adapt to constant technological changes taking place in the industry.

To compete effectively, the Telefónica Group needs to successfully market its products and services and respond to both commercial actions by competitors and other competitive factors affecting these markets, anticipating and adapting promptly to technological changes, changes in consumer preferences and general economic, political and social conditions. Failure to do so appropriately could have an adverse impact on the Group’s financial condition, results of operations and cash flows.

New products and technologies arise constantly, while the development of existing products and technologies can render obsolete the products and services the Telefónica Group offers and the technology it uses. This means that Telefónica must invest in the development of new products, technology and services so it can continue to compete effectively with current or future competitors, and which may result in the decrease of the Group’s revenue margins. In this respect, margins from traditional voice and data business are shrinking, while new sources of revenues are deriving from mobile internet and connectivity services that are being launched. Research and development costs amounted to 1,071 million euros and 983 million euros in 2012 and 2011, respectively, representing 1.7% and 1.6% of the Group’s consolidated revenue, respectively.

One technology that telecommunications operators, including Telefónica (in Spain and Latin America), are focused on is the new FTTx-type network, which offers broadband access using optical fiber with superior services, e.g. internet speed of up to 100mb or HD television services. However, substantial investment is required to deploy these networks, which entails fully or partially substituting copper loop access with optic fiber. As things stand today, scant demand for the capabilities offered by these new networks to end users could make it difficult to quantify the return on investment and justify the high investment.

In addition, many of the aforementioned works directed to network upgrade and to offer new products or services are not entirely under the Telefónica Group’s control and could be constrained by applicable regulation.

Spectrum capacity may become a limiting and costly factor.

Telefónica’s mobile operations in a number of countries may rely on the availability of spectrum. The Company’s failure to obtain sufficient or appropriate spectrum capacity or its capacity to assume the related costs, could have an adverse impact on the quality on the launching and provision of new services and on the Company’s ability to maintain the quality of existing services, which may adversely affect the Group’s financial condition, results of operations and cash flows.

In 2012, Telefónica Ireland invested 127 million euros to obtain spectrum in the 800, 900 and 1800 MHz bands. On February 20, 2013, Telefónica UK was granted two blocks of 10 MHz in the 800 MHz spectrum band for the rollout of a nationwide 4G network, total investment was of approximately 645 million euros. Meanwhile, in 2012, an investment was made in spectrum capacity in Nicaragua amounting to 5 million euros. In Brazil, Vivo was awarded a block of band with “X” of 2500 MHz (20+20 MHz), including the 450 MHz band in certain states in 2012. In Venezuela, in August 2012, a concession agreement was signed between Telefónica Venezuela and the regulator for the additional 20 MHz in the 1900 MHz frequency that had been granted to this company. Also in August 2012, Telefónica Móviles Chile, S.A. was awarded radiofrequencies for 4G technology. As regards new spectrum allocations in the countries where the Telefónica Group operates, in 2013 we are expecting auctions to take place in Slovakia, Colombia and Uruguay.

Our business could be adversely affected if our suppliers fail to provide necessary equipment and services on a timely basis.

As a mobile and fixed telephony operator and provider of telecommunications services and products, the Telefónica Group, like other companies in the industry, depends upon a small number of major suppliers for essential products and services, mainly network infrastructure and mobile handsets. Telefónica Group depends on 13 handset suppliers and five network infrastructure suppliers, which together accounted for 80% of orders in 2012. These suppliers may, among other things, extend delivery times, raise prices and limit supply due to their own shortages and business requirements.

If these suppliers fail to deliver products and services to the Telefónica Group on a timely basis, it could jeopardize network deployment and expansion plans, which in some cases could adversely affect the Telefónica Group’s ability to satisfy its license terms and requirements or have an adverse impact on the Group’s business, financial condition, results of operations and cash flows.

We may be adversely affected by unanticipated network interruptions.

Unanticipated network interruptions as a result of system failures, including those due to network, hardware or software or cyber-attacks, which affect the quality of or cause an interruption in the Telefónica Group’s service, could lead to customer dissatisfaction, reduced revenues and traffic, costly repairs, penalties or other measures imposed by regulatory authorities and could harm the Telefónica Group’s reputation.

Telefónica attempts to mitigate these risks through a number of measures, including backup systems and protective systems such as firewalls, virus scanners and other physical and logical security. However, these measures are not always effective. Although the Telefónica Group has insurance policies to cover this type of incidents and risks, these policies may not be sufficient to cover all possible monetary losses, although the claims and loss in revenue caused by service interruptions to date have been covered by these policies.

The mobile industry may be harmed by concerns stemming from actual or perceived health risks associated with radio frequency emissions.

Currently, there is significant public concern regarding alleged potential effects of electromagnetic fields, emitted by mobile telephones and base stations, on human health. This social concern has caused certain governments and administrations to take measures that have hindered the deployment of the infrastructures necessary to ensure quality of service and affected the deployment criteria of new networks.

In May 2011, the specialized cancer research body of the World Health Organization (IARC) classified the electromagnetic fields in mobile telephony as “possibly carcinogenic,” a classification which also includes products such as coffee and pickled foods. The World Health Organization subsequently indicated, in its fact sheet no. 193 published in June 2011, that to date it cannot be confirmed that the use of a mobile telephone has adverse effects on health.

The most recent official study (to the best of our knowledge), published in 2012 by Advisory Group on Non-ionising Radiation (AGNIR), concludes that there are not convincing evidences showing that mobile phone technologies cause adverse effects in the health of individuals. It cannot be certain that future reports and medical studies establish a link between the electromagnetic signals or emissions of radio frequencies and health problems.

Irrespective of the scientific evidence that may be obtained and even though the Telefónica Group has considered these risks and has an action plan for the various countries in which it provides services to ensure compliance with codes of good practice and relevant regulations, this concern, may affect the capacity to capture or retain customers, discourage the use of mobile telephones, or lead to legal costs and other expenses.

Society's worries about radiofrequency emissions could reduce the use of mobile telephones, which could cause the public authorities to implement measures restricting where transmitters and cell sites can be located and how they operate, and the use of our mobile devices, telephones and other products using mobile technology. This could lead to the Company being unable to expand or improve its mobile network. Furthermore, if any relevant authorities request that the thresholds of exposure to electromagnetic fields be reduced, the Company may have to invest in reconstructing its network to comply with these guidelines.

The adoption of new measures by governments or administrations or other regulatory interventions in this respect that may also arise in the future may adversely affect the Group’s business, financial condition, results of operations and cash flows.

Developments in the telecommunications sector have resulted, and may in the future result, in substantial write-downs of the carrying value of certain of our assets.

The Telefónica Group reviews on an annual basis, or more frequently when the circumstances require it, the value of assets and cash-generating units, to assess whether their carrying values can be supported by the future expected cash flows, including, in some cases synergies allowed for in acquisition cost. Potential changes in the regulatory, business, economic or political environment may result in the need to introduce changes to estimates made and recognize impairment losses in goodwill, intangible assets or fixed assets.

Although the recognition of impairments of property, plant and equipment, intangible assets and financial assets results in a non-cash charge on the income statement, it could adversely affect the results of the Telefónica Group’s operations. In this respect, the Telefónica Group has experienced impairment losses on certain of its investments, affecting the results of the year in which they were made. In 2012, an impairment loss was recognized on the stake in Telco, S.p.A. which, coupled with the impact of the recovery of all the operational synergies considered at the time of the investment and the profit contribution for the year, resulted in a negative impact of 1,277 million euros. In 2012, an impairment loss in goodwill was recognized amounting to 414 million euros for Telefónica operations in Ireland which, combined with the write-off of the intangible asset associated with the customer portfolio allocated to this market, resulted in a negative impact of 527 million euros.

Risks associated with the Internet may adversely affect us

Our internet access and hosting services may involve us in civil liability for illegal or illicit use of the internet. In addition, Telefónica, like all telecommunications services providers, may be held liable for the loss, release or inappropriate modification of the customer data stored on its services or carried by its networks

In most countries in which Telefónica operates, the provision of its internet access and hosting services (including the operation of websites with shelf-generated content) are regulated under a limited liability regime applicable to the content that it makes available to the public as a technical service provider, particularly content protected by copyright or similar laws. However, regulatory changes have been introduced imposing additional obligations on access providers (such as. blocking access to a website) as part of the struggle against some illegal or illicit uses of the internet, notably in Europe.

Other risks

We are involved in disputes and litigation with regulators, competitors and third parties.

Telefónica and Telefónica Group companies are party to lawsuits and other legal proceedings in the ordinary course of their businesses, the financial outcome of which is unpredictable. An adverse outcome or settlement in these or other proceedings could result in significant costs and may have a material adverse effect on the Group’s business, financial condition, results of operations and cash flows.

Overview

Telefónica, S.A., is a corporation duly organized and existing under the laws of the Kingdom of Spain, incorporated on April 19, 1924. We are:

| | · | a diversified telecommunications group which provides a comprehensive range of services through one of the world’s largest and most modern telecommunications networks; |

| | · | focused on providing telecommunications services; and |

| | · | present principally in Europe and Latin America. |

The following significant events occurred in 2012:

| | · | On February 21, 2012, Telefónica de Contenidos, S.A.U., a wholly-owned company by Telefónica, S.A., reached an agreement with Abertis Telecom, S.A. to sell the 13.23% stake of Hispasat S.A. owned by Telefónica de Contenidos, S.A.U. Following the exercise of the preferential acquisition right by the German company Eutelsat Services & Beteiligungem, GmbH, and after obtaining the necessary authorizations by the Spanish Council of Ministers on December 28, 2012, Telefónica de Contenidos, S.A.U., on January 10, 2013, transferred to Abertis Telecom, S.A. 23,343 shares of Hispasat, S.A. for a total price of 68 million euros (received in cash) and signed a contract with Eutelsat Services & Beteiligungem, GmbH for the sale of its remaining stake in Hispasat, S.A., which amounted to 19,359 shares of this entity, for a total price of 56 million euros, subject to approval of foreign investment (Dirección General de Política Comercial y de Exteriores), in accordance with Royal Decree 664/1999, of April 23, on the Legal Regime of Foreign Investment (Régimen Jurídico de las Inversiones Exteriores). The capital gain for both transactions is estimated to amount to approximately 47 million euros. |

| | · | On April 2, 2012, Telefónica Móviles Colombia, S.A., Colombia Telecomunicaciones, S.A. ESP (a company 52% owned by Telefónica Group and 48% by the Colombian Government ) and the Colombian Government reached a final agreement to restructure their fixed and mobile business in Colombia. Following this agreement, and the finalization of the merger process between Telefónica Móviles Colombia, S.A. and Colombia Telecomunicaciones, S.A. ESP on June 29, 2012, Telefónica holds 70% of the share capital of the resulting merger company while the Colombian Government controls the remaining 30%. |

| | · | On May 14, 2012, the Telefónica, S.A.’s Annual General Shareholders’ Meeting took place on second call, with the attendance, present or represented, of 54.28 % of the share capital. In such meeting, all the resolutions submitted by the Board of Directors for deliberation and vote were approved by majority of votes. |

| | · | On May 24, 2012, the credit rating agency Standard & Poor´s Rating Services (S&P’s) published its decision to lower the long-term credit rating of Telefónica, S.A. from BBB+ outlook negative to BBB outlook negative. At the same time, the rating agency's short-term credit rating remained at A-2. |

| | · | On May 25, 2012, pursuant to the resolution adopted by the shareholders of Telefónica, S.A. at the Annual General Shareholders’ Meeting, the Board of Directors resolved to execute the capital reduction of Telefónica, S.A. by the cancellation of treasury shares. Therefore, 84,209,363 of treasury shares of Telefónica, S.A. were cancelled, reducing the Company’s share capital by the sum of 84,209,363 euros, which now stands at 4,551,024,586 euros. |

| | · | On May 30, 2012, the Board of Directors of Telefónica, decided to proactively manage the Company’s assets’ portfolio, accelerating the disposal process of non-core assets. |

| | · | On June 10, 2012, Telefónica, S.A. and China United Network Communications Group Company Limited ("Unicom Parent") signed a definitive agreement under which the latter acquired 1,073,777,121 shares of China Unicom (Hong Kong) Limited ("China Unicom"), owned by Telefónica (equivalent to 4.56% of the share capital of |

| | | China Unicom). On July 21, 2012 the aforementioned agreement was complemented by a Supplemental Agreement which determined the acquisition of the shares at a price of HK$10.02 per share, for a total amount of HK$10,759,246,752.42 (approximately 1,142 million euros). The transaction was completed on July, 3, 2012, after obtaining the relevant regulatory authorization. This transaction allows Telefónica, S.A. to increase its financial flexibility, while at the same time continuing to be a key shareholder of China Unicom, with a 5.01% stake. Telefónica undertook not to sell the shares of China Unicom over a period of 12 months from the date of the agreement. Furthermore, Mr. César Alierta, chairman of Telefónica, S.A. is a member of the Board of Directors of China Unicom, while Mr. Chang Xiaobing, chairman of China Unicom, is a member of the Board of Directors of Telefónica, S.A. |

| | · | On June 20, 2012, the credit rating agency Moody’s Investors Service published its decision to lower the long-term credit rating of Telefónica, S.A. from Baa1 to Baa2. At the same time, the agency's short-term credit rating remained at P-2. Long- and short-term ratings are on review for further downgrade. |

| | · | On July 25, 2012, Telefónica, S.A. Board of Directors decided to cancel dividend and share buyback program corresponding to 2012 (including November 2012 and May 2013 cash and scrip payments, respectively). The Company intends to resume its shareholder remuneration in 2013 by paying a dividend of 0.75 euros per share. The Company expects to pay in two tranches: a first payment in the fourth quarter of 2013 and a second one in the second quarter of 2014. |

| | · | On September 17, 2012, the Board of Directors of Telefónica S.A., unanimously appointed Mr. José María Álvarez-Pallete as the new chief operating officer of the Company. Up to this moment, Mr Álvarez-Pallete had been in charge of operations in Europe. To replace him in his position as the head of this region, Ms. Eva Castillo, until that day member of the Board of Directors of the Company, was appointed chairwoman and chief executive officer of Telefónica Europe, while maintaining her position on the Board of Telefónica S.A. |

| | · | On October 12, 2012, Telefónica S.A. reached a definitive agreement, with companies controlled by Bain Capital for the sale of its Customer Relationship Management business, Atento. On December 12, 2012, the relevant regulatory authorizations were obtained and the transaction was completed. The enterprise value of the transaction amounted to 1,051 million euros, including a vendor loan of 110 million euros as well as certain deferred payments for 110 million euros. As a result of Telefónica's agreement to sell Atento, the companies involved in the sale signed a Master Service Agreement regulating Atento's relationship with the Telefónica Group as a service provider for a nine year period. Among the accounting impacts arising from the transaction, it is worth mentioning the positive effect of the reduction of the Telefónica Group’s indebtedness, which was estimated at approximately 812 million euros as of the date of the closing of the transaction, plus subsequent improvements in debt in the following years as the deferred payments are made. |

| | · | On October 29, 2012, the shares offered to the market in the initial public offering of its subsidiary Telefónica Deutschland Holding A.G. were placed at a price of 5.60 euros per share. The total volume of the offering amounted to 258.75 million shares (including 33.75 million over-allotted shares in connection with a greenshoe option granted to the underwritters). The total placement volume of the offering, including a greenshoe option represented 23.17% of the share capital of Telefónica Deutschland Holding A.G. Upon full exercise of the greenshoe option, the aggregate placement volume amounted to 1,449 million euros. The first day of trading of the shares of Telefónica Deutschland Holding AG on the regulated market (Prime Standard) of the Frankfurt Stock Exchange was, October 30, 2012. |

| | · | On October 31, 2012, Telefónica, S.A. launched an offer to purchase outside the United States the preferred securities of Telefónica Finance USA LLC, having a nominal value of 1,000 euros each and, concurrently and in connection therewith, an offer to sell ordinary shares of Telefónica, having a nominal value of 1 euro each, held as treasury stock and to subscribe for newly issued unsecured debentures of Telefónica, with a nominal value of 600 euros each. Holders of 1,941,235 preferred securities accepted the offer, which represented a 97.06% of the aggregate number of preferred securities outstanding. |

Business areas

As of January 1, 2012, the Telefónica Group’s consolidated results are reported in accordance with the new organizational structure approved in September 2011, based on two regional business units, Telefónica Europe and Telefónica Latin America, and two global business units, Telefónica Digital and Telefónica Global Resources.

As a consequence, the digital world and global resources that were previously included in the consolidation perimeters of Telefónica Latin America (Terra, Medianetworks Peru, Wayra and the joint venture Wanda), Telefónica Spain and Telefónica Europe (TIWS, TNA, Jajah, Tuenti and Terra Spain) have been excluded from their consolidation perimeters and are included within “Other companies and eliminations”.

Additionally, from the beginning of 2012, the perimeter of consolidation of Telefónica Europe includes Telefónica Spain. As a result, the results of Telefónica Europe, Telefónica Latin America and “Other companies and eliminations” have been revised for the fiscal years 2011 and, 2010 to reflect the above mentioned new organization. As this is an intragroup change, Telefónica’s consolidated results for 2011 and 2010 are not affected.

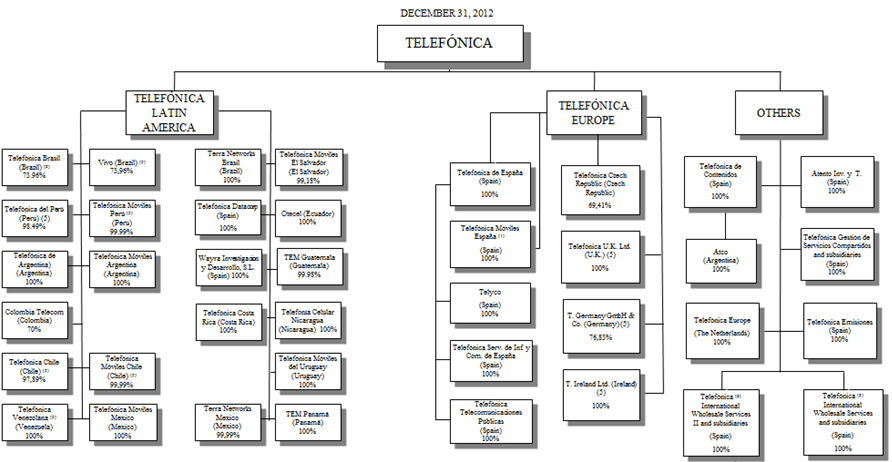

The following chart shows the organizational structure of the principal subsidiaries of the Telefónica Group at December 31, 2012, including their jurisdictions of incorporation and our ownership interest. For further detail, see Exhibit 8.1 to this Annual Report

| (1) | Ownership in Telefónica Móviles España, S.A.U. is held directly by Telefónica, S.A. |

| (2) | 91.76% representing voting interest. |

| (3) | Ownership in Telefónica International Wholesale Services, S.L. is held 92.51% by Telefónica, S.A. and 7.49% by Telefónica Datacorp, S.A.U. |

| (4) | Ownership in O2 (Europe) Ltd. (U.K.) is held directly by Telefónica, S.A. |

| (5) | Companies held indirectly. |

| (6) | Ownership in TIWS II is held directly by Telefónica, S.A. |

Telefónica, S.A., the parent company of the Telefónica Group, also operates as a holding company with the following objectives:

| | · | coordinate the Group’s activities; |

| | · | allocate resources efficiently among the Group; |

| | · | provide managerial guidelines for the Group; |

| | · | manage the Group’s portfolio of businesses; |

| | · | foster cohesion within the Group; and |

| | · | foster synergies among the Group’s subsidiaries. |

Our principal executive offices are located at Distrito Telefónica, Ronda de la Comunicación, s/n, 28050 Madrid, Spain, and our registered offices are located at Gran Vía, 28, 28013 Madrid, Spain. Our telephone number is +34 900 111 004.

Capital Expenditures and Divestitures

Our principal capital expenditures during the three years ended December 31, 2012 consisted of additions to property, plant and equipment and additions to intangible assets, including spectrum. In 2012, 2011 and 2010, we made capital expenditures of 9,458 million euros, 10,224 million euros and 10,844 million euros, respectively.

Year ended December 31, 2012

Capital expenditures in 2012 declined 7.5% compared to 2011. Capital expenditures in 2012 include the cost of spectrum in Brazil, Nicaragua, Chile, Venezuela and Ireland, amounting to 586 million euros. In Telefónica Europe, there were significant investments in further capacity expansion and quality improvement of its mobile 3G networks in Spain, United Kingdom, Germany and Czech Republic, and additionally, into the development of the LTE network in Germany. In the fixed line business, there were significant investments in the fiber optic network roll-out and data services for large corporate customers in Spain, and in improving fixed broadband network in Czech Republic. Investments in Telefónica Latin America were focused on mobile business (mainly with overlay projects, and coverage expansion and enhancing the quality of its 3G networks), as well as on development of new platforms and evolving the existing ones to support new value added services. In the fixed line business in Telefónica Latin America, significant investments were made in ultrabroadband and speed upgrades in DSL, FTTx and VDSL in Brazil, Argentina and Chile. Also, it is important to highlight the investments done by Telefónica Digital throughout 2012 in TV business including new HD channels introduction and commercial launches of OTT services and content delivery network in line with Telefónica Digital initiatives.

Year ended December 31, 2011

Capital expenditures in 2011 declined 5.7% compared with 2010. Capital expenditures in 2011 include the cost of spectrum in Spain, Brazil, Costa Rica and Colombia, amounting to 1,296 million euros. Investment in Europe continued to be focused on improving capacity and coverage of the mobile networks in the United Kingdom and Germany as well as the broadband business, primarily in the Czech Republic and Germany. Investment in the mobile business was principally directed toward improving third generation (3G) network capability. However, significant investments were also made in the fixed line business in Europe, principally in Spain, including investments in broadband to continue the localized roll-out of fiber optics, TV and data services for large corporate customers, as well as the maintenance of the traditional business. Investments in Latin America were focused mainly on the mobile business, mostly in the expansion of coverage and on 3G and GSM network capacity. In the fixed line business, network and plant upgrades and investment in broadband accounted for the bulk of the investment.

Year ended December 31, 2010

Our capital expenditures increased 49.4% to 10,844 million euros in 2010 compared with 7,257 million euros in 2009, mainly as a result of the acquisition of spectrum in Germany (1,379 million euros) and Mexico (1,237 million euros) and the full consolidation in the fourth quarter of 2010 of Vivo. Excluding such spectrum acquisitions, capital expenditures growth would have been 13.4%. In Europe, generally, capital expenditures were directed toward improving the capacity

and coverage of our mobile networks, expanding mobile third generation, or 3G, offerings, and greater investments in the ADSL business. However, in Spain, investments were directed toward further developing the fixed broadband business with a selective roll-out of fiber optics, Imagenio and data services for large corporate customers. In Latin America, capital expenditures were directed toward the transformation of the fixed telephony business and continuing to expand coverage and capacity of 3G and GSM networks in our mobile telephony business.

Financial Investments and Divestitures

There were no significant financial investments in 2012. Our principal divestures in 2012 were the sale of 4.56 percentage points of our stake in China Unicom for approximately 1,142 million euros, resulting in a loss of 97 million euros; the sale of 23.17% of Telefónica Germany Holding, A.G. for 1,499 million euros, with no impact in the results of the Group given we maintain the control over the company after this transaction, and the sale of Atento for 1,051 million euros, including a vendor loan of 110 million euros as well as certain deferred payments for 110 million euros, resulting in a capital gain of 61 million euros.

Our principal financial investment in 2011 was the extension of our strategic partnership agreement with China Unicom, which extension was executed on January 23, 2011. Telefónica acquired through its subsidiary, Telefónica Internacional, S.A.U., a number of China Unicom shares for consideration totaling 501 million dollars in the aggregate (358 million euros at each acquisition date) from third parties during the nine months following the execution of the extension. Following the completion of the transaction, Telefónica holds, through Telefónica Internacional, S.A.U., approximately 9.57% of China Unicom’s voting share capital.

Our principal financial investments in 2010 relate to the acquisition of 50% of Brasilcel, N.V. (“Brasilcel”) (approximately 7,500 million euros), the acquisition of HanseNet (approximately 275 million euros) and the acquisition of a 22% stake in D.T.S, Distribuidora de Televisión Digital, S.A. (approximately 488 million euros). Our principal divesture in 2010 was the reduction of our stake in Portugal Telecom S.G.P.S., S.A. (“Portugal Telecom”) by 7.98%, resulting in cash inflow of 631 million euros, though we retained a certain amount of economic exposure to fluctuations in the value of Portugal Telecom’s shares through the use of derivative instruments.

Public Takeover Offers

On October 31, 2012 Telefónica, S.A. launched an offer to purchase outside the United States the preferred securities of Telefónica Finance USA LLC, having a nominal value of 1,000 euros each and, concurrently and in connection therewith, an offer to sell ordinary shares of Telefónica, having a nominal value of 1 euro each, held as treasury stock and to subscribe for newly issued unsecured debentures of Telefónica, with a nominal value of 600 euros each. Holders of 1,941,235 preferred securities accepted the offer, which represented a 97.06% of the aggregate number of preferred securities outstanding.

Recent Developments

The principal events that have occurred since December 31, 2012 are set forth below:

| | · | On February 8, 2013, the Venezuelan bolivar fuertes was devalued from 4.3 bolivar fuertes per U.S. dollar to 6.3 bolivar fuertes per U.S. dollar. |

The new exchange rate of 6.3 bolivar fuertes per U.S. dollar will be used from 2013 in the conversion of the financial information of Venezuelan subsidiaries. The principal matters to be considered in 2013 are as follows:

| | • | The decrease of the Telefónica Group's net assets in Venezuela as a result of the conversion to euros at the new exchange rate with a balancing entry in Group equity of approximately 1,000 million euros, based on the net assets as at December 31, 2012. |

| | • | Increase in the net financial debt resulting from application of the new exchange rate to the net asset value in bolivar fuertes of approximately 873 million euros, as per the balance as at December 31, 2012. |

The income and cash flows from Venezuela will be converted at the new devalued closing exchange rate as of January 1, 2013.

| | · | On February 20, 2013, Telefónica UK Limited won two 10 MHz blocks in the 800 MHz spectrum band in the UK spectrum auction. |

Total investment by Telefónica UK in new frequencies amounted to 550 million pounds sterling (approximately 645 million euros).

For information related to our significant financing transactions completed in 2012 and through the date of this Annual Report, see Note 13 to our Consolidated Financial Statements and “Item 5. Operating and Financial Review and Prospects – Liquidity and Capital Resources – Anticipated Sources of Liquidity.

The Telefónica Group is one of the world’s leading mobile and fixed communications services providers. Its strategy is to become a leader in the new digital world and transform the possibilities it brings into reality.

Against this backdrop and with the aim of reinforcing its growth story, actively participating in the digital world and capturing the most of the opportunities afforded by its scale and industrial alliances, in September 2011 a new organizational structure was approved. This new structure, which was fully operational in 2012, is as follows:

This new organization bolsters the Telefónica Group’s place in the digital world, enabling it to tap any growth opportunities arising in this environment, drive innovation, strengthen the product and services portfolio and maximize the advantages afforded by its large customer bases in an increasingly connected world. In addition, the creation of a Global Resources operating unit aims to ensure the profitability and sustainability of the business by leveraging economies of scale and driving Telefónica’s transformation into a fully global group.

Telefónica Europe’s and Telefónica Latin America’s objective is to shore up the results of the business and generate sustainable growth through available capacity, backed by the Global Corporation. The two differentiated segments are as follows: (i) Telefónica Europe, which now includes Telefónica Spain as well as the operations already forming part of the Telefónica Europe segment before; and (ii) Telefónica Latin America. Group’s results of 2011 and 2010 have been restated to reflect this organizational structure, wothout any impact on consolidated figures.

The Telefónica Group’s growth strategy for the next few years is geared towards:

| · | Improving the customer experience to continue increasing the number of accesses. |

| | - | Boosting the penetration of smartphones in all markets to accelerate the growth of mobile data, unlocking the value of its increased usage. |

| | - | Defending the competitive position in the wireline business with a focus on broadband, offering faster speeds, bundled offers and full IP voice and video services. |

| | - | Leveraging growth opportunities arising in an increasingly digital environment: e.g. video, OTT, financial services, cloud computing, eHealth and media. |

| · | Continuing efforts to transform the Group’s operating model: |

| | - | Increasing network capacity in the markets where we operate through technological advances and acquisitions of spectrum. |

| | - | Accelerating the transformation primarily through the systems area. |

| | - | Proceeding towards becoming an international digital and online service provider group. |

| · | Maximizing economies of scale to boost efficiency. |

The Telefónica Group has operations in Spain, the United Kingdom, Germany, the Czech Republic, Ireland and Slovakia in Europe, as well as Brazil, Mexico, several countries in Central America, Venezuela, Colombia, Peru, Argentina, Chile, Uruguay and Ecuador in Latin America.

Telefónica has an industrial alliance with Telecom Italia, S.p.A. and a strategic alliance with China Unicom, in which the Group holds a 5% stake. In addition, the “Partners Program” was created in 2011 in line with the objective of unlocking the value of Telefónica’s scale. Three operators have signed up for this program (Bouygues, Etisalat and Sunrise). This initiative makes a host of services available to selected operators under commercial terms that allow the partners to leverage on Telefónica’s scale and to cooperate in key business areas (e.g. roaming, services to multinationals, procurement, handsets, etc.)

2012 highlights

The Group's total accesses rose 3.0% year-on-year, to nearly 316 million at the 2012 year end, driven by access growth in Latin America (5.5% year-on-year).

Telefónica Latin America's revenues rose 5.5% year-on-year and 6.7% in 2012 stripping out exchange rate differences and hyperinflationary adjustments in Venezuela, underpinned by growth in the customer base. The quality of the customer base itself has also improved, with a growing weight of contract and smartphone customers.

Mobile data revenues continued to drive growth in 2012, drawing heavily from the steep rise in non-SMS data revenues.

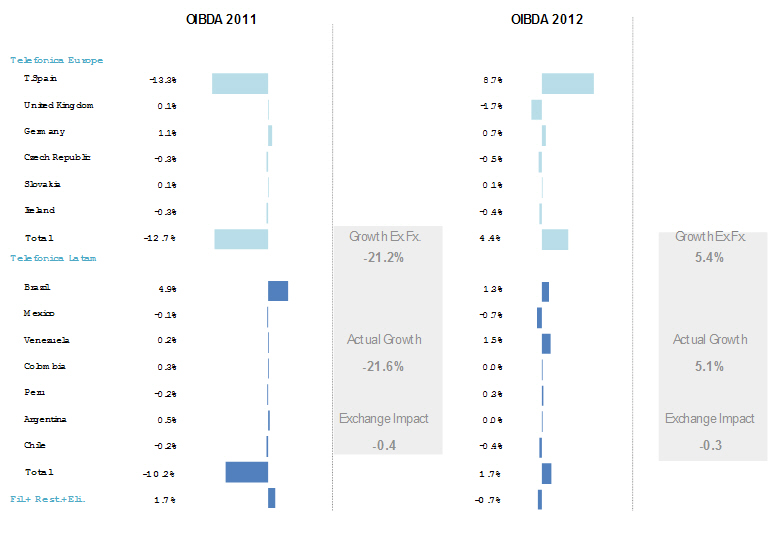

OIBDA in 2012 amounted to 21,231 million euros, with reported growth of 5.1%, affected by the recognition of 2,671 million euros of restructuring expenses at Telefónica Spain in 2011 and the 527 million euros write-down made by the Telefónica Group against its stake in Telefónica Ireland in 2012, due to the slowdown in activities in the prevailing market uncertainty.

| Accesses |

| Thousands of accesses | | 2010 | | 2011 | | 2012 | | %Var 10/11 | | %Var 11/12 |

| Fixed telephony accesses (1) (2) | | 41,355.7 | | 40,119.2 | | 40,002.6 | | (3.0)% | | (0.3)% |

| Internet and data accesses | | 18,611.4 | | 19,134.2 | | 19,402.6 | | 2.8% | | 1.4% |

| Narrowband | | 1,314.1 | | 909.2 | | 653.2 | | (30.8)% | | (28.2)% |

| Broadband (3) | | 17,129.6 | | 18,066.3 | | 18,596.2 | | 5.5% | | 2.9% |

| Other (4) | | 167.8 | | 158.7 | | 153.1 | | (5.4)% | | (3.5)% |

| Mobile Accesses (5) | | 220,240.5 | | 238,748.6 | | 247,269.5 | | 8.4% | | 3.6% |

| Prepay (6) | | 151,273.9 | | 162,246.9 | | 165,759.7 | | 7.3% | | 2.2% |

| Contract (7) | | 68,966.6 | | 76,501.7 | | 81,509.8 | | 10.9% | | 6.5% |

| Pay TV (8) | | 2,787.4 | | 3,309.9 | | 3,336.2 | | 18.7% | | 0.8% |

| Unbundled loops | | 2,529.2 | | 2,928.7 | | 3,308.8 | | 15.8% | | 13.0% |

| Share ULL | | 264.0 | | 205.0 | | 183.5 | | (22.3)% | | (10.5)% |

| Full ULL | | 2,265.3 | | 2,723.7 | | 3,125.3 | | 20.2% | | 14.7% |

| Wholesale ADSL (9) | | 687.4 | | 849.3 | | 800.6 | | 23.6% | | (5.7)% |

| Other (10) | | 1,420.7 | | 1,518.0 | | 1,621.8 | | 6.8% | | 6.8% |

| Final Client Accesses | | 282,994.9 | | 301,311.8 | | 310,010.8 | | 6.5% | | 2.9% |

| Wholesale Accesses | | 4,637.4 | | 5,296.0 | | 5,731.3 | | 14.2% | | 8.2% |

| Total Accesses | | 287,632.3 | | 306,607.8 | | 315,742.1 | | 6.6% | | 3.0% |

(1) PSTN (including Public Use Telephony) x1; ISDN Basic access x1; ISDN Primary access; 2/6 Access x30. Company’s accesses for internal use included and total fixed wireless included. Includes VoIP and Naked ADSL. Since the first quarter of 2012, fixed telephony accesses include 384 thousand VoIP lines in Germany and 65 thousand fixed lines in UK to homogenize these accesses to Group’s criteria.

(2) It includes the reclassification in the fourth quarter of 2012 in Argentina of 157 thousand “fixed wireless” previously included in mobile contract accesses.

(3) DSL, satellite, optic fiber, cable and broadband circuits.

(4) Retail circuits other than broadband.

(5) In the first quarter of 2012, 2.0 million inactive accesses were disconnected in Spain.

(6) In the first quarter of 2012, 1.2 million inactive accesses were disconnected in Spain. In the third quarter of 2011 360 thousand inactive accesses were disconnected in Chile. In Brazil, 1.0 million inactive accesses were disconnected in the fourth quarter of 2011 and 1.6 million inactive accesses were disconnected in the second quarter of 2012.

(7) First quarter of 2012 includes the disconnection of 800 thousand inactive accesses in Spain.

(8) Includes 150 thousand clients of TVA in June 2011.(9) Includes ULL rented by Telefónica Germany and Telefónica UK.(10) Circuits for other operators. Includes Wholesale Line Rental (WLR) in Spain.

Accesses by region

The Telefónica Group’s strategy is predicated on capturing growth in its markets and especially on attracting high-value customers.

This strategy led to a 3.0% increase in total accesses, to nearly 316 million at the 2012 year end, driven primarily by contract, mobile broadband and fixed broadband customers. Accesses in Telefónica Latin America (67% of total) were particularly noteworthy, rising 5.5% compared to the December 2011 figure, despite the disconnection of inactive customers in Brazil (1.6 million accesses) and the implementation of more restrictive criteria concerning both new connections and disconnections. Total accesses in Telefónica Europe dropped 1.9% year-on-year, due to the disconnection of 2.0 million inactive mobile accesses in Spain in the first quarter of 2012.

Mobile broadband accesses stood at 52.8 million at December 2012, reflecting a solid 38% year-on-year increase and representing 21% of mobile accesses (up 5 p.p. year-on-year).

At December 31, 2012, the Telefónica Group holds significant direct and indirect stakes (of over 5% in all cases) in listed telecommunications companies other than in those in which it has control. These companies are China Unicom and Telecom Italia, S.p.A.

2012 Consolidated results

| | | Year ended December 31 | | Percent Change |

| Results of operations | | 2012 | | 2011 | | 2010 | | 2012 vs 2011 | | 2011 vs 2010 |

| Millions of euros | | Total | | % of revenues | | Total | | % of revenues | | Total | | % of revenues | | Total | | % | | Total | | % |

| Revenues | | 62,356 | | 100.0% | | 62,837 | | 100.0% | | 60,737 | | 100.0% | | (481) | | (0.8)% | | 2,100 | | 3.5% |

| Other income | | 2,323 | | 3.7% | | 2,107 | | 3.4% | | 5,869 | | 9.7% | | 216 | | 10.3% | | (3,762) | | (64.1)% |

| Supplies | | (18,074) | | (29.0)% | | (18,256) | | (29.1)% | | (17,606) | | (29.0)% | | 182 | | (1.0)% | | (650) | | 3.7% |

| Personnel expenses | | (8,569) | | (13.7)% | | (11,080) | | (17.6)% | | (8,409) | | (13.8)% | | 2,511 | | (22.7)% | | (2,671) | | 31.8% |

| Other expenses | | (16,805) | | (27.0)% | | (15,398) | | (24.5)% | | (14,814) | | (24.4)% | | (1,407) | | 9.1% | | (584) | | 3.9% |

| Operating income before depreciation and amortization (OIBDA)(*) | | 21,231 | | 34.0% | | 20,210 | | 32.2% | | 25,777 | | 42.4% | | 1,021 | | 5.1% | | (5,567) | | (21.6)% |

| Depreciation and amortization | | (10,433) | | (16.7)% | | (10,146) | | (16.1)% | | (9,303) | | (15.3)% | | (287) | | 2.8% | | (843) | | 9.1% |

| Operating income | | 10,798 | | 17.3% | | 10,064 | | 16.0% | | 16,474 | | 27.1% | | 734 | | 7.3% | | (6,410) | | (38.9)% |

| Share of profit (loss) of associates | | (1,275) | | (2.0)% | | (635) | | (1.0)% | | 76 | | 0.1% | | (640) | | 100.8% | | (711) | | n.m. |

| Net financial expense | | (3,659) | | (5.9)% | | (2,941) | | (4.7)% | | (2,649) | | (4.4)% | | (718) | | 24.4% | | (292) | | 11.0% |

| Corporate income tax | | (1,461) | | (2.3)% | | (301) | | (0.5)% | | (3,829) | | (6.3)% | | (1,160) | | n.m. | | 3,528 | | (92.1)% |