As filed with the Securities and Exchange Commission on September 12, 2008

Securities Act File No. 333-152728

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

x Pre-Effective Amendment No. 1

¨ Post-Effective Amendment No. __

(Check appropriate box or boxes)

BLACKROCK EQUITY DIVIDEND FUND

(Exact Name of Registrant as Specified in the Declaration of Trust)

100 Bellevue Parkway

Wilmington, DE 19809

(Address of Principal Executive Offices)

Telephone Number: (800)441-7762

(Area Code and Telephone Number)

Donald C. Burke

Chief Executive Officer

800 Scudders Mill Road

Plainsboro, NJ 08536

Mailing address: P.O. Box 9011, Princeton, NJ 08543-9011

(Name and Address of Agent for Service)

| Copies to: |

| |

| Joel H. Goldberg, Esq. | Jennifer E. Vollmer, Esq. | Howard B. Surloff, Esq. |

| Willkie Farr & Gallagher LLP | The PNC Financial Services Group, Inc. | BlackRock Advisors, LLC |

| 787 Seventh Avenue | 1600 Market Street | 100 Bellevue Parkway |

| New York, New York 10019-6099 | Philadelphia, Pennsylvania 19103 | Wilmington, Delaware 19809 |

Title of securities being registered: Investor A, Investor C and Institutional shares

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

An indefinite amount of the Registrant’s securities has been registered under the Securities Act of 1933, as amended, pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended. In reliance upon such Rule, no filing fee is being paid at this time.

EXPLANATORY NOTE

This Registration Statement is organized as follows:

| 1. | Letter to Shareholders of PNC Equity Income Fund, a series of PNC Funds, Inc. |

| |

| 2. | Questions and Answers for Shareholders of PNC Equity Income Fund, a series of PNC Funds, Inc. |

| |

| 3. | Notice of Special Meeting of Shareholders of PNC Equity Income Fund, a series of PNC Funds, Inc. |

| |

| 4. | Combined Prospectus/Proxy Statement regarding the proposed reorganization of PNC Equity Income Fund, a series of PNC Funds, Inc., into the BlackRock Equity Dividend Fund |

| |

| 5. | Statement of Additional Information regarding the proposed reorganization of PNC Equity Income Fund, a series of PNC Funds, Inc., into the BlackRock Equity Dividend Fund |

| |

| 6. | Part C Information |

| |

| 7. | Exhibits |

| |

September [ ], 2008

Dear Shareholder:

You are cordially invited to attend a special shareholder meeting (the “Special Meeting”) of PNC Equity Income Fund (the “PNC Fund”), a series of PNC Funds, Inc. (the “PNC Corporation”), to be held on October 31, 2008. Before the meeting, I would like to provide you with additional background and ask for your vote on an important proposal affecting the PNC Fund.

The proposal you will be asked to consider at the meeting, as described in the enclosed Combined Prospectus/Proxy Statement, is the proposed reorganization (the “Reorganization”) of the PNC Fund into BlackRock Equity Dividend Fund (the “BlackRock Fund”), a fund with investment objectives, policies and strategies similar to those of the PNC Fund. This proposed Reorganization is part of the initiative undertaken by the parent of the PNC Fund’s adviser, PNC Bank, National Association, and the efforts of the Board of Directors of the PNC Corporation, to improve the performance of certain equity funds that are series of the PNC Corporation. It was determined that the PNC Fund would benefit from the Reorganization with the BlackRock Fund, due to the BlackRock Fund’s historic performance, lower expense ratios, broader asset base, and the ability of investors to exchange with other funds in the wider BlackRock mutual fund complex.

The Board of Directors of the PNC Corporation believes the Reorganization is in the best interests of the PNC Fund and its shareholders, and unanimously recommends that you vote “For” the proposed Reorganization.

I encourage you to carefully review the enclosed materials, which explain this proposal in more detail. As a shareholder, your vote is important, and we hope that you will respond today to ensure that your shares will be represented at the meeting. You may vote using one of the methods below by following the instructions on your proxy card:

- By touchtone telephone;

- By Internet;

- By returning the enclosed proxy card in the postage-paid envelope; or

- In person at the Special Meeting.

If you do not vote using one of these methods, you may be called by Broadridge Financial Solutions, Inc., our proxy solicitor, to vote your shares.

As always, we appreciate your support.

Sincerely,

/s/ Kevin A. McCreadie

Kevin A. McCreadie

President

PNC Funds, Inc. PNC Equity Income Fund

Two Hopkins Plaza Baltimore, Maryland 21201 (800) 551-2145

Please vote now. Your vote is important.

To avoid the wasteful and unnecessary expense of further solicitation, we urge you to promptly indicate your voting instructions on the enclosed proxy card, date and sign it and return it in the envelope provided, no matter how large or small your holdings may be. If you submit a properly executed proxy but do not indicate how you wish your shares to be voted, your shares will be voted “For” the Reorganization. If your shares are held through a broker, you must provide voting instructions to your broker about how to vote your shares in order for your broker to submit your vote at the Special Meeting.

QUESTIONS & ANSWERS

We recommend that you read the complete Combined Prospectus/Proxy Statement. For your convenience, we have provided a brief overview of the proposal to be voted on.

| Q: | Why is a shareholder meeting being held? |

| |

| A: | You are being asked to consider the proposed reorganization (“Reorganization”) and to approve an agreement and plan of reorganization (the “Reorganization Agreement”) between PNC Equity Income Fund (the “PNC Fund”), a series of PNC Funds, Inc. (the “PNC Corporation”), which is a Maryland corporation, and BlackRock Equity Dividend Fund (the “BlackRock Fund”), which is a Massachusetts business trust. The BlackRock Fund pursues investment policies similar to those of the PNC Fund. If the proposed Reorganization is approved and completed, then you will become a shareholder of the BlackRock Fund and the PNC Fund will be terminated, dissolved and liquidated as a series of the PNC Corporation. Please refer to the Combined Prospectus/Proxy Statement for a detailed explanation of the proposed Reorganization and for a more complete description of the BlackRock Fund. |

| |

| Q: | How does the Board of Directors suggest that I vote? |

| |

| A: | After careful consideration, the Board of Directors of the PNC Corporation (the “PNC Fund Board”) has determined that the proposed Reorganization will benefit the PNC Fund’s shareholders and recommends that you cast your vote “For” the proposed Reorganization. The PNC Fund Board believes that the Reorganization will benefit PNC Fund shareholders because they will become invested in a fund with investment objectives, policies and strategies similar to those of the PNC Fund. This proposed Reorganization is part of the initiative undertaken by the parent of the PNC Fund’s adviser, PNC Bank, National Association (“PNC Bank”), after its acquisition of the PNC Fund’s adviser, and the efforts of the PNC Fund Board, to improve the performance of certain equity funds that are series of the PNC Corporation. It was determined that the PNC Fund would benefit from the Reorganization with the BlackRock Fund, due to the BlackRock Fund’s historic performance, lower expense ratios, broader asset base, and the ability of investors to exchange into another fund in the wider BlackRock mutual fund complex. In addition, certain fixed costs, such as printing shareholder reports and proxy statements, legal expenses, audit fees, mailing costs and other expenses, will be spread across a larger asset base, thereby potentially lowering the total operating expenses borne by shareholders. |

| |

| Q: | How will the Reorganization affect me? |

| |

| A: | If PNC Fund shareholders approve the proposed Reorganization, then the BlackRock Fund will acquire all of the assets and certain stated liabilities of the PNC Fund and you will receive Investor A, Investor C or Institutional shares of the BlackRock Fund that will have an aggregate net asset value equal to the aggregate net asset value of the Class A, Class C or Institutional shares of the PNC Fund that you own immediately prior to the Reorganization. |

| |

| Q. | Will I own the same number of shares of the BlackRock Fund as I currently own of the PNC Fund? |

| |

| A. | No, you will receive shares of the BlackRock Fund with the same aggregate net asset value as the shares of the PNC Fund you own prior to the Reorganization. However, the number of shares you receive will depend on the relative net asset value of the shares of the PNC Fund and the BlackRock Fund as of the close of trading on the New York Stock Exchange on the business day before the closing of the Reorganization (“Valuation Time”). Thus, if as of the Valuation Time the net asset value of an Investor A share of the BlackRock Fund is lower than the net asset value of a Class A share of the PNC Fund, you will receive a greater number of shares of the BlackRock Fund in the Reorganization than you held in the PNC Fund before the Reorganization. On the other hand, if the net asset value of an Investor A share of the BlackRock Fund is higher than the net asset value of a Class A share of the PNC Fund, you will receive fewer shares of the BlackRock Fund in the Reorganization than you held in the PNC Fund before the Reorganization. The aggregate net asset value of your BlackRock Fund shares immediately after the Reorganization will be the same as the aggregate net asset value of your PNC Fund shares immediately prior to the Reorganization. |

| |

| Q: | Who will advise the combined fund (“Combined Fund”) once the Reorganization is completed? |

| |

| A: | BlackRock Advisors, LLC (“BlackRock Advisors”) will serve as the Combined Fund’s investment adviser and the portfolio managers who currently run the day-to-day operations of the BlackRock Fund will manage the Combined Fund following the Reorganization. |

| |

| Q: | How do operating expenses paid by the BlackRock Fund compare to those payable by the PNC Fund? |

| |

| A: | Following the Reorganization, the BlackRock Fund’s projected net operating expenses are expected to be lower than those of the PNC Fund. After the Reorganization, the net operating expenses paid by PNC Fund shareholders are expected to be lower than the net operating expenses currently paid by PNC Fund shareholders. The PNC Fund has estimated annual total fund operating expenses of 1.28%, 1.78% and 0.78% for Class A, Class C and Institutional shares, respectively, which includes voluntary waivers and expense reimbursements undertaken by the PNC Fund’s adviser that can be terminated at its option at any time. Upon completion of the Reorganization, the BlackRock Fund has estimated annual fund operating expenses of 0.98%, 1.75%, and 0.72% for Investor A, Investor C and Institutional shares, respectively, which includes any contractual or voluntary waivers or expense reimbursements. |

| |

| Q: | Are there any differences in front-end sales loads or contingent deferred sales charges? |

| |

| A: | There are certain differences in the front-end sales loads, contingent deferred sales charges (“CDSCs”) and the service and distribution fees of the Investor A and Investor C shares of the BlackRock Fund and the Class A and Class C shares of the PNC Fund, which are included in the table below. PNC Fund shareholders enrolled in automatic investment plans that are active at the time of the Reorganization will continue to participate in automatic investment plans with the BlackRock Fund; however, shareholders will receive the class of shares they received through the Reorganization. While a sales charge will not be imposed in connection with the Reorganization, a sales charge will be imposed on future purchases of Investor A and Investor C shares of the BlackRock Fund by Class A and Class C shareholders of the PNC Fund, unless the shareholder is eligible for a reduction or waiver. PNC Fund shareholders enrolled in automatic investment plans that are active at the time of the Reorganization will continue to participate in automatic investment plans with the BlackRock Fund; however, shareholders will receive the class of shares they received through the Reorganization. The Institutional shares of both Funds are identical in that there are no front-end sales charges, CDSCs or service and distribution fees. |

| |

| | PNC Fund

Class A

| BlackRock Fund

Investor A

|

Front-end Sales Charge | 4.75% | 5.25% |

Contingent Deferred

Sales Charges (“CDSCs”) | 1.00% on investments of $1 million

or more if redeemed within one year | 1.00% on investments of $1 million

or more if redeemed within

eighteen months |

Service and Distribution Fees | 0.50% | 0.25% |

| | PNC Fund

Class C

| BlackRock Fund

Investor C

|

Front-end Sales Charge | None | None |

CDSCs | 1.00% if redeemed

within one year | 1.00% if redeemed

within one year |

Service and Distribution Fees | 1.00% | 1.00% |

| | PNC Fund

Institutional

| BlackRock Fund

Institutional

|

Front-end Sales Charge | None | None |

CDSCs | None | None |

Service and Distribution Fees | None | None |

| Q: | Will I have to pay any sales load, commission or other similar fee in connection with the Reorganization? |

| |

| A: | No, you will not pay any sales load, commission or other similar fee in connection with the Reorganization. |

| |

| Q: | What will I have to do to open an account in the BlackRock Fund? What happens to my account if the Reorganization is approved? |

| |

| A: | If the Reorganization is approved, an account will be set up in your name and your shares automatically will be converted into shares of the BlackRock Fund, and we will send you written confirmation that this change has taken place. You will receive Investor A, Investor C or Institutional shares of the BlackRock Fund with an aggregate net asset value equal to the aggregate net asset value of the Class A, Class C or Institutional shares, respectively, of the PNC Fund you own immediately prior to the Reorganization. If you currently hold certificates representing your shares of the PNC Fund, it is not necessary to surrender such certificates. No certificates for shares of the BlackRock Fund will be issued in connection with the Reorganization. |

| |

| Q: | I have received other proxy statements from other funds in the PNC Funds Inc. complex. Is this a duplicate proxy statement and do I have to vote again? |

| |

| A: | This is not a duplicate proxy statement. You are being asked to vote separately for each fund that you own. |

| |

| Q: | What happens if the Reorganization is not approved? |

| |

| A: | If the Reorganization is not approved by shareholders of the PNC Fund, the PNC Fund Board will consider other alternatives. |

| |

| Q: | Will I have to pay any federal taxes as a result of the Reorganization? |

| |

| A: | The Reorganization is expected to qualify as a tax-free “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended. If the Reorganization so qualifies, in general, the PNC Fund will not recognize any gain or loss as a result of the transfer of all of its assets and certain stated liabilities in exchange for shares of the BlackRock Fund or as a result of its liquidation, and you will not recognize any gain or loss upon your receipt of shares of the BlackRock Fund in connection with the Reorganization. |

| | A portion of the portfolio assets of the PNC Fund may be sold in connection with the Reorganization. The tax impact of any such sales will depend on the difference between the price at which such portfolio assets are sold and the PNC Fund’s basis in such assets. Any capital gains recognized in these sales on a net basis will be distributed to the PNC Fund’s shareholders as capital gain dividends (to the extent of net realized long-term capital gains) and/or ordinary dividends (to the extent of net realized short-term capital gains) during or with respect to the year of sale, and such distributions will be taxable to shareholders. In addition, prior to the Reorganization the PNC Fund will distribute to its shareholders all investment company taxable income not previously distributed to shareholders, and such distribution will be taxable to shareholders. |

| Q: | Who will pay for the Reorganization? |

| |

| A: | BlackRock Advisors has agreed to bear the expenses of the PNC Fund and the BlackRock Fund incurred directly in connection with the Reorganization, including expenses of preparing, printing and mailing proxies, proxy solicitation fees, legal fees, audit fees, fees and expenses relating to any special meeting, fees and expenses relating to the special shareholder meeting of the PNC Fund shareholders (“Special Meeting”), fees and expenses relating to the preparation and filing of regulatory documents, expenses of preparing and distributing the prospectus, statement of additional information and supplements, and fees and expenses relating to conversion of the PNC Fund and its shareholders to the BlackRock Fund’s service platform, but excluding the PNC Fund’s portfolio transaction costs (the costs of repositioning the PNC Fund’s portfolio in connection with the Reorganization). BlackRock Advisors has also agreed to bear the expenses of PNC Bank and PNC Capital Advisors, Inc. (“PNC Capital”) relating to the Reorganization, up to a previously agreed-upon amount. To the extent the combined costs and expenses of the PNC Fund and PNC Capital borne by BlackRock exceed that amount, PNC Bank will be responsible for its costs and expenses. With the exception of the costs of repositioning its portfolio in connection with the Reorganization, the PNC Fund will bear no costs associated with the Reorganization. |

| |

| Q: | What if I redeem my shares before the Reorganization takes place? |

| |

| A: | If you choose to redeem your shares before the Reorganization takes place, the redemption will be treated as a normal sale of shares and, generally, will be a taxable transaction. |

| |

| Q: | How do I vote my proxy? |

| |

| A: | You may cast your vote by mail, telephone, internet or in person at the Special Meeting. To vote by mail, please mark your vote on the enclosed proxy card and sign, date and return the card in the postage-paid envelope provided. To vote by telephone or over the internet, please have the enclosed proxy card in hand and call the number or go to the website address listed on the proxy card and follow the instructions. To vote at the Special Meeting, please attend the Special Meeting and have the proxy card in hand. |

| |

| Q: | When will the Reorganization occur? |

| |

| A: | If approved by shareholders, the Reorganization is expected to occur during the fourth quarter of 2008. The Reorganization will not take place if the Reorganization is not approved by the PNC Fund’s shareholders at the Special Meeting. |

| |

| Q: | Whom do I contact for further information? |

| |

| A: | You can contact your financial adviser for further information. You may also call Broadridge Financial Solutions, Inc., our proxy solicitation firm, at 1-866-451-3785. |

| |

Important additional information about the proposal is set forth in the accompanying Combined Prospectus/Proxy Statement. Please read it carefully.

(This page intentionally left blank.)

September [ ], 2008

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 31, 2008

To the Shareholders:

This is to notify you that a Special Meeting of Shareholders (the “Special Meeting”) of PNC Equity Income Fund (the “PNC Fund”), a series of PNC Funds, Inc. (the “PNC Corporation”), will be held on October 31, 2008 at 10:00 A.M., Eastern time, at the offices of PNC Capital Advisors, Inc. at Two Hopkins Plaza, 2nd Floor, Baltimore, Maryland 21201, for the following purposes:

| | 1. | To consider a proposal to approve an Agreement and Plan of Reorganization (the “Reorganization Agreement”) pursuant to which BlackRock Equity Dividend Fund (the “BlackRock Fund”) would acquire all of the assets and certain stated liabilities of the PNC Fund, in exchange for shares of the BlackRock Fund, which will be distributed by the PNC Fund to the holders of its shares in complete liquidation thereof; and |

| |

| | 2. | To consider any adjournment or postponement of the Special Meeting, if necessary or appropriate. |

The Board of Directors of the PNC Corporation has fixed the close of business on September 2, 2008 as the record date for determination of shareholders of the PNC Fund entitled to notice of, and to vote at, the Special Meeting and any adjournments or postponements thereof.

It is very important that your voting instructions be received prior to the meeting date. Instructions for shares held of record in the name of a nominee, such as a broker-dealer or director of an employee benefit plan, may be subject to earlier cutoff dates established by such intermediaries for receipt of such instructions.

Your vote is important regardless of the size of your holdings in the PNC Fund. Whether or not you expect to be present at the Special Meeting, please complete and sign the enclosed proxy card and return it promptly in the enclosed envelope. Shareholders may also vote by telephone or over the Internet; please see page 44 for details. If you vote by proxy and then desire to change your vote or vote in person at the Special Meeting, you may revoke your proxy at any time prior to the votes being tallied at the Special Meeting. Please refer to the section of the enclosed Combined Prospectus/Proxy Statement entitled “Voting Information and Requirements — Manner of Voting” for more information.

By Order of the Board of Directors,

/s/ Jennifer E. Vollmer

Jennifer E. Vollmer

Secretary

Baltimore, Maryland

PNC Funds, Inc. PNC Equity Income Fund

Two Hopkins Plaza Baltimore, Maryland 21201 (800) 551-2145

(This page intentionally left blank.)

COMBINED PROSPECTUS/PROXY STATEMENT

PNC FUNDS, INC.

PNC EQUITY INCOME FUND

Two Hopkins Plaza

Baltimore, Maryland 21201

(800) 551-2145

BLACKROCK EQUITY DIVIDEND FUND

100 Bellevue Parkway

Wilmington, Delaware 19809

(800) 441-7762

This Combined Prospectus/Proxy Statement is furnished to you as a shareholder of PNC Equity Income Fund (the “PNC Fund”), a series of PNC Funds, Inc. (the “PNC Corporation”). A special meeting of shareholders of the PNC Fund (the “Special Meeting”) will be held at Two Hopkins Plaza, 2nd Floor, Baltimore, Maryland 21201 on October 31, 2008 at 10:00 A.M. Eastern time, to consider the items that are listed below and discussed in greater detail elsewhere in this Combined Prospectus/Proxy Statement. Shareholders of record of the PNC Fund at the close of business on September 2, 2008 (the “Record Date”) are entitled to notice of, and to vote at, the Special Meeting or any adjournments thereof. This Combined Prospectus/Proxy Statement, proxy card and accompanying Notice of Special Meeting of Shareholders are first being sent or given to shareholders of the PNC Fund on or about September 19, 2008. Whether or not you expect to attend the Special Meeting or any adjournment or postponement thereof, the Board of Directors of the PNC Corporation (the “PNC Fund Board”) requests that shareholders vote their shares by completing and returning the enclosed proxy card, by calling the toll-free number, or over the Internet.

The purposes of the Special Meeting are:

1. To consider a proposal to approve an Agreement and Plan of Reorganization (the “Reorganization Agreement”) pursuant to which BlackRock Equity Dividend Fund (the “BlackRock Fund”) would acquire all of the assets and certain stated liabilities of the PNC Fund, in exchange for shares of the BlackRock Fund, which will be distributed by the PNC Fund to the holders of its shares in complete liquidation thereof; and

2. To consider any adjournment or postponement of the Special Meeting, if necessary or appropriate.

The PNC Fund Board and the Board of Trustees of BlackRock Fund (the “BlackRock Board”) have each approved the reorganization (the “Reorganization”) by which the PNC Fund would be reorganized into the BlackRock Fund. The BlackRock Fund has investment objectives, policies and strategies similar to those of the PNC Fund. This proposed Reorganization is part of the initiative undertaken by the parent of the PNC Fund’s adviser, PNC Bank, National Association, after its acquisition of the PNC Fund’s adviser, and the efforts of the PNC Fund Board, to improve the performance of certain equity funds that are series of the PNC Corporation. It was determined that the PNC Fund would benefit from the Reorganization with the BlackRock Fund, due to the BlackRock Fund’s historic performance, lower expense ratios, broader asset base, and the ability of investors to exchange into another fund in the wider BlackRock mutual fund complex.

If the PNC Fund shareholders approve the Reorganization, the PNC Fund will transfer all of its assets and certain stated liabilities to the BlackRock Fund. The BlackRock Fund will simultaneously issue Investor A, Investor C and Institutional shares to the PNC Fund in an amount equal to the aggregate net asset value of the outstanding Class A, Class C and Institutional shares of the PNC Fund immediately prior to the Reorganization. Immediately thereafter, the PNC Fund will distribute

these shares of the BlackRock Fund to its shareholders. After distributing these shares, the PNC Fund will be terminated, dissolved and liquidated as a series of a Maryland corporation. When the Reorganization is complete, the PNC Fund’s shareholders will hold Investor A, Investor C or Institutional shares of the BlackRock Fund corresponding to the Class A, Class C or Institutional shares of the PNC Fund. The aggregate net asset value of the BlackRock Fund shares received in the Reorganization will equal the aggregate net asset value of the PNC Fund shares held immediately prior to the Reorganization. After the Reorganization, the BlackRock Fund will continue to operate as a registered open-end investment company.

This Combined Prospectus/Proxy Statement sets forth concisely the information shareholders of the PNC Fund should know before voting on the Reorganization and constitutes an offering of the BlackRock Fund. Please read it carefully and retain it for future reference.

The following documents each have been filed with the Securities and Exchange Commission (the “SEC”), and are incorporated herein by reference into (each legally forms a part of) this Combined Prospectus/Proxy Statement:

- A Statement of Additional Information dated September [ ], 2008 (the “Reorganization SAI”), relating to this Combined Prospectus/Proxy Statement;

The prospectus relating to the Class A and Class C shares of the PNC Fund, dated September 28, 2007, as supplemented (the “PNC Fund Prospectus”);

The prospectus relating to the Institutional Class shares of the PNC Fund, dated September 28, 2007, as supplemented (the “Institutional PNC Fund Prospectus”);

The statement of additional information relating to the PNC Fund, dated September 28, 2007, as supplemented (the “PNC Fund SAI”);

The Annual Report to Shareholders of the PNC Fund for the fiscal year ended May 31, 2008 (the “PNC Fund Annual Report”); and

The BlackRock Fund statement of additional information (the “BlackRock SAI”) dated November 28, 2007 (and as currently supplemented).

The following documents each have been filed with the SEC, and are incorporated herein by reference into (each legally forms a part of) and also accompany this Combined Prospectus/Proxy Statement:

- The BlackRock Fund prospectus (the “BlackRock Prospectus”) dated November 28, 2007 (and as currently supplemented);

- The Annual Report to Shareholders of the BlackRock Fund for the fiscal year ended July 31, 2007 (the “BlackRock Annual Report”); and

- The Semi-Annual Report to Shareholders of the BlackRock Fund for the fiscal period ended January 31, 2008 (the “BlackRock Semi-Annual Report”).

Except as otherwise described herein, the policies and procedures set forth under “About Your Investment” in the BlackRock Prospectus will apply to the Investor A, Investor C and Institutional shares to be issued by the BlackRock Fund in connection with the Reorganization. The Funds are subject to the informational requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, as amended (the “Investment Company Act”), and in accordance therewith, file reports and other information, including proxy materials and charter documents, with the SEC.

Copies of the foregoing and any more recent reports filed after the date hereof may be obtained without charge by calling or writing:

| PNC Funds, Inc. | BlackRock Equity Dividend Fund |

| PNC Equity Income Fund | 100 Bellevue Parkway |

| Two Hopkins Plaza | Wilmington, Delaware 19809 |

| Baltimore, Maryland 21201 | (800) 441-7762 |

| (800) 551-2145 | |

If you wish to request the Reorganization SAI, please ask for the “Reorganization SAI.” The Reorganization SAI may also be obtained without charge at (800) 441-7762.

You also may view or obtain these documents from the SEC:

| In Person: | At the SEC’s Public Reference Room at 100 F Street, N.E., |

| | Washington, DC 20549. |

| | |

| By Mail: | Public Reference Section |

| | Office of Consumer Affairs and Information Services |

| | Securities and Exchange Commission |

| | 100 F Street, N.E. |

| | Washington, DC 20549 (duplicating fee required) |

| | |

| By E-mail: | publicinfo@sec.gov

(duplicating fee required) |

| | |

| By Internet: | www.sec.gov |

The PNC Fund Board knows of no business other than that discussed above that will be presented for consideration at the Special Meeting. If any other matter is properly presented, it is the intention of the persons named in the enclosed proxy to vote in accordance with their best judgment.

No person has been authorized to give any information or make any representation not contained in this Combined Prospectus/Proxy Statement and, if so given or made, such information or representation must not be relied upon as having been authorized. This Combined Prospectus/Proxy Statement does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

Neither the SEC nor any state regulator has approved or disapproved of these securities or

passed upon the adequacy of this Combined Prospectus/Proxy Statement.

Any representation to the contrary is a criminal offense.

The date of this Combined Prospectus/Proxy Statement is September [ ], 2008.

TABLE OF CONTENTS

| | Page |

| SUMMARY | 1 |

| The Proposed Reorganization | 1 |

| Background and Reasons for the Proposed Reorganization | 2 |

| Investment Objectives and Principal Investment Strategies | 4 |

| Fees and Expenses | 5 |

| Federal Tax Consequences | 8 |

| Purchase, Exchange and Redemption | 9 |

| Principal Investment Risks | 10 |

| COMPARISON OF THE PNC FUND AND THE BLACKROCK FUND | 11 |

| Investment Objectives and Principal Investment Strategies | 11 |

| Main Differences in Investment Strategies | 13 |

| Fundamental Investment Restrictions | 13 |

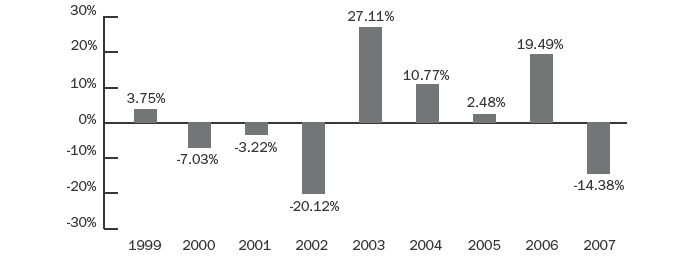

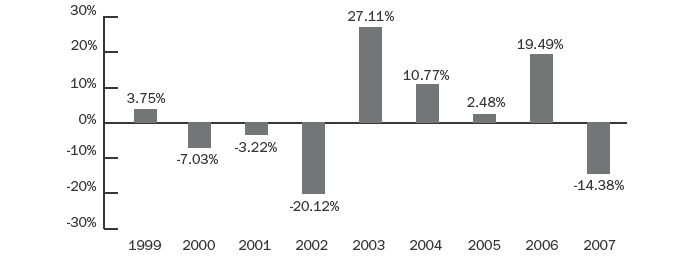

| Performance History | 19 |

| Management of the Funds | 21 |

| Administration Agreements | 23 |

| Other Service Providers | 24 |

| Distribution and Service Fees | 24 |

| Purchase, Exchange, Redemption and Valuation of Shares | 25 |

| Distributions | 28 |

| Market Timing | 28 |

| FINANCIAL HIGHLIGHTS | 28 |

| INFORMATION ABOUT THE REORGANIZATION | 29 |

| General | 29 |

| Terms of the Reorganization Agreement | 29 |

| Reasons for the Reorganization | 30 |

| Material U.S. Federal Income Tax Consequences of the Reorganization | 32 |

| Expenses of the Reorganization | 34 |

| Continuation of Shareholder Accounts and Plans; Share Certificates | 34 |

| Legal Matters | 34 |

| OTHER INFORMATION | 35 |

| Capitalization | 35 |

| Shareholder Information | 36 |

| Shareholder Rights and Obligations | 37 |

| Solicitation of Proxies | 42 |

| VOTING INFORMATION AND REQUIREMENTS | 42 |

| General | 42 |

| Shareholder Approval | 42 |

| Manner of Voting | 44 |

| APPENDIX A — Investment Restrictions | A-1 |

| APPENDIX B — Form of Agreement and Plan of Reorganization | B-1 |

SUMMARY

The following is a summary of certain information contained elsewhere in this Combined Prospectus/Proxy Statement and is qualified in its entirety by reference to the more complete information contained herein. Shareholders should read the entire Combined Prospectus/Proxy Statement carefully.

Each of the PNC Fund and the BlackRock Fund is an open-end management investment company registered with the SEC. The PNC Fund is organized as a corporation under the laws of the State of Maryland, and is a series of PNC Funds, Inc. The BlackRock Fund is a business trust organized under the laws of the Commonwealth of Massachusetts. The investment objective of the PNC Fund is current income and long-term capital growth consistent with reasonable risk. The BlackRock Fund’s investment objective is to seek long-term total return and current income.

The PNC Fund is advised by PNC Capital Advisors, Inc. (“PNC Capital”), formerly known as Mercantile Capital Advisors, Inc. PNC Capital is a wholly-owned subsidiary of PNC Bank, National Association (“PNC Bank”), which is a wholly-owned subsidiary of The PNC Financial Services Group, Inc., a financial holding company (“PNC”). The BlackRock Fund is managed by BlackRock Advisors, LLC (“BlackRock Advisors”) and sub-advised by BlackRock Investment Management, LLC (the “Sub-Adviser”). BlackRock Advisors is an indirect, wholly owned subsidiary of BlackRock, Inc. (“BlackRock”). On September 29, 2006, BlackRock and Merrill Lynch & Co., Inc. (“ML & Co.”) combined Merrill Lynch Investment Managers, L.P. (“MLIM”) and certain affiliates with BlackRock to create a new asset management company that is one of the world’s largest asset management firms with over $1 trillion in assets under management. As a result of that transaction, Merrill Lynch, a financial services holding company and the parent of Merrill Lynch, Pierce, Fenner & Smith Incorporated, owns approximately 49% of BlackRock, PNC owns approximately 34%, and approximately 17% is held by employees and public shareholders. ML & Co. and PNC may be deemed “controlling persons” of BlackRock Advisors (as defined under the Investment Company Act) because of their ownership of BlackRock’s voting securities and/or their power to exercise a controlling influence over BlackRock’s management or policies. The Sub-Adviser is an affiliate of BlackRock Advisors and an indirect wholly owned subsidiary of BlackRock.

Shares of the PNC Fund are offered through its distributor, PNC Fund Distributor, LLC (“PNC Distributor”). Shares of the BlackRock Fund may be purchased through its distributors, FAM Distributors, Inc. (“FAMD”) and BlackRock Distributors, Inc. (“BDI”) through September 30, 2008; however, effective October 1, 2008, BlackRock Investments, Inc. (“BII”) will serve as the BlackRock Fund’s sole distributor and shares may be purchased through BII.

The Proposed Reorganization

The PNC Fund Board, including the Directors who are not “interested persons” of the PNC Corporation (as defined in the Investment Company Act) (the “Independent Directors”), has unanimously approved the Reorganization Agreement. The BlackRock Board, including the Trustees who are not “interested” persons of the BlackRock Fund (as defined in the Investment Company Act), has unanimously approved the Reorganization Agreement. Subject to approval by the PNC Fund shareholders, the Reorganization Agreement provides for:

the transfer of all of the assets and certain stated liabilities of the PNC Fund to the BlackRock Fund in exchange for shares of the BlackRock Fund;

the distribution of such shares to the PNC Fund’s shareholders; and

the liquidation, termination and dissolution of the PNC Fund as a series of a Maryland corporation.

If the proposed Reorganization is approved and completed, the PNC Fund’s shareholders would hold Investor A, Investor C or Institutional shares of the BlackRock Fund with an aggregate net asset value (or “NAV”) equal to the aggregate net asset value of the Class A, Class C or Institutional shares, respectively, of the PNC Fund owned immediately prior to the Reorganization.

1

Background and Reasons for the Proposed Reorganization

In 2007, PNC acquired Mercantile Bankshares Corporation (“Mercantile”), which was the parent of the PNC Fund’s investment adviser, Mercantile Capital Advisors, Inc., which was then renamed PNC Capital. Following the acquisition of Mercantile, PNC Bank hired an independent consultant to evaluate the Mercantile mutual fund complex. After its review, it was determined that PNC Bank should seek to merge three large cap funds advised by PNC Capital into comparable, historically better-performing funds managed by another adviser. As a result, PNC Bank solicited proposals from several investment advisers, including BlackRock Advisors. After completing their due diligence and based upon meetings with BlackRock Advisors, PNC Bank recommended BlackRock Advisors’ proposal to the PNC Fund Board. Based on BlackRock Advisors’ review of its mutual fund lineup, it determined that the PNC Fund should be reorganized into the BlackRock Fund. Each respective reorganization is not contingent upon the others.

In approving the Reorganization Agreement, the PNC Fund Board, including the Independent Directors, determined that the Reorganization is advisable and in the best interests of the PNC Fund and that the interests of the shareholders of the PNC Fund will not be diluted with respect to net asset value as a result of the Reorganization. Before reaching this conclusion, the PNC Fund Board engaged in a thorough review process relating to the proposed Reorganization. The PNC Fund Board approved the Reorganization at a meeting held on July 9, 2008. The PNC Fund Board has directed that the Reorganization be submitted for consideration at the Special Meeting.

The factors considered by the PNC Fund Board with regard to the Reorganization include, but are not limited to, the following:

The similarity of the investment objectives, policies and strategies of the PNC Fund and the BlackRock Fund. See “Comparison of the PNC Fund and the BlackRock Fund—Investment Objectives and Principal Investment Strategies.”

The relative performance histories of each Fund. See “Comparison of the PNC Fund and the BlackRock Fund—Performance History.”

The expectation that the combined fund resulting from the completion of the Reorganization (the “Combined Fund”) will have net operating expenses lower than those of the PNC Fund prior to the Reorganization and will achieve certain operating efficiencies from its larger net asset size.

- PNC Fund shareholders will pay no sales charges in connection with the Reorganization. There are certain differences in the front-end sales loads, contingent deferred sales charges (“CDSCs”) and the service and distribution fees of the Investor A and Investor C shares of the BlackRock Fund and the Class A and Class C shares of the PNC Fund, which are included in the table below. The Institutional shares of both Funds are identical in that there are no front-end sales charges, CDSCs or service and distribution fees. While a sales charge will not be imposed in connection with the Reorganization, a sales charge will be imposed on future purchases of Investor A and Investor C shares of the BlackRock Fund by Class A and Class C shareholders of the PNC Fund, unless the shareholder is eligible for a reduction or waiver. PNC Fund shareholders enrolled in automatic investment plans that are active at the time of the Reorganization will continue to participate in automatic investment plans with the BlackRock Fund; however, shareholders will receive the class of shares they received through the Reorganization. The Institutional shares of both Funds are identical in that there are no front-end sales charges, CDSCs or service and distribution fees.

2

| | PNC Fund

Class A

| BlackRock Fund

Investor A

|

Front-end Sales Charge | 4.75% | 5.25% |

Contingent Deferred Sales

Charges (“CDSCs”) | 1.00% on investments of $1 million

or more if redeemed within one year | 1.00% on investments of $1 million

or more if redeemed within

eighteen months |

Service and Distribution Fees | 0.50% | 0.25% |

| | PNC Fund

Class C

| BlackRock Fund

Investor C

|

Front-end Sales Charge | None | None |

CDSCs | 1.00% if redeemed

within one year | 1.00% if redeemed

within one year |

Service and Distribution Fees | 1.00% | 1.00% |

| | PNC Fund

Institutional

| BlackRock Fund

Institutional

|

Front-end Sales Charge | None | None |

CDSCs | None | None |

Service and Distribution Fees | None | None |

The fact that there is expected to be no gain or loss recognized by shareholders for federal income tax purposes as a result of the Reorganization, as the Reorganization is expected to be a tax-free transaction. In addition, prior to the Reorganization the PNC Fund will distribute to its shareholders all investment company taxable income not previously distributed to shareholders, and such distribution will be taxable to shareholders.

The reputation of BlackRock Advisors as an investment manager and the experience and qualifications of the trustees and officers of the BlackRock Fund and the investment team that will manage the Combined Fund. See “Management of the Funds.”

The fact that the asset base of the PNC Fund is not expected to grow from its current level of approximately $39.5 million as of April 30, 2008, and that the BlackRock Fund’s assets have grown consistently over the last few years.

The quality of the shareholder services the PNC Fund shareholders would have access to following the Reorganization and the fact that they would have access to a larger fund family with a broader array of options. These options include the ability generally to exchange their shares for shares of the same class of another fund managed by BlackRock Advisors. See “Comparison of the PNC Fund and the BlackRock Fund—Purchase, Exchange, Redemption and Valuation of Shares” and “Information about the Reorganization—Continuation of Shareholder Accounts and Plans; Share Certificates.”

The fact that BlackRock Advisors or one of its affiliates will be responsible for all of the costs associated with the Reorganization for the PNC Fund and BlackRock Fund excluding portfolio transaction costs (the costs of repositioning the PNC Fund’s portfolio in connection with the Reorganization), as well as for PNC Capital and PNC Bank up to a previously agreed upon amount. To the extent that the costs exceed this amount, PNC Capital and PNC Bank will be responsible for their respective costs. With the exception of the costs of repositioning the PNC Fund’s portfolio in connection with the Reorganization, the PNC Fund will bear no costs associated with the Reorganization.

Any benefits resulting from the Reorganization to PNC Capital and its affiliates.

The fact that PNC Bank recommended that the Reorganization be approved by the PNC Fund Board based upon its due diligence of BlackRock Advisors and other potential candidates.

The PNC Fund Board unanimously concluded that, based upon the factors and determinations summarized above, completion of the Reorganization is advisable and in the best interests of the PNC Fund and that the interests of the shareholders of the PNC Fund will not be diluted with respect to net

3

asset value as a result of the Reorganization. The BlackRock Fund Board concluded that completion of the Reorganization is advisable and in the best interests of the BlackRock Fund and that the interests of the shareholders of the BlackRock Fund will not be diluted with respect to net asset value as a result of the Reorganization. The determinations were made on the basis of each Director’s business judgment after consideration of all of the factors taken as a whole, though individual Directors may have placed different weight on various factors and assigned different degrees of materiality to various conclusions.

If the Reorganization is not approved by shareholders of the PNC Fund, the PNC Fund Board will consider other alternatives.

The PNC Fund Board recommends that you vote “For” the Reorganization.

Investment Objectives and Principal Investment Strategies

Comparison. The investment objectives of the PNC Fund and the BlackRock Fund are somewhat similar, since both Funds have a focus on current income. However, the PNC Fund also seeks long-term capital growth consistent with reasonable risk, while the BlackRock Fund emphasizes long-term total return more than current income. Both Funds employ similar strategies in achieving their respective objectives, since both Funds have policies under which at least 80% of their net assets are invested in equity securities that produce dividends. The PNC Fund’s investment strategy focuses on investments in income-producing equities of U.S. companies, while the BlackRock Fund is allowed to invest generally in equity and dividend paying securities. The PNC Fund and the BlackRock Fund allow for investments in American Depositary Receipts (“ADRs”) and European Depositary Receipts (“EDRs”), as well as convertible securities. The PNC Fund also allows for investments in Global Depositary Receipts (“GDRs”, and with ADRs and EDRs, “Depositary Receipts”) (and only sponsored ADRs), but limits its investment in equity securities of foreign companies (including all Depositary Receipts) to 20% of net assets, and convertible securities to 10% of the total assets of the Fund. The BlackRock Fund limits investments in securities of foreign issuers to 25% of its total assets, but does not have a limit on convertible securities (other than ensuring that the Fund meets its 80% policies). Both Funds may engage in temporary defensive measures.

Investment Objectives. The investment objective of the PNC Fund is current income and long-term capital growth consistent with reasonable risk. The BlackRock Fund’s investment objective is to seek long-term total return and current income. The PNC Fund can change its investment objective by approval of its board upon providing shareholders at least 30 days’ notice. The BlackRock Fund’s investment objectives are fundamental and may not be changed without the approval of the holders of a majority of the Fund’s outstanding voting securities as defined in the Investment Company Act.

Principal Investment Strategies. The PNC Fund invests at least 80% of its net assets (including borrowings for investment purposes) in income-producing equities of U.S. companies. The PNC Fund primarily has invested in large-cap stocks (considered by the Fund’s adviser to be a company with a minimum market capitalization of $10 billion) of any economic sector, but has at times emphasized particular companies or market sectors. It has an objective of maintaining a dividend yield that is above-average and over time, realizing a growth of dividend income.

The PNC Fund may hold equities, including common and preferred stock of U.S. and foreign companies. The Fund may also invest in EDRs, GDRs and ADRs. However, the PNC Fund may not hold more than 20% of its net assets in equity securities of foreign companies, including investments through EDRs, GDRs and sponsored ADRs.

The PNC Fund also may not hold more than 10% of its total assets in convertible securities that are rated BBB by the Standard & Poor’s Division of The McGraw-Hill Companies, Inc. (“S&P”) or Baa by Moody’s Investors Service, Inc. (“Moody’s”) respectively, or below at the time of investment.

To earn additional income, the PNC Fund may lend portfolio securities to qualified financial institutions. Although these loans are fully collateralized, the Fund’s performance could be hurt if a borrower defaults or becomes insolvent, or if the Fund wishes to sell a security before its return can be arranged.

4

As a temporary defensive investment, the PNC Fund could shift up to 100% of assets into cash (which earns no income), money market instruments, or other investments that are not part of its main strategy. Although a defensive strategy may help the Fund avoid losses, it would mean the Fund was not pursuing its investment objective, and could hurt performance by causing the Fund to miss participating in favorable market trends.

The BlackRock Fund invests at least 80% of its assets in equity securities and at least 80% of its assets in dividend paying securities. This policy is a non-fundamental policy of the Fund and may not be changed without 60 days’ prior notice to shareholders. For these purposes, assets include any borrowings for investment purposes. The Fund will focus on issuers that have good prospects for capital appreciation. The Fund may invest in securities of companies with any market capitalization. The Fund may engage in various portfolio strategies involving options and futures to seek to increase its return or to hedge its portfolio against movements in the equity markets, interest rates and exchange rates between currencies.

In addition, the BlackRock Fund may invest in securities convertible into common stocks, non-convertible preferred stocks and debt securities. The Fund may invest in debt securities of any maturity that are rated in the four highest quality ratings (i.e., investment grade) as determined by either Moody’s (currently Aaa, Aa, A and Baa for bonds) or S&P (currently AAA, AA, A and BBB for bonds).

The BlackRock Fund normally will invest a portion of its assets in short-term debt securities, money market securities, including repurchase agreements, or cash. The Fund reserves the right to hold, as a temporary defensive measure or as a reserve for redemptions, short-term U.S. Government securities, money market securities, including repurchase agreements, or cash in such proportions as, in the opinion of BlackRock Advisors, prevailing market or economic conditions warrant. The BlackRock Fund invests in such securities or cash when management is unable to find enough attractive long-term investments to reduce exposure to stocks when management believes it is advisable to do so or to meet redemptions. Except during temporary defensive periods, such investments will not exceed 20% of the BlackRock Fund’s assets. As a temporary measure for defensive purposes, the Fund may invest more heavily in these securities or cash, without limitation. During such periods, the Fund’s investments in dividend-paying common stocks will be limited and the Fund may, therefore, not be able to achieve its investment objective.

The BlackRock Fund also may invest in ADRs, EDRs or other securities convertible into securities of foreign issuers. The Fund may invest up to 25% of its total assets in securities of foreign issuers, may invest in securities from any country and may invest in securities denominated in both U.S. dollars and non-U.S. dollar currencies.

The Combined Fund’s investment objectives and principal investment strategies will be those of the BlackRock Fund.

For additional information on risks, see “Comparison of the PNC Fund and the BlackRock Fund—Principal Investment Risks.” For information about the fundamental investment restrictions applicable to each Fund, see Appendix A.

Fees and Expenses

Assuming shareholders of the PNC Fund approve the proposed Reorganization, all of the assets and certain stated liabilities of the PNC Fund will be combined with those of the BlackRock Fund and each PNC Fund shareholder will receive Investor A, Investor C or Institutional shares of the BlackRock Fund corresponding to the Class A, Class C or Institutional shares, respectively, of the PNC Fund held by the PNC Fund shareholder. After the Reorganization, the PNC Fund’s shareholders will hold shares of the BlackRock Fund with an aggregate net asset value equal to the aggregate net asset value of the PNC Fund shares owned immediately prior to the Reorganization.

5

Fee Table of the PNC Fund, BlackRock Fund and the

Pro Forma Combined Fund as of April 30, 2008 (unaudited)

The fee table below provides information about the fees and expenses attributable to the Class A, Class C and Institutional shares of the PNC Fund, the Investor A, Investor C and Institutional shares of the BlackRock Fund and, assuming the Reorganization had taken place on April 30, 2008, the estimated pro forma fees and expenses attributable to the Investor A, Investor C and Institutional shares of the Pro Forma Combined Fund. Future fees and expenses may be greater or less than those indicated below. For information concerning the net assets of each Fund as of August 15, 2008, see “Other Information—Capitalization.”

| | | | | | | | Pro Forma

Combined

BlackRock

Fund |

| | | | | | | |

| | | | | BlackRock

Fund |

| | PNC Fund |

| |

|

|

|

| | Class

A | Investor

A(1) | Investor A

Shares(1)(2) |

| |

| |

| |

|

|

|

Shareholder Fees (fees paid directly from a

shareholder’s investment): | | | | | | | | | |

| Maximum Sales Charge (Load) imposed on purchases | | | | | | | | | |

| (as a percentage of offering price) | | 4.75 | % | | 5.25 | %(3) | | 5.25 | %(3) |

| Maximum Deferred Sales Charge (Load) (as a percentage of original | | | | | | | | | |

| purchase price or redemption proceeds, whichever is lower) | | None | (4) | | None | (4) | | None | (4) |

| Maximum Sales Charge (Load) Imposed on Dividend Reinvestments | | None | | | None | | | None | |

| Redemption Fee | | None | | | None | | | None | |

| Exchange Fee | | None | | | None | | | None | |

| Annual Fund Operating Expenses | | | | | | | | | |

| (expenses that are deducted from Fund assets): | | | | | | | | | |

| Management Fees | | 0.60 | % | | 0.60 | %(5) | | 0.60 | %(5) |

| Distribution and/or Service (12b-1) Fees | | 0.50 | % | | 0.25 | %(6) | | 0.25 | %(6) |

| Other Expenses (including administration, if applicable, and | | | | | | | | | |

| transfer agency fees) | | 0.53 | % | | 0.13 | %(7) | | 0.13 | %(7) |

| Acquired Fund Fees and Expenses | | — | | | — | (8) | | — | (8) |

| Total Annual Fund Operating Expenses | | 1.63 | %(9) | | 0.98 | %(10) | | 0.98 | %(10) |

| | |

| | |

| | |

| |

| | | | | | | Pro Forma

Combined

BlackRock

Fund |

| | | | | | |

| | | | BlackRock

Fund |

| | PNC Fund |

| |

|

|

|

| | Class

C | Investor

C(1) | Investor C

Shares(1)(2) |

| |

| |

| |

|

|

|

Shareholder Fees (fees paid directly from a

shareholder’s investment): | | | | | | | | |

| Maximum Sales Charge (Load) imposed on purchases | | | | | | | | |

| (as a percentage of offering price) | None | | | None | | | None | |

| Maximum Deferred Sales Charge (Load) (as a percentage of original | | | | | | | | |

| purchase price or redemption proceeds, whichever is lower) | 1.00 | % | | 1.00 | %(3) | | 1.00 | %(3) |

| Maximum Sales Charge (Load) Imposed on Dividend Reinvestments | None | | | None | | | None | |

| Redemption Fee | None | | | None | | | None | |

| Exchange Fee | None | | | None | | | None | |

| Annual Fund Operating Expenses | | | | | | | | |

| (expenses that are deducted from Fund assets): | | | | | | | | |

| Management Fees | 0.60 | % | | 0.60 | %(5) | | 0.60 | %(5) |

| Distribution and/or Service (12b-1) Fees | 1.00 | % | | 1.00 | %(6) | | 1.00 | %(6) |

| Other Expenses (including administration, if applicable, and | | | | | | | | |

| transfer agency fees) | 0.53 | % | | 0.15 | %(7) | | 0.15 | %(7) |

| Acquired Fund Fees and Expenses | — | | | — | (8) | | — | (8) |

| Total Annual Fund Operating Expenses | 2.13 | %(9) | | 1.75 | %(10) | | 1.75 | %(10) |

| |

| | |

| | |

| |

(footnotes appear on next page)

6

| | | | | | | Pro Forma

Combined

BlackRock

Fund |

| | | | | | |

| | | | BlackRock

Portfolio |

| | PNC Fund |

| |

|

|

|

| | Institutional | Institutional | Institutional

Shares(1)(2) |

| | Class | Shares(1) |

| |

|

|

|

Shareholder Fees (fees paid directly from

a shareholder’s investment): | | | | | | | | |

| Maximum Sales Charge (Load) imposed on purchases | | | |

| (as a percentage of offering price) | None | | | None | | | None | |

| Maximum Deferred Sales Charge (Load) (as a percentage of original | | | | | | | | |

| purchase price or redemption proceeds, whichever is lower) | None | | | None | | | None | |

| Maximum Sales Charge (Load) Imposed on Dividend Reinvestments | None | | | None | | | None | |

| Redemption Fee | None | | | None | | | None | |

| Exchange Fee | None | | | None | | | None | |

| Annual Fund Operating Expenses | | | | | | | | |

| (expenses that are deducted from Fund assets): | | | | | | | | |

| Management Fees | 0.60 | % | | 0.60 | %(5) | | 0.60 | %(5) |

| Distribution and/or Service (12b-1) Fees | None | | | None | | | None | |

| Other Expenses (including administration, if applicable, and | | | | | | | | |

| transfer agency fees) | 0.53 | % | | 0.12 | %(7) | | 0.12 | %(7) |

| Acquired Fund Fees and Expenses | — | | | — | (8) | | — | (8) |

| Total Annual Fund Operating Expenses | 1.13 | %(9) | | 0.72 | %(10) | | 0.72 | %(10) |

| |

| | |

| | |

| |

| (1) | In addition, certain selected securities dealers or other financial intermediaries may charge clients a processing fee when a client buys or redeems shares. For example, Merrill Lynch, Pierce, Fenner & Smith Incorporated generally charges a fee of $5.35 when a client buys or redeems shares. Also, PNC Global Investment Servicing (U.S.) Inc. (“PNC GIS”), formerly PFPC Inc., the BlackRock Fund’s transfer agent, charges a fee of $7.50 for redemption payments made by wire transfer and $15 for redemption by check sent via overnight mail. |

| | |

| (2) | Assumes the Reorganization had taken place on April 30, 2008. |

| | |

| (3) | Some investors may qualify for reductions in or waivers of the sales charge (load). See “Your Account—Pricing of Shares” in the BlackRock Fund prospectus. |

| | |

| (4) | You may pay a deferred sales charge if you purchase $1 million or more and you redeem within twelve months on the PNC Fund and eighteen months on the BlackRock Fund. |

| | |

| (5) | Under the management agreement between BlackRock Advisors and the BlackRock Fund, BlackRock Advisors provides certain administrative services to the BlackRock Fund. |

| | |

| (6) | If you hold Investor C shares over time, it may cost you more in distribution and service (12b-1) fees than the maximum sales charge that you would have paid if you had bought Investor A shares. |

| | |

| (7) | PNC GIS, an affiliate of BlackRock Advisors, provides transfer agency services to the Fund. The Fund pays a fee for these services. BlackRock Advisors or its affiliates also provide certain accounting services to the Fund and the Fund reimburse BlackRock Advisors or its affiliates for these services. The BlackRock Fund does not pay a separate administration fee to BlackRock Advisors. |

| | |

| (8) | Acquired Fund Fees and Expenses were less than 0.01%. |

| | |

| (9) | As a result of voluntary waivers and expense reimbursements, the Net Total Annual Fund Operating Expenses of Class A, Class C and Institutional shares of the PNC Fund are expected to be 1.28%, 1.78% and 0.78%, respectively. The waivers and reimbursements may be terminated at any time at the option of the investment adviser. |

| | |

| (10) | BlackRock Advisors has voluntarily agreed to waive and/or reimburse fees and/or expenses so that expenses incurred by each investor of shares of the BlackRock Fund will not exceed 0.90% (excluding distribution and/or service fees). This waiver may be reduced or discontinued by BlackRock Advisors at any time without notice. During the twelve-month period ended April 30, 2008, BlackRock Advisors did not waive any fees or expenses for Investor A, Investor C and Institutional shares of the BlackRock Fund pursuant to the agreement. BlackRock Advisors has agreed to continue this waiver for the Combined Fund. |

7

EXAMPLES:

These examples assume that an investor invests $10,000 in the relevant Fund for the time periods indicated, that the investment has a 5% return each year, that the investor pays the sales charges, if any, that apply to the particular class and that the Fund’s operating expenses remain the same. These assumptions are not meant to indicate that the investor will receive a 5% annual rate of return. The annual return may be more or less than the 5% used in these examples. Although actual costs may be higher or lower, based on these assumptions, an investor’s costs would be:

Expenses if you did redeem your shares:

|

| | 1 Year | 3 Years | 5 Years | 10 Years |

|

| PNC Fund Class A | $633 | $965 | $1,319 | $2,316 |

| BlackRock Fund Investor A | $620 | $821 | $1,038 | $1,663 |

| BlackRock Fund Pro Forma | | | | |

| Combined Investor A Shares* | $620 | $821 | $1,038 | $1,663 |

| |

|

| | 1 Year | 3 Years | 5 Years | 10 Years |

|

| PNC Fund Class C | $316 | $667 | $1,144 | $2,462 |

| BlackRock Fund Investor C | $278 | $551 | $ 949 | $2,062 |

| BlackRock Fund Pro Forma | | | | |

| Combined Investor C Shares* | $278 | $551 | $ 949 | $2,062 |

| |

|

| | 1 Year | 3 Years | 5 Years | 10 Years |

|

| PNC Fund Institutional Class | $115 | $359 | $622 | $1,375 |

| BlackRock Fund Institutional Class | $ 74 | $230 | $401 | $ 894 |

| BlackRock Fund Pro Forma | | | | |

| Combined Institutional Shares* | $ 74 | $230 | $401 | $ 894 |

Expenses if you did not redeem your shares:

|

| | 1 Year | 3 Years | 5 Years | 10 Years |

|

| PNC Fund Class A | $633 | $965 | $1,319 | $2,316 |

| BlackRock Fund Investor A | $620 | $821 | $1,038 | $1,663 |

| BlackRock Fund Pro Forma | | | | |

| Combined Investor A Shares* | $620 | $821 | $1,038 | $1,663 |

| |

|

| | 1 Year | 3 Years | 5 Years | 10 Years |

|

| PNC Fund Class C | $216 | $667 | $1,144 | $2,462 |

| BlackRock Fund Investor C | $178 | $551 | $ 949 | $2,062 |

| BlackRock Fund Pro Forma | | | | |

| Combined Investor C Shares* | $178 | $551 | $ 949 | $2,062 |

| |

|

| | 1 Year | 3 Years | 5 Years | 10 Years |

|

| PNC Fund Institutional Class | $115 | $359 | $622 | $1,375 |

| BlackRock Fund Institutional Class | $ 74 | $230 | $401 | $ 894 |

| BlackRock Fund Pro Forma | | | | |

| Combined Institutional Shares* | $ 74 | $230 | $401 | $ 894 |

* Assuming the Reorganization had taken place on April 30, 2008.

Federal Tax Consequences

The Reorganization is expected to qualify as a tax-free “reorganization” for U.S. federal income tax purposes. If the Reorganization so qualifies, in general, neither the PNC Fund, the BlackRock Fund, nor their respective shareholders will recognize gain or loss for U.S. federal income tax purposes in the transactions contemplated by the Reorganization. As a condition to the closing of the Reorganization, the PNC Fund, PNC Bank and the BlackRock Fund will receive an opinion from Willkie Farr & Gallagher LLP, special United States federal income tax counsel to the BlackRock Fund, to that

8

effect. An opinion of counsel is not binding on the Internal Revenue Service (the “IRS”) or any court and thus does not preclude the IRS from asserting, or a court from rendering, a contrary position.

If any of the portfolio assets of the PNC Fund are sold (or deemed sold by reason of marking to market of certain assets upon the termination of the PNC Fund’s taxable year) by the PNC Fund in connection with the Reorganization, the tax impact of such sales (or deemed sales) will depend on the difference between the price at which such portfolio assets are sold and the PNC Fund’s basis in such assets. Any gains will be distributed to the PNC Fund’s shareholders as either capital-gain dividends (to the extent of long-term capital gains) or ordinary dividends (to the extent of short-term capital gains) during or with respect to the year of sale (or deemed sale), and such distributions will be taxable to shareholders.

At any time prior to the consummation of the Reorganization, a shareholder may redeem shares of the PNC Fund, likely resulting in recognition of gain or loss to such shareholder for U.S. federal and state income tax purposes. For more information about the U.S. federal income tax consequences of the Reorganization, see “Material U.S. Federal Income Tax Consequences of the Reorganization.”

Purchase, Exchange and Redemption

PNC Fund

Purchases. The PNC Fund publicly offers its shares on a continuous basis. Class A, Class C and Institutional shares of the PNC Fund can be purchased or redeemed through orders placed with its distributor, PNC Distributor, and its intermediaries. Shareholders of the PNC Fund may purchase or redeem their shares at the net asset value (or “NAV”), which is computed as of the close of trading on the New York Stock Exchange (“NYSE”) on any day the NYSE is open for trading, through written or telephone instructions. The order must be placed before the close of regular trading on the NYSE, which is normally 4:00 p.m., Eastern time. Orders made after the close of trading will be priced based on the next calculation of NAV per share. Investments in Class A and Class C shares generally can be made by a minimum purchase amount of $1,000. Institutional shares can be purchased either: (i) from the trust or banking departments of PNC Bank or PNC Bank, Delaware, another financial intermediary that has entered into an agreement with PNC Distributor to sell shares; (ii) directly from the PNC Fund through an investment of $1 million or more with the PNC Fund; or (iii) if you had an Institutional Class share account directly with the PNC Fund on September 30, 2002. Class A shares are purchased at NAV, and adjusted for the applicable sales charges, while Class C and Institutional shares are purchased at NAV. Institutional shares are redeemed at NAV, while Class A and Class C shares are redeemed at NAV, and adjusted for any applicable sales charges. Class A shares do not have a CDSC, except there is a CDSC of 1.00% for an investment of $1 million or more and the redemption is made 1 year after the investment. Class C shares have a CDSC of 1.00% if shares are redeemed within 1 year.

Redemptions. The PNC Fund does not charge a redemption fee. PNC Fund shareholders have the right to exchange their shares for shares of the same class of another fund in the PNC mutual fund complex, provided that the share class and fund is available and open to new investors, and as long as those shares may be legally sold in the investor’s state. There is a minimum required amount for exchanges of PNC Fund Class A and Class C shares of $1,000, if opening a new account (or $100 if adding to a an existing account) and $500 for Institutional shares, if opening a new account (with no minimum if adding to an existing account). Shares to be exchanged at the price based on the respective NAV. Accounts with less than $1,000 of Class A or Class C shares as a result of withdrawals and less than $500 of Institutional shares can be closed.

Exchanging Shares. PNC Fund shareholders can exchange some or all of their shares of the PNC Fund for the same class of shares in any other PNC fund, as long as those shares may legally be sold in your state.

In general, there are no sales charges when shareholders exchange from one fund to another. One exception is with Class A shares when you are exchanging from a money market fund into a stock or bond fund. Unless a shareholder is eligible for a sales charge waiver, shareholders will be charged the sales charge on the fund into which they are exchanging. Note that once shareholders

9

have paid a sales charge, they will be given credit for having paid that charge in all future exchanges of the money involved.

BlackRock Fund

Purchases. The BlackRock Fund publicly offers its shares on a continuous basis. Investor A, Investor C and Institutional shares may be purchased or redeemed through orders placed with its distributors, BDI and FAMD, or their intermediaries through September 30, 2008; however, effective October 1, 2008, BII will serve as the BlackRock Fund’s sole distributor and shares may be purchased or redeemed through orders placed with BII or its intermediaries. Shareholders of the BlackRock Fund may purchase or redeem their shares at NAV, which is computed as of the close of trading on the NYSE on any day the NYSE is open for trading, through written or telephone instructions. The order must be placed before the close of regular trading on the NYSE, which is normally 4:00 p.m., Eastern time. Orders made after the close of trading will be priced based on the next calculation of NAV per share. Investments in Investor A and Investor C shares generally can be made by a minimum purchase amount of $1,000. Institutional shares may be purchased by the following: (i) investors who currently own Institutional shares of the Fund may make additional purchases of Institutional shares of the Fund except for investors holding shares through certain omnibus accounts at financial intermediaries that are omnibus with the Fund and do not meet the applicable investment minimums; (ii) institutional and individual retail investors with a minimum investment of $2 million who purchase through certain broker-dealers or directly from the Fund’s transfer agent; (iii) certain qualified retirement plans; (iv) investors in selected fee based programs; (v) registered investment advisers with a minimum investment of $250,000; (vi) trust department clients of PNC Bank and Merrill Lynch Bank & Trust Company, FSB and their affiliates for whom they (a) act in a fiduciary capacity (excluding participant directed employee benefit plans), (b) otherwise have investment discretion, or (c) act as custodian for at least $2 million in assets; (vii) unaffiliated banks, thrifts or trust companies that have agreements with either FAMD or BDI; (viii) holders of certain Merrill Lynch & Co., Inc. (“Merrill Lynch”) sponsored unit investment trusts (“UITs”) who reinvest dividends received from such UITs in shares of the Fund; and (ix) employees and directors/trustees of BlackRock, BlackRock funds, Merrill Lynch, PNC or their affiliates. Investor A shares are purchased at NAV, and adjusted for the applicable sales charges, while Investor C and Institutional shares are purchased at NAV. Institutional shares are redeemed at NAV, while Investor A and Investor C shares are redeemed at NAV, and adjusted for any applicable sales charges. Class A shares do not have a CDSC, except there is a CDSC of 1.00% for redemption of an investment of $1 million or more and the redemption is made 18 months after the investment. Investor C shares have a CDSC of 1.00% if shares are redeemed within 1 year.

Redemptions. The BlackRock Fund does not charge a redemption fee. BlackRock Fund shareholders have the right to exchange their shares for shares of the same class of another fund in the BlackRock mutual fund complex, provided that the share class and fund is available and open to new investors. There is a minimum required amount for exchanges of BlackRock Fund Investor A and Investor C shares of $1,000 and none for Institutional shares. Shares are exchanged at the respective net asset value. Accounts with less than $500 of Investor A and Investor C shares, as a result of withdrawals, can be closed, while Institutional shares can be closed for failure to keep the minimum required initial investment.

Exchanging Shares. BlackRock Fund shareholders have the right to exchange their shares for shares of the same class of another fund in the BlackRock mutual fund complex, provided that the share class and fund is available and open to new investors. There is a minimum required amount for exchanges of BlackRock Fund Investor A of $1,000 and none for Institutional shares. Shares are exchanged at NAV.

Principal Investment Risks

Because of their similar investment policies, many of the risks associated with an investment in the BlackRock Fund are substantially similar to those associated with an investment in the PNC Fund. Such primary investment risks for both Funds include market risk, selection or management risk and convertible securities risk. The PNC Fund lists primary investment risks of equity risk, value investing, sector risk and foreign investment risk. The BlackRock Fund lists income producing stock availability and mid-cap securities as additional primary investment risks.

10

You will find additional descriptions of specific risks in the prospectuses and statements of additional information for the PNC Fund and the BlackRock Fund.

There is no guarantee that shares of the Combined Fund will not lose value. This means that as shareholders of the Combined Fund, the PNC Fund shareholders could lose money. As with any fund, the value of the BlackRock Fund’s investments, and, therefore, the value of the BlackRock Fund’s shares, may fluctuate. In addition, there are specific factors that may affect the value of a particular security. Also, the BlackRock Fund may invest in securities that underperform the markets, the relevant indices or securities selected by other funds with similar investment objectives and investment strategies.

COMPARISON OF THE PNC FUND

AND THE BLACKROCK FUND

Investment Objectives and Principal Investment Strategies

PNC Fund. The PNC Fund’s investment objective is current income and long-term capital growth consistent with reasonable risk.

Under normal circumstances, the PNC Fund invests at least 80% of its net assets (which includes borrowings for investment purposes) in income-producing equities of U.S. companies. The Fund’s principal investment strategies include:

Under normal market conditions, investing primarily in income producing equities of large-cap companies. the PNC Fund’s adviser considers a large-cap company to be a company with a relatively large market capitalization with a minimum cap of $10 billion.

Under normal circumstances, investing at least 80% of its net assets (which includes borrowings for investment purposes) in income-producing equities (common and preferred stocks, and securities convertible into common stock) of U.S. companies.

Investing in companies that it believes will produce above-average dividend yields and “out-of-favor stocks” that are currently selling at an attractive price relative to other measures of worth.

Investing in securities of domestic and foreign issuers.

The PNC Fund primarily favors large-cap stocks of any economic sector, and may at times emphasize particular companies or market sectors. The Fund has an objective of maintaining a dividend yield that is above-average and over time, realizing a growth of dividend income. The Fund’s adviser looks for a history of growth of sales, earnings and dividends.

The PNC Fund’s adviser would sell a stock when it has met established price targets or has become relatively overvalued compared to other issues, as determined by the adviser. A stock may also be sold as a result of deterioration in the performance of the stock or in the financial condition of the issuer of the stock.

Principal types of securities the PNC Fund may hold include:

Equities, including common and preferred stock of U.S. and foreign companies;

EDRs, GDRs and sponsored ADRs; and

Convertible securities of any credit rating (convertible into common stock).

No more than 20% of the Fund’s net assets may be invested in equity securities of foreign companies, including investments through EDRs, GDRs and sponsored ADRs. No more than 10% of the Fund’s total assets may be invested in convertible securities that are rated BBB/Baa or below at the time of investment.