| | SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. __) Filed by the Registrant [ ]

Filed by a Party other than the Registrant [X]

Check the appropriate box: [ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[X] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Section 240.14a-11(c)or Section 240.14a-12 LADISH CO, INC.

(Name of Registrant as Specified in its Charter) GRACE BROTHERS LTD.

(Name of Person(s) Filing Proxy Statement if other than the Registrant) Payment of Filing Fee (Check the appropriate box): [X] No fee required. [ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. - Title of each class of securities to which transaction applies:

- Aggregate number of securities to which transaction applies:

- Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

- Proposed maximum aggregate value of transaction:

- Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.- Amount Previously Paid:

- Form, Schedule or Registration Statement No.:

- Filing Party:

- Date Filed:

SOLICITATION OF PROXIES BY GRACE BROTHERS, LTD.Ladish Co., Inc. : Annual Meeting and Election of Board of Directors Background - Who is Grace Brothers?

- Our nearly 30% stake in Ladish. How did we acquire it?

- What has been our relationship with management and the Board of Directors?

Why Do We Seek A Change? - Current board is filled with insiders and members with insider relationships - Chief Executive Officer

- Chief Financial Officer/General Counsel

- Joint venture partner

- Former CFO of principal law firm

- Former senior banker with principal lender

- Is there oversight and direction from the board?

- Lack of standard governance policies

Ladish's Performance- Lack of affirmative action during difficult times within industry

- "Large headcount reductions remain unlikely: While management has reduced headcount in certain areas, we are unlikely to see the 15-20% reductions in workforce we have seen at other commercial suppliers." Adam Weiner, CSFB 11/12/02)

- Accounting restatements, Audit firm fiasco and threatened Nasdaq de-listing

- Missed opportunities for realizing shareholder value

- Wyman-Gordon sold to Precision Castparts - 6.6x Ebitda

- Doncasters taken private in LBO - 7.3x Ebitda

- Declining financial performance after significant capital investment (see attached)

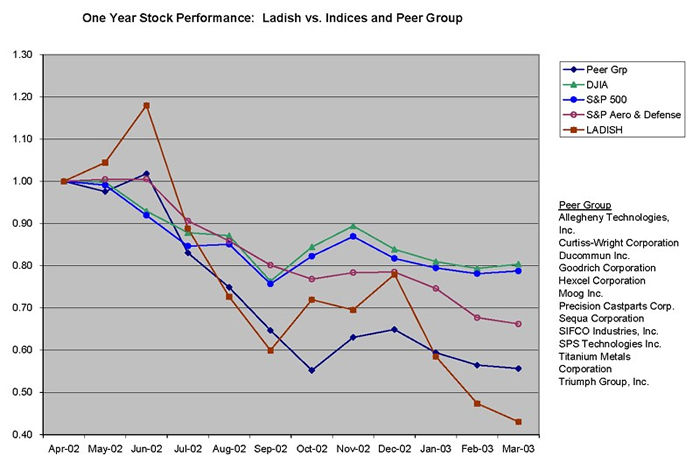

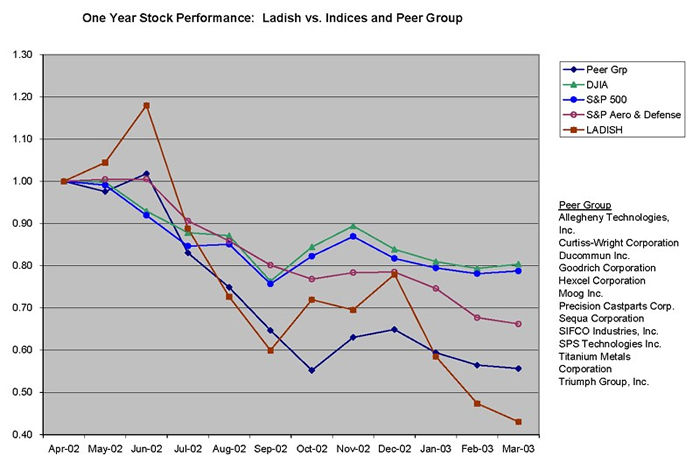

- The Share Price tells the story: price performance compared to peer groups and indices (see attached)

One Year Stock Performance

It's Time for a Change! What is Grace Brothers seeking? What would we expect our Nominees to do? - Become a proactive board that will work with and challenge management to develop and implement a dynamic strategic plan that will be responsive to the current economic challenges facing the industry

- Work with senior management team that emphasizes "shareholder return" as one of its key objectives

- Establish a governance culture that recognizes the value of real independence on the Board of Directors

- Using their knowledge and expertise, provide the necessary oversight to allow the company to develop and achieve objectives appropriate in the industry and consistent with increasing shareholder value.

- What are we not seeking to do?

- We are not seeking to gain control of Ladish

- We are not seeking to replace management

Our NomineesOur nominees to the Board of Directors are independent! No ties with Grace Brothers other than Ms. Hampton. Mr. Sullivan is not our Director. - J. Robert Peart is currently a Managing Director with RESIDCO, a transportation investment banking firm. From 1999 until 2001, Mr. Peart was Senior Vice President and General Manager of the engine sales and leasing division of AAR Corporation. From 1996 until 1999 he was CFO of Southern Air Transport, a privately held cargo airline. From 1988 until 1995, Mr. Peart was with Bank of Montreal in various corporate finance roles, including management responsibility for the bank's transportation/aerospace division.

- Gregg G. Williams is President and Chief Operating Officer of Williams International Co., LLC, a manufacturer of gas turbine engines. Mr. Williams has been with Williams International for more than 20 years. Mr. Williams holds numerous patents related to gas turbine engines and turbo machinery

- James C. Hill was Chairman and CEO of Vision Metals, Inc., a Michigan based privately held steel manufacturing company from 1997 to 2001. From 1983 until 1997, Mr. Hill was Vice President of Quanex Corporation and President of the Quanex Tube Group, a producer of specialty steel tubing.

- Robert J. Daniels, retired in 1995 as President and CEO of Liquid Carbonic Industries and Executive Vice President of CBI Industries, Inc., its parent. Mr. Daniels was a member of the Board of Directors of CBI from 1988 to 1995. From 1983 until 1987, Mr. Daniels served as Chief Financial Officer of Liquid Carbonics, after holding various financial positions with the Company since he joined in 1966. In 1996 he served as chairman of the Compressed Gas Association of North America, an industry trade association, located in Washington D.C. Formerly he was a director of IOMA, the international association of industrial gas manufacturers, and has served on several U.S. and European business boards of directors. Mr. Daniels is currently a member of the Japan America Society, the Northwestern University Associates, the Chicago Council of Foreign Relations and the Stratford Festival.

- Robert W. Sullivan is President of The Plitt Company, a seafood distribution concern. Mr. Sullivan had been President of The Martec Group, a sales and marketing consulting group for more than fifteen years. Mr. Sullivan is a Director of Furr's Restaurant Group in Dallas, Texas. Mr. Sullivan has been a Director of Ladish since 1993 and is one of the nominees included in the Company's proxy statement.

- Margaret B. Hampton has been a Portfolio Manager at Grace Brothers since 1997. Previously, Ms. Hampton was a Managing Director for First Chicago Capital Corporation, a position she held for more than five years. Ms. Hampton is a Director of Furr's Restaurant Group in Dallas, Texas. Ms. Hampton has been a Director of Ladish since 2001 and is one of the nominees included in the Company's proxy statement.

| |