| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| FORM N-CSR |

|

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number | 811-05188 |

| |

| AMERICAN CENTURY VARIABLE PORTFOLIOS, INC. |

| (Exact name of registrant as specified in charter) |

| |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| |

| CHARLES A. ETHERINGTON |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| |

| Date of fiscal year end: | 12-31 |

| |

| Date of reporting period: | 06-30-2010 |

| |

| |

| |

| | |

| |

| ITEM 1. REPORTS TO STOCKHOLDERS. |

|

| Semiannual Report | |

| June 30, 2010 | |

|

| American Century Investments® |

VP Income & Growth Fund

| |

| Market Perspective | 2 |

| U.S. Stock Index Returns | 2 |

| |

| VP Income & Growth | |

| |

| Performance | 3 |

| Portfolio Commentary | 5 |

| Top Ten Holdings | 7 |

| Five Largest Overweights | 7 |

| Five Largest Underweights. | 7 |

| Types of Investments in Portfolio | 7 |

| |

| Shareholder Fee Example | 8 |

| |

| Financial Statements | |

| |

| Schedule of Investments | 10 |

| Statement of Assets and Liabilities | 15 |

| Statement of Operations | 16 |

| Statement of Changes in Net Assets | 17 |

| Notes to Financial Statements | 18 |

| Financial Highlights | 24 |

| |

| Other Information | |

| |

| Proxy Voting Results | 27 |

| Board Approval of Management Agreements | 28 |

| Additional Information | 34 |

| Index Definitions | 35 |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

By Enrique Chang, Chief Investment Officer, American Century Investments

The U.S. stock market posted negative returns for the six months ended June 30, 2010, with the bulk of the decline occurring over the last two months of the period as investor sentiment shifted dramatically.

Stocks began 2010 on a positive note, gaining ground in the first four months of the year and extending the broad market rally that began in March 2009. Investors cheered the improving U.S. economy, which appeared to remain on a gradual path to recovery following the severe recession in late 2008 and early 2009. Emerging evidence of recovery included increased manufacturing activity, a pickup in consumer spending, and signs of stabilization in the housing sector. In addition, corporate earnings continued to exceed expectations as many companies were able to boost profit margins thanks to aggressive cost-cutting measures.

However, market conditions changed abruptly toward the end of April as persistent worries about sovereign debt problems in Europe and questions about the sustainability of the domestic economic recovery (validated to some degree by weaker economic data late in the period) weighed on investor confidence. Consequently, the equity market peaked in late April and then reversed direction in May and June. In addition, market volatility increased dramatically—the S&P 500 Index moved up or down by more than 1% on nearly half of the trading days in the second quarter of 2010.

The decline over the last two months of the period erased the market’s gains from earlier in the year, resulting in negative returns overall for the six-month period. Although stocks fell across the board in the first half of 2010 (see the table below), small-cap stocks held up the best, while large-cap shares suffered the biggest losses. Meanwhile, value issues outperformed their growth-oriented counterparts across all market capitalizations. The financials sector, which is by far the heaviest sector weighting in most value indices, was among the better-performing sectors in the stock market during the six-month period. In contrast, most growth indices are dominated by the information technology sector, which was one of the weaker-performing sectors in the market.

| | | | |

| U.S. Stock Index Returns | | | | |

| For the six months ended June 30, 2010* | | | | |

| Russell 1000 Index (Large-Cap) | –6.40% | | Russell 2000 Index (Small-Cap) | –1.95% |

| Russell 1000 Value Index | –5.12% | | Russell 2000 Value Index | –1.64% |

| Russell 1000 Growth Index | –7.65% | | Russell 2000 Growth Index | –2.31% |

| Russell Midcap Index | –2.06% | | *Total returns for periods less than one year are not annualized. |

| Russell Midcap Value Index | –0.88% | | | |

| Russell Midcap Growth Index | –3.31% | | | |

2

| | | | | | | | |

| VP Income & Growth | | | | | | |

| |

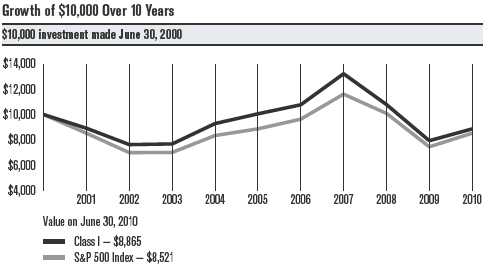

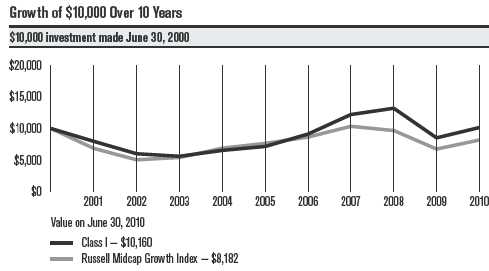

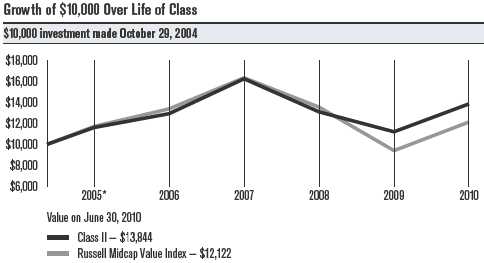

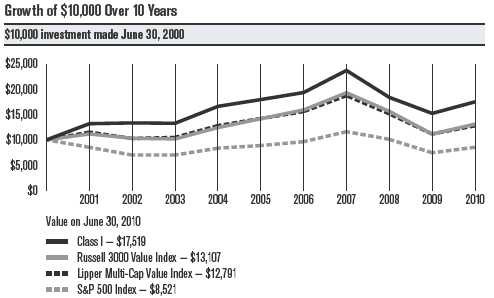

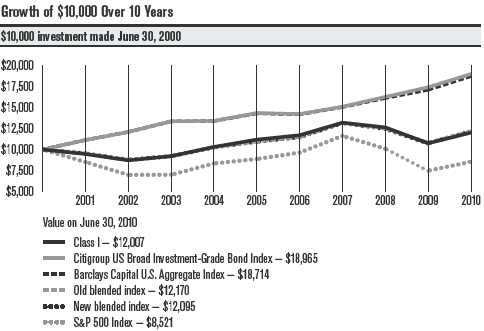

| Total Returns as of June 30, 2010 | | | | | |

| | | | | | Average Annual Returns | |

| | | Ticker | | | | | Since | Inception |

| | | Symbol | 6 months(1) | 1 year | 5 years | 10 years | Inception | Date |

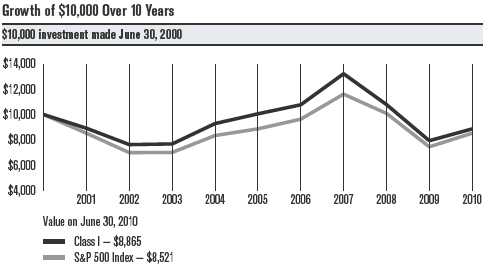

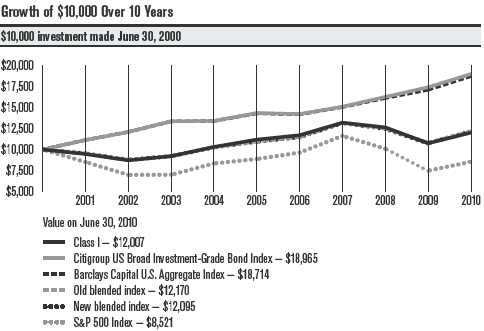

| Class I | AVGIX | -6.38% | 11.78% | -2.49% | -1.20% | 2.57% | 10/30/97 |

| S&P 500 Index | — | -6.65% | 14.43% | -0.79% | -1.59% | 2.72%(2) | — |

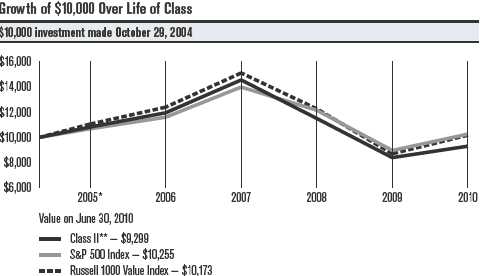

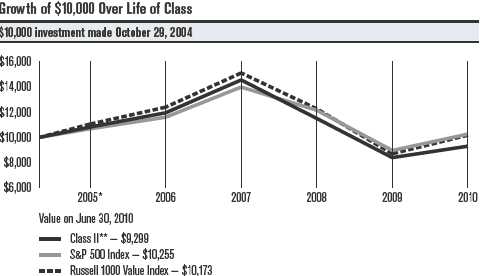

| Class II | AVPGX | -6.49% | 11.51% | -2.72% | — | 0.63% | 5/1/02 |

| Class III | AIGTX | -6.38% | 11.78% | -2.49% | — | 2.15% | 6/26/02 |

| (1) | Total returns for periods less than one year are not annualized. | | | | | |

| (2) | Since October 31, 1997, the date nearest Class I’s inception for which data are available. | | | |

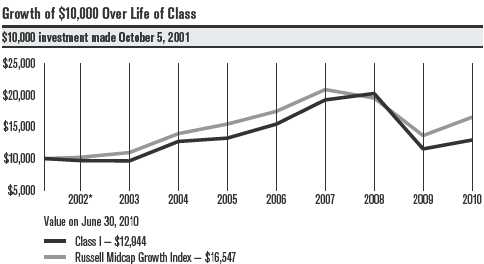

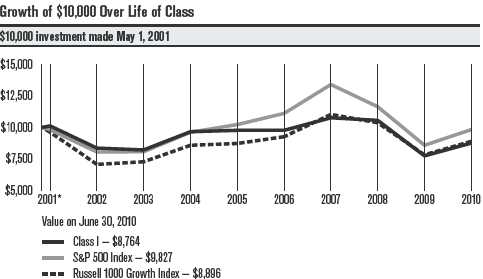

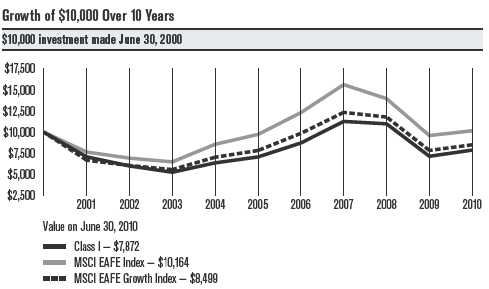

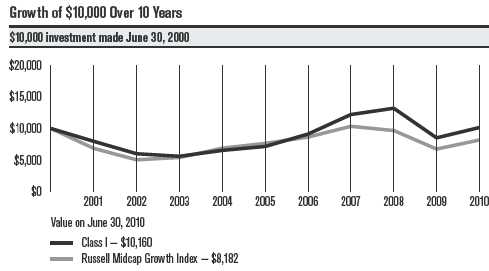

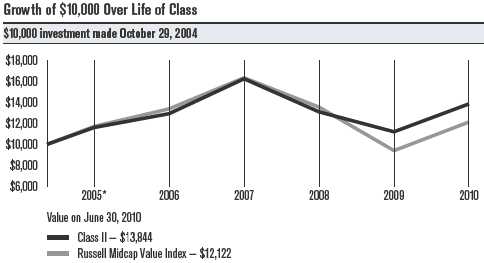

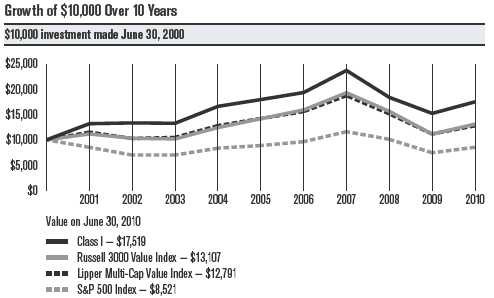

The performance information presented does not include charges and deductions imposed by the insurance company separate account under the variable annuity or variable life insurance contracts. The inclusion of such charges could significantly lower performance. Please refer to the insurance company separate account prospectus for a discussion of the charges related to insurance contracts.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-6488.

Unless otherwise indicated, performance reflects Class I shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

3

VP Income & Growth

| | |

| Total Annual Fund Operating Expenses | | |

| Class I | Class II | Class III |

| 0.70% | 0.95% | 0.70% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-6488.

Unless otherwise indicated, performance reflects Class I shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

4

VP Income & Growth

Portfolio Managers: Kurt Borgwardt, Zili Zhang, and Lynette Pang

On March 31, 2010, VP Income & Growth portfolio manager John Schniedwind, who was also chief investment officer for quantitative equity, retired from American Century Investments after 27 years with the firm. Kurt Borgwardt, Zili Zhang, and Lynette Pang remain as portfolio managers for VP Income & Growth.

Performance Summary

VP Income & Growth returned –6.38%* for the first half of 2010, compared with the –6.65% return of its benchmark, the S&P 500 Index.

VP Income & Growth declined during the six-month period, reflecting the broad pullback in the U.S. equity market, but it held up slightly better than the S&P 500. The fund’s tilt toward value contributed favorably to performance versus the index as value stocks outpaced growth issues during the period. However, individual stock selection was the main factor behind the fund’s overall outperformance of the benchmark.

Consumer Sectors Outperformed

Stock selection was most successful in the consumer discretionary and consumer staples sectors, which were the only two sectors of the portfolio to post positive returns during the six-month period. Stock choices among specialty retailers and internet retailers delivered the bulk of the outperformance in the consumer discretionary sector. The top contributor in this sector was discount clothing retailer Ross Stores, which enjoyed strong same-store sales increases and raised its earnings projections for 2010. Another strong performer was online movie rental firm Netflix, which reported healthy subscriber growth and generated better-than-expected earnings amid increased customer usage of streaming video.

In the consumer staples sector, an overweight position in food products makers and stock selection among food and staples retailers contributed the most to outperformance. Food producer Del Monte Foods was the best contributor in this sector; the company consistently exceeded earnings expectations and raised its dividend as cost-cutting measures boosted profit margins. Other top contributors in this sector included cosmetics maker Estee Lauder, which benefited from robust sales in Asia, and beverage maker Dr Pepper Snapple Group, which got a lift from improving juice sales.

Materials Also Added Value

VP Income & Growth’s holdings in the materials sector—the worst-performing sector in the S&P 500—also contributed to the fund’s overall outperformance of the index. Virtually all of the performance in this sector resulted from stock selection in the chemicals industry, and two companies in particular stood out. One of these was specialty chemicals producer Ashland, where aggressive cost-reduction efforts and contributions from a recent acquisition provided a strong boost to the company’s earnings.

*All fund returns referenced in this commentary are for Class I shares. Total returns for periods less than one year are not annualized.

5

VP Income & Growth

The other company was agricultural products maker Monsanto, which was an underweight position in the portfolio throughout the period. Monsanto fell sharply during the period as the company faced intense price competition in its Roundup herbicide business, as well as tepid demand for its new enhanced seed products, that weighed on earnings.

Technology and Financials Detracted

The portfolio’s holdings in the information technology and financials sectors underperformed their counterparts in the S&P 500. Stock selection in the computer hardware industry was entirely responsible for the underper-formance in the information technology sector. Disk-drive makers Western Digital and Seagate Technology were notable detractors as lower prices in the disk-drive industry resulting from a supply and demand imbalance weighed on their stock prices. An underweight position in consumer electronics maker Apple also hurt relative results as the company continued to deliver robust earnings and benefited from the successful introduction of its iPad tablet computer.

Underperformance in the financials sector was driven by stock selection among diversified financial services companies and an underweight position in real estate investment trusts. One of the biggest detractors was financial services giant Bank of America, which tumbled amid uncertainty regarding the impact of the pending financial reform legislation wending its way through Congress.

The portfolio’s health care holdings also detracted from performance versus the index, weighed down by lagging results from health care providers. The most significant detractor was health services provider Coventry Health Care, which reported solid earnings during the six-month period but fell victim to concerns about the impact of the federal government’s health care reform legislation. Another noteworthy decliner in the health care sector was drug maker Pfizer, which reported disappointing earnings and suffered setbacks in the approval of some of its developing medications.

A Look Ahead

The market environment has grown increasingly choppy in recent months, reflecting greater uncertainty about the resilience of the economic recovery. Although most businesses weathered the 2008 recession relatively well, stubbornly high unemployment suggests that the corporate sector is not yet confident enough in the strength of the recovery to expand payrolls. This economic uncertainty—and the stock market volatility that often accompanies it—is likely to continue as we move into the second half of 2010.

The quantitative investment process we use to manage VP Income & Growth has a framework that is objective, disciplined, and systematic—in other words, it avoids getting caught up in the fads and emotions that can drive short-term market movements. We believe that this approach will produce superior relative performance over the long term.

6

| | |

| VP Income & Growth | | |

| |

| Top Ten Holdings | | |

| | | % of net assets as of 6/30/10 |

| Exxon Mobil Corp. | | 3.5% |

| International Business Machines Corp. | | 2.6% |

| Johnson & Johnson | | 2.6% |

| Chevron Corp. | | 2.2% |

| JPMorgan Chase & Co. | | 2.2% |

| AT&T, Inc. | | 2.1% |

| Bank of America Corp. | | 1.9% |

| Intel Corp. | | 1.9% |

| Procter & Gamble Co. (The) | | 1.9% |

| Microsoft Corp. | | 1.9% |

| |

| Five Largest Overweights as of June 30, 2010 | |

| | % of net assets | % of S&P 500 Index |

| Eli Lilly & Co. | 1.41% | 0.36% |

| Constellation Energy Group, Inc. | 1.00% | 0.07% |

| Amgen, Inc. | 1.47% | 0.54% |

| Prudential Financial, Inc. | 1.18% | 0.27% |

| International Business Machines Corp. | 2.60% | 1.70% |

| |

| Five Largest Underweights as of June 30, 2010 | |

| | % of net assets | % of S&P 500 Index |

| Merck & Co., Inc. | 0.08% | 1.17% |

| Berkshire Hathaway, Inc., Class B | 0.34% | 1.42% |

| PepsiCo, Inc. | — | 1.05% |

| Coca-Cola Co. (The) | 0.23% | 1.24% |

| Apple, Inc. | 1.63% | 2.46% |

| |

| Types of Investments in Portfolio | | |

| | | % of net assets as of 6/30/10 |

| Common Stocks | | 99.6% |

| Temporary Cash Investments | | 0.4% |

| Other Assets and Liabilities | | —(1) |

| (1) Category is less than 0.05% of total net assets. | | |

7

|

| Shareholder Fee Example (Unaudited) |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/ exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from January 1, 2010 to June 30, 2010.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

8

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | |

| | Beginning | Ending | Expenses Paid | |

| | Account Value | Account Value | During Period* | Annualized |

| | 1/1/10 | 6/30/10 | 1/1/10 – 6/30/10 | Expense Ratio* |

| Actual | | | | |

| Class I | $1,000 | $936.20 | $3.41 | 0.71% |

| Class II | $1,000 | $935.10 | $4.61 | 0.96% |

| Class III | $1,000 | $936.20 | $3.41 | 0.71% |

| Hypothetical | | | | |

| Class I | $1,000 | $1,021.27 | $3.56 | 0.71% |

| Class II | $1,000 | $1,020.03 | $4.81 | 0.96% |

| Class III | $1,000 | $1,021.27 | $3.56 | 0.71% |

| *Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, |

| multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

9

| | | | | | |

| VP Income & Growth | | | | | |

| |

| JUNE 30, 2010 (UNAUDITED) | | | | | | |

| | Shares | Value | | | Shares | Value |

| Common Stocks — 99.6% | | | CHEMICALS — 2.4% | | |

| AEROSPACE & DEFENSE — 1.6% | | | Ashland, Inc. | 42,220 | $ 1,959,852 |

| Cubic Corp. | 2,772 | $ 100,845 | | Cytec Industries, Inc. | 2,467 | 98,655 |

| General Dynamics Corp. | 1,690 | 98,966 | | E.I. du Pont de Nemours & Co. | 60,144 | 2,080,381 |

| Honeywell International, Inc. | 13,229 | 516,328 | | Huntsman Corp. | 14,882 | 129,027 |

| Lockheed Martin Corp. | 1,959 | 145,946 | | Lubrizol Corp. | 1,464 | 117,574 |

| Northrop Grumman Corp. | 42,348 | 2,305,425 | | Minerals Technologies, Inc. | 3,711 | 176,421 |

| | | | | OM Group, Inc.(1) | 21,497 | 512,918 |

| Raytheon Co. | 11,982 | 579,809 | | | | |

| | | 3,747,319 | | Valspar Corp. | 12,471 | 375,627 |

| AIR FREIGHT & LOGISTICS — 0.4% | | | | | 5,450,455 |

| FedEx Corp. | 4,976 | 348,867 | | COMMERCIAL BANKS — 3.1% | | |

| United Parcel Service, Inc., | | | | BB&T Corp. | 5,731 | 150,783 |

| Class B | 11,458 | 651,846 | | Canadian Imperial | | |

| | | 1,000,713 | | Bank of Commerce | 401 | 24,954 |

| AUTO COMPONENTS — 0.2% | | | | CapitalSource, Inc. | 51,637 | 245,792 |

| Goodyear Tire & | | | | Cullen/Frost Bankers, Inc. | 1,580 | 81,212 |

| Rubber Co. (The)(1) | 4,331 | 43,050 | | Fifth Third Bancorp. | 27,729 | 340,789 |

| TRW Automotive | | | | First Horizon National Corp.(1) | 91 | 1,041 |

| Holdings Corp.(1) | 17,430 | 480,545 | | PNC Financial Services | | |

| | | 523,595 | | Group, Inc. | 2,645 | 149,443 |

| AUTOMOBILES — 0.2% | | | | Regions Financial Corp. | 15,666 | 103,082 |

| Ford Motor Co.(1) | 55,414 | 558,573 | | SunTrust Banks, Inc. | 2,446 | 56,992 |

| BEVERAGES — 1.4% | | | | Toronto-Dominion Bank (The) | 26,699 | 1,733,032 |

| Coca-Cola Co. (The) | 10,374 | 519,945 | | U.S. Bancorp. | 76,784 | 1,716,122 |

| Coca-Cola Enterprises, Inc. | 19,298 | 499,046 | | Wells Fargo & Co. | 87,618 | 2,243,021 |

| Dr Pepper Snapple Group, Inc. | 55,339 | 2,069,125 | | Westamerica Bancorp. | 3,117 | 163,705 |

| | | 3,088,116 | | | | 7,009,968 |

| BIOTECHNOLOGY — 2.4% | | | | COMMERCIAL SERVICES & SUPPLIES — 0.7% |

| Amgen, Inc.(1) | 63,673 | 3,349,200 | | R.R. Donnelley & Sons Co. | 83,847 | 1,372,576 |

| Biogen Idec, Inc.(1) | 6,925 | 328,591 | | Republic Services, Inc. | 11,114 | 330,419 |

| Cephalon, Inc.(1) | 22,877 | 1,298,270 | | | | 1,702,995 |

| Cubist Pharmaceuticals, Inc.(1) | 17,279 | 355,947 | | COMMUNICATIONS EQUIPMENT — 0.9% | |

| | | | | Arris Group, Inc.(1) | 31,295 | 318,896 |

| Talecris Biotherapeutics Holdings | | | | | | |

| Corp.(1) | 11,887 | 250,816 | | Cisco Systems, Inc.(1) | 59,708 | 1,272,378 |

| | | 5,582,824 | | CommScope, Inc.(1) | 11,216 | 266,604 |

| CAPITAL MARKETS — 1.9% | | | | Motorola, Inc.(1) | 15,469 | 100,858 |

| Apollo Investment Corp. | 62,257 | 580,858 | | | | 1,958,736 |

| Bank of New York | | | | COMPUTERS & PERIPHERALS — 5.5% | |

| Mellon Corp. (The) | 31,474 | 777,093 | | Apple, Inc.(1) | 14,794 | 3,721,135 |

| BlackRock, Inc. | 1,503 | 215,530 | | EMC Corp.(1) | 34,477 | 630,929 |

| Goldman Sachs | | | | | | |

| Group, Inc. (The) | 11,641 | 1,528,114 | | Hewlett-Packard Co. | 82,102 | 3,553,375 |

| | | | | SanDisk Corp.(1) | 26,727 | 1,124,405 |

| Investment Technology | | | | | | |

| Group, Inc.(1) | 3,132 | 50,300 | | Seagate Technology(1) | 113,409 | 1,478,853 |

| Legg Mason, Inc. | 41,941 | 1,175,606 | | Synaptics, Inc.(1) | 4,440 | 122,100 |

| | | 4,327,501 | | Western Digital Corp.(1) | 60,670 | 1,829,807 |

| | | | | | | 12,460,604 |

10

| | | | | | |

| VP Income & Growth | | | | | |

| |

| | Shares | Value | | | Shares | Value |

| CONSTRUCTION & ENGINEERING — 1.3% | | | ENERGY EQUIPMENT & SERVICES — 0.6% | |

| EMCOR Group, Inc.(1) | 80,408 | $ 1,863,053 | | Complete Production | | |

| | | | | Services, Inc.(1) | 22,560 | $ 322,608 |

| Shaw Group, Inc. (The)(1) | 28,939 | 990,293 | | | | |

| | | 2,853,346 | | National Oilwell Varco, Inc. | 12,957 | 428,488 |

| CONSUMER FINANCE — 0.7% | | | | Transocean Ltd.(1) | 15,602 | 722,841 |

| American Express Co. | 24,319 | 965,465 | | | | 1,473,937 |

| AmeriCredit Corp.(1) | 34,132 | 621,885 | | FOOD & STAPLES RETAILING — 1.0% | |

| Cash America International, Inc. | 2,064 | 70,733 | | SUPERVALU, INC. | 6,033 | 65,398 |

| | | 1,658,083 | | Wal-Mart Stores, Inc. | 47,877 | 2,301,447 |

| CONTAINERS & PACKAGING — 0.1% | | | | | 2,366,845 |

| Graphic Packaging Holding Co.(1) | 72,573 | 228,605 | | FOOD PRODUCTS — 3.7% | | |

| DIVERSIFIED CONSUMER SERVICES — 0.1% | | | ConAgra Foods, Inc. | 2,121 | 49,462 |

| Apollo Group, Inc., Class A(1) | 899 | 38,180 | | Corn Products International, Inc. | 7,996 | 242,279 |

| | | | | Del Monte Foods Co. | 131,179 | 1,887,666 |

| Corinthian Colleges, Inc.(1) | 9,282 | 91,428 | | | | |

| | | | | Dole Food Co., Inc.(1) | 27,167 | 283,352 |

| | | 129,608 | | | | |

| | | | | Fresh Del Monte Produce, Inc.(1) | 1,409 | 28,518 |

| DIVERSIFIED FINANCIAL SERVICES — 4.5% | | | | | |

| Bank of America Corp. | 307,768 | 4,422,626 | | General Mills, Inc. | 40,602 | 1,442,183 |

| Citigroup, Inc.(1) | 178,176 | 669,942 | | Hershey Co. (The) | 9,872 | 473,165 |

| CME Group, Inc. | 520 | 146,406 | | Kraft Foods, Inc., Class A | 27,056 | 757,568 |

| JPMorgan Chase & Co. | 134,200 | 4,913,062 | | Sara Lee Corp. | 118,848 | 1,675,757 |

| | | 10,152,036 | | Tyson Foods, Inc., Class A | 100,194 | 1,642,179 |

| DIVERSIFIED TELECOMMUNICATION | | | | | 8,482,129 |

| SERVICES — 3.9% | | | | GAS UTILITIES — 0.2% | | |

| AT&T, Inc. | 194,287 | 4,699,803 | | Nicor, Inc. | 12,033 | 487,336 |

| Qwest Communications | | | | HEALTH CARE EQUIPMENT & SUPPLIES — 1.6% |

| International, Inc. | 124,977 | 656,129 | | Becton, Dickinson & Co. | 30,511 | 2,063,154 |

| Verizon Communications, Inc. | 129,351 | 3,624,415 | | Hill-Rom Holdings, Inc. | 23,942 | 728,555 |

| | | 8,980,347 | | Medtronic, Inc. | 22,955 | 832,578 |

| ELECTRIC UTILITIES — 1.0% | | | | | | 3,624,287 |

| Entergy Corp. | 4,019 | 287,841 | | HEALTH CARE PROVIDERS & SERVICES — 1.8% |

| Exelon Corp. | 18,592 | 705,938 | | Cardinal Health, Inc. | 4,087 | 137,364 |

| NextEra Energy, Inc. | 22,682 | 1,105,975 | | Centene Corp.(1) | 11,247 | 241,811 |

| PPL Corp. | 3,874 | 96,656 | | Coventry Health Care, Inc.(1) | 41,902 | 740,827 |

| | | 2,196,410 | | Humana, Inc.(1) | 29,046 | 1,326,531 |

| ELECTRICAL EQUIPMENT — 0.4% | | | WellPoint, Inc.(1) | 35,238 | 1,724,195 |

| Brady Corp., Class A | 2,381 | 59,334 | | | | 4,170,728 |

| Emerson Electric Co. | 17,837 | 779,299 | | HOTELS, RESTAURANTS & LEISURE — 1.2% | |

| General Cable Corp.(1) | 3,995 | 106,467 | | McDonald’s Corp. | 31,755 | 2,091,702 |

| | | 945,100 | | Starbucks Corp. | 17,395 | 422,698 |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & | | | Wyndham Worldwide Corp. | 6,373 | 128,352 |

| COMPONENTS — 0.9% | | | | | | 2,642,752 |

| Anixter International, Inc.(1) | 7,672 | 326,827 | | | | |

| | | | | HOUSEHOLD DURABLES — 0.7% | |

| Celestica, Inc.(1) | 157,034 | 1,265,694 | | American Greetings Corp., | | |

| Tech Data Corp.(1) | 13,890 | 494,762 | | Class A | 17,040 | 319,670 |

| Tyco Electronics Ltd. | 2,162 | 54,872 | | Blyth, Inc. | 1,030 | 35,092 |

| | | 2,142,155 | | | | |

11

| | | | | | |

| VP Income & Growth | | | | | |

| |

| | Shares | Value | | | Shares | Value |

| Garmin Ltd. | 5,067 | $ 147,855 | | Automatic Data Processing, Inc. | 35,218 | $ 1,417,877 |

| Whirlpool Corp. | 12,229 | 1,073,951 | | Computer Sciences Corp. | 25,889 | 1,171,477 |

| | | 1,576,568 | | Convergys Corp.(1) | 52,553 | 515,545 |

| HOUSEHOLD PRODUCTS — 3.0% | | | International Business | | |

| Kimberly-Clark Corp. | 39,803 | 2,413,256 | | Machines Corp. | 48,150 | 5,945,562 |

| Procter & Gamble Co. (The) | 72,134 | 4,326,597 | | | | 10,822,969 |

| | | 6,739,853 | | LEISURE EQUIPMENT & PRODUCTS — 0.1% | |

| INDEPENDENT POWER PRODUCERS & | | | Eastman Kodak Co.(1) | 44,620 | 193,651 |

| ENERGY TRADERS — 1.0% | | | | MACHINERY — 2.6% | | |

| Constellation Energy Group, Inc. | 70,723 | 2,280,817 | | Briggs & Stratton Corp. | 13,700 | 233,174 |

| INDUSTRIAL CONGLOMERATES — 1.7% | | | Caterpillar, Inc. | 20,402 | 1,225,548 |

| 3M Co. | 8,764 | 692,268 | | Cummins, Inc. | 4,736 | 308,456 |

| Carlisle Cos., Inc. | 24,627 | 889,773 | | Eaton Corp. | 18,894 | 1,236,423 |

| General Electric Co. | 156,256 | 2,253,212 | | Mueller Industries, Inc. | 5,930 | 145,878 |

| | | 3,835,253 | | Oshkosh Corp.(1) | 42,538 | 1,325,484 |

| INSURANCE — 4.9% | | | | Parker-Hannifin Corp. | 15,378 | 852,864 |

| ACE Ltd. | 32,320 | 1,663,834 | | Timken Co. | 23,041 | 598,836 |

| Allied World Assurance Co. | | | | | | 5,926,663 |

| Holdings Ltd. | 3,074 | 139,498 | | MEDIA — 2.6% | | |

| Allstate Corp. (The) | 2,465 | 70,819 | | Comcast Corp., Class A | 101,704 | 1,766,598 |

| American Financial Group, Inc. | 55,936 | 1,528,172 | | Gannett Co., Inc. | 63,217 | 850,901 |

| Arch Capital Group Ltd.(1) | 2,902 | 216,199 | | | | |

| | | | | Scholastic Corp. | 11,335 | 273,400 |

| Aspen Insurance Holdings Ltd. | 39,330 | 973,024 | | Time Warner, Inc. | 88,124 | 2,547,665 |

| Berkshire Hathaway, Inc., | | | | Walt Disney Co. (The) | 14,734 | 464,121 |

| Class B(1) | 9,750 | 776,978 | | | | |

| Endurance Specialty | | | | | | 5,902,685 |

| Holdings Ltd. | 6,972 | 261,659 | | METALS & MINING — 1.2% | | |

| Hartford Financial Services | | | | Freeport-McMoRan | | |

| Group, Inc. (The) | 3,729 | 82,523 | | Copper & Gold, Inc. | 30,107 | 1,780,227 |

| Horace Mann Educators Corp. | 9,215 | 140,990 | | Kinross Gold Corp. | | |

| Loews Corp. | 1,388 | 46,234 | | New York Shares | 2,568 | 43,887 |

| MetLife, Inc. | 1,682 | 63,512 | | Reliance Steel & Aluminum Co. | 16,545 | 598,102 |

| Principal Financial Group, Inc. | 79,466 | 1,862,683 | | Worthington Industries, Inc. | 21,618 | 278,007 |

| Protective Life Corp. | 4,859 | 103,934 | | | | 2,700,223 |

| Prudential Financial, Inc. | 50,207 | 2,694,108 | | MULTILINE RETAIL — 0.6% | | |

| | | | | Big Lots, Inc.(1) | 8,057 | 258,549 |

| Reinsurance Group of | | | | | | |

| America, Inc. | 1,720 | 78,621 | | Dillard’s, Inc., Class A | 20,008 | 430,172 |

| Sun Life Financial, Inc. | 18,859 | 496,180 | | Dollar Tree, Inc.(1) | 5,819 | 242,224 |

| Transatlantic Holdings, Inc. | 1,869 | 89,637 | | Family Dollar Stores, Inc. | 10,638 | 400,947 |

| | | 11,288,605 | | Macy’s, Inc. | 2,698 | 48,294 |

| INTERNET SOFTWARE & SERVICES — 1.1% | | | | | 1,380,186 |

| AOL, Inc.(1) | 21,291 | 442,640 | | MULTI-UTILITIES — 1.5% | | |

| EarthLink, Inc. | 39,952 | 318,018 | | DTE Energy Co. | 29,680 | 1,353,705 |

| Google, Inc., Class A(1) | 3,920 | 1,744,204 | | Integrys Energy Group, Inc. | 43,353 | 1,896,260 |

| | | 2,504,862 | | NiSource, Inc. | 11,139 | 161,515 |

| IT SERVICES — 4.7% | | | | | | 3,411,480 |

| Accenture plc, Class A | 42,886 | 1,657,544 | | OFFICE ELECTRONICS — 0.1% | | |

| Acxiom Corp.(1) | 7,826 | 114,964 | | Xerox Corp. | 35,432 | 284,873 |

12

| | | | | | |

| VP Income & Growth | | | | | |

| |

| | Shares | Value | | | Shares | Value |

| OIL, GAS & CONSUMABLE FUELS — 9.8% | | | Maxim Integrated Products, Inc. | 14,568 | $ 243,723 |

| Chevron Corp. | 75,378 | $ 5,115,151 | | Micron Technology, Inc.(1) | 125,311 | 1,063,890 |

| ConocoPhillips | 68,305 | 3,353,092 | | RF Micro Devices, Inc.(1) | 76,237 | 298,087 |

| Exxon Mobil Corp. | 140,825 | 8,036,883 | | Texas Instruments, Inc. | 51,663 | 1,202,715 |

| Hess Corp. | 9,705 | 488,550 | | | | 8,119,249 |

| Murphy Oil Corp. | 33,461 | 1,657,993 | | SOFTWARE — 3.3% | | |

| Occidental Petroleum Corp. | 46,487 | 3,586,472 | | ACI Worldwide, Inc.(1) | 9,998 | 194,661 |

| Williams Cos., Inc. (The) | 11,797 | 215,649 | | Fair Isaac Corp. | 3,950 | 86,071 |

| | | 22,453,790 | | Mentor Graphics Corp.(1) | 1,161 | 10,275 |

| PAPER & FOREST PRODUCTS — 0.3% | | | Microsoft Corp. | 187,142 | 4,306,137 |

| Domtar Corp. | 3,988 | 196,010 | | Oracle Corp. | 69,214 | 1,485,333 |

| International Paper Co. | 18,716 | 423,543 | | Symantec Corp.(1) | 65,381 | 907,488 |

| | | 619,553 | | Synopsys, Inc.(1) | 22,066 | 460,517 |

| PERSONAL PRODUCTS — 0.4% | | | | | | 7,450,482 |

| Estee Lauder Cos., Inc. (The), | | | | SPECIALTY RETAIL — 2.5% | | |

| Class A | 16,700 | 930,691 | | | | |

| | | | | AnnTaylor Stores Corp.(1) | 4,914 | 79,951 |

| PHARMACEUTICALS — 7.4% | | | | | | |

| Bristol-Myers Squibb Co. | 124,737 | 3,110,941 | | Barnes & Noble, Inc. | 17,280 | 222,912 |

| Eli Lilly & Co. | 95,811 | 3,209,668 | | Gap, Inc. (The) | 106,323 | 2,069,045 |

| Endo Pharmaceuticals | | | | Home Depot, Inc. (The) | 8,486 | 238,202 |

| Holdings, Inc.(1) | 16,552 | 361,165 | | OfficeMax, Inc.(1) | 5,311 | 69,362 |

| Forest Laboratories, Inc.(1) | 10,940 | 300,084 | | Rent-A-Center, Inc.(1) | 56,533 | 1,145,358 |

| Johnson & Johnson | 99,205 | 5,859,047 | | Ross Stores, Inc. | 23,851 | 1,271,020 |

| King Pharmaceuticals, Inc.(1) | 27,635 | 209,750 | | Williams-Sonoma, Inc. | 27,334 | 678,430 |

| Merck & Co., Inc. | 5,402 | 188,908 | | | | 5,774,280 |

| Pfizer, Inc. | 259,401 | 3,699,058 | | TEXTILES, APPAREL & LUXURY GOODS — 0.5% |

| | | 16,938,621 | | Jones Apparel Group, Inc. | 56,022 | 887,949 |

| REAL ESTATE INVESTMENT TRUSTS (REITs) — 0.6% | | Timberland Co. (The), Class A(1) | 8,736 | 141,086 |

| CBL & Associates Properties, Inc. | 9,740 | 121,166 | | | | 1,029,035 |

| Duke Realty Corp. | 6,608 | 75,001 | | THRIFTS & MORTGAGE FINANCE(2) | |

| Public Storage | 6,353 | 558,492 | | Ocwen Financial Corp.(1) | 7,668 | 78,137 |

| Simon Property Group, Inc. | 7,755 | 626,216 | | TOBACCO — 1.1% | | |

| Vornado Realty Trust | 103 | 7,514 | | Philip Morris International, Inc. | 12,588 | 577,034 |

| | | 1,388,389 | | Reynolds American, Inc. | 35,202 | 1,834,728 |

| ROAD & RAIL — 0.5% | | | | | | 2,411,762 |

| CSX Corp. | 21,330 | 1,058,608 | | WIRELESS TELECOMMUNICATION SERVICES — 0.1% |

| SEMICONDUCTORS & SEMICONDUCTOR | | | Sprint Nextel Corp.(1) | 78,776 | 334,010 |

| EQUIPMENT — 3.6% | | | | TOTAL COMMON STOCKS | | |

| Broadcom Corp., Class A | 4,899 | 161,520 | | (Cost $217,849,435) | | 227,380,398 |

| Integrated Device | | | | | | |

| Technology, Inc.(1) | 13,340 | 66,033 | | | | |

| Intel Corp. | 226,934 | 4,413,866 | | | | |

| LSI Corp.(1) | 145,525 | 669,415 | | | | |

13

| | | | | |

| VP Income & Growth | | | | |

| |

| | Shares | Value | | Notes to Schedule of Investments |

| Temporary Cash Investments — 0.4% | | (1) | Non-income producing. |

| JPMorgan U.S. Treasury | | | | (2) | Category is less than 0.05% of total net assets. |

| Plus Money Market Fund | | | | | |

| Agency Shares | 29,122 | $ 29,122 | | | |

| Repurchase Agreement, Goldman Sachs | | | See Notes to Financial Statements. |

| Group, Inc., (collateralized by various | | | | |

| U.S. Treasury obligations, 2.75%, 7/31/10, | | | | |

| valued at $917,875), in a joint trading | | | | |

| account at 0.01%, dated 6/30/10, | | | | | |

| due 7/1/10 (Delivery value $900,000) | 900,000 | | | |

| TOTAL TEMPORARY | | | | | |

| CASH INVESTMENTS | | | | | |

| (Cost $929,122) | | 929,122 | | | |

| TOTAL INVESTMENT | | | | | |

| SECURITIES — 100.0% | | | | | |

| (Cost $218,778,557) | | 228,309,520 | | | |

| OTHER ASSETS AND LIABILITIES(2) | (49,673) | | | |

| TOTAL NET ASSETS — 100.0% | | $228,259,847 | | | |

14

|

| Statement of Assets and Liabilities |

| | | |

| JUNE 30, 2010 (UNAUDITED) | | | |

| Assets | | | |

| Investment securities, at value (cost of $218,778,557) | | $228,309,520 |

| Receivable for capital shares sold | | | 39,535 |

| Dividends and interest receivable | | | 291,424 |

| | | | 228,640,479 |

| | | | |

| Liabilities | | | |

| Payable for capital shares redeemed | | | 238,454 |

| Accrued management fees | | | 139,306 |

| Distribution fees payable | | | 2,872 |

| | | | 380,632 |

| | | | |

| Net Assets | | | $228,259,847 |

| | | | |

| Net Assets Consist of: | | | |

| Capital (par value and paid-in surplus) | | | $306,997,248 |

| Accumulated net investment loss | | | (23,553) |

| Accumulated net realized loss on investment transactions | | (88,244,811) |

| Net unrealized appreciation on investments | | | 9,530,963 |

| | | | $228,259,847 |

| |

| | Net assets | Shares outstanding | Net asset value per share |

| Class I, $0.01 Par Value | $212,091,366 | 42,397,497 | $5.00 |

| Class II, $0.01 Par Value | $13,237,787 | 2,645,191 | $5.00 |

| Class III, $0.01 Par Value | $2,930,694 | 585,808 | $5.00 |

| |

| |

| See Notes to Financial Statements. | | | |

15

| |

| FOR THE SIX MONTHS ENDED JUNE 30, 2010 (UNAUDITED) | |

| Investment Income (Loss) | |

| Income: | |

| Dividends (net of foreign taxes withheld of $6,321) | $ 2,722,002 |

| Interest | 7,751 |

| | 2,729,753 |

| | |

| Expenses: | |

| Management fees | 895,108 |

| Distribution fees — Class II | 18,190 |

| Directors’ fees and expenses | 3,663 |

| Other expenses | 22,179 |

| | 939,140 |

| | |

| Net investment income (loss) | 1,790,613 |

| | |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on: | |

| Investment transactions | 7,605,776 |

| Futures contract transactions | 54,002 |

| | 7,659,778 |

| | |

| Change in net unrealized appreciation (depreciation) on investments | (24,391,910) |

| | |

| Net realized and unrealized gain (loss) | (16,732,132) |

| | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $(14,941,519) |

| |

| |

| See Notes to Financial Statements. | |

16

|

| Statement of Changes in Net Assets |

| | |

| SIX MONTHS ENDED JUNE 30, 2010 (UNAUDITED) AND YEAR ENDED DECEMBER 31, 2009 | |

| Increase (Decrease) in Net Assets | 2010 | 2009 |

| Operations | | |

| Net investment income (loss) | $ 1,790,613 | $ 4,778,867 |

| Net realized gain (loss) | 7,659,778 | (42,920,403) |

| Change in net unrealized appreciation (depreciation) | (24,391,910) | 77,540,078 |

| Net increase (decrease) in net assets resulting from operations | (14,941,519) | 39,398,542 |

| | | |

| Distributions to Shareholders | | |

| From net investment income: | | |

| Class I | (1,759,662) | (11,010,568) |

| Class II | (90,728) | (576,303) |

| Class III | (23,788) | (134,815) |

| Decrease in net assets from distributions | (1,874,178) | (11,721,686) |

| | | |

| Capital Share Transactions | | |

| Net increase (decrease) in net assets from capital share transactions | (16,295,704) | (28,726,221) |

| | | |

| Redemption Fees | | |

| Increase in net assets from redemption fees | 259 | 567 |

| | | |

| Net increase (decrease) in net assets | (33,111,142) | (1,048,798) |

| | | |

| Net Assets | | |

| Beginning of period | 261,370,989 | 262,419,787 |

| End of period | $228,259,847 | $261,370,989 |

| | | |

| Accumulated undistributed net investment income (loss) | $(23,553) | $60,012 |

| |

| |

| See Notes to Financial Statements. | | |

17

|

| Notes to Financial Statements |

JUNE 30, 2010 (UNAUDITED)

1. Organization and Summary of Significant Accounting Policies

Organization — American Century Variable Portfolios, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act) as an open-end management investment company. VP Income & Growth Fund (the fund) is one fund in a series issued by the corporation. The fund is diversified under the 1940 Act. The fund’s investment objective is to seek capital growth by investing in common stocks. Income is a secondary objective. The following is a summary of the fund’s significant accounting policies.

Multiple Class — The fund is authorized to issue Class I, Class II and Class III. The share classes differ principally in their respective distribution and shareholder servicing expenses and arrangements. All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Security Valuations — Securities traded primarily on a principal securities exchange are valued at the last reported sales price, or at the mean of the latest bid and asked prices where no last sales price is available. Depending on local convention or regulation, securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official close price. Investments in open-end management investment companies are valued at the reported net asset value. Discount notes may be valued through a commercial pricing service or at amortized cost, which approximates fair value. Securities traded on foreign securities exchanges and over-the-counter markets are normally completed before the close of business on days that the New York Stock Exchange (the Exchange) is open and may also take place on days when the Exchange is not open. If an event occurs after the value of a security was established but before the net asset value per share was determined that was likely to materially change the net asset value, that security would be valued as determined in accordance with procedures adopted by the Board of Directors. If the fund determines that the market price of a portfolio security is not readily available, or that the valuation methods mentioned above do not reflect the security’s fair value, such security is valued as determined by the Board of Directors or its designee, in accordance with procedures adopted by the Board of Directors, if such determination would materially impact a fund’s net asset value. Certain other circumstances may cause the fund to use alternative procedures to value a security such as: a security has been declared in default; trading in a security has been halted during the trading day; or there is a foreign market holiday and no trading will commence .

Security Transactions — For financial reporting purposes, security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. Each repurchase agreement is recorded at cost. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

18

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. The fund is no longer subject to examination by tax authorities for years prior to 2006. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. Accordingly, no provision has been made for federal or state income taxes.

Distributions to Shareholders — Distributions to shareholders are recorded on the ex-dividend date. Distributions from net investment income, if any, are generally declared and paid quarterly. Distributions from net realized gains, if any, are generally declared and paid annually.

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of December 31, 2009, the fund had accumulated capital losses of $(85,971,201), which represent net capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes. Future capital loss carryover utilization in any given year may be subject to Internal Revenue Code limitations. Capital loss carryovers of $(33,351,678) and $(52,619,523) expire in 2016 and 2017, respectively.

The fund has elected to treat $(379,568) of net capital losses incurred in the two-month period ended December 31, 2009, as having been incurred in the following fiscal year for federal income tax purposes.

Redemption — The fund may impose a 1.00% redemption fee on shares held less than 60 days. The fee may not be applicable to all classes. The redemption fee is retained by the fund and helps cover transaction costs that long-term investors may bear when the fund sells securities to meet investor redemptions.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

Use of Estimates — The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America, which may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates.

Subsequent Events — In preparing the financial statements, management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

19

2. Fees and Transactions with Related Parties

Management Fees — The corporation has entered into a Management Agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The Agreement provides that all expenses of managing and operating the fund, except brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on the daily net assets of the specific class of shares of the fund and paid monthly in arrears. For funds with a stepped fee schedule, the rate of the fee is determined by applying a fee rate calculation formula. This formula takes into account the fund’s assets as well as certain assets, if any, of other clients of the investment advisor outside the American Century Investments family of funds (such as subadvised funds and separate accounts) that have very similar investment teams and investment strategies (strategy assets). The annual management fee schedule for each class of the fund ranges from 0.65% to 0.70% for Class I, Class II and Class III. The effective annual management fee for each class for the six months ended June 30, 2010 was 0.70%.

Distribution Fees — The Board of Directors has adopted the Master Distribution Plan (the plan) for Class II, pursuant to Rule 12b-1 of the 1940 Act. The plan provides that Class II will pay American Century Investment Services, Inc. (ACIS) an annual distribution fee equal to 0.25%. The fee is computed and accrued daily based on the Class II daily net assets and paid monthly in arrears. The distribution fee provides compensation for expenses incurred in connection with distributing shares of Class II including, but not limited to, payments to brokers, dealers, and financial institutions that have entered into sales agreements with respect to shares of the fund. Fees incurred under the plan during the six months ended June 30, 2010, are detailed in the Statement of Operations.

Related Parties — Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC), the parent of the corporation’s investment advisor, ACIM, the distributor of the corporation, ACIS, and the corporation’s transfer agent, American Century Services, LLC.

The fund is eligible to invest in a money market fund for temporary purposes, which is managed by J.P. Morgan Investment Management, Inc. (JPMIM). The fund has a Mutual Funds Services Agreement with J.P. Morgan Investor Services Co. (JPMIS) and a securities lending agreement with JPMorgan Chase Bank (JPMCB). JPMCB is a custodian of the fund. JPMIM, JPMIS and JPMCB are wholly owned subsidiaries of JPMorgan Chase & Co. (JPM). JPM is an equity investor in ACC.

3. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the six months ended June 30, 2010, were $75,996,863 and $91,405,585 respectively.

As of June 30, 2010, the composition of unrealized appreciation and depreciation of investment securities based on the aggregate cost of investments for federal income tax purposes was as follows:

| | |

| Federal tax cost of investments | $227,122,113 |

| Gross tax appreciation of investments | $ 22,096,820 |

| Gross tax depreciation of investments | (20,909,413) |

| Net tax appreciation (depreciation) of investments | $ 1,187,407 |

The difference between book-basis and tax-basis cost and unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales.

20

| | | | |

| 4. Capital Share Transactions | | | | |

| |

| Transactions in shares of the fund were as follows: | | |

| | Six months ended June 30, 2010 | Year ended December 31, 2009 |

| | Shares | Amount | Shares | Amount |

| Class I/Shares Authorized | 300,000,000 | | 300,000,000 | |

| Sold | 1,334,325 | $ 7,297,874 | 2,662,082 | $ 12,250,101 |

| Issued in reinvestment of distributions | 318,613 | 1,759,662 | 2,752,869 | 11,010,568 |

| Redeemed | (4,514,571) | (24,755,221) | (10,966,102) | (50,738,660) |

| | (2,861,633) | (15,697,685) | (5,551,151) | (27,477,991) |

| Class II/Shares Authorized | 50,000,000 | | 50,000,000 | |

| Sold | 191,931 | 1,047,822 | 375,445 | 1,760,514 |

| Issued in reinvestment of distributions | 16,428 | 90,728 | 144,662 | 576,303 |

| Redeemed | (260,054) | (1,425,574) | (786,135) | (3,611,604) |

| | (51,695) | (287,024) | (266,028) | (1,274,787) |

| Class III/Shares Authorized | 50,000,000 | | 50,000,000 | |

| Sold | 50,839 | 285,190 | 155,550 | 773,484 |

| Issued in reinvestment of distributions | 4,310 | 23,788 | 33,500 | 134,815 |

| Redeemed | (111,021) | (619,973) | (196,583) | (881,742) |

| | (55,872) | (310,995) | (7,533) | 26,557 |

| Net increase (decrease) | (2,969,200) | $(16,295,704) | (5,824,712) | $(28,726,221) |

5. Fair Value Measurements

The fund’s securities valuation process is based on several considerations and may use multiple inputs to determine the fair value of the positions held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels as follows:

• Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical securities;

• Level 2 valuation inputs consist of significant direct or indirect observable market data (including quoted prices for similar securities, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.); or

• Level 3 valuation inputs consist of significant unobservable inputs (including a fund’s own assumptions).

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the valuation inputs used to determine the fair value of the fund’s securities as of June 30, 2010. The Schedule of Investments provides additional details on the fund’s portfolio holdings.

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investment Securities | | | |

| Common Stocks | $227,380,398 | — | — |

| Temporary Cash Investments | 29,122 | $900,000 | — |

| Total Value of Investment Securities | $227,409,520 | $900,000 | — |

21

6. Derivative Instruments

Equity Price Risk — The fund is subject to equity price risk in the normal course of pursuing its investment objectives. A fund may enter into futures contracts based on an equity index in order to manage its exposure to changes in market conditions. A fund may purchase futures contracts to gain exposure to increases in market value or sell futures contracts to protect against a decline in market value. Upon entering into a futures contract, a fund is required to deposit either cash or securities in an amount equal to a certain percentage of the contract value (initial margin). Subsequent payments (variation margin) are made or received daily, in cash, by a fund. The variation margin is equal to the daily change in the contract value and is recorded as unrealized gains and losses. A fund recognizes a realized gain or loss when the contract is closed or expires. Net realized and unrealized gains or losses occurring during the holding period of futures contracts are a component of net realized gain (loss) on futures contract transactions and change in net unrealized appreciation (depreciation) on futures contracts, respectively. One of the risks of entering into futures contracts is the possibility that the change in value of the contract may not correlate with the changes in value of the underlying securities. During the period, the fund infrequently purchased equity price risk derivative instruments for temporary investment purposes.

At period end, the fund did not have any equity price risk derivative instruments disclosed on the Statement of Assets and Liabilities. For the six months ended June 30, 2010, the effect of equity price risk derivative instruments on the Statement of Operations was $54,002 in net realized gain (loss) on futures contract transactions.

7. Interfund Lending

The fund, along with certain other funds in the American Century Investments family of funds, may participate in an interfund lending program, pursuant to an Exemptive Order issued by the Securities and Exchange Commission (SEC). This program provides an alternative credit facility allowing the fund to borrow from or lend to other funds in the American Century Investments family of funds that permit such transactions. Interfund lending transactions are subject to each fund’s investment policies and borrowing and lending limits. The interfund loan rate earned/paid on interfund lending transactions is determined daily based on the average of certain current market rates. Interfund lending transactions normally extend only overnight, but can have a maximum duration of seven days. The program is subject to annual approval by the Board of Directors. During the six months ended June 30, 2010, the fund did not uti lize the program.

22

8. Corporate Event

As part of a long-standing estate and business succession plan established by ACC Co-Chairman James E. Stowers, Jr., the founder of American Century Investments, ACC Co-Chairman Richard W. Brown succeeded Mr. Stowers as trustee of a trust that holds a greater-than-25% voting interest in ACC, the parent corporation of the fund’s advisor. Under the 1940 Act, this is presumed to represent control of ACC even though it is less than a majority interest. The change of trustee may technically be considered a “change of control” of ACC and therefore also a change of control of the fund’s advisor even though there has been no change to its management and none is anticipated. The “change of control” resulted in the assignment of the fund’s investment advisory agreement. Under the 1940 Act, an assignment automatically terminated such agreement, making the approval of a new agreement neces sary.

On February 18, 2010, the Board of Directors approved an interim investment advisory agreement under which the fund will be managed until a new agreement is approved by fund shareholders. On March 29, 2010, the Board of Directors approved a new investment advisory agreement. The interim agreement and the new agreement are substantially identical to the terminated agreements (with the exception of different effective and termination dates) and will not result in changes in the management of American Century Investments, the fund, its investment objectives, fees or services provided. The new agreement for the fund was approved by shareholders at a Special Meeting of Shareholders on June 16, 2010. The new agreement went into effect on July 16, 2010.

23

| | | | | | | |

| VP Income & Growth | | | | | |

| |

| Class I | | | | | | |

| For a Share Outstanding Throughout the Years Ended December 31 (except as noted) | | |

| | | 2010(1) | 2009 | 2008 | 2007 | 2006 | 2005 |

| Per-Share Data | | | | | | |

| Net Asset Value, | | | | | | |

| Beginning of Period | $5.38 | $4.82 | $8.46 | $8.63 | $7.51 | $7.32 |

| Income From | | | | | | |

| Investment Operations | | | | | | |

| Net Investment | | | | | | |

| Income (Loss)(2) | 0.04 | 0.09 | 0.12 | 0.12 | 0.14 | 0.13 |

| Net Realized and | | | | | | |

| Unrealized Gain (Loss) | (0.38) | 0.70 | (2.77) | (0.13) | 1.12 | 0.20 |

| Total From | | | | | | |

| Investment Operations | (0.34) | 0.79 | (2.65) | (0.01) | 1.26 | 0.33 |

| Distributions | | | | | | |

| From Net | | | | | | |

| Investment Income | (0.04) | (0.23) | (0.14) | (0.16) | (0.14) | (0.14) |

| From Net | | | | | | |

| Realized Gains | — | — | (0.85) | — | — | — |

| Total Distributions | (0.04) | (0.23) | (0.99) | (0.16) | (0.14) | (0.14) |

| Net Asset Value, | | | | | | |

| End of Period | $5.00 | $5.38 | $4.82 | $8.46 | $8.63 | $7.51 |

| |

| Total Return(3) | (6.38)% | 18.10% | (34.59)% | (0.07)% | 17.09% | 4.63% |

| | | | | | | |

| Ratios/Supplemental Data | | | | | | |

| Ratio of Operating | | | | | | |

| Expenses to | | | | | | |

| Average Net Assets | 0.71%(4) | 0.70% | 0.70% | 0.71% | 0.70% | 0.70% |

| Ratio of Net Investment | | | | | | |

| Income (Loss) to | | | | | | |

| Average Net Assets | 1.43%(4) | 1.98% | 1.86% | 1.39% | 1.75% | 1.81% |

| Portfolio Turnover Rate | 30% | 46% | 57% | 54% | 63% | 76% |

| Net Assets, End of Period | | | | | | |

| (in thousands) | $212,091 | $243,409 | $245,028 | $481,304 | $615,658 | $772,330 |

| (1) | Six months ended June 30, 2010 (unaudited). | | | | | |

| (2) | Computed using average shares outstanding throughout the period. | | | | |

| (3) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year |

| | are not annualized. Total returns are calculated based on the net asset value of the last business day. The total return of the classes may not |

| | precisely reflect the class expense differences because of the impact of calculating the net asset values to two decimal places. If net asset |

| | values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The |

| | calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of |

| | value between one class and another. | | | | | |

| (4) | Annualized | | | | | | |

See Notes to Financial Statements.

24

| | | | | | | |

| VP Income & Growth | | | | | |

| |

| Class II | | | | | | |

| For a Share Outstanding Throughout the Years Ended December 31 (except as noted) | | |

| | | 2010(1) | 2009 | 2008 | 2007 | 2006 | 2005 |

| Per-Share Data | | | | | | |

| Net Asset Value, | | | | | | |

| Beginning of Period | $5.38 | $4.81 | $8.44 | $8.62 | $7.50 | $7.30 |

| Income From | | | | | | |

| Investment Operations | | | | | | |

| Net Investment | | | | | | |

| Income (Loss)(2) | 0.03 | 0.08 | 0.10 | 0.10 | 0.12 | 0.11 |

| Net Realized and | | | | | | |

| Unrealized Gain (Loss) | (0.38) | 0.70 | (2.76) | (0.14) | 1.12 | 0.22 |

| Total From | | | | | | |

| Investment Operations | (0.35) | 0.78 | (2.66) | (0.04) | 1.24 | 0.33 |

| Distributions | | | | | | |

| From Net | | | | | | |

| Investment Income | (0.03) | (0.21) | (0.12) | (0.14) | (0.12) | (0.13) |

| From Net | | | | | | |

| Realized Gains | — | — | (0.85) | — | — | — |

| Total Distributions | (0.03) | (0.21) | (0.97) | (0.14) | (0.12) | (0.13) |

| Net Asset Value, | | | | | | |

| End of Period | $5.00 | $5.38 | $4.81 | $8.44 | $8.62 | $7.50 |

| |

| Total Return(3) | (6.49)% | 17.77% | (34.73)% | (0.43)% | 16.81% | 4.52% |

| | | | | | | |

| Ratios/Supplemental Data | | | | | | |

| Ratio of Operating | | | | | | |

| Expenses to | | | | | | |

| Average Net Assets | 0.96%(4) | 0.95% | 0.95% | 0.96% | 0.95% | 0.95% |

| Ratio of Net Investment | | | | | | |

| Income (Loss) to | | | | | | |

| Average Net Assets | 1.18%(4) | 1.73% | 1.61% | 1.14% | 1.50% | 1.56% |

| Portfolio Turnover Rate | 30% | 46% | 57% | 54% | 63% | 76% |

| Net Assets, End of Period | | | | | | |

| (in thousands) | $13,238 | $14,511 | $14,261 | $25,158 | $27,778 | $27,857 |

| (1) | Six months ended June 30, 2010 (unaudited). | | | | | |

| (2) | Computed using average shares outstanding throughout the period. | | | | |

| (3) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year |

| | are not annualized. Total returns are calculated based on the net asset value of the last business day. The total return of the classes may not |

| | precisely reflect the class expense differences because of the impact of calculating the net asset values to two decimal places. If net asset |

| | values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The |

| | calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of |

| | value between one class and another. | | | | | |

| (4) | Annualized | | | | | | |

See Notes to Financial Statements.

25

| | | | | | | |

| VP Income & Growth | | | | | |

| |

| Class III | | | | | | |

| For a Share Outstanding Throughout the Years Ended December 31 (except as noted) | | |

| | | 2010(1) | 2009 | 2008 | 2007 | 2006 | 2005 |

| Per-Share Data | | | | | | |

| Net Asset Value, | | | | | | |

| Beginning of Period | $5.38 | $4.82 | $8.46 | $8.63 | $7.51 | $7.32 |

| Income From | | | | | | |

| Investment Operations | | | | | | |

| Net Investment | | | | | | |

| Income (Loss)(2) | 0.04 | 0.09 | 0.12 | 0.12 | 0.13 | 0.13 |

| Net Realized and | | | | | | |

| Unrealized Gain (Loss) | (0.38) | 0.70 | (2.77) | (0.13) | 1.13 | 0.20 |

| Total From | | | | | | |

| Investment Operations | (0.34) | 0.79 | (2.65) | (0.01) | 1.26 | 0.33 |

| Distributions | | | | | | |

| From Net | | | | | | |

| Investment Income | (0.04) | (0.23) | (0.14) | (0.16) | (0.14) | (0.14) |

| From Net | | | | | | |

| Realized Gains | — | — | (0.85) | — | — | — |

| Total Distributions | (0.04) | (0.23) | (0.99) | (0.16) | (0.14) | (0.14) |

| Net Asset Value, | | | | | | |

| End of Period | $5.00 | $5.38 | $4.82 | $8.46 | $8.63 | $7.51 |

| |

| Total Return(3) | (6.38)% | 18.10% | (34.59)% | (0.07)% | 17.09% | 4.63% |

| | | | | | | |

| Ratios/Supplemental Data | | | | | | |

| Ratio of Operating | | | | | | |

| Expenses to | | | | | | |

| Average Net Assets | 0.71%(4) | 0.70% | 0.70% | 0.71% | 0.70% | 0.70% |

| Ratio of Net Investment | | | | | | |

| Income (Loss) to | | | | | | |

| Average Net Assets | 1.43%(4) | 1.98% | 1.86% | 1.39% | 1.75% | 1.81% |

| Portfolio Turnover Rate | 30% | 46% | 57% | 54% | 63% | 76% |

| Net Assets, End of Period | | | | | | |

| (in thousands) | $2,931 | $3,451 | $3,131 | $7,222 | $9,838 | $5,601 |

| (1) | Six months ended June 30, 2010 (unaudited). | | | | | |

| (2) | Computed using average shares outstanding throughout the period. | | | | |

| (3) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year |

| | are not annualized. Total returns are calculated based on the net asset value of the last business day. The total return of the classes may not |

| | precisely reflect the class expense differences because of the impact of calculating the net asset values to two decimal places. If net asset |

| | values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The |

| | calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of |

| | value between one class and another. | | | | | |

| (4) | Annualized | | | | | | |

See Notes to Financial Statements.

26

A special meeting of shareholders was held on June 16, 2010, to vote on the following proposals. Each proposal received the required number of votes and was adopted. A summary of voting results is listed below each proposal.

Proposal 1:

To elect one Director to the Board of Directors of American Century Variable Portfolios, Inc. (the proposal was voted on by all shareholders of funds issued by American Century Variable Portfolios, Inc.):

| | |

| John R. Whitten | For: | 2,509,343,092 |

| | Withhold: | 137,098,251 |

| | Abstain: | 0 |

| | Broker Non-Vote: | 0 |

The other directors whose term of office continued after the meeting include Jonathan S. Thomas, Thomas A. Brown, Andrea C. Hall, James A. Olson, Donald H. Pratt, and M. Jeannine Strandjord.

Proposal 2:

To approve a management agreement between the fund and American Century Investment Management, Inc.:

| | |

| Class I, Class II, and Class III | For: | 204,378,640 |

| | Against: | 10,157,345 |

| | Abstain: | 15,115,205 |

| | Broker Non-Vote: | 0 |

27

|

| Board Approval of Management Agreements |

American Century Investment Management, Inc. (“ACIM” or the “Advisor”) currently serves as investment advisor to the Fund under a management agreement (the “Current Management Agreement”) that took effect on July 16, 2010, following approval by the Fund’s Board of Directors (the “Board”) and shareholders. The Advisor previously served as investment advisor to the Fund pursuant to a management agreement (the “Prior Management Agreement”) and an interim management agreement (the “Interim Management Agreement”). The Interim Management Agreement terminated in accordance with its terms on July 16, 2010, upon the effectiveness of the Current Management Agreement. The Prior Management Agreement terminated on February 16, 2010, as a result of a change of control of the Advisor’s parent company, American Century Companies, Inc. (“ACC”). The cha nge in control occurred as the result of a change in the trustee of a trust created by James E. Stowers, Jr., the founder of American Century Investments, which holds shares representing a significant interest in ACC stock. Mr. Stowers previously served as the trustee of the trust. On February 16, 2010, Richard W. Brown, Co-Chairman of ACC with Mr. Stowers, became the trustee in accordance with the terms of the trust and Mr. Stowers’ long-standing estate and succession plan.

On February 18, 2010, the Board approved the Interim Agreement in accordance with Rule 15a-4 under the Investment Company Act to ensure continued management of the Fund by the Advisor after the termination of the Prior Agreement and until shareholder approval of the Current Management Agreement as required under the Act. The Board approved the Current Agreement and recommended its approval to shareholders. Fund shareholders approved the Current Agreement at a meeting held on June 16, 2010.

The Interim Agreement and the Current Agreement are substantially identical to the Prior Agreement except for their effective dates and the termination provisions of the Interim Agreement. Under the Current Agreement, the Advisor will provide the same services as provided by the Advisor, be subject to the same duties, and receive the same compensation rate as under the Prior Agreement.

Basis for Board Approval of Interim Agreement

In considering the approval of the Interim Agreement, Rule 15a-4 requires the Board to approve the contract within ten business days of the termination of the prior agreement and to determine that the compensation to be received under the interim agreement is no greater than would have been received under the corresponding prior agreement. In connection with the approval, the Board noted that it oversees on a continuous basis and evaluates at its quarterly meetings, directly and through the committees of the Board, the nature and quality of significant services provided by the Advisor, the investment performance of the Fund, shareholder services, audit and compliance functions and a variety of other matters relating to the Fund’s operations.

28

In evaluating the Interim Agreement, the Board, assisted by the advice of its independent legal counsel, considered a number of factors in addition to those required by the rule with no one factor being determinative to its analysis. Among the factors considered by the Board were the circumstances and effect of the change of control, the fact that the Advisor will provide the same services and receive the same compensation rate as under the Prior Agreement, and that the change of control did not result in a change of the personnel managing the Fund. Upon completion of its analysis, the Board approved the Interim Agreement, determining that the continued management of the Fund by the Advisor was in the best interests of the Fund and Fund shareholders.

Basis for Board Approval of Current Agreement

At a meeting held on March 29, 2010, after considering all information presented, the Board approved, and determined to recommend that shareholders approve, the Current Agreement. In connection with that approval, the Board requested and reviewed extensive data and information compiled by the Advisorand certain independent providers of evaluation data concerning the Fund and services provided to the Fund. The Board oversees on a continuous basis and evaluates at its quarterly meetings, directly and through the committees of the Board, the nature and quality of significant services provided to the Fund, the investment performance of the Fund, shareholder services, audit and compliance functions and a variety of other matters relating to the Fund’s operations. The information considered and the discussions held at the meetings included, but were not limited to:

• the nature, extent and quality of investment management, shareholder services and other services provided to the Fund;

• the wide range of programs and services provided to the Fund and its shareholders on a routine and non-routine basis;

• the compliance policies, procedures, and regulatory experience of the Advisor;

• data comparing the cost of owning the Fund to the cost of owning similar funds;

• the fact that there will be no changes to the fees, services, or personnel who provide such services as compared to the Prior Agreement;

• data comparing the Fund’s performance to appropriate benchmarks and/or a peer group of other mutual funds with similar investment objectives and strategies;

• financial data showing the profitability of the Fund to the Advisor and the overall profitability of the Advisor;

29

• data comparing services provided and charges to the Fund with those for other non-fund investment management clients of the Advisor; and

• consideration of collateral or “fall-out” benefits derived by the Advisor from the management of the Fund and potential sharing of economies of scale in connection with the management of the Fund.

The Board also considered whether there was any reason for not continuing the existing arrangement with the Advisor. In particular, the Board recognized that shareholders may have invested in the Fund on the strength of the Advisor’s industry standing and reputation and in the expectation that the Advisor will have a continuing role in providing services to the Fund.

The Board considered all of the information provided by the Advisor, the independent data providers, and the Board’s independent legal counsel, and evaluated such information for the Fund. The Board did not identify any single factor as being all-important or controlling, and each Board member may have attributed different levels of importance to different factors. In deciding to approve the Current Agreement under the terms ultimately determined by the Board to be appropriate, the Board based its decision on a number of factors, including the following:

Nature, Extent and Quality of Services — Generally. Under the Current Agreement, the Advisor is responsible for providing or arranging for all services necessary for the operation of the Fund. The Board noted that under the Current Agreement, the Advisor provides or arranges at its own expense a wide variety of services including:

• constructing and designing the Fund

• portfolio research and security selection

• initial capitalization/funding

• securities trading

• Fund administration

• custody of Fund assets

• daily valuation of the Fund’s portfolio

• shareholder servicing and transfer agency, including shareholder

confirmations, recordkeeping and communications

• legal services

• regulatory and portfolio compliance

• financial reporting

• marketing and distribution

30

The Board noted that many of these services have expanded over time both in terms of quantity and complexity in response to shareholder demands, competition in the industry, changing distribution channels and the changing regulatory environment.