| Halo Companies, Inc. One Allen Center, Suite 500700 Central Expressway South Allen, TX 75013 o: 214.644.0065 f: 214.644.0070 |

September 20, 2011

Mr. Larry Spirgel, Assistant Director

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Halo Companies, Inc. (the “Company”) |

| | Form 10-K for fiscal year ended December 31, 2010 |

| | Filed March 31, 2011 |

| | File No. 000-15862 |

Dear Mr. Spirgel:

This letter is being submitted in response to an August 24, 2011 phone call request by Michael Henderson of the SEC with the Company to further clarify Comment #4 of the letter dated July 25, 2011. In the phone conversation on August 24, 2011, the Company agreed to provide additional discussion points on the revenue recognition of Halo Debt Solutions along with additional ancillary items supporting that revenue recognition including; a customer contract, the Company’s detailed historical analysis supporting revenue recognition service period as of December 31, 2010, and supporting detail of the Company’s allowance for doubtful accounts as of December 31, 2010. In an effort to provide a full understanding of HDS service provided to its customers and the corresponding revenue recognition and collectability of the revenue generated, the Company is providing an all encompassing response, for which many of the discussion points below have been previously discussed in the Company’s original response dated June 17, 2011 and in a second response dated July 25, 2011.

Response:

The accounting literature on revenue recognition includes both broad conceptual discussions as well as certain industry-specific guidance, none of which is specific to the Debt Settlement Industry. Consequently, in the absence of authoritative literature addressing a specific arrangement or a specific industry, HDS has considered existing broad revenue recognition criteria specified in the FASB’s conceptual framework, specifically ASC Codification Topic 605 (ASC 605): Revenue Recognition. Further, SEC Staff Accounting Bulletin: No. 104 was also considered in the Company’s evaluation of appropriate revenue recognition. Per the criteria, revenue generally is realized or realizable and earned, when all of the following are met:

| · | Persuasive evidence of an arrangement exists |

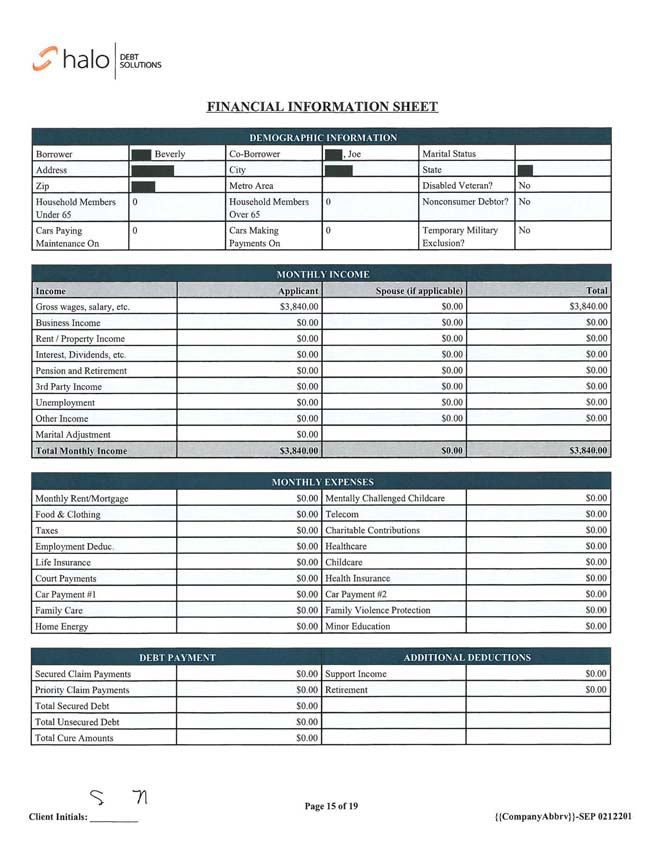

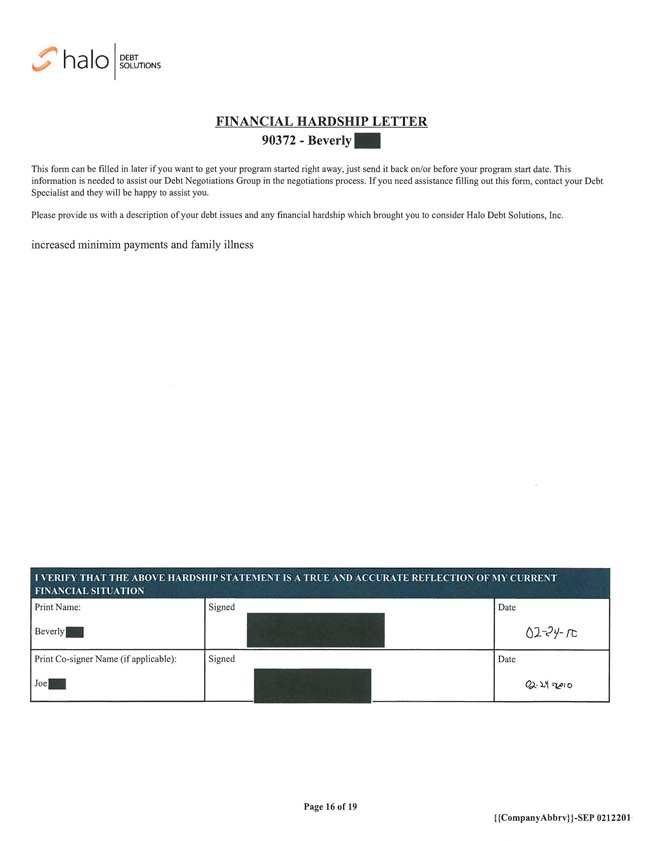

For HDS, a detailed service agreement is entered into for each customer, and that service agreement serves as evidence of the arrangement. The Company has included as Attachment A to this letter an example of an executed customer contract (please note names have been removed as a security precaution).

| · | Delivery has occurred and services have been rendered |

Background discussion and several comments regarding this point are set forth below.

1) Performance of the Service. After performance of a service, if uncertainty exists about customer acceptance, revenue should not be recognized until acceptance occurs. Customer acceptance provisions may be included in a contract, among other reasons, to enforce a customer's rights to (a) test the delivered product, (b) require the seller to perform additional services subsequent to performance of an initial service, or (c) identify other work necessary to be done before customer acceptance. The contractual customer acceptance provisions are substantive, bargained-for terms of an arrangement. Accordingly, when such contractual customer acceptance provisions exist, the service provider should not recognize revenue until customer acceptance occurs or the acceptance provisions lapse.

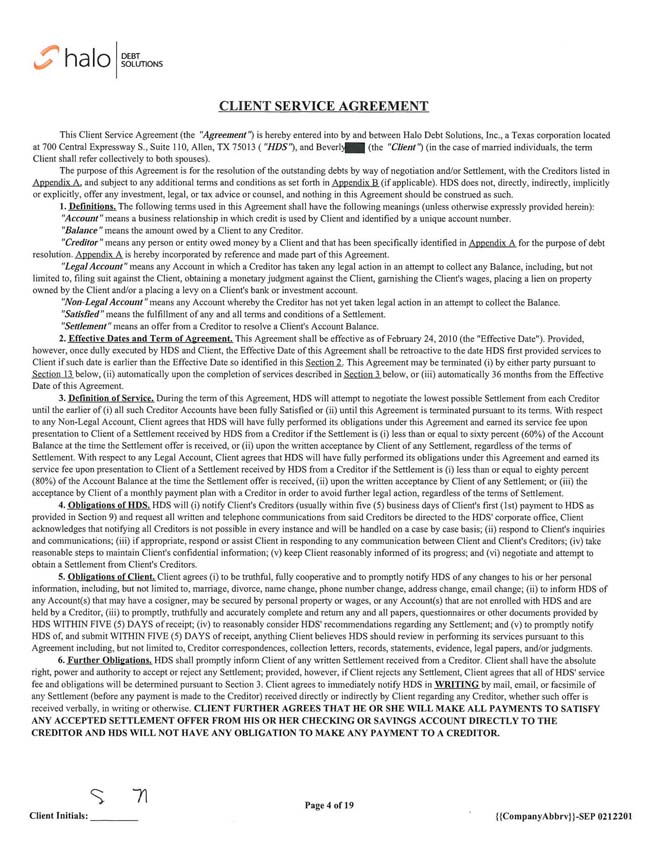

Consistent with the background provided above, HDS clearly outlines in each customer service agreement (a) the services to be performed and (b) HDS’ contractual obligations relating to the customer’s acceptance. The services to be performed are clearly defined, such that HDS will have fully performed its obligations under the agreement, and earned its fee, upon presentation to the customer of a settlement offer for a stated percentage (or lower) of amounts owed to the particular creditor. The amount of time and effort required to secure the settlement is discussed further below.

2) Substantial Completion. A service provider should substantially complete or fulfill the terms specified in the arrangement in order for performance to have occurred. When applying the substantially complete notion, only inconsequential or perfunctory actions may remain incomplete such that the failure to complete the inconsequential or perfunctory actions would not result in the customer receiving a refund or rejecting the services performed to date. In addition, the seller should have a demonstrated history of completing the remaining tasks in a timely manner and reliably estimating the remaining costs. If revenue is recognized upon substantial completion of the arrangement, all remaining costs of performance or delivery should be accrued. As a note, formal customer sign-off is not always necessary to recognize revenue provided that the seller objectively demonstrates that the criteria specified in the acceptance provisions are satisfied.

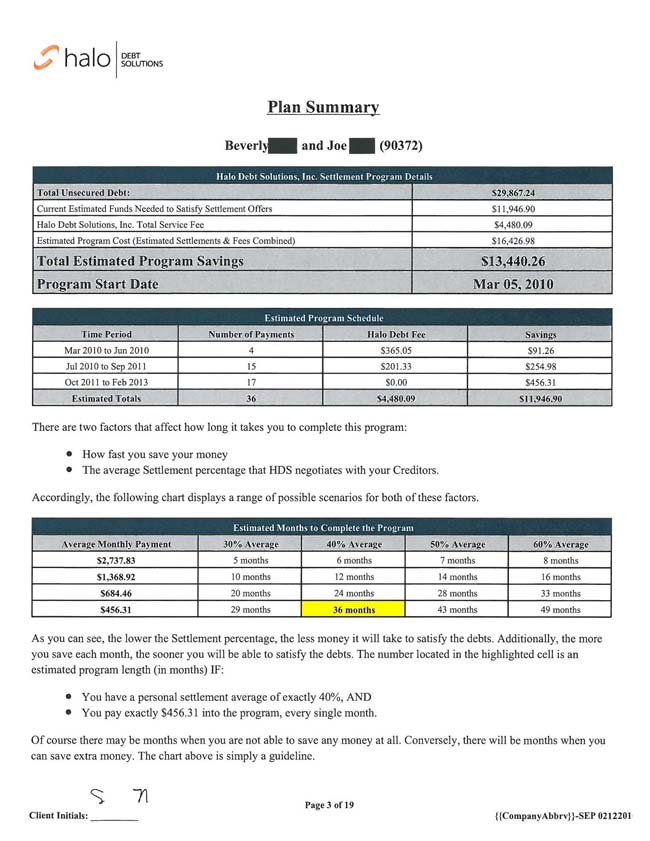

Consistent with the background provided above, HDS has determined that by completing the effort it takes to secure a settlement offer from a creditor that is at (or better than) the contractually defined settlement threshold (Attachment A Section 3 Definition of Service), HDA has substantially performed its obligations under the arrangement and delivered the service in good faith, leaving only perfunctory and inconsequential actions (if any) to be performed. The Company notes no material costs are incurred by the Company outside of the settlement term (actual settlement term defined below). As it relates to refunds for any client not at the end of the contractual service agreement, please note the following in Attachment A service agreement Section 22 Cancellation; “should the client cancel any time after three days of the effective date of the agreement, client agrees that all fees paid to HDS prior to cancellation are fully earned by HDS and the client will not receive a refund of any such fees.

3) Term of Recognition. Provided all other revenue recognition criteria are met, service revenue should be recognized on a straight-line basis, unless evidence suggests that the revenue is earned or obligations are fulfilled in a different pattern, over the contractual term of the arrangement or the expected period, during which those specified services will be performed, whichever is longer.

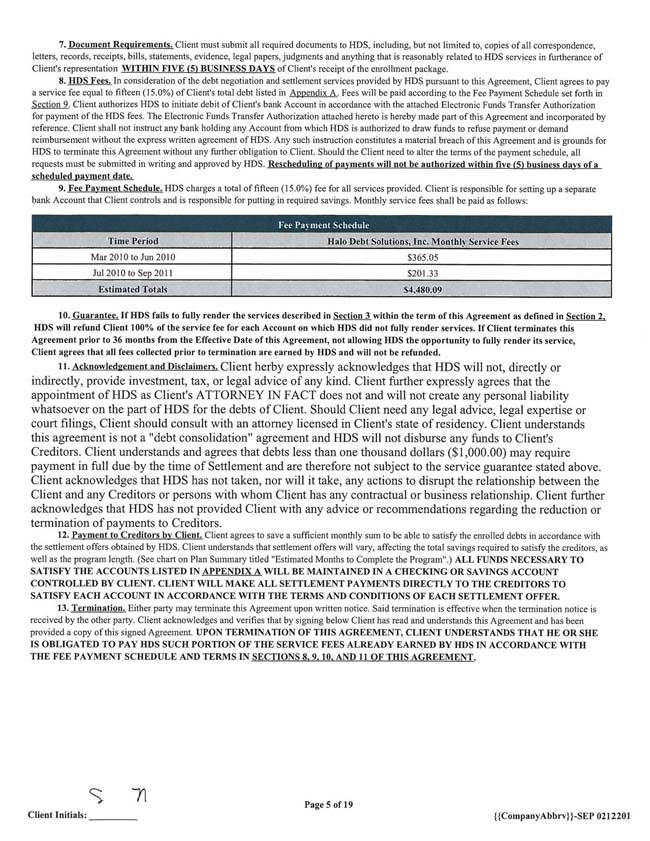

Consistent with the background provided above, HDS recognizes its revenue over the term that it takes to secure a settlement offer that is at (or better than) the contractually defined settlement threshold (Section 3 Definition of Service of Attachment A). It is over the term that it takes to secure a settlement offer that HDS has substantially performed its service and recognizes its revenue. During the term, steps are performed to obtain a satisfactory settlement as is referenced in Attachment A Section 4 Obligations of HDS. As of December 31, 2010, the amount of time it takes to receive a settlement offer from a creditor to satisfy HDS’ contractual obligation averages 10 months. This time period is supported by empirical historical evidence from both previous and existing HDS customers. The Company included as Attachment B historical analysis of both settled and unsettled accounts used in determining the 10 month period. Please note actual calculation supported 10.3 months which was rounded to the nearest whole month. Weighted average of all accounts by “creditor balance” is used to determine applicable service period used for all accounts. As such, the Company has recognized revenue on a straight-line basis over the average service period of its book of business consistent with its earning fulfillment. Although the payout term of the customer service agreement is longer than the 10 month actual service period needed to perform the settlement service, only inconsequential and perfunctory items remain after the service period (i.e. administration items including helping ensure the customer pays settlement offer to correct creditor bank account, etc.). The Company notes below in its collectability discussion the rationale of allowing for an extended payment term beyond its average service period.

| · | The seller’s price to the buyer is fixed or determinable |

As noted in Attachment A within the service agreement, specifically Section 10 Guarantee:

“If HDS fails to fully render the services described clearly in the definition of service (discussed above) within the term of this agreement, HDS will refund Client 100% of the service fee for each Account on which HDS did not fully render services. If Client terminates this Agreement prior to the contractual months from the Effective Date of this Agreement, not allowing HDS the opportunity to fully render its service, Client agrees that all fees collected prior to termination are earned by HDS and will not be refunded.”

The possibility of refunds is the only variable that would impact the fixed or determinable character of the fees earned by HDS. However, HDS has been able to accurately and reliably estimate refunds, based on historical customer data; consequently, HDS’ actual historical refunds have been immaterial to HDS and to Halo Companies, Inc. as a whole.

| · | Collectability is reasonably assured |

By way of background, HDS looks at its collectability of accounts receivable based on historical revenue recognition compared to actual write offs of customer accounts receivable balances. This analysis is re-performed at each financial reporting date (which would incorporate all past transaction history along with any changes to current economic and industry trends and changes in customer payment terms). HDS establishes an allowance, based on past transaction history with customers, current economic and industry trends, and changes in customer payment terms. HDS provides for estimated uncollectible amounts through an increase to the allowance for doubtful accounts and a charge to earnings. Balances that remain outstanding after HDS has used reasonable collection efforts are written off through a charge to the allowance for doubtful accounts.

See Attachment C for support of the Company’s lag analysis used in preparation of the allowance for doubtful accounts. Note in Attachment C the 16.3% all time write offs. This percentage is based on the sum of all account receivable write offs as a percentage of all revenue recognized. The percentage is then applied to the December 31, 2010 account receivable balance to determine the December 31, 2010 allowance for doubtful accounts. Accordingly, as of December 31, 2010, HDS had an allowance for doubtful accounts of approximately 16-17% of the year-end HDS gross accounts receivable balance.

As further discussion, HDS has established a comprehensive measure of the collectability of its service fee over the term that the service is provided. Although it varies by customer, approximately 65-75% of the service fee is collected during the average service period (defined at December 31, 2010 as 10 months). This equates to having to only collect 25-35% of the total fee earned after the service period. As a courtesy to HDS’ client base, and as part of the original contractual agreement between HDS and the customer, HDS may allow a customer a contractually agreed-upon extended period of time to pay HDS for the 25-35% balance of the total fee earned. Not only does the extended payment schedule benefit the customer from a monthly cash flow perspective, it benefits HDS, as the contractually agreed extended payment terms allow the customer to save more money during the contract period and apply those additional funds to the creditor settlements faster, further enhancing HDS’ overall collectability (i.e. fewer cancellations). Historically, of the 25-35% balance of the total fee earned, approximately 88-89% of this balance is collected, and approximately 11-12% of this balance is written off. This percentage is noted in Attachment C and is calculated as follows; sum of all accounts receivable written off after month 10 divided by the sum of fees to be received after month 10 of the contract (note the sum of fees to be received includes fees actually received and fees expected to be received that were actually written off after month 10).

Please note additional collectability language under contract as included per Attachment A of the client service agreement Section 22 Cancellations, “other than fees paid in the first 3 days of the contract, all fees paid to HDS prior to cancellation are fully earned by HDS and the client will not receive refunds of any such fees”. Under Section 13 Termination, “HDS also has full rights under the agreement to receipt of accounts receivable due for fees earned for settlements performed”. These two items noted in the contract further validate revenue recognition over the service period as they minimize collectability and refund issues.

The Company hopes the additional discussion above and the inclusion of Attachments A, B, and C will help further clarify HDS revenue recognition is in fact in accordance with ASC 605 and that the allowance for doubtful accounts is appropriate based on the Company’s actual historical data.

Lastly, as discussed in Management’s Discussion and Analysis of Financial Condition and Results of Operations in Form 10-K for the period ended December 31, 2010, the Company made a strategic decision in October 2010 not to initiate any new sales in the HDS entity. All service for existing customers would continue as is with no new volume growth in HDS after October 2010. Through the first six months of fiscal year ended 2011, the Company has recognized $453,000 of revenue in the HDS entity (related to revenue earned over the 10 month service period for all customers enrolled into HDS prior to October 2010).

Sincerely,

/s/ Brandon Cade Thompson

Brandon Cade Thompson

Chief Executive Officer