UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934 (Amendment No. __)

Filed by the Registrant X

Filed by a Party other than the Registrant

Check the appropriate box:

Preliminary Information Statement

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

x Definitive Information Statement

ADVANCED SERIES TRUST

(Name of Registrant As Specified In Its Charter)

(Name of Person(s) Filing Information Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

xNo fee required

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

Fee paid previously with preliminary materials.

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF THE INFORMATION STATEMENT

The Information Statement is available at: www.PrudentialAnnuities.com/investor/invprospectus

ADVANCED SERIES TRUST

AST BlackRock Low Duration Bond Portfolio

655 Broad Street

17th Floor

Newark, New Jersey 07102

INFORMATION STATEMENT

June 17, 2020

To the Shareholders:

At an in-person meeting held on January 23-24, 2020, the Board of Trustees (the Board) of Advanced Series Trust approved a new subadvisory agreement for the AST BlackRock Low Duration Bond Portfolio (the Portfolio). Effective May 18, 2020, BlackRock International Limited (BlackRock International) and BlackRock (Singapore) Limited (BlackRock Singapore) were added as subadvisers to the Portfolio, to serve alongside BlackRock Financial Management, Inc. (BlackRock Financial).

PGIM Investments LLC (PGIM Investments) and AST Investment Services, Inc. (ASTIS), as investment managers to the Portfolio, have entered into a new subadvisory agreement with BlackRock Financial, BlackRock International and BlackRock Singapore, to subadvise the Portfolio (the New Subadvisory Agreement). Prior to May 18, 2020, BlackRock Financial, an affiliate of BlackRock International and BlackRock Singapore, served as the sole subadviser to the Portfolio. The New Subadvisory Agreement relates to the appointments of BlackRock Financial, BlackRock International and BlackRock Singapore, to serve together as subadvisers to the Portfolio. The New Subadvisory Agreement became effective on May 18, 2020. The investment management agreement relating to the Portfolio has not been, and will not be, changed as a result of the New Subadvisory Agreement. PGIM Investments and ASTIS will continue to manage the Portfolio.

This information statement describes the circumstances surrounding the Board's approval of the New Subadvisory Agreement and provides you with an overview of its terms. This information statement does not require any action by you. It is provided to inform you about a change in the Portfolio's subadvisory arrangements.

By order of the Board,

Andrew R. French

Secretary

THIS IS NOT A PROXY STATEMENT.

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF THE INFORMATION STATEMENT

The Information Statement is available at: www.PrudentialAnnuities.com/investor/invprospectus

ADVANCED SERIES TRUST

AST BlackRock Low Duration Bond Portfolio

655 Broad Street

17th Floor

Newark, New Jersey 07102

INFORMATION STATEMENT

June 17, 2020

This information statement is being furnished in lieu of a proxy statement to beneficial shareholders of the AST BlackRock Low Duration Bond Portfolio (the Portfolio), a series of Advanced Series Trust (AST or the Trust), pursuant to the terms of an exemptive order (the Manager-of-Managers Order) issued by the Securities and Exchange Commission (the SEC). The Manager- of-Managers Order permits the Portfolio's investment managers to hire subadvisers that are not affiliated with the investment managers, and to make changes to certain existing subadvisory agreements with the approval of the Board of Trustees of the Trust, without obtaining shareholder approval.

AST is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the 1940 Act). AST is organized as a Massachusetts business trust. The Portfolio is a series of the Trust.

The Trustees of AST are collectively referred to herein as the "Board" or "Trustees." The principal executive offices of AST are located at 655 Broad Street, 17th Floor, Newark, NJ 07102. PGIM Investments LLC (PGIM Investments) and AST Investment Services, Inc. (ASTIS, and together with PGIM Investments, the Manager) serve as the investment managers of the Portfolio.

This information statement relates to the approval by the Board of a new subadvisory agreement for the Portfolio. At an in-person meeting of the Board held on January 23-24, 2020 (the Meeting), the Board, including a majority of the Trustees who are not parties to the new subadvisory agreement, and who are not interested persons of those parties, as defined in the 1940 Act (the Independent Trustees), approved a new subadvisory agreement with BlackRock Financial Management, Inc. (BlackRock Financial), BlackRock International Limited (BlackRock International) and BlackRock (Singapore) Limited (BlackRock Singapore), to subadvise the Portfolio (the New Subadvisory Agreement). Prior to May 18, 2020, BlackRock Financial, an affiliate of BlackRock International and BlackRock Singapore, served as the sole subadviser to the Portfolio pursuant to a separate subadvisory agreement (the BlackRock Subadvisory Agreement). The New Subadvisory Agreement relates to the appointments of BlackRock Financial, BlackRock International and BlackRock Singapore, to serve together as subadvisers to the Portfolio. The New Subadvisory Agreement became effective on May 18, 2020.

The investment objective of the Portfolio has not changed. The investment management agreement between the Manager and the Trust (the Management Agreement) relating to the Portfolio has not been, and will not be, changed as a result of the New Subadvisory Agreement. The Management Agreement was last approved by the Trustees, including a majority of the Independent Trustees, at the June 2020 Board meetings.

The Manager or its affiliates will pay for the costs associated with preparing and distributing this information statement to the shareholders of the Portfolio. A Notice of Internet Availability for this information statement will be mailed on or about

June 19, 2020 to shareholders investing in the Portfolio as of May 18, 2020.

THIS IS NOT A PROXY STATEMENT.

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

NEW SUBADVISORY AGREEMENT

Approval of the New Subadvisory Agreement

As required by the 1940 Act, the Board considered the New Subadvisory Agreement among the Manager and each of BlackRock Financial, BlackRock International and BlackRock Singapore, for the Portfolio. The New Subadvisory Agreement relates to the addition of BlackRock International and BlackRock Singapore as subadvisers to the Portfolio alongside BlackRock Financial, previously the Portfolio's sole subadviser. The Board, including all of the Independent Trustees, met at the Meeting, and approved the New Subadvisory Agreement for an initial two-year period, after concluding that such approval was in the best interests of the Portfolio and its beneficial shareholders.

In advance of the Meeting, the Board requested and received materials relating to the New Subadvisory Agreement and had the opportunity to ask questions and request further information in connection with its consideration.

Before approving the New Subadvisory Agreement, the Board, including all of the Independent Trustees, with advice from independent legal counsel, considered the factors it deemed relevant, including the nature, quality and extent of services to be provided to the Portfolio by BlackRock Financial, BlackRock International and BlackRock Singapore (collectively, BlackRock); the fees paid by the Manager to BlackRock Financial, and the arrangement whereby BlackRock Financial will allocate a portion of such fees to BlackRock International and BlackRock Singapore; and other benefits to BlackRock. In connection with its deliberations, the Board considered information provided by the Manager and BlackRock at, or in advance of, the Meeting. In its deliberations, the Board did not identify any single factor that, alone, was responsible for the Board's decision to approve the New Subadvisory Agreement.

The Board determined that the overall arrangements between the Manager and BlackRock were appropriate in light of the services to be performed and the fees to be charged under the New Subadvisory Agreement, and such other matters as the Board considered relevant in the exercise of its business judgment.

The material factors and conclusions that formed the basis for the Board's approval of the New Subadvisory Agreement are separately discussed below.

Nature, Quality and Extent of Services

The Board received and considered information regarding the nature and extent of services provided to the Portfolio by BlackRock Financial under the BlackRock Subadvisory Agreement, and those that would be provided by each of BlackRock Financial, BlackRock International and BlackRock Singapore under the New Subadvisory Agreement, as proposed. The Board noted that the nature and extent of services provided under the BlackRock Subadvisory Agreement, and those that would be provided under the New Subadvisory Agreement, were generally similar in that each of BlackRock Financial, BlackRock International and BlackRock Singapore would be required to provide day-to-day portfolio management services to the Portfolio, and to comply with all Portfolio policies, and applicable rules and regulations.

With respect to quality of services, the Board considered, among other things, the background and experience of the BlackRock Financial portfolio managers who would be responsible for the Portfolio, noting that the same portfolio managers would continue to oversee the Portfolio's day-to-day operations. The Board was also provided information pertaining to the organizational structure, senior management and investment operations of BlackRock Financial, BlackRock International and BlackRock Singapore, among other relevant information. The Board noted that it had also received favorable compliance reports regarding BlackRock from AST's Chief Compliance Officer. The Board also noted that BlackRock provides subadvisory services to other AST portfolios.

The Board concluded that, based on the nature of the proposed services to be rendered, the background information it had reviewed regarding BlackRock, and its prior experience with BlackRock with regard to other AST portfolios, it was reasonable to expect that the Board would be satisfied with the nature, extent and quality of investment subadvisory services to be provided to the Portfolio by BlackRock.

Performance

The Board noted that the engagement of BlackRock International and BlackRock Singapore was new and that there was no performance information to be reviewed. The Board further noted that it had reviewed the performance information of BlackRock Financial with respect to the Portfolio as part of the 2019 contract renewal process and had been satisfied with BlackRock Financial's performance at that time. The Board noted that it would have an opportunity to review the performance of BlackRock in connection with future contract renewals.

Subadvisory Fee Rates

The Board considered the proposed contractual and effective subadvisory fee rates payable by the Manager to BlackRock Financial under the New Subadvisory Agreement for the Portfolio, and the proposed fee arrangement among BlackRock Financial, BlackRock International and BlackRock Singapore under the New Subadvisory Agreement. The Board noted that there were no proposed changes to either the management fee paid to the Manager by the Portfolio or to the subadvisory fees paid by the Manager to BlackRock Financial. The Board noted, rather, that BlackRock Financial would be responsible for allocating a portion of the fees it receives from the Manager to BlackRock International and BlackRock Singapore.

Profitability

Because the engagement of BlackRock International and BlackRock Singapore with respect to the Portfolio is new, the Board noted that there was no historical profitability information with respect to the new subadvisory arrangements for the Portfolio. The Board noted that it would consider profitability information as part of future annual reviews of advisory agreements.

Economies of Scale

The Board noted that the proposed subadvisory fee schedule under the New Subadvisory Agreement contained breakpoints that reduce the fee rates on assets above specified levels. Because there will be no increase in the fees and expenses of the Portfolio or change in the fees paid by the Portfolio to the Manager or by the Manager to BlackRock Financial, the Board did not consider this factor. The Board noted that it would consider economies of scale in connection with future annual reviews of the New Subadvisory Agreement.

Other Benefits to BlackRock

The Board considered potential "fall-out" or ancillary benefits anticipated to be received by BlackRock, and its respective affiliates, in connection with the Portfolio. The Board concluded that any potential benefits to be derived by BlackRock were consistent with those generally derived by other subadvisers to other AST portfolios. The Board also concluded that any potential benefits to be derived by BlackRock were similar to the benefits derived by it in connection with its management of other AST portfolios, which are reviewed on an annual basis, and which were considered at the June 2019 Board meeting in connection with the renewal of the advisory agreements for the other AST portfolios for which BlackRock provides subadvisory services.

The Board also concluded that any potential benefits to be derived by BlackRock Financial, BlackRock International and BlackRock Singapore included potential access to additional research resources, larger assets under management and reputational benefits, which were consistent with those generally derived by subadvisers to mutual funds. The Board noted that it would review ancillary benefits in connection with future annual reviews of the New Subadvisory Agreement.

***

After full consideration of these factors, the Board concluded that approving the New Subadvisory Agreement was in the best interests of the Portfolio and its beneficial shareholders.

The New Subadvisory Agreement is attached as Exhibit A.

Information about BlackRock Financial, BlackRock International and BlackRock Singapore

BlackRock Financial is a wholly owned subsidiary of BlackRock, Inc. BlackRock Financial is a registered investment adviser and a commodity pool operator organized in New York. BlackRock Financial is located at 55 East 52nd Street, New York, New York 10055. As of March 31, 2020, BlackRock, which includes BlackRock Financial, had $6.47 trillion in assets under management.

Additional information about BlackRock Financial is attached as Exhibit B.

BlackRock International is a wholly owned subsidiary of BlackRock, Inc. BlackRock International is a registered investment advisor and a commodity pool operator organized in Edinburgh. BlackRock International is located at Exchange Place One, 1 Semple Street, Edinburgh, United Kingdom, EH3 8BL. As of March 31, 2020, BlackRock, which includes BlackRock International, had $6.47 trillion in assets under management.

Additional information about BlackRock International is attached as Exhibit C.

BlackRock Singapore is a wholly owned subsidiary of BlackRock, Inc. BlackRock Singapore is a registered investment adviser and a commodity pool operator. BlackRock Singapore is located at #18-01, Twenty Anson, 20 Anson Road, Singapore, Singapore, 079912. As of March 31, 2020, BlackRock, which includes BlackRock Singapore, had $6.47 trillion in assets under management.

Additional information about BlackRock Singapore is attached as Exhibit D.

Terms of the New Subadvisory Agreement

The material terms of the New Subadvisory Agreement are substantially similar to the material terms of the BlackRock Subadvisory Agreement. Pursuant to the BlackRock Subadvisory Agreement, the Manager has allocated management of all or a portion of the Portfolio's assets to BlackRock Financial. Under the New Subadvisory Agreement, BlackRock International and BlackRock Singapore are also authorized to act on behalf of the Portfolio. BlackRock Financial is compensated by the Manager

(and not the Portfolio) based on the amount of assets of the Portfolio it manages, and BlackRock Financial will allocate a portion of such compensation to BlackRock International and BlackRock Singapore.

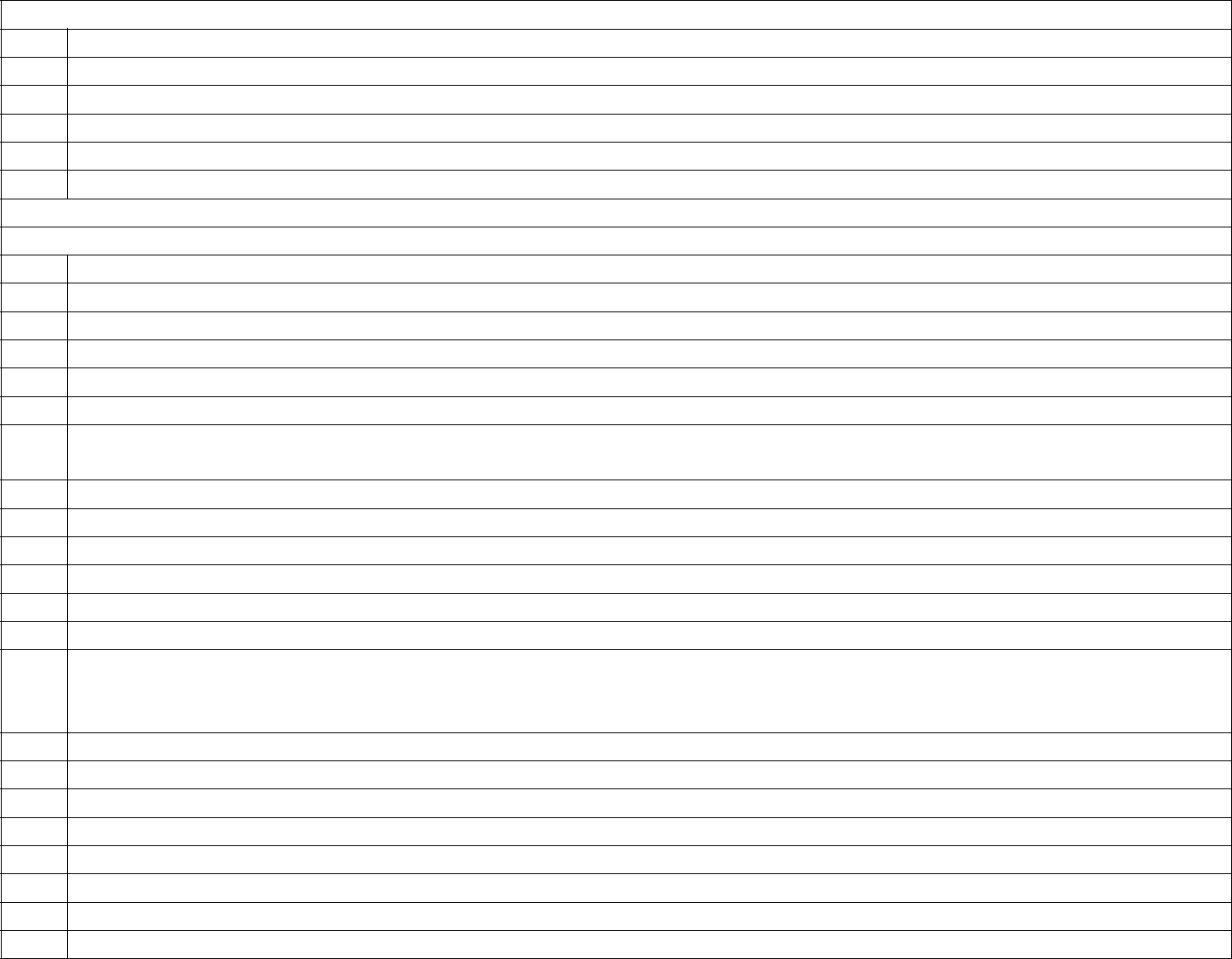

The subadvisory fee rates under the BlackRock Subadvisory Agreement, the subadvisory fee rates under the New Subadvisory Agreement, and the subadvisory fees paid to BlackRock Financial for the fiscal year ended December 31, 2019, are set forth below:

| | Subadvisory Fees Paid for the |

Previous Subadvisory Fee Rates* | New Subadvisory Fee Rates*,** | Fiscal Year Ended |

| | December 31, 2019 |

BlackRock Financial | BlackRock Financial; BlackRock | $906,447 |

0.20% of average daily net assets to $250 | International; BlackRock Singapore | |

million; | 0.20% of average daily net assets to $250 | |

0.15% of average daily net assets over | million; | |

$250 million | 0.15% of average daily net assets over | |

| $250 million | |

*In the event BlackRock invests Portfolio assets in other pooled investment vehicles it manages or subadvises, BlackRock will waive its subadvisory fee for the Portfolio in an amount equal to the acquired fund fee paid to BlackRock with respect to the Portfolio assets invested in such acquired fund. Notwithstanding the foregoing, the subadvisory fee waivers will not exceed 100% of the subadvisory fee.

**For purposes of calculating the subadvisory fee, the assets managed by BlackRock International and BlackRock Singapore in the Portfolio will be aggregated with the assets managed by BlackRock Financial in the Portfolio. The subadvisory fee will be paid to BlackRock Financial.

The New Subadvisory Agreement provides, as does the BlackRock Subadvisory Agreement, that subject to the supervision of the Manager and the Board, each of BlackRock Financial, BlackRock International and BlackRock Singapore, respectively, are responsible for managing the investment operations of the assets of the Portfolio and for making investment decisions and placing orders to purchase and sell securities for the Portfolio, all in accordance with the investment objective and policies of the Portfolio, as reflected in its current prospectus and statement of additional information, and as may be adopted from time to time by the Board. In accordance with the requirements of the 1940 Act, BlackRock Financial, BlackRock International and BlackRock Singapore, will each maintain all books and records required to be maintained by an investment adviser and will render to the Board such periodic and special reports, as the Board may reasonably request.

The New Subadvisory Agreement will remain in full force and effect for a period of two years from the date of its execution and will continue thereafter, as long as its continuance is specifically approved at least annually by vote of a majority of the outstanding voting securities (as that term is defined in the 1940 Act) of the Portfolio, or by the Board, including the approval by a majority of the Independent Trustees, at a meeting called for the purpose of voting on such approval; provided, however, that

(i)the New Subadvisory Agreement may be terminated at any time without the payment of any penalty, either by vote of the Board or by vote of a majority of the outstanding voting securities of the Portfolio, (ii) the New Subadvisory Agreement will terminate automatically in the event of its assignment (within the meaning of the 1940 Act) or upon the termination of the Trust's Management Agreement with the Manager, and (iii) the New Subadvisory Agreement may be terminated at any time by BlackRock or by the Manager on not more than 60 days', nor less than 30 days', written notice to the other party to the New Subadvisory Agreement.

The New Subadvisory Agreement provides that, in the absence of willful misfeasance, bad faith, gross negligence in the performance of their duties, or reckless disregard of their obligations and duties thereunder, none of BlackRock Financial, BlackRock International or BlackRock Singapore, respectively, will be liable for any act or omission in connection with their activities as subadvisers to the Portfolio.

MANAGEMENT AND ADVISORY ARRANGEMENTS

The Manager

The Trust is managed by PGIM Investments, 655 Broad Street, 17th Floor, Newark, NJ 07102 and ASTIS, One Corporate Drive, Shelton, Connecticut 06484.

As of March 31, 2020, PGIM Investments served as investment manager to all of the Prudential US and offshore open-end investment companies, and as administrator to closed-end investment companies, with aggregate assets of approximately $269.7 billion. PGIM Investments is a wholly-owned subsidiary of PIFM Holdco, LLC, which is a wholly-owned subsidiary of PGIM Holding Company LLC, which is a wholly-owned subsidiary of Prudential Financial, Inc. (Prudential). PGIM Investments has been in the business of providing advisory services since 1996.

As of March 31, 2020, ASTIS served as investment manager to certain Prudential US and off-shore open-end investment companies with aggregate assets of approximately $140.1 billion. ASTIS is a subsidiary of Prudential Annuities Holding Company, Inc., which is a subsidiary of Prudential Annuities, Inc., a subsidiary of Prudential. ASTIS has been in the business of providing advisory services since 1992.

Terms of the Management Agreement

Services Provided by the Manager. Pursuant to the Management Agreement with the Trust, the Manager, subject to the supervision of the Trust's Board and in conformity with the stated policies of the Portfolio, manages both the investment operations and composition of the Portfolio, including the purchase, retention, disposition and loan of securities and other assets. In connection therewith, the Manager is obligated to keep certain books and records of the Portfolio. The Manager is authorized to enter into subadvisory agreements for investment advisory services in connection with the management of the Portfolio. The Manager continues to have the ultimate responsibility for all investment advisory services performed pursuant to any such subadvisory agreement.

The Manager is specifically responsible for overseeing and managing the Portfolio and the subadvisors. In this capacity, the Manager reviews the performance of the Portfolio and BlackRock and makes recommendations to the Board with respect to the retention of investment subadvisers, the renewal of contracts, and the reorganization and merger of portfolios, and other legal and compliance matters. The Manager takes on the entrepreneurial and other risks associated with the launch of each new portfolio and its ongoing operations. The Manager utilizes the Strategic Investment Research Group (SIRG), a unit of PGIM Investments, to assist the Manager in regularly evaluating and supervising the Portfolio and BlackRock, including with respect to investment performance. SIRG is a centralized research department of PGIM Investments that is comprised of a group of highly experienced analysts. SIRG utilizes proprietary processes to analyze large quantities of industry data, both on a qualitative and quantitative level, in order to effectively oversee the Portfolio and BlackRock. The Manager utilizes this data in directly supervising the Portfolio and BlackRock. SIRG provides reports to the Board and presents to the Board at special and regularly scheduled Board meetings. The Manager bears the cost of the oversight program maintained by SIRG.

In addition, the Manager generally provides or supervises all of the administrative functions necessary for the organization, operation and management of the Trust and its portfolios. The Manager administers the Trust's corporate affairs and, in connection therewith, furnishes the Trust with office facilities, together with those ordinary clerical and bookkeeping services, which are not being furnished by the Trust's custodian or transfer agent. The Manager is also responsible for the staffing and management of dedicated groups of legal, marketing, compliance and related personnel necessary for the operation of the Trust. The legal, marketing, compliance and related personnel are also responsible for the management and oversight of the various service providers to the Trust, including, but not limited to, the custodian, transfer agent, and accounting agent. The management services of the Manager to the Trust are not exclusive under the terms of the Management Agreement, and the Manager is free to, and does, render management services to others.

The primary administrative services furnished by the Manager are more specifically detailed below:

•furnishing of office facilities;

•paying salaries of all officers and other employees of the Manager who are responsible for managing the Trust and the Portfolio;

•monitoring financial and shareholder accounting services provided by the Trust's custodian and transfer agent;

•providing assistance to the service providers of the Trust and the Portfolio, including, but not limited to, the custodian, transfer agent, and accounting agent;

•monitoring, together with BlackRock, the Portfolio's compliance with its investment policies, restrictions, and with federal and state laws and regulations, including federal and state securities laws, the Internal Revenue Code and other relevant federal and state laws and regulations;

•preparing and filing all required federal, state and local tax returns for the Trust and the Portfolio;

•preparing and filing with the SEC on Form N-CSR the Trust's annual and semi-annual reports to shareholders, including supervising financial printers who provide related support services;

•preparing and filing with the SEC required monthly reports of portfolio holdings on Form N-PORT;

•preparing and filing the Trust's registration statement with the SEC on Form N-1A, as well as preparing and filing with the SEC supplements and other documents, as applicable;

•preparing compliance, operations and other reports required to be received by the Trust's Board and/or its committees in support of the Board's oversight of the Trust; and

•organizing regular and any special meetings of the Board of the Trust, including preparing Board materials and agendas, preparing minutes, and related functions.

Expenses Borne by the Manager. In connection with its management of the corporate affairs of the Trust, the Manager bears certain expenses, including, but not limited to:

•the salaries and expenses of all of its and the Trust's personnel, except the fees and expenses of Trustees who are not affiliated persons of the Manager or BlackRock;

•all expenses incurred by the Manager or the Trust in connection with managing the ordinary course of a Trust's business, other than those assumed by the Trust, as described below;

•the fees, costs and expenses payable to BlackRock Financial, pursuant to the New Subadvisory Agreement; and

•with respect to the compliance services provided by the Manager, the cost of the Trust's Chief Compliance Officer, the Trust's Deputy Chief Compliance Officer, and all personnel who provide compliance services for the Trust, and all of the other costs associated with the Trust's compliance program, which includes the management and operation of the compliance program responsible for compliance oversight of the Portfolio and BlackRock.

Expenses Borne by the Trust. Under the terms of the Management Agreement, the Trust is responsible for the payment of Trust expenses not paid by the Manager, including:

•the fees and expenses incurred by the Trust in connection with the management of the investment and reinvestment of the Trust's assets payable to the Manager;

•the fees and expenses of Trustees who are not affiliated persons of the Manager or BlackRock;

•the fees and certain expenses of the custodian and transfer and dividend disbursing agent, including the cost of providing records to the Manager in connection with its obligation of maintaining required records of the Trust and of pricing the Trust's shares;

•the charges and expenses of the Trust's legal counsel and independent auditors;

•brokerage commissions and any issue or transfer taxes chargeable to the Trust in connection with its securities (and futures, if applicable) transactions;

•all taxes and corporate fees payable by the Trust to governmental agencies;

•the fees of any trade associations of which the Trust may be a member;

•the cost of share certificates representing and/or non-negotiable share deposit receipts evidencing shares of the Trust;

•the cost of fidelity, directors and officers, and errors and omissions insurance;

•the fees and expenses involved in registering and maintaining registration of the Trust and of its shares with the SEC and paying notice filing fees under state securities laws, including the preparation and printing of the Trust's registration statements and prospectuses for such purposes;

•allocable communications expenses with respect to investor services, and all expenses of shareholders' and Trustees' meetings and of preparing, printing and mailing reports and notices to shareholders; and

•litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the Trust's business and distribution and service (12b-1) fees.

Terms of the Management Agreement. The Management Agreement provides that the Manager will not be liable for any error of judgment by the Manager or for any loss suffered by the Trust in connection with the matters to which the Management Agreement relates, except a loss resulting from a breach of fiduciary duty with respect to the receipt of compensation for services (in which case, any award of damages shall be limited to the period and the amount set forth in Section 36(b)(3) of the 1940 Act) or loss resulting from willful misfeasance, bad faith or gross negligence or reckless disregard of duties. The Management Agreement provides that it will terminate automatically, if assigned (as defined in the 1940 Act), and that it may be terminated without penalty by either the Manager or the Trust by a vote of the Board or of a majority of the outstanding voting securities of the Trust (as defined in the 1940 Act) upon not more than 60 days', nor less than 30 days', written notice. The Management Agreement will continue in effect for a period of more than two years from the date of execution, only so long as such continuance is specifically approved at least annually in accordance with the requirements of the 1940 Act.

The table below sets forth the applicable contractual management fee rates and the management fees received by the Manager during the most recently completed fiscal year.

| | Aggregate |

| | Investment |

Portfolio | Investment Management Fee Rate* | Management Fees |

| | for the most recently |

| | completed fiscal year |

AST BlackRock Low Duration | 0.4825% of average daily net assets to $300 million; | $2,192,510 |

Bond Portfolio | 0.4725% on next $200 million of average daily net assets; | |

| 0.4625% on next $250 million of average daily net assets; | |

| 0.4525% on next $2.5 billion of average daily net assets; | |

| 0.4425% on next $2.75 billion of average daily net assets; | |

| 0.4125% on next $4 billion of average daily net assets; | |

| 0.3925% over $10 billion of average daily net assets | |

*The Manager has contractually agreed to waive 0.057% of its investment management fee through June 30, 2021. This arrangement may not be terminated or modified prior to June 30, 2021 without the prior approval of the Trust's Board of Trustees.

Directors and Officers of PGIM Investments and ASTIS

Set forth below is the name, title and principal occupation of the principal executive officer of PGIM Investments. There are no directors of PGIM Investments. The address of the principal executive officer of PGIM Investments is 655 Broad Street, 17th Floor, Newark, New Jersey 07102. None of the officers or directors of PGIM Investments are also officers or directors of BlackRock International or BlackRock Singapore.

Name | Position with PGIM Investments | Principal Occupations |

| | |

Stuart S. Parker | Chief Executive Officer, Chief | President of PGIM Investments LLC (since |

| Operating Officer, Officer-in-Charge, | January 2012); Executive Vice President of |

| President | Prudential Investment Management Services |

| | LLC (since December 2012); formerly Executive |

| | Vice President of Jennison Associates, LLC and |

| | Head of Retail Distribution of PGIM |

| | Investments LLC (June 2005-December 2011). |

Set forth below are the names, titles and principal occupations of the principal executive officer and the directors of ASTIS. Unless otherwise indicated, the address of each individual is One Corporate Drive, Shelton, Connecticut 06484. None of the officers or directors of ASTIS are also officers or directors of BlackRock International or BlackRock Singapore.

Name | Position with ASTIS | Principal Occupations |

| | |

Scott E. Benjamin* | Director and Executive Vice President | Executive Vice President (since May 2009) of |

| | PGIM Investments LLC; Executive Vice |

| | President (June 2009-June 2012) and Vice |

| | President (since June 2012) of Prudential |

| | Investment Management Services LLC; |

| | Executive Vice President (since September |

| | 2009) of AST Investment Services, Inc.; Senior |

| | Vice President of Product Development and |

| | Marketing, PGIM Investments (since February |

| | 2006); Executive Vice President (since June |

| | 2019) of Prudential Trust Company; formerly |

| | Vice President of Product Development and |

| | Product Management, PGIM Investments LLC |

| | (2003-2006). |

Timothy S. Cronin | Director, President, Chief Executive | President, Chief Executive Officer, Chief |

| Officer, Chief Operating Officer, | Operating Officer, Officer-In-Charge (since |

| Officer-in-Charge | March 2006), Director (since June 2005) of AST |

| | Investment Services, Inc.; Senior Vice President |

| | of PGIM Investments LLC (since May 2009); |

| | Vice President (since July 2006) of Pruco Life |

| | Insurance Company and Pruco Life Insurance |

| | Company of New Jersey; Senior Vice president |

| | (since May 2006) of Prudential Annuities Life |

| | Assurance Corporation; Vice President of |

| | Prudential Annuities, Inc. (since May 2003). |

Dylan J. Tyson | Director and Executive Vice President | Director, President, and Chief Executive Officer |

| | (since December 2019) of Pruco Life Insurance |

| | Company, Pruco Life Insurance Company of |

| | New Jersey, Prudential Annuities Holding |

| | Company, Inc., Prudential Annuities Information |

| | Services & Technology Corporation, Prudential |

| | Annuities Life Assurance Corporation, |

| | Prudential Annuities, Inc. and Prudential Life |

| | Insurance Company of Taiwan Inc.; Senior Vice |

| | President, Annuities (since December 2019) of |

| | Prudential Financial, Inc. and The Prudential |

| | Insurance Company of America |

* Mr. Benjamin's principal address is 655 Broad Street, 17th Floor, Newark, NJ 07102.

Set forth below is a list of the officers of the Trust who are also officers or directors of PGIM Investments and/or ASTIS.*

Name | Position with Trust | Position with PGIM Investments | Position with ASTIS |

| | | |

Timothy S. Cronin | President | Senior Vice President | Director, President, |

| | | Chief Executive |

| | | Officer, Chief |

| | | Operating Officer, |

| | | Officer-in-Charge |

Ken Allen | Vice President | Vice President | Vice President |

Claudia DiGiacomo | Chief Legal Officer and | Assistant Secretary and Vice President | N/A |

| Assistant Secretary | | |

Andrew R. French | Secretary | Assistant Secretary and Vice President | N/A |

Jonathan D. Shain | Assistant Secretary | Assistant Secretary and Vice President | N/A |

Dino Capasso | Chief Compliance Officer | Chief Compliance Officer and Vice | Chief Compliance |

| | President | Officer |

Christian J. Kelly | Treasurer & Principal | Assistant Treasurer and Vice President | Vice President |

| Financial and Accounting | | |

| Officer | | |

* Includes Mr. Cronin, who also serves as an interested trustee of the Trust.

Custodian

The Bank of New York Mellon, 240 Greenwich Street, New York, New York 10007, serves as custodian for the Trust's portfolio securities and cash, and, in that capacity, maintains certain financial accounting books and records pursuant to an agreement with the Trust. Subcustodians provide custodial services for any foreign assets held outside the United States.

Transfer Agent and Shareholder Servicing Agent

Prudential Mutual Fund Services LLC (PMFS), 655 Broad Street, 17th Floor, Newark, New Jersey 07102, serves as the transfer and dividend disbursing agent of the Portfolio. PMFS is an affiliate of PGIM Investments. PMFS provides customary transfer agency services to the Portfolio, including the handling of shareholder communications, the processing of shareholder transactions, the maintenance of shareholder account records, the payment of dividends and distributions and related functions. For these services, PMFS receives compensation from the Trust and is reimbursed for its transfer agent expenses, which include an annual fee per shareholder account, a monthly inactive account fee per shareholder account and its out-of-pocket expenses; including, but not limited to, postage, stationery, printing, allocable communication expenses and other costs.

BNY Mellon Asset Servicing (US) Inc. (BNYAS) serves as sub-transfer agent to the Trust. PMFS has contracted with BNYAS, 301 Bellevue Parkway, Wilmington, DE 19809, to provide certain administrative functions to PMFS, the Portfolio's transfer agent. PMFS will compensate BNYAS for such services.

Distribution

Prudential Annuities Distributors, Inc. (PAD) serves as the distributor for the shares of the Portfolio. Each class of shares is offered and redeemed at its net asset value without any sales load. PAD is an affiliate of PGIM Investments. PAD is registered as a broker-dealer under the Securities Exchange Act of 1934, as amended, and is a member of the Financial Industry Regulatory Authority (FINRA).

Under the distribution agreement, the Portfolio is currently subject to an annual distribution or "12b-1" fee of 0.25% of the average daily net assets of the Portfolio. For the most recently completed fiscal year, the Portfolio incurred the following amount of fees for services provided by PAD:

Portfolio | Amount Paid |

AST BlackRock Low Duration Bond Portfolio | $1,302,411 |

Brokerage

For the most recently completed fiscal year, the Portfolio paid the following in brokerage commissions to affiliated and non- affiliated broker-dealers:

Portfolio | Amount Paid |

AST BlackRock Low Duration Bond Portfolio | $36,986 |

Shareholder Communication Costs

The Manager or its affiliates will pay for the costs associated with preparing and distributing this information statement. The Portfolio pays a fee under a Rule 12b-1 plan covering a variety of services, including paying the printing and mailing costs of information statements.

Shareholder Proposals

The Trust, as a Massachusetts business trust, is not required to hold annual meetings of shareholders, and the Trustees do not intend to hold such meetings unless shareholder action is required in accordance with the 1940 Act or the Trust's Declaration of Trust. A shareholder proposal intended to be presented at any meeting of shareholders of the Trust must be received by the Trust at a reasonable time before the Trustees' solicitation relating thereto is made in order to be included in the Trust's proxy statement and form of proxy relating to that meeting and presented at the meeting. The mere submission of a proposal by a shareholder does not guarantee that the proposal will be included in the proxy statement because certain rules under the federal securities laws must be complied with before inclusion of the proposal is required.

Annual and Semi-Annual Reports

The Trust's annual reports, semi-annual reports and information statements are sent to shareholders. Only one copy of a report or information statement, as applicable, may be delivered to multiple shareholders sharing an address unless the Trust receives contrary instructions from one or more of the shareholders. A copy of the Trust's most recent annual report, semi-annual report or information statement may be obtained without charge by writing the Trust at 655 Broad Street, 17th Floor, Newark, New Jersey 07102 or by calling (800) 778-2255 (toll free).

Shareholder Information

Information on share ownership of the Portfolio is set forth in Exhibit E to this information statement.

Andrew R. French

Secretary

Dated: June 17, 2020

EXHIBIT A

ADVANCED SERIES TRUST

AST BlackRock Low Duration Bond Portfolio

SUBADVISORY AGREEMENT

Agreement made as of this 18th day of May 2020 between PGIM Investments LLC (PGIM Investments), a New York limited liability company and AST Investment Services, Inc. (ASTIS), a Maryland corporation (together, the Co-Managers), and each of BlackRock Financial Management, Inc. (BlackRock Financial), a Delaware corporation, BlackRock International Limited (BlackRock International), a corporation organized under the laws of Scotland with registered number SC160821, BlackRock (Singapore) Limited (BlackRock Singapore), a company incorporated under the laws of Singapore (collectively, BlackRock or the Subadvisers),

WHEREAS, the Co-Managers have entered into a Management Agreement (the Management Agreement) dated May 1, 2003, with Advanced Series Trust (formerly American Skandia Trust), a Massachusetts business trust (the Trust) and a diversified, open-end management investment company registered under the Investment Company Act of 1940, as amended (the 1940 Act), pursuant to which PGIM Investments and ASTIS act as Co-Managers of the Trust; and

WHEREAS, the Co-Managers, acting pursuant to the Management Agreement, desire to retain the Subadviser to provide investment advisory services to the Trust and one or more of its series as specified in Schedule A hereto (individually and collectively, with the Trust, referred to herein as the Trust) and to manage such portion of the Trust as the Co-Managers shall from time to time direct, and the Subadviser is willing to render such investment advisory services; and

WHEREAS, BlackRock International is authorized and regulated in the United Kingdom by the Financial Conduct Authority and BlackRock Singapore is a company incorporated under the laws of Singapore and licensed by the Monetary Authority of Singapore. BlackRock Financial, BlackRock International and BlackRock Singapore are each registered with the Securities and Exchange Commission (the Commission) as an investment adviser under the Investment Advisers Act of 1940, as amended (the Advisers Act).

Based on the information supplied by the Co-Managers, BlackRock International has categorized the Co-Managers and the Trust as Professional Clients. By accepting the provision of investment management services, the Co-Managers acknowledge and accept this categorization. The Co-Managers and the Trust have the right to request a different categorization at any time from BlackRock International, however, BlackRock International only provides services to Professional Clients and will no longer be able to provide services to the Co-Manager and the Trust in the event of a request for change of categorization.

References in the Subadvisory Agreement to the "Supplemental Disclosures" means the document of that title provided to potential clients of BlackRock International and its delegates prior to investment that contains BlackRock International's disclosures, as amended and notified to the Co-Managers from time to time.

This Subadvisory Agreement supersedes all previous subadvisory agreements between BlackRock and the Co-Managers with respect to the AST BlackRock Low Duration Bond Portfolio.

NOW, THEREFORE, the Parties agree as follows:

1.(a) Subject to the supervision of the Co-Managers and the Board of Trustees of the Trust, the Subadvisers shall manage such portion of the Trust's portfolio as delegated to the Subadvisers by the Co-Managers, including the purchase, retention and disposition of securities, exchange traded funds, repurchase and reverse repurchase agreements, derivatives contracts, options, futures contracts, options on futures contracts, and swap agreements and other financial instruments, all in accordance with the Trust's investment objectives, policies and restrictions as stated in its then current prospectus and statement of additional information (such Prospectus and Statement of Additional Information as currently in effect and as amended or supplemented from time to time and previously provided to the Subadvisers, being herein called the "Prospectus"). The Co-Managers hereby authorize the Subadviser , as agent on behalf of the Trust, to negotiate, enter into, amend, and perform any and all obligations and exercise any and all rights under: (x) any affirmation platform and middleware provider agreements, trading platform and exchange agreements, clearinghouse agreements or similar types of agreements,: (y) brokerage agreements and other documents to establish, operate and conduct all brokerage or other trading accounts and (z) International Swaps and Derivatives Association, Inc. ("ISDA") Master Agreements, including any schedules and annexes to such agreements, releases, consents, elections and confirmations, limited partnership agreements, repurchase agreements, and such agreements and other documentation as may be required for the purchase or sale, assignment, transfer, and ownership of any permitted investment; provided, however, that upon request the Subadviser will supply the Co-Managers with copies of any ISDA Master Agreements and the related schedules and annexes. The Co-Managers acknowledge and understand that the Trust and the Co-Managers, as applicable, will be bound by any such trading accounts established, and agreements and other documentation executed, by the Subadviser for such investment purposes as permitted hereunder. The Subadviser is permitted to open and maintain brokerage or other trading accounts in the name of the Trust, and complete all such account opening forms and agreements and provide relevant "know your customer" and other information regarding the Trust. The assets the Trust has provided to BlackRock for management may be

A-1

transferred by BlackRock as collateral or margin free and clear of any lien, pledge, claim, charge or encumbrance granted directly by the Trust, consistent with the Prospectus and applicable law. The Subadviser's management of such portion of the Trust's portfolio as delegated to the Subadviser by the Co-Managers shall be subject to the following additional understandings:

(i)The Subadvisers shall provide investment advisory services to such portion of the Trust's investments as the Co-Managers shall direct, and shall determine from time to time what investments and securities will be purchased, retained, sold or loaned by the Trust, and what portion of the assets will be invested or held uninvested as cash. The Subadvisers may delegate the performance of services and functions under this Agreement to an "affiliated person" (as defined in the 1940 Act), including foreign affiliates, of the Subadvisers so long as: (v) such delegation and the resulting performance of services and functions hereunder by any such "affiliated person" is not prohibited by, or inconsistent with the requirements of, applicable law, including the 1940 Act; (w) such delegation and the resulting performance of services and functions hereunder by any such "affiliated person" is not deemed to be advisory services under this Agreement; (x) BlackRock retains ultimate discretionary authority over any portfolio management services provided by any such "affiliated person"; (y) BlackRock exercises appropriate oversight of the performance of services and functions hereunder by any such "affiliated person"; and (z) BlackRock does not pay any portion of the subadvisory fee received from the Co-Managers hereunder to such "affiliated person". Notwithstanding anything herein to the contrary, the Subadvisers' liability to the Co-Managers under this Agreement shall not be affected in any way whatsoever by any delegation of services by the Subadvisers to any "affiliated person" of the Subadviser. In addition, notwithstanding any other provision of the Agreement, the Subadvisers: (xx) may provide information about the Co-Managers and the Trust to any "affiliated person" of the Subadvisers to which the performance of services and functions has been delegated hereunder; (yy) will act in good faith and with due diligence in the selection, use, and monitoring of any "affiliated person" of the Subadvisers to which the performance of services and functions has been delegated hereunder; and (zz) shall ensure that any "affiliated person" of the Subadvisers to which the performance of services and functions has been delegated hereunder is subject to confidentiality and non-disclosure obligations that are substantially similar to the confidentiality and non-disclosure obligations to which the Subadvisers are subject with respect to the Trust.

(ii)In the performance of its duties and obligations under this Agreement, each Subadviser shall act in conformity with the copies of the Amended and Restated Declaration of Trust of the Trust, the By-laws of the Trust and the Prospectus of the Trust, each as provided to the Subadvisers by the Co-Managers (the Trust Documents) and with the reasonable written instructions and directions of the Co- Managers and of the Board of Trustees of the Trust, co-operate with the Co-Managers' (or its designees') personnel responsible for monitoring the Trust's compliance and will conform to, and comply with, the requirements of the 1940 Act, the Commodity Exchange Act of 1936, as amended (the CEA), the Internal Revenue Code of 1986, as amended, each as applicable, and all other applicable federal and state laws and regulations, provided that compliance with the Code shall be solely with respect to the assets of the Trust under management of the Subadvisers and based solely upon information provided by the Trust's administrator, custodian and other service providers. In connection therewith, the Subadvisers shall provide reasonable assistance to the Co-Managers in preparing and filing such reports as are, or may in the future be, required by the Commission. For the avoidance of doubt, the Subadvisers are not responsible for preparing or filing any reports on behalf of the Co-Managers or the Trust.

The Co-Managers shall supply the Subadvisers in advance with written copies of such policies and procedures of the Trust applicable to each Subadviser's performance of its duties and obligations in managing the Trust's portfolio (or allocated portion thereof, as applicable), as well as any amendments, supplements or modifications thereto within a reasonable time before they become effective. The Co-Managers agree that the Subadviser shall not be responsible for compliance with the policies and procedures of the Trust not provided to the Subadviser, or not agreed upon in writing by the Subadviser, in advance in accordance with this paragraph.

(iii)In effecting transactions for the Trust, BlackRock International will act in the Trust's best interests and comply with any applicable obligations regarding best execution under the Financial Conduct Authority Rules (the "FCA Rules"). The Co-Managers confirm that they have been provided with a copy of the Supplemental Disclosures, as amended and notified to the Co-Managers from time to time, which includes information on BlackRock International's order execution policy (the "Order Execution Policy"). The Co-Managers confirm that they have read and understood, and agree to, the Order Execution Policy. In particular, the Co-Managers consent to (i) BlackRock International trading through brokers/counterparties and /or outside of a Trading Venue (as defined in the FCA Rules) and

(ii)some or all orders resulting from BlackRock International's decisions to deal on the Co-Managers' behalf, or received from the Co- Manager, to be placed with an affiliated company, who will act as agent for the purpose of executing such orders in accordance with the Order Execution Policy. Specific instructions from the Co-Managers in relation to the execution of orders may prevent BlackRock International from following its Order Execution Policy in relation to such orders in respect of the elements of execution covered by the instructions.

The Subadvisers shall determine the securities and futures contracts and other financial instruments to be purchased or sold by such portion of the Trust's portfolio, as applicable, and may place orders with or through such persons, brokers, dealers or futures commission merchants, including but not limited to any broker or dealer affiliated with the Co-Managers or the Subadvisers) to carry out the policy with respect to brokerage as set forth in the Trust's Prospectus or as the Board of Trustees may direct to the Subadvisers in advance in writing from time to time. In providing the Trust with investment supervision, it is recognized that the Subadvisers will give consideration to securing the most favorable price and efficient execution as more fully detailed in its Order Execution Policy. Within the framework of this policy, the Subadvisers may consider the size of trade, financial responsibility, reputation, financial condition, research and investment information and other services provided by brokers, dealers or futures commission merchants who may effect

A-2

or be a party to any such transaction or other transactions to which the Subadvisers' other clients may be a party. The Co-Managers (or the Subadvisers) to the Trust each shall have discretion to effect investment transactions for the Trust through broker-dealers (including, to the extent legally permissible, broker-dealers affiliated with the Subadvisers) qualified to obtain best execution of such transactions who provide brokerage and/or research services, as such services are defined in Section 28(e) of the Securities Exchange Act of 1934, as amended (the 1934 Act), and to cause the Trust to pay any such broker-dealers an amount of commission for effecting a portfolio transaction in excess of the amount of commission another broker-dealers would have charged for effecting that transaction, if the brokerage or research services provided by such broker-dealers, viewed in light of either that particular investment transaction or the overall responsibilities of the Co-Managers (or the Subadvisers) with respect to the Trust and other accounts as to which they or it may exercise investment discretion (as such term is defined in Section 3(a)(35) of the 1934 Act), are reasonable in relation to the amount of commission. On occasions when the Subadvisers deem the purchase or sale of a security, futures contract or other instrument to be in the best interest of the Trust as well as other clients of the Subadvisers, the Subadvisers, to the extent permitted by applicable laws and regulations including, for the avoidance of doubt the FCA Rules, may, but shall be under no obligation to, aggregate the securities, futures contracts or other instruments to be sold or purchased. In such event, allocation of the securities, futures contracts or other instruments so purchased or sold, as well as the expenses incurred in the transaction, will be made by the Subadvisers in the manner the Subadvisers consider to be the most equitable and consistent with its fiduciary obligations (as defined under U.S. law) to the Trust and to such other clients.

The Co-Managers acknowledge that BlackRock International does not hold Client Money and/or Safe Custody Assets for the Co- Managers and/or the Trust under the Client Asset Rules (the "CASS Rules") of the FCA.

In accordance with Section 11(a) of the 1934 Act and Rule 11a2-2(T) thereunder, and subject to any other applicable laws, rules, and regulations, including, without limitation, Section 17(e) of the 1940 Act and Rule 17e-1 promulgated thereunder, and in accordance with the Subadviser's policies and procedures, each Subadviser may engage its affiliated persons, the affiliated persons of the Co- Managers, or any other subadviser to the Trust and such Subadvisers' affiliated persons, as broker-dealers to effect portfolio transactions in securities and other investments for the Trust.

From time to time, when determined by Subadvisers in their capacity of a fiduciary to the Trust to be in the best interests of the Trust, the Subadvisers may purchase securities from, or sell securities on behalf of the Trust to, another account for which the Subadvisers serve as investment manager or subadviser at the current market price for the relevant securities in accordance with the Subadvisers' policies and procedures adopted pursuant to Rule 17a-7 under the 1940 Act and other applicable law. Notwithstanding the foregoing and pursuant to Trust's 17a-7 Procedures, a copy of which shall be provided to Subadviser, Subadviser shall provide to the Co- Managers: (i) quarterly reports on the 17a-7 transactions entered into on behalf of the Trust (ii) all reasonable information necessary for the Board of Trustees of the Trust to review such transactions.

(iv)The Subadvisers shall maintain all books and records with respect to the Trust's portfolio transactions effected by them as required by Rule 31a-l under the 1940 Act, and shall render to the Trust's Board of Trustees such periodic and special reports as the Trustees may reasonably request. The Subadvisers shall make reasonably available during the Subadvisers' normal business hours their employees and officers for consultation with any of the Trustees or officers or employees of the Trust with respect to any matter discussed herein, including, without limitation, the valuation of the Trust's securities managed by the Subadvisers.

(v)All assets of the portion of the Trust managed by the Subadvisers shall be held by a custodian who has been appointed by the Co- Managers and notified in writing to the Subadvisers (the Custodian). The Co-Managers acknowledge that they have been and will be solely responsible for the selection, appointment, monitoring and supervision of the Custodian. The Co-Managers agree to notify the Subadvisers as soon as reasonably practicable in advance of any change to the Custodian. The Subadvisers or their affiliates shall provide the Custodian on each business day with information relating to all transactions concerning the portion of the Trust's assets they manage, and shall provide the Co-Managers with such information upon reasonable request of the Co-Managers.

(vi)The investment management services provided by the Subadvisers hereunder are not to be deemed exclusive, and the Subadvisers shall be free to render similar services to others. Conflicts of interest and material interests are described in the Supplemental Disclosures. Conversely, the Subadvisers and the Co-Managers understand and agree that if the Co-Managers manage the Trust in a "manager-of-managers" style, the Co-Managers will, among other things, (i) continually evaluate the performance of the Subadvisers through quantitative and qualitative analysis and consultations with the Subadvisers, (ii) periodically make recommendations to the Trust's Board as to whether the contract with one or more subadvisers should be renewed, modified, or terminated, and (iii) periodically report to the Trust's Board regarding the results of its evaluation and monitoring functions. The Subadvisers recognize that their services may be terminated or modified pursuant to this process.

(vii)The Subadvisers acknowledge that the Co-Managers and the Trust intend to rely on Rule 17a-l0, Rule l0f-3, Rule 12d3-1 and Rule 17e-l under the 1940 Act, and the Subadvisers hereby agree that they shall not consult with any other subadviser to the Trust with respect to transactions in securities for the Trust's portfolio or any other transactions of Trust assets.

(viii)In the event the Co-Managers or Custodian engages in securities lending activities with respect to the portion of the Trust managed by the Subadvisers, the Subadvisers will not be a party to or may not necessarily be aware of such lending activities. It is understood

A-3

that the Subadvisers shall not be responsible for settlement delay or failure, corporate action failure or any related costs or loss due to such activities.

(ix)The Subadvisers shall not be responsible for filing proofs of claim or otherwise initiating or otherwise determining to participate in class action lawsuits with respect to securities held by that portion of the Trust managed by the Subadvisers.

(a)With respect to the portion of the Trust's assets the Subadvisers manage, the Subadviser shall keep the Trust's books and records required to be maintained by the Subadvisers pursuant to paragraph 1(a) hereof and shall timely furnish to the Co-Managers all information relating to the Subadvisers' services hereunder needed by the Co-Managers to keep the other books and records of the Trust required by Rule 31a-1 under the 1940 Act or any successor regulation. The Subadvisers agree that all records which they maintain for the Trust are the property of the Trust, and the Subadvisers will surrender promptly to the Trust any of such records upon the Trust's request, provided, however, that the Subadvisers may retain a copy of such records. The Subadvisers further agree to preserve for the periods prescribed by Rule 31a-2 of the Commission under the 1940 Act or any successor regulation any such records as are required to be maintained by it pursuant to paragraph 1(a) hereof.

(b)In connection with their duties under this Agreement, the Subadvisers agrees to maintain adequate compliance procedures reasonably designed to prevent violations of the 1940 Act, the Investment Advisers Act of 1940, as amended (the Advisers Act), and other applicable state and federal laws and regulations.

(c)Each Subadviser is a commodity trading advisor duly registered with the Commodity Futures Trading Commission (the CFTC) and are members in good standing of the National Futures Association (the NFA) or is relying on an exemption from registration as a commodity trading advisor. If applicable, the Subadvisers shall maintain such registration and membership in good standing during the term of this Agreement. Further, the Subadvisers agree to notify the Co-Managers within a commercially reasonable time upon (i) a statutory disqualification of the Subadvisers under Sections 8a(2) or 8a(3) of the CEA or (ii) a suspension, revocation or limitation of the Subadvisers' commodity trading advisor registration or NFA membership.

(d)The Subadvisers shall maintain a written code of ethics (the Code of Ethics) that they reasonably believe complies with the requirements of Rule 17j-1 under the 1940 Act and Rule 204A-1 under the Advisers Act, a copy of which shall be provided to the Co- Managers and the Trust, and shall institute procedures reasonably necessary to prevent any Access Person (as defined in Rule 17j-1 under the 1940 Act and Rule 204A-1 under the Advisers Act) from violating its Code of Ethics. The Subadvisers shall follow such Code of Ethics in performing its services under this Agreement. Further, the Subadvisers represent that they maintain adequate compliance procedures to ensure their compliance with the 1940 Act, the Advisers Act, and other applicable federal and state laws and regulations. In particular, the Subadvisers represent that they have policies and procedures regarding the detection and prevention of the misuse of material, non-public information by the Subadvisers and their employees as required by the applicable federal securities laws.

(e)The Subadvisers shall furnish to the Co-Managers (i) copies of all records prepared in connection with the performance of this Agreement and (ii) summaries of, or the opportunity to review printed copies of, compliance procedures maintained pursuant to paragraph 1(e) hereof, each as the Co-Managers may reasonably request, subject to applicable law, attorney-client privilege and confidentiality restrictions.

(f)The Subadvisers shall be responsible for the voting, or the abstaining from voting, of all shareholder proxies with respect to the investments and securities managed by the Subadvisers and held in the Trust's portfolio, in accordance with their standard proxy voting guidelines, and subject to such reasonable reporting and other requirements as shall be established by the Co-Managers.

(g)Upon reasonable request from the Co-Managers, the Subadvisers (through a qualified person) will reasonably assist the valuation committee of the Trust or the Co-Managers in valuing investments of the Trust managed by the Subadvisers as may be required from time to time, including making available information of which the Subadvisers have knowledge related to the investments being valued, provided that the Subadviser shall not be deemed a substitute for any independent pricing agent and/or valuation committee of the Trust pursuant to the Trust's Fair Valuation Policies and Procedures. For the avoidance of doubt, the Subadvisers are not the valuation agents for the Trust.

(h)The Co-Managers have or will furnish the Subadviser with properly certified or authenticated copies of, each of the following prior to the date hereof:

(i)the Declaration of Trust;

(ii)the By-Laws;

(iii)resolutions of the Board of Trustees of the Trust authorizing the appointment of the Subadviser and approving the execution of this Agreement by the Co-Managers;

(iv)the Prospectus; and

(v)any applicable written instructions and directions of the Co-Managers.

A-4

During the term of this Agreement, the Co-Managers agree to furnish the Subadviser at its principal office all prospectuses, proxy statements, reports to shareholders, sales literature or other material prepared for distribution to shareholders of the Trust or the public, which refer to the Subadviser in any way, prior to use thereof and not to use material if the Subadviser reasonably objects in writing:

(i)ten (10) business days (or such other time as may be mutually agreed) after receipt thereof with respect to prospectuses and proxy statements which refer to the Subadviser in any way and (ii) five (5) business days (or such other time as may be mutually agreed) after receipt thereof with respect to reports to shareholders, sales literature or other material prepared for distribution to shareholders of the Trust or the public which refer to the Subadvisers in any way. Sales literature may be furnished to the Subadvisers hereunder by electronic mail, first-class or overnight mail, facsimile transmission equipment or hand delivery. The Co-Managers agree to use commercially reasonable efforts to ensure that materials prepared by their employees or agents or their affiliates that refer to the Subadvisers are consistent with those materials previously approved by the Subadvisers as referenced in the first sentence of this paragraph. It is understood that "BlackRock" is the name of the Subadvisers' parent company, BlackRock, Inc., and any derivative names or logos associated with such name are the valuable property of the Subadvisers, that the Trust has the right to include such phrase as a part of the name of the series of the Trust managed by the Subadvisers or for any other purpose only so long as this Agreement shall continue, and that BlackRock does, in fact, consent to the use of such name as a part of the name of the series of the Trust identified herein. Upon a termination or expiration of this Agreement, the Co-Managers shall, as promptly as reasonably practicable after a termination or expiration of this Agreement: (i) supplement or otherwise amend the Prospectus to indicate that BlackRock no longer serves as a subadviser to the Trust; (ii) discontinue any new production or publication of sales literature bearing the name "BlackRock" or any related name, mark, or logo; and (iii) "buckslip" or otherwise supplement sales literature in the possession of the Co-Managers or its affiliates bearing the name "BlackRock" or any related name, mark, or logo to indicate that such firm no longer serves as a subadviser to the Trust. Notwithstanding the foregoing, the Co-Managers may, after any termination or expiration of this Agreement, retain copies of sales literature bearing the name "BlackRock" or any related name, mark or logo only to fulfill applicable legal, compliance, and regulatory requirements, and for their document retention purposes. The Co-Managers will furnish the Subadvisers with copies of all amendments of or supplements to the foregoing that impact the management of the Trust within a reasonable time before they become effective to the extent reasonably practicable. Any amendments or supplements that impact the management of the Trust will not be deemed effective with respect to the Subadvisers until the Subadvisers' receipt thereof, notice of which will be provided to the Subadvisers, to the extent reasonably practicable, within a reasonable time before such amendments or supplements become effective.

(i)Each Co-Manager represents and warrants that: (i) it is registered with the Commission as an investment adviser under the Advisers Act; (ii) such registration is current and complete and complies with all material applicable provisions of the Advisers Act and the rules and regulations thereunder; (iii) it has all requisite authority to enter into, execute, deliver and perform its obligations under this Agreement; (iv) its performance under this Agreement does not conflict with any law, regulation or order to which it is subject and (v) it will comply in all material respects with all laws (including applicable anti-corruption and anti-money laundering laws and regulations) and orders to which it may be subject in performance of its obligations under this Agreement and the execution, delivery and performance of this Agreement. This Agreement will not violate any laws or regulations or any constituent document, policy, guideline, contract or other document applicable to it in the provision of the services.

(j)With respect to BlackRock Singapore, the Co-Managers represent and warrant that: (i) there are no natural persons holding interests in the Trust, or any other persons whose information, if disclosed to BlackRock Singapore, will subject BlackRock Singapore to the provisions of the Personal Data Protection Act of Singapore; (ii) the assets of the Trust will not be derived from activities that contravene Singapore or international anti-money laundering laws and regulations; and (iii) the Trust is an "accredited investor" as defined in Section 4A of the Securities and Futures Act, Chapter 289 of Singapore. The Co-Managers hereby request not to receive a monthly or quarterly statement of account from BlackRock Singapore pursuant to Regulation 40(1A)(b)(ii) and Regulation 40(4)(b) of the Securities and Futures (Licensing and Conduct of Business Regulations).

2.The Co-Managers shall continue to have responsibility for all services to be provided to the Trust pursuant to the Management Agreement and, as more particularly discussed above, shall oversee and review the Subadvisers' performance of its duties under this Agreement. The Co-Managers shall provide (or cause the Custodian to provide) timely information to the Subadvisers regarding such matters as the composition of assets in the portion of the Trust managed by the Subadvisers, cash requirements and cash available for investment in such portion of the Trust, and all other information as may be reasonably necessary for the Subadvisers to perform their duties hereunder (including any excerpts of minutes of meetings of the Board of Trustees of the Trust that affect the duties of the Subadvisers).

3.For the services provided pursuant to this Agreement, the Co-Managers shall pay BlackRock Financial as full compensation therefor, a fee equal to the percentage of the Trust's average daily net assets of the portion of the Trust managed by the Subadvisers as described in the attached Schedule A. Expense caps or fee waivers for the Trust that may be agreed to by the Co-Managers, but not agreed to by the Subadvisers, shall not cause a reduction in the amount of the payment to the Subadvisers by the Co-Managers.

4.(a) The Subadvisers acknowledge that, in the course of its engagement by the Co-Managers, the Subadvisers may receive or have access to confidential and proprietary information of the Co-Managers or third parties with whom the Co-Managers conducts business.

A-5

Such information is collectively referred to as "Confidential Information." Confidential Information includes the Co-Managers' business and other proprietary information, written or oral.

(b)The Subadvisers certify that (i) their treatment of Confidential Information is in compliance with applicable laws and regulations with respect to privacy and data security, and (ii) they have implemented and currently maintains an effective written information security program ("Information Security Program") including administrative, technical, and physical safeguards and other security measures necessary to (a) ensure the security and confidentiality of Confidential Information; (b) protect against any anticipated threats or hazards to the security or integrity of Confidential Information; and (c) protect against unauthorized access to, destruction, modification, disclosure or use of Confidential Information that could result in substantial harm or inconvenience to the Co-Managers, or to any person who may be identified by Confidential Information. The Subadvisers shall immediately notify the Co-Managers if the Subadvisers are in material breach of this Section. At the Co-Managers' request, the Subadvisers agree to certify in writing to the Co- Managers, its compliance with the terms of this Section.

(c)The Subadvisers shall notify the Co-Managers or its agents of its designated primary security manager. The security manager will be responsible for managing and coordinating the performance of the Subadvisers' obligations set forth in its Information Security Program and this Agreement.

(d)The Subadvisers shall review and, as appropriate, revise its Information Security Program at least annually or whenever there is a material change in the Subadvisers' business practices that may reasonably affect the security, confidentiality or integrity of Confidential Information. During the course of providing the services, the Subadvisers may not alter or modify its Information Security Program in such a way that will weaken or compromise the security, confidentiality, or integrity of Confidential Information.

(e)The Subadvisers shall maintain appropriate access controls, including, but not limited to, limiting access to Confidential Information to the minimum number of the Subadviser's Employees who require such access in order to provide the services to the Co- Managers.

(f)The Subadvisers shall conduct periodic risk assessments to identify and assess reasonably foreseeable internal and external risks to the security, confidentiality, and integrity of Confidential Information; and evaluate and improve, where necessary, the effectiveness of its information security controls. Such assessments will also consider the Subadvisers' compliance with its Information Security Program and the laws applicable to the Subadvisers.

(g)The Subadvisers shall conduct regular penetration and vulnerability testing of its information technology infrastructure and networks. If any testing detects any anomalies, intrusions, or vulnerabilities in any information technology systems processing, storing or transmitting any of the Co-Managers' Confidential Information, the Subadvisers shall promptly report a summary of those findings to the Co-Managers upon request.