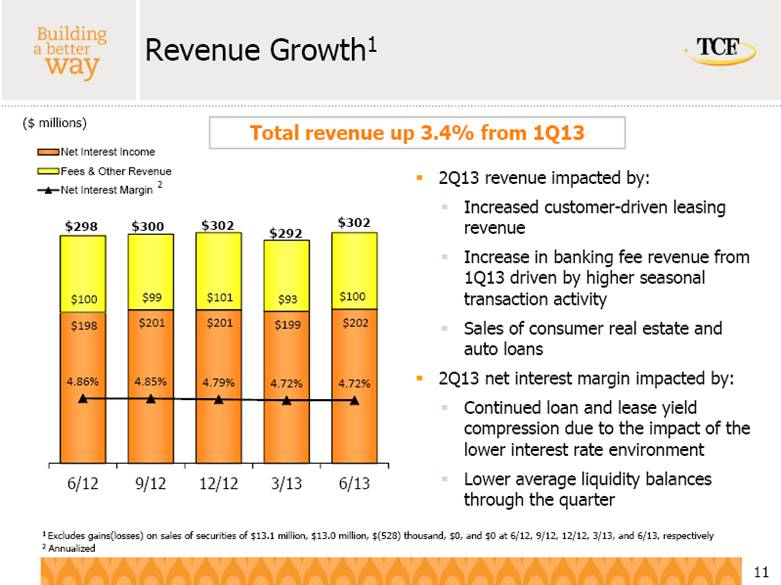

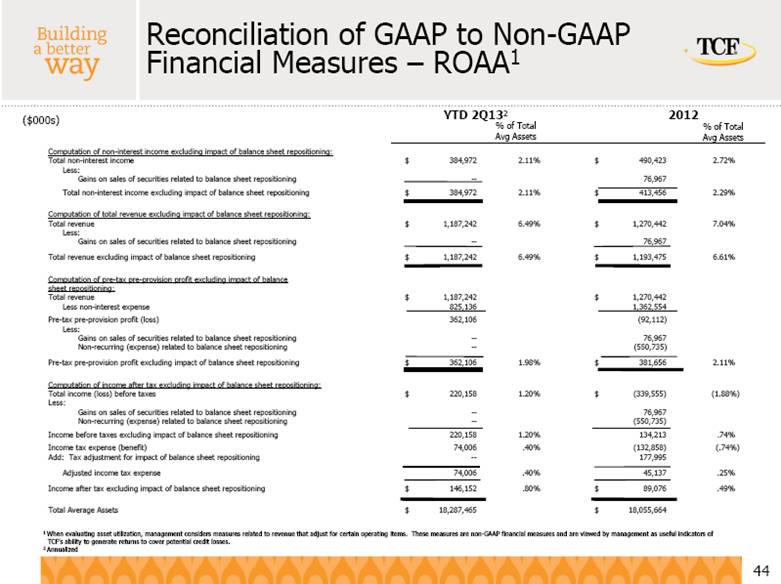

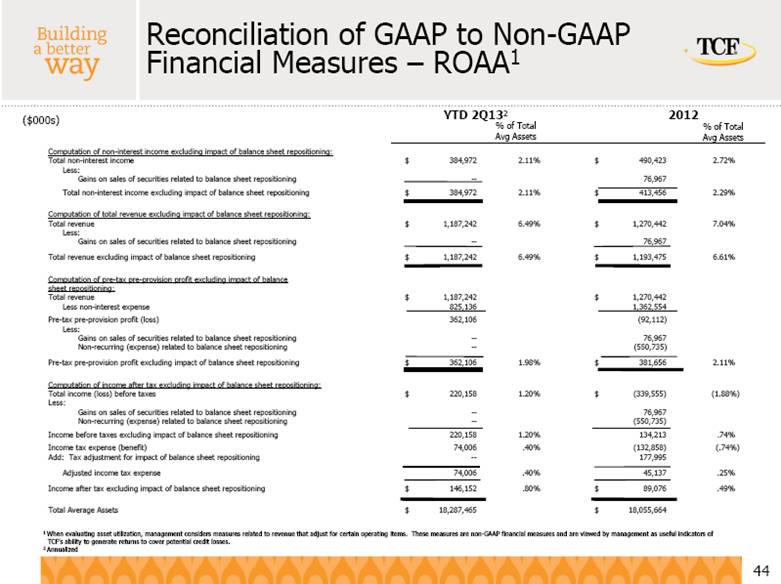

| Computation of non-interest income excluding impact of balance sheet repositioning: Total non-interest income $ 384,972 2.11% $ 490,423 2.72% Less: Gains on sales of securities related to balance sheet repositioning -- 76,967 Total non-interest income excluding impact of balance sheet repositioning $ 384,972 2.11% $ 413,456 2.29% Computation of total revenue excluding impact of balance sheet repositioning: Total revenue $ 1,187,242 6.49% $ 1,270,442 7.04% Less: Gains on sales of securities related to balance sheet repositioning -- 76,967 Total revenue excluding impact of balance sheet repositioning $ 1,187,242 6.49% $ 1,193,475 6.61% Computation of pre-tax pre-provision profit excluding impact of balance sheet repositioning: Total revenue $ 1,187,242 $ 1,270,442 Less non-interest expense 825,136 1,362,554 Pre-tax pre-provision profit (loss) 362,106 (92,112) Less: Gains on sales of securities related to balance sheet repositioning -- 76,967 Non-recurring (expense) related to balance sheet repositioning -- (550,735) Pre-tax pre-provision profit excluding impact of balance sheet repositioning $ 362,106 1.98% $ 381,656 2.11% Computation of income after tax excluding impact of balance sheet repositioning: Total income (loss) before taxes $ 220,158 1.20% $ (339,555) (1.88%) Less: Gains on sales of securities related to balance sheet repositioning -- 76,967 Non-recurring (expense) related to balance sheet repositioning -- (550,735) Income before taxes excluding impact of balance sheet repositioning 220,158 1.20% 134,213 .74% Income tax expense (benefit) 74,006 .40% (132,858) (.74%) Add: Tax adjustment for impact of balance sheet repositioning -- 177,995 Adjusted income tax expense 74,006 .40% 45,137 .25% Income after tax excluding impact of balance sheet repositioning $ 146,152 .80% $ 89,076 .49% Total Average Assets $ 18,287,465 $ 18,055,664 Reconciliation of GAAP to Non-GAAP Financial Measures – ROAA1 YTD 2Q132 % of Total Avg Assets % of Total Avg Assets ($000s) 2012 1 When evaluating asset utilization, management considers measures related to revenue that adjust for certain operating items. These measures are non-GAAP financial measures and are viewed by management as useful indicators of TCF’s ability to generate returns to cover potential credit losses. 2 Annualized |