UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under § 240.14a-12 |

AIR METHODS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| | o | Fee paid previously with preliminary materials. |

| | o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Air Methods Corporation

7211 South Peoria Street

Englewood, Colorado 80211

April 29, 2013

Dear Fellow Stockholders:

You are cordially invited to attend the 2013 Annual Meeting of Stockholders of Air Methods Corporation to be held on Thursday, May 30, 2013, at the Company’s corporate offices, 7211 South Peoria Street, in Englewood, Colorado 80112, at 1:30 p.m., Mountain Time.

At the Annual Meeting, we will ask you to elect our Class I directors, ratify the appointment of KPMG LLP as our independent registered public accountants and provide your advisory approval of our executive compensation. The attached proxy materials explain our voting procedures, describe the business we will conduct at the Annual Meeting and provide information about the Company that you should consider when you vote your shares. We hope that you will attend the meeting, but whether or not you are planning to attend, we encourage you to designate the proxies on the proxy card to vote your shares. Your vote is important to us.

2012 was another impressive year for Air Methods Corporation. Among other things, the Company returned $92 million to stockholders through a special dividend while achieving the highest earnings per share in the Company’s history of $2.39 (post-split) and growing revenue by 29% to $850.8 million. In 2012, the Company also focused on a number of strategic initiatives, including, among other things, an internal reorganization designed to increase operational efficiencies, execution of synergies associated with the Company’s 2011 purchase of Omniflight Helicopters, Inc., and the purchase of Sundance Helicopters, Inc., which will provide a pipeline and training environment for future air medical helicopter pilots.

One of the primary roles of the Company’s Board is to provide oversight of strategy development and delivery, while maintaining the highest standards of corporate governance. The Board has conducted its annual strategy review with the executive team, and believes that the executive team is focused on business initiatives that will deliver sustainable growth to you, our stockholders, in 2013 and beyond. We remain positive about the long-term future of our business.

This is a great company executing on consistent strategy with a strong executive team and excellent people. I look forward to sharing our 2013 successes with you next year at this time.

| | | Sincerely, |

| |  |

| | | C. David Kikumoto |

| | | Chairman of the Board of Directors |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Date and Time | Thursday, May 30, 2013 at 1:30 p.m., Mountain Time | |

| | | |

| Place | Corporate offices of Air Methods Corporation, 7211 South Peoria Street, Englewood, Colorado, 80211 | |

| | | |

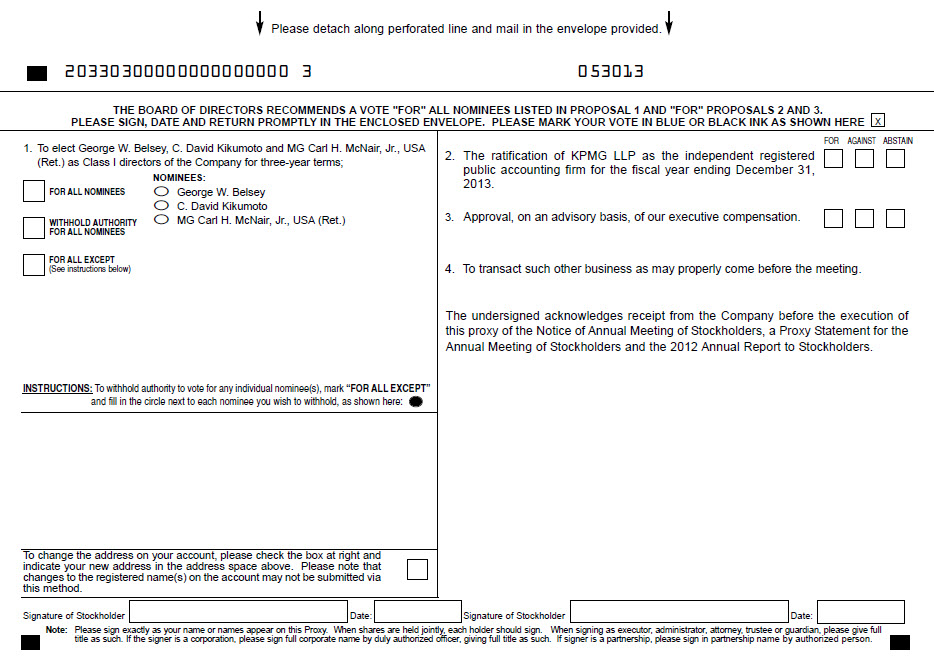

| Items of Business | Item One: To elect George W. Belsey, C. David Kikumoto and MG Carl H. McNair, Jr., USA (Ret.) as Class I directors of the Company for three-year terms. Item Two: To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013. Item Three: To approve, on an advisory basis, named executive officer compensation. | |

| | | |

| Record Date | Holders of record of our common stock as of the close of business on April 17, 2013 will be entitled to notice of, and to vote at, the Annual Meeting. A list of such stockholders will be available at the Company’s corporate office commencing Monday, May 20, 2013, for review by interested parties. The list will also be available at the Annual Meeting. | |

| | | |

| Meeting Admission | You are entitled to attend the Annual Meeting only if you were a Company stockholder at the close of business on April 17, 2013 or you hold a valid proxy to vote at the meeting. You should be prepared to present photo identification to be admitted to the meeting. If your shares are not registered in your name but are held in “street name” through a bank, broker or other nominee, you must provide proof of beneficial ownership at the record date. Proof of beneficial ownership could include items such as your most recent account statement prior to April 17, 2013, a copy of the voting instruction card provided by your nominee, or other similar evidence of share ownership. | |

| | | |

| Voting By Proxy | Your vote is very important. Whether or not you plan to attend the Annual Meeting in person, please promptly vote by telephone or over the Internet, or by completing, signing, dating and returning your proxy card or voting instructions so that your shares will be represented at the Annual Meeting. | |

| | BY ORDER OF THE BOARD OF DIRECTORS, |

| | |  |

| | | Crystal L. Gordon |

| | | Senior Vice President, General Counsel & Secretary |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON MAY 30, 2013: This notice, the accompanying proxy statement and the Company’s Annual Report to stockholders for the fiscal year ended December 31, 2012 are available on our website www.airmethods.com under the “Investors” tab.

2013 PROXY STATEMENT AT A GLANCE

This summary highlights information contained elsewhere in these proxy materials, but does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Meeting Information

Date and Time: May 30, 2013, 1:30 p.m., Mountain Time | Place: 7211 South Peoria Street, Englewood, Colorado 80211 |

Record Date: April 17, 2013 | Voting: Stockholders of record as of April 17, 2013 are entitled to vote by telephone or over the Internet, or by completing, signing, dating and returning your proxy card or voting instructions. |

Voting Matters and Board Recommendations

| Proposals | Board’s Recommendation | Page |

| To elect George W. Belsey, C. David Kikumoto and MG Carl H. McNair, Jr., USA (Ret.) as Class I directors of the Company for three-year terms. | FOR all Director Nominees | 4 |

| To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013. | FOR | 48 |

| To approve, on an advisory basis, named executive officer compensation. | FOR | 51 |

2012 Performance Highlights

Financial Highlights

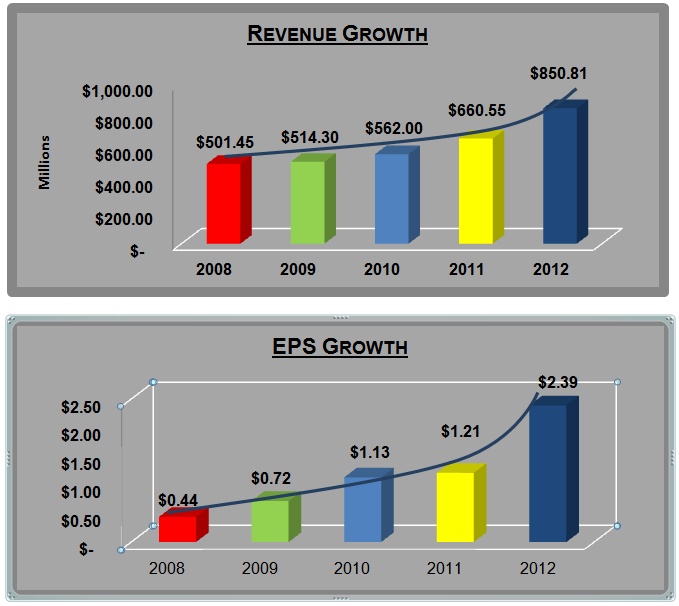

In 2012, Air Methods Corporation (“Air Methods” or the “Company”) surpassed its impressive performance in 2011. Highlights from 2012 include, among other things:

| | · | Revenue increased by 29% to $850.8 million compared to $660.50 million in 2011. |

| | · | Earnings per diluted share were $2.39 (post-stock split), the highest in the Company’s history. |

| | · | Net patient transport revenue increased 42% to $590.7 million from $416.3 million. |

| | · | As shown below, the Company has delivered increases in revenue and earnings per share during the last five years, with the largest increases in both financial metrics occurring in 2012. |

Creating Shareowner Value; Outperforming Market and Peers

| | · | Dividends - The Company shared its 2012 success with its stockholders through the issuance of a special cash dividend of $7.00 per share in December 2012. In 2012, the Company also successfully completed a 3-for-1 stock split. |

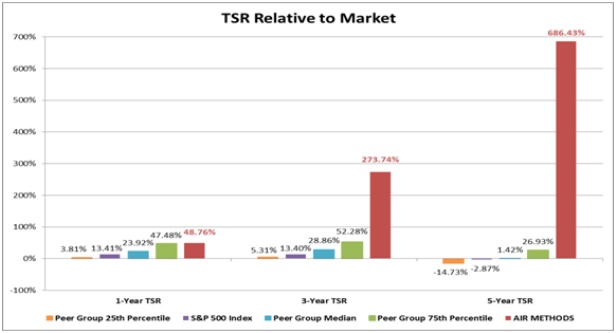

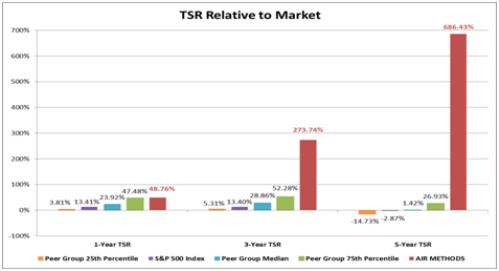

| | · | Total Shareholder Return – The Company has continued to outperform the market and its compensation peer group as evidenced by the graph below, which displays the Company’s cumulative total shareholder return relative to the S&P 500 Index and the Company’s Compensation Peer Group for the one, three and five-year periods ended December 31, 2012. |

Proposals to be Voted on by Stockholders

Proposal One: Election of Directors (pages 4-5)

Each director nominee receiving the highest number of votes cast (plurality) at the Annual Meeting will be elected for a term of three (3) years. The nominating and corporate governance committee of the Board of Directors has evaluated each individual director nominee listed below and confirmed that he has the skills, education, experience and qualifications required to help further the success of the Company’s business and represent stockholder interests.

Name | Age | Director Since | Committee Membership |

| George W. Belsey | 73 | 1994 | Chairman of the Health Care Affairs Committee, a subcommittee of the Finance & Strategic Planning Committee (Independent) |

| C. David Kikumoto | 63 | 2004 | None. Chairman of the Board (Not Independent) |

MG Carl H. McNair, Jr., USA (Ret.) | 79 | 1996 | Chairman of the Audit Committee (Independent) |

Attendance – Messrs. Kikumoto and McNair attended all of the Board and applicable committee meetings, while Mr. Belsey attended 80% of the Board meetings.

Key Qualifications of Each Nominee – Senior leadership experience, health care experience, regulated industries/government experience and financial experience (See pages 6-7 for additional details)

Proposal Two: Ratification of KPMG LLP as Independent Auditors (page 48)

The Board of Directors recommends a vote FOR the approval of the appointment of KPMG LLP (“KPMG”) as the Company’s independent accountants for the 2013 fiscal year.

Type of Fees | | 2012 | | | 2011 | |

| Audit Fees | | $ | 841,000 | | | $ | 775,000 | |

| Audit-Related Fees | | $ | 5,500 | | | $ | 300,000 | |

| Tax Fees | | | --- | | | | --- | |

| All Other Fees | | $ | 97,251 | | | | --- | |

| Total | | $ | 943,751 | | | $ | 1,075,000 | |

Proposal Three: Advisory Vote to Approve Executive Compensation

We are requesting that stockholders approve, on an advisory basis, the compensation for the named executive officers as disclosed in this proxy statement. The Board recommends a vote FOR this Proposal No. 3 because it believes that the executive compensation programs established for the named executive officers and the compensation amounts paid thereunder align with the interests of stockholders. This advisory proposal was supported by approximately 89% and 91% of the votes cast in each of 2012 and 2011, respectively. Please see the Compensation Discussion and Analysis, Summary Compensation Table and other tables and disclosures beginning on page 37 of this proxy statement for a full discussion of our executive compensation program.

2012 Compensation Decisions

The table below highlights the 2012 total annual direct compensation actions for each of the named executive officers. As noted above under 2012 Performance Highlights, the 2012 compensation aligns with the Company’s strong performance (see pages 17-35 for additional detail). This table does not include all of the information included in the Summary Compensation Table.

Named Executive Officer | | Base Salary Earnings1 | | | 2012 Annual Cash Incentive Compensation | | | Equity Awards2 | | | 2012 Total Annual Direct Compensation | |

| Aaron D. Todd, Chief Executive Officer | | $ | 521,655 | | | $ | 720,000 | | | $ | 264,000 | | | $ | 1,505,655 | |

| Michael D. Allen, President, Domestic Air Medical Services | | $ | 348,005 | | | $ | 354,600 | | | | --- | | | $ | 702,605 | |

| Trent J. Carman, Chief Financial Officer | | $ | 314,569 | | | $ | 330,000 | | | $ | 176,000 | | | $ | 820,569 | |

| Crystal L. Gordon, SVP, General Counsel and Secretary | | $ | 205,000 | | | $ | 240,000 | | | $ | 448,770 | | | $ | 893,770 | |

| Sharon J. Keck, Chief Accounting Officer | | $ | 224,724 | | | $ | 202,500 | | | $ | 527,975 | | | $ | 955,199 | |

| | 1. | As discussed in the Compensation Discussion & Analysis, the Company’s compensation and stock option committee raised the salaries of each of the named executive officers on July 1, 2013. Accordingly, the base salary earnings reflect the amounts earned in 2012, but not the actual 2012 base salary for each named executive officer. |

| | 2. | The 2012 equity grants consisted solely of stock, which is valued at the closing price of the common stock on the date of grant. |

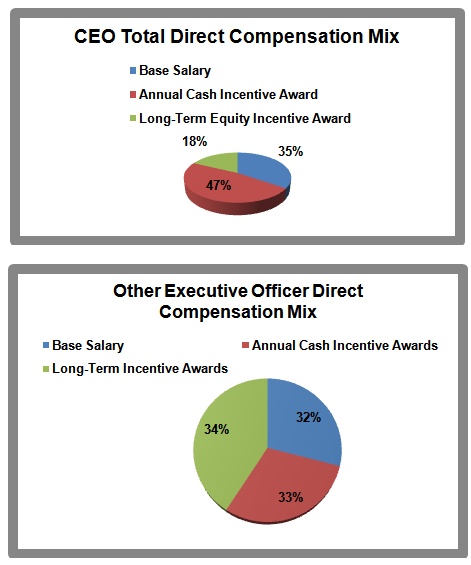

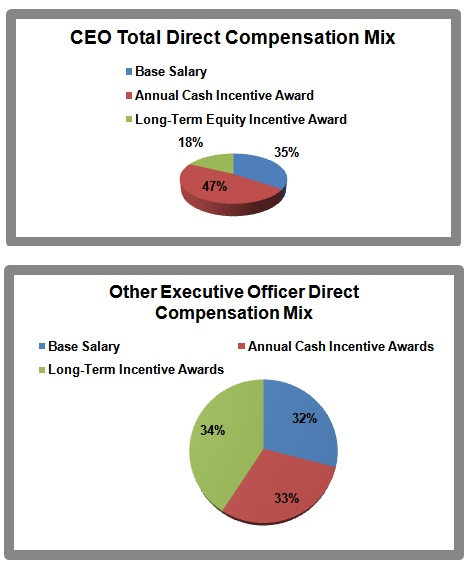

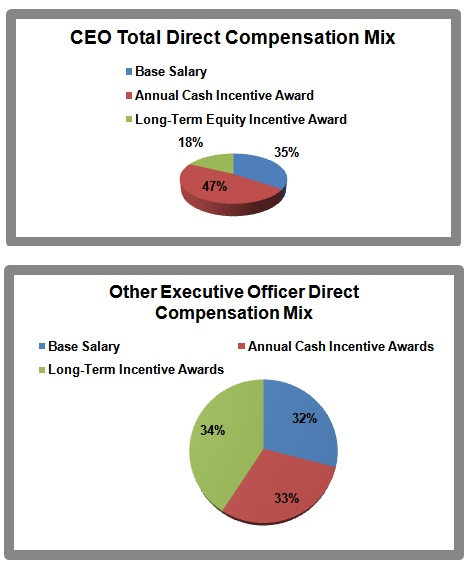

Alignment of Pay with Performance

To align pay levels for named executive officers with the Company’s performance, our pay mix places the greatest emphasis on performance-based incentives. Approximately 65% of our CEO’s total direct compensation and approximately 67% of the average total direct compensation of our other named executive officers was performance-based in 2012. Note that the long-term equity incentive award amounts utilized in the foregoing calculations do not include the potential amounts payable under the 2011-2014 Bonus Plan and the 2012-2014 Bonus Plan, as the performance period under such plans does not end until June 30, 2014, and therefore such payment amounts remain at risk (see page [ ] of the Compensation Discussion & Analysis for additional details regarding the 2011-2014 Bonus Plan and the 2012-2014 Bonus Plan).

| 1 |

| | |

| 4 |

| | |

| 4 |

| | |

| | | 4 |

| | | |

| | | 5 |

| | | |

| | | 5 |

| | | |

| 5 |

| | |

| 10 |

| | |

| | | 10 |

| | | |

| | | 11 |

| | | |

| | | 11 |

| | | |

| | | 11 |

| | | |

| | | 12 |

| | | |

| | | 12 |

| | | |

| | | 12 |

| | | |

| | | 12 |

| | | |

| | | 12 |

| | | |

| | | 13 |

| | | |

| | | 13 |

| | | |

| | | 14 |

| | | |

| | | 15 |

| | | |

| | | 15 |

| | | |

| | | 16 |

| | | |

| | | 16 |

| | | |

| | | 16 |

| | | |

| | | 16 |

| | | |

| | | 16 |

| | | |

| 16 |

| | |

| 17 |

| | |

| 17 |

| | |

| 36 |

| | |

| 42 |

| | |

| 44 |

| 45 |

| | |

| 48 |

| | |

| | | 48 |

| | | |

| | | 49 |

| | | |

| | | 49 |

| | | |

| | | 49 |

| | | |

| | | 49 |

| | | |

| 51 |

| | |

| | | 51 |

| | | |

| | | 51 |

| | | |

| 51 |

| | |

| 51 |

| | |

| 52 |

AIR METHODS CORPORATION

7211 South Peoria Street

Englewood, CO 80112

(303) 792-7400

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 30, 2013

The Board of Directors of Air Methods Corporation, a Delaware corporation (the “Company”), is soliciting the enclosed proxy for use at our Annual Meeting to be held on Thursday, May 30, 2013, beginning at 1:30 p.m., Mountain Time, at our corporate headquarters, located at 7211 South Peoria Street, in Englewood, Colorado 80112, and at any time and date to which the Annual Meeting may be properly adjourned or postponed. This proxy statement and the accompanying Notice of Annual Meeting of Stockholders describe the purpose of the Annual Meeting. Distribution of these proxy solicitation materials is scheduled to begin on or about April 29, 2013. The proxy statement, the Company’s Annual Report to stockholders for the fiscal year ended December 31, 2012 and proxy card are also available on our website www.airmethods.com under the “Investors” tab.

Why am I receiving this proxy statement and proxy card?

You have received these proxy materials because our Board of Directors is soliciting your proxy to vote your shares on the proposals described below at the Annual Meeting. This proxy statement describes issues on which we would like you to vote on at our Annual Meeting. It also provides you with information on these issues so that you may make an informed decision on the proposals to be voted on at the Annual Meeting.

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will vote on the following three items of business:

| | 1) | To elect George W. Belsey, C. David Kikumoto and MG Carl H. McNair, Jr. US (Ret.) as Class I directors of the Company for three-year terms. |

| | 2) | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013. |

| | 3) | To approve, on an advisory basis, named executive officer compensation. |

You will also vote on such other matters as may properly come before the meeting or any postponement or adjournment thereof.

What are the recommendations of the Board of Directors?

Our Board of Directors recommends that you vote:

| | · | “FOR” the election of each of the three (3) nominated directors (see Proposal 1). |

| | · | “FOR” the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013 (see Proposal 2). |

| | · | “FOR” the approval of the advisory vote on executive compensation (see Proposal 3). |

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

What shares are entitled to vote?

As of April 17, 2013, the record date for the Annual Meeting, we had 38,879,886 shares of common stock outstanding. Each share of our common stock outstanding on the record date is entitled to one vote on each item being voted on at the Annual Meeting. You can vote all of the shares that you owned on the record date. These shares include: (1) shares held directly in your name as the stockholder of record, and (2) shares held for you as the beneficial owner through a broker, bank or other nominee.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most stockholders hold their shares through a broker, bank or other holder of record rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered, with respect to those shares, the stockholder of record, and we are sending these proxy materials directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to the named proxy holder or to vote in person at the Annual Meeting. We have enclosed a proxy card for you to use.

Beneficial Owner. If your shares are held in a brokerage account, by a bank, or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you from that holder together with a voting instruction card. As the beneficial owner, you have the right to direct your broker, bank or other nominee how to vote and are also invited to attend the Annual Meeting.

Since a beneficial owner is not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, bank or other nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting. Your broker, bank or other nominee has enclosed or provided voting instructions for you to use in directing the broker, bank or other nominee how to vote your shares.

Who may attend the Annual Meeting?

All stockholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting. If you are not a stockholder of record but hold shares through a broker, bank or other nominee (i.e., in street name), you should provide proof of beneficial ownership on the record date, such as your most recent account statement as of April 17, 2013, a copy of the voting instruction card provided by your broker, bank or other nominee, or other similar evidence of ownership. Registration and seating will begin at 1:00 p.m., Mountain Time. Cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting.

How may I vote my shares in person at the Annual Meeting?

Shares held in your name as the stockholder of record may be voted in person at the Annual Meeting. Shares held beneficially in street name may be voted in person only if you obtain a legal proxy from the broker, bank or other nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions prior to the Annual Meeting as described below so that your vote will be counted if you later decide not to attend the Annual Meeting.

How may I vote my shares without attending the Annual Meeting?

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. If you are a stockholder of record, you may vote by submitting a proxy. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, bank or other nominee. For directions on how to vote, please refer to the instructions included on your proxy card or, for shares held beneficially in street name, the voting instruction card provided by your broker, bank or other nominee.

May I change my vote or revoke my proxy after I return my proxy card?

Yes. Even after you have submitted your proxy, you may change the votes you cast or revoke your proxy at any time before the votes are cast at the Annual Meeting by: (1) delivering a written notice of your revocation to our corporate secretary at our principal executive office, 7211 South Peoria Street, Englewood, Colorado 80112; or (2) executing and delivering a later dated proxy. In addition, the powers of the proxy holders will be suspended if you attend the Annual Meeting in person and so request, although attendance at the Annual Meeting will not by itself revoke a previously granted proxy.

What is a broker non-vote?

If you are a beneficial owner whose shares are held of record by a broker, bank or other nominee and you do not provide voting instructions to such broker, bank or other nominee, your shares will not be voted on any proposal on which the broker, bank or other nominee does not have discretionary authority to vote. This is called a “broker non-vote.” Your broker, bank or other nominee only has discretionary authority to vote on Proposal Two (Ratification of KPMG LLP). Therefore, your broker will not have discretion to vote on Proposals One or Three unless you specifically instruct your broker on how to vote your shares by returning your completed and signed voting instruction card.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of one-third of the shares of our common stock outstanding as of the record date will constitute a quorum. There must be a quorum for any action to be taken at the meeting (other than an adjournment or postponement of the meeting). If you submit a properly executed proxy card, even if you abstain from voting, then your shares will be counted for purposes of determining the presence of a quorum. Broker non-votes will be counted for purposes of determining the presence of a quorum at the Annual Meeting.

What vote is required to approve each item?

| Proposal | Vote Required |

| Proposal No. 1: Election of three (3) Class I directors | The three nominees who receive the greatest number of votes cast (plurality) will be elected as directors for a term of three (3) years. There is no cumulative voting for directors. Abstentions and broker non-votes will not be counted for purposes of the election of directors and therefore, will have no effect on the outcome of such election. |

| Proposal No. 2: Ratification of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013 | Majority of votes cast. Abstentions and broker non-votes are not considered votes cast and therefore will have no effect on the outcome of Proposal No. 2. |

| Proposal No. 3: Advisory vote on the compensation for the Company’s named executive officers | Majority of votes cast. Abstentions are not considered votes cast and therefore will have no effect on the outcome of Proposal No. 3. |

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, it means that you hold shares registered in more than one name or brokerage account. You should sign and return all proxies for each proxy card that you receive in order to ensure that all of your shares are voted.

Who will count the proxy votes?

Votes will be counted by our transfer agent, American Stock Transfer & Trust Company.

Where can I find voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will file with the Securities and Exchange Commission (“SEC”) a Current Report on Form 8-K containing the final voting results within four business days of the Annual Meeting or, if final results are not available at that time, within four business days of the date on which final voting results become available.

How will voting on any other business be conducted?

We do not expect any matters to be presented for a vote at the Annual Meeting other than the matters described in this proxy statement. If you grant a proxy, either of the officers named as proxy holder, Aaron D. Todd or Crystal L. Gordon or their nominee(s) or substitute(s), will have the discretion to vote your shares on any additional matters that are properly presented for a vote at the Annual Meeting. If a nominee is not available as a candidate for Class I director, the person named as the proxy holder will vote your proxy for another candidate nominated by our Board of Directors.

What rights of appraisal or similar rights of dissenters do I have with respect to any matter to be acted upon at the meeting?

No action is proposed herein for which the laws of the State of Delaware or our bylaws provide a right to our stockholders to dissent and obtain appraisal of, or payment for, such stockholders’ common stock.

The Company also is mailing with this Proxy Statement its Annual Report for the year ended December 31, 2012, which includes financial statements as filed with the SEC on Form 10-K. The Annual Report does not constitute a part of the proxy soliciting material. The Company will furnish a copy of the Form 10-K to any stockholder free of charge and will furnish a copy of any exhibit to the Form 10-K upon payment of the Company’s reasonable expenses in furnishing such exhibit(s). Interested parties may request a copy of the Form 10-K or any exhibit thereto from the Secretary of the Company at the Company’s principal offices, 7211 South Peoria Street, Englewood, Colorado 80112.

The Company’s Board of Directors currently is comprised of ten directors, divided among three classes, with three directors in Class I, four directors in Class II, and three directors in Class III. Class I directors’ terms will expire at the 2013 Annual Meeting to be held on May 30, 2013; Class II directors hold office for a term expiring at the 2014 Annual Meeting; and Class III directors hold office for a term expiring at the 2015 Annual Meeting.

Our Board of Directors has nominated George W. Belsey, C. David Kikumoto and MG Carl H. McNair, Jr. USA (Ret.) to serve as the three Class I directors for a three-year term expiring at the Annual Meeting in the year 2016 or until their successors have been duly elected and qualified, or until the earlier of their respective deaths, resignations or retirement.

The principal occupation and certain other information regarding the nominees and the other directors whose terms of office will continue after the Annual Meeting, can be found beginning on page 6. Information about the share ownership of the nominees and other directors can be found beginning on page 46.

Assuming the presence of a quorum, the three persons receiving the highest number of “FOR” votes from stockholders in the election of directors at the Annual Meeting will be elected. Cumulative voting is not permitted in the election of directors. Consequently, each stockholder is entitled to one vote for each share of common stock held in the stockholder’s name. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Board of Directors may propose.

The Board of Directors recommends a vote “FOR” the proposal to elect each of George W. Belsey, C. David Kikumoto and MG Carl H. McNair, Jr. USA (Ret.) as Class I directors on our Board of Directors.

Summary information concerning the Company’s directors and named executive officers is set forth below:

| | | | | | Class/Year Term of Office Expires(1) |

| George W. Belsey | | 73 | | Director/Lead Independent Director | | I/2013* |

| Ralph J. Bernstein | | 55 | | Director | | III/2015 |

| Mark D. Carleton | | 52 | | Director | | III/2015 |

| John J. Connolly, Ed.D. | | 73 | | Director | | II/2014 |

| Jeffrey A. Dorsey | | 64 | | Director | | II/2014 |

| C. David Kikumoto | | 63 | | Chairman of the Board | | I/2013* |

| MG Carl H. McNair, Jr. USA (Ret.) | | 79 | | Director | | I/2013* |

| Lowell D. Miller, Ph.D. | | 80 | | Director | | III/2015 |

| Morad Tahbaz | | 57 | | Director | | II/2014 |

| Aaron D. Todd | | 51 | | Director and Chief Executive Officer | | II/2014 |

| Michael D. Allen | | 50 | | President, Domestic Air Medical Services | | N/A |

| Trent J. Carman | | 52 | | Chief Financial Officer and Treasurer | | N/A |

| Crystal L. Gordon | | 34 | | SVP, General Counsel and Secretary | | N/A |

| Sharon J. Keck | | 46 | | Chief Accounting Officer and Controller | | N/A |

| (1) | Refers to the calendar year in which the Annual Meeting of stockholders is expected to be held and at which the term of the pertinent director class shall expire. |

Below, you can find the principal occupation and other information about each of the individuals listed in the chart set forth above.

Director Nominees – Class I Directors

Mr. George W. Belsey has served on the Board of Directors since December 1992, including serving as the Board’s Chairman from April 1994 to October 2011. Mr. Belsey was appointed Chief Executive Officer of the Company effective in June 1994, and served in that capacity until July 2003, and thereafter provided consulting services to the Company pursuant to the terms of his Consulting Agreement which terminated in 2008. Mr. Belsey previously served in various executive and administrative positions at the American Hospital Association and at a number of hospitals. He received his Bachelor’s Degree in Economics from DePauw University in Greencastle, Indiana, and holds a Master’s Degree in Business Administration from George Washington University, Washington, D.C.

Other Public Company Board Service: None.

Recent Past Public Company Board Service: None.

Key Attributes, Experience and Skills: Mr. Belsey brings to the Board of Directors, among his other skills and qualifications, a vast understanding of the Company’s business acquired through his prior service as the Company’s Chief Executive Officer and Chairman of the Board. Mr. Belsey has also served in other executive positions in the health care industry. This experience, combined with his knowledge of the Company and its operations, make him particularly well-suited to serve our Board of Directors. In light of the foregoing, our Board of Directors has concluded that Mr. Belsey should be re-elected as a member of our Board.

Mr. C. David Kikumoto has served on the Board of Directors since June 2004. Mr. Kikumoto is the cofounder and Chief Executive Officer of Denver Management Advisors. From 1999 to 2000, Mr. Kikumoto was President and Vice Chairman of Anthem Blue Cross and Blue Shield, Colorado and Nevada, and from 1987 to 1999, served in several roles, including Chief Executive Officer of Blue Cross and Blue Shield of Colorado, Nevada and New Mexico. He received his Bachelor of Science degree in accounting from the University of Utah, pursued graduate studies at the University of Utah, and graduated from the Executive Development Program at the University of Chicago.

Other Public Company Board Service: None.

Recent Past Public Company Board Service: Corgenix (April 2006 – March 2011).

Key Attributes, Experience and Skills: Mr. Kikumoto brings to the Board of Directors, among his other skills and qualifications, significant experience in the health care industry, as well as extensive management and operations experience gained while serving in executive positions with Anthem Blue Cross and Blue Shield. Additionally, given Mr. Kikumoto’s prior experience and service on several other private company boards, he is versed on a number of complex issues affecting the health care industry. In light of the foregoing, our Board of Directors has concluded that Mr. Kikumoto should be re-elected as a member of our Board.

Major General Carl H. McNair, Jr., USA (Ret.) has served on the Board of Directors since March 1996. In April 1999, General McNair retired from his position as Corporate Vice President and President, Enterprise Management, for DynCorp, a technical and professional services company headquartered in Reston, Virginia, where he was responsible for the company’s core businesses in facility management, marine operations, test and evaluation, administration and security, and biotechnology and health services. He then served as Special Assistant, Government Relations and Legislative Affairs to the CEO of DynCorp until 2003 when DynCorp was acquired by Computer Sciences Corporation. He continued service in the corporate offices of Computer Sciences Corporation until 2010.

During his more than three decades of military service, General McNair held many high level command and staff positions in Army Research, Development and Acquisition, as well as extensive aviation experience in the development and operation of both rotary and fixed wing aircraft, which led to his command of the United States Army Aviation Center and service as the first Chief of the Army Aviation Branch. General McNair currently serves on multiple non-profit boards, including, without limitation, the boards of Easter Seals, the Army Historical Foundation and the Army Aviation Association of America.

General McNair has a Bachelor of Science degree in Engineering from the U.S. Military Academy at West Point, a Bachelor’s degree and Master’s degree in Aerospace Engineering from the Georgia Institute of Technology, and a Master of Science degree in Public Administration from Shippensburg University.

Other Public Company Board Service: None.

Recent Past Public Company Board Service: None.

Key Attributes, Experience and Skills: Major General Carl H. McNair, Jr. USA (Ret.) brings to the Board of Directors, among his other skills and qualifications, a vast understanding of the aviation and health care industries, and a technical understanding of our business that he gained through his service in the military and DynCorp. Further, he has significant knowledge and understanding of our business and operations, which he gained through his prior service on our Board. In light of the foregoing, our Board of Directors has concluded that Major General Carl H. McNair, Jr. USA (Ret.) should be re-elected as a member of our Board.

Continuing Directors for Term Ending Upon the 2014 Annual Meeting of Stockholders – Class II Directors

Dr. John J. Connolly has served on the Board since May 2012. He is the President and CEO of Castle Connolly Medical Ltd., publisher of America’s Top Doctors® and other consumer guides to help people find the best health care. Dr. Connolly previously served as President of New York Medical College, the nation’s second largest private medical college, for more than ten years. He is a Fellow of the New York Academy of Medicine, a Fellow of the New York Academy of Sciences, a Director of the Northeast Business Group on Health, a member of the President’s Council of the United Hospital Fund, and a member of the Board of Advisors of the Whitehead Institute for Biomedical Research.

Other Public Company Board Service: None.

Recent Past Public Company Board Service: Morton’s Restaurant Group, Inc. (2006-2012).

Key Attributes, Experience and Skills: Dr. Connolly brings to the Board of Directors, among his other skills and qualifications, insight into the dynamics of the evolving health care industry and financial expertise gained during his work with Castle Connolly Medical Ltd. Dr. Connolly also has extensive corporate governance experience, which he gained during his service on the board of directors of Morton Restaurant Group, Inc. In light of the foregoing, our Board of Directors concluded that Dr. Connolly should continue as a member of our Board of Directors.

Mr. Jeffrey A. Dorsey has served on the Board since May 2012. He began his career at Portsmouth General Hospital in 1972. Following work as a senior administrator at Virginia Beach General Hospital, Mr. Dorsey joined Hospital Corporation of America (HCA) in 1980 and worked for them as an Administrator in Terre Haute, Indiana, Riyadh, Saudi Arabia, Emporia, Kansas and Denver, Colorado where in 1995 he helped form and served as President and Chief Executive Officer of HealthONE LLC. Mr. Dorsey most recently served as the President and Chief Executive Officer of the HCA Continental Division, including operations in Oklahoma, Kansas, and HCA-HealthONE LLC, the largest healthcare system in the metro-Denver area with 8,500 employees and 3,000-affiliated physicians.

Other Public Company Board Service: None.

Recent Past Public Company Board Service: None.

Key Attributes, Experience and Skills: Mr. Dorsey brings to the Board of Directors, among his other skills and qualifications, a vast understanding of the health care industry and insight into the dynamics of the evolving health care industry. Further, as a result of Mr. Dorsey’s service in senior management positions at various health care systems, he has an understanding of the operations of a health care company. In light of the foregoing, our Board of Directors concluded that Mr. Dorsey should continue as a member of our Board of Directors.

Mr. Morad Tahbaz has served on the Board of Directors since February 1994. He is a co-founder and General Partner of Americas Partners, an investment firm. Additionally, Mr. Tahbaz is the founder and a partner of M.T. Capital, L.L.C., an investment company for real estate and private equity transactions. Mr. Tahbaz received his Bachelor’s degree in Philosophy and Fine Arts from Colgate University and attended the Institute for Architecture and Urban Studies in New York City. He holds a Master’s degree in Business Administration from Columbia University Graduate School of Business.

Other Public Company Board Service: None.

Recent Past Public Company Board Service: Empire Resorts, Inc. (2003-2005)

Key Attributes, Experience and Skills: Mr. Tahbaz brings to the Board of Directors, among his other skills and qualifications, valuable strategic planning and management skills gained as a General Partner of Americas Partners, as well as extensive institutional knowledge of the Company’s business and operations. Mr. Tahbaz also has extensive corporate governance experience, which he gained during his service on the board of directors of Empire Resorts, Inc. In light of the foregoing, our Board of Directors concluded that Mr. Tahbaz should continue as a member of our Board of Directors.

Mr. Aaron D. Todd has served on the Board of Directors since June 2002 and as Chief Executive Officer since July 2003. He joined the Company as Chief Financial Officer in July of 1995 and was appointed Secretary and Treasurer during that same year. Mr. Todd holds a Bachelor of Science degree in Accounting from Brigham Young University.

Other Public Company Board Service: None.

Recent Past Public Company Board Service: None.

Key Attributes, Experience and Skills: Mr. Todd brings to the Board of Directors, among his other skills and qualifications, a vast understanding of financial and accounting matters, as well as significant knowledge and understanding of our operations and the aviation and health care industries generally. In light of the foregoing, our Board of Directors concluded that Mr. Todd should continue as a member of our Board of Directors.

Continuing Directors for Term Ending Upon the 2015 Annual Meeting of Stockholders – Class III Directors

Mr. Ralph J. Bernstein has served on the Board of Directors since February 1994. He is the co-founder and General Partner of Bernstein Capital, LLC. Prior to forming Bernstein Capital, LLC, Mr. Bernstein was the managing partner of Americas Partners and Americas Tower Partners. He holds a Bachelor of Arts Degree in Economics from the University of California at Davis.

Other Public Company Board Service: None.

Recent Past Public Company Board Service: Empire Resorts, Inc. (2004 – 2010).

Key Attributes, Experience and Skills: Mr. Bernstein brings to the Board of Directors, among his other skills and qualifications, valuable strategic planning and management skills gained as a General Partner of Bernstein Capital, LLC. In addition and as a result of Mr. Bernstein’s prior service on our Board of Directors, Mr. Bernstein has a vast amount of institutional knowledge regarding the Company’s operations and business generally. In light of the foregoing, our Board of Directors has concluded that Mr. Bernstein should continue as a member of our Board.

Mr. Mark D. Carleton has served on the Board of Directors since August 2008 and has been a Senior Vice President at Liberty Media Corporation since December 2003. His primary responsibilities include corporate development and oversight of Liberty’s technology, music, telecom, satellite and sports interests. Prior to joining Liberty Media Corporation, Mark was a partner at KPMG LLP, where he had overall responsibility for the communications sector. Mr. Carleton was also a member of KPMG LLP’s Board of Directors. Mr. Carleton received a Bachelor of Science degree in Accounting from Colorado State University, where he currently is a member of the College of Business Global Leadership Council. He also is a member of the University of Colorado Sports and Entertainment Advisory Council. In addition, Mr. Carleton was the Executive in Residence at the Colorado State University Business School for the 2011-2012 school year. Mr. Carleton also serves on the Board of Directors for Junior Achievement-Rocky Mountain, Inc.

Other Public Company Board Service: Live Nation Entertainment (January 2010 – present), Barnes & Noble, Inc. (September 2011 – present), Mobile Streams, Inc. (January 2006 – present), Sirius XM Radio (February 2013 – Present) and Ideiasnet (July 2011- present).

Recent Past Public Company Board Service: The DIRECTV Group, Inc. (February 2008 – June 2009) and Ticketmaster Entertainment (August 2008 – February 2010).

Key Attributes, Experience and Skills: Mr. Carleton brings to the Board of Directors, among his other skills and qualifications, financial and accounting expertise acquired while serving as a partner at KPMG LLP. In addition, Mr. Carleton’s service on other public company boards has provided him with a number of skills, including leadership development and succession planning, risk assessment, and shareholder and government relations. In light of the foregoing, our Board of Directors concluded that Mr. Carleton should continue as a member of our Board.

Dr. Lowell D. Miller has served on the Board of Directors since June 1990. Since 1989, Dr. Miller has been involved with various scientific endeavors including a pharmaceutical research and development consulting business and as a guest lecturer at the university level. In addition, he has led or been involved with many fund-raising activities for educational purposes. He is a long-term member of the American Chemical Society and the American Society of Toxicology. Dr. Miller has a Bachelor of Science degree, a Master’s degree in Biochemistry and a Doctorate degree in Biochemistry all awarded by the University of Missouri.

Other Public Company Board Service: None.

Recent Past Public Company Board Service: None.

Key Attributes, Experience and Skills: Dr. Miller brings to the Board of Directors, among his other skills and qualifications, vast institutional knowledge of our business and operations, as well as an understanding of the regulatory issues confronting our industry. In light of the foregoing, our Board of Directors concluded that Dr. Miller should continue as a member of our Board.

Named Executive Officers*

Mr. Michael D. Allen was named President, Domestic Air Medical Services in August 2012. Mr. Allen has been with Air Methods since 1992 and served in several positions including line pilot, safety representative, aviation site manager, training captain/check airman, operations manager and Senior Vice President. As the President, Domestic Air Medical Services Mr. Allen has responsibility and over site of all business, aviation, maintenance, clinical and dispatch operations supporting 320 air medical base sites with over 3,350 employees and more than 400 aircraft. Prior to joining the Company Mr. Allen worked for Petroleum Helicopters, Inc. and served in the US Army. During his more than five years of service in the US Army Mr. Allen served in Germany as an aero scout pilot and as a maintenance test pilot. Mr. Allen graduated from Portland State University with a BS in Mathematics.

Mr. Trent J. Carman joined the Company in April 2003 and is the Chief Financial Officer and Treasurer. Prior to joining the Company, Mr. Carman served as Chief Financial Officer of StorNet, Inc. from January 2000 until April 2003, and served in various capacities including Senior Vice President and Chief Financial Officer for United Artists Theatre Circuit, Inc., from June 1992 until January 2000. Mr. Carman received his Bachelor of Science degree in Accounting from Utah State University and holds a Master’s degree in Business Administration-Finance from Indiana University.

Ms. Crystal L. Gordon was appointed as Senior Vice President, General Counsel and Secretary of the Company in April 2012. Prior to her appointment, Ms. Gordon was the Vice President and Associate General Counsel of the Company. Before joining the Company in April 2011, Ms. Gordon was with Davis Graham & Stubbs LLP in Denver, Colorado focusing on mergers and acquisitions, securities offerings, SEC compliance matters, and corporate governance. Ms. Gordon received her law degree from the University of Denver, and received her Bachelor of Science degree in Biology from Santa Clara University. Prior to attending law school, Ms. Gordon worked as a compliance associate with a boutique investment advisory firm in Northern California.

Ms. Sharon J. Keck joined the Company as Accounting Manager in October 1993 and was named Controller in July 1995. She assumed the additional position of Chief Accounting Officer in January 2002. Ms. Keck holds a Bachelor of Science degree in Accounting from Bob Jones University.

* Biographical information for Mr. Aaron D. Todd, our Chief Executive Officer, is set forth above under Continuing Directors for Term Ending Upon the 2014 Annual Meeting of Stockholders – Class II Directors

CORPORATE GOVERNANCE AND BOARD MATTERS

Board of Directors and Governance Principles

The core responsibility of the Company’s Board is to exercise its business judgment to act in what it reasonably believes to be in the best interests of the Company and its stockholders. Further, members of the Board fulfill their responsibilities consistent with their fiduciary duty to the stockholders, and in compliance with all applicable laws and regulations. The primary responsibilities of the Board include:

| | · | Oversight of management performance and assurance that stockholder interests are served; |

| | · | Oversight of the Company’s business affairs and long-term strategy, including Chief Executive Officer succession planning; and |

| | · | Monitoring adherence to the Company’s standards and policies, including, among other things, policies governing internal controls over financial reporting. |

In fulfilling such responsibilities, the Board is guided by the principles set forth in the Corporate Governance Guidelines, a copy of which is available on our website www.airmethods.com under the “Investors” tab. The Corporate Governance Guidelines were adopted by the Board in May 2010. To ensure sound corporate governance practices, the Board regularly reviews the governance practices set forth in the Corporate Governance Guidelines, as well as Delaware law (the state in which we are incorporated) and the listing standards of The NASDAQ® Stock Market, and SEC regulations. The Board also considers best practices suggested by recognized corporate governance authorities.

The Board also performs its responsibilities in accordance with the Code of Business Conduct for Members of the Board of Directors adopted on November 2, 2011 (the “Director Code of Conduct”). A copy of the Director Code of Conduct is available on our website www.airmethods.com under the “Investors” tab.

The Board separated the positions of Chairman and Chief Executive Officer in July 2003. Maintaining separate positions allows our Chief Executive Officer to focus on developing and implementing the Company’s business plans and supervising the Company’s day-to-day business operations and allows our Chairman to lead the Board in its oversight and advisory roles. Because of the many responsibilities of the Board and the significant time and effort required by each of the Chairman and the Chief Executive Officer to perform their respective duties, the Company believes that having separate persons in these roles enhances the ability of each to discharge those duties effectively and, as a corollary, enhances the Company’s prospects for success. The Board also believes that having separate positions provides a clear delineation of responsibilities for each position and fosters greater accountability of management. At this time, the Board has determined for the foregoing reasons that its leadership structure is appropriate and in the best interests of the Company’s stockholders. The Company will continue to periodically evaluate whether this leadership structure best serves the Company and its stockholders.

Because the Board determined that David Kikumoto, our Chairman, is not an independent director under the applicable NASDAQ® rules and regulations, our Board has appointed George Belsey as “Lead Independent Director” to preside at all executive sessions of the directors who are all independent, as defined under applicable NASDAQ® rules and regulations. As the Lead Independent Director, Mr. Belsey has the responsibility of presiding at all executive sessions of the Board and to the extent appropriate, consulting with the Chairman and the Chief Executive Officer regarding such executive sessions. The Board generally holds executive sessions at each regular meeting.

Our Board, together with our named executive officers, oversees the management of risks inherent in the operation of the Company’s businesses and the implementation of its strategic plan. The Board performs this oversight role by reviewing the operations of the Company’s business and corporate functions and addressing the primary risks associated therewith. The Board has delegated certain responsibilities to the finance and strategic planning committee and the audit committee, including, among other things, reviewing the risks associated with the Company’s strategic plan, discussing policies with management regarding financial risk assessment and enterprise risk management, developing guidelines to govern the process by which major financial and accounting risk assessment is undertaken by the Company, identifying the primary risks to the Company’s business and interim updates of those risks, and monitoring and evaluating the primary risks associated with particular business units and functions.

In an effort to continue appropriately monitoring and understanding the Company’s risks, in 2012, the Board formed the health care affairs committee, which is a subcommittee of the finance and strategic planning committee. The health care affairs committee is comprised of Board members with a strong background in health care. The health care affairs committee focuses on health care matters impacting the Company, including the Company’s health care compliance efforts. Since the formation of the health care affairs committee, the committee has focused on, among other things, the Company’s health care compliance plan and management of risks related to health care.

In performing such functions, the audit committee, the finance and strategic planning committee, and the health care affairs committee have full access to management, as well as the ability to engage advisors. The foregoing committees provide reports to the Board regarding the risk areas identified above. In addition, the compensation and stock option committee and the nominating and corporate governance committee address relevant risks during their respective meetings. The Board believes that the work undertaken by the audit committee, the finance and strategic planning committee and the health care affairs committee, together with the work of the full Board, the other committees, and our named executive officers, enables the Board to effectively oversee the Company’s risk management.

Currently, the Company’s Board has ten members. The Board has determined that eight of those ten directors, namely Drs. Connolly and Miller and Messrs. Belsey, Bernstein, Dorsey, Carleton, McNair, and Tahbaz, satisfy The NASDAQ® Stock Market standard for director independence. The Board has determined that Mr. Todd, as our Chief Executive Officer, and Mr. Kikumoto are not independent under The NASDAQ® Stock Market standard for director independence. In accordance with NASDAQ® rules, the Board has made a determination that, given Mr. Kikumoto’s relationship with Denver Management Advisors, Inc., which had been previously retained by the Company to provide compensation advisory services, in 2010 and 2011, Mr. Kikumoto is not independent.

The Board held five meetings in 2012. Each director attended at least 80% of the Board and applicable committee meetings during 2012. Four members of the Board attended the Company’s 2012 Annual Meeting. The Board does not have a policy for Board member attendance at the Company’s annual meetings.

Our Board conducts its business through meetings of the Board and through activities of the standing committees, as further described below. The Board and each of the standing committees meets throughout the year on a set schedule and also holds special meetings and acts by written consent from time to time, as appropriate. Board agendas include regularly scheduled executive sessions of the independent directors to meet without the presence of management. The Board has delegated various responsibilities and authority to different committees of the Board, as described below. Members of the Board have access to all of our members of management outside of Board meetings.

The Board has established an audit committee, finance and strategic planning committee, compensation and stock option committee and a nominating and corporate governance committee. Each of the committees regularly report on their activities and actions to the full Board. The full text of all of the charters for each Board committee is available on the Company’s website at www.airmethods.com. The contents of our website are not incorporated by reference into this document for any purpose.

The audit committee, which met 6 times during 2012, currently consists of Messrs. McNair (Chairman) and Carleton and Dr. Connolly. The Board has determined that all members of the audit committee are “independent” within the meaning of the listing standards of The NASDAQ® Stock Market and the SEC rules governing audit committees. In addition, the Board determined that Mr. Carleton and Dr. Connolly meet the criteria of an “audit committee financial expert” as defined under the applicable SEC rules.

See the “Audit Committee Report” on page 49 for a description of the audit committee’s duties and responsibilities.

The finance and strategic planning committee was formed by the Board in April 2003. The current members of the finance and strategic planning committee are Messrs. Tahbaz (Chairman), Belsey, Bernstein, Carleton, Connolly, Dorsey and Todd. The finance and strategic planning committee oversees establishment and achievement of corporate financial objectives and key growth initiatives, including acquisitions that are significant to the Company’s business. In addition, the committee analyzes and evaluates the capital structure of the Company. The finance and strategic planning committee met 7 times in 2012.

Compensation and Stock Option Committee

The compensation and stock option committee currently consists of Dr. Miller (Chairman) and Messrs. Dorsey and Bernstein. The compensation and stock option committee, which met 6 times in 2012, is responsible for making recommendations to the Board regarding executive compensation matters. The specific nature of the compensation and stock option committee’s responsibilities is described under “Compensation Discussion and Analysis.”

The Board has determined that all members of the compensation and stock option committee are “independent” within the meaning of The NASDAQ® Stock Market’s listing standards.

The nominating and corporate governance committee currently consists of Messrs. Bernstein (Chairman), Tahbaz and Dr. Miller. Mr. Bernstein replaced Mr. Belsey as the Chairman of the nominating and corporate governance committee in November 2012. The nominating and corporate governance committee provides committee membership recommendations to the Board along with changes to those committees. In addition, the nominating and corporate governance committee identifies, evaluates and recommends to the Board individuals, including individuals proposed by stockholders, qualified to serve as members of the Board. The nominating and corporate governance committee also identifies, evaluates and recommends to the Board, nominees for election as directors of the Company at the next annual or special meeting of stockholders at which directors are to be elected. The nominating and corporate governance committee also develops and recommends to the Board corporate governance principles applicable to the Company and oversees succession planning for the chief executive officer. The nominating and corporate governance committee met 5 times in 2012.

The Board has determined that all members of the nominating and corporate governance committee are “independent” within the meaning of The NASDAQ® Stock Market’s listing standards.

In accordance with its written charter, the nominating and corporate governance committee investigates suggestions for candidates for membership on the Board, including candidates nominated by our stockholders, and recommends prospective directors, as required, to provide an appropriate balance of knowledge, experience and capability on the Board.

Directors may be nominated by the Board or by stockholders in accordance with our Bylaws. Our Bylaws provide that a stockholder may bring certain business before an annual meeting, including, among other things, the nomination of directors, if such stockholder has delivered written notice to the Secretary of the Company and such notice is received by the Secretary, not less than sixty (60) days and not more than ninety (90) days prior to the anniversary date of the immediately preceding annual meeting. The stockholder notice must include the following information with respect to each matter the stockholder proposes to bring before the annual meeting: (i) a brief description of the business desired to be brought before the annual meeting, (ii) the name and address, as they appear on the Company’s books, of the stockholder proposing such business, (iii) the class and number of shares of the Company which are beneficially owned by the stockholder, and (iv) any material interest of the stockholder in such business. The presiding officer of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the foregoing procedure.

In recommending candidates for appointment or re-election to the Board, the nominating and corporate governance committee considers the appropriate balance of experience, skills and characteristics required of the Board. Specifically, the nominating and corporate governance committee considers, among other things, the candidate’s independence, character, corporate governance skills and abilities, business experience, industry specific experience, training and education, commitment to performing the duties of a director, and other skills, abilities or attributes that fill specific needs of the Board or its committees. While there is no formal policy with regard to consideration of diversity in identifying director nominees, the nominating and corporate governance committee considers diversity in business experience, professional expertise, gender and ethnic background, along with various other factors when evaluating director nominees.

In addition, the nominating and corporate governance committee seeks to ensure that at least a majority of the directors are independent under the rules of The NASDAQ® Stock Market, and that members of the Company’s audit committee meet the financial literacy and sophistication requirements under The NASDAQ® Stock Market rules and at least one of them qualifies as an “audit committee financial expert” under the rules of the SEC. Nominees for director are selected on the basis of their depth and breadth of experience, integrity, ability to make independent analytical inquiries, understanding of the Company’s business environment and willingness to devote adequate time to Board duties.

In determining whether to recommend a director for re-election, the nominating and corporate governance committee considers, among other things, the director’s past attendance at meetings and participation in and contributions to the activities of the Board.

The following table summarizes all compensation earned by members of the Board during the fiscal year ended December 31, 2012:

| Name | | Fees Earned or Paid in Cash ($) | | | Stock Awards(12) ($) | | | Option Grants(13) ($) | | | All Other Compensation(14) ($) | | | Total ($) | |

George W. Belsey(1)(10) | | | 106,100 | | | | 22,000 | | | | 13,875 | | | | 3,500 | | | | 145,475 | |

Ralph J. Bernstein(2)(10) | | | 99,000 | | | | 22,000 | | | | 13,875 | | | | 117,460 | | | | 252,335 | |

Mark D. Carleton(3)(10) | | | 94,300 | | | | 22,000 | | | | 13,875 | | | | 117,460 | | | | 247,635 | |

John J. Connolly, Ed.D.(4) (11) | | | 52,100 | | | | 13,673 | | | | 7,529 | | | | 2,100 | | | | 75,402 | |

Jeffrey A. Dorsey(5)(11) | | | 47,800 | | | | 13,673 | | | | 7,529 | | | | 2,100 | | | | 71,102 | |

C. David Kikumoto(6)(10) | | | 160,500 | | | | 22,000 | | | | 13,875 | | | | 29,960 | | | | 226,335 | |

MG Carl H. McNair, Jr. USA (Ret.)(7)(10) | | | 99,900 | | | | 22,000 | | | | 13,875 | | | | 117,460 | | | | 253,235 | |

Lowell D. Miller Ph.D.(8)(10) | | | 104,100 | | | | 22,000 | | | | 13,875 | | | | --- | | | | 139,975 | |

Morad Tahbaz(9)(10) | | | 104,750 | | | | 22,000 | | | | 13,875 | | | | 117,460 | | | | 258,085 | |

| (1) | As of December 31, 2012, Mr. Belsey held one stock option award exercisable for an aggregate 1,500 shares of the Company’s common stock, all of which are fully vested. |

| (2) | As of December 31, 2012, Mr. Bernstein held four stock option awards exercisable for an aggregate 50,340 shares of the Company’s common stock, all of which are fully vested. |

| (3) | As of December 31, 2012, Mr. Carleton held four stock option awards exercisable for an aggregate 50,340 shares of the Company’s common stock, all of which are fully vested. |

| (4) | As of December 31, 2012, Dr. Connolly held one stock option award exercisable for an aggregate 900 shares of the Company’s common stock, all of which are fully vested. |

| (5) | As of December 31, 2012, Mr. Dorsey held one stock option award exercisable for an aggregate 900 shares of the Company’s common stock, all of which are fully vested. |

| (6) | As of December 31, 2012, Mr. Kikumoto held two stock option awards exercisable for an aggregate 12,840 shares of the Company’s common stock, all of which are fully vested. |

| (7) | As of December 31, 2012, General McNair held four stock option awards exercisable for an aggregate 50,340 shares of the Company’s common stock, all of which are fully vested. |

| (8) | As of December 31, 2012, Dr. Miller did not hold any unexercised stock options. |

| (9) | As of December 31, 2012, Mr. Tahbaz held four stock option awards exercisable for an aggregate 50,340 shares of the Company’s common stock, all of which are fully vested. |

| (10) | As of December 31, 2012, such director held 750 shares of restricted stock which vested fully and were freely tradable on January 1, 2013. |

| (11) | As of December 31, 2012, such director held 450 shares of restricted stock which vested fully and were freely tradable on January 1, 2013. |

| (12) | Restricted stock is valued at the closing price of the common stock on the date of grant. |

| (13) | Option awards are calculated in accordance with the requirements of FASB ASC Topic 718, as explained below. The options granted in 2012 vested immediately upon grant and will expire five years from date of grant. The fair value of each option grant is estimated on the date of grant using the Black-Scholes option-pricing model. The Company uses historical option exercise data for similar employee groups, as well as the vesting period and contractual term, to estimate the expected term of options granted; the expected term represents the period of time that options granted are expected to be outstanding. Expected volatility is based on historical volatility of the Company’s stock. The risk-free rate for periods within the contractual life of the option is based on the U.S. Treasury yield curve in effect at the time of the grant. The amounts presented in these columns reflect the dollar amount to be recognized for financial statement reporting purposes over the vesting term of the options (excluding any impact of assumed forfeitures), in accordance with FASB ASC Topic 718. Assumptions used in the calculation of expense for the 2012 awards are included in Note 10 to the consolidated financial statements in our 2012 Annual Report on Form 10-K, which was filed with the SEC on March 1, 2013. |

| (14) | In connection with the Company’s issuance of a special cash dividend of $7.00 per share, the Company’s compensation and stock option committee approved a one-time special cash bonus to certain employees and directors holding vested and unexercised compensatory stock options granted under the Second Amended and Restated 2006 Equity Plan. Accordingly, certain directors received an amount equal to $7.00 per share covered by any unexercised and vested stock option held by such director on December 28, 2012. |

During fiscal year 2012, the Company awarded both options and restricted stock to our non-employee directors. On February 2, 2012, the Company granted each non-employee director (other than Messrs. Dorsey and Connolly who were not on the Board at such time) an option to purchase 1,500 shares at $29.33, on a post-split basis. The options vested immediately upon grant. The expiration date for these options is February 2, 2017. Each of Messrs. Dorsey and Connolly were awarded an option to purchase 900 shares at $30.38, on a post-split basis, on May 31, 2012 following their appointments to the Board. The options vested immediately upon grant. The expiration date for these grants is May 31, 2017.

On February 2, 2012, the Company also awarded 750 shares of restricted stock to each non-employee director (other than Messrs. Dorsey and Connolly). All shares vested and became freely tradable on January 1, 2013. Each of Messrs. Dorsey and Connolly were awarded 450 shares of restricted stock on May 31, 2012. All shares vested and became freely tradable on January 1, 2013.

We also reimburse our non-employee directors for their reasonable expenses incurred in attending Board and committee meetings. Board members who are also officers do not receive any separate compensation or fees for attending Board or committee meetings.

The non-employee directors were entitled to receive the following compensation for serving on our Board and committees of our Board:

| | · | Annual retainer of $60,000 |

| | · | Board chairman annual retainer of $90,000 (such amount is in addition to the annual retainer amount received by all Board members); |

| | · | Board attendance fee of $2,500 per meeting; and |

| | · | Effective July 1, 2012, following a discussion of the Board, the compensation and stock option committee approved a new compensation structure for the committee chairs and the committee members pursuant to which each committee chairman and committee member will be paid the same annual retainer amount rather than having differing amounts paid to different committees. Each committee chairman is now paid an annual retainer in the amount of $24,000 and each committee member is paid an annual retainer of $8,000. All committee members also receive a $600 fee for each committee meeting. |

Certain Relationships and Related Transactions

None.

The audit committee charter charges the audit committee with the responsibility to investigate, review, and report to the Board the propriety and ethical implications of any transactions between the Company and any employee, officer, or Board member, or any affiliates of the foregoing. The audit committee charter operates in conjunction with other aspects of the Director Code of Conduct and the Company’s Code of Conduct. The audit committee evaluates related party transactions for purposes of recommending to the disinterested members of the Board that the transactions are fair, reasonable and within the Company policies and practices. The Board will approve or ratify only transactions that are fair to the Company and not inconsistent with the best interests of the Company and its stockholders. Related party transactions involving directors are also subject to approval or ratification by the disinterested directors when so required under Delaware law. Applicable transactions may be reported to the audit committee by our independent auditors, employees, officers, Board members, or other parties.

Compensation and Stock Option Committee Interlocks and Insider Participation

During the last fiscal year, none of the members of the compensation and stock option committee has been or will be one of the Company’s officers or employees. The Company does not have any interlocking relationships between its named executive officers and the compensation and stock option committee and the named executive officers and compensation committee of any other entities, nor has any such interlocking relationship existed in the past.

We have adopted a Code of Ethics for our officers and employees, as well as the Director Code of Conduct for our non-employee directors (together, the “Codes”). The Codes are intended to promote honest and ethical conduct, compliance with applicable laws, full and accurate reporting, and prompt internal reporting of violations of the code, as well as other matters. Each year, our employees and our non-employee directors confirm that they have read the applicable Code and will comply with its standards. Both Codes are available on our website www.airmethods.com under the “Investor” tab.

Based on our review of the copies of reports filed and upon written representations, we believe that during 2012, named executive officers, directors and ten percent stockholders of the Company were in compliance with their filing requirements under Section 16(a) of the Exchange Act of 1934, as amended, except as follows: Form 4s reporting a sale of shares for each of George Belsey, Trent J. Carman and Edward T. Rupert (former Section 16 officer) were filed late due to an administrative error.

The Board recommends that stockholders initiate any communications with the Board in writing directed to the Company’s secretary at: Secretary, Air Methods Corporation, 7211 South Peoria, Englewood, Colorado 80112. This centralized process assists the Board in reviewing and responding to stockholder communications in an appropriate manner. Each communication intended for the Board and received by the Secretary that is a communication made by the stockholder in such capacity (as opposed to acting in its capacity as a party with a commercial relationship with the Company) will be promptly forwarded to the specified party.

This Compensation Discussion and Analysis (“CD&A”) describes the philosophy and the material elements of our compensation program for fiscal year 2012 for our named executive officers, including our chief executive officer, our chief financial officer and our three other most highly compensated executive officers (collectively, the “named executive officers”). The CD&A has been organized into two sections. The first section, “2012 and 2013 Compensation Decisions,” summarizes the compensation actions taken during 2012 and year-to-date for 2013, as well as highlights the Company’s strong performance during 2012. The second section, “Other Compensation Practices and Philosophies,” discusses our general compensation philosophy and policies.

References to “Air Methods”, the “Company”, “we”, “us” and “our” in this discussion and analysis refer to Air Methods Corporation and its management, as applicable.

Section I – 2012 and 2013 Compensation Decisions

Overview of 2012 Performance

Despite a challenging political and macro-environment, 2012 was a year full of accomplishments for the Company. Among other things, we delivered solid earnings growth, generated strong cash flows, returned capital to stockholders through the issuance of a special cash dividend ($7.00 per share) and continued our disciplined acquisition strategy with the purchase of Sundance Helicopters, Inc. Company achievements in 2012 included:

| | · | Revenue increased by 29% to $850.8 million compared to $660.5 million in 2011; |

| | · | Earnings per diluted share were $2.39 for fiscal year 2012, the highest in the Company’s history; and |

| | · | Net patient transport revenue increased 42% to $590.7 million from $416.3 million in 2011. |

In 2012, the Company continued to outperform our peer group (the “Compensation Peer Group;” see page 32 for further details) and the broader market. The following graph displays the Company’s cumulative total shareholder return relative to the S&P 500 Index and the Company’s Compensation Peer Group for the one, three and five-year periods ended December 31, 2012.

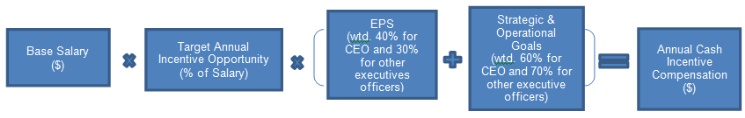

Executive Compensation Program for 2012

At our 2012 annual meeting of stockholders, our stockholders approved the compensation of our named executive officers with 89% of the votes cast. After considering this strong stockholder support and the Company’s financial and operational performance over the past several years, our compensation and stock option committee (the “Committee”) concluded that the compensation paid to the named executive officers and the Company’s overall pay practices did not require revisions to address stockholder concerns. As such, the Committee did not make any significant changes from the compensation program adopted in early 2012 or to our 2013 compensation program. Our compensation program contains a significant amount of performance based compensation, specifically focused on achieving EPS targets, and the Committee believes that 2012 compensation for our named executive officers reflects the Company’s strong operational and financial performance.