Filed by TCF Financial Corporation Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: TCF Financial Corporation SEC File No.: 001-10253 Date: January 31, 2019

CREATING A PREMIER MIDWEST BANK Enhancing Value for Our Shareholders, Customers and Communities All-Company Meeting JANUARY 31, 2019

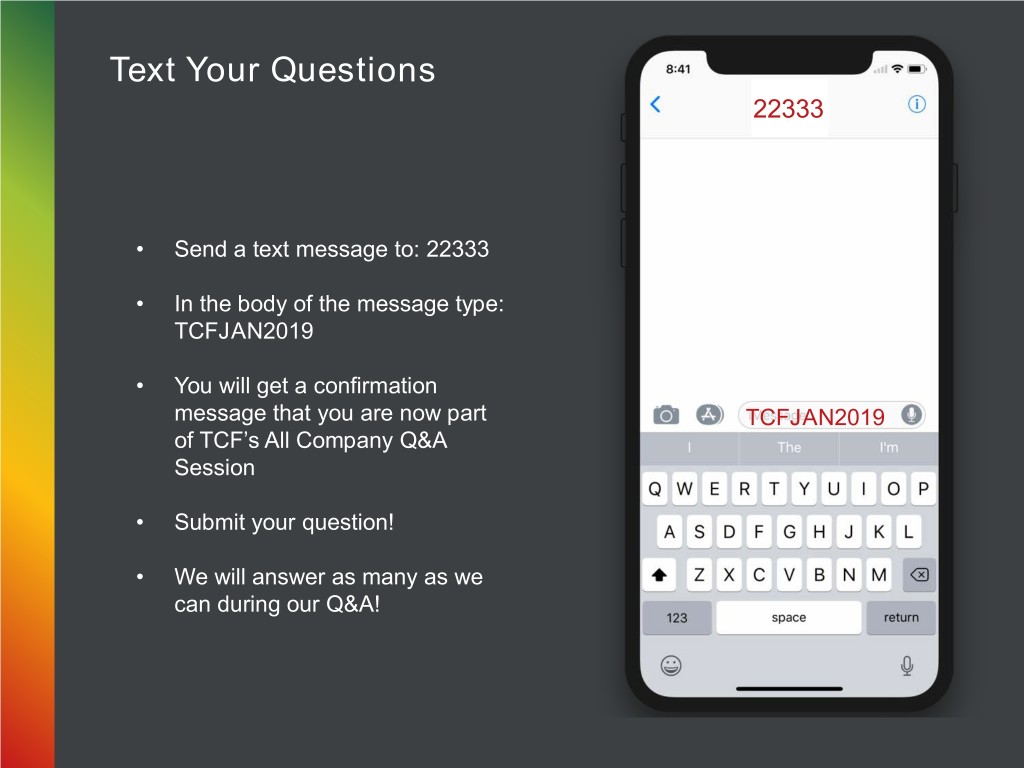

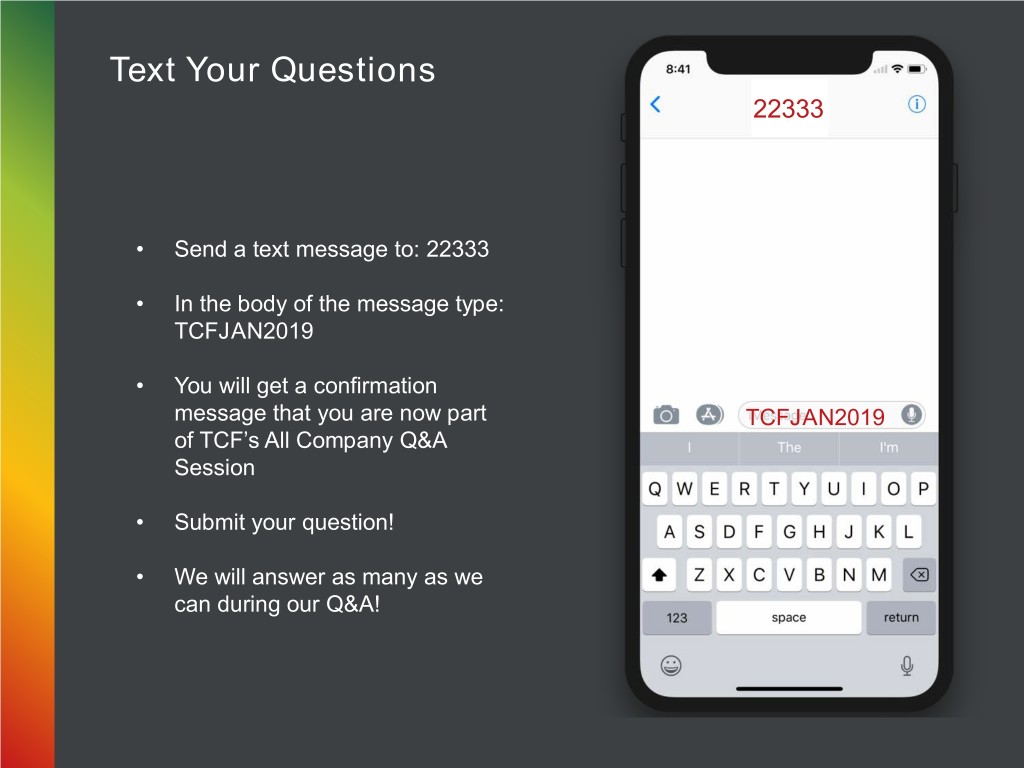

Text Your Questions 22333 • Send a text message to: 22333 • In the body of the message type: TCFJAN2019 • You will get a confirmation message that you are now part TCFJAN2019 of TCF’s All Company Q&A Session • Submit your question! • We will answer as many as we can during our Q&A!

Cautionary Note Regarding Forward-Looking Statements Statements included in this communication which are not historical in nature are intended to be, and hereby are identified as, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include, but are not limited to, statements regarding the outlook and expectations of Chemical and TCF with respect to their planned merger, the strategic benefits and financial benefits of the merger, including the expected impact of the transaction on the combined company’s future financial performance (including anticipated accretion to earnings per share, the tangible book value earn-back period and other operating and return metrics), and the timing of the closing of the transaction. Words such as “may,” “anticipate,” “plan,” “estimate,” “expect,” “project,” “assume,” “approximately,” “continue,” “should,” “could,” “will,” “poised,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements are subject to risks, uncertainties and assumptions that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence, which could cause actual results to differ materially from anticipated results. Such risks, uncertainties and assumptions, include, among others, the following: • the failure to obtain necessary regulatory approvals when expected or at all (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction); • the failure of either Chemical or TCF to obtain shareholder approval, or to satisfy any of the other closing conditions to the transaction on a timely basis or at all; • the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the merger agreement; • the possibility that the anticipated benefits of the transaction, including anticipated cost savings and strategic gains, are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy, competitive factors in the areas where Chemical and TCF do business, or as a result of other unexpected factors or events; • the impact of purchase accounting with respect to the transaction, or any change in the assumptions used regarding the assets purchased and liabilities assumed to determine their fair value; • diversion of management’s attention from ongoing business operations and opportunities; • potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; • the ability of either company to effectuate share repurchases and the prices at which such repurchases may be effectuated; • the outcome of any legal proceedings that may be instituted against Chemical or TCF; • the integration of the businesses and operations of Chemical and TCF, which may take longer than anticipated or be more costly than anticipated or have unanticipated adverse results relating to Chemical’s or TCF’s existing businesses; • business disruptions following the merger; and • other factors that may affect future results of Chemical and TCF including changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Additional factors that could cause results to differ materially from those described above can be found in the risk factors described in Item 1A of each of Chemical’s and TCF’s Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2017. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. Chemical and TCF disclaim any obligation to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events or otherwise, except as required by law. 4

Additional Information Important Additional Information and Where to Find It This communication is being made in respect of the proposed merger transaction between Chemical and TCF. In connection with the proposed merger, Chemical will file with the SEC a Registration Statement on Form S-4 that will include the Joint Proxy Statement of Chemical and TCF and a Prospectus of Chemical, as well as other relevant documents regarding the proposed transaction. A definitive Joint Proxy Statement/Prospectus will also be sent to Chemical and TCF shareholders. INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. A free copy of the Joint Proxy Statement/Prospectus, once available, as well as other filings containing information about Chemical and TCF, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Chemical by accessing Chemical’s website at http://www.chemicalbank.com (which website is not incorporated herein by reference) or from TCF by accessing TCF’s website at http://www.tcfbank.com (which website is not incorporated herein by reference). Copies of the Joint Proxy Statement/Prospectus once available can also be obtained, free of charge, by directing a request to Chemical Investor Relations at Investor Relations, Chemical Financial Corporation, 333 W. Fort Street, Suite 1800, Detroit, MI 48226, by calling (800) 867-9757 or by sending an e-mail to investorinformation@chemicalbank.com, or to TCF Investor Relations at Investor Relations, TCF Financial Corporation, 200 Lake Street East, EXO-02C, Wayzata, MN 55391 by calling (952) 745-2760 or by sending an e-mail to investor@tcfbank.com. Participants in Solicitation Chemical and TCF and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Chemical and TCF shareholders in respect of the transaction described in the Joint Proxy Statement/Prospectus. Information regarding Chemical’s directors and executive officers is contained in Chemical’s Annual Report on Form 10-K for the year ended December 31, 2017, its Proxy Statement on Schedule 14A, dated March 16, 2018, and certain of its Current Reports on Form 8-K, which are filed with the SEC. Information regarding TCF’s directors and executive officers is contained in TCF’s Annual Report on Form 10-K for the year ended December 31, 2017, its Proxy Statement on Schedule 14A, dated March 14, 2018, and certain of its Current Reports on Form 8-K, which are filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Joint Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. Non-GAAP Financial Measures This presentation contains certain non-GAAP financial measures that are not in accordance with U.S. generally accepted accounting principles (GAAP). Chemical and TCF use certain non-GAAP financial measures to provide meaningful, supplemental information regarding their operational results and to enhance investors’ overall understanding of Chemical’s and TCF’s financial performance. The limitations associated with non-GAAP financial measures include the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently. These disclosures should not be considered an alternative to Chemical’s and TCF’s GAAP results. 5

Welcome Craig Dahl Chairman & CEO 6

Before I Begin… The TCF team knows no boundaries – We are a national company! All of our markets and locations are important to our future and growth. Our merger will give us scale to grow in all of our markets. Minnesota is home base for me, but I go wherever the business and team needs me. My commitment to be visible and involved in all of our locations and businesses is as strong as ever. 7

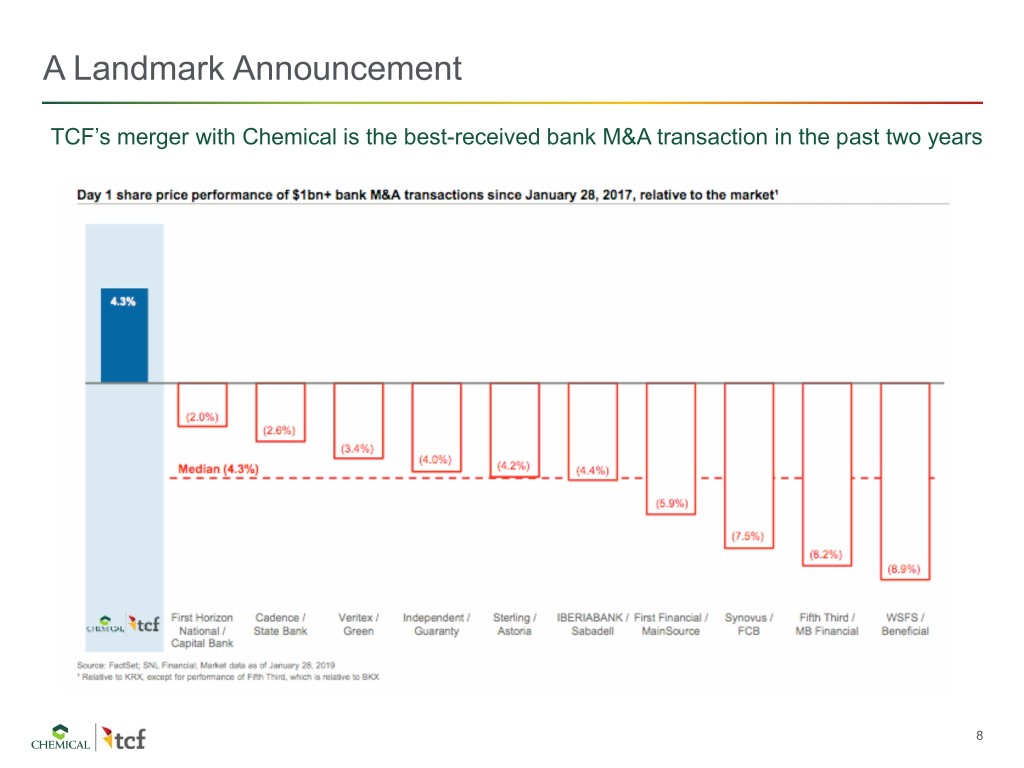

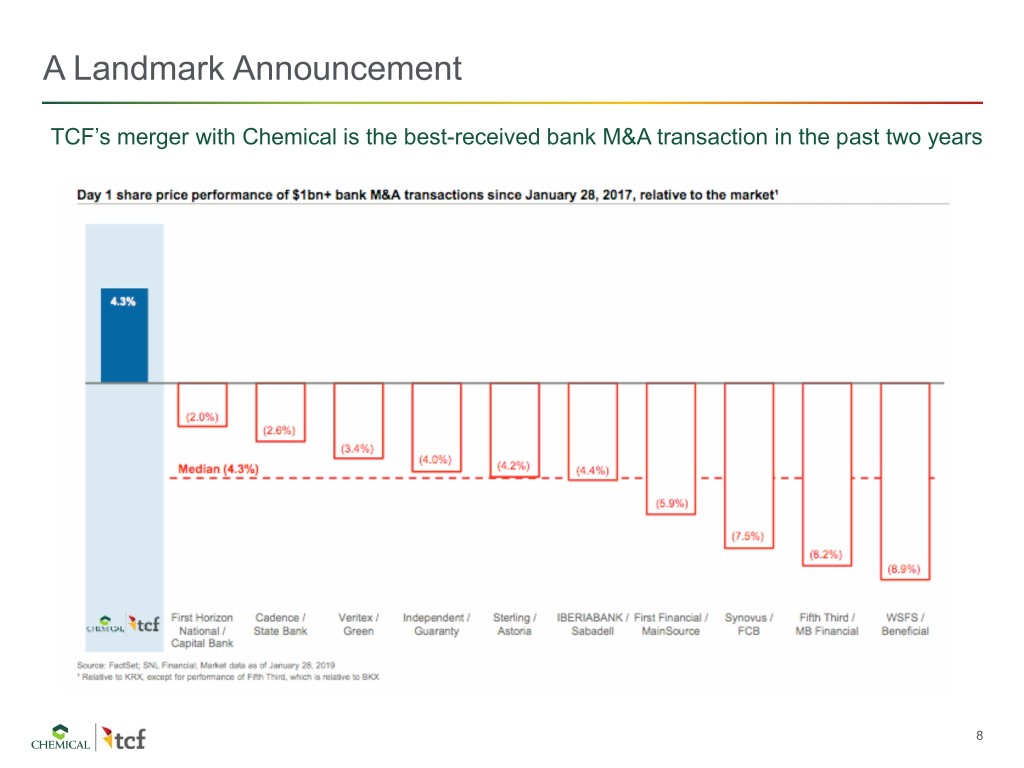

A Landmark Announcement TCF’s merger with Chemical is the best-received bank M&A transaction in the past two years 8

Reaction to Our Announcement In our view, the deal offers several key strategic and financial benefits including: a top ten position in some of the Midwest region's most attractive market places, greater scale, a balanced deposit mix & loan portfolio, and a regional bank poised to deliver ‘best in class’ operating metrics.” – Kevin Reevey (D.A. Davidson) Thank you for making a bold move! - TCF team member email From a strategic standpoint, the combination of TCF's national businesses and strong retail deposit franchise with Chemical’s strong commercial and consumer base is a good marriage, in our view, that extends the lending / deposit- taking opportunities for both companies.” – Jon Arfstrom (RBC Capital Markets) We are incrementally bullish on TCF shares as we like the prospects for a more diverse bank with enhanced growth prospects and improved profitability metrics. – David Long (Raymond James) 9

Our Vision for the New TCF 10

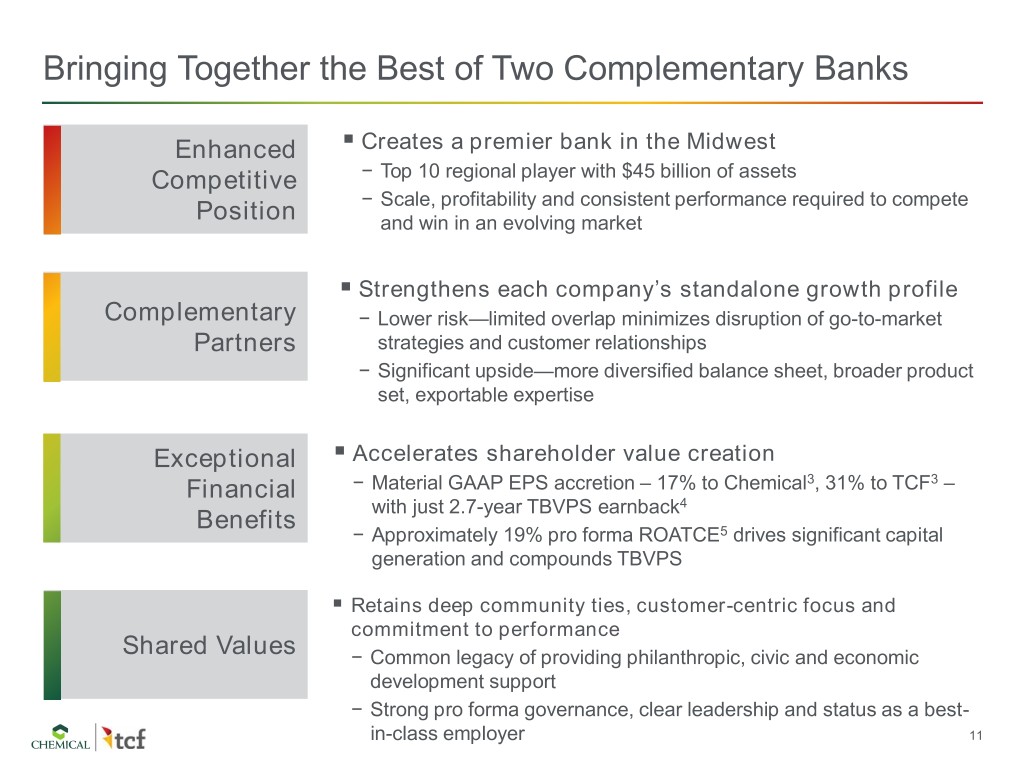

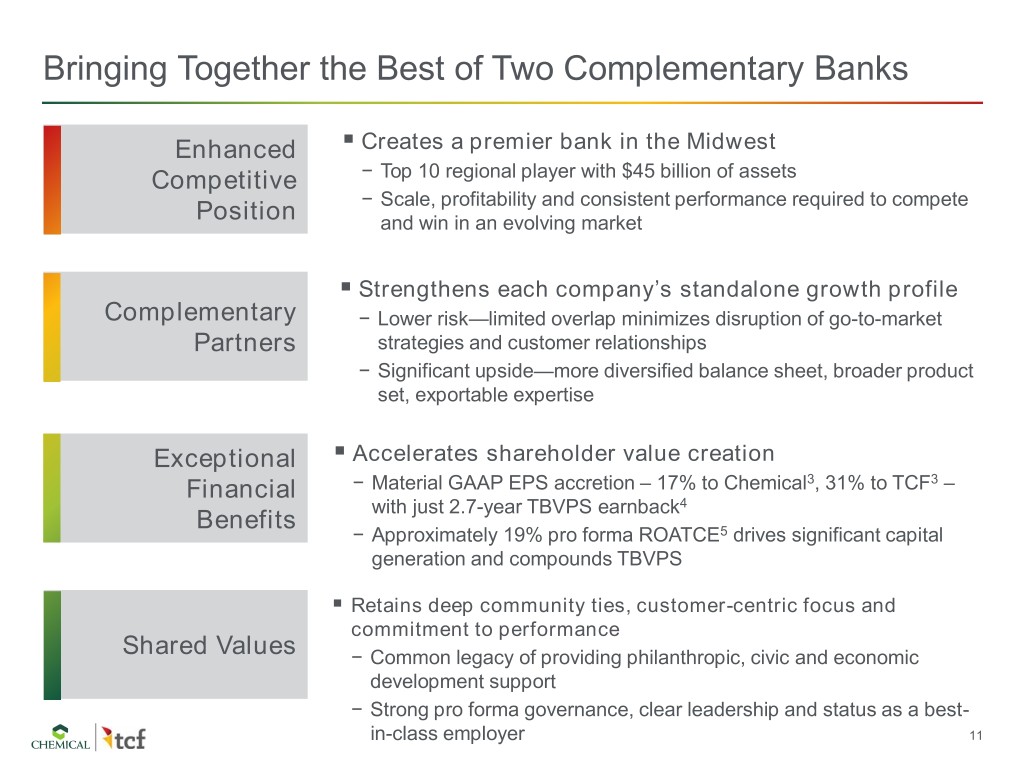

Bringing Together the Best of Two Complementary Banks Enhanced . Creates a premier bank in the Midwest Competitive − Top 10 regional player with $45 billion of assets − Scale, profitability and consistent performance required to compete Position and win in an evolving market . Strengthens each company’s standalone growth profile Complementary − Lower risk—limited overlap minimizes disruption of go-to-market Partners strategies and customer relationships − Significant upside—more diversified balance sheet, broader product set, exportable expertise Exceptional . Accelerates shareholder value creation 3 3 Financial − Material GAAP EPS accretion – 17% to Chemical , 31% to TCF – with just 2.7-year TBVPS earnback4 Benefits − Approximately 19% pro forma ROATCE5 drives significant capital generation and compounds TBVPS . Retains deep community ties, customer-centric focus and commitment to performance Shared Values − Common legacy of providing philanthropic, civic and economic development support − Strong pro forma governance, clear leadership and status as a best- in-class employer 11

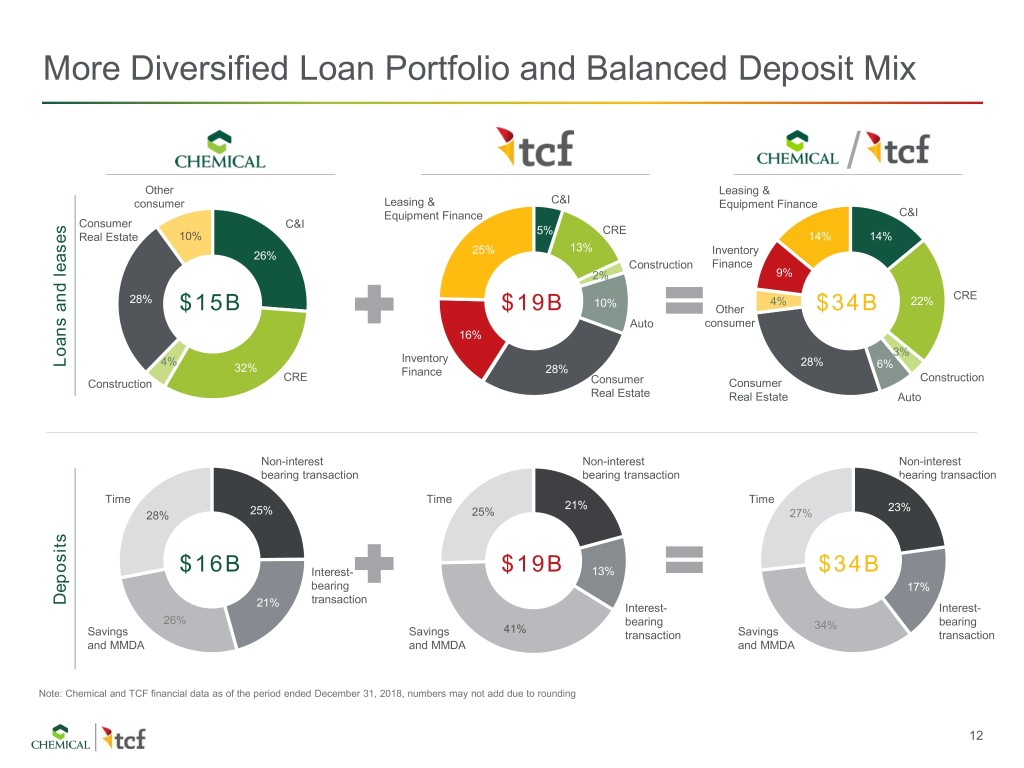

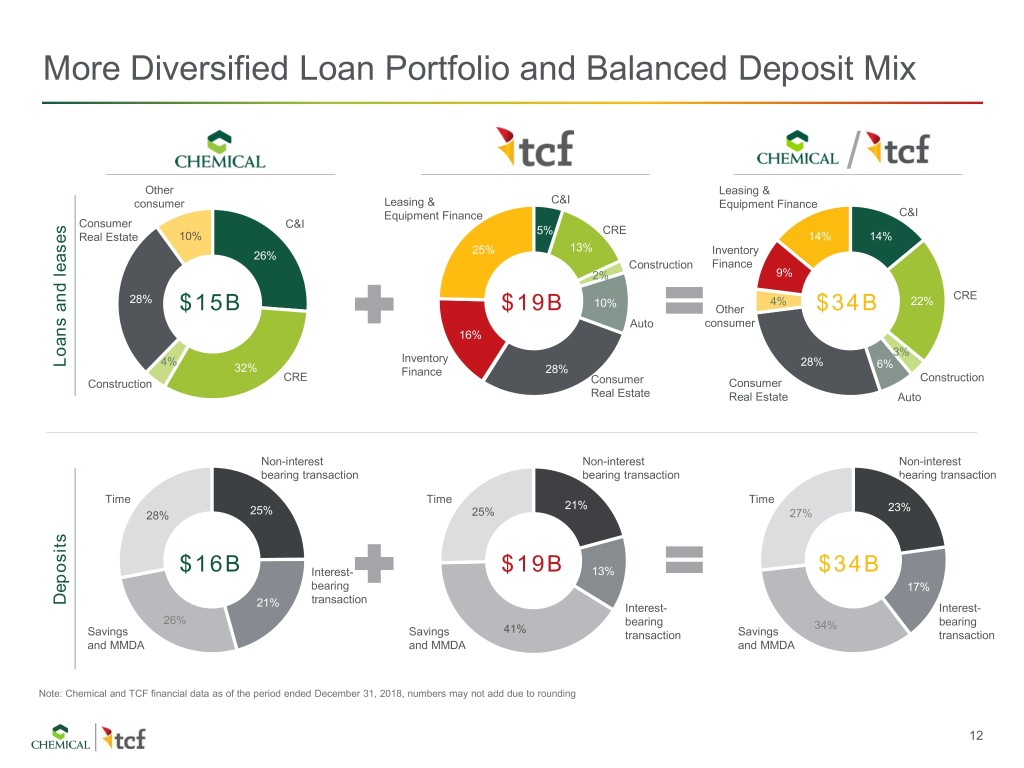

More Diversified Loan Portfolio and Balanced Deposit Mix / Other Leasing & consumer Leasing & C&I Equipment Finance Equipment Finance C&I Consumer C&I 5% CRE Real Estate 10% 14% 14% 25% 13% 26% Inventory Construction Finance 2% 9% CRE 28% 10% 4% 22% $15B $19B Other $34B Auto consumer 16% 3% Inventory Loans and leases and Loans 4% 28% 32% 28% 6% CRE Finance Construction Construction Consumer Consumer Real Estate Real Estate Auto Non-interest Non-interest Non-interest bearing transaction bearing transaction bearing transaction Time Time Time 21% 23% 28% 25% 25% 27% $16B Interest- $19B 13% $34B bearing 17% Deposits transaction 21% Interest- Interest- 26% bearing bearing 41% 34% Savings Savings transaction Savings transaction and MMDA and MMDA and MMDA Note: Chemical and TCF financial data as of the period ended December 31, 2018, numbers may not add due to rounding 12

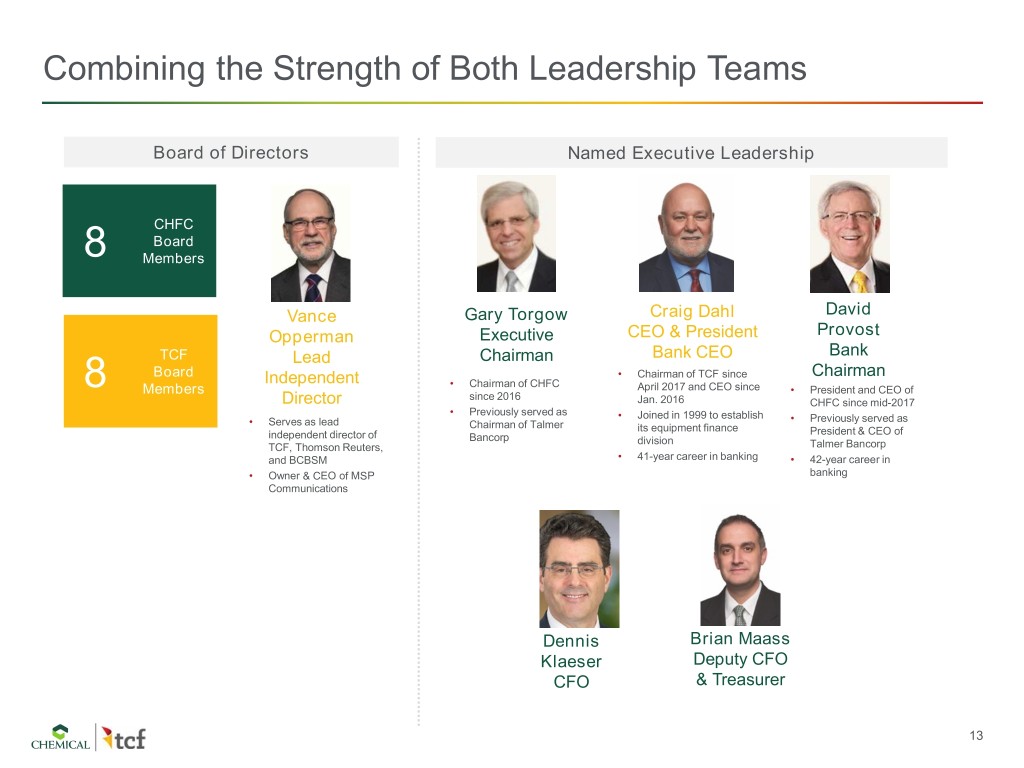

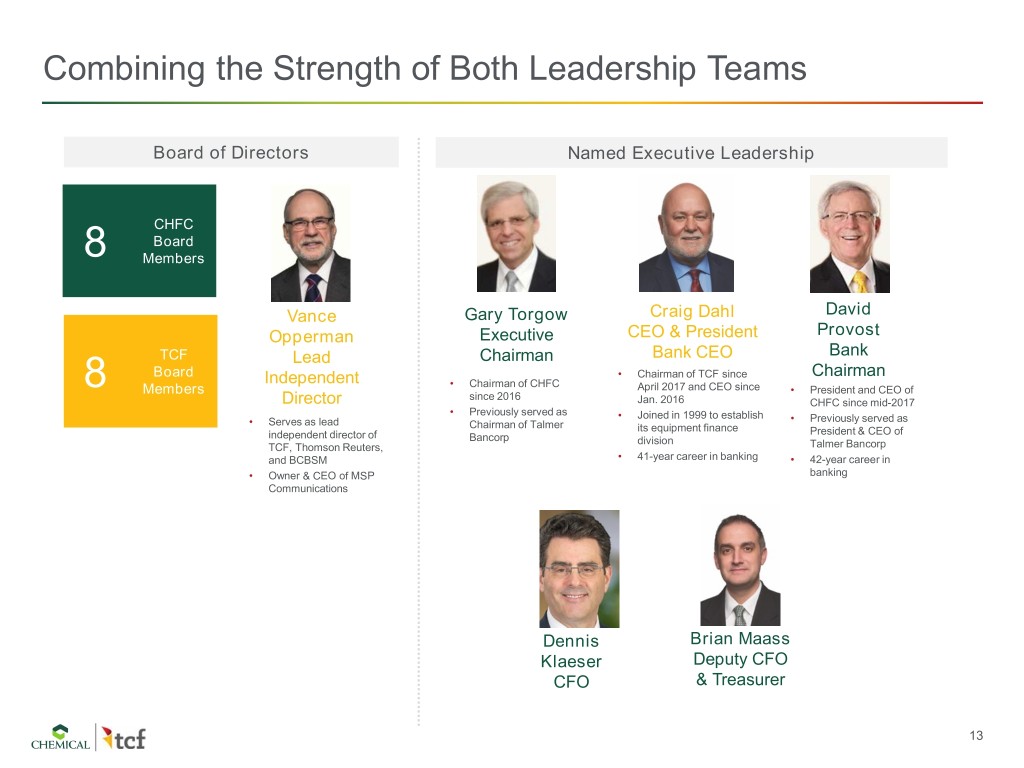

Combining the Strength of Both Leadership Teams Board of Directors Named Executive Leadership CHFC Board 8 Members Vance Gary Torgow Craig Dahl David Opperman Executive CEO & President Provost TCF Lead Chairman Bank CEO Bank Board • Chairman of TCF since Chairman Independent • Chairman of CHFC 8 Members April 2017 and CEO since • President and CEO of since 2016 Director Jan. 2016 CHFC since mid-2017 • Previously served as • Joined in 1999 to establish • Serves as lead • Previously served as Chairman of Talmer its equipment finance independent director of President & CEO of Bancorp division TCF, Thomson Reuters, Talmer Bancorp and BCBSM • 41-year career in banking • 42-year career in • Owner & CEO of MSP banking Communications Dennis Brian Maass Klaeser Deputy CFO CFO & Treasurer 13

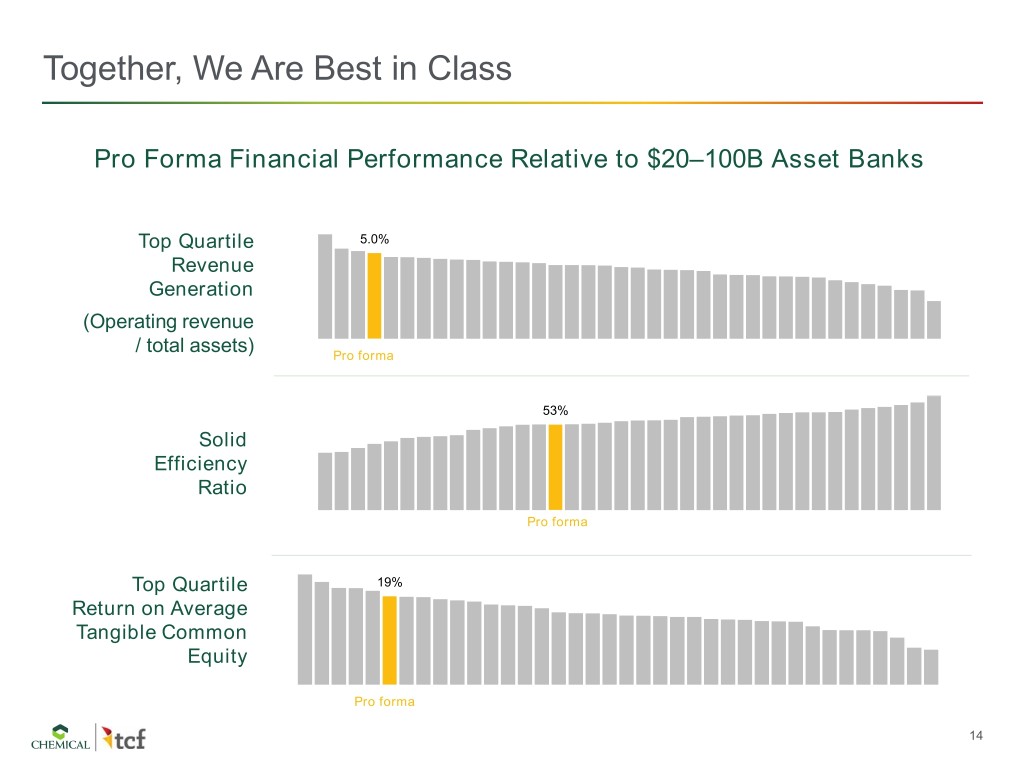

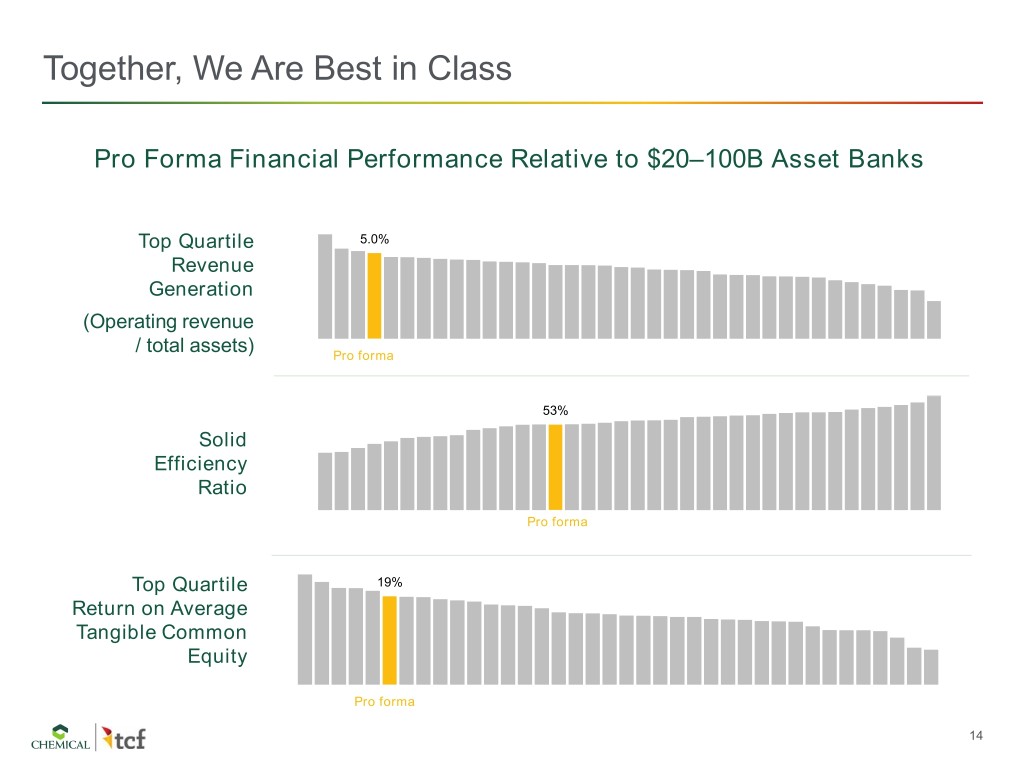

Together, We Are Best in Class Pro Forma Financial Performance Relative to $20–100B Asset Banks Top Quartile 5.0% Revenue Generation (Operating revenue / total assets) Pro forma 53% Solid Efficiency Ratio Pro forma Top Quartile 19% Return on Average Tangible Common Equity Pro forma 14

Combination Benefits Key Stakeholders Customers Communities Employees & Culture • Broader product suite • Combined company will • Shared values and have several major • Improved speed to market principles centers of influence • Lower credit - Detroit • Strong community concentrations - Twin Cities orientation • increased lending - Chicago • Highly complementary capabilities - Midland business models • Further investments in • Longstanding commitment • Strengthened ability to technology and digital to meeting needs of our recruit and retain top-tier banking communities talent • Continued focus on • Ability to invest in talent, supporting community programs and infrastructure • Strong compliance and development credit culture • Increased professional • Commitment to continue to development and career provide meaningful opportunities within larger contributions to charitable banking platform and community organizations 15

Building a Company To Win 16

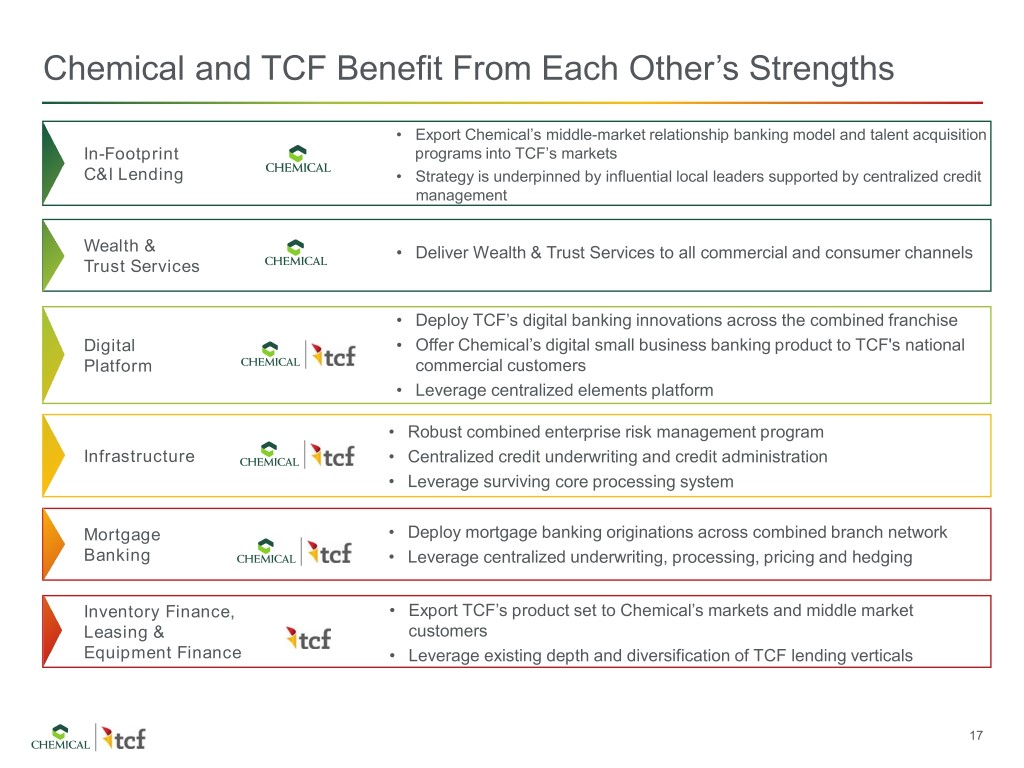

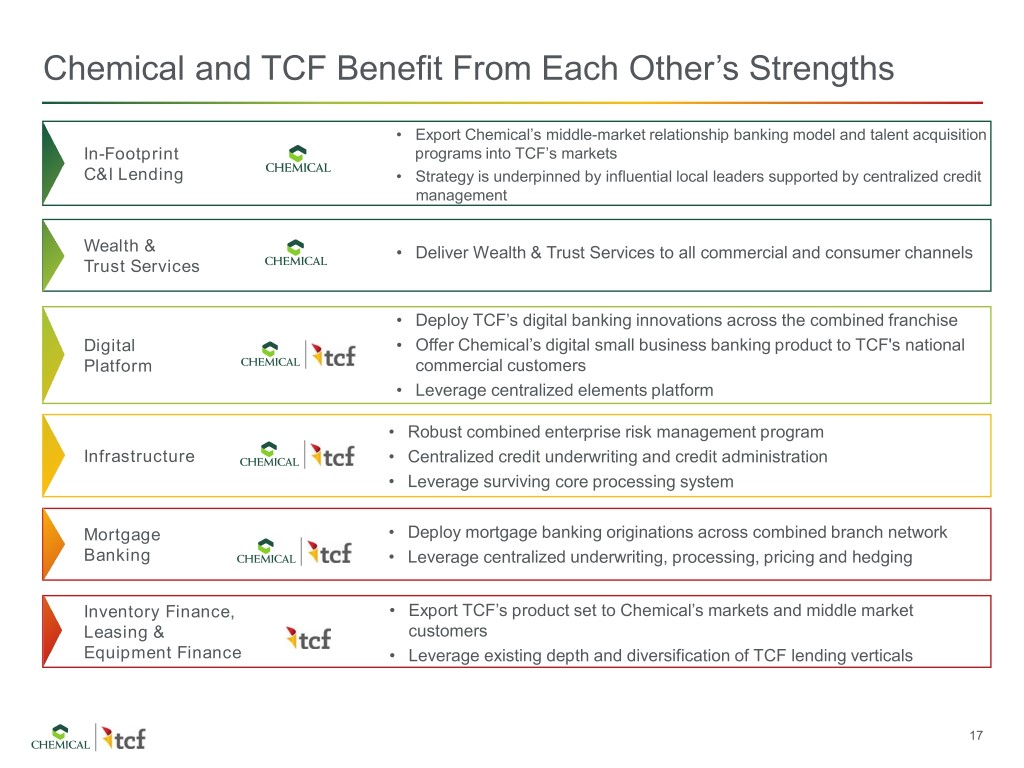

Chemical and TCF Benefit From Each Other’s Strengths • Export Chemical’s middle-market relationship banking model and talent acquisition In-Footprint programs into TCF’s markets C&I Lending • Strategy is underpinned by influential local leaders supported by centralized credit management Wealth & • Deliver Wealth & Trust Services to all commercial and consumer channels Trust Services • Deploy TCF’s digital banking innovations across the combined franchise Digital • Offer Chemical’s digital small business banking product to TCF's national Platform commercial customers • Leverage centralized elements platform • Robust combined enterprise risk management program Infrastructure • Centralized credit underwriting and credit administration • Leverage surviving core processing system Mortgage • Deploy mortgage banking originations across combined branch network Banking • Leverage centralized underwriting, processing, pricing and hedging Inventory Finance, • Export TCF’s product set to Chemical’s markets and middle market Leasing & customers Equipment Finance • Leverage existing depth and diversification of TCF lending verticals 17

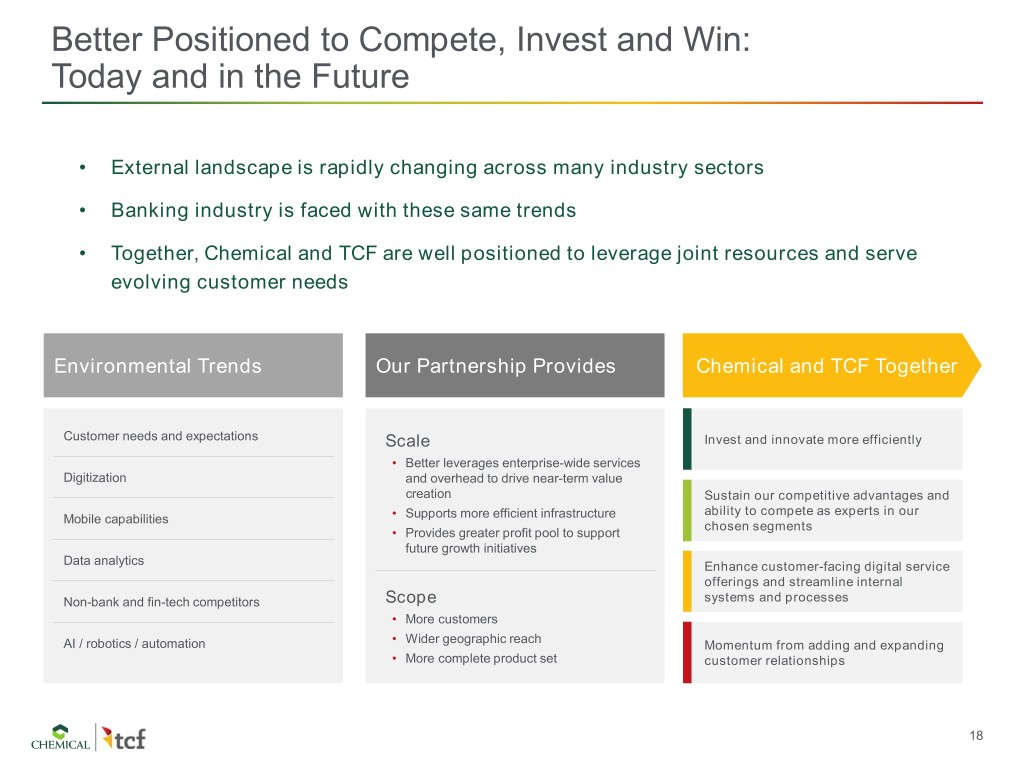

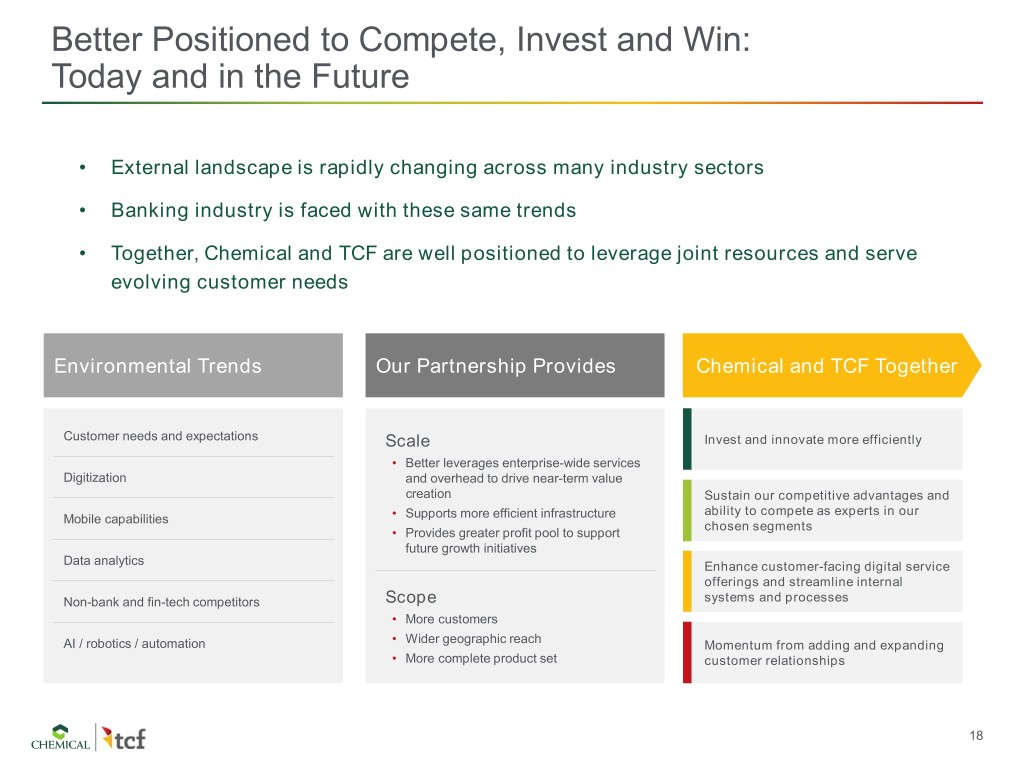

Better Positioned to Compete, Invest and Win: Today and in the Future • External landscape is rapidly changing across many industry sectors • Banking industry is faced with these same trends • Together, Chemical and TCF are well positioned to leverage joint resources and serve evolving customer needs Environmental Trends Our Partnership Provides Chemical and TCF Together Customer needs and expectations Scale Invest and innovate more efficiently • Better leverages enterprise-wide services Digitization and overhead to drive near-term value creation Sustain our competitive advantages and ability to compete as experts in our Mobile capabilities • Supports more efficient infrastructure • Provides greater profit pool to support chosen segments future growth initiatives Data analytics Enhance customer-facing digital service offerings and streamline internal Non-bank and fin-tech competitors Scope systems and processes • More customers • Wider geographic reach AI / robotics / automation Momentum from adding and expanding • More complete product set customer relationships 18

What’s Next 19

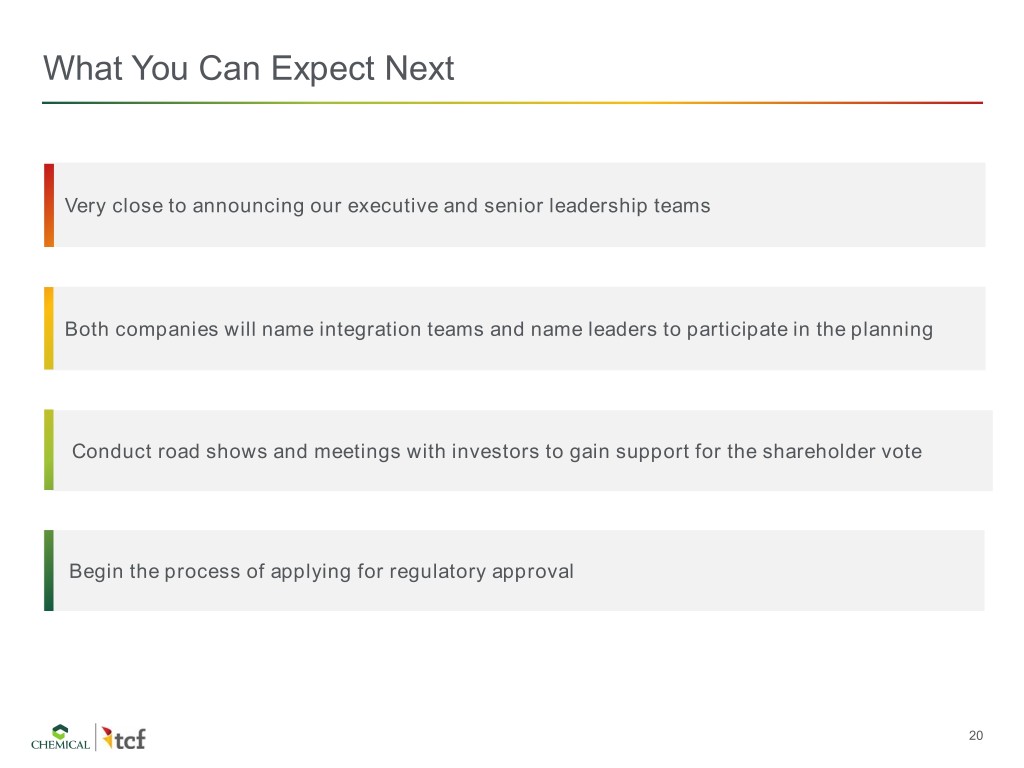

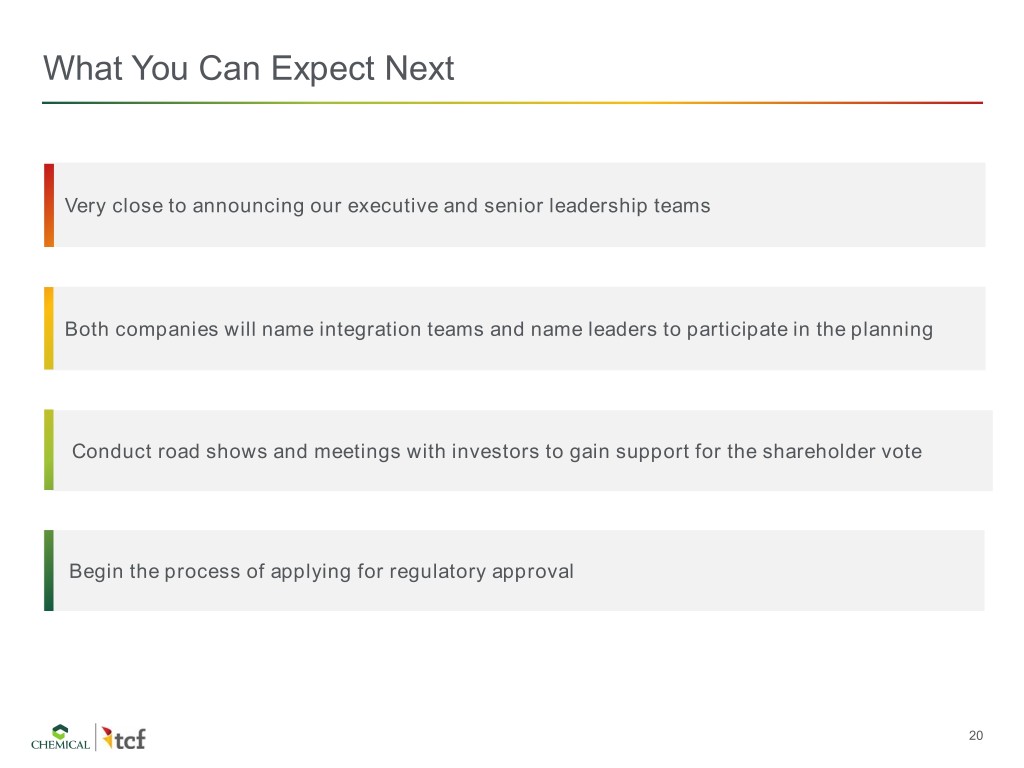

What You Can Expect Next Very close to announcing our executive and senior leadership teams Both companies will name integration teams and name leaders to participate in the planning Conduct road shows and meetings with investors to gain support for the shareholder vote Begin the process of applying for regulatory approval 20

What I Need From You The Customer . #1 priority is to continue provide outstanding First services to our customers Ask Questions & . Submit your questions to the Merger News site Provide . Provide constructive feedback on the process Feedback . Be patient – we won’t have all the answers right now Support the . Participate in integration planning if asked . Process Ensure we continue to run the business as TCF . Until the merger closes, we operate as separate companies Understand . Do not contact Chemical employees unless authorized to do so the Ground . Any customer communication must be coordinated Rules through Legal and Corporate Communications 21

Questions & Answers 22

22333 Text Your Questions • Send a text message to: 22333 • In the body of the message type: TCFJAN2019 • You will get a confirmation message that you are now part TCFJAN2019 of TCF’s All Company Q&A Session • Submit your question! • We will answer as many as we can during our Q&A!

The announcement included $180 million in cost savings. What does this mean for possible job cuts? When will we know more about the future of my job? 24

With our headquarters moving to Detroit, does this mean I will have to relocate there? How many jobs are expected to move from TCF’s current locations to Detroit? 25

Who is going to lead specific businesses and functions? When will we know details about the transition plan and leadership? 26

Closing Comments 27

This is Our Day After Tomorrow Moment Decline 28

Day After Tomorrow Thinking is Not About ”Hanging Around” Lee Schafer Leadership of both companies long ago realized how hard it is to get revenue growth in banking. What really matters now is cutting costs and becoming efficient enough to hang around as the industry consolidates. A TCF customer won’t care that it can’t match U.S. Bancorp’s technology budget. When he or she opens the TCF Bank app on a smartphone, it has to work. 29

A Winning Formula for An Outstanding Company Premier bank in the Midwest—scaled to compete and win Complementary partners together positioned for superior growth, profitability and consistency Exceptional financial benefits and value creation for all stakeholders Shared values—strong community ties, customer-centric focus and commitment to performance 30

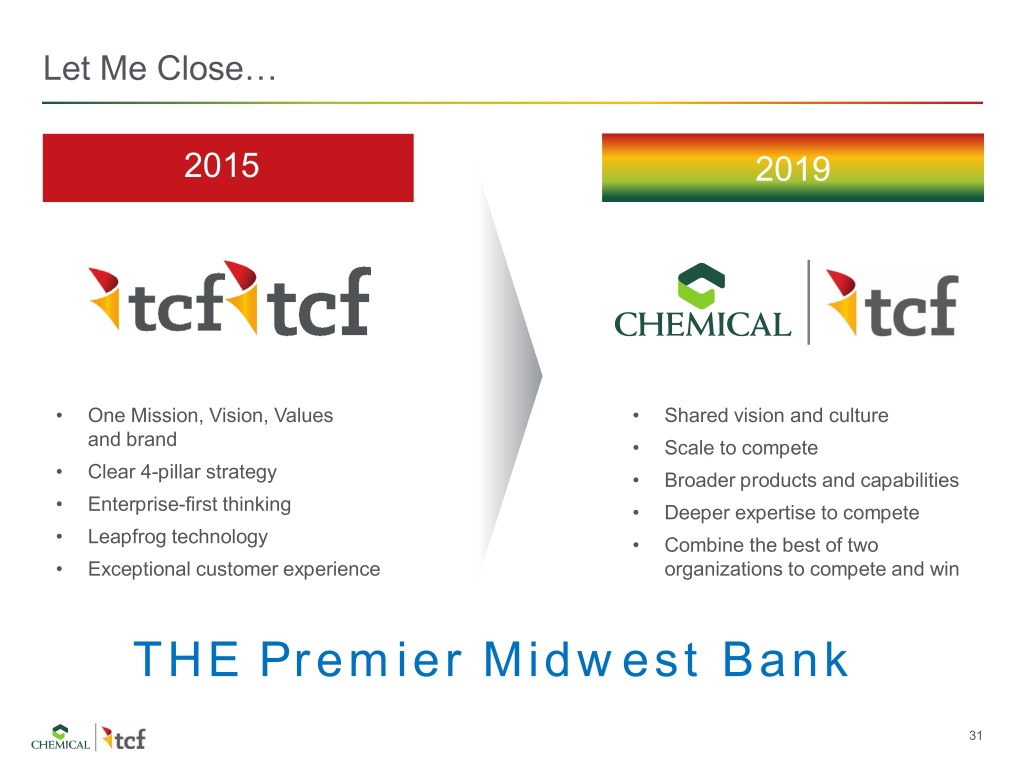

Let Me Close… 2015 2019 • One Mission, Vision, Values • Shared vision and culture and brand • Scale to compete • Clear 4-pillar strategy • Broader products and capabilities • Enterprise-first thinking • Deeper expertise to compete • Leapfrog technology • Combine the best of two • Exceptional customer experience organizations to compete and win THE Premier Midwest Bank 31

CREATING A PREMIER MIDWEST BANK Enhancing Value for Our Shareholders, Customers and Communities All-Company Meeting JANUARY 31, 2019