UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-01716

AB CAP FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Stephen M. Woetzel

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: June 30, 2024

Date of reporting period: June 30, 2024

ITEM 1. REPORTS TO STOCKHOLDERS.

Please scan QR code for Fund Information

AB Select US Equity Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB Select US Equity Portfolio (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AUUIX-A. You can also request this information by contacting us at (800) 227 4618 .

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $130 | 1.16% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

During the 12-month period ended June 30, 2024, all share classes of the Fund, except Class C, outperformed the benchmark before sales charges. During the period, security selection contributed to relative performance, while sector selection detracted. Security selection within the consumer discretionary, financials, and technology sectors contributed, while selection within the industrials, energy, and health care sectors detracted. In terms of sector selection, underweight positions to consumer discretionary and real estate, and an overweight position to communication services contributed to relative returns, while an underweight to information technology, the Fund's transactional cash position, and an overweight to health care detracted.

The Fund did not utilize derivatives during the 12-month period.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

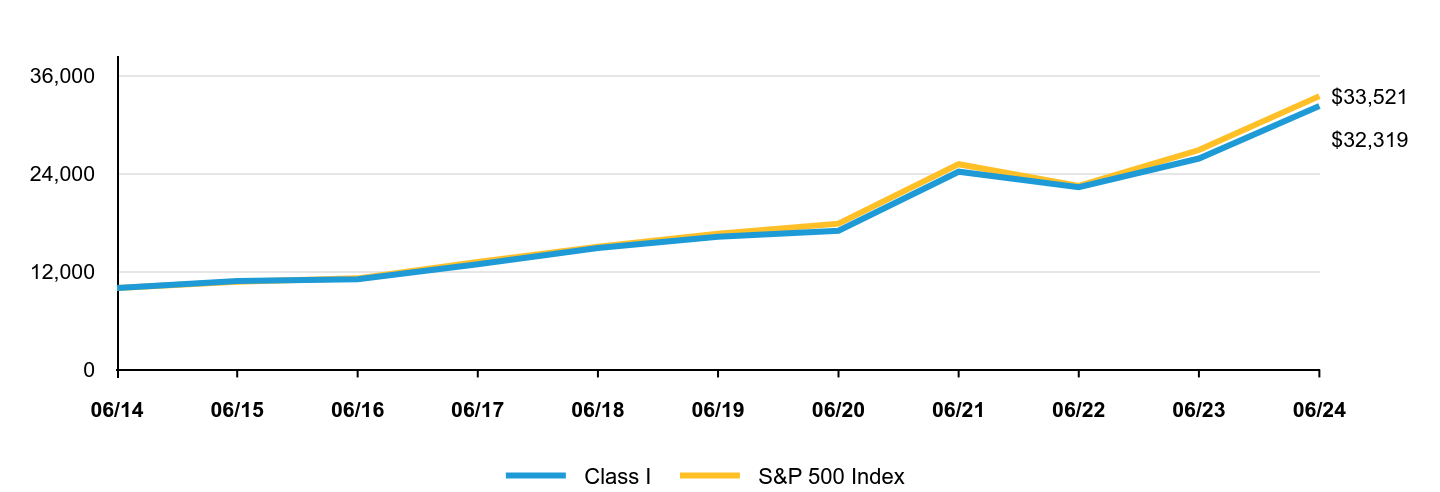

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class I | S&P 500 Index |

|---|

| 06/14 | $10,000 | $10,000 |

| 06/15 | $10,834 | $10,742 |

| 06/16 | $11,052 | $11,171 |

| 06/17 | $12,903 | $13,170 |

| 06/18 | $14,884 | $15,064 |

| 06/19 | $16,280 | $16,633 |

| 06/20 | $17,005 | $17,881 |

| 06/21 | $24,252 | $25,175 |

| 06/22 | $22,355 | $22,503 |

| 06/23 | $25,869 | $26,912 |

| 06/24 | $32,319 | $33,521 |

Average Annual Total Returns

| Class Name | 1 Year | 5 Years | 10 Years |

|---|

| Class I (without sales charges) | 24.93% | 14.70% | 12.45% |

| Class I (with sales charges) | 24.93% | 14.70% | 12.45% |

| S&P 500 Index | 24.56% | 15.05% | 12.86% |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/AUUIX-A for the most recent performance information.

- Net Assets$265,328,298

- # of Portfolio Holdings77

- Portfolio Turnover Rate171%

- Total Advisory Fees Paid$2,216,702

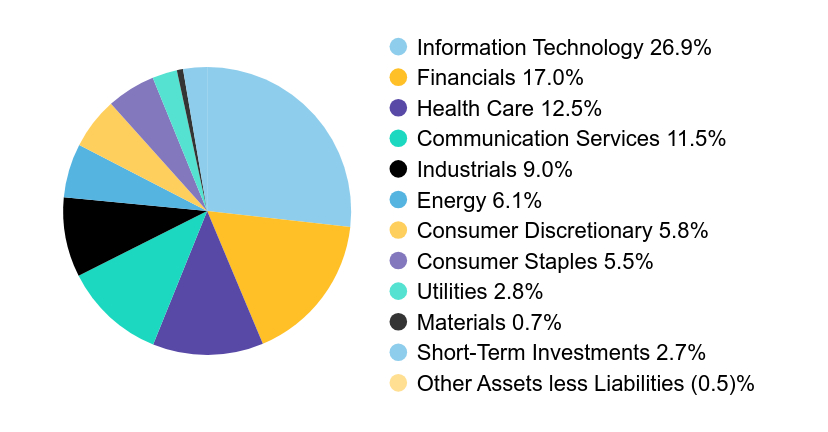

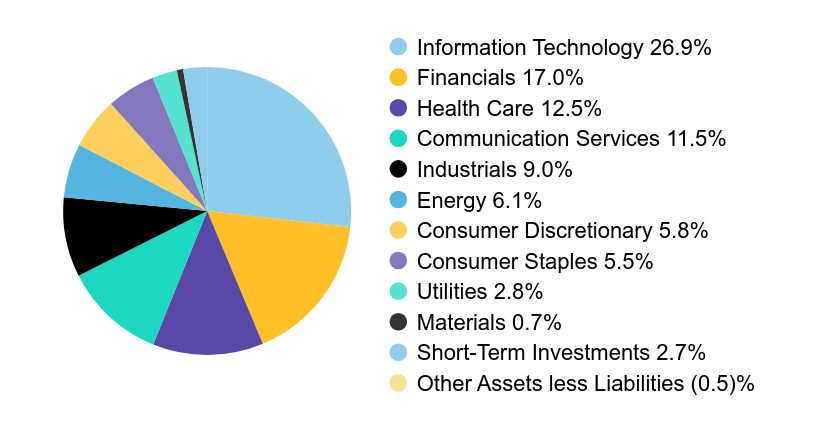

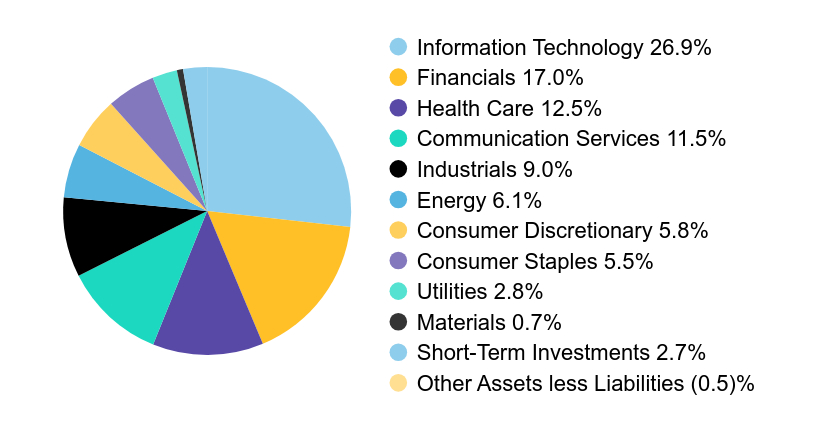

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

| Apple, Inc. | $18,095,207 | 6.8% |

| Microsoft Corp. | $17,862,804 | 6.7% |

| NVIDIA Corp. | $16,210,548 | 6.1% |

| Berkshire Hathaway, Inc. - Class B | $11,920,460 | 4.5% |

| Alphabet, Inc. - Class A | $11,385,468 | 4.3% |

| Amazon.com, Inc. | $9,445,867 | 3.6% |

| Meta Platforms, Inc. - Class A | $7,926,842 | 3.0% |

| EOG Resources, Inc. | $5,088,673 | 1.9% |

| Honeywell International, Inc. | $4,812,765 | 1.8% |

| JPMorgan Chase & Co. | $4,534,669 | 1.7% |

| $107,283,303 | 40.4% |

| Value | Value |

|---|

| Information Technology | 26.9% |

| Financials | 17.0% |

| Health Care | 12.5% |

| Communication Services | 11.5% |

| Industrials | 9.0% |

| Energy | 6.1% |

| Consumer Discretionary | 5.8% |

| Consumer Staples | 5.5% |

| Utilities | 2.8% |

| Materials | 0.7% |

| Short-Term Investments | 2.7% |

| Other Assets less Liabilities | (0.5)% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/AUUIX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618 .

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618 .

Information Regarding the Review and Approval of the Fund's Advisory Agreement

Information regarding the Fund's Board of Directors'/Trustees' review of the advisory agreement is available on the Fund's website [https://www.abfunds.com/link/AB/AUUIX-A]. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

Please scan QR code for Fund Information

AB Global Core Equity Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB Global Core Equity Portfolio (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/GCEAX-A. You can also request this information by contacting us at (800) 227 4618 .

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $110 | 1.03% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

During the 12-month period ended June 30, 2024, all share classes of the Fund underperformed the benchmark before sales charges. Both security selection and sector allocation detracted from performance, relative to the benchmark. Overall security selection detracted the most, particularly selection within consumer discretionary and health care, while selection within communication services and materials contributed. Sector allocation also detracted as losses from underweights to consumer discretionary and health care offset gains from overweights to communication services and materials. Country positioning (a result of bottom-up security analysis combined with fundamental research) was negative; losses from an overweight to China were partially offset by contributions from an overweight to Denmark.

The Fund did not utilize derivatives during the six- or 12-month periods.

Top contributors to performance:

During the 12-month period, although overall security selection and sector allocation were negative, selection within, and allocation to, some sectors contributed to performance.

Top detractors from performance:

During the 12-month period, the Fund's underperformance relative to the benchmark was driven largely by security selection and, to lesser extent, sector allocation.

Security Selection

Top contributors

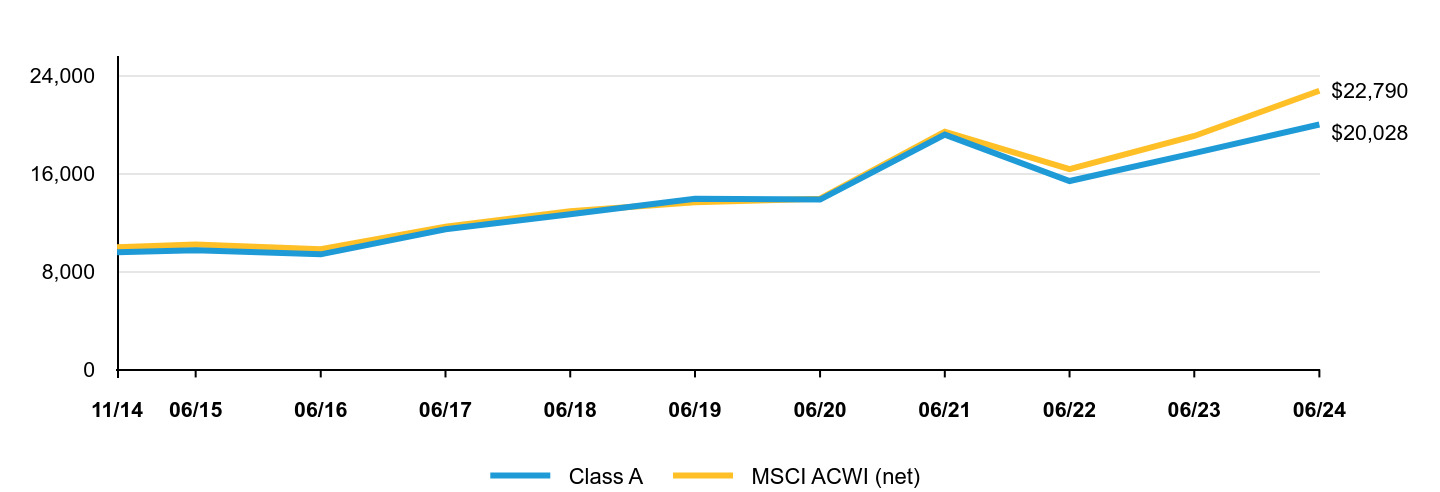

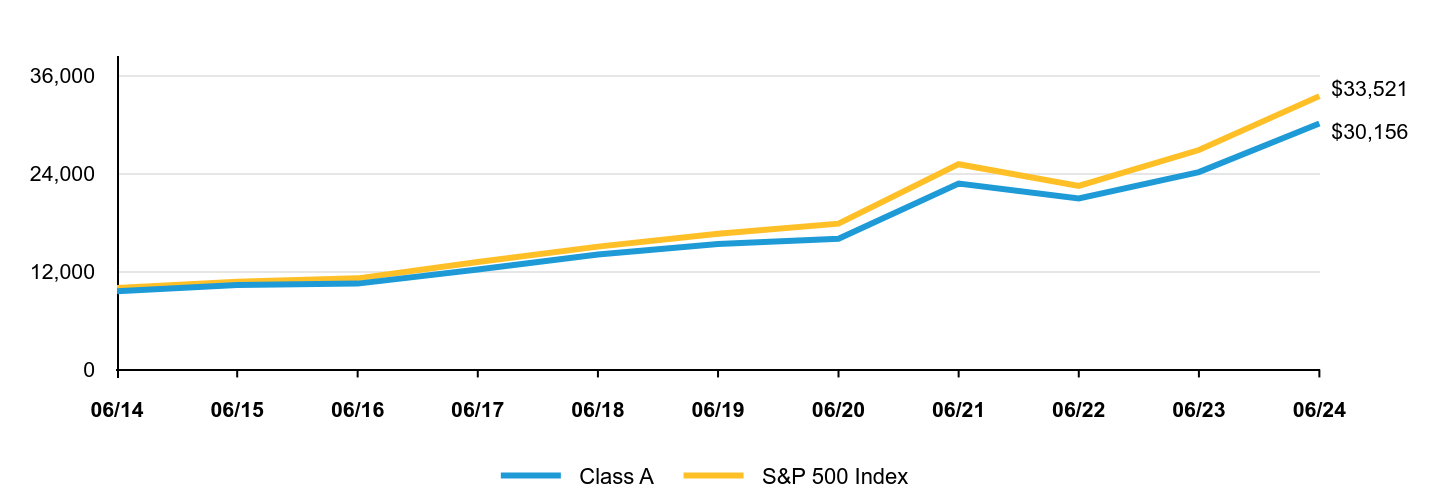

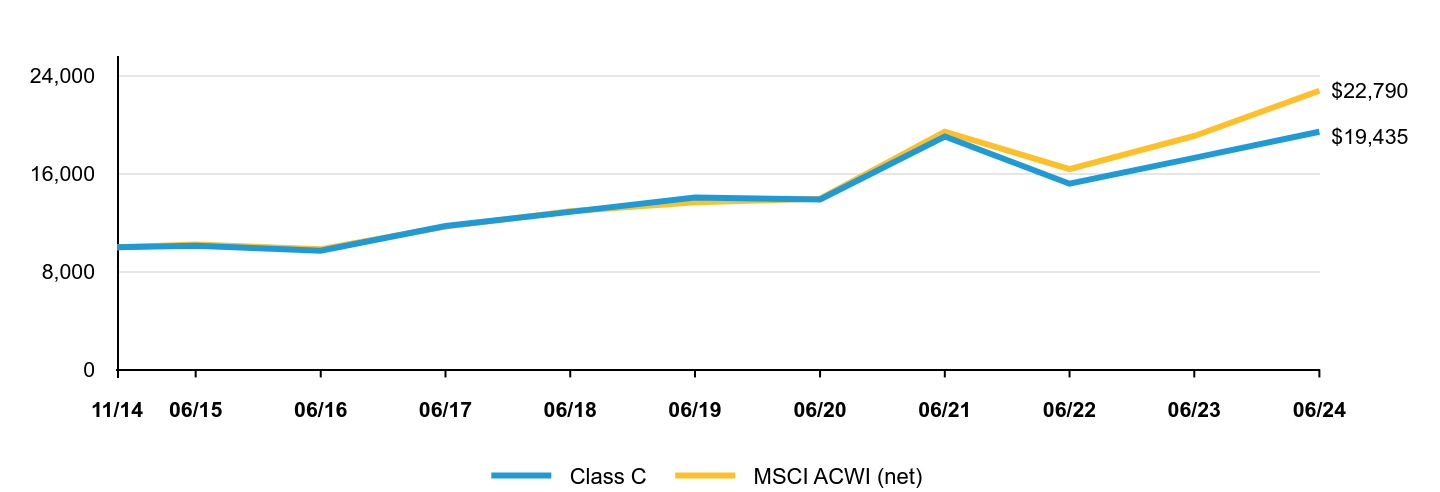

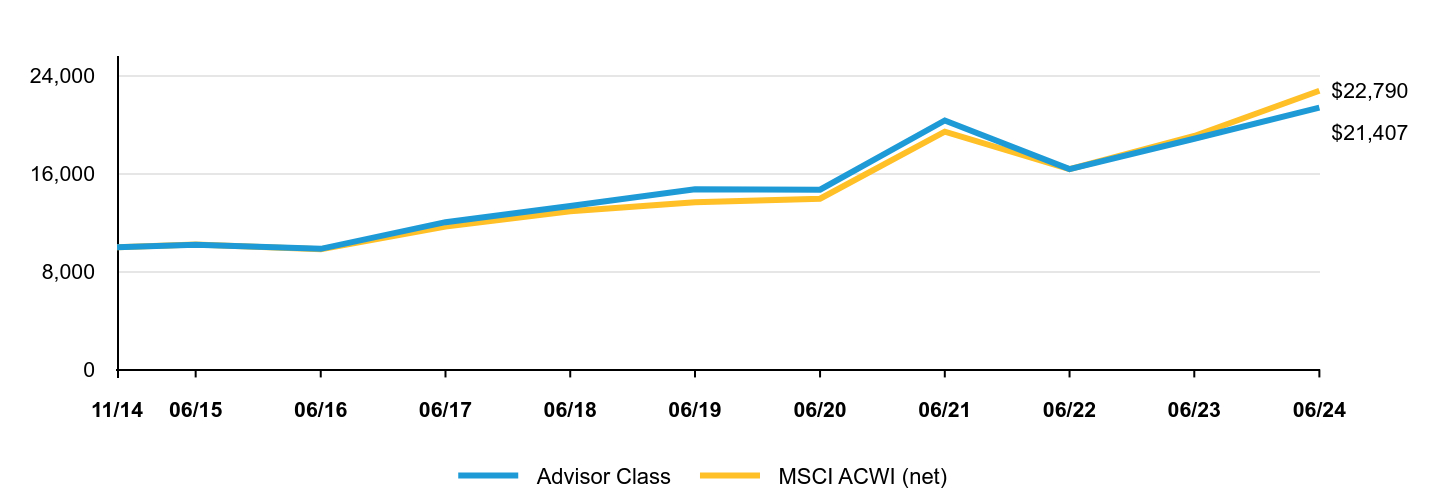

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class A | MSCI ACWI (net) |

|---|

| 11/14 | $9,579 | $10,000 |

| 06/15 | $9,743 | $10,213 |

| 06/16 | $9,412 | $9,832 |

| 06/17 | $11,465 | $11,679 |

| 06/18 | $12,694 | $12,932 |

| 06/19 | $13,958 | $13,674 |

| 06/20 | $13,891 | $13,963 |

| 06/21 | $19,198 | $19,446 |

| 06/22 | $15,407 | $16,383 |

| 06/23 | $17,686 | $19,091 |

| 06/24 | $20,028 | $22,790 |

Average Annual Total Returns

| Class Name | 1 Year | 5 Years | Since Inception 11/12/2014 |

|---|

| Class A (without sales charges) | 13.24% | 7.49% | 7.96% |

| Class A (with sales charges) | 8.44% | 6.56% | 7.48% |

| MSCI ACWI (net) | 19.38% | 10.76% | 8.92% |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/GCEAX-A for the most recent performance information.

- Net Assets$2,850,356,242

- # of Portfolio Holdings71

- Portfolio Turnover Rate52%

- Total Advisory Fees Paid$19,849,616

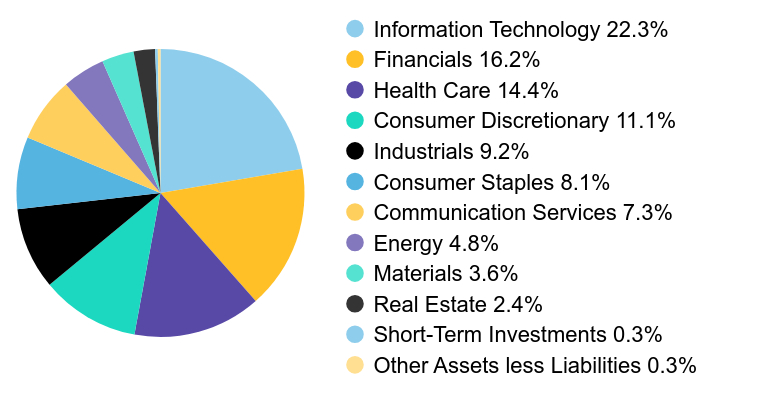

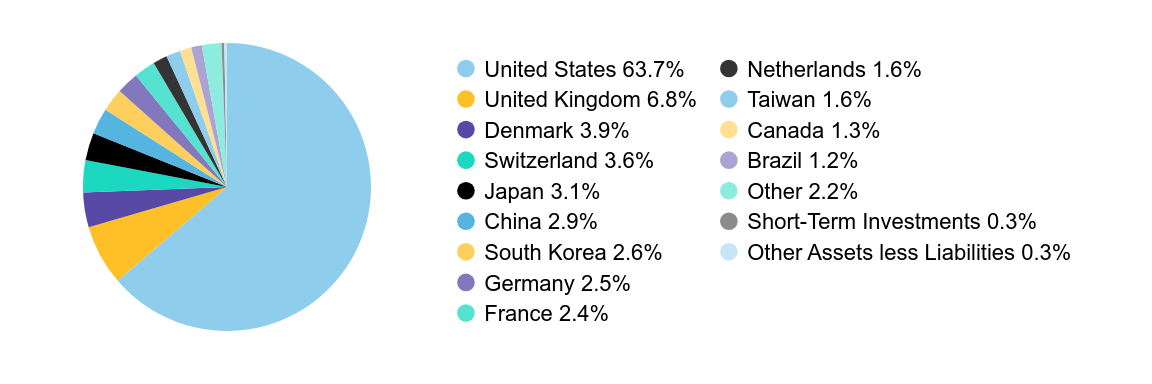

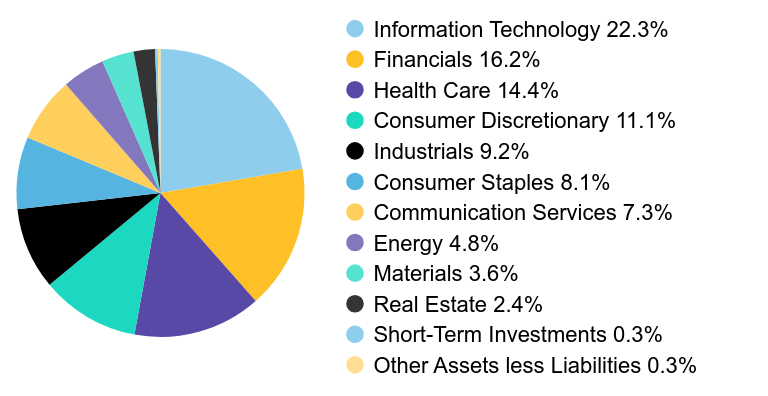

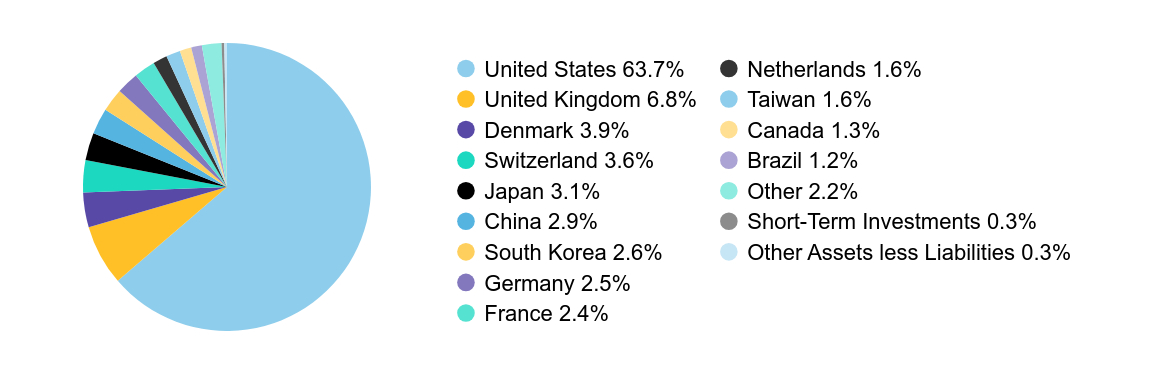

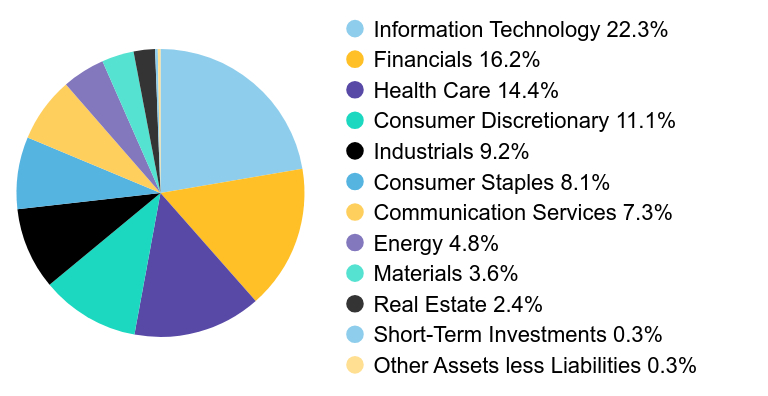

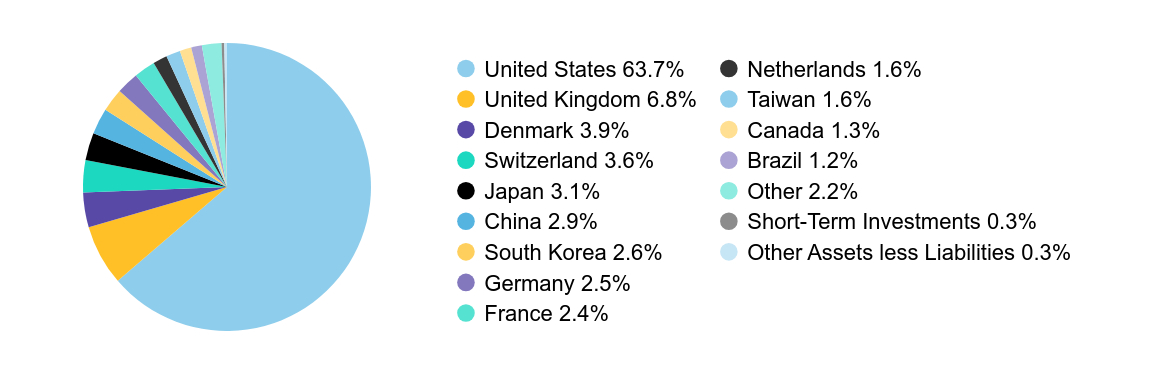

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

| Microsoft Corp. | $217,109,091 | 7.6% |

| Elevance Health, Inc. | $129,570,647 | 4.5% |

| NVIDIA Corp. | $118,878,836 | 4.2% |

| Otis Worldwide Corp. | $114,570,577 | 4.0% |

| Goldman Sachs Group, Inc. (The) | $110,945,050 | 3.9% |

| Coca-Cola Co. (The) | $104,028,287 | 3.7% |

| Alphabet, Inc. - Class C | $92,889,574 | 3.2% |

| NIKE, Inc. - Class B | $78,878,473 | 2.8% |

| Samsung Electronics Co., Ltd. | $74,754,118 | 2.6% |

| Asahi Group Holdings Ltd. | $68,834,895 | 2.4% |

| $1,110,459,548 | 38.9% |

| Value | Value |

|---|

| Information Technology | 22.3% |

| Financials | 16.2% |

| Health Care | 14.4% |

| Consumer Discretionary | 11.1% |

| Industrials | 9.2% |

| Consumer Staples | 8.1% |

| Communication Services | 7.3% |

| Energy | 4.8% |

| Materials | 3.6% |

| Real Estate | 2.4% |

| Short-Term Investments | 0.3% |

| Other Assets less Liabilities | 0.3% |

| Value | Value |

|---|

| United States | 63.7% |

| United Kingdom | 6.8% |

| Denmark | 3.9% |

| Switzerland | 3.6% |

| Japan | 3.1% |

| China | 2.9% |

| South Korea | 2.6% |

| Germany | 2.5% |

| France | 2.4% |

| Netherlands | 1.6% |

| Taiwan | 1.6% |

| Canada | 1.3% |

| Brazil | 1.2% |

| Other | 2.2% |

| Short-Term Investments | 0.3% |

| Other Assets less Liabilities | 0.3% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/GCEAX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618 .

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618 .

Information Regarding the Review and Approval of the Fund's Advisory Agreement

Information regarding the Fund's Board of Directors'/Trustees' review of the advisory agreement is available on the Fund's website [https://www.abfunds.com/link/AB/GCEAX-A]. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

Please scan QR code for Fund Information

AB Select US Equity Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB Select US Equity Portfolio (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AUUAX-A. You can also request this information by contacting us at (800) 227 4618 .

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $162 | 1.44% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

During the 12-month period ended June 30, 2024, all share classes of the Fund, except Class C, outperformed the benchmark before sales charges. During the period, security selection contributed to relative performance, while sector selection detracted. Security selection within the consumer discretionary, financials, and technology sectors contributed, while selection within the industrials, energy, and health care sectors detracted. In terms of sector selection, underweight positions to consumer discretionary and real estate, and an overweight position to communication services contributed to relative returns, while an underweight to information technology, the Fund's transactional cash position, and an overweight to health care detracted.

The Fund did not utilize derivatives during the 12-month period.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class A | S&P 500 Index |

|---|

| 06/14 | $9,577 | $10,000 |

| 06/15 | $10,345 | $10,742 |

| 06/16 | $10,525 | $11,171 |

| 06/17 | $12,259 | $13,170 |

| 06/18 | $14,102 | $15,064 |

| 06/19 | $15,382 | $16,633 |

| 06/20 | $16,025 | $17,881 |

| 06/21 | $22,805 | $25,175 |

| 06/22 | $20,974 | $22,503 |

| 06/23 | $24,199 | $26,912 |

| 06/24 | $30,156 | $33,521 |

Average Annual Total Returns

| Class Name | 1 Year | 5 Years | 10 Years |

|---|

| Class A (without sales charges) | 24.62% | 14.41% | 12.15% |

| Class A (with sales charges) | 19.31% | 13.42% | 11.67% |

| S&P 500 Index | 24.56% | 15.05% | 12.86% |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/AUUAX-A for the most recent performance information.

- Net Assets$265,328,298

- # of Portfolio Holdings77

- Portfolio Turnover Rate171%

- Total Advisory Fees Paid$2,216,702

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

| Apple, Inc. | $18,095,207 | 6.8% |

| Microsoft Corp. | $17,862,804 | 6.7% |

| NVIDIA Corp. | $16,210,548 | 6.1% |

| Berkshire Hathaway, Inc. - Class B | $11,920,460 | 4.5% |

| Alphabet, Inc. - Class A | $11,385,468 | 4.3% |

| Amazon.com, Inc. | $9,445,867 | 3.6% |

| Meta Platforms, Inc. - Class A | $7,926,842 | 3.0% |

| EOG Resources, Inc. | $5,088,673 | 1.9% |

| Honeywell International, Inc. | $4,812,765 | 1.8% |

| JPMorgan Chase & Co. | $4,534,669 | 1.7% |

| $107,283,303 | 40.4% |

| Value | Value |

|---|

| Information Technology | 26.9% |

| Financials | 17.0% |

| Health Care | 12.5% |

| Communication Services | 11.5% |

| Industrials | 9.0% |

| Energy | 6.1% |

| Consumer Discretionary | 5.8% |

| Consumer Staples | 5.5% |

| Utilities | 2.8% |

| Materials | 0.7% |

| Short-Term Investments | 2.7% |

| Other Assets less Liabilities | (0.5)% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/AUUAX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618 .

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618 .

Information Regarding the Review and Approval of the Fund's Advisory Agreement

Information regarding the Fund's Board of Directors'/Trustees' review of the advisory agreement is available on the Fund's website [https://www.abfunds.com/link/AB/AUUAX-A]. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

Please scan QR code for Fund Information

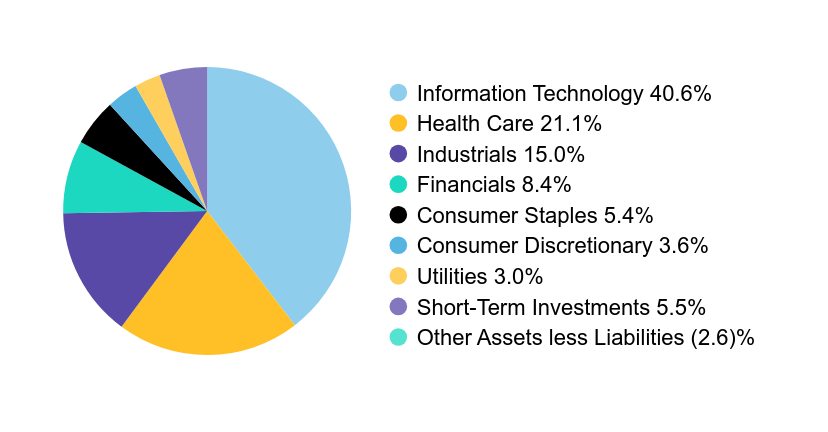

AB Sustainable US Thematic Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB Sustainable US Thematic Portfolio (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/FFTYX-A. You can also request this information by contacting us at (800) 227 4618 .

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $70 | 0.65% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

During the 12-month period ended June 30, 2024, the Fund underperformed the benchmark before sales charges. Both security selection and sector allocation detracted from performance, relative to the benchmark. Security selection detracted most, led by selection within healthcare, technology and industrials. Regarding sector allocation, contributions from an overweight to technology and an underweight to consumer discretionary were offset by an underweight to communication services and an overweight to health care. From a theme perspective, Health and Empowerment detracted, while Climate contributed.

The Fund did not utilize derivatives during the six- or 12-month periods.

Top contributors to performance:

During the 12-month period, although overall security selection and sector allocation were negative, selection within, and allocation to, some sectors contributed to performance.

Top detractors from performance:

Security Selection

Top contributors

Top detractors

Communication Services (underweight)

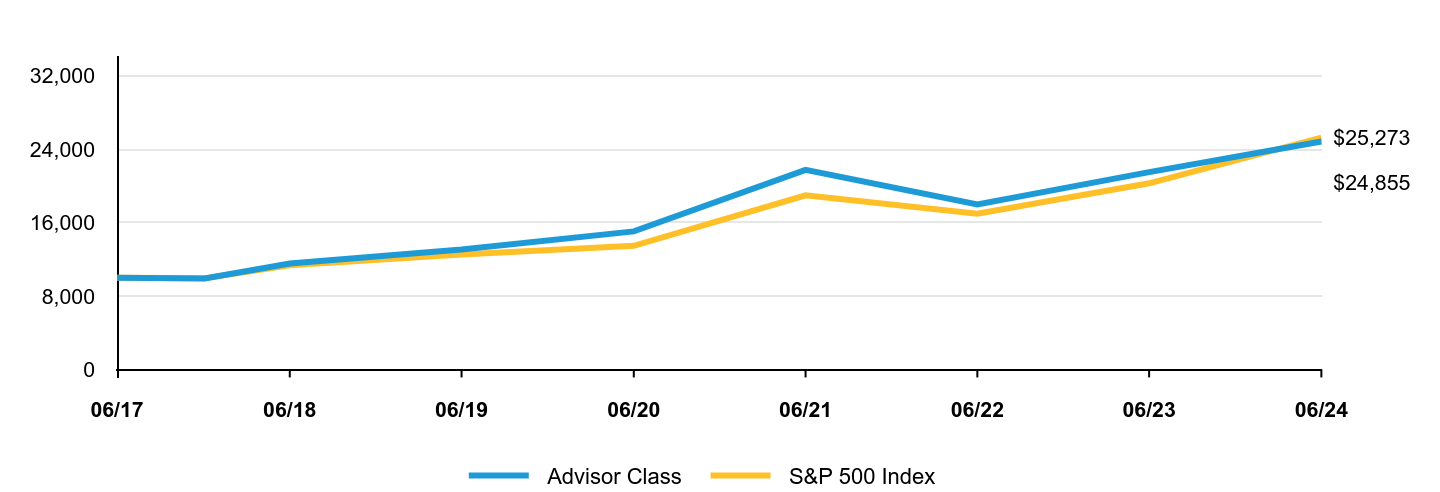

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Advisor Class | S&P 500 Index |

|---|

| 06/17 | $10,000 | $10,000 |

| 12/17 | $9,910 | $9,930 |

| 06/18 | $11,542 | $11,357 |

| 06/19 | $13,067 | $12,541 |

| 06/20 | $15,050 | $13,482 |

| 06/21 | $21,763 | $18,981 |

| 06/22 | $17,991 | $16,966 |

| 06/23 | $21,507 | $20,291 |

| 06/24 | $24,855 | $25,273 |

Average Annual Total Returns

| Class Name | 1 Year | 5 Years | Since Inception 6/28/2017 |

|---|

| Advisor Class (without sales charges) | 15.56% | 13.72% | 13.88% |

| Advisor Class (with sales charges) | 15.56% | 13.72% | 13.88% |

| S&P 500 Index | 24.56% | 15.05% | 14.14% |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/FFTYX-A for the most recent performance information.

- Net Assets$122,078,194

- # of Portfolio Holdings42

- Portfolio Turnover Rate33%

- Total Advisory Fees Paid$411,091

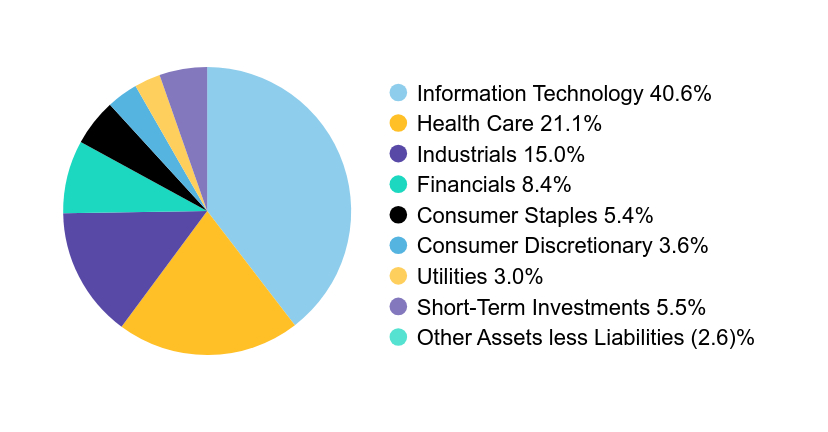

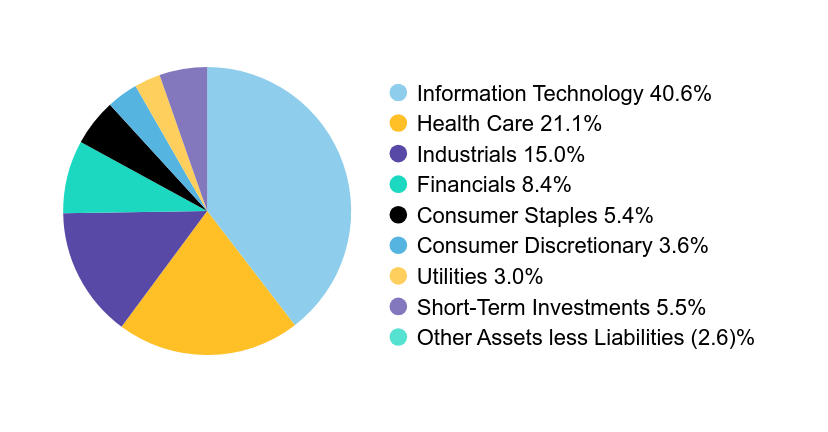

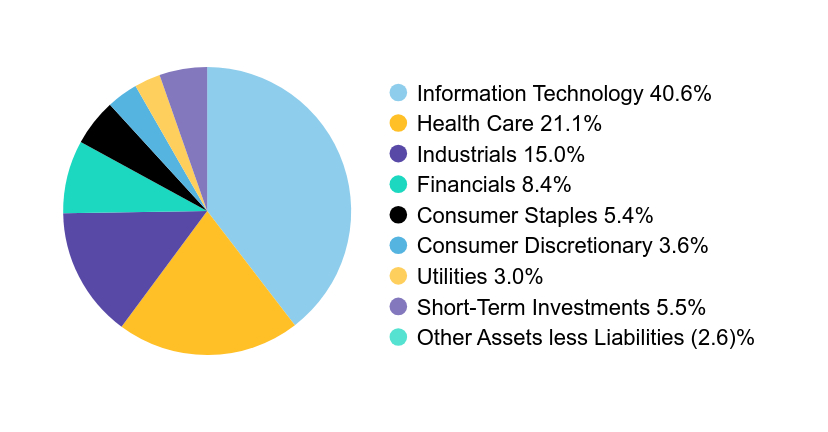

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

| NVIDIA Corp. | $7,551,877 | 6.2% |

| Microsoft Corp. | $5,095,677 | 4.2% |

| Visa, Inc. - Class A | $4,106,343 | 3.4% |

| Veralto Corp. | $4,008,212 | 3.3% |

| Flex Ltd. | $3,774,366 | 3.1% |

| NextEra Energy, Inc. | $3,616,054 | 3.0% |

| Waste Management, Inc. | $3,532,270 | 2.9% |

| Aflac, Inc. | $3,527,120 | 2.9% |

| Unilever PLC (Sponsored ADR) | $3,347,846 | 2.7% |

| Intuit, Inc. | $3,332,712 | 2.7% |

| $41,892,477 | 34.4% |

| Value | Value |

|---|

| Information Technology | 40.6% |

| Health Care | 21.1% |

| Industrials | 15.0% |

| Financials | 8.4% |

| Consumer Staples | 5.4% |

| Consumer Discretionary | 3.6% |

| Utilities | 3.0% |

| Short-Term Investments | 5.5% |

| Other Assets less Liabilities | (2.6)% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/FFTYX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618 .

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618 .

Information Regarding the Review and Approval of the Fund's Advisory Agreement

Information regarding the Fund's Board of Directors'/Trustees' review of the advisory agreement is available on the Fund's website [https://www.abfunds.com/link/AB/FFTYX-A]. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

Please scan QR code for Fund Information

AB Select US Equity Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB Select US Equity Portfolio (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AUUYX-A. You can also request this information by contacting us at (800) 227 4618 .

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $134 | 1.19% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

During the 12-month period ended June 30, 2024, all share classes of the Fund, except Class C, outperformed the benchmark before sales charges. During the period, security selection contributed to relative performance, while sector selection detracted. Security selection within the consumer discretionary, financials, and technology sectors contributed, while selection within the industrials, energy, and health care sectors detracted. In terms of sector selection, underweight positions to consumer discretionary and real estate, and an overweight position to communication services contributed to relative returns, while an underweight to information technology, the Fund's transactional cash position, and an overweight to health care detracted.

The Fund did not utilize derivatives during the 12-month period.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

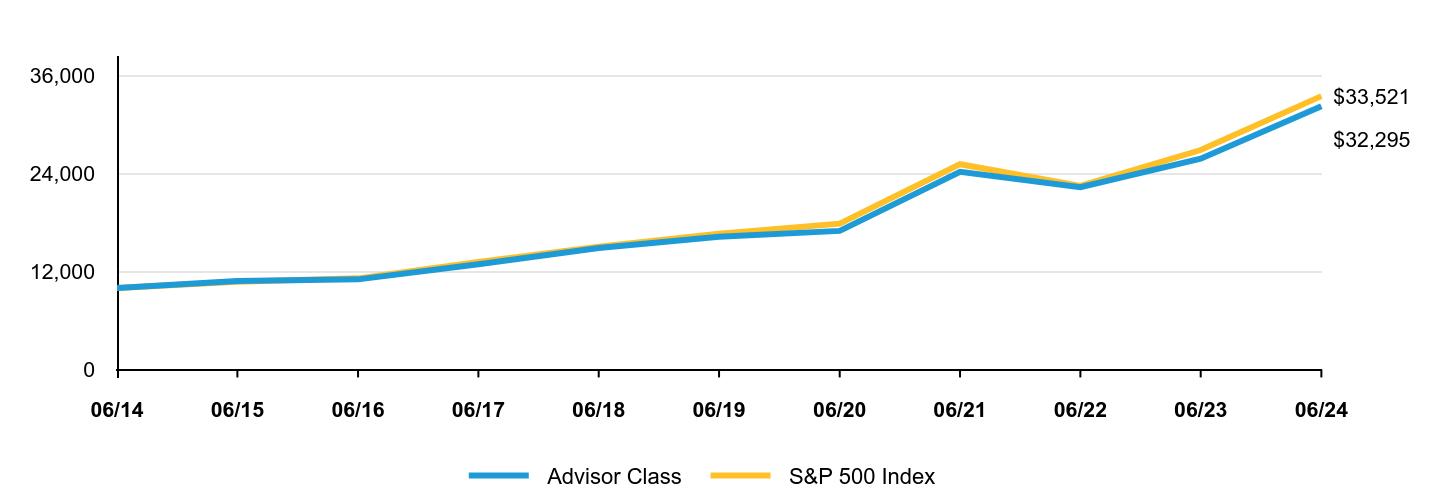

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Advisor Class | S&P 500 Index |

|---|

| 06/14 | $10,000 | $10,000 |

| 06/15 | $10,840 | $10,742 |

| 06/16 | $11,047 | $11,171 |

| 06/17 | $12,905 | $13,170 |

| 06/18 | $14,883 | $15,064 |

| 06/19 | $16,273 | $16,633 |

| 06/20 | $16,995 | $17,881 |

| 06/21 | $24,240 | $25,175 |

| 06/22 | $22,345 | $22,503 |

| 06/23 | $25,849 | $26,912 |

| 06/24 | $32,295 | $33,521 |

Average Annual Total Returns

| Class Name | 1 Year | 5 Years | 10 Years |

|---|

| Advisor Class (without sales charges) | 24.94% | 14.69% | 12.44% |

| Advisor Class (with sales charges) | 24.94% | 14.69% | 12.44% |

| S&P 500 Index | 24.56% | 15.05% | 12.86% |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/AUUYX-A for the most recent performance information.

- Net Assets$265,328,298

- # of Portfolio Holdings77

- Portfolio Turnover Rate171%

- Total Advisory Fees Paid$2,216,702

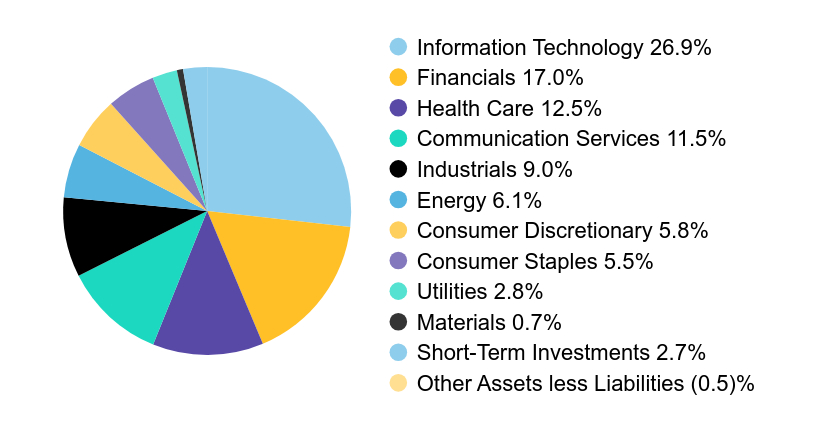

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

| Apple, Inc. | $18,095,207 | 6.8% |

| Microsoft Corp. | $17,862,804 | 6.7% |

| NVIDIA Corp. | $16,210,548 | 6.1% |

| Berkshire Hathaway, Inc. - Class B | $11,920,460 | 4.5% |

| Alphabet, Inc. - Class A | $11,385,468 | 4.3% |

| Amazon.com, Inc. | $9,445,867 | 3.6% |

| Meta Platforms, Inc. - Class A | $7,926,842 | 3.0% |

| EOG Resources, Inc. | $5,088,673 | 1.9% |

| Honeywell International, Inc. | $4,812,765 | 1.8% |

| JPMorgan Chase & Co. | $4,534,669 | 1.7% |

| $107,283,303 | 40.4% |

| Value | Value |

|---|

| Information Technology | 26.9% |

| Financials | 17.0% |

| Health Care | 12.5% |

| Communication Services | 11.5% |

| Industrials | 9.0% |

| Energy | 6.1% |

| Consumer Discretionary | 5.8% |

| Consumer Staples | 5.5% |

| Utilities | 2.8% |

| Materials | 0.7% |

| Short-Term Investments | 2.7% |

| Other Assets less Liabilities | (0.5)% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/AUUYX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618 .

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618 .

Information Regarding the Review and Approval of the Fund's Advisory Agreement

Information regarding the Fund's Board of Directors'/Trustees' review of the advisory agreement is available on the Fund's website [https://www.abfunds.com/link/AB/AUUYX-A]. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

Please scan QR code for Fund Information

AB Select US Equity Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB Select US Equity Portfolio (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/AUUCX-A. You can also request this information by contacting us at (800) 227 4618 .

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $246 | 2.20% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

During the 12-month period ended June 30, 2024, all share classes of the Fund, except Class C, outperformed the benchmark before sales charges. During the period, security selection contributed to relative performance, while sector selection detracted. Security selection within the consumer discretionary, financials, and technology sectors contributed, while selection within the industrials, energy, and health care sectors detracted. In terms of sector selection, underweight positions to consumer discretionary and real estate, and an overweight position to communication services contributed to relative returns, while an underweight to information technology, the Fund's transactional cash position, and an overweight to health care detracted.

The Fund did not utilize derivatives during the 12-month period.

Top contributors to performance:

Top detractors from performance:

Security Selection

Top contributors

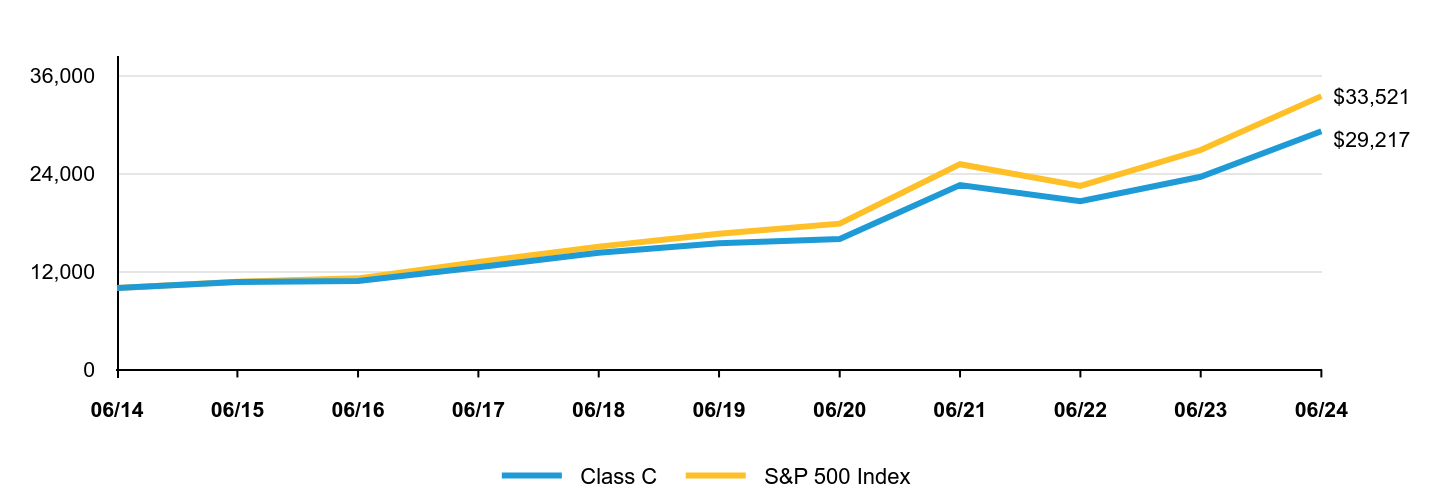

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class C | S&P 500 Index |

|---|

| 06/14 | $10,000 | $10,000 |

| 06/15 | $10,731 | $10,742 |

| 06/16 | $10,836 | $11,171 |

| 06/17 | $12,526 | $13,170 |

| 06/18 | $14,304 | $15,064 |

| 06/19 | $15,486 | $16,633 |

| 06/20 | $16,006 | $17,881 |

| 06/21 | $22,609 | $25,175 |

| 06/22 | $20,644 | $22,503 |

| 06/23 | $23,634 | $26,912 |

| 06/24 | $29,217 | $33,521 |

Average Annual Total Returns

| Class Name | 1 Year | 5 Years | 10 Years |

|---|

| Class C (without sales charges) | 23.62% | 13.54% | 11.32% |

| Class C (with sales charges) | 22.62% | 13.54% | 11.32% |

| S&P 500 Index | 24.56% | 15.05% | 12.86% |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/AUUCX-A for the most recent performance information.

- Net Assets$265,328,298

- # of Portfolio Holdings77

- Portfolio Turnover Rate171%

- Total Advisory Fees Paid$2,216,702

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

| Apple, Inc. | $18,095,207 | 6.8% |

| Microsoft Corp. | $17,862,804 | 6.7% |

| NVIDIA Corp. | $16,210,548 | 6.1% |

| Berkshire Hathaway, Inc. - Class B | $11,920,460 | 4.5% |

| Alphabet, Inc. - Class A | $11,385,468 | 4.3% |

| Amazon.com, Inc. | $9,445,867 | 3.6% |

| Meta Platforms, Inc. - Class A | $7,926,842 | 3.0% |

| EOG Resources, Inc. | $5,088,673 | 1.9% |

| Honeywell International, Inc. | $4,812,765 | 1.8% |

| JPMorgan Chase & Co. | $4,534,669 | 1.7% |

| $107,283,303 | 40.4% |

| Value | Value |

|---|

| Information Technology | 26.9% |

| Financials | 17.0% |

| Health Care | 12.5% |

| Communication Services | 11.5% |

| Industrials | 9.0% |

| Energy | 6.1% |

| Consumer Discretionary | 5.8% |

| Consumer Staples | 5.5% |

| Utilities | 2.8% |

| Materials | 0.7% |

| Short-Term Investments | 2.7% |

| Other Assets less Liabilities | (0.5)% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/AUUCX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618 .

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618 .

Information Regarding the Review and Approval of the Fund's Advisory Agreement

Information regarding the Fund's Board of Directors'/Trustees' review of the advisory agreement is available on the Fund's website [https://www.abfunds.com/link/AB/AUUCX-A]. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

Please scan QR code for Fund Information

AB Sustainable US Thematic Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB Sustainable US Thematic Portfolio (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/SUTCX-A. You can also request this information by contacting us at (800) 227 4618 .

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $177 | 1.65% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

During the 12-month period ended June 30, 2024, the Fund underperformed the benchmark before sales charges. Both security selection and sector allocation detracted from performance, relative to the benchmark. Security selection detracted most, led by selection within healthcare, technology and industrials. Regarding sector allocation, contributions from an overweight to technology and an underweight to consumer discretionary were offset by an underweight to communication services and an overweight to health care. From a theme perspective, Health and Empowerment detracted, while Climate contributed.

The Fund did not utilize derivatives during the six- or 12-month periods.

Top contributors to performance:

During the 12-month period, although overall security selection and sector allocation were negative, selection within, and allocation to, some sectors contributed to performance.

Top detractors from performance:

Security Selection

Top contributors

Top detractors

Communication Services (underweight)

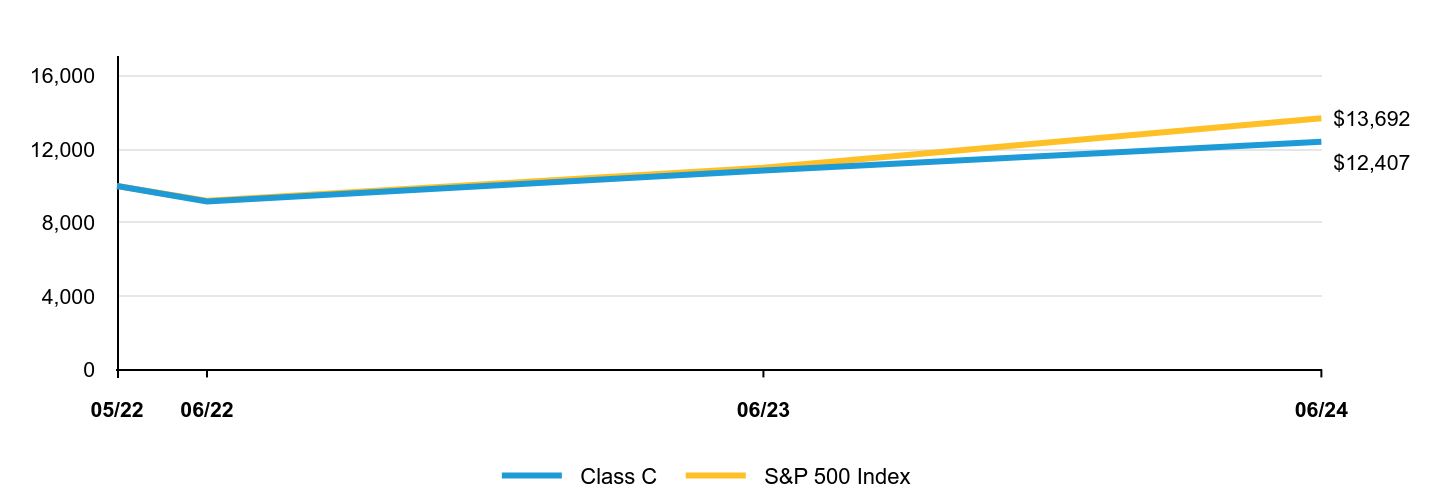

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class C | S&P 500 Index |

|---|

| 05/22 | $10,000 | $10,000 |

| 06/22 | $9,160 | $9,191 |

| 06/23 | $10,842 | $10,992 |

| 06/24 | $12,407 | $13,692 |

Average Annual Total Returns

| Class Name | 1 Year | Since Inception 5/02/2022 |

|---|

| Class C (without sales charges) | 14.43% | 10.45% |

| Class C (with sales charges) | 13.43% | 10.45% |

| S&P 500 Index | 24.56% | 15.56% |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/SUTCX-A for the most recent performance information.

- Net Assets$122,078,194

- # of Portfolio Holdings42

- Portfolio Turnover Rate33%

- Total Advisory Fees Paid$411,091

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

| NVIDIA Corp. | $7,551,877 | 6.2% |

| Microsoft Corp. | $5,095,677 | 4.2% |

| Visa, Inc. - Class A | $4,106,343 | 3.4% |

| Veralto Corp. | $4,008,212 | 3.3% |

| Flex Ltd. | $3,774,366 | 3.1% |

| NextEra Energy, Inc. | $3,616,054 | 3.0% |

| Waste Management, Inc. | $3,532,270 | 2.9% |

| Aflac, Inc. | $3,527,120 | 2.9% |

| Unilever PLC (Sponsored ADR) | $3,347,846 | 2.7% |

| Intuit, Inc. | $3,332,712 | 2.7% |

| $41,892,477 | 34.4% |

| Value | Value |

|---|

| Information Technology | 40.6% |

| Health Care | 21.1% |

| Industrials | 15.0% |

| Financials | 8.4% |

| Consumer Staples | 5.4% |

| Consumer Discretionary | 3.6% |

| Utilities | 3.0% |

| Short-Term Investments | 5.5% |

| Other Assets less Liabilities | (2.6)% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/SUTCX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618 .

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618 .

Information Regarding the Review and Approval of the Fund's Advisory Agreement

Information regarding the Fund's Board of Directors'/Trustees' review of the advisory agreement is available on the Fund's website [https://www.abfunds.com/link/AB/SUTCX-A]. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

Please scan QR code for Fund Information

AB International Low Volatility Equity Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB International Low Volatility Equity Portfolio (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/ISRYX-A. You can also request this information by contacting us at (800) 227 4618 .

This report describes changes to the Fund that occurred during the period.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $81 | 0.75% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

During the 12-month period ended June 30, 2024, Advisor Class shares of the Fund outperformed the benchmark before sales charges. Overall sector allocation and security selection contributed to performance, relative to the benchmark. Security selection within industrials and health care contributed the most, while selection within communication services and financials detracted. In terms of sector allocation, overweights to financials and technology added to gains and offset losses from an underweight to health care and an overweight to energy. Country allocation (a result of bottom-up security analysis combined with fundamental research) detracted, led by an underweight to Japan; an underweight to France contributed.

The Fund used derivatives in the form of currency forwards for hedging purposes, which detracted from absolute performance for the 12-month period.

Top contributors to performance:

Top detractors from performance:

During the 12-month period, overall security selection and sector allocation were positive, but selection within, and allocation to, some sectors detracted from performance.

Security Selection

Top contributors

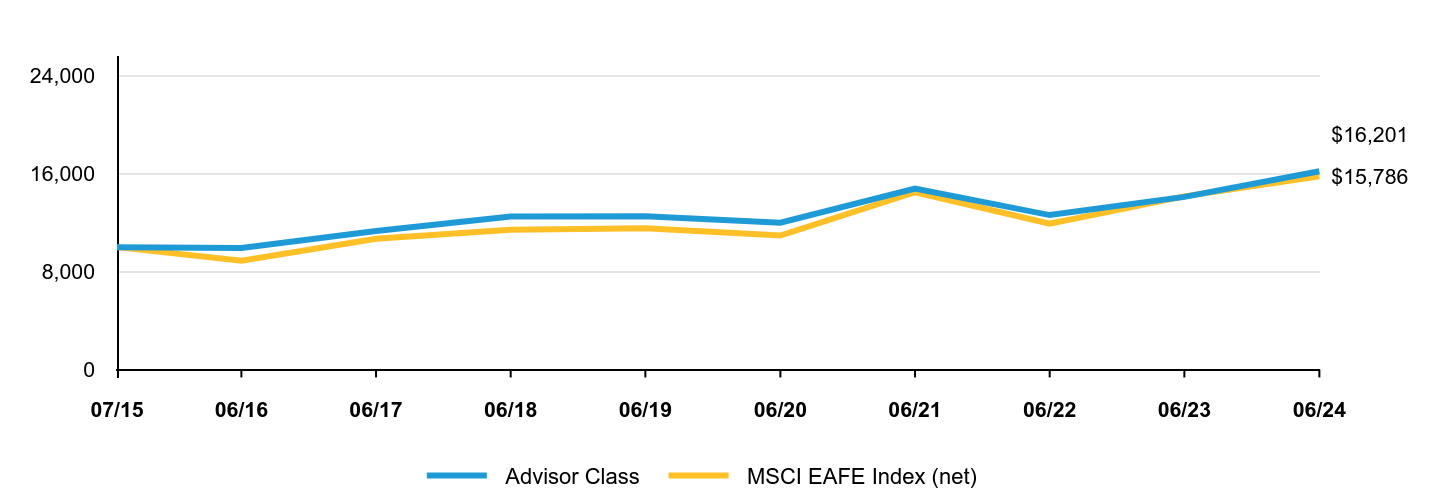

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Advisor Class | MSCI EAFE Index (net) |

|---|

| 07/15 | $10,000 | $10,000 |

| 06/16 | $9,937 | $8,886 |

| 06/17 | $11,325 | $10,687 |

| 06/18 | $12,509 | $11,418 |

| 06/19 | $12,517 | $11,541 |

| 06/20 | $11,999 | $10,949 |

| 06/21 | $14,790 | $14,491 |

| 06/22 | $12,621 | $11,916 |

| 06/23 | $14,112 | $14,153 |

| 06/24 | $16,201 | $15,786 |

Average Annual Total Returns

| Class Name | 1 Year | 5 Years | Since Inception 7/29/2015 |

|---|

| Advisor Class (without sales charges) | 14.80% | 5.30% | 5.56% |

| Advisor Class (with sales charges) | 14.80% | 5.30% | 5.56% |

| MSCI EAFE Index (net) | 11.54% | 6.46% | 5.25% |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/ISRYX-A for the most recent performance information.

- Net Assets$789,456,195

- # of Portfolio Holdings89

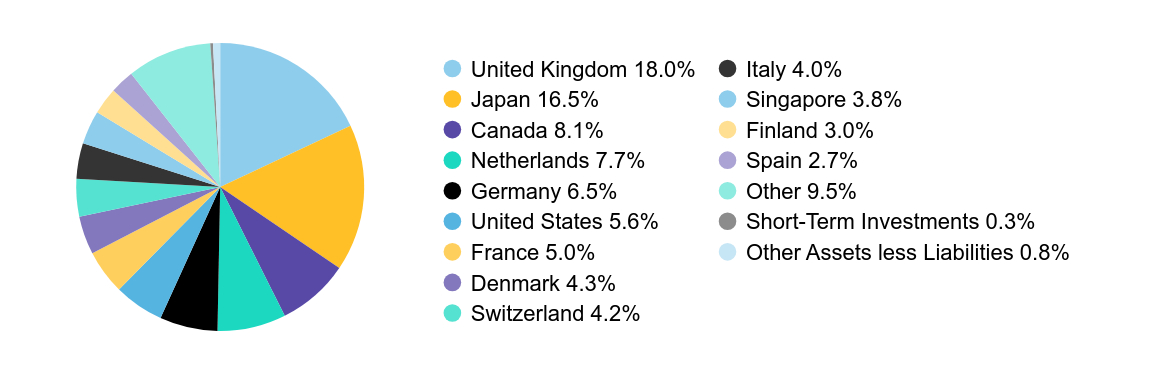

- Portfolio Turnover Rate43%

- Total Advisory Fees Paid$4,573,075

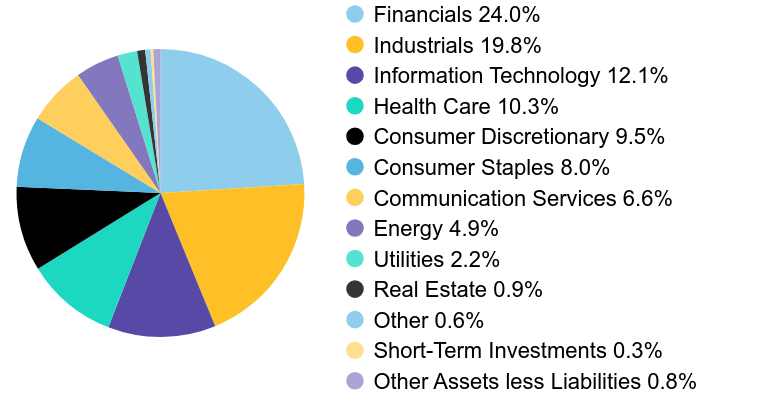

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

| Novo Nordisk A/S - Class B | $33,432,781 | 4.2% |

| Shell PLC | $24,331,454 | 3.1% |

| Constellation Software, Inc./Canada | $23,875,164 | 3.0% |

| Oversea-Chinese Banking Corp., Ltd. | $16,758,244 | 2.1% |

| Wolters Kluwer NV | $16,217,731 | 2.1% |

| RELX PLC | $16,187,631 | 2.0% |

| Sumitomo Mitsui Financial Group, Inc. | $16,016,009 | 2.0% |

| Prysmian SpA | $15,556,301 | 2.0% |

| Mitsubishi UFJ Financial Group, Inc. | $14,750,543 | 1.9% |

| Honda Motor Co., Ltd. | $14,617,840 | 1.9% |

| $191,743,698 | 24.3% |

| Value | Value |

|---|

| Financials | 24.0% |

| Industrials | 19.8% |

| Information Technology | 12.1% |

| Health Care | 10.3% |

| Consumer Discretionary | 9.5% |

| Consumer Staples | 8.0% |

| Communication Services | 6.6% |

| Energy | 4.9% |

| Utilities | 2.2% |

| Real Estate | 0.9% |

| Other | 0.6% |

| Short-Term Investments | 0.3% |

| Other Assets less Liabilities | 0.8% |

| Value | Value |

|---|

| United Kingdom | 18.0% |

| Japan | 16.5% |

| Canada | 8.1% |

| Netherlands | 7.7% |

| Germany | 6.5% |

| United States | 5.6% |

| France | 5.0% |

| Denmark | 4.3% |

| Switzerland | 4.2% |

| Italy | 4.0% |

| Singapore | 3.8% |

| Finland | 3.0% |

| Spain | 2.7% |

| Other | 9.5% |

| Short-Term Investments | 0.3% |

| Other Assets less Liabilities | 0.8% |

The Fund's name was changed to "AB International Low Volatility Equity Portfolio". The Fund's investment strategies were modified to reflect that the Advisors seek to achieve the Fund's investment objectives by investing, under normal circumstances, at least 80% of it's net assets, including any borrowings for investment purposes, in equity securities of non-U.S. companies, an in companies in at least three countries other than the United States. These changes were effective as of July 5, 2023.

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/ISRYX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618 .

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618 .

Information Regarding the Review and Approval of the Fund's Advisory Agreement

Information regarding the Fund's Board of Directors'/Trustees' review of the advisory agreement is available on the Fund's website [https://www.abfunds.com/link/AB/ISRYX-A]. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

Please scan QR code for Fund Information

AB Global Core Equity Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB Global Core Equity Portfolio (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/GCECX-A. You can also request this information by contacting us at (800) 227 4618 .

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $190 | 1.79% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

During the 12-month period ended June 30, 2024, all share classes of the Fund underperformed the benchmark before sales charges. Both security selection and sector allocation detracted from performance, relative to the benchmark. Overall security selection detracted the most, particularly selection within consumer discretionary and health care, while selection within communication services and materials contributed. Sector allocation also detracted as losses from underweights to consumer discretionary and health care offset gains from overweights to communication services and materials. Country positioning (a result of bottom-up security analysis combined with fundamental research) was negative; losses from an overweight to China were partially offset by contributions from an overweight to Denmark.

The Fund did not utilize derivatives during the six- or 12-month periods.

Top contributors to performance:

During the 12-month period, although overall security selection and sector allocation were negative, selection within, and allocation to, some sectors contributed to performance.

Top detractors from performance:

During the 12-month period, the Fund's underperformance relative to the benchmark was driven largely by security selection and, to lesser extent, sector allocation.

Security Selection

Top contributors

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class C | MSCI ACWI (net) |

|---|

| 11/14 | $10,000 | $10,000 |

| 06/15 | $10,122 | $10,213 |

| 06/16 | $9,708 | $9,832 |

| 06/17 | $11,727 | $11,679 |

| 06/18 | $12,884 | $12,932 |

| 06/19 | $14,060 | $13,674 |

| 06/20 | $13,895 | $13,963 |

| 06/21 | $19,051 | $19,446 |

| 06/22 | $15,186 | $16,383 |

| 06/23 | $17,302 | $19,091 |

| 06/24 | $19,435 | $22,790 |

Average Annual Total Returns

| Class Name | 1 Year | 5 Years | Since Inception 11/12/2014 |

|---|

| Class C (without sales charges) | 12.33% | 6.69% | 7.14% |

| Class C (with sales charges) | 11.33% | 6.69% | 7.14% |

| MSCI ACWI (net) | 19.38% | 10.76% | 8.92% |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/GCECX-A for the most recent performance information.

- Net Assets$2,850,356,242

- # of Portfolio Holdings71

- Portfolio Turnover Rate52%

- Total Advisory Fees Paid$19,849,616

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

| Microsoft Corp. | $217,109,091 | 7.6% |

| Elevance Health, Inc. | $129,570,647 | 4.5% |

| NVIDIA Corp. | $118,878,836 | 4.2% |

| Otis Worldwide Corp. | $114,570,577 | 4.0% |

| Goldman Sachs Group, Inc. (The) | $110,945,050 | 3.9% |

| Coca-Cola Co. (The) | $104,028,287 | 3.7% |

| Alphabet, Inc. - Class C | $92,889,574 | 3.2% |

| NIKE, Inc. - Class B | $78,878,473 | 2.8% |

| Samsung Electronics Co., Ltd. | $74,754,118 | 2.6% |

| Asahi Group Holdings Ltd. | $68,834,895 | 2.4% |

| $1,110,459,548 | 38.9% |

| Value | Value |

|---|

| Information Technology | 22.3% |

| Financials | 16.2% |

| Health Care | 14.4% |

| Consumer Discretionary | 11.1% |

| Industrials | 9.2% |

| Consumer Staples | 8.1% |

| Communication Services | 7.3% |

| Energy | 4.8% |

| Materials | 3.6% |

| Real Estate | 2.4% |

| Short-Term Investments | 0.3% |

| Other Assets less Liabilities | 0.3% |

| Value | Value |

|---|

| United States | 63.7% |

| United Kingdom | 6.8% |

| Denmark | 3.9% |

| Switzerland | 3.6% |

| Japan | 3.1% |

| China | 2.9% |

| South Korea | 2.6% |

| Germany | 2.5% |

| France | 2.4% |

| Netherlands | 1.6% |

| Taiwan | 1.6% |

| Canada | 1.3% |

| Brazil | 1.2% |

| Other | 2.2% |

| Short-Term Investments | 0.3% |

| Other Assets less Liabilities | 0.3% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/GCECX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618 .

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618 .

Information Regarding the Review and Approval of the Fund's Advisory Agreement

Information regarding the Fund's Board of Directors'/Trustees' review of the advisory agreement is available on the Fund's website [https://www.abfunds.com/link/AB/GCECX-A]. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

Please scan QR code for Fund Information

AB Global Core Equity Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB Global Core Equity Portfolio (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/GCEYX-A. You can also request this information by contacting us at (800) 227 4618 .

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Advisor Class | $83 | 0.78% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

During the 12-month period ended June 30, 2024, all share classes of the Fund underperformed the benchmark before sales charges. Both security selection and sector allocation detracted from performance, relative to the benchmark. Overall security selection detracted the most, particularly selection within consumer discretionary and health care, while selection within communication services and materials contributed. Sector allocation also detracted as losses from underweights to consumer discretionary and health care offset gains from overweights to communication services and materials. Country positioning (a result of bottom-up security analysis combined with fundamental research) was negative; losses from an overweight to China were partially offset by contributions from an overweight to Denmark.

The Fund did not utilize derivatives during the six- or 12-month periods.

Top contributors to performance:

During the 12-month period, although overall security selection and sector allocation were negative, selection within, and allocation to, some sectors contributed to performance.

Top detractors from performance:

During the 12-month period, the Fund's underperformance relative to the benchmark was driven largely by security selection and, to lesser extent, sector allocation.

Security Selection

Top contributors

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Advisor Class | MSCI ACWI (net) |

|---|

| 11/14 | $10,000 | $10,000 |

| 06/15 | $10,186 | $10,213 |

| 06/16 | $9,863 | $9,832 |

| 06/17 | $12,041 | $11,679 |

| 06/18 | $13,368 | $12,932 |

| 06/19 | $14,733 | $13,674 |

| 06/20 | $14,696 | $13,963 |

| 06/21 | $20,360 | $19,446 |

| 06/22 | $16,382 | $16,383 |

| 06/23 | $18,860 | $19,091 |

| 06/24 | $21,407 | $22,790 |

Average Annual Total Returns

| Class Name | 1 Year | 5 Years | Since Inception 11/12/2014 |

|---|

| Advisor Class (without sales charges) | 13.51% | 7.76% | 8.22% |

| Advisor Class (with sales charges) | 13.51% | 7.76% | 8.22% |

| MSCI ACWI (net) | 19.38% | 10.76% | 8.92% |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/GCEYX-A for the most recent performance information.

- Net Assets$2,850,356,242

- # of Portfolio Holdings71

- Portfolio Turnover Rate52%

- Total Advisory Fees Paid$19,849,616

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

| Microsoft Corp. | $217,109,091 | 7.6% |

| Elevance Health, Inc. | $129,570,647 | 4.5% |

| NVIDIA Corp. | $118,878,836 | 4.2% |

| Otis Worldwide Corp. | $114,570,577 | 4.0% |

| Goldman Sachs Group, Inc. (The) | $110,945,050 | 3.9% |

| Coca-Cola Co. (The) | $104,028,287 | 3.7% |

| Alphabet, Inc. - Class C | $92,889,574 | 3.2% |

| NIKE, Inc. - Class B | $78,878,473 | 2.8% |

| Samsung Electronics Co., Ltd. | $74,754,118 | 2.6% |

| Asahi Group Holdings Ltd. | $68,834,895 | 2.4% |

| $1,110,459,548 | 38.9% |

| Value | Value |

|---|

| Information Technology | 22.3% |

| Financials | 16.2% |

| Health Care | 14.4% |

| Consumer Discretionary | 11.1% |

| Industrials | 9.2% |

| Consumer Staples | 8.1% |

| Communication Services | 7.3% |

| Energy | 4.8% |

| Materials | 3.6% |

| Real Estate | 2.4% |

| Short-Term Investments | 0.3% |

| Other Assets less Liabilities | 0.3% |

| Value | Value |

|---|

| United States | 63.7% |

| United Kingdom | 6.8% |

| Denmark | 3.9% |

| Switzerland | 3.6% |

| Japan | 3.1% |

| China | 2.9% |

| South Korea | 2.6% |

| Germany | 2.5% |

| France | 2.4% |

| Netherlands | 1.6% |

| Taiwan | 1.6% |

| Canada | 1.3% |

| Brazil | 1.2% |

| Other | 2.2% |

| Short-Term Investments | 0.3% |

| Other Assets less Liabilities | 0.3% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/GCEYX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618 .

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618 .

Information Regarding the Review and Approval of the Fund's Advisory Agreement

Information regarding the Fund's Board of Directors'/Trustees' review of the advisory agreement is available on the Fund's website [https://www.abfunds.com/link/AB/GCEYX-A]. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

Please scan QR code for Fund Information

AB Sustainable US Thematic Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB Sustainable US Thematic Portfolio (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/SUTZX-A. You can also request this information by contacting us at (800) 227 4618 .

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class Z | $70 | 0.65% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

During the 12-month period ended June 30, 2024, the Fund underperformed the benchmark before sales charges. Both security selection and sector allocation detracted from performance, relative to the benchmark. Security selection detracted most, led by selection within healthcare, technology and industrials. Regarding sector allocation, contributions from an overweight to technology and an underweight to consumer discretionary were offset by an underweight to communication services and an overweight to health care. From a theme perspective, Health and Empowerment detracted, while Climate contributed.

The Fund did not utilize derivatives during the six- or 12-month periods.

Top contributors to performance:

During the 12-month period, although overall security selection and sector allocation were negative, selection within, and allocation to, some sectors contributed to performance.

Top detractors from performance:

Security Selection

Top contributors

Top detractors

Communication Services (underweight)

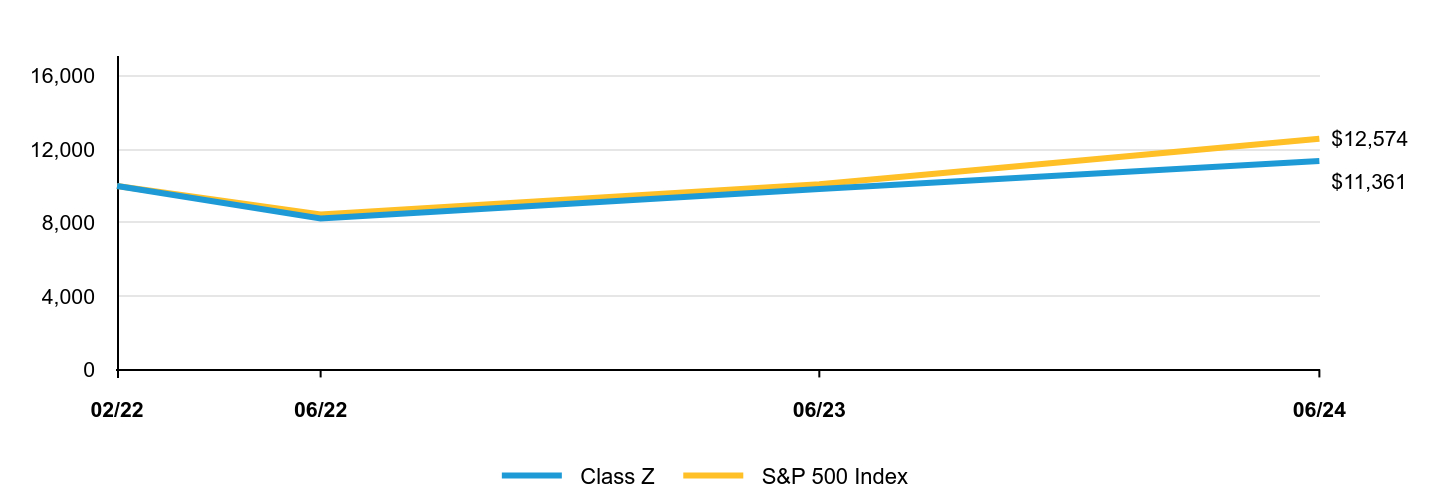

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class Z | S&P 500 Index |

|---|

| 02/22 | $10,000 | $10,000 |

| 06/22 | $8,226 | $8,441 |

| 06/23 | $9,832 | $10,095 |

| 06/24 | $11,361 | $12,574 |

Average Annual Total Returns

| Class Name | 1 Year | Since Inception 2/01/2022 |

|---|

| Class Z (without sales charges) | 15.55% | 5.44% |

| Class Z (with sales charges) | 15.55% | 5.44% |

| S&P 500 Index | 24.56% | 9.94% |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/SUTZX-A for the most recent performance information.

- Net Assets$122,078,194

- # of Portfolio Holdings42

- Portfolio Turnover Rate33%

- Total Advisory Fees Paid$411,091

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

| NVIDIA Corp. | $7,551,877 | 6.2% |

| Microsoft Corp. | $5,095,677 | 4.2% |

| Visa, Inc. - Class A | $4,106,343 | 3.4% |

| Veralto Corp. | $4,008,212 | 3.3% |

| Flex Ltd. | $3,774,366 | 3.1% |

| NextEra Energy, Inc. | $3,616,054 | 3.0% |

| Waste Management, Inc. | $3,532,270 | 2.9% |

| Aflac, Inc. | $3,527,120 | 2.9% |

| Unilever PLC (Sponsored ADR) | $3,347,846 | 2.7% |

| Intuit, Inc. | $3,332,712 | 2.7% |

| $41,892,477 | 34.4% |

| Value | Value |

|---|

| Information Technology | 40.6% |

| Health Care | 21.1% |

| Industrials | 15.0% |

| Financials | 8.4% |

| Consumer Staples | 5.4% |

| Consumer Discretionary | 3.6% |

| Utilities | 3.0% |

| Short-Term Investments | 5.5% |

| Other Assets less Liabilities | (2.6)% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/SUTZX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618 .

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618 .

Information Regarding the Review and Approval of the Fund's Advisory Agreement

Information regarding the Fund's Board of Directors'/Trustees' review of the advisory agreement is available on the Fund's website [https://www.abfunds.com/link/AB/SUTZX-A]. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

Please scan QR code for Fund Information

AB Sustainable US Thematic Portfolio

Annual Shareholder Report

This annual shareholder report contains important information about the AB Sustainable US Thematic Portfolio (the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.abfunds.com/link/AB/SUTAX-A. You can also request this information by contacting us at (800) 227 4618 .

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $97 | 0.90% |

How Did the Fund Perform Last Year? What Affected the Fund's Performance?

During the 12-month period ended June 30, 2024, the Fund underperformed the benchmark before sales charges. Both security selection and sector allocation detracted from performance, relative to the benchmark. Security selection detracted most, led by selection within healthcare, technology and industrials. Regarding sector allocation, contributions from an overweight to technology and an underweight to consumer discretionary were offset by an underweight to communication services and an overweight to health care. From a theme perspective, Health and Empowerment detracted, while Climate contributed.

The Fund did not utilize derivatives during the six- or 12-month periods.

Top contributors to performance:

During the 12-month period, although overall security selection and sector allocation were negative, selection within, and allocation to, some sectors contributed to performance.

Top detractors from performance:

Security Selection

Top contributors

Top detractors

Communication Services (underweight)

The following graph shows the performance of hypothetical $10,000 investments in the Fund and a broad-based securities market index over the most recently completed 10 fiscal years of the Fund. The Fund's performance reflects sales charges and assumes the reinvestment of dividends.

| Class A | S&P 500 Index |

|---|

| 02/22 | $9,575 | $10,000 |

| 06/22 | $7,867 | $8,441 |

| 06/23 | $9,387 | $10,095 |

| 06/24 | $10,826 | $12,574 |

Average Annual Total Returns

| Class Name | 1 Year | Since Inception 2/01/2022 |

|---|

| Class A (without sales charges) | 15.34% | 5.23% |

| Class A (with sales charges) | 10.43% | 3.35% |

| S&P 500 Index | 24.56% | 9.94% |

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://www.abfunds.com/link/AB/SUTAX-A for the most recent performance information.

- Net Assets$122,078,194

- # of Portfolio Holdings42

- Portfolio Turnover Rate33%

- Total Advisory Fees Paid$411,091

Graphical Representation of Holdings

| Company | U.S. $ Value | % of Net Assets |

| NVIDIA Corp. | $7,551,877 | 6.2% |

| Microsoft Corp. | $5,095,677 | 4.2% |

| Visa, Inc. - Class A | $4,106,343 | 3.4% |

| Veralto Corp. | $4,008,212 | 3.3% |

| Flex Ltd. | $3,774,366 | 3.1% |

| NextEra Energy, Inc. | $3,616,054 | 3.0% |

| Waste Management, Inc. | $3,532,270 | 2.9% |

| Aflac, Inc. | $3,527,120 | 2.9% |

| Unilever PLC (Sponsored ADR) | $3,347,846 | 2.7% |

| Intuit, Inc. | $3,332,712 | 2.7% |

| $41,892,477 | 34.4% |

| Value | Value |

|---|

| Information Technology | 40.6% |

| Health Care | 21.1% |

| Industrials | 15.0% |

| Financials | 8.4% |

| Consumer Staples | 5.4% |

| Consumer Discretionary | 3.6% |

| Utilities | 3.0% |

| Short-Term Investments | 5.5% |

| Other Assets less Liabilities | (2.6)% |

Availability of Additional Information

You can find additional information at https://www.abfunds.com/link/AB/SUTAX-A, including the Fund's:

• Prospectus

• Financial information

• Fund holdings

• Proxy voting information

You can also request this information by contacting us at (800) 227 4618 .

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent by contacting us at (800) 227 4618 .

Information Regarding the Review and Approval of the Fund's Advisory Agreement

Information regarding the Fund's Board of Directors'/Trustees' review of the advisory agreement is available on the Fund's website [https://www.abfunds.com/link/AB/SUTAX-A]. You can request this information, free of charge, by contacting us at (800) 227 4618 or by scanning the QR code below.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

Please scan QR code for Fund Information

ITEM 2. CODE OF ETHICS.

(a) The registrant has adopted a code of ethics that applies to its principal executive officer, principal financial officer and principal accounting officer. A copy of the registrant’s code of ethics is filed herewith as Exhibit 19(a)(1).

(b) During the period covered by this report, no material amendments were made to the provisions of the code of ethics adopted in 2(a) above.

(c) During the period covered by this report, no implicit or explicit waivers to the provisions of the code of ethics adopted in 2(a) above were granted.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The registrant’s Board of Directors has determined that independent directors Garry L. Moody, Marshall C. Turner, Jr., Jorge A. Bermudez and Carol C. McMullen qualify as audit committee financial experts.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) - (c) The following table sets forth the aggregate fees billed* by the independent registered public accounting firm Ernst & Young LLP, for the Fund’s last two fiscal years, for professional services rendered for: (i) the audit of the Fund’s annual financial statements included in the Fund’s annual report to stockholders; (ii) assurance and related services that are reasonably related to the performance of the audit of the Fund’s financial statements and are not reported under (i), which include advice and education related to accounting and auditing issues, quarterly press release review (for those Funds that issue quarterly press releases), and preferred stock maintenance testing (for those Funds that issue preferred stock); and (iii) tax compliance, tax advice and tax return preparation.

| | | | | | | | | | | | | | | | |

| | | | | | Audit

Fees | | | Audit-Related

Fees | | | Tax Fees | |

AB Select US Equity | | | 2023 | | | $ | 36,240 | | | $ | — | | | $ | 19,069 | |

| | | 2024 | | | $ | 36,240 | | | $ | — | | | $ | 20,785 | |

AB Global Core Equity | | | 2023 | | | $ | 44,022 | | | $ | — | | | $ | 27,423 | |

| | | 2024 | | | $ | 44,022 | | | $ | — | | | $ | 22,326 | |

AB International Low Volatility Equity | | | 2023 | | | $ | 47,201 | | | $ | — | | | $ | 19,527 | |

| | | 2024 | | | $ | 47,201 | | | $ | — | | | $ | 24,567 | |

AB Sustainable US Thematic | | | 2023 | | | $ | 31,605 | | | $ | — | | | $ | 19,601 | |

| | | 2024 | | | $ | 31,605 | | | $ | — | | | $ | 19,460 | |

(d) Not applicable.

(e) (1) Beginning with audit and non-audit service contracts entered into on or after May 6, 2003, the Fund’s Audit Committee policies and procedures require the pre-approval of all audit and non-audit services provided to the Fund by the Fund’s independent registered public accounting firm. The Fund’s Audit Committee policies and procedures also require pre-approval of all audit and non-audit services provided to the Adviser and Service Affiliates to the extent that these services are directly related to the operations or financial reporting of the Fund.

(e) (2) No percentage of services addressed by (b) and (c) of this Item 4 were approved pursuant to the waiver provision of paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. No amounts are reported for Item 4 (d).

(f) Not applicable.

(g) The following table sets forth the aggregate non-audit services provided to the Fund, the Fund’s Adviser and entities that control, are controlled by or under common control with the Adviser that provide ongoing services to the Fund: (“Service Affiliates”):

| | | | | | | | | | | | |

| | | | | | All Fees for

Non-Audit Services

Provided to the

Portfolio, the Adviser

and Service Affiliates | | | Total Amount of

Foregoing Column Pre-

approved by the Audit

Committee

(Portion Comprised of

Audit Related Fees)

(Portion Comprised of

Tax Fees) | |

AB Select US Equity | | | 2023 | | | $ | 1,562,038 | | | $ | 19,069 | |

| | | | | | | | | | $ | — | |

| | | | | | | | | | $ | (19,069 | ) |

| | | 2024 | | | $ | 2,095,621 | | | $ | 20,785 | |

| | | | | | | | | | $ | — | |

| | | | | | | | | | $ | (20,785 | ) |

AB Global Core Equity | | | 2023 | | | $ | 1,570,392 | | | $ | 27,423 | |

| | | | | | | | | | $ | — | |

| | | | | | | | | | $ | (27,423 | ) |

| | | 2024 | | | $ | 2,097,162 | | | $ | 22,326 | |

| | | | | | | | | | $ | — | |

| | | | | | | | | | $ | (22,326 | ) |

AB International Low Volatility Equity | | | 2023 | | | $ | 1,562,496 | | | $ | 19,527 | |

| | | | | | | | | | $ | — | |

| | | | | | | | | | $ | (19,527 | ) |

| | | 2024 | | | $ | 2,099,403 | | | $ | 24,567 | |

| | | | | | | | | | $ | — | |

| | | | | | | | | | $ | (24,567 | ) |

AB Sustainable US Thematic | | | 2023 | | | $ | 1,562,570 | | | $ | 19,601 | |

| | | | | | | | | | $ | — | |

| | | | | | | | | | $ | (19,601 | ) |

| | | 2024 | | | $ | 2,094,296 | | | $ | 19,460 | |

| | | | | | | | | | $ | — | |

| | | | | | | | | | $ | (19,460 | ) |

(h) The Audit Committee of the Fund has considered whether the provision of any non-audit services not pre-approved by the Audit Committee provided by the Fund’s independent registered public accounting firm to the Adviser and Service Affiliates is compatible with maintaining the auditor’s independence.

(i) Not applicable.

(j) Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable to the registrant.

ITEM 6. INVESTMENTS.

Please see Schedule of Investments contained in the Report to Shareholders included under Item 1 of this Form N-CSR.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

JUN 06.30.24

ANNUAL REPORT

AB GLOBAL CORE EQUITY PORTFOLIO

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

PORTFOLIO OF INVESTMENTS

June 30, 2024

| | | | | | | | | | | | |

| Company | | | | | Shares | | | U.S. $ Value | |

| |

COMMON STOCKS – 99.4% | | | | | | | | | | | | |

Information Technology – 22.3% | | | | | | | | | | | | |

IT Services – 2.5% | | | | | | | | | | | | |

Accenture PLC – Class A | | | | | | | 145,397 | | | $ | 44,114,904 | |

Akamai Technologies, Inc.(a) | | | | | | | 298,047 | | | | 26,848,074 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 70,962,978 | |

| | | | | | | | | | | | |

Semiconductors & Semiconductor Equipment – 8.1% | | | | | | | | | | | | |

Analog Devices, Inc. | | | | | | | 77,303 | | | | 17,645,183 | |

Infineon Technologies AG | | | | | | | 947,259 | | | | 34,764,689 | |

NVIDIA Corp. | | | | | | | 962,270 | | | | 118,878,836 | |

QUALCOMM, Inc. | | | | | | | 79,663 | | | | 15,867,276 | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | | | | | 1,517,000 | | | | 44,945,107 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 232,101,091 | |

| | | | | | | | | | | | |

Software – 9.1% | | | | | | | | | | | | |

Microsoft Corp. | | | | | | | 485,757 | | | | 217,109,091 | |

Roper Technologies, Inc. | | | | | | | 73,945 | | | | 41,679,839 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 258,788,930 | |

| | | | | | | | | | | | |

Technology Hardware, Storage & Peripherals – 2.6% | | | | | | | | | | | | |

Samsung Electronics Co., Ltd. | | | | | | | 1,270,166 | | | | 74,754,118 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 636,607,117 | |

| | | | | | | | | | | | |

Financials – 16.2% | | | | | | | | | | | | |

Banks – 2.0% | | | | | | | | | | | | |

ABN AMRO Bank NV | | | | | | | 1,191,958 | | | | 19,576,329 | |

BNP Paribas SA | | | | | | | 606,274 | | | | 38,772,498 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 58,348,827 | |

| | | | | | | | | | | | |

Capital Markets – 11.4% | | | | | | | | | | | | |

B3 SA – Brasil Bolsa Balcao | | | | | | | 18,584,100 | | | | 34,042,537 | |

BlackRock, Inc. | | | | | | | 20,963 | | | | 16,504,589 | |

CVC Capital Partners PLC(a)(b) | | | | | | | 1,412,042 | | | | 25,911,998 | |

EQT AB | | | | | | | 570,514 | | | | 16,725,973 | |

Euronext NV | | | | | | | 274,903 | | | | 25,475,354 | |