SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý

Filed by a party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement | o Confidential, For Use of the |

| Commission Only (as permitted by |

| Rule 14a-6(e)(2)) |

o Definitive Proxy Statement

ý Definitive Additional Materials

o Soliciting Material Under Rule 14a-12

LADISH CO., INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check appropriate box):

ý No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price of other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

o Fee paid previously with preliminary materials:

o Check box if any part of fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

2

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[LADISH CO., INC LOGO]

INVESTOR PRESENTATION

May 2003

3

Forward Looking Statements

Certain statements made in this presentation and other written or oral statements made by or on behalf of the company may constitute “forward-looking statements” within the meaning of the federal securities laws. Statements regarding future events and developments and the company’s future performance, as well as management’s expectations, beliefs, intentions, plans, estimates or projections relating to the future, are forward-looking statements within the meaning of these laws. Management believes that these forward-looking statements are reasonable; however, you should not place undue reliance on such statements. These statements are based on current expectations and speak only as of the date of such statements. The company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new information or otherwise. Among the factors that might impact the company’s performance are market conditions and demand for the company’s products; competition; interest rates and capital costs; technologies; continued impact upon the commercial aerospace industry from the September 11, 2001 terrorist attacks; raw material and energy prices; unstable governments and business conditions in emerging economies; taxes; and legal, regulatory and environmental issues. These and other important risk factors regarding the company are included under the caption “Forward Looking Statements” in the company’s Annual Report on Form 10-K for the year ended December 31, 2002 and may be discussed in subsequent filings with the SEC.

The company and certain other persons may be deemed participants in the solicitation of proxies from shareholders in connection with the Company’s 2003 Annual Meeting of Shareholders. Information concerning such participants is available in the company’s Proxy Statement filed with the Securities and Exchange Commission on April 2, 2003. Shareholders are advised to read the company’s Proxy Statement and other relevant documents when they become available, because they contain or will contain important information. Shareholders may obtain, free of charge, copies of the company’s Proxy Statement and any other documents filed by the company with the SEC in connection with the 2003 Annual Meeting of Shareholders at the SEC’s website at (http://www.sec.gov) or by contacting the company at the number listed below.

[LADISH CO., INC LOGO]

(414) 747-2611

4

Introduction

Ladish’s current Board and management are committed to enhancing value for all shareholders.

• Ladish is executing an effective business plan and positioning the company for future growth

• Both the Board and management have extensive direct industry experience to guide the Company through the current cycle

• The existing Board is highly-qualified, independent-minded and committed to good corporate governance and enhancing the Board’s independence

• We believe Grace’s interests are not aligned with other shareholders

5

Company Highlights

•Leading Market Position in Forging Products (#2 Supplier)

•Advanced Equipment and Manufacturing Capabilities

•Led Development “One-Stop-Shop” Approach to Engine Suppliers

•Excellent Relationships with Blue Chip Customer Base

•Long-term Contracts Represent 65% of Current Backlog, Providing Revenue Visibility when Market Recovers

•Strong, Experienced Management Team with a Highly-Skilled Workforce

•Strong Financial Position

6

BUSINESS OVERVIEW

7

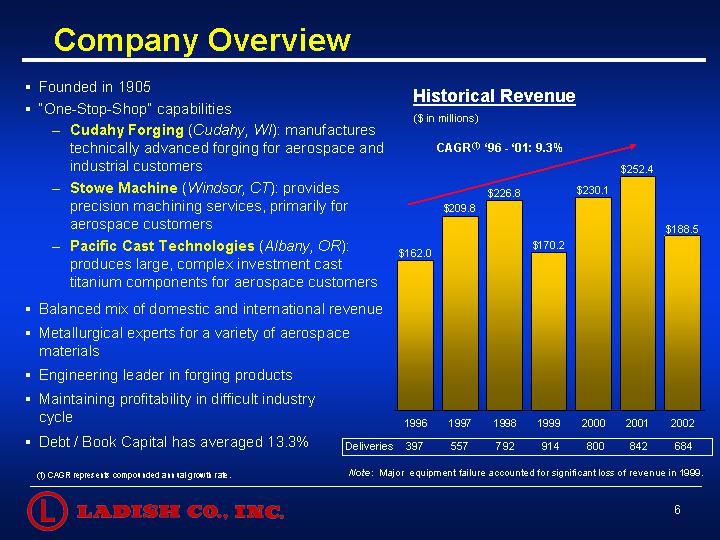

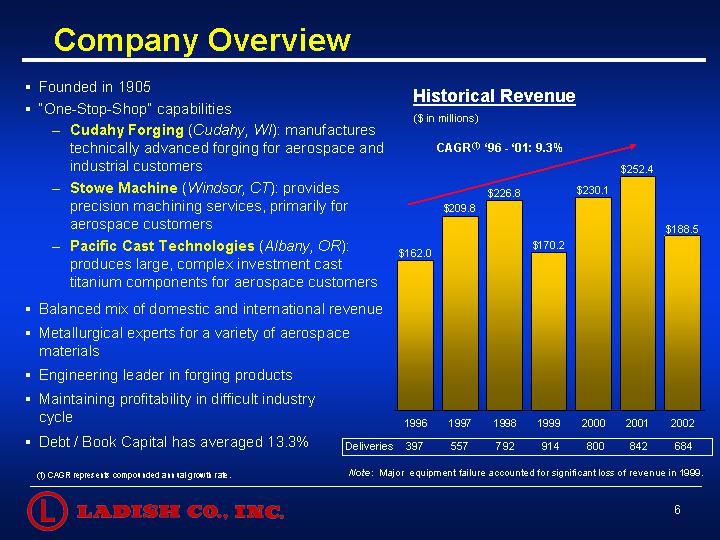

Company Overview

• Founded in 1905

• “One-Stop-Shop” capabilities

• Cudahy Forging (Cudahy, WI): manufactures technically advanced forging for aerospace and industrial customers

• Stowe Machine (Windsor, CT): provides precision machining services, primarily for aerospace customers

• Pacific Cast Technologies (Albany, OR): produces large, complex investment cast titanium components for aerospace customers

• Balanced mix of domestic and international revenue

• Metallurgical experts for a variety of aerospace materials

• Engineering leader in forging products

• Maintaining profitability in difficult industry cycle

• Debt / Book Capital has averaged 13.3%

Historical Revenue

($ in millions)

CARG(1) ’96 - ’01:9.3%

(1) CAGR represents compounded annual growth rate.

Note: Major equipment failure accounted for significant loss of revenue in 1999.

8

Leading Supplier to Aerospace Markets

Ladish has focused on becoming a leading supplier of large, engineered specialty metal components for critical applications in the commercial and military aerospace engine and select other end markets

• Ladish primary manufacturing end markets:

• Jet engines

• Commercial aircraft

• Defense aircraft

• Helicopters

• Launch Vehicles

• Heavy-duty off-road vehicles

• Industrial and marine turbines

2002 Sales Breakdown

[CHART]

Note: Aerospace defined as satellite, rocket and aircraft components other than jet engines.

9

Ladish’s Strategic Platform

Multi-Path Plan for Broadening Product Offerings

[CHART]

Pre 1997 | 1997 to Date | Progression |

10

A “One-Stop-Shop” Solution

[PICTURE]

11

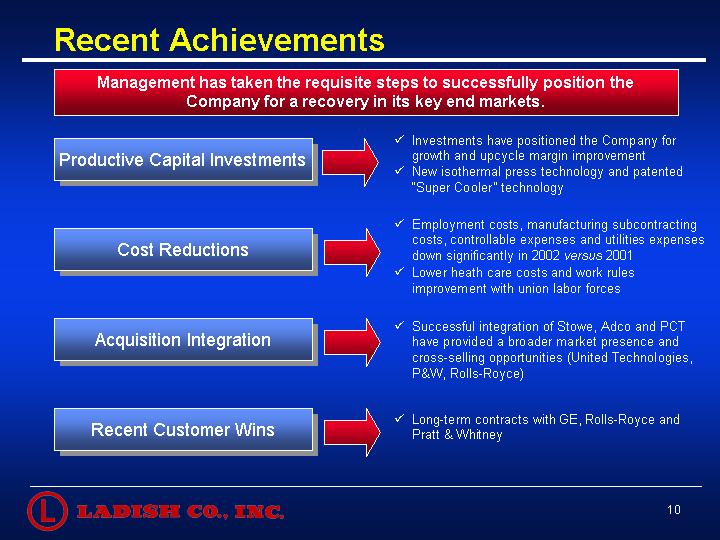

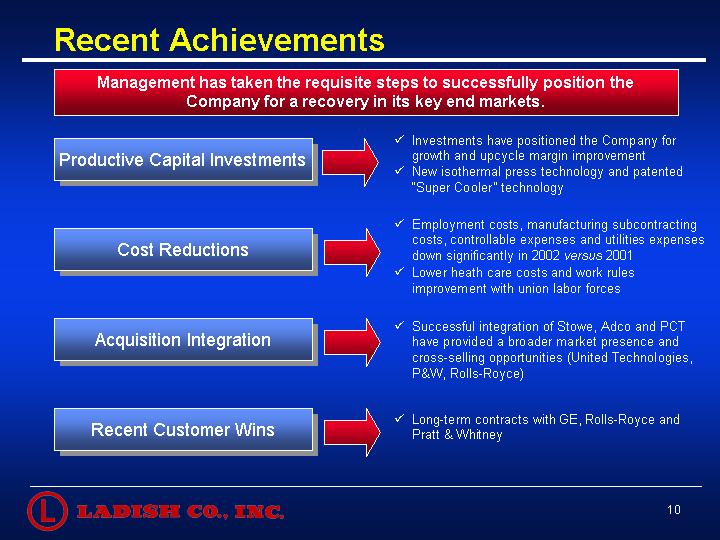

Recent Achievements

Management has taken the requisite steps to successfully position the Company for a recovery in its key end markets.

Productive Capital Investments | • | Investments have positioned the Company for growth and up cycle margin improvement |

| • | New isothermal press technology and patented “Super Cooler” technology |

| | |

Cost Reductions | • | Employment costs, manufacturing subcontracting costs, controllable expenses and utilities expenses down significantly in 2002 versus 2001 |

| • | Lower heath care costs and work rules improvement with union labor forces |

| | |

Acquisition Integration | • | Successful integration of Stowe, Adco and PCT have provided a broader market presence and cross-selling opportunities (United Technologies, P&W, Rolls-Royce) |

| | |

Recent Customer Wins | • | Long-term contracts with GE, Rolls-Royce and Pratt & Whitney |

12

More Opportunities for Growth and Profitability

• Broaden Product Offering / Expansion of Capabilities

• Significant New Programs / Customers

• Pursue Further Cost Reductions

• Selectively Pursue Acquisitions

• Enhance Global Presence

13

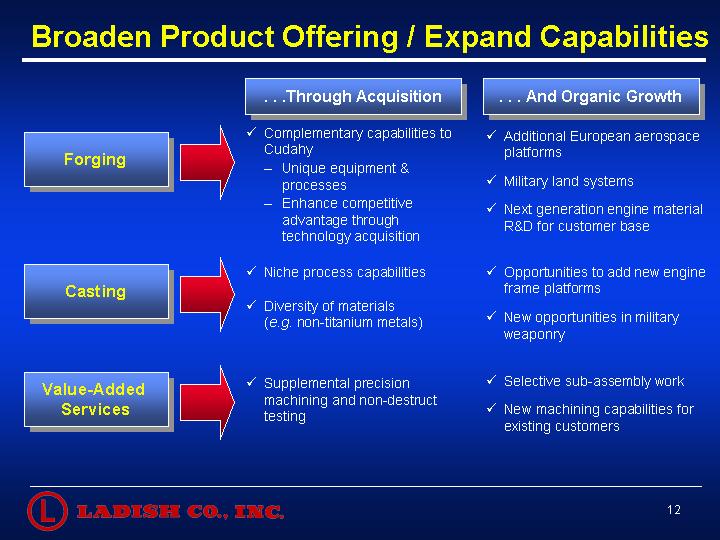

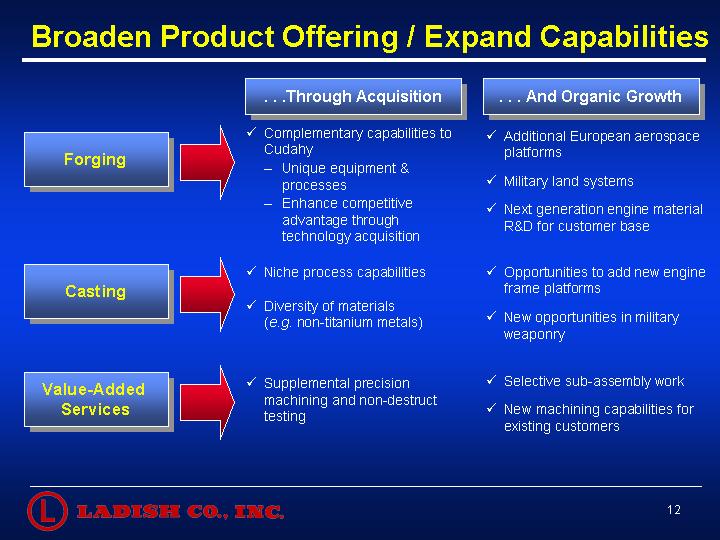

Broaden Product Offering / Expand Capabilities

| . . .Through Acquisition | | . . . And Organic Growth |

| | | |

Forging | • Complementary capabilities to Cudahy | | • Additional European aerospace platforms |

| • Unique equipment & processes | | • Military land systems |

| • Enhance competitive advantage through technology acquisition | | • Next generation engine material R&D for customer base |

| | | |

Casting | • Niche process capabilities | | • Opportunities to add new engine frame platforms |

| • Diversity of materials (e.g. non-titanium metals) | | • New opportunities in military weaponry |

| | | |

Value-Added Services | • Supplemental precision machining and non-destruct testing | | • Selective sub-assembly work |

| | | • New machining capabilities for existing customers |

14

New Programs / Customers

Business | | Comments |

| | |

Cudahy | | • 4 New Engine Programs |

| | • 2 New Customers |

| | • 2 New Launch Vehicles |

| | • 1 Airframe |

| | |

PCT | | • 2 Boeing Airframe Programs |

| | • 4 New Engine Programs |

| | • 1 New Military Weapon Program |

| | |

Stowe | | • 2 New Programs |

| | • 4 New Customers |

15

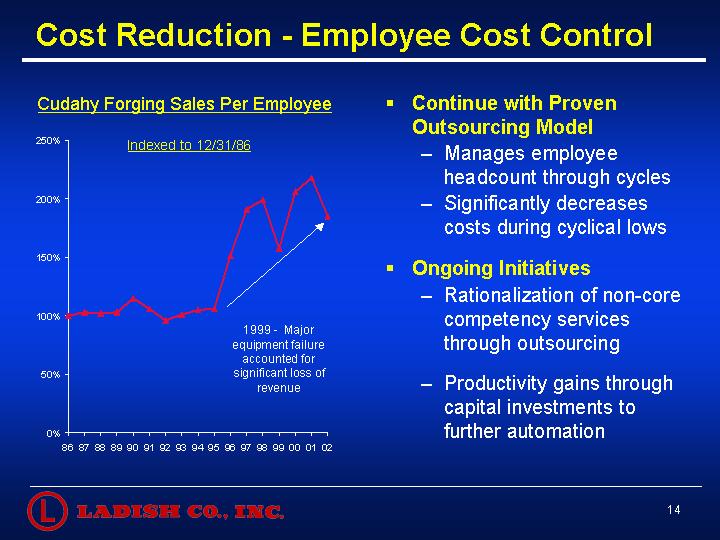

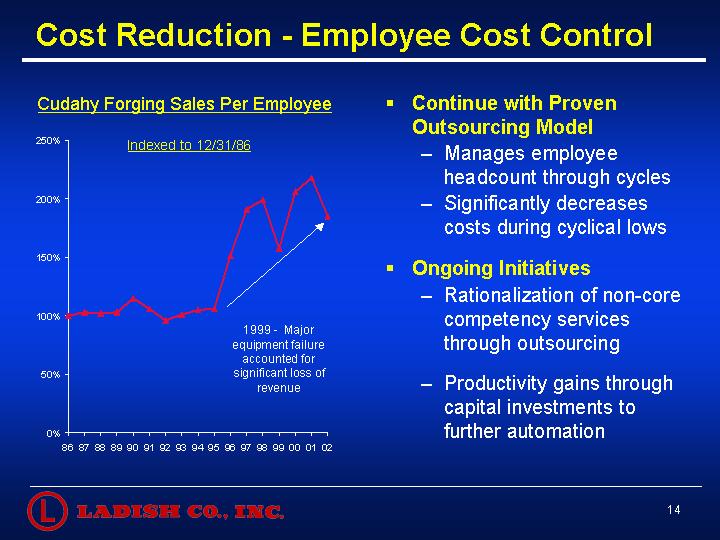

Cost Reduction - Employee Cost Control

Cudahy Forging Sales Per Employee

[CHART]

• Continue with Proven Outsourcing Model

• Manages employee headcount through cycles

• Significantly decreases costs during cyclical lows

• Ongoing Initiatives

• Rationalization of non-core competency services through outsourcing

• Productivity gains through capital investments to further automation

16

Selectively Pursue Acquisition Opportunities

Casting

• Niche process / materials capabilities

Value-Added Services

• Supplemental precision machining

Forging

• Complementary capabilities to Cudahy

• International expansion

17

Enhance Global Presence

Ladish is seeking to continue to position itself internationally to more effectively meet its customers demands and improve its cost structure.

Sourcing arrangements aimed at improving competitive advantage

• Existing titanium material sourcing through supply agreements in China and Russia

• Beginning to establish sales presence in China

Opportunities in Poland

• Exploring broadening presence through JV’s and potentially through acquisitions

• Access lower cost manufacturing

• Enhance EU growth opportunities

18

INDUSTRY ENVIRONMENT

19

Challenging Industry Environment

Current Environment

• Airline Losses

• Weak Passenger Traffic

• Airline Bankruptcies

• Increases in Military

Supply Chain Drivers

• Load Factors

• Airline Profitability

• Commercial Aircraft Orders

• Military Demand

Industry Impact

• Cyclical Demand at Low Point

• Pricing Pressures

• Reduced Volumes

• Military “Flow Down” Materializing

20

Global Commercial Aircraft Deliveries

• Industry estimates predict a slowing recovery in deliveries in 2004/2005

• Ladish revenues tend to lead the delivery cycle by 6 to 12 months

Historical and Projected Large Commercial Aircraft Deliveries

[CHART]

Source: SpeedNews (January 2003); Forecast International (February 2003).

21

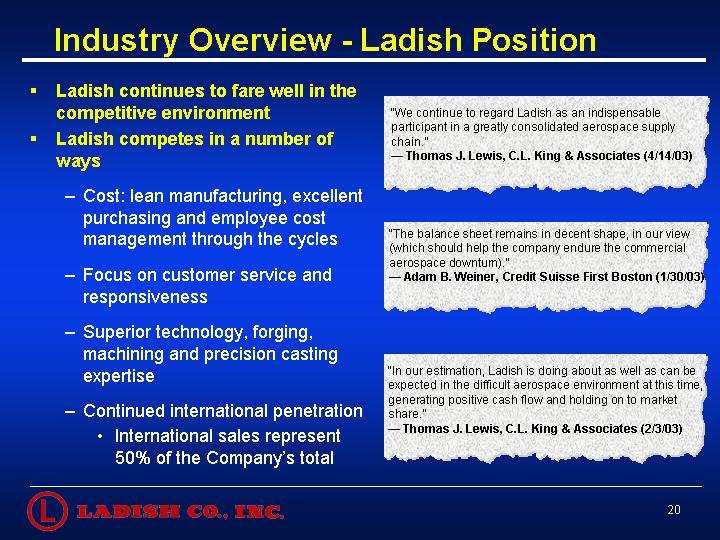

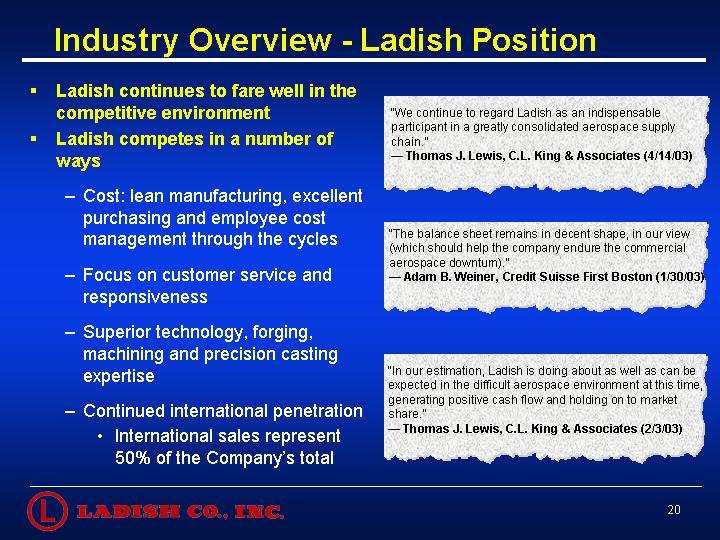

Industry Overview - Ladish Position

• Ladish continues to fare well in the competitive environment

• Ladish competes in a number of ways

• Cost: lean manufacturing, excellent purchasing and employee cost management through the cycles

• Focus on customer service and responsiveness

• Superior technology, forging, machining and precision casting expertise

• Continued international penetration

• International sales represent 50% of the Company’s total

[GRAPHICS]

22

MANAGEMENT AND BOARD

23

Strong, Experienced Management Team

Ladish Executive Management

[CHART]

Segment Management

• Cudahy Forging

• Executive staff of six

• 140+ years industry experience

• Pacific Cast Technologies

• Management staff of six

• 80+ years of industry experience

• Stowe Machine

• Management staff of five

• 70+ years of industry experience

• Incentive compensation programs tied to financial performance objectives

• Ongoing focus on increasing equity ownership through incentive option awards

24

Qualified, Knowledgeable Board

• Substantial industry experience

• Interests aligned with all Ladish shareholders

• Independent board

• 3 Independent Representatives

• 2 Grace Representatives

• 2 Company Representatives

• Track record of successfully managing the company through industry cycles

• Plan for capturing market opportunities and enhancing shareholder value

• As in the past, will continue to consider all strategic opportunities that are presented to the company

25

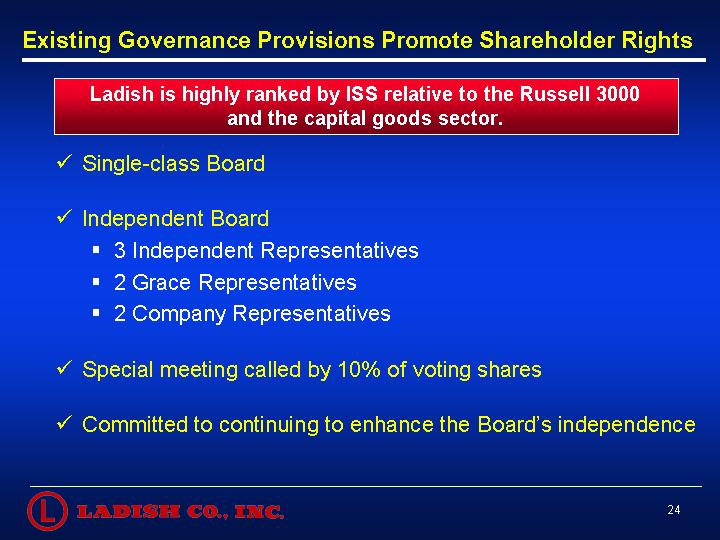

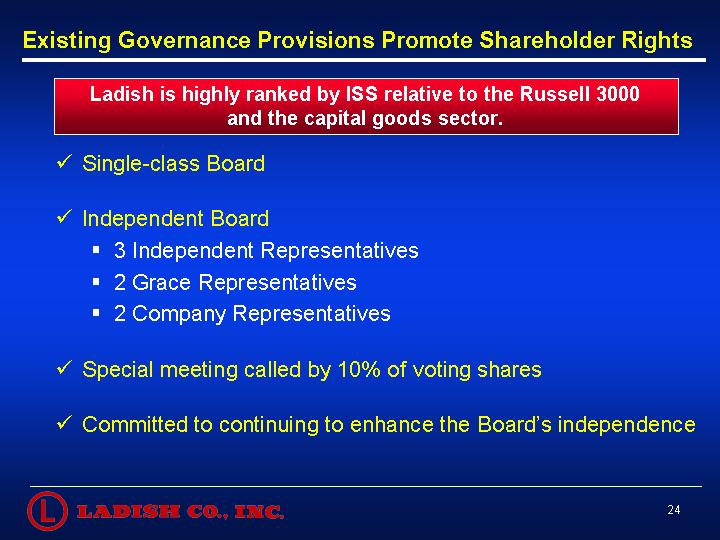

Existing Governance Provisions Promote Shareholder Rights

Ladish is highly ranked by ISS relative to the Russell 3000 and the capital goods sector.

• Single-class Board

• Independent Board

• 3 Independent Representatives

• 2 Grace Representatives

• 2 Company Representatives

• Special meeting called by 10% of voting shares

• Committed to continuing to enhance the Board’s independence

26

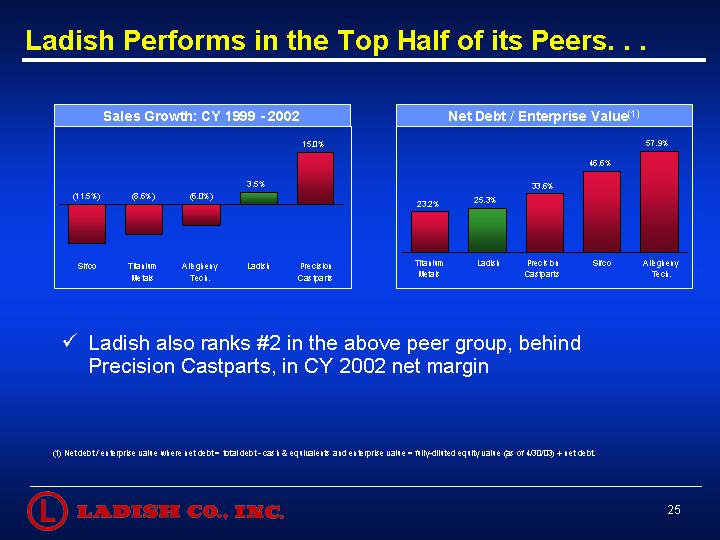

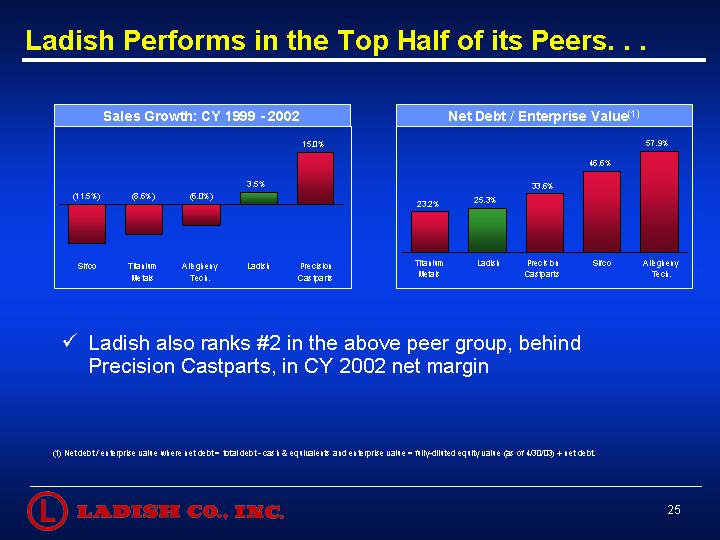

Ladish Performs in the Top Half of its Peers. . .

Sales Growth: CY 1999 - 2002

[CHART]

Net Debt / Enterprise Value(1)

[CHART]

• Ladish also ranks #2 in the above peer group, behind Precision Castparts, in CY 2002 net margin

(1) Net debt / enterprise value where net debt = total debt - cash & equivalents and enterprise value = fully-diluted equity value (as of 4/30/03) + net debt.

27

. . . And Has Outperformed its Peers Since its IPO

[CHART]

Note: Comparable Companies Index includes Allegheny Technologies, Pr ecision Castparts, Sifco Industries, and Titanium Metals.

Note: Share price as of 4/30/03.

Source: Factset Research Systems.

28

GRACE PROPOSAL

29

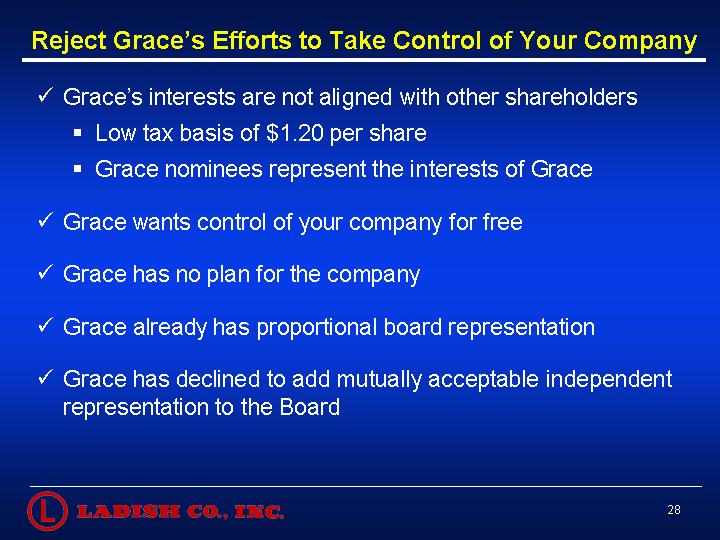

Reject Grace’s Efforts to Take Control of Your Company

• Grace’s interests are not aligned with other shareholders

• Low tax basis of $1.20 per share

• Grace nominees represent the interests of Grace

• Grace wants control of your company for free

• Grace has no plan for the company

• Grace already has proportional board representation

• Grace has declined to add mutually acceptable independent representation to the Board

30

FINANCIAL OVERVIEW

31

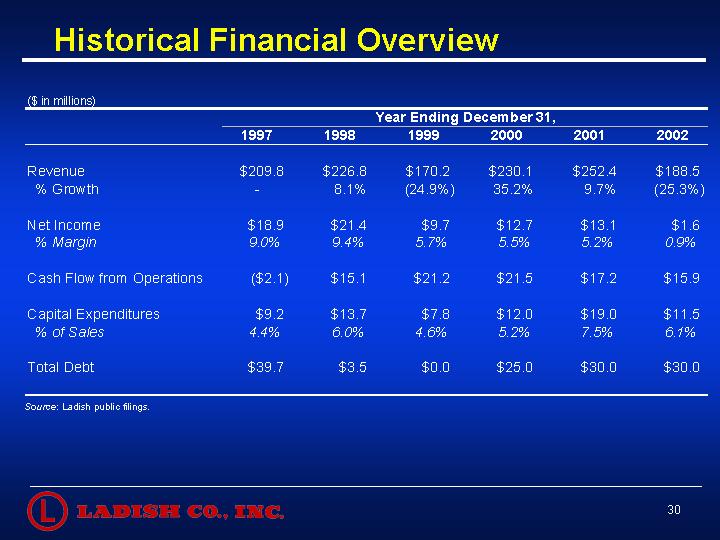

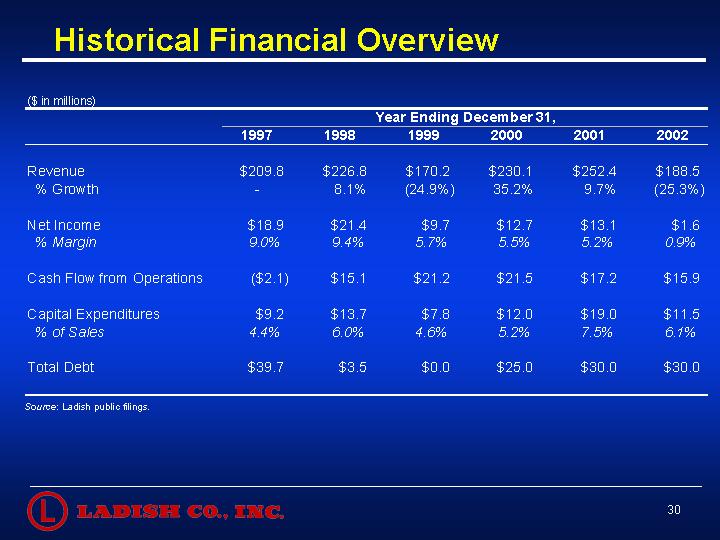

Historical Financial Overview

($ in millions)

| | Year Ending December 31, | |

| | 1997 | | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | |

| | | | | | | | | | | | | |

Revenue | | $ | 209.8 | | $ | 226.8 | | $ | 170.2 | | $ | 230.1 | | $ | 252.4 | | $ | 188.5 | |

% Growth | | — | | 8.1 | % | (24.9 | )% | 35.2 | % | 9.7 | % | (25.3 | )% |

| | | | | | | | | | | | | |

Net Income | | $ | 18.9 | | $ | 21.4 | | $ | 9.7 | | $ | 12.7 | | $ | 13.1 | | $ | 1.6 | |

% Margin | | 9.0 | % | 9.4 | % | 5.7 | % | 5.5 | % | 5.2 | % | 0.9 | % |

| | | | | | | | | | | | | |

Cash Flow from Operations | | $ | (2.1 | ) | $ | 15.1 | | $ | 21.2 | | $ | 21.5 | | $ | 17.2 | | $ | 15.9 | |

| | | | | | | | | | | | | |

Capital Expenditures | | $ | 9.2 | | $ | 13.7 | | $ | 7.8 | | $ | 12.0 | | $ | 19.0 | | $ | 11.5 | |

% of Sales | | 4.4 | % | 6.0 | % | 4.6 | % | 5.2 | % | 7.5 | % | 6.1 | % |

| | | | | | | | | | | | | |

Total Debt | | $ | 39.7 | | $ | 3.5 | | $ | 0.0 | | $ | 25.0 | | $ | 30.0 | | $ | 30.0 | |

Source: Ladish public filings.

32

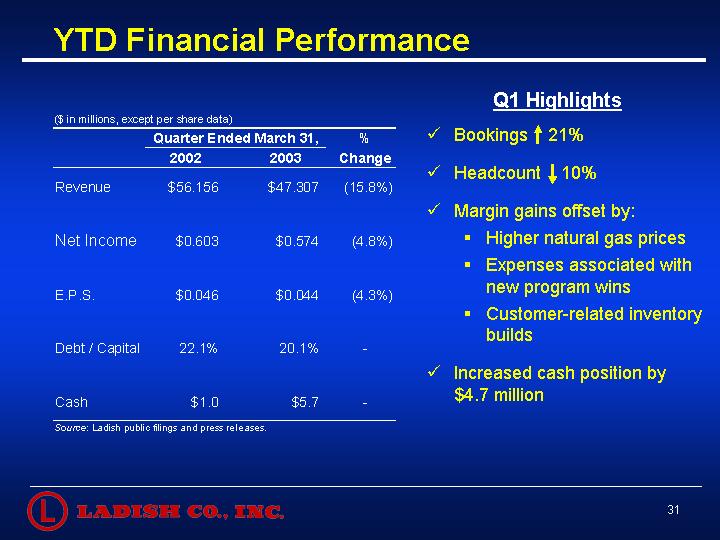

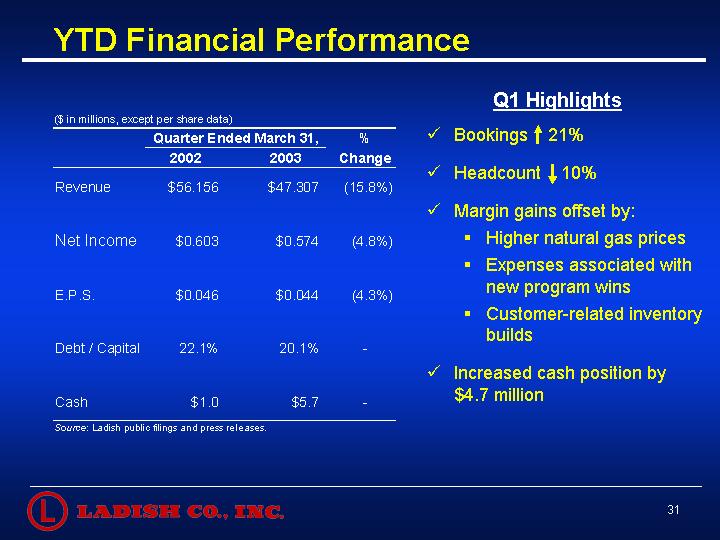

YTD Financial Performance

($ in millions, except per share data)

| | Quarter Ended March 31, | | %

Change | |

2002 | | 2003 |

| | | | | | | |

Revenue | | $ | 56.156 | | $ | 47.307 | | (15.8 | )% |

| | | | | | | |

Net Income | | $ | 0.603 | | $ | 0.574 | | (4.8 | )% |

| | | | | | | |

E.P.S. | | $ | 0.046 | | $ | 0.044 | | (4.3 | )% |

| | | | | | | |

Debt / Capital | | 22.1 | % | 20.1 | % | — | |

| | | | | | | |

Cash | | $ | 1.0 | | $ | 5.7 | | — | |

Source: Ladish public filings and press releases.

Q1 Highlights

• Bookings 21%

• Headcount 10%

• Margin gains offset by:

• Higher natural gas prices

• Expenses associated with new program wins

• Customer-related inventory builds

• Increased cash position by $4.7 million

33

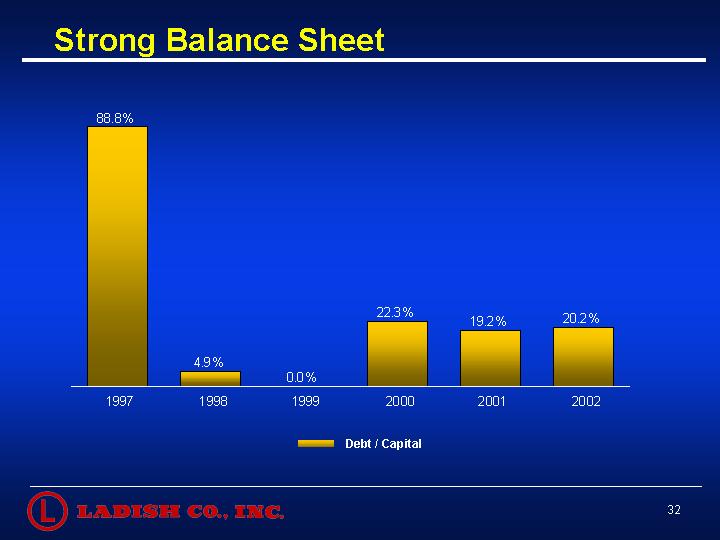

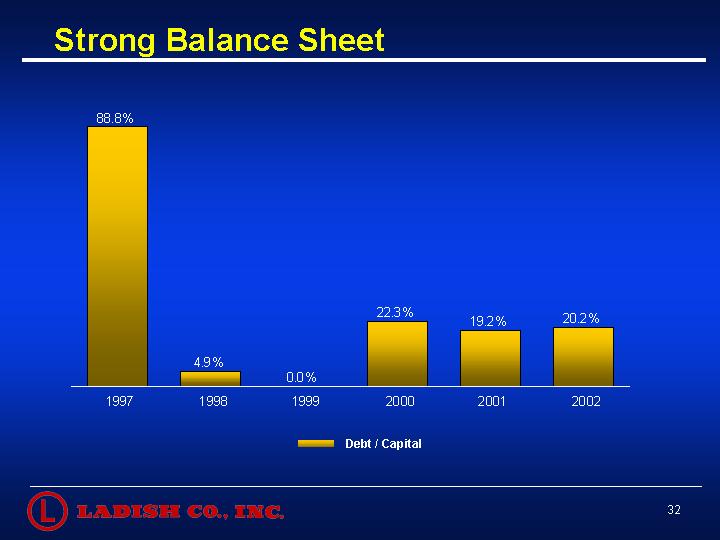

Strong Balance Sheet

[CHART]

34

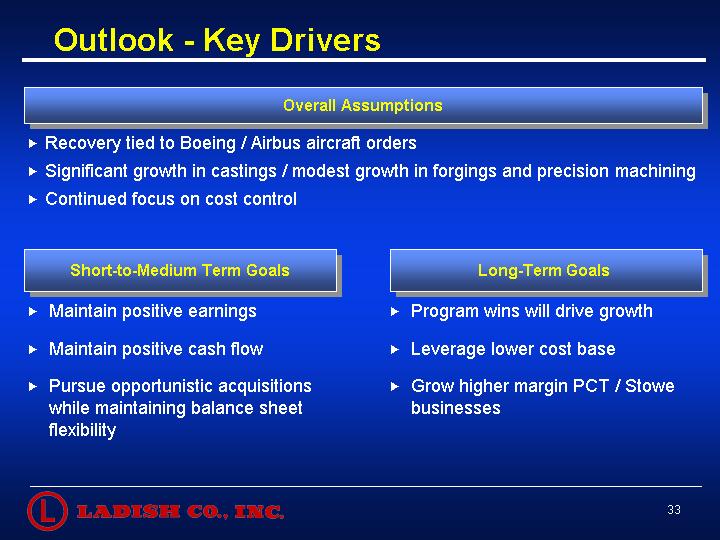

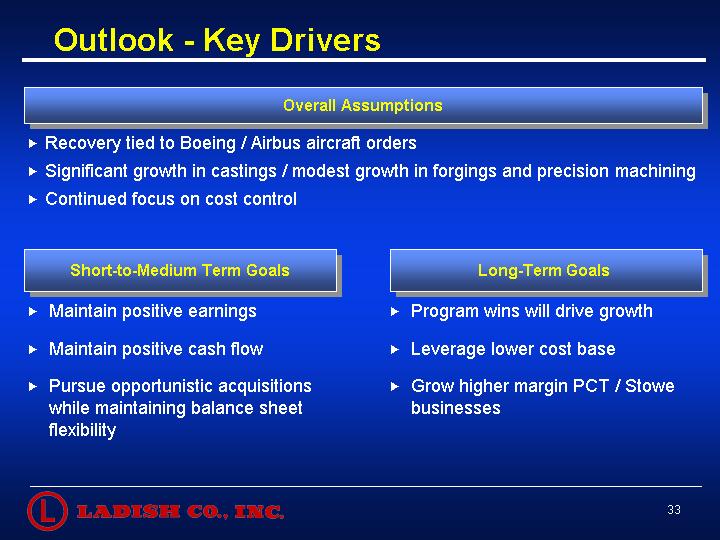

Outlook - Key Drivers

Overall Assumptions

• Recovery tied to Boeing / Airbus aircraft orders

• Significant growth in castings / modest growth in forgings and precision machining

• Continued focus on cost control

Short-to-Medium Term Goals

• Maintain positive earnings

• Maintain positive cash flow

• Pursue opportunistic acquisitions while maintaining balance sheet flexibility

Long-Term Goals

• Program wins will drive growth

• Leverage lower cost base

• Grow higher margin PCT / Stowe businesses

35