Exhibit 99.1

NEWS RELEASE

CONTACT: Jason Korstange

(952) 745-2755

tcfbank.com

FOR IMMEDIATE RELEASE

TCF FINANCIAL CORPORATION 200 Lake Street East, Wayzata, MN 55391-1693

TCF Reports Quarterly Net Income of $25.5 Million, or 16 Cents Per Share

FIRST QUARTER HIGHLIGHTS

- Net interest margin of 4.72 percent, up 58 basis points from the first quarter of 2012

- Pre-tax pre-provision profit of $87.7 million, up 24.3 percent from the first quarter of 2012

- Provision for credit losses of $38.4 million, down 20.9 percent from the first quarter of 2012

- Average deposits increased $1.8 billion, or 14.4 percent, from the first quarter of 2012

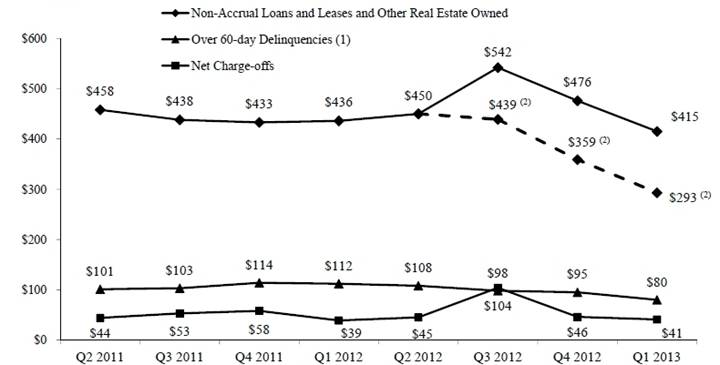

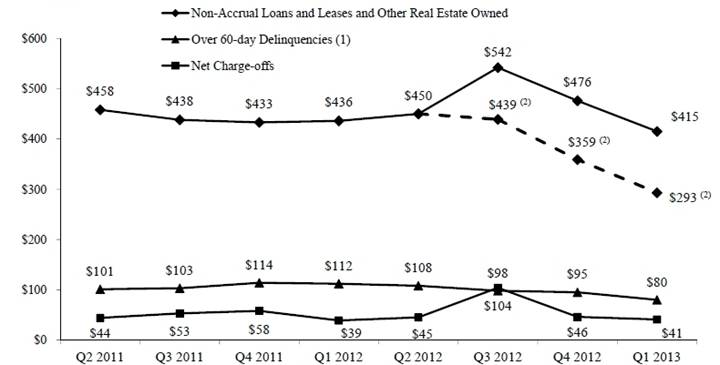

- Non-accrual loans and leases and other real estate owned decreased $61.3 million, or 12.9 percent, from the fourth quarter of 2012

- Over 60-day accruing delinquent loans decreased by $15.5 million, or 16.3 percent, from the fourth quarter of 2012

- Announced common and preferred stock dividend payments payable May 31, 2013 and June 3, 2013, respectively

Summary of Financial Results | | | | | | | | | | Table 1 |

| | | | | | | | | | | |

($ in thousands, except per-share data) | | | | | | | | Percent Change | |

| | 1Q | | 4Q | | 1Q | | 1Q13 vs | | 1Q13 vs | |

| | 2013 | | 2012 | | 2012 (3) | | 4Q12 | | 1Q12 | |

Net income (loss) | | $ | 25,450 | | $ | 23,551 | | $ | (282,894 | ) | 8.1 | % | N.M | .% |

Net interest income | | 199,091 | | 201,063 | | 180,173 | | (1.0 | ) | 10.5 | |

Pre-tax pre-provision profit(1) | | 87,742 | | 87,151 | | 70,578 | | .7 | | 24.3 | |

Diluted earnings (loss) per common share | | .16 | | .15 | | (1.78 | ) | 6.7 | | N.M | . |

| | | | | | | | | | | |

Financial Ratios(2) | | | | | | | | | | | |

Return on average assets | | .70 | % | .63 | % | (5.96 | )% | | | | |

Return on average common equity | | 6.36 | | 5.93 | | (63.38 | ) | | | | |

Net interest margin | | 4.72 | | 4.79 | | 4.14 | | | | | |

Net charge-offs as a percentage of

average loans and leases | | 1.06 | | 1.18 | | 1.06 | | | | | |

| | | | | | | | | | | |

(1) Pre-tax pre-provision profit (‘‘PTPP’’) is calculated as total revenues less non-interest expense. First quarter 2012 PTPP excludes the non-recurring net loss of $473.8 million related to the balance sheet repositioning completed in the first quarter of 2012. |

(2) Annualized. |

(3) Includes a net, after-tax charge of $295.8 million, or $1.87 per share, related to the balance sheet repositioning. |

N.M. Not meaningful. |

| | | | | | | | | | | | | | |

2

WAYZATA, MN, April 19, 2013 – TCF Financial Corporation (“TCF”) (NYSE: TCB) today reported net income for the first quarter of 2013 of $25.5 million, compared with a net loss of $282.9 million for the first quarter of 2012 (inclusive of a net after-tax charge of $295.8 million, or $1.87 per common share, related to a balance sheet repositioning involving certain investments and borrowings in that period) and net income of $23.6 million for the fourth quarter of 2012. Diluted earnings per common share was 16 cents for the first quarter of 2013, compared with a loss per common share of $1.78 for the first quarter of 2012 (earnings per common share of 8 cents before the balance sheet repositioning charge) and diluted earnings per common share of 15 cents for the fourth quarter of 2012.

Chairman’s Statement

“TCF’s first quarter results were highlighted by strong credit quality improvements as well as additional core revenue generation,” said William A. Cooper, Chairman and Chief Executive Officer. “Our encouraging credit trends, which began in late 2012 and have continued into 2013, include decreases in non-accrual loans and leases, other real estate owned and net charge-offs. Revenue increased during the quarter due to the impact of continued core auto loan sales and expanded core consumer real estate loan sales.

“TCF’s focus throughout 2013 is to generate results based on the momentum created through our building and investing strategies in 2012. We executed on this initiative in the first quarter as net interest margin remained strong and loan and lease balances continued to grow. I am encouraged by our progress so far and am confident that we are in position to drive results moving forward.”

-more-

3

Revenue

Total Revenue | | | | | | | | | | Table 2 | |

| | | | | | | | Percent Change | |

| | 1Q | | 4Q | | 1Q | | 1Q13 vs | | 1Q13 vs | |

($ in thousands) | | 2013 | | 2012 | | 2012 | | 4Q12 | | 1Q12 | |

Net interest income | | $ | 199,091 | | $ | 201,063 | | $ | 180,173 | | (1.0 | )% | 10.5 | % |

Fees and other revenue: | | | | | | | | | | | |

Fees and service charges | | 39,323 | | 44,262 | | 41,856 | | (11.2 | ) | (6.1 | ) |

Card revenue | | 12,417 | | 12,974 | | 13,207 | | (4.3 | ) | (6.0 | ) |

ATM revenue | | 5,505 | | 5,584 | | 6,199 | | (1.4 | ) | (11.2 | ) |

Total banking fees | | 57,245 | | 62,820 | | 61,262 | | (8.9 | ) | (6.6 | ) |

Leasing and equipment finance | | 16,460 | | 26,149 | | 22,867 | | (37.1 | ) | (28.0 | ) |

Gains on sales of consumer real estate loans | | 8,126 | | 854 | | - | | N.M | . | N.M | . |

Gains on sales of auto loans | | 7,146 | | 6,869 | | 2,250 | | 4.0 | | N.M | . |

Other | | 3,726 | | 3,973 | | 2,355 | | (6.2 | ) | 58.2 | |

Total fees and other revenue | | 92,703 | | 100,665 | | 88,734 | | (7.9 | ) | 4.5 | |

Subtotal | | 291,794 | | 301,728 | | 268,907 | | (3.3 | ) | 8.5 | |

(Losses) gains on securities, net | | - | | (528 | ) | 76,611 | | (100.0 | ) | (100.0 | ) |

Total revenue | | $ | 291,794 | | $ | 301,200 | | $ | 345,518 | | (3.1 | ) | (15.5 | ) |

| | | | | | | | | | | |

Net interest margin (1) | | 4.72 | % | 4.79 | % | 4.14 | % | | | | |

Fees and other revenue as

a % of total revenue | | 31.77 | | 33.42 | | 25.68 | | | | | |

| | | | | | | | | | | |

N.M. = Not meaningful. | | | | | | | | | | | |

(1) Annualized. | | | | | | | | | | | |

Net Interest Income

· Net interest income for the first quarter of 2013 increased $18.9 million, or 10.5 percent, compared with the first quarter of 2012, and decreased slightly from the fourth quarter of 2012. The increase from the first quarter of 2012 was primarily due to the balance sheet repositioning completed in that quarter, which resulted in a $28.6 million reduction to the cost of borrowings, partially offset by a $14.3 million reduction of interest income on lower levels of mortgage-backed securities for the first quarter of 2013, as well as higher average loan balances primarily from the inventory finance and auto finance portfolios. These increases were partially offset by reduced interest income due to lower average balances of consumer real estate loans as a result of loan sales in the third and fourth quarters of 2012 and first quarter of 2013, as well as lower yields as new originations in our lending businesses continued to be impacted by the low interest rate environment.

· Net interest margin in the first quarter of 2013 was 4.72 percent, compared with 4.14 percent in the first quarter of 2012 and 4.79 percent in the fourth quarter of 2012. The increase from the first quarter of

-more-

4

2012 was primarily due to a lower average cost of borrowings as a result of the balance sheet repositioning. The decrease from the fourth quarter of 2012 was primarily due to lower yields in the commercial portfolio and the Company’s increased liquidity position driven by the increased loan sale activity late in the quarter.

Non-interest Income

· Fees and service charges in the first quarter of 2013 were $39.3 million, down $2.5 million, or 6.1 percent, from the first quarter of 2012 and down $4.9 million, or 11.2 percent, from the fourth quarter of 2012. The decrease from the first quarter of 2012 was due to the elimination of the monthly maintenance fee on deposit products through the reintroduction of free checking. The decrease from the fourth quarter of 2012 was primarily due to lower transaction activity and higher average balances per customer during the first quarter of 2013, partially offset by growth in the account base for the third consecutive quarter driven by the reintroduction of free checking.

· Leasing and equipment finance revenue was $16.5 million during first quarter of 2013, down $6.4 million, or 28 percent, from the first quarter of 2012 and down $9.7 million, or 37.1 percent, from the fourth quarter of 2012. The decreases were primarily due to lower operating lease and sales-type lease revenue growth in the leasing and equipment finance portfolio as a result of customer driven events.

· In the first quarter of 2013 and the fourth quarter of 2012, respectively, TCF sold $279.2 million and $25.7 million of consumer real estate loans, recognizing gains in the same respective periods.

· TCF sold $179.8 million, $72 million and $159.6 million of auto loans during the first quarters of 2013 and 2012, and the fourth quarter of 2012, respectively, resulting in gains in the same respective periods.

-more-

5

Loans and Leases

Period-End and Average Loans and Leases | | | | | | | | | Table 3 | |

| | | | | | | | Percent Change | |

($ in thousands) | | 1Q | | 4Q | | 1Q | | 1Q13 vs | | 1Q13 vs | |

| | 2013 | | 2012 | | 2012 | | 4Q12 | | 1Q12 | |

Period-End: | | | | | | | | | | | |

Consumer real estate | | $ | 6,418,666 | | $ | 6,674,501 | | $ | 6,815,909 | | (3.8 | )% | (5.8 | )% |

Commercial | | 3,334,716 | | 3,405,235 | | 3,467,089 | | (2.1 | ) | (3.8 | ) |

Leasing and equipment finance | | 3,185,234 | | 3,198,017 | | 3,118,755 | | (.4 | ) | 2.1 | |

Inventory finance | | 1,931,363 | | 1,567,214 | | 1,637,958 | | 23.2 | | 17.9 | |

Auto finance | | 719,666 | | 552,833 | | 139,047 | | 30.2 | | N.M | . |

Other | | 23,701 | | 27,924 | | 29,178 | | (15.1 | ) | (18.8 | ) |

Total | | $ | 15,613,346 | | $ | 15,425,724 | | $ | 15,207,936 | | 1.2 | | 2.7 | |

| | | | | | | | | | | |

Average: | | | | | | | | | | | |

Consumer real estate | | $ | 6,556,426 | | $ | 6,663,660 | | $ | 6,845,063 | | (1.6 | ) | (4.2 | ) |

Commercial | | 3,345,780 | | 3,452,768 | | 3,457,720 | | (3.1 | ) | (3.2 | ) |

Leasing and equipment finance | | 3,199,499 | | 3,184,540 | | 3,128,329 | | .5 | | 2.3 | |

Inventory finance | | 1,686,364 | | 1,570,829 | | 1,145,183 | | 7.4 | | 47.3 | |

Auto finance | | 670,096 | | 504,565 | | 85,562 | | 32.8 | | N.M | . |

Other | | 13,641 | | 14,704 | | 17,582 | | (7.2 | ) | (22.4 | ) |

Total | | $ | 15,471,806 | | $ | 15,391,066 | | $ | 14,679,439 | | .5 | | 5.4 | |

| | | | | | | | | | | |

N.M. = Not meaningful. | | | | | | | | | | | |

· Loans and leases were $15.6 billion at March 31, 2013, an increase of $405.4 million, or 2.7 percent, compared with March 31, 2012 and an increase of $187.6 million, or 1.2 percent, compared with December 31, 2012. Quarterly average loans and leases were $15.5 billion for the first quarter of 2013, an increase of $792.4 million, or 5.4 percent, compared with the first quarter of 2012 and an increase of $80.7 million, or .5 percent, compared with the fourth quarter of 2012. The increases in period-end and average loans and leases from both periods were primarily due to growth in inventory finance as a result of the Bombardier Recreational Products, Inc. (“BRP”) program, as well as the continued growth of auto finance, as we continue to expand the business. These increases were partially offset by decreases in consumer real estate loans driven by sales in the third and fourth quarters of 2012 and the first quarter of 2013, as well as decreases in commercial loans due to payoffs in the low rate environment exceeding new originations.

-more-

6

Credit Quality

Credit Trends | Table 4 |

| |

(In millions) |

|

(At or for the Quarter Ended) |

|

(1) Excludes acquired portfolios and non-accrual loans and leases. (2) Excludes $122.1 million, $117.7 million and $103.2 million of non-accrual assets at March 31, 2013, December 31, 2012 and

September 30, 2012, respectively, associated with the implementation of clarifying bankruptcy-related regulatory guidance in the third

quarter of 2012.

|

· Over 60-day delinquencies improved for the fifth consecutive quarter. The over 60-day delinquency rate excluding acquired portfolios and non-accrual loans and leases at March 31, 2013 was .53 percent, down from .64 percent at December 31, 2012 and .77 percent at March 31, 2012. The decreases from both periods were primarily a result of reduced delinquencies in the consumer real estate portfolio.

· Net charge-offs decreased $4.5 million from the fourth quarter of 2012, primarily due to improved credit quality in the consumer real estate portfolio.

· Non-accrual loans and leases were $343.4 million at March 31, 2013, a decrease of $36.1 million, or 9.5 percent, from December 31, 2012 and an increase of $34.4 million, or 11.1 percent, from March 31, 2012. The decrease from December 31, 2012 was primarily due to improved credit quality in the commercial and consumer real estate portfolios resulting in fewer loans entering non-accrual status. The

-more-

7

increase from March 31, 2012 was primarily due to the implementation of clarifying bankruptcy-related regulatory guidance in the third quarter of 2012. At March 31, 2013, $122.1 million of non-accrual assets were associated with the clarifying bankruptcy-related guidance of which 84 percent were less than 60 days past due.

· Other real estate owned was $71.8 million at March 31, 2013, a decrease of $25.2 million from December 31, 2012, and a decrease of $55.5 million from March 31, 2012. The decrease in both periods was primarily due to a portfolio sale of 184 consumer properties during the first quarter of 2013, as well as a decrease in the number of consumer real estate loans transferred from non-accrual status.

· Provision for credit losses was $38.4 million, a decrease of $10.1 million from the fourth quarter of 2012 and a decrease of $10.2 million from the first quarter of 2012. The decrease from the fourth quarter of 2012 was primarily due to decreased charge-offs in the consumer real estate portfolio and lower reserve balances on the leasing and equipment finance portfolio as a result of reduced loss experience. The decrease in provision from the first quarter of 2012 was primarily due to a reduction in the reserve rate for the commercial, leasing and equipment finance and inventory finance portfolios as a result of improved credit quality.

-more-

8

Deposits

Average Deposits | | | | | | | | | | Table 5 |

| | | | | | | | Percent Change | | |

($ in thousands) | | 1Q | | 4Q | | 1Q | | 1Q13 vs | | 1Q13 vs | |

| | 2013 | | 2012 | | 2012 | | 4Q12 | | 1Q12 | |

| | | | | | | | | | | |

Checking | | $ | 4,784,945 | | $ | 4,627,627 | | $ | 4,565,065 | | 3.4 | % | 4.8 | % |

Savings | | 6,114,219 | | 6,103,302 | | 5,905,118 | | .2 | | 3.5 | |

Money market | | 815,374 | | 819,596 | | 662,493 | | (.5 | ) | 23.1 | |

Subtotal | | 11,714,538 | | 11,550,525 | | 11,132,676 | | 1.4 | | 5.2 | |

Certificates | | 2,323,267 | | 2,206,173 | | 1,135,673 | | 5.3 | | 104.6 | |

Total average deposits | | $ | 14,037,805 | | $ | 13,756,698 | | $ | 12,268,349 | | 2.0 | | 14.4 | |

| | | | | | | | | | | |

Average interest rate on deposits (1) | | .28% | | .32% | | .30% | | | | | |

| | | | | | | | | | | |

(1) Annualized. | | | | | | | | | | | |

· Total average deposits for the first quarter of 2013 increased $1.8 billion, or 14.4 percent, from the first quarter of 2012, primarily due to special programs for certificates of deposits, the assumption of $778 million of deposits from Prudential Bank & Trust, FSB in June 2012 and the reintroduction of free checking. The average interest rate on deposits in the first quarter of 2013 was .28 percent, down four basis points from the fourth quarter of 2012 and down two basis points from the first quarter of 2012.

-more-

9

Non-interest Expense

Non-interest Expense | | | | | | | | | | Table 6 |

| | | | | | | | Percent Change | |

($ in thousands) | | 1Q | | 4Q | | 1Q | | 1Q13 vs | | 1Q13 vs | |

| | 2013 | | 2012 | | 2012 | | 4Q12 | | 1Q12 | |

Compensation and

employee benefits | | $ | 104,229 | | $ | 101,678 | | $ | 95,967 | | 2.5 | % | 8.6 | % |

Occupancy and equipment | | 32,875 | | 32,809 | | 32,246 | | .2 | | 2.0 | |

FDIC insurance | | 7,710 | | 8,671 | | 6,386 | | (11.1 | ) | 20.7 | |

Advertising and marketing | | 5,732 | | 4,303 | | 2,617 | | 33.2 | | 119.0 | |

Operating lease depreciation | | 5,635 | | 5,905 | | 6,731 | | (4.6 | ) | (16.3 | ) |

Deposit account premiums | | 602 | | 523 | | 5,971 | | 15.1 | | (89.9 | ) |

Other | | 37,939 | | 53,472 | | 37,296 | | (29.0 | ) | 1.7 | |

Core operating expenses | | 194,722 | | 207,361 | | 187,214 | | (6.1 | ) | 4.0 | |

Loss on termination of debt | | - | | - | | 550,735 | | N.M. | | (100.0 | ) |

Foreclosed real estate and

repossessed assets, net | | 10,167 | | 7,582 | | 11,047 | | 34.1 | | (8.0 | ) |

Other credit costs, net | | (837 | ) | (894 | ) | (288) | | 6.4 | | (190.6 | ) |

Total non-interest expense | | $ | 204,052 | | $ | 214,049 | | $ | 748,708 | | (4.7 | ) | (72.7 | ) |

| | | | | | | | | | | |

N.M. = Not meaningful. | | | | | | | | | | | |

· Compensation and employee benefits expense for the first quarter of 2013 increased $8.3 million, or 8.6 percent, from the first quarter of 2012. The increase was primarily due to increased staff levels to support the growth of auto finance and to support the assets of the BRP program in inventory finance.

· The combined expense associated with advertising, marketing and deposit account premiums decreased $2.3 million from the first quarter of 2012. The decrease from the first quarter of 2012 is attributable to TCF’s change in strategy for acquiring high quality accounts through the reintroduction of free checking, versus the utilization of high dollar deposit account premiums.

· The increase in foreclosed real estate and repossessed assets expense from the fourth quarter of 2012 is driven by the acceleration of expenses related to a portfolio sale of consumer properties during the first quarter of 2013.

-more-

10

Capital

Capital Information | | | | | Table 7 | |

At period end | | | | | | |

($ in thousands, except per-share data) | | 1Q | | | 4Q | |

| | 2013 | | | 2012 | |

Total equity | | $ | 1,900,159 | | | | | $ | 1,876,643 | | | |

Book value per common share | | $ | 9.86 | | | | | $ | 9.79 | | | |

Tangible realized common equity to tangible assets (1) | | 7.55 | % | | | | 7.52 | % | | |

| | | | | | | | | | |

Risk-based capital (2) | | | | | | | | | | |

Tier 1 | | $ | 1,666,630 | | 11.14 | % | | $ | 1,633,336 | | 11.09 | % |

Total | | 2,019,082 | | 13.49 | | | 2,007,835 | | 13.63 | |

| | | | | | | | | | |

Tier 1 leverage capital | | $ | 1,666,630 | | 9.23 | % | | $ | 1,633,336 | | 9.21 | % |

| | | | | | | | | | |

Tier 1 common capital (3) | | $ | 1,382,457 | | 9.24 | % | | $ | 1,356,826 | | 9.21 | % |

| | | | | | | | | | |

(1) Excludes the impact of goodwill, other intangibles and accumulated other comprehensive income (loss) (see “Reconciliation of

GAAP to Non-GAAP Financial Measures” table). |

(2) The Company’s capital ratios continue to be in excess of “well-capitalized” regulatory benchmarks. |

(3) Excludes the effect of preferred shares, qualifying trust preferred securities and qualifying non-controlling interest in subsidiaries

(see “Reconciliation of GAAP to Non-GAAP Financial Measures” table). |

|

· On April 17, 2013, the Board of Directors of TCF declared a regular quarterly cash dividend of 5 cents per common share payable on May 31, 2013, to stockholders of record at the close of business on May 15, 2013. TCF also declared a dividend on the 7.50% Series A and 6.45% Series B Non-Cumulative Perpetual Preferred Stock, both payable on June 3, 2013, to stockholders of record at the close of business on May 15, 2013.

-more-

11

Webcast Information

A live webcast of TCF’s conference call to discuss the first quarter earnings will be hosted at TCF’s website, http://ir.tcfbank.com, on April 19, 2013 at 8:00 a.m. CT. A slide presentation for the call will be available on the website prior to the call. Additionally, the webcast will be available for replay at TCF’s website after the conference call. The website also includes free access to company news releases, TCF’s annual report, investor presentations and SEC filings.

TCF is a Wayzata, Minnesota-based national bank holding company with $18.5 billion in total assets at March 31, 2013. TCF has nearly 430 branches in Minnesota, Illinois, Michigan, Colorado, Wisconsin, Indiana, Arizona and South Dakota, providing retail and commercial banking services. TCF, through its subsidiaries, also conducts commercial leasing and equipment finance business in all 50 states, commercial inventory finance business in the U.S. and Canada, and indirect auto finance business in over 40 states. For more information about TCF, please visit http://ir.tcfbank.com.

-more-

12

Cautionary Statements for Purposes of the Safe Harbor Provisions of the Securities Litigation Reform Act

Any statements contained in this earnings release regarding the outlook for the Company’s businesses and their respective markets, such as projections of future performance, guidance, statements of the Company’s plans and objectives, forecasts of market trends and other matters, are forward-looking statements based on the Company’s assumptions and beliefs. Such statements may be identified by such words or phrases as “will likely result,” “are expected to,” “will continue,” “outlook,” “will benefit,” “is anticipated,” “estimate,” “project,” “management believes” or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those discussed in such statements and no assurance can be given that the results in any forward-looking statement will be achieved. For these statements, TCF claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Any forward-looking statement speaks only as of the date on which it is made, and we disclaim any obligation to subsequently revise any forward-looking statement to reflect events or circumstances after such date or to reflect the occurrence of anticipated or unanticipated events.

Certain factors could cause the Company’s future results to differ materially from those expressed or implied in any forward-looking statements contained in this earnings release. These factors include the factors discussed in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2012 under the heading “Risk Factors,” the factors discussed below and any other cautionary statements, written or oral, which may be made or referred to in connection with any such forward-looking statements. Since it is not possible to foresee all such factors, these factors should not be considered as complete or exhaustive.

Adverse Economic or Business Conditions; Competitive Conditions; Credit and Other Risks. Deterioration in general economic and banking industry conditions, including defaults, anticipated defaults or rating agency downgrades of sovereign debt (including debt of the U.S.), or continued high rates of or increases in unemployment in TCF’s primary banking markets; adverse economic, business and competitive developments such as shrinking interest margins, reduced demand for financial services and loan and lease products, deposit outflows, deposit account attrition or an inability to increase the number of deposit accounts; customers completing financial transactions without using a bank; adverse changes in credit quality and other risks posed by TCF’s loan, lease, investment and securities available for sale portfolios, including declines in commercial or residential real estate values or changes in the allowance for loan and lease losses dictated by new market conditions or regulatory requirements; interest rate risks resulting from fluctuations in prevailing interest rates or other factors that result in a mismatch between yields earned on TCF’s interest-earning assets and the rates paid on its deposits and borrowings; foreign currency exchange risks; counterparty risk, including the risk of defaults by our counterparties or diminished availability of counterparties who satisfy our credit quality requirements; decreases in demand for the types of equipment that TCF leases or finances; the effect of any negative publicity.

Legislative and Regulatory Requirements. New consumer protection and supervisory requirements and regulations, including those resulting from action by the Consumer Financial Protection Bureau and changes in the scope of Federal preemption of state laws that could be applied to national banks; the imposition of requirements with an adverse impact relating to TCF’s lending, loan collection and other business activities as a result of the Dodd-Frank Act, or other legislative or regulatory developments such as mortgage foreclosure moratorium laws or imposition of underwriting or other limitations that impact the ability to use certain variable-rate products; impact of legislative, regulatory or other changes affecting customer account charges and fee income; changes to bankruptcy laws which would result in the loss of all or part of TCF’s security interest due to collateral value declines; deficiencies in TCF’s compliance under the Bank Secrecy Act in past or future periods, which may result in regulatory enforcement action including monetary penalties; increased health care costs resulting from Federal health care reform legislation; adverse regulatory examinations and resulting enforcement actions or other adverse consequences such as increased capital requirements or higher deposit insurance assessments; heightened regulatory practices, requirements or expectations, including, but not limited to, requirements related to the Bank Secrecy Act and anti-money laundering compliance activity.

Earnings/Capital Risks and Constraints, Liquidity Risks. Limitations on TCF’s ability to pay dividends or to increase dividends because of financial performance deterioration, regulatory restrictions or limitations; increased deposit insurance premiums, special assessments or other costs related to adverse conditions in the banking industry, the economic impact on banks of the Dodd-Frank Act and other regulatory reform legislation; the impact of financial regulatory reform, including additional capital, leverage, liquidity and risk management requirements or changes in the composition of qualifying regulatory capital (including those resulting from U.S. implementation of Basel III

-more-

13

requirements); adverse changes in securities markets directly or indirectly affecting TCF’s ability to sell assets or to fund its operations; diminished unsecured borrowing capacity resulting from TCF credit rating downgrades and unfavorable conditions in the credit markets that restrict or limit various funding sources; costs associated with new regulatory requirements or interpretive guidance relating to liquidity; uncertainties relating to customer opt-in preferences with respect to overdraft fees on point of sale and ATM transactions or the success of TCF’s reintroduction of free checking, which may have an adverse impact on TCF’s fee revenue; uncertainties relating to future retail deposit account changes, including limitations on TCF’s ability to predict customer behavior and the impact on TCF’s fee revenues.

Supermarket Branching Risk; Growth Risks. Adverse developments affecting TCF’s supermarket banking relationships or any of the supermarket chains in which TCF maintains supermarket branches, including SUPERVALU’s sale of several of its supermarket chains, including Jewel-Osco®, in which TCF has 156 branches; slower than anticipated growth in existing or acquired businesses; inability to successfully execute on TCF’s growth strategy through acquisitions or cross-selling opportunities; failure to expand or diversify TCF’s balance sheet through programs or new opportunities; failure to successfully attract and retain new customers, including the failure to attract and retain manufacturers and dealers to expand the inventory finance business; risks related to new product additions and addition of distribution channels (or entry into new markets) for existing products.

Technological and Operational Matters. Technological or operational difficulties, loss or theft of information, cyber-attacks and other security breaches, counterparty failures and the possibility that deposit account losses (fraudulent checks, etc.) may increase; failure to keep pace with technological change.

Litigation Risks. Results of litigation, including class action litigation concerning TCF’s lending or deposit activities including account servicing processes or fees or charges, or employment practices, and possible increases in indemnification obligations for certain litigation against Visa U.S.A. and potential reductions in card revenues resulting from such litigation or other litigation against Visa.

Accounting, Audit, Tax and Insurance Matters. Changes in accounting standards or interpretations of existing standards; federal or state monetary, fiscal or tax policies, including adoption of state legislation that would increase state taxes; ineffective internal controls; adverse state or Federal tax assessments or findings in tax audits; lack of or inadequate insurance coverage for claims against TCF; potential for claims and legal action related to TCF’s fiduciary responsibilities.

-more-

14

TCF FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(Dollars in thousands, except per-share data)

(Unaudited)

| | Three Months Ended March 31, | | Change | |

| | 2013 | | 2012 | | $ | | % | |

Interest income: | | | | | | | | | |

Loans and leases | | $ | 204,905 | | $ | 205,984 | | $ | (1,079) | | (.5) | % |

Securities available for sale | | 4,795 | | 19,112 | | (14,317) | | (74.9) | |

Investments and other | | 5,850 | | 2,433 | | 3,417 | | 140.4 | |

Total interest income | | 215,550 | | 227,529 | | (11,979) | | (5.3) | |

Interest expense: | | | | | | | | | |

Deposits | | 9,681 | | 9,061 | | 620 | | 6.8 | |

Borrowings | | 6,778 | | 38,295 | | (31,517) | | (82.3) | |

Total interest expense | | 16,459 | | 47,356 | | (30,897) | | (65.2) | |

Net interest income | | 199,091 | | 180,173 | | 18,918 | | 10.5 | |

Provision for credit losses | | 38,383 | | 48,542 | | (10,159) | | (20.9) | |

Net interest income after provision for

credit losses | | 160,708 | | 131,631 | | 29,077 | | 22.1 | |

Non-interest income: | | | | | | | | | |

Fees and service charges | | 39,323 | | 41,856 | | (2,533) | | (6.1) | |

Card revenue | | 12,417 | | 13,207 | | (790) | | (6.0) | |

ATM revenue | | 5,505 | | 6,199 | | (694) | | (11.2) | |

Subtotal | | 57,245 | | 61,262 | | (4,017) | | (6.6) | |

Leasing and equipment finance | | 16,460 | | 22,867 | | (6,407) | | (28.0) | |

Gain on sale of consumer real estate loans | | 8,126 | | - | | 8,126 | | N.M. | |

Gain on sales of auto loans | | 7,146 | | 2,250 | | 4,896 | | N.M. | |

Other | | 3,726 | | 2,355 | | 1,371 | | 58.2 | |

Fees and other revenue | | 92,703 | | 88,734 | | 3,969 | | 4.5 | |

Gains on securities, net | | - | | 76,611 | | (76,611) | | (100.0) | |

Total non-interest income | | 92,703 | | 165,345 | | (72,642) | | (43.9) | |

Non-interest expense: | | | | | | | | | |

Compensation and employee benefits | | 104,229 | | 95,967 | | 8,262 | | 8.6 | |

Occupancy and equipment | | 32,875 | | 32,246 | | 629 | | 2.0 | |

FDIC insurance | | 7,710 | | 6,386 | | 1,324 | | 20.7 | |

Advertising and marketing | | 5,732 | | 2,617 | | 3,115 | | 119.0 | |

Operating lease depreciation | | 5,635 | | 6,731 | | (1,096) | | (16.3) | |

Deposit account premiums | | 602 | | 5,971 | | (5,369) | | (89.9) | |

Other | | 37,939 | | 37,296 | | 643 | | 1.7 | |

Subtotal | | 194,722 | | 187,214 | | 7,508 | | 4.0 | |

Loss on termination of debt | | - | | 550,735 | | (550,735) | | (100.0) | |

Foreclosed real estate and repossessed assets, net | | 10,167 | | 11,047 | | (880) | | (8.0) | |

Other credit costs, net | | (837) | | (288) | | (549) | | (190.6) | |

Total non-interest expense | | 204,052 | | 748,708 | | (544,656) | | (72.7) | |

Income (loss) before income tax expense (benefit) | | 49,359 | | (451,732) | | 501,091 | | N.M. | |

Income tax expense (benefit) | | 17,559 | | (170,244) | | 187,803 | | N.M. | |

Income (loss) after income tax expense (benefit) | | 31,800 | | (281,488) | | 313,288 | | N.M. | |

Income attributable to non-controlling interest | | 1,826 | | 1,406 | | 420 | | 29.9 | |

Net income (loss) attributable to TCF Financial Corporation | | 29,974 | | (282,894) | | 312,868 | | N.M. | |

Preferred stock dividends | | 4,524 | | - | | 4,524 | | N.M. | |

Net income (loss) available to common stockholders | | $ | 25,450 | | $ | (282,894) | | $ | 308,344 | | N.M. | |

Net income (loss) per common share: | | | | | | | | | |

Basic | | $ | .16 | | $ | (1.78) | | $ | 1.94 | | N.M. | |

Diluted | | .16 | | (1.78) | | 1.94 | | N.M. | |

| | | | | | | | | |

Dividends declared per common share | | $ | .05 | | $ | .05 | | $ | - | | - | |

| | | | | | | | | |

Average common and common equivalent

shares outstanding (in thousands): | | | | | | | | | |

Basic | | 160,390 | | 158,506 | | 1,884 | | 1.2 | |

Diluted | | 161,140 | | 158,506 | | 2,634 | | 1.7 | |

N.M. Not meaningful. | | | | | | | | | |

-more-

15

TCF FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Dollars in thousands, except per-share data)

(Unaudited)

| | Three Months Ended March 31, | | Change | |

| | 2013 | | 2012 | | $ | | % | |

Net income (loss) attributable to TCF Financial Corporation | | $ | 29,974 | | $ | (282,894) | | $ | 312,868 | | N.M. | % |

Other comprehensive income (loss): | | | | | | | | | |

Reclassification adjustment for securities gains

included in net income | | - | | (76,967) | | 76,967 | | (100.0) | |

Unrealized holding losses arising during the

period on securities available for sale | | (13,829) | | (7,768) | | (6,061) | | (78.0) | |

Foreign currency hedge | | 537 | | (404) | | 941 | | N.M. | |

Foreign currency translation adjustment | | (622) | | 385 | | (1,007) | | N.M. | |

Recognized postretirement prior service cost

and transition obligation | | (12) | | (7) | | (5) | | (71.4) | |

Income tax benefit | | 5,019 | | 31,208 | | (26,189) | | (83.9) | |

Total other comprehensive loss | | (8,907) | | (53,553) | | 44,646 | | 83.4 | |

Comprehensive income (loss) | | $ | 21,067 | | $ | (336,447) | | $ | 357,514 | | N.M. | |

| | | | | | | | | |

N.M. Not meaningful. | | | | | | | | | |

-more-

16

TCF FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(Dollars in thousands, except per-share data)

(Unaudited)

| | At Mar. 31 | | At Dec. 31 | | Change | |

| | 2013 | | 2012 | | $ | | % | |

ASSETS | | | | | | | | | |

| | | | | | | | | |

Cash and due from banks | | $ | 1,213,747 | | $ | 1,100,347 | | $ | 113,400 | | 10.3 | % |

Investments | | 122,070 | | 120,867 | | 1,203 | | 1.0 | |

Securities available for sale | | 677,088 | | 712,091 | | (35,003) | | (4.9) | |

Loans and leases held for sale | | 20,217 | | 10,289 | | 9,928 | | 96.5 | |

Loans and leases: | | | | | | | | | |

Consumer real estate | | 6,418,666 | | 6,674,501 | | (255,835) | | (3.8) | |

Commercial | | 3,334,716 | | 3,405,235 | | (70,519) | | (2.1) | |

Leasing and equipment finance | | 3,185,234 | | 3,198,017 | | (12,783) | | (.4) | |

Inventory finance | | 1,931,363 | | 1,567,214 | | 364,149 | | 23.2 | |

Auto finance | | 719,666 | | 552,833 | | 166,833 | | 30.2 | |

Other loans and leases | | 23,701 | | 27,924 | | (4,223) | | (15.1) | |

Total loans and leases | | 15,613,346 | | 15,425,724 | | 187,622 | | 1.2 | |

Allowance for loan and lease losses | | (263,596) | | (267,128) | | 3,532 | | 1.3 | |

Net loans and leases | | 15,349,750 | | 15,158,596 | | 191,154 | | 1.3 | |

Premises and equipment, net | | 438,616 | | 440,466 | | (1,850) | | (.4) | |

Goodwill | | 225,640 | | 225,640 | | - | | - | |

Other assets | | 456,898 | | 457,621 | | (723) | | (.2) | |

Total assets | | $ | 18,504,026 | | $ | 18,225,917 | | $ | 278,109 | | 1.5 | |

| | | | | | | | | |

LIABILITIES AND EQUITY | | | | | | | | | |

| | | | | | | | | |

Deposits: | | | | | | | | | |

Checking | | $ | 5,051,730 | | $ | 4,834,632 | | $ | 217,098 | | 4.5 | |

Savings | | 6,151,147 | | 6,104,104 | | 47,043 | | .8 | |

Money market | | 801,443 | | 820,553 | | (19,110) | | (2.3) | |

Subtotal | | 12,004,320 | | 11,759,289 | | 245,031 | | 2.1 | |

Certificates of deposit | | 2,295,784 | | 2,291,497 | | 4,287 | | .2 | |

Total deposits | | 14,300,104 | | 14,050,786 | | 249,318 | | 1.8 | |

Short-term borrowings | | 3,717 | | 2,619 | | 1,098 | | 41.9 | |

Long-term borrowings | | 1,926,794 | | 1,931,196 | | (4,402) | | (.2) | |

Total borrowings | | 1,930,511 | | 1,933,815 | | (3,304) | | (.2) | |

Accrued expenses and other liabilities | | 373,252 | | 364,673 | | 8,579 | | 2.4 | |

Total liabilities | | 16,603,867 | | 16,349,274 | | 254,593 | | 1.6 | |

Equity: | | | | | | | | | |

Preferred stock, par value $.01 per share, | | | | | | | | | |

30,000,000 authorized; and 4,006,900 shares issued | | 263,240 | | 263,240 | | - | | - | |

Common stock, par value $.01 per share, | | | | | | | | | |

280,000,000 shares authorized; 163,910,124 | | | | | | | | | |

and 163,428,763 shares issued | | 1,639 | | 1,634 | | 5 | | .3 | |

Additional paid-in capital | | 757,346 | | 750,040 | | 7,306 | | 1.0 | |

Retained earnings, subject to certain restrictions | | 894,861 | | 877,445 | | 17,416 | | 2.0 | |

Accumulated other comprehensive income | | 3,536 | | 12,443 | | (8,907) | | (71.6) | |

Treasury stock at cost, 42,566 shares, and other | | (41,396) | | (41,429) | | 33 | | .1 | |

Total TCF Financial Corporation stockholders’ equity | | 1,879,226 | | 1,863,373 | | 15,853 | | .9 | |

Non-controlling interest in subsidiaries | | 20,933 | | 13,270 | | 7,663 | | 57.7 | |

Total equity | | 1,900,159 | | 1,876,643 | | 23,516 | | 1.3 | |

Total liabilities and equity | | $ | 18,504,026 | | $ | 18,225,917 | | $ | 278,109 | | 1.5 | |

-more-

17

TCF FINANCIAL CORPORATION AND SUBSIDIARIES

SUMMARY OF CREDIT QUALITY DATA

(Dollars in thousands)

(Unaudited)

| | At | | At | | At | | At | | At | | Change from | |

| | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, | | Mar. 31, | | Dec. 31, | | Mar. 31, | |

| | 2013 | | 2012 | | 2012 | | 2012 | | 2012 | | 2012 | | 2012 | |

Delinquency Data - Principal Balances (1) | | | | | | | | | | | | | | | |

60 days or more: | | | | | | | | | | | | | | | |

Consumer real estate | | | | | | | | | | | | | | | |

First mortgage lien | | $ | 66,164 | | $ | 76,020 | | $ | 80,153 | | $ | 86,714 | | $ | 88,092 | | $ | (9,856) | | $ | (21,928) | |

Junior lien | | 9,674 | | 13,141 | | 13,388 | | 13,967 | | 15,563 | | (3,467) | | (5,889) | |

Total consumer real estate | | 75,838 | | 89,161 | | 93,541 | | 100,681 | | 103,655 | | (13,323) | | (27,817) | |

Commercial | | 906 | | 2,630 | | 2,652 | | 5,616 | | 3,425 | | (1,724) | | (2,519) | |

Leasing and equipment finance | | 2,067 | | 2,568 | | 1,554 | | 1,492 | | 4,919 | | (501) | | (2,852) | |

Inventory finance | | 156 | | 119 | | 80 | | 206 | | 185 | | 37 | | (29) | |

Auto finance | | 563 | | 532 | | 305 | | 62 | | 2 | | 31 | | 561 | |

Other | | - | | 31 | | 22 | | 34 | | 52 | | (31) | | (52) | |

Subtotal | | 79,530 | | 95,041 | | 98,154 | | 108,091 | | 112,238 | | (15,511) | | (32,708) | |

Acquired portfolios | | 578 | | 982 | | 1,069 | | 1,483 | | 2,198 | | (404) | | (1,620) | |

Total delinquencies | | $ | 80,108 | | $ | 96,023 | | $ | 99,223 | | $ | 109,574 | | $ | 114,436 | | $ | (15,915) | | $ | (34,328) | |

| | | | | | | | | | | | | | | |

Delinquency Data - % of Portfolio (1) | | | | | | | | | | | | | | | |

60 days or more: | | | | | | | | | | | | | | | |

Consumer real estate | | | | | | | | | | | | | | | |

First mortgage lien | | 1.67 | % | 1.88 | % | 1.93 | % | 1.93 | % | 1.93 | % | (21) | bps | (26) | bps |

Junior lien | | .43 | | .55 | | .59 | | .64 | | .74 | | (12) | | (31) | |

Total consumer real estate | | 1.22 | | 1.38 | | 1.46 | | 1.51 | | 1.55 | | (16) | | (33) | |

Commercial | | .03 | | .08 | | .08 | | .17 | | .10 | | (5) | | (7) | |

Leasing and equipment finance | | .07 | | .08 | | .05 | | .05 | | .17 | | (1) | | (10) | |

Inventory finance | | .01 | | .01 | | .01 | | .01 | | .01 | | - | | - | |

Auto finance | | .08 | | .10 | | .08 | | .02 | | - | | (2) | | 8 | |

Other | | - | | .12 | | .09 | | .13 | | .20 | | (12) | | (20) | |

Subtotal | | .53 | | .64 | | .67 | | .74 | | .77 | | (11) | | (24) | |

Acquired portfolios | | .37 | | .58 | | .50 | | .58 | | .66 | | (21) | | (29) | |

Total delinquencies | | .52 | | .64 | | .67 | | .73 | | .77 | | (12) | | (25) | |

| | | | | | | | | | | | | | | |

(1) Excludes non-accrual loans and leases. | | | | | | | | | | | | | | | |

| | At | | At | | At | | At | | At | | Change from | |

| | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, | | Mar. 31, | | Dec. 31, | | Mar. 31, | |

| | 2013 | | 2012 | | 2012 | | 2012 | | 2012 | | 2012 | | 2012 | |

Non-Accrual Loans and Leases | | | | | | | | | | | | | | | |

Non-accrual loans and leases: | | | | | | | | | | | | | | | |

Consumer real estate | | | | | | | | | | | | | | | |

First mortgage lien | | $ | 186,218 | | $ | 199,631 | | $ | 197,649 | | $ | 122,406 | | $ | 125,895 | | $ | (13,413) | | $ | 60,323 | |

Junior lien | | 33,907 | | 35,269 | | 35,936 | | 18,272 | | 23,409 | | (1,362) | | 10,498 | |

Total consumer real estate | | 220,125 | | 234,900 | | 233,585 | | 140,678 | | 149,304 | | (14,775) | | 70,821 | |

Commercial | | 108,505 | | 127,746 | | 169,339 | | 150,215 | | 135,677 | | (19,241) | | (27,172) | |

Leasing and equipment finance | | 11,695 | | 13,652 | | 15,812 | | 29,429 | | 20,015 | | (1,957) | | (8,320) | |

Inventory finance | | 1,480 | | 1,487 | | 1,120 | | 1,900 | | 1,109 | | (7) | | 371 | |

Auto finance | | 106 | | 101 | | - | | - | | - | | 5 | | 106 | |

Other | | 1,477 | | 1,571 | | 1,957 | | 2,204 | | 2,838 | | (94) | | (1,361) | |

Total non-accrual loans and leases | | $ | 343,388 | | $ | 379,457 | | $ | 421,813 | | $ | 324,426 | | $ | 308,943 | | $ | (36,069) | | $ | 34,445 | |

| | | | | | | | | | | | | | | |

Non-accrual loans and leases - rollforward | | | | | | | | | | | | | | | |

Balance, beginning of period | | $ | 379,457 | | $ | 421,813 | | $ | 324,426 | | $ | 308,943 | | $ | 298,311 | | $ | (42,356) | | $ | 81,146 | |

Additions | | 56,712 | | 88,235 | | 210,916 | | 111,739 | | 85,670 | | (31,523) | | (28,958) | |

Charge-offs | | (24,968) | | (27,657) | | (49,116) | | (28,228) | | (19,683) | | 2,689 | | (5,285) | |

Transfers to other assets | | (18,892) | | (17,305) | | (24,632) | | (34,473) | | (25,603) | | (1,587) | | 6,711 | |

Return to accrual status | | (34,692) | | (55,261) | | (30,300) | | (22,200) | | (21,243) | | 20,569 | | (13,449) | |

Payments received | | (15,399) | | (30,832) | | (9,652) | | (12,261) | | (9,202) | | 15,433 | | (6,197) | |

Other, net | | 1,170 | | 464 | | 171 | | 906 | | 693 | | 706 | | 477 | |

Balance, end of period | | $ | 343,388 | | $ | 379,457 | | $ | 421,813 | | $ | 324,426 | | $ | 308,943 | | $ | (36,069) | | $ | 34,445 | |

-more-

18

TCF FINANCIAL CORPORATION AND SUBSIDIARIES

SUMMARY OF CREDIT QUALITY DATA, CONTINUED

(Dollars in thousands)

(Unaudited)

| | | | | | | | | | | | Change from | |

| | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, | | Mar 31, | | Dec 31, | | Mar 31, | |

| | 2013 | | 2012 | | 2012 | | 2012 | | 2012 | | 2012 | | 2012 | |

Other Real Estate Owned | | | | | | | | | | | | | | | |

Other real estate owned (1) | | | | | | | | | | | | | | | |

Consumer real estate | | $ | 46,404 | | $ | 69,599 | | $ | 85,764 | | $ | 83,176 | | $ | 84,996 | | $ | (23,195) | | $ | (38,592) | |

Commercial real estate | | 25,359 | | 27,379 | | 34,662 | | 42,700 | | 42,232 | | (2,020) | | (16,873) | |

Total other real estate owned | | $ | 71,763 | | $ | 96,978 | | $ | 120,426 | | $ | 125,876 | | $ | 127,228 | | $ | (25,215) | | $ | (55,465) | |

| | | | | | | | | | | | | | | |

Other real estate owned - rollforward | | | | | | | | | | | | | | | |

Balance, beginning of period | | $ | 96,978 | | $ | 120,426 | | $ | 125,876 | | $ | 127,228 | | $ | 134,898 | | $ | (23,448) | | $ | (37,920) | |

Transferred in | | 20,855 | | 18,444 | | 26,097 | | 33,739 | | 25,624 | | 2,411 | | (4,769) | |

Sales | | (40,456) | | (39,528) | | (28,479) | | (29,448) | | (28,601) | | (928) | | (11,855) | |

Writedowns | | (5,294) | | (4,614) | | (3,493) | | (6,237) | | (5,267) | | (680) | | (27) | |

Other, net | | (320) | | 2,250 | | 425 | | 594 | | 574 | | (2,570) | | (894) | |

Balance, end of period | | $ | 71,763 | | $ | 96,978 | | $ | 120,426 | | $ | 125,876 | | $ | 127,228 | | $ | (25,215) | | $ | (55,465) | |

| | | | | | | | | | | | | | | |

Ending number of properties owned | | | | | | | | | | | | | | | |

Consumer real estate | | 224 | | 418 | | 425 | | 426 | | 466 | | (194) | | (242) | |

Commercial real estate | | 18 | | 18 | | 26 | | 32 | | 32 | | - | | (14) | |

Total | | 242 | | 436 | | 451 | | 458 | | 498 | | (194) | | (256) | |

| | | | | | | | | | | | | | | |

(1) Includes properties owned and foreclosed properties subject to redemption. | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | Change from | |

| | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, | | Mar 31, | | Dec 31, | | Mar 31, | |

| | 2013 | | 2012 | | 2012 | | 2012 | | 2012 | | 2012 | | 2012 | |

Non-Accrual Loans and Leases and Other Real Estate Owned | | | | | | | | | | | | | | | |

Non-accrual loans and leases | | $ | 221,278 | | $ | 261,796 | | $ | 318,611 | | $ | 324,426 | | $ | 308,943 | | $ | (40,518) | | $ | (87,665) | |

Loans discharged in bankruptcy (1) | | 122,110 | | 117,661 | | 103,202 | | - | | - | | 4,449 | | 122,110 | |

Other real estate owned | | 71,763 | | 96,978 | | 120,426 | | 125,876 | | 127,228 | | (25,215) | | (55,465) | |

Total non-accrual loans and leases and other real estate owned | | $ | 415,151 | | $ | 476,435 | | $ | 542,239 | | $ | 450,302 | | $ | 436,171 | | $ | (61,284) | | $ | (21,020) | |

| | | | | | | | | | | | | | | |

Percent of total loans and leases and other real estate owned | | 2.65 | % | 3.07 | % | 3.54 | % | 2.93 | % | 2.84 | % | (42) | bps | (19) | bps |

| | | | | | | | | | | | | | | |

(1) Consumer real estate loans required to be reported as nonaccrual loans, regardless of delinquency status, due to the implementation of clarifying regulatory guidance in the third quarter of 2012, related to the discharge of a borrowers’ personal liability following Chapter 7 bankruptcy proceedings. |

-more-

19

TCF FINANCIAL CORPORATION AND SUBSIDIARIES

SUMMARY OF CREDIT QUALITY DATA, CONTINUED

(Dollars in thousands)

(Unaudited)

Allowance for Loan and Lease Losses

| | At March 31, 2013 | | At December 31, 2012 | | At March 31, 2012 | | Change from | |

| | | | % of | | | | % of | | | | % of | | Dec. 31, | | Mar. 31, | |

| | Balance | | Portfolio | | Balance | | Portfolio | | Balance | | Portfolio | | 2012 | | 2012 | |

Consumer real estate | | $ | 182,687 | | 2.85 | % | $ | 182,013 | | 2.73 | % | $ | 183,825 | | 2.70 | % | 12 | bps | 15 | bps |

Commercial | | 48,556 | | 1.46 | | 51,575 | | 1.51 | | 50,444 | | 1.45 | | (5) | | 1 | |

Leasing and | | | | | | | | | | | | | | | | | |

equipment finance | | 17,541 | | .55 | | 21,037 | | .66 | | 21,537 | | .69 | | (11) | | (14) | |

Inventory finance | | 8,788 | | .46 | | 7,569 | | .48 | | 7,556 | | .46 | | (2) | | - | |

Auto finance | | 5,390 | | .75 | | 4,136 | | .75 | | 1,019 | | .73 | | - | | 2 | |

Other | | 634 | | 2.67 | | 798 | | 2.86 | | 912 | | 3.13 | | (19) | | (46) | |

Total | | $ | 263,596 | | 1.69 | | $ | 267,128 | | 1.73 | | $ | 265,293 | | 1.74 | | (4) | | (5) | |

Net Charge-Offs

| | | | | | | | | | | | Change from | |

| | Quarter Ended | | Quarter Ended | |

| | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, | | Mar. 31, | | Dec. 31, | | Mar. 31, | |

| | 2013 | | 2012 | | 2012 | | 2012 | | 2012 | | 2012 | | 2012 | |

Consumer real estate | | | | | | | | | | | | | | | |

First mortgage lien | | $ | 19,907 | | $ | 22,163 | | $ | 40,469 | | $ | 18,369 | | $ | 19,526 | | $ | (2,256) | | $ | 381 | |

Junior lien | | 10,540 | | 11,757 | | 34,202 | | 16,487 | | 16,162 | | (1,217) | | (5,622) | |

Total consumer real estate | | 30,447 | | 33,920 | | 74,671 | | 34,856 | | 35,688 | | (3,473) | | (5,241) | |

Commercial | | 7,849 | | 8,351 | | 20,547 | | 8,455 | | 1,524 | | (502) | | 6,325 | |

Leasing and equipment finance | | 1,210 | | 1,345 | | 7,521 | | 1,173 | | 151 | | (135) | | 1,059 | |

Inventory finance | | 355 | | 193 | | 444 | | 225 | | 643 | | 162 | | (288) | |

Auto finance | | 836 | | 771 | | 280 | | 81 | | 2 | | 65 | | 834 | |

Other | | 307 | | 940 | | 991 | | 69 | | 925 | | (633) | | (618) | |

Total | | $ | 41,004 | | $ | 45,520 | | $ | 104,454 | | $ | 44,859 | | $ | 38,933 | | $ | (4,516) | | $ | 2,071 | |

| | | | | | | | | | | | | | | |

Net Charge-Offs as a Percentage of Average Loans and Leases | | | | | | | | | | | | | |

| | | | | | | | | | | | Change from | |

| | Quarter Ended (1) | | Quarter Ended | |

| | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, | | Mar. 31, | | Dec. 31, | | Mar. 31, | |

| | 2013 | | 2012 | | 2012 | | 2012 | | 2012 | | 2012 | | 2012 | |

Consumer real estate | | | | | | | | | | | | | | | |

First mortgage lien | | 1.90 | % | 2.06 | % | 3.60 | % | 1.58 | % | 1.66 | % | (16) | bps | 24 | bps |

Junior lien | | 1.78 | | 1.99 | | 6.12 | | 3.07 | | 3.03 | | (21) | | (125) | |

Total consumer real estate | | 1.86 | | 2.04 | | 4.44 | | 2.05 | | 2.09 | | (18) | | (23) | |

Commercial | | .94 | | .97 | | 2.32 | | .97 | | .18 | | (3) | | 76 | |

Leasing and equipment finance | | .15 | | .17 | | .95 | | .15 | | .02 | | (2) | | 13 | |

Inventory finance | | .08 | | .05 | | .12 | | .06 | | .22 | | 3 | | (14) | |

Auto finance | | .50 | | .61 | | .30 | | .14 | | .01 | | (11) | | 49 | |

Other | | 9.01 | | N.M. | | N.M. | | N.M. | | N.M. | | N.M. | | N.M. | |

Total | | 1.06 | | 1.18 | | 2.74 | | 1.18 | | 1.06 | | (12) | | - | |

| | | | | | | | | | | | | | | |

(1) Annualized. | | | | | | | | | | | | | | | |

N.M. Not Meaningful. | | | | | | | | | | | | | | | |

-more-

20

TCF FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED AVERAGE BALANCE SHEETS, YIELDS AND RATES

(Dollars in thousands)

(Unaudited)

| | Three Months Ended March 31, | |

| | 2013 | | 2012 | |

| | Average | | | | Yields and | | Average | | | | Yields and | |

| | Balance | | Interest | | Rates(1) (2) | | Balance | | Interest | | Rates(1) (2) | |

ASSETS: | | | | | | | | | | | | | |

Investments and other | | $ | 815,420 | | $ | 3,246 | | 1.61 % | | $ | 745,861 | | $ | 2,388 | | 1.29 % | |

U.S. Government sponsored entities: | | | | | | | | | | | | | |

Mortgage-backed securities, fixed-rate | | 674,860 | | 4,794 | | 2.84 | | 2,087,017 | | 19,109 | | 3.66 | |

U.S. Treasury securities | | 900 | | - | | .07 | | - | | - | | - | |

Other securities | | 106 | | 1 | | 2.49 | | 230 | | 3 | | 5.24 | |

Total securities available for sale(3) | | 675,866 | | 4,795 | | 2.84 | | 2,087,247 | | 19,112 | | 3.66 | |

Loans and leases held for sale | | 154,766 | | 2,604 | | 6.82 | | 5,872 | | 45 | | 3.08 | |

Loans and leases: | | | | | | | | | | | | | |

Consumer real estate: | | | | | | | | | | | | | |

Fixed-rate | | 3,916,709 | | 57,058 | | 5.91 | | 4,443,148 | | 66,155 | | 5.99 | |

Variable-rate | | 2,639,717 | | 33,082 | | 5.08 | | 2,401,915 | | 30,068 | | 5.03 | |

Total consumer real estate | | 6,556,426 | | 90,140 | | 5.58 | | 6,845,063 | | 96,223 | | 5.65 | |

Commercial: | | | | | | | | | | | | | |

Fixed- and adjustable-rate | | 2,478,079 | | 32,554 | | 5.33 | | 2,737,848 | | 38,209 | | 5.61 | |

Variable-rate | | 867,701 | | 7,514 | | 3.51 | | 719,872 | | 7,512 | | 4.20 | |

Total commercial | | 3,345,780 | | 40,068 | | 4.86 | | 3,457,720 | | 45,721 | | 5.32 | |

Leasing and equipment finance | | 3,199,499 | | 40,913 | | 5.11 | | 3,128,329 | | 44,001 | | 5.63 | |

Inventory finance | | 1,686,364 | | 25,605 | | 6.16 | | 1,145,183 | | 18,725 | | 6.58 | |

Auto finance | | 670,096 | | 8,642 | | 5.23 | | 85,562 | | 1,583 | | 7.44 | |

Other | | 13,641 | | 276 | | 8.19 | | 17,582 | | 368 | | 8.42 | |

Total loans and leases | | 15,471,806 | | 205,644 | | 5.38 | | 14,679,439 | | 206,621 | | 5.65 | |

Total interest-earning assets | | 17,117,858 | | 216,289 | | 5.11 | | 17,518,419 | | 228,166 | | 5.24 | |

Other assets | | 1,126,694 | | | | | | 1,379,289 | | | | | |

Total assets | | $ | 18,244,552 | | | | | | $ | 18,897,708 | | | | | |

LIABILITIES AND EQUITY: | | | | | | | | | | | | | |

Non-interest bearing deposits: | | | | | | | | | | | | | |

Retail | | $ | 1,426,314 | | | | | | $ | 1,359,781 | | | | | |

Small business | | 744,168 | | | | | | 708,416 | | | | | |

Commercial and custodial | | 329,992 | | | | | | 305,064 | | | | | |

Total non-interest bearing deposits | | 2,500,474 | | | | | | 2,373,261 | | | | | |

Interest-bearing deposits: | | | | | | | | | | | | | |

Checking | | 2,308,263 | | 497 | | .09 | | 2,214,192 | | 902 | | .16 | |

Savings | | 6,090,427 | | 3,369 | | .22 | | 5,882,730 | | 5,436 | | .37 | |

Money market | | 815,374 | | 630 | | .31 | | 662,493 | | 610 | | .37 | |

Subtotal | | 9,214,064 | | 4,496 | | .20 | | 8,759,415 | | 6,948 | | .32 | |

Certificates of deposit | | 2,323,267 | | 5,185 | | .90 | | 1,135,673 | | 2,113 | | .75 | |

Total interest-bearing deposits | | 11,537,331 | | 9,681 | | .34 | | 9,895,088 | | 9,061 | | .37 | |

Total deposits | | 14,037,805 | | 9,681 | | .28 | | 12,268,349 | | 9,061 | | .30 | |

Borrowings: | | | | | | | | | | | | | |

Short-term borrowings | | 8,631 | | 8 | | .40 | | 436,171 | | 329 | | .30 | |

Long-term borrowings | | 1,927,139 | | 6,770 | | 1.41 | | 3,817,165 | | 37,966 | | 4.00 | |

Total borrowings | | 1,935,770 | | 6,778 | | 1.41 | | 4,253,336 | | 38,295 | | 3.62 | |

Total interest-bearing liabilities | | 13,473,101 | | 16,459 | | .49 | | 14,148,424 | | 47,356 | | 1.35 | |

Total deposits and borrowings | | 15,973,575 | | 16,459 | | .42 | | 16,521,685 | | 47,356 | | 1.15 | |

Other liabilities | | 390,825 | | | | | | 577,142 | | | | | |

Total liabilities | | 16,364,400 | | | | | | 17,098,827 | | | | | |

Total TCF Financial Corporation stockholders’ equity | | 1,863,393 | | | | | | 1,785,375 | | | | | |

Non-controlling interest in subsidiaries | | 16,759 | | | | | | 13,506 | | | | | |

Total equity | | 1,880,152 | | | | | | 1,798,881 | | | | | |

Total liabilities and equity | | $ | 18,244,552 | | | | | | $ | 18,897,708 | | | | | |

Net interest income and margin | | | | $ | 199,830 | | 4.72 | | | | $ | 180,810 | | 4.14 | |

| | | | | | | | | | | | | |

(1) Annualized. | | | | | | | | | | | | | |

(2) Interest and yields are presented on a fully tax equivalent basis. |

(3) Average balances and yields of securities available for sale are based upon the historical amortized cost and excludes equity securities. |

-more-

21

TCF FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED QUARTERLY STATEMENTS OF INCOME AND FINANCIAL HIGHLIGHTS

(Dollars in thousands, except per-share data)

(Unaudited)

| | At or For the Three Months Ended | |

| | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, | | Mar. 31, | |

| | 2013 | | 2012 | | 2012 | | 2012 | | 2012 | |

Interest income: | | | | | | | | | | | |

Loans and leases | | $ | 204,905 | | $ | 210,490 | | $ | 210,140 | | $ | 208,766 | | $ | 205,984 | |

Securities available for sale | | 4,795 | | 4,615 | | 5,607 | | 5,816 | | 19,112 | |

Investments and other | | 5,850 | | 3,922 | | 4,105 | | 3,633 | | 2,433 | |

Total interest income | | 215,550 | | 219,027 | | 219,852 | | 218,215 | | 227,529 | |

Interest expense: | | | | | | | | | | | |

Deposits | | 9,681 | | 10,972 | | 10,757 | | 10,197 | | 9,061 | |

Borrowings | | 6,778 | | 6,992 | | 8,536 | | 9,794 | | 38,295 | |

Total interest expense | | 16,459 | | 17,964 | | 19,293 | | 19,991 | | 47,356 | |

Net interest income | | 199,091 | | 201,063 | | 200,559 | | 198,224 | | 180,173 | |

Provision for credit losses | | 38,383 | | 48,520 | | 96,275 | | 54,106 | | 48,542 | |

Net interest income after provision for

credit losses | | 160,708 | | 152,543 | | 104,284 | | 144,118 | | 131,631 | |

Non-interest income: | | | | | | | | | | | |

Fees and service charges | | 39,323 | | 44,262 | | 43,745 | | 48,090 | | 41,856 | |

Card revenue | | 12,417 | | 12,974 | | 12,927 | | 13,530 | | 13,207 | |

ATM revenue | | 5,505 | | 5,584 | | 6,122 | | 6,276 | | 6,199 | |

Subtotal | | 57,245 | | 62,820 | | 62,794 | | 67,896 | | 61,262 | |

Leasing and equipment finance | | 16,460 | | 26,149 | | 20,498 | | 23,207 | | 22,867 | |

Gain on sale of consumer real estate loans | | 8,126 | | 854 | | 4,559 | | - | | - | |

Gain on sale of auto loans | | 7,146 | | 6,869 | | 7,486 | | 5,496 | | 2,250 | |

Other | | 3,726 | | 3,973 | | 3,688 | | 3,168 | | 2,355 | |

Fees and other revenue | | 92,703 | | 100,665 | | 99,025 | | 99,767 | | 88,734 | |

(Losses) gains on securities, net | | - | | (528) | | 13,033 | | 13,116 | | 76,611 | |

Total non-interest income | | 92,703 | | 100,137 | | 112,058 | | 112,883 | | 165,345 | |

Non-interest expense: | | | | | | | | | | | |

Compensation and employee benefits | | 104,229 | | 101,678 | | 98,409 | | 97,787 | | 95,967 | |

Occupancy and equipment | | 32,875 | | 32,809 | | 33,006 | | 32,731 | | 32,246 | |

FDIC insurance | | 7,710 | | 8,671 | | 6,899 | | 8,469 | | 6,386 | |

Advertising and marketing | | 5,732 | | 4,303 | | 4,248 | | 5,404 | | 2,617 | |

Operating lease depreciation | | 5,635 | | 5,905 | | 6,325 | | 6,417 | | 6,731 | |

Deposit account premiums | | 602 | | 523 | | 485 | | 1,690 | | 5,971 | |

Other | | 37,939 | | 53,472 | | 36,173 | | 36,956 | | 37,296 | |

Subtotal | | 194,722 | | 207,361 | | 185,545 | | 189,454 | | 187,214 | |

Loss on termination of debt | | - | | - | | - | | - | | 550,735 | |

Foreclosed real estate and repossessed assets, net | | 10,167 | | 7,582 | | 10,670 | | 12,059 | | 11,047 | |

Other credit costs, net | | (837) | | (894) | | 593 | | 1,476 | | (288) | |

Total non-interest expense | | 204,052 | | 214,049 | | 196,808 | | 202,989 | | 748,708 | |

Income (loss) before income tax expense (benefit) | | 49,359 | | 38,631 | | 19,534 | | 54,012 | | (451,732) | |

Income tax expense (benefit) | | 17,559 | | 10,540 | | 6,304 | | 20,542 | | (170,244) | |

Income (loss) after income tax expense (benefit) | | 31,800 | | 28,091 | | 13,230 | | 33,470 | | (281,488) | |

Income attributable to non-controlling interest | | 1,826 | | 1,306 | | 1,536 | | 1,939 | | 1,406 | |

Net income (loss) attributable to TCF Financial Corporation | | 29,974 | | 26,785 | | 11,694 | | 31,531 | | (282,894) | |

Preferred stock dividends | | 4,524 | | 3,234 | | 2,372 | | - | | - | |

Net income (loss) available to common stockholders | | $ | 25,450 | | $ | 23,551 | | $ | 9,322 | | $ | 31,531 | | $ | (282,894) | |

Net income (loss) per common share: | | | | | | | | | | | |

Basic | | $ | .16 | | $ | .15 | | $ | .06 | | $ | .20 | | $ | (1.78) | |

Diluted | | .16 | | .15 | | .06 | | .20 | | (1.78) | |

| | | | | | | | | | | |

Dividends declared per common share | | $ | .05 | | $ | .05 | | $ | .05 | | $ | .05 | | $ | .05 | |

Financial Highlights: | | | | | | | | | | | |

Pre-tax pre-provision profit(1) | | $ | 87,742 | | $ | 87,151 | | $ | 115,809 | | $ | 108,118 | | $ | 70,578 | |

Return on average assets(2) | | .70 | % | .63 | % | .30 | % | .76 | % | (5.96) | % |

Return on average common equity(2) | | 6.36 | | 5.93 | | 2.36 | | 8.13 | | (63.38) | |

Net interest margin(2) | | 4.72 | | 4.79 | | 4.85 | | 4.86 | | 4.14 | |

| | | | | | | | | | | |

(1) Pre-tax pre-provision profit (‘‘PTPP’’) is calculated as total revenues less non-interest expense. First quarter 2012 PTPP excludes the net loss of $473.8 million related to the balance sheet repositioning completed in the first quarter of 2012. |

(2) Annualized. |

-more-

22

TCF FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED QUARTERLY AVERAGE BALANCE SHEETS

(In thousands)

(Unaudited)

| | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, | | Mar. 31, | |

| | 2013 | | 2012 | | 2012 | | 2012 | | 2012 | |

| | | | | | | | | | | |

ASSETS | | | | | | | | | | | |

Cash and due from banks | | $ | 945,928 | | $ | 777,995 | | $ | 628,697 | | $ | 555,590 | | $ | 863,310 | |

Investments | | 122,014 | | 122,970 | | 123,223 | | 149,813 | | 168,805 | |

U.S. Government sponsored entities: | | | | | | | | | | | |

Mortgage-backed securities | | 676,296 | | 696,506 | | 701,155 | | 736,251 | | 2,021,574 | |

U.S. Treasury securities | | 900 | | - | | - | | - | | - | |

Other securities | | 2,400 | | 2,150 | | 2,224 | | 2,097 | | 1,678 | |

Total securities available for sale | | 679,596 | | 698,656 | | 703,379 | | 738,348 | | 2,023,252 | |

Loans and leases held for sale | | 154,766 | | 53,140 | | 80,549 | | 44,788 | | 5,872 | |

Loans and leases: | | | | | | | | | | | |

Consumer real estate: | | | | | | | | | | | |

Fixed-rate | | 3,916,709 | | 4,012,702 | | 4,197,903 | | 4,365,670 | | 4,443,148 | |

Variable-rate | | 2,639,717 | | 2,650,958 | | 2,531,351 | | 2,427,745 | | 2,401,915 | |

Total consumer real estate | | 6,556,426 | | 6,663,660 | | 6,729,254 | | 6,793,415 | | 6,845,063 | |

Commercial: | | | | | | | | | | | |

Fixed- and adjustable-rate | | 2,478,079 | | 2,614,824 | | 2,682,193 | | 2,730,085 | | 2,737,848 | |

Variable-rate | | 867,701 | | 837,944 | | 855,918 | | 761,964 | | 719,872 | |

Total commercial | | 3,345,780 | | 3,452,768 | | 3,538,111 | | 3,492,049 | | 3,457,720 | |

Leasing and equipment finance | | 3,199,499 | | 3,184,540 | | 3,164,592 | | 3,145,914 | | 3,128,329 | |

Inventory finance | | 1,686,364 | | 1,570,829 | | 1,440,298 | | 1,571,004 | | 1,145,183 | |

Auto finance | | 670,096 | | 504,565 | | 367,271 | | 223,893 | | 85,562 | |

Other | | 13,641 | | 14,704 | | 16,280 | | 17,647 | | 17,582 | |

Total loans and leases | | 15,471,806 | | 15,391,066 | | 15,255,806 | | 15,243,922 | | 14,679,439 | |

Allowance for loan and lease losses | | (265,392) | | (269,578) | | (264,626) | | (266,187) | | (257,895) | |

Net loans and leases | | 15,206,414 | | 15,121,488 | | 14,991,180 | | 14,977,735 | | 14,421,544 | |

Premises and equipment, net | | 440,437 | | 442,287 | | 442,456 | | 438,438 | | 435,412 | |

Goodwill | | 225,640 | | 225,640 | | 225,640 | | 225,640 | | 225,640 | |

Other assets | | 469,757 | | 506,212 | | 521,397 | | 524,466 | | 753,873 | |

Total assets | | $ | 18,244,552 | | $ | 17,948,388 | | $ | 17,716,521 | | $ | 17,654,818 | | $ | 18,897,708 | |

| | | | | | | | | | | |

LIABILITIES AND EQUITY | | | | | | | | | | | |

Non-interest-bearing deposits: | | | | | | | | | | | |

Retail | | $ | 1,426,314 | | $ | 1,294,027 | | $ | 1,275,722 | | $ | 1,316,767 | | $ | 1,359,781 | |

Small business | | 744,168 | | 775,334 | | 746,511 | | 725,052 | | 708,416 | |

Commercial and custodial | | 329,992 | | 329,919 | | 324,739 | | 310,321 | | 305,064 | |

Total non-interest bearing deposits | | 2,500,474 | | 2,399,280 | | 2,346,972 | | 2,352,140 | | 2,373,261 | |

Interest-bearing deposits: | | | | | | | | | | | |

Checking | | 2,308,263 | | 2,248,481 | | 2,255,561 | | 2,306,810 | | 2,214,192 | |

Savings | | 6,090,427 | | 6,083,168 | | 6,153,079 | | 6,031,015 | | 5,882,730 | |

Money market | | 815,374 | | 819,596 | | 848,899 | | 748,016 | | 662,493 | |

Subtotal | | 9,214,064 | | 9,151,245 | | 9,257,539 | | 9,085,841 | | 8,759,415 | |

Certificates of deposit | | 2,323,267 | | 2,206,173 | | 1,953,208 | | 1,608,653 | | 1,135,673 | |

Total interest-bearing deposits | | 11,537,331 | | 11,357,418 | | 11,210,747 | | 10,694,494 | | 9,895,088 | |

Total deposits | | 14,037,805 | | 13,756,698 | | 13,557,719 | | 13,046,634 | | 12,268,349 | |

Borrowings: | | | | | | | | | | | |

Short-term borrowings | | 8,631 | | 47,715 | | 65,531 | | 705,888 | | 436,171 | |

Long-term borrowings | | 1,927,139 | | 1,928,507 | | 1,985,094 | | 1,986,182 | | 3,817,165 | |

Total borrowings | | 1,935,770 | | 1,976,222 | | 2,050,625 | | 2,692,070 | | 4,253,336 | |

Accrued expenses and other liabilities | | 390,825 | | 434,471 | | 343,336 | | 335,113 | | 577,142 | |

Total liabilities | | 16,364,400 | | 16,167,391 | | 15,951,680 | | 16,073,817 | | 17,098,827 | |

Equity: | | | | | | | | | | | |

Preferred stock | | 263,240 | | 180,359 | | 166,721 | | 10,993 | | - | |

Common stock | | 1,637 | | 1,634 | | 1,631 | | 1,625 | | 1,617 | |

Additional paid-in capital | | 753,583 | | 749,445 | | 742,598 | | 738,089 | | 727,596 | |

Retained earnings, subject to certain restrictions | | 880,582 | | 866,895 | | 862,570 | | 846,349 | | 1,052,632 | |

Accumulated other comprehensive income | | 5,624 | | 13,131 | | 19,321 | | 11,601 | | 46,029 | |

Treasury stock at cost and other | | (41,273) | | (43,462) | | (42,890) | | (45,499) | | (42,499) | |

Total TCF Financial Corporation stockholders’

equity | | 1,863,393 | | 1,768,002 | | 1,749,951 | | 1,563,158 | | 1,785,375 | |

Non-controlling interest in subsidiaries | | 16,759 | | 12,995 | | 14,890 | | 17,843 | | 13,506 | |

Total equity | | 1,880,152 | | 1,780,997 | | 1,764,841 | | 1,581,001 | | 1,798,881 | |

Total liabilities and equity | | $ | 18,244,552 | | $ | 17,948,388 | | $ | 17,716,521 | | $ | 17,654,818 | | $ | 18,897,708 | |

-more-

23

TCF FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED QUARTERLY YIELDS AND RATES(1) (2)

(Unaudited)

| | Mar. 31, | | Dec. 31, | | Sep. 30, | | Jun. 30, | | Mar. 31, | |

| | 2013 | | 2012 | | 2012 | | 2012 | | 2012 | |

| | | | | | | | | | | |

ASSETS | | | | | | | | | | | |

| | | | | | | | | | | |

Investments and other | | 1.61 | % | 1.77 | % | 2.09 | % | 2.48 | % | 1.29 | % |

U.S. Government sponsored entities: | | | | | | | | | | | |

Mortgage-backed securities, fixed-rate | | 2.84 | | 2.64 | | 3.15 | | 3.17 | | 3.66 | |

U.S. Treasury securities | | .07 | | - | | - | | - | | - | |

Other securities | | 2.49 | | 2.52 | | 3.32 | | 4.14 | | 5.24 | |

Total securities available for sale(3) | | 2.84 | | 2.64 | | 3.15 | | 3.17 | | 3.66 | |

Loans and leases held for sale | | 6.82 | | 8.00 | | 7.89 | | 8.80 | | 3.08 | |

Loans and leases: | | | | | | | | | | | |

Consumer real estate: | | | | | | | | | | | |

Fixed-rate | | 5.91 | | 5.95 | | 5.94 | | 5.84 | | 5.99 | |

Variable-rate | | 5.08 | | 5.07 | | 5.04 | | 5.00 | | 5.03 | |

Total consumer real estate | | 5.58 | | 5.60 | | 5.60 | | 5.54 | | 5.65 | |

Commercial: | | | | | | | | | | | |

Fixed- and adjustable-rate | | 5.33 | | 5.60 | | 5.57 | | 5.49 | | 5.61 | |

Variable-rate | | 3.51 | | 3.55 | | 3.77 | | 3.99 | | 4.20 | |

Total commercial | | 4.86 | | 5.10 | | 5.14 | | 5.16 | | 5.32 | |

Leasing and equipment finance | | 5.11 | | 5.24 | | 5.33 | | 5.48 | | 5.63 | |

Inventory finance | | 6.16 | | 6.11 | | 6.19 | | 6.07 | | 6.58 | |

Auto finance | | 5.23 | | 5.53 | | 5.97 | | 6.89 | | 7.44 | |

Other | | 8.19 | | 8.31 | | 7.83 | | 7.66 | | 8.42 | |

Total loans and leases | | 5.38 | | 5.47 | | 5.50 | | 5.52 | | 5.65 | |

| | | | | | | | | | | |

Total interest-earning assets | | 5.11 | | 5.21 | | 5.32 | | 5.34 | | 5.24 | |

| | | | | | | | | | | |

LIABILITIES | | | | | | | | | | | |

| | | | | | | | | | | |

Interest-bearing deposits: | | | | | | | | | | | |

Checking | | .09 | | .11 | | .12 | | .15 | | .16 | |

Savings | | .22 | | .29 | | .31 | | .34 | | .37 | |

Money market | | .31 | | .35 | | .38 | | .39 | | .37 | |

Subtotal | | .20 | | .25 | | .27 | | .30 | | .32 | |

Certificates of deposit | | .90 | | .92 | | .92 | | .86 | | .75 | |

Total interest-bearing deposits | | .34 | | .38 | | .38 | | .38 | | .37 | |

Total deposits | | .28 | | .32 | | .32 | | .31 | | .30 | |

Borrowings: | | | | | | | | | | | |

Short-term borrowings | | .40 | | .41 | | .24 | | .30 | | .30 | |

Long-term borrowings | | 1.41 | | 1.44 | | 1.71 | | 1.87 | | 4.00 | |

Total borrowings | | 1.41 | | 1.41 | | 1.66 | | 1.46 | | 3.62 | |

| | | | | | | | | | | |

Total interest-bearing liabilities | | .49 | | .54 | | .58 | | .60 | | 1.35 | |

| | | | | | | | | | | |

Net interest margin | | 4.72 | | 4.79 | | 4.85 | | 4.86 | | 4.14 | |

| | | | | | | | | | | |

(1) Annualized. |

(2) Yields are presented on a fully tax equivalent basis. |

(3) Average yields of securities available for sale are based upon the historical amortized cost and excludes equity

securities. |

-more-

24

TCF FINANCIAL CORPORATION AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES(1)

(Dollars in thousands)

(Unaudited)

| | At Mar. 31, | | At Dec. 31, | |

| | 2013 | | 2012 | |

Computation of tangible realized common equity to tangible assets: | | | | | |

Total equity | | $ | 1,900,159 | | $ | 1,876,643 | |

Less: Non-controlling interest in subsidiaries | | 20,933 | | 13,270 | |

Total TCF Financial Corp. stockholders’ equity | | 1,879,226 | | 1,863,373 | |

Less: | | | | | |

Preferred stock | | 263,240 | | 263,240 | |

Goodwill | | 225,640 | | 225,640 | |

Other intangibles | | 7,860 | | 8,674 | |

Accumulated other comprehensive income | | 3,536 | | 12,443 | |

Tangible realized common equity | | $ | 1,378,950 | | $ | 1,353,376 | |

| | | | | |

Total assets | | $ | 18,504,026 | | $ | 18,225,917 | |

Less: | | | | | |

Goodwill | | 225,640 | | 225,640 | |

Other intangibles | | 7,860 | | 8,674 | |

Tangible assets | | $ | 18,270,526 | | $ | 17,991,603 | |

| | | | | |

Tangible realized common equity to tangible assets | | 7.55 | % | 7.52 | % |

| | | | | |

| | At Mar. 31, | | At Dec. 31, | |

| | 2013 | | 2012 | |

Computation of tier 1 risk-based capital ratio: | | | | | |

Total tier 1 capital | | $ | 1,666,630 | | $ | 1,633,336 | |

Total risk-weighted assets | | 14,964,703 | | 14,733,203 | |

Total tier 1 risk-based capital ratio | | 11.14 | % | 11.09 | % |

| | | | | |

Computation of tier 1 common capital ratio: | | | | | |

Total tier 1 capital | | $ | 1,666,630 | | $ | 1,633,336 | |

Less: | | | | | |

Preferred stock | | 263,240 | | 263,240 | |

Qualifying non-controlling interest in subsidiaries | | 20,933 | | 13,270 | |

Total tier 1 common capital | | $ | 1,382,457 | | $ | 1,356,826 | |

| | | | | |

Total tier 1 common capital ratio | | 9.24 | % | 9.21 | % |

| | | | | |

(1) When evaluating capital adequacy and utilization, management considers financial measures such as Tangible Realized Common Equity to Tangible Assets and the Tier 1 Common Capital Ratio. These measures are non-GAAP financial measures and are viewed by management as useful indicators of capital levels available to withstand unexpected market or economic conditions, and also provide investors, regulators, and other users with information to be viewed in relation to other banking institutions. |

###