- FAST Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Fastenal (FAST) 8-KGrowth Through Customer Service

Filed: 17 Apr 03, 12:00am

Exhibit 99.1 Growth Through Customer Service

|

WELCOME TO THE

2003 ANNUAL

SHAREHOLDER’S MEETING

| www.fastenal.com

[LOGO OF BOLTS]

|

CSP CONVERSION COMPLETE |

|

CSP Conversion with

NO

Business Interruptions

STATISTICS ON THREE GROUPS OF STORES |

|

| • | COMPANY – All stores operating on December 31, 2001, |

| except Canada and Singapore (961 stores) |

| • | 3rd QTR’02 – Stores converted to CSP in the 3rd Quarter |

| of 2002 (24 stores) |

| • | RANDOM SAMPLE – A random sample of non-CSP stores |

| to serve as a benchmark (24 stores) |

OPERATING STATISTICS |

|

| • | Sales per day (daily average sales) |

| • | New accounts added |

| • | Activity levels (active accounts) |

| • | Productivity (sales per employee) |

| • | Collections (days out) |

| • | Gross margin |

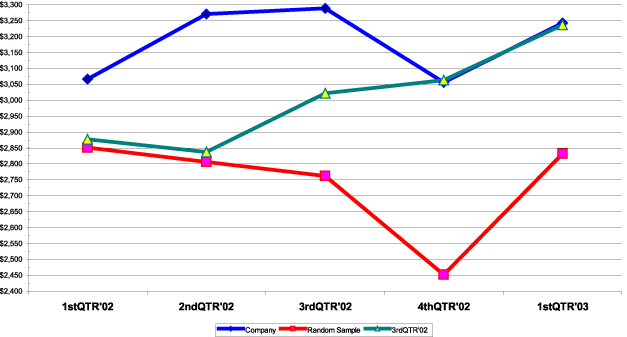

DAILY AVERAGE SALES PER STORE |

|

DEFINITION: Daily average sales is the sales per store divided by the number of business days in the period.

MONTHLY NEW ACCOUNTS PER STORE |

|

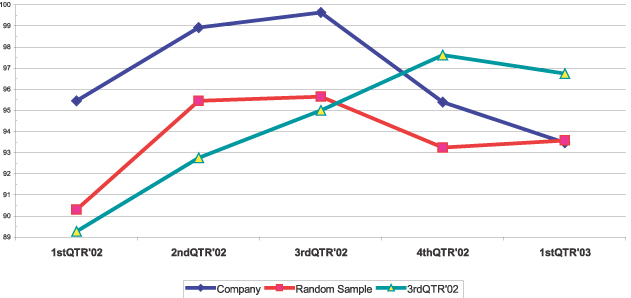

MONTHLY ACTIVE ACCOUNTS PER STORE |

|

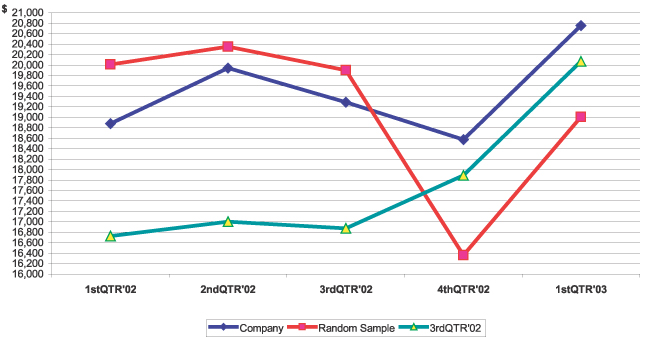

PRODUCTIVITY—MONTHLY SALES PER EMPLOYEE (FTE) |

|

FTE | ||||

Full-time employee = 1 Part-time employee = .5 |

DEFINITION: Sales per month divided by full-time equivalent (FTE).

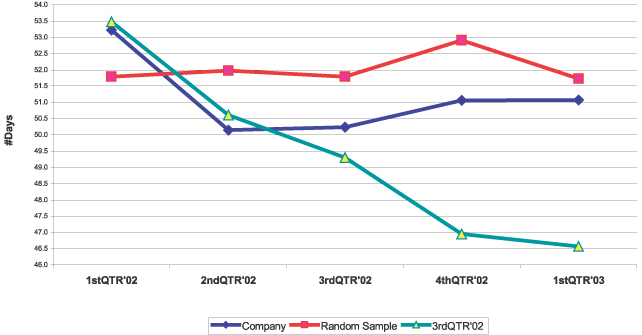

COLLECTIONS – DAYS OUT |

|

DEFINITION: Days Out represent the number of calendar days, on average, between when a sale occurs and when the cash is collected. The Company usually operates around 51.

SUMMARYOF FINDINGS |

|

| • | Statistics with noticeable impact in the 3rdQtr’02 CSP group |

| • | Daily sales average increased. |

| • | # of invoices increased. |

| • | # of new accounts increased, trend slipped in Q1-2003. |

| • | # of active accounts increased, trend slipped in Q1-2003. |

| • | Days out decreased 4 days from Q2-2002. |

SUMMARY OF FINDINGS |

|

| • | Statistics with inconclusive impact |

| • | Gross margin percentage. |

| • | October 2002 CSP stores (15 stores) |

| • | No conclusive impact on statistics. |

| • | Average sales of the October group was approximately 2X the average sales of the 3rdQtr’02 CSP group ($140,000 per month vs. $70,000 per month). |

INITIAL CSP ASSUMPTIONS – SCENARIO A |

|

| • | Inventory shifts from the ‘Historical model’ to the ‘CSP model’. Inventory turns stays the same. |

| • | ‘Historical model’ – approximately 60% of inventory in the store and approximately 40% in the distribution center. |

| • | ‘CSP model’– approximately 70 to 75% in the store and 25 to 30% in the distribution center. |

| • | Shelving and signage investment is $6,000 per store. |

| • | Occupancy costs increase $500 per store. |

| • | Gross margin = 50%. |

CSP needs to produce $1,500 in sales per month of incremental revenue to offset incremental expenses and to produce a 32.5% pre-tax return on shelving and signage invest. (32.5% pre-tax = approximately 20% after-tax return given Fastenal’s 38.3% tax rate.)

INITIAL CSP ASSUMPTIONS—SCENARIO B |

|

| • | Inventory assumption is too optimistic, inventory per store increases $30,000 without corresponding decrease at the distribution center. |

| • | Shelving and signage investment is $6,000 per store. |

| • | Occupancy costs increase $500 per store. |

| • | Gross margin = 50%. |

CSP needs to produce $3,000 in sales per month of incremental revenue to offset incremental expenses and to produce a 32.5% pre-tax return on inventory, shelving, and signage invest. (32.5% pre-tax = approximately 20% after-tax return given Fastenal’s 38.3% tax rate.)

CONCLUSION |

|

We believe the tangible results to date support the continued investment in the CSP initiative.