Exhibit 99.2

Air Methods Corporation NASDAQ: AIRM 4 Q16 Earnings Presentation

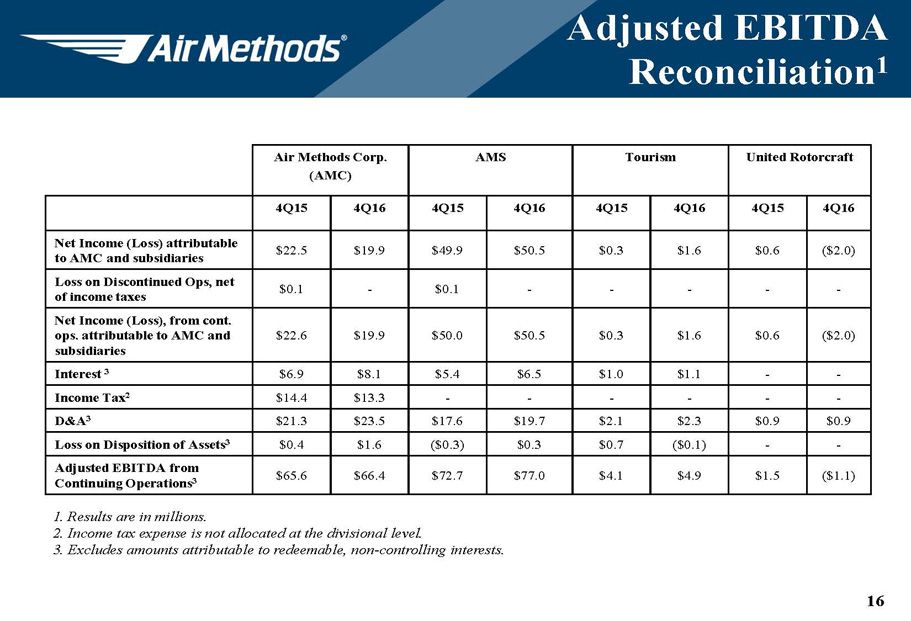

2 Non - GAAP Financial Information Non - GAAP Financial Information: This presentation may discuss Adjusted EBITDA from continuing operations and Adjusted EBITDA margin, which are not calculated in conformity with U.S. Generally Accepted Accounting Principles (GAAP). The Company defines Adjusted EBITDA from continuing operations as earnings attributable to Air Methods Corp. and its subsidiaries (AMC) before interest, income taxes, depreciation, amortization, gain or loss on disposition of assets, and discontinued operations. The Company defines Adjusted EBITDA margin as Adjusted EBITDA from continuing operations divided by revenue. Free cash flow is defined as cash flow from continuing operations less capital expenditures. Buyouts of previously leased aircraft, payments for hospital contract conversions, and proceeds from the disposition of assets are excluded from the calculation. To supplement the Company’s consolidated financial statements presented on a GAAP basis, management believes that these non - GAAP measures provide useful information about the Company’s core operating results and thus are appropriate to enhance the overall understanding of the Company’s past financial performance and its prospects for the future. Management believes the additions and subtractions from net income used to calculate Adjusted EBITDA from continuing operations reflect the measurements that its bank creditors and third party stock analysts use in evaluating the Company. These adjustments to the Company's GAAP results are made with the intent of providing both management and investors a more complete understanding of the Company's underlying operational results and trends and performance. Management uses these non - GAAP measures to evaluate the Company's financial results. The presentation of non - GAAP measures is not meant to be considered in isolation or as a substitute for or superior to financial results determined in accordance with GAAP.

3 IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT Air Methods intends to file a proxy statement with the U.S. Securities and Exchange Commission (the “SEC”) with respect to its 2017 Annual Meeting (the “2017 Proxy Statement”). AIR METHODS STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE 2017 PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), THE ACCOMPANYING WHITE PROXY CARD AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Air Methods, its directors, executive officers and other employees may be deemed to be participants in the solicitation of proxies from Air Methods stockholders in connection with the matters to be considered at Air Methods’ 2017 Annual Meeting. Information about Air Methods’ directors and executive officers is available in Air Methods’ proxy statement, dated April 29, 2016, for its 2016 Annual Meeting. To the extent holdings of Air Methods’ securities by such directors or executive officers have changed since the amounts printed in the 2016 proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. More detailed information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the 2017 Proxy Statement and other materials to be filed with the SEC in connection with Air Methods’ 2017 Annual Meeting. Stockholders will be able to obtain the 2017 Proxy Statement, any amendments or supplements thereto and other documents filed by Air Methods with the SEC free of charge at the SEC’s website at www.sec.gov . Copies also will be available free of charge at Air Methods’ website ( www.airmethods.com ) or by writing to Air Methods’ Corporate Secretary at Air Methods, 7211 South Peoria Street, Englewood, Colorado 80112, or by calling Air Methods’ Corporate Secretary at (303) 792 - 7400.

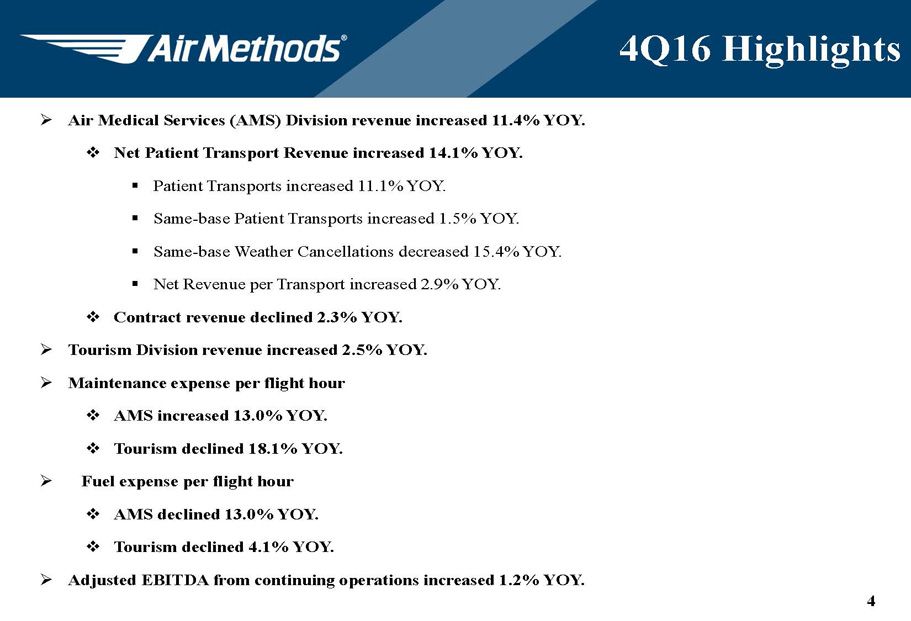

4 4Q16 Highlights » Air Medical Services (AMS) Division revenue increased 11.4% YOY. □ Net Patient Transport Revenue increased 14.1% YOY. ▪ Patient Transports increased 11.1% YOY. ▪ Same - base Patient Transports increased 1.5% YOY. ▪ Same - base Weather Cancellations decreased 15.4% YOY. ▪ Net Revenue per Transport increased 2.9% YOY. □ Contract revenue declined 2.3% YOY. » Tourism Division revenue increased 2.5% YOY. » Maintenance expense per flight hour □ AMS increased 13.0% YOY. □ Tourism declined 18.1% YOY. » Fuel expense per flight hour □ AMS declined 13.0% YOY. □ Tourism declined 4.1% YOY. » Adjusted EBITDA from continuing operations increased 1.2% YOY.

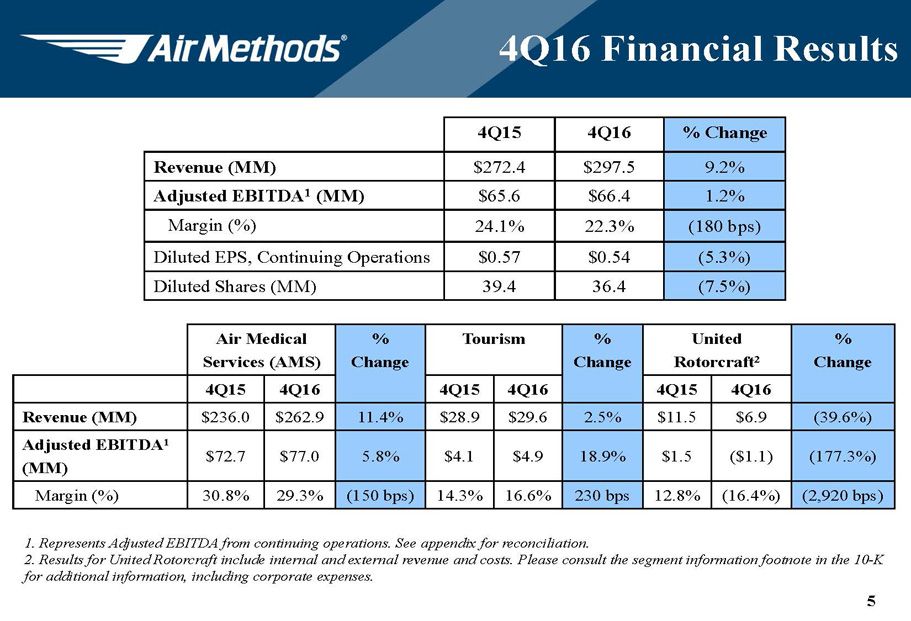

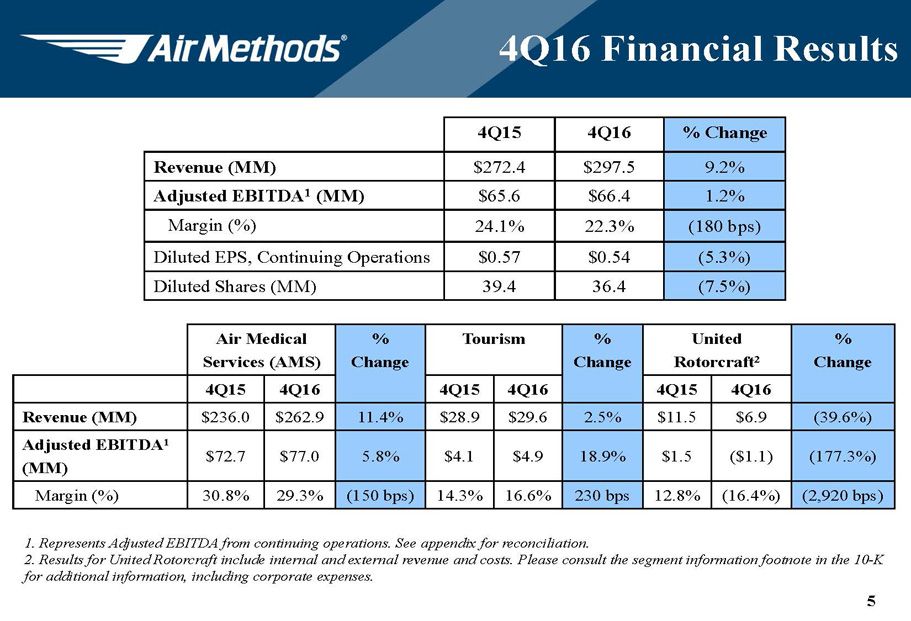

5 4Q16 Financial Results 4Q15 4Q16 % Change Revenue (MM) $272.4 $297.5 9.2% Adjusted EBITDA 1 (MM) $65.6 $66.4 1.2% Margin (%) 24.1% 22.3% (180 bps) Diluted EPS, Continuing Operations $0.57 $0.54 (5.3%) Diluted Shares (MM) 39.4 36.4 (7.5%) Air Medical Services (AMS) % Change Tourism % Change United Rotorcraft 2 % Change 4Q15 4Q16 4Q15 4Q16 4Q15 4Q16 Revenue (MM) $236.0 $262.9 11.4% $28.9 $29.6 2.5% $11.5 $6.9 (39.6%) Adjusted EBITDA 1 (MM) $72.7 $77.0 5.8% $4.1 $4.9 18.9% $1.5 ($1.1) (177.3%) Margin (%) 30.8% 29.3% (150 bps) 14.3% 16.6% 230 bps 12.8% (16.4%) (2,920 bps) 1. Represents Adjusted EBITDA from continuing operations. See appendix for reconciliation. 2. Results for United Rotorcraft include internal and external revenue and costs. Please consult the segment information foot not e in the 10 - K for additional information, including corporate expenses.

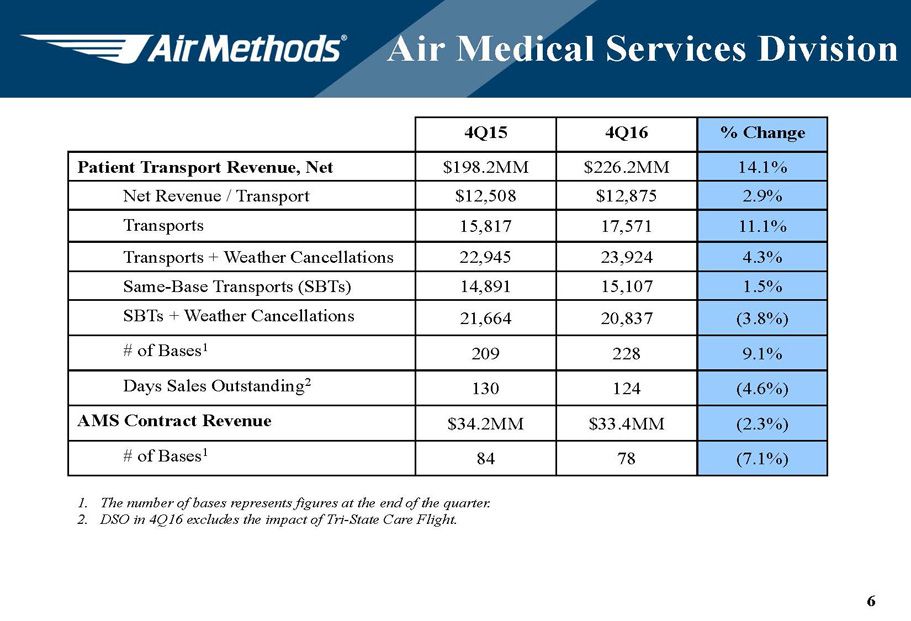

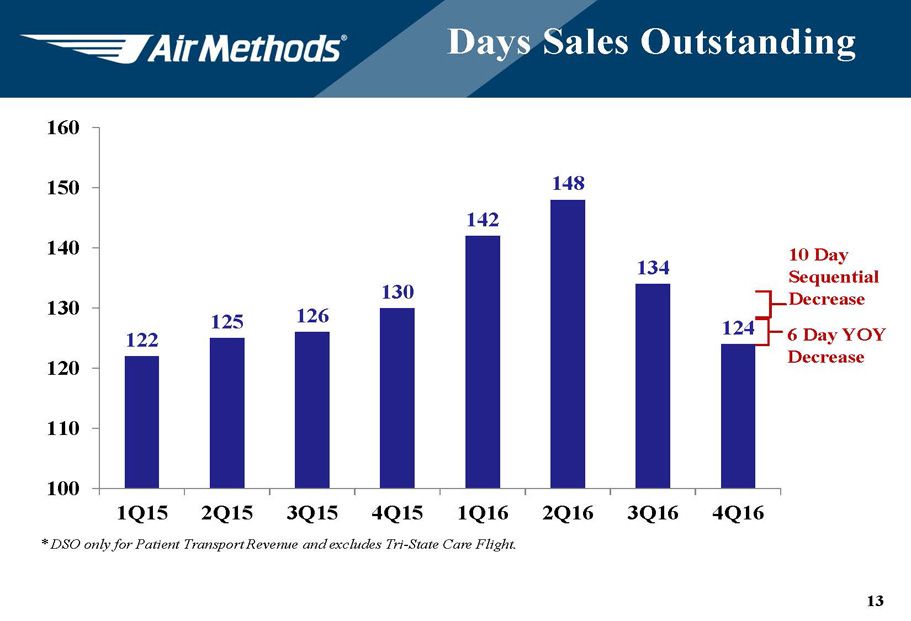

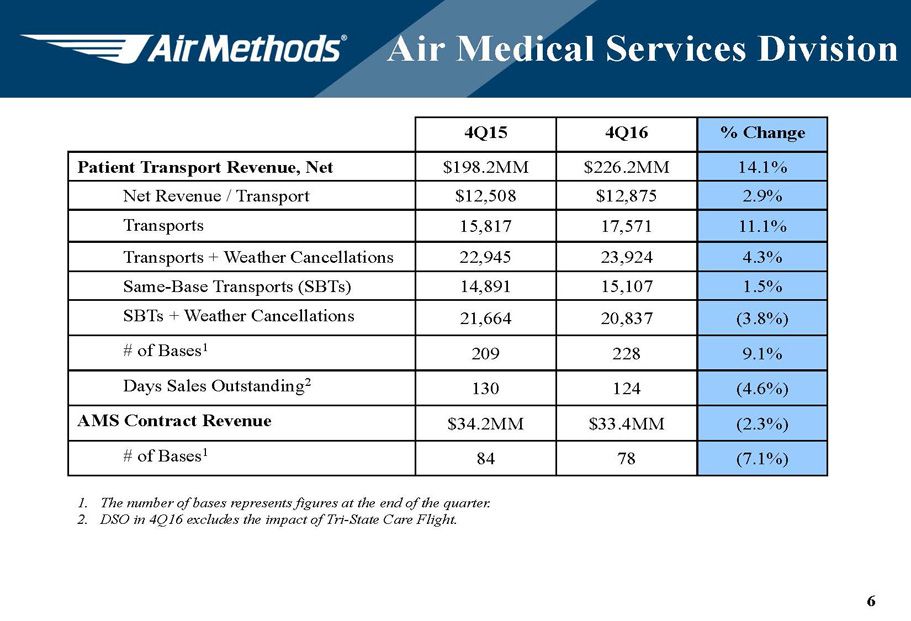

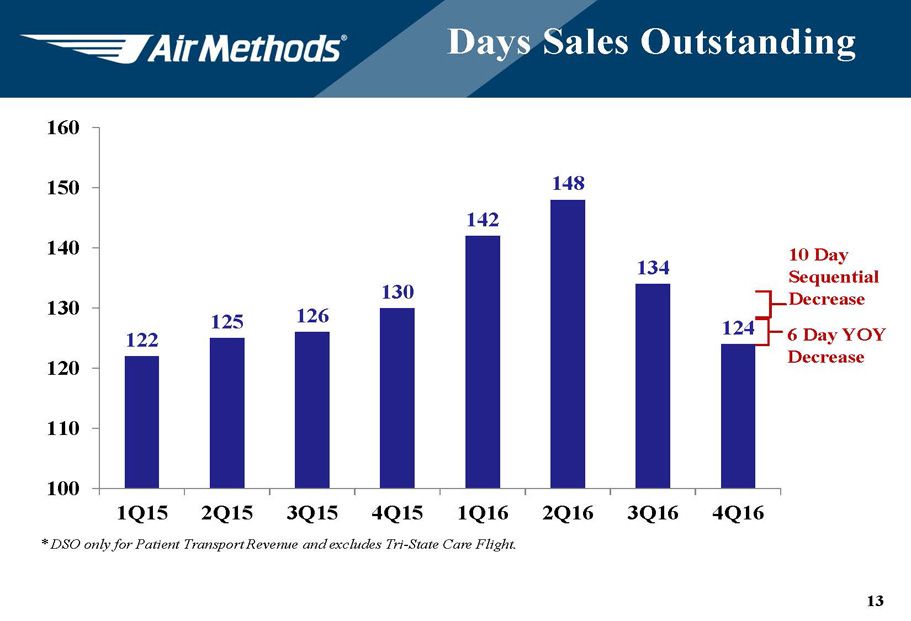

6 Air Medical Services Division 4Q15 4Q16 % Change Patient Transport Revenue, Net $198.2MM $226.2MM 14.1% Net Revenue / Transport $12,508 $12,875 2.9% Transports 15,817 17,571 11.1% Transports + Weather Cancellations 22,945 23,924 4.3% Same - Base Transports (SBTs) 14,891 15,107 1.5% SBTs + Weather Cancellations 21,664 20,837 (3.8%) # of Bases 1 209 228 9.1% Days Sales Outstanding 2 130 124 (4.6%) AMS Contract Revenue $34.2MM $33.4MM (2.3%) # of Bases 1 84 78 (7.1%) 1. The number of bases represents figures at the end of the quarter. 2. DSO in 4Q16 excludes the impact of Tri - State Care Flight.

7 Air Medical Services Division Expenses (Millions) 4Q15 4Q16 % Change Flight Center Expenses $104.2 $115.0 10.3% Aircraft Operating Expenses $35.2 $41.6 18.0% Maintenance $26.5 $33.4 26.3% Fuel $5.5 $5.6 2.4%

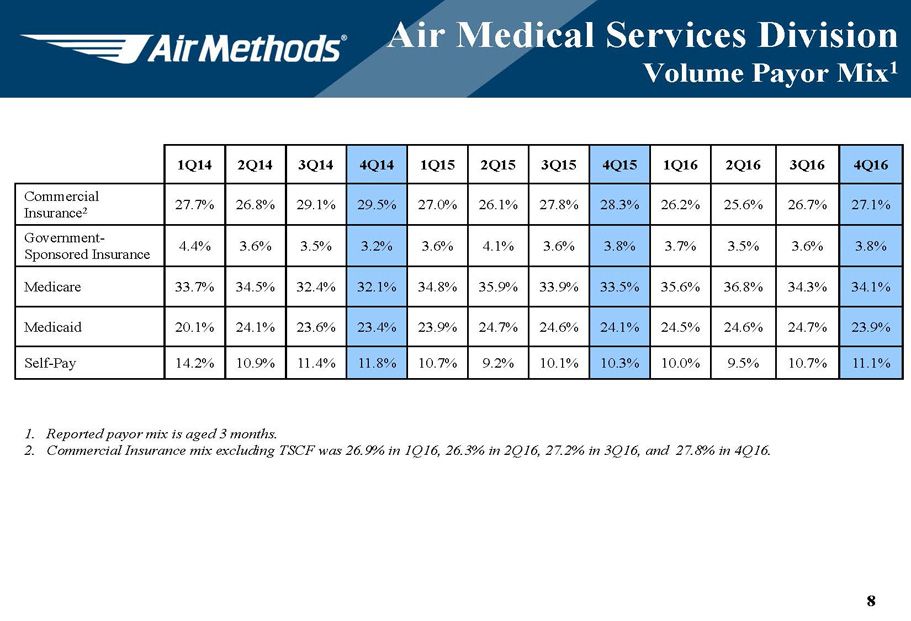

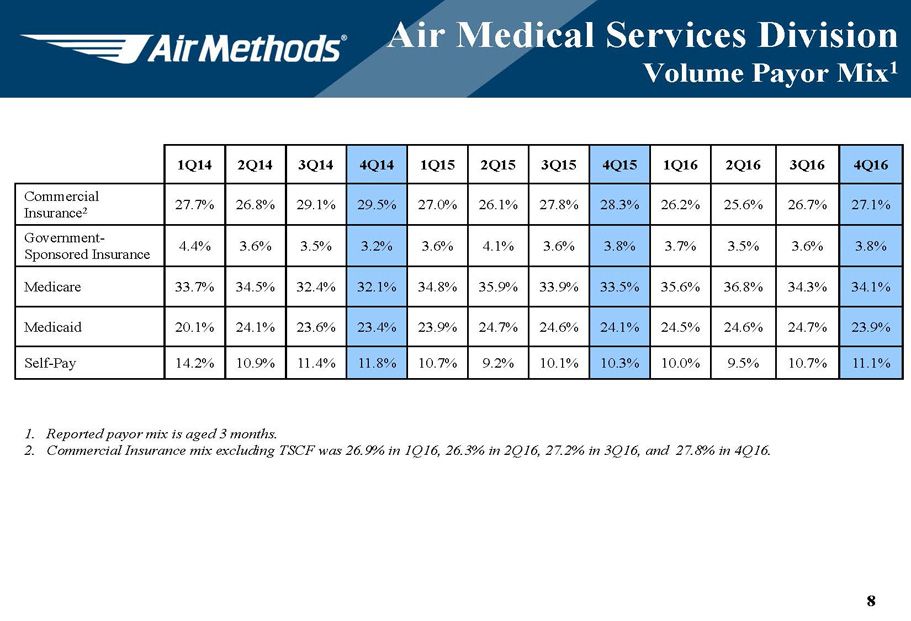

8 Air Medical Services Division Volume Payor Mix 1 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 Commercial Insurance 2 27.7% 26.8% 29.1% 29.5% 27.0% 26.1% 27.8% 28.3% 26.2% 25.6% 26.7% 27.1% Government - Sponsored Insurance 4.4% 3.6% 3.5% 3.2% 3.6% 4.1% 3.6% 3.8% 3.7% 3.5% 3.6% 3.8% Medicare 33.7% 34.5% 32.4% 32.1% 34.8% 35.9% 33.9% 33.5% 35.6% 36.8% 34.3% 34.1% Medicaid 20.1% 24.1% 23.6% 23.4% 23.9% 24.7% 24.6% 24.1% 24.5% 24.6% 24.7% 23.9% Self - Pay 14.2% 10.9% 11.4% 11.8% 10.7% 9.2% 10.1% 10.3% 10.0% 9.5% 10.7% 11.1% 1. Reported payor mix is aged 3 months. 2. Commercial Insurance mix excluding TSCF was 26.9 % in 1Q16, 26.3% in 2Q16, 27.2% in 3Q16, and 27.8% in 4Q16.

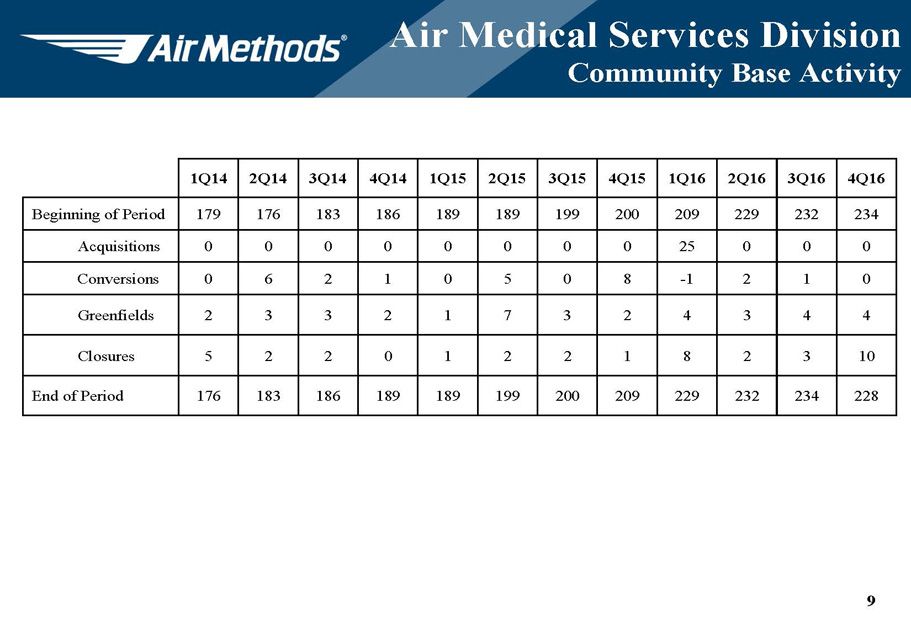

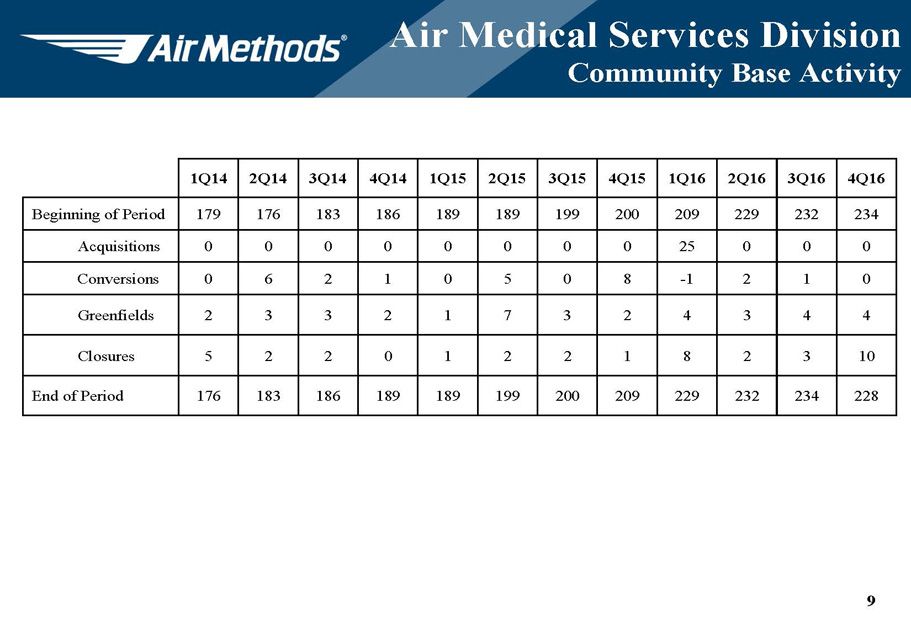

9 Air Medical Services Division Community Base Activity 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 Beginning of Period 179 176 183 186 189 189 199 200 209 229 232 234 Acquisitions 0 0 0 0 0 0 0 0 25 0 0 0 Conversions 0 6 2 1 0 5 0 8 - 1 2 1 0 Greenfields 2 3 3 2 1 7 3 2 4 3 4 4 Closures 5 2 2 0 1 2 2 1 8 2 3 10 End of Period 176 183 186 189 189 199 200 209 229 232 234 228

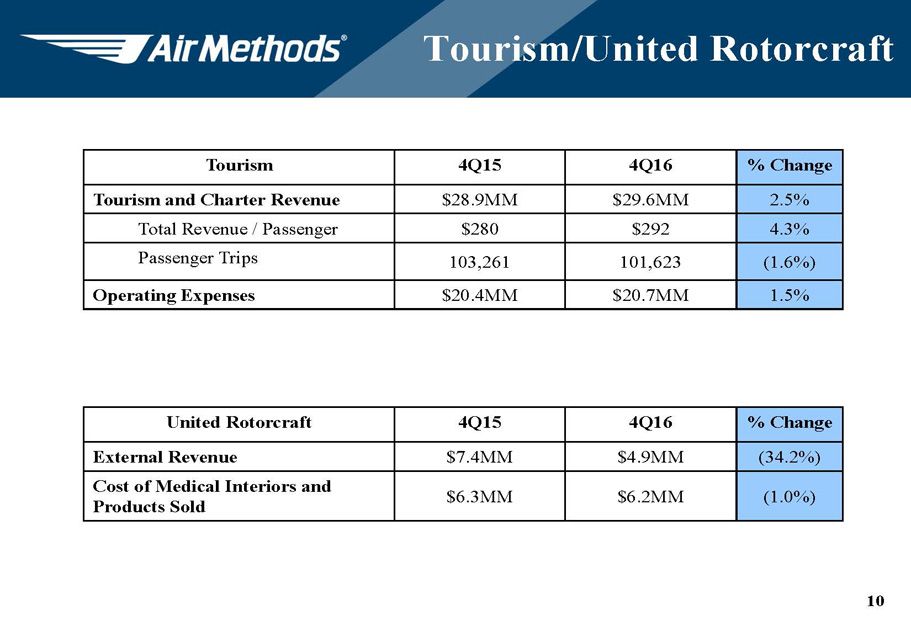

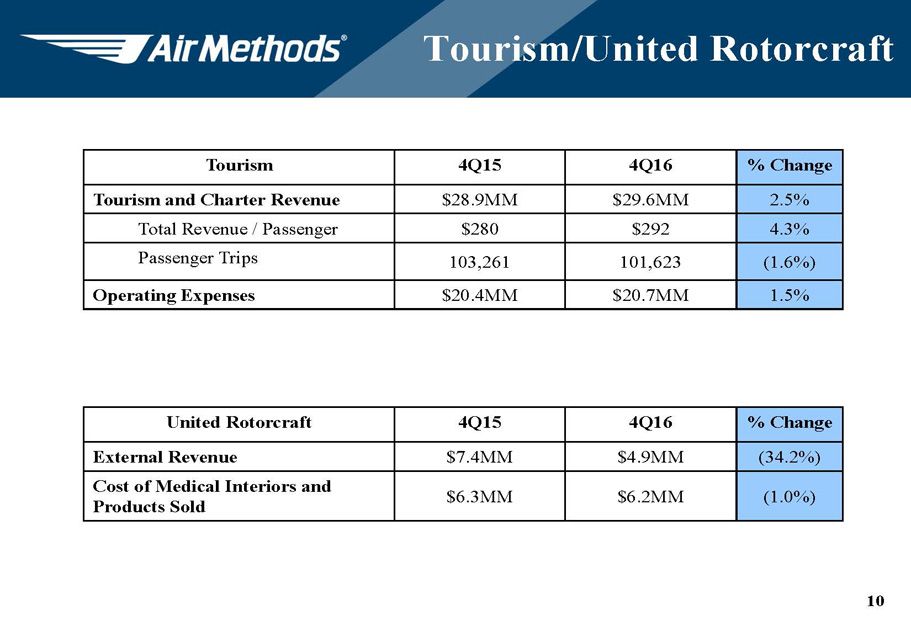

10 Tourism/United Rotorcraft Tourism 4Q15 4Q16 % Change Tourism and Charter Revenue $28.9MM $29.6MM 2.5% Total Revenue / Passenger $280 $292 4.3% Passenger Trips 103,261 101,623 (1.6%) Operating Expenses $20.4MM $20.7MM 1.5% United Rotorcraft 4Q15 4Q16 % Change External Revenue $7.4MM $4.9MM (34.2%) Cost of Medical Interiors and Products Sold $6.3MM $6.2MM (1.0%)

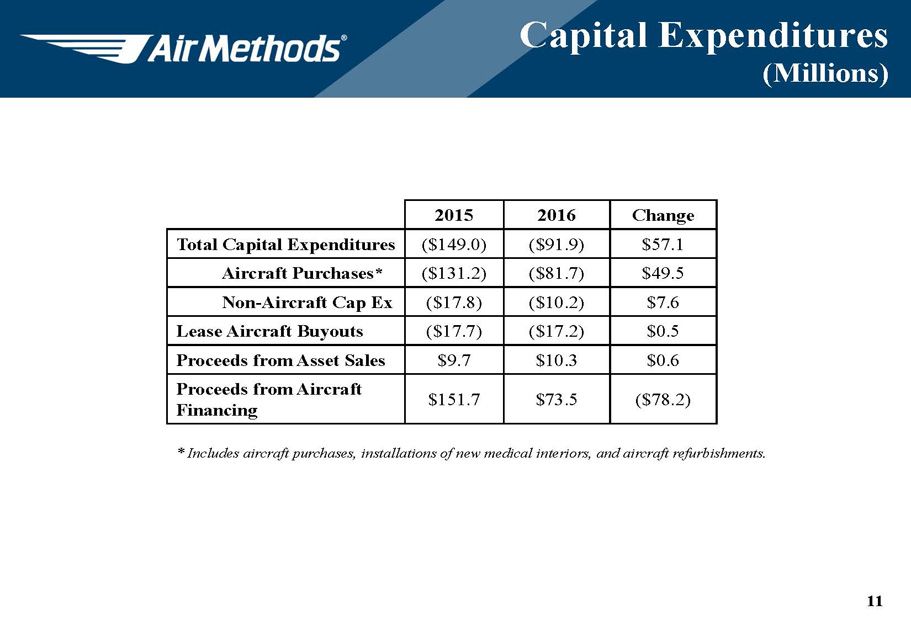

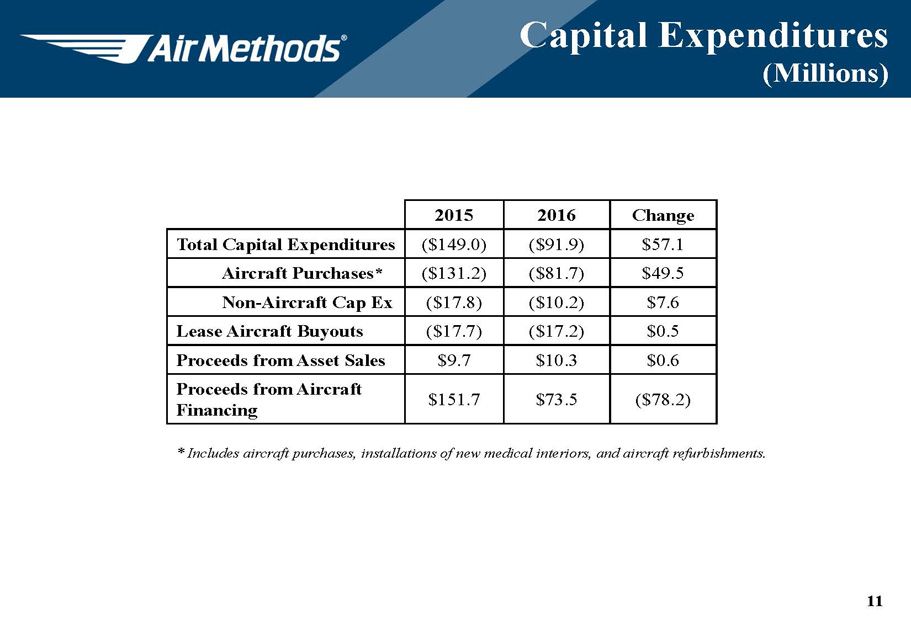

11 Capital Expenditures (Millions) 2015 2016 Change Total Capital Expenditures ($149.0) ($91.9) $57.1 Aircraft Purchases* ($131.2) ($81.7) $49.5 Non - Aircraft Cap Ex ($17.8) ($10.2) $7.6 Lease Aircraft Buyouts ($17.7) ($17.2) $0.5 Proceeds from Asset Sales $9.7 $10.3 $0.6 Proceeds from Aircraft Financing $151.7 $73.5 ($78.2) * Includes aircraft purchases, installations of new medical interiors, and aircraft refurbishments.

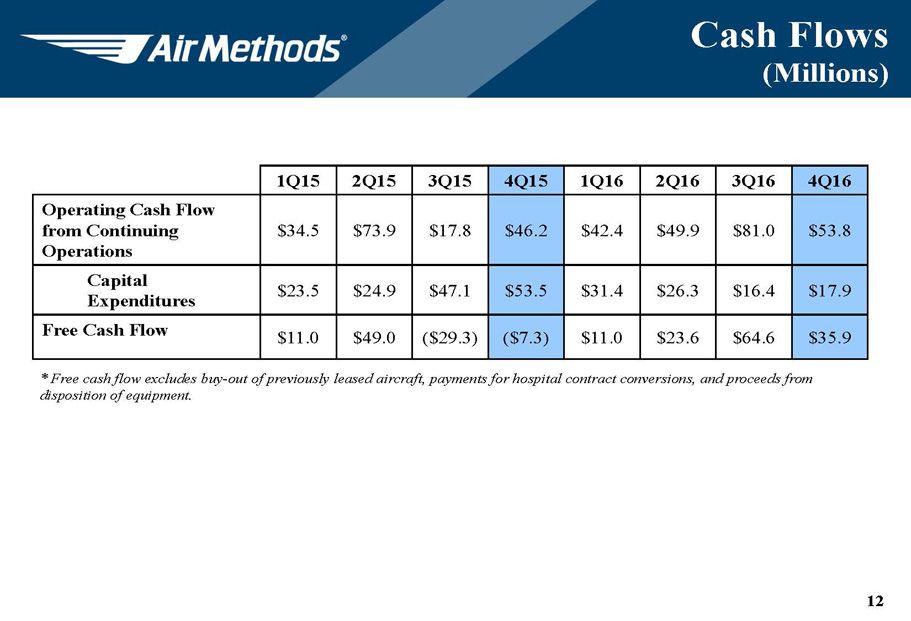

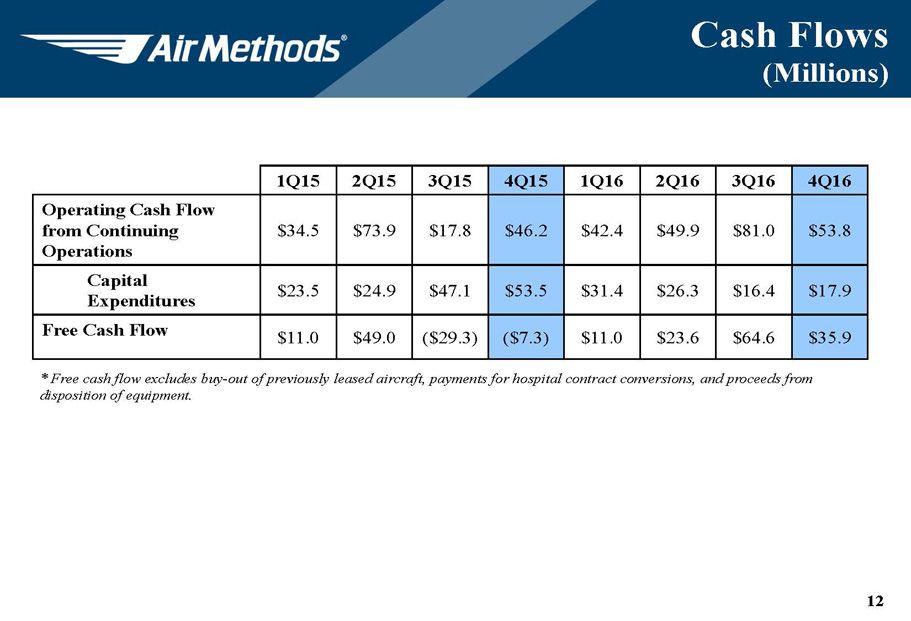

12 Cash Flows (Millions) 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 Operating Cash Flow from Continuing Operations $34.5 $73.9 $17.8 $46.2 $42.4 $49.9 $81.0 $53.8 Capital Expenditures $23.5 $24.9 $47.1 $53.5 $31.4 $26.3 $16.4 $17.9 Free Cash Flow $11.0 $49.0 ($29.3) ($7.3) $11.0 $23.6 $64.6 $35.9 * Free cash flow excludes buy - out of previously leased aircraft, payments for hospital contract conversions, and proceeds from disposition of equipment.

13 122 125 126 130 142 148 134 124 100 110 120 130 140 150 160 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 Days Sales Outstanding 10 Day Sequential Decrease 6 Day YOY Decrease * DSO only for Patient Transport Revenue and excludes Tri - State Care Flight.

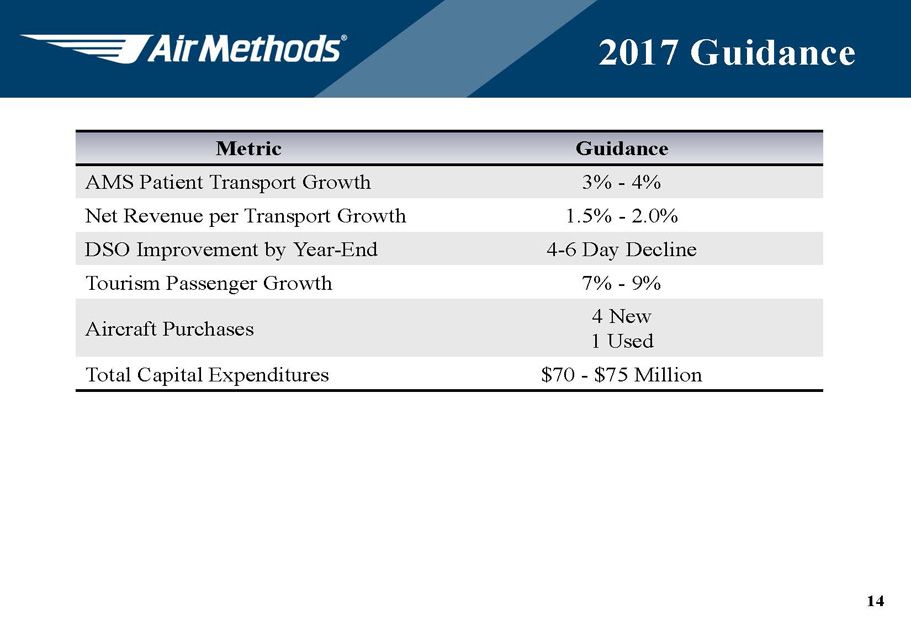

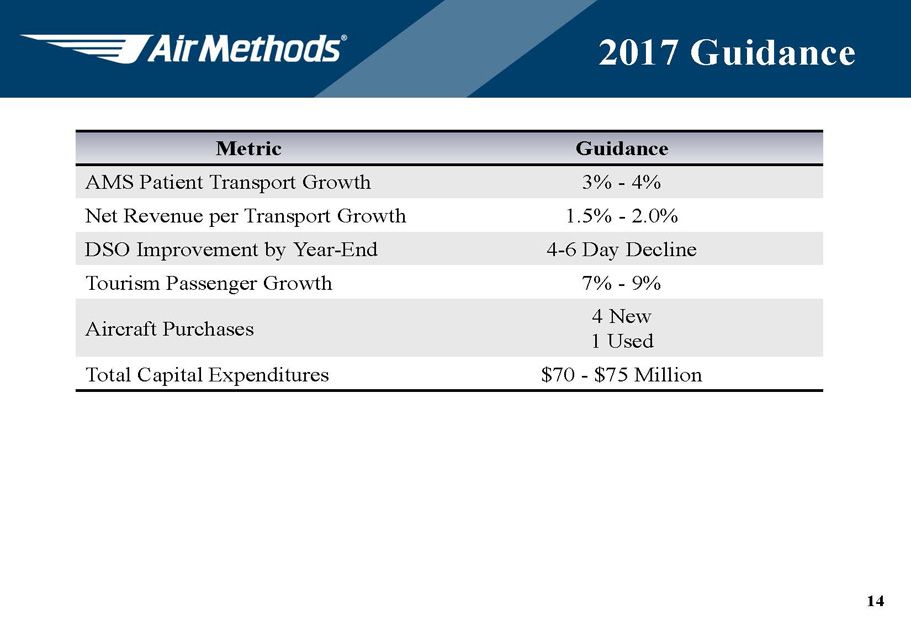

14 2017 Guidance Metric Guidance AMS Patient Transport Growth 3% - 4% Net Revenue per Transport Growth 1.5% - 2.0% DSO Improvement by Year - End 4 - 6 Day Decline Tourism Passenger Growth 7% - 9% Aircraft Purchases 4 New 1 Used Total Capital Expenditures $ 70 - $75 Million

15 Appendix

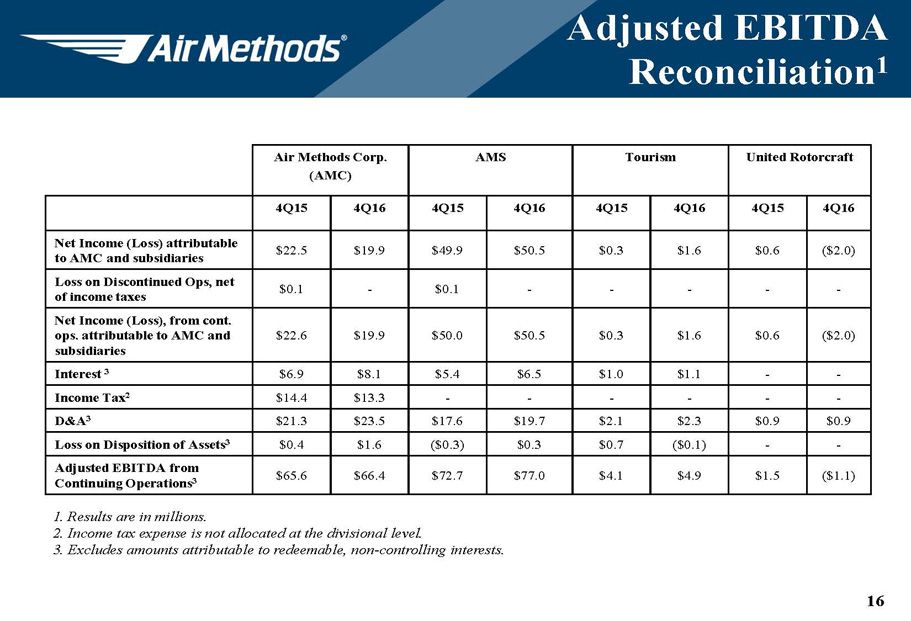

16 Adjusted EBITDA Reconciliation 1 Air Methods Corp. (AMC) AMS Tourism United Rotorcraft 4Q15 4Q16 4Q15 4Q16 4Q15 4Q16 4Q15 4Q16 Net Income (Loss) attributable to AMC and subsidiaries $22.5 $19.9 $49.9 $50.5 $0.3 $1.6 $0.6 ($2.0) Loss on Discontinued Ops, net of income taxes $0.1 - $0.1 - - - - - Net Income (Loss), from cont. ops. attributable to AMC and subsidiaries $22.6 $19.9 $50.0 $50.5 $0.3 $1.6 $0.6 ($2.0) Interest 3 $6.9 $8.1 $5.4 $6.5 $1.0 $1.1 - - Income Tax 2 $14.4 $13.3 - - - - - - D&A 3 $21.3 $23.5 $17.6 $19.7 $2.1 $2.3 $0.9 $0.9 Loss on Disposition of Assets 3 $0.4 $1.6 ($0.3) $0.3 $0.7 ($0.1) - - Adjusted EBITDA from Continuing Operations 3 $65.6 $66.4 $72.7 $77.0 $4.1 $4.9 $1.5 ($1.1) 1. Results are in millions. 2. Income tax expense is not allocated at the divisional level. 3. Excludes amounts attributable to redeemable, non - controlling interests.