QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

ý | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

o | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

Ebix, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||||

Ebix, Inc.

1900 E. GOLF ROAD, SUITE 1050

SCHAUMBURG, ILLINOIS 60173

, 2004

Dear Stockholder:

On behalf of our Board of Directors, I cordially invite you to the Annual Meeting of Stockholders of Ebix, Inc. to be held at , local time, on , , 2004, at our Atlanta office, located at 5 Concourse Parkway, Suite 3200, Atlanta, Georgia.

The business of the meeting is described in detail in the attached notice of meeting and proxy statement. Also included is a proxy card and postage paid return envelope.

It is important that your shares are represented and voted at the Annual Meeting, regardless of the size of your holdings. Whether or not you plan to attend, please complete and return the enclosed proxy to ensure that your shares will be represented at the Annual Meeting. If you attend the meeting, you may withdraw your proxy by voting in person.

| | | |

|---|---|---|

Sincerely, | ||

Robin Raina Chairman of the Board and Chief Executive Officer |

Ebix, Inc.

1900 E. GOLF ROAD, SUITE 1050

SCHAUMBURG, ILLINOIS 60173

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON , 2004

Notice is hereby given that the Annual Meeting of Stockholders of Ebix, Inc. will be held at our Atlanta office, located at 5 Concourse Parkway, Suite 3200, Atlanta, Georgia, at , local time, on , , 2004, and at any adjournments or postponements thereof, for the following purposes:

- 1.

- To elect seven directors to serve until the 2005 annual meeting or until their respective successors are elected and qualified.

- 2.

- To approve an amendment to our Certificate of Incorporation to reduce the number of authorized shares of our Common Stock from 40,000,000 to 10,000,000 and the number of authorized shares of our Preferred Stock from 2,000,000 to 500,000.

- 3.

- To approve an amendment to our 1996 Stock Incentive Plan to increase the number of shares of our Common Stock reserved for issuance thereunder from 837,500 to 1,137,500 shares and to prohibit the repricing of options granted under the plan.

- 4.

- To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof.

Our Board of Directors has fixed the close of business on , 2004 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof.

Whether or not you plan to attend the meeting, please complete, sign, date and return the enclosed proxy in the envelope provided.

| | | |

|---|---|---|

By Order of the Board of Directors | ||

Richard J. Baum Executive Vice President—Finance and Administration, Chief Financial Officer and Secretary | ||

Dated: , 2004 |

Ebix, Inc.

1900 E. GOLF ROAD, SUITE 1050

SCHAUMBURG, ILLINOIS 60173

(847) 789-3047

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON , 2004

PROXY STATEMENT

SUMMARY

We sent you this proxy statement because our Board of Directors is soliciting your proxy to vote your shares of our Common Stock at our upcoming Annual Meeting of Stockholders. The meeting is to be held at our Atlanta office located at 5 Concourse Parkway, Suite 3200, Atlanta, Georgia, at , local time, on , , 2004. If your proxy is properly submitted by an executed proxy card returned in a timely manner, it will be voted at the meeting according to the directions you provide. If you do not provide any direction, your proxy will be voted "FOR" all the nominees for election as directors and "FOR" each of the proposals to amend our Certificate of Incorporation and our 1996 Stock Incentive Plan. Your proxy also will be voted on any other matters presented for a vote in accordance with the judgment of the persons acting under the proxies. You may revoke your proxy at any time before it is voted at the annual meeting by:

- •

- attending the meeting, giving written notice of revocation to the secretary of the meeting prior to the voting of your proxy and voting your shares in person, although your attendance at the meeting will not by itself revoke your proxy;

- •

- sending a written notice to our Secretary indicating that you want to revoke your proxy; or

- •

- delivering to our Secretary a duly executed proxy bearing a later date, which revokes all previous proxies.

Our principal executive office is located at 1900 E. Golf Road, Suite 1050, Schaumburg, Illinois 60173 (telephone 847.789.3047). This proxy statement is dated , 2004, and we expect to mail proxy materials to stockholders beginning on or about that date.

SHARES OUTSTANDING AND VOTING RIGHTS

Only stockholders of record at the close of business on , 2004 are entitled to vote at the Annual Meeting of Stockholders. Our only voting stock outstanding is our Common Stock, of which 2,899,745 shares were outstanding at the close of business on August 20, 2004. Each share of our Common Stock is entitled to one vote. A quorum of stockholders is necessary to take action at the Annual Meeting. For purposes of each of the actions proposed to be taken at the Annual Meeting, the presence in person or by proxy of a majority of the outstanding shares of our Common Stock will constitute a quorum of stockholders. Abstentions and broker non-votes (which occur when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner) will be counted as shares present in the determination of whether the shares of Common Stock represented at the meeting constitute a quorum.

Directors are elected by a plurality of the shares of Common Stock that are present in person or represented by proxy and entitled to vote at the Annual Meeting. This means that the seven nominees receiving the highest number of "FOR" votes will be elected. Neither abstentions nor broker non-votes will have any effect in determining the outcome of the election of directors.

The affirmative vote of a majority of all of our outstanding shares of capital stock is required to approve the proposal to amend our Certificate of Incorporation to reduce the number of authorized

1

shares of our Common Stock and Preferred Stock. Abstentions and broker non-votes will have the same effect as votes "AGAINST" the amendment to our Certificate of Incorporation.

The affirmative vote of a majority of the shares of our Common Stock present in person or represented by proxy at the annual meeting is required in order to approve an amendment to our 1996 Stock Incentive Plan. Abstentions will have the same effect as votes "AGAINST" the amendment to our 1996 Stock Incentive Plan. Broker non-votes will have no effect in determining the outcome of the vote to amend our 1996 Stock Incentive Plan, other than to reduce the total number of outstanding shares of capital stock counted as present for this purpose.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth, as of August 20, 2004, the ownership of our Common Stock by each of our directors, by each of our Named Executive Officers (as defined on page 8), by all of our current executive officers and directors as a group, and by all persons known to us to be beneficial owners of more than five percent of our Common Stock. The information set forth in the table as to the current directors, executive officers and principal stockholders is based, except as otherwise indicated, upon information provided to us by such persons. Unless otherwise indicated, each person has sole investment and voting power with respect to the shares shown below as beneficially owned by such person.

| | Common Stock | ||||

|---|---|---|---|---|---|

| Name of Beneficial Owner | Ownership | Percent of Class | |||

| BRiT Insurance Holdings PLC (1) | 930,163 | 32.1 | % | ||

| Rennes Foundation (2) | 343,121 | 11.8 | % | ||

| CF Epic Insurance and General Fund (3) | 222,223 | 7.7 | % | ||

| Craig Wm. Earnshaw (4) | 200,000 | 6.9 | % | ||

| Heart Consulting Pty. Ltd. (5) | 157,728 | 5.4 | % | ||

| Robin Raina (6) | 327,624 | 11.3 | % | ||

| Richard J. Baum (7) | 70,390 | 2.4 | % | ||

| Douglas Chisholm (8) | 5,647 | * | |||

| Dennis Drislane (7) | 5,272 | * | |||

| William W. G. Rich (7) | 4,653 | * | |||

| Pavan Bhalla | 0 | * | |||

| Paul Hodges | 0 | * | |||

| Hans Ueli Keller | 0 | * | |||

| Kenneth D. Merin | 0 | * | |||

All directors and executive officers as a group (9 persons) (9) | 413,586 | 12.5 | % | ||

- *

- Less than 1%.

- (1)

- The address of BRiT Insurance Holdings PLC is 55 Bishopsgate, London, EC2N 3AS, United Kingdom. The address and information set forth in the table as to this stockholder are based on a Schedule 13D/A filed by this stockholder on October 21, 2002. As of August 20, 2004, BRiT Insurance Holdings PLC owned approximately 70% of the equity interests of CF Epic Insurance and General Fund, but did not have voting or dispositive control over the shares of our Common Stock owned by CF Epic Insurance and General Fund.

- (2)

- The address of the Rennes Foundation is Aeulestrasse 38, FL 9490 Vaduz, Principality of Liechtenstein. The address and information set forth in the table as to this stockholder are based on a Schedule 13G/A filed by this stockholder on February 12, 2004.

2

- (3)

- The address of CF Epic Insurance and General Fund is c/o Simon Shaw, Investment Manager, 55 Bishopsgate, London, EC2N 3AS, United Kingdom.

- (4)

- The address of Craig Wm. Earnshaw is 1301 Little Kate Road, Park City, Utah, 84060.

- (5)

- These shares are subject to a repurchase commitment by us pursuant to which Heart Consulting Pty. Ltd. may require us to repurchase such shares at any time during January 2006 for an aggregate purchase price of A$2,000,000 ($1,399,000 USD) minus any proceeds received by Heart Consulting Pty. Ltd. from earlier sales of any portion of such shares. The address of Heart is C/- PPF Partners, Level 2, 52 Collins Street, Melbourne, Victoria Australia 3000.

- (6)

- Includes 327,189 shares of Common Stock that may be purchased by exercising outstanding options within 60 days after August 20, 2004. The address of Mr. Raina is 5 Concourse Parkway, Suite 3200, Atlanta, Georgia 30328.

- (7)

- Represents shares of Common Stock that may be purchased by exercising outstanding options within 60 days after August 20, 2004.

- (8)

- Includes 5,272 shares of Common Stock that may be purchased by exercising outstanding options within 60 days after August 20, 2004.

- (9)

- Includes 412,776 shares of Common Stock that may be purchased by exercising outstanding options within 60 days after August 20, 2004.

PROPOSAL 1. ELECTION OF DIRECTORS

Seven directors will be elected at the Annual Meeting. The directors elected will hold office until their successors are elected (which should occur at the next annual meeting) and qualified, unless they die, resign or are removed from office prior to that time. In the absence of specific instructions, executed proxies which do not indicate for whom votes should be cast will be voted "FOR" the election of the nominees named below as directors. In the event that any nominee is unable or declines to serve as a director (which is not anticipated), the proxyholders will vote for such substitute nominee as the Board of Directors recommends or vote to allow the vacancy to remain open until filled by the Board of Directors, as the Board of Directors recommends.

Our Board of Directors recently determined that it would be in our best interest to reduce the size of our Board of Directors from eight to seven members for the purpose of maintaining efficiency and productivity, considering the size of our company. To that end, our Board of Directors has nominated seven directors to continue to serve on our Board of Directors as set forth in this proposal. The term of office of the eighth director, Douglas Chisholm, will end on the date of the Annual Meeting.

Set forth below is information as to each nominee for director, including age, principal occupation and employment during the past five years, directorships with other publicly-held companies, and period of service as a member of our Board of Directors. The nominees are all current members of the Board of Directors.

ROBIN RAINA, 38, was elected as a director in February 2000. Mr. Raina joined Ebix, Inc. in October 1997 as our Vice President—Professional Services and was promoted to Senior Vice President—Sales and Marketing in February 1998. Mr. Raina was promoted to Executive Vice President, Chief Operating Officer in December 1998. Mr. Raina was appointed President effective August 2, 1999, Chief Executive Officer effective September 23, 1999 and Chairman in May 2002. Prior to joining us, from 1990 to 1997, Mr. Raina held senior management positions for Mindware/BPR, an international technology consulting firm, serving in Asia and North America. While employed by Mindware/BPR, Mr. Raina was responsible for managing projects for multinational corporations, including setting up offshore laboratories, building intranets, managing service bureaus and support centers, providing custom programming, and year 2000 conversions. Mr. Raina holds an Industrial Engineering degree from Thapar University in Punjab, India.

3

PAVAN BHALLA, 41, was appointed as a director in June 2004. Mr. Bhalla has served as Senior Vice President—Finance of MCI Inc., a global telecommunications company, and presently oversees financial management of MCI's Enterprise Markets operating unit. Before joining MCI in August 2003, Mr. Bhalla spent over seven years with BellSouth Corporation, a telecommunications company, serving in a variety of executive positions, including Chief Financial Officer of BellSouth Long Distance Inc. from 1999 to 2002, Corporate Controller of BellSouth Cellular Corp. from 1997 to 1999, and Regional Director of Finance of BellSouth Cellular Corp. from 1996 to 1997.

DENNIS DRISLANE, 55, was elected as a director in October 2000. Mr. Drislane is President of Cypress Point Communications, which is his health care and technology consulting company. Mr. Drislane was a Senior Vice President of WebMD (formerly Healtheon), an Internet healthcare company, from July 1997 to February 2001, where he left to start his own consulting business. Prior to WebMD, Mr. Drislane spent 24 years with Electronic Data Systems (EDS), a computer services company, in a number of senior executive positions.

PAUL JOSEPH HODGES, 45, was appointed as a director in July 2004. Mr. Hodges has served as a corporate broker for Collins Stewart, a financial services company, specializing in the insurance, other financials and water sectors, since 2000. Prior to joining Collins Stewart, Mr. Hodges spent three years as a founding member of Schroder Securities, a financial services company, working on insurance archaeology projects and spent over 15 years working for stock brokerage firms as a composite insurance analyst.

HANS UELI KELLER, 53, was appointed as a director in July 2004. Mr. Keller most recently spent over 20 years with Zurich-based Credit Suisse, a global financial services company, serving as Executive Board Member from 1997 to 2000, Head of Retail Banking from 1993 to 1996, and Head of Marketing from 1985 to 1992. He is presently also serving as Chairman of the Board of Swisscontent Corp. AG, in addition to being a member of the board of directors of KdLabs AG.

KENNETH D. MERIN, 57, was appointed as a director in July 2004. Mr. Merin is an attorney at law with approximately 20 years of experience in the insurance business. He currently supervises the insurance regulatory practice at the law firm of Purcell, Ries, Shannon, Mulcahy, and O'Neill, based in New Jersey, where he has practiced since 1996. He is also the President of the Charles Hayden Foundation, a New York City-based non-profit organization dedicated to helping underprivileged children, a position he has held since 2000. Mr. Merin has an extensive background in public policy matters affecting state and federal governments. From 1975 through 1980 he worked for the U.S. Congress in various capacities. Mr. Merin has also served in various capacities in New Jersey state government, including as Commissioner of Insurance.

WILLIAM W. G. RICH, 68, was elected as a director in November 2000. Since 1989, Mr. Rich has served as Chief Executive Officer of Strategic Business Partners, Inc., which specializes in mergers, acquisitions and strategic alliances between financial software developers and service providers with a specialty in insurance and banking. Under a contract between Strategic Business Partners and Sherwood International LLC, an insurance software and consulting firm, Mr. Rich served from 1996 to 2002 as Sherwood's Director of Marketing, Life and Annuities, North America. Since 2002, Mr. Rich has been active with Strategic Business Partners in North America and Europe.

Required Vote

The seven nominees receiving the highest number of votes will be elected to the Board of Directors. Stockholders do not have the right to cumulate their votes in the election of directors.

Board Recommendation

Our Board of Directors recommends that you vote "FOR" the election of the nominees for director listed above.

4

INFORMATION CONCERNING THE BOARD OF DIRECTORS AND COMMITTEES

Our Board of Directors has a standing Audit Committee that consists exclusively of non-employee directors, each of whom meets the independence requirements of the NASDAQ Stock Market. Pursuant to a written charter that is attached to this proxy statement asExhibit A, the Audit Committee exercises oversight responsibility regarding the quality and integrity of our auditing and financial reporting practices. In discharging this responsibility, the Audit Committee, among other things, selects the independent auditors, pre-approves the audit and any non-audit services to be provided by the auditors and reviews the results and scope of the annual audit performed by the auditors. The Board of Directors anticipates adopting an amended Audit Committee Charter prior to the Annual Meeting. The Audit Committee currently consists of Messrs. Bhalla (Chairman), Drislane and Chisholm. After reviewing the qualifications of the current members of the committee, and any relationships they may have with the Company that might affect their independence from the Company, our Board of Directors has determined that (1) all current members of the Audit Committee are "independent" as that concept is defined in Section 10A of the Securities Exchange Act of 1934, (2) all current members of the Audit Committee are "independent" as that concept is defined in the NASDAQ listing standards, (3) all current members of the Audit Committee are financially literate, and (4) Mr. Bhalla qualifies as an "audit committee financial expert" as defined under SEC rules promulgated under the Sarbanes-Oxley Act of 2002. The Audit Committee met four times during 2003.

Our Board of Directors has a standing Compensation Committee that consists exclusively of non-employee directors. The Compensation Committee is responsible for approving compensation of officers and directors and administration of our various employee benefit plans. Our Board of Directors intends to adopt a written charter for the Compensation Committee, which will be posted on our website as soon as it is available. The Compensation Committee currently consists of Messrs. Chisholm and Rich. Mr. William R. Baumel served on the Compensation Committee until his resignation in April 2004; Mr. Chisholm was appointed to the Compensation Committee on July 13, 2004. The Compensation Committee met five times during 2003.

To comply with the new rules and regulations which are the result of the adoption of the Sarbanes-Oxley Act of 2002, our Board of Directors intends to establish a Corporate Governance and Nominating Committee prior to the date of the Annual Meeting. The Corporate Governance and Nominating Committee will have responsibility for recommending to the Board of Directors the persons to be nominated for election as directors by stockholders and recommending the persons to be elected by the Board of Directors to fill any vacancies. It also will make recommendations to the Board of Directors concerning the qualifications of members of the Board of Director's committees, committee member appointment and removal and appointment of committee chairs. In addition, the Corporate Governance and Nominating Committee will be charged with considering matters of corporate governance generally and reviewing and recommending to the Board of Directors, periodically, our Corporate Governance Guidelines. Our Board of Directors intends that each of the members of the Corporate Governance and Nominating Committee will be "independent," as that concept is defined in the NASDAQ listing standards. See "Nominating Procedures."

The Board of Directors held eight meetings during 2003. Each of the directors attended at least 75 percent of the meetings of our Board of Directors and its committees on which he served during 2003.

Corporate Governance Practices And Policies

Our Board of Directors has been carefully following the corporate governance developments that have been taking place as a result of the adoption of the Sarbanes-Oxley Act of 2002, the rules adopted thereunder by the Securities and Exchange Commission ("SEC"), new NASDAQ listing standards and other corporate governance recommendations.

5

Our Board of Directors intends to adopt Corporate Governance Guidelines to address, among other things, the Board's composition, qualifications and responsibilities, director education and stockholder communication with directors. These Corporate Governance Guidelines, which will be posted on our website as soon as they are available, will provide that directors are expected to attend our annual meeting of stockholders. In 2003, each member of the Board of Directors, except for Mr. Rich, attended our 2003 annual meeting of stockholders.

Our Board of Directors has adopted a Code of Ethics for Senior Financial Officers, applicable to our Chief Executive Officer, Chief Operating Officer, Corporate Controller and any other senior financial officers, as well as a Code of Conduct, articulating standards of business and professional ethics, applicable to all of our directors, officers and employees. The full texts of the Code of Ethics for Senior Financial Officers and Code of Conduct are available on our website.

Nominating Procedures

As described above, our Board of Directors intends to create a Corporate Governance and Nominating Committee, consisting entirely of independent directors. The Corporate Governance and Nominating Committee will operate under a written charter, which will be posted on our website as soon as it is available. The Corporate Governance and Nominating Committee will consider many factors when considering candidates for election to the Board of Directors, including that the proper skills and experiences are represented on the Board of Directors and its committees and that the composition of the Board of Directors and each such committee satisfies applicable legal requirements and the NASDAQ listing standards. Depending upon the current needs of the Board of Directors, certain factors may be weighed more or less heavily by the Corporate Governance and Nominating Committee.

The Corporate Governance and Nominating Committee will consider candidates for the Board of Directors from any reasonable source, including stockholder recommendations. The Corporate Governance and Nominating Committee will not evaluate candidates differently based on who has made the proposal. The Corporate Governance and Nominating Committee will have the authority under its charter to hire and pay a fee to consultants or search firms to assist in the process of identifying and evaluating candidates. No such consultants or search firms have been used to date and, accordingly, no fees have been paid to consultants or search firms in the past fiscal year.

Stockholders who wish to suggest qualified candidates should write to the Secretary, Ebix, Inc., 1900 E. Golf Road, Suite 1050, Schaumburg, Illinois 60173, specifying the name of the candidates and stating in detail the qualifications of such persons for consideration by the Corporate Governance and Nominating Committee. A written statement from the candidate consenting to be named as a candidate and, if nominated and elected, to serve as a director should accompany any such recommendation.

Newly Appointed Directors

In 2004, Messrs. Bhalla, Hodges, Keller and Merin were appointed to our Board of Directors. Because these appointments were prior to the establishment of our Corporate Governance and Nominating Committee, each of these individuals were appointed following an assessment by our Board of Directors of such individual's background, skills and experiences through recommendations from third parties, background checks, interviews and interaction between the current members of our Board of Directors and the nominated individual. Each individual showed a commitment to continuing to build on our goals, and our Board of Directors felt that each such individual would bring valuable experience and knowledge to our Board of Directors and our company. Our second largest stockholder, Rennes Foundation, recommended Mr. Keller for a position on our Board of Directors. Another stockholder, CF Epic Insurance and General Fund, recommended Messrs. Hodges and Merin for positions on our Board of Directors. Mr. Bhalla was recommended by Robin Raina, our Chairman and

6

Chief Executive Officer. We did not retain a search firm or otherwise pay any third party in connection with identifying these Board candidates.

Director Compensation

Under the Non-Employee Directors Stock Option Plan (the "1998 Director Option Plan"), each non-employee director, upon initial election or appointment to serve on the Board of Directors, receives a grant of an option to purchase 1,500 shares of Common Stock at an exercise price per share of 100% of the fair market value of a share on the date of the grant. Of the 1,500 shares of Common Stock subject to such an option, the option becomes exercisable with respect to (a) 500 shares on the day prior to the first anniversary of the date of the grant and (b) 125 shares on the last day of each of the eight calendar quarters commencing on the last day of the calendar quarter ending on or after the first anniversary of the date of the grant. Each option has a term of ten years beginning on the date of the grant. Upon appointment to our Board of Directors, each of Messrs. Bhalla, Hodges, Keller and Merin was granted an option to purchase 1,500 shares of Common Stock pursuant to the 1998 Director Option Plan.

In addition, the 1998 Director Option Plan provides for each non-employee director, immediately following each annual meeting of our stockholders, to be granted an option to purchase 450 shares of Common Stock at an exercise price per share of 100% of the fair market value of a share of Common Stock on the date of the grant. Of the 450 shares of Common Stock subject to each such option, the option becomes exercisable with respect to 112.5 shares on the last day of each of the four calendar quarters beginning with the calendar quarter ending on or after the date of the grant. Each option has a term of ten years beginning on the date of grant.

In May 2003, our Board of Directors determined that each Board of Director member will receive options to purchase 1,500 shares of Common Stock each year, including the options automatically awarded under the 1998 Director Option Plan. Each member of the Compensation Committee will receive additional options to purchase 150 shares of Common Stock per year. Each Audit Committee member will receive additional options to purchase 375 shares of Common Stock per year. These options will be granted immediately following each annual meeting of stockholders at an exercise price per share of 100% of the fair market value of a share of Common Stock on the date of the grant. These options will become exercisable on the last day of each of the four calendar quarters, beginning with the first calendar quarter ending on or after the date of the grant, and will have a term of ten years beginning on the date of grant. Accordingly, following our annual meeting of stockholders on October 17, 2003, Mr. Baumel, who resigned as a member of our Board of Directors on April 30, 2004, received options to purchase 2,025 shares of Common Stock, each of Messrs. Chisholm and Drislane received options to purchase 1,875 shares of Common Stock and Mr. Rich received options to purchase 1,650 shares of Common Stock. Each of these options has an exercise price of $5.55 per share.

In addition, each member of the Audit Committee, other than its Chairman, receives cash compensation of $2,500 per year. The Audit Committee Chairman receives cash compensation of $5,000 per year.

EXECUTIVE OFFICERS

We have two executive officers, Mr. Raina, information as to whom is provided above, and Richard J. Baum, our Executive Vice President—Finance & Administration, Chief Financial Officer and Secretary.

RICHARD J. BAUM, 66, has been Executive Vice President—Finance & Administration, Chief Financial Officer and Secretary since July 21, 1999, having joined us as Senior Controller in June 1999. Since 1988, he had been President of Consulting Capabilities Corp., a general business consulting firm specializing in turnaround and crisis management. His prior executive level posts include Chief Financial Officer of General American Equities (1983-1987), Vice President of American Invesco Corp

7

(1979-1983), Chief Financial Officer of Norlin Music, Inc. (1977-1979), Chief Financial Officer and member of the Board of Midas International Corp. (1972-1977). He is a CPA and holds an MBA from the University of Chicago.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our officers and directors and persons who beneficially own more than ten percent of a registered class of our equity securities to file with the Securities and Exchange Commission reports of securities ownership on Form 3 and changes in such ownership on Forms 4 and 5. Officers, directors and more than ten percent beneficial owners also are required by rules promulgated by the Securities and Exchange Commission to furnish us with copies of all such Section 16(a) reports that they file. Based solely upon a review of the copies of Forms 3, 4, and 5 furnished to us and representations by certain executive officers and directors that no such reports were required for them, we believe that, during 2003, all of our directors, officers and more-than-ten-percent beneficial owners filed all such reports on a timely basis, except that each of Messrs. Rich, Chisholm and Drislane filed a Form 4 on October 21, 2003 for an October 17, 2003 option exercise and each of Messrs. Baum and Raina filed a Form 4 on October 3, 2003 for a September 16, 2003 option exercise.

EXECUTIVE COMPENSATION

The table below contains information regarding the annual and long-term compensation for the years ended December 31, 2003, December 31, 2002 and December 31, 2001 for our Chief Executive Officer and other executive officer as of December 31, 2003 (collectively, the "Named Executive Officers").

SUMMARY COMPENSATION TABLE

| | | | | Long Term Compensation Awards | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Annual Compensation | | ||||||||||

| Name and Principal Position | | Securities Underlying Options (#) | All Other Compensation ($)(1) | ||||||||||

| Year | Salary ($) | Bonus ($)(2) | |||||||||||

| Robin Raina— President, Chief Executive Officer and Chairman of the Board | 2003 2002 2001 | $ $ $ | 350,000 313,462 300,050 | $ $ $ | 624,310 162,500 150,000 | 110,000 125,000 125,000 | $ $ $ | 2,105 3,894 2,550 | |||||

Richard J. Baum Executive Vice President—Chief Financial Officer and Secretary | 2003 2002 2001 | $ $ $ | 200,000 197,692 190,050 | $ $ $ | 232,150 100,000 35,625 | 12,000 31,250 31,250 | $ $ $ | 3,000 2,965 2,550 | |||||

- (1)

- Represents matching contributions pursuant to our 401(k) plan.

- (2)

- The 2003 bonuses include supplemental bonuses of $132,000 for Mr. Baum and $449,000 for Mr. Raina that were based upon the achievement of operating cash flow goals.

8

Option Grants for the Year Ended December 31, 2003

The table below contains information regarding individual grants of options to purchase shares of Common Stock made during the year ended December 31, 2003 to each of the Named Executive Officers. We did not award any stock appreciation rights in 2003.

OPTION GRANTS IN LAST FISCAL YEAR

| | | Individual Grants (1) | | | | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term (2) | |||||||||||

| | Number of Securities Underlying Options Granted (#) | | | ||||||||||||

| | % of Total Options Granted to Employees in Fiscal Year | | | ||||||||||||

| Name | Exercise Price Per Share ($/Sh) | Expiration Date | |||||||||||||

| 5% ($) | 10% ($) | ||||||||||||||

| Robin Raina (3) | 110,000 | 74.8 | % | $ | 5.35 | 9/16/13 | $ | 370,104 | $ | 937,917 | |||||

| Richard J. Baum (3) | 12,000 | 8.2 | % | $ | 5.35 | 9/16/13 | $ | 40,375 | $ | 102,318 | |||||

- (1)

- All options were granted under our 1996 Stock Incentive Plan.

- (2)

- Potential realizable value is presented net of the option exercise price but before any federal or state income taxes associated with exercise. These amounts represent certain assumed rates of appreciation prescribed by the SEC. Actual gains are dependent on the future performance of the Common Stock and the option holders' continued employment over the vesting period. The potential realizable values do not reflect our prediction of our stock price performance. The amounts reflected in the table may not be achieved.

- (3)

- The options become exercisable each year, in equal annual installments on the first four anniversaries of the grant date, unless accelerated vesting criteria are met. Because we reported a pre-tax profit for the year ended December 31, 2003, these options vested as to 50% of the remaining unvested shares on the date the profit was reported. If we report a net profit of $2,000,000 for the year ended December 31, 2004, these options will vest as to all remaining unvested shares on the date the profit is reported.

December 31, 2003 Option Values

The table below contains information regarding unexercised options to purchase Common Stock held by the Named Executive Officers as of December 31, 2003. No stock options were exercised by the Named Executive Officers during 2003.

FISCAL YEAR-END OPTION VALUES

| | Number of Securities Underlying Unexercised Options at Year-End(#) | Value of Unexercised In-the-Money Options at Year-End($)(1) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Name | ||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||

| Robin Raina | 192,785 | 212,216 | $ | 961,998 | $ | 1,350,607 | ||||

| Richard J. Baum | 46,484 | 41,766 | $ | 240,536 | $ | 230,509 | ||||

- (1)

- The value per option is calculated by subtracting the exercise price per share from the closing price of our Common Stock on the NASDAQ Smallcap Market on December 31, 2003, which was $12.26.

9

Employment and Severance Agreements

We entered into an Executive Severance Agreement with Mr. Baum, dated October 4, 2000, which provides for a severance payment if a change of control of our company occurs and, within 12 months thereafter, either Mr. Baum's employment is terminated without cause or he resigns due to a demotion or other new and onerous requirements being placed on him. Under the Agreement, the severance payment is equal to one year's salary (based on the highest monthly salary earned by Mr. Baum during the 12 months preceding his termination) plus a bonus equal to the fraction of the calendar year worked up to the termination, multiplied by the bonus paid to him in the prior calendar year. Under certain circumstances, the Agreement also provides medical insurance subsidies for a period of 12 months and indemnification. Under the Agreement, Mr. Baum agrees to hold our proprietary information confidential and, for a period of 12 months following his termination, cooperate with us with respect to corporate administrative affairs arising during his employment. If his termination results in payment of the Agreement's severance benefits, Mr. Baum will be subject to a non-competition agreement for a period of one year following his termination. When used in the foregoing summary the terms "cause" and "change of control" have the meanings given to them in the Agreement.

EQUITY COMPENSATION PLAN INFORMATION

As of December 31, 2003, we maintained the 1996 Stock Incentive Plan and our 1998 Non-Employee Directors Stock Option Plan, each of which was approved by our stockholders. We also maintained the 2001 Stock Incentive Plan, which was not approved by our stockholders. As discussed below, our Board of Directors has determined it is in our best interest to terminate the 2001 Stock Incentive Plan. The table below provides information as of December 31, 2003 related to these plans.

| Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options Warrants and Rights | Weighted-Average Exercise Price of Outstanding Options Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans | |||||

|---|---|---|---|---|---|---|---|---|

| Equity Compensation Plans Approved by Security Holders | 659,882 | $ | 11.56 | 156,468 | ||||

Equity Compensation Plans not Approved by Security Holders | — | — | 62,500 | |||||

Total | 659,882 | $ | 11.56 | 218,968 | ||||

The above table does not reflect the additional number of shares of Common Stock to be available for grant under the 1996 Stock Incentive Plan subject to stockholder approval of the amendment to the 1996 Stock Incentive Plan at the Annual Meeting.

The following is a summary description of our only non-stockholder-approved plan.

2001 Stock Incentive Plan

During 2001, our Board of Directors adopted the 2001 Stock Incentive Plan (the "2001 Plan"), which provides for the granting of stock options and other incentive awards to employees and consultants. The total number of shares reserved for issuance under the 2001 Plan is 62,500. No options or other incentive awards have been granted under the 2001 Plan and we have no intention of making any awards under the 2001 Plan. Our Board of Directors determined that it is in our best interest to terminate the 2001 Plan and voted to approve the termination of the 2001 Plan.

10

REPORT OF COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors reviews and makes recommendations to the Board of Directors regarding salaries, compensation and benefits of officers and other key employees and grants options to purchase Common Stock.

During 2003 the members of the Compensation Committee were Messrs. Baumel and Rich. Mr. Chisholm became a member of the Compensation Committee on July 13, 2004.

COMPENSATION PHILOSOPHY. Our goals are to reward executives consistent with our company's performance and to encourage the executives to increase stockholder value. To achieve these goals, the Compensation Committee has adopted the following objectives as guidelines:

- •

- Display a willingness to pay executives compensation necessary to attract and retain highly qualified executives.

- •

- Be willing to compensate executives for superior performance or for assuming new responsibilities or new positions within our company.

- •

- Take into account historical levels of executive compensation and compensation structures competitive with other companies of a similar size.

- •

- Implement a balance between short and long-term compensation to complement our annual and long-term business objectives and strategies.

- •

- Provide compensation opportunities based on our performance, encourage stock ownership by executives and align executive compensation with the interests of stockholders.

COMPENSATION PROGRAM COMPONENTS. The Compensation Committee reviews our compensation program to ensure that pay levels and incentive opportunities are competitive with the market and reflect our performance. The particular elements of the compensation program for executive officers are further explained below.

BASE SALARY. Base pay levels are largely determined by evaluating the responsibilities of the position held and the experience of the individual and by comparing the salary scale with companies of similar size and complexity with which the members of the Committee are familiar. Actual base salaries are kept within a competitive salary range for each position that is established through job evaluation and market comparisons.

ANNUAL INCENTIVES. We have historically awarded cash bonuses to certain of our salaried employees (including the Named Executive Officers). Bonuses are based on various factors, including profitability, revenue growth, management development and other specific performance criteria.

STOCK OPTION PROGRAM. The Compensation Committee strongly believes that by providing those persons who have substantial responsibility for our management and growth with an opportunity to increase their ownership of our stock, the interests of stockholders and executives will be closely aligned. Therefore, our officers (including the Named Executive Officers) and other key employees are eligible to receive either incentive stock options or nonqualified stock options as the Compensation Committee may determine from time to time, giving them the right to purchase shares of our Common Stock at an exercise price equal to 100 percent of the fair market value of the Common Stock at the date of grant. The number of stock options granted to officers is based on several factors, including options held as a percentage of total outstanding shares, exercise price of existing options, retention considerations and competitive practices.

CHIEF EXECUTIVE OFFICER COMPENSATION. Mr. Raina's base salary as Chief Executive Officer during 2003 was based on his compensation level in 2002 and the Compensation Committee's assessment of the value to us of continuity and stability in our management. The Compensation

11

Committee also compared Mr. Raina's compensation to compensation levels in the marketplace for chief executive officers of companies of comparable size with which the members are familiar.

In 2003, Mr. Raina received options to purchase 110,000 shares of our Common Stock, based on our subjective analysis of his performance and the performance of our company, and considering the Common Stock and stock options already held by him. Mr. Raina also received a bonus of $175,310, based on success in achieving profit goals of our company. In addition, on May 9, 2003, our Board of Directors established a supplemental executive bonus plan. The plan provided that bonuses would be paid based on the extent to which operating cash flow exceeded a target amount, with depreciation and amortization being held constant. A bonus pool consisting of a maximum of 25% of any such excess would be established and the pool would be divided as follows: 68% of the pool to Mr. Raina, 20% of the pool to Mr. Baum and 9% of the pool to certain other key employees. Under this plan, a bonus was paid to Mr. Raina for 2003 of $449,000.

COMPLIANCE WITH INTERNAL REVENUE CODE SECTION 162(m). The Compensation Committee has considered the impact of Section 162(m) of the Internal Revenue Code, which generally disallows a tax deduction to publicly held corporations for compensation over $1 million paid to the corporation's Chief Executive Officer and four other most highly compensated executive officers, unless such compensation qualifies as "performance-based" compensation. It is the Compensation Committee's general policy to qualify, to the extent reasonable, compensation for deductibility under applicable tax laws.

Respectfully submitted,

The Members of the Compensation Committee

Douglas Chisholm

William Rich

12

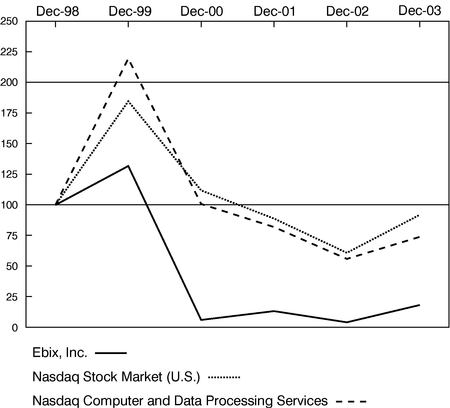

PERFORMANCE GRAPH

The line graph below compares the yearly percentage change in cumulative total stockholder return on our Common Stock for the last five fiscal years with the NASDAQ Stock Market (U.S.) stock index and the NASDAQ Computer and Data Processing Index. The following graph assumes the investment of $100 on December 31, 1998, and the reinvestment of any dividends (rounded to the nearest dollar).

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN

AMONG EBIX, INC. (FORMERLY DELPHI INFORMATION SYSTEMS, INC.),

THE NASDAQ STOCK MARKET (U.S.) INDEX AND THE NASDAQ COMPUTER DATA

PROCESSING INDEX

| | 12/31/98 | 12/31/99 | 12/31/00 | 12/31/01 | 12/31/02 | 12/31/03 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EBIX, INC | $ | 100 | $ | 132 | $ | 6 | $ | 13 | $ | 4 | $ | 18 | ||||||

| NASDAQ STOCK MARKET (U.S.) | $ | 100 | $ | 185 | $ | 112 | $ | 89 | $ | 61 | $ | 92 | ||||||

| NASDAQ COMPUTER AND DATA PROCESSING | $ | 100 | $ | 220 | $ | 101 | $ | 82 | $ | 56 | $ | 74 | ||||||

13

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

As of August 20, 2004, BRiT Insurance Holdings PLC ("BRiT") held 930,163 shares of Common Stock, representing approximately 32 percent of our outstanding Common Stock. During 2003, approximately $3,245,000 was recognized as services revenue from BRiT and its affiliates related to call center and development projects. During the first six months of 2004, approximately $1,677,000 was recognized as services revenue from BRiT and its affiliates. Total accounts receivable from BRiT and its affiliates at June 30, 2004 were $708,000. We continue to provide services for BRiT and its affiliates and to receive payments for such services. We currently expect that our total 2004 revenue from BRiT will be equal to or greater than that recognized in 2003, although there can be no assurance to that effect. In addition, as of August 20, 2004, CF Epic Insurance and General Fund, of which BRiT owns approximately 70% of the equity interests as of such date, beneficially owned 7.7% of our outstanding Common Stock.

During 2003, we hired Rahul Raina as the Director of Business Process Outsourcing for the Delphi Consulting Division of our company. He is paid an annual salary of $90,000 and on August 11, 2003, after becoming an employee of our company, we granted options to Mr. Raina to purchase 25,000 shares of our Common Stock. The options vest over four years from the date of grant, expire ten years from the date of grant, and were issued with an exercise price below the fair market value of the stock on the date of grant. This grant was not subject to any of our stock incentive plans. The total intrinsic value associated with the granting of options was $96,250, which will be recognized ratably as compensation expense over the four-year vesting period in accordance with APB Opinion No. 25. The Company recognized compensation expense of approximately $10,000 related to these options during the year ended December 31, 2003. Rahul Raina is the brother of Robin Raina, our Chairman of the Board, President and Chief Executive Officer.

PROPOSAL 2. APPROVAL OF AMENDMENT TO CERTIFICATE OF INCORPORATION

TO REDUCE AUTHORIZED SHARES

General

Our certificate of incorporation, as currently in effect, provides that the total number of shares of capital stock that we are authorized to issue is 42,000,000 shares, consisting of 40,000,000 shares of Common Stock and 2,000,000 shares of Preferred Stock. Subject to subsequent approval by our stockholders, our Board of Directors approved an amendment to our certificate of incorporation to reduce the number of shares of Common Stock authorized for issuance under our certificate of incorporation to 10,000,000 shares. The amendment approved by the Board of Directors would also reduce the number of shares of Preferred Stock authorized for issuance to 500,000 shares. As more fully described below, the proposed amendment is intended to result in state franchise tax savings while continuing to provide us with sufficient flexibility to meet future needs for issuances of Common Stock.

Reasons for Amendment

Although alternative methods of calculating state franchise taxes are allowed by some states in some instances, it is often to our economic advantage to calculate certain state franchise taxes using the "assumed par value capital method." Under this tax calculation method, however, a large number of authorized shares of capital stock with a corresponding low number of shares of outstanding capital stock typically results in a larger franchise tax obligation. We believe that we can achieve state franchise tax savings by reducing our authorized number of shares of capital stock. Accordingly, our Board of Directors has proposed that we reduce the authorized number of our shares of Common Stock by 30,000,000 shares and our authorized number of shares of Preferred Stock by 1,500,000 shares. The number of shares that would remain available following the proposed amendment is considered by our Board of Directors to be adequate for our currently anticipated requirements, as we had only 2,899,745

14

shares of Common Stock outstanding as of the record date for the meeting to which this proxy statement relates, plus 1,137,500 shares reserved for issuance pursuant to our 1996 Stock Incentive Plan subject to stockholder approval at the Annual Meeting of the amendment to such plan. Furthermore, adoption of the proposed amendment would not adversely affect the rights of the holders of our currently outstanding shares of Common Stock.

If the proposed amendment is adopted, it will become effective upon filing of the amendment with the Secretary of the State of Delaware. While we anticipate franchise tax savings, we cannot assure you that the amendment will result in tax savings in Delaware or other states, as states may change the methods they use to calculate franchise tax or our assets or issued shares of stock may change in a way that eliminates any tax savings.

Any subsequent increase in the authorized shares of our Common Stock, whether for capital raising acquisitions, anti-takeover measures or any other reason, would require approval by our stockholders of another amendment to our certificate of incorporation.

Form of Amendment

If the amendment is approved, our certificate of incorporation will be amended by deleting the last two sentences of the first paragraph of Article 4 in their entirety and inserting in their place the following:

"The total number of shares of Preferred Stock authorized to be issued is 500,000 and each of such shares shall have a par value of ten cents ($.10). The total number of shares of Common Stock authorized to be issued is 10,000,000 and each such shares shall have a par value of ten cents ($.10)."

Required Vote

The affirmative vote of a majority of the outstanding shares of our capital stock is required to approve the amendment to our certificate of incorporation.

Board Recommendation

Our Board of Directors recommends that you vote "FOR" approval of the proposed amendment to our certificate of incorporation.

PROPOSAL 3. APPROVAL OF AMENDMENT TO 1996 STOCK INCENTIVE PLAN

Our Board of Directors has adopted an amendment to our 1996 Stock Incentive Plan, subject to approval of the incentive plan amendment by our stockholders at the Annual Meeting. The incentive plan amendment will increase by 300,000, to 1,137,500, the number of shares of our Common Stock reserved and available for grant under the 1996 Stock Incentive Plan and prohibit the repricing of options.

The 1996 Stock Incentive Plan was adopted by our Board of Directors and was approved by our stockholders on September 4, 1996. Under the 1996 Stock Incentive Plan, 6,000,000 shares of our Common Stock were originally reserved and available for grant. An amendment to the 1996 Stock Incentive Plan to reflect a 1-for-5 reverse stock split reducing the number of shares reserved and available for grant to 1,200,000 and then to increase that number to 2,700,000 was adopted by our Board of Directors and was approved by our stockholders on October 29, 1999. A second amendment to the 1996 Stock Incentive Plan increasing the number of shares reserved and available for grant to a total of 4,700,000 was adopted by our Board of Directors and was approved by our stockholders on May 30, 2001. A third amendment to the 1996 Stock Incentive Plan increasing the number of shares reserved and available for grant to a total of 6,700,000 was adopted by our Board of Directors and was

15

approved by our stockholders on September 30, 2002, and the total number of shares available for grant was then reduced to 837,500 to reflect a 1-for-8 reverse stock split on October 1, 2002.

The 1996 Stock Incentive Plan is designed to enable us to attract and retain directors and officers and other employees and consultants by providing them with appropriate rewards for superior performance. We believe that the proposed increase in the number of shares reserved for issuance under the 1996 Stock Incentive Plan is necessary in order to provide an opportunity for individuals with a high degree of training, experience, expertise and ability to acquire a proprietary interest in our success, and to more closely align their interests with those of our stockholders.

Stockholder approval of the incentive plan amendment is sought to continue (1) to meet the requirements of the NASDAQ SmallCap Market, (2) to qualify certain compensation under the 1996 Stock Incentive Plan as performance-based compensation that is tax deductible without limitation under Section 162(m) of the Internal Revenue Code of 1986, and (3) to qualify certain stock options granted under the 1996 Stock Incentive Plan as incentive stock options. Furthermore, Section 17 of the 1996 Stock Incentive Plan requires stockholder approval of any amendment to increase the number of shares of our Common Stock reserved for issuance under the plan.

As of August 20, 2004, options to purchase a total of 675,299 shares of our Common Stock were outstanding, and options to purchase a total of 61,021 shares of our Common Stock had previously been exercised, under the 1996 Stock Incentive Plan. As a result, only 101,180 shares remained available for new awards under the 1996 Stock Incentive Plan. Consequently, our Board of Directors adopted the incentive plan amendment to authorize an additional 300,000 shares of our Common Stock, representing approximately 10.3% of the shares of our Common Stock outstanding as of August 20, 2004, for awards under the 1996 Stock Incentive Plan. The number of shares covered by outstanding options and available for grant under the 1996 Stock Incentive Plan is subject to adjustment in the event of stock dividends, stock splits, combinations of shares, and certain other transactions or events, as described under "—Adjustments" below.

The following summary of the material features of the 1996 Stock Incentive Plan and the proposed amendment does not purport to be complete and is qualified in its entirety by reference to the complete text of the 1996 Stock Incentive Plan, as amended by the proposed amendment that is subject to stockholder approval and reflecting the 1-for-8 reverse stock split that occurred on October 1, 2002, attached asExhibit B.

Shares and Performance Units Available Under the 1996 Stock Incentive Plan

Subject to adjustment as provided in the 1996 Stock Incentive Plan, the aggregate number of shares of our Common Stock that may be covered by outstanding awards, except replacement option rights (as described below), granted under the 1996 Stock Incentive Plan and issued or transferred upon the exercise or payment thereof and the aggregate number of performance units (as described below) that may be granted under the 1996 Stock Incentive Plan, as amended by the proposed amendment, will not exceed 1,137,500. Shares of our Common Stock issued or transferred under the 1996 Stock Incentive Plan may be shares of original issuance or treasury shares or a combination of them. The aggregate number of shares of our Common Stock that may be covered by replacement option rights granted under the 1996 Stock Incentive Plan during any calendar year will not exceed 5% of the shares of our Common Stock outstanding on January 1 of that year, subject to adjustment as provided in the 1996 Stock Incentive Plan. The shares issued under the 1996 Stock Incentive Plan may be originally issued shares or treasury shares. Shares covered by an award under the 1996 Stock Incentive Plan will no longer be available for any other award at the earlier of (a) when they are actually issued, (b) when dividends or dividend equivalents are paid on them or (c) in the case of restricted stock, at the earlier of (1) when they are no longer subject to a substantial risk of forfeiture or (2) when dividends are paid on them. Shares previously covered by an award will be available for

16

issuance under the 1996 Stock Incentive Plan if the benefit provided by the award is paid in cash, and performance units that are not earned at the end of the applicable performance period will be available for future grants of performance units. Under the 1996 Stock Incentive Plan no participant may receive option rights, appreciation rights, restricted shares, deferred shares and performance shares covering a total of more than 125,000 shares of our Common Stock during any calendar year.

Eligibility

Our directors, officers (including officers who are also directors) and other employees and consultants may be selected by our Board of Directors to receive benefits under the 1996 Stock Incentive Plan. As of August 20, 2004, there were seven non-employee directors, two officers (including an executive officer who is also a director), approximately 240 other employees, and one consultant eligible to participate in the 1996 Stock Incentive Plan.

Option Rights

Option rights entitle the option holder to purchase shares of our Common Stock at a price equal to or greater than market value on the date of grant, except that the option price of a replacement option right may be less than the market value on the date of grant. Replacement option rights are otherwise subject to the same terms, conditions and discretion as other option rights under the 1996 Stock Incentive Plan. A replacement option right is an option right that is granted in exchange for the surrender and cancellation of an option to purchase shares of another corporation that has been acquired by us.

The option price is payable at the time of exercise (1) in cash, (2) by the transfer to us of nonforfeitable, nonrestricted shares of our Common Stock that are already owned by the option holder and have a value at the time of exercise equal to the option price, (3) with any other legal consideration that our Board of Directors may deem appropriate or (4) by any combination of the foregoing methods of payment. Any grant of option rights may provide for deferred payment of the option price from the proceeds of sale through a broker on the date of exercise of some or all of the shares of our Common Stock to which the exercise relates (although, in the case of executive officers and directors, these "broker's cashless exercises" may be affected by the restrictions on personal loans to executive officers provided by the Sarbanes-Oxley Act of 2002.)

Option rights granted under the 1996 Stock Incentive Plan may be option rights that are intended to qualify as "incentive stock options" within the meaning of Section 422 of the Internal Revenue Code of 1986 or option rights that are not intended to so qualify. At or after the date of grant of any nonqualified option rights, our Board of Directors may provide for the payment of dividend equivalents to the option holder on a current, deferred or contingent basis or may provide that dividend equivalents be credited against the option price.

No option right may be exercised more than ten years from the date of grant. Each grant may specify a period of continuous employment or other service with us that is necessary before the option rights will become exercisable and may provide for the earlier exercise of the option rights in the event of a change in control of us or other similar transaction or event. Successive grants may be made to the same option holder regardless of whether option rights previously granted to him or her remain unexercised.

Appreciation Rights

Appreciation rights granted under the 1996 Stock Incentive Plan may be either free-standing appreciation rights or appreciation rights that are granted in tandem with option rights. An appreciation right represents the right to receive from us the difference (the "spread"), or a percentage of the difference not in excess of 100%, between the base price per share of our Common Stock, in the

17

case of a free-standing appreciation right, or the option price of the related option right, in the case of a tandem appreciation right, and the market value of our Common Stock on the date of exercise of the appreciation right. Tandem appreciation rights may only be exercised at a time when the related option right is exercisable and the spread is positive, and the exercise of a tandem appreciation right requires the surrender of the related option right for cancellation. A free-standing appreciation right must have a base price that is at least equal to the fair market value of a share of our Common Stock on the date of grant, must specify the period of continuous employment or other service that is necessary before the appreciation right becomes exercisable (except that it may provide for its earlier exercise in the event of a change in control of us or other similar transaction or event) and may not be exercised more than ten years from the date of grant. Any grant of appreciation rights may specify that the amount payable by us upon exercise may be paid in cash, shares of our Common Stock or a combination thereof and may either grant to the recipient or retain in our Board of Directors the right to elect among those alternatives. Our Board of Directors may provide with respect to any grant of appreciation rights for the payment of dividend equivalents thereon in cash or our Common Stock on a current, deferred or contingent basis.

Restricted Shares

A grant of restricted shares involves the immediate transfer by us to the recipient of ownership of a specific number of shares of our Common Stock in consideration of the performance of services. The recipient is entitled immediately to voting, dividend and other ownership rights in the shares. The transfer may be made without additional consideration or for consideration in an amount that is less than the market value of the shares on the date of grant, as our Board of Directors may determine. Our Board of Directors may condition a grant of restricted shares on the achievement of specified performance objectives ("management objectives"), as more fully described below under "performance shares and performance units," in addition to a specified period of employment or other service with us before the shares or any portion thereof will become vested and nonforfeitable.

Restricted shares must be subject to a "substantial risk of forfeiture," within the meaning of Section 83 of the Internal Revenue Code, for a period to be determined by our Board of Directors. An example would be a provision that the restricted shares would be forfeited if the recipient ceased to be employed by us during a specified period of years. In order to enforce the forfeiture provisions, the transferability of restricted shares is prohibited or restricted in a manner and to the extent prescribed by our Board of Directors for the period during which the forfeiture provisions are to continue. Our Board of Directors may provide for a shorter period during which the forfeiture provisions are to apply in the event of a change in control of us or other similar transaction or event.

Deferred Shares

A grant of deferred shares constitutes an agreement by us to deliver shares of our Common Stock to the recipient in the future in consideration of the performance of services, subject to the fulfillment of such conditions during such period of time (the "deferral period") as our Board of Directors may specify. During the deferral period, the recipient has no right to transfer any rights under his or her grant of deferred shares and no right to vote the shares of Common Stock covered thereby. On or after the date of any grant of deferred shares, our Board of Directors may authorize the payment of dividend equivalents thereon on a current, deferred or contingent basis in either cash or additional shares of our Common Stock. Grants of deferred shares may be made without additional consideration or for consideration in an amount that is less than the market value of the shares on the date of grant. Deferred shares must be subject to a deferral period, as determined by our Board of Directors on the date of grant, except that our Board of Directors may provide for a shorter deferral period in the event of a change in control of us or other similar transaction or event.

18

Performance Shares and Performance Units

A performance share is the equivalent of one share of our Common Stock, and a performance unit is the equivalent of $1.00. A recipient may be granted any number of performance shares or performance units. The recipient will be given one or more management objectives to meet within a specified period (the "performance period"). The performance period may be subject to earlier termination in the event of a change in control of us or other similar transaction or event. A minimum level of acceptable achievement will also be established by our Board of Directors. If, by the end of the performance period the recipient has achieved the specified management objectives, he or she will be deemed to have fully earned the performance shares or performance units. If the recipient has not achieved the management objectives but has attained or exceeded the predetermined minimum level of acceptable achievement, he or she will be deemed to have partly earned the performance shares or performance units in accordance with a predetermined formula. To the extent earned, the performance shares or performance units will be paid to the recipient at the time and in the manner determined by our Board of Directors in cash, shares of our Common Stock or any combination thereof. Management objectives may be described in terms of either company-wide objectives or objectives that are related to the performance of the division, subsidiary, department or function within our company or a subsidiary in which the recipient is employed or with respect to which the recipient provides other services. Our Board of Directors may adjust any management objectives and the related minimum level of acceptable achievement if, in its judgment, transactions or events have occurred after the date of grant that are unrelated to the recipient's performance and result in distortion of the management objectives or the related minimum level of acceptable achievement.

Transferability

Awards granted under the 1996 Stock Incentive Plan are transferable only if and to the extent so provided in the related grant. Where transfers are permitted, the transferee may or may not have the same rights as the original recipient, depending upon tax and securities laws and regulations and other factors. These factors will be the responsibility of the transferor and transferee.

Adjustments

The maximum number of shares that may be issued or transferred under the 1996 Stock Incentive Plan, the number of shares covered by outstanding option rights or appreciation rights and the option prices or base prices per share applicable thereto, and the number of shares covered by outstanding grants of deferred shares and performance shares, are subject to adjustment in the event of stock dividends, stock splits, combinations of shares, recapitalizations, mergers, consolidations, spin-offs, reorganizations, liquidations, issuances of rights or warrants, and similar transactions or events. In the event of any such transaction or event, our Board of Directors may in its discretion provide in substitution for any or all outstanding awards under the 1996 Stock Incentive Plan such alternative consideration as it may in good faith determine to be equitable in the circumstances and may require the surrender of all awards so replaced. Our Board of Directors may also make or provide for such adjustments in the aggregate number of shares and the aggregate number of performance units covered by the 1996 Stock Incentive Plan as it may determine to be appropriate in order to reflect any such transaction or event.

Administration

The 1996 Stock Incentive Plan is administered by our Board of Directors. Our Board of Directors may delegate the authority to a committee of two or more non-employee directors; references in this section to our Board of Directors refer to our Board of Directors or such delegated committee. In connection with its administration of the 1996 Stock Incentive Plan, our Board of Directors is authorized to interpret the 1996 Stock Incentive Plan and related agreements and other documents.

19

Our Board of Directors may make grants to participants under any or a combination of all of the various categories of awards that are authorized under the 1996 Stock Incentive Plan and may provide for such special terms for awards to participants who either are foreign nationals or are employed by or provide other services to us outside the United States of America as it may consider necessary or appropriate to accommodate differences in local law, tax policy or custom. Our Board of Directors may, with the concurrence of the affected participant, cancel any agreement evidencing an award granted under the 1996 Stock Incentive Plan. In the event of any such cancellation, our Board of Directors may authorize the granting of a new award under the 1996 Stock Incentive Plan (which may or may not cover the same number of shares that had been the subject of the prior award) in such manner, at such price and subject to such other terms, conditions and discretion as would have been applicable under the 1996 Stock Incentive Plan had the cancelled award not been granted. Our Board of Directors may also grant any award or combination of awards authorized under the 1996 Stock Incentive Plan (including but not limited to replacement option rights) in exchange for the cancellation of an award that was not granted under the 1996 Stock Incentive Plan (including but not limited to an award that was granted by us by merger or otherwise, prior to the adoption of the 1996 Stock Incentive Plan), and any such award or combination of awards so granted under the 1996 Stock Incentive Plan may or may not cover the same number of shares of our Common Stock as had been covered by the cancelled award and will be subject to such other terms, conditions and discretion as are permitted under the 1996 Stock Incentive Plan. However, neither our Board of Directors nor the Compensation Committee will be permitted to (i) amend an option to reduce its exercise price, (ii) cancel an option and regrant an option with a lower exercise price than the original exercise price of the cancelled option, or (iii) take any other action (whether in the form of an amendment, cancellation or replacement grant) that has the effect of repricing an option.

Amendment

The 1996 Stock Incentive Plan may be amended from time to time by our Board of Directors, but an amendment to increase the aggregate number of shares of our Common Stock that may be issued or transferred and covered by outstanding awards or the aggregate number of performance units that may be granted under the 1996 Stock Incentive Plan requires further approval by the stockholders.

Federal Income Tax Consequences

The following is a brief summary of certain of the federal income tax consequences of certain transactions under the 1996 Stock Incentive Plan based on United States federal income tax laws in effect on September 15, 2004. This summary is not intended to be exhaustive and does not describe state, local or foreign tax consequences.

Nonqualified Stock Options

A participant will not recognize income upon the grant of a nonqualified stock option. Generally, the participant will recognize ordinary income at the time of exercise equal to the amount of the excess (the "taxable spread") of the fair market value of the underlying stock at the time of exercise over the option price. If a participant pays the option price of a nonqualified stock option in cash, the participant's basis in the shares of our Common Stock acquired on exercise will be equal to the fair market value of the stock on exercise, and the holding period will commence on the date of exercise.

If a participant pays the option price of a nonqualified stock option by the surrender of shares of our Common Stock that he or she already owns, he or she will not recognize gain or loss on the shares surrendered. A number of shares received on exercise that is equal to the number of shares surrendered will have a tax basis equal to the basis of the shares surrendered, and the participant's holding period of the shares received will include the holding period of the shares surrendered. To the extent that the number of shares received upon exercise exceeds the number of shares surrendered, the

20

excess shares will have a basis equal to their fair market value and a holding period that will commence on the date of exercise. However, if the shares received upon exercise are considered substantially nonvested property within the meaning of Section 83 of the Code, and an election under Section 83(b) of the Internal Revenue Code to have the shares taxed to the participant as ordinary income at their fair market value on the date of transfer, less any amount paid by him or her is not made within 30 days after the shares are transferred to him or her, the participant will generally recognize ordinary income in the year during which the restrictions terminate on the shares received.

Incentive Stock Options