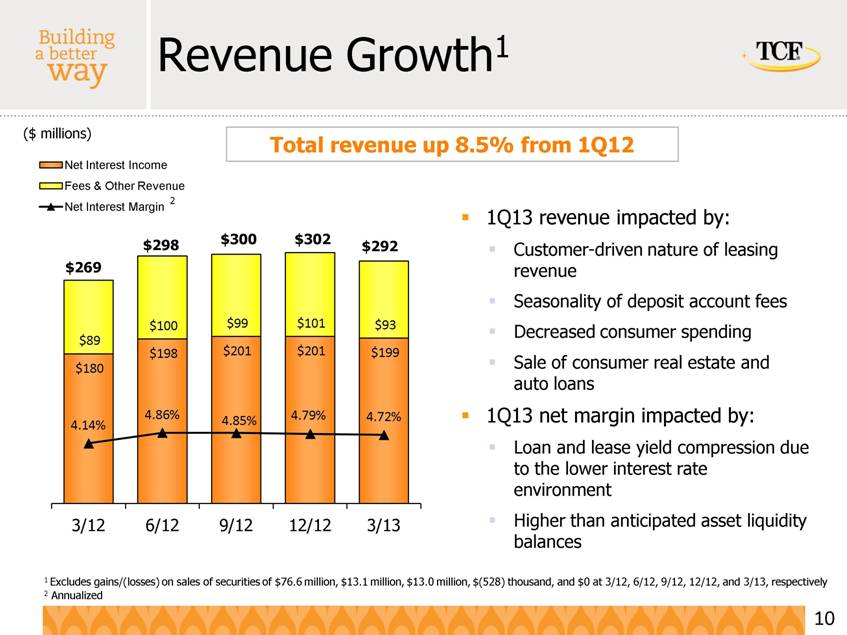

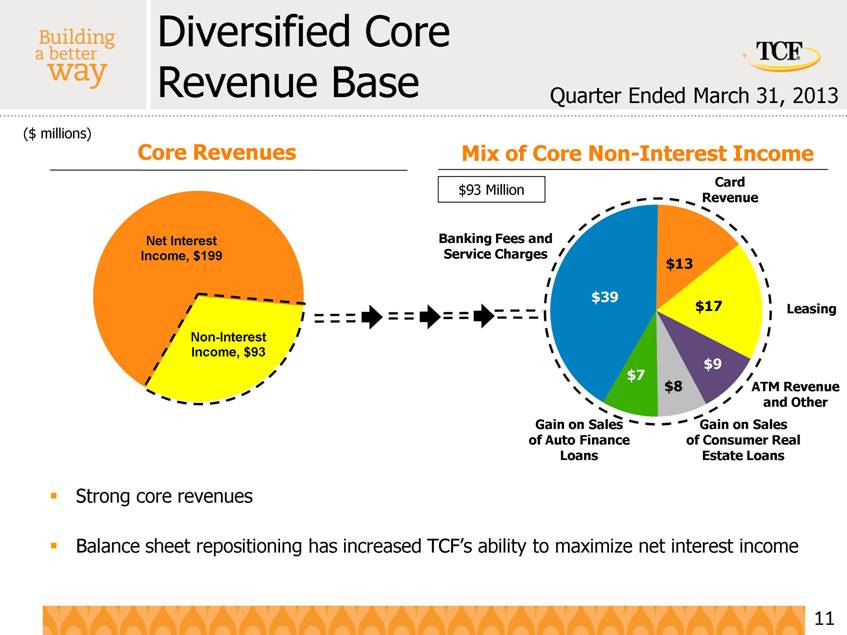

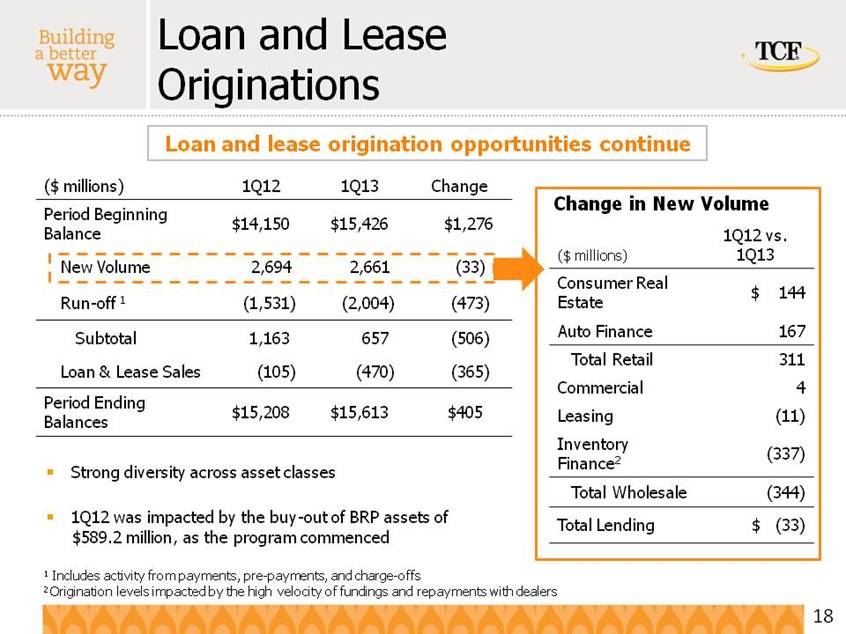

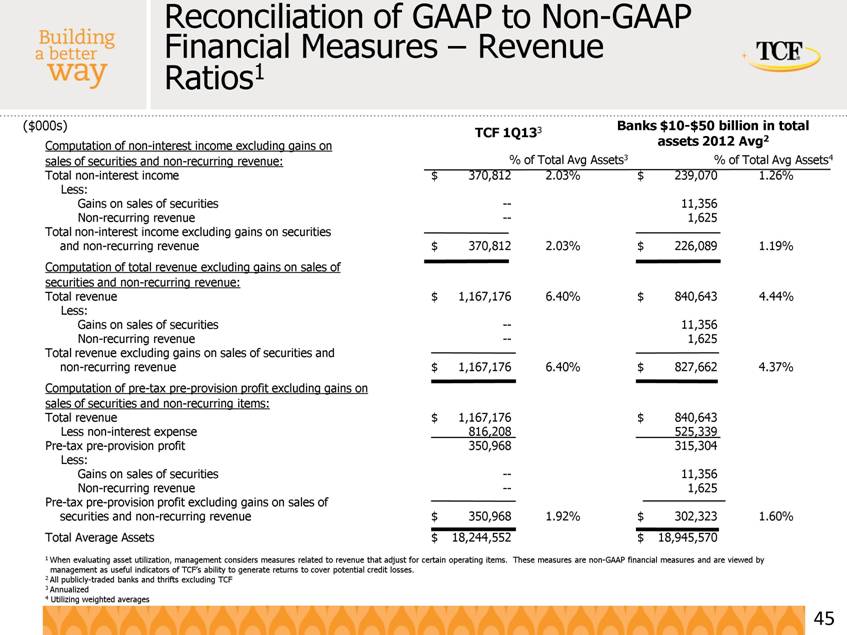

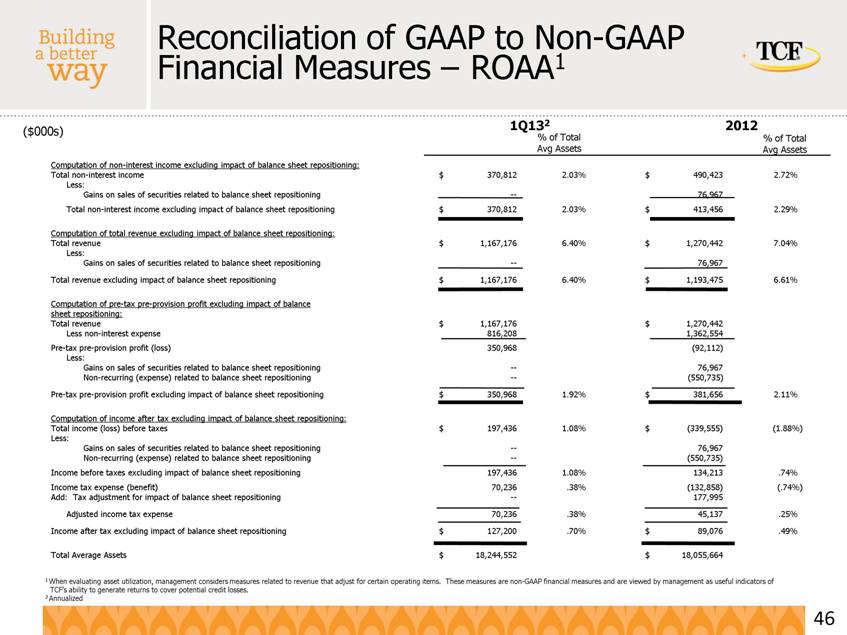

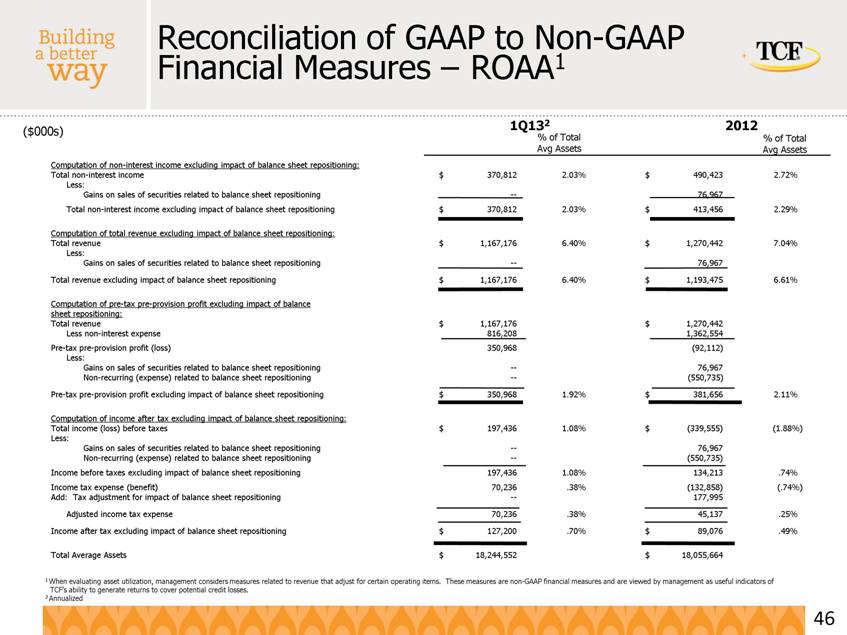

| Computation of non-interest income excluding impact of balance sheet repositioning: Total non-interest income $ 370,812 2.03% $ 490,423 2.72% Less: Gains on sales of securities related to balance sheet repositioning -- 76,967 Total non-interest income excluding impact of balance sheet repositioning $ 370,812 2.03% $ 413,456 2.29% Computation of total revenue excluding impact of balance sheet repositioning: Total revenue $ 1,167,176 6.40% $ 1,270,442 7.04% Less: Gains on sales of securities related to balance sheet repositioning -- 76,967 Total revenue excluding impact of balance sheet repositioning $ 1,167,176 6.40% $ 1,193,475 6.61% Computation of pre-tax pre-provision profit excluding impact of balance sheet repositioning: Total revenue $ 1,167,176 $ 1,270,442 Less non-interest expense 816,208 1,362,554 Pre-tax pre-provision profit 350,968 (92,112) Less: Gains on sales of securities related to balance sheet repositioning -- 76,967 Non-recurring (expense) related to balance sheet repositioning -- (550,735) Pre-tax pre-provision profit excluding impact of balance sheet repositioning $ 350,968 1.92% $ 381,656 2.11% Computation of income after tax excluding impact of balance sheet repositioning: Total income (loss) before taxes $ 197,436 1.08% $ (339,555) (1.88%) Less: Gains on sales of securities related to balance sheet repositioning -- 76,967 Non-recurring (expense) related to balance sheet repositioning -- (550,735) Income before taxes excluding impact of balance sheet repositioning 197,436 1.08% 134,213 .74% Income tax expense (benefit) 70,236 .38% (132,858) (.74%) Less: Tax adjustment for impact of balance sheet repositioning -- 177,995 Adjusted income tax expense (benefit) 70,236 .38% 45,137 .25% Income after tax excluding impact of balance sheet repositioning $ 127,200 .70% $ 89,076 .49% Total Average Assets $ 18,244,552 $ 18,055,664 Reconciliation of GAAP to Non-GAAP Financial Measures – ROAA1 1Q132 % of Total Avg Assets % of Total Avg Assets ($000s) 2012 1 When evaluating asset utilization, management considers measures related to revenue that adjust for certain operating items. These measures are non-GAAP financial measures and are viewed by management as useful indicators of TCF’s ability to generate returns to cover potential credit losses. 2 Annualized |