UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | | 811-05162 |

| | | |

| Exact name of registrant as specified in charter: | | Delaware VIP® Trust |

| | | |

| Address of principal executive offices: | | 2005 Market Street |

| | | Philadelphia, PA 19103 |

| | | |

| Name and address of agent for service: | | David F. Connor, Esq. |

| | | 2005 Market Street |

| | | Philadelphia, PA 19103 |

| | | |

| Registrant’s telephone number, including area code: | | (800) 523-1918 |

| | | |

| Date of fiscal year end: | | December 31 |

| | | |

| Date of reporting period: | | December 31, 2011 |

Item 1. Reports to Stockholders

| Delaware VIP® Trust |

| Delaware VIP Diversified Income Series |

| |

| |

| |

| |

| |

| |

| Annual Report |

| |

| |

| December 31, 2011 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Table of contents

| > Portfolio management review | | 1 |

| | | |

| > Performance summary | | 2 |

| | | |

| > Disclosure of Series expenses | | 4 |

| | | |

| > Security type/sector allocation | | 5 |

| | | |

| > Statement of net assets | | 6 |

| | | |

| > Statement of operations | | 25 |

| | | |

| > Statements of changes in net assets | | 25 |

| | | |

| > Financial highlights | | 26 |

| | | |

| > Notes to financial statements | | 28 |

| | | |

| > Report of independent registered public accounting firm | | 38 |

| | | |

| > Other Series information | | 39 |

| | | |

| > Board of trustees/directors and officers addendum | | 41 |

Investments in Delaware VIP® Diversified Income Series are not and will not be deposits with or liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its holding companies, including subsidiaries or related companies (Macquarie Group), and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. No Macquarie Group company guarantees or will guarantee the performance of the Series, the repayment of capital from the Series, or any particular rate of return.

Unless otherwise noted, views expressed herein are current as of Dec. 31, 2011, and are subject to change.

The Series is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor and member of Macquarie Group. Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Series’ distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

This material may be used in conjunction with the offering of shares in the Delaware VIP Diversified Income Series only if preceded or accompanied by the Series’ current prospectus.

© 2012 Delaware Management Holdings, Inc.

All third-party trademarks cited are the property of their respective owners.

| Delaware VIP® Trust — Delaware VIP Diversified Income Series | |

| Portfolio management review | Jan. 10, 2012 |

For the fiscal year ended Dec. 31, 2011, Delaware VIP Diversified Income Series Standard Class shares returned +6.39% and Service Class shares returned +6.15% (both figures reflect returns with dividends reinvested). The Series’ benchmark, the Barclays Capital U.S. Aggregate Index, returned +7.84% for the same period.

A deeply unsettled global macroeconomic environment was broadly supportive of fixed income prices during the Series’ fiscal year, as investors generally accepted low nominal yields in exchange for mitigating risk.

Beginning in early spring 2011, for example, a series of events seemed to curtail investors’ appetite for risk (thus boosting demand for U.S. Treasurys). The tragic earthquake, tsunami, and nuclear crisis in Japan disrupted global supply chains, destabilizing what was still a fragile economic recovery in Europe. Additionally, geopolitical unrest in North Africa and the Middle East continued to contribute to higher commodity prices (especially oil), which compelled many consumers to pull back their spending even further.

In September 2011, demand for intermediate-term and long-maturity Treasury debt was strengthened by another Federal Reserve program called Operation Twist, in which the U.S. central bank began using proceeds from the sale and maturing of its short-term Treasury holdings to buy longer-dated government paper in an attempt to drive down mortgage rates. During the final months of the Series’ fiscal year, a firmer tone to U.S. economic data caused a rally in credit-sensitive sectors of the fixed income market, most notably high yield bonds. (Source: Bloomberg.)

The Series’ commitment to seek broad diversification allows us the flexibility to shift the portfolio’s holdings across many fixed income asset classes based on where we believe the best opportunities potentially lie. While we generally shied away from riskier asset classes during the fiscal year, the Series’ relatively minimal exposure to areas such as emerging market and non-dollar debt, at times, detracted from its returns versus the benchmark.

Performance generally benefited from its overweight position in investment grade corporate bonds. Within this asset class, we concluded that the BBB- and A-rated area generally offered the best risk-reward trade-off, and we emphasized positions in those categories. We maintained an overweight exposure to the financial sector, with a focus on domestic finance and banking names. We decreased this exposure as European debt and banking issues threatened to influence U.S. entities. Additionally, legacy housing issues negatively influenced the sector in 2011. We hedged the Series’ finance exposure with CDX protection on the European banking sector. An overweight exposure to industrial company bonds was a significant contributor to returns. This sector enjoyed price gains as the U.S. Treasury market generally rallied in price during the fiscal year.

Exposure to high-quality sovereign investments contributed to the Series’ returns in 2011. We found favor with investments in countries that we believe have generally practiced fiscal prudence, and that also enjoy the benefits of natural resources development. Australian, Canadian, and Norwegian bonds have been prominent investments in the Series. We found it necessary to hedge part of the currency exposure, but still captured gains as the bonds and notes rallied.

Exposures to the lower-credit-quality sectors of bank loans, convertible bonds, and traditional high yield bonds, lagged general market returns. The slowing of domestic economic activity, along with diminished prospects for growth abroad, caused an increase in required yield premiums for these sectors.

A relatively small allocation to U.S. Treasury notes and bonds detracted from performance in 2011. This sector enjoyed a flight-to-quality bid as the European situation deteriorated throughout most of this period. As mentioned, the Fed’s Operation Twist program supported longer-maturity Treasury bonds in 2011. We augmented the Series’ small allocation to this sector with interest rate futures, thereby attempting to capture some of this effect.

We believe the sluggish pace of global economic growth should continue, or even decelerate, as the deleveraging cycle plays out and expands to include governmental entities worldwide. Within this environment, we believe that a “normal” cyclical recovery is unlikely unless policy makers embrace systemic changes that promote robust productivity growth and discourage excessive debt accumulation. Until then, we plan to continue to seek value and focus on quality, liquidity, and downside protection for taking risk.

Unless otherwise noted, views expressed herein are current as of Dec. 31, 2011, and are subject to change.

Diversified Income Series-1

Delaware VIP® Trust — Delaware VIP Diversified Income Series

Performance summary

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Carefully consider the Series’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Series’ prospectuses and, if available, their summary prospectuses, which may be obtained by calling 800 523-1918. Investors should read the prospectuses and, if available, the summary prospectuses carefully before investing.

| Delaware VIP Diversified Income Series | | | | | | | | | | |

| Average annual total returns | | | | | | | | | | |

| For periods ended Dec. 31, 2011 | | 1 year | | 3 years | | 5 years | | 10 years | | Lifetime |

| Standard Class shares (commenced operations on May 16, 2003) | | +6.39% | | +13.43% | | +8.44% | | n/a | | +7.31% |

| Service Class shares (commenced operations on May 16, 2003) | | +6.15% | | +13.19% | | +8.18% | | n/a | | +7.03% |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

As described in the Series’ most recent prospectus, the net expense ratio for Service Class shares of the Series was 0.95%, while total operating expenses for Standard Class and Service Class shares were 0.70% and 1.00%, respectively. The management fee for Standard Class and Service Class shares was 0.60%.

The Series’ distributor has contracted to limit the 12b-1 fees for Service Class shares to no more than 0.25% of average daily net assets from April 29, 2011, through April 30, 2012.

Earnings from a variable annuity or variable life investment compound tax-free until withdrawal, and as a result, no adjustments were made for income taxes.

Expense limitations were in effect for all classes during certain periods shown in the Series performance chart above and in the Performance of a $10,000 Investment chart on the next page.

Performance data do not reflect insurance fees related to a variable annuity or variable life investment or the deferred sales charge that would apply to certain withdrawals of investments held for fewer than eight years. Performance shown here would have been reduced if such fees were included and the expense limitation removed. For more information about fees, consult your variable annuity or variable life prospectus.

Investments in variable products involve risk.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Series may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Series may be prepaid prior to maturity, potentially forcing the Series to reinvest that money at a lower interest rate.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Series to obtain precise valuations of the high yield securities in its portfolio.

The Series may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivative transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

The Series may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

If and when the Series invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Series will be subject to special risks, including counterparty risk.

Please read both the contract and underlying prospectus for specific details regarding the product’s risk profile.

Diversified Income Series-2

Delaware VIP® Diversified Income Series

Performance summary (continued)

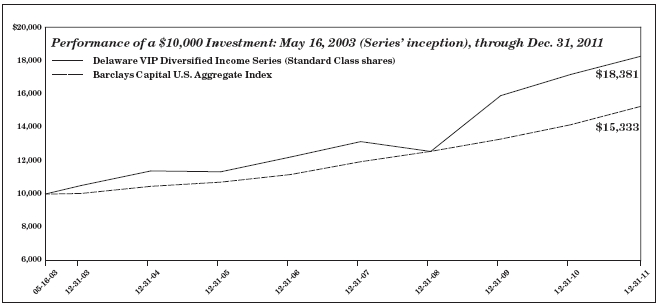

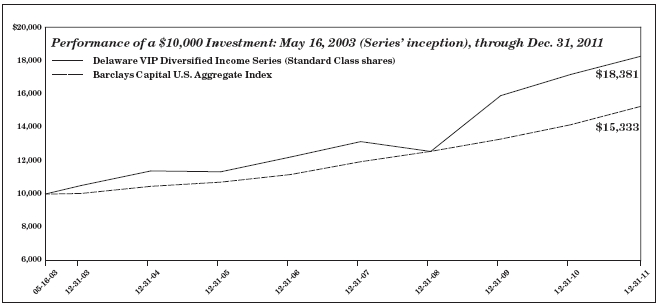

| For period beginning May 16, 2003 (Series’ inception), through Dec. 31, 2011 | | Starting value | | Ending value |

| –– | Delaware VIP Diversified Income Series (Standard Class shares) | | $10,000 | | $18,381 |

| – – | Barclays Capital U.S. Aggregate Index | | $10,000 | | $15,333 |

The chart shows a $10,000 investment in the Delaware VIP Diversified Income Series Standard Class shares for the period from May 16, 2003, through Dec. 31, 2011.

The chart also shows $10,000 invested in the Barclays Capital U.S. Aggregate Index for the period from May 16, 2003, through Dec. 31, 2011. The Barclays Capital U.S. Aggregate Index is a broad composite of more than 8,000 securities that tracks the investment grade domestic bond market.

Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

Performance of Service Class shares will vary due to different charges and expenses.

Past performance is not a guarantee of future results.

Diversified Income Series-3

Delaware VIP® Trust — Delaware VIP Diversified Income Series

Disclosure of Series Expenses

For the Six Month Period July 1, 2011 to December 31, 2011

As a shareholder of the Series, you incur ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Series expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six month period from July 1, 2011 to December 31, 2011.

Actual Expenses

The first section of the table shown, “Actual Series Return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second section of the table shown, “Hypothetical 5% Return,” provides information about hypothetical account values and hypothetical expenses based on the Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. As a shareholder of the Series, you do not incur any transaction costs, such as sales charges (loads), redemption fees or exchange fees, but shareholders of other funds may incur such costs. Also, the fees related to the variable annuity investment or the deferred sales charge that could apply have not been included. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The Series’ actual expenses shown in the table reflect fee waivers in effect for Service Class shares. The expenses shown in the table assume reinvestment of all dividends and distributions.

Expense Analysis of an Investment of $1,000

| | | | | | | | | | | | Expenses |

| | Beginning | | | Ending | | | | Paid During |

| | Account | | Account | | Annualized | | Period |

| | Value | | Value | | Expense | | 7/1/11 to |

| | 7/1/11 | | 12/31/11 | | Ratio | | 12/31/11* |

| Actual Series Return | | | | | | | | | | | | | | | |

| Standard Class | | | $ | 1,000.00 | | | $ | 1,030.90 | | 0.68% | | | $ | 3.48 | |

| Service Class | | | | 1,000.00 | | | | 1,029.10 | | 0.93% | | | | 4.76 | |

| Hypothetical 5% Return (5% return before expenses) | | | | | |

| Standard Class | | | $ | 1,000.00 | | | $ | 1,021.78 | | 0.68% | | | $ | 3.47 | |

| Service Class | | | | 1,000.00 | | | $ | 1,020.52 | | 0.93% | | | | 4.74 | |

*“Expenses Paid During Period” are equal to the Series’ annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Diversified Income Series-4

Delaware VIP® Trust — Delaware VIP Diversified Income Series

Security Type/Sector Allocation

As of December 31, 2011

Sector designations may be different than the sector designations presented in other Series materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one series being different than another series’ sector designations.

| Percentage |

| Security Type/Sector | of Net Assets |

| Agency Asset-Backed Securities | 0.02 | % |

| Agency Collateralized Mortgage Obligations | 2.05 | % |

| Agency Mortgage-Backed Securities | 9.14 | % |

| Commercial Mortgage-Backed Securities | 4.67 | % |

| Convertible Bonds | 1.69 | % |

| Corporate Bonds | 48.81 | % |

| Automotive | 1.06 | % |

| Banking | 5.52 | % |

| Basic Industry | 5.29 | % |

| Brokerage | 0.43 | % |

| Capital Goods | 1.04 | % |

| Communications | 6.46 | % |

| Consumer Cyclical | 1.14 | % |

| Consumer Non-Cyclical | 4.75 | % |

| Electric | 3.16 | % |

| Energy | 4.89 | % |

| Finance Companies | 1.80 | % |

| Healthcare | 0.97 | % |

| Insurance | 1.76 | % |

| Natural Gas | 3.20 | % |

| Real Estate | 2.07 | % |

| Services | 1.30 | % |

| Technology | 1.97 | % |

| Transportation | 1.46 | % |

| Utilities | 0.54 | % |

| Municipal Bond | 0.00 | % |

| Non-Agency Asset-Backed Securities | 1.22 | % |

| Non-Agency Collateralized Mortgage Obligations | 0.60 | % |

| Regional Bonds | 4.16 | % |

| Senior Secured Loans | 3.99 | % |

| Sovereign Bonds | 10.61 | % |

| Supranational Banks | 0.57 | % |

| U.S. Treasury Obligations | 6.30 | % |

| Common Stock | 0.00 | % |

| Convertible Preferred Stock | 0.23 | % |

| Preferred Stock | 0.32 | % |

| Warrant | 0.00 | % |

| Short-Term Investments | 10.35 | % |

| Securities Lending Collateral | 1.75 | % |

| Total Value of Securities | 106.48 | % |

| Written Options | (0.01 | %) |

| Obligation to Return Securities Lending Collateral | (1.85 | %) |

| Other Liabilities Net of Receivables and Other Assets | (4.62 | %) |

| Total Net Assets | 100.00 | % |

Diversified Income Series-5

Delaware VIP® Trust — Delaware VIP Diversified Income Series

Statement of Net Assets

December 31, 2011

| | | Principal | | Value |

| | | | Amount° | | (U.S. $) |

| AGENCY ASSET-BACKED | | | | | | | |

| SECURITIES–0.02% | | | | | | | |

| Fannie Mae Grantor Trust | | | | | | | |

| Series 2003-T4 2A5 | | | | | | | |

| 5.407% 9/26/33 | | USD | | 275,098 | | $ | 290,432 |

| •Fannie Mae Whole Loan | | | | | | | |

| Series 2002-W11 AV1 | | | | | | | |

| 0.634% 11/25/32 | | | | 4,000 | | | 3,694 |

| Total Agency Asset-Backed | | | | | | | |

| Securities (cost $277,894) | | | | | | | 294,126 |

| |

| AGENCY COLLATERALIZED | | | | | | | |

| MORTGAGE OBLIGATIONS–2.05% | | | | | | | |

| Fannie Mae Grantor Trust | | | | | | | |

| • | Series 1999-T2 A1 | | | | | | | |

| 7.50% 1/19/39 | | | | 935 | | | 1,039 |

| Series 2001-T8 A2 | | | | | | | |

| 9.50% 7/25/41 | | | | 7,922 | | | 9,249 |

| Series 2002-T4 A3 | | | | | | | |

| 7.50% 12/25/41 | | | | 18,464 | | | 21,251 |

| Series 2004-T1 1A2 | | | | | | | |

| 6.50% 1/25/44 | | | | 14,459 | | | 16,234 |

| Fannie Mae REMICs | | | | | | | |

| Series 1996-46 ZA | | | | | | | |

| 7.50% 11/25/26 | | | | 74,990 | | | 84,862 |

| Series 2001-50 BA | | | | | | | |

| 7.00% 10/25/41 | | | | 96,452 | | | 111,064 |

| Series 2002-90 A1 | | | | | | | |

| 6.50% 6/25/42 | | | | 11,573 | | | 13,389 |

| Series 2002-90 A2 | | | | | | | |

| 6.50% 11/25/42 | | | | 36,360 | | | 41,820 |

| Series 2003-26 AT | | | | | | | |

| 5.00% 11/25/32 | | | | 3,626,668 | | | 3,842,115 |

| Series 2003-38 MP | | | | | | | |

| 5.50% 5/25/23 | | | | 1,483,497 | | | 1,624,369 |

| Series 2003-122 AJ | | | | | | | |

| 4.50% 2/25/28 | | | | 39,179 | | | 40,005 |

| Series 2005-110 MB | | | | | | | |

| 5.50% 9/25/35 | | | | 337,961 | | | 372,175 |

| Series 2009-94 AC | | | | | | | |

| 5.00% 11/25/39 | | | | 1,400,000 | | | 1,573,486 |

| Series 2010-41 PN | | | | | | | |

| 4.50% 4/25/40 | | | | 1,675,000 | | | 1,823,232 |

| Series 2010-96 DC | | | | | | | |

| 4.00% 9/25/25 | | | | 3,200,000 | | | 3,444,596 |

| Series 2010-116 Z | | | | | | | |

| 4.00% 10/25/40 | | | | 78,839 | | | 78,479 |

| Fannie Mae Whole Loan | | | | | | | |

| • | Series 2002-W6 2A1 | | | | | | | |

| 6.658% 6/25/42 | | | | 33,175 | | | 37,492 |

| Series 2004-W9 2A1 | | | | | | | |

| 6.50% 2/25/44 | | | | 4,946 | | | 5,507 |

| Series 2004-W11 1A2 | | | | | | | |

| 6.50% 5/25/44 | | | | 56,364 | | | 62,857 |

| Freddie Mac REMICs | | | | | | | |

| Series 1730 Z 7.00% 5/15/24 | | | | 64,715 | | | 74,047 |

| Series 2326 ZQ 6.50% 6/15/31 | | | | 67,996 | | | 77,817 |

| Series 2557 WE 5.00% 1/15/18 | | | | 1,365,000 | | | 1,480,276 |

| Series 2622 PE 4.50% 5/15/18 | | | | 3,456,794 | | | 3,676,257 |

| Series 2662 MA 4.50% 10/15/31 | | | | 26,428 | | | 26,644 |

| Series 2687 PG 5.50% 3/15/32 | | | | 691,300 | | | 756,974 |

| Series 2694 QG 4.50% 1/15/29 | | | | 384,042 | | | 388,213 |

| Series 2762 LG 5.00% 9/15/32 | | | | 3,895,000 | | | 4,103,817 |

| Series 2809 DC 4.50% 6/15/19 | | | | 1,000,000 | | | 1,066,722 |

| Series 2872 GC 5.00% 11/15/29 | | | | 479,355 | | | 483,065 |

| Series 2890 PC 5.00% 7/15/30 | | | | 1,127,013 | | | 1,142,671 |

| Series 3022 MB 5.00% 12/15/28 | | | | 50,380 | | | 50,681 |

| Series 3123 HT 5.00% 3/15/26 | | | | 95,000 | | | 105,530 |

| Series 3128 BC 5.00% 10/15/27 | | | | 330,720 | | | 330,674 |

| Series 3131 MC 5.50% 4/15/33 | | | | 930,000 | | | 990,090 |

| Series 3337 PB 5.50% 7/15/30 | | | | 352,774 | | | 353,794 |

| Series 3416 GK 4.00% 7/15/22 | | | | 21,798 | | | 22,599 |

| Series 3656 PM 5.00% 4/15/40 | | | | 2,540,000 | | | 2,857,835 |

| wFreddie Mac Structured Pass | | | | | | | |

| Through Securities | | | | | | | |

| Series T-54 2A 6.50% 2/25/43 | | | | 19,708 | | | 21,938 |

| Series T-58 2A 6.50% 9/25/43 | | | | 7,826 | | | 8,983 |

| GNMA Series 2010-113 KE | | | | | | | |

| 4.50% 9/20/40 | | | | 4,115,000 | | | 4,608,203 |

| NCUA Guaranteed Notes | | | | | | | |

| Series 2010-C1 A2 | | | | | | | |

| 2.90% 10/29/20 | | | | 1,420,000 | | | 1,499,253 |

| Total Agency Collateralized | | | | | | | |

| Mortgage Obligations | | | | | | | |

| (cost $35,480,308) | | | | | | | 37,329,304 |

| |

| AGENCY MORTGAGE-BACKED | | | | | | | |

| SECURITIES–9.14% | | | | | | | |

| Fannie Mae | | | | | | | |

| 5.50% 1/1/13 | | | | 12,588 | | | 12,837 |

| 6.50% 8/1/17 | | | | 17,978 | | | 19,693 |

| •Fannie Mae ARM | | | | | | | |

| 2.277% 10/1/33 | | | | 22,302 | | | 23,364 |

| 5.05% 8/1/35 | | | | 67,742 | | | 72,290 |

| 5.139% 11/1/35 | | | | 447,326 | | | 474,934 |

| 5.534% 6/1/37 | | | | 6,660 | | | 7,104 |

| 5.938% 8/1/37 | | | | 443,683 | | | 480,812 |

| Fannie Mae Relocation 15 yr | | | | | | | |

| 4.00% 9/1/20 | | | | 302,737 | | | 312,964 |

| Fannie Mae Relocation 30 yr | | | | | | | |

| 5.00% 11/1/33 | | | | 13,063 | | | 13,988 |

| 5.00% 8/1/34 | | | | 14,149 | | | 15,151 |

| 5.00% 11/1/34 | | | | 26,689 | | | 28,578 |

| 5.00% 4/1/35 | | | | 66,295 | | | 70,990 |

| | 5.00% 10/1/35 | | | | 116,501 | | | 124,751 |

| 5.00% 1/1/36 | | | | 153,753 | | | 164,642 |

| 5.00% 2/1/36 | | | | 72,711 | | | 77,860 |

Diversified Income Series-6

Delaware VIP® Diversified Income Series

Statement of Net Assets (continued)

| | | Principal | | Value |

| | | | Amount° | | (U.S. $) |

| AGENCY MORTGAGE-BACKED | | | | | | | |

| SECURITIES (continued) | | | | | | | |

| Fannie Mae S.F. 15 yr | | | | | | | |

| 3.00% 11/1/26 | | USD | | 1,628,105 | | $ | 1,684,206 |

| 4.00% 7/1/25 | | | | 3,662,148 | | | 3,863,465 |

| 4.00% 11/1/25 | | | | 5,632,699 | | | 5,993,388 |

| 4.50% 3/1/39 | | | | 752,745 | | | 801,658 |

| 5.00% 5/1/21 | | | | 336,108 | | | 363,080 |

| 6.00% 12/1/22 | | | | 1,237,031 | | | 1,341,312 |

| Fannie Mae S.F. 15 yr TBA | | | | | | | |

| 3.50% 1/1/26 | | | | 1,000,000 | | | 1,045,625 |

| Fannie Mae S.F. 20 yr | | | | | | | |

| 5.00% 8/1/28 | | | | 1,261,308 | | | 1,363,243 |

| 5.50% 8/1/28 | | | | 1,459,882 | | | 1,589,498 |

| Fannie Mae S.F. 30 yr | | | | | | | |

| 5.00% 5/1/34 | | | | 8,193 | | | 8,860 |

| 5.00% 1/1/35 | | | | 10,825 | | | 11,706 |

| 5.00% 5/1/35 | | | | 21,304 | | | 23,033 |

| 5.00% 6/1/35 | | | | 37,224 | | | 40,244 |

| 5.00% 9/1/35 | | | | 422,774 | | | 457,073 |

| 5.00% 12/1/36 | | | | 3,447,451 | | | 3,727,139 |

| 5.00% 12/1/37 | | | | 426,957 | | | 461,529 |

| 5.00% 2/1/38 | | | | 312,485 | | | 337,788 |

| 6.00% 7/1/38 | | | | 9,918,325 | | | 10,932,204 |

| 6.50% 2/1/36 | | | | 886,396 | | | 999,628 |

| 6.50% 3/1/36 | | | | 870,373 | | | 981,558 |

| 7.50% 3/1/32 | | | | 619 | | | 740 |

| 7.50% 4/1/32 | | | | 2,143 | | | 2,566 |

| Fannie Mae S.F. 30 yr TBA | | | | | | | |

| 3.50% 1/1/41 | | | | 24,865,000 | | | 25,572,098 |

| 4.00% 2/1/41 | | | | 16,700,000 | | | 17,498,470 |

| 5.50% 1/1/38 | | | | 31,330,000 | | | 34,115,431 |

| 6.00% 1/1/38 | | | | 35,635,000 | | | 39,237,479 |

| 6.00% 2/1/38 | | | | 5,765,000 | | | 6,334,294 |

| •Freddie Mac ARM | | | | | | | |

| 2.467% 12/1/33 | | | | 44,986 | | | 47,044 |

| 2.495% 7/1/36 | | | | 209,713 | | | 220,754 |

| 2.61% 4/1/34 | | | | 2,763 | | | 2,922 |

| 4.649% 2/1/37 | | | | 360,610 | | | 382,873 |

| 5.266% 8/1/37 | | | | 6,700 | | | 7,138 |

| 5.734% 6/1/37 | | | | 515,164 | | | 549,085 |

| 5.927% 10/1/37 | | | | 150,163 | | | 162,153 |

| 6.208% 10/1/37 | | | | 8,748 | | | 9,446 |

| Freddie Mac Relocation 30 yr | | | | | | | |

| 5.00% 9/1/33 | | | | 26,539 | | | 28,331 |

| Freddie Mac S.F. 15 yr | | | | | | | |

| 4.50% 5/1/20 | | | | 725,824 | | | 773,556 |

| 5.00% 6/1/18 | | | | 256,627 | | | 274,565 |

| Freddie Mac S.F. 30 yr | | | | | | | |

| 4.50% 10/1/35 | | | | 619,730 | | | 658,423 |

| 5.00% 3/1/34 | | | | 29,976 | | | 32,965 |

| 5.00% 2/1/36 | | | | 10,968 | | | 11,802 |

| 6.00% 2/1/36 | | | | 1,354,760 | | | 1,492,612 |

| 6.50% 8/1/38 | | | | 362,996 | | | 406,851 |

| GNMA I S.F. 30 yr 7.00% 12/15/34 | | | | 307,114 | | | 350,912 |

| Total Agency Mortgage-Backed | | | | | | | |

| Securities (cost $163,348,149) | | | | | | | 166,098,705 |

| | | | | | | | |

| COMMERCIAL MORTGAGE-BACKED | | | | | | | |

| SECURITIES–4.67% | | | | | | | |

| #American Tower Trust | | | | | | | |

| Series 2007-1A AFX | | | | | | | |

| 144A 5.42% 4/15/37 | | | | 1,890,000 | | | 2,003,103 |

| BAML Commercial | | | | | | | |

| Mortgage Securities | | | | | | | |

| Series 2004-2 A3 | | | | | | | |

| 4.05% 11/10/38 | | | | 197,275 | | | 199,604 |

| • | Series 2004-3 A5 | | | | | | | |

| 5.54% 6/10/39 | | | | 1,175,415 | | | 1,265,565 |

| • | Series 2005-1 A5 | | | | | | | |

| 5.162% 11/10/42 | | | | 4,615,000 | | | 5,030,018 |

| • | Series 2005-6 A4 | | | | | | | |

| 5.193% 9/10/47 | | | | 1,280,000 | | | 1,415,666 |

| • | Series 2006-2 A4 | | | | | | | |

| 5.731% 5/10/45 | | | | 1,765,000 | | | 1,975,745 |

| Series 2006-4 A4 | | | | | | | |

| 5.634% 7/10/46 | | | | 3,465,000 | | | 3,834,182 |

| •Bear Stearns Commercial | | | | | | | |

| Mortgage Securities | | | | | | | |

| Series 2005-PW10 A4 | | | | | | | |

| 5.405% 12/11/40 | | | | 1,684,000 | | | 1,853,707 |

| Series 2005-T20 A4A | | | | | | | |

| 5.145% 10/12/42 | | | | 870,000 | | | 962,130 |

| Series 2006-PW12 A4 | | | | | | | |

| 5.72% 9/11/38 | | | | 1,230,000 | | | 1,372,017 |

| #CFCRE Commercial Mortgage | | | | | | | |

| Trust Series 2011-C1 A2 144A | | | | | | | |

| 3.759% 4/15/44 | | | | 1,115,000 | | | 1,160,899 |

| •Citigroup/Deutsche Bank | | | | | | | |

| Commercial Mortgage | | | | | | | |

| Trust Series 2005-CD1 A4 | | | | | | | |

| 5.225% 7/15/44 | | | | 1,350,000 | | | 1,491,998 |

| wCommercial Mortgage Pass | | | | | | | |

| Through Certificates | | | | | | | |

| • | Series 2005-C6 A5A | | | | | | | |

| 5.116% 6/10/44 | | | | 2,540,000 | | | 2,784,782 |

| Series 2006-C7 A2 | | | | | | | |

| 5.69% 6/10/46 | | | | 27,088 | | | 27,078 |

| # | Series 2010-C1 A1 144A | | | | | | | |

| 3.156% 7/10/46 | | | | 1,826,787 | | | 1,874,026 |

| •Credit Suisse Mortgage Capital | | | | | | | |

| Certificates Series 2006-C1 AAB | | | | | | | |

| 5.419% 2/15/39 | | | | 93,972 | | | 98,739 |

| •#DBUBS Mortgage Trust | | | | | | | |

| Series 2011-LC1A C 144A | | | | | | | |

| 5.557% 11/10/46 | | | | 1,720,000 | | | 1,619,045 |

| Goldman Sachs Mortgage | | | | | | | |

| Securities II | | | | | | | |

| *• | Series 2004-GG2 A6 | | | | | | | |

| 5.396% 8/10/38 | | | | 2,310,000 | | | 2,473,481 |

| Series 2005-GG4 A4 | | | | | | | |

| 4.761% 7/10/39 | | | | 2,070,000 | | | 2,169,337 |

| Series 2005-GG4 A4A | | | | | | | |

| 4.751% 7/10/39 | | | | 5,185,000 | | | 5,535,060 |

Diversified Income Series-7

Delaware VIP® Diversified Income Series

Statement of Net Assets (continued)

| | | Principal | | Value |

| | | | Amount° | | (U.S. $) |

| COMMERCIAL MORTGAGE-BACKED | | | | | | | |

| SECURITIES (continued) | | | | | | | |

| Goldman Sachs Mortgage | | | | | | | |

| Securities II (continued) | | | | | | | |

| • | Series 2006-GG6 A4 | | | | | | | |

| 5.553% 4/10/38 | | USD | | 4,245,000 | | $ | 4,615,313 |

| # | Series 2010-C1 A2 144A | | | | | | | |

| 4.592% 8/10/43 | | | | 3,090,000 | | | 3,383,550 |

| •# | Series 2010-C1 C 144A | | | | | | | |

| 5.635% 8/10/43 | | | | 3,340,000 | | | 3,029,998 |

| •Greenwich Capital Commercial | | | | | | | |

| Funding Series 2005-GG5 A5 | | | | | | | |

| 5.224% 4/10/37 | | | | 6,780,000 | | | 7,259,231 |

| •JPMorgan Chase Commercial | | | | | | | |

| Mortgage Securities | | | | | | | |

| Series 2005-LDP3 A4A | | | | | | | |

| 4.936% 8/15/42 | | | | 880,000 | | | 960,832 |

| Series 2005-LDP4 A4 | | | | | | | |

| 4.918% 10/15/42 | | | | 2,321,000 | | | 2,523,206 |

| Series 2005-LDP5 A4 | | | | | | | |

| 5.205% 12/15/44 | | | | 2,685,000 | | | 2,970,147 |

| Lehman Brothers-UBS Commercial | | | | | | | |

| Mortgage Trust Series 2004-C1 | | | | | | | |

| A4 4.568% 1/15/31 | | | | 2,710,000 | | | 2,832,638 |

| Merrill Lynch Mortgage Trust | | | | | | | |

| Series 2005-CIP1 A2 | | | | | | | |

| 4.96% 7/12/38 | | | | 1,083,471 | | | 1,093,293 |

| • | Series 2005-CKI1 A6 | | | | | | | |

| 5.22% 11/12/37 | | | | 900,000 | | | 996,609 |

| •Morgan Stanley Capital I | | | | | | | |

| Series 2004-T15 A4 | | | | | | | |

| 5.27% 6/13/41 | | | | 1,200,000 | | | 1,290,496 |

| Series 2007-T27 A4 | | | | | | | |

| 5.638% 6/11/42 | | | | 4,890,000 | | | 5,570,409 |

| •#Morgan Stanley Dean Witter | | | | | | | |

| Capital I Series 2001-TOP1 E | | | | | | | |

| 144A 7.412% 2/15/33 | | | | 100,000 | | | 98,069 |

| #OBP Depositor Trust Series | | | | | | | |

| 2010-OBP A 144A | | | | | | | |

| 4.646% 7/15/45 | | | | 1,890,000 | | | 2,112,867 |

| #Timberstar Trust Series 2006-1A A | | | | | | | |

| 144A 5.668% 10/15/36 | | | | 3,845,000 | | | 4,294,065 |

| #WF-RBS Commercial Mortgage | | | | | | | |

| Trust Series 2011-C3 A4 144A | | | | | | | |

| 4.375% 3/15/44 | | | | 2,460,000 | | | 2,619,403 |

| Total Commercial Mortgage- | | | | | | | |

| Backed Securities | | | | | | | |

| (cost $78,127,583) | | | | | | | 84,796,308 |

| |

| CONVERTIBLE BONDS–1.69% | | | | | | | |

| AAR 1.75% exercise price $29.27, | | | | | | | |

| expiration date 1/1/26 | | | | 1,014,000 | | | 1,014,000 |

| Advanced Micro Devices | | | | | | | |

| 5.75% exercise price $20.13, | | | | | | | |

| expiration date 8/15/12 | | | | 486,000 | | | 493,290 |

| 6.00% exercise price $28.08, | | | | | | | |

| expiration date 4/30/15 | | | | 1,054,000 | | | 1,034,238 |

| #Alaska Communications | | | | | | | |

| Systems Group 144A 6.25% | | | | | | | |

| exercise price $10.28, | | | | | | | |

| expiration date 4/27/18 | | | | 889,000 | | | 570,071 |

| Alcatel-Lucent USA 2.875% | | | | | | | |

| exercise price $15.35, | | | | | | | |

| expiration date 6/15/25 | | | | 1,185,000 | | | 1,045,763 |

| *Alere 3.00% exercise price $43.98, | | | | | | | |

| expiration date 5/15/16 | | | | 834,000 | | | 794,385 |

| #Altra Holdings 144A 2.75% | | | | | | | |

| exercise price $27.70, | | | | | | | |

| expiration date 2/27/31 | | | | 414,000 | | | 392,265 |

| Amgen 0.375% exercise price $78.45, | | | | | | | |

| expiration date 2/1/13 | | | | 1,220,000 | | | 1,230,675 |

| *#Ares Capital 144A 5.75% | | | | | | | |

| exercise price $19.12, | | | | | | | |

| expiration date 2/1/16 | | | | 917,000 | | | 887,198 |

| ϕArvinMeritor 4.00% | | | | | | | |

| exercise price $26.73, | | | | | | | |

| expiration date 2/15/27 | | | | 1,128,000 | | | 733,200 |

| #BGC Partners 144A 4.50% | | | | | | | |

| exercise price $9.84, | | | | | | | |

| expiration date 7/13/16 | | | | 241,000 | | | 212,080 |

| Chesapeake Energy 2.25% | | | | | | | |

| exercise price $85.81, | | | | | | | |

| expiration date 12/15/38 | | | | 861,000 | | | 714,630 |

| #Clearwire Communications 144A | | | | | | | |

| 8.25% exercise price $7.08, | | | | | | | |

| expiration date 11/30/40 | | | | 583,000 | | | 376,035 |

| #Corporate Office Properties 144A | | | | | | | |

| 4.25% exercise price $48.00, | | | | | | | |

| expiration date 4/12/30 | | | | 410,000 | | | 379,250 |

| Dendreon 2.875% | | | | | | | |

| exercise price $51.24, | | | | | | | |

| expiration date 1/13/16 | | | | 364,000 | | | 257,075 |

| Equinix 4.75% exercise price $84.32, | | | | | | | |

| expiration date 6/15/16 | | | | 606,000 | | | 855,975 |

| #Gaylord Entertainment 144A 3.75% | | | | | | | |

| exercise price $27.25, | | | | | | | |

| expiration date 9/29/14 | | | | 760,000 | | | 849,300 |

| ϕGeneral Cable 4.50% | | | | | | | |

| exercise price $36.75, | | | | | | | |

| expiration date 11/15/29 | | | | 512,000 | | | 487,040 |

| Health Care REIT 3.00% | | | | | | | |

| exercise price $51.13, | | | | | | | |

| expiration date 11/30/29 | | | | 901,000 | | | 1,035,024 |

| ϕHologic 2.00% exercise price $38.59, | | | | | | | |

| expiration date 12/15/37 | | | | 2,082,000 | | | 1,996,117 |

| Intel 2.95% exercise price $30.36, | | | | | | | |

| expiration date 12/15/35 | | | | 865,000 | | | 905,006 |

| James River Coal 4.50% | | | | | | | |

| exercise price $25.78, | | | | | | | |

| expiration date 12/1/15 | | | | 312,000 | | | 244,140 |

Diversified Income Series-8

Delaware VIP® Diversified Income Series

Statement of Net Assets (continued)

| | | Principal | | Value |

| | | | Amount° | | (U.S. $) |

| CONVERTIBLE BONDS (continued) | | | | | | | |

| Jefferies Group 3.875% | | | | | | | |

| exercise price $38.13, | | | | | | | |

| | expiration date 11/1/29 | | USD | | 929,000 | | $ | 771,070 |

| L-3 Communications Holdings | | | | | | | |

| 3.00% exercise price $96.48, | | | | | | | |

| expiration date 8/1/35 | | | | 570,000 | | | 548,625 |

| *Leap Wireless International 4.50% | | | | | | | |

| exercise price $93.21, | | | | | | | |

| expiration date 7/15/14 | | | | 1,241,000 | | | 1,085,875 |

| #Lexington Realty Trust 144A 6.00% | | | | | | | |

| exercise price $7.09, | | | | | | | |

| expiration date 1/11/30 | | | | 950,000 | | | 1,135,250 |

| Linear Technology 3.00% | | | | | | | |

| exercise price $43.39, | | | | | | | |

| expiration date 5/1/27 | | | | 1,760,000 | | | 1,806,199 |

| Live Nation Entertainment 2.875% | | | | | | | |

| exercise price $27.14, | | | | | | | |

| expiration date 7/14/27 | | | | 1,398,000 | | | 1,242,472 |

| MGM Resorts International 4.25% | | | | | | | |

| exercise price $18.58, | | | | | | | |

| expiration date 4/10/15 | | | | 369,000 | | | 351,011 |

| Mirant (Escrow) 2.50% | | | | | | | |

| exercise price $67.95, | | | | | | | |

| expiration date 6/15/21 | | | | 110,000 | | | 0 |

| National Retail Properties 5.125% | | | | | | | |

| exercise price $25.38, | | | | | | | |

| expiration date 6/15/28 | | | | 465,000 | | | 531,263 |

| NuVasive | | | | | | | |

| 2.25% exercise price $44.74, | | | | | | | |

| expiration date 3/15/13 | | | | 353,000 | | | 346,823 |

| 2.75% exercise price $42.13, | | | | | | | |

| expiration date 6/30/17 | | | | 614,000 | | | 450,523 |

| #Owens-Brockway Glass Container | | | | | | | |

| 144A 3.00% exercise price $47.47, | | | | | | | |

| expiration date 5/28/15 | | | | 1,432,000 | | | 1,338,919 |

| Pantry 3.00% exercise price $50.09, | | | | | | | |

| expiration date 11/15/12 | | | | 562,000 | | | 552,165 |

| *Peabody Energy 4.75% | | | | | | | |

| exercise price $58.31, | | | | | | | |

| expiration date 12/15/41 | | | | 151,000 | | | 154,775 |

| Rovi 2.625% exercise price $47.36, | | | | | | | |

| expiration date 2/10/40 | | | | 681,000 | | | 681,000 |

| SanDisk 1.50% exercise price $52.37, | | | | | | | |

| expiration date 8/11/17 | | | | 822,000 | | | 972,015 |

| SBA Communications 4.00% | | | | | | | |

| exercise price $30.38, | | | | | | | |

| expiration date 10/1/14 | | | | 380,000 | | | 579,500 |

| Transocean 1.50% | | | | | | | |

| exercise price $164.09, | | | | | | | |

| expiration date 12/15/37 | | | | 597,000 | | | 589,538 |

| VeriSign 3.25% exercise price $34.37, | | | | | | | |

| expiration date 8/15/37 | | | | 909,000 | | | 1,090,800 |

| Total Convertible Bonds | | | | | | | |

| (cost $30,961,364) | | | | | | | 30,734,580 |

| | | | | | | | |

| CORPORATE BONDS–48.81% | | | | | | | |

| Automotive–1.06% | | | | | | | |

| #Allison Transmission 144A | | | | | | | |

| 11.00% 11/1/15 | | | | 1,398,000 | | $ | 1,481,880 |

| *America Axle & Manufacturing | | | | | | | |

| 7.875% 3/1/17 | | | | 1,785,000 | | | 1,776,075 |

| ArvinMeritor 8.125% 9/15/15 | | | | 2,010,000 | | | 1,809,000 |

| #Chrysler Group 144A | | | | | | | |

| 8.25% 6/15/21 | | | | 1,250,000 | | | 1,143,750 |

| *Ford Motor 7.45% 7/16/31 | | | | 3,045,000 | | | 3,669,225 |

| Ford Motor Credit | | | | | | | |

| 5.00% 5/15/18 | | | | 3,075,000 | | | 3,090,661 |

| 12.00% 5/15/15 | | | | 1,445,000 | | | 1,780,948 |

| *Goodyear Tire & Rubber | | | | | | | |

| 8.25% 8/15/20 | | | | 790,000 | | | 865,050 |

| Johnson Controls 3.75% 12/1/21 | | | | 2,240,000 | | | 2,317,547 |

| Tomkins 9.00% 10/1/18 | | | | 1,136,000 | | | 1,265,220 |

| | | | | | | | 19,199,356 |

| Banking–5.52% | | | | | | | |

| Abbey National Treasury Services | | | | | | | |

| 4.00% 4/27/16 | | | | 2,245,000 | | | 2,016,050 |

| #AgriBank 144A 9.125% 7/15/19 | | | | 2,750,000 | | | 3,585,901 |

| #Bank of Montreal 144A | | | | | | | |

| 2.85% 6/9/15 | | | | 2,145,000 | | | 2,225,232 |

| BB&T 5.25% 11/1/19 | | | | 10,782,000 | | | 11,786,819 |

| BB&T Capital Trust II | | | | | | | |

| 6.75% 6/7/36 | | | | 2,470,000 | | | 2,475,839 |

| •BB&T Capital Trust IV | | | | | | | |

| 6.82% 6/12/57 | | | | 995,000 | | | 1,004,950 |

| #Canadian Imperial Bank of | | | | | | | |

| Commerce 144A 2.60% 7/2/15 | | | | 2,145,000 | | | 2,220,322 |

| Capital One Capital V | | | | | | | |

| 10.25% 8/15/39 | | | | 1,815,000 | | | 1,894,406 |

| City National 5.25% 9/15/20 | | | | 2,635,000 | | | 2,620,623 |

| @#CoBank 144A 7.875% 4/16/18 | | | | 2,634,000 | | | 3,155,759 |

| #Export-Import Bank of Korea 144A | | | | | | | |

| 5.25% 2/10/14 | | | | 2,435,000 | | | 2,567,902 |

| Fifth Third Bancorp | | | | | | | |

| 3.625% 1/25/16 | | | | 3,110,000 | | | 3,158,342 |

| •Fifth Third Capital Trust IV | | | | | | | |

| 6.50% 4/15/37 | | | | 3,835,000 | | | 3,777,475 |

| •#HBOS Capital Funding 144A | | | | | | | |

| 6.071% 6/29/49 | | | | 1,240,000 | | | 781,200 |

| HSBC 4.875% 1/14/22 | | | | 1,300,000 | | | 1,376,696 |

| JPMorgan Chase | | | | | | | |

| • | 4.642% 6/21/12 | | AUD | | 3,300,000 | | | 3,355,891 |

| 5.40% 1/6/42 | | USD | | 1,400,000 | | | 1,466,548 |

| 6.00% 10/1/17 | | | | 3,230,000 | | | 3,478,758 |

| JPMorgan Chase Capital XXV | | | | | | | |

| 6.80% 10/1/37 | | | | 4,307,000 | | | 4,366,221 |

| KeyBank 6.95% 2/1/28 | | | | 4,255,000 | | | 4,729,186 |

| KeyCorp 5.10% 3/24/21 | | | | 2,190,000 | | | 2,278,406 |

| Korea Development Bank | | | | | | | |

| 8.00% 1/23/14 | | | | 3,220,000 | | | 3,544,563 |

| •National City Bank 0.904% 6/7/17 | | | | 1,905,000 | | | 1,750,104 |

Diversified Income Series-9

Delaware VIP® Diversified Income Series

Statement of Net Assets (continued)

| | | | Principal | | Value |

| | | Amount° | | (U.S. $) |

| CORPORATE BONDS (continued) | | | | | | | |

| Banking (continued) | | | | | | | |

| PNC Bank 6.875% 4/1/18 | | USD | | 5,710,000 | | $ | 6,484,185 |

| •#PNC Preferred Funding Trust II | | | | | | | |

| 144A 6.113% 3/29/49 | | | | 2,500,000 | | | 1,837,500 |

| SunTrust Bank | | | | | | | |

| • | 0.796% 8/24/15 | | | | 1,965,000 | | | 1,825,579 |

| 3.50% 1/20/17 | | | | 2,785,000 | | | 2,802,576 |

| SVB Financial Group | | | | | | | |

| | 5.375% 9/15/20 | | | | 865,000 | | | 887,707 |

| U.S. Bank 4.95% 10/30/14 | | | | 1,755,000 | | | 1,908,592 |

| US Bancorp 4.125% 5/24/21 | | | | 1,000,000 | | | 1,113,248 |

| •USB Capital IX 3.50% 10/29/49 | | | | 8,100,000 | | | 5,658,174 |

| Wachovia | | | | | | | |

| • | 0.773% 10/15/16 | | | | 1,755,000 | | | 1,563,368 |

| 5.60% 3/15/16 | | | | 4,065,000 | | | 4,357,078 |

| Wells Fargo 4.75% 2/9/15 | | | | 2,165,000 | | | 2,260,344 |

| | | | | | | | 100,315,544 |

| Basic Industry–5.29% | | | | | | | |

| *AK Steel 7.625% 5/15/20 | | | | 1,295,000 | | | 1,223,775 |

| Alcoa | | | | | | | |

| 5.40% 4/15/21 | | | | 2,480,000 | | | 2,489,121 |

| 6.75% 7/15/18 | | | | 3,610,000 | | | 3,990,364 |

| #Algoma Acquisition 144A | | | | | | | |

| 9.875% 6/15/15 | | | | 1,305,000 | | | 1,128,825 |

| ArcelorMittal 9.85% 6/1/19 | | | | 4,000,000 | | | 4,454,804 |

| Barrick North America Finance | | | | | | | |

| 4.40% 5/30/21 | | | | 6,620,000 | | | 7,183,335 |

| #Cemex Espana Luxembourg 144A | | | | | | | |

| 9.25% 5/12/20 | | | | 1,059,000 | | | 818,078 |

| *#Cemex Finance 144A | | | | | | | |

| 9.50% 12/14/16 | | | | 620,000 | | | 547,150 |

| •#Cemex SAB 144A 5.579% 9/30/15 | | | | 3,493,000 | | | 2,632,849 |

| Century Aluminum 8.00% 5/15/14 | | | | 1,229,000 | | | 1,232,073 |

| CF Industries 7.125% 5/1/20 | | | | 1,165,000 | | | 1,380,525 |

| #CODELCO 144A 3.75% 11/4/20 | | | | 1,198,000 | | | 1,222,614 |

| Compass Minerals International | | | | | | | |

| 8.00% 6/1/19 | | | | 904,000 | | | 978,580 |

| Dow Chemical | | | | | | | |

| 4.125% 11/15/21 | | | | 2,630,000 | | | 2,702,983 |

| 8.55% 5/15/19 | | | | 9,021,000 | | | 11,819,421 |

| Ecolab | | | | | | | |

| 3.00% 12/8/16 | | | | 4,860,000 | | | 5,032,982 |

| 5.50% 12/8/41 | | | | 980,000 | | | 1,090,160 |

| #FMG Resources August 2006 144A | | | | | | | |

| 7.00% 11/1/15 | | | | 1,070,000 | | | 1,086,050 |

| Georgia-Pacific 8.00% 1/15/24 | | | | 5,225,000 | | | 6,712,849 |

| #Georgia-Pacific 144A | | | | | | | |

| 5.40% 11/1/20 | | | | 395,000 | | | 438,298 |

| 8.25% 5/1/16 | | | | 455,000 | | | 505,647 |

| Headwaters 7.625% 4/1/19 | | | | 1,585,000 | | | 1,410,650 |

| Hexion U.S. Finance | | | | | | | |

| 8.875% 2/1/18 | | | | 1,165,000 | | | 1,098,013 |

| International Paper | | | | | | | |

| 4.75% 2/15/22 | | | | 275,000 | | | 292,890 |

| 9.375% 5/15/19 | | | | 2,990,000 | | | 3,890,851 |

| #Kinross Gold 144A 5.125% 9/1/21 | | | | 2,365,000 | | | 2,325,419 |

| Lyondell Chemical 8.00% 11/1/17 | | | | 225,000 | | | 246,938 |

| #MacDermid 144A 9.50% 4/15/17 | | | | 1,111,000 | | | 1,111,000 |

| Mohawk Industries | | | | | | | |

| 6.875% 1/15/16 | | | | 621,000 | | | 670,680 |

| *Momentive Performance Materials | | | | | | | |

| 11.50% 12/1/16 | | | | 1,460,000 | | | 1,095,000 |

| #Nalco 144A 6.625% 1/15/19 | | | | 560,000 | | | 648,200 |

| #Newcrest Finance 144A | | | | | | | |

| 4.45% 11/15/21 | | | | 1,260,000 | | | 1,245,282 |

| Norcraft Finance | | | | | | | |

| 10.50% 12/15/15 | | | | 1,445,000 | | | 1,354,688 |

| #Nortek 144A 8.50% 4/15/21 | | | | 1,380,000 | | | 1,173,000 |

| Novelis 8.75% 12/15/20 | | | | 1,475,000 | | | 1,589,313 |

| Ply Gem Industries | | | | | | | |

| 13.125% 7/15/14 | | | | 1,385,000 | | | 1,232,650 |

| =@Port Townsend 12.431% 8/27/12 | | | | 209,728 | | | 95,426 |

| Rio Tinto Finance USA | | | | | | | |

| 3.75% 9/20/21 | | | | 5,270,000 | | | 5,533,489 |

| Ryerson | | | | | | | |

| • | 7.804% 11/1/14 | | | | 457,000 | | | 422,725 |

| 12.00% 11/1/15 | | | | 1,155,000 | | | 1,172,325 |

| Smurfit Kappa Funding | | | | | | | |

| 7.75% 4/1/15 | | | | 945,000 | | | 949,725 |

| Steel Dynamics 7.75% 4/15/16 | | | | 1,465,000 | | | 1,534,588 |

| Teck Resources | | | | | | | |

| 4.75% 1/15/22 | | | | 1,270,000 | | | 1,367,854 |

| 9.75% 5/15/14 | | | | 1,280,000 | | | 1,505,030 |

| #Xstrata Canada Financial 144A | | | | | | | |

| 4.95% 11/15/21 | | | | 5,350,000 | | | 5,476,319 |

| | | | | | | | 96,112,538 |

| Brokerage–0.43% | | | | | | | |

| •Bear Stearns 4.947% 12/7/12 | | AUD | | 1,440,000 | | | 1,458,115 |

| Jefferies Group | | | | | | | |

| 6.25% 1/15/36 | | USD | | 695,000 | | | 575,249 |

| 6.45% 6/8/27 | | | | 878,000 | | | 739,715 |

| Lazard Group 6.85% 6/15/17 | | | | 4,829,000 | | | 5,071,222 |

| | | | | | | | 7,844,301 |

| Capital Goods–1.04% | | | | | | | |

| Anixter 10.00% 3/15/14 | | | | 426,000 | | | 466,470 |

| Berry Plastics 9.75% 1/15/21 | | | | 1,155,000 | | | 1,157,888 |

| Case New Holland 7.75% 9/1/13 | | | | 1,000,000 | | | 1,067,500 |

| Kratos Defense & Security | | | | | | | |

| Solutions 10.00% 6/1/17 | | | | 565,000 | | | 581,950 |

| #Meccanica Holdings USA 144A | | | | | | | |

| 6.25% 7/15/19 | | | | 3,640,000 | | | 2,984,174 |

| #Plastipak Holdings 144A | | | | | | | |

| 10.625% 8/15/19 | | | | 873,000 | | | 969,030 |

| Pregis 12.375% 10/15/13 | | | | 1,193,000 | | | 1,145,280 |

| *RBS Global/Rexnord | | | | | | | |

| 11.75% 8/1/16 | | | | 928,000 | | | 979,040 |

| Republic Services | | | | | | | |

| 5.70% 5/15/41 | | | | 95,000 | | | 109,389 |

Diversified Income Series-10

Delaware VIP® Diversified Income Series

Statement of Net Assets (continued)

| | | | Principal | | Value |

| | | Amount° | | (U.S. $) |

| CORPORATE BONDS (continued) | | | | | | | |

| Capital Goods (continued) | | | | | | | |

| #Reynolds Group Issuer 144A | | | | | | | |

| 9.00% 4/15/19 | | USD | | 3,065,000 | | $ | 2,927,075 |

| Stanley Black & Decker | | | | | | | |

| 3.40% 12/1/21 | | | | 1,580,000 | | | 1,615,577 |

| TriMas 9.75% 12/15/17 | | | | 815,000 | | | 888,350 |

| #Votorantim Cimentos 144A | | | | | | | |

| 7.25% 4/5/41 | | | | 4,135,000 | | | 4,041,962 |

| | | | | | | | 18,933,685 |

| Communications–6.46% | | | | | | | |

| Affinion Group 7.875% 12/15/18 | | | | 1,400,000 | | | 1,190,000 |

| America Movil SAB | | | | | | | |

| 5.00% 3/30/20 | | | | 2,720,000 | | | 3,018,580 |

| American Tower REIT | | | | | | | |

| 5.90% 11/1/21 | | | | 5,135,000 | | | 5,408,833 |

| Avaya 9.75% 11/1/15 | | | | 1,185,000 | | | 1,072,425 |

| #Avaya 144A 7.00% 4/1/19 | | | | 1,265,000 | | | 1,233,375 |

| Avaya PIK 10.125% 11/1/15 | | | | 455,000 | | | 411,775 |

| #Brasil Telecom 144A | | | | | | | |

| 9.75% 9/15/16 | | BRL | | 7,508,000 | | | 3,969,181 |

| *CCO Holdings 7.375% 6/1/20 | | USD | | 220,000 | | | 233,200 |

| CenturyLink 6.45% 6/15/21 | | | | 1,875,000 | | | 1,881,744 |

| Citizens Communications | | | | | | | |

| 6.25% 1/15/13 | | | | 336,000 | | | 344,400 |

| Clear Channel Communications | | | | | | | |

| 9.00% 3/1/21 | | | | 635,000 | | | 538,163 |

| #Clearwire Communications 144A | | | | | | | |

| 12.00% 12/1/15 | | | | 2,169,000 | | | 2,087,663 |

| #Columbus International 144A | | | | | | | |

| 11.50% 11/20/14 | | | | 1,925,000 | | | 2,045,313 |

| *Cricket Communications | | | | | | | |

| 7.75% 10/15/20 | | | | 1,910,000 | | | 1,676,025 |

| Crown Castle International | | | | | | | |

| 9.00% 1/15/15 | | | | 270,000 | | | 293,963 |

| #Crown Castle Towers 144A | | | | | | | |

| 4.883% 8/15/20 | | | | 9,815,000 | | | 10,048,959 |

| #Digicel 144A 8.25% 9/1/17 | | | | 185,000 | | | 187,775 |

| #Digicel Group 144A | | | | | | | |

| 8.875% 1/15/15 | | | | 670,000 | | | 663,300 |

| 10.50% 4/15/18 | | | | 280,000 | | | 284,200 |

| DIRECTV Holdings 5.00% 3/1/21 | | | | 3,055,000 | | | 3,275,556 |

| DISH DBS | | | | | | | |

| 6.75% 6/1/21 | | | | 603,000 | | | 652,748 |

| 7.875% 9/1/19 | | | | 1,140,000 | | | 1,293,900 |

| Entravision Communications | | | | | | | |

| 8.75% 8/1/17 | | | | 635,000 | | | 625,475 |

| Historic TW 6.875% 6/15/18 | | | | 4,410,000 | | | 5,262,831 |

| Intelsat Bermuda 11.25% 2/4/17 | | | | 1,545,000 | | | 1,498,650 |

| #Intelsat Bermuda PIK 144A | | | | | | | |

| 11.50% 2/4/17 | | | | 610,000 | | | 590,175 |

| Intelsat Jackson Holdings | | | | | | | |

| 7.25% 10/15/20 | | | | 835,000 | | | 849,613 |

| 11.25% 6/15/16 | | | | 693,000 | | | 729,816 |

| Lamar Media 6.625% 8/15/15 | | | | 829,000 | | | 849,725 |

| Level 3 Financing | | | | | | | |

| 9.25% 11/1/14 | | | | 218,000 | | | 223,995 |

| 10.00% 2/1/18 | | | | 930,000 | | | 990,450 |

| MetroPCS Wireless | | | | | | | |

| 6.625% 11/15/20 | | | | 655,000 | | | 612,425 |

| Nielsen Finance | | | | | | | |

| 11.50% 5/1/16 | | | | 383,000 | | | 440,450 |

| * | 11.625% 2/1/14 | | | | 368,000 | | | 424,580 |

| NII Capital 10.00% 8/15/16 | | | | 1,400,000 | | | 1,596,000 |

| PAETEC Holding 8.875% 6/30/17 | | | | 698,000 | | | 757,330 |

| Qwest | | | | | | | |

| 6.75% 12/1/21 | | | | 2,230,000 | | | 2,436,275 |

| 8.375% 5/1/16 | | | | 6,420,000 | | | 7,385,394 |

| #Sinclair Television Group 144A | | | | | | | |

| 9.25% 11/1/17 | | | | 785,000 | | | 859,575 |

| #Sirius XM Radio 144A | | | | | | | |

| 8.75% 4/1/15 | | | | 1,083,000 | | | 1,191,300 |

| Sprint Capital 8.75% 3/15/32 | | | | 1,185,000 | | | 964,294 |

| Sprint Nextel | | | | | | | |

| 6.00% 12/1/16 | | | | 565,000 | | | 471,775 |

| 8.375% 8/15/17 | | | | 600,000 | | | 540,750 |

| #Telcordia Technologies 144A | | | | | | | |

| 11.00% 5/1/18 | | | | 1,230,000 | | | 1,568,250 |

| Telecom Italia Capital | | | | | | | |

| 5.25% 10/1/15 | | | | 310,000 | | | 284,607 |

| Telefonica Emisiones | | | | | | | |

| 5.462% 2/16/21 | | | | 950,000 | | | 908,150 |

| 6.421% 6/20/16 | | | | 2,495,000 | | | 2,613,525 |

| Telesat Canada | | | | | | | |

| 11.00% 11/1/15 | | | | 2,129,000 | | | 2,296,659 |

| 12.50% 11/1/17 | | | | 391,000 | | | 438,898 |

| Time Warner Cable | | | | | | | |

| 8.25% 4/1/19 | | | | 3,485,000 | | | 4,383,422 |

| #UPC Holding 144A | | | | | | | |

| 9.875% 4/15/18 | | | | 590,000 | | | 632,038 |

| #UPCB Finance III 144A | | | | | | | |

| 6.625% 7/1/20 | | | | 1,870,000 | | | 1,851,300 |

| Verizon Communications | | | | | | | |

| 3.50% 11/1/21 | | | | 1,805,000 | | | 1,883,133 |

| Viacom 3.875% 12/15/21 | | | | 5,520,000 | | | 5,646,788 |

| Videotron 6.375% 12/15/15 | | | | 32,000 | | | 32,720 |

| #VimpelCom 144A | | | | | | | |

| • | 4.576% 6/29/14 | | | | 1,440,000 | | | 1,415,097 |

| 7.504% 3/1/22 | | | | 1,263,000 | | | 1,067,235 |

| Virgin Media Finance | | | | | | | |

| 8.375% 10/15/19 | | | | 850,000 | | | 937,125 |

| Virgin Media Secured Finance | | | | | | | |

| 6.50% 1/15/18 | | | | 7,925,000 | | | 8,459,937 |

| #Vivendi 144A 6.625% 4/4/18 | | | | 4,625,000 | | | 5,263,305 |

| West 7.875% 1/15/19 | | | | 425,000 | | | 423,938 |

| #Wind Acquisition Finance 144A | | | | | | | |

| 11.75% 7/15/17 | | | | 1,645,000 | | | 1,480,500 |

| Windstream | | | | | | | |

| 7.875% 11/1/17 | | | | 235,000 | | | 255,563 |

| 8.125% 8/1/13 | | | | 455,000 | | | 489,125 |

Diversified Income Series-11

Delaware VIP® Diversified Income Series

Statement of Net Assets (continued)

| | | Principal | | Value |

| | | | Amount° | | (U.S. $) |

| CORPORATE BONDS (continued) | | | | | | | |

| Communications (continued) | | | | | | | |

| #WPP Finance 2010 144A | | | | | | | |

| 4.75% 11/21/21 | | USD | | 2,975,000 | | $ | 2,959,093 |

| #XM Satellite Radio 144A | | | | | | | |

| 13.00% 8/1/13 | | | | 910,000 | | | 1,037,400 |

| | | | | | | | 117,439,764 |

| Consumer Cyclical–1.14% | | | | | | | |

| *CKE Restaurants | | | | | | | |

| 11.375% 7/15/18 | | | | 1,078,000 | | | 1,180,410 |

| CVS Caremark 5.75% 5/15/41 | | | | 4,200,000 | | | 5,020,326 |

| Dave & Buster’s 11.00% 6/1/18 | | | | 350,000 | | | 357,000 |

| #Delphi 144A 6.125% 5/15/21 | | | | 1,865,000 | | | 1,930,275 |

| Federated Retail Holdings | | | | | | | |

| 5.90% 12/1/16 | | | | 2,550,000 | | | 2,852,619 |

| *Hanesbrands 6.375% 12/15/20 | | | | 1,965,000 | | | 2,004,300 |

| *Levi Strauss 7.625% 5/15/20 | | | | 320,000 | | | 328,400 |

| *New Albertsons 7.25% 5/1/13 | | | | 294,000 | | | 307,230 |

| OSI Restaurant Partners | | | | | | | |

| 10.00% 6/15/15 | | | | 836,000 | | | 868,395 |

| Quiksilver 6.875% 4/15/15 | | | | 1,990,000 | | | 1,858,163 |

| #Sealy Mattress 144A | | | | | | | |

| 10.875% 4/15/16 | | | | 295,000 | | | 323,763 |

| Wyndham Worldwide | | | | | | | |

| 5.625% 3/1/21 | | | | 1,610,000 | | | 1,665,397 |

| 5.75% 2/1/18 | | | | 1,940,000 | | | 2,056,357 |

| | | | | | | | 20,752,635 |

| Consumer Non-Cyclical–4.75% | | | | | | | |

| Amgen 3.45% 10/1/20 | | | | 1,370,000 | | | 1,340,753 |

| #Aristotle Holding 144A | | | | | | | |

| 3.50% 11/15/16 | | | | 880,000 | | | 897,238 |

| 4.75% 11/15/21 | | | | 2,160,000 | | | 2,239,501 |

| 6.125% 11/15/41 | | | | 1,015,000 | | | 1,101,315 |

| Becton Dickinson 3.125% 11/8/21 | | | | 2,140,000 | | | 2,218,491 |

| Bio-Rad Laboratories | | | | | | | |

| 4.875% 12/15/20 | | | | 455,000 | | | 474,368 |

| 8.00% 9/15/16 | | | | 515,000 | | | 566,500 |

| CareFusion 6.375% 8/1/19 | | | | 8,080,000 | | | 9,555,941 |

| Celgene 3.95% 10/15/20 | | | | 5,290,000 | | | 5,337,499 |

| Coca-Cola Enterprises | | | | | | | |

| 3.50% 9/15/20 | | | | 2,155,000 | | | 2,259,115 |

| 4.50% 9/1/21 | | | | 3,650,000 | | | 4,058,099 |

| Del Monte 7.625% 2/15/19 | | | | 1,635,000 | | | 1,577,775 |

| #Dole Food 144A 8.00% 10/1/16 | | | | 705,000 | | | 738,488 |

| Dr Pepper Snapple Group | | | | | | | |

| 2.60% 1/15/19 | | | | 1,030,000 | | | 1,025,742 |

| 3.20% 11/15/21 | | | | 445,000 | | | 452,460 |

| Express Scripts 3.125% 5/15/16 | | | | 3,050,000 | | | 3,070,017 |

| General Mills 3.15% 12/15/21 | | | | 2,305,000 | | | 2,340,105 |

| Hospira 6.40% 5/15/15 | | | | 3,051,000 | | | 3,302,814 |

| Ingles Markets 8.875% 5/15/17 | | | | 851,000 | | | 925,463 |

| Jarden | | | | | | | |

| 6.125% 11/15/22 | | | | 680,000 | | | 698,700 |

| 7.50% 1/15/20 | | | | 365,000 | | | 390,550 |

| Kellogg 4.00% 12/15/20 | | | | 15,000 | | | 15,905 |

| Medco Health Solutions | | | | | | | |

| 4.125% 9/15/20 | | | | 1,275,000 | | | 1,272,812 |

| 7.125% 3/15/18 | | | | 1,045,000 | | | 1,219,601 |

| NBTY 9.00% 10/1/18 | | | | 1,635,000 | | | 1,806,675 |

| #Pernod-Ricard 144A | | | | | | | |

| 4.45% 1/15/22 | | | | 4,255,000 | | | 4,466,503 |

| Quest Diagnostics 4.70% 4/1/21 | | | | 5,345,000 | | | 5,708,925 |

| Safeway 4.75% 12/1/21 | | | | 2,465,000 | | | 2,530,027 |

| Sara Lee 4.10% 9/15/20 | | | | 1,491,000 | | | 1,507,476 |

| #Scotts Miracle-Gro 144A | | | | | | | |

| 6.625% 12/15/20 | | | | 540,000 | | | 550,800 |

| *Smucker (J.M.) 3.50% 10/15/21 | | | | 3,890,000 | | | 3,987,876 |

| Tops Holding 10.125% 10/15/15 | | | | 510,000 | | | 535,500 |

| Tyson Foods 10.50% 3/1/14 | | | | 840,000 | | | 974,400 |

| #Viskase 144A 9.875% 1/15/18 | | | | 1,430,000 | | | 1,455,025 |

| #Woolworths 144A | | | | | | | |

| 3.15% 4/12/16 | | | | 975,000 | | | 1,007,994 |

| 4.55% 4/12/21 | | | | 5,505,000 | | | 5,914,814 |

| Yale University 2.90% 10/15/14 | | | | 3,520,000 | | | 3,729,334 |

| *Yankee Candle 9.75% 2/15/17 | | | | 1,185,000 | | | 1,161,300 |

| Zimmer Holdings 4.625% 11/30/19 | | | | 3,610,000 | | | 3,940,882 |

| | | | | | | | 86,356,783 |

| Electric–3.16% | | | | | | | |

| Ameren Illinois 9.75% 11/15/18 | | | | 5,870,000 | | | 7,733,838 |

| #American Transmission Systems | | | | | | | |

| 144A 5.25% 1/15/22 | | | | 4,370,000 | | | 4,934,023 |

| Baltimore Gas & Electric | | | | | | | |

| 3.50% 11/15/21 | | | | 1,890,000 | | | 1,929,873 |

| Carolina Power & Light | | | | | | | |

| 3.00% 9/15/21 | | | | 1,300,000 | | | 1,338,879 |

| #Centrais Eletricas Brasileiras 144A | | | | | | | |

| 5.75% 10/27/21 | | | | 4,290,000 | | | 4,478,760 |

| CMS Energy | | | | | | | |

| 4.25% 9/30/15 | | | | 5,345,000 | | | 5,428,906 |

| 6.25% 2/1/20 | | | | 1,820,000 | | | 1,920,311 |

| Commonwealth Edison | | | | | | | |

| 3.40% 9/1/21 | | | | 3,150,000 | | | 3,268,840 |

| 4.00% 8/1/20 | | | | 780,000 | | | 841,760 |

| Duquense Light Holdings | | | | | | | |

| 5.50% 8/15/15 | | | | 1,076,000 | | | 1,121,920 |

| Florida Power 5.65% 6/15/18 | | | | 645,000 | | | 771,726 |

| Ipalco Enterprises 5.00% 5/1/18 | | | | 1,370,000 | | | 1,349,450 |

| Jersey Central Power & Light | | | | | | | |

| 5.625% 5/1/16 | | | | 495,000 | | | 559,908 |

| LG&E & KU Energy | | | | | | | |

| 3.75% 11/15/20 | | | | 1,675,000 | | | 1,694,122 |

| #LG&E & KU Energy 144A | | | | | | | |

| 4.375% 10/1/21 | | | | 2,930,000 | | | 2,994,483 |

| *Pennsylvania Electric | | | | | | | |

| 5.20% 4/1/20 | | | | 3,195,000 | | | 3,581,269 |

| •PPL Capital Funding | | | | | | | |

| 6.70% 3/30/67 | | | | 335,000 | | | 327,147 |

| PPL Electric Utilities | | | | | | | |

| 3.00% 9/15/21 | | | | 1,540,000 | | | 1,559,658 |

Diversified Income Series-12

Delaware VIP® Diversified Income Series

Statement of Net Assets (continued)

| | | | Principal | | Value |

| | | Amount° | | (U.S. $) |

| CORPORATE BONDS (continued) | | | | | | | |

| Electric (continued) | | | | | | | |

| Public Service Company of Oklahoma | | | | | | | |

| 5.15% 12/1/19 | | USD | | 3,595,000 | | $ | 4,015,263 |

| Puget Energy 6.00% 9/1/21 | | | | 1,065,000 | | | 1,103,993 |

| Southern California Edison | | | | | | | |

| 5.50% 8/15/18 | | | | 1,145,000 | | | 1,374,180 |

| Wisconsin Electric Power | | | | | | | |

| 2.95% 9/15/21 | | | | 190,000 | | | 194,057 |

| •Wisconsin Energy 6.25% 5/15/67 | | | | 4,880,000 | | | 4,887,940 |

| | | | | | | | 57,410,306 |

| Energy–4.89% | | | | | | | |

| Antero Resources Finance | | | | | | | |

| 9.375% 12/1/17 | | | | 545,000 | | | 591,325 |

| Berry Petroleum 10.25% 6/1/14 | | | | 980,000 | | | 1,113,525 |

| #BG Energy Capital 144A | | | | | | | |

| 4.00% 10/15/21 | | | | 6,695,000 | | | 6,914,937 |

| Chesapeake Energy | | | | | | | |

| 6.125% 2/15/21 | | | | 570,000 | | | 588,525 |

| 6.625% 8/15/20 | | | | 47,000 | | | 50,643 |

| | 6.875% 11/15/20 | | | | 38,000 | | | 40,850 |

| 7.25% 12/15/18 | | | | 141,000 | | | 156,510 |

| 9.50% 2/15/15 | | | | 207,000 | | | 238,050 |

| Complete Production Services | | | | | | | |

| 8.00% 12/15/16 | | | | 1,381,000 | | | 1,443,145 |

| Comstock Resources 7.75% 4/1/19 | | | | 315,000 | | | 300,825 |

| Copano Energy 7.75% 6/1/18 | | | | 820,000 | | | 856,900 |

| Ecopetrol 7.625% 7/23/19 | | | | 3,416,000 | | | 4,150,440 |

| Encana 3.90% 11/15/21 | | | | 5,065,000 | | | 5,098,677 |

| #ENI 144A 4.15% 10/1/20 | | | | 3,855,000 | | | 3,827,441 |

| *Forest Oil 7.25% 6/15/19 | | | | 907,000 | | | 929,675 |

| #Helix Energy Solutions Group 144A | | | | | | | |

| 9.50% 1/15/16 | | | | 1,529,000 | | | 1,597,805 |

| #Hercules Offshore 144A | | | | | | | |

| 10.50% 10/15/17 | | | | 1,300,000 | | | 1,270,750 |

| #Hilcorp Energy I 144A | | | | | | | |

| 7.625% 4/15/21 | | | | 640,000 | | | 673,600 |

| Holly 9.875% 6/15/17 | | | | 435,000 | | | 482,850 |

| #IPIC GMTN 144A 5.50% 3/1/22 | | | | 1,688,000 | | | 1,696,440 |

| Linn Energy 8.625% 4/15/20 | | | | 615,000 | | | 670,350 |

| #Linn Energy 144A 6.50% 5/15/19 | | | | 210,000 | | | 209,475 |

| #Murray Energy 144A | | | | | | | |

| 10.25% 10/15/15 | | | | 1,070,000 | | | 1,067,325 |

| #NFR Energy 144A 9.75% 2/15/17 | | | | 875,000 | | | 791,875 |

| Noble Energy | | | | | | | |

| 4.15% 12/15/21 | | | | 1,430,000 | | | 1,482,274 |

| 8.25% 3/1/19 | | | | 3,610,000 | | | 4,701,083 |

| Pemex Project Funding Master | | | | | | | |

| Trust 6.625% 6/15/35 | | | | 1,510,000 | | | 1,727,063 |

| Petrobras International Finance | | | | | | | |

| 3.875% 1/27/16 | | | | 1,025,000 | | | 1,061,091 |

| 5.375% 1/27/21 | | | | 2,820,000 | | | 2,976,795 |

| 5.75% 1/20/20 | | | | 2,359,000 | | | 2,536,208 |

| 5.875% 3/1/18 | | | | 315,000 | | | 346,301 |

| Petrohawk Energy 7.25% 8/15/18 | | | | 1,615,000 | | | 1,824,950 |

| Petroleum Development | | | | | | | |

| 12.00% 2/15/18 | | | | 822,000 | | | 895,980 |

| Pride International | | | | | | | |

| 6.875% 8/15/20 | | | | 8,765,000 | | | 10,293,484 |

| Quicksilver Resources | | | | | | | |

| 9.125% 8/15/19 | | | | 685,000 | | | 729,525 |

| Range Resources | | | | | | | |

| 5.75% 6/1/21 | | | | 390,000 | | | 424,125 |

| 8.00% 5/15/19 | | | | 1,167,000 | | | 1,307,040 |

| #Ras Laffan Liquefied Natural Gas III | | | | | | | |

| 144A 5.832% 9/30/16 | | | | 329,715 | | | 353,619 |

| SandRidge Energy 7.50% 3/15/21 | | | | 360,000 | | | 359,100 |

| #SandRidge Energy 144A | | | | | | | |

| 9.875% 5/15/16 | | | | 1,249,000 | | | 1,342,675 |

| Statoil Asa 3.15% 1/23/22 | | | | 4,975,000 | | | 5,127,553 |

| Transocean | | | | | | | |

| 5.05% 12/15/16 | | | | 340,000 | | | 347,543 |

| 6.375% 12/15/21 | | | | 3,641,000 | | | 3,877,122 |

| Weatherford International | | | | | | | |

| 5.125% 9/15/20 | | | | 2,115,000 | | | 2,201,713 |

| 9.625% 3/1/19 | | | | 2,550,000 | | | 3,302,393 |

| Williams | | | | | | | |

| 7.75% 6/15/31 | | | | 628,000 | | | 783,343 |

| 8.75% 3/15/32 | | | | 678,000 | | | 890,738 |

| #Woodside Finance 144A | | | | | | | |

| 8.125% 3/1/14 | | | | 1,300,000 | | | 1,454,487 |

| 8.75% 3/1/19 | | | | 3,000,000 | | | 3,783,531 |

| | | | | | | | 88,891,674 |

| Finance Companies–1.80% | | | | | | | |

| #CDP Financial 144A | | | | | | | |

| 4.40% 11/25/19 | | | | 4,590,000 | | | 4,988,673 |

| 5.60% 11/25/39 | | | | 3,200,000 | | | 3,938,570 |

| E Trade Financial PIK | | | | | | | |

| 12.50% 11/30/17 | | | | 1,642,000 | | | 1,863,670 |

| #FUEL Trust 144A 3.984% 6/15/16 | | | | 1,625,000 | | | 1,626,365 |

| General Electric Capital | | | | | | | |

| 4.65% 10/17/21 | | | | 4,125,000 | | | 4,313,595 |

| 6.00% 8/7/19 | | | | 8,370,000 | | | 9,628,931 |

| •#ILFC E-Capital Trust I 144A | | | | | | | |

| 4.34% 12/21/65 | | | | 1,545,000 | | | 919,244 |

| •#ILFC E-Capital Trust II 144A | | | | | | | |

| 6.25% 12/21/65 | | | | 760,000 | | | 516,800 |

| International Lease Finance | | | | | | | |

| 6.25% 5/15/19 | | | | 1,898,000 | | | 1,755,868 |

| 8.25% 12/15/20 | | | | 795,000 | | | 804,938 |

| 8.75% 3/15/17 | | | | 950,000 | | | 980,875 |

| Nuveen Investments | | | | | | | |

| 10.50% 11/15/15 | | | | 503,000 | | | 501,743 |

| #Nuveen Investments 144A | | | | | | | |

| 10.50% 11/15/15 | | | | 840,000 | | | 829,500 |

| | | | | | | | 32,668,772 |

| Healthcare–0.97% | | | | | | | |

| Accellent | | | | | | | |

| 8.375% 2/1/17 | | | | 635,000 | | | 625,475 |

| 10.00% 11/1/17 | | | | 10,000 | | | 8,150 |

Diversified Income Series-13

Delaware VIP® Diversified Income Series

Statement of Net Assets (continued)

| | | | Principal | | Value |

| | | Amount° | | (U.S. $) |

| CORPORATE BONDS (continued) | | | | | | | |

| Healthcare (continued) | | | | | | | |

| Biomet 11.625% 10/15/17 | | USD | | 781,000 | | $ | 851,290 |

| Biomet PIK 10.375% 10/15/17 | | | | 698,000 | | | 759,075 |

| Boston Scientific 6.00% 1/15/20 | | | | 1,935,000 | | | 2,163,603 |

| *Community Health Systems | | | | | | | |

| 8.875% 7/15/15 | | | | 476,000 | | | 492,660 |

| DENTSPLY International | | | | | | | |

| 4.125% 8/15/21 | | | | 2,115,000 | | | 2,185,939 |

| HCA 7.50% 2/15/22 | | | | 1,245,000 | | | 1,276,125 |

| *HCA Holdings 7.75% 5/15/21 | | | | 1,405,000 | | | 1,436,613 |

| #Multiplan 144A 9.875% 9/1/18 | | | | 1,250,000 | | | 1,306,250 |

| #Mylan 144A 6.00% 11/15/18 | | | | 1,310,000 | | | 1,354,213 |

| Radnet Management | | | | | | | |

| 10.375% 4/1/18 | | | | 570,000 | | | 504,450 |

| Teva Pharmaceutical Finance IV | | | | | | | |

| 3.65% 11/10/21 | | | | 4,500,000 | | | 4,586,543 |

| | | | | | | | 17,550,386 |

| Insurance–1.76% | | | | | | | |

| American International Group | | | | | | | |

| 4.875% 9/15/16 | | | | 285,000 | | | 269,976 |

| 8.25% 8/15/18 | | | | 3,145,000 | | | 3,337,477 |

| •Chubb 6.375% 3/29/67 | | | | 3,000,000 | | | 2,977,500 |

| Coventry Health Care | | | | | | | |

| 5.45% 6/15/21 | | | | 4,190,000 | | | 4,664,680 |

| #Highmark 144A | | | | | | | |

| 4.75% 5/15/21 | | | | 2,485,000 | | | 2,551,422 |

| 6.125% 5/15/41 | | | | 515,000 | | | 558,490 |

| •ING Groep 5.775% 12/29/49 | | | | 1,495,000 | | | 1,196,000 |

| •#Liberty Mutual Group 144A | | | | | | | |

| 7.00% 3/15/37 | | | | 790,000 | | | 671,500 |

| MetLife | | | | | | | |

| 6.40% 12/15/36 | | | | 75,000 | | | 71,344 |

| 6.817% 8/15/18 | | | | 2,630,000 | | | 3,132,751 |

| #MetLife Capital Trust X 144A | | | | | | | |

| 9.25% 4/8/38 | | | | 3,120,000 | | | 3,580,199 |

| Prudential Financial | | | | | | | |

| 3.875% 1/14/15 | | | | 1,020,000 | | | 1,057,233 |

| 4.50% 11/15/20 | | | | 785,000 | | | 790,787 |

| 4.50% 11/16/21 | | | | 585,000 | | | 592,045 |

| 6.00% 12/1/17 | | | | 1,880,000 | | | 2,093,497 |

| =@#‡tTwin Reefs Pass Through Trust | | | | | | | |

| 144A 1.386% 12/31/49 | | | | 600,000 | | | 0 |

| •XL Group 6.50% 12/31/49 | | | | 1,210,000 | | | 958,925 |

| •#ZFS Finance USA Trust II 144A | | | | | | | |

| 6.45% 12/15/65 | | | | 2,275,000 | | | 2,093,000 |

| •#ZFS Finance USA Trust IV 144A | | | | | | | |

| 5.875% 5/9/32 | | | | 1,445,000 | | | 1,372,750 |

| | | | | | | | 31,969,576 |

| Natural Gas–3.20% | | | | | | | |

| AmeriGas Partners 6.50% 5/20/21 | | | | 730,000 | | | 720,875 |

| CenterPoint Energy 5.95% 2/1/17 | | | | 2,590,000 | | | 2,932,408 |

| El Paso Pipeline Partners | | | | | | | |

| Operating 6.50% 4/1/20 | | | | 2,000,000 | | | 2,214,252 |

| •Enbridge Energy Partners | | | | | | | |

| 8.05% 10/1/37 | | | | 4,085,000 | | | 4,321,174 |

| Energy Transfer Partners | | | | | | | |

| 9.70% 3/15/19 | | | | 4,870,000 | | | 5,974,526 |

| Enterprise Products Operating | | | | | | | |

| • | 7.034% 1/15/68 | | | | 4,580,000 | | | 4,769,026 |

| 9.75% 1/31/14 | | | | 2,840,000 | | | 3,282,182 |

| EQT 4.875% 11/15/21 | | | | 2,080,000 | | | 2,103,729 |

| Inergy 6.875% 8/1/21 | | | | 550,000 | | | 555,500 |

| Kinder Morgan Energy Partners | | | | | | | |

| * | 4.15% 3/1/22 | | | | 5,230,000 | | | 5,330,599 |

| 9.00% 2/1/19 | | | | 3,840,000 | | | 4,850,845 |

| Nisource Finance | | | | | | | |

| 4.45% 12/1/21 | | | | 1,815,000 | | | 1,858,235 |

| 5.80% 2/1/42 | | | | 2,265,000 | | | 2,377,765 |

| Plains All American Pipeline | | | | | | | |

| 8.75% 5/1/19 | | | | 3,435,000 | | | 4,394,416 |

| Sempra Energy 6.15% 6/15/18 | | | | 2,600,000 | | | 3,068,796 |

| •TransCanada Pipelines | | | | | | | |

| 6.35% 5/15/67 | | | | 6,420,000 | | | 6,448,840 |

| Williams Partners 7.25% 2/1/17 | | | | 2,495,000 | | | 2,963,124 |

| | | | | | | | | 58,166,292 |

| Real Estate–2.07% | | | | | | | |

| Brandywine Operating Partnership | | | | | | | |

| 4.95% 4/15/18 | | | | 2,655,000 | | | 2,617,007 |

| Developers Diversified Realty | | | | | | | |

| 4.75% 4/15/18 | | | | 2,200,000 | | | 2,107,785 |

| 7.50% 4/1/17 | | | | 1,060,000 | | | 1,145,570 |

| 7.875% 9/1/20 | | | | 2,175,000 | | | 2,430,204 |

| 9.625% 3/15/16 | | | | 865,000 | | | 1,007,090 |

| Digital Realty Trust | | | | | | | |

| 5.25% 3/15/21 | | | | 2,595,000 | | | 2,604,557 |

| 5.875% 2/1/20 | | | | 2,105,000 | | | 2,193,682 |

| ERP Operating 4.625% 12/15/21 | | | | 2,725,000 | | | 2,784,236 |

| Health Care REIT 5.25% 1/15/22 | | | | 3,575,000 | | | 3,509,173 |

| Host Hotels & Resorts | | | | | | | |

| 6.00% 11/1/20 | | | | 1,140,000 | | | 1,171,350 |

| #Host Hotels & Resorts 144A | | | | | | | |

| 5.875% 6/15/19 | | | | 905,000 | | | 925,363 |

| 6.00% 10/1/21 | | | | 960,000 | | | 986,400 |

| Host Marriott 6.375% 3/15/15 | | | | 1,065,000 | | | 1,088,963 |

| #Qatari Diar Finance 144A | | | | | | | |

| 5.00% 7/21/20 | | | | 1,601,000 | | | 1,713,070 |

| Regency Centers | | | | | | | |

| 4.80% 4/15/21 | | | | 1,960,000 | | | 1,996,926 |

| 5.875% 6/15/17 | | | | 575,000 | | | 626,906 |

| Simon Property Group | | | | | | | |

| 4.125% 12/1/21 | | | | 1,920,000 | | | 2,011,772 |

| *Ventas Realty 6.50% 6/1/16 | | | | 490,000 | | | 505,653 |

| Vornado Realty 5.00% 1/15/22 | | | | 2,640,000 | | | 2,667,097 |

| #WEA Finance 144A | | | | | | | |

| 4.625% 5/10/21 | | | | 3,555,000 | | | 3,495,759 |

| | | | | | | | 37,588,563 |

| Services–1.30% | | | | | | | |

| Ameristar Casinos 7.50% 4/15/21 | | | | 1,175,000 | | | 1,216,125 |

| #Ashtead Capital 144A | | | | | | | |

| 9.00% 8/15/16 | | | | 832,000 | | | 871,520 |

Diversified Income Series-14

Delaware VIP® Diversified Income Series

Statement of Net Assets (continued)

| | | | Principal | | Value |

| | | Amount° | | (U.S. $) |

| CORPORATE BONDS (continued) | | | | | | | |

| Services (continued) | | | | | | | |

| Beazer Homes USA | | | | | | | |

| 9.125% 5/15/19 | | USD | | 700,000 | | $ | 481,250 |

| Casella Waste Systems | | | | | | | |

| 11.00% 7/15/14 | | | | 115,000 | | | 125,350 |

| Corrections Corporation of America | | | | | | | |

| 7.75% 6/1/17 | | | | 1,220,000 | | | 1,329,800 |

| #Equinox Holdings 144A | | | | | | | |

| 9.50% 2/1/16 | | | | 225,000 | | | 232,313 |

| FTI Consulting | | | | | | | |

| 6.75% 10/1/20 | | | | 670,000 | | | 695,125 |

| 7.75% 10/1/16 | | | | 340,000 | | | 353,600 |

| *Geo Group 6.625% 2/15/21 | | | | 645,000 | | | 651,450 |

| Iron Mountain 7.75% 10/1/19 | | | | 290,000 | | | 307,763 |

| *Marina District Finance | | | | | | | |

| 9.875% 8/15/18 | | | | 440,000 | | | 403,700 |

| M/I Homes 8.625% 11/15/18 | | | | 1,010,000 | | | 898,900 |

| MGM Resorts International | | | | | | | |

| 11.375% 3/1/18 | | | | 2,935,000 | | | 3,243,175 |

| Mobile Mini 6.875% 5/1/15 | | | | 629,000 | | | 636,076 |

| PHH 9.25% 3/1/16 | | | | 3,045,000 | | | 2,907,975 |

| *Pinnacle Entertainment | | | | | | | |

| 8.75% 5/15/20 | | | | 1,610,000 | | | 1,585,850 |

| Royal Caribbean Cruises | | | | | | | |

| 7.00% 6/15/13 | | | | 1,130,000 | | | 1,192,150 |

| RSC Equipment Rental | | | | | | | |

| 10.25% 11/15/19 | | | | 975,000 | | | 1,067,625 |

| Ryland Group 8.40% 5/15/17 | | | | 1,088,000 | | | 1,138,320 |

| #ServiceMaster PIK 144A | | | | | | | |

| 10.75% 7/15/15 | | | | 1,070,000 | | | 1,112,800 |

| Standard Pacific 10.75% 9/15/16 | | | | 1,090,000 | | | 1,149,950 |

| Western Union 3.65% 8/22/18 | | | | 1,655,000 | | | 1,699,347 |

| Wynn Las Vegas 7.75% 8/15/20 | | | | 240,000 | | | 267,600 |

| | | | | | | | 23,567,764 |

| Technology–1.97% | | | | | | | |

| Amkor Technology 7.375% 5/1/18 | | | | 550,000 | | | 565,125 |

| Broadcom 2.70% 11/1/18 | | | | 1,985,000 | | | 2,009,989 |

| CDW 12.535% 10/12/17 | | | | 705,000 | | | 712,050 |

| Fidelity National Information | | | | | | | |

| Services 7.875% 7/15/20 | | | | 320,000 | | | 347,200 |

| First Data | | | | | | | |

| * | 9.875% 9/24/15 | | | | 1,255,000 | | | 1,185,975 |

| 10.55% 9/24/15 | | | | 735,000 | | | 704,681 |

| * | 11.25% 3/31/16 | | | | 720,000 | | | 601,200 |