UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| For the fiscal year ended | December 31, 2007 |

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| For the transition period from | | to | |

Commission file number 0-16079

AIR METHODS CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 84-0915893 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification no.) |

7301 South Peoria, Englewood, Colorado 80112

(Address of principal executive offices and zip code)

303-792-7400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Not Applicable

Securities registered pursuant to Section 12(g) of the Act:

COMMON STOCK, $.06 PAR VALUE PER SHARE (the "Common Stock")

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated Filer o Accelerated Filer x Non-accelerated Filer o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $369,880,000

The number of outstanding shares of Common Stock as of February 29, 2008, was 12,151,879.

To Form 10-K

| | | Page |

| PART I |

| | | |

| ITEM 1. | | 1 |

| | General | 1 |

| | Employees | 4 |

| | Government Regulation | 4 |

| | Internet Address | 4 |

| | | |

| ITEM 1A. | | 4 |

| | | |

| ITEM 1B. | | 8 |

| | | |

| ITEM 2. | | 8 |

| | Facilities | 8 |

| | Equipment and Parts | 9 |

| | | |

| ITEM 3. | | 10 |

| | | |

| ITEM 4. | | 10 |

| | | |

| | | |

| PART II |

| | | |

| ITEM 5. | | 11 |

| | | |

| ITEM 6. | | 13 |

| | | |

| ITEM 7. | | 15 |

| | Overview | 15 |

| | Results of Operations | 17 |

| | Liquidity and Capital Resources | 23 |

| | Outlook for 2008 | 26 |

| | Critical Accounting Policies | 27 |

| | New Accounting Standards | 28 |

| | | |

| ITEM 7A. | | 28 |

| | | |

| ITEM 8. | | 28 |

| | | |

| ITEM 9. | | 28 |

| | | |

| ITEM 9A. | | 29 |

| | | |

| ITEM 9B. | | 29 |

| PART III |

| | | |

| ITEM 10. | | 30 |

| | | |

| ITEM 11. | | 30 |

| | | |

| ITEM 12. | | 30 |

| | | |

| ITEM 13. | | 30 |

| | | |

| ITEM 14. | | 30 |

| | | |

| | | |

| PART IV |

| | | |

| ITEM 15. | | IV-1 |

| | | |

| | IV-4 |

PART I

General

Air Methods Corporation, a Delaware corporation, (Air Methods or the Company) was established in Colorado in 1982 and now serves as the largest provider of air medical emergency transport services and systems throughout the United States of America. We provide air medical emergency transport services under two service delivery models: Community-Based Services (CBS) and the Hospital-Based Services (HBS). FSS Airholdings, Inc. (FSS), Rocky Mountain Holdings, LLC (RMH), Mercy Air Service, Inc. (Mercy Air), and LifeNet, Inc. (LifeNet) all operate as wholly-owned subsidiaries of Air Methods.

In October 2007, we acquired 100% of the outstanding common stock of FSS, the parent company of CJ Systems Aviation Group, Inc. (CJ) for $25 million in cash. The purchase price was financed through borrowings under our Revolving Credit, Term Loan and Security Agreement with a commercial bank group. CJ was headquartered in Pittsburgh, Pennsylvania, and provided air medical transportation services under both the community-based and hospital-based service delivery models throughout the United States utilizing a fleet of more than 113 helicopters and fixed-wing aircraft.

As of December 31, 2007, our CBS Division provided air medical transportation services in 21 states, while our HBS Division provided air medical transportation services to hospitals located in 32 states and the District of Columbia under operating agreements with original terms ranging from one to ten years. Under both CBS and HBS operations, we transport persons requiring intensive medical care from either the scene of an accident or general care hospitals to highly skilled trauma centers or tertiary care centers. Under the CBS delivery model, our employees provide medical care to patients en route, while under the HBS delivery model, medical care en route is provided by employees or contractors of our customer hospitals. Our Products Division designs, manufactures, and installs aircraft medical interiors and other aerospace or medical transport products. Financial information for each of our operating segments is included in the notes to our consolidated financial statements included in Item 8 of this report.

Community-Based Services

Services provided by our CBS Division include medical care, aircraft operation and maintenance, 24-hour communications and dispatch, and medical billing and collections. CBS aircraft are typically based at fire stations, airports, or hospital locations. CBS revenue consists of flight fees billed directly to patients, their insurers, or governmental agencies. Due to weather conditions and other factors, the number of flights is generally higher during the summer months than during the remainder of the year, causing revenue generated from operations to fluctuate accordingly.

The division operates 135 helicopters and four fixed wing aircraft under both Instrument Flight Rules (IFR) and Visual Flight Rules (VFR) in 21 states. Although the division does not generally contract directly with specific hospitals, it has long-standing relationships with several leading healthcare institutions in the metropolitan areas in which it operates.

The acquisition of CJ in October 2007 resulted in the addition of nineteen CBS bases, primarily in the Midwest and Southeast regions. Also in 2007, we acquired certain business assets from air medical service providers in Florida and South Carolina, resulting in the addition of four new base locations, and opened nine other new CBS bases, including the conversion of one of our HBS customers to CBS operations. In 2007 we entered into a contract with the Federal Emergency Management Agency (FEMA) to support its disaster recovery efforts as needed. During the third quarter of 2007, we mobilized thirteen aircraft to respond to the threat posed by Hurricane Dean in Texas. At the end of June 2007, our contract with the State of Mississippi to provide air medical transportation services in Gulfport, Mississippi, expired.

Communications and dispatch operations for substantially all CBS locations are conducted from our national center in Omaha, Nebraska, or from the regional center in St. Louis, Missouri. Medical billing and collections are processed primarily from our offices in San Bernardino, California.

Competition for the CBS Division comes primarily from four national operators (OmniFlight, Inc.; PHI, Inc.; Med-Trans, Inc.; and Air Evac Lifeteam) and from smaller regional carriers and alternative air ambulance providers such as local governmental entities. We believe that our competitive strengths center on the quality of our patient care and customer service and the medical capability of the aircraft we deploy, as well as our ability to tailor the service delivery model to a hospital’s or community’s specific needs. Availability of new aircraft to respond to growth opportunities also provides a competitive advantage. Unlike many other operators, we maintain in-house core competencies in hiring, training, and management of medical staff; billing and collection services; and dispatch and communication functions, in addition to aviation operations. We believe that choosing not to outsource these services allows us to better ensure the quality of patient care and enhance control over the associated costs.

Hospital-Based Services

Our HBS Division provides hospital clients with medically-equipped helicopters and airplanes which are generally based at hospitals. Our responsibility is to operate and maintain the aircraft in accordance with Federal Aviation Regulations (FAR) Part 135 standards. Hospital clients provide medical personnel and all medical care on board the aircraft. The division operates 187 helicopters and sixteen fixed wing aircraft in 32 states and the District of Columbia. Under the typical operating agreement with a hospital, we earn approximately 65% of our revenue from a fixed monthly fee and 35% from an hourly flight fee from the hospital, regardless of when, or if, the hospital is reimbursed for these services by its patients, their insurers, or the federal government. Both monthly and hourly fees are generally subject to annual increases based on changes in the consumer price index, hull and liability insurance premiums, or spare parts prices from aircraft manufacturers. Because the majority of the division's flight revenue is generated from fixed monthly fees, seasonal fluctuations in flight hours do not significantly impact monthly revenue in total.

The acquisition of CJ resulted in the addition of 28 hospital contracts, representing 74 base locations, in October 2007. Two of the CJ contracts, representing nine base locations, expired at the beginning of 2008 and were not renewed. We began operations under new contracts, representing a total of seven aircraft, in Oregon, Texas, and Pennsylvania during 2007. Of the fifteen Air Methods’ hospital contracts due for renewal in 2007, ten were renewed for terms ranging from one to three years, one converted to CBS operations, and two opted to contract with other providers upon contract expiration. We made the decision not to renew one contract, which provided for risk-sharing with a hospital customer, when it expired in the third quarter of 2007. Renewal of one contract is still under negotiation with the customer and is expected to be completed during the first quarter of 2008.

We operate some of our HBS contracts under the service mark AIR LIFE(R), which is generally associated within the industry with our standard of service.

Competition for the HBS Division comes primarily from four national operators: OmniFlight, Inc.; PHI, Inc.; Metro Aviation, Inc.; and Med-Trans, Inc. Operators generally compete on the basis of price, safety record, accident prevention and training, and the medical capability of the aircraft. Price is a significant element of competition because of the continued pressure on many healthcare organizations to contain costs to their consumers. We believe that our competitive strengths center on the quality of our training, maintenance, and customer service and on the medical capability of the aircraft we deploy. Availability of new aircraft to respond to customer needs also provides a competitive advantage.

Aviation Support Services

Our aviation support services group is a full-service maintenance provider, performing airframe inspection, modification, repair and refurbishment; engine repair; component and hydraulic systems repair and overhaul; and non-destructive component testing at our headquarters in metropolitan Denver, Colorado, and at the former CJ headquarters in Pittsburgh, Pennsylvania, for both CBS and HBS divisions. We are a Customer Service Facility for American Eurocopter Corporation (AEC), Bell Helicopter, Inc. (Bell), and several avionics manufacturers and a Federal Aviation Administration (FAA) Certified Repair Station authorized to perform airframe, avionics, and engine repairs. In-house repair, maintenance, and testing capabilities provide cost savings and decrease aircraft down time by avoiding the expense and delay of having this work performed by nonaffiliated vendors. The aviation support services group also provides aircraft procurement, spare parts and medical supplies procurement, inventory, and aircraft recordkeeping services for our flight operations and maintains the Approved Aircraft Inspection Program (AAIP) for the Part 135 operations certificate.

Products Division

Our Products Division designs, manufactures, and certifies modular medical interiors, multi-mission interiors, and other aerospace and medical transport products. These interiors and other products range from basic life support to intensive care suites to advanced search and rescue systems. With a full range of engineering, manufacturing and certification capabilities, the division has also designed and integrated aircraft communication and navigation systems, environmental control systems, and structural and electrical systems. Manufacturing capabilities include avionics, electrical, composites, machining, welding, sheetmetal, and upholstery. The division also offers quality assurance and certification services pursuant to its FAA Designated Alteration Station (DAS) authorization, Parts Manufacturer Approvals (PMA's), and ISO9001:2000 (Quality Systems) certification.

We maintain patents covering several products, including the Litter Lift System, used in the U.S. Army’s HH-60L helicopter and in the Medical Evacuation Vehicle (MEV), and the Articulating Patient Loading System and Modular Equipment Frame, which were developed as part of the modular interior concept. Raw materials and components used in the manufacture of interiors and other products are generally widely available from several different vendors.

In 2007, we completed production of 27 MEV litter systems and seven modular medical interior kits for commercial customers. As of December 31, 2007, contracts for ten HH-60L units, fifty MEV units, and three commercial medical interiors were in process. We also have two design contracts with the U.S. Army: one for an upgraded HH-60M multi-mission interior and one for an interim medical system. The M Model is the new model of the Black Hawk helicopter, replacing the HH-60L. Deliveries under all contracts in process are expected to be completed by early 2009, and remaining revenue is estimated at $7.4 million. As of December 31, 2006, the revenue remaining to be recognized on medical interiors and other products in process was estimated at $2.6 million.

In the third quarter of 2007, the division entered into a long-term agreement with AEC to provide their single-engine emergency medical services customers with medical interiors, avionics and airframe modifications, and equipment. Under the terms of this agreement, AEC customers that select a single-engine aircraft will be offered Products Division’s services and products by AEC. There is no assurance that the agreement will result in any orders for the division’s services or products.

Our competition in the aircraft interior design and manufacturing industry comes primarily from three companies based in the United States and three in Europe. Competition is based mainly on product availability, price, and product features, such as configuration and weight. With the development of a line of interiors for Eurocopter aircraft to complement our established line of interiors for Bell aircraft, we believe that we have demonstrated the ability to compete on the basis of each of these factors.

Employees

As of December 31, 2007, we had 2,739 full time and 394 part time employees, comprised of 1,076 pilots; 534 aviation machinists, airframe and power plant (A&P) engineers, and other manufacturing/maintenance positions; 833 flight nurses and paramedics; and 690 business and administrative personnel. Our pilots are IFR-rated where required by contract, and all have completed an extensive ground school and flight training program at the commencement of their employment with us, as well as local area orientation and annual training provided by us. All of our aircraft mechanics must possess FAA A&P licenses. All flight nurses and paramedics hold the appropriate state and county licenses, as well as Cardiopulmonary Resuscitation, Advanced Cardiac Life Support, and/or Pediatric Advanced Life Support certifications.

In September 2003, our pilots voted to be represented by a collective bargaining unit, and we signed a collective bargaining agreement (CBA) on March 31, 2006. The agreement is effective January 1, 2006, through April 30, 2009. Other employee groups may also elect to be represented by unions in the future.

Government Regulation

We are subject to the Federal Aviation Act of 1958, as amended. All of our flight and maintenance operations are regulated and actively supervised by the U.S. Department of Transportation through the FAA. Medical interiors and other aerospace products developed by us are subject to FAA certification. Air Methods and CJ each hold a Part 135 Air Carrier Certificate, and Air Methods, Mercy Air, LifeNet, and CJ each hold Part 145 Repair Station Certificates from the FAA. A Part 135 certificate requires that the voting interests of the holder of the certificate cannot be more than 25% owned by foreign persons. As of December 31, 2007, we are not aware of any foreign person who holds more than 5% of outstanding Common Stock.

In 2006 the FAA updated its interpretation of existing standards regarding operational control. Operational control refers to the ability of a Part 135 certificate holder to track, communicate with, and affect a flight by its aircraft while en route. In 2007, in response to these new interpretations, we completed the implementation of an FAA-approved training course for all communication specialists, both employees and contractors, that perform flight tracking on our aircraft and the establishment of an operational control center which allows us, from a single location, to track flight plans and flight conditions for all aircraft and to contact our pilots en route.

We are also subject to laws, regulations, and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002, Securities and Exchange Commission (SEC) regulations, and NASDAQ Market rules.

Internet Address

Our internet site is www.airmethods.com. We make available free of charge, on or through the website, all annual, quarterly, and current reports, as well as any amendments to these reports, as soon as reasonably practicable after electronically filing these reports with the Securities and Exchange Commission. This reference to the website does not incorporate by reference the information contained in the website and such information should not be considered a part of this report.

Our actual operating results may differ materially from those described in forward-looking statements as a result of various factors, including but not limited to, those discussed in “Outlook for 2008” and those described below.

| · | Flight volume – Almost all CBS revenue and approximately 35% of HBS revenue is dependent upon flight volume. Approximately 24% of our total operating expenses also vary with the number of hours flown. Poor visibility, high winds, and heavy precipitation can affect the safe operation of aircraft and therefore result in a reduced number of flight hours due to the inability to fly during these conditions. Prolonged periods of adverse weather conditions could have an adverse impact on our operating results. Typically, the months from November through February tend to have lower flight volume due to weather conditions and other factors, resulting in lower CBS operating revenue during these months. Flight volume for CBS operations can also be affected by the distribution of calls among competitors by local government agencies and the entrance of new competitors into a market. The past several years have seen significant increases in the number of community-based units operated within the industry. Although to date we have not experienced an overall decrease in patient transports for CBS bases open longer than one year (Same-Base Transports) on an annual basis primarily attributed to competition, further increases in the total number of community-based units may create overcapacity which may, in turn, lead to reductions in flight volume for any one provider. |

| · | Collection rates – We respond to calls for air medical transport without pre-screening the creditworthiness of the patient. The CBS Division invoices patients and their insurers directly for services rendered and recognizes revenue net of provisions for contractual discounts and estimated uncompensated care. Both provisions are estimated during the period the related services are performed based on historical collection experience and any known trends or changes in reimbursement rate schedules and payer mix. The provisions are adjusted as required based on actual collections in subsequent periods. Net reimbursement per transport for CBS operations is primarily a function of price, payer mix, and timely and effective collection efforts. Both the pace of collections and the ultimate collection rate are affected by the overall health of the U.S. economy, which impacts the number of indigent patients and funding for state-run programs, such as Medicaid. Medicaid reimbursement rates in many jurisdictions have remained well below the cost of providing air medical transportation. In addition, the collection rate is impacted by changes in the cost of healthcare and health insurance; as the cost of healthcare increases, health insurance coverage provided by employers may be reduced or eliminated entirely, resulting in an increase in the uninsured population. Our ability to collect price increases in our standard charge structure has generally been limited to accounts covered by insurance providers. Although we have not yet experienced significant increased limitations in the amount reimbursed by insurance companies, continued price increases may cause insurance companies to limit coverage for air medical transport to amounts less than our standard rates. There is no assurance that we will be able to maintain historical collection rates after the implementation of price increases for CBS transports. |

| · | Dependence on third party suppliers – We currently obtain a substantial portion of our helicopter spare parts and components from AEC and Bell and maintain supply arrangements with other parties for our engine and related dynamic components. As of December 31, 2007, AEC aircraft comprise 73% of our helicopter fleet while Bell aircraft constitute 22%. Almost all of the new helicopters scheduled for delivery in 2008 are AEC aircraft. Since both manufacturers are essentially sold out of new aircraft for the foreseeable future, both have been passing through increases in the price of new aircraft and spare parts which are higher than overall inflationary trends. In addition, increases in spare parts prices tend to be higher for aircraft which are no longer in production. Increases in our monthly and hourly flight fees billed to our HBS customers in certain cases are limited to changes in the consumer price index. As a result, an unusually high increase in the price of parts may not be fully passed on to our HBS customers. The ability to pass on price increases for CBS operations may be limited by reimbursement rates established by Medicare, Medicaid, and insurance providers and by other market considerations. Based upon the manufacturing capabilities and industry contacts of AEC, Bell, and other suppliers, we believe we will not be subject to material interruptions or delays in obtaining aircraft parts and components but do not have an alternative source of supply for AEC, Bell, and certain other aircraft parts. Failure or significant delay by these vendors in providing necessary parts could, in the absence of alternative sources of supply, have a material adverse effect on us. |

| · | Aircraft availability – The recent high rate of growth in the air medical transportation and other helicopter services industries has generated strong demand for new models of helicopters. Most major helicopter manufacturers are sold out of the majority of new aircraft models suitable for medical missions for at least the next two years. Quality used aircraft are also in short supply worldwide. We have endeavored to mitigate the shortage of suitable aircraft and limit our exposure to the effect of price increases on new aircraft primarily through long-term arrangements with a single aircraft manufacturer which provides us options to purchase up to ten aircraft each year for the next several years. We also have a purchase commitment with another aircraft manufacturer for fifteen aircraft, with deliveries scheduled to begin in late 2008 or early 2009, as well as options for an additional fifteen aircraft in future years. In addition, prior to the acquisition, CJ had signed purchase commitments for seventeen aircraft which were still in effect as of December 31, 2007. Despite these purchase commitments and options, if our future needs for aircraft exceed our current projections, the shortage of aircraft could prevent us from pursuing certain expansion opportunities. If our future needs for aircraft are less than our current projections, the ownership costs for new deliveries could exceed our ability to recover them through increased revenue. Presently, a vibrant secondary market for these models of aircraft exists which may allow us to sell aircraft not needed in our operations. |

| · | Employee unionization - In September 2003, our pilots voted to be represented by a collective bargaining unit, and we signed a CBA on March 31, 2006. The agreement is effective January 1, 2006, through April 30, 2009. The CBA establishes procedures for training, addressing grievances, discipline and discharge, among other matters, and defines vacation, holiday, sick, health insurance, and other employee benefits. The CBA also establishes wage scales, including adjustments for geographic locations, covering each year of the agreement. There can be no assurance that the CBA will be renewed prior to expiration, and if the CBA is renewed, there can be no assurance that the renewal terms will resemble the terms of the current CBA. Union personnel have also actively attempted to organize other employee groups in the past and these groups may elect to be represented by unions in the future. |

| · | Employee recruitment and retention - An important aspect of our operations is the ability to hire and retain employees who have advanced aviation, nursing, and other technical skills. In addition, hospital contracts typically contain minimum certification requirements for pilots and mechanics. Employees who meet these standards are in great demand and are likely to remain a limited resource in the foreseeable future. If we are unable to recruit and retain a sufficient number of these employees, the ability to maintain and grow the business could be negatively impacted. A limited supply of qualified applicants may also contribute to wage increases which outpace the rate of inflation. |

| · | Competition – HBS operations face significant competition from several national and regional air medical transportation providers for contracts with hospitals and other healthcare institutions. In addition to the national and regional providers, CBS operations also face competition from smaller regional carriers and alternative air ambulance providers such as sheriff departments. Operators generally compete on the basis of price, safety record, accident prevention and training, and the medical capability of the aircraft. There can be no assurance that we will be able to continue to compete successfully for new or renewing contracts in the future. |

| · | Fuel costs – Fuel accounted for 3.3% of total operating expenses for the year ended December 31, 2007. Both the cost and availability of fuel are influenced by many economic and political factors and events occurring in oil-producing countries throughout the world, and fuel costs fluctuate widely. The price per barrel of oil has maintained near record levels over the past several years. We cannot predict the future cost and availability of fuel. The unavailability of adequate fuel supplies could have an adverse effect on our cost of operations and profitability. Generally, our HBS customers pay for all fuel consumed in medical flights. However, our ability to pass on increased fuel costs for CBS operations may be limited by economic and competitive conditions and by reimbursement rates established by Medicare, Medicaid, and insurance providers. We do not currently have any agreements in place to hedge our fuel costs. |

| · | Aviation industry hazards and insurance limitations – Hazards are inherent in the aviation industry and may result in loss of life and property, thereby exposing us to potentially substantial liability claims arising from the operation of aircraft. We may also be sued in connection with medical malpractice claims arising from events occurring during medical flights. Under HBS operating agreements, our customers have agreed to indemnify us against liability arising from medical malpractice claims and to maintain insurance covering such liability, but there can be no assurance that a hospital will not challenge the indemnification rights or will have sufficient assets or insurance coverage for full indemnity. In CBS operations, our personnel perform medical procedures on transported patients, which may expose us to significant direct legal exposure to medical malpractice claims. We maintain general liability aviation insurance, aviation product liability coverage, and medical malpractice insurance, and believe our level of coverage is customary in the industry and adequate to protect against claims. However, there can be no assurance that it will be sufficient to cover potential claims or that present levels of coverage will be available in the future at reasonable cost. A limited number of hull and liability insurance underwriters provide coverage for air medical operators. A significant downturn in insurance market conditions could have a material adverse effect on our cost of operations. Approximately 43% of any increases in hull and liability insurance may be passed through to our HBS customers according to contract terms. In addition, loss of any aircraft as a result of accidents could cause adverse publicity and interruption of services to client hospitals, which could adversely affect our operating results and relationship with such hospitals. |

| · | Restrictive debt covenants – Our senior credit facility contains restrictive financial and operating covenants, including restrictions on our ability to incur additional indebtedness and to engage in various corporate transactions such as mergers, acquisitions, asset sales and the payment of cash dividends. These covenants may restrict future growth through the limitation on acquisitions and may adversely impact our ability to implement our business plan. Failure to comply with the covenants defined in the agreement or to maintain the required financial ratios could result in an event of default and accelerate payment of the principal balances due under the senior credit facility. Given factors beyond our control, such as interruptions in operations from unusual weather patterns not included in current projections, there can be no assurance that we will be able to remain in compliance with financial covenants in the future, or that, in the event of non-compliance, we will be able to obtain waivers from the lenders, or that to obtain such waivers, we will not be required to pay lenders significant cash or equity compensation. |

| · | Governmental regulation – The air medical transportation services and products industry is subject to extensive regulation by governmental agencies, including the FAA, which impose significant compliance costs on us. In addition, reimbursement rates for air ambulance services established by governmental programs such as Medicare directly affect CBS revenue and indirectly affect HBS revenue from customers. Changes in laws or regulations or in reimbursement rates could have a material adverse impact on our cost of operations or revenue from flight operations. Periodically the FAA issues airworthiness directives covering one or more models of aircraft. Although we believe that our aircraft are currently in compliance with all FAA-issued airworthiness directives, additional airworthiness directives likely will be issued in the future and may result in additional operating costs or make a particular model of aircraft uneconomical to operate. In recent years, the accident rate for the entire air medical transportation industry has exceeded historical levels, leading to increased scrutiny from government regulatory agencies. Such increased scrutiny could result in new regulations and increases in the cost of compliance with regulations. |

| · | Compliance with corporate governance and public disclosure regulations – Laws, regulations, and standards relating to corporate governance and public disclosure—including the Sarbanes-Oxley Act of 2002, related SEC regulations, and NASDAQ Market rules—are subject to varying interpretations in many cases due to lack of specificity. Their application may evolve over time as new guidance is provided by regulatory and governing bodies, which may result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. Our efforts to maintain high standards of corporate governance and public disclosure in compliance with evolving laws and regulations have resulted in, and are likely to continue to result in, increased general and administrative expenses and a diversion of management’s time and attention from revenue-generating activities to compliance activities. In particular, compliance with Section 404 of the Sarbanes-Oxley Act of 2002, which requires us to include management and auditor reports on internal controls as part of our annual report, has required commitment of significant financial and managerial resources. In addition, board members, the chief executive officer, and the chief financial officer could face an increased risk of personal liability in connection with the performance of their duties. As a result, we may have difficulty attracting and retaining qualified board members and executive officers. If efforts to comply with new or changed laws, regulations, and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, our reputation may be harmed. |

| · | Internal controls – We are required by Section 404 of the Sarbanes-Oxley Act of 2002 to include management and auditor reports on internal controls as part of our annual report. Management concluded that internal control over financial reporting was effective at December 31, 2007, and our independent auditors attested to that conclusion. As permitted by SEC guidance, management’s assessment of the effectiveness of our internal control over financial reporting excludes the evaluation of internal controls over financial reporting of FSS Airholdings, Inc. and its subsidiaries, which were acquired on October 1, 2007. There can be no assurance that material weaknesses in internal controls over financial reporting will not be discovered in the future or that we and our independent auditors will be able to conclude that internal control over financial reporting is effective in the future. Although it is unclear what impact failure to comply fully with Section 404 or the discovery of a material weakness in internal controls over financial reporting would have on us, it may subject us to regulatory scrutiny and result in additional expenditures to meet the requirements, a reduced ability to obtain financing, or a loss of investor confidence in the accuracy of our financial reports. |

| · | Debt and lease obligations – We are obligated under debt facilities providing for up to approximately $152.7 million of indebtedness, of which approximately $114.2 million was outstanding (net of $5.1 million of cash) at December 31, 2007, and operating lease obligations which total $352.9 million over the remaining terms of the leases. If we fail to meet our payment obligations or otherwise default under the agreements governing indebtedness or lease obligations, the lenders under those agreements will have the right to accelerate the indebtedness and exercise other rights and remedies against us. These rights and remedies include the rights to repossess and foreclose upon the assets that serve as collateral, initiate judicial foreclosure against us, petition a court to appoint a receiver for us, and initiate involuntary bankruptcy proceedings against us. If lenders exercise their rights and remedies, our assets may not be sufficient to repay outstanding indebtedness and lease obligations, and there may be no assets remaining after payment of indebtedness and lease obligations to provide a return on common stock. |

| · | Department of Defense funding – Several of the projects which have historically been significant sources of revenue for the Products Division, including HH-60L and MEV systems, are dependent upon Department of Defense funding. Failure of the U.S. Congress to approve funding for the production of additional HH-60L or MEV units could have a material adverse impact on Products Division revenue. |

| · | Foreign ownership – Federal law requires that United States air carriers be citizens of the United States. For a corporation to qualify as a United States citizen, the president and at least two-thirds of the directors and other managing officers of the corporation must be United States citizens and at least 75% of the voting interest of the corporation must be owned or controlled by United States citizens. If we are unable to satisfy these requirements, operating authority from the Department of Transportation may be revoked. As of December 31, 2007, we are not aware of any foreign person who holds more than 5% of outstanding Common Stock. Because we are unable to control the transfer of our stock, we are unable to assure that we can remain in compliance with these requirements in the future. |

| UNRESOLVED STAFF COMMENTS |

None.

Facilities

The lease for our headquarters, consisting of approximately 108,000 square feet of office and hangar space, in metropolitan Denver, Colorado, at Centennial Airport extends through October 2008. We have entered into an agreement to purchase the buildings, subject to an existing ground lease with the airport authority which expires in October 2044, in October 2008 for approximately $6,725,000 plus the cost of certain building improvements. We are currently exploring financing options to fund the purchase of the building. We also own and lease various properties for depot level maintenance and administration purposes. We believe that these facilities are in good condition and suitable for our present requirements.

Equipment and Parts

As of December 31, 2007, we managed and operated a fleet of 342 aircraft, composed of the following:

| Type | | Number of Company-Owned Aircraft | | | Number of Company-Leased Aircraft | | | Number of Customer- Owned Aircraft | | | Total | |

| | | | | | | | | | | | | |

| Helicopters: | | | | | | | | | | | | |

| Bell 206 | | | 4 | | | | 2 | | | | 1 | | | | 7 | |

| Bell 222 | | | 13 | | | | 13 | | | | -- | | | | 26 | |

| Bell 230 | | | -- | | | | -- | | | | 1 | | | | 1 | |

| Bell 407 | | | 8 | | | | 6 | | | | 7 | | | | 21 | |

| Bell 412 | | | 3 | | | | 2 | | | | -- | | | | 5 | |

| Bell 430 | | | -- | | | | 2 | | | | 10 | | | | 12 | |

| Eurocopter AS 350 | | | 13 | | | | 46 | | | | 4 | | | | 63 | |

| Eurocopter AS 355 | | | 2 | | | | 2 | | | | -- | | | | 4 | |

| Eurocopter AS 365 | | | 1 | | | | 2 | | | | 6 | | | | 9 | |

| Eurocopter BK 117 | | | 18 | | | | 41 | | | | 6 | | | | 65 | |

| Eurocopter BO 105 | | | 2 | | | | 3 | | | | -- | | | | 5 | |

| Eurocopter EC 130 | | | -- | | | | 10 | | | | -- | | | | 10 | |

| Eurocopter EC 135 | | | -- | | | | 55 | | | | 10 | | | | 65 | |

| Eurocopter EC 145 | | | -- | | | | 7 | | | | 6 | | | | 13 | |

| Boeing MD 902 | | | -- | | | | -- | | | | 1 | | | | 1 | |

| Agusta 109 | | | 2 | | | | 7 | | | | 5 | | | | 14 | |

| Agusta 119 | | | -- | | | | -- | | | | 1 | | | | 1 | |

| | | | 66 | | | | 198 | | | | 58 | | | | 322 | |

| | | | | | | | | | | | | | | | | |

| Airplanes: | | | | | | | | | | | | | | | | |

| King Air E 90 | | | 1 | | | | 1 | | | | 2 | | | | 4 | |

| King Air B 100 | | | -- | | | | 3 | | | | -- | | | | 3 | |

| King Air B 200 | | | 1 | | | | 1 | | | | 3 | | | | 5 | |

| Lear 55 | | | -- | | | | 1 | | | | -- | | | | 1 | |

| Pilatus PC 12 | | | -- | | | | 2 | | | | 5 | | | | 7 | |

| | | | 2 | | | | 8 | | | | 10 | | | | 20 | |

| | | | | | | | | | | | | | | | | |

| TOTALS | | | 68 | | | | 206 | | | | 68 | | | | 342 | |

We generally pay all insurance, taxes, and maintenance expense for each aircraft in our fleet. Because helicopters are insured at replacement cost which usually exceeds book value, we believe that helicopter accidents covered by hull and liability insurance will generally result in full reimbursement of any damages sustained. In the ordinary course of business, we may from time to time purchase and sell helicopters in order to best meet the specific needs of our operations.

We have experienced no significant difficulties in obtaining required parts for our helicopters. Repair and replacement components are purchased primarily through AEC and Bell, since AEC and Bell aircraft make up the majority of our fleet. Based upon the manufacturing capabilities and industry contacts of AEC and Bell, we believe we will not be subject to material interruptions or delays in obtaining aircraft parts and components. Any termination of production by AEC or Bell would require us to obtain spare parts from other suppliers, which are not currently in place.

None.

| SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of security holders during the quarter ended December 31, 2007.

PART II

| MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS |

Our common stock is traded on the NASDAQ Global Select Market System under the trading symbol "AIRM." The following table shows, for the periods indicated, the high and low closing prices for our common stock. The quotations for the common stock represent prices between dealers and do not reflect adjustments for retail mark-ups, mark-downs or commissions, and may not represent actual transactions.

| | Year Ended December 31, 2007 | |

| | | | | | | |

| Common Stock | | High | | | Low | |

| | | | | | | |

| First Quarter | | $ | 29.11 | | | $ | 22.62 | |

| Second Quarter | | | 37.58 | | | | 24.64 | |

| Third Quarter | | | 48.68 | | | | 36.89 | |

| Fourth Quarter | | | 57.47 | | | | 44.82 | |

| | | | | | | | | |

| | Year Ended December 31, 2006 | |

| | | | | | | | | |

| Common Stock | | High | | | Low | |

| | | | | | | | | |

| First Quarter | | $ | 30.00 | | | $ | 17.45 | |

| Second Quarter | | | 31.00 | | | | 20.44 | |

| Third Quarter | | | 26.30 | | | | 18.28 | |

| Fourth Quarter | | | 29.55 | | | | 22.77 | |

As of February 29, 2008, there were approximately 222 holders of record of our common stock. We estimate that we have approximately 4,500 beneficial owners of common stock.

We have not paid any cash dividends since inception and intend to retain any future earnings to finance the growth of our business rather than to pay dividends. In addition, our senior credit facility contains a covenant which restricts the payment of dividends.

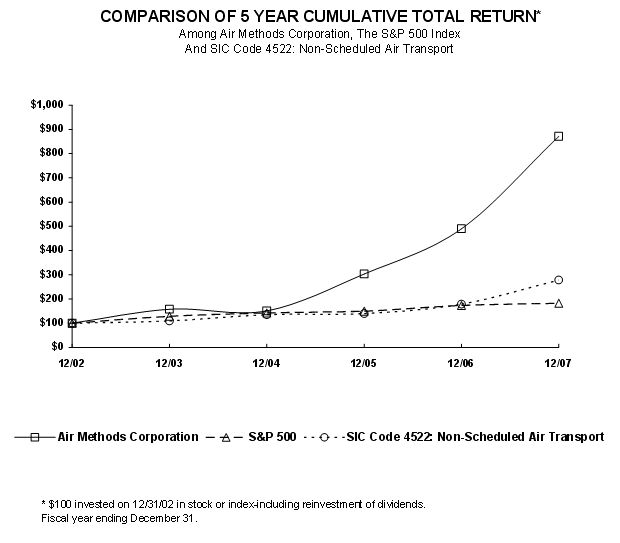

Stock Performance Graph

The following graph compares our cumulative total stockholder return for the period from December 31, 2002 through December 31, 2007, against the Standard & Poor’s 500 Index (S&P 500) and “peer group” companies in industries similar to those of the Company. The S&P 500 is a widely used composite index reflecting the returns of five hundred publicly traded companies in a variety of industries. The Peer Group consists of all publicly traded companies in SIC Group 4522: “Non-scheduled Air Transport,” including Airnet Systems Income; Bristow Group, Inc.; Home Energy Savings Corp.; and PHI, Inc. We believe that this Peer Group is our most appropriate peer group for stock comparison purposes due to the limited number of publicly traded companies engaged in air or ground medical transport and because this Peer Group contains a number of companies with capital costs and operating constraints similar to ours. The graph shows the value at the end of each of the last five fiscal years of $100 invested in our common stock or the indices on December 31, 2002, and assumes reinvestment of dividends. Historical stock price performance is not necessarily indicative of future stock price performance.

INDEXED RETURNS

| | | Base Period | | | Years Ending | |

| | | Dec-02 | | | Dec-03 | | | Dec-04 | | | Dec-05 | | | Dec-06 | | | Dec-07 | |

| AIR METHODS CORPORATION | | | 100.00 | | | | 157.52 | | | | 150.85 | | | | 303.46 | | | | 489.74 | | | | 871.25 | |

| S & P 500 | | | 100.00 | | | | 128.68 | | | | 142.69 | | | | 149.70 | | | | 173.34 | | | | 182.87 | |

| PEER GROUP | | | 100.00 | | | | 109.67 | | | | 135.21 | | | | 139.67 | | | | 178.84 | | | | 278.39 | |

The following tables present selected consolidated financial information of the Company and our subsidiaries which has been derived from our audited consolidated financial statements. This selected financial data should be read in conjunction with our consolidated financial statements and notes thereto appearing in Item 8 of this report. Revenue, expenses, and total assets as of and for the year ended December 31, 2007, increased in part as a result of the acquisition of CJ in October 2007. See “Business – General” in Item 1 of this report. Revenue for all years has been adjusted to reflect the presentation of revenue exclusive of uncompensated care, as discussed in Note 2 to the consolidated financial statements.

| SELECTED FINANCIAL DATA OF THE COMPANY | |

| (Amounts in thousands except share and per share amounts) | |

| | | | |

| | | | |

| | | Year Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Statement of Operations Data: | | | | | | | | | | | | | | | |

| Revenue | | $ | 396,349 | | | | 319,504 | | | | 276,178 | | | | 230,211 | | | | 209,936 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating expenses | | | (293,424 | ) | | | (244,227 | ) | | | (211,072 | ) | | | (184,458 | ) | | | (169,164 | ) |

| General and administrative expenses | | | (53,298 | ) | | | (40,710 | ) | | | (36,971 | ) | | | (33,691 | ) | | | (25,209 | ) |

| Other expense, net | | | (4,179 | ) | | | (4,223 | ) | | | (8,110 | ) | | | (6,698 | ) | | | (7,197 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Income before income taxes | | | 45,448 | | | | 30,344 | | | | 20,025 | | | | 5,364 | | | | 8,366 | |

| Income tax expense | | | (17,911 | ) | | | (13,144 | ) | | | (8,193 | ) | | | (2,121 | ) | | | (3,263 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Income before cumulative effect of change in accounting principle | | | 27,537 | | | | 17,200 | | | | 11,832 | | | | 3,243 | | | | 5,103 | |

| Cumulative effect of change in method of accounting for maintenance costs, net of income taxes | | | - | | | | - | | | | - | | | | 8,595 | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 27,537 | | | | 17,200 | | | | 11,832 | | | | 11,838 | | | | 5,103 | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic income per common share: | | | | | | | | | | | | | | | | | | | | |

| Income before cumulative effect of change in accounting principle | | $ | 2.30 | | | | 1.46 | | | | 1.07 | | | | .30 | | | | .53 | |

| Cumulative effect of change in method of accounting for maintenance costs, net of income taxes | | | - | | | | - | | | | - | | | | .79 | | | | - | |

| Net income | | $ | 2.30 | | | | 1.46 | | | | 1.07 | | | | 1.09 | | | | .53 | |

| | | | | | | | | | | | | | | | | | | | | |

| Diluted income per common share: | | | | | | | | | | | | | | | | | | | | |

| Income before cumulative effect of change in accounting principle | | $ | 2.20 | | | | 1.40 | | | | 1.02 | | | | .29 | | | | .51 | |

| Cumulative effect of change in method of accounting for maintenance costs, net of income taxes | | | - | | | | - | | | | - | | | | .76 | | | | - | |

| Net income | | $ | 2.20 | | | | 1.40 | | | | 1.02 | | | | 1.05 | | | | .51 | |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average number of shares of Common Stock outstanding - basic | | | 11,953,871 | | | | 11,748,107 | | | | 11,058,971 | | | | 10,894,863 | | | | 9,665,278 | |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average number of shares of Common Stock outstanding - diluted | | | 12,512,077 | | | | 12,306,047 | | | | 11,654,885 | | | | 11,314,827 | | | | 10,052,989 | |

SELECTED FINANCIAL DATA OF THE COMPANY

(Amounts in thousands)

| | | As of December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Balance Sheet Data: | | | | | | | | | | | | | | | |

| Total assets | | $ | 369,552 | | | | 250,157 | | | | 221,532 | | | | 204,723 | | | | 215,649 | |

| Long-term liabilities | | | 125,433 | | | | 95,014 | | | | 89,649 | | | | 89,490 | | | | 114,657 | |

| Stockholders' equity | | | 142,020 | | | | 107,314 | | | | 86,211 | | | | 73,079 | | | | 60,688 | |

SELECTED OPERATING DATA

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| For year ended December 31: | | | | | | | | | | | | | | | |

| CBS patient transports | | | 39,256 | (1) | | | 34,116 | | | | 31,841 | | | | 30,159 | | | | 25,676 | |

| HBS medical missions | | | 59,658 | (1) | | | 50,670 | | | | 49,644 | | | | 46,630 | | | | 46,570 | |

| As of December 31: | | | | | | | | | | | | | | | | | | | | |

| CBS bases | | | 106 | | | | 76 | | | | 69 | | | | 64 | | | | 59 | |

| HBS bases | | | 157 | | | | 90 | | | | 87 | | | | 86 | | | | 78 | |

| | | | | | | | | | | | | | | | | | | | | |

(1) Includes transports and missions for CJ locations from October 1, 2007 through December 31, 2007, only. | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion of the results of operations and financial condition should be read in conjunction with our consolidated financial statements and notes thereto included in Item 8 of this report. This report, including the information incorporated by reference, contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. The use of any of the words “believe,” “expect,” “anticipate,” “plan,” “estimate,” and similar expressions are intended to identify such statements. Forward-looking statements include statements concerning our possible or assumed future results; successful integration of CJ; flight volume and collection rates for CBS operations; size, structure and growth of our air medical services and products markets; continuation and/or renewal of HBS contracts; acquisition of new and profitable Products Division contracts; and other matters. The actual results that we achieve may differ materially from those discussed in such forward-looking statements due to the risks and uncertainties described in the Risk Factors section of this report, in Management’s Discussion and Analysis of Financial Condition and Results of Operations, and in other sections of this report, as well as in our quarterly reports on Form 10-Q. We undertake no obligation to update any forward-looking statements.

Overview

We provide air medical transportation services throughout the United States and design, manufacture, and install medical aircraft interiors and other aerospace and medical transport products. Our divisions, or business segments, are organized according to the type of service or product provided and consist of the following:

| · | Community-Based Services (CBS) - provides air medical transportation services to the general population as an independent service. Revenue consists of flight fees billed directly to patients, their insurers, or governmental agencies, and cash flow is dependent upon collection from these individuals or entities. In 2007 the CBS Division generated 64% of our total revenue, compared to 65% in 2006 and 61% in 2005. |

| · | Hospital-Based Services (HBS) - provides air medical transportation services to hospitals throughout the U.S. under exclusive operating agreements. Revenue consists primarily of fixed monthly fees (approximately 65% of total contract revenue) and hourly flight fees (approximately 35% of total contract revenue) billed to hospital customers. In 2007 the HBS Division generated 33% of our total revenue, compared to 34% in 2006 and 36% in 2005. |

| · | Products Division - designs, manufactures, and installs aircraft medical interiors and other aerospace and medical transport products for domestic and international customers. In 2007 the Products Division generated 3% of our total revenue, compared to 1% in 2006 and 3% in 2005. |

See Note 13 to the consolidated financial statements included in Item 8 of this report for operating results by segment.

We believe that the following factors have the greatest impact on our results of operations and financial condition:

| · | Flight volume. Fluctuations in flight volume have a greater impact on CBS operations than HBS operations because almost all of CBS revenue is derived from flight fees, as compared to approximately 35% of HBS revenue. By contrast, 76% of our costs primarily associated with flight operations (including salaries, aircraft ownership costs, hull insurance, and general and administrative expenses) incurred during the year ended December 31, 2007, are mainly fixed in nature. While flight volume is affected by many factors, including competition and the effectiveness of marketing and business development initiatives, the greatest single variable has historically been weather conditions. Adverse weather conditions—such as fog, high winds, or heavy precipitation—hamper our ability to operate our aircraft safely and, therefore, result in reduced flight volume. Total patient transports for CBS operations were approximately 39,300 for 2007 compared to approximately 34,100 for 2006. Same-Base Transports for CBS operations were approximately 32,200 in 2007 compared to 33,300 in 2006. The decrease in Same-Base Transports has been partially attributed to shifting of transports to newly-opened bases in adjacent locations. |

| · | Reimbursement per transport. We respond to calls for air medical transports without pre-screening the creditworthiness of the patient and are subject to collection risk on services provided to insured and uninsured patients. Medicare and Medicaid also receive contractual discounts from our standard charges for flight services. Flight revenue is recorded net of provisions for contractual discounts and estimated uncompensated care. Both provisions are estimated during the period the related services are performed based on historical collection experience and any known trends or changes in reimbursement rate schedules and payer mix. The provisions are adjusted as required based on actual collections in subsequent periods. Net reimbursement per transport for CBS operations is primarily a function of price, payer mix, and timely and effective collection efforts. Both the pace of collections and the ultimate collection rate are affected by the overall health of the U.S. economy, which impacts the number of indigent patients and funding for state-run programs, such as Medicaid. Medicaid reimbursement rates in many jurisdictions have remained well below the cost of providing air medical transportation. In addition, the collection rate is impacted by changes in the cost of healthcare and health insurance; as the cost of healthcare increases, health insurance coverage provided by employers may be reduced or eliminated entirely, resulting in an increase in the uninsured population. The average gross charge per transport increased 12.5% in the year ended December 31, 2007, compared to 2006, contributing to an increase of 7.1% in net reimbursement per transport in the year ended December 31, 2007, compared to the year ended December 31, 2006. Provisions for contractual discounts and estimated uncompensated care as a percentage of related gross billings for CBS operations are as follows: |

| | | For years ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | |

| Gross billings | | | 100 | % | | | 100 | % | | | 100 | % |

| Provision for contractual discounts | | | 32 | % | | | 29 | % | | | 26 | % |

| Provision for uncompensated care | | | 19 | % | | | 20 | % | | | 19 | % |

The increase in the total percentage of uncollectible accounts is primarily attributable to price increases. Although price increases generally increase the net reimbursement per transport from insurance payers, the amount per transport collectible from private patient payers and Medicare and Medicaid does not increase proportionately with price increases. Therefore, depending upon overall payer mix, price increases will usually result in an increase in the percentage of uncollectible accounts. Although we have not yet experienced significant increased limitations in the amount reimbursed by insurance companies, continued price increases may cause insurance companies to limit coverage for air medical transport to amounts less than our standard rates.

| · | Aircraft maintenance. Both CBS and HBS operations are directly affected by fluctuations in aircraft maintenance costs. Proper operation of the aircraft by flight crews and standardized maintenance practices can help to contain maintenance costs. Increases in spare parts prices from original equipment manufacturers (OEM’s) tend to be higher for aircraft which are no longer in production. Five models of aircraft within our fleet, representing 31% of the rotor wing fleet, are no longer in production and are, therefore, susceptible to price increases which outpace general inflationary trends. In addition, on-condition components are more likely to require replacement with age. Since January 1, 2006, we have taken delivery of 48 new aircraft and have the option to purchase 34 additional aircraft through the end of 2008. We plan to replace discontinued models and other older aircraft with the new aircraft expected to be delivered under these options, as well as to provide capacity for base expansion. Replacement models of aircraft typically have higher ownership costs than the models targeted for replacement but lower maintenance costs. Total maintenance expense for CBS and HBS operations increased 3.3% from 2006 to 2007, while total flight volume for CBS and HBS operations increased 14.8% over the same period. During the year ended December 31, 2007, we incurred costs on fewer significant maintenance events related to older models of aircraft than during 2006. Maintenance cost per hour on newer aircraft has remained relatively constant on an annual basis. Maintenance cost per hour on older models of aircraft, however, may vary more widely on a quarterly basis depending on component overhaul and replacement and aircraft refurbishment cycles. |

| · | Aircraft availability. The recent high rate of growth in the air medical transportation and other helicopter services industries has generated strong demand for new models of helicopters. Quality used aircraft are also in short supply worldwide. We have endeavored to mitigate the shortage of suitable aircraft primarily through long-term arrangements with a single aircraft manufacturer which provides us options to purchase up to ten aircraft each year for the next several years. We also have a purchase commitment with another manufacturer for fifteen aircraft, with deliveries scheduled to begin in late 2008 or 2009, as well as options for an additional fifteen aircraft in future years. |

| · | Competitive pressures from low-cost providers. We are recognized within the industry for our standard of service and our use of cabin-class aircraft. Many of our competitors utilize aircraft with lower ownership and operating costs and do not require a similar level of experience for aviation and medical personnel. Reimbursement rates established by Medicare, Medicaid, and most insurance providers are not contingent upon the type of aircraft used or the experience of personnel. However, we believe that higher quality standards help to differentiate our service from competitors and, therefore, lead to higher utilization. Deploying multiple aircraft in a market also serves as a barrier to entry for lower cost providers. |

| · | Employee recruitment and relations. The ability to deliver quality services is partially dependent upon our ability to hire and retain employees who have advanced aviation, nursing, and other technical skills. In addition, hospital contracts typically contain minimum certification requirements for pilots and mechanics. Employees who meet these standards are in great demand and are likely to remain a limited resource in the foreseeable future. In September 2003, our pilots voted to be represented by a collective bargaining unit, and we signed a collective bargaining agreement (CBA) on March 31, 2006. The agreement is effective January 1, 2006, through April 30, 2009. Other employee groups may also elect to be represented by unions in the future. |

Results of Operations

Year ended December 31, 2007 compared to 2006

We reported net income of $27,537,000 for the year ended December 31, 2007, compared to $17,200,000 for the year ended December 31, 2006. Net income for the year ended December 31, 2007, included a pre-tax loss on early extinguishment of debt of $757,000 (with a tax effect of approximately $310,000). Net income for the year ended December 31, 2006, included a litigation settlement of $1,417,000 (with a tax effect of approximately $581,000).

Flight Operations – Community-based Services and Hospital-based Services

Net flight revenue increased $72,498,000, or 23.1%, from $313,879,000 for the year ended December 31, 2006, to $386,377,000 for the year ended December 31, 2007. Flight revenue is generated by both CBS and HBS operations and is recorded net of provisions for contractual discounts and uncompensated care.

| · | CBS – Net flight revenue increased $48,085,000, or 23.3%, to $254,871,000 for the following reasons: |

| | Net revenue of $11,052,000 from CJ’s CBS operations from the acquisition date through December 31, 2007. |

| | Increase of 12.5% in average gross charge per transport for the year ended December 31, 2007, compared to 2006. Net reimbursement per transport increased approximately 7.1% over the same period. |

| | Incremental net revenue of $30,066,000 generated from the addition of 23 new CBS bases during either 2007 or 2006, and $992,000 pursuant to a contract to support FEMA in disaster recovery efforts. During the third quarter of 2007, we mobilized thirteen aircraft to respond to the threat posed by Hurricane Dean in Texas. |

| | Closure of one base during the fourth quarter of 2006, the conversion of another base to HBS operations during the first quarter of 2007, and the expiration in June 2007 of our contract with the State of Mississippi to provide air medical transportation services in Gulfport, Mississippi, resulting in a decrease in net revenue of approximately $5,068,000. |

| | Decrease of approximately 3.1% in Same Base Transports in 2007 compared to 2006. The decrease in Same-Base Transports has been partially attributed to shifting of transports to newly-opened bases in adjacent locations. |

| · | HBS – Net flight revenue increased $24,413,000, or 22.8%, to $131,506,000 for the following reasons: |

| | Net revenue of $19,286,000 from CJ’s HBS operations from the acquisition date through December 31, 2007. |

| | Incremental net revenue of $6,292,000 generated from the addition of four new contracts, the expansion of three contracts, and the conversion of one CBS location to HBS operations during either 2007 or 2006. |

| | Cessation of service under three contracts and the conversion of two contracts to CBS operations during either 2007 or 2006, resulting in a decrease in net revenue of approximately $4,844,000. |

| | Annual price increases in the majority of contracts based on changes in the Consumer Price Index or spare parts prices from aircraft manufacturers and the renewal of contracts at higher rates. |

| | Flight volume for all contracts—excluding CJ and other new contracts, contract expansions, and the discontinued contracts discussed above—remained relatively unchanged. |

Flight center costs (consisting primarily of pilot, mechanic, and medical staff salaries and benefits) increased $29,938,000, or 22.4%, to $163,734,000 for the year ended December 31, 2007, compared to 2006. Changes by business segment were as follows:

| · | CBS – Flight center costs increased $17,745,000, or 20.4%, to $104,887,000 for the following reasons: |

| | Flight center costs of approximately $5,287,000 related to CJ’s CBS operations from the acquisition date through December 31, 2007. |

| | Increase of $13,628,000 for the addition of personnel and facilities to staff new base locations and contracts described above. |

| | Decrease of $1,980,000 due to the closure of base locations described above. |

| | Increases in salaries for merit pay raises. |

| · | HBS - Flight center costs increased $12,193,000, or 26.1%, to $58,847,000 primarily due to the following: |

| | Flight center costs of approximately $8,065,000 related to CJ’s HBS operations from the acquisition date through December 31, 2007. |

| | Increase of approximately $2,737,000 for the addition of personnel to staff new base locations described above. |

| | Decrease of approximately $1,711,000 due to the base closures described above. |

| | Increases in salaries for merit pay raises. |

Aircraft operating expenses increased $5,342,000, or 7.1%, for the year ended December 31, 2007, in comparison to 2006. Aircraft operating expenses consist of fuel, insurance, and maintenance costs and generally are a function of the size of the fleet, the type of aircraft flown, and the number of hours flown. The increase in costs is due to the following:

| · | Aircraft operating expenses of $7,310,000 related to CJ’s operations from the acquisition date through December 31, 2007. |

| · | Decrease of 8.4% in the cost of aircraft maintenance, excluding the effect of CJ aircraft and other new aircraft added to the fleet during the year. Annual price increases in the cost of spare parts and overhauls were offset in part by our ability to use exchange components rather than new parts in certain instances and by increased life-cycle intervals approved on certain life-limited components. Since the first quarter of 2006, we have placed 45 new helicopters into service and eliminated seventeen aircraft which were older models. Maintenance cost per hour on newer aircraft tend to remain relatively constant on an annual basis. Maintenance cost per hour on older models of aircraft, however, may vary more widely on a quarterly basis depending on component overhaul and replacement and aircraft refurbishment cycles. During 2007 we incurred costs on fewer significant maintenance events related to older models of aircraft than during 2006. |

| · | Changes in flight volume for bases open longer than one year for both CBS and HBS as described above. |

| · | Increase of approximately 17.6% in the cost of aircraft fuel per hour flown. Total fuel costs were $12,218,000 for the year ended December 31, 2007, compared to $9,461,000 for the year ended December 31, 2006. |

| · | Decrease in hull insurance rates effective July 2007 and 2006. |

Aircraft rental expense increased $6,924,000, or 32.1%, for the year ended December 31, 2007, in comparison to the year ended December 31, 2006. Expense for 76 CJ aircraft under operating leases totaled approximately $3,370,000 from the acquisition date through December 31, 2007. Incremental rental expense incurred in 2007 for 32 other leased aircraft added to our fleet during either 2007 or 2006 totaled $5,641,000. The increase for new aircraft was offset in part by selling two aircraft and refinancing thirteen at lower lease rates or through debt financing.

Medical Interiors and Products

Sales of medical interiors and products increased $4,347,000, or 77.3%, from $5,625,000 for the year ended December 31, 2006, to $9,972,000 for the year ended December 31, 2007. In 2007, we completed production of 27 MEV litter systems and seven modular medical interior kits for commercial customers. As of December 31, 2007, two design contracts with the U.S. Army and contracts for ten HH-60L units, fifty MEV units, and three commercial medical interiors were in process. Revenue by product line for the year ended December 31, 2007, was as follows:

| · | $3,044,000 - multi-mission interiors |

| · | $4,196,000 - modular medical interiors |

| · | $2,732,000 - other aerospace and medical transport products |

In 2006, we completed production of 21 MEV litter systems and eleven modular, medical interior kits for commercial customers. We also continued work on eleven HH-60L units. In the fourth quarter, we began production of 27 additional MEV units. Revenue by product line for the year ended December 31, 2006, was as follows:

| · | $2,291,000 - multi-mission interiors |

| · | $2,538,000 - modular medical interiors |

| · | $434,000 - other aerospace and medical transport products |

Cost of medical interiors and products increased $4,484,000, or 165.7%, for the year ended December 31, 2007, as compared to the previous year, due in part to the change in sales volume. The average net margin earned on projects during 2007 was 17.3% compared to 40.0% in 2006, reflecting increases in the cost of raw materials used to manufacture our aircraft interior systems and the change in product mix. Margins earned on multi-mission interiors are generally higher than margins earned on medical interiors for commercial customers. In addition, aircraft interiors completed for commercial customers during 2007 included some new types of aircraft in which we had not previously installed our modular interior, leading to higher engineering and documentation costs and lower profit margins. In order to meet schedule requirements for both the external contracts described above and the significant number of aircraft interiors manufactured and installed in our own fleet during 2007, the Products Division relied more heavily on outside contractors to supplement in-house labor than was necessary in the prior year.

General Expenses

Depreciation and amortization expense increased $1,508,000, or 11.7%, for the year ended December 31, 2007. Depreciation on assets acquired in the CJ transaction totaled approximately $792,000 from the acquisition date through December 31, 2007. The remainder of the increase is primarily the result of placing three aircraft totaling $6,013,000 into service and the purchase of new rotable equipment and aircraft interiors.

General and administrative (G&A) expenses increased $12,588,000, or 30.9%, for the year ended December 31, 2007, compared to the year ended December 31, 2006, reflecting the impact of the CJ acquisition and increases in compensation for merit pay raises. G&A expenses include executive management, accounting and finance, billing and collections, information services, human resources, aviation management, pilot training, dispatch and communications, and CBS program administration. We increased staffing for G&A departments over 9% in the fourth quarter to manage the expanded operations with the acquisition of CJ, and increased staffing in our Information Services department over the course of the year to support scheduled systems upgrades. Because of the additional program administration required for CBS operations, growth in CBS operations will generally necessitate more G&A support than growth in HBS operations. In addition, G&A expenses for the year ended December 31, 2007, included stock compensation expense of $1,746,000 related to the grant of stock options, compared to $373,000 of stock compensation expense in the year ended December 31, 2006. G&A expenses were 13.4% of revenue in 2007 compared to 12.7% of revenue in 2006.

Interest expense decreased $212,000, or 3.6%, for the year ended December 31, 2007, compared to 2006, primarily as a result of regularly scheduled payments of long-term debt and decreased borrowings against our line of credit. The average balance outstanding against the line was approximately $10.8 million during 2007, compared to $14.6 million during 2006. In addition, the weighted average interest rate paid on variable rate debt decreased approximately 40 basis points from 2006 to 2007. These decreases were offset in part by new notes and capital lease obligations of $29,925,000, primarily related to the CJ acquisition, originated during 2007 with a weighted average interest rate of 7.4%.

Income tax expense was $17,911,000, or 39.4% of income before taxes, in 2007 and $13,144,000, or 43.3% of income before taxes, in 2006. In 2007 we changed certain elections related to fixed asset tax depreciation methods applied in prior years and filed amended returns for those periods. The changes resulted in the recovery of approximately $5.8 million of net operating loss carryforwards which had previously expired unused and in a decrease of $1,052,000 in deferred income tax expense for the year ended December 31, 2007. Excluding the effect of these changes, the effective tax rate for 2007 was 41.7%. For years prior to 2006, our income tax expense was determined using a federal statutory rate of 34% because we believed that our deferred tax assets and liabilities would be recovered or settled at that rate. Due to an increase in projected taxable income for the year ended December 31, 2006, and for future years, we revised our estimated tax rate to 35% in 2006. Deferred income tax expense of $525,000 was recognized for the year ended December 31, 2006, as a result of applying the new estimated rate to deferred tax assets and liabilities. The effective tax rate for 2006, excluding the effect of applying the new estimated rate against deferred tax balances, was 41.6%.

Year ended December 31, 2006 compared to 2005

We reported net income of $17,200,000 for the year ended December 31, 2006, compared to $11,832,000 for the year ended December 31, 2005. Net income for the year ended December 31, 2005, included a loss on early extinguishment of debt of $3,104,000 (with a tax effect of approximately $1,211,000).

Operating income was $34,567,000 for the year ended December 31, 2006, compared to $28,135,000 for the year ended December 31, 2005. Net reimbursement for CBS operations improved 13.9% for 2006 compared to the prior year, while Same-Base Transports for CBS operations increased approximately 2%. Improvement in net reimbursement during 2006 was offset in part by increases in the cost of aircraft maintenance and in salaries and benefits, primarily as a result of the implementation of the CBA.

Flight Operations – Community-based Services and Hospital-based Services

Net flight revenue increased $45,630,000, or 17.0%, from $268,249,000 for the year ended December 31, 2005, to $313,879,000 for the year ended December 31, 2006.

| · | CBS – Net flight revenue increased $37,396,000, or 22.1%, to $206,786,000 for the following reasons: |

| | Average price increases totaling approximately 27.5% for all CBS operations since March 2005, including 6.5% in mid-June 2006. Net reimbursement per transport increased approximately 13.9% in 2006 compared to 2005. |

| | Incremental net revenue of $21,319,000 from the addition of fifteen new CBS bases during either 2006 or 2005, and from the provision of air medical transportation services in Gulfport, Mississippi, in the aftermath of Hurricane Katrina, pursuant to a contract with the State of Mississippi. |

| | Closure of five bases during either 2006 or 2005, resulting in a decrease in net revenue of $3,581,000. |

| | Increase of approximately 2.0% in Same Base Transports in 2006 compared to 2005. Cancellations due to unfavorable weather conditions did not change materially over the prior year. |

| · | HBS – Net flight revenue increased $8,234,000, or 8.3%, to $107,093,000 for the following reasons: |