UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-05181 |

|

Morgan Stanley Equally Weighted S&P 500 Fund |

(Exact name of registrant as specified in charter) |

|

522 Fifth Avenue, New York, New York | | 10036 |

(Address of principal executive offices) | | (Zip code) |

|

Ronald E. Robison 522 Fifth Avenue, New York, New York 10036 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 212-296-6990 | |

|

Date of fiscal year end: | June 30, 2008 | |

|

Date of reporting period: | June 30, 2008 | |

| | | | | | | | |

Item 1 - Report to Shareholders

INVESTMENT MANAGEMENT

Welcome, Shareholder:

In this report, you'll learn about how your investment in Morgan Stanley Equally-Weighted S&P 500 Fund performed during the annual period. We will provide an overview of the market conditions, and discuss some of the factors that affected performance during the reporting period. In addition, this report includes the Fund's financial statements and a list of Fund investments.

This material must be preceded or accompanied by a prospectus for the fund being offered.

Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objective. The Fund is subject to market risk, which is the possibility that market values of securities owned by the Fund will decline and, therefore, the value of the Fund's shares may be less than what you paid for them. Accordingly, you can lose money investing in this Fund. Please see the prospectus for more complete information on investment risks.

Fund Report

For the year ended June 30, 2008

| Total Return for the 12 Months Ended June 30, 2008+ | |

| Class A | | Class B | | Class C | | Class I++ | | S&P

Equal

Weight

Index1 | | Lipper

Multi-Cap

Core Funds

Index2 | |

| | –17.31 | % | | | –17.96 | % | | | –17.89 | % | | | –17.11 | % | | | –16.88 | % | | | –12.67 | % | |

+ Share classes listed above represent classes with the full 12 month period total returns to report. Class R and Class W shares commenced operations on March 31, 2008 and therefore are not listed on the table above.

++ Formerly Class D shares. Renamed Class I shares effective March 31, 2008.

The performance of the Fund's share classes varies because each has different expenses. The Fund's total returns assume the reinvestment of all distributions but do not reflect the deduction of any applicable sales charges. Such costs would lower performance. See Performance Summary for standardized performance and benchmark information.

Market Conditions

The 12-month period ended June 30, 2008 was a period of slow growth for the U.S. economy. The housing market downturn, rising unemployment and tightening in credit conditions have affected all segments of the economy. Consumer expectations also declined, notwithstanding the effect of tax rebates widely considered to be temporary. In this environment, major global stock markets retreated in the last 12 months, with most markets posting double-digit declines.

Complicating the economic picture is the fact that the soft economy is accompanied by rising prices for commodities, particularly food and energy. Concerns about the economy have until recently kept the Federal Reserve (the "Fed") focused on supporting growth. However, as global inflation risk is emerging as a serious threat (inflation is even higher in emerging economies), the Fed has expressed its concern about rising inflation expectations, indicating a shift of stance, while the European Central Bank raised interest rates in an attempt to keep inflation there in check. All said, several economic indicators held up quite well, with U.S. real gross domestic product (GDP) growth estimated to have grown at an annualized rate slightly above one percent in the second quarter of 2008.

Performance Analysis

Class A, B, C and I shares of Morgan Stanley Equally-Weighted S&P 500 Fund underperformed the S&P Equal Weight Index and the Lipper Multi-Cap Core Funds Index for the 12 months ended June 30, 2008, assuming no deduction of applicable sales charges.

Amid market turmoil, energy was the best performing sector for the Fund and the S&P Equal Weight Index during the 12-month period. Energy prices continued to soar, supporting huge profits for many energy companies, which in turn commanded significant investor attention for energy stocks. The worst performing sectors were financials, consumer discretionary and telecommunications services, as well as information technology, all with double-digit negative returns. The credit crunch and continuing downgrade of financial companies continued to impact the financial sector, where the full extent of losses remains unclear. At the same time, higher unemployment and declining consumer confidence with no sign of stabilization in

2

U.S. housing led to the negative performance of consumer-oriented stocks.

Other performance trends within the Fund and the S&P Equal Weight Index during the period included the underperformance of value stocks within the large- and mid-capitalization segments, as investors were looking for the larger, higher-quality companies (many of which are classified as growth stocks) in an environment of slowing economic growth. On an individual stock basis, the highest returning holdings in the overall portfolio were dominated by energy stocks.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Fund in the future.

| TOP 10 HOLDINGS as of 06/30/08 | |

| Sprint Nextel Corp. | | | 0.2 | % | |

| Eastman Kodak Co. | | | 0.2 | | |

| CenturyTel, Inc. | | | 0.2 | | |

| Weatherford International Ltd. (Bermuda) | | | 0.2 | | |

| Jabil Circuit, Inc. | | | 0.2 | | |

| Barr Pharmaceuticals Inc. | | | 0.2 | | |

| Peabody Energy Corp. | | | 0.2 | | |

| Murphy Oil Corp. | | | 0.2 | | |

| Forest Laboratories, Inc. | | | 0.2 | | |

| King Pharmaceuticals, Inc. | | | 0.2 | | |

| TOP FIVE INDUSTRIES as of 06/30/08 | |

| Electric Utilities | | | 5.5 | % | |

| Medical Specialties | | | 3.5 | | |

| Real Estate Investment Trusts | | | 2.6 | | |

| Semiconductors | | | 2.5 | | |

| Major Banks | | | 2.5 | | |

Subject to change daily. Provided for informational purposes only and should not be deemed a recommendation to buy or sell the securities mentioned above. Top 10 holdings and top five industries are as a percentage of net assets. Morgan Stanley is a full-service securities firm engaged in securities trading and brokerage activities, investment banking, research and analysis, financing and financial advisory services.

3

Investment Strategy

The Fund invests in a diversified portfolio of common stocks represented in the Standard & Poor's® 500 Composite Stock Price Index ("S&P 500"). The S&P 500 is a well known stock market index that includes common stocks of 500 companies. The Fund generally invests in each stock included in the S&P 500 in approximately equal proportions. This approach differs from the S&P 500 because stocks in the S&P 500 are represented in proportion to their market value or market-capitalization. For example, the 50 largest companies in the S&P 500 represent approximately 50 percent of the S&P 500's value; however, these same 50 companies represent roughly 10 percent of the Fund's value. The Fund may invest in foreign securities represented in the S&P 500, including depositary receipts.

For More Information About Portfolio Holdings

Each Morgan Stanley fund provides a complete schedule of portfolio holdings in its semiannual and annual reports within 60 days of the end of the fund's second and fourth fiscal quarters. The semiannual reports and the annual reports are filed electronically with the Securities and Exchange Commission (SEC) on Form N-CSRS and Form N-CSR, respectively. Morgan Stanley also delivers the semiannual and annual reports to fund shareholders and makes these reports available on its public web site, www.morganstanley.com. Each Morgan Stanley fund also files a complete schedule of portfolio holdings with the SEC for the fund's first and third fiscal quarters on Form N-Q. Morgan Stanley does not deliver the reports for the first and third fiscal quarters to shareholders, nor are the reports posted to the Morgan Stanley public web site. You may, however, obtain the Form N-Q filings (as well as the Form N-CSR and N-CSRS filings) by access ing the SEC's web site, http://www.sec.gov. You may also review and copy them at the SEC's public reference room in Washington, DC. Information on the operation of the SEC's public reference room may be obtained by calling the SEC at (800) SEC-0330. You can also request copies of these materials, upon payment of a duplicating fee, by electronic request at the SEC's e-mail address (publicinfo@sec.gov) or by writing the public reference section of the SEC, Washington, DC 20549-0102.

Proxy Voting Policy and Procedures and Proxy Voting Record

You may obtain a copy of the Fund's Proxy Voting Policy and Procedures without charge, upon request, by calling toll free (800) 869-NEWS or by visiting the Mutual Fund Center on our Web site at www.morganstanley.com. It is also available on the Securities and Exchange Commission's Web site at http://www.sec.gov.

You may obtain information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 without charge by visiting the Mutual Fund Center on our Web site at www.morganstanley.com. This information is also available on the Securities and Exchange Commission's Web site at http://www.sec.gov.

4

Householding Notice

To reduce printing and mailing costs, the Fund attempts to eliminate duplicate mailings to the same address. The Fund delivers a single copy of certain shareholder documents, including shareholder reports, prospectuses and proxy materials, to investors with the same last name who reside at the same address. Your participation in this program will continue for an unlimited period of time unless you instruct us otherwise. You can request multiple copies of these documents by calling (800) 869-NEWS, 8:00 a.m. to 8:00 p.m., ET. Once our Customer Service Center has received your instructions, we will begin sending individual copies for each account within 30 days.

5

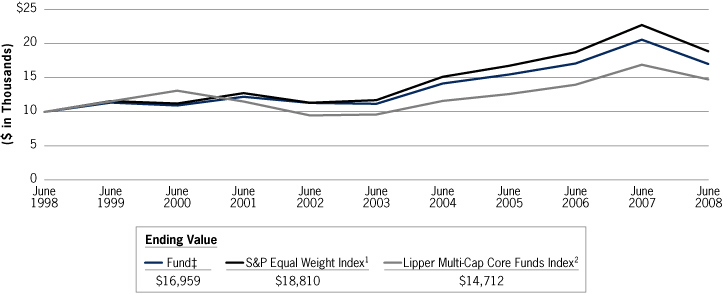

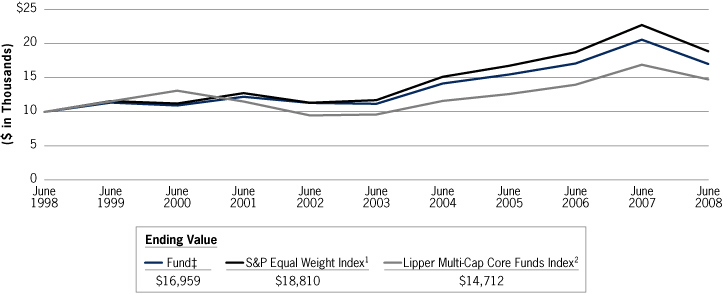

Performance Summary

Performance of $10,000 Investment—Class B

Over 10 Years

6

| Average Annual Total Returns—Period Ended June 30, 2008 | |

| Symbol | | Class A Shares*

(Since 07/28/97)

VADAX | | Class B Shares**

(Since 12/01/87)

VADBX | | Class C Shares†

(Since 07/28/97)

VADCX | | Class I Shares††

(Since 07/28/97)

VADDX | | Class R Shares#

(Since 03/31/08)

VADRX | | Class W Shares##

(Since 03/31/08)

VADWX | |

| 1 Year | | (17.31)%3

(21.65)4 | | (17.96)%3

(21.65)4 | | (17.89)%3

(18.62)4 | | (17.11)%3

— | | —

— | | —

— | |

| 5 Years | | 9.183

8.014 | | 8.363

8.074 | | 8.393

8.394 | | 9.453

— | | —

— | | —

— | |

| 10 Years | | 6.043

5.474 | | 5.423

5.424 | | 5.263

5.264 | | 6.293

— | | —

— | | —

— | |

Since Inception

| | 6.963

6.434 | | 10.903

10.904 | | 6.183

6.184 | | 7.213

— | | (2.63)%3

— | | (2.57)%3

— | |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For most recent month-end performance figures, please visit www.morganstanley.com/msim or speak with your Financial Advisor. Investment returns and principal value will fluctuate and fund shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for periods less than one year are not annualized. Performance for Class A, Class B, Class C, Class I, Class R, and Class W shares will vary due to differences in sales charges and expenses. See the Fund's current prospectus for complete details on fees and sales charges.

* The maximum front-end sales charge for Class A is 5.25%.

** The maximum contingent deferred sales charge (CDSC) for Class B is 5.0%. The CDSC declines to 0% after six years. Effective April 2005, Class B shares will generally convert to Class A shares approximately eight years after the end of the calendar month in which the shares were purchased. Performance for periods greater than eight years reflects this conversion (beginning April 2005).

† The maximum contingent deferred sales charge for Class C is 1.0% for shares redeemed within one year of purchase.

†† Class I (formerly Class D) has no sales charge.

# Class R has no sales charge.

## Class W has no sales charge.

(1) The Standard & Poor's Equal Weight Index (S&P EWI) is the equally-weighted version of the widely regarded S&P 500® Index, which measures 500 leading companies in leading U.S. industries. The S&P EWI has the same constituents as the capitalization-weighted S&P 500® Index, but each company in the S&P EWI is allocated a fixed weight, rebalancing quarterly. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(2) The Lipper Multi-Cap Core Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper Multi-Cap Core Funds classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 30 funds represented in this Index. The Fund is in the Lipper Multi-Cap Core Funds classification as of the date of this report.

(3) Figure shown assumes reinvestment of all distributions and does not reflect the deduction of any sales charges.

(4) Figure shown assumes reinvestment of all distributions and the deduction of the maximum applicable sales charge. See the Fund's current prospectus for complete details on fees and sales charges.

‡ Ending value assuming a complete redemption on June 30, 2008.

7

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees; and (2) ongoing costs, including advisory fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period 01/01/08 – 06/30/08.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs, and will not help you determine the relative total cost of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account Value | | Ending

Account Value | | Expenses Paid

During Period@ | |

| | | 01/01/08 | | 06/30/08 | | 01/01/08 –

06/30/08 | |

| Class A | |

| Actual (–11.27% return) | | $ | 1,000.00 | | | $ | 887.30 | | | $ | 2.86 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,021.83 | | | $ | 3.07 | | |

| Class B | |

| Actual (–11.62% return) | | $ | 1,000.00 | | | $ | 883.80 | | | $ | 6.37 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,018.10 | | | $ | 6.82 | | |

| Class C | |

| Actual (–11.57% return) | | $ | 1,000.00 | | | $ | 884.30 | | | $ | 6.18 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,018.30 | | | $ | 6.62 | | |

| Class I@@ | |

| Actual (–11.15% return) | | $ | 1,000.00 | | | $ | 888.50 | | | $ | 1.69 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,023.07 | | | $ | 1.81 | | |

| Class R@@@ | |

| Actual (–2.63% return) | | $ | 1,000.00 | | | $ | 973.70 | | | $ | 3.03 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,021.83 | | | $ | 3.07 | | |

| Class W@@@ | |

| Actual (–2.57% return) | | $ | 1,000.00 | | | $ | 974.30 | | | $ | 2.64 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,022.23 | | | $ | 2.66 | | |

@ Expenses are equal to the Fund's annualized expense ratios of 0.61%, 1.36%, 1.32%, 0.36%, 0.86% and 0.71% for Class A, Class B, Class C, Class I, Class R and Class W shares, respectively, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period) for Class A, B, C and I shares and multiplied by 91/365 (to reflect the actual days in the period for the actual example) for Class R and W shares.

@@ Formerly Class D shares. Renamed Class I shares effective March 31, 2008.

@@@ Shares were first issued on March 31, 2008. Returns listed represent the period from March 31, 2008 through June 30, 2008.

8

Investment Advisory Agreement Approval

Nature, Extent and Quality of Services

The Board reviewed and considered the nature and extent of the investment advisory services provided by the Investment Adviser under the Advisory Agreement, including portfolio management, investment research and equity and fixed income securities trading. The Board also reviewed and considered the nature and extent of the non-advisory, administrative services provided by the Fund's Administrator under the Administration Agreement, including accounting, clerical, bookkeeping, compliance, business management and planning, and the provision of supplies, office space and utilities at the Investment Adviser's expense. (The Investment Adviser and the Administrator together are referred to as the "Adviser" and the Advisory and Administration Agreements together are referred to as the "Management Agreement.") The Board also compared the nature of the services provided by the Adviser with similar services provided by non-affiliated advi sers as reported to the Board by Lipper Inc. ("Lipper").

The Board reviewed and considered the qualifications of the portfolio managers, the senior administrative managers and other key personnel of the Adviser who provide the advisory and administrative services to the Fund. The Board determined that the Adviser's portfolio managers and key personnel are well qualified by education and/or training and experience to perform the services in an efficient and professional manner. The Board concluded that the nature and extent of the advisory and administrative services provided were necessary and appropriate for the conduct of the business and investment activities of the Fund. The Board also concluded that the overall quality of the advisory and administrative services was satisfactory.

Performance Relative to Comparable Funds Managed by Other Advisers

On a regular basis, the Board reviews the performance of all funds in the Morgan Stanley Fund Complex, including the Fund, compared to their peers, paying specific attention to the underperforming funds. In addition, the Board specifically reviewed the Fund's performance for the one-, three- and five-year periods ended December 31, 2007, as shown in a report provided by Lipper (the "Lipper Report"), compared to the performance of comparable funds selected by Lipper (the "performance peer group"). The Board also discussed with the Adviser the performance goals and the actual results achieved in managing the Fund. The Board noted that the Adviser is evaluating various strategic alternatives to improve performance. The Board concluded that it would continue to monitor the Fund's performance.

Fees Relative to Other Proprietary Funds Managed by the Adviser with Comparable Investment Strategies

The Board reviewed the advisory and administrative fee (together, the "management fee") rate paid by the Fund under the Management Agreement. The Board noted that the management fee rate was comparable to the management fee rates charged by the Adviser to other proprietary funds it manages with investment strategies comparable to those of the Fund.

9

Fees and Expenses Relative to Comparable Funds Managed by Other Advisers

The Board reviewed the management fee rate and total expense ratio of the Fund as compared to the average management fee rate and average total expense ratio for funds, selected by Lipper (the "expense peer group"), managed by other advisers with investment strategies comparable to those of the Fund, as shown in the Lipper Report. The Board concluded that the Fund's management fee rate and total expense ratio were competitive with those of its expense peer group.

Breakpoints and Economies of Scale

The Board reviewed the structure of the Fund's management fee schedule under the Management Agreement and noted that it includes a breakpoint. The Board also reviewed the level of the Fund's management fee and noted that the fee, as a percentage of the Fund's net assets, would decrease as net assets increase because the management fee includes a breakpoint. The Board concluded that the Fund's management fee would reflect economies of scale as assets increase.

Profitability of the Adviser and Affiliates

The Board considered information concerning the costs incurred and profits realized by the Adviser and affiliates during the last year from their relationship with the Fund and during the last two years from their relationship with the Morgan Stanley Fund Complex and reviewed with the Adviser the cost allocation methodology used to determine the profitability of the Adviser and affiliates. Based on its review of the information it received, the Board concluded that the profits earned by the Adviser and affiliates were not excessive in light of the advisory, administrative and other services provided to the Fund.

Fall-Out Benefits

The Board considered so-called "fall-out benefits" derived by the Adviser and affiliates from their relationship with the Fund and the Morgan Stanley Fund Complex, such as sales charges on sales of Class A shares and "float" benefits derived from handling of checks for purchases and sales of Fund shares, through a broker-dealer affiliate of the Adviser. The Board also considered that a broker-dealer affiliate of the Adviser receives from the Fund 12b-1 fees for distribution and shareholder services. The Board also considered that, from time to time, the Adviser may, directly or indirectly, effect trades on behalf of certain Morgan Stanley Funds through various electronic communications networks or other alternative trading systems in which the Adviser's affiliates have ownership interests and/or board seats. The Board concluded that the fall-out benefits were relatively small and noted that the sales charges and 12b-1 fees were competitive with those of other broker-dealers.

10

Soft Dollar Benefits

The Board considered whether the Adviser realizes any benefits as a result of brokerage transactions executed through "soft dollar" arrangements. Under such arrangements, brokerage commissions paid by the Fund and/or other funds managed by the Adviser would be used to pay for research that a securities broker obtains from third parties, or to pay for both research and execution services from securities brokers who effect transactions for the Fund. The Board recognized that the receipt of such research from brokers may reduce the Adviser's costs but concluded that the receipt of such research strengthens the investment management resources of the Adviser, which may ultimately benefit the Fund and other funds in the Morgan Stanley Complex.

Adviser Financially Sound and Financially Capable of Meeting the Fund's Needs

The Board considered whether the Adviser is financially sound and has the resources necessary to perform its obligations under the Management Agreement. The Board concluded that the Adviser has the financial resources necessary to fulfill its obligations under the Management Agreement.

Historical Relationship Between the Fund and the Adviser

The Board also reviewed and considered the historical relationship between the Fund and the Adviser, including the organizational structure of the Adviser, the policies and procedures formulated and adopted by the Adviser for managing the Fund's operations and the Board's confidence in the competence and integrity of the senior managers and key personnel of the Adviser. The Board concluded that it is beneficial for the Fund to continue its relationship with the Adviser.

Other Factors and Current Trends

The Board considered the controls and procedures adopted and implemented by the Adviser and monitored by the Fund's Chief Compliance Officer and concluded that the conduct of business by the Adviser indicates a good faith effort on its part to adhere to high ethical standards in the conduct of the Fund's business.

General Conclusion

After considering and weighing all of the above factors, the Board concluded that it would be in the best interest of the Fund and its shareholders to approve renewal of the Management Agreement for another year.

11

Morgan Stanley Equally-Weighted S&P 500 Fund

Portfolio of Investment n June 30, 2008

NUMBER OF

SHARES | |

| | VALUE | |

| | | Common Stocks (99.9%) | |

| | | Advertising/Marketing Services (0.4%) | |

| | 366,342 | | | Interpublic Group of

Companies, Inc. (The) (a) | | $ | 3,150,541 | | |

| | 71,790 | | | Omnicom Group, Inc. | | | 3,221,935 | | |

| | | | 6,372,476 | | |

| | | Aerospace & Defense (1.8%) | |

| | 43,624 | | | Boeing Co. | | | 2,866,969 | | |

| | 38,691 | | | General Dynamics Corp. | | | 3,257,782 | | |

| | 63,433 | | | Goodrich Corp. | | | 3,010,530 | | |

| | 34,887 | | | L-3 Communications

Holdings, Inc. | | | 3,170,182 | | |

| | 32,409 | | | Lockheed Martin Corp. | | | 3,197,472 | | |

| | 47,454 | | | Northrop Grumman Corp. | | | 3,174,673 | | |

| | 29,924 | | | Precision Castparts Corp. | | | 2,883,776 | | |

| | 57,144 | | | Raytheon Co. | | | 3,216,064 | | |

| | 65,766 | | | Rockwell Collins, Inc. | | | 3,154,137 | | |

| | | | 27,931,585 | | |

| | | Agricultural Commodities/

Milling (0.2%) | |

| | 101,257 | | | Archer-Daniels-Midland Co. | | | 3,417,424 | | |

| | | Air Freight/Couriers (0.8%) | |

| | 56,184 | | | C.H. Robinson

Worldwide, Inc. | | | 3,081,130 | | |

| | 77,112 | | | Expeditors International of

Washington, Inc. | | | 3,315,816 | | |

| | 41,073 | | | FedEx Corp. | | | 3,236,142 | | |

| | 49,842 | | | United Parcel Service,

Inc. (Class B) | | | 3,063,787 | | |

| | | | 12,696,875 | | |

| | | Airlines (0.2%) | |

| | 234,449 | | | Southwest Airlines Co. | | | 3,057,215 | | |

| | | Aluminum (0.2%) | |

| | 88,594 | | | Alcoa, Inc. | | | 3,155,718 | | |

| | | Apparel/Footwear (1.2%) | |

| | 106,267 | | | Coach, Inc. (a) | | | 3,068,991 | | |

| | 221,128 | | | Jones Apparel Group, Inc. | | | 3,040,510 | | |

| | 206,883 | | | Liz Claiborne, Inc. | | | 2,927,394 | | |

| | 49,574 | | | Nike, Inc. (Class B) | | | 2,955,106 | | |

NUMBER OF

SHARES | |

| | VALUE | |

| | 51,359 | | | Polo Ralph Lauren Corp. | | $ | 3,224,318 | | |

| | 47,434 | | | V.F. Corp. | | | 3,376,352 | | |

| | | | 18,592,671 | | |

| | | Apparel/Footwear

Retail (1.0%) | |

| | 49,001 | | | Abercrombie & Fitch Co.

(Class A) | | | 3,071,383 | | |

| | 189,574 | | | Gap, Inc. (The) | | | 3,160,198 | | |

| | 181,663 | | | Limited Brands, Inc. | | | 3,061,021 | | |

| | 97,929 | | | Nordstrom, Inc. | | | 2,967,249 | | |

| | 101,880 | | | TJX Companies, Inc. (The) | | | 3,206,164 | | |

| | | | 15,466,015 | | |

| | | Auto Parts: O.E.M. (0.4%) | |

| | 35,404 | | | Eaton Corp. | | | 3,008,278 | | |

| | 107,404 | | | Johnson Controls, Inc. | | | 3,080,347 | | |

| | | | 6,088,625 | | |

| | | Automotive

Aftermarket (0.2%) | |

| | 162,638 | | | Goodyear Tire &

Rubber Co. (The) (a) | | | 2,899,836 | | |

| | | Beverages: Alcoholic (0.8%) | |

| | 54,526 | | | Anheuser-Busch

Companies, Inc. | | | 3,387,155 | | |

| | 43,602 | | | Brown-Forman Corp.

(Class B) | | | 3,295,003 | | |

| | 167,075 | | | Constellation Brands Inc.

(Class A) (a) | | | 3,318,110 | | |

| | 59,994 | | | Molson Coors Brewing Co.

(Class B) | | | 3,259,474 | | |

| | | | 13,259,742 | | |

| | | Beverages:

Non-Alcoholic (0.8%) | |

| | 61,648 | | | Coca-Cola Co. (The) | | | 3,204,463 | | |

| | 180,276 | | | Coca-Cola Enterprises Inc. | | | 3,118,775 | | |

| | 110,637 | | | Pepsi Bottling Group,

Inc. (The) | | | 3,088,985 | | |

| | 50,830 | | | PepsiCo, Inc. | | | 3,232,280 | | |

| | | | 12,644,503 | | |

See Notes to Financial Statements

12

Morgan Stanley Equally-Weighted S&P 500 Fund

Portfolio of Investment n June 30, 2008 continued

NUMBER OF

SHARES | |

| | VALUE | |

| | | Biotechnology (1.3%) | |

| | 73,236 | | | Amgen Inc. (a) | | $ | 3,453,810 | | |

| | 57,026 | | | Biogen Idec Inc. (a) | | | 3,187,183 | | |

| | 55,523 | | | Celgene Corp. (a) | | | 3,546,254 | | |

| | 47,998 | | | Genzyme Corp. (a) | | | 3,456,816 | | |

| | 60,455 | | | Gilead Sciences, Inc. (a) | | | 3,201,092 | | |

| | 46,092 | | | Millipore Corp. (a) | | | 3,127,803 | | |

| | | | 19,972,958 | | |

| | | Broadcasting (0.2%) | |

| | 93,342 | | | Clear Channel

Communications, Inc. | | | 3,285,638 | | |

| | | Building Products (0.2%) | |

| | 198,682 | | | Masco Corp. | | | 3,125,268 | | |

| | | Cable/Satellite TV (0.4%) | |

| | 167,923 | | | Comcast Corp. (Class A) | | | 3,185,499 | | |

| | 121,086 | | | DIRECTV Group,

Inc. (The) (a) | | | 3,137,338 | | |

| | | | 6,322,837 | | |

| | | Casino/Gaming (0.2%) | |

| | 112,826 | | | International

Game Technology | | | 2,818,393 | | |

| | | Chemicals: Agricultural (0.2%) | |

| | 23,638 | | | Monsanto Co. | | | 2,988,789 | | |

| | | Chemicals: Major

Diversified (1.0%) | |

| | 88,028 | | | Dow Chemical Co. (The) | | | 3,073,057 | | |

| | 71,557 | | | Du Pont (E.I.) de

Nemours & Co. | | | 3,069,080 | | |

| | 45,889 | | | Eastman Chemical Co. | | | 3,159,916 | | |

| | 183,475 | | | Hercules Inc. (a) | | | 3,106,232 | | |

| | 67,511 | | | Rohm & Haas Co. | | | 3,135,211 | | |

| | | | 15,543,496 | | |

| | | Chemicals: Specialty (0.8%) | |

| | 32,224 | | | Air Products &

Chemicals, Inc. | | | 3,185,665 | | |

| | 65,442 | | | Ashland Inc. | | | 3,154,304 | | |

| | 34,024 | | | Praxair, Inc. | | | 3,206,422 | | |

| | 58,519 | | | Sigma-Aldrich Corp. | | | 3,151,833 | | |

| | | | 12,698,224 | | |

NUMBER OF

SHARES | |

| | VALUE | |

| | | Coal (0.7%) | |

| | 30,027 | | | CONSOL Energy, Inc. | | $ | 3,374,134 | | |

| | 37,019 | | | Massey Energy Co. | | | 3,470,531 | | |

| | 41,192 | | | Peabody Energy Corp. | | | 3,626,956 | | |

| | | | 10,471,621 | | |

| | | Commercial Printing/

Forms (0.2%) | |

| | 106,987 | | | Donnelley (R.R.) & Sons Co. | | | 3,176,444 | | |

| | | Computer

Communications (0.6%) | |

| | 134,255 | | | Cisco Systems, Inc. (a) | | | 3,122,771 | | |

| | 145,473 | | | Juniper Networks, Inc. (a) | | | 3,226,591 | | |

| | 219,222 | | | QLogic Corp. (a) | | | 3,198,449 | | |

| | | | 9,547,811 | | |

| | | Computer Peripherals (0.6%) | |

| | 205,471 | | | EMC Corp. (a) | | | 3,018,369 | | |

| | 95,914 | | | Lexmark International, Inc.

(Class A) (a) | | | 3,206,405 | | |

| | 141,978 | | | NetApp, Inc. | | | 3,075,243 | | |

| | 42,000 | | | Seagate Technology Inc.

(Escrow) (d) (a) | | | 0 | | |

| | | | 9,300,017 | | |

| | | Computer Processing

Hardware (0.8%) | |

| | 18,875 | | | Apple Inc. (a) | | | 3,160,430 | | |

| | 141,371 | | | Dell Inc. (a) | | | 3,093,197 | | |

| | 72,482 | | | Hewlett-Packard Co. | | | 3,204,429 | | |

| | 295,891 | | | Sun Microsystems (a) | | | 3,219,294 | | |

| | | | 12,677,350 | | |

| | | Construction Materials (0.2%) | |

| | 51,753 | | | Vulcan Materials Co. | | | 3,093,794 | | |

| | | Containers/Packaging (0.8%) | |

| | 63,962 | | | Ball Corp. | | | 3,053,546 | | |

| | 139,515 | | | Bemis Company, Inc. | | | 3,127,926 | | |

| | 146,829 | | | Pactiv Corp. (a) | | | 3,117,180 | | |

| | 159,194 | | | Sealed Air Corp. | | | 3,026,278 | | |

| | | | 12,324,930 | | |

See Notes to Financial Statements

13

Morgan Stanley Equally-Weighted S&P 500 Fund

Portfolio of Investment n June 30, 2008 continued

NUMBER OF

SHARES | |

| | VALUE | |

| | | Contract Drilling (1.1%) | |

| | 41,795 | | | ENSCO International Inc. | | $ | 3,374,528 | | |

| | 70,206 | | | Nabors Industries, Ltd.

(Bermuda) (a) | | | 3,456,241 | | |

| | 51,713 | | | Noble Corp.

(Cayman Islands) | | | 3,359,276 | | |

| | 73,546 | | | Rowan Companies, Inc. | | | 3,438,276 | | |

| | 22,231 | | | Transocean Inc.

(Cayman Islands) | | | 3,387,782 | | |

| | | | 17,016,103 | | |

| | | Data Processing

Services (1.6%) | |

| | 59,713 | | | Affiliated Computer Services,

Inc. (Class A) (a) | | | 3,194,048 | | |

| | 77,655 | | | Automatic Data

Processing, Inc. | | | 3,253,745 | | |

| | 214,950 | | | Convergys Corp. (a) | | | 3,194,157 | | |

| | 85,924 | | | Fidelity National Information

Services, Inc. | | | 3,171,455 | | |

| | 68,704 | | | Fiserv, Inc. (a) | | | 3,117,100 | | |

| | 102,132 | | | Paychex, Inc. | | | 3,194,689 | | |

| | 142,589 | | | Total System Services, Inc. | | | 3,168,328 | | |

| | 131,796 | | | Western Union Co. | | | 3,257,997 | | |

| | | | 25,551,519 | | |

| | | Department Stores (0.8%) | |

| | 252,524 | | | Dillard's, Inc. (Class A) | | | 2,921,703 | | |

| | 76,240 | | | Kohl's Corp. (a) | | | 3,052,650 | | |

| | 158,205 | | | Macy's Inc. | | | 3,072,341 | | |

| | 89,698 | | | Penney (J.C.) Co., Inc. | | | 3,255,140 | | |

| | | | 12,301,834 | | |

| | | Discount Stores (1.2%) | |

| | 100,124 | | | Big Lots, Inc. (a) | | | 3,127,874 | | |

| | 48,132 | | | Costco Wholesale Corp. | | | 3,375,978 | | |

| | 170,518 | | | Family Dollar Stores, Inc. | | | 3,400,129 | | |

| | 44,255 | | | Sears Holdings Corp. (a) | | | 3,259,823 | | |

| | 66,187 | | | Target Corp. | | | 3,077,034 | | |

| | 58,799 | | | Wal-Mart Stores, Inc. | | | 3,304,504 | | |

| | | | 19,545,342 | | |

NUMBER OF

SHARES | |

| | VALUE | |

| | | Drugstore Chains (0.4%) | |

| | 79,982 | | | CVS Caremark Corp. | | $ | 3,164,888 | | |

| | 94,327 | | | Walgreen Co. | | | 3,066,571 | | |

| | | | 6,231,459 | | |

| | | Electric Utilities (5.5%) | |

| | 169,125 | | | AES Corp. (The) (a) | | | 3,248,891 | | |

| | 63,144 | | | Allegheny Energy, Inc. (a) | | | 3,164,146 | | |

| | 77,472 | | | Ameren Corp. | | | 3,271,643 | | |

| | 80,020 | | | American Electric

Power Co., Inc. | | | 3,219,205 | | |

| | 204,834 | | | CenterPoint Energy, Inc. | | | 3,287,586 | | |

| | 215,932 | | | CMS Energy Corp. | | | 3,217,387 | | |

| | 83,347 | | | Consolidated Edison, Inc. | | | 3,258,034 | | |

| | 40,020 | | | Constellation Energy Group | | | 3,285,642 | | |

| | 70,265 | | | Dominion Resources, Inc. | | | 3,336,885 | | |

| | 76,950 | | | DTE Energy Co. | | | 3,265,758 | | |

| | 187,213 | | | Duke Energy Corp. | | | 3,253,762 | | |

| | 64,359 | | | Edison International | | | 3,306,765 | | |

| | 27,344 | | | Entergy Corp. | | | 3,294,405 | | |

| | 36,933 | | | Exelon Corp. | | | 3,322,493 | | |

| | 40,871 | | | FirstEnergy Corp. | | | 3,364,909 | | |

| | 49,813 | | | FPL Group, Inc. | | | 3,266,737 | | |

| | 64,235 | | | Integrys Energy Group, Inc. | | | 3,265,065 | | |

| | 128,170 | | | Pepco Holdings, Inc. | | | 3,287,560 | | |

| | 83,748 | | | PG&E Corp. | | | 3,323,958 | | |

| | 102,990 | | | Pinnacle West Capital Corp. | | | 3,169,002 | | |

| | 64,422 | | | PPL Corp. | | | 3,367,338 | | |

| | 78,113 | | | Progress Energy, Inc. | | | 3,267,467 | | |

| | 72,261 | | | Public Service Enterprise

Group Inc. | | | 3,318,948 | | |

| | 95,913 | | | Southern Co. (The) | | | 3,349,282 | | |

| | 153,578 | | | TECO Energy, Inc. | | | 3,300,391 | | |

| | 161,764 | | | Xcel Energy, Inc. | | | 3,246,603 | | |

| | | | 85,259,862 | | |

| | | Electrical Products (0.6%) | |

| | 78,914 | | | Cooper Industries Ltd.

(Class A) (Bermuda) | | | 3,117,103 | | |

| | 61,363 | | | Emerson Electric Co. | | | 3,034,400 | | |

| | 123,620 | | | Molex Inc. | | | 3,017,564 | | |

| | | | 9,169,067 | | |

See Notes to Financial Statements

14

Morgan Stanley Equally-Weighted S&P 500 Fund

Portfolio of Investment n June 30, 2008 continued

NUMBER OF

SHARES | |

| | VALUE | |

| | | Electronic Components (0.8%) | |

| | 221,276 | | | Jabil Circuit, Inc. | | $ | 3,631,139 | | |

| | 50,791 | | | MEMC Electronic

Materials, Inc. (a) | | | 3,125,678 | | |

| | 156,189 | | | SanDisk Corp. (a) | | | 2,920,734 | | |

| | 89,869 | | | Tyco Electronics Ltd.

(Bermuda) | | | 3,219,108 | | |

| | | | 12,896,659 | | |

| | | Electronic Equipment/

Instruments (0.8%) | |

| | 88,051 | | | Agilent

Technologies, Inc. (a) | | | 3,129,332 | | |

| | 277,988 | | | JDS Uniphase Corp. (a) | | | 3,157,944 | | |

| | 62,807 | | | Rockwell Automation, Inc. | | | 2,746,550 | | |

| | 235,953 | | | Xerox Corp. (a) | | | 3,199,523 | | |

| | | | 12,233,349 | | |

| | | Electronic Production

Equipment (0.8%) | |

| | 164,580 | | | Applied Materials, Inc. | | | 3,141,832 | | |

| | 82,558 | | | KLA-Tencor Corp. | | | 3,360,936 | | |

| | 154,366 | | | Novellus Systems, Inc. (a) | | | 3,271,016 | | |

| | 297,755 | | | Teradyne, Inc. (a) | | | 3,296,148 | | |

| | | | 13,069,932 | | |

| | | Electronics/Appliance

Stores (0.4%) | |

| | 78,632 | | | Best Buy Co., Inc. | | | 3,113,827 | | |

| | 251,372 | | | RadioShack Corp. | | | 3,084,334 | | |

| | | | 6,198,161 | | |

| | | Electronics/Appliances (0.6%) | |

| | 266,564 | | | Eastman Kodak Co. | | | 3,846,518 | | |

| | 73,269 | | | Harman International

Industries, Inc. | | | 3,032,604 | | |

| | 50,122 | | | Whirlpool Corp. | | | 3,094,031 | | |

| | | | 9,973,153 | | |

| | | Engineering &

Construction (0.4%) | |

| | 17,270 | | | Fluor Corp. | | | 3,213,602 | | |

| | 37,872 | | | Jacobs Engineering

Group, Inc. (a) | | | 3,056,270 | | |

| | | | 6,269,872 | | |

NUMBER OF

SHARES | |

| | VALUE | |

| | | Environmental Services (0.4%) | |

| | 243,958 | | | Allied Waste

Industries, Inc. (a) | | $ | 3,078,750 | | |

| | 86,373 | | | Waste Management, Inc. | | | 3,257,126 | | |

| | | | 6,335,876 | | |

| | | Finance/Rental/

Leasing (1.4%) | |

| | 121,844 | | | American Capital

Strategies, Ltd. | | | 2,896,232 | | |

| | 80,881 | | | Capital One Financial Corp. | | | 3,074,287 | | |

| | 360,748 | | | CIT Group, Inc. | | | 2,456,694 | | |

| | 229,567 | | | Discover Financial Services | | | 3,023,397 | | |

| | 138,936 | | | Fannie Mae | | | 2,710,641 | | |

| | 151,607 | | | Freddie Mac | | | 2,486,355 | | |

| | 45,711 | | | Ryder System, Inc. | | | 3,148,574 | | |

| | 144,837 | | | SLM Corp. | | | 2,802,596 | | |

| | | | 22,598,776 | | |

| | | Financial

Conglomerates (1.1%) | |

| | 80,331 | | | American Express Co. | | | 3,026,069 | | |

| | 171,402 | | | Citigroup, Inc. | | | 2,872,697 | | |

| | 87,377 | | | JPMorgan Chase & Co. | | | 2,997,889 | | |

| | 68,307 | | | Leucadia National Corp. (a) | | | 3,206,331 | | |

| | 68,532 | | | Principal Financial

Group, Inc. | | | 2,876,288 | | |

| | 48,841 | | | Prudential Financial, Inc. | | | 2,917,761 | | |

| | | | 17,897,035 | | |

| | | Financial Publishing/

Services (0.6%) | |

| | 95,553 | | | Equifax, Inc. | | | 3,212,492 | | |

| | 76,629 | | | McGraw-Hill Companies,

Inc. (The) | | | 3,074,355 | | |

| | 87,239 | | | Moody's Corp. | | | 3,004,511 | | |

| | | | 9,291,358 | | |

| | | Food Distributors (0.2%) | |

| | 114,426 | | | SYSCO Corp. | | | 3,147,859 | | |

| | | Food Retail (0.8%) | |

| | 122,976 | | | Kroger Co. (The) | | | 3,550,317 | | |

| | 111,159 | | | Safeway Inc. | | | 3,173,589 | | |

See Notes to Financial Statements

15

Morgan Stanley Equally-Weighted S&P 500 Fund

Portfolio of Investment n June 30, 2008 continued

NUMBER OF

SHARES | |

| | VALUE | |

| | 104,356 | | | SUPERVALU, Inc. | | $ | 3,223,557 | | |

| | 125,686 | | | Whole Foods Market, Inc. | | | 2,977,501 | | |

| | | | 12,924,964 | | |

| | | Food: Major Diversified (1.4%) | |

| | 98,985 | | | Campbell Soup Co. | | | 3,312,038 | | |

| | 149,146 | | | ConAgra Foods Inc. | | | 2,875,535 | | |

| | 52,492 | | | General Mills, Inc. | | | 3,189,939 | | |

| | 67,033 | | | Heinz (H.J.) Co. | | | 3,207,529 | | |

| | 64,865 | | | Kellogg Co. | | | 3,114,817 | | |

| | 113,251 | | | Kraft Foods Inc. (Class A) | | | 3,221,991 | | |

| | 261,507 | | | Sara Lee Corp. | | | 3,203,461 | | |

| | | | 22,125,310 | | |

| | | Food: Meat/Fish/Dairy (0.4%) | |

| | 176,430 | | | Dean Foods Co. (a) | | | 3,461,557 | | |

| | 222,316 | | | Tyson Foods, Inc. (Class A) | | | 3,321,401 | | |

| | | | 6,782,958 | | |

| | | Food: Specialty/Candy (0.6%) | |

| | 98,016 | | | Hershey Foods Co. (The) | | | 3,212,964 | | |

| | 89,118 | | | McCormick & Co., Inc.

(Non-Voting) | | | 3,177,948 | | |

| | 42,515 | | | Wrigley (Wm.) Jr. Co. | | | 3,306,817 | | |

| | | | 9,697,729 | | |

| | | Forest Products (0.2%) | |

| | 62,712 | | | Weyerhaeuser Co. | | | 3,207,092 | | |

| | | Gas Distributors (1.3%) | |

| | 363,524 | | | Dynegy, Inc. (Class A) (a) | | | 3,108,130 | | |

| | 77,947 | | | Nicor Inc. | | | 3,319,763 | | |

| | 191,773 | | | NiSource, Inc. | | | 3,436,572 | | |

| | 48,706 | | | Questar Corp. | | | 3,460,074 | | |

| | 59,745 | | | Sempra Energy | | | 3,372,605 | | |

| | 120,645 | | | Spectra Energy Corp. | | | 3,467,337 | | |

| | | | 20,164,481 | | |

| | | Home Building (0.9%) | |

| | 221,127 | | | Centex Corp. | | | 2,956,468 | | |

| | 271,153 | | | D.R. Horton, Inc. | | | 2,942,010 | | |

| | 181,662 | | | KB Home | | | 3,075,538 | | |

NUMBER OF

SHARES | |

| | VALUE | |

| | 217,207 | | | Lennar Corp. (Class A) | | $ | 2,680,334 | | |

| | 295,891 | | | Pulte Homes, Inc. | | | 2,849,430 | | |

| | | | 14,503,780 | | |

| | | Home Furnishings (0.4%) | |

| | 186,161 | | | Leggett & Platt, Inc. | | | 3,121,920 | | |

| | 182,162 | | | Newell Rubbermaid, Inc. | | | 3,058,500 | | |

| | | | 6,180,420 | | |

| | | Home Improvement

Chains (0.6%) | |

| | 126,021 | | | Home Depot, Inc. (The) | | | 2,951,412 | | |

| | 144,900 | | | Lowe's Companies, Inc. | | | 3,006,675 | | |

| | 66,280 | | | Sherwin-Williams Co. | | | 3,044,240 | | |

| | | | 9,002,327 | | |

| | | Hospital/Nursing

Management (0.2%) | |

| | 620,651 | | | Tenet Healthcare Corp. (a) | | | 3,450,820 | | |

| | | Hotels/Resorts/

Cruiselines (0.8%) | |

| | 93,263 | | | Carnival Corp (Panama)

(Units) (c) | | | 3,073,948 | | |

| | 120,512 | | | Marriott International, Inc.

(Class A) | | | 3,162,235 | | |

| | 74,438 | | | Starwood Hotels & Resorts

Worldwide, Inc. | | | 2,982,731 | | |

| | 175,401 | | | Wyndham

Worldwide Corp. (a) | | | 3,141,432 | | |

| | | | 12,360,346 | | |

| | | Household/Personal

Care (1.4%) | |

| | 92,223 | | | Avon Products, Inc. | | | 3,321,872 | | |

| | 61,925 | | | Clorox Co. (The) | | | 3,232,485 | | |

| | 47,522 | | | Colgate-Palmolive Co. | | | 3,283,770 | | |

| | 71,837 | | | Estee Lauder Companies, Inc.

(The) (Class A) | | | 3,336,829 | | |

| | 82,269 | | | International Flavors &

Fragrances, Inc. | | | 3,213,427 | | |

See Notes to Financial Statements

16

Morgan Stanley Equally-Weighted S&P 500 Fund

Portfolio of Investment n June 30, 2008 continued

NUMBER OF

SHARES | |

| | VALUE | |

| | 54,071 | | | Kimberly-Clark Corp. | | $ | 3,232,364 | | |

| | 52,375 | | | Procter &

Gamble Co. (The) | | | 3,184,924 | | |

| | | | 22,805,671 | | |

| | | Industrial

Conglomerates (1.8%) | |

| | 45,303 | | | 3M Co. | | | 3,152,636 | | |

| | 41,310 | | | Danaher Corp. | | | 3,193,263 | | |

| | 120,820 | | | General Electric Co. (b) | | | 3,224,686 | | |

| | 61,034 | | | Honeywell International, Inc. | | | 3,068,790 | | |

| | 84,952 | | | Ingersoll-Rand Co. Ltd.

(Class A) (Bermuda) | | | 3,179,753 | | |

| | 51,633 | | | ITT Corp. | | | 3,269,918 | | |

| | 64,035 | | | Textron, Inc. | | | 3,069,198 | | |

| | 76,612 | | | Tyco International Ltd.

(Bermuda) | | | 3,067,544 | | |

| | 48,083 | | | United Technologies Corp. | | | 2,966,721 | | |

| | | | 28,192,509 | | |

| | | Industrial Machinery (0.4%) | |

| | 68,054 | | | Illinois Tool Works Inc. | | | 3,233,246 | | |

| | 43,533 | | | Parker Hannifin Corp. | | | 3,104,774 | | |

| | | | 6,338,020 | | |

| | | Industrial Specialties (0.4%) | |

| | 74,928 | | | Ecolab Inc. | | | 3,221,155 | | |

| | 55,162 | | | PPG Industries, Inc. | | | 3,164,644 | | |

| | | | 6,385,799 | | |

| | | | | Information Technology

Services (1.4%) | | | | | |

| | 106,987 | | | Citrix Systems, Inc. (a) | | | 3,146,488 | | |

| | 94,598 | | | Cognizant Technology Solutions

Corp. (Class A) (a) | | | 3,075,381 | | |

| | 69,236 | | | Computer

Sciences Corp. (a) | | | 3,243,014 | | |

| | 134,420 | | | Electronic Data

Systems Corp. | | | 3,312,109 | | |

| | 26,951 | | | International Business

Machines Corp. | | | 3,194,502 | | |

NUMBER OF

SHARES | |

| | VALUE | |

| | 142,958 | | | Teradata Corp | | $ | 3,308,048 | | |

| | 778,368 | | | Unisys Corp. (a) | | | 3,074,554 | | |

| | | | 22,354,096 | | |

| | | Insurance Brokers/

Services (0.4%) | |

| | 70,280 | | | AON Corp. | | | 3,228,663 | | |

| | 125,687 | | | Marsh & McLennan

Companies, Inc. | | | 3,336,990 | | |

| | | | 6,565,653 | | |

| | | Integrated Oil (1.3%) | |

| | 34,238 | | | Chevron Corp. | | | 3,394,013 | | |

| | 35,663 | | | ConocoPhillips | | | 3,366,231 | | |

| | 38,959 | | | Exxon Mobil Corp. | | | 3,433,457 | | |

| | 26,994 | | | Hess Corp. | | | 3,406,373 | | |

| | 65,197 | | | Marathon Oil Corp. | | | 3,381,768 | | |

| | 36,798 | | | Murphy Oil Corp. | | | 3,608,044 | | |

| | | | 20,589,886 | | |

| | | Internet Retail (0.5%) | |

| | 40,790 | | | Amazon.com, Inc. (a) | | | 2,991,131 | | |

| | 72,832 | | | Gamestop Corp (Class A) (a) | | | 2,942,413 | | |

| | 160,663 | | | IAC/InterActiveCorp. (a) | | | 3,097,583 | | |

| | | | 9,031,127 | | |

| | | Internet Software/

Services (0.8%) | |

| | 92,405 | | | Akamai

Technologies, Inc. (a) | | | 3,214,770 | | |

| | 6,054 | | | Google Inc. (Class A) (a) | | | 3,186,947 | | |

| | 82,951 | | | VeriSign, Inc. (a) | | | 3,135,548 | | |

| | 149,618 | | | Yahoo! Inc. (a) | | | 3,091,108 | | |

| | | | 12,628,373 | | |

| | | Investment Banks/

Brokers (1.9%) | |

| | 74,205 | | | Ameriprise Financial, Inc. | | | 3,017,917 | | |

| | 154,223 | | | Charles Schwab

Corp. (The) | | | 3,167,740 | | |

| | 7,706 | | | CME Group Inc. | | | 2,952,862 | | |

| | 921,467 | | | E*TRADE Group, Inc. (a) | | | 2,893,406 | | |

See Notes to Financial Statements

17

Morgan Stanley Equally-Weighted S&P 500 Fund

Portfolio of Investment n June 30, 2008 continued

NUMBER OF

SHARES | |

| | VALUE | |

| | 18,002 | | | Goldman Sachs Group,

Inc. (The) | | $ | 3,148,550 | | |

| | 25,510 | | | IntercontinentalExchange Inc. | | | 2,908,140 | | |

| | 136,696 | | | Lehman Brothers

Holdings Inc. | | | 2,707,948 | | |

| | 92,018 | | | Merrill Lynch & Co., Inc. | | | 2,917,891 | | |

| | 85,523 | | | Morgan Stanley (Note 4) | | | 3,084,815 | | |

| | 57,163 | | | NYSE Euronext | | | 2,895,878 | | |

| | | | 29,695,147 | | |

| | | Investment Managers (1.1%) | |

| | 89,990 | | | Federated Investors, Inc.

(Class B) | | | 3,097,456 | | |

| | 32,943 | | | Franklin Resources, Inc. | | | 3,019,226 | | |

| | 110,712 | | | Janus Capital Group, Inc. | | | 2,930,547 | | |

| | 65,312 | | | Legg Mason, Inc. | | | 2,845,644 | | |

| | 55,533 | | | Price (T.) Rowe Group, Inc. | | | 3,135,949 | | |

| | 48,834 | | | State Street Corp. | | | 3,124,888 | | |

| | | | 18,153,710 | | |

| | | Life/Health Insurance (1.2%) | |

| | 50,504 | | | AFLAC, Inc. | | | 3,171,651 | | |

| | 174,108 | | | Genworth Financial Inc.

(Class A) | | | 3,100,863 | | |

| | 68,362 | | | Lincoln National Corp. | | | 3,098,166 | | |

| | 58,138 | | | MetLife, Inc. | | | 3,067,942 | | |

| | 55,080 | | | Torchmark Corp. | | | 3,230,442 | | |

| | 149,687 | | | UnumProvident Corp. | | | 3,061,099 | | |

| | | | 18,730,163 | | |

| | | Major Banks (2.5%) | |

| | 122,068 | | | Bank of America Corp. | | | 2,913,763 | | |

| | 81,620 | | | Bank of New York

Mellon Corp. | | | 3,087,685 | | |

| | 133,929 | | | BB&T Corp. | | | 3,049,563 | | |

| | 112,099 | | | Comerica, Inc. | | | 2,873,097 | | |

| | 495,961 | | | Huntington

Bancshares, Inc. | | | 2,861,695 | | |

| | 286,909 | | | KeyCorp | | | 3,150,261 | | |

| | 655,062 | | | National City Corp. | | | 3,124,646 | | |

| | 57,173 | | | PNC Financial

Services Group | | | 3,264,578 | | |

NUMBER OF

SHARES | |

| | VALUE | |

| | 294,836 | | | Regions Financial Corp. | | $ | 3,216,661 | | |

| | 88,759 | | | SunTrust Banks, Inc. | | | 3,214,851 | | |

| | 111,495 | | | U.S. Bancorp | | | 3,109,596 | | |

| | 189,791 | | | Wachovia Corp. | | | 2,947,454 | | |

| | 135,023 | | | Wells Fargo & Co. | | | 3,206,796 | | |

| | | | 40,020,646 | | |

| | | Major

Telecommunications (0.9%) | |

| | 96,080 | | | AT&T Inc. | | | 3,236,935 | | |

| | 74,222 | | | Embarq Corp. | | | 3,508,474 | | |

| | 418,214 | | | Sprint Nextel Corp. | | | 3,973,033 | | |

| | 93,501 | | | Verizon

Communications, Inc. | | | 3,309,935 | | |

| | | | 14,028,377 | | |

| | | Managed Health Care (1.2%) | |

| | 80,783 | | | Aetna, Inc. | | | 3,274,135 | | |

| | 91,408 | | | CIGNA Corp. | | | 3,234,929 | | |

| | 106,540 | | | Coventry Health

Care, Inc. (a) | | | 3,240,947 | | |

| | 78,819 | | | Humana, Inc. (a) | | | 3,134,632 | | |

| | 121,978 | | | UnitedHealth Group Inc. | | | 3,201,923 | | |

| | 68,491 | | | WellPoint Inc. (a) | | | 3,264,281 | | |

| | | | 19,350,847 | | |

| | | Media Conglomerates (1.0%) | |

| | 165,403 | | | CBS Corp. (Class B) | | | 3,223,704 | | |

| | 103,571 | | | Disney (Walt) Co. (The) | | | 3,231,415 | | |

| | 203,448 | | | News Corp. (Class A) | | | 3,059,858 | | |

| | 226,579 | | | Time Warner, Inc. | | | 3,353,369 | | |

| | 105,017 | | | Viacom Inc. (Class B) (a) | | | 3,207,219 | | |

| | | | 16,075,565 | | |

| | | Medical Distributors (0.8%) | |

| | 83,159 | | | AmerisourceBergen Corp. | | | 3,325,528 | | |

| | 64,035 | | | Cardinal Health, Inc. | | | 3,302,925 | | |

| | 57,945 | | | McKesson Corp. | | | 3,239,705 | | |

| | 107,404 | | | Patterson

Companies, Inc. (a) | | | 3,156,604 | | |

| | | | 13,024,762 | | |

See Notes to Financial Statements

18

Morgan Stanley Equally-Weighted S&P 500 Fund

Portfolio of Investment n June 30, 2008 continued

NUMBER OF

SHARES | |

| | VALUE | |

| | | Medical Specialties (3.5%) | |

| | 98,308 | | | Applera Corp. - Applied

Biosystems Group | | $ | 3,291,352 | | |

| | 37,468 | | | Bard (C.R.), Inc. | | | 3,295,311 | | |

| | 52,810 | | | Baxter International, Inc. | | | 3,376,671 | | |

| | 41,853 | | | Becton, Dickinson & Co. | | | 3,402,649 | | |

| | 260,889 | | | Boston Scientific Corp. (a) | | | 3,206,326 | | |

| | 70,340 | | | Covidien Ltd. | | | 3,368,583 | | |

| | 82,784 | | | Hospira, Inc. (a) | | | 3,320,466 | | |

| | 11,710 | | | Intuitive Surgical, Inc. (a) | | | 3,154,674 | | |

| | 65,029 | | | Medtronic, Inc. | | | 3,365,251 | | |

| | 79,179 | | | Pall Corp. | | | 3,141,823 | | |

| | 116,441 | | | PerkinElmer, Inc. | | | 3,242,882 | | |

| | 82,004 | | | St. Jude Medical, Inc. (a) | | | 3,352,324 | | |

| | 52,861 | | | Stryker Corp. | | | 3,323,900 | | |

| | 57,481 | | | Thermo Fisher

Scientific, Inc. (a) | | | 3,203,416 | | |

| | 64,510 | | | Varian Medical

Systems, Inc. (a) | | | 3,344,844 | | |

| | 52,560 | | | Waters Corp. (a) | | | 3,390,120 | | |

| | 48,314 | | | Zimmer Holdings, Inc. (a) | | | 3,287,768 | | |

| | | | 56,068,360 | | |

| | | Miscellaneous Commercial

Services (0.2%) | |

| | 125,400 | | | Cintas Corp. | | | 3,324,354 | | |

| | | Miscellaneous

Manufacturing (0.2%) | |

| | 64,788 | | | Dover Corp. | | | 3,133,796 | | |

| | | Motor Vehicles (0.5%) | |

| | 569,375 | | | Ford Motor Co. (a) | | | 2,738,694 | | |

| | 239,888 | | | General Motors Corp. | | | 2,758,712 | | |

| | 88,831 | | | Harley-Davidson, Inc. | | | 3,221,012 | | |

| | | | 8,718,418 | | |

| | | Multi-Line Insurance (0.6%) | |

| | 103,055 | | | American International

Group, Inc. | | | 2,726,835 | | |

| | 47,894 | | | Hartford Financial Services

Group, Inc. (The) | | | 3,092,516 | | |

| | 49,242 | | | SAFECO Corp. (a) | | | 3,307,093 | | |

| | | | 9,126,444 | | |

NUMBER OF

SHARES | |

| | VALUE | |

| | | Office Equipment/

Supplies (0.4%) | |

| | 71,498 | | | Avery Dennison Corp. | | $ | 3,140,907 | | |

| | 93,872 | | | Pitney Bowes, Inc. | | | 3,201,035 | | |

| | | | 6,341,942 | | |

| | | Oil & Gas Pipelines (0.4%) | |

| | 157,678 | | | El Paso Corp. | | | 3,427,920 | | |

| | 86,713 | | | Williams Companies,

Inc. (The) | | | 3,495,401 | | |

| | | | 6,923,321 | | |

| | | Oil & Gas Production (2.3%) | |

| | 43,442 | | | Anadarko Petroleum Corp. | | | 3,251,199 | | |

| | 24,159 | | | Apache Corp. | | | 3,358,101 | | |

| | 50,582 | | | Cabot Oil & Gas Corp. | | | 3,425,919 | | |

| | 51,721 | | | Chesapeake Energy Corp. | | | 3,411,517 | | |

| | 27,853 | | | Devon Energy Corp. | | | 3,346,816 | | |

| | 25,367 | | | EOG Resources, Inc. | | | 3,328,150 | | |

| | 34,742 | | | Noble Energy, Inc. | | | 3,493,656 | | |

| | 38,628 | | | Occidental Petroleum Corp. | | | 3,471,112 | | |

| | 52,845 | | | Range Resources Corp. | | | 3,463,461 | | |

| | 72,593 | | | Southwestern Energy Co. (a) | | | 3,456,153 | | |

| | 47,111 | | | XTO Energy, Inc. | | | 3,227,575 | | |

| | | | 37,233,659 | | |

| | | Oil Refining/Marketing (0.6%) | |

| | 85,193 | | | Sunoco, Inc. | | | 3,466,503 | | |

| | 162,558 | | | Tesoro Corp. | | | 3,213,772 | | |

| | 77,818 | | | Valero Energy Corp. | | | 3,204,545 | | |

| | | | 9,884,820 | | |

| | | Oilfield Services/

Equipment (1.7%) | |

| | 39,182 | | | Baker Hughes Inc. | | | 3,422,156 | | |

| | 102,863 | | | BJ Services Co. | | | 3,285,444 | | |

| | 60,632 | | | Cameron

International Corp. (a) | | | 3,355,981 | | |

| | 66,122 | | | Halliburton Co. | | | 3,509,095 | | |

| | 39,154 | | | National-Oilwell

Varco, Inc. (a) | | | 3,473,743 | | |

| | 31,778 | | | Schlumberger Ltd.

(Netherlands Antilles) | | | 3,413,911 | | |

See Notes to Financial Statements

19

Morgan Stanley Equally-Weighted S&P 500 Fund

Portfolio of Investment n June 30, 2008 continued

NUMBER OF

SHARES | |

| | VALUE | |

| | 41,806 | | | Smith International, Inc. | | $ | 3,475,751 | | |

| | 73,973 | | | Weatherford International Ltd.

(Bermuda) (a) | | | 3,668,321 | | |

| | | | 27,604,402 | | |

| | | Other Consumer

Services (0.8%) | |

| | 62,617 | | | Apollo Group, Inc.

(Class A) (a) | | | 2,771,428 | | |

| | 159,501 | | | Block (H&R), Inc. | | | 3,413,321 | | |

| | 117,432 | | | eBay Inc. (a) | | | 3,209,417 | | |

| | 167,074 | | | Expedia, Inc. (a) | | | 3,070,820 | | |

| | | | 12,464,986 | | |

| | | Other Consumer

Specialties (0.2%) | |

| | 51,319 | | | Fortune Brands, Inc. | | | 3,202,819 | | |

| | | Other Metals/Minerals (0.2%) | |

| | 225,652 | | | Titanium Metals Corp. | | | 3,156,871 | | |

| | | Packaged Software (2.0%) | |

| | 81,580 | | | Adobe Systems, Inc. (a) | | | 3,213,436 | | |

| | 89,699 | | | Autodesk, Inc. (a) | | | 3,032,723 | | |

| | 88,546 | | | BMC Software, Inc. (a) | | | 3,187,656 | | |

| | 140,589 | | | CA Inc. | | | 3,246,200 | | |

| | 342,805 | | | Compuware Corp. (a) | | | 3,270,360 | | |

| | 115,788 | | | Intuit Inc. (a) | | | 3,192,275 | | |

| | 117,182 | | | Microsoft Corp. (b) | | | 3,223,677 | | |

| | 535,286 | | | Novell, Inc. (a) | | | 3,152,835 | | |

| | 149,687 | | | Oracle Corp. (a) | | | 3,143,427 | | |

| | 170,784 | | | Symantec Corp. (a) | | | 3,304,670 | | |

| | | | 31,967,259 | | |

| | | Personnel Services (0.4%) | |

| | 156,557 | | | Monster Worldwide Inc. (a) | | | 3,226,640 | | |

| | 131,325 | | | Robert Half

International, Inc. | | | 3,147,860 | | |

| | | | 6,374,500 | | |

| | | Pharmaceuticals: Generic

Drugs (0.6%) | |

| | 80,527 | | | Barr

Pharmaceuticals Inc. (a) | | | 3,630,157 | | |

| | 275,903 | | | Mylan Laboratories, Inc. | | | 3,330,149 | | |

NUMBER OF

SHARES | |

| | VALUE | |

| | 123,897 | | | Watson

Pharmaceuticals, Inc. (a) | | $ | 3,366,281 | | |

| | | | 10,326,587 | | |

| | | Pharmaceuticals: Major (1.7%) | |

| | 62,006 | | | Abbott Laboratories | | | 3,284,458 | | |

| | 169,037 | | | Bristol-Myers Squibb Co. | | | 3,470,330 | | |

| | 51,641 | | | Johnson & Johnson | | | 3,322,582 | | |

| | 70,489 | | | Lilly (Eli) & Co. | | | 3,253,772 | | |

| | 94,166 | | | Merck & Co., Inc. | | | 3,549,117 | | |

| | 190,886 | | | Pfizer, Inc. (b) | | | 3,334,778 | | |

| | 178,140 | | | Schering-Plough Corp. | | | 3,507,577 | | |

| | 69,135 | | | Wyeth | | | 3,315,715 | | |

| | | | 27,038,329 | | |

| | | Pharmaceuticals: Other (0.6%) | |

| | 60,687 | | | Allergan, Inc. | | | 3,158,758 | | |

| | 103,538 | | | Forest Laboratories, Inc. (a) | | | 3,596,910 | | |

| | 342,450 | | | King

Pharmaceuticals, Inc. (a) | | | 3,585,452 | | |

| | | | 10,341,120 | | |

| | | Precious Metals (0.4%) | |

| | 28,267 | | | Freeport-McMoRan Copper &

Gold, Inc. | | | 3,312,610 | | |

| | 67,581 | | | Newmont Mining Corp. | | | 3,525,025 | | |

| | | | 6,837,635 | | |

| | | Property - Casualty

Insurers (1.5%) | |

| | 57,924 | | | ACE Ltd. (Cayman Islands) | | | 3,191,033 | | |

| | 69,076 | | | Allstate Corp. (The) | | | 3,149,175 | | |

| | 64,309 | | | Chubb Corp. (The) | | | 3,151,784 | | |

| | 114,863 | | | Cincinnati Financial Corp. | | | 2,917,520 | | |

| | 66,844 | | | Loews Corp. | | | 3,134,984 | | |

| | 165,404 | | | Progressive Corp. (The) | | | 3,096,363 | | |

| | 72,497 | | | St. Paul Travelers

Companies, Inc. (The) | | | 3,146,370 | | |

| | 116,645 | | | XL Capital Ltd. (Class A)

(Cayman Islands) | | | 2,398,221 | | |

| | | | 24,185,450 | | |

See Notes to Financial Statements

20

Morgan Stanley Equally-Weighted S&P 500 Fund

Portfolio of Investment n June 30, 2008 continued

NUMBER OF

SHARES | |

| | VALUE | |

| | | Publishing: Books/

Magazines (0.2%) | |

| | 114,268 | | | Meredith Corp. | | $ | 3,232,642 | | |

| | | Publishing:

Newspapers (0.8%) | |

| | 144,646 | | | Gannett Co., Inc. | | | 3,134,479 | | |

| | 208,185 | | | New York Times Co.

(The) (Class A) | | | 3,203,967 | | |

| | 74,775 | | | Scripps (E.W.) Co. (Class A) | | | 3,106,154 | | |

| | 5,917 | | | Washington Post Co.

(The) (Class B) | | | 3,472,687 | | |

| | | | 12,917,287 | | |

| | | Pulp & Paper (0.4%) | |

| | 135,133 | | | International Paper Co. | | | 3,148,599 | | |

| | 135,799 | | | MeadWestvaco Corp. | | | 3,237,448 | | |

| | | | 6,386,047 | | |

| | | Railroads (0.8%) | |

| | 32,111 | | | Burlington Northern

Santa Fe Corp. | | | 3,207,568 | | |

| | 51,027 | | | CSX Corp. | | | 3,205,006 | | |

| | 51,900 | | | Norfolk Southern Corp. | | | 3,252,573 | | |

| | 43,029 | | | Union Pacific Corp. | | | 3,248,690 | | |

| | | | 12,913,837 | | |

| | | Real Estate

Development (0.2%) | |

| | 160,431 | | | CB Richard Ellis Group, Inc.

(Class A) (a) | | | 3,080,275 | | |

| | | Real Estate Investment

Trusts (2.6%) | |

| | 93,080 | | | Apartment Investment &

Management Co. (Class A) | | | 3,170,305 | | |

| | 35,689 | | | AvalonBay Communities, Inc. | | | 3,182,031 | | |

| | 34,568 | | | Boston Properties, Inc. | | | 3,118,725 | | |

| | 81,984 | | | Equity Residential | | | 3,137,528 | | |

| | 86,644 | | | General Growth

Properties, Inc. | | | 3,035,139 | | |

| | 101,102 | | | HCP INC | | | 3,216,055 | | |

| | 227,671 | | | Host Hotels & Resorts Inc. | | | 3,107,709 | | |

NUMBER OF

SHARES | |

| | VALUE | |

| | 90,955 | | | Kimco Realty Corp. | | $ | 3,139,767 | | |

| | 75,012 | | | Plum Creek Timber Co., Inc. | | | 3,203,763 | | |

| | 58,189 | | | ProLogis | | | 3,162,572 | | |

| | 40,273 | | | Public Storage, Inc. | | | 3,253,656 | | |

| | 34,789 | | | Simon Property Group, Inc. | | | 3,127,183 | | |

| | 35,853 | | | Vornado Realty Trust | | | 3,155,064 | | |

| | | | 41,009,497 | | |

| | | Recreational Products (0.6%) | |

| | 70,474 | | | Electronic Arts Inc. (a) | | | 3,131,160 | | |

| | 88,951 | | | Hasbro, Inc. | | | 3,177,330 | | |

| | 175,961 | | | Mattel, Inc. | | | 3,012,452 | | |

| | | | 9,320,942 | | |

| | | Regional Banks (1.2%) | |

| | 327,207 | | | Fifth Third Bancorp | | | 3,330,967 | | |

| | 422,486 | | | First Horizon

National Corp. | | | 3,139,071 | | |

| | 45,118 | | | M&T Bank Corp. | | | 3,182,624 | | |

| | 190,228 | | | Marshall & Ilsley

Corp | | | 2,916,195 | | |

| | 45,510 | | | Northern Trust Corp. | | | 3,120,621 | | |

| | 103,087 | | | Zions Bancorporation | | | 3,246,210 | | |

| | | | 18,935,688 | | |

| | | Restaurants (1.0%) | |

| | 104,553 | | | Darden Restaurants, Inc. | | | 3,339,423 | | |

| | 57,632 | | | McDonald's Corp. | | | 3,240,071 | | |

| | 191,994 | | | Starbucks Corp. (a) | | | 3,021,986 | | |

| | 110,086 | | | Wendy's International, Inc. | | | 2,996,541 | | |

| | 90,558 | | | Yum! Brands, Inc. | | | 3,177,680 | | |

| | | | 15,775,701 | | |

| | | Retail Strip Centers (0.2%) | |

| | 89,528 | | | Developers Diversified

Realty Corp. | | | 3,107,517 | | |

| | | Savings Banks (0.5%) | |

| | 192,329 | | | Hudson City Bancorp, Inc. | | | 3,208,048 | | |

| | 370,029 | | | Sovereign Bancorp, Inc. | | | 2,723,413 | | |

| | 518,505 | | | Washington Mutual, Inc. | | | 2,556,230 | | |

| | | | 8,487,691 | | |

See Notes to Financial Statements

21

Morgan Stanley Equally-Weighted S&P 500 Fund

Portfolio of Investment n June 30, 2008 continued

NUMBER OF

SHARES | |

| | VALUE | |

| | | Semiconductors (2.5%) | |

| | 473,258 | | | Advanced Micro

Devices, Inc. (a) | | $ | 2,759,094 | | |

| | 148,811 | | | Altera Corp. | | | 3,080,388 | | |

| | 99,491 | | | Analog Devices, Inc. | | | 3,160,829 | | |

| | 123,023 | | | Broadcom Corp.

(Class A) (a) | | | 3,357,298 | | |

| | 147,880 | | | Intel Corp. (b) | | | 3,176,462 | | |

| | 100,825 | | | Linear Technology Corp. | | | 3,283,870 | | |

| | 470,565 | | | LSI Logic Corp. (a) | | | 2,889,269 | | |

| | 104,388 | | | Microchip Technology Inc. | | | 3,188,010 | | |

| | 457,548 | | | Micron Technology, Inc. (a) | | | 2,745,288 | | |

| | 149,687 | | | National

Semiconductor Corp. | | | 3,074,571 | | |

| | 167,413 | | | NVIDIA Corp. (a) | | | 3,133,971 | | |

| | 112,514 | | | Texas Instruments Inc. | | | 3,168,394 | | |

| | 120,909 | | | Xilinx, Inc. | | | 3,052,952 | | |

| | | | 40,070,396 | | |

| | | Services to the Health

Industry (1.0%) | |

| | 52,195 | | | Express Scripts, Inc. (a) | | | 3,273,670 | | |

| | 142,774 | | | IMS Health Inc. | | | 3,326,634 | | |

| | 47,312 | | | Laboratory Corp. of

America Holdings (a) | | | 3,294,335 | | |

| | 73,627 | | | Medco Health

Solutions Inc. (a) | | | 3,475,194 | | |

| | 68,604 | | | Quest Diagnostics Inc. | | | 3,325,236 | | |

| | | | 16,695,069 | | |

| | | Specialty Insurance (0.5%) | |

| | 48,698 | | | Assurant, Inc. | | | 3,212,120 | | |

| | 591,782 | | | MBIA Inc. | | | 2,597,923 | | |

| | 359,572 | | | MGIC Investment Corp. | | | 2,196,985 | | |

| | | | 8,007,028 | | |

| | | Specialty Stores (1.2%) | |

| | 276,363 | | | AutoNation, Inc. (a) | | | 2,769,157 | | |

| | 28,765 | | | AutoZone, Inc. (a) | | | 3,480,853 | | |

| | 114,823 | | | Bed Bath & Beyond Inc. (a) | | | 3,226,526 | | |

| | 273,395 | | | Office Depot, Inc. (a) | | | 2,990,941 | | |

NUMBER OF

SHARES | |

| |

VALUE | |

| | 134,419 | | | Staples, Inc. | | $ | 3,192,451 | | |

| | 73,253 | | | Tiffany & Co. | | | 2,985,060 | | |

| | | | 18,644,988 | | |

| | | Specialty

Telecommunications (1.1%) | |

| | 76,399 | | | American Tower Corp.

(Class A) (a) | | | 3,227,858 | | |

| | 106,574 | | | CenturyTel, Inc. | | | 3,792,969 | | |

| | 299,101 | | | Citizens

Communications Co. | | | 3,391,805 | | |

| | 848,222 | | | Qwest Communications

International, Inc. (a) | | | 3,333,512 | | |

| | 259,254 | | | Windstream Corp. | | | 3,199,194 | | |

| | | | 16,945,338 | | |

| | | Steel (0.8%) | |

| | 43,270 | | | AK Steel Holding Corp. (a) | | | 2,985,630 | | |

| | 52,810 | | | Allegheny

Technologies, Inc. | | | 3,130,577 | | |

| | 43,781 | | | Nucor Corp. | | | 3,269,127 | | |

| | 18,098 | | | United States Steel Corp. | | | 3,344,148 | | |

| | | | 12,729,482 | | |

| | | Telecommunication

Equipment (0.9%) | |

| | 129,120 | | | Ciena Corp. (a) | | | 2,991,710 | | |

| | 130,961 | | | Corning Inc. (a) | | | 3,018,651 | | |

| | 416,633 | | | Motorola, Inc. | | | 3,058,086 | | |

| | 68,166 | | | QUALCOMM, Inc. | | | 3,024,525 | | |

| | 658,977 | | | Tellabs, Inc. (a) | | | 3,064,243 | | |

| | | | 15,157,215 | | |

| | | Tobacco (1.0%) | |

| | 159,194 | | | Altria Group, Inc. | | | 3,273,029 | | |

| | 46,651 | | | Lorillard, Inc. | | | 3,226,383 | | |

| | 65,871 | | | Philip Morris

International Inc. (a) | | | 3,253,369 | | |

| | 66,951 | | | Reynolds American, Inc. | | | 3,124,603 | | |

| | 61,972 | | | UST, Inc. | | | 3,384,291 | | |

| | | | 16,261,675 | | |

See Notes to Financial Statements

22

Morgan Stanley Equally-Weighted S&P 500 Fund

Portfolio of Investment n June 30, 2008 continued

NUMBER OF

SHARES | |

| | VALUE | |

| | | Tools/Hardware (0.6%) | |

| | 56,548 | | | Black & Decker Corp. | | $ | 3,252,075 | | |

| | 60,433 | | | Snap-On, Inc. | | | 3,143,120 | | |

| | 72,275 | | | Stanley Works (The) | | | 3,240,088 | | |

| | | | 9,635,283 | | |

| | | Trucks/Construction/

Farm Machinery (1.1%) | |

| | 41,832 | | | Caterpillar Inc. | | | 3,088,038 | | |

| | 46,817 | | | Cummins Inc. | | | 3,067,450 | | |

| | 43,316 | | | Deere & Co. | | | 3,124,383 | | |

| | 88,451 | | | Manitowoc Co., Inc. | | | 2,877,311 | | |

| | 73,676 | | | PACCAR, Inc. | | | 3,081,867 | | |

| | 53,808 | | | Terex Corp. (a) | | | 2,764,117 | | |

| | | | 18,003,166 | | |

| | | Wholesale Distributors (0.4%) | |

| | 79,598 | | | Genuine Parts Co. | | | 3,158,449 | | |

| | 38,112 | | | Grainger (W.W.), Inc. | | | 3,117,562 | | |

| | | | 6,276,011 | | |

| | | | | Total Common Stocks

(Cost $1,134,395,547) | | | 1,590,135,896 | | |

NUMBER OF

SHARES (000) | | | | VALUE | |

| | | Short-Term Investment (e) (0.1%) | | | |

| | | Investment Company | | | |

| | 2,091 | | | Morgan Stanley Institutional

Liquidity Money Market

Portfolio - Institutional Class

(Cost $2,090,660) | | $ | 2,090,660 | | |

Total Investments

(Cost $1,136,486,207) (f) (g) | | | 100.0 | % | | | 1,592,226,556 | | |

Liabilities in Excess of

Other Assets | | | (0.0 | ) | | | (238,786 | ) | |

| Net Assets | | | 100.0 | % | | $ | 1,591,987,770 | | |

(a) Non-income producing security.

(b) A portion of this security has been physically segregated in connection with open futures contracts in the amount of $234,000.

(c) Consists of one or more class of securities traded together as a unit; stocks with attached paired trust shares.

(d) A Security with total market value equal to $0 has been valued at its fair value as determined in good faith under procedures established by and under the general supervision of the Fund's Trustees.

(e) See Note 4 to the financial statements regarding investments in Morgan Stanley Institutional Liquidity Money Market Portfolio - Institutional Class.

(f) Securities have been designated as collateral in an amount equal to $6,427,720 in connection with open futures contracts.

(g) The aggregate cost for federal income tax purposes is $1,150,323,533. The aggregate gross unrealized appreciation is $601,749,315 and the aggregate gross unrealized depreciation is $159,846,292, resulting in net unrealized appreciation of $441,903,023.

See Notes to Financial Statements

23

Morgan Stanley Equally-Weighted S&P 500 Fund

Portfolio of Investment n June 30, 2008 continued

Futures Contracts Open at June 30, 2008:

NUMBER OF

CONTRACTS | | LONG/SHORT | | DESCRIPTION, DELIVERY

MONTH AND YEAR | | UNDERLYING FACE

AMOUNT AT VALUE | | UNREALIZED

DEPRECIATION | |

| | 65 | | | Long | | S&P 500 E-Mini Index

September 2008 | | $ | 4,163,575 | | | $ | (115,180 | ) | |

Summary of Investments

| SECTOR | | VALUE | | PERCENT OF

TOTAL

INVESTMENTS | |

| Finance | | $ | 269,600,720 | | | | 16.9 | % | |

| Electronic Technology | | | 152,884,314 | | | | 9.6 | | |

| Health Technology | | | 123,747,354 | | | | 7.8 | | |

| Consumer Non-Durables | | | 122,170,259 | | | | 7.7 | | |

| Retail Trade | | | 109,346,217 | | | | 6.9 | | |

| Utilities | | | 105,424,343 | | | | 6.6 | | |

| Technology Services | | | 92,501,247 | | | | 5.8 | | |

| Consumer Services | | | 85,253,395 | | | | 5.4 | | |

| Producer Manufacturing | | | 80,392,393 | | | | 5.0 | | |

| Energy Minerals | | | 78,179,986 | | | | 4.9 | | |

| Consumer Durables | | | 64,434,651 | | | | 4.1 | | |

| Industrial Services | | | 64,149,574 | | | | 4.0 | | |

| Process Industries | | | 59,744,709 | | | | 3.8 | | |

| Health Services | | | 39,496,736 | | | | 2.5 | | |

| Non-Energy Minerals | | | 32,180,592 | | | | 2.0 | | |

| Communications | | | 30,973,715 | | | | 1.9 | | |

| Transportation | | | 28,667,927 | | | | 1.8 | | |

| Commercial Services | | | 28,539,132 | | | | 1.8 | | |

| Distribution Services | | | 22,448,632 | | | | 1.4 | | |

| Investment Company | | | 2,090,660 | | | | 0.1 | | |

| | | $ | 1,592,226,556 | ^ | | | 100.0 | % | |

^ Does not include open long futures contracts with an underlying face amount of $4,163,575 with unrealized depreciation of $115,180.

See Notes to Financial Statements

24

Morgan Stanley Equally-Weighted S&P 500 Fund

Financial Statements

Statement of Assets and Liabilities

June 30, 2008

| Assets: | |

| Investments in securities, at value (cost $1,132,015,314) | | $ | 1,587,051,081 | | |

| Investment in affiliate, at value (cost $4,470,893) | | | 5,175,475 | | |

| Receivable for: | |

| Investments sold | | | 2,970,618 | | |

| Dividends | | | 2,251,319 | | |

| Shares of beneficial interest sold | | | 842,550 | | |

| Variation margin | | | 6,422 | | |

| Dividends from affiliate | | | 162 | | |

| Prepaid expenses and other assets | | | 367,387 | | |

| Total Assets | | | 1,598,665,014 | | |

| Liabilities: | |

| Payable for: | |

| Investments purchased | | | 2,986,495 | | |

| Shares of beneficial interest redeemed | | | 2,179,216 | | |

| Distribution fee | | | 582,879 | | |

| Investment advisory fee | | | 172,254 | | |

| Administration fee | | | 115,510 | | |

| Payable to bank | | | 15,180 | | |

| Accrued expenses and other payables | | | 625,710 | | |

| Total Liabilities | | | 6,677,244 | | |

| Net Assets | | $ | 1,591,987,770 | | |

| Composition of Net Assets: | |

| Paid-in-capital | | $ | 987,588,657 | | |

| Net unrealized appreciation | | | 455,625,169 | | |

| Accumulated undistributed net investment income | | | 11,361,084 | | |

| Accumulated undistributed net realized gain | | | 137,412,860 | | |

| Net Assets | | $ | 1,591,987,770 | | |

| Class A Shares: | |

| Net Assets | | $ | 799,622,224 | | |

| Shares Outstanding (unlimited authorized, $.01 par value) | | | 23,950,014 | | |

| Net Asset Value Per Share | | $ | 33.39 | | |

Maximum Offering Price Per Share,

(net asset value plus 5.54% of net asset value) | | $ | 35.24 | | |

| Class B Shares: | |

| Net Assets | | $ | 352,174,401 | | |

| Shares Outstanding (unlimited authorized, $.01 par value) | | | 10,664,193 | | |

| Net Asset Value Per Share | | $ | 33.02 | | |

| Class C Shares: | |