The results to date strongly suggest the need for follow up drill investigation. These surface results will be combined with proposed geophysical survey data to form the basis for new drill targets to be explored during 2010.

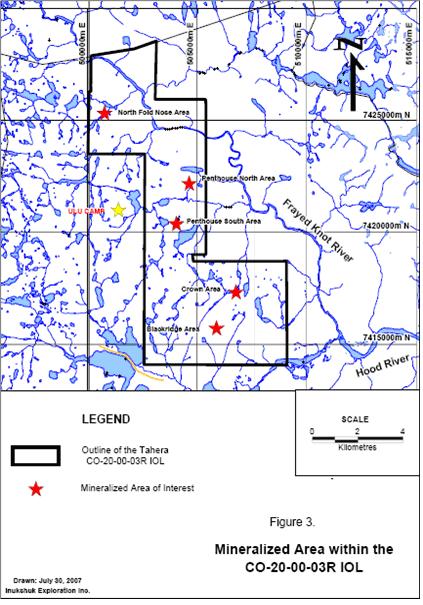

The North Fold Nose is another area where significant gold mineralization was identified through rock chip sampling. These samples were collected over an area measuring 400 metres by 800 metres. The North Fold Nose zone is located approximately 3 km north of the ULU deposit and appears to be the northern extension of the same major fold structure which hosts the ULU deposit.

Significant results are presented in table format below.

The mineralization in the Blackridge, Crown, Penthouse and North Fold Nose Areas of the property all require additional mapping and drill testing during a proposed 2010 exploration program.

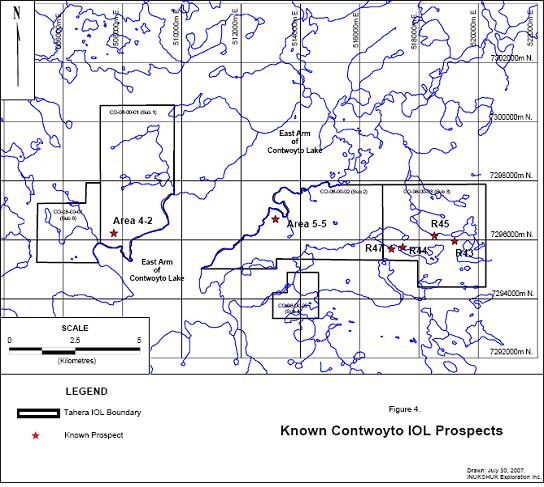

With the use of recent airborne geophysical surveys and new structural data, Golden River Resources has outlined numerous zones of banded iron formations with strike lengths of over several kilometres on the Contwoyto concessions. A total of 381 samples were collected from the six Contwoyto concession subsections. To date the scope of work has been limited to a more regional nature in this area. The majority of the best values (between 600 and 14,000 ppb gold) come from folded and faulted deformation zones within several of the iron formation horizons. The size and nature of at least three areas appear similar to the nearby Lupin Mine. Further detailed work is required over the principle areas of the Contwoyto concession including proposed ground geophysical surveying and geological mapping.

Golden River remains very encouraged by the 2004 and 2006 exploration programs which were successful in finding new locations of strong mineralization. Following these initial field investigation programs, the characteristics and gold-bearing potential of the Hood and Contwoyto IOL’s are better understood. Subsequent to the acquisition of the results of a proposed geophysical program yet to be undertaken within both areas, it can be reasonably expected that additional quality drill targets should be identified.

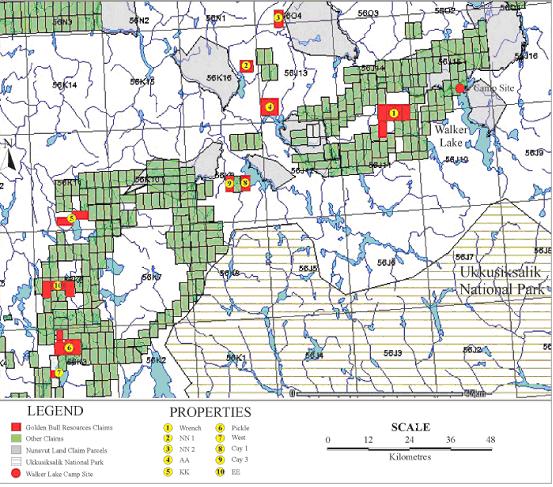

In June 2002, highly prospective ground within the Committee Bay Greenstone Belt (“CBGB”) was selected and staked on behalf of the Company. Golden River Resources owns 100 percent interest of its Committee Bay Area Properties. All claims are on federally owned ground and mineral title is administered by the federal government.

The Committee Bay Greenstone Belt is located approximately 240 kilometres northeast of Baker Lake in Nunavut, Canada and is believed to represent the largest under-explored greenstone belt in North America, with potential to host world-class gold deposits.

The geology is highly prospective for banded iron formation hosted gold mineralization (as in the 3 million ounce Meadowbank and the 4.6 million ounce Meliadine gold deposits located to the south of the properties, and north the hamlets of Baker Lake and Rankin Inlet, respectively). The Golden River Resources (through Golden Bull Resources, a 100 percent subsidiary of Golden River Resources) Properties protect several auriferous iron formations. In addition to the banded iron formation (“BIF”)-hosted gold targets, this belt has potential for shear-hosted lode gold, Witswaterstrand-style gold, komatiite-hosted stratiform-nickel-copper (Kambalda analogy), and platinum group elements (“PGE’s”) occurring in layered igneous complexes (Laughland Lake Anorthosite Suite).

Originally 29 properties were staked comprising a land area of 71,694 acres in the Committee Bay Greenstone Belt in central Nunavut, Canada. These properties were recorded on October 16, 2002. From the original area the company retained a total of 49,815.9 acres on 22 claims which comprise 10 individual properties. To maintain the properties in good standing, the company was required to spend a total of CDN$197,798 of assessment work by October 16, 2004. A total of CDN$98,879 (CDN$2 per acre) is required in each subsequent year up to 2012 (at which point a decision to bring the properties to lease must be made). During the 2004 field season, the company spent CDN$1.567 million on exploration and all amounts in excess of the 2004 commitment were applied to offset against future assessment commitments. As a result of the amount the company spent during 2004, it has already met the expenditure commitments until 2010 for some properties and to 2012 for most others. A list of the mining properties in the Committee Bay Greenstone Belt is included as Appendix B to this Annual Report.

The Committee Bay Claims are located 245 to 365 kilometres northeast of the hamlet of Baker Lake (Qamani’tuaq), Nunavut, Canada, or 210 to 320 kilometres west to southwest of the hamlet of Repulse Bay (Naujat). The remote community of Kugaaruk (formerly Pelly Bay) is 190 to 305 kilometres northeast of the claim groups. The company’s land holdings in the Committee Bay Greenstone Belt include 22 properties in 10 claim blocks. These properties total approximately 49,815.9 acres and all were recorded on October 16, 2002. The sole exception to this is the GB 1 Claim which was recorded on September 13, 2004. There are no known encumbrances on any of the Company’s properties.

Figure 5. – Location of Committee Bay Area Properties

Access to the properties is by fixed wing aircraft. Alternatively, float equipped planes have the option of landing at some of the larger lakes (Laughland Lake, Walker Lake, etc.) or on sections of the Hayes River. Helicopter support is required to mobilize personnel from camp to the property areas.

The Committee Bay Greenstone Belt lies within the zone of permafrost. The mean annual temperature of -20 degrees Celsius reflects its Arctic location (the Arctic Circle transects the property area). The climate is typical of the Eastern Arctic with average temperatures in the winter months of -30 degrees Celsius to -35 degrees Celsius, and +10 degrees Celsius to +12 degrees Celsius in the summer. The ground remains snow covered for more than 250 days a year (generally September to June). Rivers break up in June and lakes are generally ice bound until mid July.

The project area is on the northern section of the Wager Plateau, a shield area that has been significantly modified by glacial processes. Elevations range from 122 metres above sea level in the southwest to 560 metres above sea level in the northeast.

The closest community with regularly scheduled air service is Baker Lake, about 350 kilometres to the southwest. Canadian North and First Air flights arrive from Yellowknife and Iqaluit. Calm Air flies from Winnipeg to Rankin Inlet (Kangiqliniq) and then on to Baker Lake daily except Sundays. Kivalliq Air flies from Cambridge Bay (Qaluktuuttiaq) to Baker Lake enroute to Rankin Inlet. Fuel and expediting services are available in Baker Lake or Rankin Inlet. There is no infrastructure in the claim area. Committee Bay Resources maintains the Hayes River field camp which seasonally services their Three Bluffs Deposit. A winter airstrip and fairly regular supply flights generally service this site.

All previous work reported by companies is quoted from Open File government assessment reports.

Following the release of Heywood’s original geology map of the area in 1961, several exploration companies performed work within the Committee Bay Greenstone Belt The nickel-copper potential of ultramafic rocks was the primary target of this first exploration wave. Between 1969 and 1970, explorers mapped, sampled and conducted limited geophysical surveys on areas now covered by the company’s current “AA” and “EE” Properties. This historical program outlined several electromagnetic conductors to be coincident with surface mineralization. The best trenched nickel value occurred on the “EE” Property within a 1.46 kilometre long conductor.

Further exploration was undertaken during the general nickel-copper reconnaissance between 1970 and 1974 and more detailed work followed in 1975 and again in 1976. Geologic mapping, ground magnetic and EM surveys were conducted in the Hayes River Area. Although prospective rock units carrying nickel and copper values were identified, no further follow up work was recommended.

In 1986, reconnaissance rock samples were taken from within the area currently held by the company’s Pickle Property.

Southwest of the Central Tonalite, in the area of the company’s Pickle Property, several permits were granted to the Committee Bay Joint Venture (CBJV) in 1993. Sampling by CBJV returned gold values in sheared, banded iron formation which hosted pyrite +/- arsenopyrite mineralization. Although CBJV’s Pickle 1 Claim was staked in 1995, no follow-up work was reported. The airborne magnetic expression of the iron formation at this site is 70–100 metres thick and traceable intermittently on surface for 1.35 kilometres.

In 1992, reconnaissance sampling in the Committee Bay Area was undertaken on behalf of the CBJV. Several highly anomalous gold values were returned from rock samples taken by field crews. Follow-up work was performed in 1993. High gold values corresponded to samples of banded iron formation containing quartz veining and/or silicification and pyrite, pyrrhotite, (±) arsenopyrite mineralization. In 1995, additional rock samples were obtained, and eight drill holes totaling 811.41 metres were completed. This work exclusively focused on the Bluff Claims in Hayes River Area and the Inuk Area located further to the northeast. In 1996, the CBJV flew a 13,262 line-kilometre detailed geophysical survey (magnetics and VLF), collected additional rock samples and drilled 6 diamond drill holes at Three Bluffs. Approximately CDN$5.4 million was collectively spent on the Committee Bay Greenstone Belt between 1992 and 2001 by explorers. This exploration focused on three areas: Laughland Lake, Hayes River and Curtis River.

Numerous gold occurrences were discovered by the CBJV between 1992 and 2001. Of particular note are the Pickle, Four Hills, Cop, Ghost Coyote, Ridge, Bluff Group and West Plains Prospects.

The company’s five Wrench Claims which comprise the Wrench Property were previously within prospecting permits granted to the CBJV in 1994. Reconnaissance sampling by the CBJV returned a series of gold anomalies over a distance of approximately three kilometres and all located within sheared, oxide banded, iron formation in their northern part of their adjacent BLUFF Claim Block.

The Committee Bay Greenstone Belt was the subject of two separate 3 year (2000-2003) government Targeted Geoscience Initiatives (“TGI”). These TGIs consisted of a collaboration among the Geological Survey of Canada, Canada-Nunavut Geoscience Office and university partners. The stated objective of the TGI was to increase the level and cost-effectiveness of private sector exploration for mineral resources within the Committee Bay Greenstone Belt. Government work in the Committee Bay Greenstone Belt included 1:100,000 scale geologic mapping, prospecting, surficial mapping, drift prospecting, and airborne geophysical surveys. Airborne magnetic surveys (400 metre flight line spacing) were carried out and released as total field maps in 2002. Quaternary research involved multimedia sampling for gold and base metals and this drift prospecting/sampling was carried out between 2001 and 2003.

The government aeromagnetic survey shows a northeast continuation of the Three Bluffs iron formation for at least three kilometres onto the Golden River (through a 100 percent ownership of its subsidiary Golden Bull Resources) Wrench properties. Government sampling in 2001 on this trend, eastward from the Three Bluffs Deposit, returned gold values from sulphide-bearing (pyrite + pyrrhotite), quartz-veined intervals of oxide banded iron formation within the area currently covered by the boundaries of the company’s Wrench Property.

Numerous other prospective gold targets within the greenstone belt (West Plains, Four Hills, Coyote, etc) are the subject of ongoing investigation by Committee Bay Resources Limited (“CBR”). For the most part, the mineral properties of Golden River Resources either border on, or are along strike of, an adjacent CBR Prospect.

| Figure 6 - | Location of the Company’s Committee Bay Greenstone Belt Claims. |

Geologic Setting

The Prince Albert Group (“PAG”) incorporates a series of Archean-aged greenstone belts that stretch approximately 600 kilometres northeast from the Aylmer Shear Zone in the south to the eastern tip of Melville Peninsula in the north. A 300 kilometres long section southwest of Committee Bay is referred to as the Committee Bay Greenstone Belt.

The stratigraphy of the Committee Bay Greenstone Belt includes banded iron formation up to 50 metres thick, komatiite volcanic flows, basalts, intermediate to felsic tuffs, and quartz-cobble conglomerates. Deformation is recorded by major shear zones, second order faults, complex folding, and felsic intrusions. Numerous gold prospects are spread out over a 260 x 40 kilometre area including CBR’s Inuk Zone in northeast Committee Bay and their Three Bluffs Zone in the Hayes River Area.

The approximate age of the Committee Bay Greenstone Belt ranges from 2.718 billion years to 2.732 billion year old. Younger plutonic intrusions include the 1830 Million year old Hudson monzo-granites. Laterally continuous, northeast-trending, quartz-feldspar porphyry dikes, 0.5 metre to 10 metre wide, are traceable for hundreds of metres in the Three Bluffs Area. Age dates for these porphyry dikes are not currently available.

Prospects

The Committee Bay Greenstone Belt appears to have the potential to host a number of mineral deposit types including banded iron formation hosted gold, shear-hosted lode gold, komatiite hosted, stratiform, nickel-copper (Kambalda analogy) mineralization, and platinum group elements in layered igneous complexes.

Examples of iron formation-hosted gold mineralization include the company’s Wrench Property where government sampling in 2001 returned gold values from samples of sulphide-bearing (pyrite + pyrrhotite), quartz-veined intervals of oxide banded iron formation. This section of anomalous, gold-bearing iron formation is over 6.5 kilometres long and includes not only the CBR Three Bluff occurrence but also the company’s adjacent Wrench Claim Block.

Other iron formation-hosted gold examples include mineralization on the company’s Pickle Property. The gold values are found in sulphide-rich sections (arsenopyrite and pyrite) of the sheared, oxide + silicate facies banded iron formation. The airborne magnetic expression of the iron formation at this site is 70–100 metres thick and traceable intermittently on surface for 1.35 kilometres.

In addition, anomalous gold values have been identified in sampling of iron formation found on the Company’s NN1 and NN2 Properties.

An example of shear-hosted, gold mineralization in the Committee Bay Greenstone Belt is CBR’s Coyote Prospect where high-grade gold values were returned from an intensely sheared gabbro with quartz veins, pyrite + pyrrhotite + chalcopyrite + visible gold. The hosting structure is a splay off the east-west Walker Lake Shear Zone and is a classic setting for shear-hosted gold mineralization. Through Golden Bull Resources, Golden River Resources holds title to a claim immediately adjacent to either side of the Coyote Claim Prospect. Rock exposure on these two claims is extremely limited.

Komatiite-hosted (Kabalda-style) nickel potential exists on the company’s EE Property (EE 1-3 Claims). These properties cover anomalous nickel values spread over 930 metres along a contact between a thick ultramafic body and sediments. Elevated copper values were also reported in samples. A second ultramafic/sediment contact on the western edge of the western EE Claim also has anomalous nickel over a similar strike length. The folded stratigraphy in the centre of the EE Property is also appears to have the potential to host gold mineralization but exposure is somewhat limited in this area.

The Laughland Lake Anorthosite Suite (“LLAS”) also has good PGE-hosting potential. Although the company has no claims in the area, rusty zones defined by sulphide gossans of up to 100 metres wide and 500 metres long have been reported. Moderately anomalous platinum, palladium nickel and copper values have been reported from sampling of these zones.

Work Program

A total of CDN$1.567 million was spent on the company’s Committee Bay Greenstone Belt 2004 program. A large portion of the expense went to establishing a re-usable base-camp into this extremely remote location. All field, office, and camp supplies, as well as fuel, were flown in to a tiny island at the north end of Walker Lake upon which the base camp had been established. All subsequent field activities were helicopter supported.

The 2004 exploration program began in late May with a geophysical program on the Wrench Property. This is covered in the “Geophysical Surveys” section. Subsequently, between June 2004 and early September 2004, a regional, grassroots-type prospecting/mapping program was undertaken to explore all of the company’s mineral properties in the Committee Bay Greenstone Belt. Each of the 22 claim blocks which comprise the company’s 10 properties holds significant mineralization. In some localities outcrop was not abundant or even observed; however, many of the claim sites were selected to cover key magnetic anomalies identified from the government regional airborne survey.

A total of 1,476 rock samples were removed and analyzed from the company’s 22 existing mineral claims. In addition, a small soil grid was established on the Wrench Property and 658 soil samples were collected. Anomalous gold values were returned from sampling on several of the claim areas. Of particular note were the results from the company’s Wrench Property which cover an area adjacent to the CBR’s Three Bluffs Deposit. This property was found to exhibit identical structures and lithologies as to those CBR has identified on their adjacent Three Bluffs Property. Sampling along exposed banded iron formation produced high gold values within the 1.5 kilometre strike length of the targeted iron formation horizon.

Geophysical Surveys

The entire Committee Bay Greenstone Belt Area has been covered by government funded, 400 metre flight-line spacing airborne magnetic surveys to produce map coverage at a scale of 1:100,000. These surveys identity areas where linear magnetic anomalies exist: generally linear magnetic anomalies reflect underlying magnetic banded iron formation. This was undertaken as part of the government TGI initiative. To date the company’s Wrench Property is the only area that has been subjected to ground geophysical surveys.

Wrench Property

An eighty six-line grid was established over the Wrench Claims by Aurora Geosciences Ltd. of Yellowknife, NWT. Grid point control was accomplished using GPS technology. Lines were spaced every one hundred metres and in total the grid was comprised of 176.46 line kilometres. Subsequently, two geophysical surveys were undertaken. Total field magnetic surveying was carried out with readings obtained at 6.25 metre stations. Horizontal loop electromagnetic (HLEM) surveying was also undertaken. Readings for this survey were spaced at twenty five metre intervals.

The Wrench Claim Group comprises five contiguous properties covering approximately 4,900 hectares. A government aeromagnetic survey confirms that the Wrench iron formation is directly connected with, and along strike from, CBR’s Three Bluffs iron formation-hosted gold deposit.

The geophysical program served a number of purposes. The magnetic survey accurately traced the iron formation and delineated important structural information such as faulting and folding. The HLEM component highlighted where the conductive pyrrhotite-rich sections of the iron formation are located and, in conjunction with the magnetic surveys, define potential trenching and drill targets.

The magnetic survey outlined a strong, six kilometre long, northeast-trending, magnetic anomaly along that exists along the western half of the grid. In the southeastern portion of the grid, two additional strong, parallel, magnetic anomalies were also recorded. The HLEM survey outlined 17 distinct conductive trends/anomalies, most of which are coincident with, or flank, very strong magnetic features.

Field verification of the magnetic anomalies indicated that the magnetic anomalies are a result of the presence of continuous banded iron formation units that underlie the grid area.

Proposed Work

We did not conduct any exploration activities on our Committee Bay prospects during fiscal 2008 or 2009. A work commitment of $2.00 per acre or an equal amount assessed as an in lieu of assessment fee payment (totalling CDN$20,236.80 per year) will be required on or before October 16, 2010 to keep the KK and AA properties in good standing for a year past their current expiry date of October 16, 2010.

The large assessment credit excess accrued as a result of the 2004 program that was applied toward the claims allowed the company to meet its expenditure commitments until 2012 for most properties (see Appendix B). However, as a result of the high gold potential of the claims and exploration interest in the Committee Bay Greenstone Belt, further work is being planned.

Future exploration programs will involve additional ground geophysical surveys, geologic mapping, prospecting, sampling, and drilling. Identification and definition of drill targets will be the primary objective.

Four areas already present themselves as obvious drill targets:

| i) | the Wrench Prospect which is along strike of CBR’s Three Bluffs Deposit; |

| ii) | the Pickle Property iron formation which has the thickest intervals of sheared banded iron formation |

| iii) | the West Claim/Property which is adjacent to, and on strike with, the geophysical anomalies currently identified CBR on their West Plains Property and |

| iv) | the “S”-folded magnetic anomaly underlying the KK Property will have to be drill tested as there is no outcrop exposed in the area of the anomaly or more specifically, the fold hinges |

The company has not scheduled the timing of these future exploration activities, which will depend on the availability of funds and ongoing developments on its Slave Craton Prospects.

REGULATION

Mining in Canada

The mining industry in Canada operates under both federal and provincial or territorial legislation governing the exploration, development, production and decommissioning of mines. Such legislation relates to the method of acquisition and ownership of mining rights, labour, health and safety standards, royalties, mining and income taxes, exports, reclamation and rehabilitation of mines, and other matters. The mining industry in Canada is also subject to legislation at both the federal and provincial or territorial levels concerning the protection of the environment. Legislation imposes high standards on the mining industry to reduce or eliminate the effects of waste generated by extraction and processing operations and subsequently deposited on the ground or emitted into the air or water. The design of mines and mills, and the conduct of extraction and processing operations, are subject to the regulatory restrictions. The exploration, construction, development and operation of a mine, mill or refinery require compliance with environmental legislation and regulatory reviews, and the obtaining of land use and other permits, water licenses and similar authorizations from various governmental agencies. Legislation is in place for lands under federal jurisdiction or located in certain provinces and territories that provide for the preparation of costly environmental impact assessment reports prior to the commencement of any mining operations. These reports require a detailed technical and scientific assessment as well as a prediction of the impact on the environment of proposed mine exploration and development.

Failure to comply with the requirements of environmental legislation may result in regulatory or court orders being issued that could result in the cessation, curtailment or modification of operations or that could require the installation of additional facilities or equipment to protect the environment. Violators may be required to compensate those suffering loss or damage by reason of mining activities and the violators, including our officers and directors, may be fined or, in some cases, imprisoned if convicted of an offence under such legislation. Provincial and territorial mining legislation establishes requirements for the decommissioning, reclamation and rehabilitation of mining properties that are closed. Closure requirements relate to the protection and restoration of the environment and the protection of public safety. Some former mining properties must be managed for a long time following closure in order to fulfill regulatory closure requirements. The cost of closure of existing and former mining properties and, in particular, the cost of long-term management of open or closed mining properties can be substantial.

Government Regulations

We are committed to complying and, to our knowledge, are in compliance with all governmental and environmental regulations. Permits from a variety of regulatory authorities are required for many aspects of mine operation and reclamation. Our exploration work is subject to the Mining Land Use Regulations of the Indian and Northern Affairs Canada Mining Act. This Act requires us to obtain permits prior to performing significant exploration programs.

We cannot predict the extent to which future legislation and regulation could cause additional expense, capital expenditures, restrictions, and delays in the development of our Canadian properties, including those with respect to mining properties. Our activities are not only subject to extensive federal, provincial and local regulations controlling the mining of and exploration for mineral properties, but also the possible effects of such activities upon the environment. We will be obligated to take steps to ensure that such streams draining the property do not become contaminated as a result of our activities on the property. We are not aware of any environmental problems on the property as of the date of this filing.

The mining industry in Nunavut, where our exploration properties are situated, operates under Canadian federal and territorial legislation governing prospecting, development, production, environmental protection, exports, income taxes, labour standards, mine safety and other matters. We believe our Canadian operations are operating in substantial compliance with applicable law.

Our exploration works is subject to environmental regulation primarily by the Federal Department of Indian Affairs and Northern Development and the Nunavut Water Board. The Department of Fisheries & Oceans (Canada) and the Department of the Environment (Canada) have an enforcement role in the event of environmental incidents, but presently have no direct regulatory role in relation to exploration activity.

On April 1, 1999, the Nunavut Land Claims Agreement, dated May 28, 1993, between the Inuit of Canada’s eastern arctic region and Her Majesty the Queen in right of Canada, came into force. Under this agreement, the Inuit were granted ownership of approximately 360,000 square kilometres of land in an area referred to as the Nunavut Settlement Area, including ownership of subsurface rights in approximately 37,500 square kilometres of those lands. Third party interests in lands in the Nunavut Settlement Area created prior to April 1, 1999 are protected under the Nunavut Land Claims Agreement. Where a third party was granted a mining lease under the Canada Mining Regulations in lands comprising the Nunavut Settlement Area, that interest continues in accordance with the terms and conditions on which it was granted, including any rights granted under the legislation that give rise to the interest. However, where any successor legislation has the effect of diminishing the rights afforded to the federal government, it will not bind the Inuit without its consent. The Inuit are entitled to receive whatever compensation is payable by the interest holder for the use of exploitation of mineral rights. The federal government continues to administer the third party interest on behalf of the Inuit, unless the third party and the Inuit enter into an agreement under which the third party agrees to the administration of their interest by the Inuit. In the event such an agreement is reached, the applicable legislation will cease to apply to the third party interest. Subsurface interests in such lands continue to be administered in accordance with applicable legislation relating to those interests and are not affected by the Nunavut Land Claims Agreement.

Third party interests in lands in the Nunavut Settlement Area created on or after April 1, 1999 are granted, in the case of surface rights, by the appropriate regional Inuit Association and, in the case of subsurface rights, by Nunavut Tunngavik Incorporated which will hold subsurface title to Inuit owned lands and will be additionally responsible, in consultation with the appropriate regional Inuit Associations, for the administration and management of those subsurface rights.

Government Requirements for Maintenance of Claims

The regulations governing the requirements for the maintenance of claims is dependant upon whether the claims are within a federal jurisdiction of if they are located on ground that is controlled by the NTI under the Nunavut Land Claims Agreement.

Within The Slave Craton

Tahera controlled mineral properties within the Slave Craton fall under the jurisdiction of both the Federal government and the Nunavut Land Claims Agreement. Fees and exploration expenditures associated with the maintenance of Tahera Corporation’s ground covered under the Slave Craton Agreement with Golden River Resources is the responsibility of Tahera Diamond Corporation.

Within The Committee Bay Greenstone Belt

The Nunavut Government has granted the company interest in the 22 mineral claims which comprise 10 distinct mineral properties in the Committee Bay Greenstone Belt described in this report. All claims fall under the jurisdiction of Federal regulations.

To keep the existing 22 claims in good standing, the company was required to spend a total of CDN$197,798 of qualifying assessment work by October 16, 2004. Assessment work must be filed with the Mining Recorder within 30 days of the claim’s anniversary date or within 60 days of the lapsing notice date.

A total of CDN$98,879 (CDN$2 per acre) is required in each subsequent year up to 2012 (at which point a decision to bring the properties to lease must be made).

In 2004 the company spent a total of CDN$1,566,962 of on its Committee Bay Area Properties. All assessment work was filed and the excess of CDN$1,369,164 was used to offset the expenditure (assessment) requirement due in following years. As a result the company has already met its assessment expenditure commitments until 2012 for most properties (for a detailed listing, see Appendix B).

Employees

We use temporary employees in our field exploration program. The services of our Chief Executive Officer, Joseph Gutnick and Chief Financial Officer and Secretary, Peter Lee, as well as clerical employees are provided to us on a part-time as needed basis pursuant to a Service Agreement dated November 25, 1988 (the “Service Agreement”) between us and AXIS Consultants Pty Limited (“AXIS”). AXIS also provides us with office facilities, equipment, administration and clerical in Melbourne Australia pursuant to the Service Agreement. The Service Agreement may be terminated by written notice by either party.

Other than this, we rely primarily upon consultants to accomplish our exploration activities. We are not subject to a union labour contract or collective bargaining agreement.

You should carefully consider each of the following risk factors and all of the other information provided in this Annual Report before purchasing our common stock. An investment in our common stock involves a high degree of risk, and should be considered only by persons who can afford the loss of their entire investment. The risks and uncertainties described below are not the only ones we face. There may be additional risks and uncertainties that are not known to us or that we do not consider to be material at this time. If the events described in these risks occur, our business, financial condition and results of operations would likely suffer. Additionally, this Annual Report contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from the results discussed in the forward-looking statements. This section discusses the risk factors that might cause those differences.

Risk Factors

Risks of Our Business

We Lack an Operating History And Have Losses Which We Expect To Continue Into the Future.

To date we have no source of revenue. We have no operating history as a mineral exploration or mining company upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon:

| - | exploration and development of the property covered by our mineral claims; |

| - | our ability to locate economically viable mineral reserves in the property covered by our mineral claims; |

| - | our ability to raise the capital necessary to conduct exploration and preserve our interest in the mineral claims, increase our interest in the mineral claims and continue as an exploration and mining company; and |

| - | our ability to generate revenues and profitably operate a mine on the property covered by our mineral claims. |

We Have No Known Gold Or Other Mineral Reserves And We Cannot Assure You That We Will Find Such Reserves. If We Develop A Gold Or Other Mineral Reserve, There Is No Guarantee That Production Will Be Profitable.

We have not identified any gold or other commercial mineral reserves on the properties covered by our mineral claims and we cannot guarantee we will ever find any. Also, to the extent that commercial mineral reserves have been identified by other companies on properties that are adjacent to or within the same geographic region as our exploration properties, this does not mean that we will be successful in identifying commercial mineral reserves on our properties. Even if we find a gold or other commercial minerals reserve, there is no assurance that we will be able to mine them. Even if we develop a mine, there is no assurance that we will make a profit. If we do not find gold or other commercial minerals you could loose part or all of your investment.

We Will Need Additional Financing To Determine If There Is Gold Or Other Commercial Minerals And To Maintain The Mineral Claims.

Our success will depend on our ability to raise additional capital. We have met our legal exploration commitments on the Committee Bay Properties until 2012 and Tahera is required to fulfill the minimum exploration commitments on the Slave Properties. However, at this time, we have not found a gold deposit and further exploration is required. There is no assurance whatsoever that funds will be available from any source or, if available, that they can be obtained on terms acceptable to us to make these investments. If funds are not available in the amounts required to maintain an interest, we will be unable to proceed further on the Committee Bay Properties and Slave Properties and our operations would be severely limited, and we would be unable to reach our objective. This could cause the loss of all or part of your investment.

There Are Risks Associated With Our Agreement With Tahera

In June 2008 the Company agreed on terms with Tahera to take full control of the properties listed in the 2002 Tahera/GRR agreement. At the date of this filing the agreement transferring control of the properties had not been executed, and until it is finalized the Company will ensure all other Tahera related agreements remain current. The agreement with Tahera dated March 7, 2002 gives us rights of access to exploration data of Tahera covering gold, silver and base metal potential on properties held by Tahera or properties which are adjacent to or in the area of the Tahera properties. If during our exploration for gold, silver or base metals, we discover diamonds, Tahera retains the rights to the diamonds. Under the agreement, if we wish to conduct exploration on the properties, we need to seek access to the properties and enter into an access agreement with Tahera, suitable to Tahera, which sets out the terms of our access. Our access cannot interfere with Tahera’s operations on the properties. Tahera has the sole and unfetted discretion to sell, transfer, assign, encumber, mortgage, pledge, hypothecate, allow to lapse, forfeit, surrender or in any way dispose of its interest in the properties. If Tahera were to sell, transfer or assign the properties, we would have to negotiate access with the new owners of the properties and there can be no assurance we would receive access. We undertake exploration at our sole risk. Subject to Tahera’s rights, we have the right to exploit opportunities for gold, silver or base metals on the properties. We have granted Tahera a 2% net smelter return royalty.

On January 16, 2008, Tahera Diamond Corporation obtained an order from the Ontario Superior Court granting it protection pursuant to the provisions of the Companies’ Creditors Arrangement Act (“CCAA”).

In June 2008, the Company agreed on terms with Tahera Diamond Corporation to obtain full control of the mining properties that are listed in the Tahera/GRR agreement through the issuance of 3,000,000 shares of common stock, but final agreements have not been executed, as at September 24, 2009.

Our Acquisition Of A Controlling Interest In Acadian Is Subject To A Number Of Risks That Could Have A Material Adverse Impact On Our Business And Financial Condition And Results Of Operations.

We have entered into an agreement to acquire up to 68% of the outstanding shares of Acadian and as of the date of this report had acquired 52% of Acadian. Our future success will depend on our ability to integrate Acadian with our existing operations, which will result in significant additional demands on our capital resources, and will place a significant strain on our management, administrative, operational, financial and technical resources. Our acquisition of Acadian involves numerous risks, including, but not limited to:

| · | possible decreases in capital resources or dilution to existing stockholders; |

| · | difficulties and expenses incurred in connection with an acquisition; |

| · | the difficulties of operating an acquired business; |

| · | the diversion of management’s attention from other business concerns; and |

| · | a limited ability to predict future operating results of Acadian. |

In the event that the operations of Acadian do not meet expectations, we may be required to restructure Acadian or write-off the value of some or all of the assets of Acadian. We cannot assure you that our acquisition of Acadian will be successfully integrated into our operations or will have the intended financial or strategic results.

In addition, acquisitions entail an inherent risk that we could become subject to contingent or other liabilities in connection with the acquisitions, including liabilities arising from events or conduct pre-dating our acquisition and that were not known to us at the time of acquisition. Although we conducted due diligence in connection with our acquisition of Acadian, this does not mean that we necessarily identified all potential problems or issues in connection with such acquisition, some of which could be significant.

Our failure to successfully to integrate and successfully manage Acadian could have a material adverse effect on our business, financial condition and results of operations.

The Report Of Our Independent Registered Public Accounting Firm Contains An Explanatory Paragraph Questioning Our Ability To Continue As A Going Concern.

The report of our independent registered public accounting firm on our consolidated financial statements as of June 30, 2009 and for the years ended June 30, 2009 and 2008 and for the period July 1, 2002 (inception of exploration stage) through June 30, 2009 includes an explanatory paragraph questioning our ability to continue as a going concern. This paragraph indicates that we have not yet commenced revenue producing operations and have a retained deficit of A$38,445,000 which conditions raise substantial doubt about our ability to continue as a going concern. Our consolidated financial statements do not include any adjustment that might result from the outcome of this uncertainty.

We Are A Small Operation And Do Not Have Significant Capital.

Because we will have limited working capital, we must limit our exploration. If we are unable to raise the capital required to undertake adequate exploration, we may not find gold or other commercial minerals even though our property may contain gold or other commercial minerals. If we do not find gold or other commercial minerals we may be forced to cease operations and you may lose your entire investment.

We May Not Find Any Ore Reserves That Are Economical

If we are unable to raise the required capital or we do not find gold or other commercial minerals on the properties or we cannot remove the gold or other commercial minerals discovered economically, we may have to look for other mineral rights on other properties in Canada or other parts of the world. Alternatively, we may cease operations altogether and you may lose your entire investment.

Weather Interruptions In Nunavut May Affect And Delay Our Proposed Exploration Operations.

We can only work above ground at our mineral claims in Nunavut, Canada from late May until early October and from mid December to March of each year. Once we are able to work underground, we plan to conduct our exploration year round, however, it is possible that snow or rain could cause roads leading to our claims to be impassible. This could impair our ability to meet our objectives and may increase our costs beyond our ability, if any, to secure financing, which would adversely affect the value of your investment and our ability to carry on business.

If Our Officers And Directors Stopped Working For Us, We Would Be Adversely Impacted.

None of our other officers or directors works for us on a full-time basis. There are no proposals or definitive arrangements to compensate our officers and directors or to engage them on a full-time basis. They each rely on other business activities to support themselves. They each have a conflict of interest in that they are officers and directors of other companies. You must rely on their skills and experience in order for us to reach our objective. We have no employment agreements or key man life insurance policy on any of them. The loss of some or all of these officers and directors could adversely affect our ability to carry on business and could cause you to lose part or all of your investment.

We Could Encounter Delays Due To Regulatory And Permitting Delays.

We could face delays in obtaining mining permits and environmental permits. Such delays, could jeopardize financing, if any, in which case we would have to delay or abandon work on the properties.

Gold Price Fluctuations.

If we are successful in developing a gold ore reserve, our ability to raise the money to put it into production and operate it at a profit will be dependant on the then existing market price of gold. Declines in the market prices of gold may render reserves containing relatively low grades of ore uneconomic to exploit, and we may be required to discontinue exploration, development or mining on the properties, or write down our assets. If the price of gold is too low we will not be able to raise the money or produce any revenue. We cannot predict the future market price of gold. A sustained decline in the market price of gold could cause a reduction in the value of your investment and you may lose all or part of your investment.

There Are Uncertainties Inherent In The Estimation Of Gold Or Other Mineral Reserves.

Based upon our preliminary study of the properties we believe that the potential for discovering gold reserves exists, but we have not identified such gold reserves and we are not able to estimate the probability of finding recoverable gold ore. Such estimates cannot be calculated from the current available information. Reserve estimates, including the economic recovery of gold ore, will require us to make assumptions about recovery costs and gold market prices. Reserve estimation is, by its nature, an imprecise and subjective process and the accuracy of such estimates is a function of the quality of available data and of engineering and geological interpretation, judgment and experience. The economic feasibility of the properties will be based upon our estimates of the size and grade of ore reserves, metallurgical recoveries, production rates, capital and operating costs, and the future price of gold. If such estimates are incorrect or vary substantially it could effect our ability to develop an economical mine and would reduce the value of your investment.

If We Define An Economic Ore Reserve And Achieve Production, It Will Decline In The Future. An Ore Reserve Is A Wasting Asset.

Our future ore reserve and production, if any, will decline as a result of the exhaustion of reserves and possible closure of any mine that might be developed. Eventually, at some unknown time in the future, all of the economically extractable ore will be removed from the properties, and there will be no ore remaining. This is called depletion of reserves. Ultimately, we must acquire or operate other properties in order to continue as an on going business. Our success in continuing to develop reserves, if any, will affect the value of your investment.

There Are Significant Risks Associated With Mining Activities.

The mining business is generally subject to risks and hazards, including quantity of production, quality of the ore, environmental hazards, industrial accidents, the encountering of unusual or unexpected geological formations, cave-ins, flooding, earthquakes and periodic interruptions due to inclement or hazardous weather conditions. These occurrences could result in damage to, or destruction of, our mineral properties or production facilities, personal injury or death, environmental damage, reduced production and delays in mining, asset write-downs, monetary losses and possible legal liability. We could incur significant costs that could adversely affect our results of operation. Insurance fully covering many environmental risks (including potential liability for pollution or other hazards as a result of disposal of waste products occurring from exploration and production) is not generally available to us or to other companies in the industry. What liability insurance we carry may not be adequate to cover any claim.

We Are Subject To Significant Environmental And Other Governmental Regulations That Can Require Substantial Capital Expenditure, And Can Be Time-Consuming.

We are required to comply with various Canadian laws and regulations pertaining to exploration, development and the discharge of materials into the environment or otherwise relating to the protection of the environment, all of which can increase the costs and time required to attain operations. We will have to obtain exploration, development and environmental permits, licenses or approvals that may be required for our operations. There can be no assurance that we will be successful in obtaining, if required, a permit to commence exploration, development and operation, or that such permit can be obtained in a timely basis. If we are unsuccessful in obtaining the required permits it may adversely affect our ability to carry on business and cause you to lose part or all of your investment.

Mining Accidents Or Other Adverse Events At Our Property Could Reduce Our Production Levels.

If and when we reach production it may fall below estimated levels as a result of mining accidents, cave-ins or flooding on the properties. In addition, production may be unexpectedly reduced if, during the course of mining, unfavorable ground conditions or seismic activity are encountered, ore grades are lower than expected, or the physical or metallurgical characteristics of the ore are less amenable to mining or processing than expected. The happening of these types of events would reduce our profitably or could cause us to cease operations which would cause you to lose part or all of your investment.

The acquisition of gold mineral properties is subject to substantial competition. If we must pursue alternative properties, companies with greater financial resources, larger staffs, more experience, and more equipment for exploration and development may be in a better position than us to compete for properties. We may have to undertake greater risks than more established companies in order to compete which could affect the value of your investment.

We Are Substantially Dependent Upon AXIS To Carry Out Our Activities

We are substantially dependent upon AXIS for our senior management, financial and accounting, corporate legal and other corporate headquarters functions. For example, each of our officers is employed by AXIS and, as such, is required by AXIS to devote substantial amounts of time to the business and affairs of the other shareholders of AXIS.

Pursuant to a services agreement, AXIS provides us with office facilities, administrative personnel and services, management and geological staff and services. No fixed fee is set in the agreement and we are required to reimburse AXIS for any direct costs incurred by AXIS for us. In addition, we pay a proportion of AXIS indirect costs based on a measure of our utilization of the facilities and activities of AXIS plus a service fee of not more than 15% of the direct and indirect costs. AXIS has charged us a service fee of 15% for this fiscal year. This service agreement may be terminated by us or AXIS on 60 days’ notice. See “Certain Relationships and Related Party Transactions.”

Future Sales of Common Stock Could Depress The Price Of Our Common Stock

Future sales of substantial amounts of common stock pursuant to Rule 144 under the Securities Act of 1933 or otherwise by certain stockholders could have a material adverse impact on the market price for the common stock at the time. As of June 30, 2009, there were 120,700,223 outstanding shares of our common stock held by stockholders which are deemed “restricted securities” as defined by Rule 144 under the Securities Act. Under certain circumstances, these shares may be sold without registration pursuant to the provisions of Rule 144. In general, under rule 144, a person (or persons whose shares are aggregated) who has satisfied a six-month holding period and who is not an affiliate of the Company may sell restricted securities without limitation as long as the Company is current in its SEC reports. A person who is an affiliate of the Company may sell within any three-month period a number of restricted securities which does not exceed the greater of one (1%) percent of the shares outstanding or the average weekly trading volume during the four calendar weeks preceding the notice of sale required by Rule 144. In addition, Rule 144 permits, under certain circumstances, the sale of restricted securities by a non-affiliate without any limitations after a one-year holding period. Any sales of shares by stockholders pursuant to Rule 144 may have a depressive effect on the price of our Common stock.

Our Common Stock Is Traded Over the Counter, Which May Deprive Stockholders Of The Full Value Of Their Shares

Our common stock is quoted via the Over The Counter Bulletin Board (OTCBB). As such, our common stock may have fewer market makers, lower trading volumes and larger spreads between bid and asked prices than securities listed on an exchange such as the New York Stock Exchange or the NASDAQ Stock Market. These factors may result in higher price volatility and less market liquidity for the common stock.

A Low Market Price May Severely Limit The Potential Market For Our Common Stock

Our common stock is currently trading at a price substantially below $5.00 per share, subjecting trading in the stock to certain SEC rules requiring additional disclosures by broker-dealers. These rules generally apply to any equity security that has a market price of less than $5.00 per share, subject to certain exceptions (a “penny stock”). Such rules require the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and the risks associated therewith and impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and institutional or wealthy investors. For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to the sale. The broker-dealer also must disclose the commissions payable to the broker-dealer, current bid and offer quotations for the penny stock and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Such information must be provided to the customer orally or in writing before or with the written confirmation of trade sent to the customer. Monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock. The additional burdens imposed upon broker-dealers by such requirements could discourage broker-dealers from effecting transactions in our common stock.

The Market Price Of Your Shares Will Be Volatile.

The stock market price of gold mining exploration companies like us has been volatile. Securities markets may experience price and volume volatility. The market price of our stock may experience wide fluctuations that could be unrelated to our financial and operating results. Such volatility or fluctuations could adversely affect your ability to sell your shares and the value you might receive for those shares.

Not applicable

The Company occupies certain executive and office facilities in Melbourne, Victoria, Australia which are provided to it pursuant to the Service Agreement with AXIS. See “Item 1- Business- Employees” and “Item 12- Certain Relationships and Related Transactions”. The Company believes that its administrative space is adequate for its current needs.

In addition, we have an office in North America at Suite 1801, 1 Yonge Street, Toronto ON Canada. The office receives mail, couriers and facsimiles on our behalf and forwards any documents received to us. The lease is for six months and can be renewed on a month to month basis. We pay a fee of CDN$30 per month. This is a temporary arrangement whilst we determine whether to open a permanent office.

There are no pending legal proceedings to which the Company is a party, or to which any of its property is the subject, which the Company considers material.

Not Applicable

PART II

Our common stock is traded in the over-the-counter market and quoted on the OTC-Bulletin Board under the symbol “GORV”. The trading for the common stock has been sporadic and the market for the common stock cannot be classified as an established trading market.

The following table sets out the high and low bid information for the common stock as reported by the OTC Bulletin Board for each period/quarter indicated in US$:

| Calendar Period | High Bid(1) | Low Bid(1) | |

| | | | |

| | | | |

| 2007 | | | |

| First Quarter | 0.14 | 0.12 | |

| Second Quarter | 0.12 | 0.12 | |

| Third Quarter | 0.12 | 0.10 | |

| Fourth Quarter | 0.11 | 0.06 | |

| | | | |

| 2008 | | | |

| First Quarter | 0.10 | 0.06 | |

| Second Quarter | 0.40 | 0.05 | |

| Third Quarter | 0.09 | 0.04 | |

| Fourth Quarter | 0.01 | 0.00 | |

| | | | |

| 2009 | | | |

| First Quarter | 0.09 | 0.01 | |

| Second Quarter | 0.15 | 0.07 | |

| (1) | The quotations set out herein reflect inter-dealer prices without retail mark-up, mark-down or commission and may not necessarily reflect actual transactions. |

As of September 24, 2009, there were 167,990,840 shares of common stock issued and outstanding. We have 20,000,000 warrants outstanding which expire on April 30, 2011, each of which is exercisable to purchase one share of common stock for a purchase price of A$0.20 (US$0.1542). The warrants contain a cashless exercise provision whereby the holder, at its option, may exercise the warrants by surrender and cancellation of a portion of the shares of our common stock issuable upon the exercise of the warrants based on the then current market price of our common stock. If the holder of the warrants elected to exercise the warrants pursuant to this provision, we would not receive any proceeds from the exercise of the warrants.

For information concerning shares issuable upon exercise of outstanding stock options see Notes 8 and 9 of the Notes to the Consolidated Financial Statements.

To date we have not paid any dividends on our common stock and we do not expect to declare or pay any dividends on our common stock in the foreseeable future. Payment of any dividends will depend upon our future earnings, if any, our financial condition, and other factors deemed relevant by the Board of Directors.

Shareholders

As of September 24, 2009, the Company had approximately 96 shareholders of record.

Dividend Policy

It is the present policy of the Board of Directors to retain earnings, when incurred, for use in our business. We have not declared any cash dividends to the holders of its Common Stock and do not intend to declare such dividends in the foreseeable future.

Transfer Agent

Our United States Transfer Agent and Registrar is Continental Stock Transfer and Trust Company.

Our selected consolidated financial data presented below for each of the years in the two-year period ended June 30, 2009, and the balance sheet data at June 30, 2009 and 2008 have been derived from consolidated financial statements, which have been audited by PKF, Certified Public Accountants, a Professional Corporation. The selected financial data should be read in conjunction with our consolidated financial statements for each of the years in the two-year period ended June 30, 2009, and Notes thereto, which are included elsewhere in this Annual Report.

(Consolidated Statement of Operations Data)

(in thousands, except per share data)

| | | | Year Ended June 30 | | | | | |

| | | | 2008

A$000s | | | | 2009

A$000s | | | | 2009

Conv.

Transl

US$000s | |

| Revenues | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Costs and expenses | | | 1,140 | | | | 1,018 | | | | 819 | |

| | | | | | | | | | | | | |

| Loss from operations | | | (1,140 | ) | | | (1,018 | ) | | | (819 | ) |

| | | | | | | | | | | | | |

| Other income (loss) | | | (5 | ) | | | (38 | ) | | | (31 | ) |

| | | | | | | | | | | | | |

| Profit (loss) before income taxes and equity in losses of unconsolidated entity | | | (1,145 | ) | | | (1,056 | ) | | | (850 | ) |

| | | | | | | | | | | | | |

| Provision for income taxes | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Profit (loss) before equity in losses of unconsolidated entity | | | (1,145 | ) | | | (1,056 | ) | | | (850 | ) |

| | | | | | | | | | | | | |

| Equity in losses of unconsolidated entity | | | - | | | | (280 | ) | | | (225 | ) |

| | | | | | | | | | | | | |

| Net (loss) | | | (1,145 | ) | | | (1,336 | ) | | | (1,075 | ) |

| | | | | | | | | | | | | |

| | | | A$ | | | | A$ | | | $US | |

| Net profit (loss) per share on continuing operations | | | (0.03 | ) | | | (0.01 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | |

| Weighted average number of shares outstanding (000s) | | | 36,714 | | | | 92,605 | | | | 92,605 | |

| | | | | | | | | | | | | |

| Balance Sheet Data | | | | | | | | | | | | |

| | | | A$000s | | | | A$000s | | | US$000s | |

| Total assets | | | 38 | | | | 823 | | | | 662 | |

| Total liabilities | | | 711 | | | | 1,338 | | | | 1,076 | |

| | | | | | | | | | | | | |

| Stockholders’ equity (deficit) | | | (673 | ) | | | (515 | ) | | | (414 | ) |

General

The following discussion and analysis of our financial condition and plan of operation should be read in conjunction with the Financial Statements and accompanying notes and the other financial information appearing elsewhere in this report. This report contains numerous forward-looking statements relating to our business. Such forward-looking statements are identified by the use of words such as believes, intends, expects, hopes, may, should, plan, projected, contemplates, anticipates or similar words. Actual operating schedules, results of operations, ore grades and mineral deposit estimates and other projections and estimates could differ materially from those projected in the forward-looking statements.

We are an exploration stage mining company. Our objective is to exploit our interest in the mineral claims in Nunavut, Canada. Our principal exploration target is for gold and we are seeking to determine whether adequate gold reserves are present on the property covered by our claims to develop an operating mine. We are in the initial stages of our exploration program and we have not yet identified any ore reserves. We have not generated any revenues from operations.

Foreign Currency Translation

The majority of our administrative operations are in Australia and, as a result, our accounts are reported in Australian dollars. The income and expenses of its foreign operations are translated into Australian dollars at the average exchange rate prevailing during the period. Assets and liabilities of the foreign operations are translated into Australian dollars at the period-end exchange rate. The following table shows the period-end rates of exchange of the Australian and Canadian dollar compared with the US dollar during the periods indicated.

| | Year ended June 30 | | | | |

| | 2008 | | A$1.00 | = | US$0.9615 |

| | | | CDN$1.00 | = | US$0.9900 |

| | 2009 | | A$1.00 | = | US$0.8048 |

| | | | CDN$1.00 | = | US$0.8655 |

The exchange rate between the A$ and US$ has moved by 16.3% between June 30, 2008 and 2009. Accordingly, a direct comparison of costs between fiscal 2009 and 2008 is not necessarily a true comparison.

In light of its investment in Acadian Mining Corporation reaching 52% during July 2009, the Company is in the process of determining if its functional and reporting currency should change from the Australian dollar to the Canadian dollar. This determination has involved considering all economic facts and circumstances affecting the parent and subsidiary. On March 17, 2009, the Company announced that it had reached agreement with Acadian Mining Corporation (TSX: ADA) ("Acadian") to subscribe in a private placement transaction for up to 338,111,334 common shares in Acadian. The Subscription is contemplated to close in two or more tranches. Following closing of all tranches, Golden River will hold 68.45% of Acadian and this will result in increasingly significant levels of transactions conducted in the Canadian dollar. Statement of Financial Accounting Standards (‘‘SFAS’’) No. 52, Foreign Currency Translation, states that the functional currency of an entity is the currency of the primary economic environment in which the entity operates.

Results of Operations

Year ended June 30, 2009 versus Year ended June 30, 2008

Total costs and expenses have decreased from A$1,140,000 for the year ended June 30, 2008 to A$1,018,000 (US$819,000) for the year ended June 30, 2009. The decrease was a net result of:

| i) | A decrease in exploration expenditure written off from A$193,000 in fiscal 2008 to A$175,000 (US$141,000) in fiscal 2009. In fiscal 2009, no field exploration was undertaken. The costs incurred relate to consultants providing exploration advice and maintenance costs of the Slave and Committee Bay Properties. The Committee Bay and Slave Properties are in Nunavut in an isolated area and exploration can only be undertaken between June and August each year due to ground conditions. Exploration is costly as we were required to hire and construct a temporary camp which also had to be transported by charter flight. All supplies and casual employees also needed to be transported to the temporary camp by charter flights and/or helicopter. The properties are located approximately 100 kilometers from the camp and employees are transported by helicopter daily from camp to the exploration site. |

| ii) | An increase in legal, accounting and professional costs from A$78,000 in fiscal 2008 to A$440,000 (US$354,000) in fiscal 2009. During fiscal 2009, we incurred professional expenses of A$262,000 (US$210,000) associated with the Company’s SEC compliance obligations and due diligence costs incurred in relation to the investment in Acadian; legal expenses of A$21,000 (US$17,000) for general legal work; audit fees of A$124,000 (US$100,000) for professional services in relation to financial statements in the quarterly reports on Form 10-Q and annual report on Form 10-K; and A$33,000 (US$26,000) from our stock transfer agent for management of the share register. During fiscal 2008, we incurred legal expenses of A$8,000 for general legal work; audit fees of A$50,000 for professional services in relation to financial statements, the quarterly reports on Form 10-Qs and annual report on Form 10-K; and A$20,000 from our stock transfer agent for management of the share register. |

| iii) | A decrease in administrative costs from A$474,000 in fiscal 2008 to A$201,000 (US$162,000) in fiscal 2009. During fiscal 2009, AXIS charged us A$150,000 (US$121,000) for management and service fees and Director’s fees and salaries incurred on behalf of the Company which relate to fees paid to an independent director, President and Chief Executive Officer, Director, Secretary and Chief Financial Officer and other staff of AXIS who provide services to the Company; A$15,000 (US$12,000) for lodgement of Company filings with the SEC and A$36,000 (US$29,000) for overseas travel. During fiscal 2008, AXIS charged us A$439,000 (US$422,000) for management and service fees; Director’s fees and salaries incurred on behalf of the Company which relate to fees paid to an independent director, President and Chief Executive Officer, Director, Secretary and Chief Financial Officer and other staff of AXIS who provide services to the Company; and we incurred A$10,000 for lodgement of Company filings with the SEC and A$25,000 for printing, stationery and couriers. |

| iv) | A decrease in stock based compensation from A$388,000 for fiscal 2008 to A$201,000 (US$162,000) for fiscal 2009. Following shareholder approval on January 27, 2005 the Company issued 1,400,000 options at an exercise price of US$1.00 per option pursuant to the 2004 Stock Option Plan. Of the total 1,400,000 options issued, 350,000 vested immediately following shareholder approval, 50,000 vested on March 31, 2005, 333,331 vested on July 27, 2005, 333,334 vested on January 27, 2006 and the balance vested on July 27, 2006. The exercise price of US$1.00 was derived from the issue price of common stock from the placement of shares on March 31, 2004 and was considered by the Company’s Directors to be the fair value of the common stock. The options expire on October 15, 2014. The Company accounted for all options issued in 2004 based upon their fair market value using the Black Scholes pricing model. There were no employee stock options issued by the Company prior to 2004 or in 2005 or 2007. The Company calculated the fair value of the options at US$0.9663 per option using the Black Scholes valuation method. The total value of the options equates to A$1,744,800 (US$1,352,820) and was amortized over the vesting period. At June 30, 2008 the options were fully vested. |

On October 19, 2006, the Directors of the Company issued a further 4,650,000 options under the Stock Option Plan. The options have no issue price, an exercise price of US30.84 cents, and a latest exercise date of October 19, 2016. The options vest 1/3 on October 19, 2007 (“T1”), 1/3 on October 19, 2008 (“T2”) and 1/3 on October 19, 2009 (“T3”). The Company obtained an external valuation of the options from an unrelated third party. The Company has calculated the fair value of the 4,650,000 options at US$0.222 per option for T1, US$0.228 for T2 and US$0.234 for T3 using the binomial option pricing model. The total value of the options equates to A$1,406,287 (US$1,060,200) and is being amortized over the vesting periods. For 2009, the amortisation amounted to A$201,457 (US$162,133) and 600,000 options were forfeited. At June 30, 2009, the remaining value of the unamortized deferred compensation of 4,050,000 outstanding options amounted to A$42,055 (US$31,055).

Accordingly, the loss from operations decreased from A$1,140,000 for the year ended June 30, 2008 to A$1,018,000 (US$819,000) for the year ended June 30, 2009.

Other income increased from A$nil for the year ended June 30, 2008 to A$8,000 for the year ended June 30, 2009 being interest received.

Foreign currency exchange loss increased from A$5,000 for the year ended June 30, 2008 to A$46,000 for the year ended June 30, 2009, primarily as a result of transactions relating to the acquisition of an investment in Acadian Mining Corporation.

Effective May 31, 2009, the Company acquired a 19.9% interest in Acadian and has accounted for that investment as an Investment in Non-Consolidated Entity, as the Company has significant influence (but not control) over Acadian. For the month of June 2009, the Company has brought to account its share of the losses in Acadian of A$280,000 (US$225,000) as equity in losses of unconsolidated entity.

The net loss amounted to A$1,336,000 (US$1,075,000) for the year ended June 30, 2009 compared to a net loss of A$1,145,000 for the year ended June 30, 2008. The net loss per common equivalent share in 2009 was A$0.01 (US$0.01) compared with a net loss with a common equivalent share price of A$0.03 in the prior year.

Liquidity and Capital Resources

For the fiscal year 2009, net cash used in operating activities was A$778,000 (US$626,000) primarily consisting of amounts spent on exploration of A$175,000 (US$141,000), and administration A$201,000 (US$162,000); net cash used in investing activities of A$1,171,000 (US$942,000) being the cost of the 19.9% investment in Acadian; and net cash provided by financing activities of A$1,961,000 (US$1,578,000) being funds from the sale of common stock of A$755,000 (US$607,000) and a loan to the Company of A$1,206,000 (US$971,000).

Effective as of June 9, 2006, Golden River Resources, entered into a Subscription Agreement with RAB Special Situations Fund (Master) Limited (“RAB”) pursuant to which the Company issued to RAB in a private placement transaction (the ”Private Placement”) for an aggregate purchase price of A$2,000,000 (US$1,542,000): (i)10,000,000 special warrants (the “Special Warrants”), each of which is exercisable at any time to acquire, without additional consideration, one (1) share (the “Special Warrant Shares”) of Common Stock, US$0.001 par value (“Common Stock"), of the Company, and (ii) warrants (the “Warrants”) for the purchase of 20,000,000 shares of Common Stock, US$0.001 par value (the “Warrant Shares”), at an exercise price of A$0.20 (US$0.1542) to be exercisable until April 30, 2011. In early July 2009. the Company announced that it had closed a transaction to purchase from RAB Special Situations (Master) Fund Limited (“RAB”) the special warrant to purchase 10,000,000 shares of Common Stock in the Company for no additional consideration expiring on June 9, 2016; and the warrant to purchase 20,000,000 shares of Common Stock in the Company at an exercise price of $0.1542 per share ($0.0364541, per share as adjusted) expiring on April 30, 2011, held by RAB, for an aggregate purchase price of US$500,000. Closing occurred in early July 2009. Following settlement of the purchase, the Company cancelled the Special Warrant to purchase 10,000,000 shares of Common Stock in the Company for no additional consideration expiring on June 9, 2016, and the Warrant to purchase 20,000,000 shares of Common Stock in the Company at an exercise price of $0.1542 per share ($0.0364541, per share as adjusted) expiring on April 30, 2011.

As of June 30, 2009 we had short-term obligations of A$1,338,000 (US$1,076,000) consisting mainly of accounts payable and accrued expenses and short-term advances.

We have A$20,000 (US$16,000) in cash at June 30, 2009.

Effective December 9, 2008, the Company completed a private placement offering in which the Company sold an aggregate of 100,000,000 shares of common stock at a purchase prices of US$0.005 per share for aggregate proceeds of US$500,000 (A$755,000). The Private Placement was made to Fast Knight Nominees Pty Ltd, a company associated with Mr Joseph I. Gutnick, President and Chief Executive Officer of Golden River Resources Corporation, and was effected pursuant to the terms of a Subscription Agreement.

On March 17, 2009, the Company announced that it had reached agreement with Acadian Mining Corporation (TSX: ADA) ("Acadian") to subscribe in a private placement transaction for up to 338,111,334 common shares in Acadian for aggregate gross investment of up to CDN$10 million (A$11.6 million). The Subscription is contemplated to close in two or more tranches. Following closing of all tranches, Golden River will hold 68.45% of Acadian. The closing of the first tranche, for an aggregate of CDN$1.0 million (A$1.2 million) (38,111,334 shares) was subject to receipt of the required regulatory approvals, including the approval of the Toronto Stock Exchange which occurred in early June 2009. Upon completion of closing of the initial tranche, the Company was entitled to nominate one member to the board of directors of Acadian and nominated Mr Menachem Vorchheimer. The remaining CDN$9 million (A$10.4 million) of the Offering (300,000,000 shares at CDN$0.03 [A$0.04] per share) will close in one or more tranches upon the receipt of all necessary regulatory approvals, approval of the shareholders of Acadian and the satisfaction of certain other conditions precedent, including completion of due diligence by the Company. Acadian obtained approval from its shareholders at its annual meeting in June 2009. Throughout July, August and September, 2009, further closings for an aggregate of CDN$5 million (A$5.5 million) have occurred.

Upon completion of the CDN$10.0 million Offering, the board of directors of Acadian will be comprised of six members – three nominees of each of Golden River and Acadian. The proceeds of the Offering are to be used by Acadian for operational overheads, the advancement of Acadian’s gold properties and the discharge of the creditor’s of Acadian’s wholly-owned subsidiary, ScoZinc Limited, all in accordance with a plan and budget to be approved by Golden River.

Upon closing the transaction, Acadian will focus on continuing the development of its five advanced gold projects; Beaver Dam, Fifteen Mile Stream, Forest Hill, Goldenville and Tangier, all of which host Canadian National Instrument 43-101 compliant gold mineralised deposits. Beaver Dam and Fifteen Mile Stream are being evaluated as potential open pit deposits and Forest Hill, Goldenville and Tangier as underground deposits. Acadian is pursuing a central servicing and processing strategy as an integral part of its development plan with respect to its gold properties. The mill at Acadian’s Scotia Mine (lead-zinc) is expected to become idle in late March – early April 2009 due to cessation of mining zinc-lead ore at Scotia Mine resulting from low zinc and lead prices. As such, the Scotia Mill is presently being considered as a potential processing facility for the material sourced from one or more of Acadian’s gold deposits. The Scotia Mill is capable of processing in excess of 3,000 tpd (grinding at 100 mesh), and will require only relatively minor modifications to process gold ore. Proceeding with this plan will be dependent on favourable project economics, various governmental approvals and additional funding.

Since June 30, 2009, the Company has raised in a private placement transaction with Northern Capital Resources Corp (“NCRC”), A$5,029,320 (US$4,127,671) through the sale of 41,276,710 shares of common stock at an issue price of US$0.10 per share. The proceeds have been utilized to fund the closing of several further tranches of the acquisition of shares in Acadian, repay the A$650,000 short term advance from Wilzed Pty Ltd, settle the repurchase of the A$500,000 warrants from RAB and for working capital purposes. Furthermore, NCRC has entered into a subscription agreement for a further 43,723,290 shares of common stock in the Company, to be subscribed for progressively up to March 2010, which will raise US$4,372,329. These funds will be used to fund the remaining tranches of our investment in Acadian and for working capital purposes.