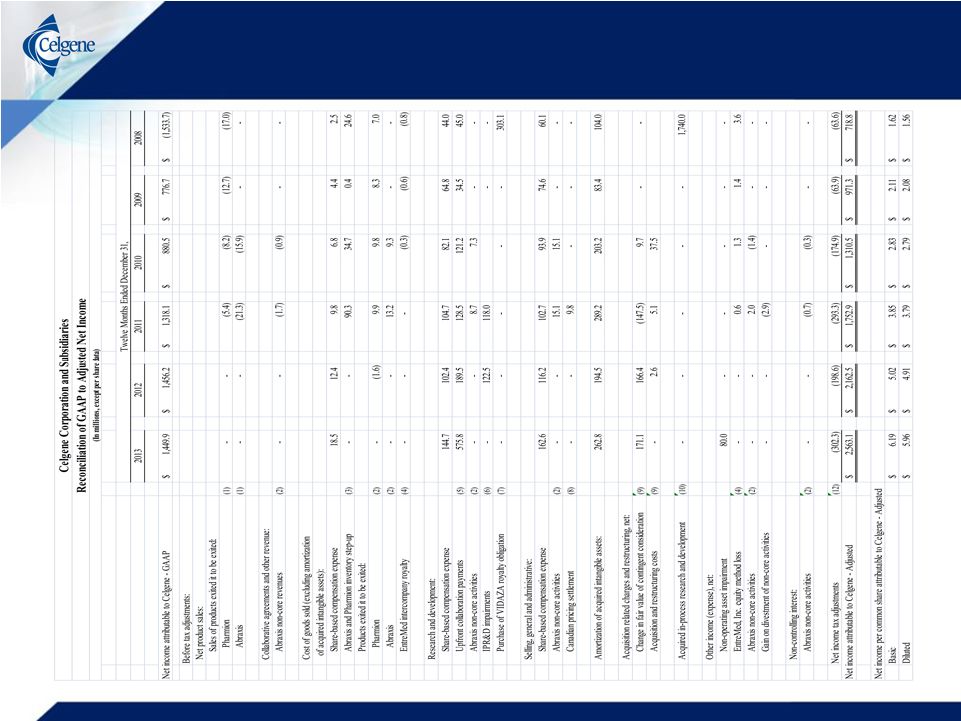

Reconciliation Tables 17 Explanation of adjustments: (1) Exclude sales related to non-core former Pharmion Corp., or Pharmion, and Abraxis BioScience Inc., or Abraxis products to be divested. (2) Exclude the estimated impact of activities arising from the acquisition of Abraxis that are not related to core nab technology and were divested in 2011, including other miscellaneous revenues, cost of goods sold (excluding amortization of acquired intangible assets), operating expenses and other costs related to such activities. Exclude the net (benefit) cost of activities arising from the acquisition of Pharmion that are planned to be exited. (3) Exclude acquisition-related inventory step-up adjustments to fair value which were expensed for Abraxis in 2011 and 2010 and Pharmion in 2009 and 2008. (4) Exclude the Company's share of EntreMed, Inc. THALOMID royalties and equity losses. (5) Exclude upfront payments for research and development collaboration arrangements and purchases of intellectual property for unapproved products. (6) Exclude in-process research and development, or IPR&D, impairments. (7) Exclude the purchase of VIDAZA royalty obligations related to unapproved forms. (8) Exclude pricing settlement with the Patented Medicine Prices Review Board of Canada related to sales of THALOMID. (9) Exclude acquisition related charges and restructuring, including changes in the fair value of contingent consideration, related to the acquisitions of Gloucester, Abraxis and Avila. (10) Exclude the IPR&D write-off related to the acquisition of Pharmion Corp. in 2008. (11) Exclude impairment of royalty receivable asset that was received in 2011 as partial consideration in the sale of the non-core assets obtained by Celgene in the acquisition of Abraxis. (12) Net income tax adjustments reflect the estimated tax effect of the above adjustments and the impact of certain other non-operating tax adjustments, including one-time effects of changes in tax law, acquisition related matters, adjustments to the amount of unrecognized tax benefits and deferred taxes on unremitted foreign earnings. Celgene Corporation and Subsidiaries Reconciliation of GAAP to Adjusted Net Income |