December 01, 2016

Ms. Melissa Raminpour

Branch Chief

Office of Transportation and Leisure

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

| Re: | Air Methods Corporation |

| Form 10-K for the Year Ended December 31, 2015 |

| Filed February 26, 2016 |

| Commission File Number: 000-16079 |

Ms. Raminpour:

We (“Air Methods” or the “Company”) are in receipt of your review letter dated November 18, 2016, and have responded to each of your review comments below.

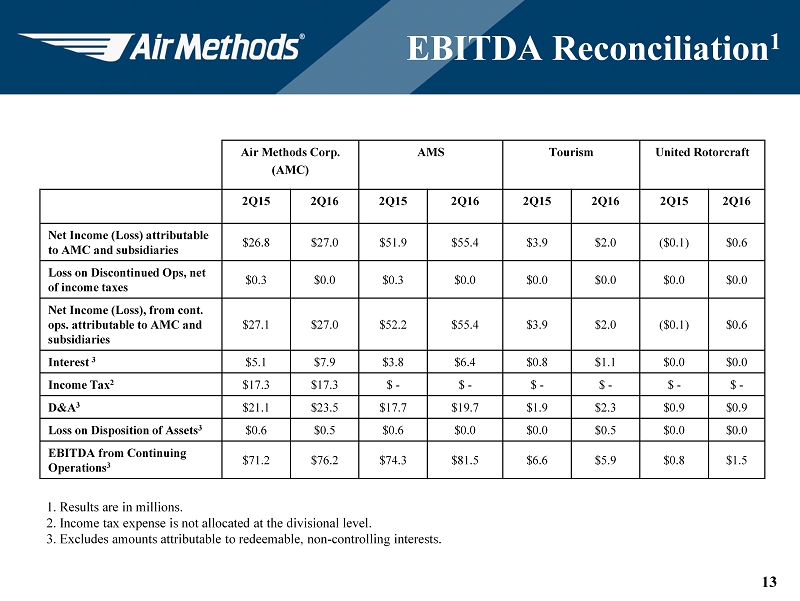

Comment #1

Reference is made to the non-GAAP measure EBITDA referred to in Exhibits 99.1 and 99.2 of your Form 8-K filed on August 4, 2016. You define EBITDA as net income from continuing operations before interest, income taxes, depreciation, amortization, gain or loss on disposition of assets, and discontinued operations. We also note the measure excludes redeemable non-controlling interest. Please be advised earnings is intended to represent net income as presented on the statement of operations under GAAP, and EBITDA should only reflect adjustments for interest, taxes, depreciation, and amortization. In this regard, please revise the title of your non-GAAP financial measure to distinguish it from EBITDA such as Adjusted EBITDA. Refer to Question 103.01 of the C&DIs with respect to Non-GAAP Financial Measures at the SEC website http://www.sec.gov/divisions/corpfin/guidance/nongaapinterp.htm.

Company Response to Comment #1

In future filings with the Commission, including exhibits, we will modify the title of our non-GAAP financial measure from “EBITDA” to “Adjusted EBITDA.”

Comment #2

In a related matter, please revise to include all disclosures required by Item 10(e)(1)(i) of Regulation S-K, including a statement disclosing why management believes thepresentation of non-GAAP financial measure provides useful information to investors, and to the extent material, a statement disclosing the additional purpose, if any, for which management uses the non-GAAP measure.

Company Response to Comment #2

On page 2 of Exhibit 99.2 (“Investor Presentation, 2nd quarter 2016”), filed with our Form 8-K on August 4, 2016, we have included discussion of the reasons management believes that presentation of the non-GAAP measure EBITDA is useful to investors. In future filings with the Commission, we will include the same disclosure in our press releases which present the non-GAAP measure. Please see attached template for future press releases. For your convenience, we have also attached our Investor Presentation for the 2nd quarter 2016. As noted above, the Investor Presentation for the 2nd quarter 2016 was attached as Exhibit 99.2 to our Form 8-K filed on August 4, 2016.

* * * * * * * * * * * * * * * * * * * * * *

Please contact me at 303-792-7400 if you should have any further questions or comments.

Sincerely,

/s/ Peter P. Csapo

Peter P. Csapo

Chief Financial Officer

Air Methods Corporation

Enclosures: 2

Press Release Header

Press Release Content

| Forward Looking Statements: |

| |

| |

| Non-GAAP Financial Information: |

| |

| |

CONTACTS:

Exhibit 99.2

Air Methods Corporation NASDAQ: AIRM 2 Q16 Earnings Presentation

2 Non - GAAP Financial Information Non - GAAP Financial Information: This presentation may discuss EBITDA from continuing operations and EBITDA margin, which are not calculated in conformity with U.S. Generally Accepted Accounting Principles (GAAP). The Company defines EBITDA from continuing operations as earnings attributable to Air Methods Corp. (AMC) and it subsidiaries before interest, income taxes, depreciation, amortization gain or loss on disposition of assets, and discontinued operations. The Company defines EBITDA margin as EBITDA from continuing operations divided by revenue. To supplement the Company’s consolidated financial statements presented on a GAAP basis, management believes that these non - GAAP measures provide useful information about the Company’s core operating results and thus are appropriate to enhance the overall understanding of the Company’s past financial performance and its prospects for the future. Management believes the additions and subtractions from net income used to calculate EBITDA from continuing operations reflect the measurements that its bank creditors and third party stock analysts use in evaluating the Company. These adjustments to the Company's GAAP results are made with the intent of providing both management and investors a more complete understanding of the Company's underlying operational results and trends and performance. Management uses these non - GAAP measures to evaluate the Company's financial results. The presentation of non - GAAP measures is not meant to be considered in isolation or as a substitute for or superior to financial res ults determined in accordance with GAAP.

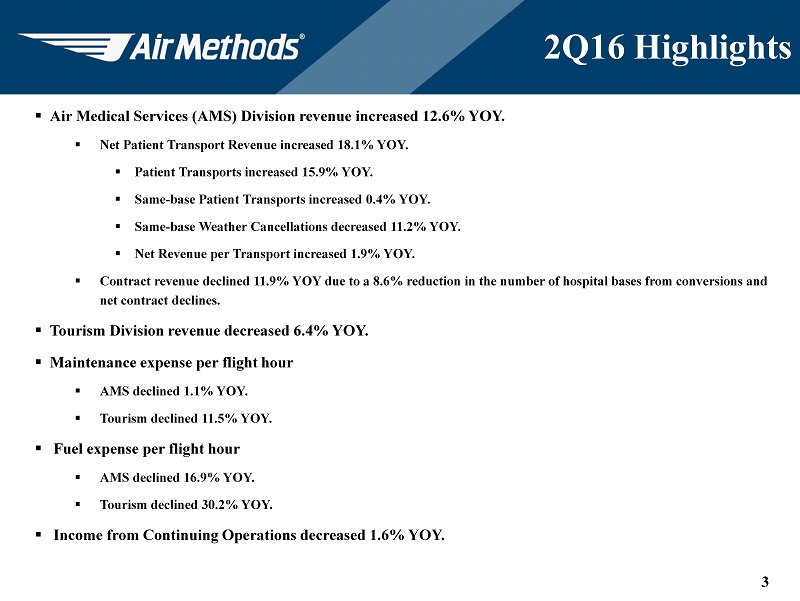

3 2Q16 Highlights ▪ Air Medical Services (AMS) Division revenue increased 12.6% YOY. ▪ Net Patient Transport Revenue increased 18.1% YOY. ▪ Patient Transports increased 15.9% YOY. ▪ Same - base Patient Transports increased 0.4% YOY. ▪ Same - base Weather Cancellations decreased 11.2% YOY. ▪ Net Revenue per Transport increased 1.9% YOY. ▪ Contract revenue declined 11.9% YOY due to a 8.6% reduction in the number of hospital bases from conversions and net contract declines. ▪ Tourism Division revenue decreased 6.4% YOY. ▪ Maintenance expense per flight hour ▪ AMS declined 1.1% YOY. ▪ Tourism declined 11.5% YOY. ▪ Fuel expense per flight hour ▪ AMS declined 16.9% YOY. ▪ Tourism declined 30.2% YOY. ▪ Income from Continuing Operations decreased 1.6% YOY.

4 2Q16 Financial Results 2Q15 2Q16 % Change Revenue (000,000s) $263.6 $292.6 11.0% EBITDA 1 (000,000s) $71.2 $76.2 7.0% Margin (%) 27.0% 26.0% - 100 bps Diluted EPS, Continuing Operations $0.69 $0.70 1.4% Diluted Shares (000,000s) 39.4 38.5 - 2.4% Air Medical Services (AMS) % Change Tourism % Change United Rotorcraft 2 % Change 2Q15 2Q16 2Q15 2Q16 2Q15 2Q16 Revenue (000,000s) $224.7 $252.9 12.6% $34.4 $32.2 - 6.5% $9.2 $11.1 20.9% EBITDA 1 (000,000s) $74.3 $81.5 9.8% $6.6 $5.9 - 11.1% $0.8 $1.5 89.3% Margin (%) 33.0% 32.2% - 80 bps 19.2% 18.3% - 90 bps 8.5% 13.3% 480 bps 1. Represents EBITDA from continuing operations. See appendix for reconciliation. 2. Results for United Rotorcraft include internal and external revenue and costs. Please consult the segment information foot not e in the 10Q for additional information, including corporate expenses.

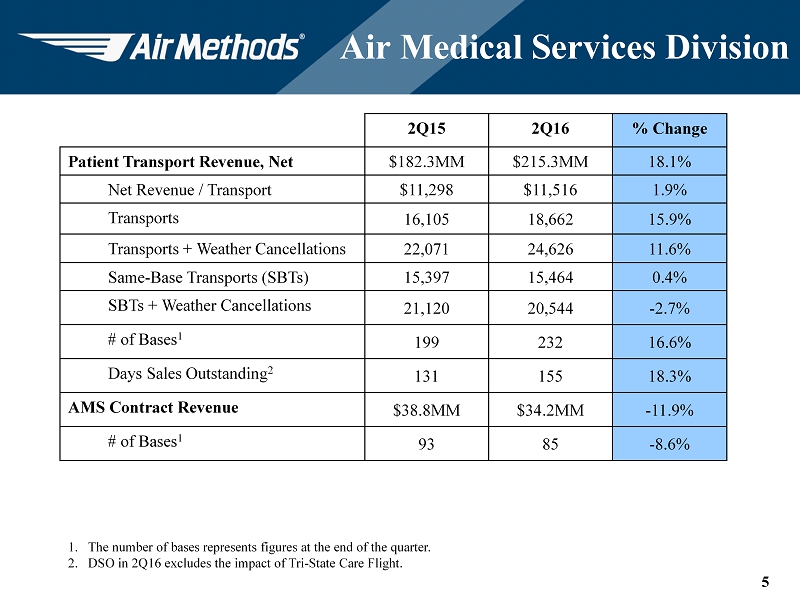

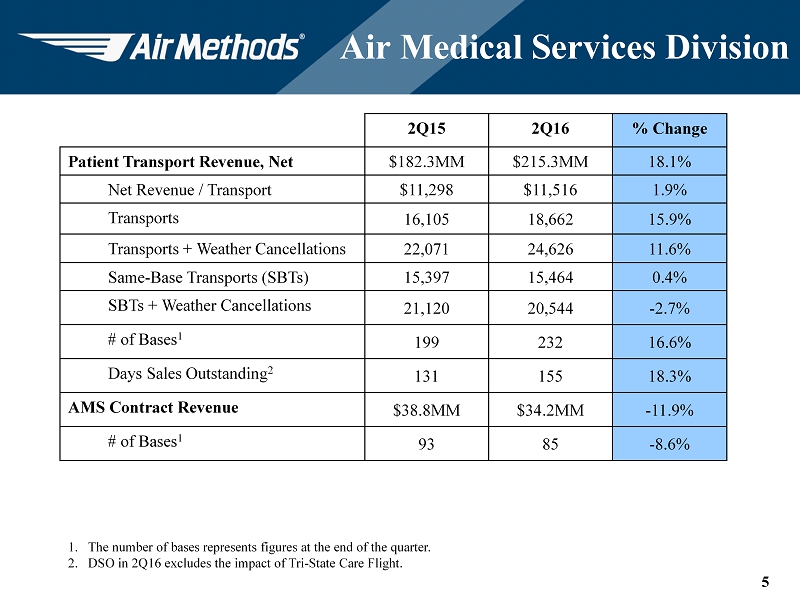

5 Air Medical Services Division 2Q15 2Q16 % Change Patient Transport Revenue, Net $182.3MM $215.3MM 18.1% Net Revenue / Transport $11,298 $11,516 1.9% Transports 16,105 18,662 15.9% Transports + Weather Cancellations 22,071 24,626 11.6% Same - Base Transports (SBTs) 15,397 15,464 0.4% SBTs + Weather Cancellations 21,120 20,544 - 2.7% # of Bases 1 199 232 16.6% Days Sales Outstanding 2 131 155 18.3% AMS Contract Revenue $38.8MM $34.2MM - 11.9% # of Bases 1 93 85 - 8.6% 1. The number of bases represents figures at the end of the quarter. 2. DSO in 2Q16 excludes the impact of Tri - State Care Flight.

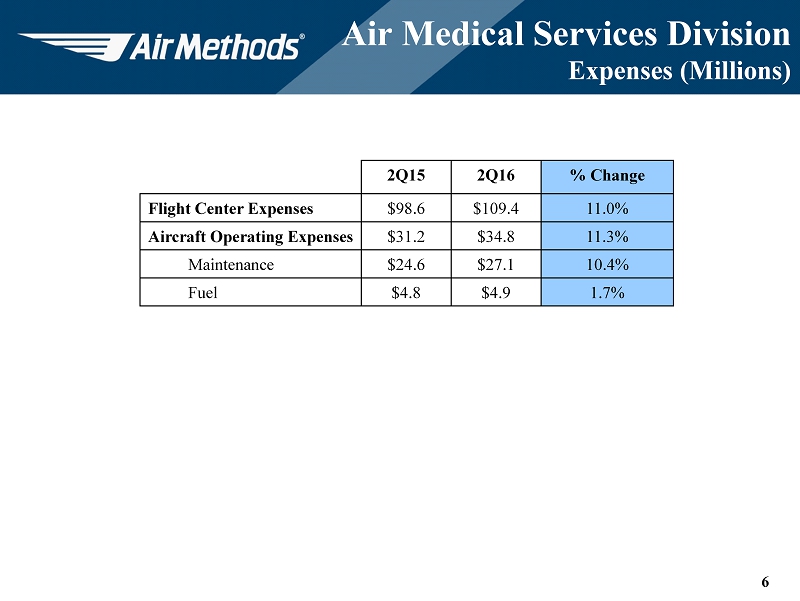

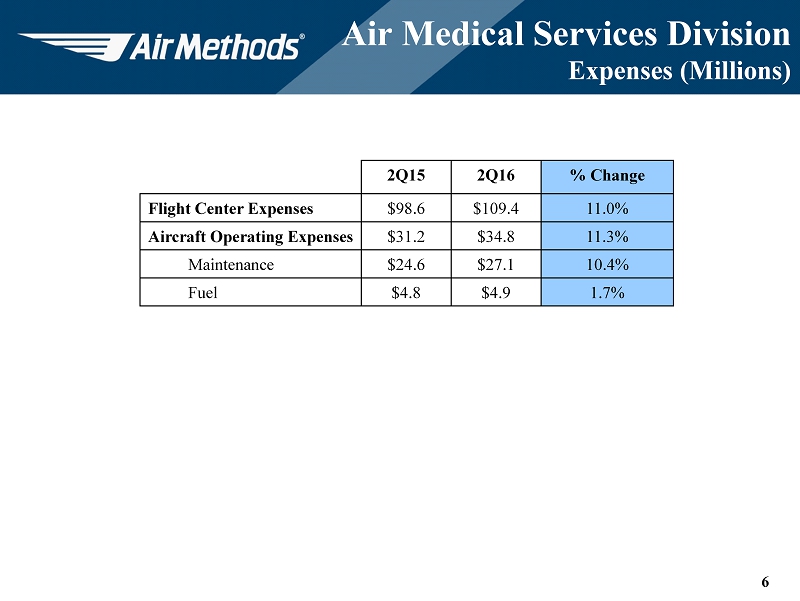

6 Air Medical Services Division Expenses (Millions) 2Q15 2Q16 % Change Flight Center Expenses $98.6 $109.4 11.0% Aircraft Operating Expenses $31.2 $34.8 11.3% Maintenance $24.6 $27.1 10.4% Fuel $4.8 $4.9 1.7%

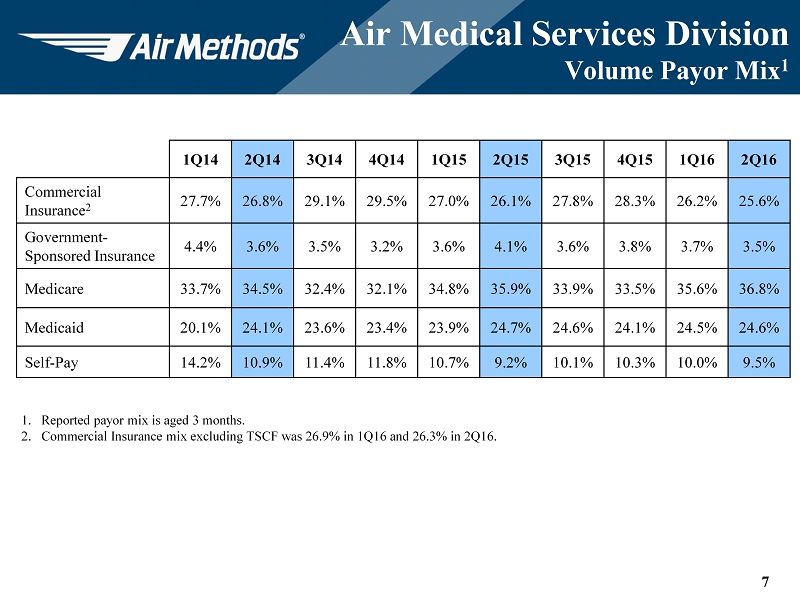

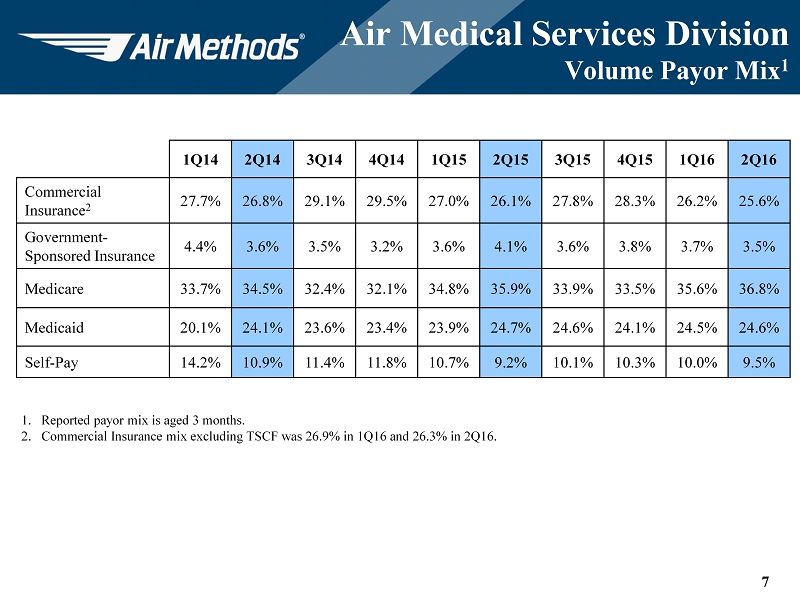

7 Air Medical Services Division Volume Payor Mix 1 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Commercial Insurance 2 27.7% 26.8% 29.1% 29.5% 27.0% 26.1% 27.8% 28.3% 26.2% 25.6% Government - Sponsored Insurance 4.4% 3.6% 3.5% 3.2% 3.6% 4.1% 3.6% 3.8% 3.7% 3.5% Medicare 33.7% 34.5% 32.4% 32.1% 34.8% 35.9% 33.9% 33.5% 35.6% 36.8% Medicaid 20.1% 24.1% 23.6% 23.4% 23.9% 24.7% 24.6% 24.1% 24.5% 24.6% Self - Pay 14.2% 10.9% 11.4% 11.8% 10.7% 9.2% 10.1% 10.3% 10.0% 9.5% 1. Reported payor mix is aged 3 months. 2. Commercial Insurance mix excluding TSCF was 26.9 % in 1Q16 and 26.3% in 2Q16.

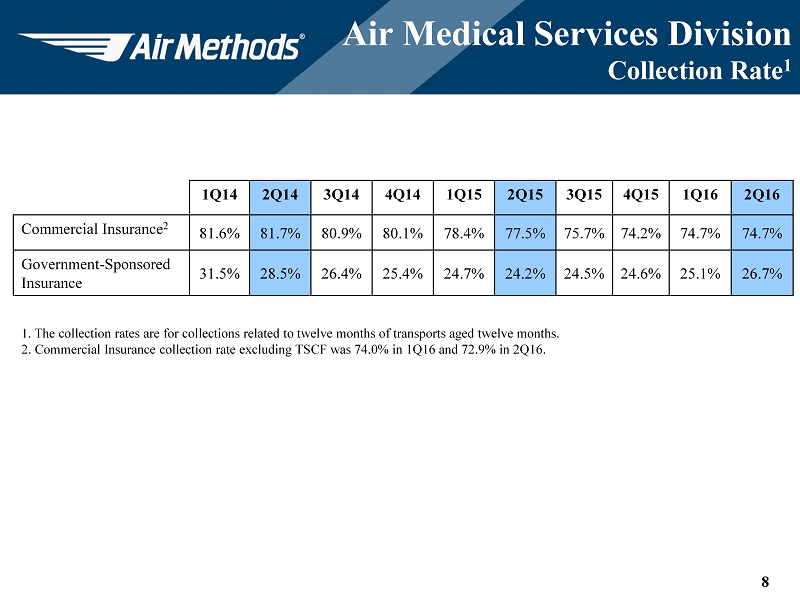

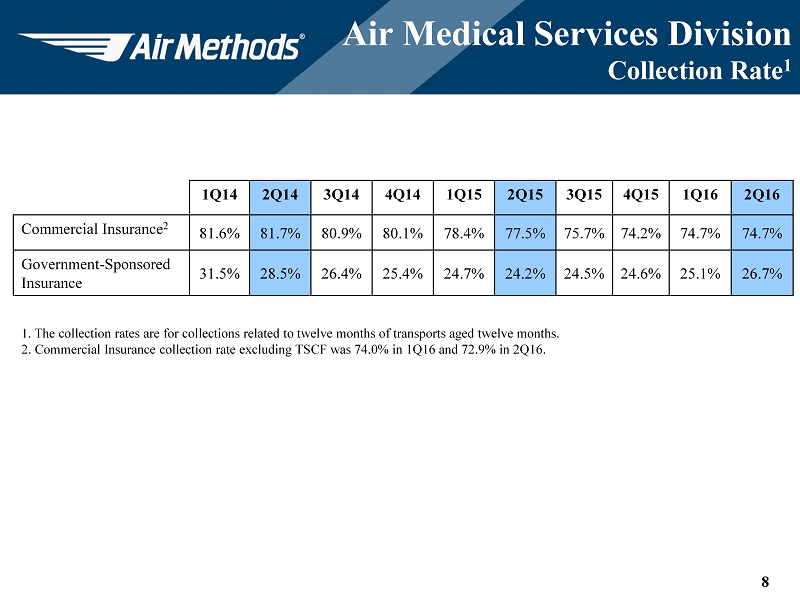

8 Air Medical Services Division Collection Rate 1 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Commercial Insurance 2 81.6% 81.7% 80.9% 80.1% 78.4% 77.5% 75.7% 74.2% 74.7% 74.7% Government - Sponsored Insurance 31.5% 28.5% 26.4% 25.4% 24.7% 24.2% 24.5% 24.6% 25.1% 26.7% 1 . The collection rates are for collections related to twelve months of transports aged twelve months. 2. Commercial Insurance collection rate excluding TSCF was 74.0% in 1Q16 and 72.9% in 2Q16.

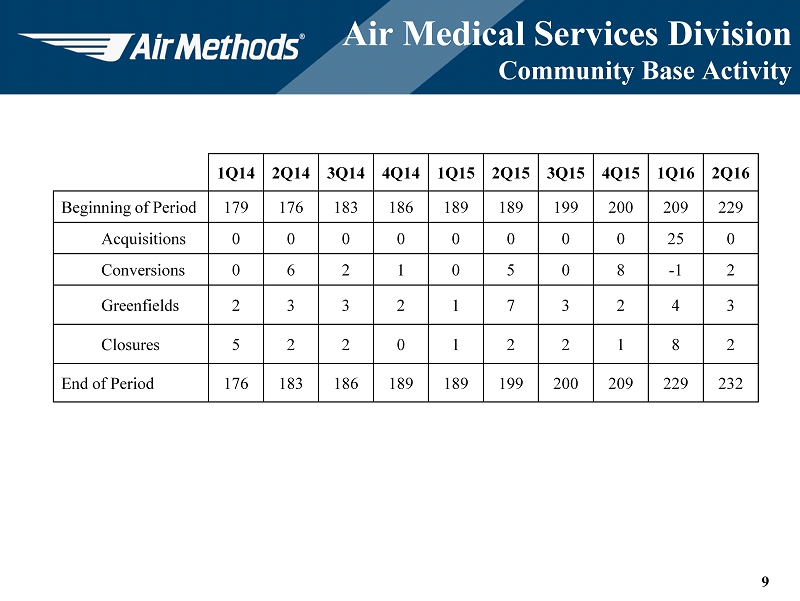

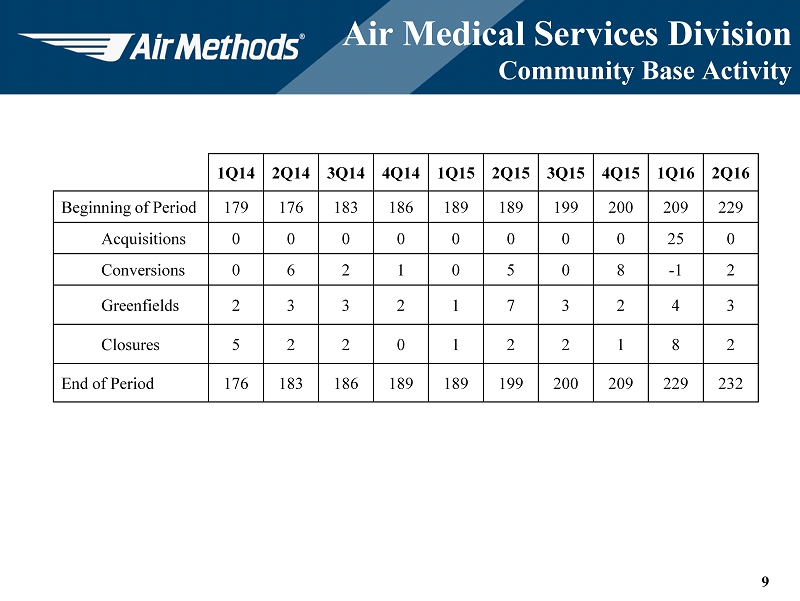

9 Air Medical Services Division Community Base Activity 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Beginning of Period 179 176 183 186 189 189 199 200 209 229 Acquisitions 0 0 0 0 0 0 0 0 25 0 Conversions 0 6 2 1 0 5 0 8 - 1 2 Greenfields 2 3 3 2 1 7 3 2 4 3 Closures 5 2 2 0 1 2 2 1 8 2 End of Period 176 183 186 189 189 199 200 209 229 232

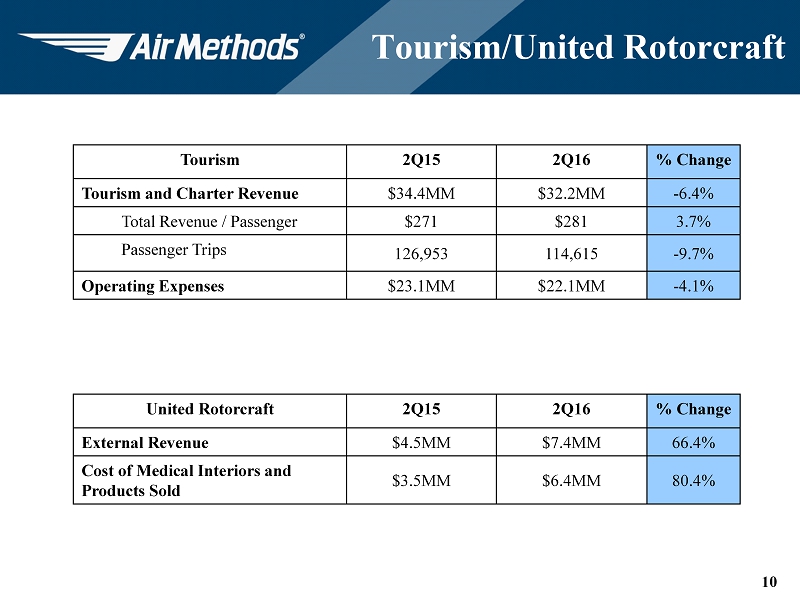

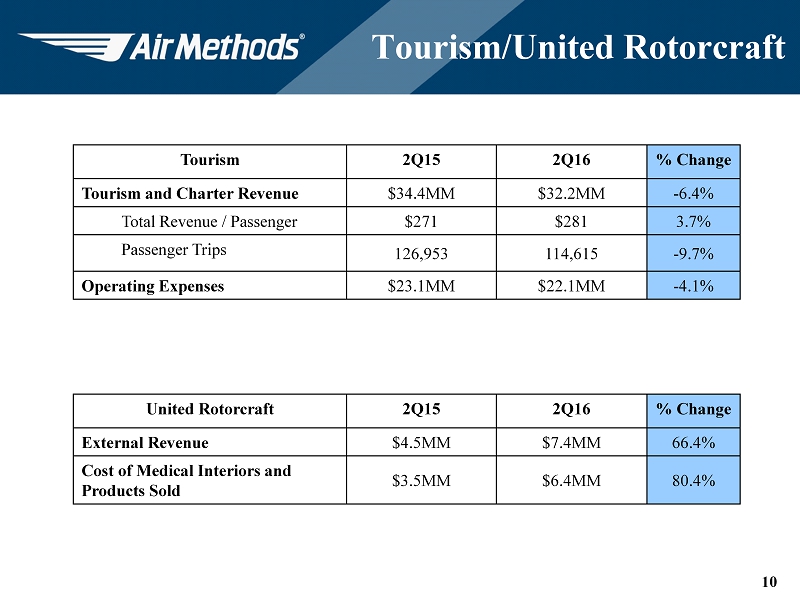

10 Tourism/United Rotorcraft Tourism 2Q15 2Q16 % Change Tourism and Charter Revenue $34.4MM $32.2MM - 6.4% Total Revenue / Passenger $271 $281 3.7% Passenger Trips 126,953 114,615 - 9.7% Operating Expenses $23.1MM $22.1MM - 4.1% United Rotorcraft 2Q15 2Q16 % Change External Revenue $4.5MM $7.4MM 66.4% Cost of Medical Interiors and Products Sold $3.5MM $6.4MM 80.4%

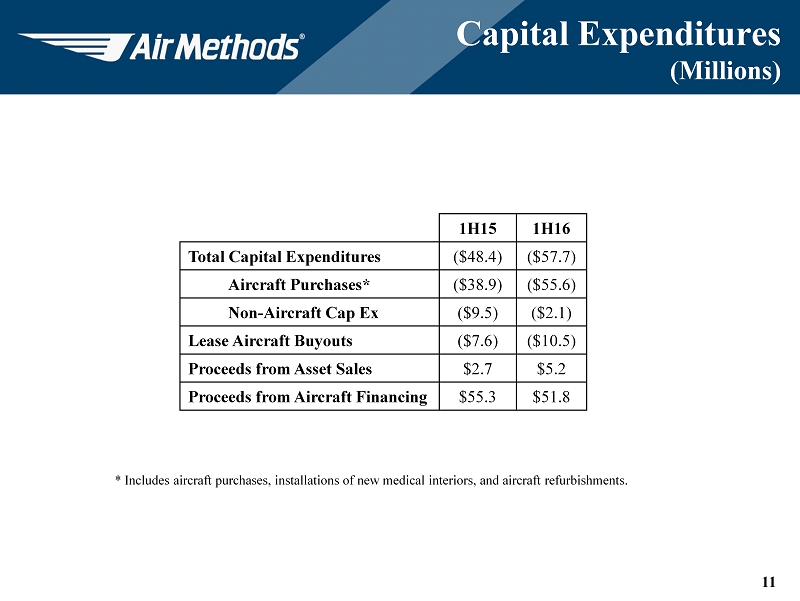

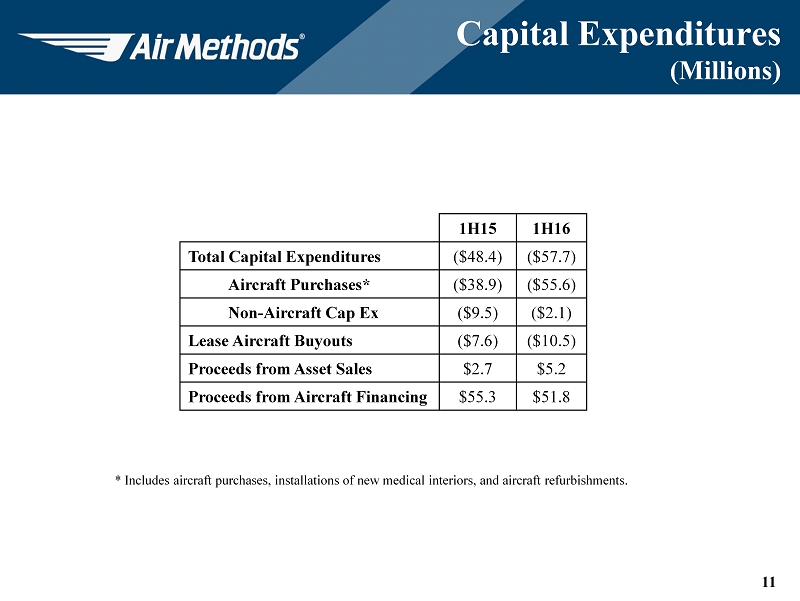

11 Capital Expenditures (Millions) 1H15 1H16 Total Capital Expenditures ($48.4) ($57.7) Aircraft Purchases* ($38.9) ($55.6) Non - Aircraft Cap Ex ($9.5) ($2.1) Lease Aircraft Buyouts ($7.6) ($10.5) Proceeds from Asset Sales $2.7 $5.2 Proceeds from Aircraft Financing $55.3 $51.8 * Includes aircraft purchases, installations of new medical interiors, and aircraft refurbishments.

12 Appendix

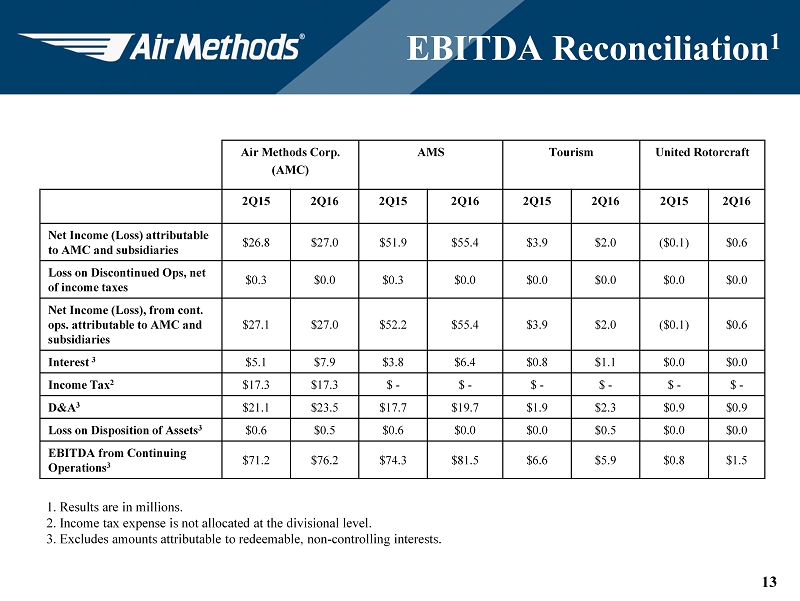

13 EBITDA Reconciliation 1 Air Methods Corp. (AMC) AMS Tourism United Rotorcraft 2Q15 2Q16 2Q15 2Q16 2Q15 2Q16 2Q15 2Q16 Net Income (Loss) attributable to AMC and subsidiaries $26.8 $27.0 $51.9 $55.4 $3.9 $2.0 ($0.1) $0.6 Loss on Discontinued Ops, net of income taxes $0.3 $0.0 $0.3 $0.0 $0.0 $0.0 $0.0 $0.0 Net Income (Loss), from cont. ops. attributable to AMC and subsidiaries $27.1 $27.0 $52.2 $55.4 $3.9 $2.0 ($0.1) $0.6 Interest 3 $5.1 $7.9 $3.8 $6.4 $0.8 $1.1 $0.0 $0.0 Income Tax 2 $17.3 $17.3 $ - $ - $ - $ - $ - $ - D&A 3 $21.1 $23.5 $17.7 $19.7 $1.9 $2.3 $0.9 $0.9 Loss on Disposition of Assets 3 $0.6 $0.5 $0.6 $0.0 $0.0 $0.5 $0.0 $0.0 EBITDA from Continuing Operations 3 $71.2 $76.2 $74.3 $81.5 $6.6 $5.9 $0.8 $1.5 1. Results are in millions. 2. Income tax expense is not allocated at the divisional level. 3. Excludes amounts attributable to redeemable, non - controlling interests.