0000816153 tbit:MSCIEAFENetTotalReturnUSDIndex95Member 2015-11-30 0000816153 tbit:C000042672Member 2024-01-31 0000816153 tbit:MSCIAllCountryWorldexUSANetTotalReturnUSDIndex160Member 2021-11-30 0000816153 tbit:MSCIAllCountryWorldexUSANetTotalReturnUSDIndex209Member 2021-07-31 0000816153 tbit:MSCIAllCountryWorldexUSANetTotalReturnUSDIndex250Member 2018-08-31 0000816153 tbit:MSCIAllCountryWorldexUSANetTotalReturnUSDIndex289Member 2015-09-30 0000816153 tbit:C000081861Member 2023-04-30 0000816153 tbit:Russell3000Index373Member 2019-03-31 0000816153 tbit:Russell3000Index413Member 2018-10-31 0000816153 tbit:Russell2500GrowthIndex452Member 2018-04-30 0000816153 tbit:Russell2500GrowthIndex492Member 2017-08-31 0000816153 tbit:ThornburgInvestmentIncomeBuilderFundsBlendedIndex604Member 2024-05-31 0000816153 tbit:ThornburgSummitFundsBlendedIndex667Member 2024-05-31 0000816153 tbit:BloombergUSAggregateTotalReturnValueIndex733Member 2024-05-31 0000816153 tbit:BloombergUSGovernmentIntermediateTotalReturnIndex809Member 2017-03-31 0000816153 tbit:BloombergUSGovernmentIntermediateTotalReturnIndex843Member 2024-08-31 0000816153 tbit:BloombergUSAggregateTotalReturnValueIndex902Member 2021-07-31 0000816153 tbit:BloombergUSAggregateTotalReturnValueIndex973Member 2024-03-31 0000816153 tbit:BloombergIntermediateUSGovernmentCreditTotalReturnIndex1041Member 2023-05-31 0000816153 tbit:BloombergUSUniversalTotalReturnIndex1244Member 2018-11-30 0000816153 tbit:BloombergUSUniversalTotalReturnIndex1305Member 2019-02-28 0000816153 tbit:BloombergUSUniversalTotalReturnIndex1365Member 2019-05-31 0000816153 tbit:C000001438Member 2022-05-31 0000816153 tbit:C000032355Member 2015-07-31 0000816153 tbit:ICEBofAUSMunicipalSecuritiesIndex1724Member 2016-11-30 0000816153 tbit:ICEBofAUSMunicipalSecuritiesIndex1789Member 2020-05-31 0000816153 tbit:C000032368Member 2017-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05201

Thornburg Investment Trust

(Exact name of registrant as specified in charter)

c/o Thornburg Investment Management, Inc.

2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Address of principal executive offices) (Zip code)

Garrett Thornburg

2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Name and address of agent for service)

Registrant’s telephone number, including area code: 505-984-0200

Date of fiscal year end: September 30, 2024

Date of reporting period: September 30, 2024

Item 1. Reports to Stockholders

| (a) | The following are the reports transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1): |

Thornburg Global Opportunities Fund Tailored Shareholder Report

Thornburg Global Opportunities Fund CLASS: A TICKER: THOAX Annual Shareholder Report | |

This annual shareholder report contains important information about the Thornburg Global Opportunities Fund Class A Shares for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.thornburg.com/download. You can also request this information by contacting us at 1-800-847-0200. This report also describes changes to the Fund that occurred during the reporting period.

How did the Fund perform last year and what affected its performance?

The Fund’s Class A shares underperformed the MSCI All Country World Net Total Return USD Index (the 'Index”) during the 12-month period ended September 30, 2024. During the period, major world events included the ongoing Russian/Ukraine conflict, moderating inflation figures in the U.S., Mideast tensions, and upcoming political contests in the U.S. Despite the conflicting economic and geo-political signals, the S&P 500, the Bloomberg U.S. Aggregate Bond, and the MSCI ACWI indexes reported varying positive returns for the period, +36.3%, +11.6%, and +31.8%, respectively. In brief, most equities repriced higher due to a surprising level of economic strength and resilient corporate profits, while interest rates declined along with inflation rates, creating a more favorable backdrop for the economy. Stock selection was a positive contributor to relative performance, consistent with the Fund’s bottom-up investment approach. Sector and geographic allocations detracted from relative results. The Fund’s cash and currency forwards allocations were also a drag on performance. During the period, stock selection in communication services, energy, and the U.S. helped to drive relative performance. The Fund’s underweight allocation and weaker security selection in information technology hampered relative returns. In South Korea, both an overweight positioning and negative security selection detracted from returns.

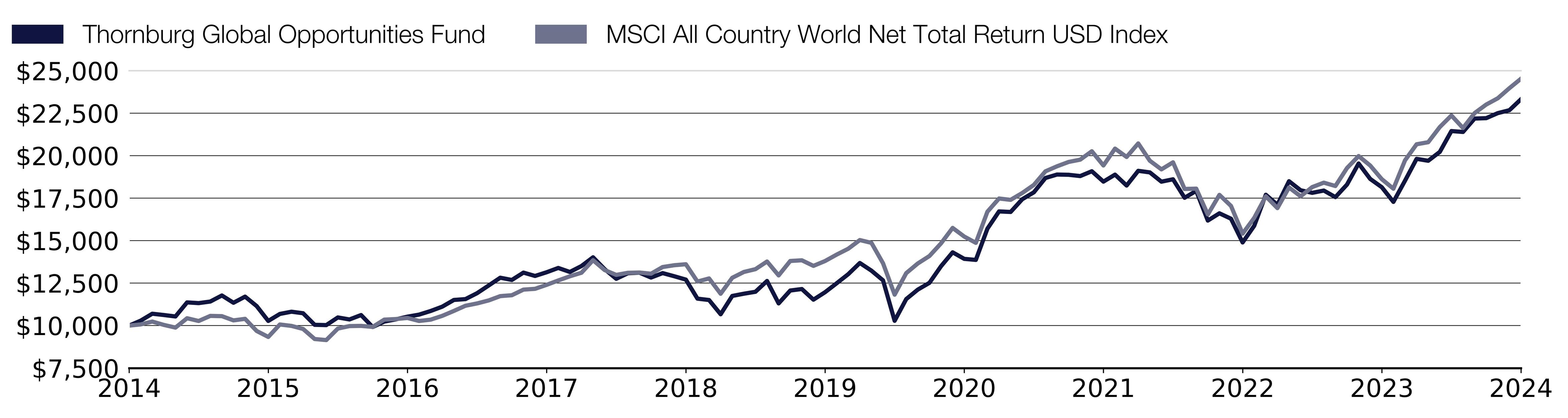

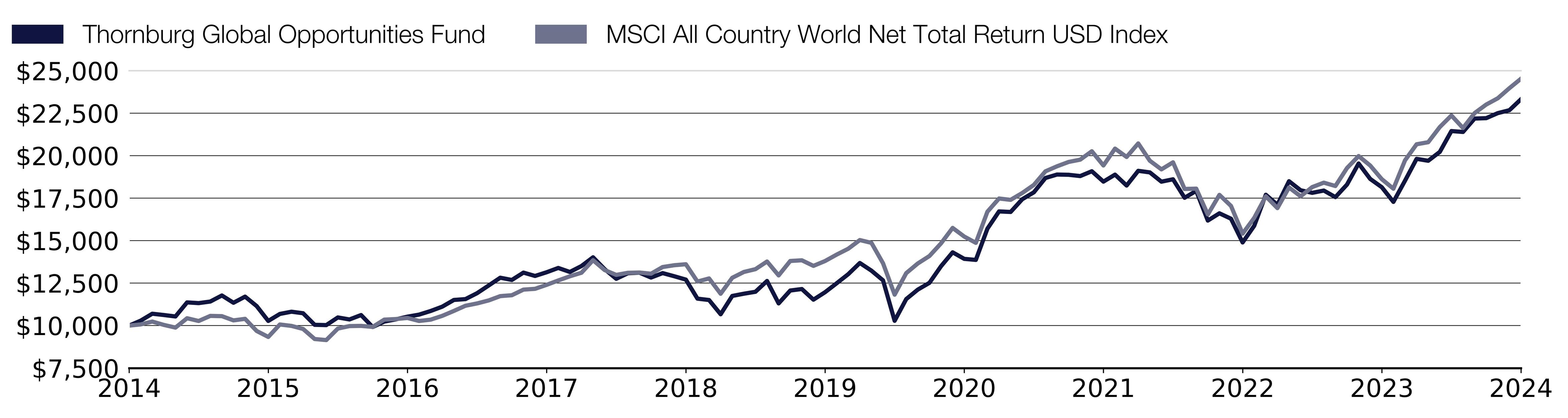

How did the Fund perform over the past 10 years?

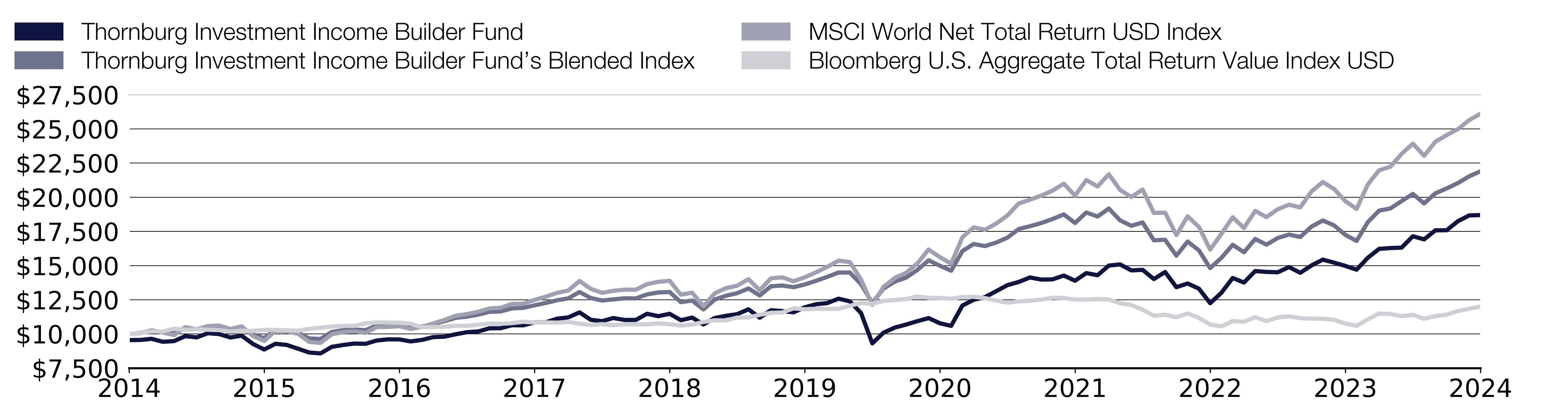

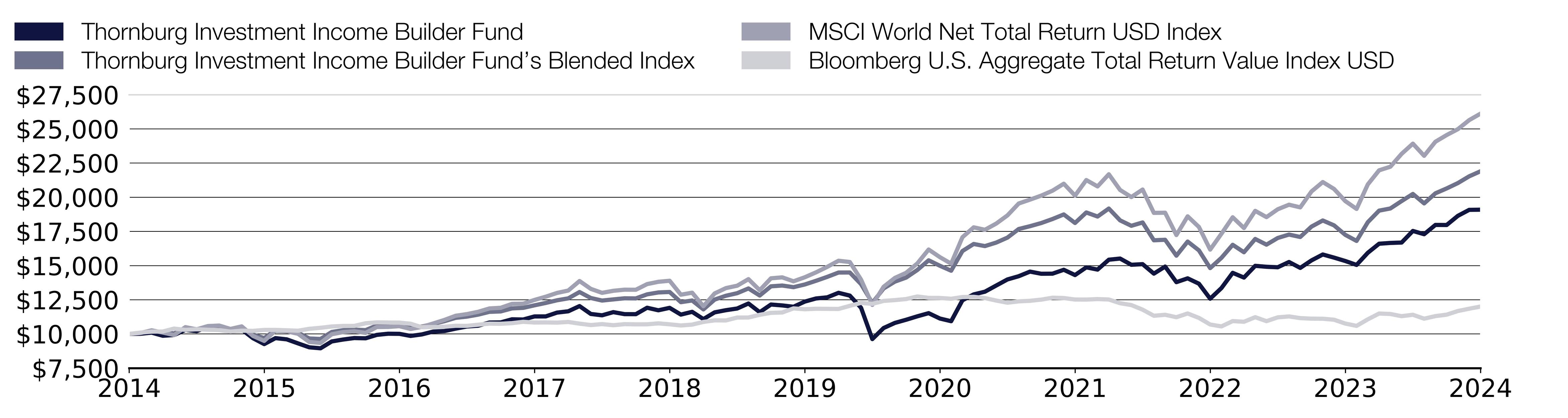

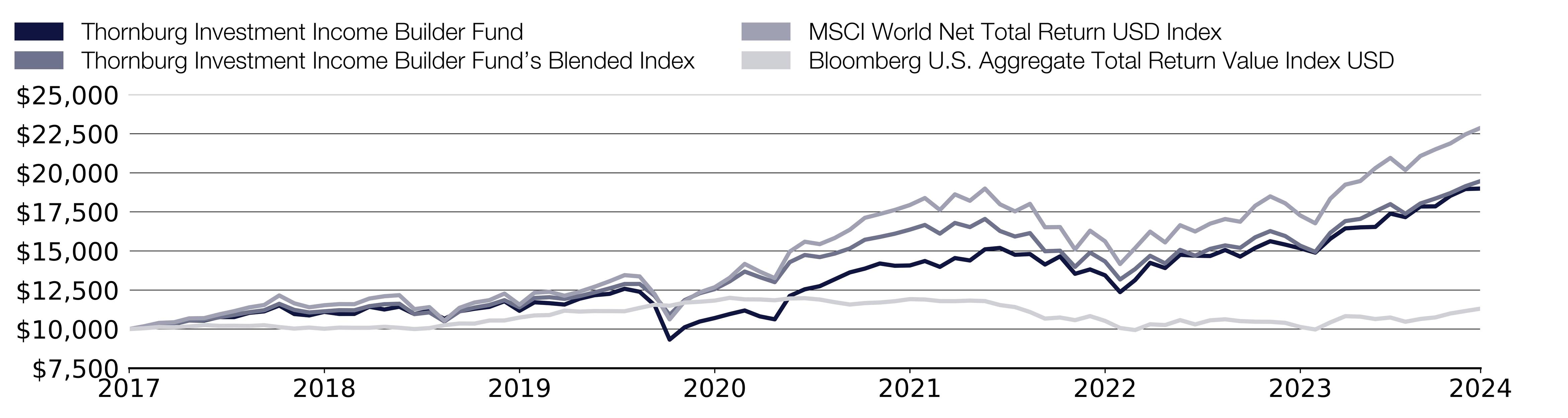

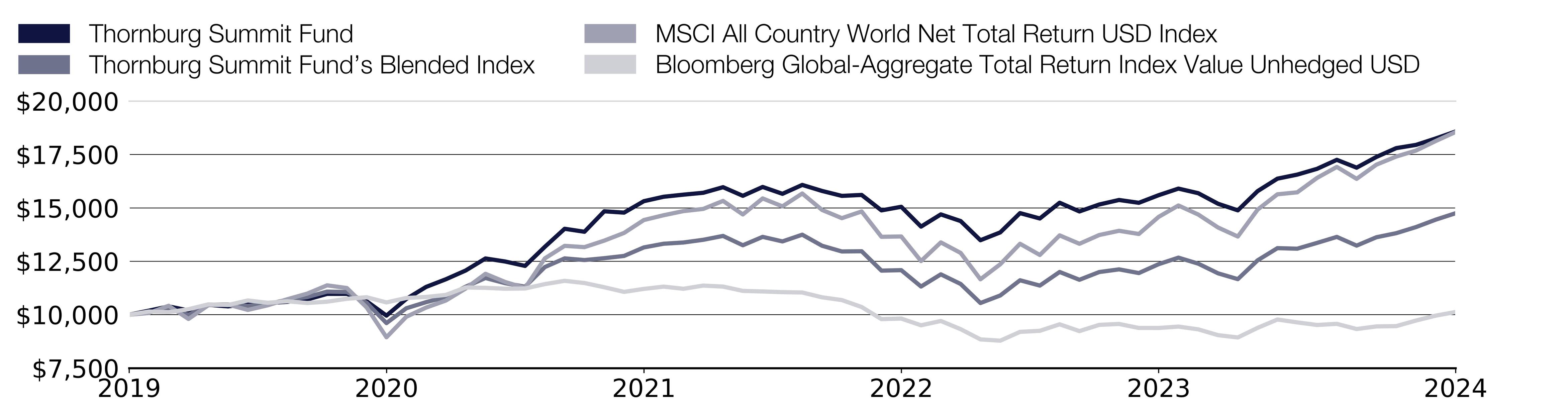

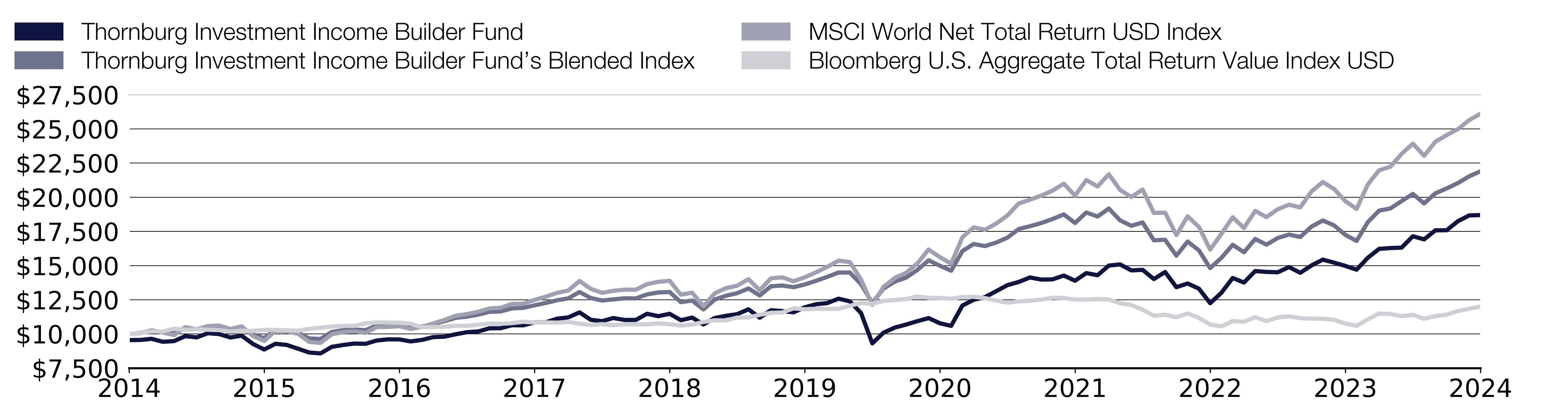

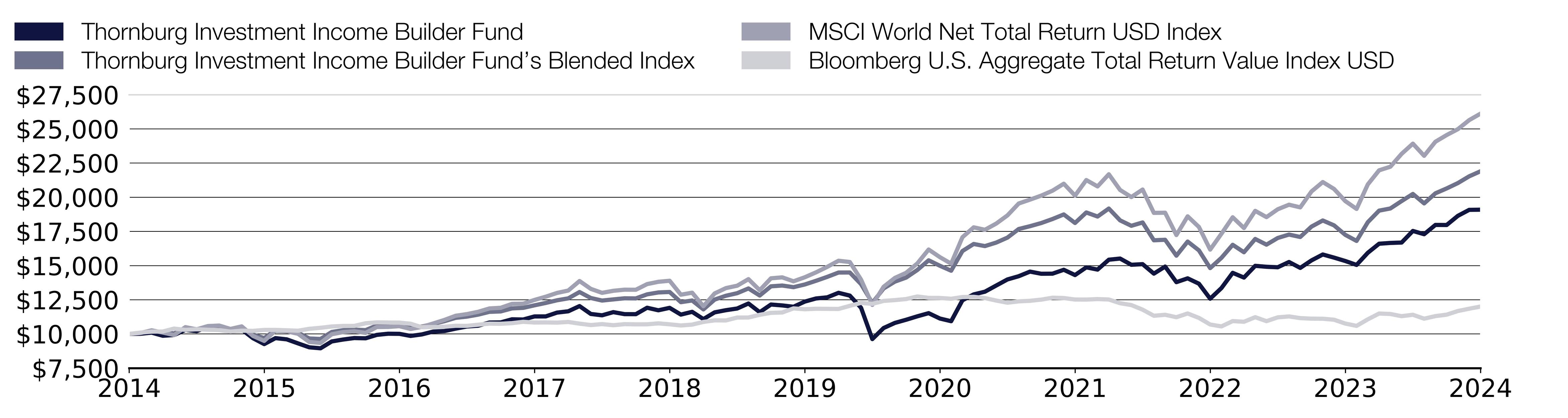

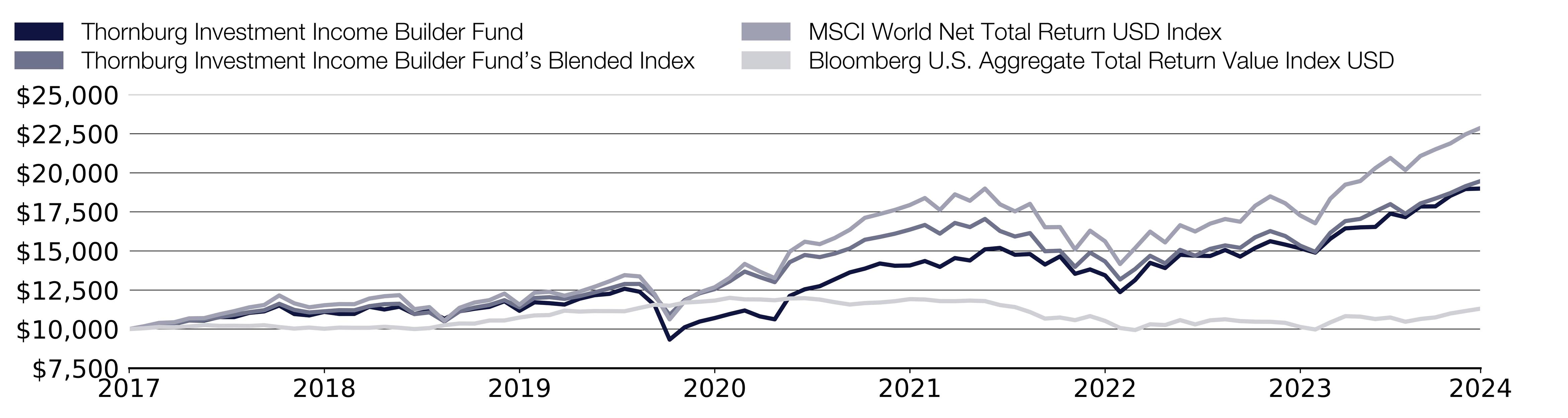

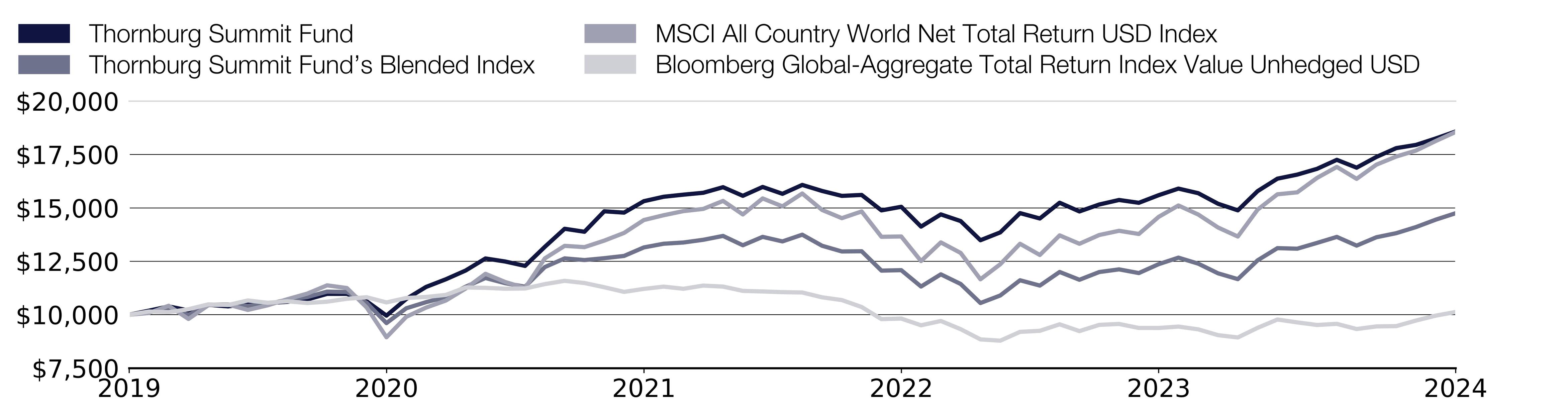

The line graph below reflects a hypothetical $10,000 investment and assumes the deduction of the maximum sales charge associated with that investment. The returns shown in the line graph and table assume the reinvestment of dividends and capital gains, but do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. The performance information shown below represents past performance and is no guarantee of future results. For Fund performance current to the most recent month end, visit https://www.thornburg.com/product/mutual-funds/fgo/THOAX or call 1-800-847-0200. Performance for other share classes of the Fund will vary.

Cumulative Performance

Growth Table

Date | Thornburg Global Opportunities Fund | MSCI All Country World Net Total Return USD Index |

09/30/2014 | 9549.4862 | 10000 |

10/31/2014 | 9827.0408 | 10070.4015 |

11/30/2014 | 10221.2487 | 10238.8433 |

12/31/2014 | 10144.8207 | 10041.2717 |

01/31/2015 | 10068.3926 | 9884.2795 |

02/28/2015 | 10856.8085 | 10434.5511 |

03/31/2015 | 10820.6057 | 10272.8725 |

04/30/2015 | 10909.1014 | 10570.9341 |

05/31/2015 | 11251.0164 | 10557.1413 |

06/30/2015 | 10840.7183 | 10308.6058 |

07/31/2015 | 11186.6559 | 10398.1255 |

08/31/2015 | 10655.682 | 9685.3233 |

09/30/2015 | 9818.9957 | 9334.4339 |

10/31/2015 | 10217.2262 | 10067.0465 |

11/30/2015 | 10341.9246 | 9983.9174 |

12/31/2015 | 10257.9614 | 9803.8662 |

01/31/2016 | 9612.299 | 9212.5892 |

02/29/2016 | 9592.122 | 9149.2172 |

03/31/2016 | 10023.9088 | 9827.2446 |

04/30/2016 | 9910.9178 | 9972.308 |

05/31/2016 | 10161.112 | 9984.8759 |

06/30/2016 | 9486.3191 | 9924.4328 |

07/31/2016 | 9789.2028 | 10352.1142 |

08/31/2016 | 9918.4332 | 10386.9422 |

09/30/2016 | 10070.9793 | 10450.5805 |

10/31/2016 | 10184.2273 | 10273.192 |

11/30/2016 | 10386.4558 | 10351.2621 |

12/31/2016 | 10631.4649 | 10574.8749 |

01/31/2017 | 11008.4097 | 10864.043 |

02/28/2017 | 11057.0478 | 11168.8146 |

03/31/2017 | 11390.4474 | 11305.4106 |

04/30/2017 | 11824.1762 | 11481.6274 |

05/31/2017 | 12261.9585 | 11735.1688 |

06/30/2017 | 12139.3623 | 11788.5291 |

07/31/2017 | 12553.3426 | 12117.9572 |

08/31/2017 | 12366.6456 | 12164.3945 |

09/30/2017 | 12573.6357 | 12399.4036 |

10/31/2017 | 12817.1535 | 12656.8857 |

11/30/2017 | 12593.9289 | 12901.9065 |

12/31/2017 | 12932.5853 | 13109.9159 |

01/31/2018 | 13420.7609 | 13849.5047 |

02/28/2018 | 12757.6557 | 13267.8667 |

03/31/2018 | 12216.5944 | 12983.8641 |

04/30/2018 | 12529.8404 | 13107.839 |

05/31/2018 | 12562.3854 | 13124.1879 |

06/30/2018 | 12285.7526 | 13053.1473 |

07/31/2018 | 12537.9767 | 13446.7994 |

08/31/2018 | 12363.0471 | 13552.4017 |

09/30/2018 | 12175.9131 | 13611.407 |

10/31/2018 | 11101.9268 | 12591.3835 |

11/30/2018 | 11024.6323 | 12775.5352 |

12/31/2018 | 10227.3608 | 11875.5991 |

01/31/2019 | 11259.6707 | 12813.3987 |

02/28/2019 | 11384.5469 | 13156.1402 |

03/31/2019 | 11492.7729 | 13321.5465 |

04/30/2019 | 12100.5038 | 13771.3814 |

05/31/2019 | 10839.2542 | 12954.468 |

06/30/2019 | 11567.6987 | 13802.7479 |

07/31/2019 | 11655.112 | 13843.1675 |

08/31/2019 | 11051.5437 | 13514.8046 |

09/30/2019 | 11471.9602 | 13799.1266 |

10/31/2019 | 11979.7901 | 14176.8026 |

11/30/2019 | 12492.9325 | 14522.8991 |

12/31/2019 | 13130.0688 | 15034.2955 |

01/31/2020 | 12699.5748 | 14868.2501 |

02/29/2020 | 12155.1264 | 13667.3235 |

03/31/2020 | 9871.8197 | 11822.1855 |

04/30/2020 | 11095.7734 | 13088.6676 |

05/31/2020 | 11631.7807 | 13657.8975 |

06/30/2020 | 12015.8489 | 14094.3125 |

07/31/2020 | 12952.8066 | 14839.706 |

08/31/2020 | 13746.2662 | 15748.003 |

09/30/2020 | 13374.8596 | 15240.2279 |

10/31/2020 | 13315.7722 | 14869.7412 |

11/30/2020 | 15084.9676 | 16702.6307 |

12/31/2020 | 16060.8146 | 17478.1127 |

01/31/2021 | 16029.1899 | 17398.658 |

02/28/2021 | 16747.5217 | 17801.6296 |

03/31/2021 | 17145.089 | 18277.1328 |

04/30/2021 | 17958.2948 | 19076.2595 |

05/31/2021 | 18152.5606 | 19373.0962 |

06/30/2021 | 18143.525 | 19628.3949 |

07/31/2021 | 18066.7222 | 19763.6596 |

08/31/2021 | 18346.8264 | 20258.3342 |

09/30/2021 | 17764.0289 | 19421.4506 |

10/31/2021 | 18161.5962 | 20412.8235 |

11/30/2021 | 17545.4124 | 19921.2376 |

12/31/2021 | 18376.0423 | 20718.1276 |

01/31/2022 | 18288.2669 | 19700.6071 |

02/28/2022 | 17761.6144 | 19191.767 |

03/31/2022 | 17901.0224 | 19607.4662 |

04/30/2022 | 16852.8806 | 18038.0232 |

05/31/2022 | 17245.2884 | 18059.165 |

06/30/2022 | 15567.2289 | 16536.8516 |

07/31/2022 | 15980.2897 | 17691.6605 |

08/31/2022 | 15675.6574 | 17040.3131 |

09/30/2022 | 14333.2098 | 15409.0425 |

10/31/2022 | 15278.0863 | 16338.9605 |

11/30/2022 | 17037.6688 | 17606.2413 |

12/31/2022 | 16474.6254 | 16913.4626 |

01/31/2023 | 17808.2345 | 18125.7322 |

02/28/2023 | 17299.4278 | 17606.2413 |

03/31/2023 | 17154.8196 | 18149.1107 |

04/30/2023 | 17283.3602 | 18409.9478 |

05/31/2023 | 16913.8059 | 18212.749 |

06/30/2023 | 17626.1353 | 19270.2098 |

07/31/2023 | 18820.492 | 19975.663 |

08/31/2023 | 17947.4869 | 19417.4566 |

09/30/2023 | 17476.1712 | 18614.5489 |

10/31/2023 | 16646.0129 | 18054.8514 |

11/30/2023 | 17853.4202 | 19721.2696 |

12/31/2023 | 19095.0603 | 20668.5483 |

01/31/2024 | 18987.4027 | 20789.7007 |

02/29/2024 | 19486.0274 | 21681.8618 |

03/31/2024 | 20670.2611 | 22362.6052 |

04/30/2024 | 20619.2654 | 21624.7737 |

05/31/2024 | 21384.2011 | 22503.0355 |

06/30/2024 | 21406.8658 | 23004.2603 |

07/31/2024 | 21695.8415 | 23375.2263 |

08/31/2024 | 21865.8272 | 23968.8998 |

09/30/2024 | 22489.1081 | 24525.7216 |

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class A | $149.00 | 1.30% |

End Block

Thornburg Global Opportunities Fund Tailored Shareholder Report

Thornburg Global Opportunities Fund Tailored Shareholder Report | |

Annual Performance | 1 Year | 5 Year | 10 Year |

|---|

Global Opportunities Fund Class A (with sales charge) | 22.88% | 13.36% | 8.44% |

Global Opportunities Fund Class A (without sales charge) | 28.68% | 14.41% | 8.94% |

MSCI All Country World Net Total Return USD Index | 31.76% | 12.19% | 9.39% |

Key Fund Statistics

(as of September 30, 2024)

| |

|---|

Fund Size (Millions) | $1,306.0M |

Number of Holdings | 37 |

Annual Portfolio Turnover | 14.91% |

Total Advisory Fee | $9.3M |

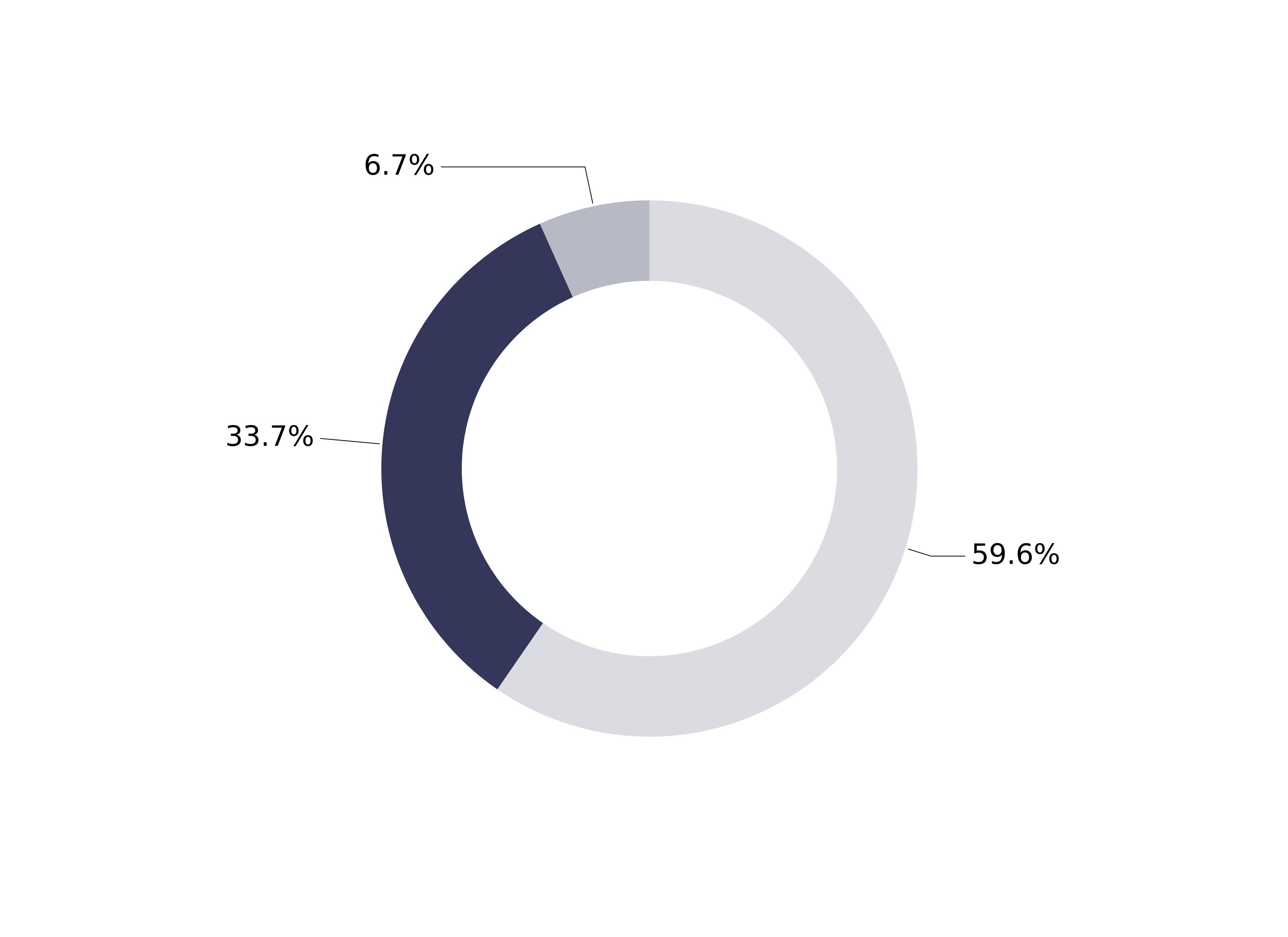

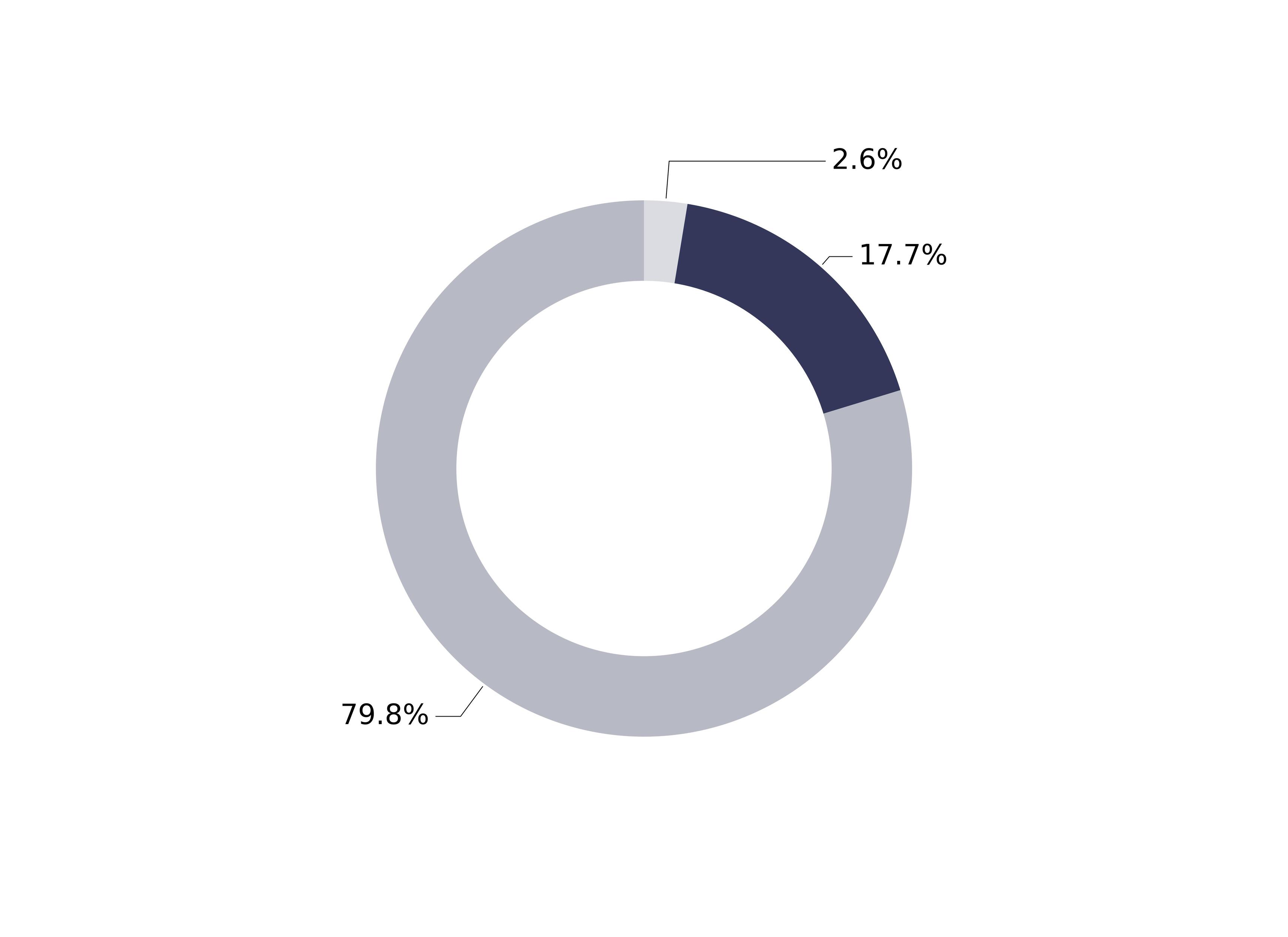

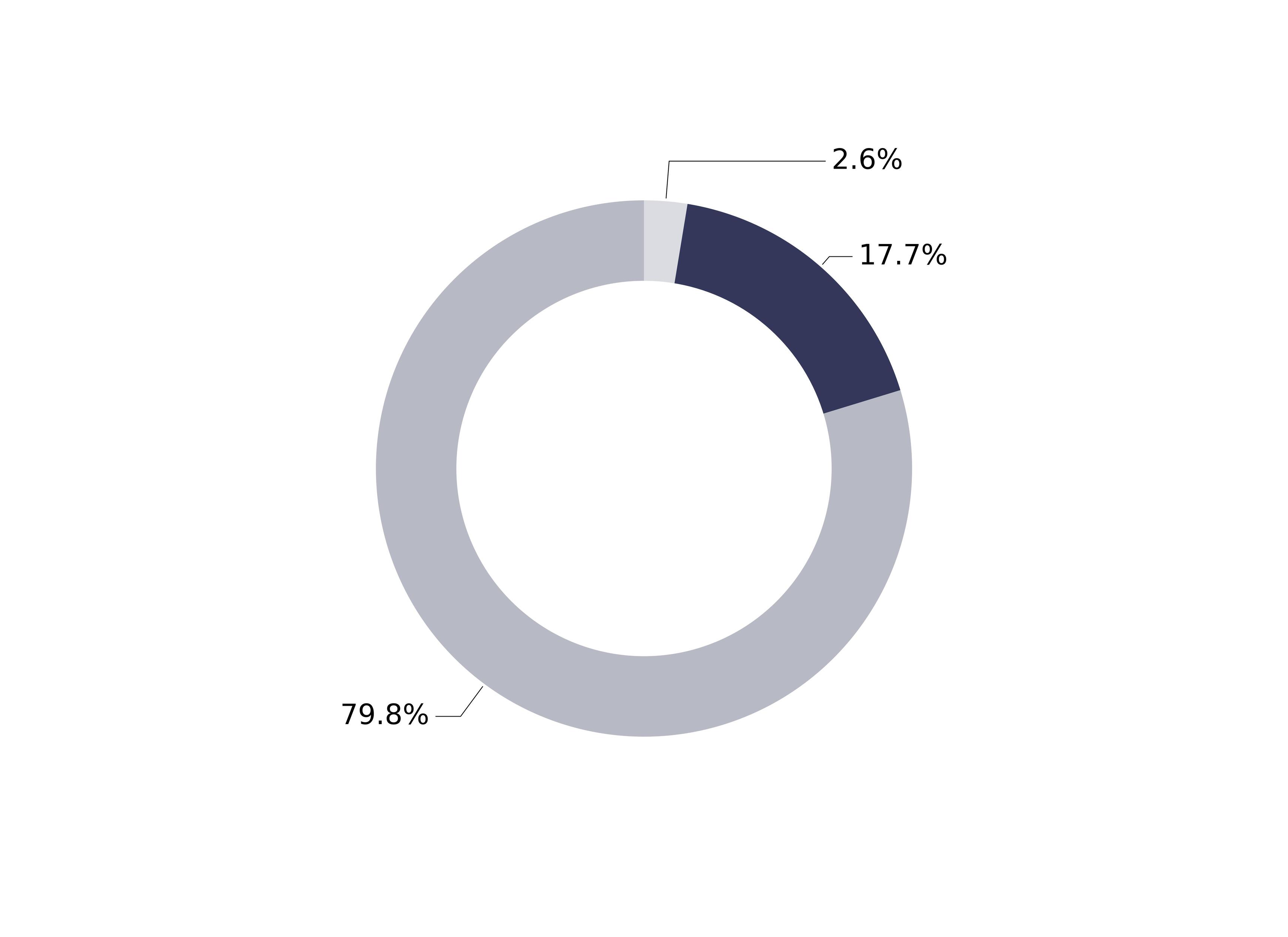

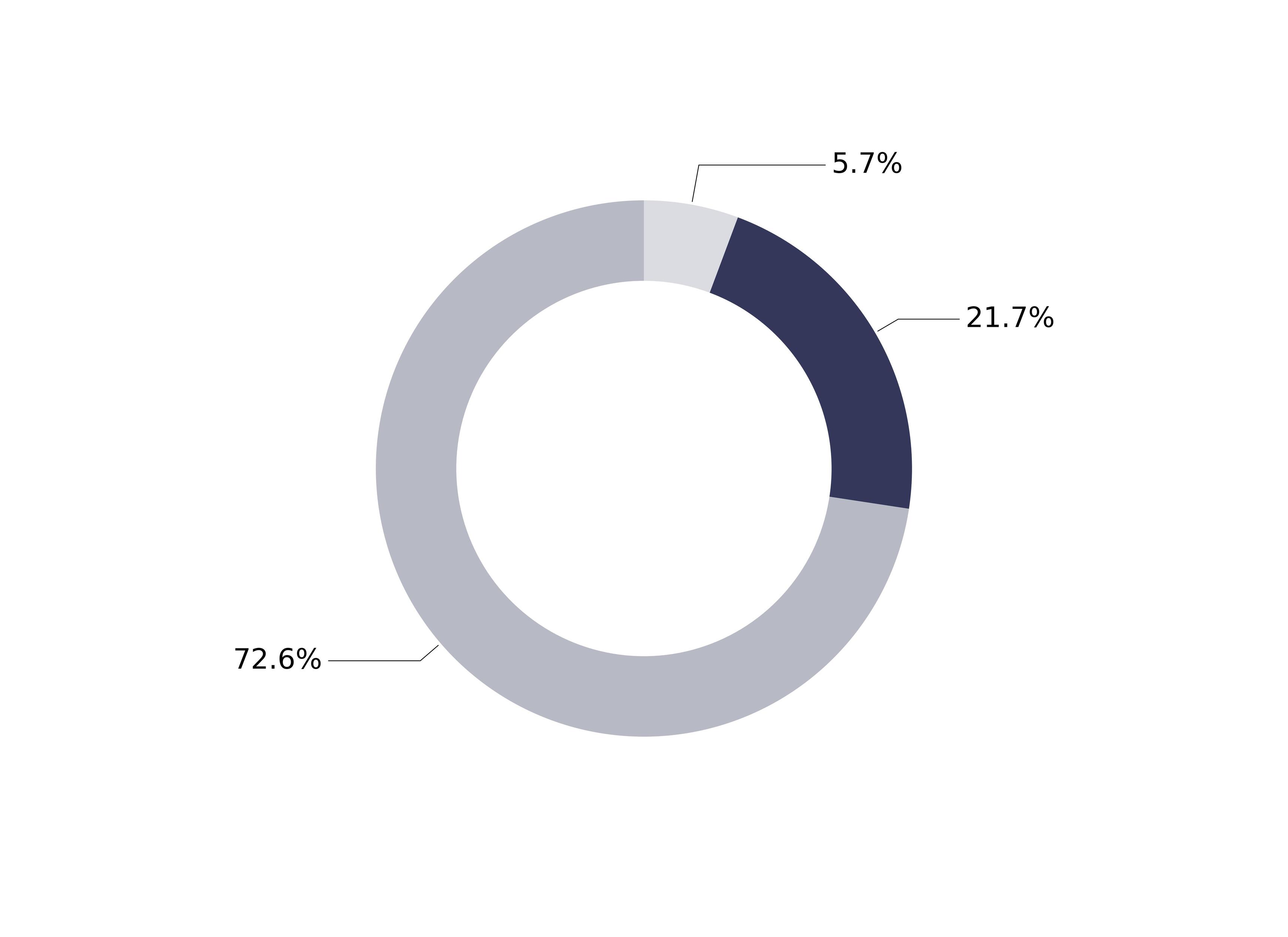

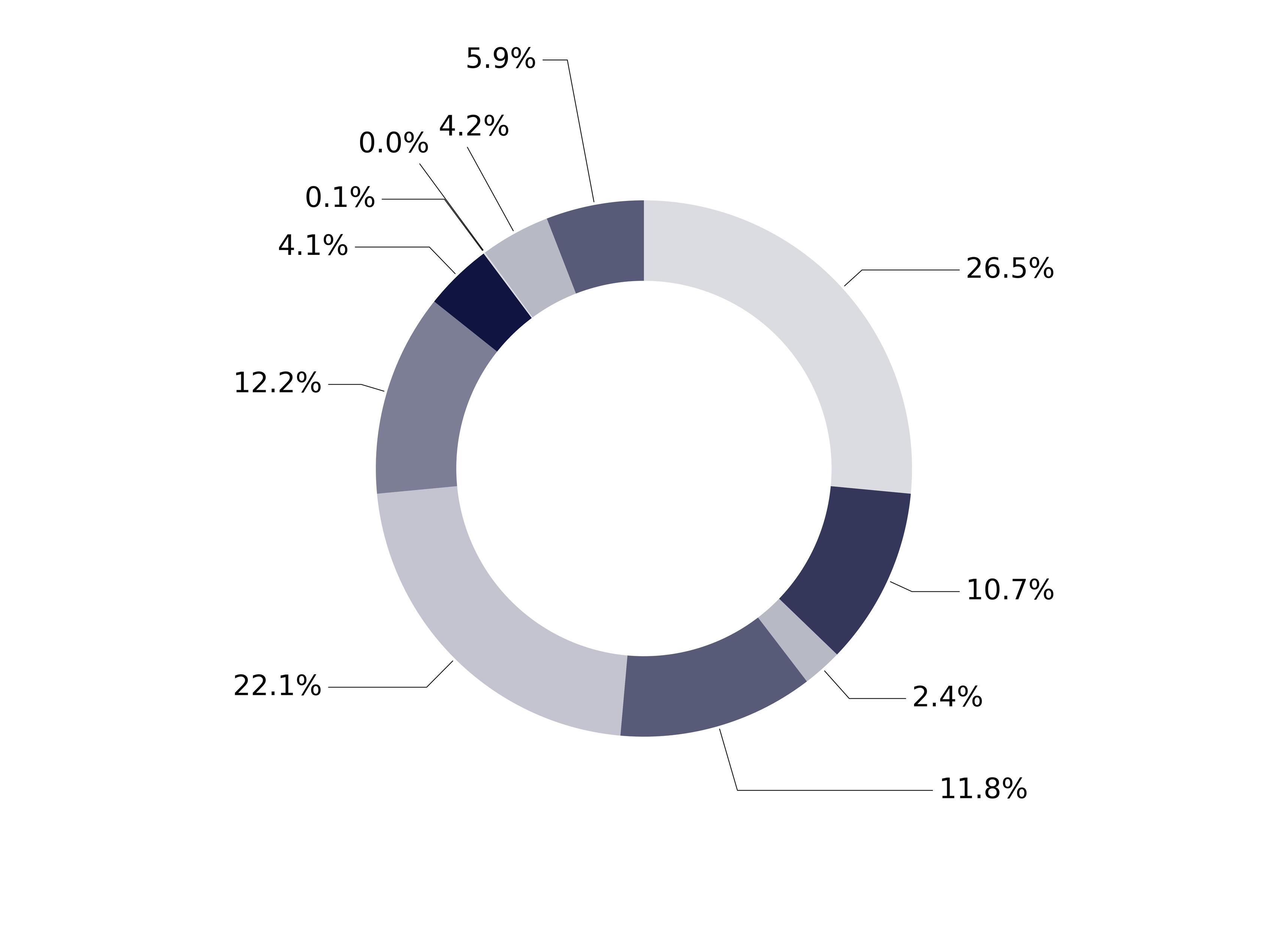

What did the Fund invest in?

(as of September 30, 2024)

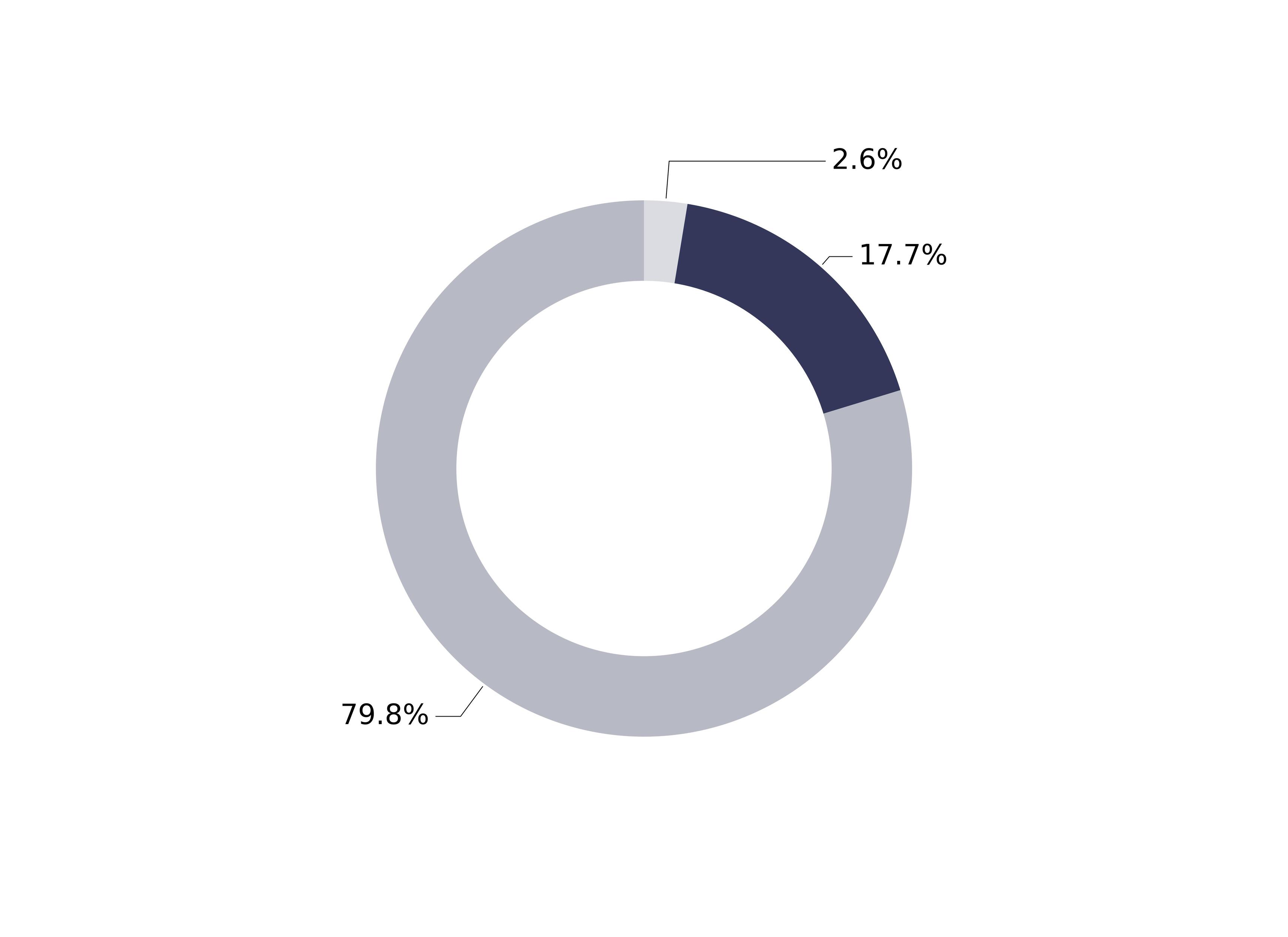

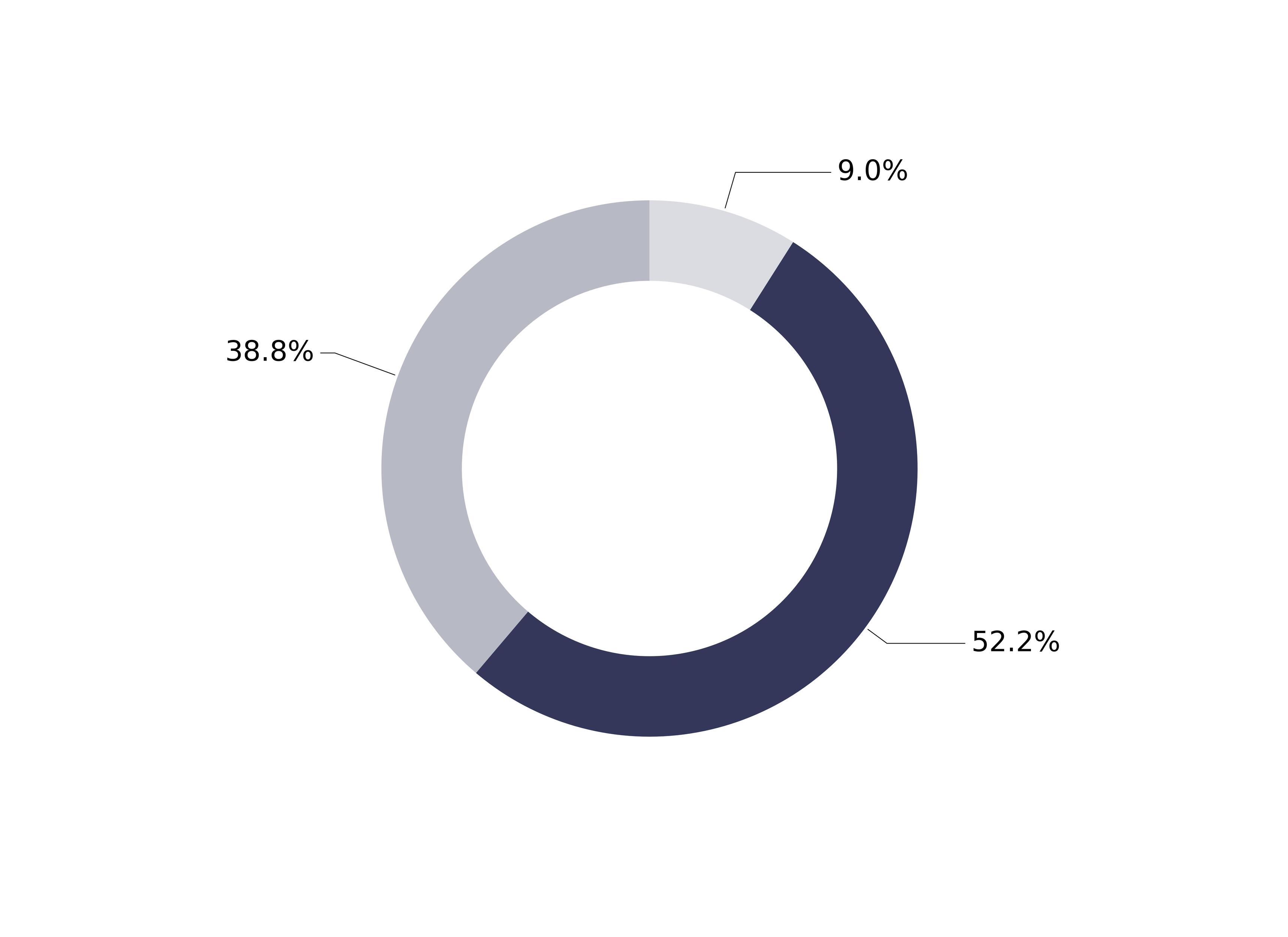

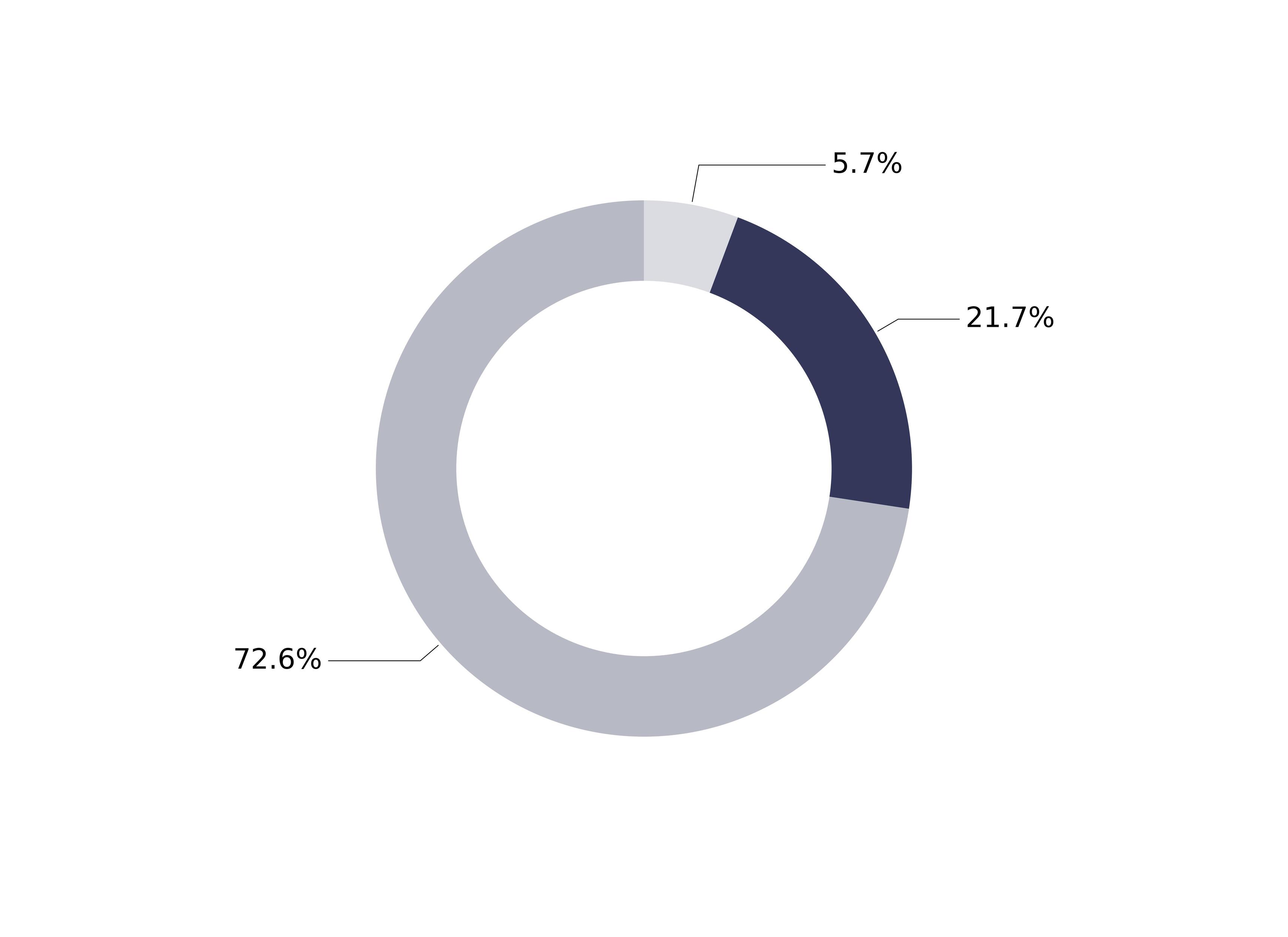

Market Capitalization Exposure | (%) |

|---|

| Small Cap (<$2.5 B) | 2.6 |

| Mid Cap ($2.5-12 B) | 17.7 |

| Large Cap (>$12 B) | 79.8 |

Market Capitalization Exposure | (%) |

Small Cap (<$2.5 B) | 2.6% |

Mid Cap ($2.5-12 B) | 17.7% |

Large Cap (>$12 B) | 79.8% |

Expressed as a percentage of the Fund’s net assets.

How has the Fund changed?

This is a summary of certain changes to the Fund since October 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 1, 2025 at https://www.thornburg.com/download or upon request by calling 1-800-847-0200.

Changes In and Disagreements with Accountants

No changes and/or disagreements occurred in the current reporting period.

End Block

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, visit www.thornburg.com/download.

Thornburg Global Opportunities Fund Tailored Shareholder Report | |

Thornburg Global Opportunities Fund Tailored Shareholder Report

Thornburg Global Opportunities Fund CLASS: C TICKER: THOCX Annual Shareholder Report | |

This annual shareholder report contains important information about the Thornburg Global Opportunities Fund Class C Shares for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.thornburg.com/download. You can also request this information by contacting us at 1-800-847-0200. This report also describes changes to the Fund that occurred during the reporting period.

How did the Fund perform last year and what affected its performance?

The Fund’s Class C shares underperformed the MSCI All Country World Net Total Return USD Index (the 'Index”) during the 12-month period ended September 30, 2024. During the period, major world events included the ongoing Russian/Ukraine conflict, moderating inflation figures in the U.S., Mideast tensions, and upcoming political contests in the U.S. Despite the conflicting economic and geo-political signals, the S&P 500, the Bloomberg U.S. Aggregate Bond, and the MSCI ACWI indexes reported varying positive returns for the period, +36.3%, +11.6%, and +31.8%, respectively. In brief, most equities repriced higher due to a surprising level of economic strength and resilient corporate profits, while interest rates declined along with inflation rates, creating a more favorable backdrop for the economy. Stock selection was a positive contributor to relative performance, consistent with the Fund’s bottom-up investment approach. Sector and geographic allocations detracted from relative results. The Fund’s cash and currency forwards allocations were also a drag on performance.During the period, stock selection in communication services, energy, and the U.S. helped to drive relative performance. The Fund’s underweight allocation and weaker security selection in information technology hampered relative returns. In South Korea, both an overweight positioning and negative security selection detracted from returns.

How did the Fund perform over the past 10 years?

The line graph below reflects a hypothetical $10,000 investment. The returns shown in the line graph and table assume the reinvestment of dividends and capital gains, but do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. The performance information shown below represents past performance and is no guarantee of future results. For Fund performance current to the most recent month end, visit https://www.thornburg.com/product/mutual-funds/fgo/THOCX or call 1-800-847-0200. Performance for other share classes of the Fund will vary.

Cumulative Performance

Growth Table

Date | Thornburg Global Opportunities Fund | MSCI All Country World Net Total Return USD Index |

09/30/2014 | 10000.0039 | 10000 |

10/31/2014 | 10284.1194 | 10070.4015 |

11/30/2014 | 10684.464 | 10238.8433 |

12/31/2014 | 10602.6731 | 10041.2717 |

01/31/2015 | 10512.2728 | 9884.2795 |

02/28/2015 | 11330.181 | 10434.5511 |

03/31/2015 | 11282.8284 | 10272.8725 |

04/30/2015 | 11368.924 | 10570.9341 |

05/31/2015 | 11717.6112 | 10557.1413 |

06/30/2015 | 11287.1332 | 10308.6058 |

07/31/2015 | 11635.8203 | 10398.1255 |

08/31/2015 | 11076.1989 | 9685.3233 |

09/30/2015 | 10202.3286 | 9334.4339 |

10/31/2015 | 10606.9779 | 10067.0465 |

11/30/2015 | 10731.8165 | 9983.9174 |

12/31/2015 | 10637.1114 | 9803.8662 |

01/31/2016 | 9956.9561 | 9212.5892 |

02/29/2016 | 9935.4322 | 9149.2172 |

03/31/2016 | 10374.5198 | 9827.2446 |

04/30/2016 | 10253.986 | 9972.308 |

05/31/2016 | 10503.6632 | 9984.8759 |

06/30/2016 | 9801.9841 | 9924.4328 |

07/31/2016 | 10107.6234 | 10352.1142 |

08/31/2016 | 10232.4621 | 10386.9422 |

09/30/2016 | 10387.4341 | 10450.5805 |

10/31/2016 | 10495.0536 | 10273.192 |

11/30/2016 | 10701.6831 | 10351.2621 |

12/31/2016 | 10943.2993 | 10574.8749 |

01/31/2017 | 11322.288 | 10864.043 |

02/28/2017 | 11369.6616 | 11168.8146 |

03/31/2017 | 11705.5834 | 11305.4106 |

04/30/2017 | 12140.5591 | 11481.6274 |

05/31/2017 | 12584.1482 | 11735.1688 |

06/30/2017 | 12450.6408 | 11788.5291 |

07/31/2017 | 12864.083 | 12117.9572 |

08/31/2017 | 12665.9753 | 12164.3945 |

09/30/2017 | 12868.3897 | 12399.4036 |

10/31/2017 | 13109.5644 | 12656.8857 |

11/30/2017 | 12877.0031 | 12901.9065 |

12/31/2017 | 13207.4222 | 13109.9159 |

01/31/2018 | 13702.9698 | 13849.5047 |

02/28/2018 | 13013.5122 | 13267.8667 |

03/31/2018 | 12457.637 | 12983.8641 |

04/30/2018 | 12767.8929 | 13107.839 |

05/31/2018 | 12793.7476 | 13124.1879 |

06/30/2018 | 12505.0372 | 13053.1473 |

07/31/2018 | 12754.9656 | 13446.7994 |

08/31/2018 | 12569.6739 | 13552.4017 |

09/30/2018 | 12367.1457 | 13611.407 |

10/31/2018 | 11268.3226 | 12591.3835 |

11/30/2018 | 11182.1404 | 12775.5352 |

12/31/2018 | 10366.2804 | 11875.5991 |

01/31/2019 | 11407.264 | 12813.3987 |

02/28/2019 | 11529.2203 | 13156.1402 |

03/31/2019 | 11629.3986 | 13321.5465 |

04/30/2019 | 12239.1798 | 13771.3814 |

05/31/2019 | 10954.2837 | 12954.468 |

06/30/2019 | 11681.6656 | 13802.7479 |

07/31/2019 | 11760.066 | 13843.1675 |

08/31/2019 | 11145.9292 | 13514.8046 |

09/30/2019 | 11564.0649 | 13799.1266 |

10/31/2019 | 12069.3122 | 14176.8026 |

11/30/2019 | 12580.1104 | 14522.8991 |

12/31/2019 | 13209.1159 | 15034.2955 |

01/31/2020 | 12773.6506 | 14868.2501 |

02/29/2020 | 12219.4219 | 13667.3235 |

03/31/2020 | 9914.5346 | 11822.1855 |

04/30/2020 | 11141.7551 | 13088.6676 |

05/31/2020 | 11673.9906 | 13657.8975 |

06/30/2020 | 12052.2736 | 14094.3125 |

07/31/2020 | 12980.3866 | 14839.706 |

08/31/2020 | 13767.7432 | 15748.003 |

09/30/2020 | 13389.4602 | 15240.2279 |

10/31/2020 | 13319.0819 | 14869.7412 |

11/30/2020 | 15083.7608 | 16702.6307 |

12/31/2020 | 16042.4344 | 17478.1127 |

01/31/2021 | 15999.9316 | 17398.658 |

02/28/2021 | 16713.0337 | 17801.6296 |

03/31/2021 | 17095.5586 | 18277.1328 |

04/30/2021 | 17893.6662 | 19076.2595 |

05/31/2021 | 18077.8448 | 19373.0962 |

06/30/2021 | 18054.2322 | 19628.3949 |

07/31/2021 | 17969.2267 | 19763.6596 |

08/31/2021 | 18233.6883 | 20258.3342 |

09/30/2021 | 17643.3721 | 19421.4506 |

10/31/2021 | 18025.897 | 20412.8235 |

11/30/2021 | 17404.343 | 19921.2376 |

12/31/2021 | 18216.341 | 20718.1276 |

01/31/2022 | 18119.3309 | 19700.6071 |

02/28/2022 | 17591.1648 | 19191.767 |

03/31/2022 | 17715.1222 | 19607.4662 |

04/30/2022 | 16669.5689 | 18038.0232 |

05/31/2022 | 17041.4409 | 18059.165 |

06/30/2022 | 15376.1008 | 16536.8516 |

07/31/2022 | 15769.5307 | 17691.6605 |

08/31/2022 | 15462.3321 | 17040.3131 |

09/30/2022 | 14125.7484 | 15409.0425 |

10/31/2022 | 15047.3444 | 16338.9605 |

11/30/2022 | 16776.1303 | 17606.2413 |

12/31/2022 | 16209.3211 | 16913.4626 |

01/31/2023 | 17512.4995 | 18125.7322 |

02/28/2023 | 16996.7736 | 17606.2413 |

03/31/2023 | 16841.5013 | 18149.1107 |

04/30/2023 | 16963.501 | 18409.9478 |

05/31/2023 | 16586.411 | 18212.749 |

06/30/2023 | 17274.0456 | 19270.2098 |

07/31/2023 | 18427.4971 | 19975.663 |

08/31/2023 | 17562.4085 | 19417.4566 |

09/30/2023 | 17091.0461 | 18614.5489 |

10/31/2023 | 16270.321 | 18054.8514 |

11/30/2023 | 17437.2686 | 19721.2696 |

12/31/2023 | 18629.6259 | 20668.5483 |

01/31/2024 | 18513.4811 | 20789.7007 |

02/29/2024 | 18989.6748 | 21681.8618 |

03/31/2024 | 20127.8938 | 22362.6052 |

04/30/2024 | 20064.0142 | 21624.7737 |

05/31/2024 | 20795.7264 | 22503.0355 |

06/30/2024 | 20801.5337 | 23004.2603 |

07/31/2024 | 21068.6667 | 23375.2263 |

08/31/2024 | 21219.655 | 23968.8998 |

09/30/2024 | 21806.1862 | 24525.7216 |

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class C | $243.00 | 2.14% |

End Block

Thornburg Global Opportunities Fund Tailored Shareholder Report

Thornburg Global Opportunities Fund Tailored Shareholder Report | |

Annual Performance | 1 Year | 5 Year | 10 Year |

|---|

Global Opportunities Fund Class C (with sales charge) | 26.59% | 13.53% | 8.11% |

Global Opportunities Fund Class C (without sales charge) | 27.59% | 13.53% | 8.11% |

MSCI All Country World Net Total Return USD Index | 31.76% | 12.19% | 9.39% |

Key Fund Statistics

(as of September 30, 2024)

| |

|---|

Fund Size (Millions) | $1,306.0M |

Number of Holdings | 37 |

Annual Portfolio Turnover | 14.91% |

Total Advisory Fee | $9.3M |

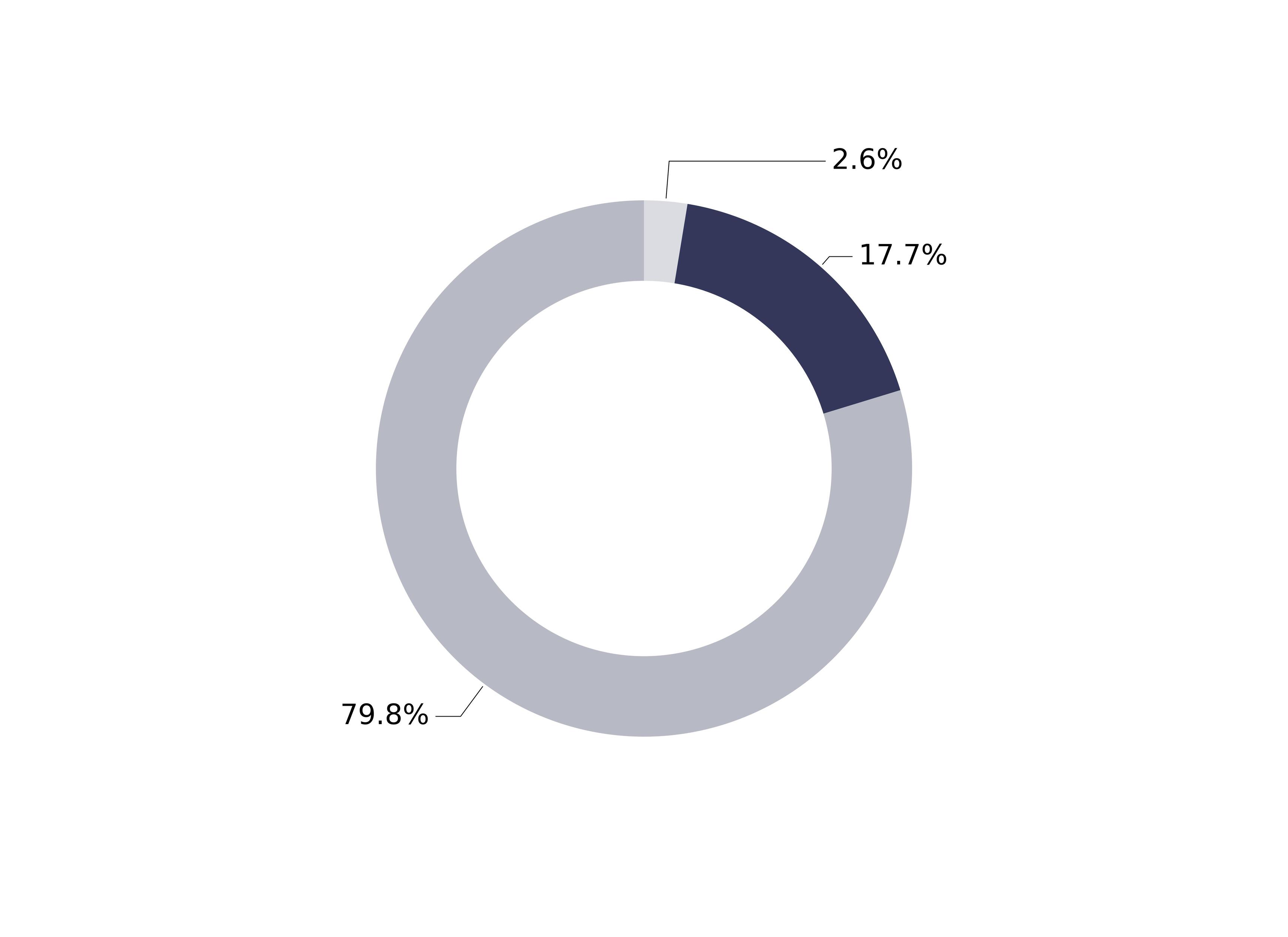

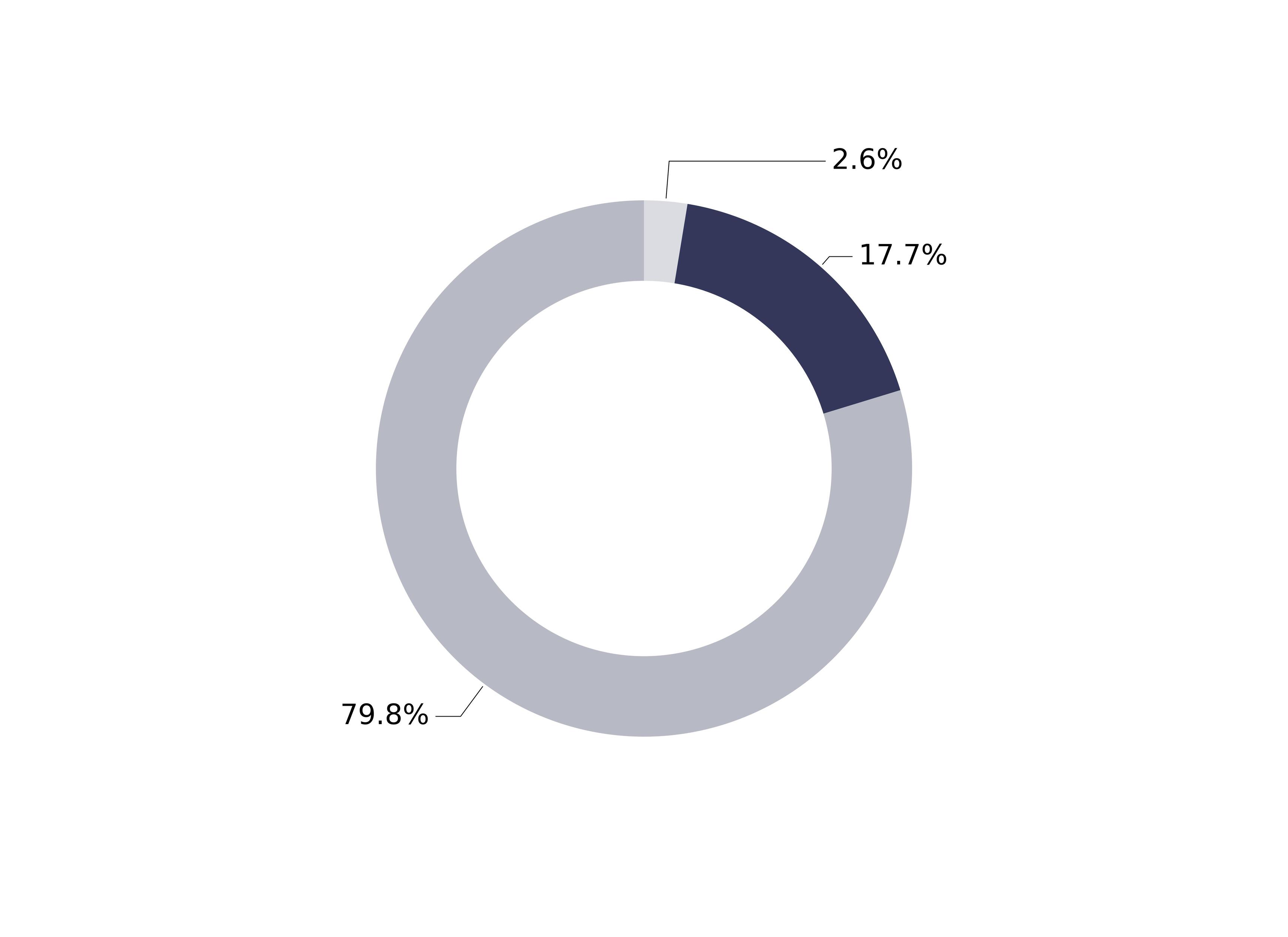

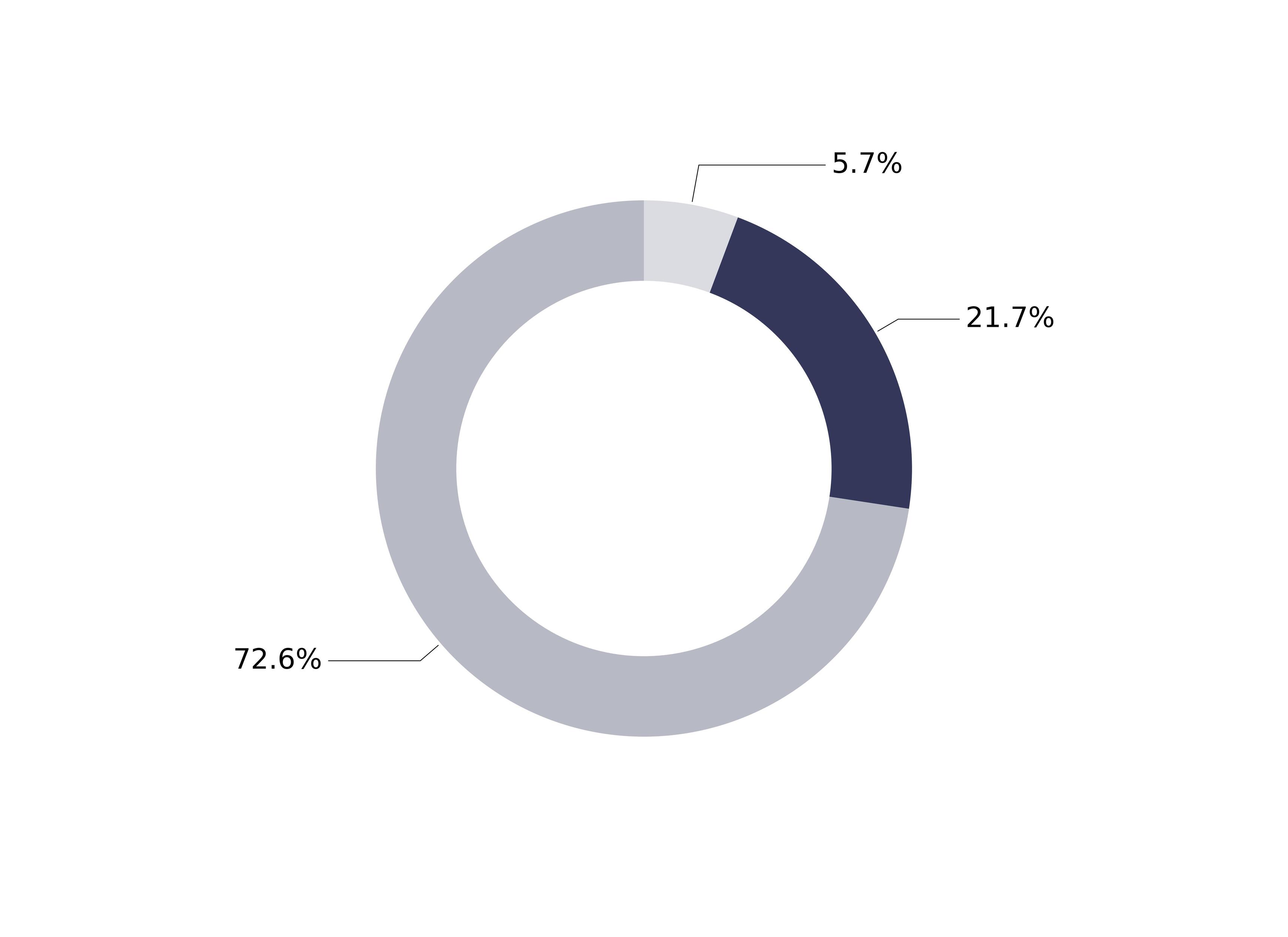

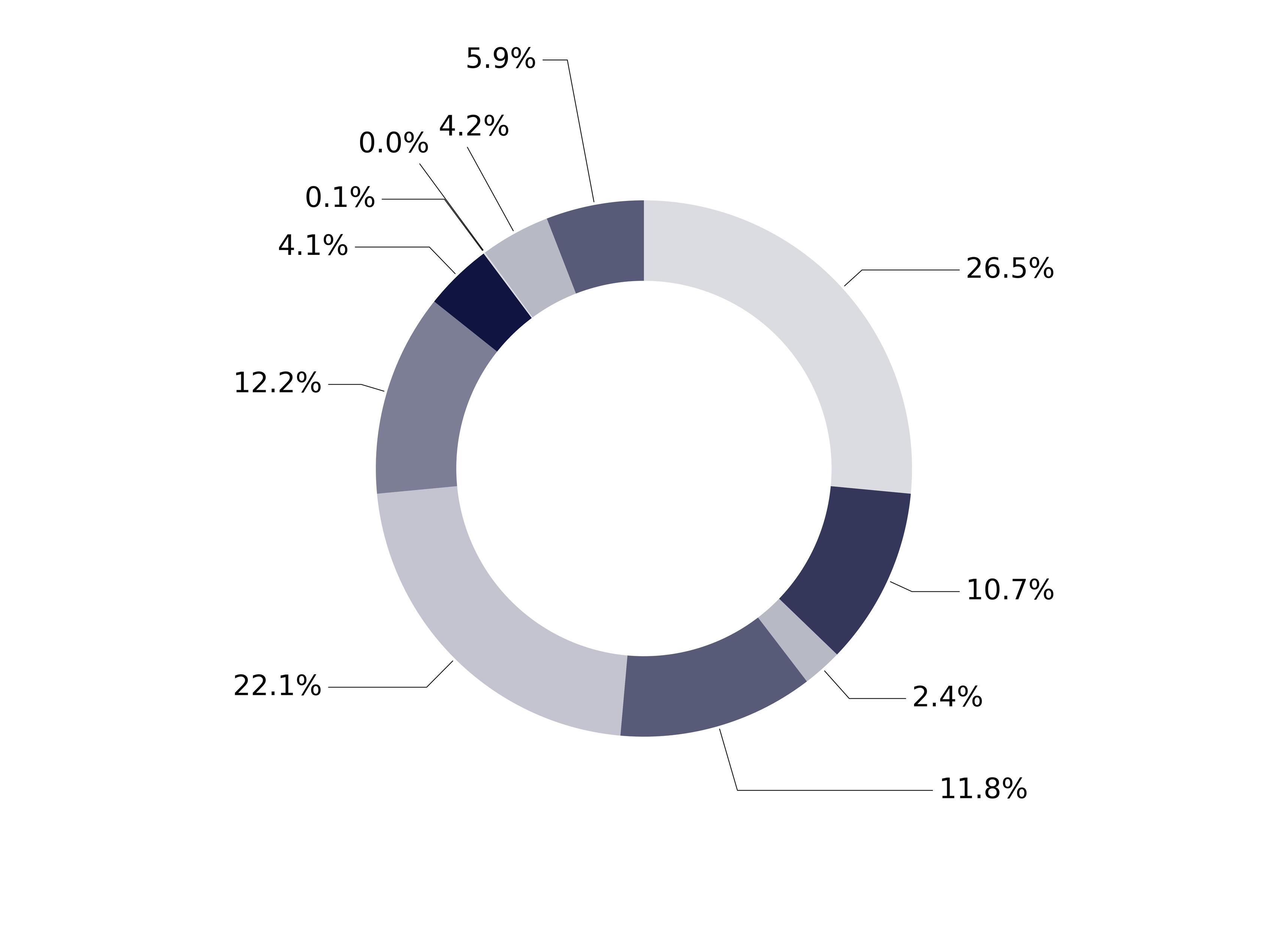

What did the Fund invest in?

(as of September 30, 2024)

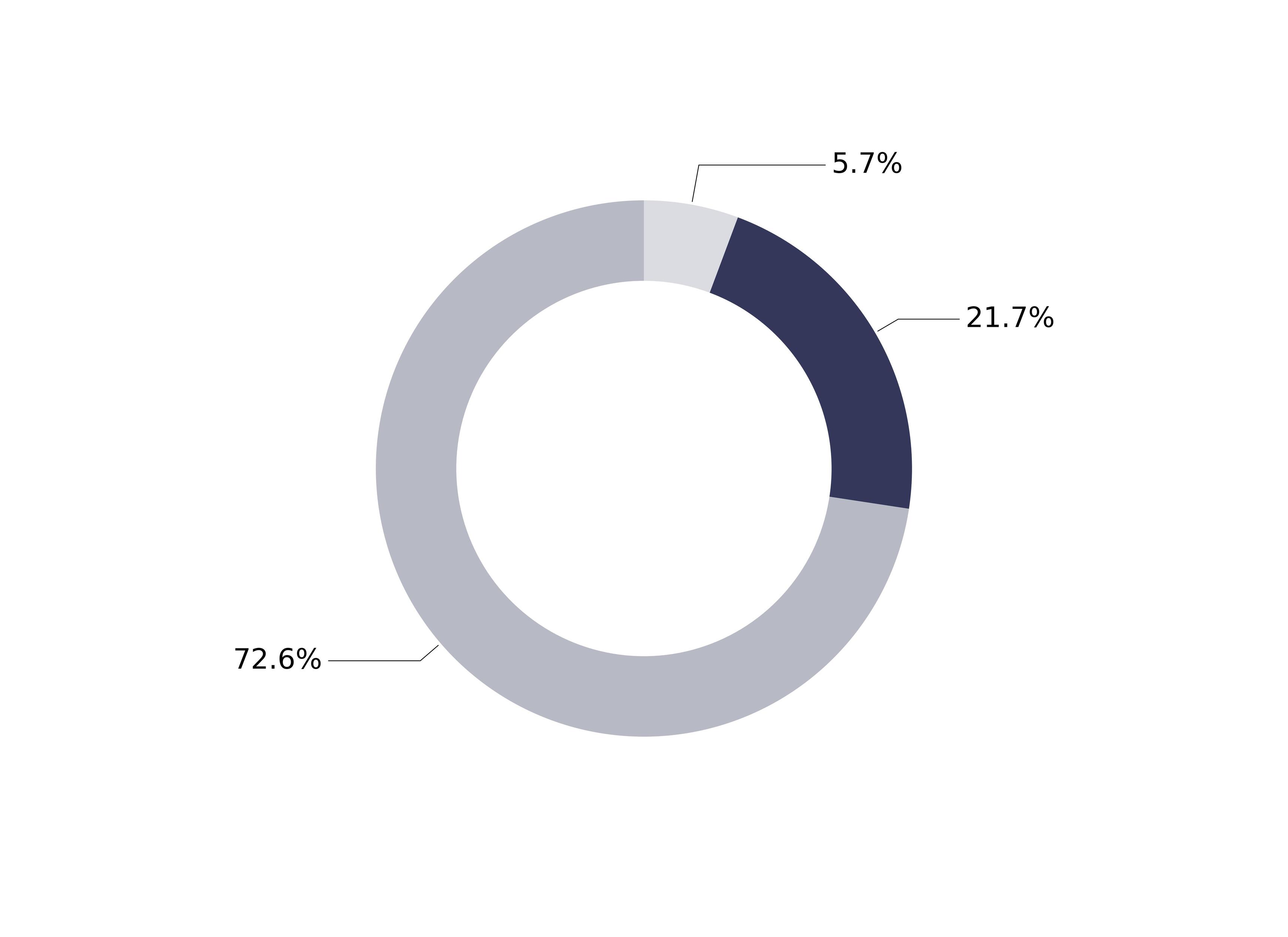

Market Capitalization Exposure | (%) |

|---|

| Small Cap (<$2.5 B) | 2.6 |

| Mid Cap ($2.5-12 B) | 17.7 |

| Large Cap (>$12 B) | 79.8 |

Market Capitalization Exposure | (%) |

Small Cap (<$2.5 B) | 2.6% |

Mid Cap ($2.5-12 B) | 17.7% |

Large Cap (>$12 B) | 79.8% |

Expressed as a percentage of the Fund’s net assets.

How has the Fund changed?

This is a summary of certain changes to the Fund since October 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 1, 2025 at https://www.thornburg.com/download or upon request by calling 1-800-847-0200.

Changes In and Disagreements with Accountants

No changes and/or disagreements occurred in the current reporting period.

End Block

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, visit www.thornburg.com/download.

Thornburg Global Opportunities Fund Tailored Shareholder Report | |

Thornburg Global Opportunities Fund Tailored Shareholder Report

Thornburg Global Opportunities Fund CLASS: I TICKER: THOIX Annual Shareholder Report | |

This annual shareholder report contains important information about the Thornburg Global Opportunities Fund Class I Shares for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.thornburg.com/download. You can also request this information by contacting us at 1-800-847-0200. This report also describes changes to the Fund that occurred during the reporting period.

How did the Fund perform last year and what affected its performance?

The Fund’s Class I shares underperformed the MSCI All Country World Net Total Return USD Index (the 'Index”) during the 12-month period ended September 30, 2024. During the period, major world events included the ongoing Russian/Ukraine conflict, moderating inflation figures in the U.S., Mideast tensions, and upcoming political contests in the U.S. Despite the conflicting economic and geo-political signals, the S&P 500, the Bloomberg U.S. Aggregate Bond, and the MSCI ACWI indexes reported varying positive returns for the period, +36.3%, +11.6%, and +31.8%, respectively. In brief, most equities repriced higher due to a surprising level of economic strength and resilient corporate profits, while interest rates declined along with inflation rates, creating a more favorable backdrop for the economy. Stock selection was a positive contributor to relative performance, consistent with the Fund’s bottom-up investment approach. Sector and geographic allocations detracted from relative results. The Fund’s cash and currency forwards allocations were also a drag on performance. During the period, stock selection in communication services, energy, and the U.S. helped to drive relative performance. The Fund’s underweight allocation and weaker security selection in information technology hampered relative returns. In South Korea, both an overweight positioning and negative security selection detracted from returns.

How did the Fund perform over the past 10 years?

The line graph below reflects a hypothetical $10,000 investment. The returns shown in the line graph and table assume the reinvestment of dividends and capital gains, but do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. The performance information shown below represents past performance and is no guarantee of future results. For Fund performance current to the most recent month end, visit https://www.thornburg.com/product/mutual-funds/fgo/THOIX or call 1-800-847-0200. Performance for other share classes of the Fund will vary.

Cumulative Performance

Growth Table

Date | Thornburg Global Opportunities Fund | MSCI All Country World Net Total Return USD Index |

09/30/2014 | 10000.0076 | 10000 |

10/31/2014 | 10294.2491 | 10070.4015 |

11/30/2014 | 10706.1872 | 10238.8433 |

12/31/2014 | 10632.4899 | 10041.2717 |

01/31/2015 | 10552.578 | 9884.2795 |

02/28/2015 | 11381.1383 | 10434.5511 |

03/31/2015 | 11347.4912 | 10272.8725 |

04/30/2015 | 11444.2267 | 10570.9341 |

05/31/2015 | 11805.9332 | 10557.1413 |

06/30/2015 | 11381.1383 | 10308.6058 |

07/31/2015 | 11747.0508 | 10398.1255 |

08/31/2015 | 11191.8733 | 9685.3233 |

09/30/2015 | 10317.0482 | 9334.4339 |

10/31/2015 | 10737.6372 | 10067.0465 |

11/30/2015 | 10872.2256 | 9983.9174 |

12/31/2015 | 10787.469 | 9803.8662 |

01/31/2016 | 10110.6082 | 9212.5892 |

02/29/2016 | 10093.6867 | 9149.2172 |

03/31/2016 | 10550.5677 | 9827.2446 |

04/30/2016 | 10436.3475 | 9972.308 |

05/31/2016 | 10698.631 | 9984.8759 |

06/30/2016 | 9994.5996 | 9924.4328 |

07/31/2016 | 10317.0061 | 10352.1142 |

08/31/2016 | 10456.9983 | 10386.9422 |

09/30/2016 | 10616.9856 | 10450.5805 |

10/31/2016 | 10740.34 | 10273.192 |

11/30/2016 | 10961.5272 | 10351.2621 |

12/31/2016 | 11222.5256 | 10574.8749 |

01/31/2017 | 11619.3678 | 10864.043 |

02/28/2017 | 11679.1074 | 11168.8146 |

03/31/2017 | 12033.2099 | 11305.4106 |

04/30/2017 | 12490.2754 | 11481.6274 |

05/31/2017 | 12960.1558 | 11735.1688 |

06/30/2017 | 12832.7291 | 11788.5291 |

07/31/2017 | 13273.6134 | 12117.9572 |

08/31/2017 | 13080.9941 | 12164.3945 |

09/30/2017 | 13303.8056 | 12399.4036 |

10/31/2017 | 13569.3677 | 12656.8857 |

11/30/2017 | 13333.7884 | 12901.9065 |

12/31/2017 | 13694.5709 | 13109.9159 |

01/31/2018 | 14218.8061 | 13849.5047 |

02/28/2018 | 13518.3935 | 13267.8667 |

03/31/2018 | 12946.8911 | 12983.8641 |

04/30/2018 | 13282.0579 | 13107.839 |

05/31/2018 | 13320.731 | 13124.1879 |

06/30/2018 | 13032.8313 | 13053.1473 |

07/31/2018 | 13303.543 | 13446.7994 |

08/31/2018 | 13118.7715 | 13552.4017 |

09/30/2018 | 12921.1091 | 13611.407 |

10/31/2018 | 11786.6984 | 12591.3835 |

11/30/2018 | 11709.3523 | 12775.5352 |

12/31/2018 | 10864.2322 | 11875.5991 |

01/31/2019 | 11963.4576 | 12813.3987 |

02/28/2019 | 12100.309 | 13156.1402 |

03/31/2019 | 12219.5021 | 13321.5465 |

04/30/2019 | 12868.4424 | 13771.3814 |

05/31/2019 | 11530.8307 | 12954.468 |

06/30/2019 | 12307.7933 | 13802.7479 |

07/31/2019 | 12400.499 | 13843.1675 |

08/31/2019 | 11764.8024 | 13514.8046 |

09/30/2019 | 12215.0875 | 13799.1266 |

10/31/2019 | 12758.0784 | 14176.8026 |

11/30/2019 | 13311.1772 | 14522.8991 |

12/31/2019 | 13989.2197 | 15034.2955 |

01/31/2020 | 13531.2927 | 14868.2501 |

02/29/2020 | 12956.6393 | 13667.3235 |

03/31/2020 | 10523.3411 | 11822.1855 |

04/30/2020 | 11834.2693 | 13088.6676 |

05/31/2020 | 12408.9227 | 13657.8975 |

06/30/2020 | 12821.9549 | 14094.3125 |

07/31/2020 | 13827.5984 | 14839.706 |

08/31/2020 | 14671.6206 | 15748.003 |

09/30/2020 | 14281.0359 | 15240.2279 |

10/31/2020 | 14222.6726 | 14869.7412 |

11/30/2020 | 16118.2923 | 16702.6307 |

12/31/2020 | 17159.4793 | 17478.1127 |

01/31/2021 | 17130.5831 | 17398.658 |

02/28/2021 | 17905.9624 | 17801.6296 |

03/31/2021 | 18329.7721 | 18277.1328 |

04/30/2021 | 19206.2878 | 19076.2595 |

05/31/2021 | 19418.1926 | 19373.0962 |

06/30/2021 | 19413.3766 | 19628.3949 |

07/31/2021 | 19336.3203 | 19763.6596 |

08/31/2021 | 19639.7296 | 20258.3342 |

09/30/2021 | 19018.463 | 19421.4506 |

10/31/2021 | 19451.9048 | 20412.8235 |

11/30/2021 | 18794.8876 | 19921.2376 |

12/31/2021 | 19690.6206 | 20718.1276 |

01/31/2022 | 19602.3713 | 19700.6071 |

02/28/2022 | 19045.2977 | 19191.767 |

03/31/2022 | 19199.734 | 19607.4662 |

04/30/2022 | 18080.0712 | 18038.0232 |

05/31/2022 | 18504.7709 | 18059.165 |

06/30/2022 | 16706.6918 | 16536.8516 |

07/31/2022 | 17153.4538 | 17691.6605 |

08/31/2022 | 16833.5502 | 17040.3131 |

09/30/2022 | 15393.9838 | 15409.0425 |

10/31/2022 | 16408.8505 | 16338.9605 |

11/30/2022 | 18310.5662 | 17606.2413 |

12/31/2022 | 17705.7707 | 16913.4626 |

01/31/2023 | 19145.8706 | 18125.7322 |

02/28/2023 | 18600.8129 | 17606.2413 |

03/31/2023 | 18451.6392 | 18149.1107 |

04/30/2023 | 18595.0754 | 18409.9478 |

05/31/2023 | 18204.9289 | 18212.749 |

06/30/2023 | 18973.7472 | 19270.2098 |

07/31/2023 | 20264.6734 | 19975.663 |

08/31/2023 | 19329.4691 | 19417.4566 |

09/30/2023 | 18830.3109 | 18614.5489 |

10/31/2023 | 17941.0061 | 18054.8514 |

11/30/2023 | 19246.049 | 19721.2696 |

12/31/2023 | 20582.4462 | 20668.5483 |

01/31/2024 | 20478.9862 | 20789.7007 |

02/29/2024 | 21020.6295 | 21681.8618 |

03/31/2024 | 22304.7502 | 22362.6052 |

04/30/2024 | 22256.0632 | 21624.7737 |

05/31/2024 | 23083.7428 | 22503.0355 |

06/30/2024 | 23114.1722 | 23004.2603 |

07/31/2024 | 23436.7239 | 23375.2263 |

08/31/2024 | 23619.3003 | 23968.8998 |

09/30/2024 | 24300.9188 | 24525.7216 |

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $113.00 | 0.99% |

End Block

Thornburg Global Opportunities Fund Tailored Shareholder Report

Thornburg Global Opportunities Fund Tailored Shareholder Report | |

Annual Performance | 1 Year | 5 Year | 10 Year |

|---|

Global Opportunities Fund Class I | 29.05% | 14.75% | 9.29% |

MSCI All Country World Net Total Return USD Index | 31.76% | 12.19% | 9.39% |

Key Fund Statistics

(as of September 30, 2024)

| |

|---|

Fund Size (Millions) | $1,306.0M |

Number of Holdings | 37 |

Annual Portfolio Turnover | 14.91% |

Total Advisory Fee | $9.3M |

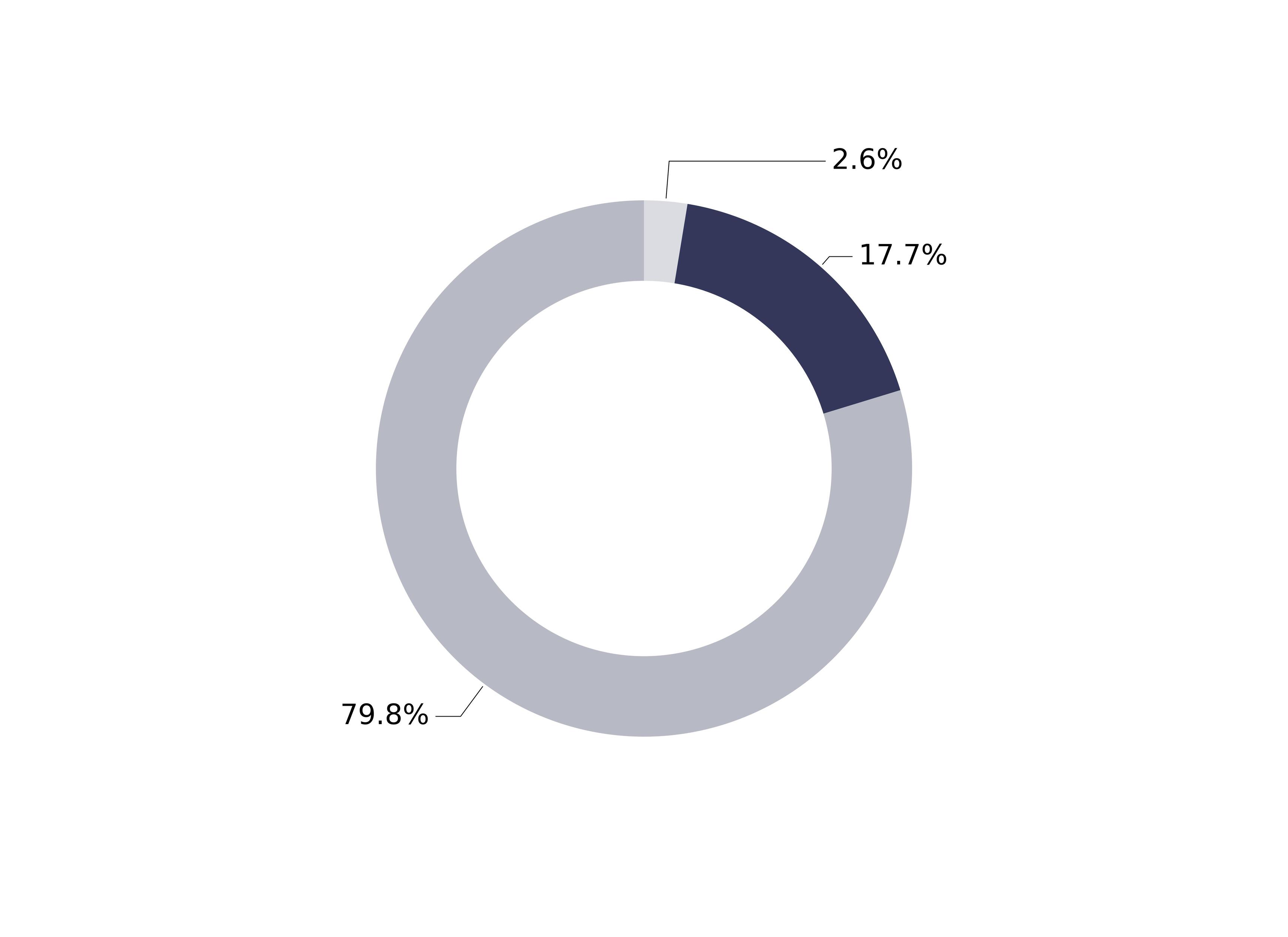

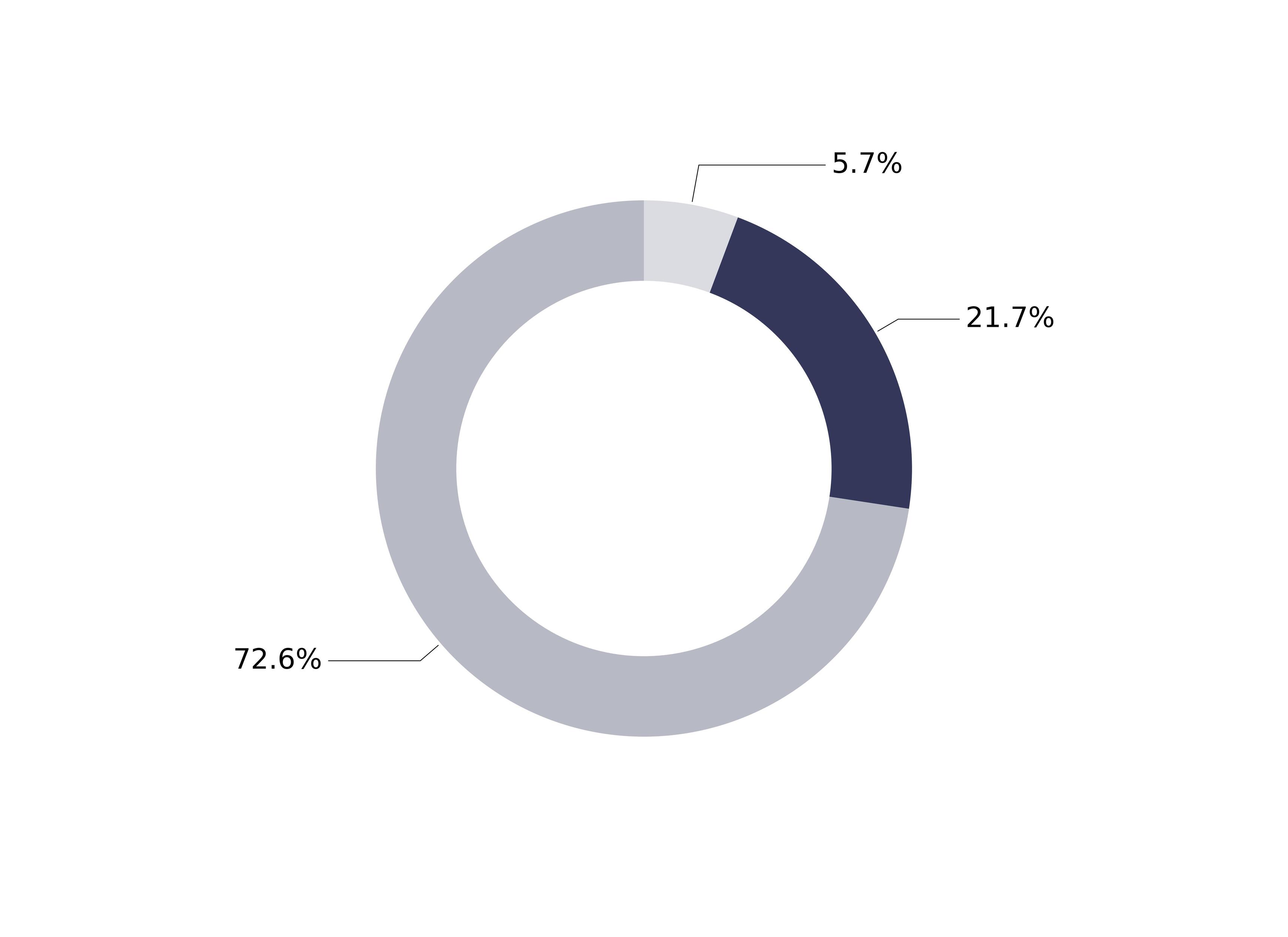

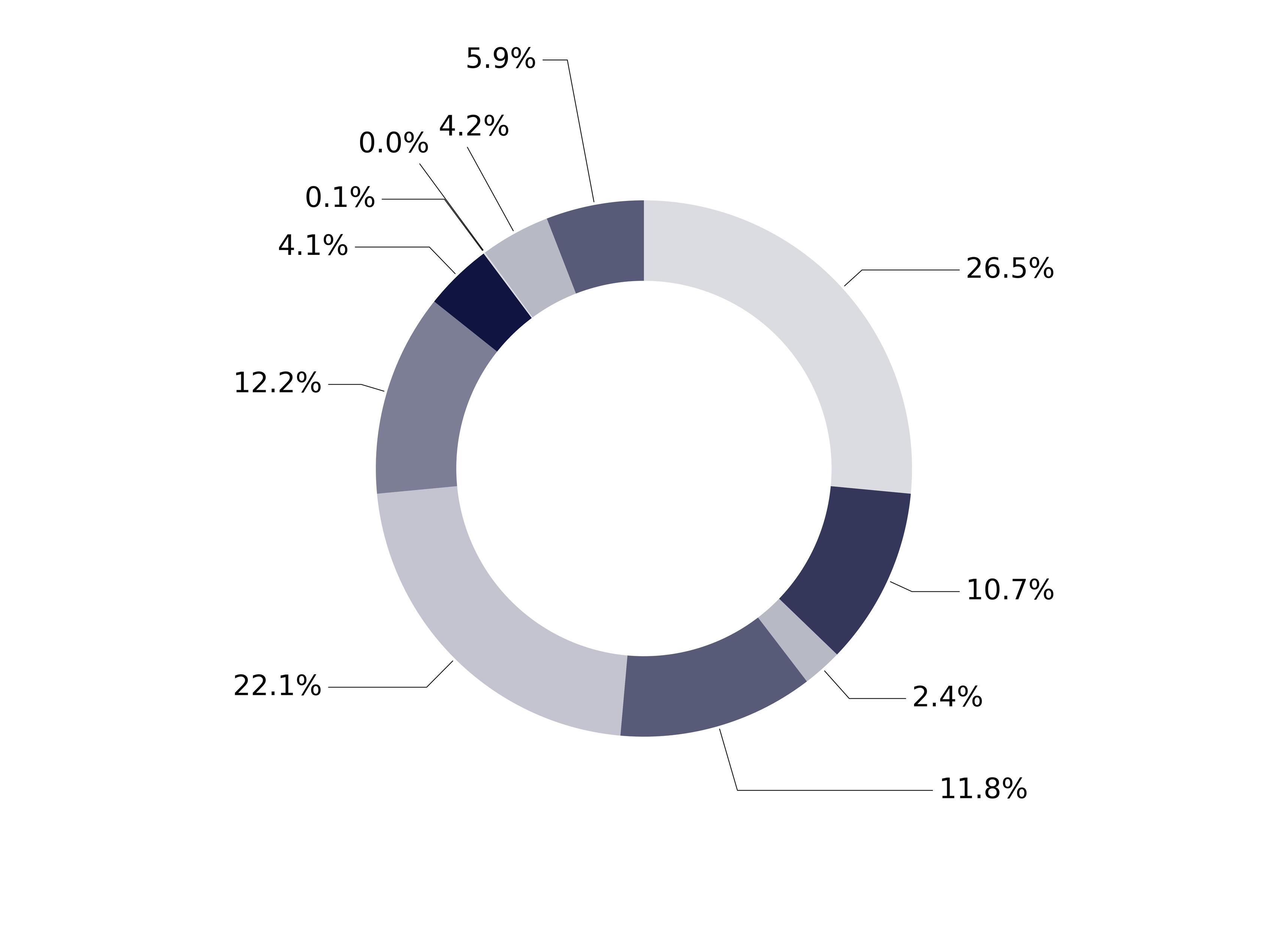

What did the Fund invest in?

(as of September 30, 2024)

Market Capitalization Exposure | (%) |

|---|

| Small Cap (<$2.5 B) | 2.6 |

| Mid Cap ($2.5-12 B) | 17.7 |

| Large Cap (>$12 B) | 79.8 |

Market Capitalization Exposure | (%) |

Small Cap (<$2.5 B) | 2.6% |

Mid Cap ($2.5-12 B) | 17.7% |

Large Cap (>$12 B) | 79.8% |

Expressed as a percentage of the Fund’s net assets.

How has the Fund changed?

This is a summary of certain changes to the Fund since October 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 1, 2025 at https://www.thornburg.com/download or upon request by calling 1-800-847-0200.

End Block

Changes In and Disagreements with Accountants

No changes and/or disagreements occurred in the current reporting period.

End Block

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, visit www.thornburg.com/download.

Thornburg Global Opportunities Fund Tailored Shareholder Report | |

Thornburg Global Opportunities Fund Tailored Shareholder Report

Thornburg Global Opportunities Fund CLASS: R3 TICKER: THORX Annual Shareholder Report | |

This annual shareholder report contains important information about the Thornburg Global Opportunities Fund Class R3 Shares for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.thornburg.com/download. You can also request this information by contacting us at 1-800-847-0200. This report also describes changes to the Fund that occurred during the reporting period.

How did the Fund perform last year and what affected its performance?

The Fund’s Class R3 shares underperformed the MSCI All Country World Net Total Return USD Index (the 'Index”) during the 12-month period ended September 30, 2024. During the period, major world events included the ongoing Russian/Ukraine conflict, moderating inflation figures in the U.S., Mideast tensions, and upcoming political contests in the U.S. Despite the conflicting economic and geo-political signals, the S&P 500, the Bloomberg U.S. Aggregate Bond, and the MSCI ACWI indexes reported varying positive returns for the period, +36.3%, +11.6%, and +31.8%, respectively. In brief, most equities repriced higher due to a surprising level of economic strength and resilient corporate profits, while interest rates declined along with inflation rates, creating a more favorable backdrop for the economy. Stock selection was a positive contributor to relative performance, consistent with the Fund’s bottom-up investment approach. Sector and geographic allocations detracted from relative results. The Fund’s cash and currency forwards allocations were also a drag on performance. During the period, stock selection in communication services, energy, and the U.S. helped to drive relative performance. The Fund’s underweight allocation and weaker security selection in information technology hampered relative returns. In South Korea, both an overweight positioning and negative security selection detracted from returns.

How did the Fund perform over the past 10 years?

The line graph below reflects a hypothetical $10,000 investment. The returns shown in the line graph and table assume the reinvestment of dividends and capital gains, but do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. The performance information shown below represents past performance and is no guarantee of future results. For Fund performance current to the most recent month end, visit https://www.thornburg.com/product/mutual-funds/fgo/THORX or call 1-800-847-0200. Performance for other share classes of the Fund will vary.

Cumulative Performance

Growth Table

Date | Thornburg Global Opportunities Fund | MSCI All Country World Net Total Return USD Index |

09/30/2014 | 9999.9894 | 10000 |

10/31/2014 | 10292.9827 | 10070.4015 |

11/30/2014 | 10700.6256 | 10238.8433 |

12/31/2014 | 10619.9463 | 10041.2717 |

01/31/2015 | 10535.0207 | 9884.2795 |

02/28/2015 | 11363.0453 | 10434.5511 |

03/31/2015 | 11320.5825 | 10272.8725 |

04/30/2015 | 11414.0006 | 10570.9341 |

05/31/2015 | 11766.4419 | 10557.1413 |

06/30/2015 | 11337.5676 | 10308.6058 |

07/31/2015 | 11698.5014 | 10398.1255 |

08/31/2015 | 11137.9924 | 9685.3233 |

09/30/2015 | 10267.505 | 9334.4339 |

10/31/2015 | 10679.3942 | 10067.0465 |

11/30/2015 | 10806.7826 | 9983.9174 |

12/31/2015 | 10721.0628 | 9803.8662 |

01/31/2016 | 10040.3604 | 9212.5892 |

02/29/2016 | 10019.0884 | 9149.2172 |

03/31/2016 | 10470.0538 | 9827.2446 |

04/30/2016 | 10350.9309 | 9972.308 |

05/31/2016 | 10610.4487 | 9984.8759 |

06/30/2016 | 9904.7592 | 9924.4328 |

07/31/2016 | 10219.7365 | 10352.1142 |

08/31/2016 | 10351.6864 | 10386.9422 |

09/30/2016 | 10511.9168 | 10450.5805 |

10/31/2016 | 10627.0108 | 10273.192 |

11/30/2016 | 10840.1478 | 10351.2621 |

12/31/2016 | 11095.6683 | 10574.8749 |

01/31/2017 | 11484.3156 | 10864.043 |

02/28/2017 | 11535.5658 | 11168.8146 |

03/31/2017 | 11881.5047 | 11305.4106 |

04/30/2017 | 12329.944 | 11481.6274 |

05/31/2017 | 12786.9249 | 11735.1688 |

06/30/2017 | 12655.6101 | 11788.5291 |

07/31/2017 | 13087.2942 | 12117.9572 |

08/31/2017 | 12886.4115 | 12164.3945 |

09/30/2017 | 13104.3906 | 12399.4036 |

10/31/2017 | 13356.5625 | 12656.8857 |

11/30/2017 | 13121.487 | 12901.9065 |

12/31/2017 | 13466.3868 | 13109.9159 |

01/31/2018 | 13975.9258 | 13849.5047 |

02/28/2018 | 13282.2677 | 13267.8667 |

03/31/2018 | 12717.0648 | 12983.8641 |

04/30/2018 | 13038.2028 | 13107.839 |

05/31/2018 | 13072.4575 | 13124.1879 |

06/30/2018 | 12781.2924 | 13053.1473 |

07/31/2018 | 13042.4846 | 13446.7994 |

08/31/2018 | 12858.3655 | 13552.4017 |

09/30/2018 | 12661.4009 | 13611.407 |

10/31/2018 | 11543.8406 | 12591.3835 |

11/30/2018 | 11458.2038 | 12775.5352 |

12/31/2018 | 10628.775 | 11875.5991 |

01/31/2019 | 11698.2 | 12813.3987 |

02/28/2019 | 11829.15 | 13156.1402 |

03/31/2019 | 11942.64 | 13321.5465 |

04/30/2019 | 12571.2 | 13771.3814 |

05/31/2019 | 11257.335 | 12954.468 |

06/30/2019 | 12012.48 | 13802.7479 |

07/31/2019 | 12099.78 | 13843.1675 |

08/31/2019 | 11471.22 | 13514.8046 |

09/30/2019 | 11907.72 | 13799.1266 |

10/31/2019 | 12431.52 | 14176.8026 |

11/30/2019 | 12960.8988 | 14522.8991 |

12/31/2019 | 13617.0049 | 15034.2955 |

01/31/2020 | 13166.783 | 14868.2501 |

02/29/2020 | 12601.7987 | 13667.3235 |

03/31/2020 | 10231.5129 | 11822.1855 |

04/30/2020 | 11502.7276 | 13088.6676 |

05/31/2020 | 12054.4701 | 13657.8975 |

06/30/2020 | 12451.7247 | 14094.3125 |

07/31/2020 | 13418.3776 | 14839.706 |

08/31/2020 | 14234.9565 | 15748.003 |

09/30/2020 | 13850.9437 | 15240.2279 |

10/31/2020 | 13789.1486 | 14869.7412 |

11/30/2020 | 15617.2776 | 16702.6307 |

12/31/2020 | 16619.6581 | 17478.1127 |

01/31/2021 | 16586.5607 | 17398.658 |

02/28/2021 | 17328.8897 | 17801.6296 |

03/31/2021 | 17735.5157 | 18277.1328 |

04/30/2021 | 18572.4089 | 19076.2595 |

05/31/2021 | 18770.9937 | 19373.0962 |

06/30/2021 | 18756.8091 | 19628.3949 |

07/31/2021 | 18676.4295 | 19763.6596 |

08/31/2021 | 18960.1221 | 20258.3342 |

09/30/2021 | 18350.183 | 19421.4506 |

10/31/2021 | 18761.5373 | 20412.8235 |

11/30/2021 | 18120.8125 | 19921.2376 |

12/31/2021 | 18976.9929 | 20718.1276 |

01/31/2022 | 18879.8134 | 19700.6071 |

02/28/2022 | 18339.9274 | 19191.767 |

03/31/2022 | 18480.2978 | 19607.4662 |

04/30/2022 | 17395.1269 | 18038.0232 |

05/31/2022 | 17800.0414 | 18059.165 |

06/30/2022 | 16061.6085 | 16536.8516 |

07/31/2022 | 16482.7196 | 17691.6605 |

08/31/2022 | 16169.5857 | 17040.3131 |

09/30/2022 | 14776.6798 | 15409.0425 |

10/31/2022 | 15748.4746 | 16338.9605 |

11/30/2022 | 17566.7263 | 17606.2413 |

12/31/2022 | 16980.4429 | 16913.4626 |

01/31/2023 | 18354.9703 | 18125.7322 |

02/28/2023 | 17824.1569 | 17606.2413 |

03/31/2023 | 17673.2941 | 18149.1107 |

04/30/2023 | 17807.3944 | 18409.9478 |

05/31/2023 | 17421.8562 | 18212.749 |

06/30/2023 | 18153.82 | 19270.2098 |

07/31/2023 | 19377.4847 | 19975.663 |

08/31/2023 | 18477.8956 | 19417.4566 |

09/30/2023 | 17991.7822 | 18614.5489 |

10/31/2023 | 17136.8932 | 18054.8514 |

11/30/2023 | 18374.1106 | 19721.2696 |

12/31/2023 | 19644.6953 | 20668.5483 |

01/31/2024 | 19532.5748 | 20789.7007 |

02/29/2024 | 20051.8698 | 21681.8618 |

03/31/2024 | 21267.4923 | 22362.6052 |

04/30/2024 | 21208.4815 | 21624.7737 |

05/31/2024 | 21993.3252 | 22503.0355 |

06/30/2024 | 22011.0284 | 23004.2603 |

07/31/2024 | 22306.0824 | 23375.2263 |

08/31/2024 | 22477.2137 | 23968.8998 |

09/30/2024 | 23114.5304 | 24525.7216 |

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class R3 | $171.00 | 1.50% |

End Block

Thornburg Global Opportunities Fund Tailored Shareholder Report

Thornburg Global Opportunities Fund Tailored Shareholder Report | |

Annual Performance | 1 Year | 5 Year | 10 Year |

|---|

Global Opportunities Fund Class R3 | 28.47% | 14.19% | 8.74% |

MSCI All Country World Net Total Return USD Index | 31.76% | 12.19% | 9.39% |

Key Fund Statistics

(as of September 30, 2024)

| |

|---|

Fund Size (Millions) | $1,306.0M |

Number of Holdings | 37 |

Annual Portfolio Turnover | 14.91% |

Total Advisory Fee | $9.3M |

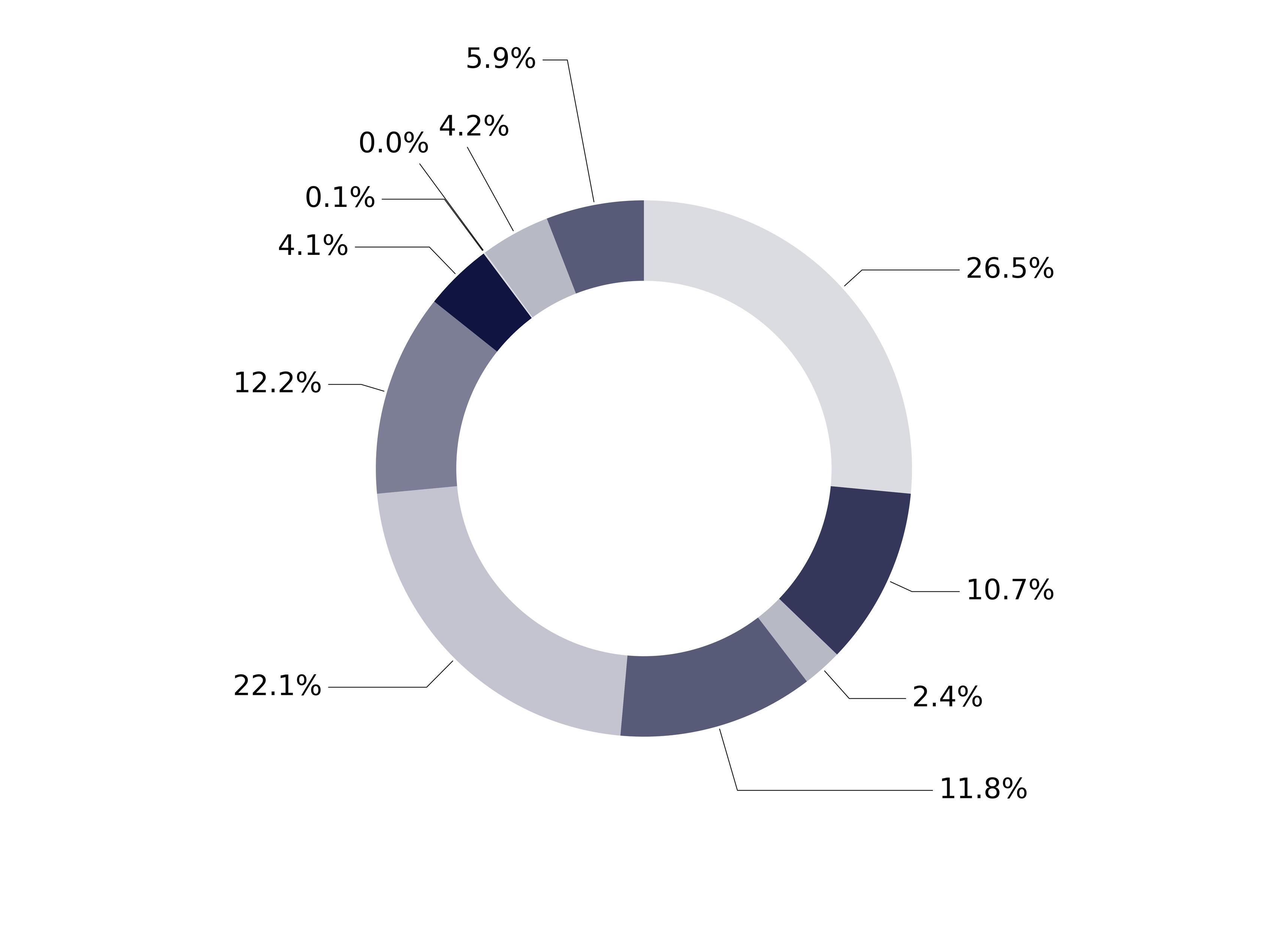

What did the Fund invest in?

(as of September 30, 2024)

Market Capitalization Exposure | (%) |

|---|

| Small Cap (<$2.5 B) | 2.6 |

| Mid Cap ($2.5-12 B) | 17.7 |

| Large Cap (>$12 B) | 79.8 |

Market Capitalization Exposure | (%) |

Small Cap (<$2.5 B) | 2.6% |

Mid Cap ($2.5-12 B) | 17.7% |

Large Cap (>$12 B) | 79.8% |

Expressed as a percentage of the Fund’s net assets.

How has the Fund changed?

This is a summary of certain changes to the Fund since October 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 1, 2025 at https://www.thornburg.com/download or upon request by calling 1-800-847-0200.

End Block

Changes In and Disagreements with Accountants

No changes and/or disagreements occurred in the current reporting period.

End Block

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, visit www.thornburg.com/download.

Thornburg Global Opportunities Fund Tailored Shareholder Report | |

Thornburg Global Opportunities Fund Tailored Shareholder Report

Thornburg Global Opportunities Fund CLASS: R4 TICKER: THOVX Annual Shareholder Report | |

This annual shareholder report contains important information about the Thornburg Global Opportunities Fund Class R4 Shares for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.thornburg.com/download. You can also request this information by contacting us at 1-800-847-0200. This report also describes changes to the Fund that occurred during the reporting period.

How did the Fund perform last year and what affected its performance?

The Fund’s Class R4 shares underperformed the MSCI All Country World Net Total Return USD Index (the 'Index”) during the 12-month period ended September 30, 2024. During the period, major world events included the ongoing Russian/Ukraine conflict, moderating inflation figures in the U.S., Mideast tensions, and upcoming political contests in the U.S. Despite the conflicting economic and geo-political signals, the S&P 500, the Bloomberg U.S. Aggregate Bond, and the MSCI ACWI indexes reported varying positive returns for the period, +36.3%, +11.6%, and +31.8%, respectively. In brief, most equities repriced higher due to a surprising level of economic strength and resilient corporate profits, while interest rates declined along with inflation rates, creating a more favorable backdrop for the economy. Stock selection was a positive contributor to relative performance, consistent with the Fund’s bottom-up investment approach. Sector and geographic allocations detracted from relative results. The Fund’s cash and currency forwards allocations were also a drag on performance. During the period, stock selection in communication services, energy, and the U.S. helped to drive relative performance. The Fund’s underweight allocation and weaker security selection in information technology hampered relative returns. In South Korea, both an overweight positioning and negative security selection detracted from returns.

How did the Fund perform over the past 10 years?

The line graph below reflects a hypothetical $10,000 investment. The returns shown in the line graph and table assume the reinvestment of dividends and capital gains, but do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. The performance information shown below represents past performance and is no guarantee of future results. For Fund performance current to the most recent month end, visit https://www.thornburg.com/product/mutual-funds/fgo/THOVX or call 1-800-847-0200. Performance for other share classes of the Fund will vary.

Cumulative Performance

Growth Table

Date | Thornburg Global Opportunities Fund | MSCI All Country World Net Total Return USD Index |

09/30/2014 | 9999.9968 | 10000 |

10/31/2014 | 10292.7417 | 10070.4015 |

11/30/2014 | 10700.039 | 10238.8433 |

12/31/2014 | 10623.6707 | 10041.2717 |

01/31/2015 | 10538.8171 | 9884.2795 |

02/28/2015 | 11366.1397 | 10434.5511 |

03/31/2015 | 11323.7129 | 10272.8725 |

04/30/2015 | 11417.0519 | 10570.9341 |

05/31/2015 | 11773.437 | 10557.1413 |

06/30/2015 | 11344.9263 | 10308.6058 |

07/31/2015 | 11705.5541 | 10398.1255 |

08/31/2015 | 11149.763 | 9685.3233 |

09/30/2015 | 10275.771 | 9334.4339 |

10/31/2015 | 10687.3109 | 10067.0465 |

11/30/2015 | 10818.834 | 9983.9174 |

12/31/2015 | 10728.5189 | 9803.8662 |

01/31/2016 | 10047.6133 | 9212.5892 |

02/29/2016 | 10030.5906 | 9149.2172 |

03/31/2016 | 10481.6906 | 9827.2446 |

04/30/2016 | 10362.5321 | 9972.308 |

05/31/2016 | 10622.1274 | 9984.8759 |

06/30/2016 | 9917.4895 | 9924.4328 |

07/31/2016 | 10236.9963 | 10352.1142 |

08/31/2016 | 10369.0591 | 10386.9422 |

09/30/2016 | 10527.7992 | 10450.5805 |

10/31/2016 | 10647.2877 | 10273.192 |

11/30/2016 | 10860.6602 | 10351.2621 |

12/31/2016 | 11115.7151 | 10574.8749 |

01/31/2017 | 11509.1917 | 10864.043 |

02/28/2017 | 11560.5148 | 11168.8146 |

03/31/2017 | 11907.335 | 11305.4106 |

04/30/2017 | 12360.7034 | 11481.6274 |

05/31/2017 | 12818.3488 | 11735.1688 |

06/30/2017 | 12686.2919 | 11788.5291 |

07/31/2017 | 13118.7305 | 12117.9572 |

08/31/2017 | 12921.7783 | 12164.3945 |

09/30/2017 | 13140.1383 | 12399.4036 |

10/31/2017 | 13392.751 | 12656.8857 |

11/30/2017 | 13157.2646 | 12901.9065 |

12/31/2017 | 13505.2978 | 13109.9159 |

01/31/2018 | 14020.1122 | 13849.5047 |

02/28/2018 | 13320.8226 | 13267.8667 |

03/31/2018 | 12754.5268 | 12983.8641 |

04/30/2018 | 13080.5759 | 13107.839 |

05/31/2018 | 13114.8968 | 13124.1879 |

06/30/2018 | 12827.4588 | 13053.1473 |

07/31/2018 | 13089.1561 | 13446.7994 |

08/31/2018 | 12904.681 | 13552.4017 |

09/30/2018 | 12707.3354 | 13611.407 |

10/31/2018 | 11587.6141 | 12591.3835 |

11/30/2018 | 11506.1018 | 12775.5352 |

12/31/2018 | 10668.3158 | 11875.5991 |

01/31/2019 | 11745.6581 | 12813.3987 |

02/28/2019 | 11877.0413 | 13156.1402 |

03/31/2019 | 11990.9067 | 13321.5465 |

04/30/2019 | 12625.9255 | 13771.3814 |

05/31/2019 | 11307.7141 | 12954.468 |

06/30/2019 | 12065.3572 | 13802.7479 |

07/31/2019 | 12152.946 | 13843.1675 |

08/31/2019 | 11526.6861 | 13514.8046 |

09/30/2019 | 11964.6301 | 13799.1266 |

10/31/2019 | 12490.1629 | 14176.8026 |

11/30/2019 | 13025.6801 | 14522.8991 |

12/31/2019 | 13684.4806 | 15034.2955 |

01/31/2020 | 13233.4896 | 14868.2501 |

02/29/2020 | 12663.1187 | 13667.3235 |

03/31/2020 | 10284.3625 | 11822.1855 |

04/30/2020 | 11562.1702 | 13088.6676 |

05/31/2020 | 12119.2767 | 13657.8975 |

06/30/2020 | 12517.2099 | 14094.3125 |

07/31/2020 | 13494.357 | 14839.706 |

08/31/2020 | 14312.3308 | 15748.003 |

09/30/2020 | 13927.662 | 15240.2279 |

10/31/2020 | 13865.7613 | 14869.7412 |

11/30/2020 | 15705.7628 | 16702.6307 |

12/31/2020 | 16719.0378 | 17478.1127 |

01/31/2021 | 16685.8933 | 17398.658 |

02/28/2021 | 17434.0123 | 17801.6296 |

03/31/2021 | 17841.2162 | 18277.1328 |

04/30/2021 | 18684.0338 | 19076.2595 |

05/31/2021 | 18887.6358 | 19373.0962 |

06/30/2021 | 18873.431 | 19628.3949 |

07/31/2021 | 18797.6721 | 19763.6596 |

08/31/2021 | 19081.7679 | 20258.3342 |

09/30/2021 | 18470.9619 | 19421.4506 |

10/31/2021 | 18882.9008 | 20412.8235 |

11/30/2021 | 18241.12 | 19921.2376 |

12/31/2021 | 19106.5306 | 20718.1276 |

01/31/2022 | 19014.5682 | 19700.6071 |

02/28/2022 | 18468.2037 | 19191.767 |

03/31/2022 | 18608.852 | 19607.4662 |

04/30/2022 | 17521.5325 | 18038.0232 |

05/31/2022 | 17927.2487 | 18059.165 |

06/30/2022 | 16179.9641 | 16536.8516 |

07/31/2022 | 16607.3185 | 17691.6605 |

08/31/2022 | 16288.155 | 17040.3131 |

09/30/2022 | 14892.4911 | 15409.0425 |

10/31/2022 | 15871.6197 | 16338.9605 |

11/30/2022 | 17698.9175 | 17606.2413 |

12/31/2022 | 17110.5497 | 16913.4626 |

01/31/2023 | 18495.3157 | 18125.7322 |

02/28/2023 | 17962.7134 | 17606.2413 |

03/31/2023 | 17811.3422 | 18149.1107 |

04/30/2023 | 17945.8943 | 18409.9478 |

05/31/2023 | 17559.0569 | 18212.749 |

06/30/2023 | 18299.0938 | 19270.2098 |

07/31/2023 | 19538.0949 | 19975.663 |

08/31/2023 | 18629.8678 | 19417.4566 |

09/30/2023 | 18142.1162 | 18614.5489 |

10/31/2023 | 17278.7399 | 18054.8514 |

11/30/2023 | 18525.6648 | 19721.2696 |

12/31/2023 | 19810.4508 | 20668.5483 |

01/31/2024 | 19697.8578 | 20789.7007 |

02/29/2024 | 20219.3414 | 21681.8618 |

03/31/2024 | 21446.0131 | 22362.6052 |

04/30/2024 | 21392.6795 | 21624.7737 |

05/31/2024 | 22180.8308 | 22503.0355 |

06/30/2024 | 22204.5346 | 23004.2603 |

07/31/2024 | 22500.8321 | 23375.2263 |

08/31/2024 | 22672.6847 | 23968.8998 |

09/30/2024 | 23318.6133 | 24525.7216 |

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class R4 | $160.00 | 1.40% |

End Block

Thornburg Global Opportunities Fund Tailored Shareholder Report

Thornburg Global Opportunities Fund Tailored Shareholder Report | |

Annual Performance | 1 Year | 5 Year | 10 Year |

|---|

Global Opportunities Fund Class R4 | 28.53% | 14.28% | 8.84% |

MSCI All Country World Net Total Return USD Index | 31.76% | 12.19% | 9.39% |

Key Fund Statistics

(as of September 30, 2024)

| |

|---|

Fund Size (Millions) | $1,306.0M |

Number of Holdings | 37 |

Annual Portfolio Turnover | 14.91% |

Total Advisory Fee | $9.3M |

What did the Fund invest in?

(as of September 30, 2024)

Market Capitalization Exposure | (%) |

|---|

| Small Cap (<$2.5 B) | 2.6 |

| Mid Cap ($2.5-12 B) | 17.7 |

| Large Cap (>$12 B) | 79.8 |

Market Capitalization Exposure | (%) |

Small Cap (<$2.5 B) | 2.6% |

Mid Cap ($2.5-12 B) | 17.7% |

Large Cap (>$12 B) | 79.8% |

Expressed as a percentage of the Fund’s net assets.

How has the Fund changed?

This is a summary of certain changes to the Fund since October 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 1, 2025 at https://www.thornburg.com/download or upon request by calling 1-800-847-0200.

End Block

Changes In and Disagreements with Accountants

No changes and/or disagreements occurred in the current reporting period.

End Block

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, visit www.thornburg.com/download.

Thornburg Global Opportunities Fund Tailored Shareholder Report | |

Thornburg Global Opportunities Fund Tailored Shareholder Report

Thornburg Global Opportunities Fund CLASS: R5 TICKER: THOFX Annual Shareholder Report | |

This annual shareholder report contains important information about the Thornburg Global Opportunities Fund Class R5 Shares for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.thornburg.com/download. You can also request this information by contacting us at 1-800-847-0200. This report also describes changes to the Fund that occurred during the reporting period.

How did the Fund perform last year and what affected its performance?

The Fund’s Class R5 shares underperformed the MSCI All Country World Net Total Return USD Index (the 'Index”) during the 12-month period ended September 30, 2024. During the period, major world events included the ongoing Russian/Ukraine conflict, moderating inflation figures in the U.S., Mideast tensions, and upcoming political contests in the U.S. Despite the conflicting economic and geo-political signals, the S&P 500, the Bloomberg U.S. Aggregate Bond, and the MSCI ACWI indexes reported varying positive returns for the period, +36.3%, +11.6%, and +31.8%, respectively. In brief, most equities repriced higher due to a surprising level of economic strength and resilient corporate profits, while interest rates declined along with inflation rates, creating a more favorable backdrop for the economy. Stock selection was a positive contributor to relative performance, consistent with the Fund’s bottom-up investment approach. Sector and geographic allocations detracted from relative results. The Fund’s cash and currency forwards allocations were also a drag on performance. During the period, stock selection in communication services, energy, and the U.S. helped to drive relative performance. The Fund’s underweight allocation and weaker security selection in information technology hampered relative returns. In South Korea, both an overweight positioning and negative security selection detracted from returns.

How did the Fund perform over the past 10 years?

The line graph below reflects a hypothetical $10,000 investment. The returns shown in the line graph and table assume the reinvestment of dividends and capital gains, but do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. The performance information shown below represents past performance and is no guarantee of future results. For Fund performance current to the most recent month end, visit https://www.thornburg.com/product/mutual-funds/fgo/THOFX or call 1-800-847-0200. Performance for other share classes of the Fund will vary.

Cumulative Performance

Growth Table

Date | Thornburg Global Opportunities Fund | MSCI All Country World Net Total Return USD Index |

09/30/2014 | 10000.0095 | 10000 |

10/31/2014 | 10294.0039 | 10070.4015 |

11/30/2014 | 10705.5961 | 10238.8433 |

12/31/2014 | 10631.7684 | 10041.2717 |

01/31/2015 | 10551.9251 | 9884.2795 |

02/28/2015 | 11383.9765 | 10434.5511 |

03/31/2015 | 11346.156 | 10272.8725 |

04/30/2015 | 11447.0107 | 10570.9341 |

05/31/2015 | 11804.2045 | 10557.1413 |

06/30/2015 | 11379.7742 | 10308.6058 |

07/31/2015 | 11745.3726 | 10398.1255 |

08/31/2015 | 11190.6716 | 9685.3233 |

09/30/2015 | 10316.5974 | 9334.4339 |

10/31/2015 | 10732.6231 | 10067.0465 |

11/30/2015 | 10867.0961 | 9983.9174 |

12/31/2015 | 10784.6499 | 9803.8662 |

01/31/2016 | 10104.2704 | 9212.5892 |

02/29/2016 | 10091.5925 | 9149.2172 |

03/31/2016 | 10547.9962 | 9827.2446 |

04/30/2016 | 10429.6693 | 9972.308 |

05/31/2016 | 10695.9048 | 9984.8759 |

06/30/2016 | 9992.8975 | 9924.4328 |

07/31/2016 | 10314.9756 | 10352.1142 |

08/31/2016 | 10450.5874 | 10386.9422 |

09/30/2016 | 10617.2014 | 10450.5805 |

10/31/2016 | 10740.4102 | 10273.192 |

11/30/2016 | 10957.0878 | 10351.2621 |

12/31/2016 | 11222.004 | 10574.8749 |

01/31/2017 | 11618.3756 | 10864.043 |

02/28/2017 | 11673.7823 | 11168.8146 |

03/31/2017 | 12031.4736 | 11305.4106 |

04/30/2017 | 12487.987 | 11481.6274 |

05/31/2017 | 12957.2998 | 11735.1688 |

06/30/2017 | 12833.3098 | 11788.5291 |

07/31/2017 | 13269.3517 | 12117.9572 |

08/31/2017 | 13076.9803 | 12164.3945 |

09/30/2017 | 13302.6207 | 12399.4036 |

10/31/2017 | 13563.5403 | 12656.8857 |

11/30/2017 | 13328.2849 | 12901.9065 |

12/31/2017 | 13686.4717 | 13109.9159 |

01/31/2018 | 14209.9042 | 13849.5047 |

02/28/2018 | 13510.5641 | 13267.8667 |

03/31/2018 | 12939.9369 | 12983.8641 |

04/30/2018 | 13274.5904 | 13107.839 |

05/31/2018 | 13313.2043 | 13124.1879 |

06/30/2018 | 13021.455 | 13053.1473 |

07/31/2018 | 13296.0426 | 13446.7994 |

08/31/2018 | 13111.5541 | 13552.4017 |

09/30/2018 | 12914.1943 | 13611.407 |

10/31/2018 | 11781.5208 | 12591.3835 |

11/30/2018 | 11700.0026 | 12775.5352 |

12/31/2018 | 10857.4705 | 11875.5991 |

01/31/2019 | 11955.1198 | 12813.3987 |

02/28/2019 | 12096.1831 | 13156.1402 |

03/31/2019 | 12215.2053 | 13321.5465 |

04/30/2019 | 12863.2151 | 13771.3814 |

05/31/2019 | 11523.1132 | 12954.468 |

06/30/2019 | 12303.3699 | 13802.7479 |

07/31/2019 | 12395.9428 | 13843.1675 |

08/31/2019 | 11756.7494 | 13514.8046 |

09/30/2019 | 12210.7971 | 13799.1266 |

10/31/2019 | 12753.0094 | 14176.8026 |

11/30/2019 | 13300.9005 | 14522.8991 |

12/31/2019 | 13981.822 | 15034.2955 |

01/31/2020 | 13524.5774 | 14868.2501 |

02/29/2020 | 12946.2975 | 13667.3235 |

03/31/2020 | 10516.6253 | 11822.1855 |

04/30/2020 | 11825.6 | 13088.6676 |

05/31/2020 | 12403.8799 | 13657.8975 |

06/30/2020 | 12816.2966 | 14094.3125 |

07/31/2020 | 13815.9588 | 14839.706 |

08/31/2020 | 14663.2061 | 15748.003 |

09/30/2020 | 14273.2034 | 15240.2279 |

10/31/2020 | 14214.9271 | 14869.7412 |

11/30/2020 | 16107.7216 | 16702.6307 |

12/31/2020 | 17152.3832 | 17478.1127 |

01/31/2021 | 17123.5314 | 17398.658 |

02/28/2021 | 17897.7209 | 17801.6296 |

03/31/2021 | 18320.8803 | 18277.1328 |

04/30/2021 | 19196.051 | 19076.2595 |

05/31/2021 | 19407.6307 | 19373.0962 |

06/30/2021 | 19402.8221 | 19628.3949 |

07/31/2021 | 19330.6926 | 19763.6596 |

08/31/2021 | 19628.8277 | 20258.3342 |

09/30/2021 | 19008.5144 | 19421.4506 |

10/31/2021 | 19441.2911 | 20412.8235 |

11/30/2021 | 18785.3635 | 19921.2376 |

12/31/2021 | 19679.2668 | 20718.1276 |

01/31/2022 | 19591.1917 | 19700.6071 |

02/28/2022 | 19035.218 | 19191.767 |

03/31/2022 | 19189.3493 | 19607.4662 |

04/30/2022 | 18071.8973 | 18038.0232 |

05/31/2022 | 18495.7584 | 18059.165 |

06/30/2022 | 16701.2295 | 16536.8516 |

07/31/2022 | 17147.1094 | 17691.6605 |

08/31/2022 | 16822.3326 | 17040.3131 |

09/30/2022 | 15385.6085 | 15409.0425 |

10/31/2022 | 16403.9762 | 16338.9605 |

11/30/2022 | 18302.0651 | 17606.2413 |

12/31/2022 | 17697.335 | 16913.4626 |

01/31/2023 | 19134.4205 | 18125.7322 |

02/28/2023 | 18590.5037 | 17606.2413 |

03/31/2023 | 18441.6422 | 18149.1107 |

04/30/2023 | 18590.5037 | 18409.9478 |

05/31/2023 | 18195.4483 | 18212.749 |

06/30/2023 | 18968.3827 | 19270.2098 |

07/31/2023 | 20250.8813 | 19975.663 |

08/31/2023 | 19317.6346 | 19417.4566 |

09/30/2023 | 18819.5213 | 18614.5489 |

10/31/2023 | 17932.0781 | 18054.8514 |

11/30/2023 | 19234.4 | 19721.2696 |

12/31/2023 | 20572.512 | 20668.5483 |

01/31/2024 | 20463.2129 | 20789.7007 |

02/29/2024 | 21009.7082 | 21681.8618 |

03/31/2024 | 22290.9361 | 22362.6052 |

04/30/2024 | 22242.3587 | 21624.7737 |

05/31/2024 | 23074.246 | 22503.0355 |

06/30/2024 | 23104.6069 | 23004.2603 |

07/31/2024 | 23420.3597 | 23375.2263 |

08/31/2024 | 23608.597 | 23968.8998 |

09/30/2024 | 24288.68 | 24525.7216 |

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class R5 | $113.00 | 0.99% |

End Block

Thornburg Global Opportunities Fund Tailored Shareholder Report

Thornburg Global Opportunities Fund Tailored Shareholder Report | |

Annual Performance | 1 Year | 5 Year | 10 Year |

|---|

Global Opportunities Fund Class R5 | 29.06% | 14.74% | 9.28% |

MSCI All Country World Net Total Return USD Index | 31.76% | 12.19% | 9.39% |

Key Fund Statistics

(as of September 30, 2024)

| |

|---|

Fund Size (Millions) | $1,306.0M |

Number of Holdings | 37 |

Annual Portfolio Turnover | 14.91% |

Total Advisory Fee | $9.3M |

What did the Fund invest in?

(as of September 30, 2024)

Market Capitalization Exposure | (%) |

|---|

| Small Cap (<$2.5 B) | 2.6 |

| Mid Cap ($2.5-12 B) | 17.7 |

| Large Cap (>$12 B) | 79.8 |

Market Capitalization Exposure | (%) |

Small Cap (<$2.5 B) | 2.6% |

Mid Cap ($2.5-12 B) | 17.7% |

Large Cap (>$12 B) | 79.8% |

Expressed as a percentage of the Fund’s net assets.

How has the Fund changed?

This is a summary of certain changes to the Fund since October 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 1, 2025 at https://www.thornburg.com/download or upon request by calling 1-800-847-0200.

End Block

Changes In and Disagreements with Accountants

No changes and/or disagreements occurred in the current reporting period.

End Block

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, visit www.thornburg.com/download.

Thornburg Global Opportunities Fund Tailored Shareholder Report | |

Thornburg Global Opportunities Fund Tailored Shareholder Report

Thornburg Global Opportunities Fund CLASS: R6 TICKER: THOGX Annual Shareholder Report | |

This annual shareholder report contains important information about the Thornburg Global Opportunities Fund Class R6 Shares for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.thornburg.com/download. You can also request this information by contacting us at 1-800-847-0200. This report also describes changes to the Fund that occurred during the reporting period.

How did the Fund perform last year and what affected its performance?

The Fund’s Class R6 shares underperformed the MSCI All Country World Net Total Return USD Index (the 'Index”) during the 12-month period ended September 30, 2024. During the period, major world events included the ongoing Russian/Ukraine conflict, moderating inflation figures in the U.S., Mideast tensions, and upcoming political contests in the U.S. Despite the conflicting economic and geo-political signals, the S&P 500, the Bloomberg U.S. Aggregate Bond, and the MSCI ACWI indexes reported varying positive returns for the period, +36.3%, +11.6%, and +31.8%, respectively. In brief, most equities repriced higher due to a surprising level of economic strength and resilient corporate profits, while interest rates declined along with inflation rates, creating a more favorable backdrop for the economy. Stock selection was a positive contributor to relative performance, consistent with the Fund’s bottom-up investment approach. Sector and geographic allocations detracted from relative results. The Fund’s cash and currency forwards allocations were also a drag on performance. During the period, stock selection in communication services, energy, and the U.S. helped to drive relative performance. The Fund’s underweight allocation and weaker security selection in information technology hampered relative returns. In South Korea, both an overweight positioning and negative security selection detracted from returns.

How did the Fund perform over the past 10 years?

The line graph below reflects a hypothetical $10,000 investment. The returns shown in the line graph and table assume the reinvestment of dividends and capital gains, but do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. The performance information shown below represents past performance and is no guarantee of future results. For Fund performance current to the most recent month end, visit https://www.thornburg.com/product/mutual-funds/fgo/THOGX or call 1-800-847-0200. Performance for other share classes of the Fund will vary.

Cumulative Performance

Growth Table

Date | Thornburg Global Opportunities Fund | MSCI All Country World Net Total Return USD Index |

04/10/2017 | 10000.0089 | 10000 |

04/30/2017 | 10328.0515 | 10183.8364 |

05/31/2017 | 10712.5316 | 10408.7195 |

06/30/2017 | 10606.7114 | 10456.0484 |

07/31/2017 | 10973.5547 | 10748.2405 |

08/31/2017 | 10814.8244 | 10789.4289 |

09/30/2017 | 11001.6612 | 10997.8745 |

10/31/2017 | 11220.5646 | 11226.2529 |

11/30/2017 | 11029.9068 | 11443.5785 |

12/31/2017 | 11326.5874 | 11628.0761 |

01/31/2018 | 11762.3616 | 12284.0678 |

02/28/2018 | 11181.3293 | 11768.1734 |

03/31/2018 | 10710.1262 | 11516.2723 |

04/30/2018 | 10990.0138 | 11626.234 |

05/31/2018 | 11021.8997 | 11640.735 |

06/30/2018 | 10784.5267 | 11577.7242 |

07/31/2018 | 11011.271 | 11926.8811 |

08/31/2018 | 10858.9272 | 12020.547 |

09/30/2018 | 10699.4976 | 12072.8827 |

10/31/2018 | 9760.6344 | 11168.1546 |

11/30/2018 | 9696.8626 | 11331.4912 |

12/31/2018 | 8997.149 | 10533.2767 |

01/31/2019 | 9908.899 | 11365.0749 |

02/28/2019 | 10025.603 | 11669.0756 |

03/31/2019 | 10124.072 | 11815.7857 |

04/30/2019 | 10663.828 | 12214.7749 |

05/31/2019 | 9555.14 | 11490.1989 |

06/30/2019 | 10200.659 | 12242.596 |

07/31/2019 | 10280.893 | 12278.4469 |

08/31/2019 | 9752.078 | 11987.1995 |

09/30/2019 | 10127.719 | 12239.3841 |

10/31/2019 | 10579.947 | 12574.3706 |

11/30/2019 | 11036.8672 | 12881.3471 |

12/31/2019 | 11601.1927 | 13334.9393 |

01/31/2020 | 11218.695 | 13187.6624 |

02/29/2020 | 10747.0716 | 12122.4789 |

03/31/2020 | 8730.6031 | 10485.9005 |

04/30/2020 | 9818.6791 | 11609.2296 |

05/31/2020 | 10297.7296 | 12114.1184 |

06/30/2020 | 10639.378 | 12501.2045 |

07/31/2020 | 11474.9313 | 13162.3447 |

08/31/2020 | 12176.796 | 13967.9751 |

09/30/2020 | 11857.429 | 13517.5948 |

10/31/2020 | 11805.439 | 13188.9849 |

11/30/2020 | 13380.7946 | 14814.6994 |

12/31/2020 | 14249.3741 | 15502.527 |

01/31/2021 | 14229.4338 | 15432.0533 |

02/28/2021 | 14871.513 | 15789.4762 |

03/31/2021 | 15226.4513 | 16211.2323 |

04/30/2021 | 15956.2681 | 16920.0321 |

05/31/2021 | 16135.7312 | 17183.3168 |

06/30/2021 | 16131.7431 | 17409.7586 |

07/31/2021 | 16071.9221 | 17529.7341 |

08/31/2021 | 16323.1705 | 17968.4946 |

09/30/2021 | 15808.7095 | 17226.2057 |

10/31/2021 | 16171.6239 | 18105.5217 |

11/30/2021 | 15627.8451 | 17669.5007 |

12/31/2021 | 16374.3608 | 18376.3167 |

01/31/2022 | 16301.2201 | 17473.8085 |

02/28/2022 | 15839.5199 | 17022.4836 |

03/31/2022 | 15967.516 | 17391.1955 |

04/30/2022 | 15039.5441 | 15999.1498 |

05/31/2022 | 15396.1047 | 16017.9018 |

06/30/2022 | 13905.8642 | 14667.6586 |

07/31/2022 | 14276.1387 | 15691.9371 |

08/31/2022 | 14011.0039 | 15114.2128 |

09/30/2022 | 12813.3259 | 13667.3279 |

10/31/2022 | 13663.5858 | 14492.1355 |

11/30/2022 | 15244.3387 | 15616.1731 |

12/31/2022 | 14744.5383 | 15001.7004 |

01/31/2023 | 15944.2876 | 16076.9449 |

02/28/2023 | 15492.0011 | 15616.1731 |

03/31/2023 | 15368.2175 | 16097.6808 |

04/30/2023 | 15492.0011 | 16329.035 |

05/31/2023 | 15168.2593 | 16154.1259 |

06/30/2023 | 15810.9821 | 17092.0599 |

07/31/2023 | 16886.9478 | 17717.7743 |

08/31/2023 | 16110.9194 | 17222.6631 |

09/30/2023 | 15696.7203 | 16510.5097 |

10/31/2023 | 14954.0183 | 16014.0759 |

11/30/2023 | 16046.6161 | 17492.1355 |

12/31/2023 | 17163.1849 | 18332.3414 |

01/31/2024 | 17077.2425 | 18439.7997 |

02/29/2024 | 17532.2312 | 19231.118 |

03/31/2024 | 18609.0378 | 19834.9157 |

04/30/2024 | 18568.5944 | 19180.4827 |

05/31/2024 | 19261.1883 | 19959.4729 |

06/30/2024 | 19291.5209 | 20404.0433 |

07/31/2024 | 19559.4587 | 20733.0783 |

08/31/2024 | 19716.177 | 21259.6476 |

09/30/2024 | 20287.4406 | 21753.5308 |

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class R6 | $97.00 | 0.85% |

End Block

Thornburg Global Opportunities Fund Tailored Shareholder Report

Thornburg Global Opportunities Fund Tailored Shareholder Report | |

Annual Performance | 1 Year | 5 Year |

|---|

Global Opportunities Fund Class R6 | 29.25% | 14.91% |

MSCI All Country World Net Total Return USD Index | 31.76% | 12.19% |

Key Fund Statistics

(as of September 30, 2024)

| |

|---|

Fund Size (Millions) | $1,306.0M |

Number of Holdings | 37 |

Annual Portfolio Turnover | 14.91% |

Total Advisory Fee | $9.3M |

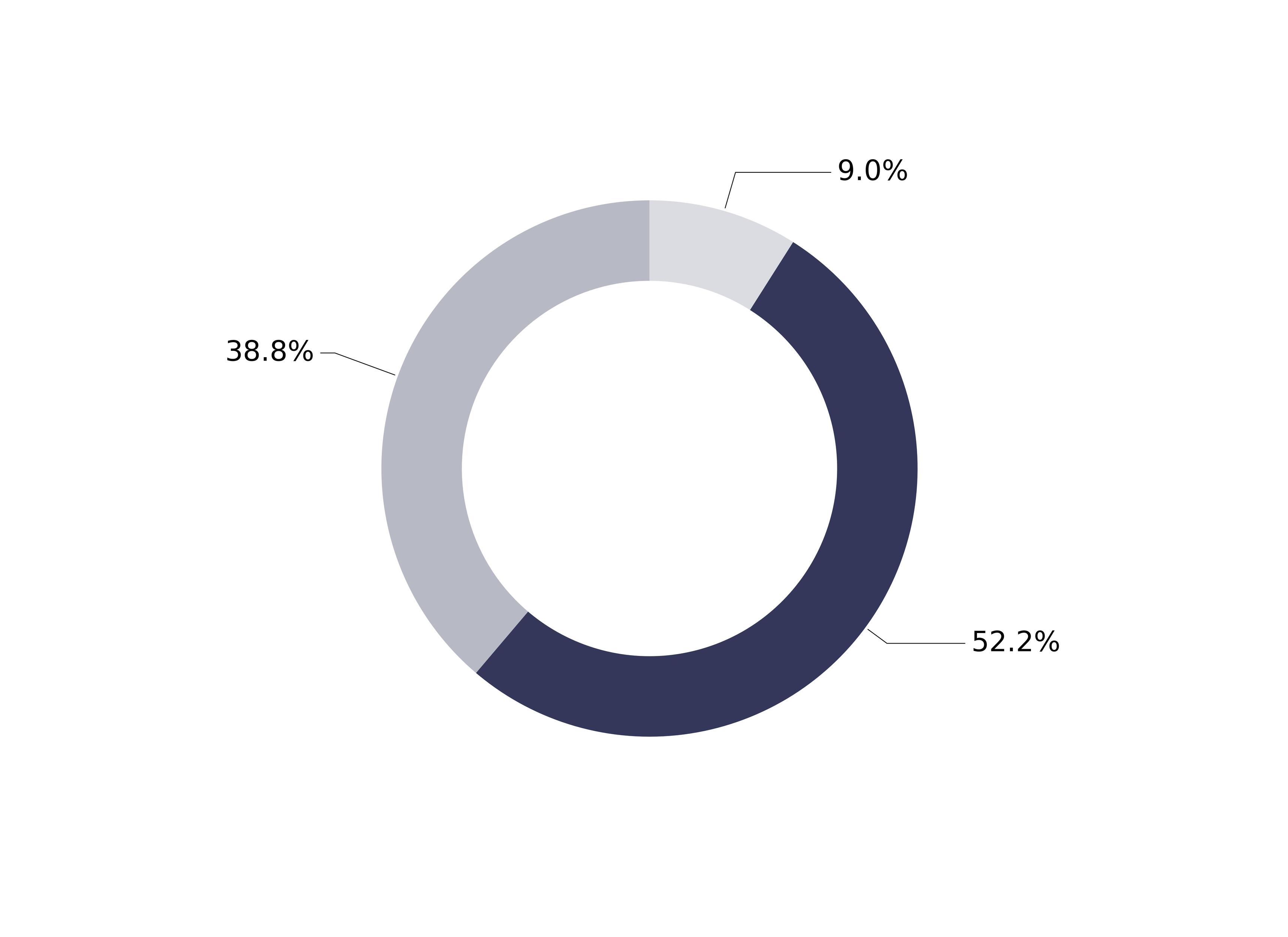

What did the Fund invest in?

(as of September 30, 2024)

Market Capitalization Exposure | (%) |

|---|

| Small Cap (<$2.5 B) | 2.6 |

| Mid Cap ($2.5-12 B) | 17.7 |

| Large Cap (>$12 B) | 79.8 |

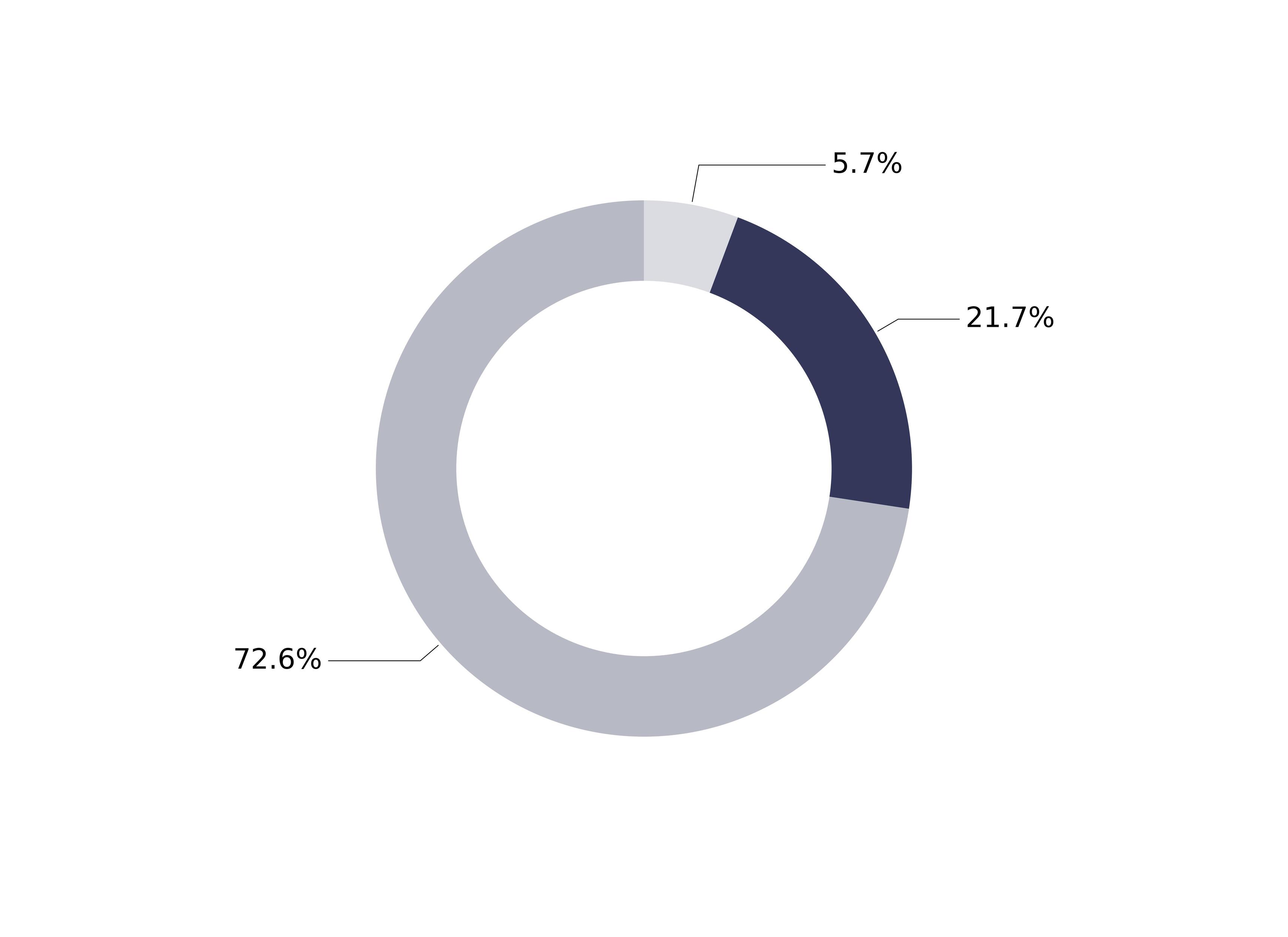

Market Capitalization Exposure | (%) |

Small Cap (<$2.5 B) | 2.6% |

Mid Cap ($2.5-12 B) | 17.7% |

Large Cap (>$12 B) | 79.8% |

Expressed as a percentage of the Fund’s net assets.

How has the Fund changed?

This is a summary of certain changes to the Fund since October 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 1, 2025 at https://www.thornburg.com/download or upon request by calling 1-800-847-0200.

End Block

Changes In and Disagreements with Accountants

No changes and/or disagreements occurred in the current reporting period.

End Block

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, visit www.thornburg.com/download.

Thornburg Global Opportunities Fund Tailored Shareholder Report | |

Thornburg International Equity Fund Tailored Shareholder Report

Thornburg International Equity Fund CLASS: A TICKER: TGVAX Annual Shareholder Report | |

This annual shareholder report contains important information about the Thornburg International Equity Fund Class A Shares for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.thornburg.com/download. You can also request this information by contacting us at 1-800-847-0200. This report also describes changes to the Fund that occurred during the reporting period.

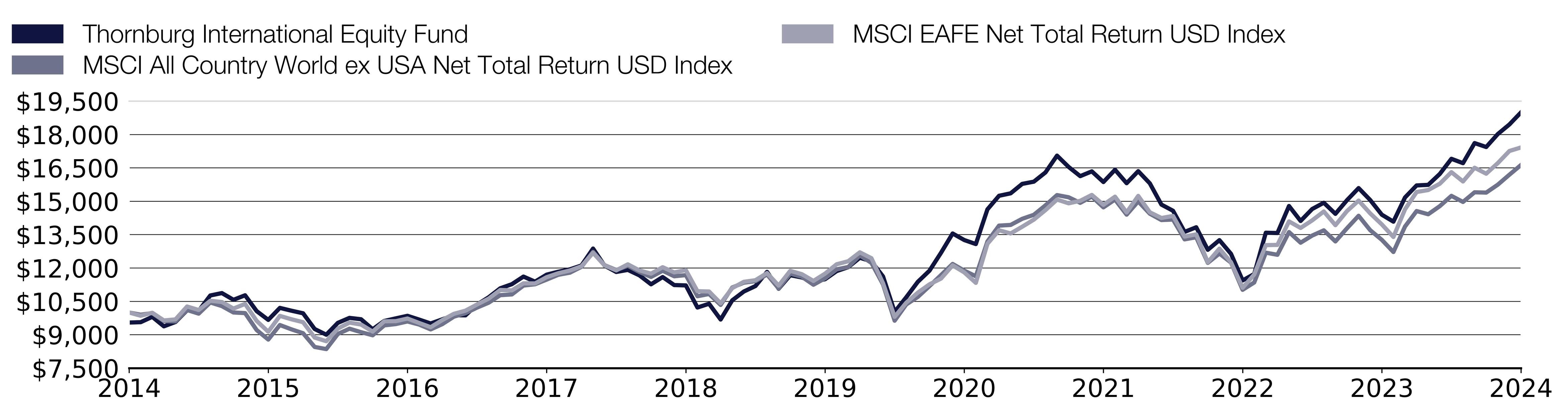

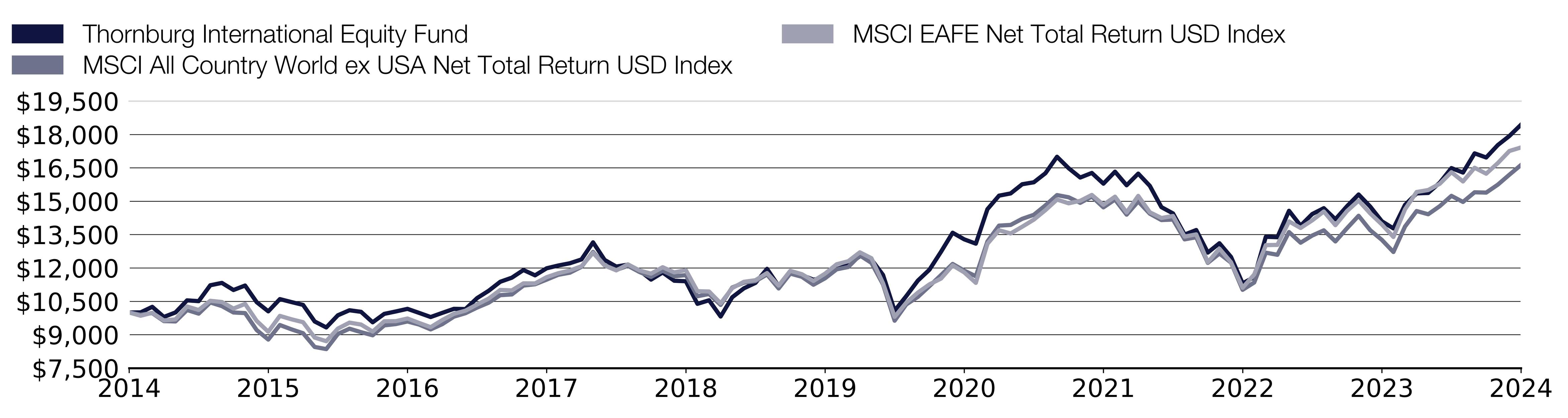

How did the Fund perform last year and what affected its performance?

The Fund’s Class A shares outperformed the MSCI All Country World ex USA Net Total Return USD Index (the “Index”) during the 12-month period ended September 30, 2024. During the period, non-U.S. equities have posted strong returns but lagged their U.S. counterparts, as U.S. mega-cap and artificial intelligence beneficiaries have continued to lead the market. Stock selection was a major contributor of the Fund’s outperformance relative to its benchmark, consistent with the Fund’s bottom-up investment approach. Sector allocation was modestly additive to performance while geographic allocation detracted from relative results. The Fund’s cash allocation was a drag on performance. Within industrials and information technology, stock selection bolstered relative returns. Additionally, stock selection in Japan and the U.S. also drove positive relative performance. An underweight positioning and weaker stock selection within financials and India hampered relative returns.

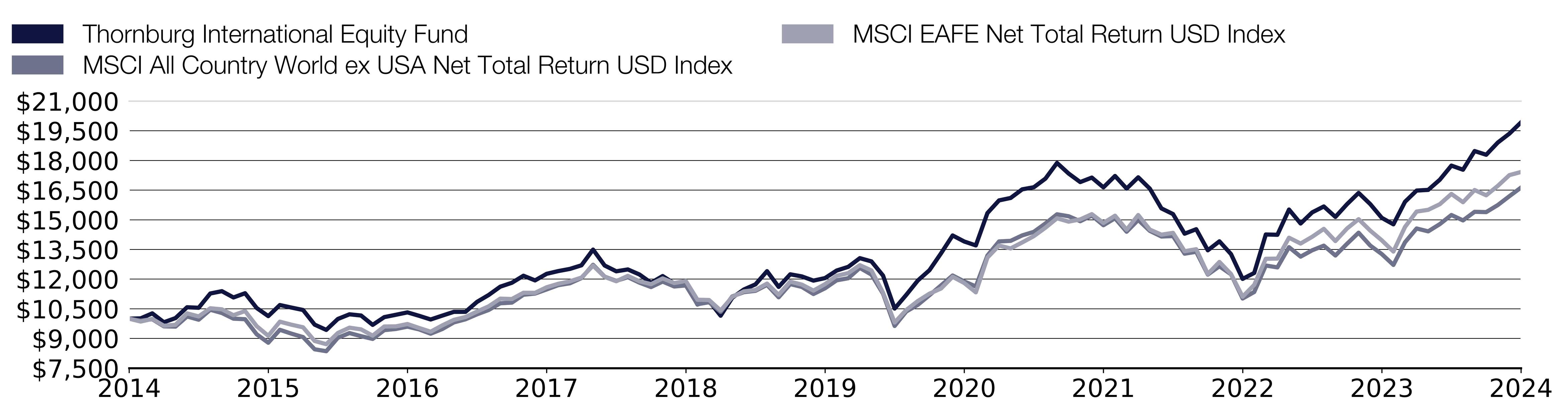

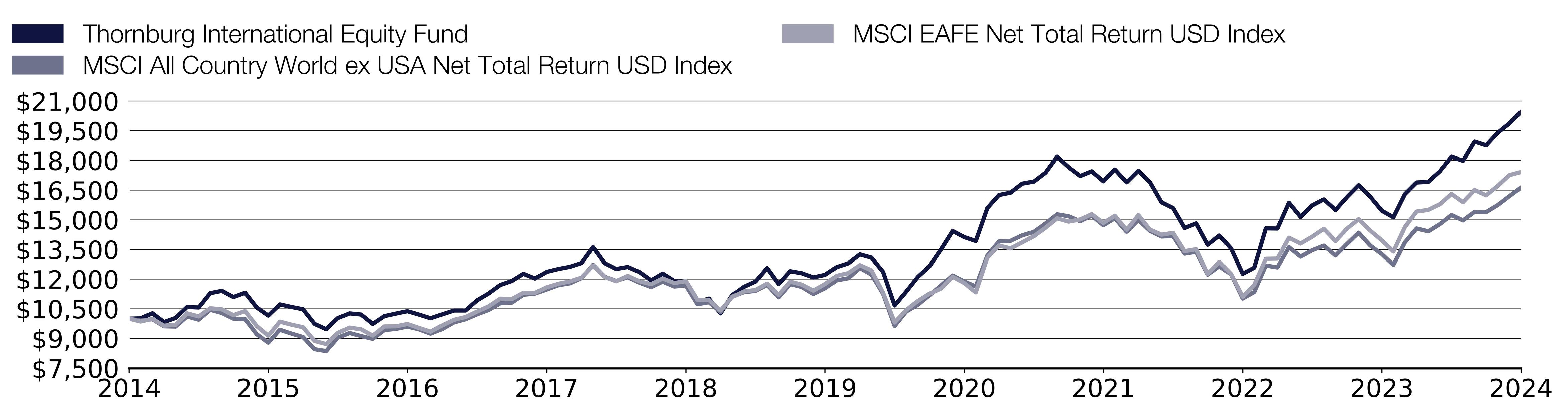

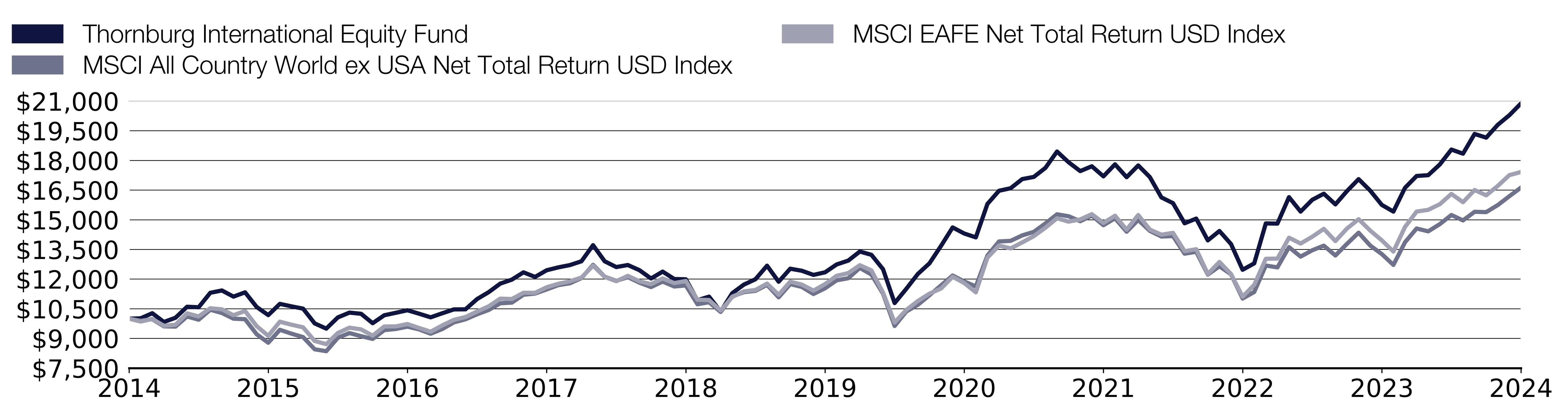

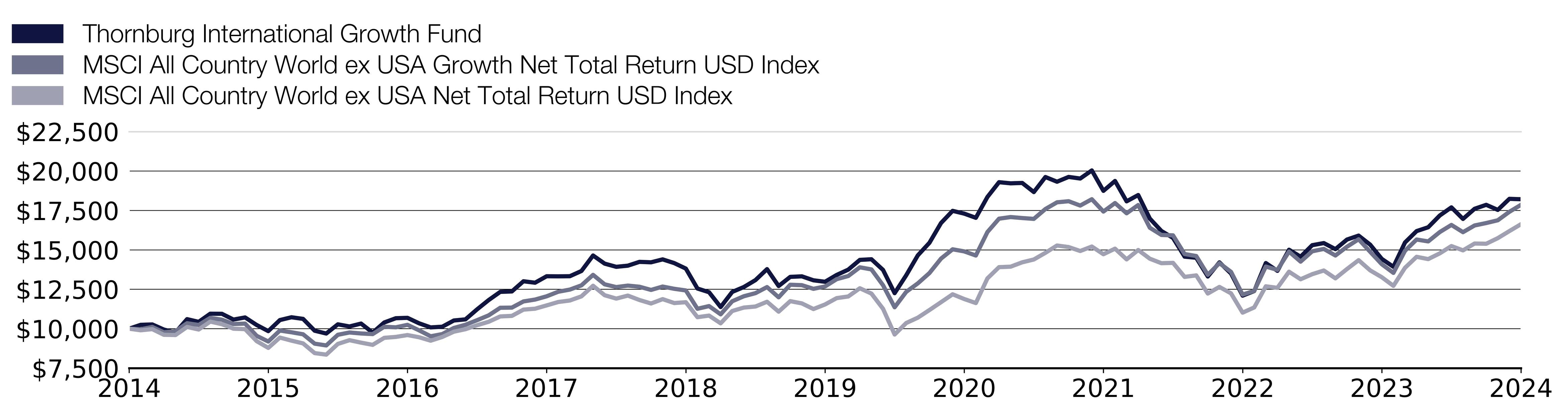

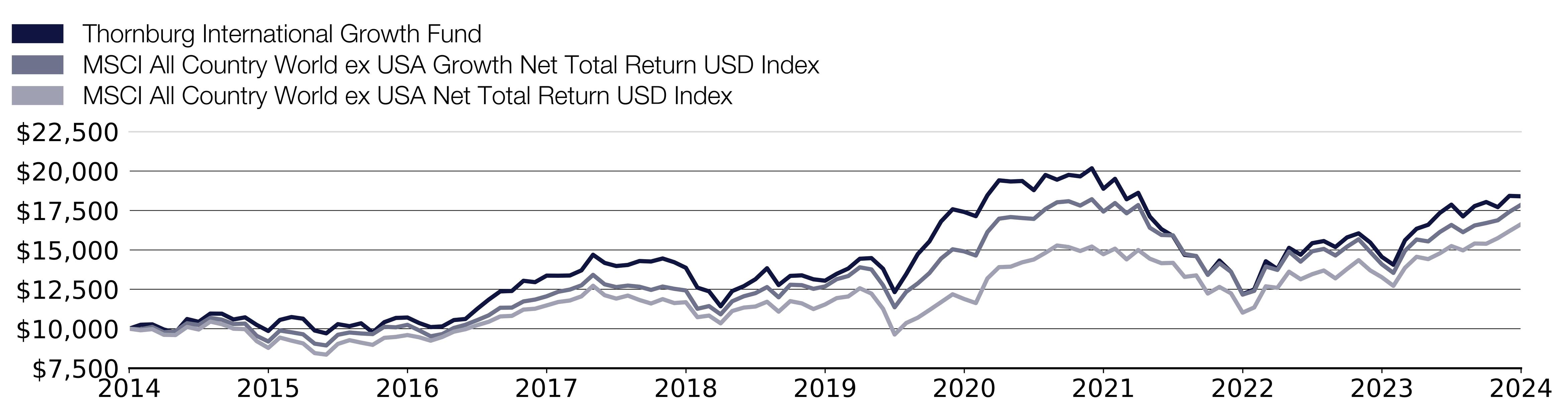

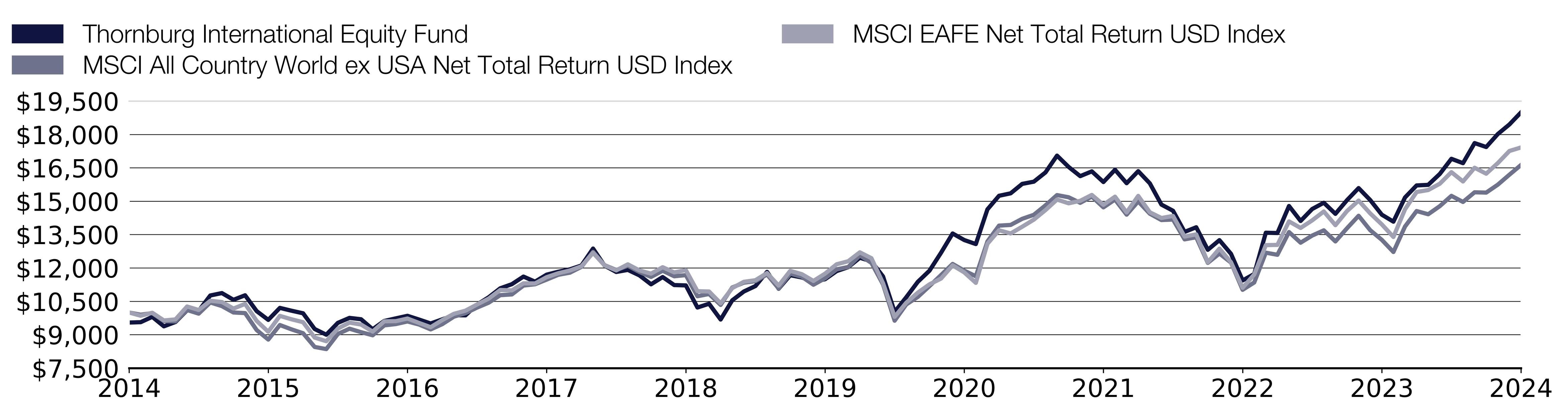

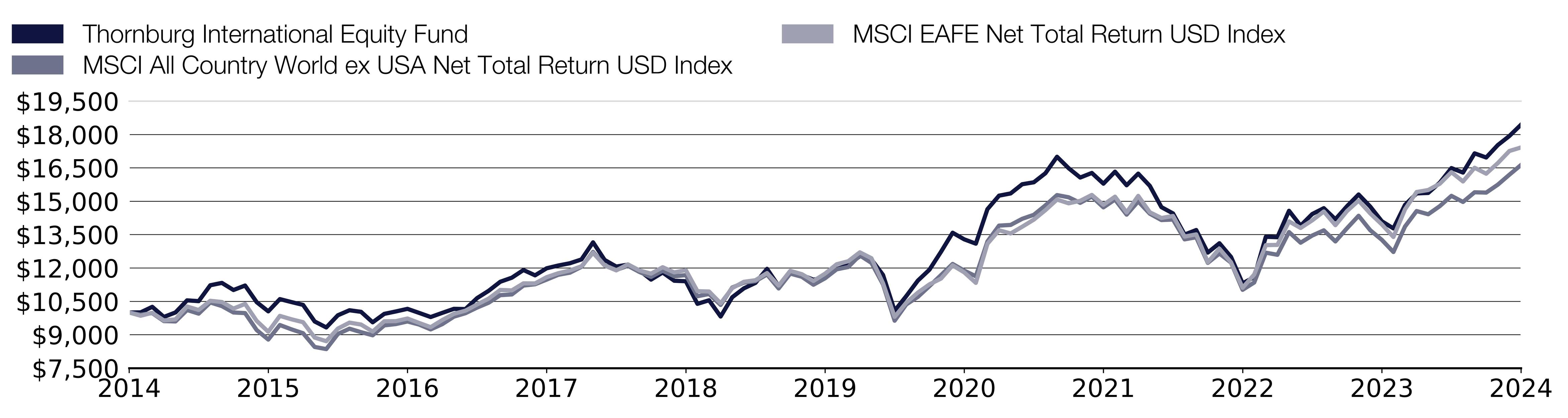

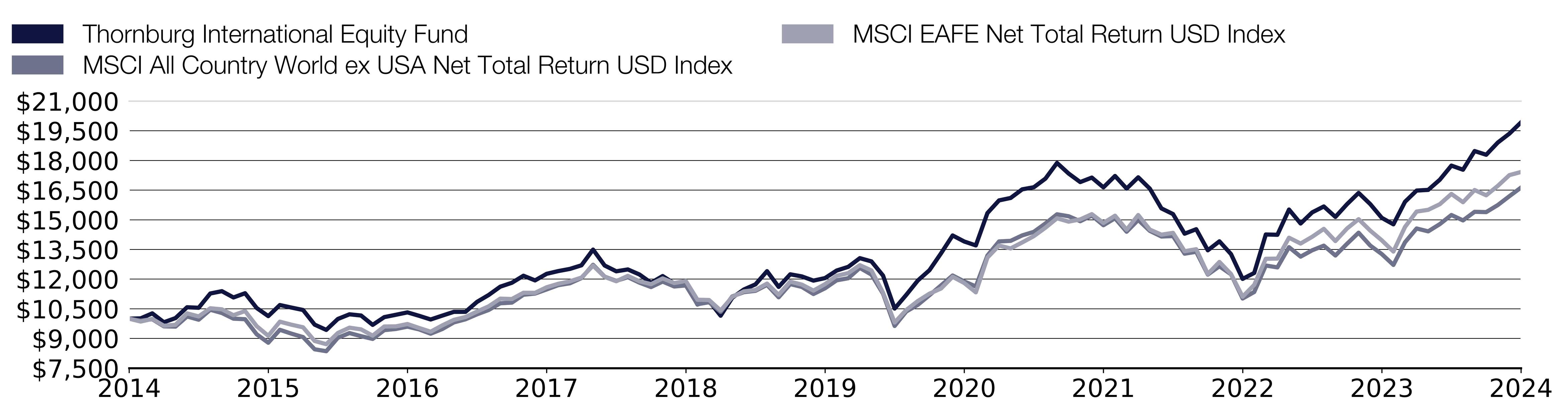

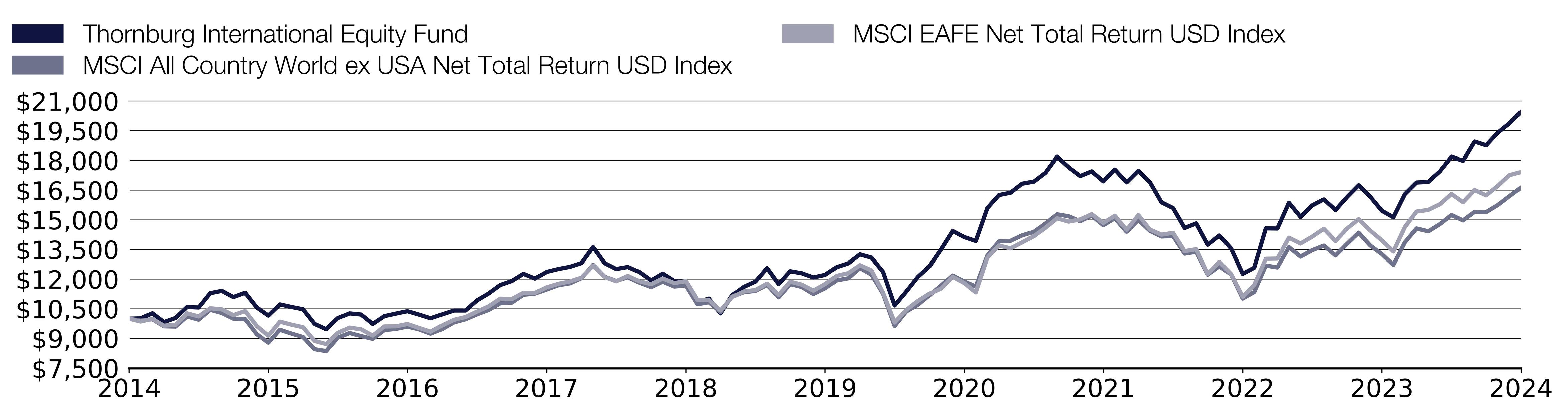

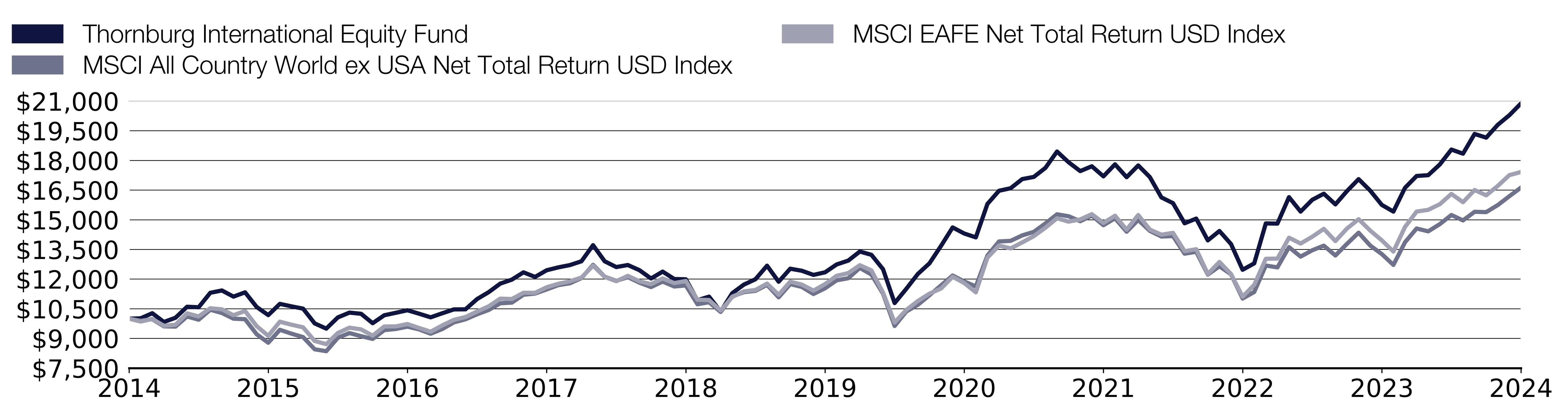

How did the Fund perform over the past 10 years?

The line graph below reflects a hypothetical $10,000 investment and assumes the deduction of the maximum sales charge associated with that investment. The returns shown in the line graph and table assume the reinvestment of dividends and capital gains, but do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. The performance information shown below represents past performance and is no guarantee of future results. For Fund performance current to the most recent month end, visit https://www.thornburg.com/product/mutual-funds/fiv/TGVAX or call 1-800-847-0200. Performance for other share classes of the Fund will vary.

Cumulative Performance

Growth Table

Date | Thornburg International Equity Fund | MSCI All Country World ex USA Net Total Return USD Index | MSCI EAFE Net Total Return USD Index |

09/30/2014 | 9548.8 | 10000 | 10000 |

10/31/2014 | 9564.8 | 9900.9916 | 9854.8027 |

11/30/2014 | 9804.3005 | 9972.6147 | 9988.8459 |

12/31/2014 | 9377.735 | 9613.0446 | 9642.8195 |

01/31/2015 | 9573.3956 | 9598.8003 | 9689.957 |

02/28/2015 | 10100.9805 | 10111.9989 | 10269.2311 |

03/31/2015 | 10076.523 | 9948.5397 | 10113.2303 |

04/30/2015 | 10764.8291 | 10451.1052 | 10526.1436 |

05/31/2015 | 10873.1413 | 10287.947 | 10472.2625 |

06/30/2015 | 10570.8248 | 10000.9028 | 10175.5462 |

07/31/2015 | 10774.3799 | 9973.1163 | 10386.8244 |

08/31/2015 | 10061.9372 | 9210.8418 | 9622.7394 |

09/30/2015 | 9668.1645 | 8783.7614 | 9134.1379 |

10/31/2015 | 10207.0458 | 9437.6483 | 9848.1483 |

11/30/2015 | 10080.6553 | 9242.8415 | 9694.9419 |

12/31/2015 | 9964.9282 | 9068.7492 | 9564.3111 |

01/31/2016 | 9258.1664 | 8451.8776 | 8872.6782 |

02/29/2016 | 9001.9136 | 8355.2767 | 8710.1239 |

03/31/2016 | 9535.0848 | 9034.6429 | 9276.8694 |

04/30/2016 | 9758.2727 | 9272.3835 | 9545.445 |

05/31/2016 | 9696.2761 | 9115.896 | 9458.7334 |

06/30/2016 | 9248.343 | 8976.4115 | 9141.226 |

07/31/2016 | 9619.7792 | 9420.3444 | 9604.511 |

08/31/2016 | 9736.6355 | 9479.93 | 9611.3298 |

09/30/2016 | 9851.5887 | 9596.794 | 9729.3984 |

10/31/2016 | 9683.4011 | 9458.8142 | 9530.3854 |

11/30/2016 | 9506.8041 | 9240.0327 | 9340.5777 |

12/31/2016 | 9691.8105 | 9476.419 | 9659.9725 |

01/31/2017 | 9876.8168 | 9812.1147 | 9940.1874 |

02/28/2017 | 9872.6121 | 9968.552 | 10082.3268 |

03/31/2017 | 10356.1515 | 10221.2893 | 10359.8799 |

04/30/2017 | 10684.1173 | 10440.0708 | 10623.4864 |

05/31/2017 | 11087.7675 | 10778.8762 | 11013.4103 |

06/30/2017 | 11272.6617 | 10812.3304 | 10993.9322 |

07/31/2017 | 11614.5133 | 11210.8719 | 11311.0613 |

08/31/2017 | 11386.6122 | 11269.5045 | 11306.7993 |

09/30/2017 | 11701.3603 | 11478.7062 | 11588.1173 |

10/31/2017 | 11832.6459 | 11694.6789 | 11764.0795 |

11/30/2017 | 11940.1705 | 11789.6748 | 11887.4756 |

12/31/2017 | 12113.2165 | 12053.1957 | 12078.2834 |

01/31/2018 | 12874.6187 | 12724.4868 | 12684.1237 |

02/28/2018 | 12103.3282 | 12124.5179 | 12111.613 |

03/31/2018 | 11821.5105 | 11910.6517 | 11893.318 |

04/30/2018 | 11915.4497 | 12100.8441 | 12164.8742 |

05/31/2018 | 11668.2412 | 11821.4237 | 11891.4326 |

06/30/2018 | 11267.7634 | 11599.2316 | 11746.1521 |

07/31/2018 | 11594.0786 | 11876.6458 | 12035.2871 |

08/31/2018 | 11233.1542 | 11628.0714 | 11802.8554 |

09/30/2018 | 11218.3217 | 11681.0364 | 11905.29 |

10/31/2018 | 10224.5436 | 10730.9268 | 10957.723 |

11/30/2018 | 10392.6453 | 10832.4932 | 10943.915 |

12/31/2018 | 9684.0259 | 10342.216 | 10412.6559 |

01/31/2019 | 10547.0583 | 11123.6502 | 11096.9768 |

02/28/2019 | 10943.451 | 11340.9771 | 11379.8535 |